With a keen focus on the practical aspects of personal finance, this Monthly Expenses Template article is your guide to maintaining monetary order in the whirlwind of daily life. Here, we shine a light on an uncomplicated yet effective tool, offering a fresh perspective on how you interact with your finances.

Our article will walk you through the advantages of our Monthly Expenses Template, equipping you with the skills to consolidate, monitor, and reassess your spending patterns. Get ready to revolutionize your financial future with this reliable and user-friendly system.

Table of Contents

What is a monthly expenses template?

A Monthly Expenses Template is a financial tool that assists individuals or businesses in tracking their income and outgoings for each month. This can be in the form of a digital spreadsheet or a physical ledger, and it often includes categories such as rent or mortgage, utilities, groceries, transportation, entertainment, and savings, among others.

The purpose of this template is to provide a clear and detailed picture of your financial status, allowing you to understand where your money is going, identify areas for potential savings, and ultimately manage your finances more effectively. By keeping a monthly record, you can spot patterns, predict future expenses, and ensure your spending aligns with your financial goals.

Monthly Expenses Templates

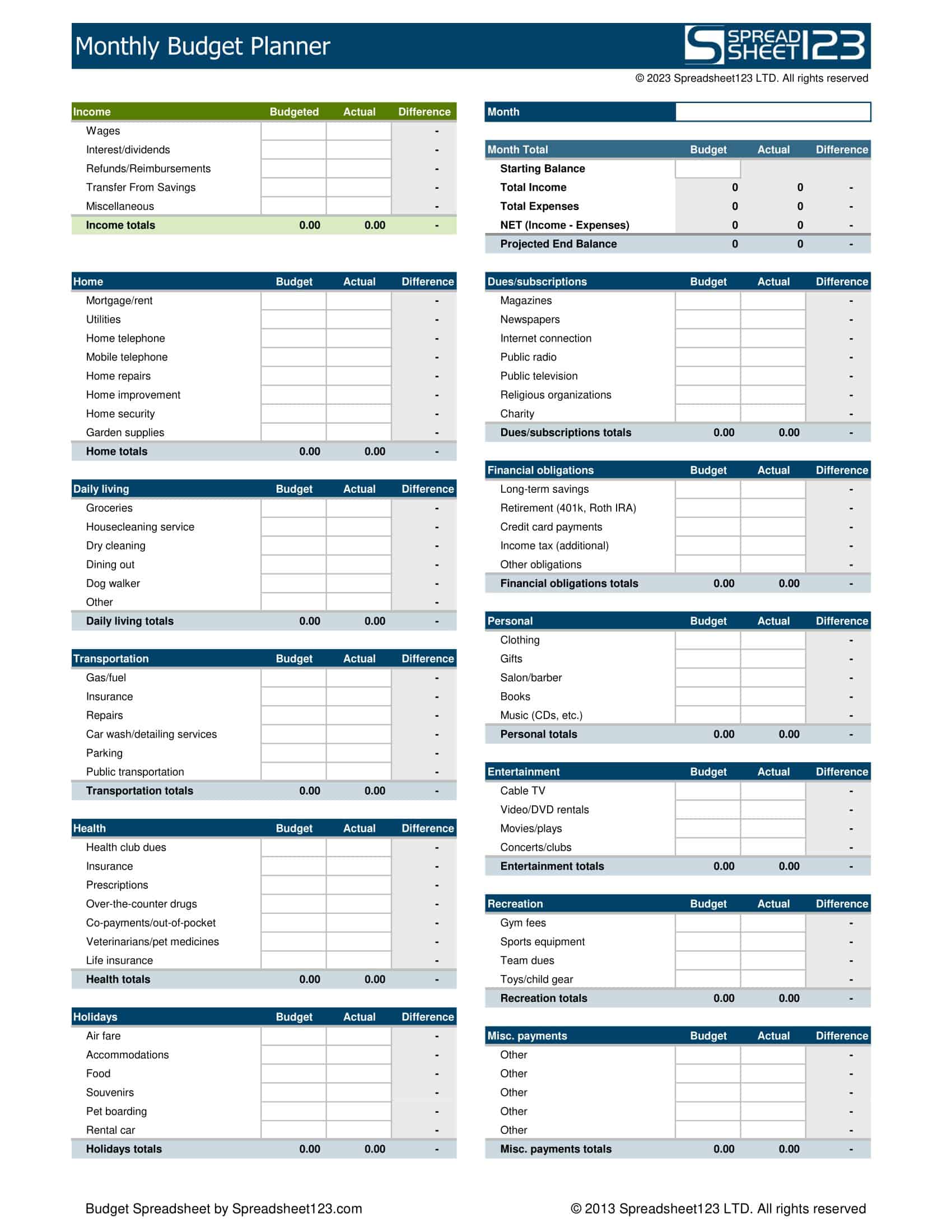

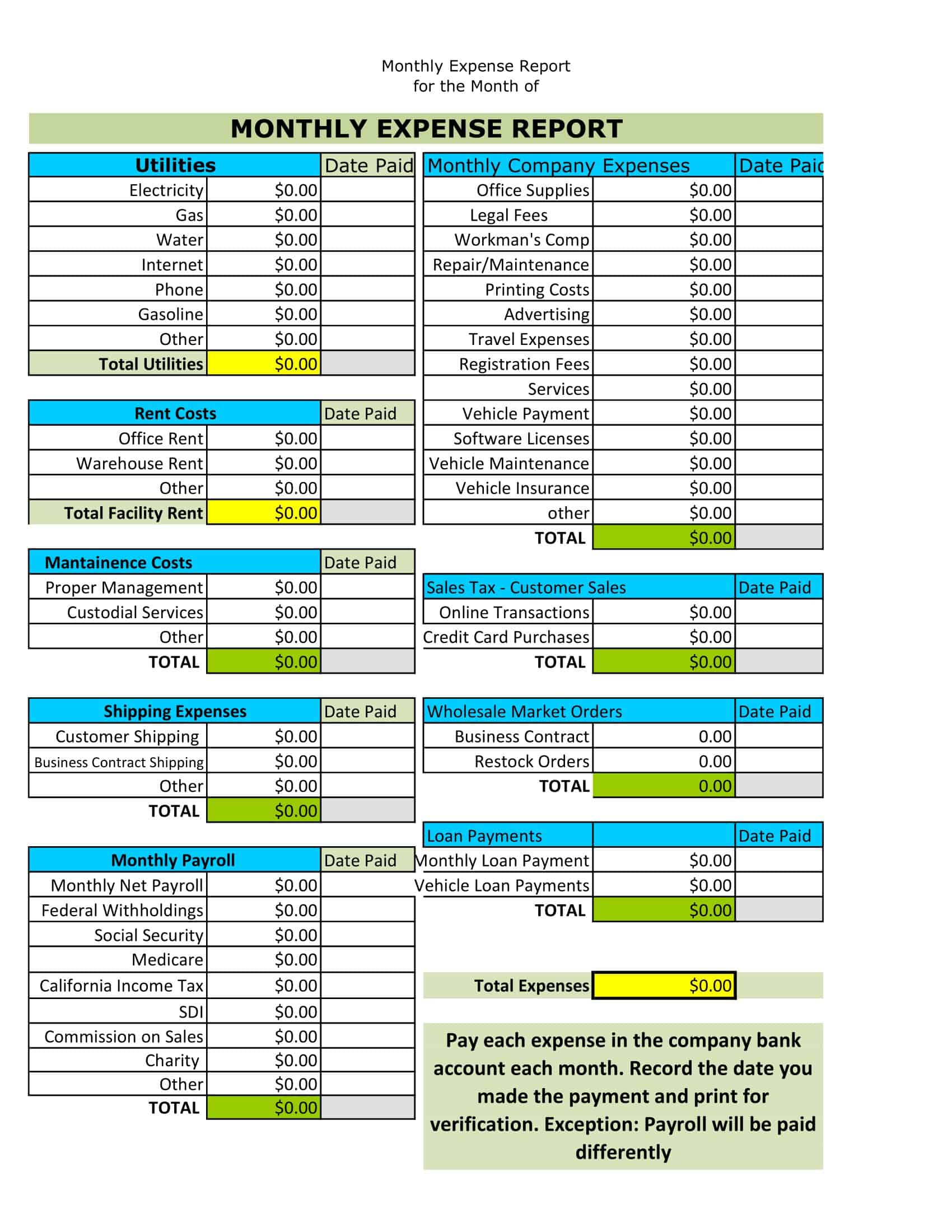

