Handling payroll requires meticulous organization to ensure a smooth process. It’s vital to dodge any complications or setbacks that could impact your company’s payroll operations. Developing an exceptional payroll template tailored to your business is key, as it helps provide your employees with their well-deserved compensation punctually. While there are various software options available to assist with payroll management, if you’re seeking a budget-friendly solution, you can download a free payroll sheet right here.

Table of Contents

What is Payroll?

Payroll refers to the total amount of money that a company pays to its employees in a given period of time, typically a month or a week. It includes all the compensation and benefits that employees receive, such as salaries, bonuses, commissions, paid time off, insurance, and other forms of compensation.

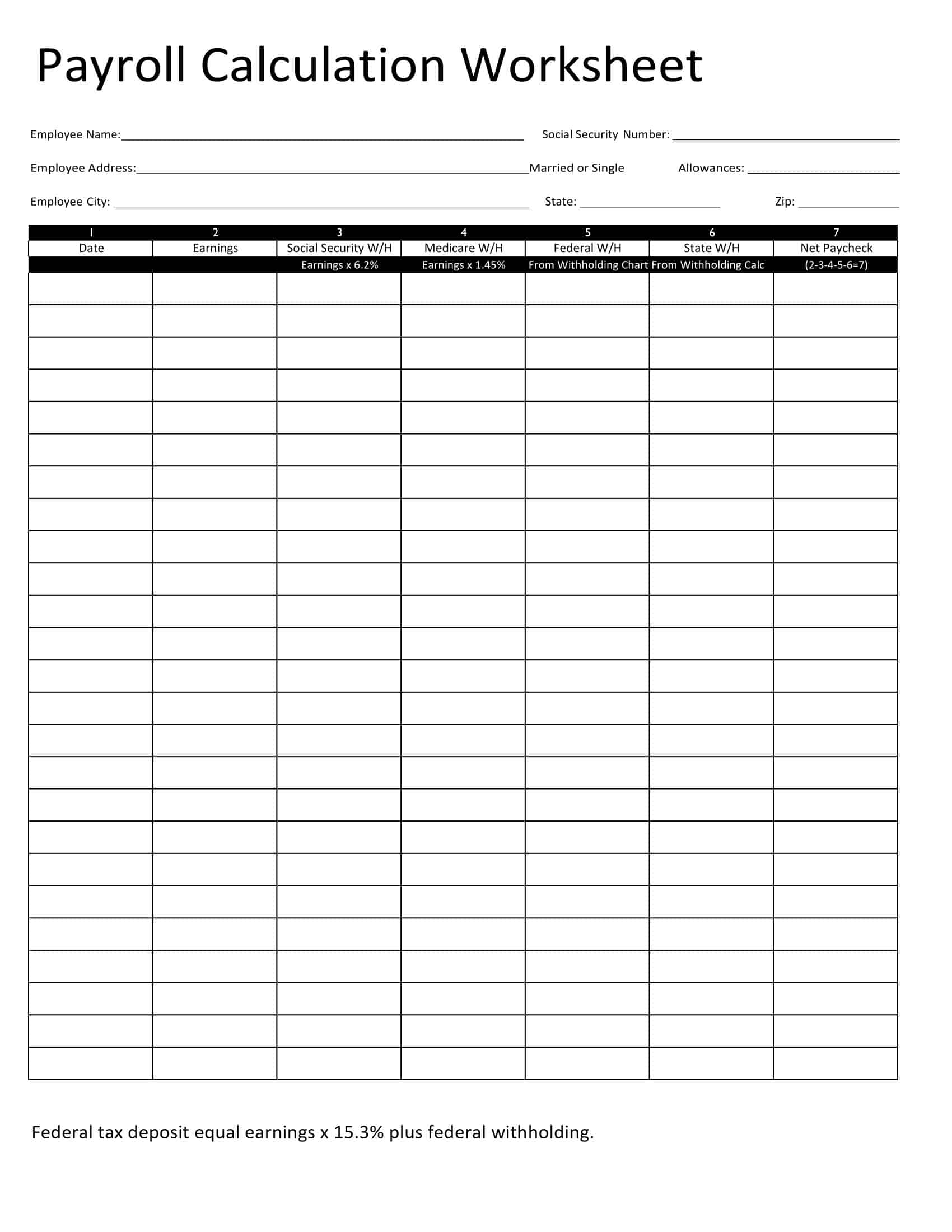

The payroll process involves calculating the total amount of money owed to employees, withholding taxes and other deductions, and distributing the remaining funds to employees through direct deposit or a physical check. In addition to the payment of salaries and wages, the payroll process also involves the administration of various taxes, such as federal and state income tax, Social Security and Medicare taxes, and unemployment insurance taxes.

