The first important step in getting your credit report fixed is writing a credit dispute letter to the credit agency explaining why you feel that the items listed on your credit files are wrong. Disputes can be constructive when issues are reported with your credit report.

Table of Contents

What is a credit dispute letter? (Form 609)

It is quite possible that the information on your credit report is wrong. If this is the case and you don’t know its reason, you should write a 609 dispute letter template. This is a way of requesting that the negative information gets removed from your credit report, even if it’s accurate.

Section 609 of the Fair Credit Reporting Act protects your credit report from being used by third parties to determine whether you are a good credit risk. Section 609 is actually a federal law that has been in effect for over 30 years. However, an alarming number of individuals remain unaware of its existence.

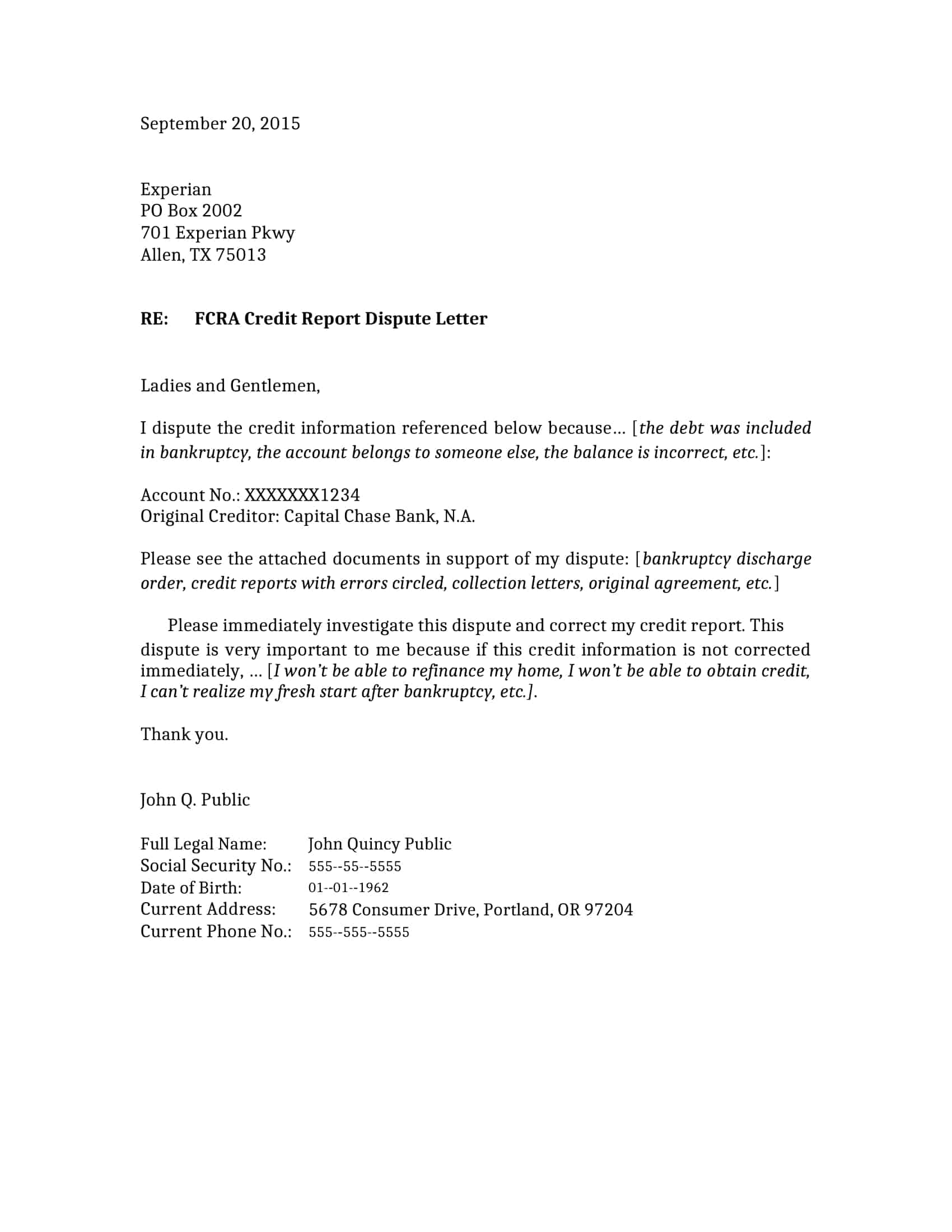

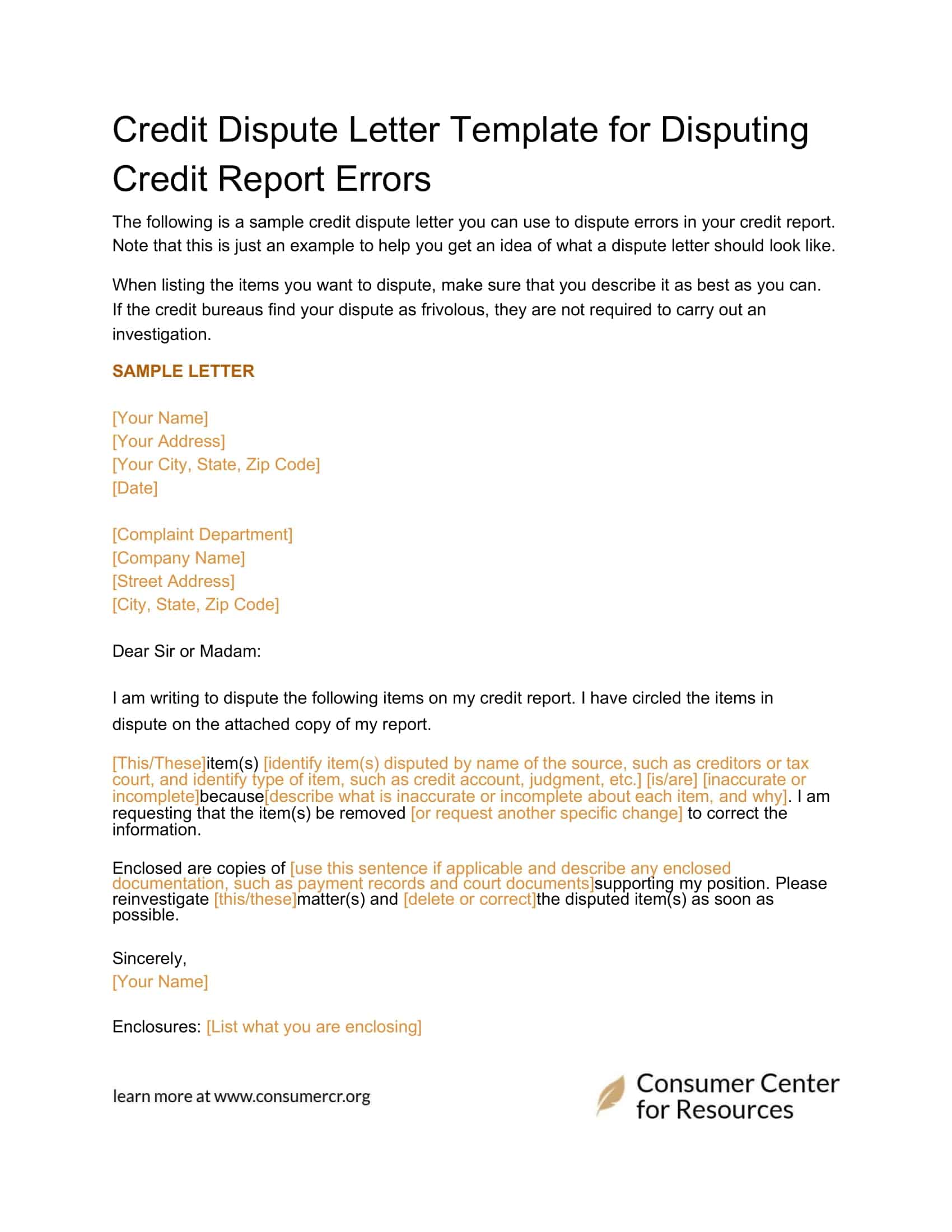

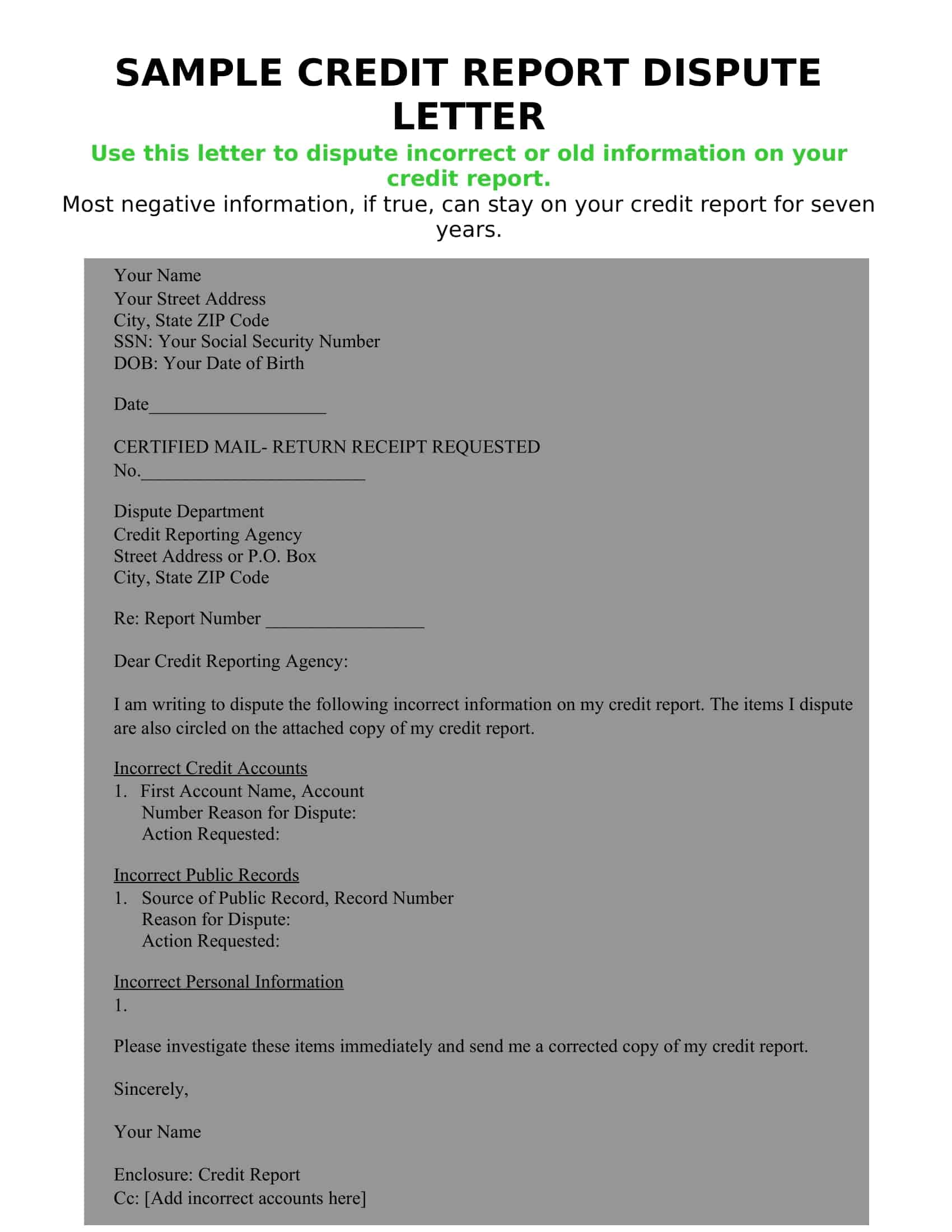

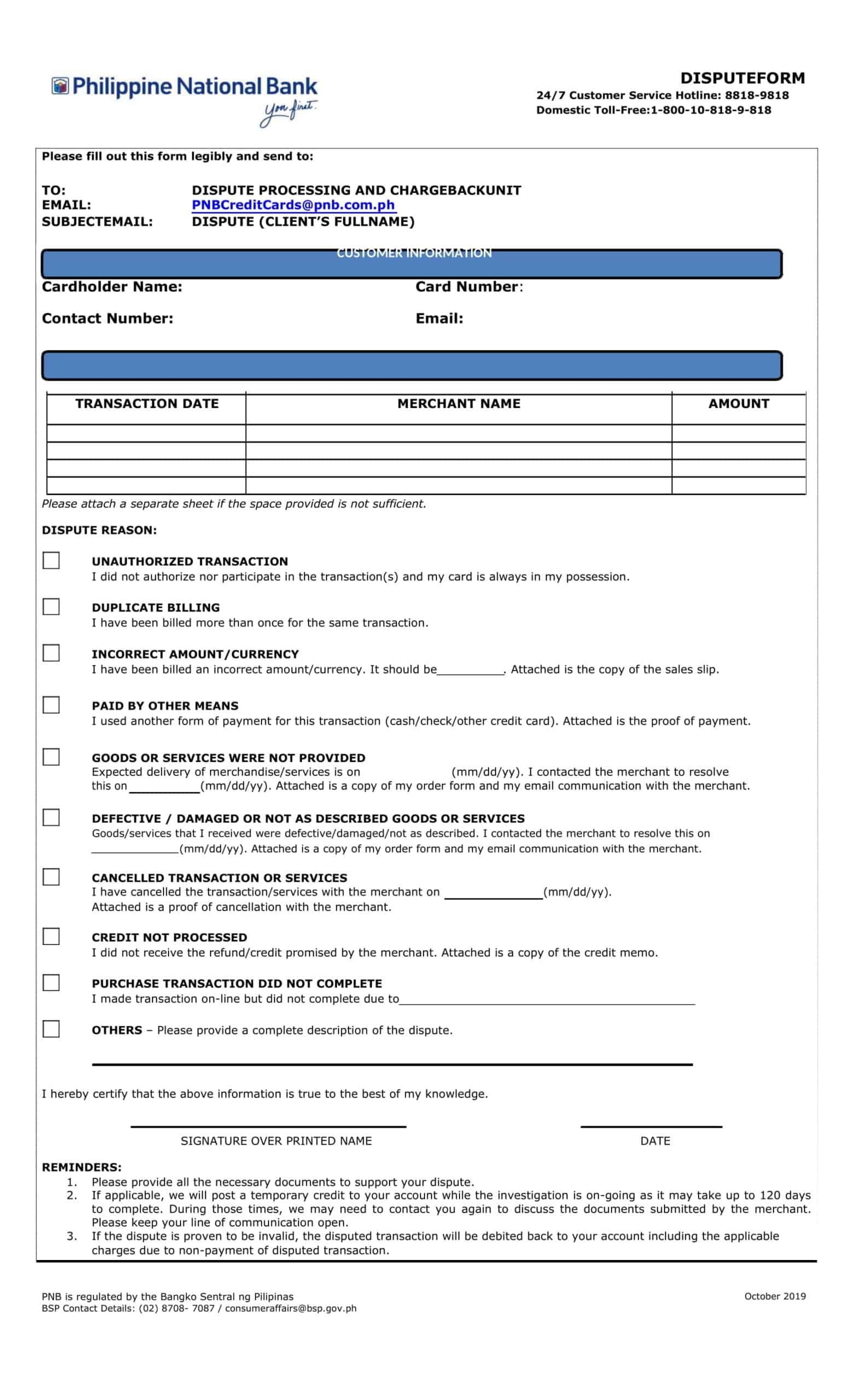

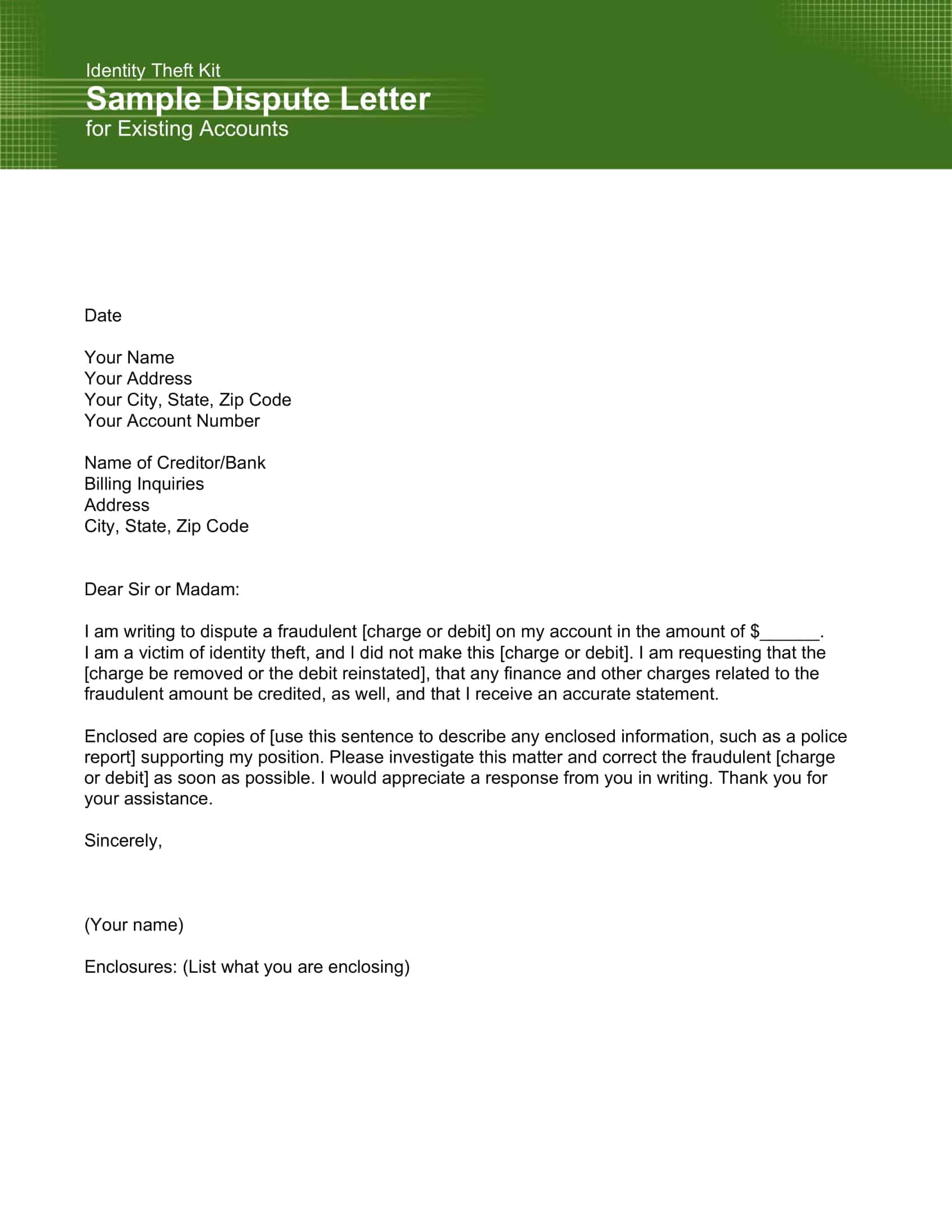

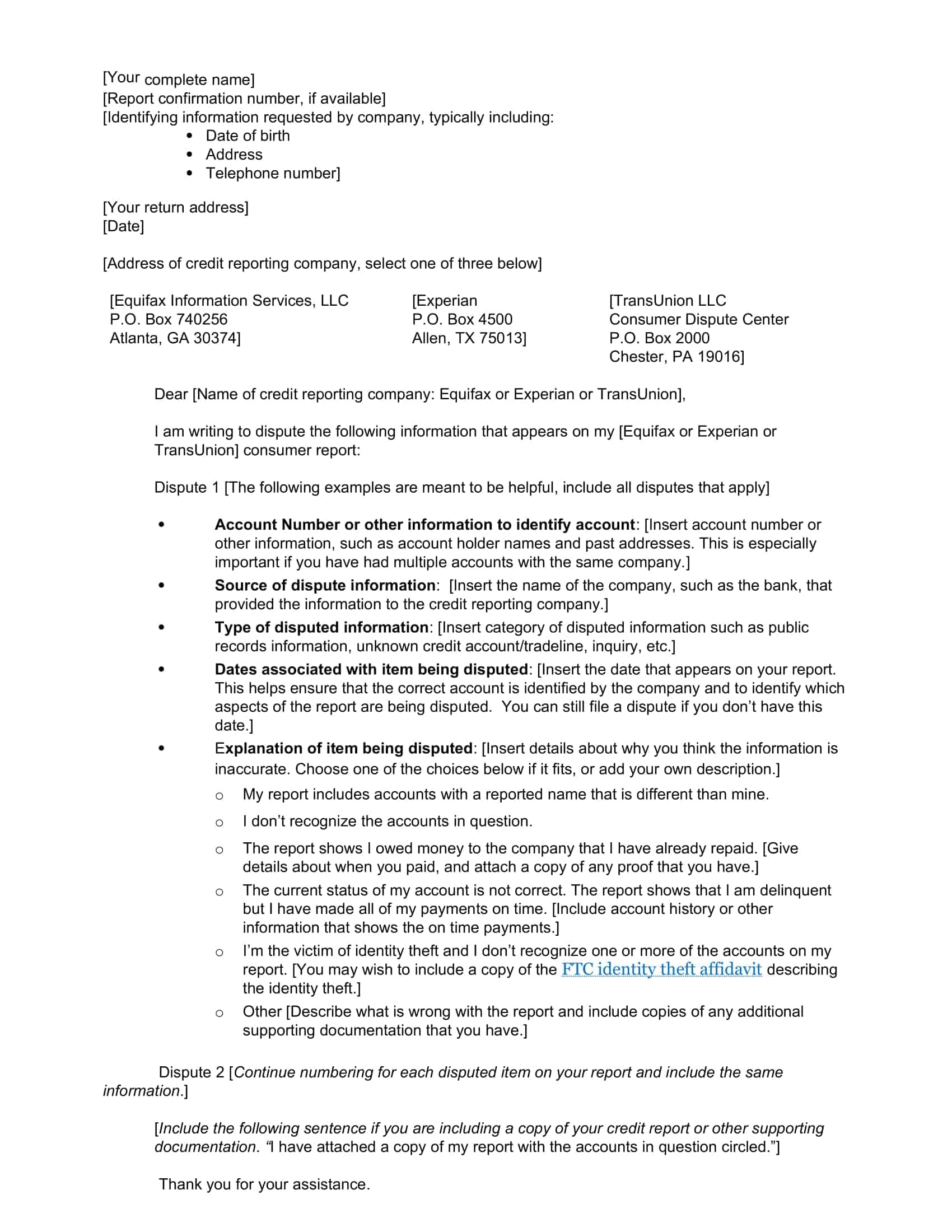

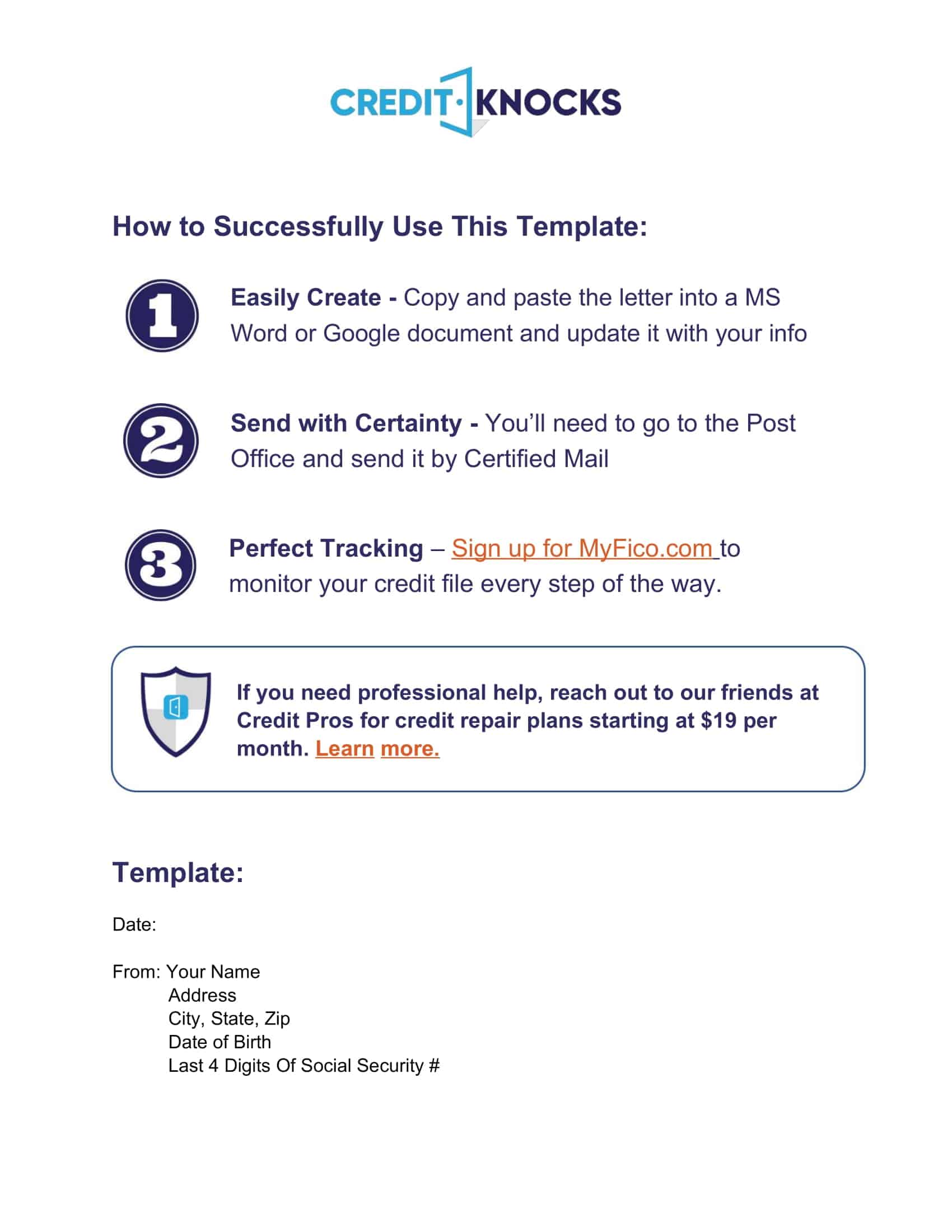

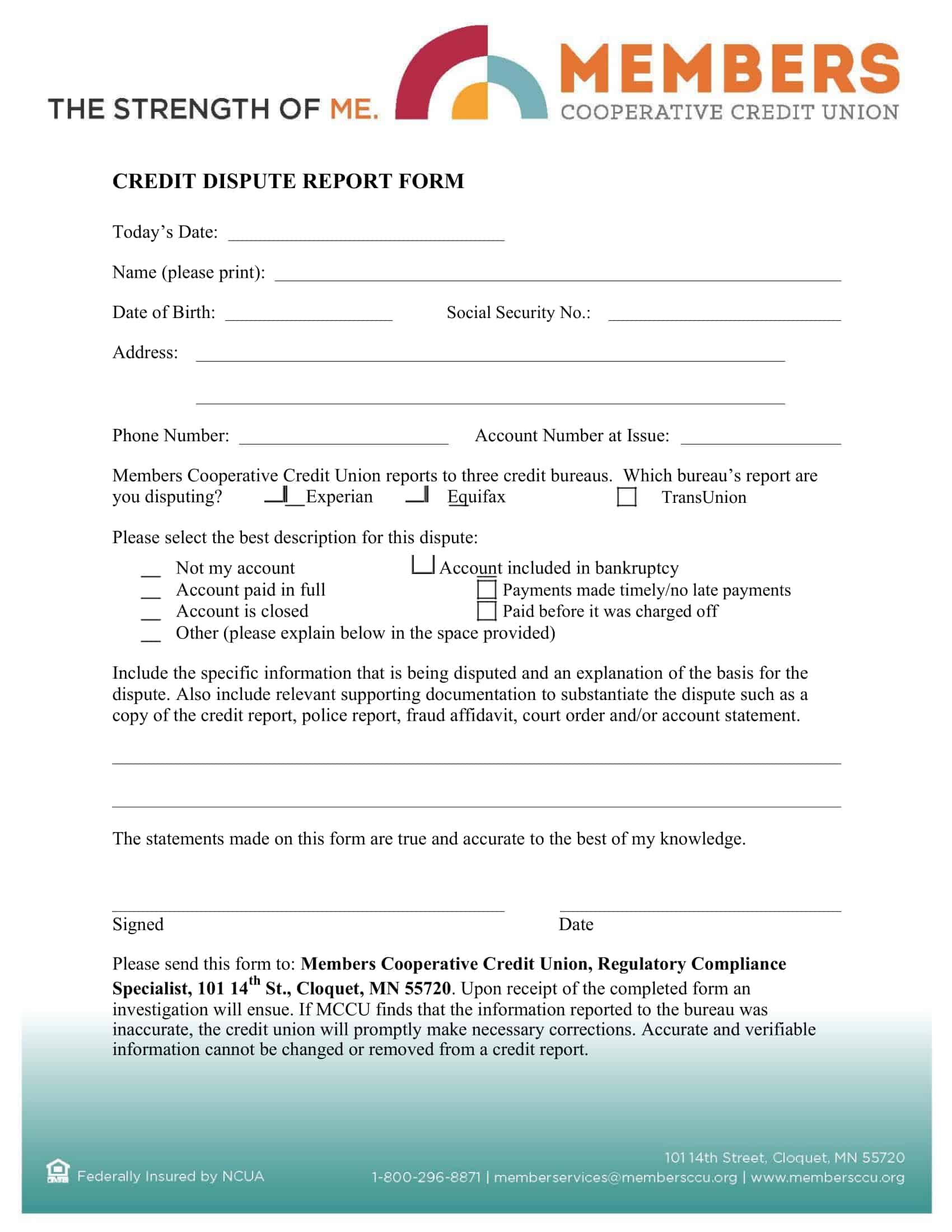

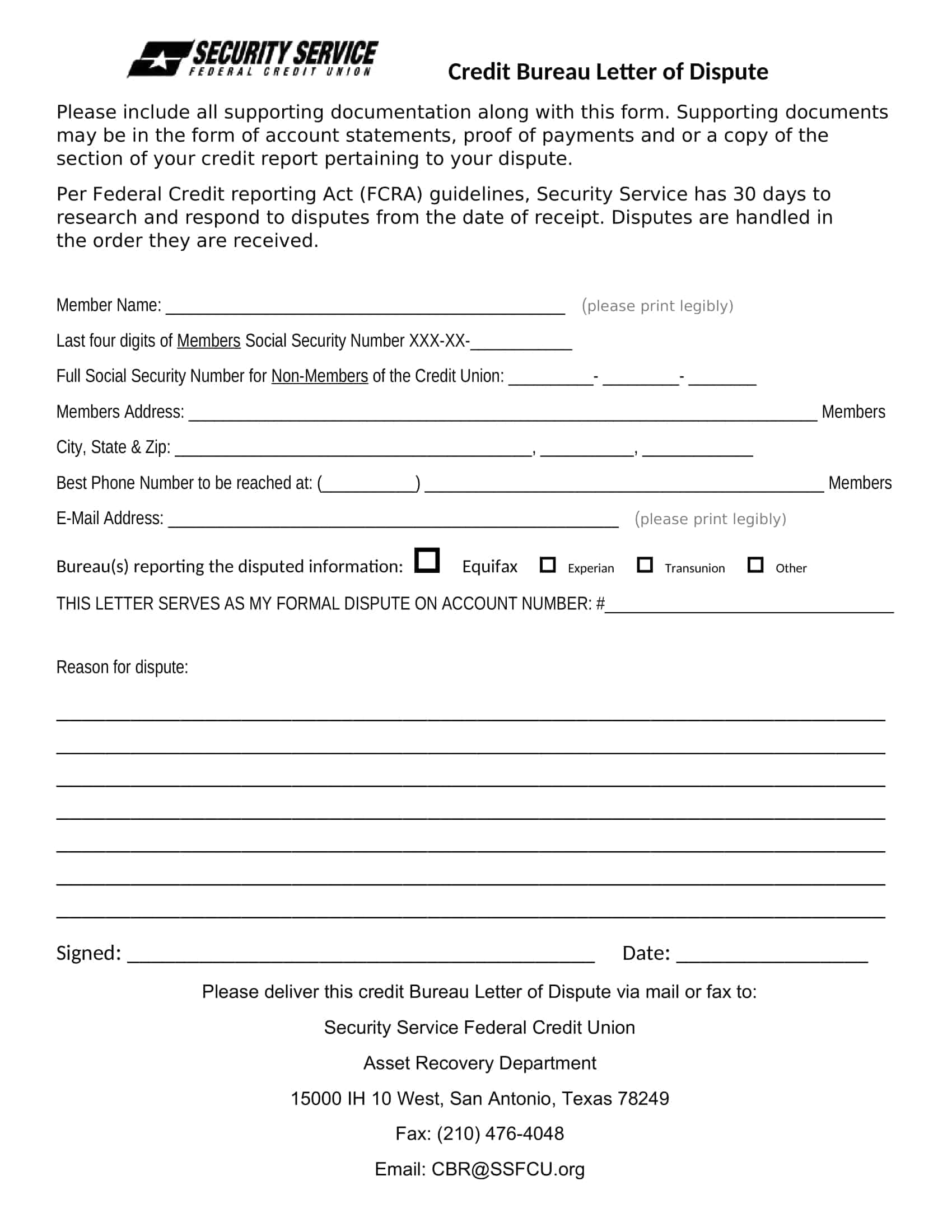

Credit Dispute Letter Templates

