Finance can be a complex and technical subject, which is why many people turn to finance representatives or attorneys to handle their loans, mortgages, and other financial matters. One such financial tool is a loan amortization schedule, which is a detailed repayment plan that shows how a loan will be paid off over time. This schedule breaks down the payments into regular installments that include both principal and interest, and outlines the amount of principal and interest due each month as well as the remaining balance of the loan.

While creating a loan amortization schedule may seem intimidating, there are now many free templates and schedules available online that allow you to easily input your loan details and get an instant calculation. If you have taken out a loan, mortgage, or car loan, understanding how a loan amortization schedule works can help you better manage your debt and plan for the future.

Table of Contents

Amortization Schedule Templates

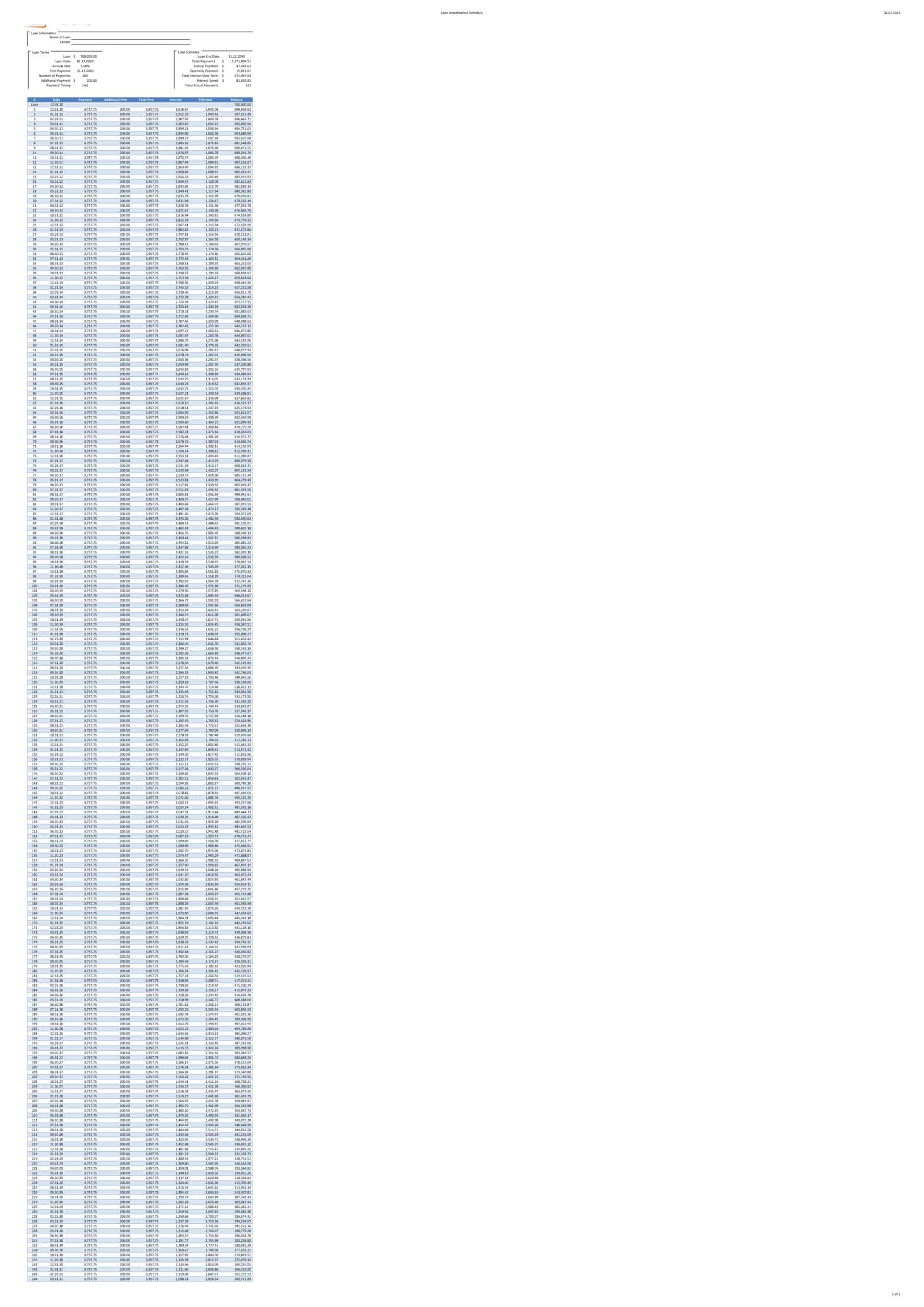

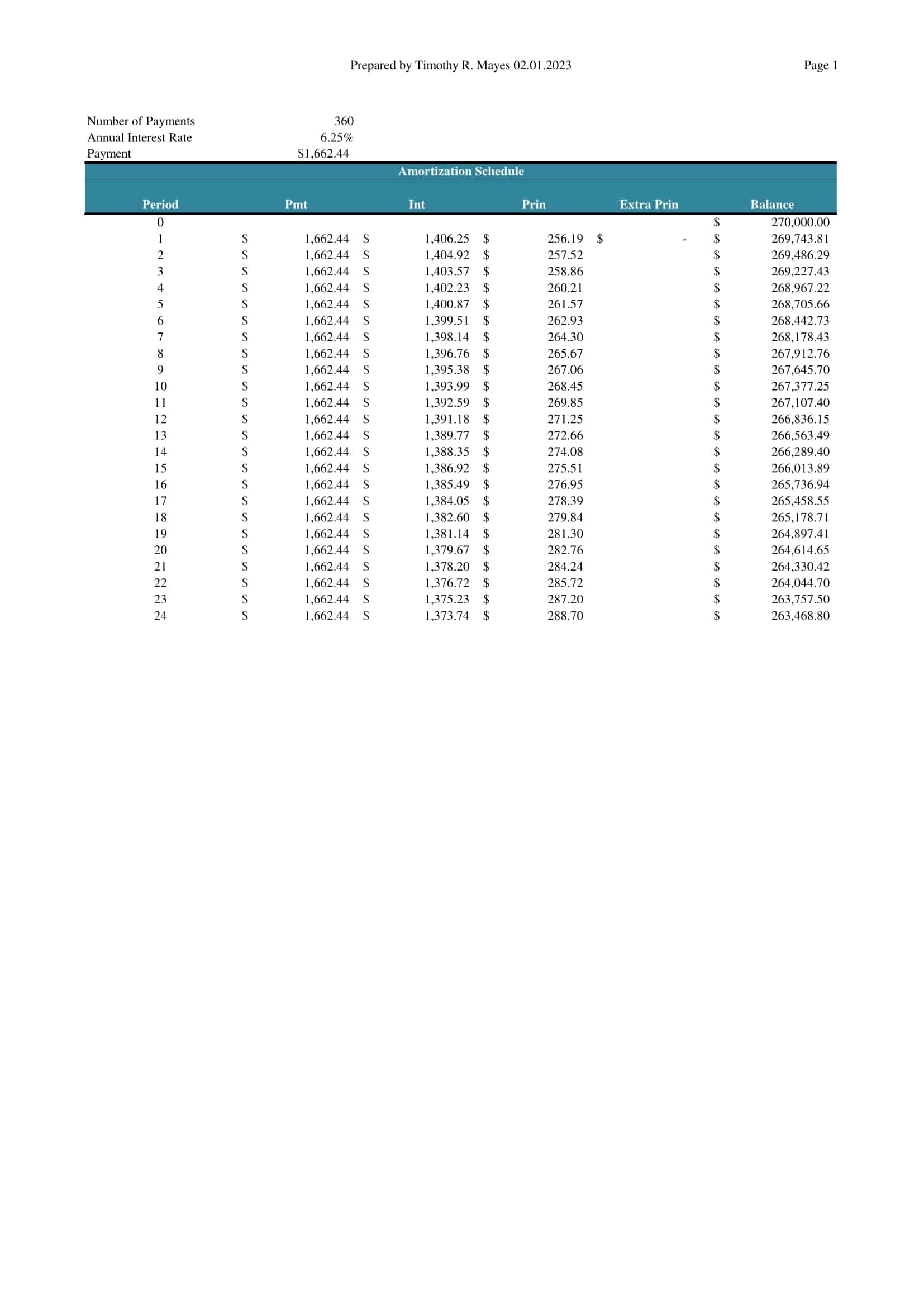

Amortization schedule templates are pre-designed documents that outline the repayment schedule for a loan or mortgage. These templates provide a detailed breakdown of each payment, including the principal amount, interest, and remaining balance, over the course of the loan term.

