When modifications are made to a Limited Liability Company (LLC) operating agreement, an updated, written record is generated to specify the section or sections of the initial LLC Operating Agreement that have undergone changes. New provisions may be introduced, existing ones might be eliminated, or the overall language and purpose of the operating agreement could be completely revamped.

To ensure that these adjustments are executed correctly and legally binding, certain fundamental guidelines must be adhered to. You cannot simply amend an LLC by drafting a brief memo and considering it done. All owners and operators participating in the LLC must consent to the amendment of the operating agreement as well. It is not permissible for a single owner to independently modify the LLC operating agreement without the awareness and agreement of the other parties engaged in the administration or oversight of the enterprise.

Table of Contents

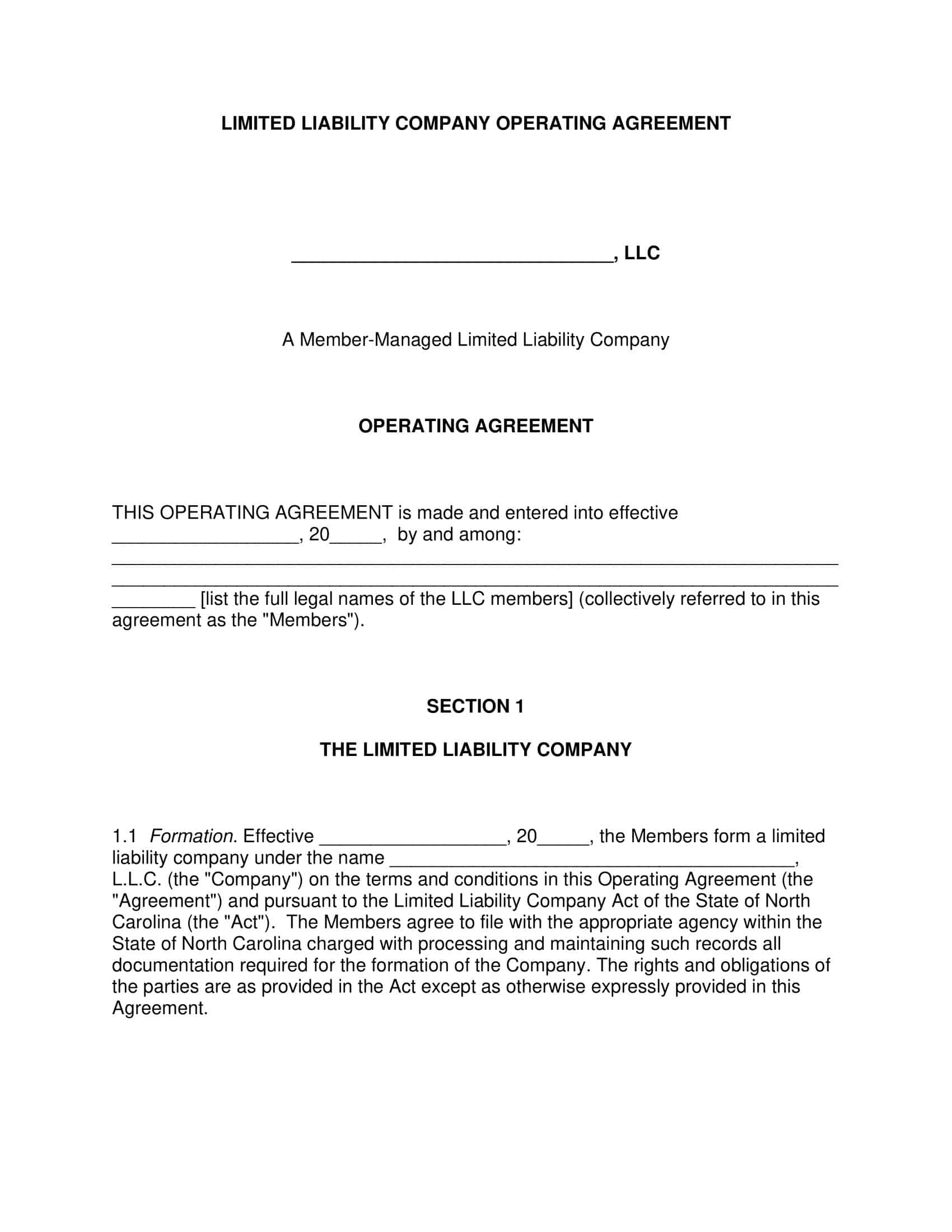

