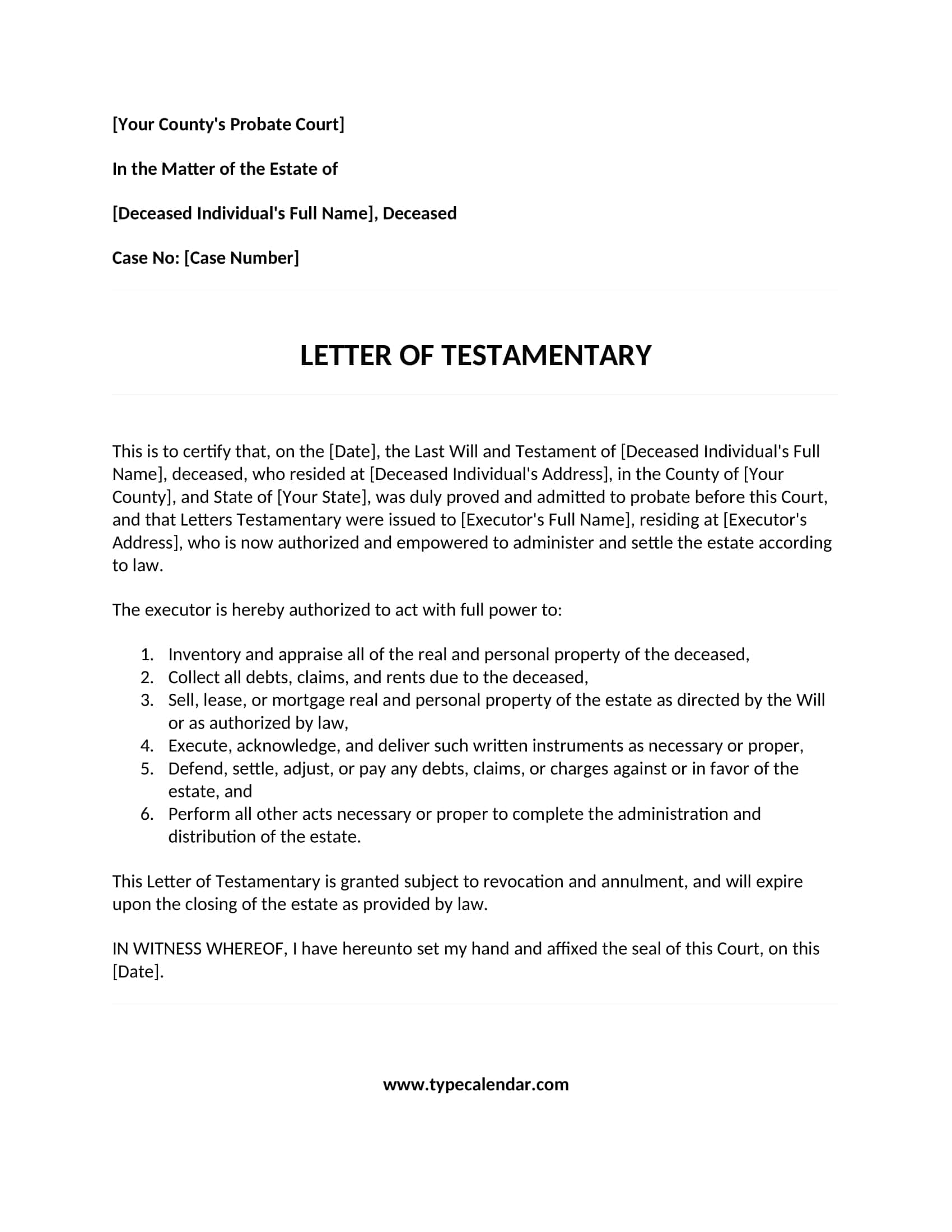

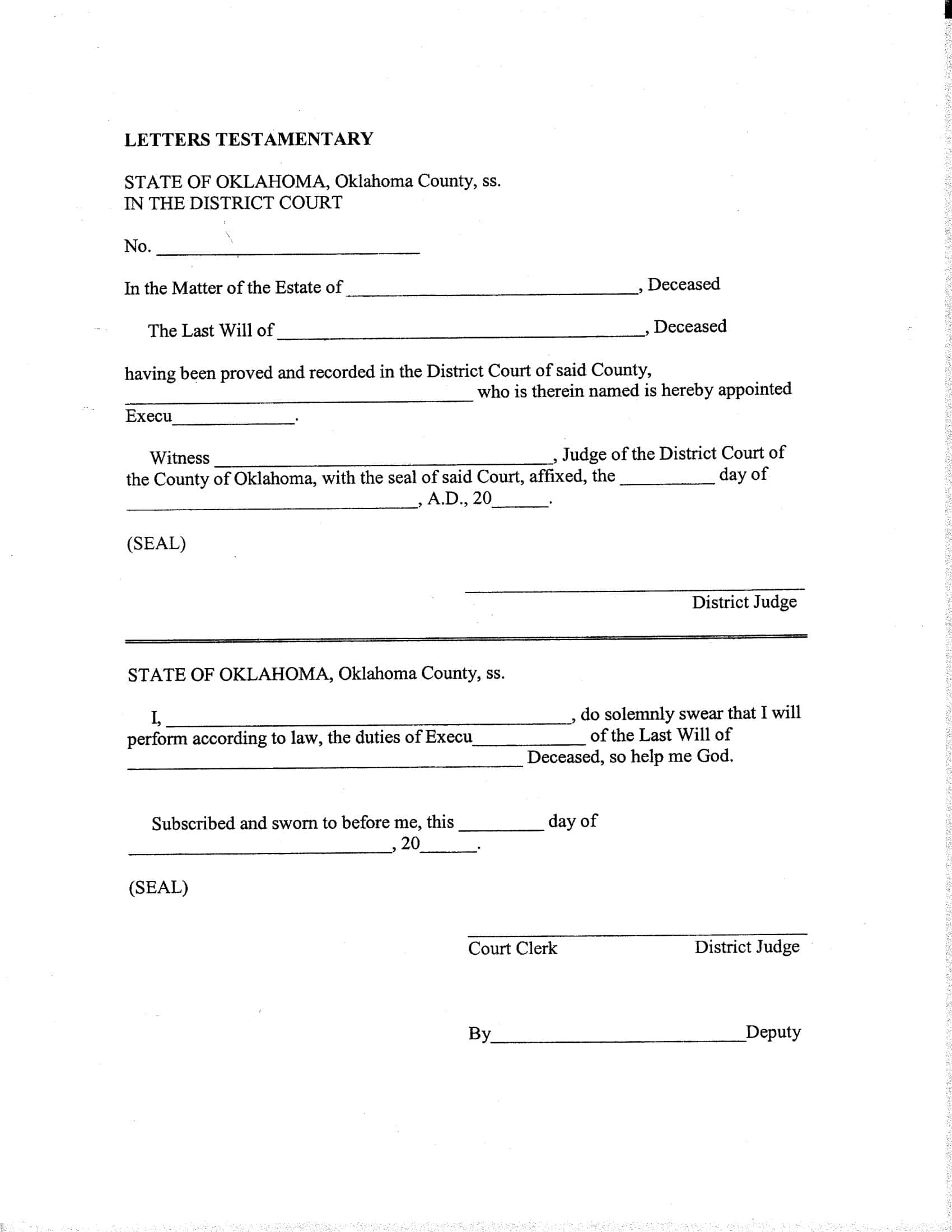

When a relative passes away, the first thing a bank, brokerage, or land registry office will ask for is a Letter of Testamentary. This court‑issued document, which officially appoints the will’s executor (the “personal representative”), is the passport to estate administration: you can access accounts, sell real property, or file tax returns only after you present it. Stamped with the court seal and listing the appointment date and judicial district, the letter’s formal wording puts to rest any third‑party doubt about your authority.

Table of Contents

Printable Letter of Testamentary Templates

State Specific Templates Made Simple

U.S. state courts use nearly identical forms but call them by slightly different names. To cover that variety, TypeCalendar has created 17 state specific Letter of Testamentary templates. We matched each state’s header language from New York Surrogate’s Court (“File No. [Deceased’s Full Name]”) to California Probate Division (“Case Number—Estate of”) word for word. The folder also includes a Co‑Executor version for joint representatives and a condensed template limited to a single‑asset trust, such as a Qualified Domestic Trust.

File Formats for Every Stage

PDF files are saved at 300 dpi, respect court page limits, and leave room for a security ribbon on top and a notary stamp below. The Word (.docx) edition locks the stamp area but keeps the decedent’s name and appointment‑date fields editable, so you can print a copy