When it comes to the realm of accounting and finance, financial statements stand as the silent narrators of a business’s financial tale. They shed light on the otherwise obscured numbers and figures, transcribing them into a comprehendible language for investors, stakeholders, and management alike.

This article primarily revolves around the essence of financial statement templates, their purpose, and the role they play in streamlining the financial story-telling process. Whether you’re an industry veteran, an academic, or a newcomer to the finance field, these templates will add value to your understanding, making financial data interpretation more manageable and more efficient.

Table of Contents

What is a financial statement?

A financial statement is a comprehensive report that outlines an organization’s financial activities and overall health. It includes various components like the balance sheet, income statement, and cash flow statement, each depicting different aspects such as the organization’s assets, liabilities, revenue, expenses, and cash flow.

On the other hand, a financial statement template is a structured tool, often a pre-formatted document or software, designed to facilitate the efficient preparation and presentation of financial statements. These templates are built to simplify the process, ensuring consistency and accuracy, while saving time and resources by standardizing the presentation of financial data.

Financial Statement Templates

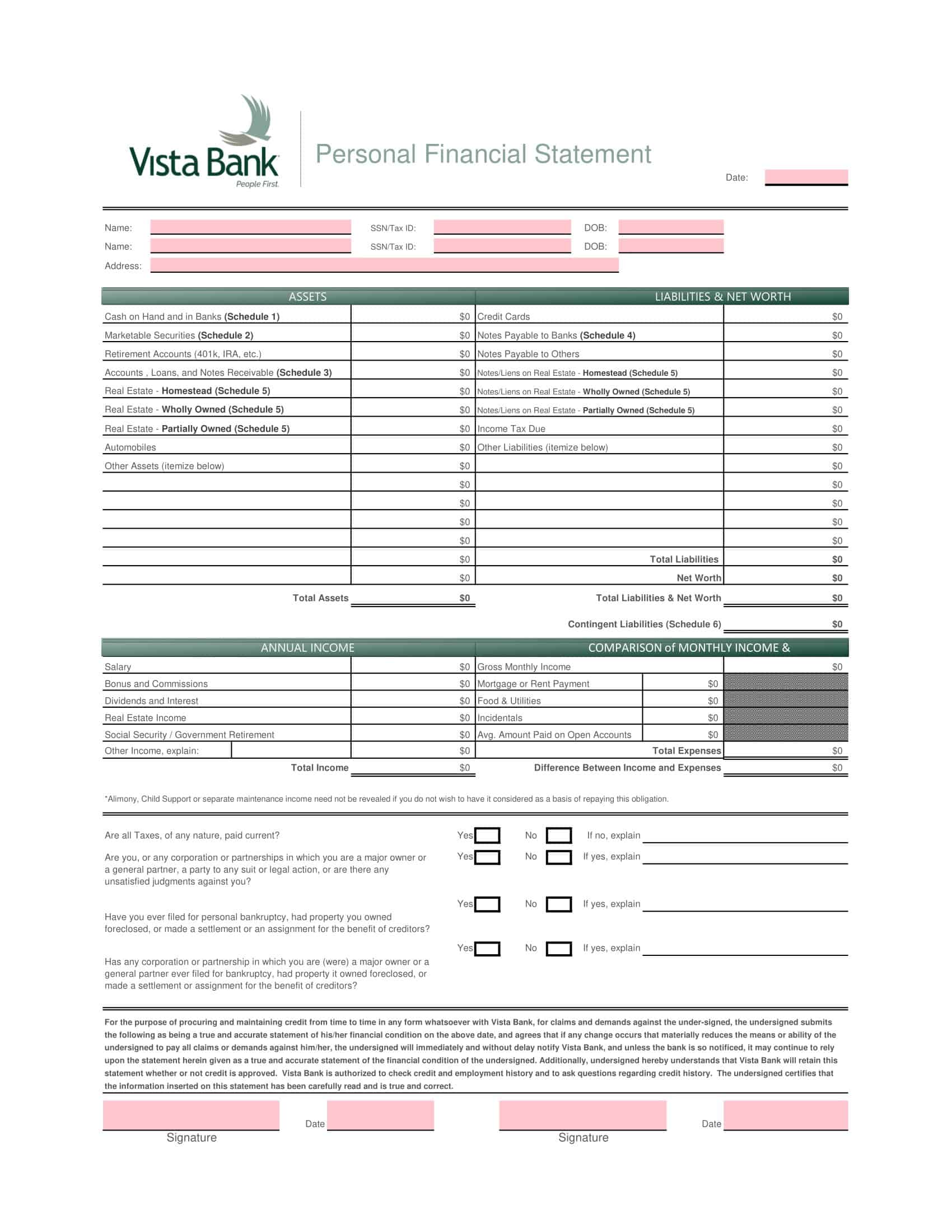

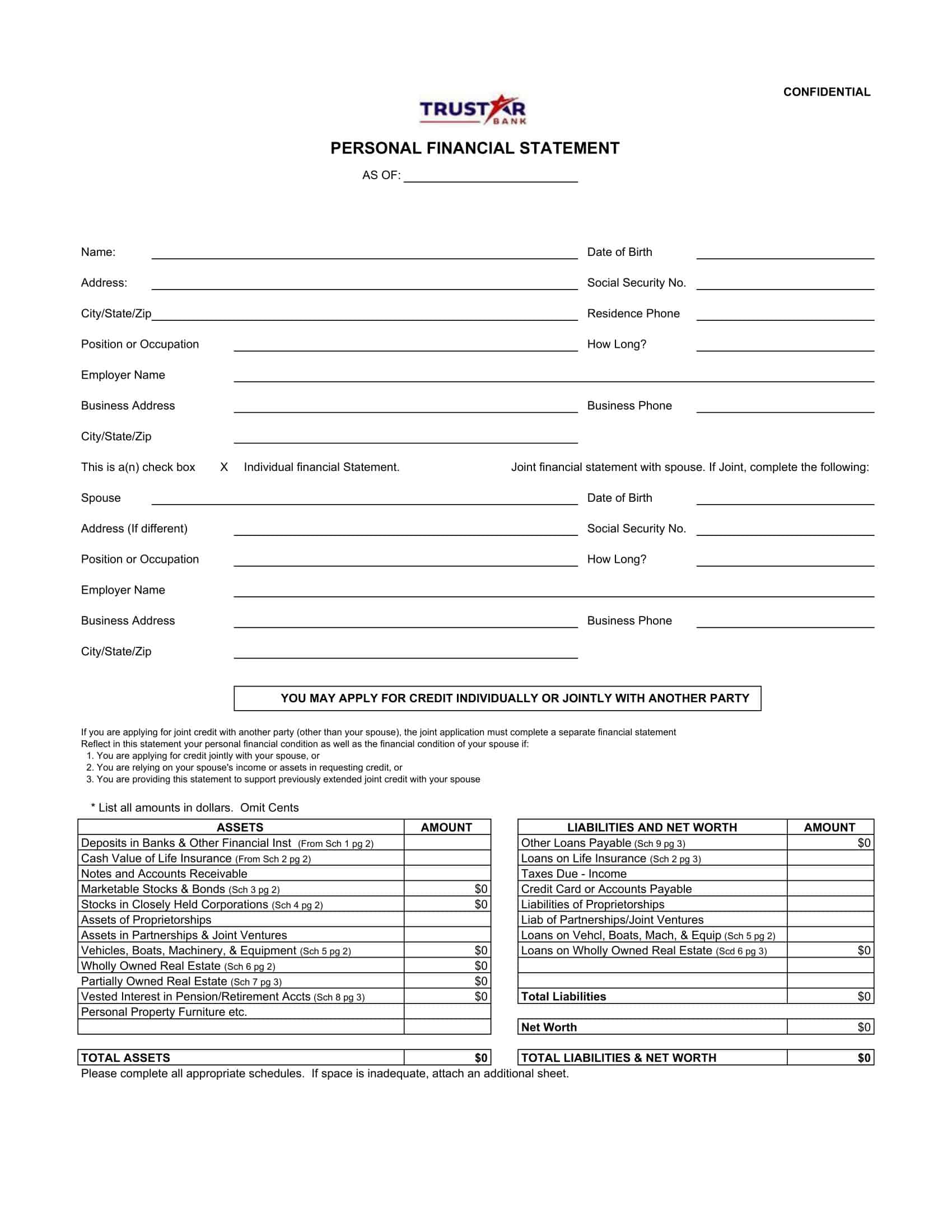

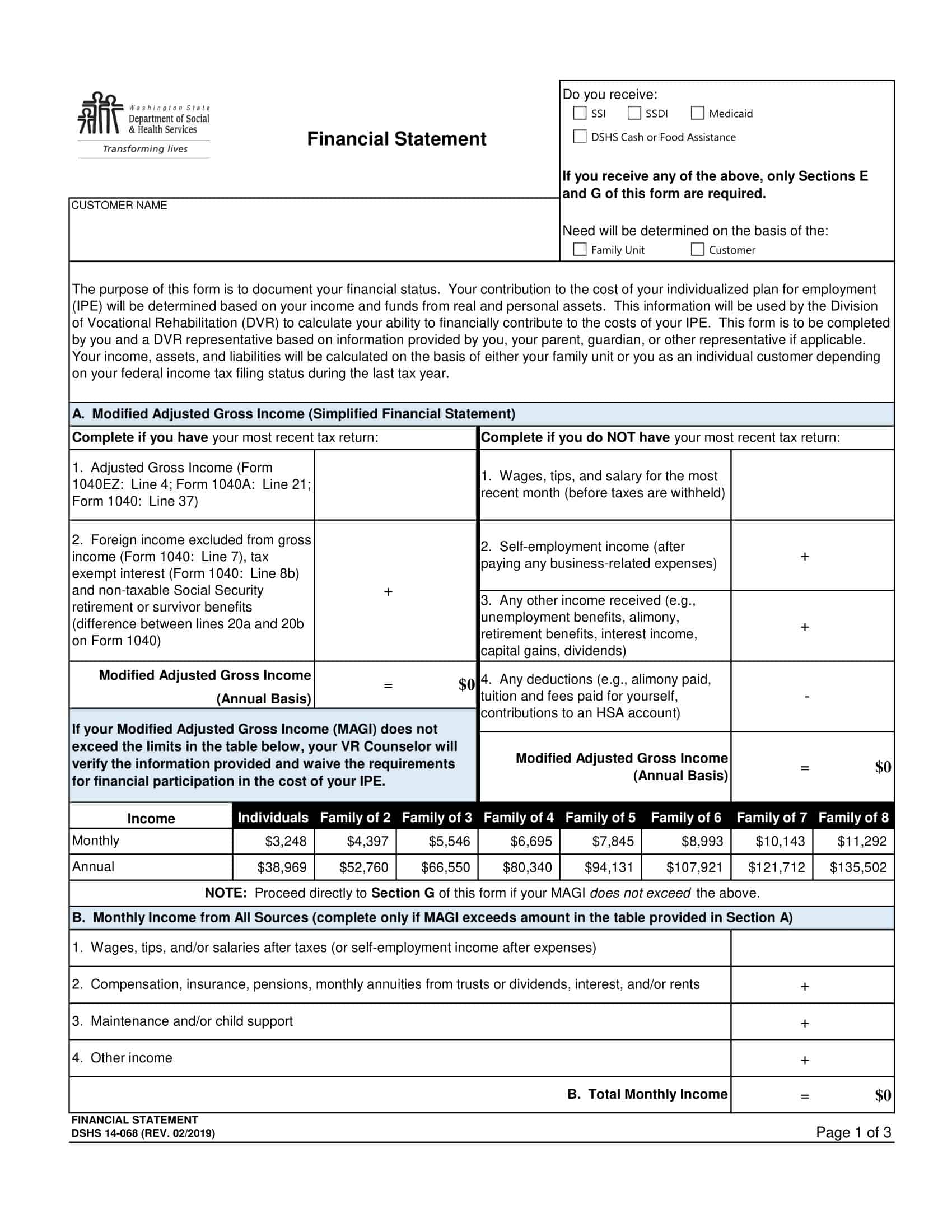

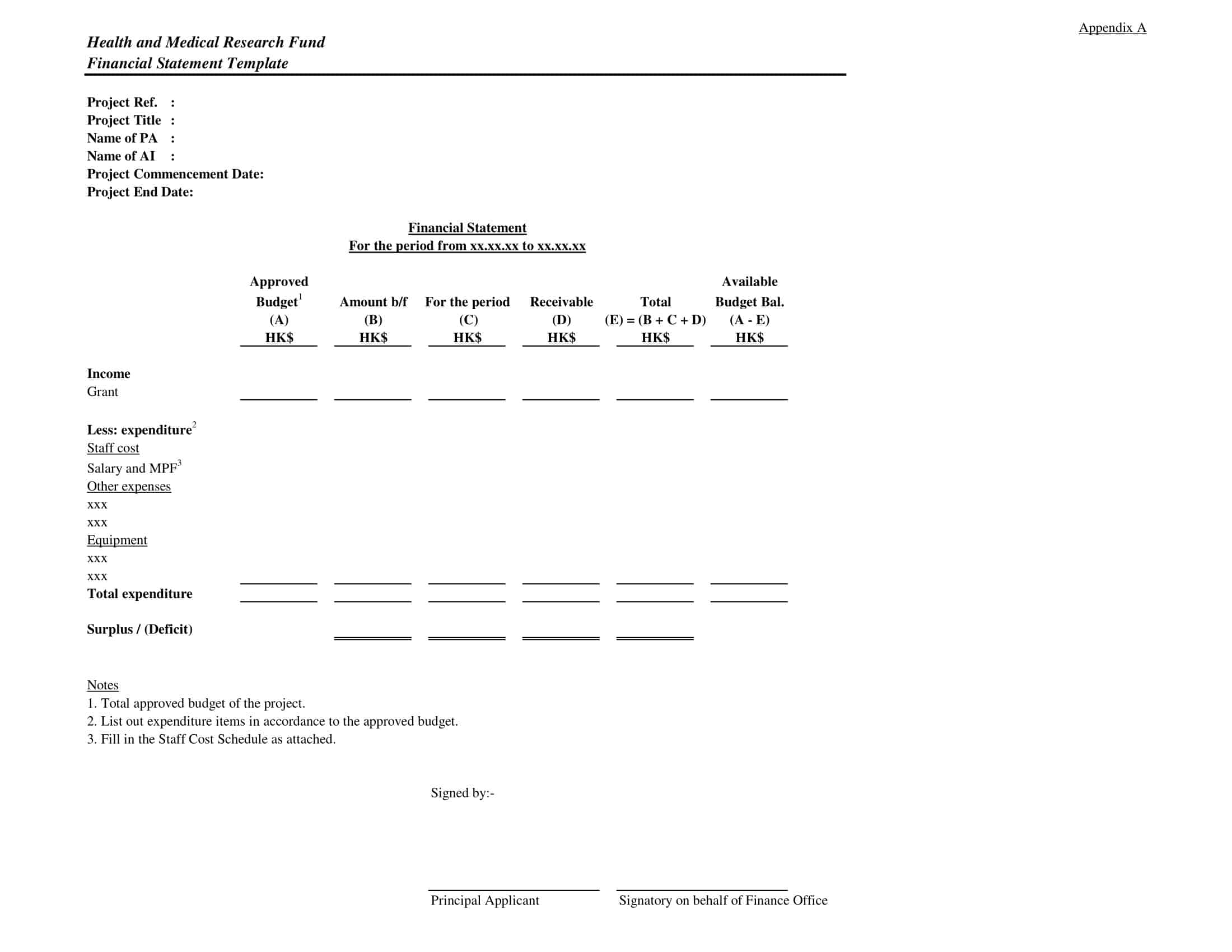

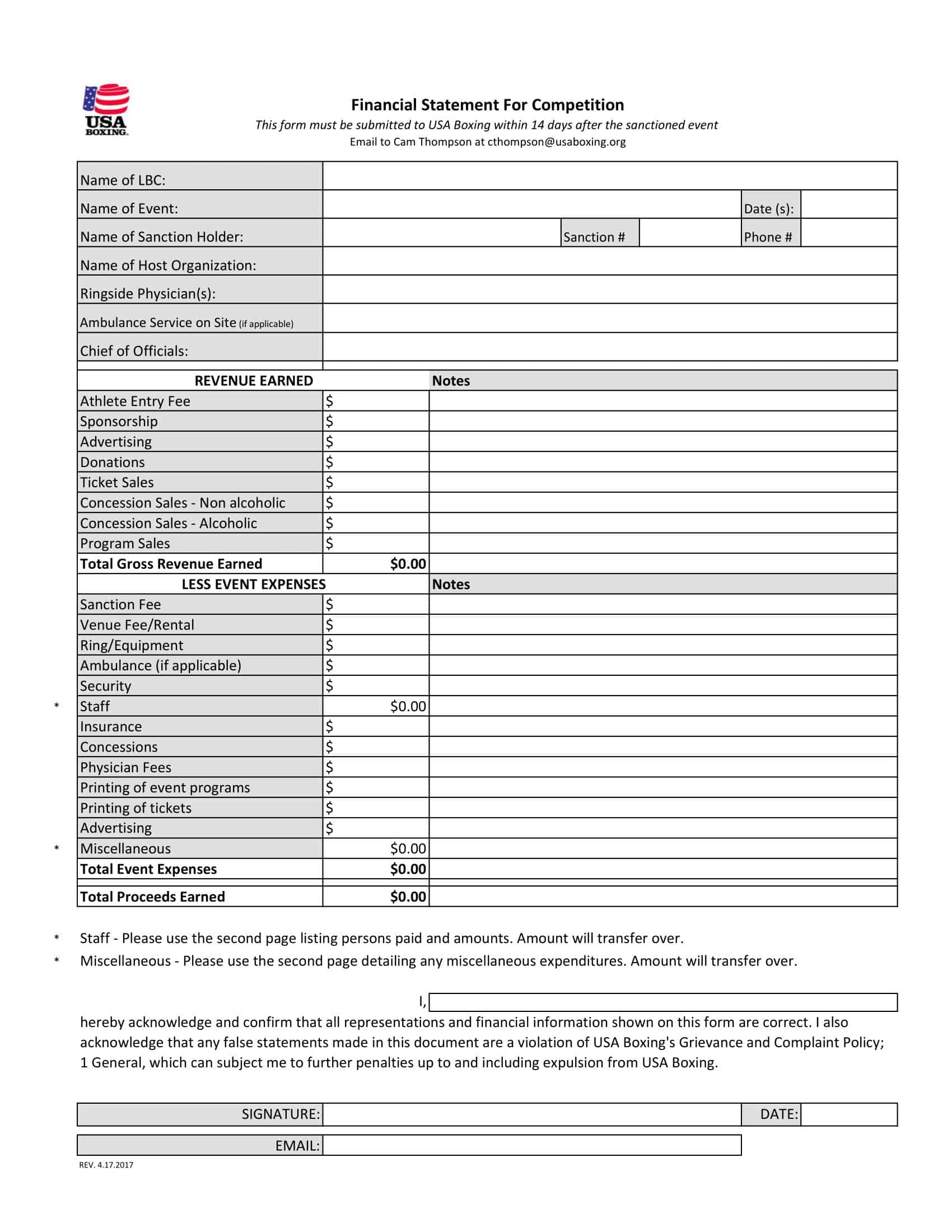

Businesses must regularly report on their financial performance. Financial statements communicate financial positions and operations. Financial statement templates help generate standard statements efficiently.