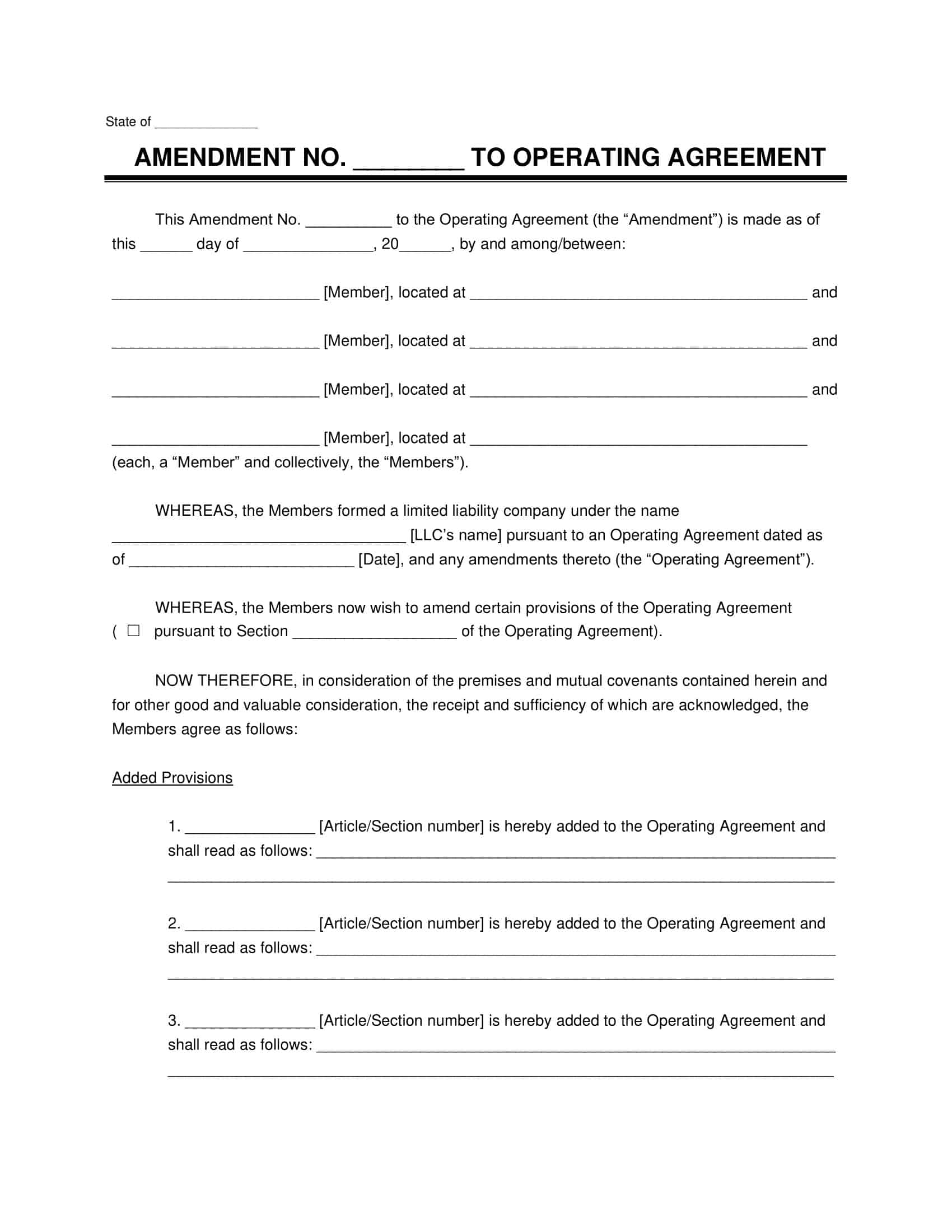

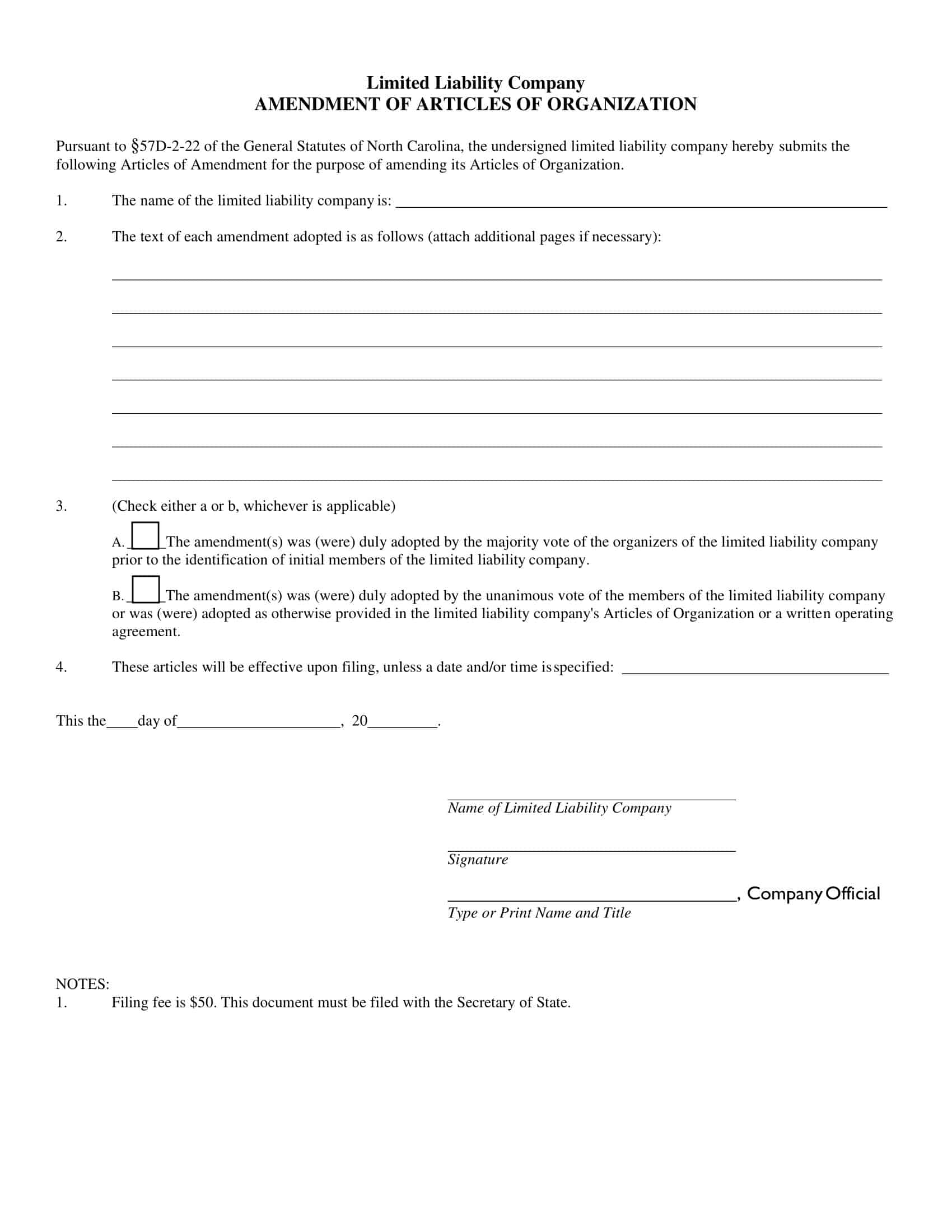

Amendment to LLC Operating Agreement Templates

“Operating Agreement Amendment Templates” are pre-designed documents that facilitate the modification and updating of an existing operating agreement for a business entity, such as a limited liability company (LLC). These templates provide a structured framework for making changes to the terms, provisions, and governance structure outlined in the original operating agreement.