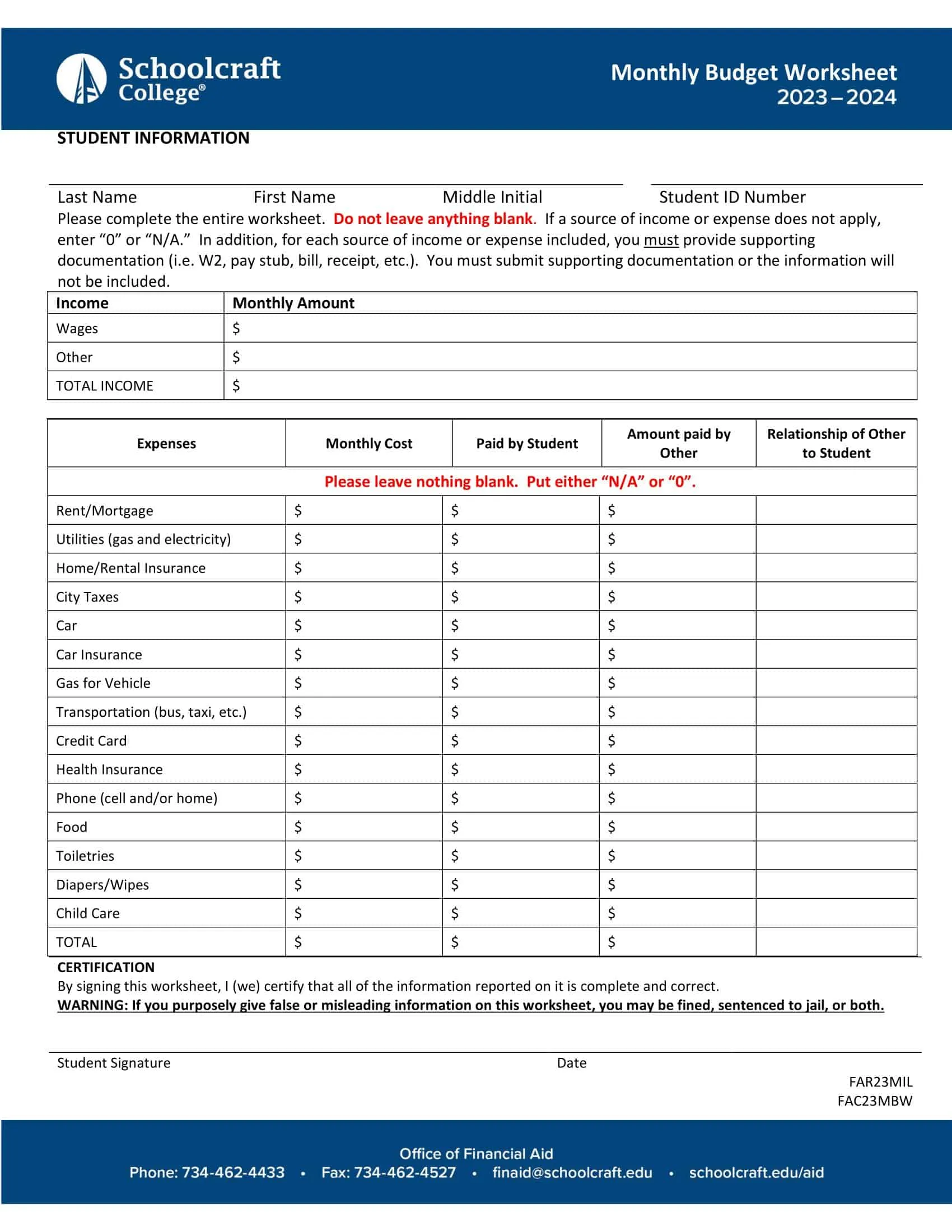

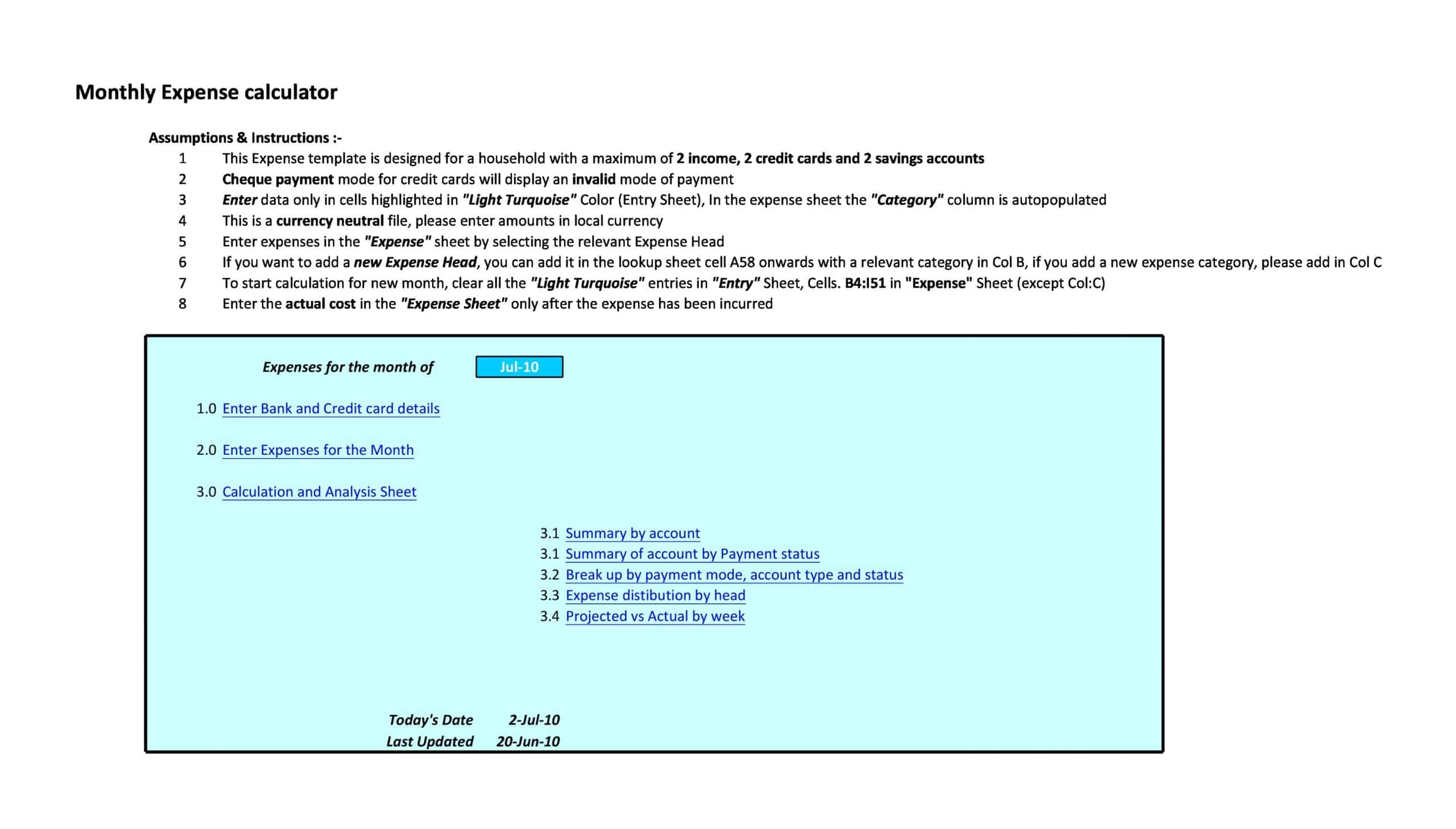

Monthly Expenses templates are preformatted documents designed for tracking and managing personal or business expenditures over a month. These templates provide a clear overview of all outgoing funds, helping users maintain a budget, save money, or audit financial habits.

Available in various formats like spreadsheets, Word documents, or PDFs, these templates feature sections for fixed expenses such as rent or mortgage, utilities, and insurance, as well as variable expenses like entertainment, dining, and shopping. They often come with date columns, expense categories, and total expenditure calculations.

Users, both individuals and businesses, rely on these templates to gain a comprehensive view of their spending patterns. They help in identifying areas of unnecessary spending and opportunities for savings.

Purpose of the Monthly Expenses Template

The Monthly Expenses serves a multitude of purposes, all intended to foster better financial awareness and management. Here’s a more detailed look at its key functions:

1. Organization of Expenses

The template aids in categorizing your expenses into specific groups such as housing, utilities, food, transportation, healthcare, entertainment, and savings. This breakdown helps you to visualize and understand your spending habits more clearly, making it easier to identify where your money is going.

