As a responsible person, you ought to know how important legally appointing an agent for your power of attorney is. Some people have been claiming that they can look after themselves, but this may prove fatal to them in the end. Therefore, it is crucial to designate an agent when you are living alone and do not have any next of kin.

When we are incapacitated with illness or accident, no matter how minor or chronic, we can’t handle our personal affairs such as managing bank accounts, paying bills, filing tax returns, and more. In such a situation, the executor/ attorney, in fact, comes into the picture as they help you to take care of these things by stepping in your shoes.

A power of attorney regards are filed with courts or notaries public, and they should be used only when you cannot make decisions on your own. The two most common types of these forms are durable and medical power of attorney. Both vary a bit in terms of their usage, and small changes can be made according to your liking while making it.

Table of Contents

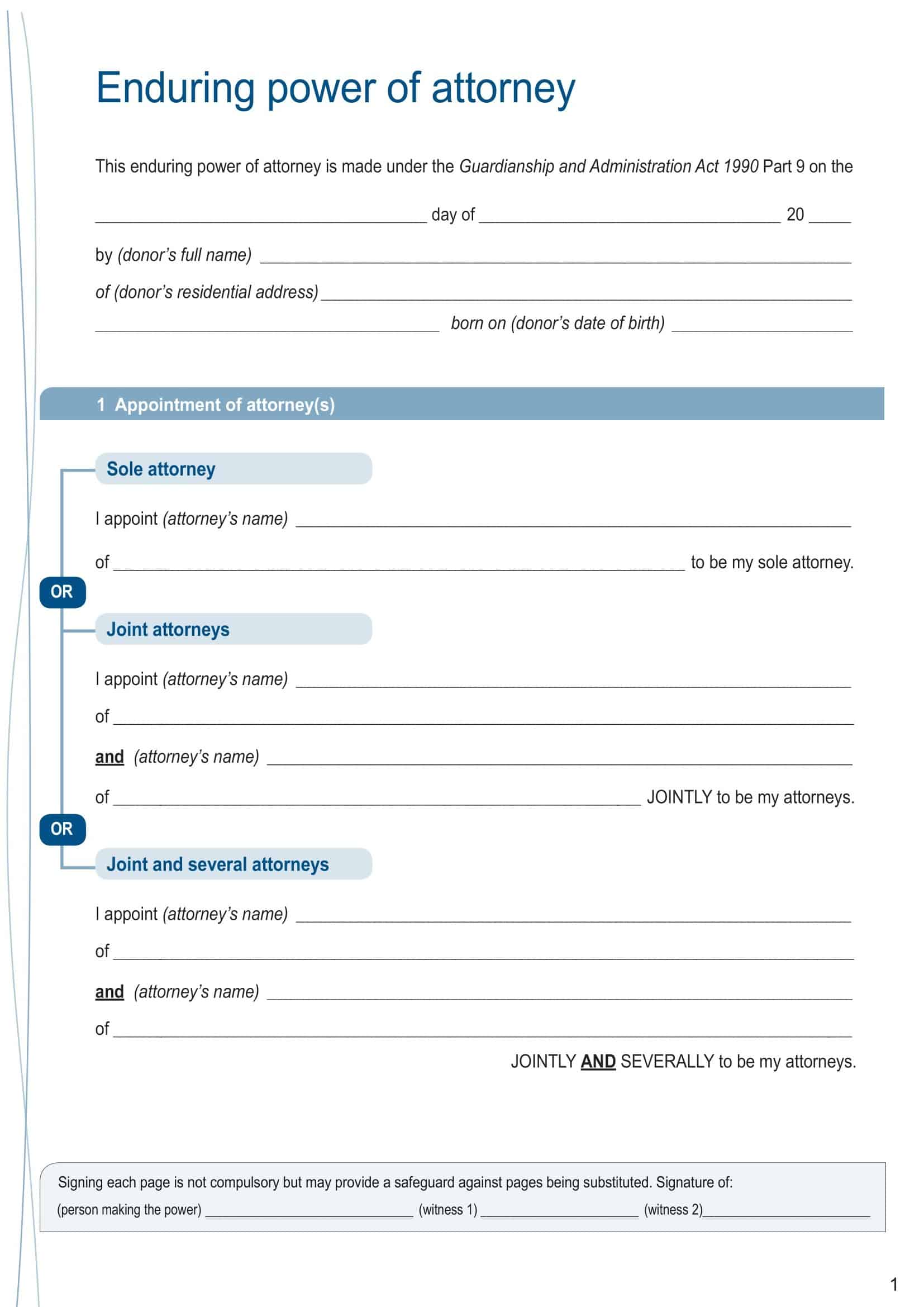

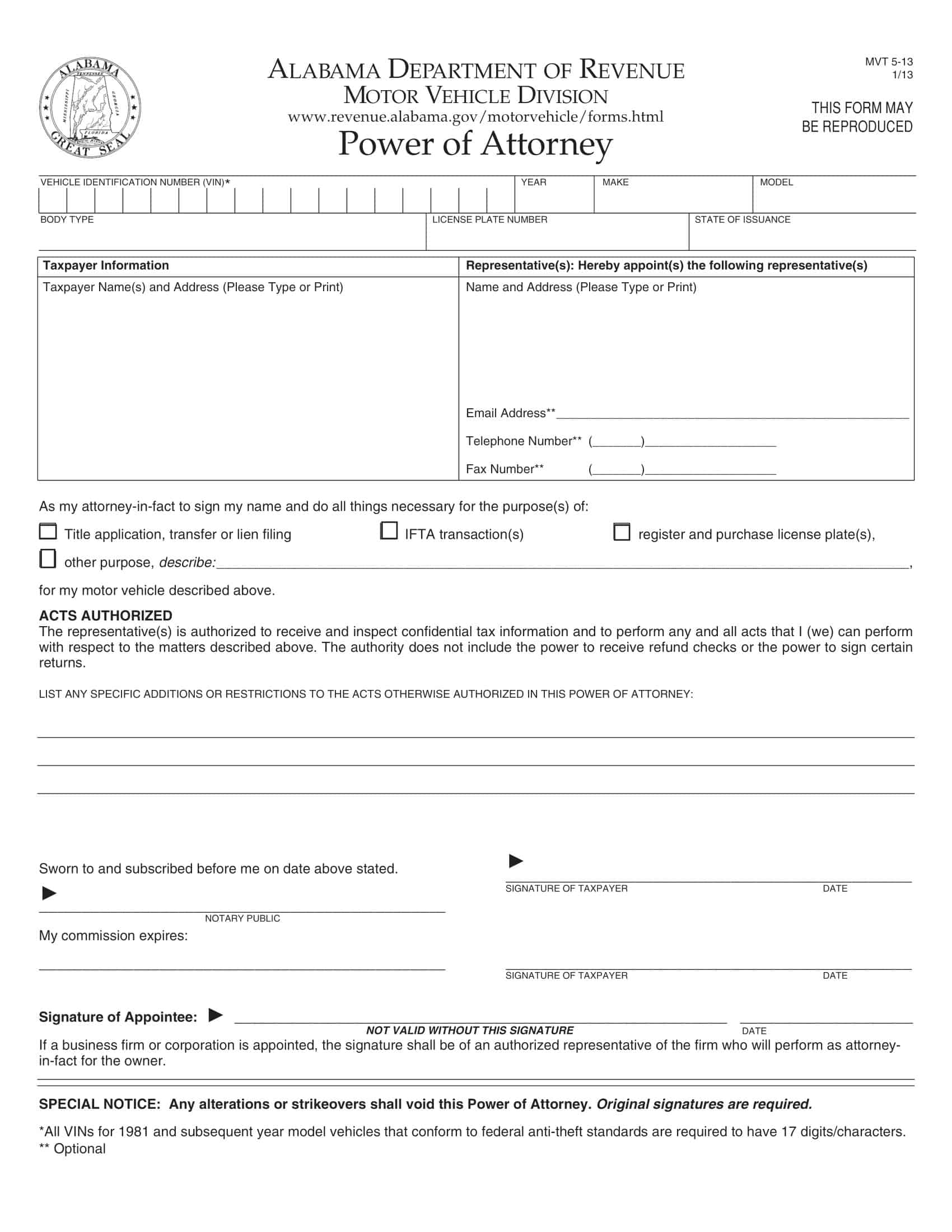

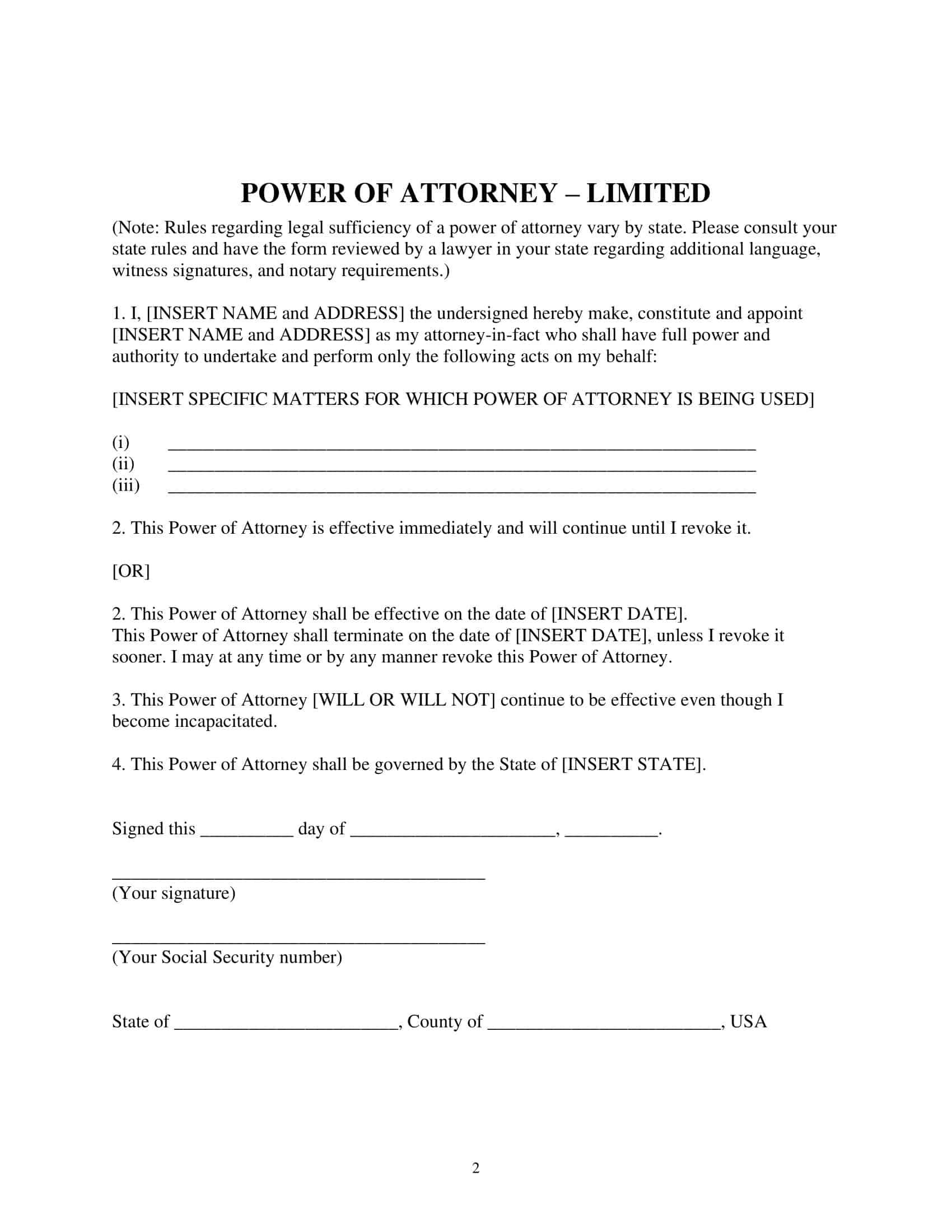

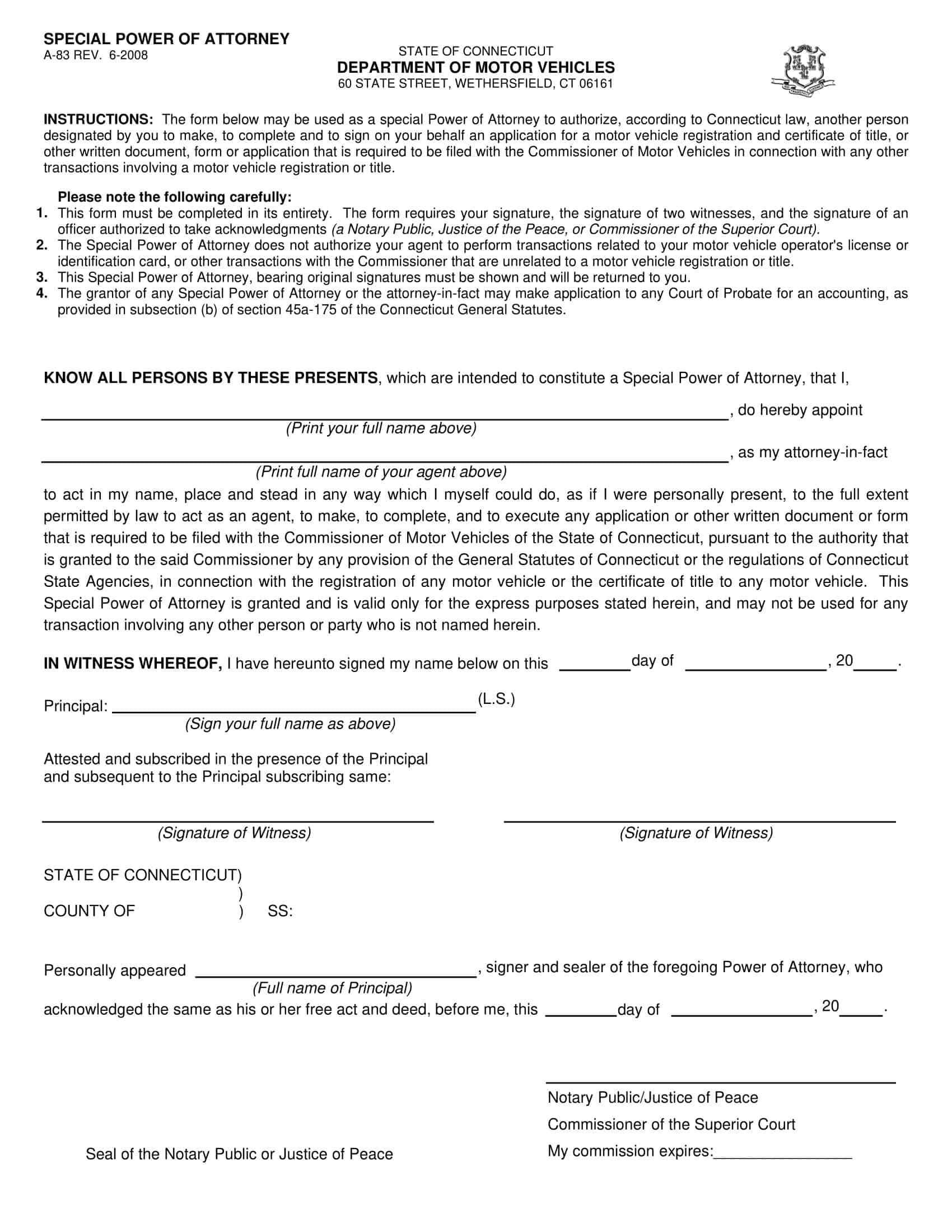

Power of Attorney Form Templates

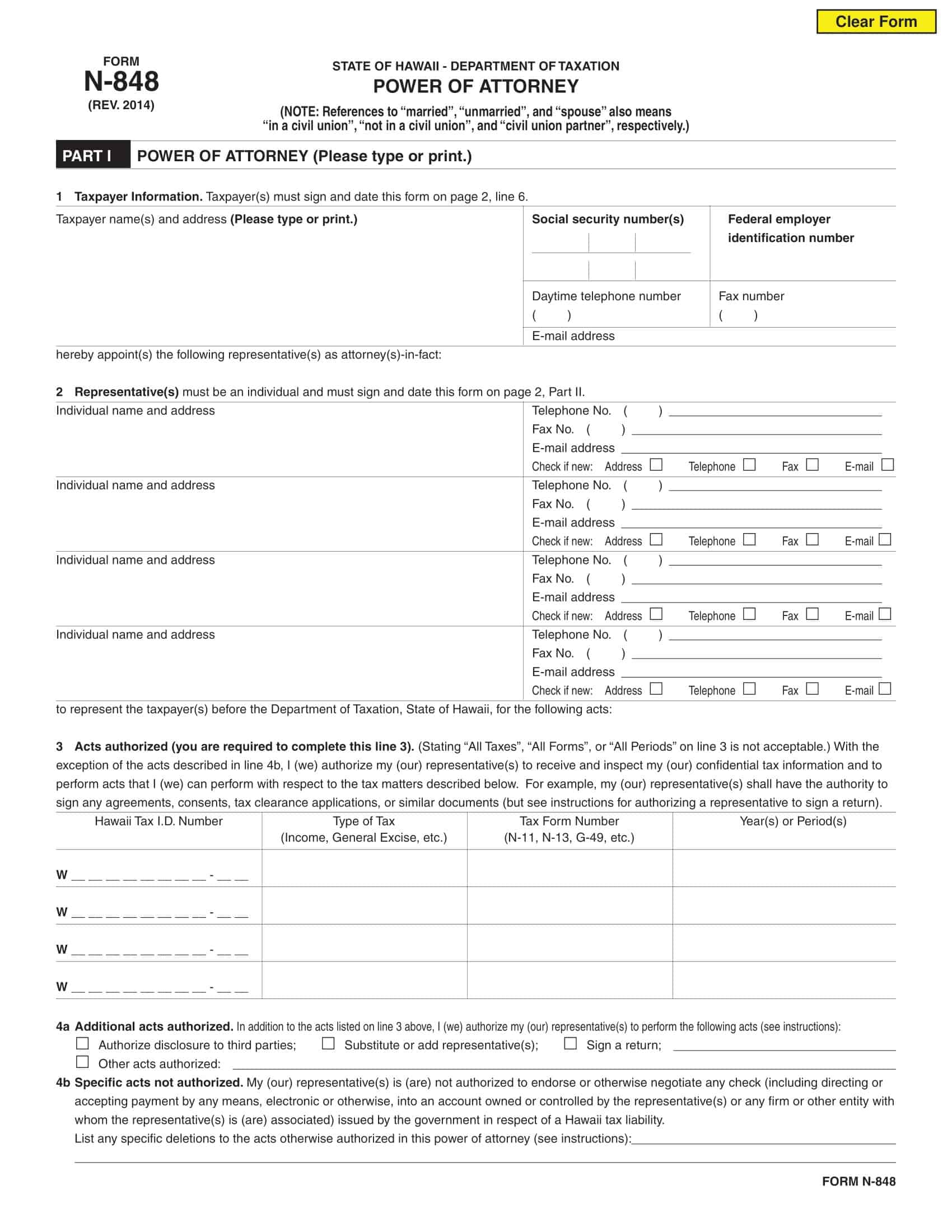

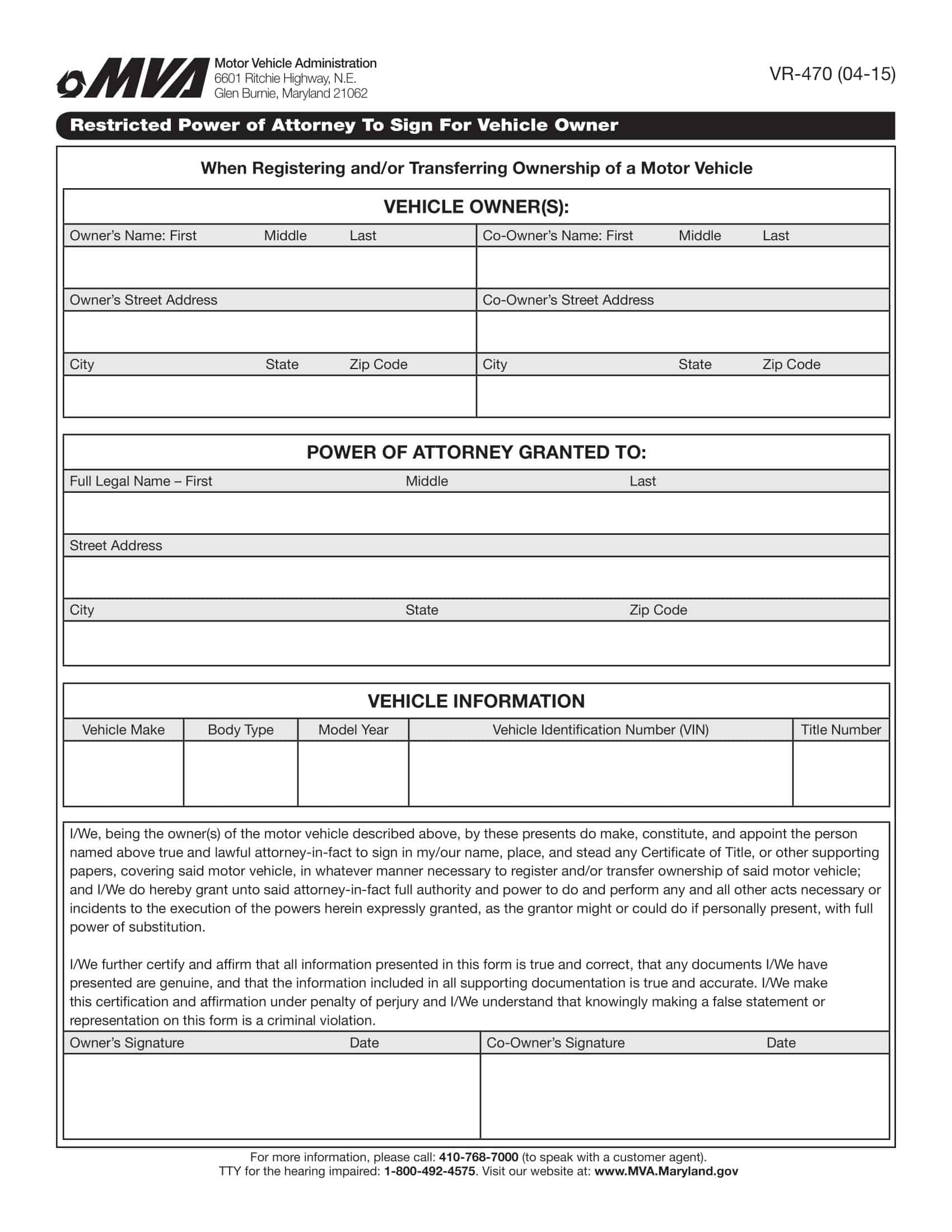

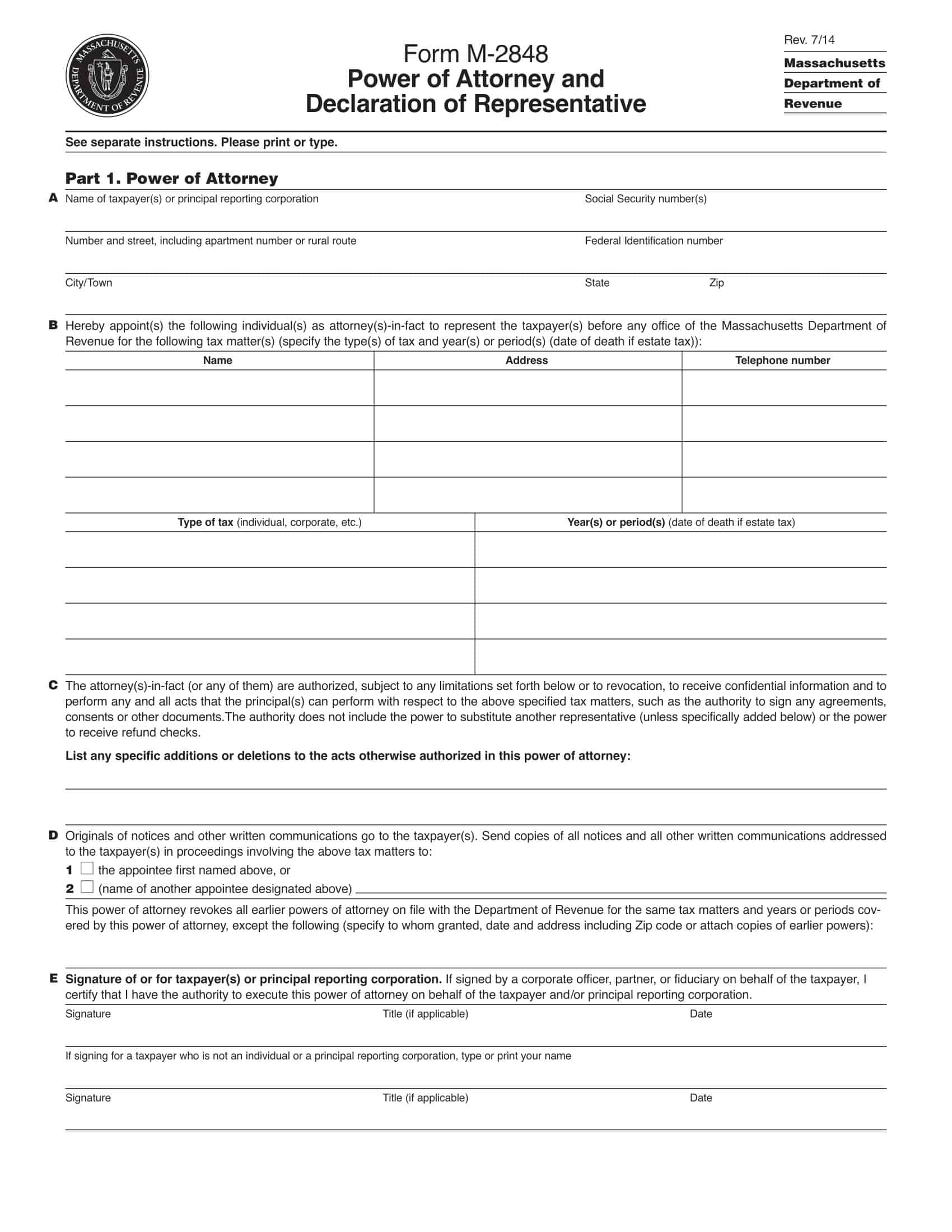

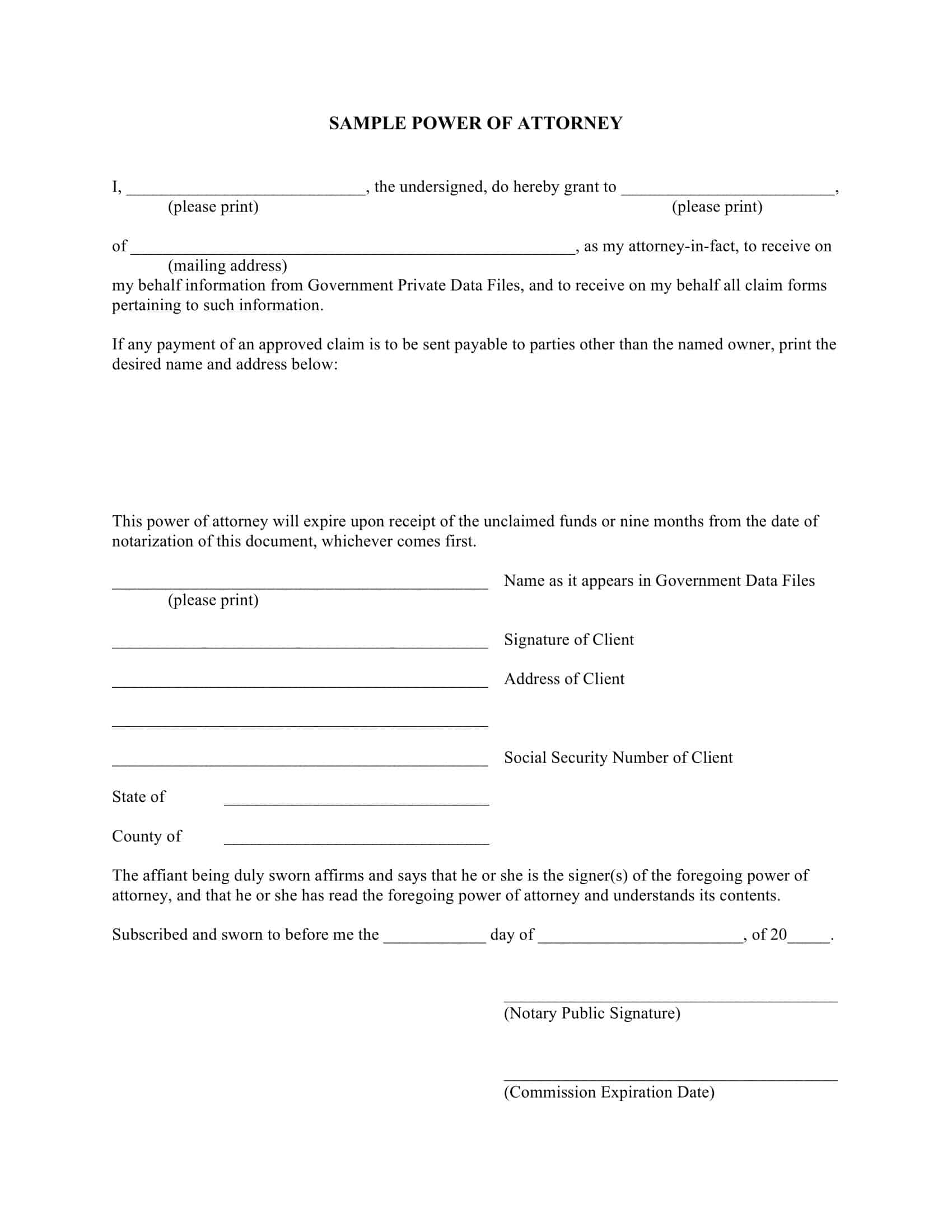

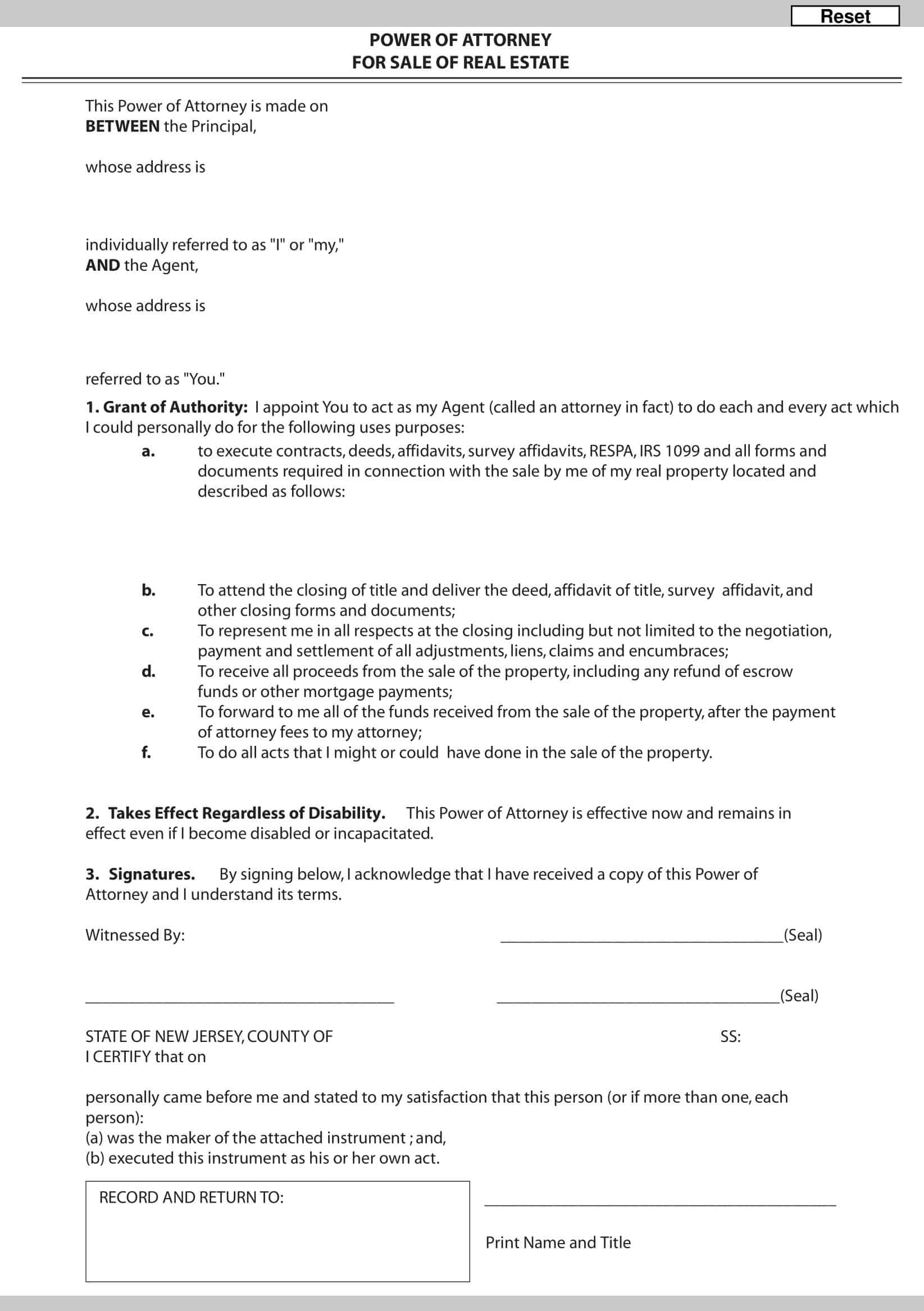

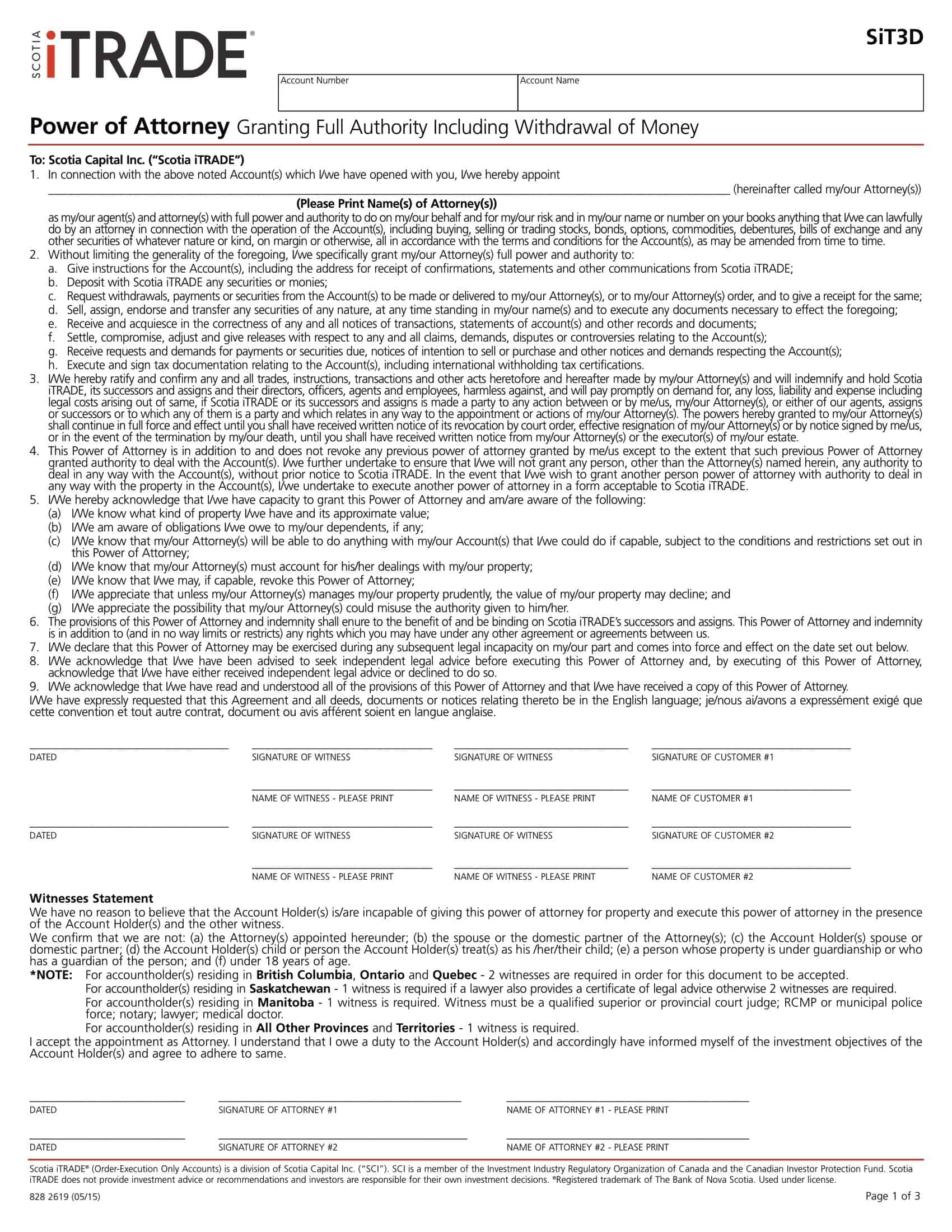