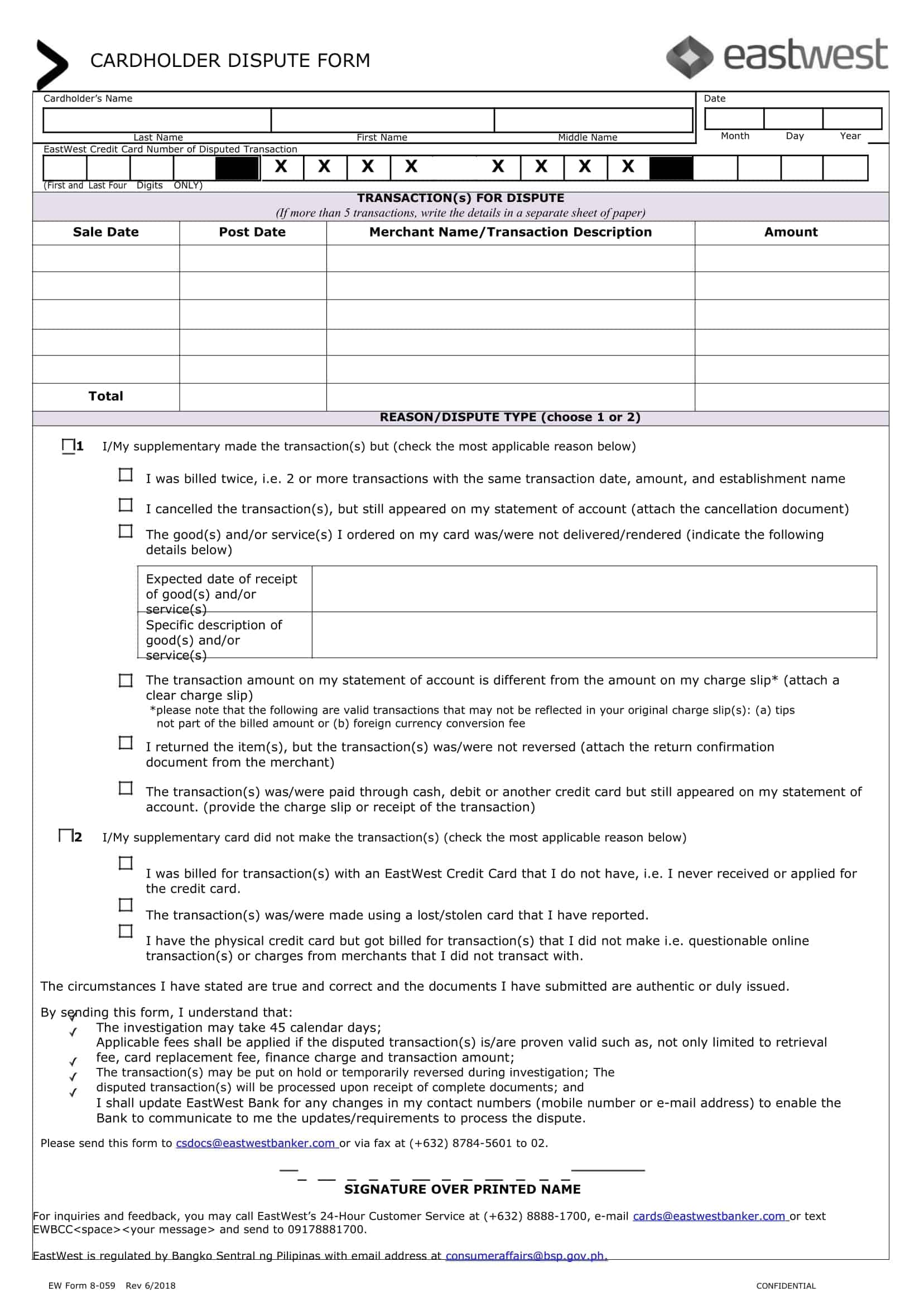

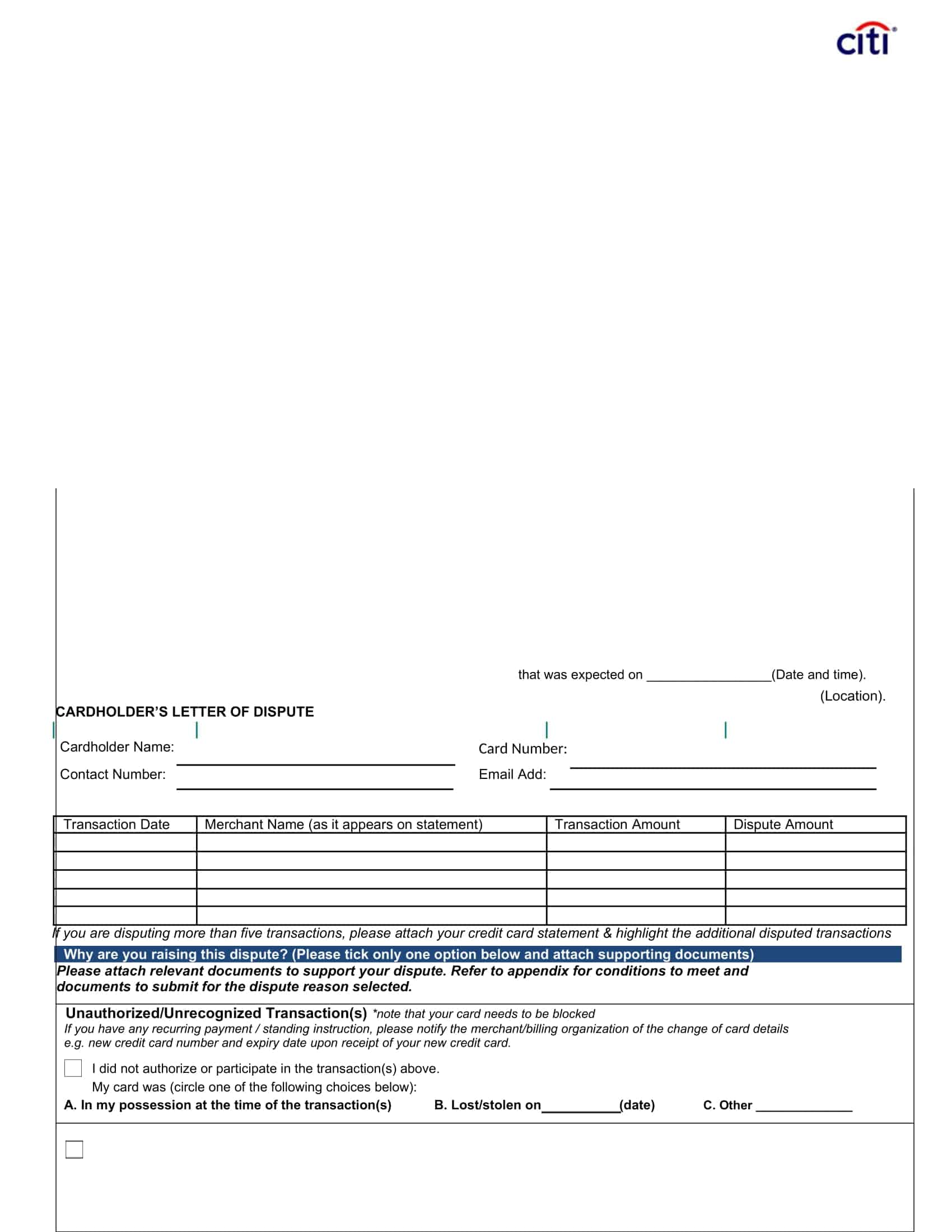

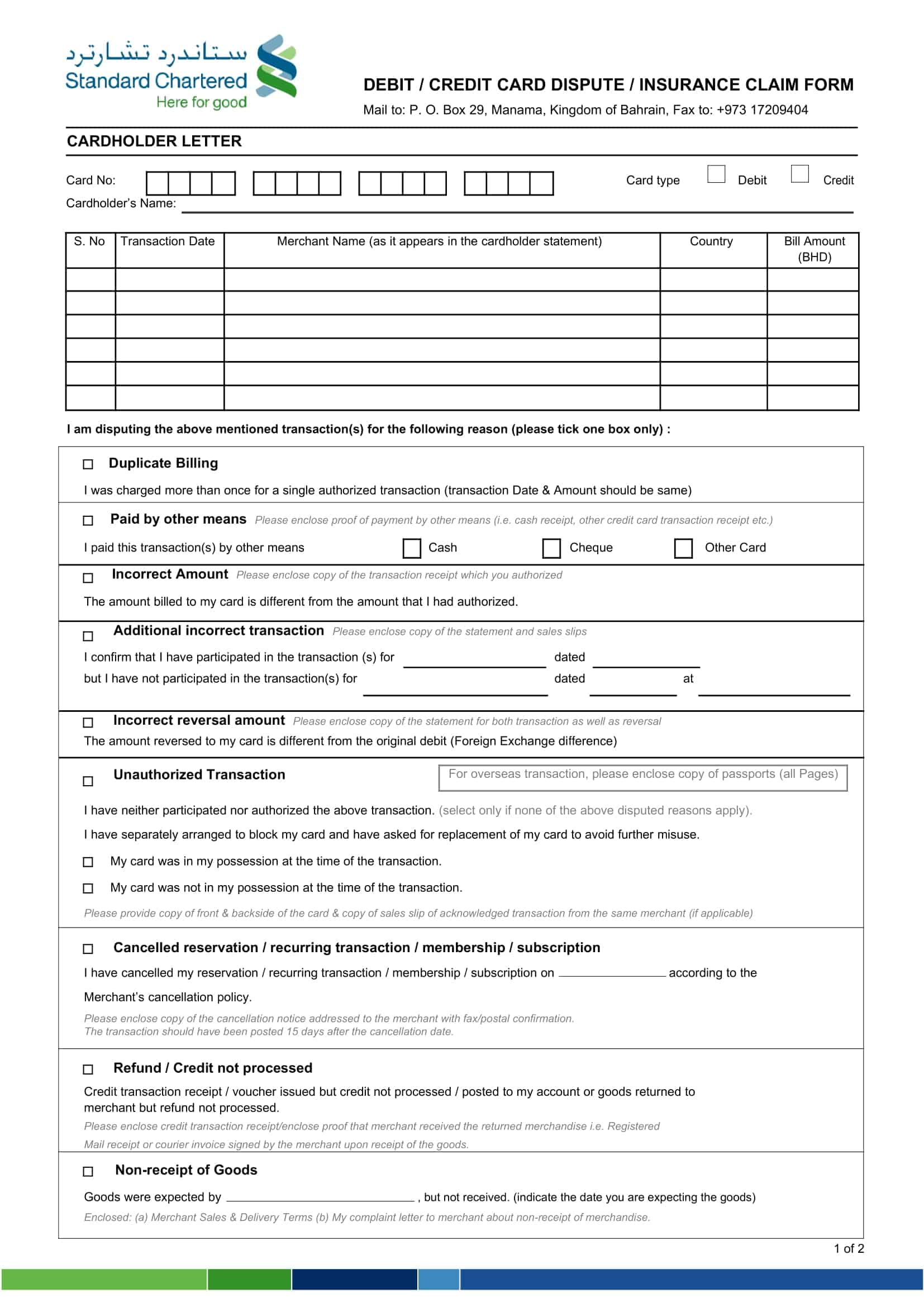

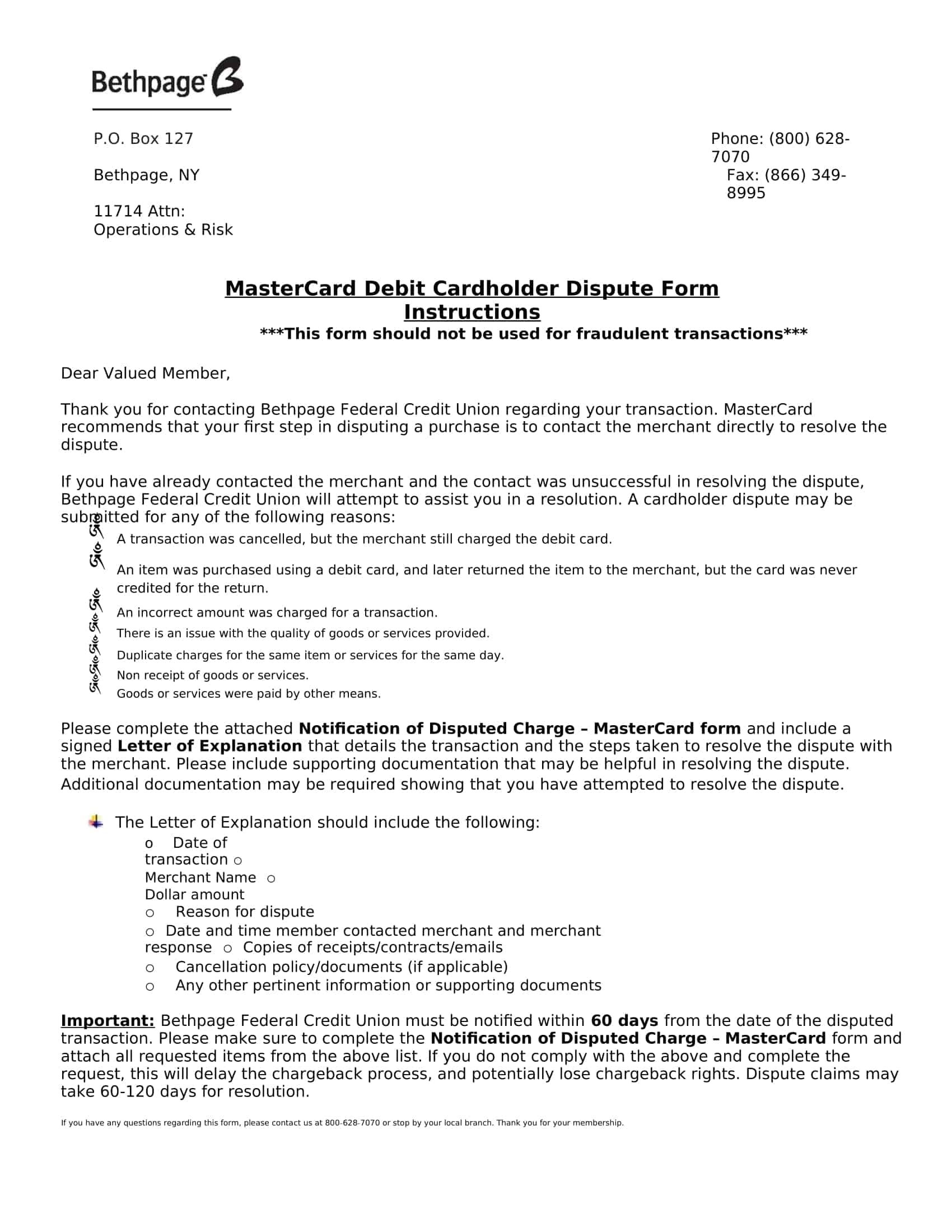

Credit dispute letter templates are pre-designed documents that provide a structured format for individuals to dispute inaccurate or erroneous information on their credit reports. These templates offer a convenient and organized way to communicate with credit bureaus and creditors to request the correction or removal of disputed items.

Credit dispute letter templates typically include sections that address important aspects such as the individual’s personal information, details of the disputed item(s), reasons for the dispute, supporting