for each heir without touching the master. In Google Docs, open comment fields let your attorney edit online; you then export the file to PDF for the court portal. Full‑vector SVGs ship with the case number set in an emboss ready font and scan cleanly with no OCR errors.

Step by Step Filing Workflow

- Enter Basic Information — In Word, add the decedent’s legal name, date of death, probate court, and case number.

- Check Authority — If you intend to sell property, tick the “Full Authority” box; some states default to limited authority.

- Convert to PDF — Use Word’s “Export to PDF” command to preserve margins.

- Submit to Court — If e‑filing is available, upload the PDF; otherwise print two copies on 25‑lb stock and hand‑deliver them.

- Duplicate Certified Copies — Once the clerk applies the seal, most banks require at least two originals; print extra color copies marked “Certified Copy.”

Printing Tips for Court‑Ready Copies

Print on 24‑lb bond with 25 % cotton to prevent ink smudging and make the raised seal pop. When printing the PDF, disable any “Fit to Page” option to avoid scaling.

Download and Get Approved Fast

Download TypeCalendar’s Letter of Testamentary template pack now; open the file for your state, fill in the name and date boxes, convert to PDF and upload to the court portal. Shorten the asset freezing period, and banks will initiate the process without questioning your authority the first step of the inheritance administration now fits into just a few minutes.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)