Payroll Templates

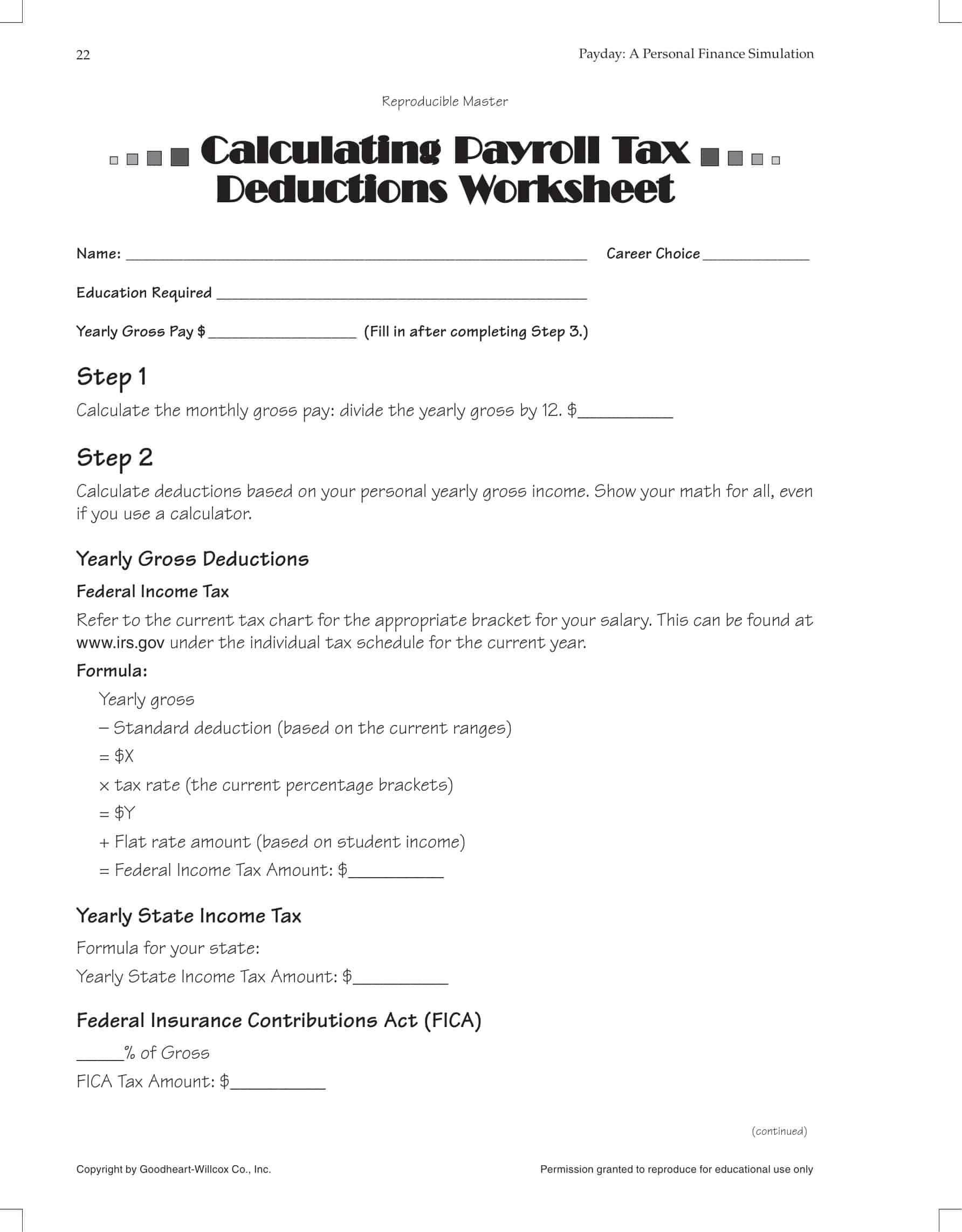

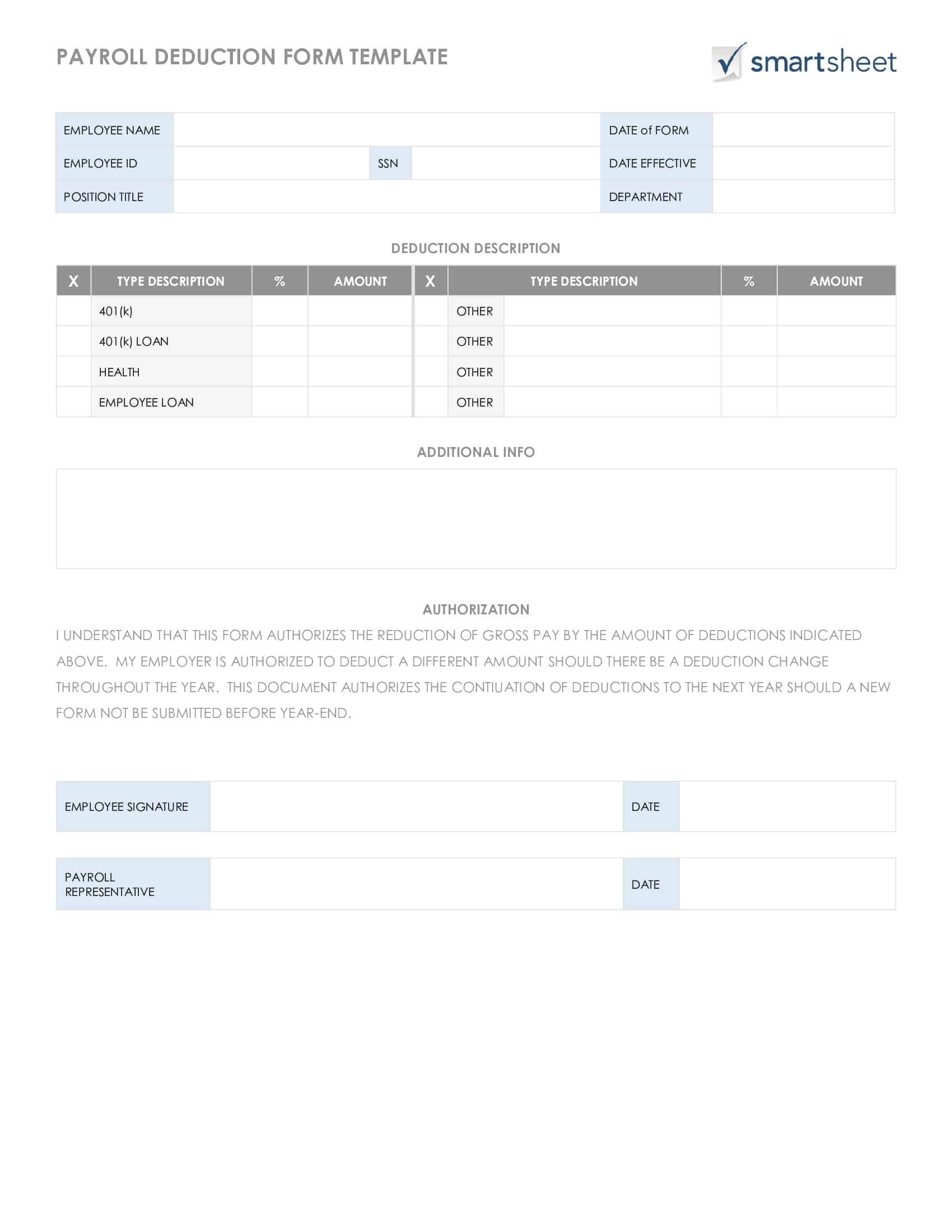

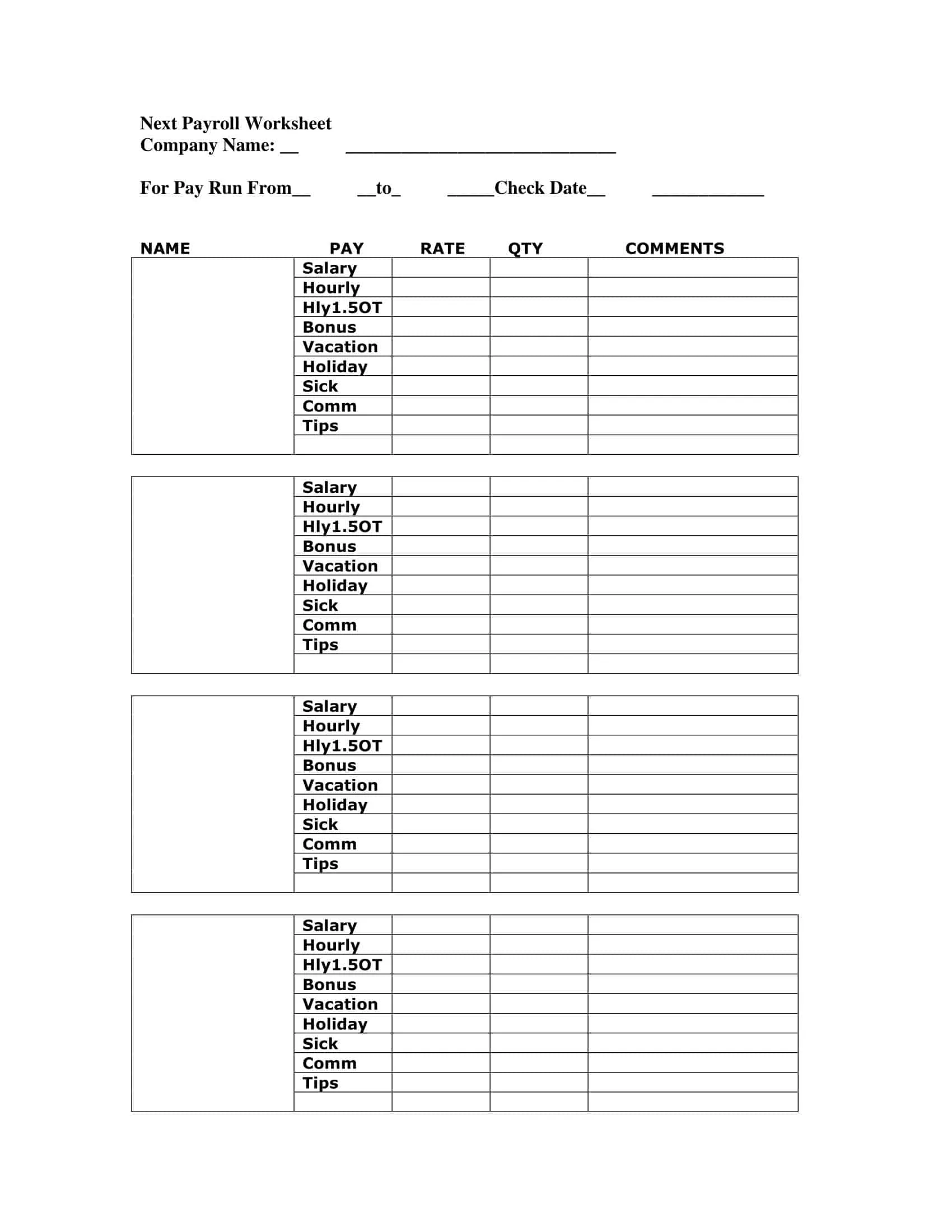

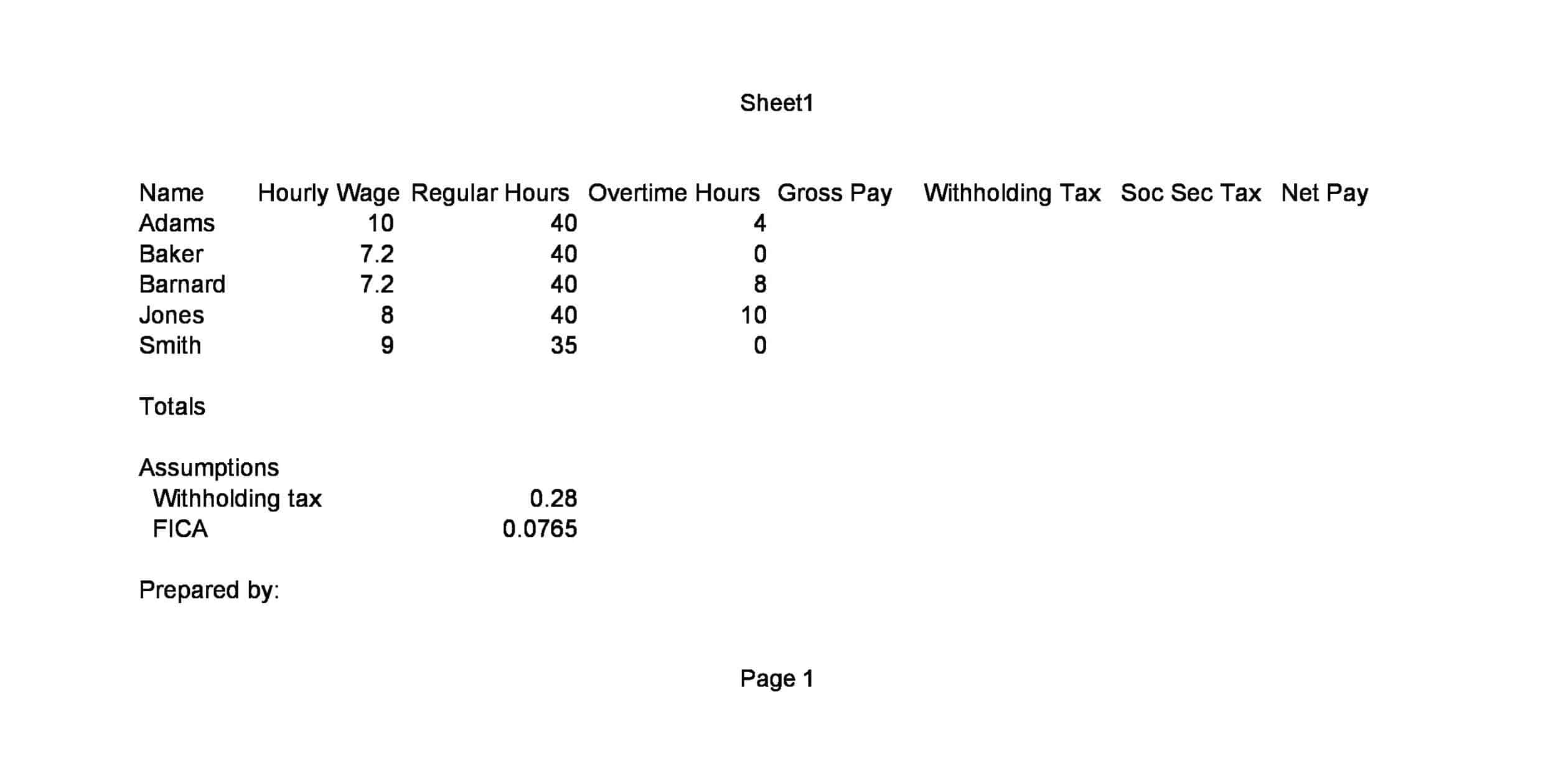

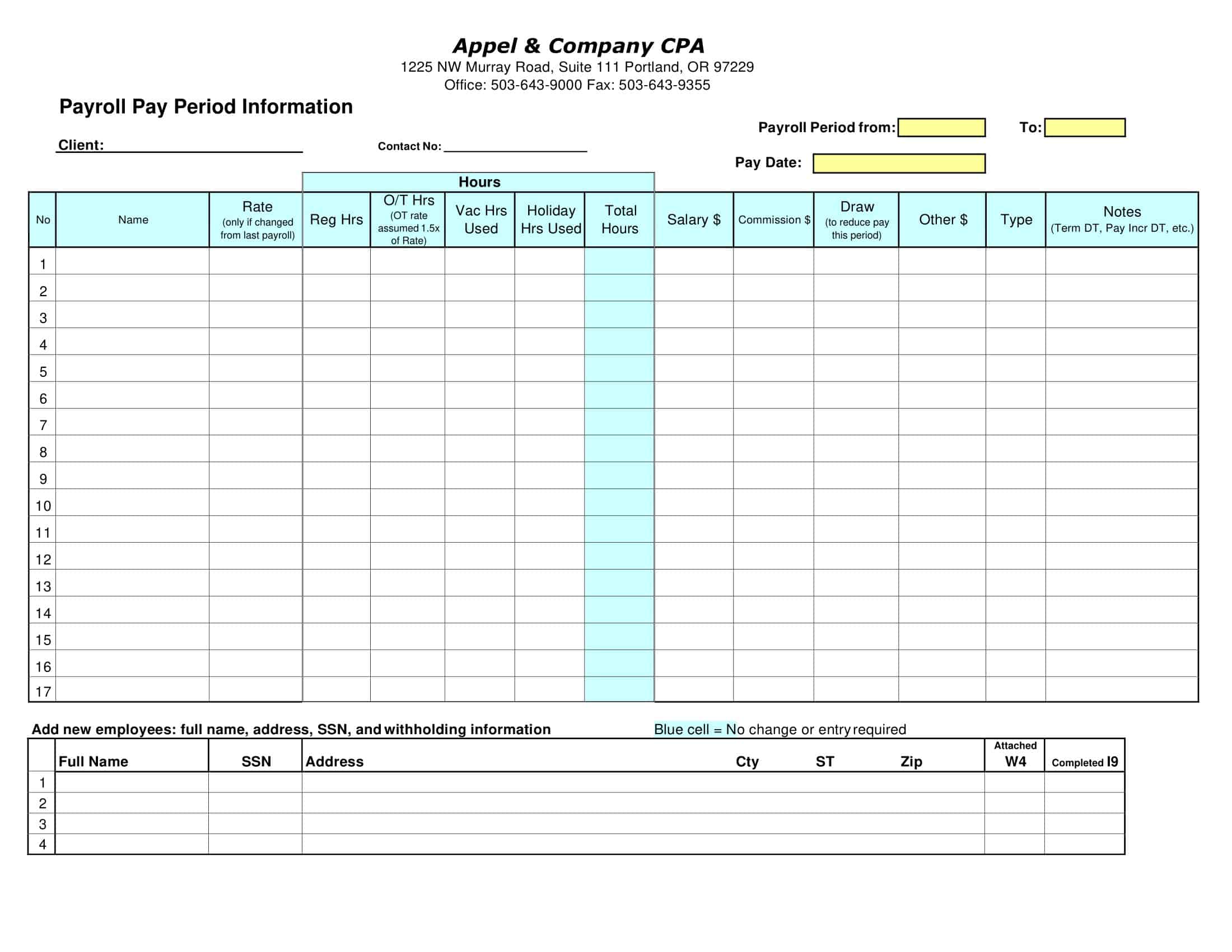

A Payroll Template is a pre-designed format used to facilitate the process of calculating and managing employee wages, salaries, deductions, and tax withholdings. These templates provide a structured framework that allows businesses or organizations to accurately and efficiently process payroll, ensuring timely and accurate compensation for employees. Payroll Templates include various sections and calculations to track working hours, determine gross pay, deduct taxes and other withholdings, and calculate net pay. They serve as a valuable tool for businesses of all sizes to streamline payroll processes and maintain accurate payroll records.

Payroll Templates assist businesses or organizations in streamlining payroll processes and maintaining accurate payroll records. By using these templates, payroll administrators or HR professionals can efficiently calculate employee