documentation, and a request for investigation and resolution. They may also incorporate sections for capturing the individual’s rights under the Fair Credit Reporting Act (FCRA) and other relevant laws.

Using a credit dispute letter template helps individuals assert their rights and initiate the process of resolving credit report inaccuracies. The template provides a structured framework that simplifies the creation of the dispute letter and ensures that all necessary details are properly documented and communicated.

Did you know that you can send a credit dispute letter by certified mail with the return receipt requested and make sure the credit bureaus have to investigate your dispute within 30 days? That’s right! All you have to do is send them a certified letter stating that you are disputing the item on your account and giving them either 30 days or 60 days to investigate

What is a 604 dispute letter?

The 604 dispute letter serves as your formal notice to request a correction. The credit bureau is not obligated to provide the correction but should respond to acknowledge you sent it.

What is a 623 dispute letter?

A 623 dispute letter is a notice that allows you to dispute a collection or debt directly with the creditor after filing a complaint with the credit bureau. A 623 is also known as a “Dispute of Debt Notice.”

What Can You Dispute on Your Credit Report?

If you are thinking about disputing items on your credit report, you need to be very careful that you don’t dispute positive items. Once they are removed, it’s pretty much impossible to get them back on your credit report.

- Late payments

- Collections

- Repossessions

- Bankruptcies

- Charge Offs

- Inquiries

- Tax Liens

How to Write a Credit Dispute Letter & Everything You’ll Need

The 609 letter is a powerful tool that you can use to challenge the validity of item(s) appearing on a credit report. Using the 609 letter, you can initiate a dispute investigation with the credit reporting agency that reported the items. When used properly, the 609 letter is your best chance of having an inaccurate or unverifiable item removed from your credit report.

Everybody seems to have their own opinion when it comes to writing a letter of complaint…everyone has different ideas about the way it should be phrased. Some people and companies will even sell you a 609 sample letter template, but there is no need to do that because there is nothing proprietary about the format and wording.

Here are the essential documents you should have on hand before writing your 609 letter:

- Social Security Card(SSN)

- Passport OR Valid ID

- Tax Document

- Birth Certificate

- Credit Report

- Driver’s license

- Utility bills(proof of your address)

