Whether you’re a frequent traveler, a business professional, or simply someone who relies on taxis for daily transportation, taxi receipts play a crucial role in keeping track of your expenses and maintaining financial records.

These small yet significant slips of paper serve as proof of payment, documenting the details of your journey and ensuring transparency in your financial transactions. In this article, we will explore the importance of taxi receipts, their key components, and how they can benefit both passengers and drivers alike.

Whether you’re seeking reimbursement, filing tax returns, or resolving any disputes, understanding the significance of a well-maintained taxi receipt is essential in navigating the world of modern transportation.

Table of Contents

What is a taxi receipt?

A taxi receipt is a document provided by a taxi driver or company to a passenger as proof of payment for a specific taxi ride. It typically includes essential details such as the date and time of the journey, the starting and ending locations, the fare amount, any additional charges or discounts applied, and the driver’s or company’s contact information.

Taxi receipts are important for passengers as they serve as evidence of payment, aiding in reimbursement, tax purposes, and expense tracking. They also benefit taxi drivers and companies by maintaining accurate financial records and facilitating transparent transactions.

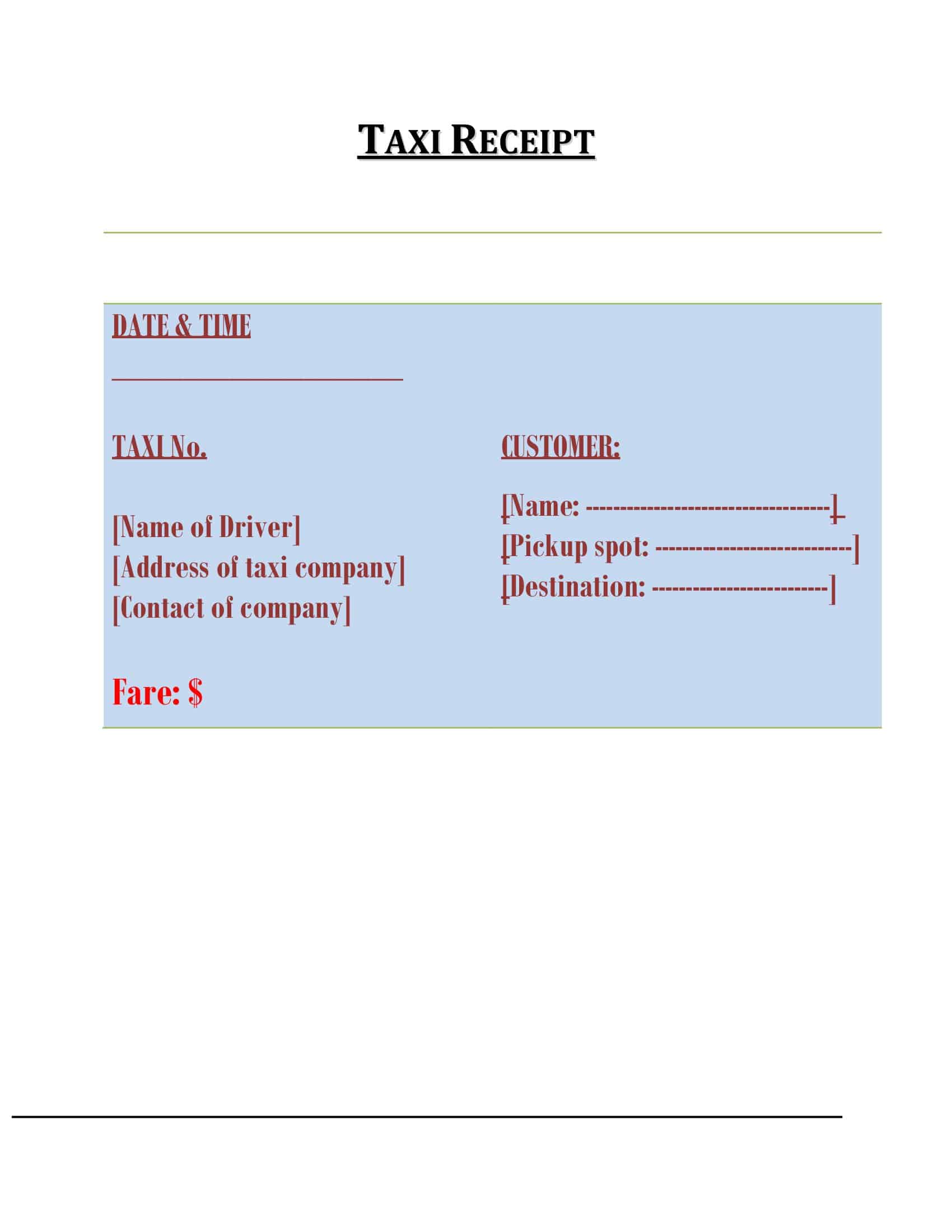

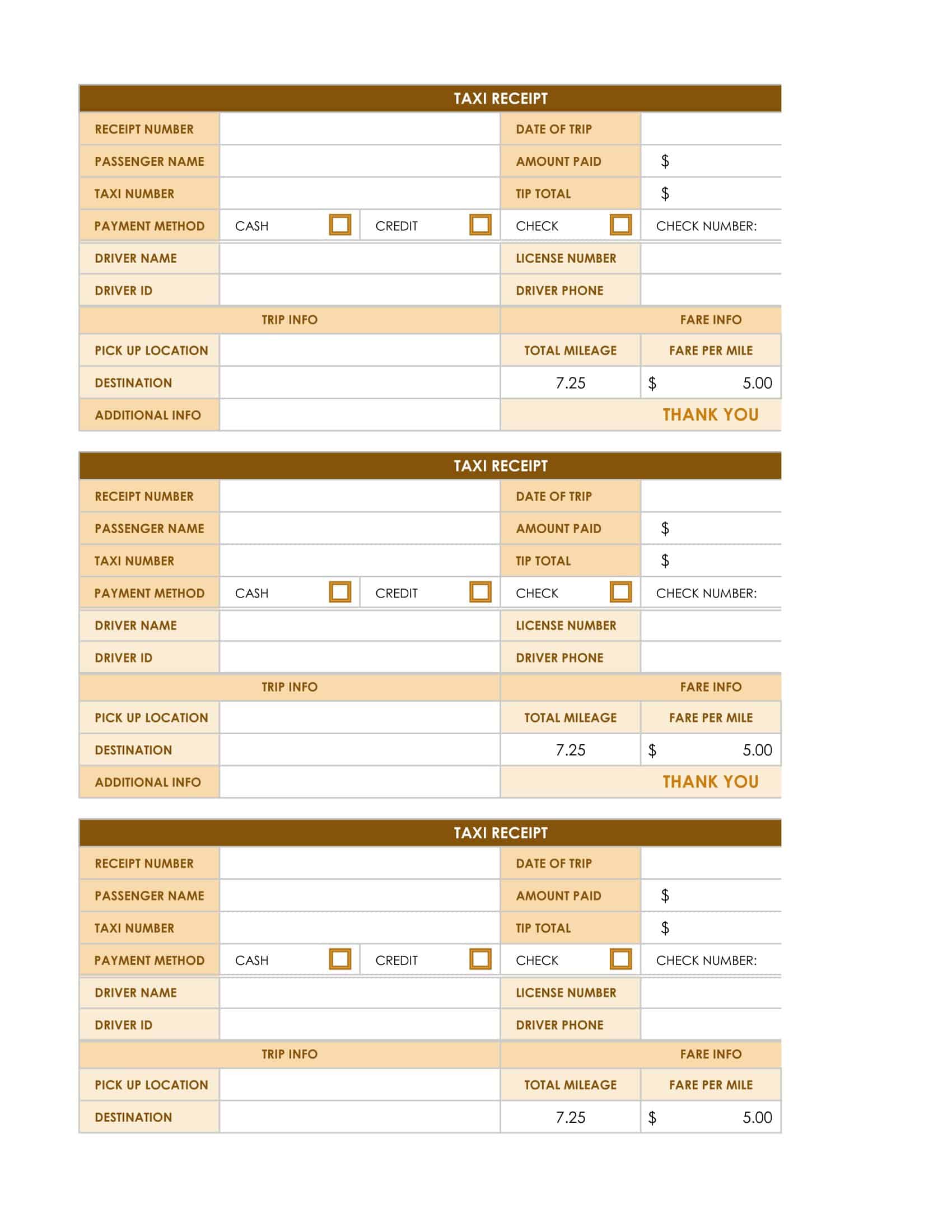

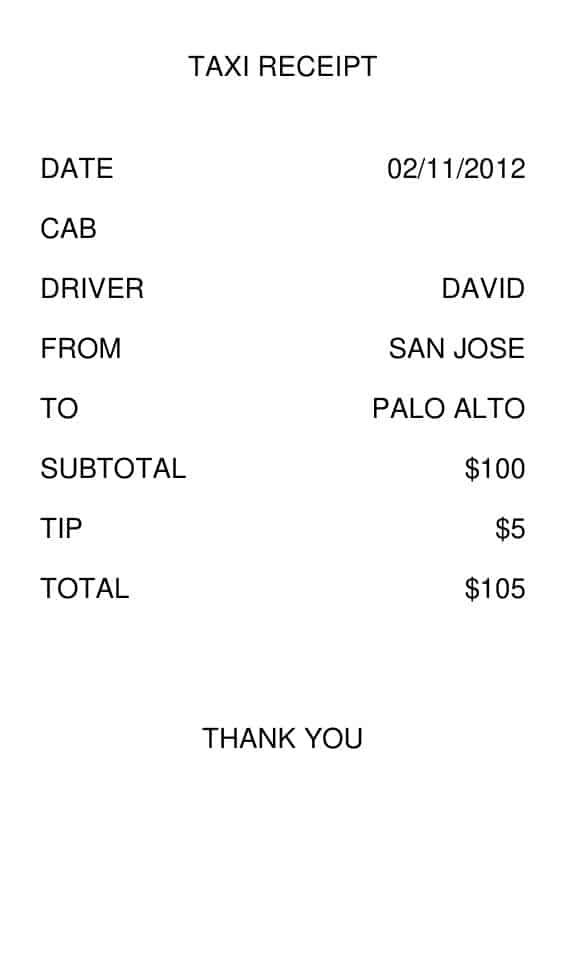

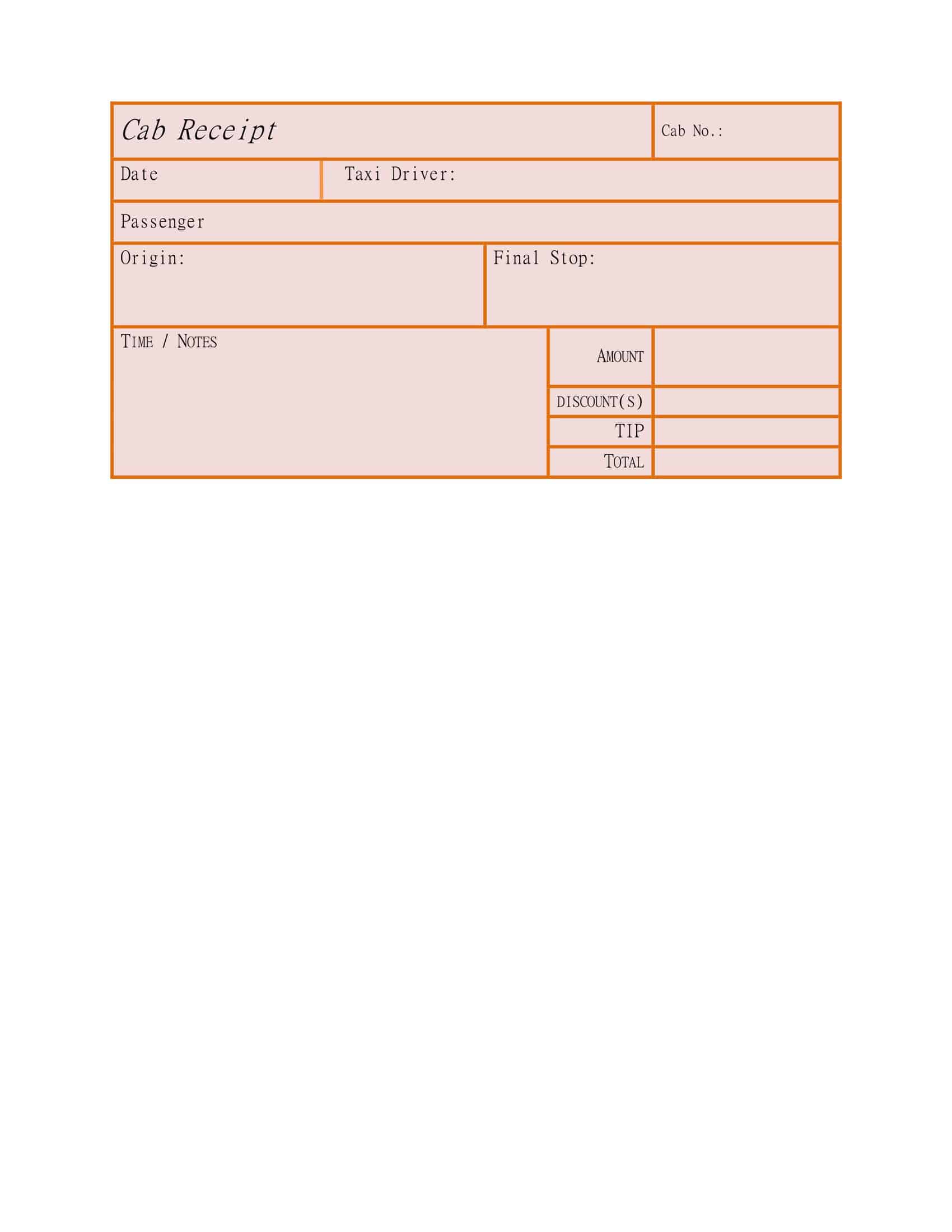

Taxi Receipt Templates

Taxi receipt templates are professionally designed documents that provide a standardized format for recording and documenting taxi fares. These templates are used by taxi drivers, transportation companies, and passengers alike to ensure accurate and reliable records of travel expenses.