The templates contain formatted layouts for income statements, balance sheets, cash flow statements, and ratios. Sections compute net revenue, profitability, assets, liabilities, equity, cash inflows, and more. Automatic calculations reduce errors. Design elements include logos, colors, and charts.

Financial statement templates allow businesses to produce polished statements without manual number-crunching. The templates perform needed calculations and present formats compliant with accounting standards. Completed statements give leadership and stakeholders clear views of the organization’s financial health. Templates can be reused and edited each reporting cycle to streamline the process. For accurate, timely financial reporting, financial statement templates are invaluable tools for reporting precise insights quickly.

Why is a financial statement important?

The significance of financial statements in the economic ecosystem cannot be overstated, given their integral role in delivering a wealth of information to a variety of stakeholders. To begin with, they provide an in-depth insight into a company’s financial health, serving as a reliable indicator of its profitability, liquidity, and solvency.

By distilling complex financial data into comprehensive reports, they enable stakeholders to make informed decisions. Investors, for example, rely on these statements to assess the viability of their investments, analyzing a firm’s profitability, growth prospects, and risk profile. Lenders use them to gauge a company’s ability to meet debt obligations, evaluating liquidity and solvency ratios.

For company management, these statements offer an effective means of internal control, enabling them to identify operational efficiencies and inefficiencies, inform budgeting decisions, and strategize for future growth. They serve as an indispensable tool in setting performance benchmarks and tracking progress over time.

From a regulatory standpoint, financial statements are pivotal as they ensure compliance with financial reporting standards, facilitating transparency and promoting fair business practices. They deter fraudulent activities, enhance market confidence, and protect the interests of smaller investors.

In a global economy characterized by increasingly complex business operations and volatile markets, the importance of financial statements as a source of reliable, standardized, and actionable financial information remains undiminished. They are the lifeblood of financial communication, bridging the knowledge gap between businesses and their stakeholders, and enabling the wheels of the economy to turn with greater predictability and assurance.

Why use a financial statement template?

Solid financial statements are indeed the backbone of any sound accounting department, and using templates amplifies their effectiveness in multiple ways.

One of the primary advantages of using a financial statement template is its ability to systematically track a company’s financial situation and identify trends. By simplifying the process of data collation and presentation, templates enable companies to maintain a clear, ongoing record of financial transactions. This facilitates trend analysis, helping businesses to spot patterns, identify growth trajectories, and anticipate potential challenges in their financial performance.

Moreover, templates play an instrumental role in determining a company’s ability to repay its debts. They facilitate the easy calculation of financial ratios such as the debt-to-equity ratio, current ratio, and quick ratio, which are essential indicators of a company’s debt management capacity. By providing these key insights, templates assist businesses in maintaining an optimal debt level and strategizing their debt management efficiently.

Another crucial aspect where financial statement templates contribute is in analyzing a company’s ability to generate cash. Cash flow statement templates provide a detailed breakdown of a company’s cash inflows and outflows from operating, investing, and financing activities. They highlight the company’s cash-generating efficiency, giving stakeholders a clear picture of the liquidity position and the ability of the business to sustain its operations, reinvest, and meet unexpected expenses.

In sum, financial statement templates serve as an efficient, reliable tool that not only simplifies financial reporting but also empowers businesses to make informed, strategic decisions for sustainable financial health and growth.

Types of Financial Statements

Generally speaking, a financial statement template comes in different types. Each type serves a unique purpose and provides a distinct perspective on the company’s financial health and operational efficiency. The financial statements offer a quantifiable outline of a company’s financial performance and its resource allocation. Before crafting a financial report template of your own, it is crucial to understand the different types of financial statements and determine what type you need first:

Income Statement

The income statement, also known as the statement of earnings, profit and loss statement (P&L), or statement of operations, is a financial statement that reports a company’s financial performance over a specific accounting period. Financial performance is assessed by giving a summary of how the business incurs its revenues and expenses through both operating and non-operating activities. It also shows the net profit or loss incurred over a specific accounting period, typically over a fiscal quarter or year.

The income statement is divided into two parts: the operating section and the non-operating section. The operating section discloses revenue and expenses that are a direct result of regular business operations. For instance, costs of goods sold and operating expenses are part of the operating section. On the other hand, the non-operating section reveals revenue and expenses resulting from activities that aren’t a direct result of regular business operations, like interest paid on loans or revenue from investments.