wages, deductions, and withholdings, ensuring accurate and timely compensation. Payroll Templates promote compliance with tax and labor laws, facilitate reporting and record-keeping requirements, and enhance the overall efficiency of payroll operations. These templates are valuable tools for businesses of all sizes, ranging from small enterprises to large corporations, to manage their payroll processes effectively.

Types of payroll templates

When it comes to managing payroll, it’s essential to have a system in place that is both efficient and accurate. One way to achieve this is by utilizing payroll templates, which can streamline the process and help ensure that employees are paid on time and correctly. With a variety of templates available, it’s crucial to find the one that best suits your business’s needs. In part, we will explore the different types of payroll templates, their advantages, and how to choose the perfect one for your organization.

Excel Payroll Templates:

Excel payroll templates are a popular choice among small business owners who prefer a simple and cost-effective solution. These templates leverage Microsoft Excel’s capabilities, such as formulas and data validation, to automate calculations and maintain employee records. Excel templates can be customized according to your business’s specific needs and typically include sections for employee information, hours worked, overtime, deductions, and taxes.

Advantages:

Cost-effective and accessible

Easy to customize

Familiar interface for most users

Cloud-Based Payroll Templates:

Cloud-based payroll templates are available through various online payroll software providers. These templates offer a more advanced and integrated solution, as they can automatically sync with other systems like HR and timekeeping software. This type of template is ideal for businesses that want a more robust payroll management system with real-time updates and built-in compliance features.

Advantages:

Real-time updates and synchronization

Automatic tax calculations and compliance features

Accessible from any device with internet connectivity

Pre-Formatted PDF Payroll Templates:

Pre-formatted PDF payroll templates are designed for businesses that prefer a more traditional approach to payroll management. These templates can be printed and filled out manually or digitally, depending on your preference. Although they lack the automated features of Excel or cloud-based templates, PDF templates are straightforward and ideal for smaller businesses with a limited number of employees.

Advantages:

Easy to use and print

Suitable for small businesses with few employees

No specialized software required

Industry-Specific Payroll Templates:

Industry-specific payroll templates cater to businesses operating within particular sectors, such as construction, retail, or hospitality. These templates are designed to accommodate the unique payroll requirements and regulations specific to each industry. For instance, a construction payroll template may include features like job costing and prevailing wage calculations.

Advantages:

Tailored to industry-specific needs

Helps ensure compliance with industry regulations

Simplifies complex payroll calculations unique to the sector

Bi-weekly Payroll Template:

Bi-weekly payroll templates are designed for businesses that pay their employees every two weeks. This type of template takes into account the unique requirements of a bi-weekly pay schedule, including calculating overtime for employees who work more than 40 hours in a week.

Advantages:

Suitable for businesses with bi-weekly pay schedules

Simplifies overtime calculations

Reduces the frequency of payroll processing

Daily Payroll Template:

Daily payroll templates cater to businesses that need to track employee hours and calculate daily wages. This type of template is particularly useful for industries with variable work schedules, such as restaurants or retail stores.

Advantages:

Enables accurate daily wage calculations

Useful for industries with variable work schedules

Facilitates close monitoring of employee hours

Employee Payroll Template:

Employee payroll templates are designed to manage individual employee payroll information, including personal details, pay rates, hours worked, deductions, and taxes. This template is an excellent tool for keeping track of each employee’s payroll history and ensuring accurate record-keeping.