A taxi receipt template typically includes essential information such as the name and contact details of the taxi company, the date and time of the journey, the starting and ending locations, the distance traveled, and the total fare. Additional details may include the driver’s name, vehicle number, and any applicable taxes or surcharges.

These templates serve multiple purposes for both the taxi service provider and the passenger. For taxi drivers and transportation companies, using a standardized receipt template ensures consistency and professionalism in their financial records. It helps them maintain accurate accounting and facilitates the tracking of income, expenses, and taxes.

What information is included on a taxi receipt?

A Free Printable Taxi Receipt Templates – Organize Your Expenses is a form of proof of transaction between the taxi driver (service provider) and the passenger (customer). Here’s a detailed guide on what information is typically included on a taxi receipt:

Taxi Company Information: This usually includes the name, address, and contact details of the taxi company. It serves to identify the taxi company providing the service. In some jurisdictions, this may also include the taxi company’s business registration number or tax identification number.

Taxi Details: These are specifics about the taxi cab that provided the service. It usually includes the taxi’s identification number, the license plate number, and the driver’s name or ID. This helps in identifying the specific taxi and driver involved in the transaction.

Date and Time: The date and time when the service was provided. This is usually when the ride started and ended. Some receipts might also include the total duration of the ride.

Pick-Up and Drop-Off Locations: The address or general description of the starting point and destination of the ride.

Fare Details: The fare details provide a breakdown of the cost of the trip. This typically includes the base fare, distance traveled or duration of the trip, any waiting time, surcharges (for late-night rides, holiday rates, luggage, etc.), and any tolls paid during the journey.

Payment Details: This section outlines the method of payment (cash, credit card, digital payment, etc.) and the total amount paid. It may also include the last four digits of the credit card if the payment was made via this method.

Tip: If a tip was given to the driver, it should be recorded here. This is optional and varies depending on the local tipping culture and passenger’s personal decision.

Total Amount: The final total amount paid, including the fare, any surcharges, and tip (if applicable).

Receipt Number: A unique number that identifies the receipt. This is useful for referencing in case of disputes, complaints, or lost property.

Driver Signature/Stamp: In some cases, the driver may sign the receipt or it might bear a company stamp. This isn’t always present, particularly for digitally issued receipts.

Importance of a Taxi Receipt for the Driver and Passenger

A taxi receipt plays an essential role for both the taxi driver and the passenger, serving as a record of the transaction that has occurred. Here’s a more detailed guide on its importance:

For the Passenger

- Expense Tracking: A taxi receipt is crucial for passengers who need to keep track of their personal or business expenditures. This can be especially important for business travelers who need to claim travel expenses from their employers.

- Tax Purposes: For self-employed individuals or business owners, taxi receipts can be used for tax deduction purposes if the ride was used for business activities. It’s necessary to keep these receipts as proof of these business expenses.

- Proof of Payment: The taxi receipt serves as proof that the passenger has indeed paid for the taxi services. If there are any disputes about whether or not the fare has been paid, the receipt serves as a record of payment.

- Lost & Found: If a passenger leaves something behind in a taxi, the receipt can be invaluable for tracking down the specific vehicle and driver. The receipt typically includes crucial details such as the taxi identification number, driver’s ID, and date and time of the ride. This information can greatly assist in the retrieval process of lost items by making it easier for the taxi company or the local taxi licensing authority to identify the particular taxi and driver.

- Service Complaints or Commendations: If a passenger experiences exceptionally poor or excellent service, the taxi receipt can be used to report the incident to the taxi company or local regulatory body. The details on the receipt can identify the specific driver involved.

For the Driver

- Income Tracking: Taxi receipts help drivers keep track of their earnings. This can be particularly important for drivers who are self-employed or those who rent their taxi from a fleet.

- Tax Purposes: For drivers, the receipt is a record of income earned, which is necessary for tax filing. It can also serve as proof of business expenses like fuel costs, vehicle maintenance, or any toll fees paid during the journey.