Balance Sheet

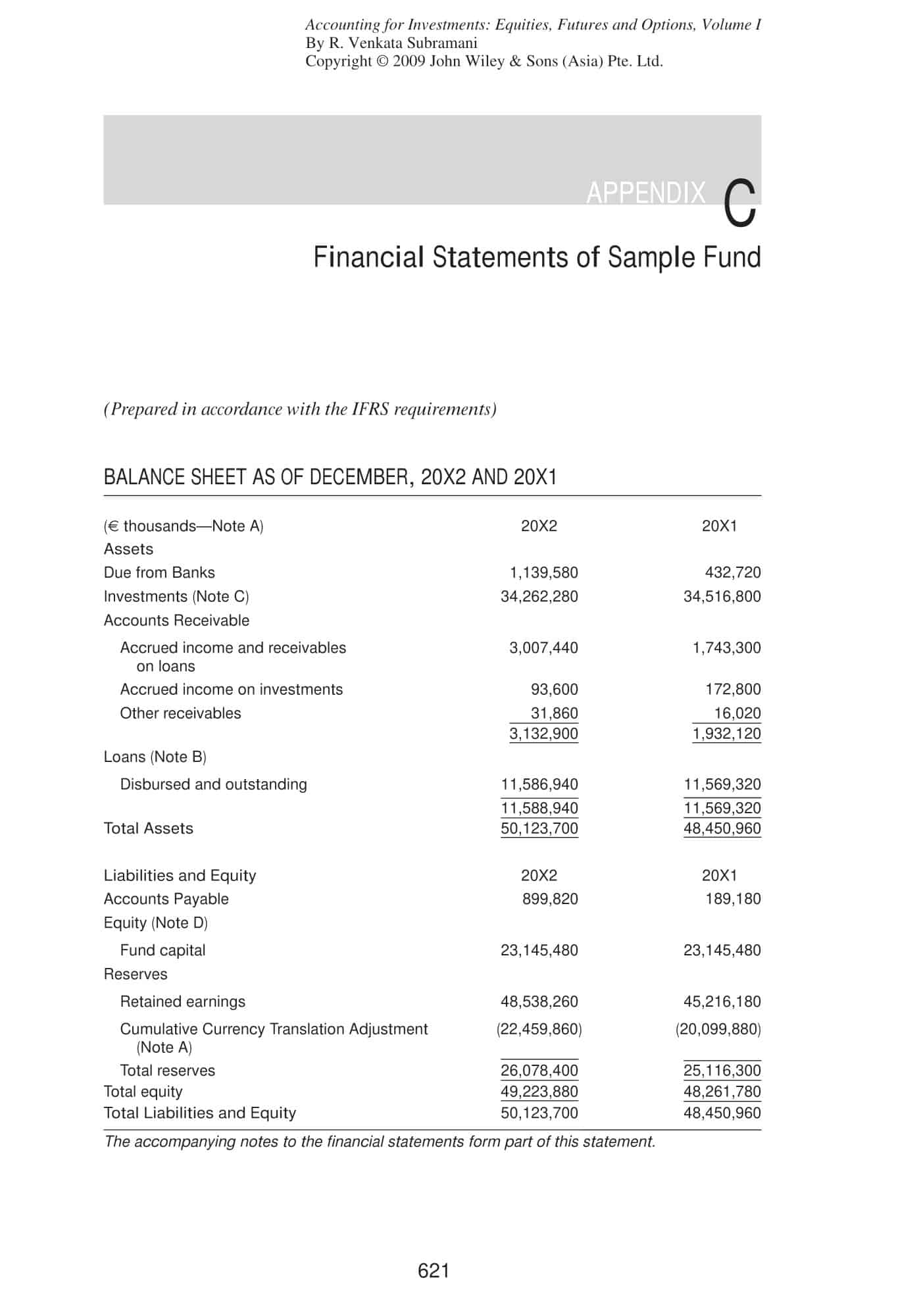

The balance sheet, also known as the statement of financial position, presents a company’s financial position at a given point in time. It consists of three main components: assets, liabilities, and equity. Assets are what a company owns, including cash, inventory, property, and other items. Liabilities are what a company owes to others, such as loans, accounts payable, etc. Equity, also referred to as shareholders’ equity, is the residual interest in the assets of the entity after deducting liabilities.

The balance sheet equation is fundamental to understanding this financial statement: Assets = Liabilities + Equity. It means that the company’s resources (assets) are funded by either creditors (liabilities) or by owners (equity). In other words, all assets are claimed by either creditors or owners.

Statement of Changes in Equity

The statement of changes in equity, often referred to as the statement of retained earnings, is a financial document that outlines the changes in equity experienced by a company during a specific accounting period. This statement provides a link between the income statement and the balance sheet, as it provides detailed information about the changes in various equity components, including retained earnings, during the accounting period.

The statement of changes in equity includes items like net income from the income statement, any payouts to shareholders in the form of dividends, the effect of changes in accounting policies, and any other gains or losses recognized directly in equity. It is essential for investors and analysts to assess the factors causing the change in a company’s retained earnings.

Statement of Cash Flows

The statement of cash flows, or cash flow statement, is a financial report that provides information about a company’s cash receipts and cash payments during an accounting period. It shows how changes in balance sheet accounts and income affect cash and cash equivalents, breaking the analysis down to operating, investing, and financing activities.

In essence, the cash flow statement is concerned with the flow of cash in and out of the business. The statement captures both the current operating results and the accompanying changes in the balance sheet. As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills.

Notes to Financial Statements

Notes to financial statements are additional information provided in a company’s financial statements. They help provide a complete understanding of the financial condition of the entity. These notes contain important disclosures that are integral to understanding a company’s financial position and the results of operations.

Notes to financial statements can include information on debt, going concern criteria, accounts, contingent liabilities, or contextual information explaining the financial numbers (e.g., to highlight future obligations, significant customers, etc.). They provide a narrative of the company’s financial health and are considered an integral part of the financial statements.

When will a company prepare a financial statement?

Financial statements are critical tools for managing a company’s financial health, making important business decisions, and attracting investors. They are typically prepared on a regular basis – usually quarterly and annually. However, the preparation process is ongoing throughout the accounting cycle. Here’s a detailed guide to when and how a company prepares financial statements:

1. The Accounting Cycle

The process of preparing financial statements is part of a larger procedure known as the accounting cycle, which includes the following steps:

- Transaction Identification: Any event that has a monetary impact on the business, such as a sale or a purchase, is considered a transaction. These transactions are identified and collected throughout the accounting period.

- Journal Entry: Each transaction is recorded in a journal, a process known as journalizing. The entries are made according to the double-entry system, where each transaction affects at least two accounts.

- Posting to Ledger: These journal entries are then posted to the company’s general ledger, where each account’s balance is calculated.