2. Tracking and Record Keeping

The template is used to record all expenses incurred during the month. Regularly updating the template allows for real-time tracking, making you aware of your current financial situation at any given moment. This feature is especially important for avoiding overspending and staying within budget.

3. Identification of Spending Patterns

Over time, the Monthly Expenses Template can reveal patterns in your spending. This might include noticing that you consistently overspend in a certain category or that your expenses peak at certain times of the month or year. These insights can be extremely helpful when planning for the future.

4. Budgeting

A detailed record of your monthly expenses provides the basis for effective budgeting. By understanding how much you typically spend in each category, you can allocate funds accordingly and make changes when necessary. The template can also help you set and meet savings goals.

5. Financial Goal Setting and Monitoring

Whether you’re aiming to save for a big purchase, pay down debt, or simply maintain a healthy financial cushion, the template can assist you in setting realistic goals and tracking your progress towards them.

6. Predicting Future Expenses

By observing the trends and patterns in your spending, you can use the Monthly Expenses Template to predict future expenses. This can be particularly useful when preparing for large, predictable costs such as annual insurance premiums or holiday spending.

7. Facilitating Financial Discussions

If you share financial responsibilities with a partner or family, the template can serve as a clear, neutral platform for discussions about spending and budgeting. It can help clarify misunderstandings and ensure everyone is on the same page.

Expense Tracking Sheet

An Expense Tracking Sheet is an instrumental tool for personal finance management. It provides a structured layout for recording all monetary transactions, helping you monitor your income and outgoings, identify trends, and strategize for future savings. This comprehensive guide will delve into the various components of the Expense Tracking Sheet, detailing how to effectively use each section.

Monthly Expense Tracker

The Monthly Expense Tracker is the heart of the Expense Tracking Sheet. It’s where you jot down each expense as it occurs, broken down by date, category (e.g., rent, utilities, groceries), and amount. This ongoing record offers a clear view of your spending habits over the month, revealing where your money goes and highlighting areas where you may be overspending. It also helps maintain transparency and accountability, especially for shared expenses.

Recording Income

A key section of the Expense Tracking Sheet is dedicated to recording income. This encompasses all your earnings, such as salary, business profits, investment returns, freelance income, and any other sources. By diligently recording your income, you’ll have a comprehensive view of your total monthly earnings. This can help you in determining your budget limitations, setting spending caps, and allocating money towards savings or investments.

Tracking Fixed Expenses

Fixed expenses are those regular, recurring costs that generally stay the same from month to month—like rent or mortgage payments, insurance premiums, and car payments. By tracking these fixed expenses, you can easily forecast your budget for the upcoming months, ensuring you always allocate sufficient funds for these necessary payments.

Tracking Variable Expenses

Variable expenses fluctuate from month to month, depending on your usage or lifestyle choices. This category includes costs like groceries, entertainment, dining out, and transportation. Tracking variable expenses can be more challenging due to their unpredictability, but it’s essential for identifying areas where you could potentially cut back and save. For example, you might notice you’re spending more than expected on dining out, suggesting that you might save money by cooking at home more often.

Tracking Savings and Investments

Finally, the Expense Tracking Sheet should include a section dedicated to tracking savings and investments. This can include contributions to savings accounts, emergency funds, retirement accounts, or any other investments. Regularly monitoring this section helps you to assess the growth of your savings and investments over time. This can be incredibly motivating and offers reassurance that you’re making progress towards your long-term financial goals.

Expense Analysis and Evaluation

Expense Analysis and Evaluation is a vital aspect of personal financial management, providing insight into your spending habits, revealing potential problem areas, and assessing your overall financial health. It is a process that involves meticulous examination and evaluation of your financial transactions over a certain period. Here’s an in-depth look at the key components of Expense Analysis and Evaluation.

Analyzing Monthly Expenses

Analyzing monthly expenses involves a careful review of all your income and outgoings over the course of a month. This includes fixed expenses such as rent or mortgage payments, variable expenses like groceries or entertainment, and your savings or investments. This analysis can be facilitated by tools like a Monthly Expenses Template or Expense Tracking Sheet.