Operating agreements serve as the foundational documents that govern the operations, rights, and responsibilities of the members or owners of an LLC. However, as circumstances change or business needs evolve, it may become necessary to amend the operating agreement to reflect these modifications accurately.

Operating agreement amendment templates provide a standardized and legally sound format for documenting changes to the original agreement. These templates typically include sections to identify the LLC, outline the specific sections or provisions being amended, and specify the new terms or language being introduced.

What is an Amendment To LLC Operating Agreement?

An Amendment to an LLC Operating Agreement is a formal, written modification made to the original operating agreement of a Limited Liability Company (LLC). This amendment serves to document any changes to the provisions, terms, or clauses in the original agreement, ensuring that the updated agreement reflects the current intentions and understandings of the LLC members.

Key Elements to Include When Revising an Operating Agreement

An Amendment to an Operating Agreement should be comprehensive, clear, and concise to effectively address the changes being made to the original document. Key components of such an amendment typically include:

Title and preamble: Clearly identify the document as an amendment to the existing operating agreement, specifying the name of the LLC, the date of the original agreement, and the purpose of the amendment.

Reference to the original agreement: Explicitly mention the section or sections of the original operating agreement that are being altered, ensuring that the context of the amendment is clear.

Detailed description of changes: Precisely outline the modifications being made, such as the addition or removal of sections, alterations to the language, or revisions to the roles and responsibilities of the members. Each change should be explained thoroughly to avoid ambiguity or misinterpretation.

Compliance with applicable laws: Ensure that the amendment adheres to relevant federal, state, and local regulations governing LLCs. This may involve consulting an attorney or a legal expert to verify that the changes are in line with the law.

Effective date: Specify the date from which the amendment will be in effect, clarifying any transitional arrangements if necessary.

Member consent and signatures: Obtain the consent and signatures of all LLC members, demonstrating their agreement to the changes. Depending on the jurisdiction, it may be necessary to have the signatures notarized to validate the amendment.

Record-keeping and filing: Retain a copy of the amendment with the original operating agreement, making it accessible to all members. In some cases, the amendment may need to be filed with the appropriate state agency to ensure compliance with reporting requirements.

Potential Obstacles to Modifying an LLC Operating Agreement

When multiple individuals operate an LLC and hold ownership stakes in the enterprise, restrictions on amending the operating agreement may arise. Operating agreements serve to prevent misunderstandings and conflicts regarding the management of the business, simplifying co-ownership. However, there are several circumstances that might hinder the amendment of your LLC operating agreement:

- The original agreement explicitly states that it cannot be amended.

- Amendments require the unanimous consent of all owners.

- A majority vote among the owners is necessary to approve an amendment.

- Amendments are allowed only after a predetermined period, such as one year, has elapsed.

- Amendments can be made exclusively during a specific quarter of the operational year.

Incorporating these provisions from the outset can significantly constrain the ability of any single owner to make changes to the LLC’s operations. This limitation often poses challenges to amending LLC operating agreements for various types of businesses. For LLCs without a sole proprietor, maintaining up-to-date operational documentation is crucial to prevent confusion, power imbalances, and issues related to ownership rights.

How to Incorporate an Amendment into an Operating Agreement

Before amending your LLC operating agreement, ensure that all members have approved the proposed changes and reached a consensus on how to implement them. Once the owners have agreed upon the modifications, adhere to the correct procedure for drafting a legally binding document that identifies the revised sections and outlines the specific changes made to the agreement.