Amortization schedule templates typically include columns or sections for the payment number, payment date, principal payment, interest payment, total payment, and the remaining balance. They may also include additional information, such as the loan amount, interest rate, loan term, and any additional fees or charges associated with the loan.

Using an amortization schedule template can help borrowers understand and plan their loan repayments. It provides a clear and structured overview of the payment amounts and interest charges over time, allowing borrowers to see how their payments will impact the remaining balance and the total cost of the loan.

What Is an Amortization Schedule?

An amortization schedule is a table that shows the breakdown of loan payments into periodic installments, showing the amount of principal and interest due in each payment and the remaining balance of the loan after each payment. The schedule typically shows the payment period, payment due date, payment amount, principal amount, interest amount, and remaining balance.

An amortization schedule can be created for any type of loan, including mortgages, car loans, and personal loans. The schedule is often used to help borrowers understand and plan for their loan payments, as it shows the total amount of interest and principal that will be paid over the life of the loan. It can also be helpful for borrowers to see how the balance of their loan decreases over time as they make payments.

Key Terms About Amortization Schedule

An amortization schedule is a table that shows the payment amounts and breakdown of interest and principal for a loan or mortgage. The schedule shows the remaining balance still owed after each payment is made, so you can see how much of your payments are going towards principal and how much is going towards interest. Here are some key terms related to amortization schedules:

Principal: The principal is the amount of money borrowed in a loan or mortgage. For example, if you take out a $200,000 mortgage, the principal is $200,000.

Interest: Interest is the cost of borrowing money, which is typically expressed as a percentage of the principal. For example, if you have a 5% interest rate on a $200,000 mortgage, the interest cost would be $10,000 per year (5% of $200,000).

Fixed interest rate: A fixed interest rate means that the interest rate on a loan or mortgage remains the same over the life of the loan. For example, if you have a 5% fixed interest rate on a 30-year mortgage, your interest rate will be 5% for the entire 30 years.

Adjustable interest rate: An adjustable interest rate, also known as a variable interest rate, means that the interest rate can change over time. Adjustable interest rates are often tied to a benchmark interest rate, such as the prime rate or the London Interbank Offered Rate (LIBOR). If the benchmark rate goes up, the adjustable interest rate on your loan or mortgage will also go up.

Term: The term of a loan or mortgage is the length of time over which it is repaid. For example, a 30-year mortgage has a term of 30 years, while a 15-year mortgage has a term of 15 years.

Monthly payment: The monthly payment on a loan or mortgage is the amount that you pay each month to repay the loan. It typically includes the principal and interest, as well as any other fees or charges, such as insurance or property taxes.

Amortization period: The amortization period is the length of time it takes to pay off a loan or mortgage. It is typically the same as the term of the loan, but it can be shorter if you make additional payments or pay off the loan early.

Extra payments: Extra payments are payments that are made on top of the regular monthly payments on a loan or mortgage. These payments can help you pay off the loan faster and save money on interest.

Prepayment: A prepayment is a payment made on a loan or mortgage before it is due. Prepayments can include extra payments or paying off the loan in full before the end of the term.

Refinancing: Refinancing is the process of taking out a new loan to pay off an existing one. People often refinance their loans or mortgages to get a lower interest rate, a shorter term, or to tap into the equity in their home.

Origination fee: An origination fee is a fee charged by the lender to cover the costs of processing and underwriting a loan. It is typically a percentage of the loan amount, and it is typically rolled into the loan balance.

Closing costs: Closing costs are the fees and expenses associated with getting a loan or mortgage.