Power of Attorney Templates are legally binding documents that grant someone the authority to act on behalf of another person (referred to as the “principal”) in various legal, financial, or personal matters. These templates provide a standardized format for creating a power of attorney document, ensuring clarity, consistency, and compliance with legal requirements. Power of Attorney Templates serve as essential tools in delegating decision-making authority and ensuring seamless representation when the principal is unable to act or make decisions themselves.

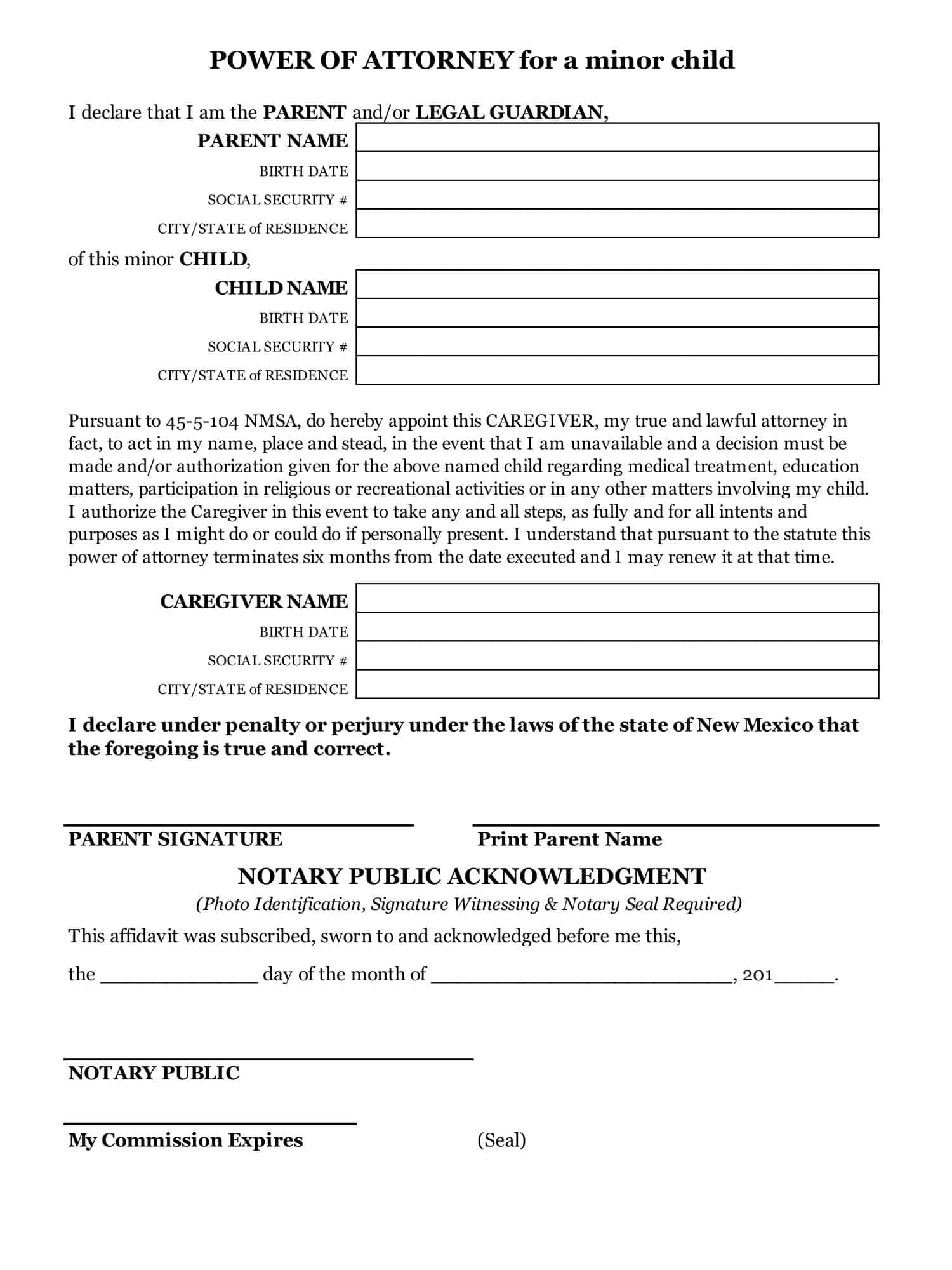

Power of Attorney Templates are used in various situations where an individual wants to grant decision-making authority to another person. This could include instances where the principal is traveling, facing a medical condition, or simply desires assistance in managing their affairs. These templates provide a clear and formal mechanism to designate a trusted individual to act on their behalf. It is important to consult with legal professionals or relevant authorities to ensure that the Power of Attorney Template aligns with the specific legal requirements in the applicable jurisdiction.

What is the Power of Attorney?

A power of attorney is a legal form that should be followed within the states of the United States. A power of attorney is created when someone appoints another individual to handle their financial, real estate, administrative or personal property matters if they get injured, incapacitated, or undergo any mental conditions that prevent them from performing their responsibilities.