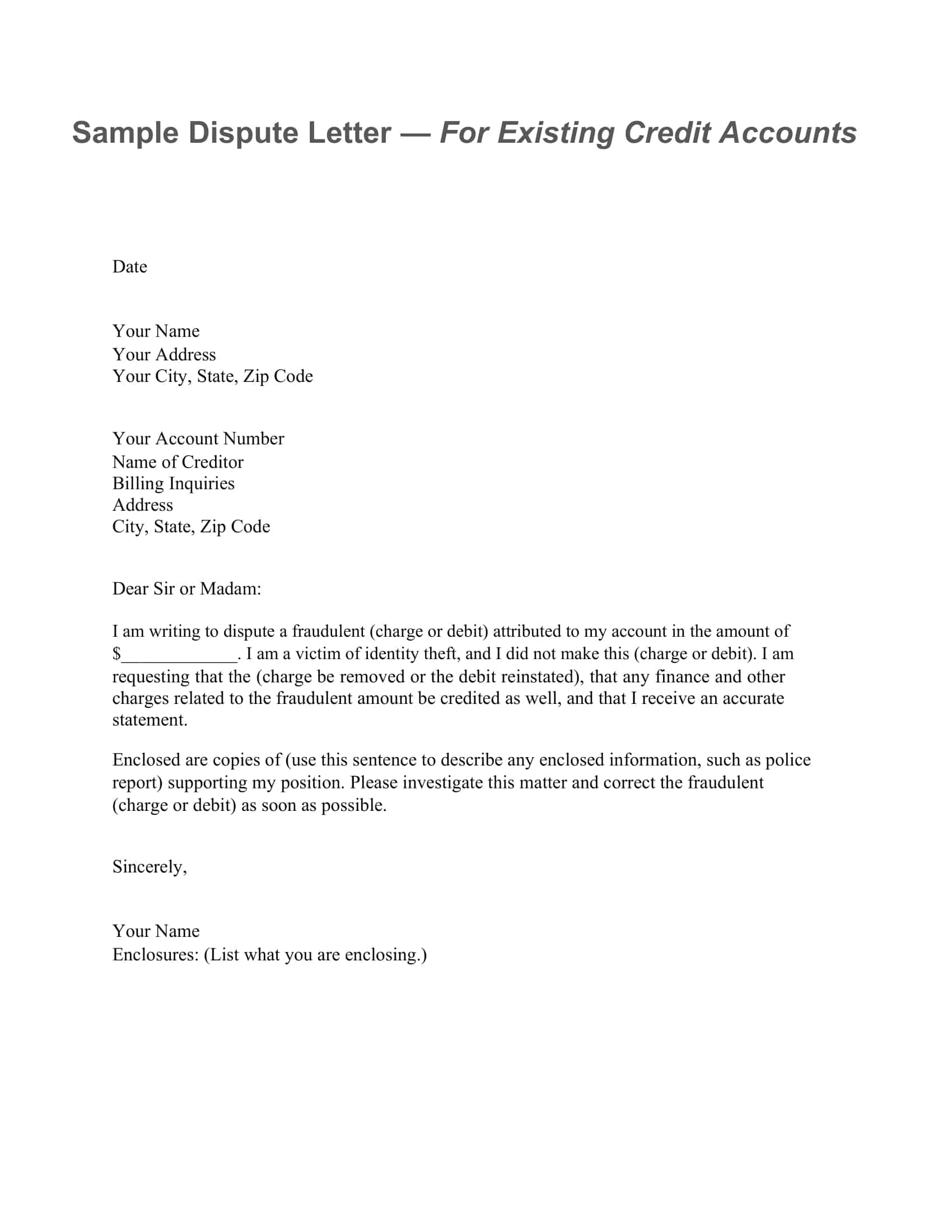

Writing Steps

Step 1

In your letter, provide the details of your dispute, including the company’s name that provided the information, the accuracy problem, and any supporting documentation.

Step 2

The dispute letter must identify the recipient by name and mailing address. Other important information you need to include is the exact dollar amount displayed on your credit report.

Step 3

You should also include copies of the evidence for all disputed items on the credit report that you are disputing, such as billing statements or other correspondences between you and the creditor. If you’re disputing anything about your credit score, include in your letter that you’re disputing your credit score and explain why.

Step 4

Now, the final ingredient to your dispute letter is a signature from you. Obviously, this isn’t a legal document if you fill the letter out yourself and sign it, so make sure that you include all of your personal information.

Conclusion

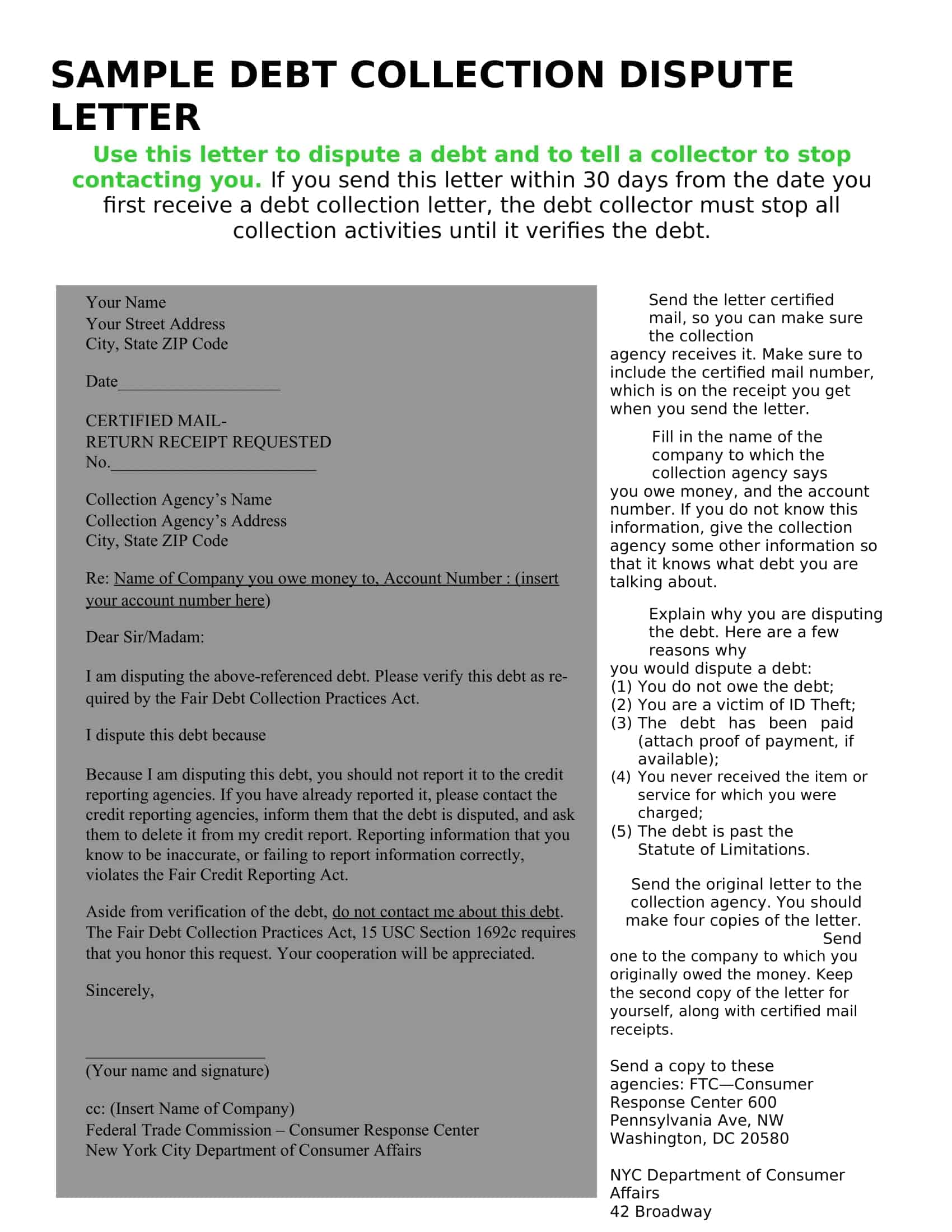

Many people receive letters from debt collection agencies claiming they owe money and threatening to sue if the debt isn’t paid. However, many of these people do not believe they owe the debt and/or believe that the information is inaccurate.

US laws allow you to dispute the debt by sending a Credit Report Dispute Letter to the collection agency when this occurs. A Credit Report Dispute Letter allows you to send an official letter stating which items on your credit report you are disputing, why you are disputing them, and what action you want to be taken regarding those items on your credit report.

FAQs

How do you write a good credit dispute letter?

State it is a dispute letter. Identify information to dispute and why you dispute it. Request removal or correction. Include copy of credit report with disputed item circled. Provide supporting documents. Note rights under FCRA. Include contact info and request response in writing.

What is a 609 dispute letter?

A 609 dispute letter cites the Fair Credit Reporting Act, Section 609 as basis for disputing and requesting removal of incorrect or unverifiable information on your credit report. Provides legal grounds.

How do I write a letter to remove negative credit?

Write to the credit bureau with negative marks. List items disputed. State they are inaccurate, unverified, or outdated. Request deletion based on your rights per FCRA. Attach copy of credit report and include proof items are wrong. Demand removal.

How do I remove collections from my credit report letter?

Send dispute letters to credit bureaus and collection agencies. Identify collection, state it is inaccurate or improper. Demand it be deleted immediately and provide written confirmation. Note consumer rights under law. Attach verification of dispute.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)