Annual percentage rate (APR): The annual percentage rate (APR) is the annual cost of borrowing money, expressed as a percentage. It includes the interest rate as well as any fees or other costs associated with the loan. The APR is used to compare the cost of borrowing money from different lenders, as it takes into account the total cost of the loan over the life of the loan.

Points: Points are a form of prepaid interest that a borrower pays to the lender at closing. One point is equal to 1% of the loan amount, so if you take out a $200,000 mortgage and pay two points, you would pay $4,000 in points. Points are often used to lower the interest rate on a loan.

Mortgage insurance: Mortgage insurance is insurance that protects the lender in case the borrower defaults on the loan. It is typically required if the borrower puts down less than 20% of the purchase price as a down payment. Mortgage insurance can be paid upfront or added to the monthly payment.

Private mortgage insurance (PMI): Private mortgage insurance (PMI) is mortgage insurance that is provided by a private company, rather than a government agency. It is typically required if the borrower puts down less than 20% of the purchase price as a down payment.

Federal Housing Administration (FHA) insurance: Federal Housing Administration (FHA) insurance is mortgage insurance provided by the government through the Federal Housing Administration. It is typically required if the borrower puts down less than 20% of the purchase price as a down payment.

Reverse mortgage: A reverse mortgage is a type of loan that allows homeowners to tap into the equity in their home. With a reverse mortgage, the borrower does not make monthly payments on the loan and the loan does not have to be repaid until the borrower sells the home or dies.

Balloon payment: A balloon payment is a large, final payment that is due at the end of a loan or mortgage term. Balloon payments are often used in conjunction with adjustable interest rate loans, as the borrower may be required to pay off the remaining balance at the end of the term if the interest rate has increased significantly.

Default: Default is when a borrower fails to make the required payments on a loan or mortgage. If a borrower defaults on a loan, the lender can foreclose on the property and take ownership in order to recoup the unpaid balance.

Types of Amortization Schedule

An amortization schedule is a table that shows the payment amounts and breakdown of interest and principal for a loan or mortgage. It is a useful tool for borrowers to understand how their loan or mortgage is being paid off over time, as it shows the remaining balance after each payment and the total amount of interest and principal paid over the life of the loan.

Amortization schedules can be based on different payment frequencies, such as monthly, weekly, or daily. Understanding the terms and features of an amortization schedule can help borrowers make informed decisions about their loans and manage their finances more effectively.

Monthly loan schedule

With a monthly loan schedule, the borrower makes payments on the loan once per month. The payment amount will typically include both principal and interest, and the amount of principal and interest paid each month will vary depending on the remaining balance and the interest rate.

Weekly loan schedule

With a weekly loan schedule, the borrower makes payments on the loan once per week. The payment amount will typically include both principal and interest, and the amount of principal and interest paid each week will vary depending on the remaining balance and the interest rate.

Daily loan schedule

With a daily loan schedule, the borrower makes payments on the loan once per day. The payment amount will typically include both principal and interest, and the amount of principal and interest paid each day will vary depending on the remaining balance and the interest rate.

It is important to note that the frequency of the payments does not affect the total amount of interest paid over the life of the loan. However, making payments more frequently (e.g. weekly or daily instead of monthly) can reduce the overall interest cost by paying off the loan faster. This is because the interest on the loan is calculated based on the outstanding balance, and making more frequent payments reduces the outstanding balance faster, resulting in less interest accruing over time.