Why Do You Need a Power of Attorney?

The primary role of a power of attorney is to grant another person (called an agent) the authority to handle your financial and legal matters. This document can be used to transfer your business and sell the real estate property if you cannot handle these matters.

A power of attorney is also recognized in family law, for example, for creating durable financial powers of attorney for health care. Delegating yourself from several tasks does not mean that you don’t have control over who can act for you. Following a few simple steps, you can sign the power of attorney form without let or hindrance from any third party.

When Do You Need a Power of Attorney?

Many situations may require you to have power of attorney. In fact, your loved ones could be at a loss of what to do if you were incapacitated and didn’t have one. For instance, let’s say you had a heart attack and were in a coma. If your loved ones do not know what to do, they might not be able to get access to your account information directly. Some other examples include if you were unable to communicate with loved ones because of a medical condition or an accident where medical treatment is needed. Knowing the need for a power of attorney would have made things much easier for your family and friends in situations such as this.

Living Trust

A living trust allows you to keep your assets separate from your estate and also protects your assets in case of creditors. When you have a power of attorney for finances, it simply allows you to have another trusted person with the power to act in place of someone else’s authority.

Married Couples

On the other hand, if you have a power of attorney, it means you have the authority to manage the assets and liabilities of your spouse. A power of attorney gives you the power to sell assets you own jointly with your spouse, open joint accounts with new partners, and close old accounts. So for married couples, we think it’s best to have a power of attorney.

Own Joint Tenancy Property

A joint tenancy or JT property lets several people create ownership on a single property. With this type of ownership, each owner takes part in the decision-making process. Each owner also possesses their own share in the said property. For example, if you and your friends decide to buy a house on a joint tenancy, then when you become incapacitated, your friends can utilize that money for you by using their power of attorney on your bank account.

How much does it cost to get a power of attorney?

It will cost you about $450 to have a power of attorney created by a lawyer. If you want an online power of attorney, expect to pay in the range of $300 to $500, depending on the site. Online services allow you to create a power of attorney online for free, but then you might want to get it notarized, which can add another $50 to $100 to the cost.