The objective here is to gain a thorough understanding of where your money is going and how your actual spending aligns with your planned budget. For example, you might discover that you’re spending a significant portion of your income on dining out, or that your utility bills have been creeping up over the past few months.

Identifying Areas of Overspending

A crucial part of Expense Analysis is the identification of areas where you might be overspending. This usually involves comparing your spending in each category to the average or recommended spending percentages. For instance, if you’re spending 50% of your income on housing when the suggested allocation is 30%, you’ve identified a potential area of overspending.

The detection of overspending is essential because it can negatively impact your ability to save, invest, or meet other financial goals. By identifying these areas, you can strategize on ways to reduce spending—whether that’s downsizing to a cheaper home, opting for a less expensive phone plan, or cutting back on discretionary expenses like entertainment.

Evaluating Financial Health

The final step of the Expense Analysis and Evaluation process is an assessment of your overall financial health. This is a comprehensive evaluation that considers not only your spending and saving habits but also other indicators such as debt-to-income ratio, savings rate, net worth, and progress towards financial goals.

An evaluation of financial health can reveal whether you’re living within your means, whether you’re on track to meet your financial goals, and whether any changes need to be made to improve your financial situation. For instance, you might find that while your spending is reasonable, your savings rate is low, indicating a need to increase savings or invest more aggressively.

Tips for Reducing Expenses

Reducing expenses is a key step towards achieving financial stability and meeting your savings goals. It involves cutting down on non-essential spending, finding ways to save on necessary costs, and reassessing your financial habits. Here are some comprehensive tips on how to effectively reduce your expenses.

Cutting Unnecessary Costs

The first step to reducing expenses is eliminating unnecessary costs. This includes reviewing your monthly expenditures and identifying any discretionary spending that you can live without. For instance, you might have subscriptions or memberships that you rarely use or luxury items that you can cut back on. It’s important to differentiate between wants and needs, prioritizing essential expenses and eliminating or minimizing the non-essentials.

Saving on Utilities

Utilities are a necessary cost, but there are several ways you can reduce these expenses. To save on electricity, consider using energy-efficient appliances, unplugging devices when not in use, and making use of natural light during the day. Water bills can be reduced by fixing leaky faucets, taking shorter showers, and using a water-saving washing machine. You can save on heating and cooling costs by maintaining your HVAC system, using insulation, and adjusting your thermostat by a few degrees.

Reducing Food and Grocery Expenses

Food is another major expense, but there are numerous ways to save. You can plan your meals for the week and make a detailed shopping list to avoid impulse buys. Opt for generic brands when possible, as they often offer the same quality for a lower price. Buying in bulk can be economical for non-perishable items, while cooking at home instead of dining out can result in significant savings. Moreover, using coupons and shopping during sales can further reduce your grocery expenses.

Lowering Transportation Costs

Transportation costs can be minimized in several ways. If possible, consider using public transportation, carpooling, biking, or walking instead of driving. If you own a car, regular maintenance can prevent costly repairs down the line, and driving efficiently (avoiding rapid acceleration and deceleration) can save on fuel costs. Additionally, shopping around for the best insurance rates can also lead to savings.

Minimizing Entertainment Expenses

Entertainment expenses can add up quickly, but there are ways to enjoy your free time without breaking the bank. Consider less expensive or free activities, like hiking, reading, or hosting a game night at home. Take advantage of free events in your community, such as concerts in the park or free museum days. Cut back on expensive cable packages and choose a more affordable streaming service instead.

How do I create a monthly expense spreadsheet?

Creating a monthly expense spreadsheet is a fundamental step towards better financial management. Here’s a step-by-step guide on how to create one using a tool like Microsoft Excel or Google Sheets:

Step 1: Open a New Spreadsheet

Start by opening your chosen spreadsheet software and creating a new, blank spreadsheet. Name your document something descriptive like “Monthly Expense Spreadsheet” for easy reference in the future.

Step 2: Set Up Your Columns

In the first row, you’ll want to set up your column headers. These headers will vary depending on your individual needs, but they typically include categories such as:

- Date

- Category (Rent, Utilities, Groceries, etc.)

- Description

- Amount

Step 3: Create Expense Categories

In the ‘Category’ column, list all the types of expenses you have in a month. These could include Housing (rent or mortgage), Utilities (electricity, water, internet), Transportation (car payments, fuel, public transit), Food, Entertainment, Healthcare, Personal Care, Savings, and so on.