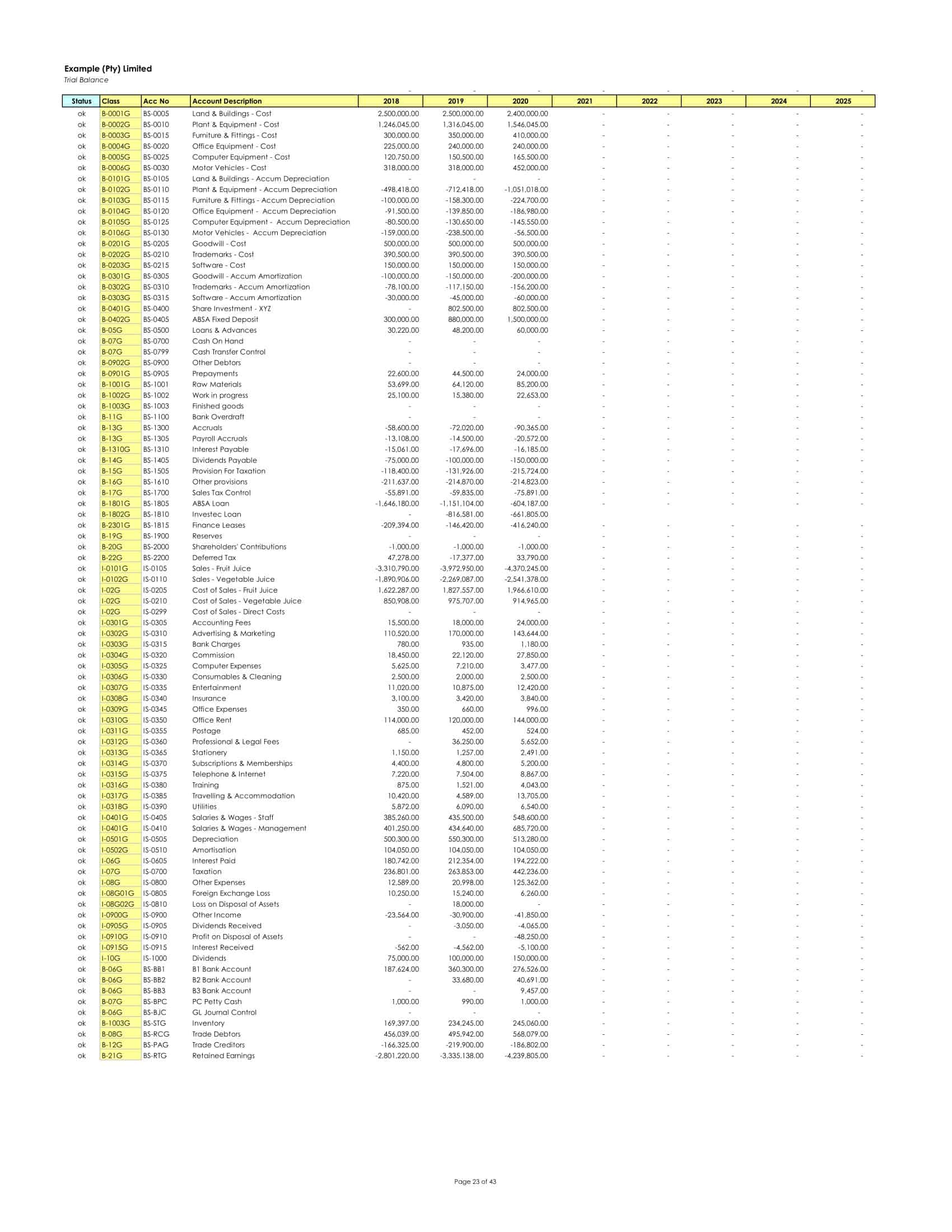

- Trial Balance Preparation: A trial balance is prepared to ensure that the total debits equal the total credits in the financial accounts. This step helps to spot any errors in journalizing and posting transactions.

- Adjusting Entries: At the end of the accounting period, adjusting entries are made for accrued and deferred items. Accrued items are those that the company has incurred but has not yet paid or recorded. Deferred items are those that the company has paid or recorded but has not yet earned or used.

- Adjusted Trial Balance: An adjusted trial balance is prepared after making all adjusting entries. This is the final step before preparing the financial statements.

2. Financial Statement Preparation

- Income Statement: The income statement is prepared first. This statement summarizes revenues, costs, and expenses to show the company’s profitability over a specific accounting period. The bottom line of this statement, the net income, is then carried over to the statement of retained earnings and the balance sheet.

- Statement of Retained Earnings: This statement shows how the company’s retained earnings have changed during the accounting period. It starts with the beginning balance of retained earnings, adds net income from the income statement, subtracts any dividends paid out to shareholders, and adjusts for any other changes, resulting in the ending retained earnings balance.

- Balance Sheet: The balance sheet provides a snapshot of the company’s financial position at a particular point in time. It lists the company’s assets, liabilities, and equity, with the total assets equaling the sum of liabilities and equity.

- Cash Flow Statement: The cash flow statement is prepared last. It summarizes the company’s cash inflows and outflows during the accounting period, divided into operating, investing, and financing activities.

3. Closing Entries and Post-Closing Trial Balance

After preparing the financial statements, closing entries are made to reset the balance of temporary accounts (like revenues, expenses, and dividends) to zero, readying them for the next accounting period. Finally, a post-closing trial balance is prepared to ensure that all debits and credits balance before the new accounting cycle begins.

4. Reporting and Analysis

The prepared financial statements are then used for reporting financial results to stakeholders, including shareholders, creditors, and regulatory bodies. Managers and decision-makers also use them for business analysis and strategic planning.

5. Audit

In many jurisdictions and in certain industries, an external audit of the financial statements is required. This involves an independent auditor reviewing the statements and supporting documentation to ensure accuracy and compliance with accounting standards and regulations.

Keep in mind that the preparation of financial statements should be done in compliance with the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the jurisdiction.

How to Write a Financial Statement

Writing a financial statement is a complex task that requires careful recording and analysis of a company’s financial transactions. The financial statement is the final output of the accounting process, and it provides stakeholders with essential information about the company’s financial performance and condition. Here’s a step-by-step guide:

Step 1: Record all Financial Transactions

The first step in preparing a financial statement is recording all financial transactions that occurred during the accounting period. These transactions are recorded as journal entries in the company’s books. For example, if a company sells a product for $100, it would debit (increase) accounts receivable or cash by $100 and credit (increase) sales revenue by $100.

This process requires diligent record-keeping and understanding of the double-entry bookkeeping system, which says that for every financial transaction, two accounts are always affected, one with a debit and one with a credit. These transactions should be recorded in real-time or as close to the actual transaction date as possible to ensure accuracy.

Step 2: Post Journal Entries to Ledger Accounts

Once all transactions have been recorded in the journal, they are then posted to the general ledger. The ledger is a collection of all the company’s accounts. It contains a separate account for each type of asset, liability, equity, revenue, and expense.

For example, continuing with our previous transaction, the $100 credit to sales revenue would be posted to the revenue account in the ledger, and the $100 debit to accounts receivable or cash would be posted to the corresponding asset account. This process involves transferring the debit and credit amounts from the journal to the appropriate ledger accounts.