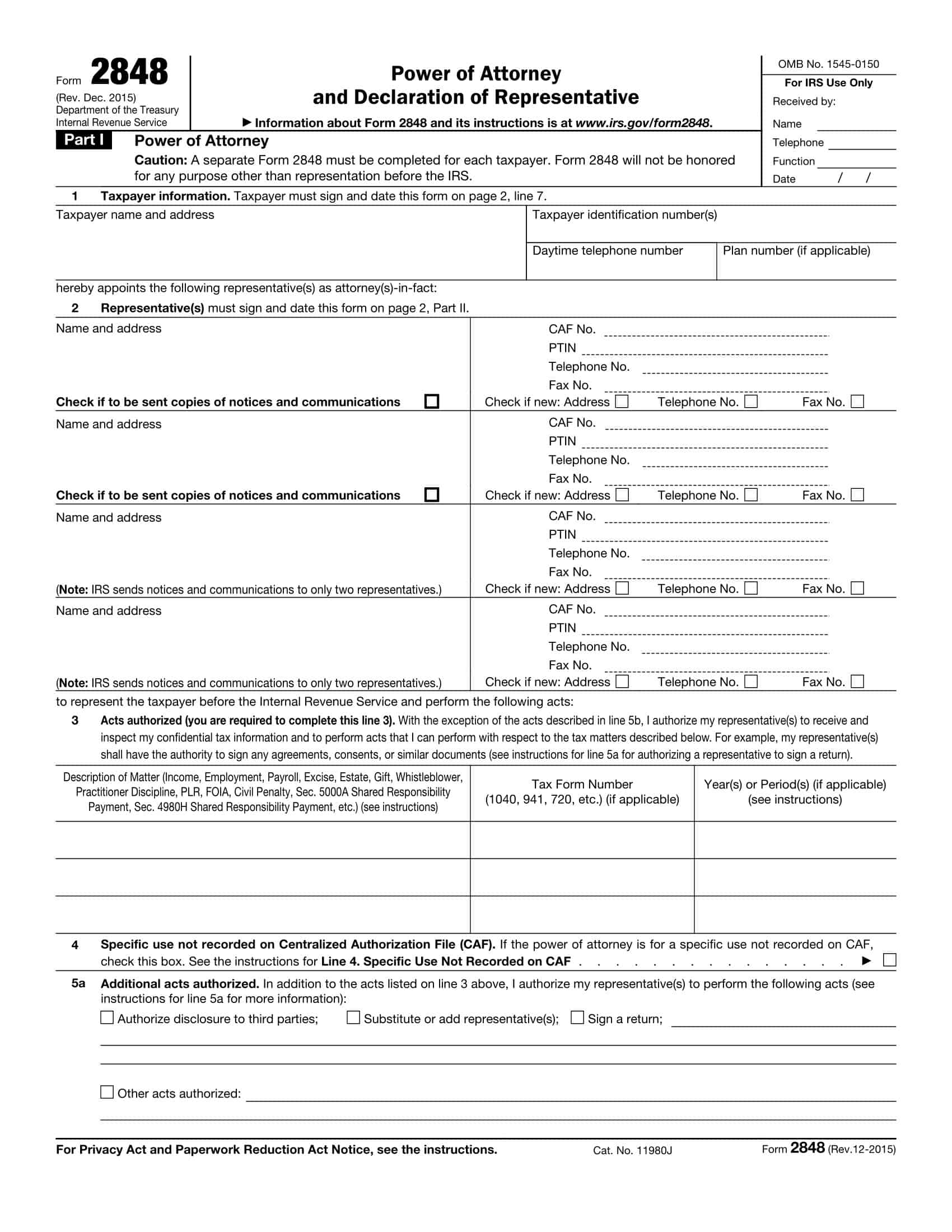

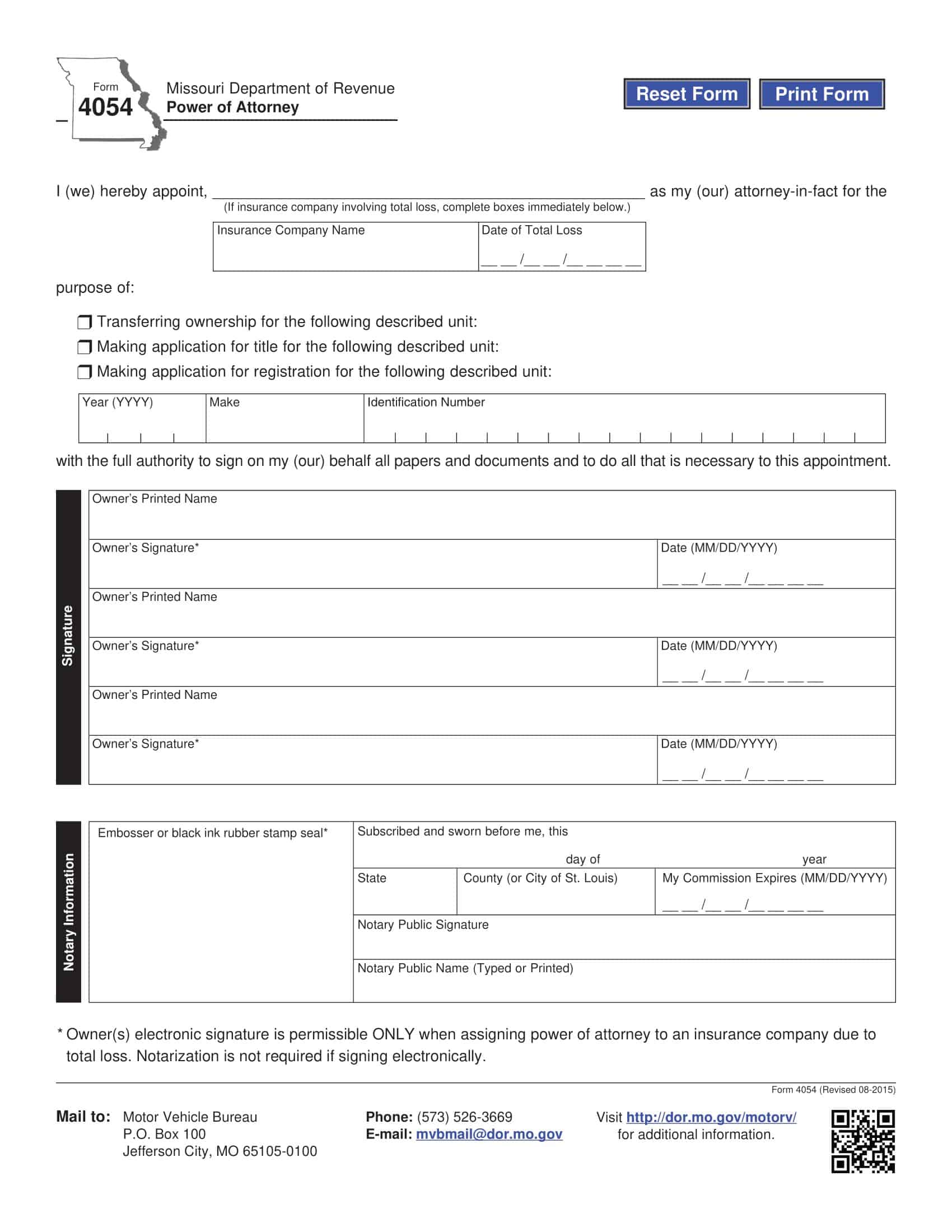

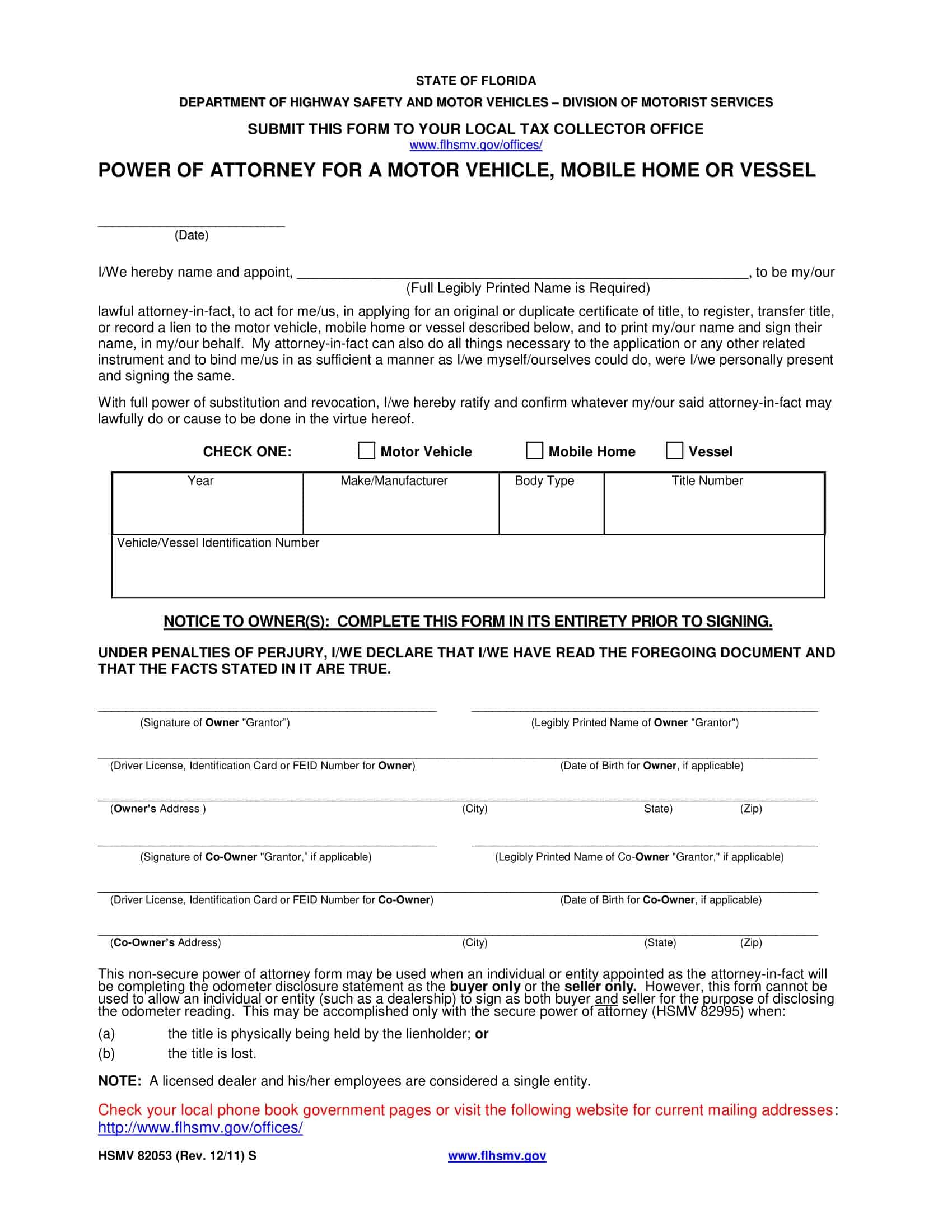

Types of Power of Attorney

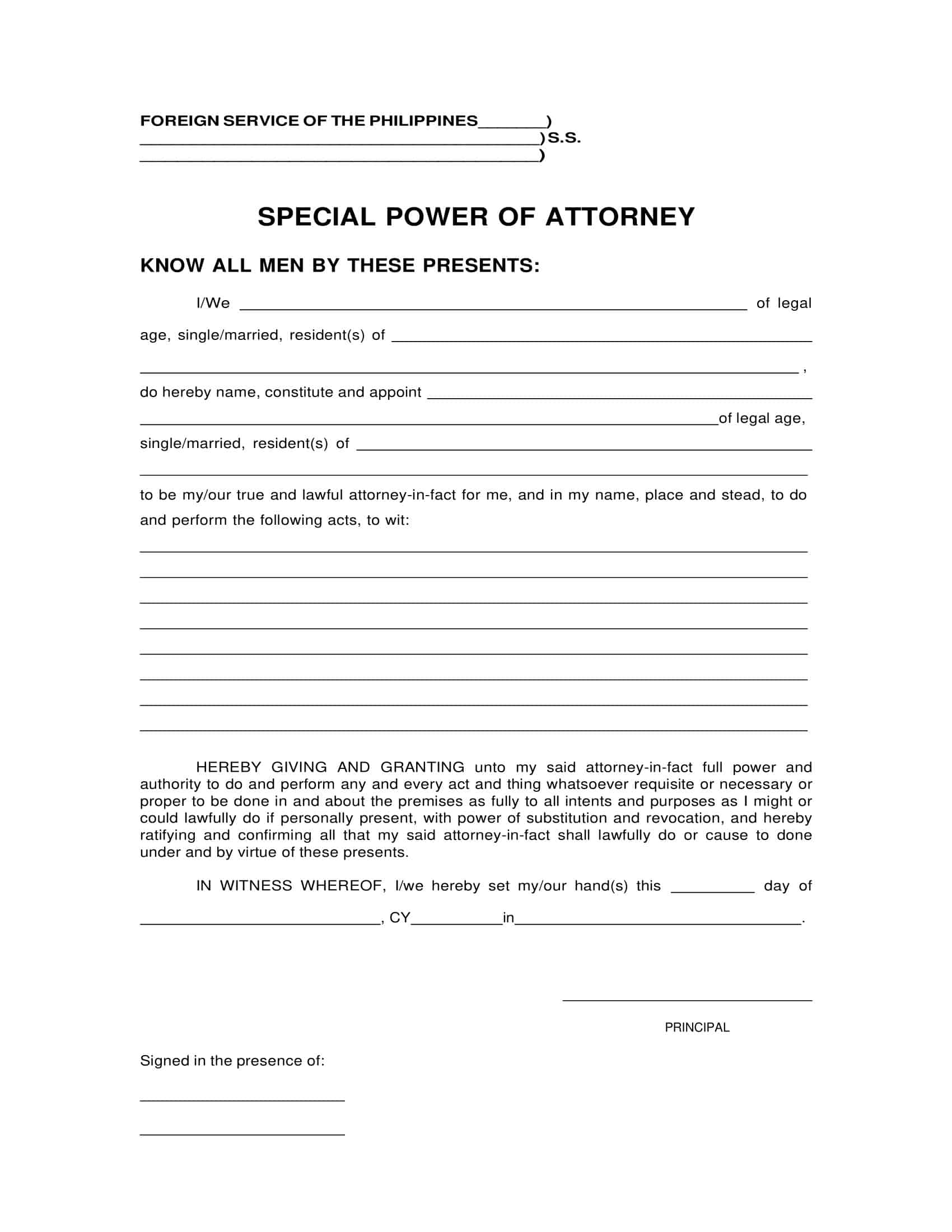

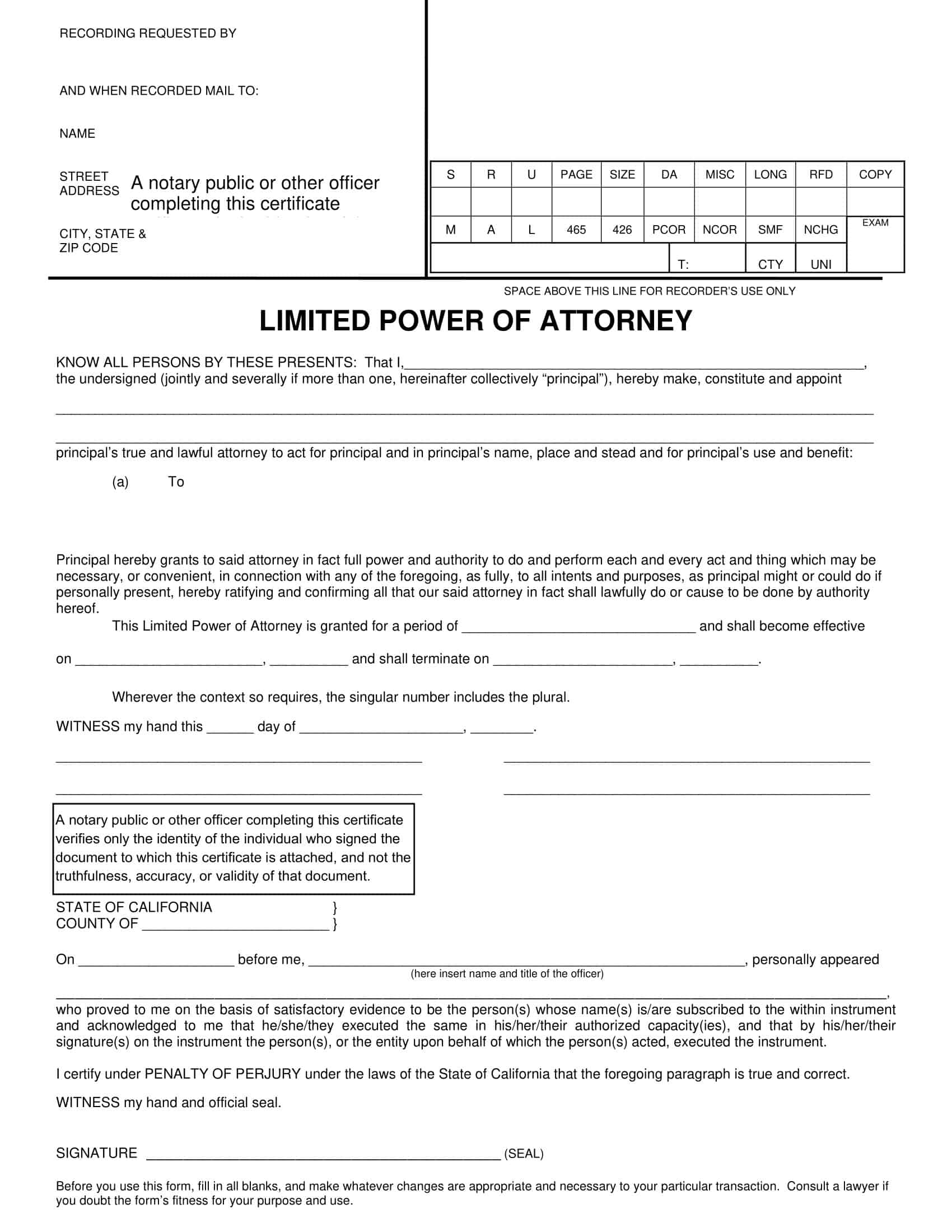

Power of attorney is an instrument by which one person grants the powers in their favor to another. It is a legal document that deals with some of the most essential matters of life. Naturally, there are many such documents available, and you should be selective in picking the best one for your purpose. There are various types of power of attorney.