Advantages:

Simplifies record-keeping for individual employees

Enables quick access to employee payroll information

Facilitates accurate tax and deduction calculations

Monthly Payroll Template:

Monthly payroll templates are suitable for businesses that pay their employees on a monthly basis. These templates ensure that employee wages are calculated accurately and consistently each month, taking into account factors like deductions, taxes, and overtime.

Advantages:

Ideal for businesses with monthly pay schedules

Consistent and accurate wage calculations

Streamlines payroll processing on a monthly basis

Online Payroll Template:

Online payroll templates are web-based solutions that allow businesses to manage their payroll processes from anywhere with an internet connection. These templates can be accessed from any device, offering a convenient and flexible payroll management solution.

Advantages:

Accessible from any device with internet connectivity

Enables real-time updates and collaboration

Provides a flexible and convenient payroll management solution

Payroll Budget Template:

Payroll budget templates help businesses estimate and track their payroll expenses. These templates are useful for forecasting future payroll costs and ensuring that the business stays within budget.

Advantages:

Facilitates accurate payroll budgeting

Helps businesses stay within budget

Enables forecasting of future payroll costs

Payroll Check Template:

Payroll check templates are designed for businesses that issue physical paychecks to their employees. These templates ensure that all necessary information is included on the check, such as the employee’s name, pay rate, hours worked, and deductions.

Advantages:

Streamlines the process of issuing physical paychecks

Ensures all relevant information is included on the check

Provides a professional and consistent appearance for paychecks

Payroll Checklist Template:

Payroll checklist templates serve as a guide for businesses to ensure that all necessary payroll tasks are completed accurately and on time. These templates can help prevent errors and oversights in the payroll process.

Advantages:

Provides a structured guide for payroll tasks

Helps prevent errors and oversights

Ensures timely completion of payroll tasks

Payroll Invoice Template:

Payroll invoice templates are designed for businesses that need to bill clients for employee labor costs, such as staffing agencies or consulting firms. These templates include information like employee hours, pay rates, and any additional expenses associated with the services provided.

Advantages:

Simplifies invoicing for employee labor costs

Provides a professional and consistent appearance for invoices

Facilitates accurate billing and record-keeping

Payroll Reconciliation Template:

Payroll reconciliation templates help businesses verify the accuracy of their payroll records by comparing them with bank statements and other financial documents. This type of template is crucial for ensuring that all payroll transactions are accounted for and that there are no discrepancies.

Advantages:

Ensures the accuracy of payroll records

Identifies discrepancies and potential errors

Facilitates compliance with financial regulations

Payroll Schedule Template:

Payroll schedule templates assist businesses in planning and organizing their payroll processes by providing a clear timeline for tasks such as data entry, processing, and issuing payments. These templates can be customized to accommodate various pay frequencies and ensure that payroll tasks are completed in a timely manner.

Advantages:

Provides a clear timeline for payroll tasks

Customizable to suit various pay frequencies

Helps ensure timely completion of payroll tasks

Weekly Payroll Template:

Weekly payroll templates cater to businesses that pay their employees on a weekly basis. These templates streamline the process of calculating employee wages, taxes, and deductions for each weekly pay period.

Advantages:

Ideal for businesses with weekly pay schedules

Streamlines weekly payroll processing

Ensures accurate wage calculations and timely payments

Various uses of payroll templates

A payroll worksheet is a vital document utilized by businesses and organizations to compile and record employee salary information. This crucial document is necessary for maintaining accurate records of employee compensation details.

You can download a template here or create your own Excel payroll template to simplify the process. Here are some additional purposes served by these templates:

One of the primary functions of a payroll template is to efficiently organize information. Employers can use the template to monitor the wages paid to their employees and ensure accuracy. Keeping this information well-structured and easily accessible helps prevent any discrepancies or errors in your payroll. When an employer needs to refer to past wage information, these templates serve as a valuable resource.

Payroll templates can also be used to maintain an official register of all salaried employees within a company. Many businesses rely on payroll services and accountants, who frequently use such templates. These records can track employee attendance, working hours, and days off.

In addition to salary details, payroll templates can store other pertinent employee information such as job title, address, gender, and more.

Another essential function of a payroll template is to calculate employee salaries accurately. The template contains data about the hours worked and corresponding pay rates for each employee. Inputting this information into the payroll sheet ensures precise calculations.

Payroll templates also enhance employee accountability. Employees should fill in and verify the accuracy of the data at the end of the payroll period. This accuracy is crucial for determining their compensation, so it is their responsibility to provide correct information.