Step 3: Prepare a Trial Balance

After all transactions have been posted to the ledger, a trial balance is prepared. The trial balance is a list of all ledger accounts and their balances at a particular point in time. The purpose of the trial balance is to check the accuracy of the ledger balances. The total of all debit balances should equal the total of all credit balances.

For example, if you have three accounts, Cash ($5,000 debit), Accounts Payable ($2,000 credit), and Sales Revenue ($3,000 credit), your trial balance is correct because the total debit of $5,000 equals the total credit of $5,000.

Step 4: Make Adjusting Entries

Once the trial balance is prepared, adjusting entries are made for accrued and deferred items. Accruals are revenues earned or expenses incurred before the cash is received or paid, and deferrals are revenues or expenses that have been prepaid but are not yet earned or used.

For example, if a company has earned $1,000 of interest on an investment but has not yet received the cash, an adjusting entry would be made to debit (increase) interest receivable (an asset) by $1,000 and credit (increase) interest income by $1,000.

Step 5: Prepare an Adjusted Trial Balance

After the adjusting entries have been posted to the ledger, an adjusted trial balance is prepared. This process is similar to the preparation of the trial balance but includes the balances of all accounts after the adjusting entries have been made.

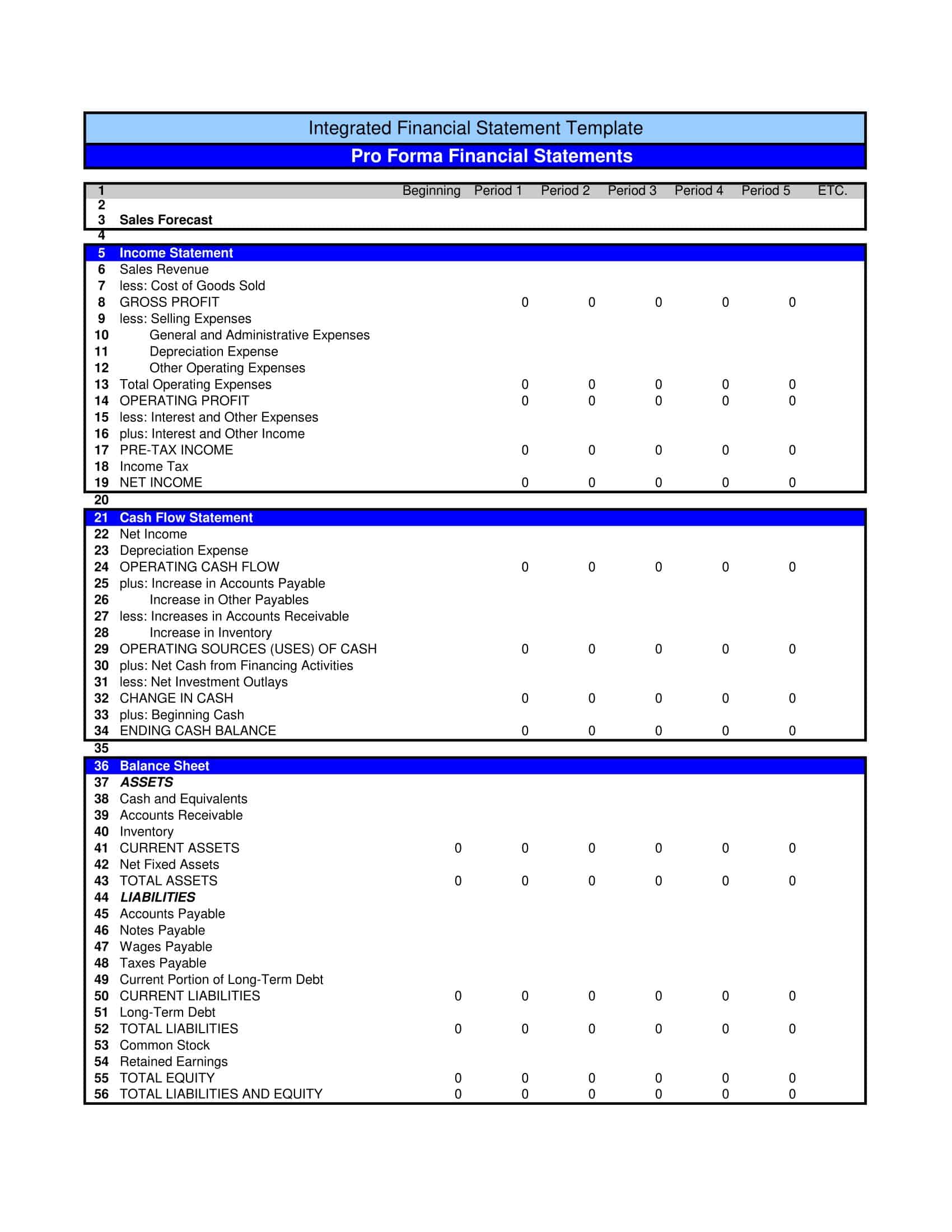

Step 6: Prepare the Financial Statements

Now you’re ready to prepare the financial statements. This starts with the income statement, which shows the company’s revenues, costs, and expenses over the accounting period. Using our examples, the $100 from sales and the $1,000 from interest income would be reported as revenues, and any costs and expenses would be subtracted to arrive at net income.

The retained earnings statement is prepared next, which starts with the beginning balance of retained earnings, adds net income, and subtracts any dividends paid.

The balance sheet is then prepared. It lists the company’s assets, liabilities, and equity. The assets would include cash and accounts receivable from our examples, as well as any other assets the company owns. The liabilities would include accounts payable from our example, as well as any other amounts the company owes. The equity section includes the ending balance of retained earnings from the retained earnings statement and any other equity accounts.

Finally, the cash flow statement is prepared, which shows the cash inflows and outflows from operating, investing, and financing activities.

Step 7: Prepare the Closing Entries

Once the financial statements have been prepared, closing entries are made. These entries “close” the temporary accounts (revenues, expenses, and dividends) by transferring their balances to the permanent Retained Earnings account. This process prepares the books for the next accounting period.

Following these steps with attention to detail and a commitment to accuracy will result in financial statements that provide valuable insights into a company’s financial performance and position. It’s important to remember that these steps should be performed in accordance with applicable accounting standards to ensure the financial statements are fair and accurate.

Limitations of Financial Statements

Financial statements are crucial tools for understanding a company’s performance and financial health. However, they also have limitations. While they provide a wealth of information about a company’s financial activities, it’s essential to understand these limitations when analyzing financial statements.