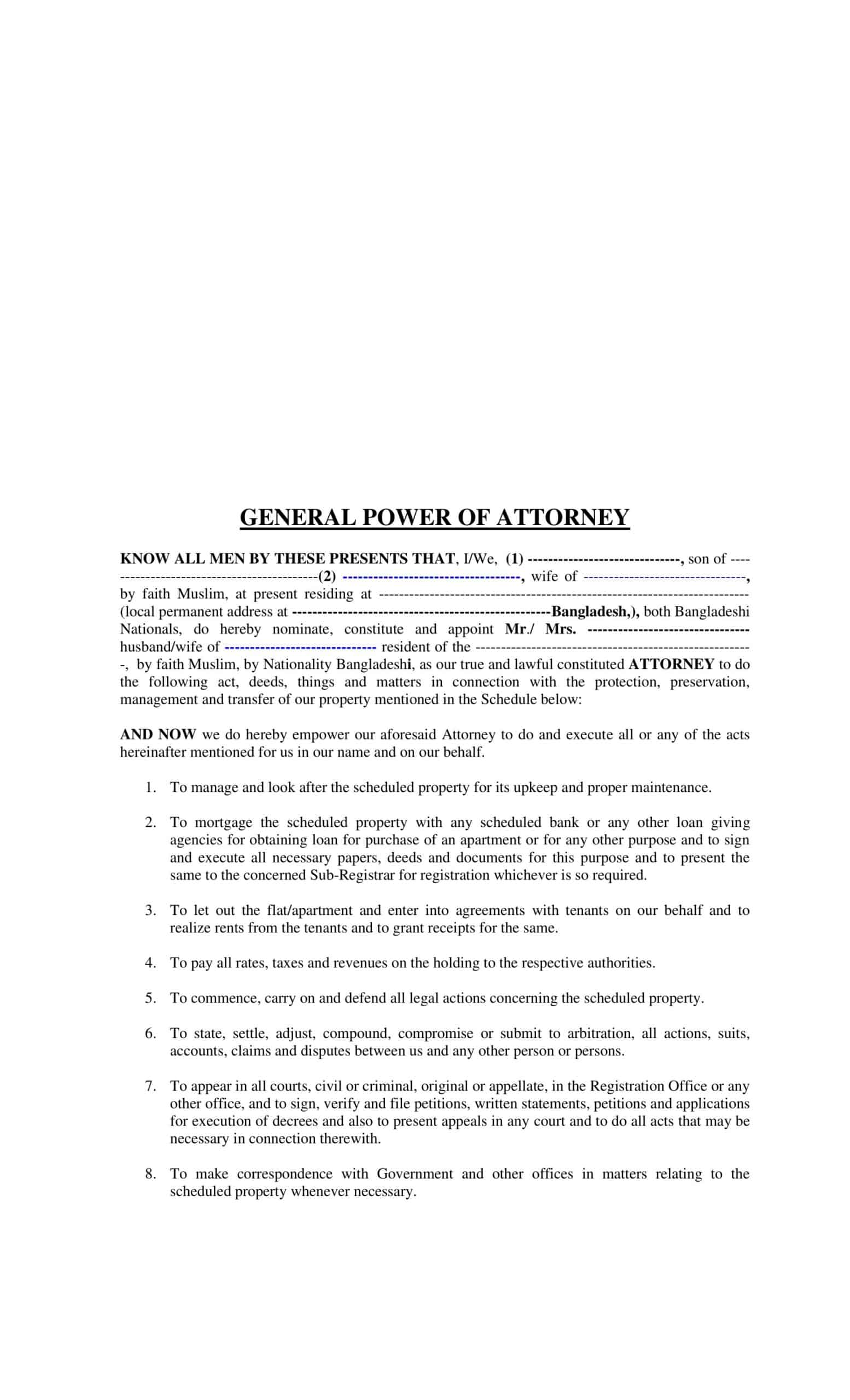

General Power of Attorney

A general power of attorney is a legal document that empowers another individual, called the “agent,” to act on your behalf. If you have not specified a limited time frame for the agent to act, a power of attorney may remain in effect indefinitely. This will give your agent the ability to represent you until they choose to relinquish the responsibility or until you rescind it. For example, if you provide someone with a limited power of attorney, they can make medical decisions on your behalf if you become too ill to make rational decisions.