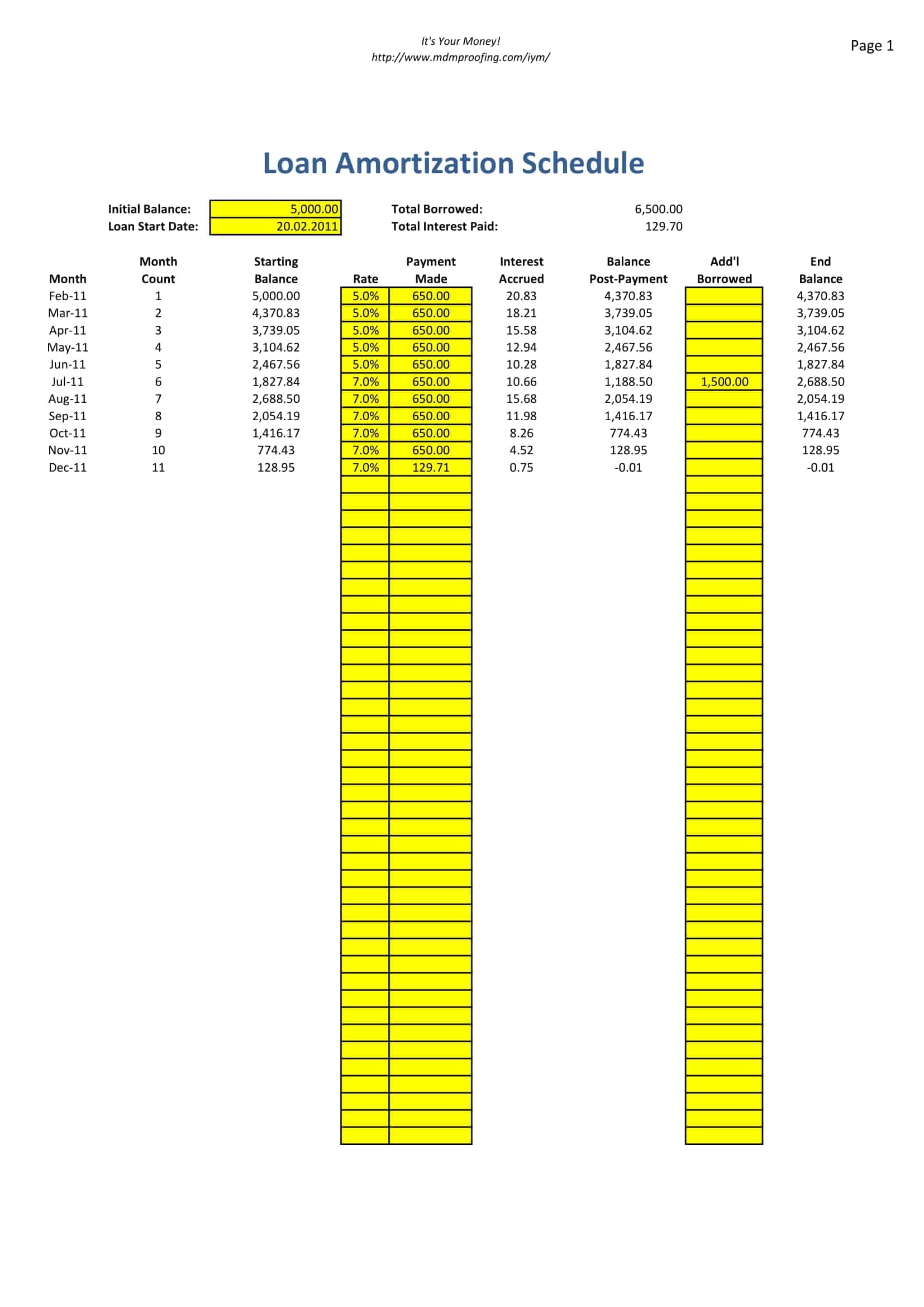

Amortization Schedule with Extra Payments

Scheduling extra payments in an amortization schedule can help you pay off your loan or mortgage faster and save money on interest. Here are some steps you can follow to schedule extra payments in an amortization schedule:

Determine the amount of the extra payment: Decide how much you want to pay above your regular monthly payment. Keep in mind that making extra payments can reduce the overall interest cost of the loan, but it may also extend the loan term if the extra payments are not large enough to significantly reduce the outstanding balance.

Determine the frequency of the extra payments: Decide how often you want to make the extra payments. You can make extra payments every month, every other month, or on any other schedule that works for you.

Determine the timing of the extra payments: Decide when you want to make the extra payments. Some options include making the extra payment at the same time as the regular payment, making the extra payment in the middle of the month, or making the extra payment at the end of the month.