1. Historical Information

Financial statements typically present historical data. They reflect financial performance and position based on past transactions and events. As a result, they may not always be an accurate indicator of future performance. Business environments are dynamic, with changing market conditions, economic indicators, and consumer behaviors, none of which may be reflected in the historical data presented in financial statements.

2. Non-financial Information

Financial statements largely focus on quantifiable, monetary transactions. Consequently, they often overlook non-financial factors that could significantly impact a company’s performance and competitive position. Elements such as employee satisfaction, corporate culture, brand recognition, and customer loyalty, while crucial to a business’s success, are not represented in financial statements.

3. Accounting Policies and Estimates

Different companies may use different accounting policies and estimates, making it challenging to compare their financial statements directly. Even though accounting standards such as GAAP and IFRS aim to standardize financial reporting, they often allow a degree of judgement and flexibility in areas such as depreciation methods, inventory valuation, and recognition of contingent liabilities. These choices can significantly impact the results presented in the financial statements.

4. Inflation and Monetary Unit Assumption

Financial statements do not account for changes in the purchasing power of money, i.e., inflation or deflation. They are prepared based on the monetary unit assumption, which assumes that the purchasing power of money is stable over time. This assumption can distort the financial position and performance of a company in periods of high inflation or deflation.

5. Window Dressing

Window dressing refers to the practice of manipulating financial statements to present a more favorable picture of a company’s financial performance and position than what is true. While generally in accordance with accounting standards, such practices can mislead users of financial statements. This is a significant limitation, as it can make analysis based on financial statements less reliable.

6. Lack of Standardization in the Notes

The notes to financial statements provide crucial qualitative and quantitative information that helps explain the numbers in the income statement, balance sheet, and cash flow statement. However, there is a lack of standardization in the presentation and content of these notes, which can make them challenging to compare across different companies.

7. Emphasis on Short-term Performance

Quarterly and annual financial statements may encourage a short-term perspective. Managers might be tempted to focus on meeting short-term targets at the expense of the company’s long-term strategic goals. This can lead to decisions that are beneficial for short-term financial reporting but detrimental in the long run.

How to read a financial statement?

Reading a financial statement is an essential skill for anyone involved in business, investment, or financial management. The three primary financial statements – the income statement, the balance sheet, and the statement of cash flows – each provide different insights into a company’s financial health and performance.

Step 1: Income Statement

Start with the income statement, also known as the profit and loss statement. This report details a company’s revenues, costs, and expenses during a specific period. The bottom line, or net income, indicates whether the company made a profit or suffered a loss.

- Revenue: This is the money that the company earns from its operations, often divided into operating revenue (from core business operations) and non-operating revenue (like investment income).

- Expenses: These are the costs incurred to generate revenue. They might include cost of goods sold (COGS), administrative and overhead costs, depreciation, and taxes.

- Net Income: Subtract total expenses from total revenue, and you get net income. A positive net income means the company is profitable, while a negative net income indicates a loss.

Step 2: Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It’s divided into assets, liabilities, and shareholders’ equity.

- Assets: These are resources that the company owns, which are expected to provide future economic benefits. Assets can be tangible, like machinery and inventory, or intangible, like patents and trademarks.

- Liabilities: These are the company’s obligations, such as loans, accounts payable, and bonds payable.

- Shareholders’ Equity: Also known as net assets or owner’s equity, it represents the ownership interest of the shareholders. It can be calculated as Total Assets – Total Liabilities.

Step 3: Statement of Cash Flows

This statement provides information about the company’s cash inflow and outflow during a specific period. It’s divided into operating, investing, and financing activities.

- Operating Activities: This section reflects cash from day-to-day business operations, like selling products or paying salaries.

- Investing Activities: Cash flows from investing activities often involve purchases or sales of long-term assets, like property and equipment.

- Financing Activities: This section involves cash flow from transactions with owners and creditors, such as issuing stocks, paying dividends, or borrowing money.

The net increase or decrease in cash shown in the statement of cash flows should equal the change in cash on the balance sheet from the beginning to the end of the period.

Step 4: Notes to the Financial Statements

These offer additional information to support the data in the other three statements. They may explain accounting practices, elaborate on line items, or disclose potential risks and uncertainties.

When reading financial statements, it’s important to look at trends over time and compare the company’s performance and position to other similar companies. Be aware of the limitations of financial statements, such as their focus on historical data and the influence of accounting estimates and judgements.

Analyzing financial statements also involves calculating financial ratios to assess liquidity, profitability, efficiency, leverage, and valuation. These ratios provide insights into a company’s performance and financial health beyond the raw financial data. Understanding how to read and analyze financial statements is a valuable skill that helps in making informed business and investment decisions.

FAQs

What does it mean if a company has a negative net income on its income statement?

If a company has a negative net income, it means that the company’s expenses exceeded its revenues during the period covered by the income statement. This is often referred to as a net loss. It could indicate financial difficulties, but it’s not necessarily a cause for alarm. Some companies, especially startups, may operate at a loss initially with the expectation of future profitability.

What is the role of notes to financial statements?

Notes to financial statements provide additional information that is not directly included in the income statement, balance sheet, or cash flow statement. They explain the company’s accounting policies, provide breakdowns of line items, and disclose any significant events or uncertainties that may impact the company’s financial position or performance. They’re essential for understanding the context behind the numbers in the financial statements.

How often are financial statements prepared?

Financial statements are typically prepared on an annual basis, at the end of the company’s fiscal year, for the annual report. However, most public companies also prepare interim financial statements on a quarterly basis to keep investors and the market updated on their performance. These are often less detailed than the annual statements.

How can I tell if a company is financially healthy from its financial statements?

There are several key indicators of financial health in the financial statements. A consistent track record of profitability, as shown in the income statement, is a positive sign. A strong balance sheet with more assets than liabilities indicates a robust financial position. Positive cash flows from operating activities suggest the company’s core business is generating cash. However, it’s also important to consider the company’s industry, size, growth stage, and other contextual factors. Financial ratios can also provide valuable insights into aspects such as liquidity, solvency, efficiency, and profitability.

Are financial statements useful for small businesses?

Yes, financial statements are useful for businesses of all sizes. For small businesses, they can help track performance, manage cash flows, plan for growth, and make informed business decisions. They’re also typically required when seeking financing from banks or investors. Even if a small business doesn’t have a legal requirement to prepare formal financial statements, the process of organizing its financial information in this way can provide valuable insights.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)