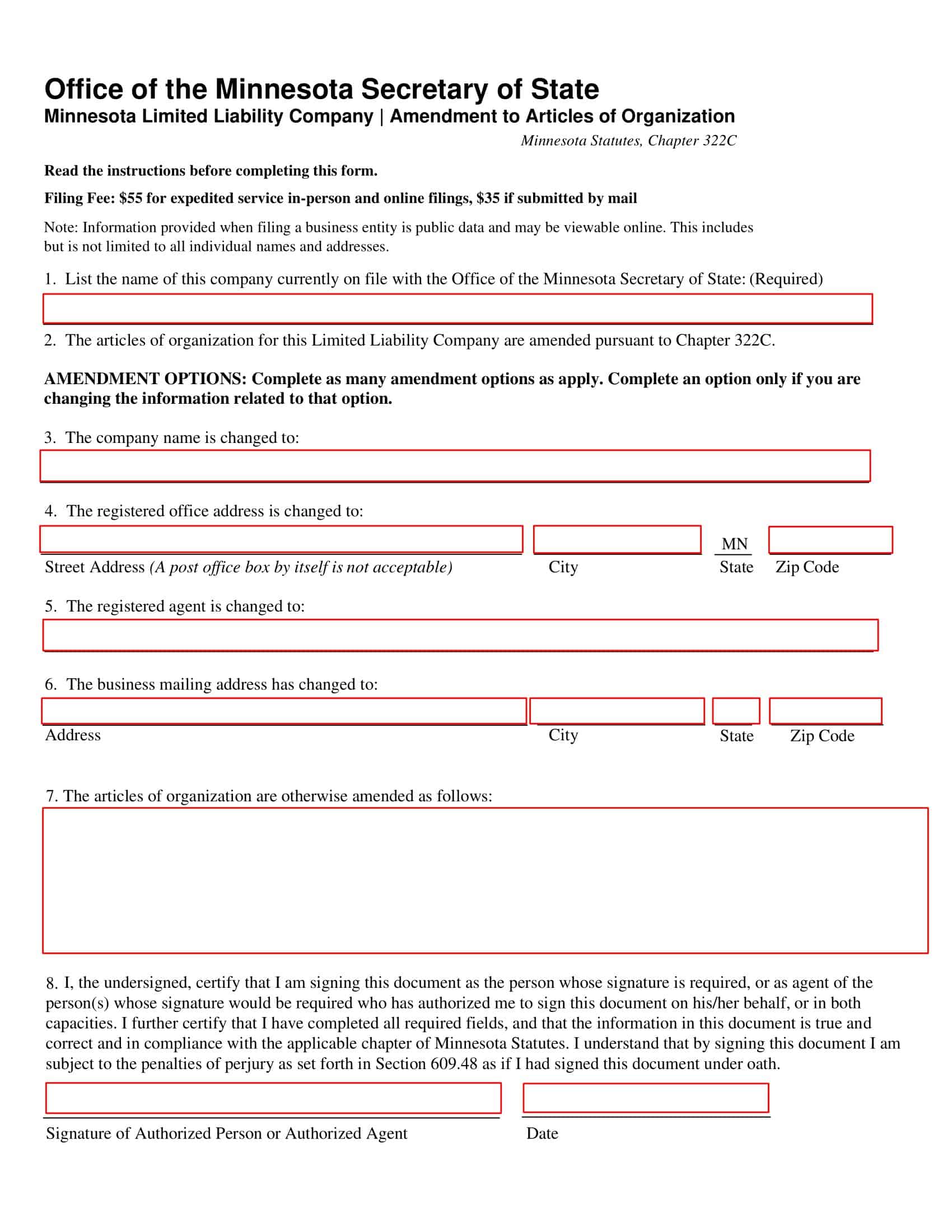

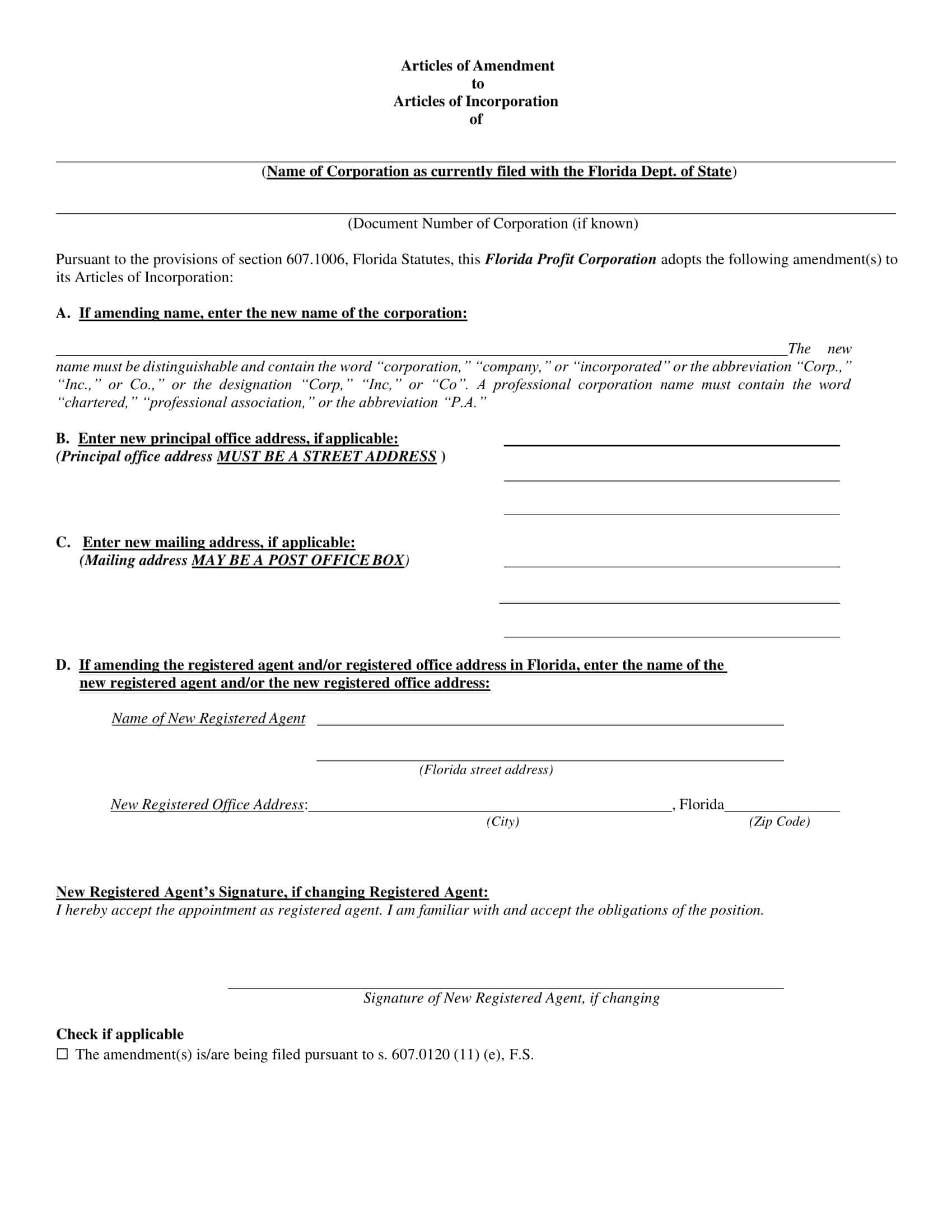

Familiarize yourself with your state’s regulations governing such amendments to ensure compliance with the necessary legal and reporting requirements for the LLC operating agreement process. Even if all members consent to the changes, an improperly created and filed document can render the amendment invalid.

In some states, annual reports are mandatory for updating LLC membership information. Verify that any amendments involving changes to your LLC’s membership are in accordance with state rules and guidelines. Avoid the potential consequences of inadequate documentation or improper processing of significant changes by adhering to the appropriate legal procedures.

How Should an LLC Approach Amendment Discussions?

To effectively address potential operating agreement amendments, it’s advisable for an LLC to hold at least one annual meeting focused on discussing any necessary alterations. These meetings should be open to all owners and provide a forum for open dialogue about potential changes to the business operations. It’s essential to understand the management structure of your LLC, as it could be either member-managed or manager-managed.