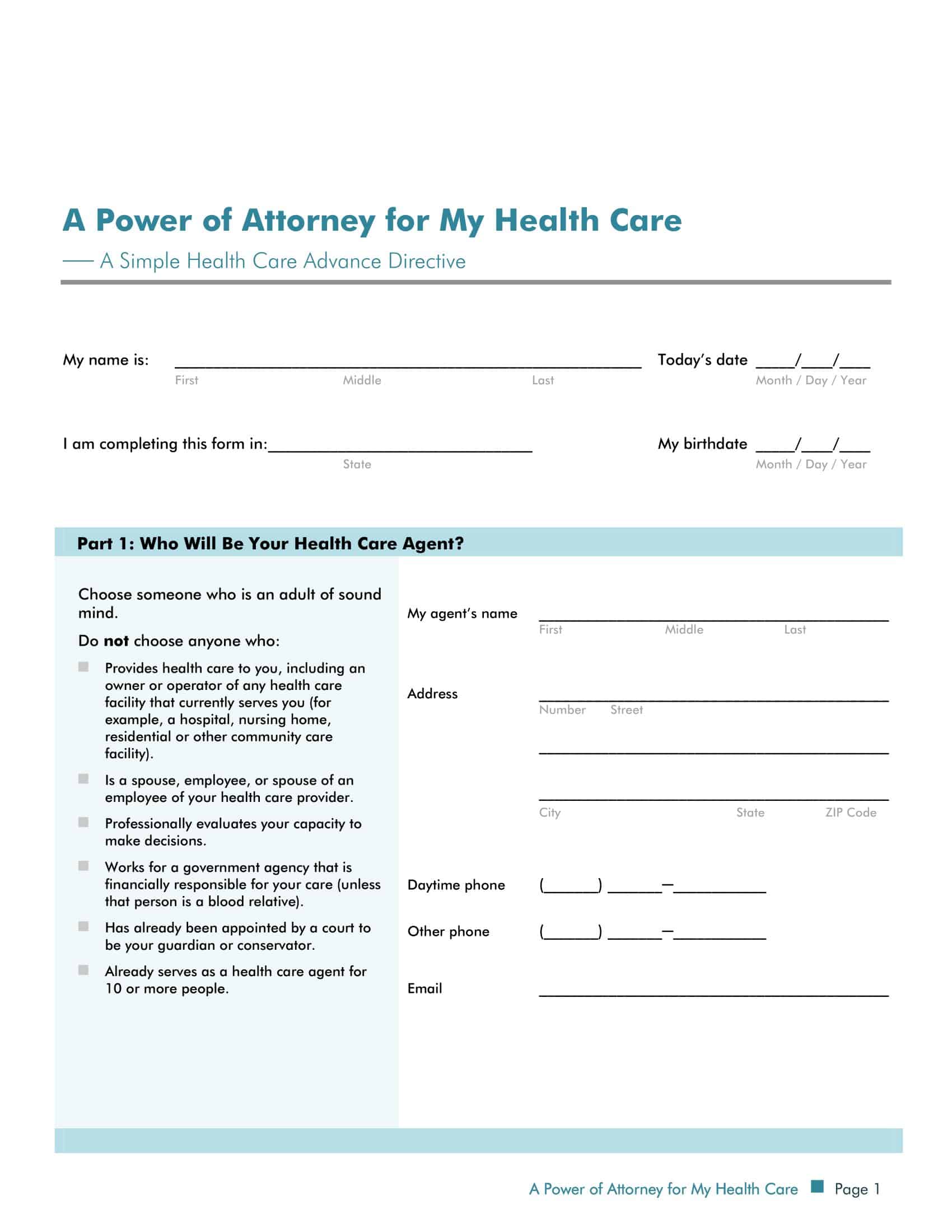

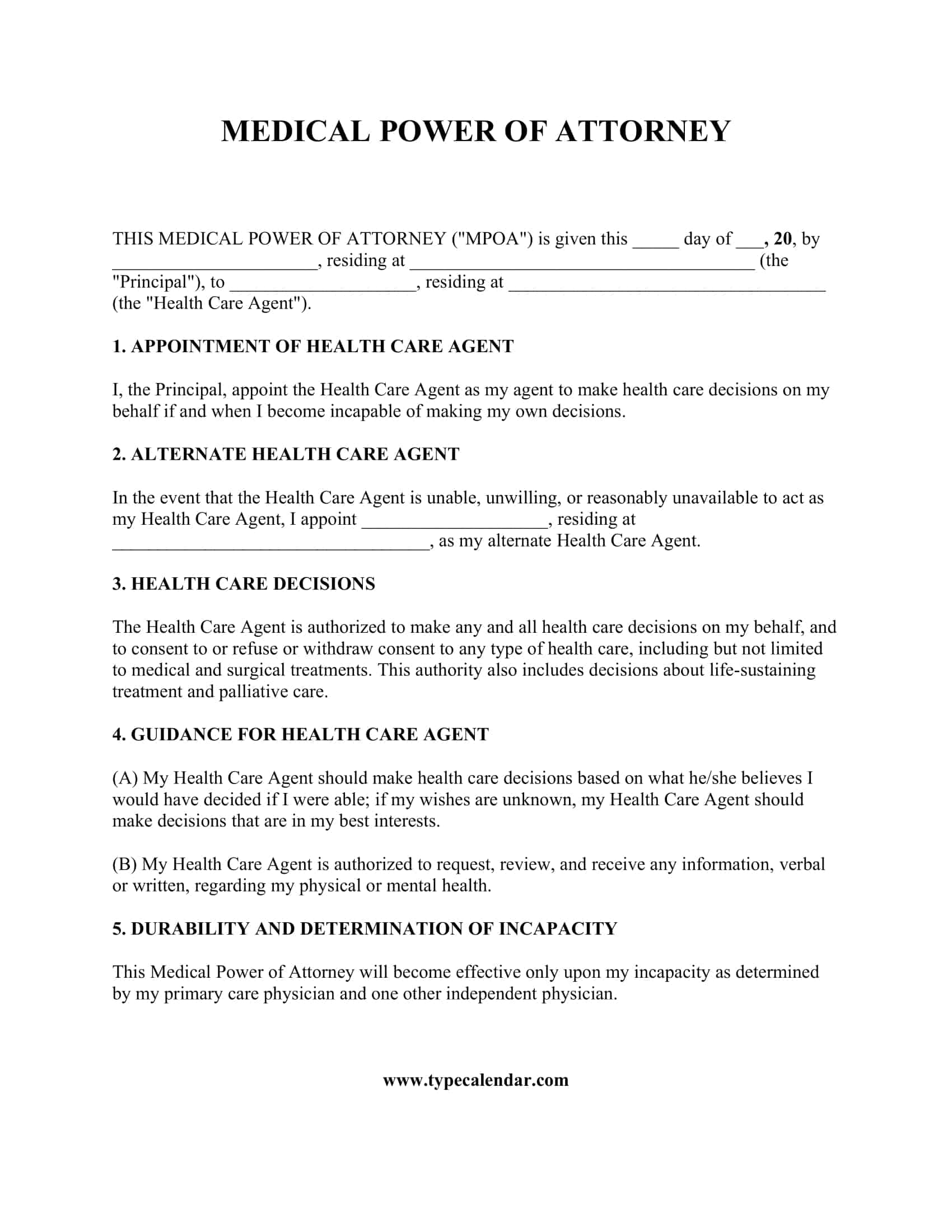

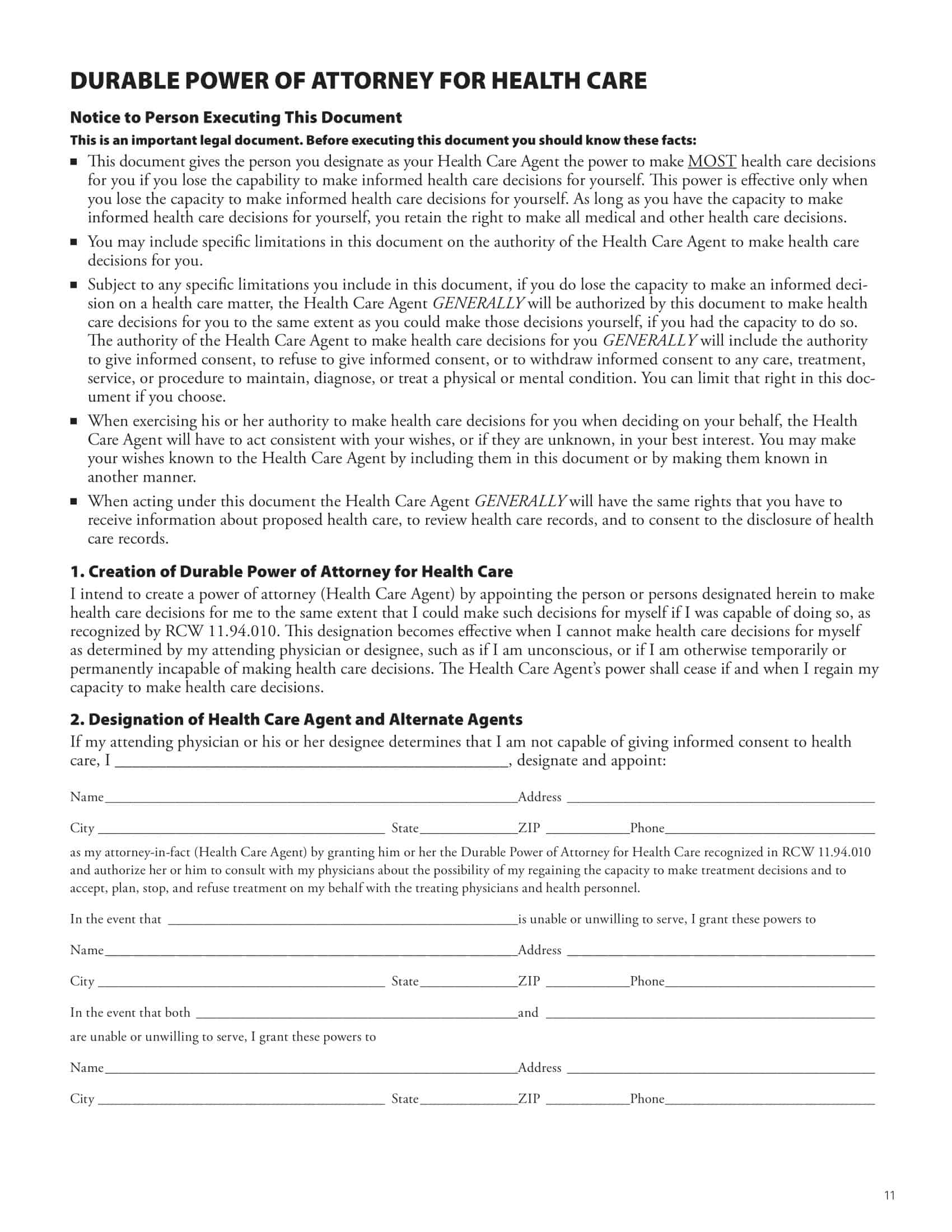

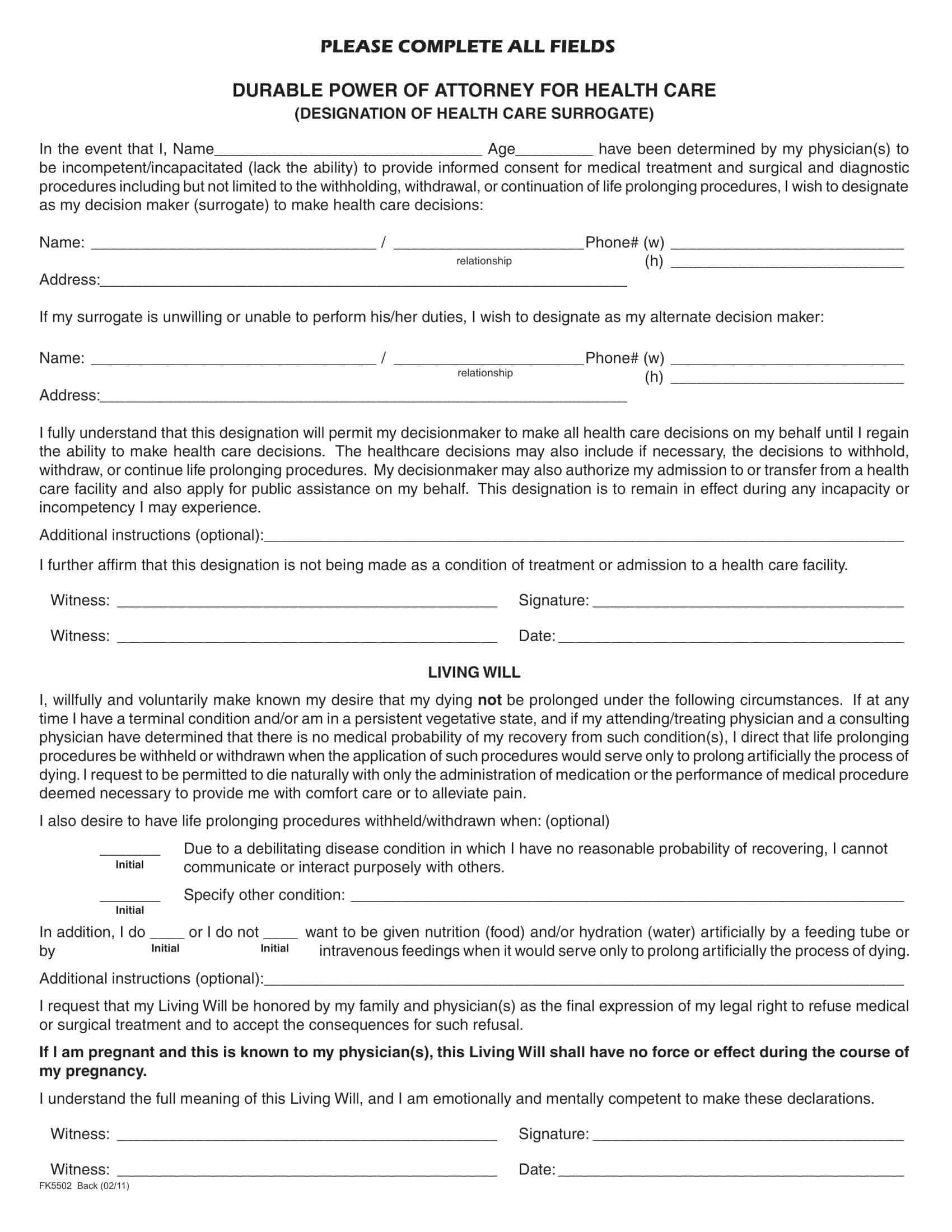

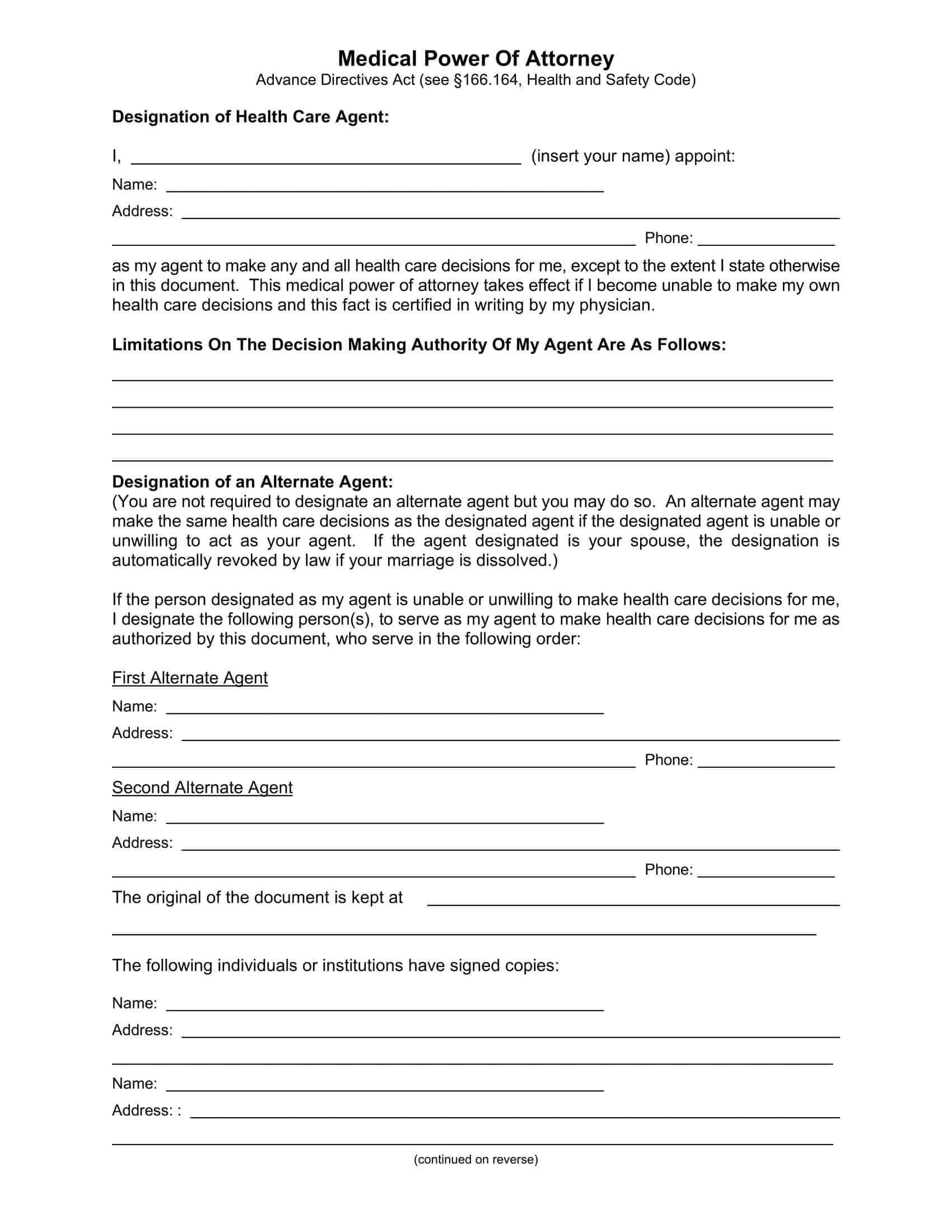

Medical Power of Attorney

A medical POA, or durable power of attorney for healthcare decisions, is a legal document that allows you to appoint someone else to make health care decisions for you if you cannot speak for yourself. You may want to create several medical POAs, each with a different person as an agent and different conditions, depending on your incapacity circumstances. The combination of a springing POA that comes into effect if triggered and a regular durable POA ensures that your wishes are respected and carried out no matter how they happen.

Springing Power of Attorney

A springing power of attorney is a limited power of attorney that becomes effective only when a certain event occurs. The typical triggering event is incapacity, by which the other person, called an “agent,” acts for you only after it is determined that you are unable to do so. In this situation, there are special problems that have to be overcome.

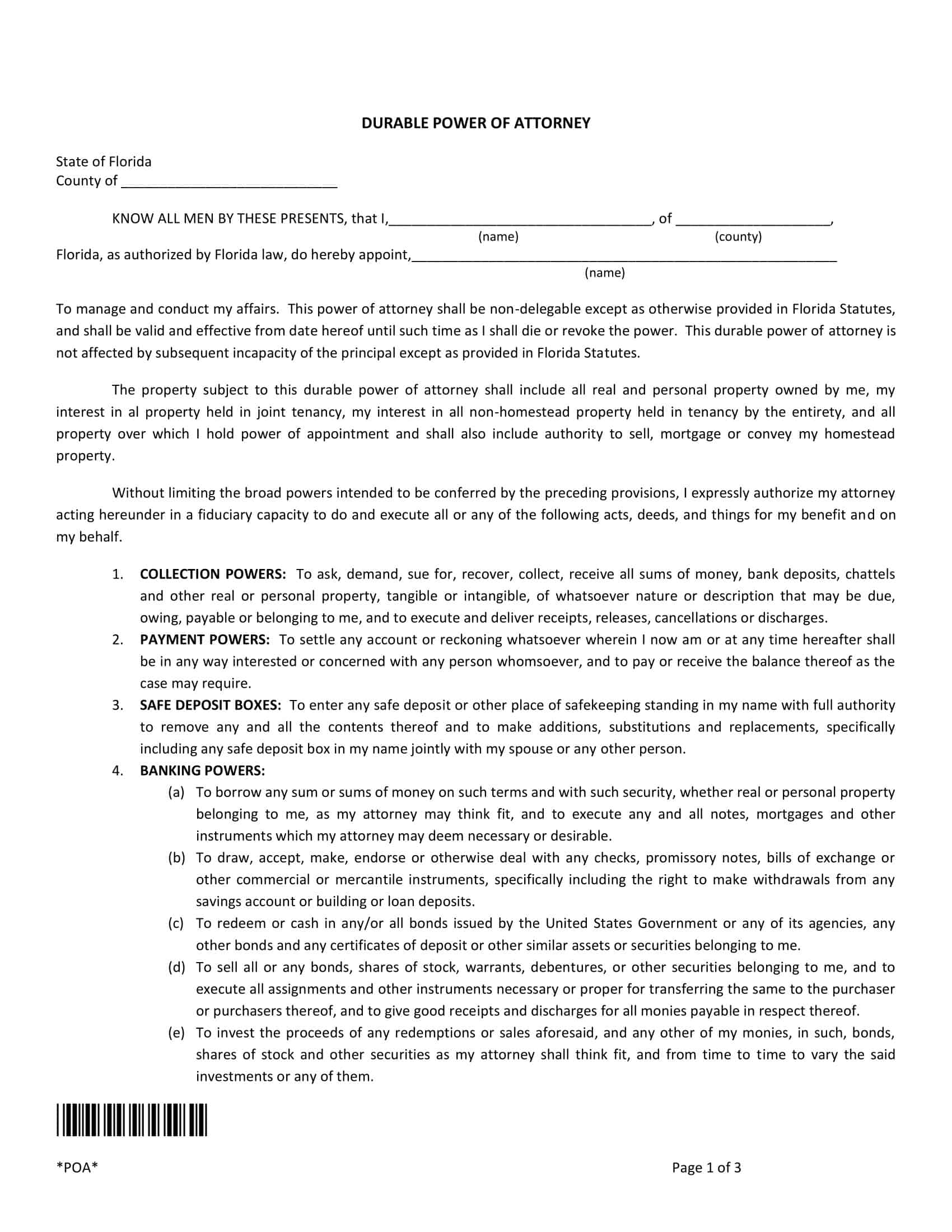

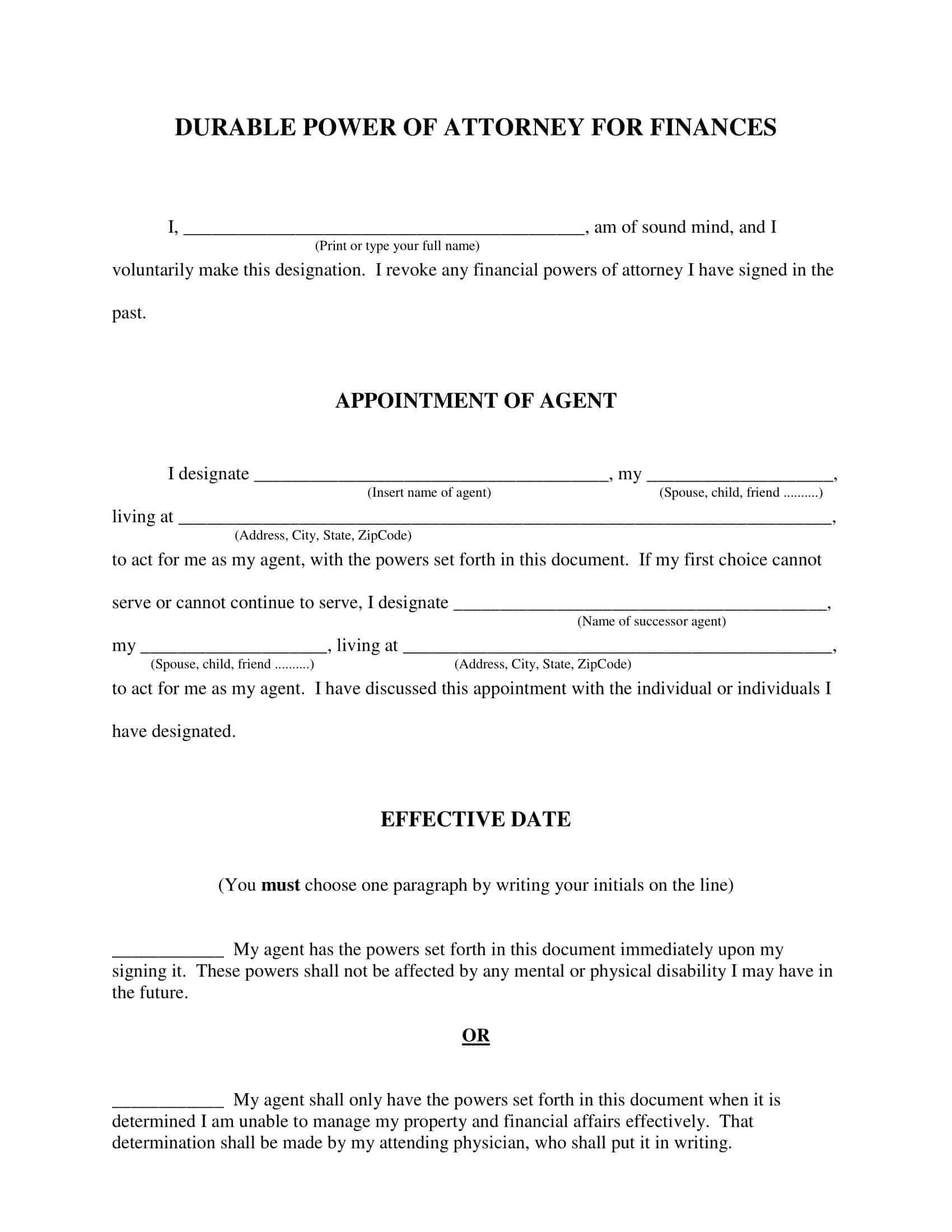

Durable Power of Attorney

A durable power of attorney (POA) is a document that gives legal authority to someone to manage your property or financial affairs if you become incapacitated, mentally ill, or mentally incompetent. A POA must be registered with the court to be effective. When you complete a durable POA, it goes into effect immediately, without the need for any further action on the part of the person who appoints an agent (you).

FAQs

What is the best form of power of attorney?

The best type of power of attorney depends on your specific needs. Many experts recommend a durable financial power of attorney so a trusted person can handle finances if you become incapacitated. A healthcare power of attorney is also important for medical decisions if unable to decide for yourself.