- Dispute Resolution: If a dispute arises about whether or not a passenger has paid, the driver can refer to the taxi receipt. Additionally, if there’s any disagreement about the cost of the trip, the receipt serves as a record of what was charged and why.

- Protection Against Fraud: Issuing a receipt can protect drivers against fraudulent claims from passengers. The receipt provides a written record of the transaction and can prove the amount paid by the passenger.

- Professionalism: Providing a receipt can make drivers appear more professional, which can enhance customer satisfaction and potentially lead to positive reviews and more business.

How to write a taxi receipt?

Writing a taxi receipt requires you to include specific information to make it valid and useful. This information ensures both the passenger and the taxi driver or company can keep accurate records of the transaction. Here’s a detailed guide on how to write a taxi receipt:

Header – Taxi Company’s Information: At the top of the receipt, write the name of the taxi company. If you’re an independent driver, you can just use your name. Underneath this, include the company’s address, contact information, and if applicable, the business registration or tax identification number.

Receipt Information: The receipt should have a unique receipt or invoice number. This number can be a simple sequence (001, 002, etc.) or can contain specific identifiers related to your business. Include the date and time when the service was provided as well.

Taxi and Driver Information: Specify the taxi’s identification number or license plate number and the name or ID of the driver. This helps in identifying the specific taxi and driver involved in the transaction.

Travel Information: Write down the pick-up and drop-off locations and possibly the route taken. In some places, the receipt may also include the total distance traveled and/or the duration of the trip.

Fare Information: Include a breakdown of the fare. This should list the base fare, any charges per mile or minute, waiting charges if applicable, and additional surcharges (e.g., for luggage, late-night rides, or holiday rates). Also include any toll fees incurred during the trip.

Payment Information: Specify the method of payment used (cash, credit/debit card, digital wallet, etc.). If payment was made by card, typically the receipt includes the last four digits of the card number for reference, without revealing the full card details for privacy and security reasons.

Total Amount: Sum up the fare, any additional charges, and tip (if given) to indicate the total amount paid. This should be clearly marked as the total.

Tip: If a tip was given to the driver, it should be listed separately, before the total amount.

Driver Signature/Stamp: The driver can sign at the bottom of the receipt. This isn’t always required, especially for digital receipts. Some companies may use a stamp instead.

FAQs

Can I create my own taxi receipt template?

Yes, you can create your own taxi receipt template if you prefer a personalized design or need specific information to be included. There are various online tools and software available that allow you to customize receipt templates.

Can I modify a taxi receipt template to suit my needs?

Yes, most receipt templates are editable, allowing you to modify them to meet your specific requirements. You can add or remove fields, change the layout, or customize the design as per your preference.

Are there any legal requirements for taxi receipts?

Legal requirements for taxi receipts can vary depending on the jurisdiction. It’s advisable to check with the local authorities or consult a legal professional to ensure compliance with any specific regulations or requirements.

How long should I keep my taxi receipts?

It’s generally recommended to keep your taxi receipts for at least three to seven years for tax and record-keeping purposes. However, specific retention periods may vary based on local laws or personal needs.

Can I use digital receipts instead of printed ones?

Yes, digital receipts are becoming increasingly common and accepted in many situations. You can use electronic receipt templates or mobile apps that generate digital receipts, which can be emailed or stored digitally.

Can I get a duplicate copy of a lost taxi receipt?

It depends on the taxi company’s policies. Some companies may be able to provide you with a duplicate copy if you provide them with specific details about the trip, such as the date, time, and locations. However, it’s always recommended to keep your receipts safe to avoid such situations.

Can I use a taxi receipt template for other modes of transportation?

While taxi receipt templates are specifically designed for taxi services, you can modify them to create receipts for other modes of transportation, such as rideshare services, limousines, or car rental services. Simply adapt the template to include the necessary details and change the relevant headings if required.

Are there any mobile apps available for generating taxi receipts?

Yes, there are several mobile apps available that allow you to generate digital taxi receipts on your smartphone. These apps often provide pre-designed templates and allow you to customize the necessary information before saving or sharing the receipt.

Can I use electronic receipts for expense reporting?

Yes, electronic receipts are commonly used for expense reporting. Many companies accept digital or scanned receipts for reimbursement purposes. However, it’s always recommended to check your organization’s expense policy or consult with your employer to ensure compliance with their specific requirements.

Are taxi receipt templates available in multiple languages?

Yes, depending on your location and the template source, you may find taxi receipt templates available in various languages. If you require a specific language, it’s recommended to search for templates tailored to that language or consider customizing a template to include the necessary translations.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)