Furthermore, payroll templates can serve as legal documents, demonstrating that employers have compensated their employees fairly. These records can also be used to resolve any disputes that may arise by justifying the compensation provided to employees.

In conclusion, using payroll templates not only streamlines the payroll process but also demonstrates your commitment to the well-being of your employees.

Guidelines for Creating Payroll Templates

Utilizing a payroll worksheet template is an efficient way to standardize your payroll procedures. Create your own templates from scratch or download one here to save time and effort.

When developing a template for your payroll system, consider the information you need to include.

Take into account your payroll policies, particularly if your business is just starting. Define these policies and inform your employees about them. This ensures that everyone in the organization is well-versed in payroll matters. Here are some helpful suggestions:

Ensure that the information in your template is entirely accurate. If you choose to download a template, review it to determine if any adjustments are needed. Make the necessary changes so that the template aligns with your specific business requirements. Double-check the document before using it to ensure no details are overlooked.

Your templates should be user-friendly. Whether used by you or your employees, they should be straightforward and hassle-free. Maintain simplicity while ensuring completeness to avoid confusion.

The template you create should enhance the efficiency of your payroll system. It should not be a redundant document that merely increases paperwork. Opt for templates that support your organization’s workflow.

Lastly, ensure your template is customizable. Whether you create it or download it, you should have the option to modify it as needed. If your payroll policies change, you may need to update your template accordingly.

Ultimately, it is up to you to decide whether a simple or complex template best suits your needs. Regardless of the template type, it will prove invaluable for your business.

Things to do and not to do when using payroll templates

Payroll templates are essential tools for managing payroll processes and ensuring accuracy in employee compensation. However, it’s vital to use these templates effectively to get the most out of them. In this part, we’ll discuss the dos and don’ts of using payroll templates to optimize their benefits and avoid potential pitfalls.

Dos:

Do choose the right template for your needs:

Select a template that matches your payroll schedule, whether it’s weekly, bi-weekly, or monthly. The right template will streamline your payroll process and ensure accurate calculations.

Do customize the template for your business:

Tailor the template to include specific information relevant to your business, such as employee details, pay rates, and deduction types. This customization will make the template more efficient and useful for your organization.

Do keep the template up-to-date:

Regularly update the template to reflect changes in payroll policies, tax rates, or employee information. Keeping the template current will help maintain accuracy and compliance with regulations.

Do maintain clear and organized records:

Ensure that your payroll templates are well-organized and easy to understand. Use consistent formatting and clear labels to make it simple for anyone using the template to find and enter information.

Do double-check calculations and data entry:

Before finalizing payroll, double-check all calculations and data entry for accuracy. This practice will help prevent errors and ensure that employees are paid correctly.

Don’ts:

Don’t use an overly complicated template:

Choose a template that is user-friendly and easy to navigate. An overly complicated template can lead to confusion, mistakes, and inefficiencies in your payroll process.

Don’t forget to back up your data:

Regularly save and back up your payroll templates to protect against data loss. This practice will help ensure that your payroll information is secure and accessible when needed.

Don’t ignore local, state, and federal regulations:

Ensure your payroll template complies with all relevant laws and regulations, including minimum wage requirements, overtime rules, and tax withholdings. Non-compliance can result in penalties and legal issues.

Don’t rely solely on the template for compliance:

While a payroll template can help manage payroll processes, it’s essential to stay informed about changes in labor laws and tax regulations. Regularly review and update your knowledge to ensure ongoing compliance.

Don’t forget employee privacy:

Be mindful of employee privacy when using and storing payroll templates. Limit access to sensitive information and follow data protection best practices to safeguard your employees’ personal information.

FAQs

How often should payroll be processed?

Payroll frequency varies depending on the company’s policy and local regulations. Common payroll frequencies include weekly, bi-weekly, semi-monthly, and monthly.

What are the main payroll taxes?

Payroll taxes typically include federal income tax, state income tax (where applicable), Social Security, and Medicare. In some cases, local taxes may also apply.

What is the difference between exempt and non-exempt employees?

Exempt employees are not entitled to overtime pay and are generally salaried professionals who meet specific criteria set by the Fair Labor Standards Act (FLSA). Non-exempt employees are eligible for overtime pay and are usually paid hourly.

How is overtime pay calculated?

Overtime pay is generally calculated as 1.5 times the regular hourly rate for any hours worked beyond the standard 40-hour workweek. However, some states may have different rules for calculating overtime pay.

What is a payroll register?

A payroll register is a detailed record of all payroll transactions for a specific pay period. It includes employee information, hours worked, pay rates, deductions, and net pay.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)