How do I write a letter as power of attorney?

When writing a letter as someone’s power of attorney, clearly state that you are acting as their legal POA in the first paragraph. Identify yourself, the grantor, and the POA document date. Then address the recipient’s agency/company and the purpose of your letter, making clear you have the authority to act on the principal’s behalf.

How do you write POA?

POA is an abbreviation for power of attorney. After introducing the full term, you can write POA to shorten future references if the context remains clear. For example: “As Jane’s Power of Attorney (POA), I am writing to…”

What is the form for power of attorney in the US?

The form to create a power of attorney document in the U.S. varies by state. Most law offices and personal document services have state-specific POA template forms that include fields to name the parties involved, delegate powers, and get proper signatures/witness requirements to make the POA legally binding.

What three decisions Cannot be made by a legal power of attorney?

Three decisions a U.S. power of attorney generally cannot make are: getting married, drafting/modifying a will, and voting on someone else’s behalf. Certain types of medical POAs may also limit force-feeding decisions.

What is the difference between a general POA and a durable POA?

A general POA ends if the principal becomes incapacitated. A durable POA remains in effect to the agent can continue acting on the principal’s behalf if they become disabled or mentally incompetent.

Which is a key disadvantage of a power of attorney?

A key POA disadvantage is the principal loses decision authority in areas delegated to the agent. The attorney-in-fact has a duty to act in the grantor’s interests but could potentially abuse their position against the principal’s best interests.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)