The distinct management styles of LLCs can impact the functioning of operating agreements and the amendment process. If you lack legal counsel to advise on the implications of these management styles on operating agreement amendments, consider hiring an attorney. Expert legal guidance is invaluable for managing a business, reducing the likelihood of issues with the operation and management of your company.

The Importance of Accurate LLC Amendments

Amending an LLC operating agreement may seem overwhelming, and while templates may provide some guidance, relying solely on them is not recommended. Attorneys specializing in LLC and business law can assist in drafting accurate and compliant amendment documents, minimizing the risk of future disputes concerning your business operations.

Significant changes to operational locations, ownership, or management structures necessitate proper amendment documentation. Ensuring that your LLC operating agreement amendments are suitable for your business type and comply with state regulations is critical to your company’s success. Follow these guidelines to protect your business operations with accurate and effective LLC amendments.

Most Common Operating Agreement Amendment Situations

Several situations may prompt an LLC to amend its operating agreement. Some of the most common circumstances include:

Changes in ownership

If a new member joins the LLC, or an existing member departs, the operating agreement should be amended to reflect the updated ownership structure and distribution of interests.

Modifications to profit and loss allocation

As an LLC’s financial situation evolves, it may be necessary to adjust the allocation of profits and losses among members, requiring an amendment to the operating agreement.

Adjustments to management structure

If the LLC transitions from member-managed to manager-managed or vice versa, or if there are changes to roles and responsibilities of the members, the operating agreement should be amended to accurately represent the new management structure.

Revisions to decision-making processes

Changes to voting requirements, quorum rules, or other decision-making procedures may necessitate an amendment to the operating agreement to ensure clarity and avoid future disputes.

Updates to capital contributions

If members contribute additional capital or if the required capital contributions change, the operating agreement should be amended to record these adjustments.

Changes in the registered agent or office

If the LLC’s registered agent or registered office location changes, the operating agreement should be updated accordingly.

Dissolution or exit strategies

Amendments may be required to address new plans or procedures for the dissolution of the LLC or the exit of members.

Legal or regulatory updates

Changes in federal, state, or local laws and regulations affecting LLCs may require amendments to the operating agreement to ensure compliance.

These common situations illustrate the importance of regularly reviewing and updating the operating agreement to maintain a transparent, up-to-date, and legally compliant operating structure for the LLC.

What Are the Implications of Failing to Amend an Operating Agreement?

Neglecting to follow the appropriate amendment process can lead to undesirable consequences. The operating agreement serves as a fundamental tool for resolving disputes among owners or between employees and owners. An outdated agreement can create complications, leading to potential legal conflicts and operational challenges.

When ownership changes occur, new partners may not receive their rightful ownership shares if amendments haven’t been filed correctly. Additionally, improperly documented agreements can result in financial discrepancies or issues with decision-making authority, such as veto power, among the owners.

LLCs lacking properly updated operating agreement documents are at risk of dissolution or closure. To safeguard your business, it is prudent to maintain thorough and accurate documentation of your operating agreement, erring on the side of over-documentation rather than under-documentation. Business ownership and management disputes can be contentious, and avoiding such issues is crucial to prevent drawn-out legal battles that could jeopardize the stability and success of your enterprise.

FAQs

When is an Operating Agreement Amendment necessary?

An amendment is necessary when there are significant changes within the LLC, such as adding or removing members, altering profit and loss allocation, changing management structure, updating decision-making processes, or adjusting capital contributions.

Do all members need to agree on an amendment?

Generally, all members should agree on the proposed changes to the operating agreement. However, the specific requirements for approving amendments may be outlined in the original operating agreement, which could include provisions for majority or unanimous votes.

Do I need a lawyer to amend my LLC Operating Agreement?

While it is not legally required to have a lawyer for amending an operating agreement, it is recommended. A lawyer with experience in LLC and business law can ensure that your amendment is accurate, compliant with state regulations, and effectively protects your business interests.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 2 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)

![Free Printable Separation Agreement Templates [PDF, Word] 3 Separation Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Separation-Agreement-1-150x150.jpg)