Update the amortization schedule: Use an amortization calculator or create an amortization schedule in a spreadsheet to see how the extra payments will affect the loan. Enter the loan amount, interest rate, and loan term, as well as the extra payment amount and frequency. The updated amortization schedule will show the revised payment amounts and the impact on the remaining balance and total interest paid.

Make the extra payments: Once you have determined the extra payment amount and frequency, make sure to follow through and make the extra payments on time. This will help you pay off the loan faster and save money on interest.

It is important to note that making extra payments may not always be the best option, as you may have other financial priorities or may need the extra cash for emergencies or other expenses. Be sure to consider your overall financial situation before committing to extra payments on a loan or mortgage.

How to create a loan amortization schedule in Excel

Here is a step-by-step guide to creating a loan amortization schedule in Excel:

- Open a new spreadsheet in Excel.

- Create the following column headers: “Payment Number,” “Payment Date,” “Principal,” “Interest,” “Extra Payment,” “Total Payment,” and “Balance.”

- Enter the loan details in the first row under the appropriate column headers. For example, enter the loan amount in the “Balance” column, the interest rate in the “Interest” column, and the loan term in the “Payment Number” column.

- Calculate the monthly payment amount using the PMT function. The PMT function takes the following arguments: rate (the interest rate per period), nper (the total number of payments), pv (the present value or loan amount), and fv (the future value or balance after the final payment). For example, to calculate the monthly payment for a $200,000 loan with a 5% annual interest rate and a 30-year term, the formula would be: =PMT(5%/12,30*12,-200000). This formula assumes that the loan is paid off in equal monthly installments and does not include any extra payments.

- Enter the payment date for the first payment in the “Payment Date” column. If the loan starts on January 1, 2022, for example, the payment date for the first payment would be February 1, 2022.

- Calculate the interest paid for the first payment using the following formula: =”Balance”*”Interest”/12. This formula assumes that the interest is calculated on a monthly basis.

- Calculate the principal paid for the first payment using the following formula: =”Total Payment”-“Interest.” This formula subtracts the interest paid from the total payment amount to determine the amount of principal paid.

- Calculate the remaining balance after the first payment using the following formula: =”Balance”-“Principal.” This formula subtracts the principal paid from the balance to determine the remaining balance.

- Repeat steps 6-8 for each subsequent payment, using the updated balance as the starting balance for the next payment.

- If you want to include extra payments in the schedule, add a column for “Extra Payment” and enter the amount of the extra payment for each payment period. Then, update the formulas for “Total Payment,” “Interest,” and “Principal” to include the extra payment. For example, the formula for “Total Payment” would become: =”Monthly Payment”+”Extra Payment,” and the formula for “Principal” would become: =”Total Payment”-“Interest.”

- Format the spreadsheet as desired and add any additional formatting or formulas as needed. For example, you may want to highlight the cells with negative values in red to make them more noticeable.

- Save the spreadsheet.

By following these steps, you can create a customized loan amortization schedule in Excel that shows the payment amounts and breakdown of interest and principal for a loan or mortgage. You can then use the schedule to track your payments and see the impact of extra payments on the loan balance and overall interest cost.

FAQs

How do I make my own amortization schedule?

To make your own amortization schedule, open a spreadsheet and create columns for payment number, payment amount, interest paid, principal paid, and balance. Input the loan terms and use a formula like =PMT() to calculate the payment. Allocate to interest and principal. Repeat, adjusting balance, to map the lifespan of the loan.

Does Excel have an amortization schedule template?

Yes, Excel has downloadable amortization schedule templates that perform the payment calculations and populate the tables automatically based on inputs like loan amount, term, rate, etc. This simplifies generating a schedule. The templates can be customized.

How do I create an amortization schedule in Excel?

In Excel, make columns for payment number, date, payment, interest, principal, and balance. Input loan data and use PMT, IPMT, and PPMT functions to calculate the values. Drag the formulas down and each row will update. Format for readability. The amortization schedule will populate.

Can I print an amortization schedule?

Yes, amortization schedules created in spreadsheet programs like Excel can be easily printed for reference. Schedule printouts are useful when prepaying a loan, selling property, reporting taxes, or determining payoff dates. Amortization websites also offer printable schedules.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)