Step 4: Input Your Expenses

For each expense you incur, fill in the appropriate cells. Include the date of the transaction, the category it falls under, a brief description for your reference, and the amount spent. Ensure that you update this spreadsheet regularly to maintain accuracy.

Step 5: Set Up Automatic Sum Functions

At the end of the ‘Amount’ column, you’ll want to set up a function that automatically sums up your expenses. This is done by typing “=SUM()” into the cell, replacing the parentheses with the range of cells you want to add up. For example, if your expenses are listed in cells B2 through B31, you would type “=SUM(B2:B31)”.

Step 6: Create Category Totals

To see how much you’re spending in each category, you can create a section where you add up all the expenses per category. This could be on the side or bottom of your spreadsheet. You would use the same SUM function, but this time you would add criteria to only sum the expenses in a specific category. For example, “=SUMIF(B2:B31,”Rent”,D2:D31)” to add up all rent expenses.

Step 7: Incorporate Income and Savings

It may also be beneficial to track your income and savings in the same spreadsheet. You can do this by adding additional categories in the same ‘Category’ column or by creating separate sections on the spreadsheet.

Step 8: Review and Analyze

Regularly review your spreadsheet to understand your spending patterns. Look for areas where you might be overspending and think about how you can cut costs.

Step 9: Adjust and Improve

Your monthly expense spreadsheet should be a living document. As your expenses or income change, or as you identify more detailed categories you want to track, adjust your spreadsheet accordingly.

FAQs

How often should I update my Monthly Expenses Template?

It is recommended to update your Monthly Expenses Template regularly to ensure accurate tracking of your expenses. Updating it weekly or bi-weekly is a good practice to stay on top of your spending. This frequency allows you to catch any discrepancies, make adjustments to your budget if necessary, and maintain an up-to-date overview of your finances.

Can I use a Monthly Expenses Template to track investments or savings?

While a Monthly Expenses Template primarily focuses on tracking expenses, you can adapt it to include sections for tracking investments or savings. You can create additional categories or columns specifically dedicated to recording investment contributions, returns, or savings deposits. This allows you to have a comprehensive overview of your financial inflows and outflows in one place. Alternatively, you may explore specialized investment or savings tracking tools for more detailed analysis and management.

How do I create a monthly expense spreadsheet?

To create a monthly expense spreadsheet, use a table with rows for expense categories like housing, transportation and columns for months. Enter anticipated or actual costs per category per month. Subtotal by category and sum monthly totals. This breakdown informs budgeting and tracks spending trends.

How do I plan my expenses for a month?

Effective ways to plan monthly expenses are: List your previous 2 month’s expenditures to categorize spending patterns, determine essential vs discretionary costs to prioritize goals aligned to values, research anticipated irregular bills coming due seasonally, project average costs for variable items like groceries or gas.

What is the 50 30 20 rule?

The 50/30/20 budgeting guideline recommends: 50% of net income covers essentials like housing, utilities, transportation 30% toward lifestyle expenses for things like dining, travel, entertainment 20% goes to building savings and repaying debts

How do you write down monthly expenses?

To write down monthly expenses by hand, get a small notebook, create expense category sections like “Groceries”, “Childcare”, “Mortgage”. Date entries when purchases occur, log cost next to items/services, tally category totals monthly adding up receipts. Transfer totals later into spreadsheets. Apps help automate tracking.

Are there any advantages to using digital templates over paper-based methods?

Yes, using digital templates for tracking monthly expenses offers several advantages over paper-based methods:

- Automated calculations: Digital templates often include built-in formulas or functions that automatically calculate totals, saving you time and reducing the chances of calculation errors.

- Easy organization: Digital templates allow you to sort, filter, and search data easily, enabling efficient organization and analysis of your expenses.

- Accessibility: Digital templates can be accessed and updated from various devices, making it convenient to record expenses on the go.

- Data backup: Electronic templates can be backed up regularly to prevent data loss, whereas paper-based methods may be susceptible to damage or loss.

- Flexibility and customization: Digital templates can be easily customized to suit your needs, and you can adjust columns, categories, and formatting with ease.

- Integration with other tools: Digital templates can be integrated with personal finance apps or accounting software, providing a seamless flow of data and additional financial insights.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)