If a debt collector is hounding you, chances are that at some point, you’ll have to deal with debt validation. Worry not if that time comes and you don’t know what this is. In this article, you’ll get an overview of debt validation and see how it affects your rights in dealing with creditors or debt collectors.

Table of Contents

What is a Debt Validation Letter?

The Debt Validation Letter, also sometimes referred to as a debt validation or debt validation request, is a type of letter that a consumer uses to dispute their legal obligation to pay a vendor.

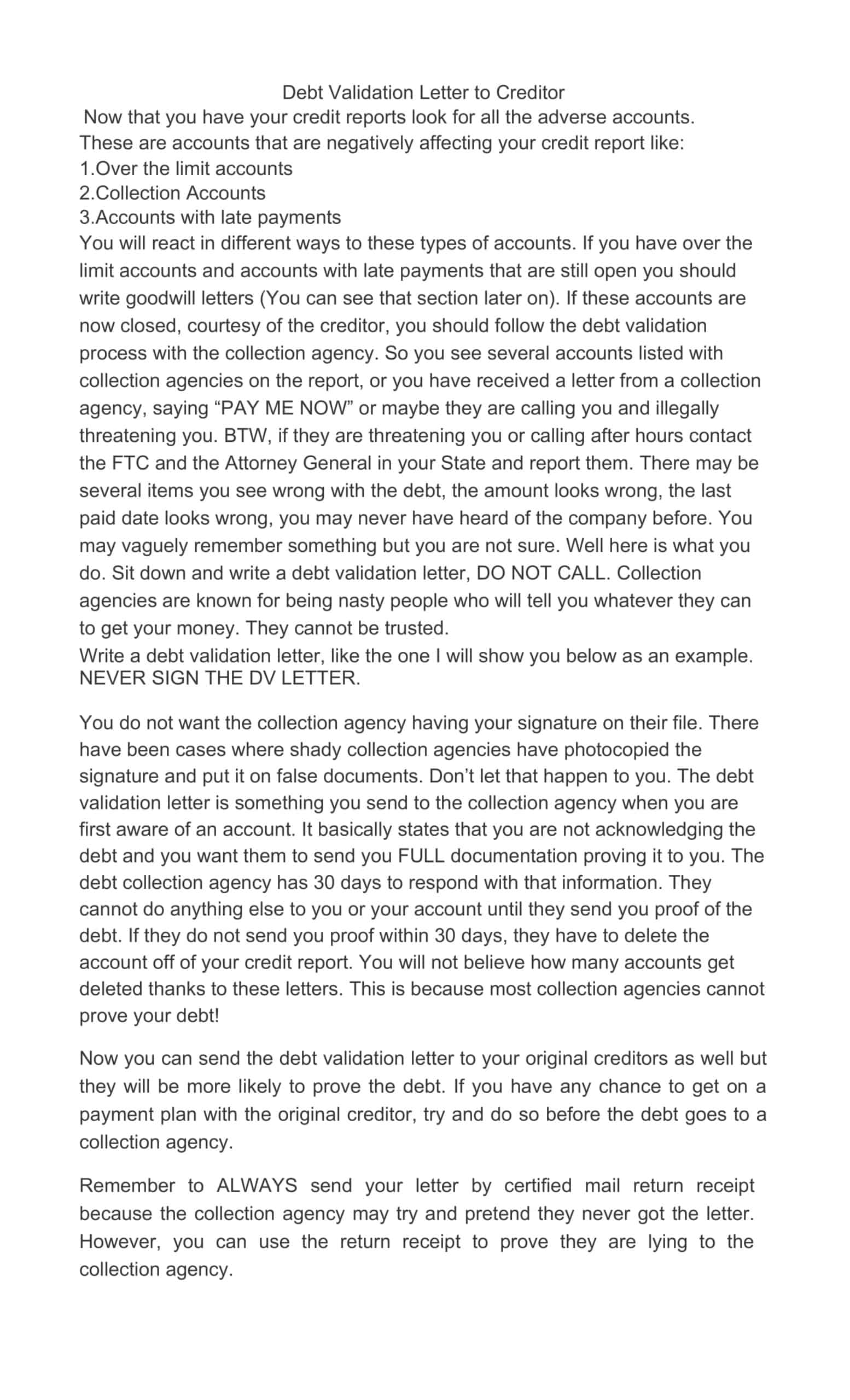

The letter begins with all the necessary contact information, stating that you are disputing the debt and giving your reasons for the dispute. The intermediary may disagree with you, but they are legally bound to investigate your claim and respond in writing to you within 30 days from the date of receipt. The Debt Validation Letter should be sent by certified mail, return receipt should be requested so that you can document who signed for it and when. If it still needs to be returned or signed for, send it again.

The purpose of the debt validation letter is to collect information about any debts you may owe and request verification that a debt exists and is owed by you.

A debt validation letter can be used as part of an effort to dispute or reduce the amount owed on your credit report. It also helps protect you from paying debts that aren’t yours, which could result in legal trouble and negative effects on your credit score.

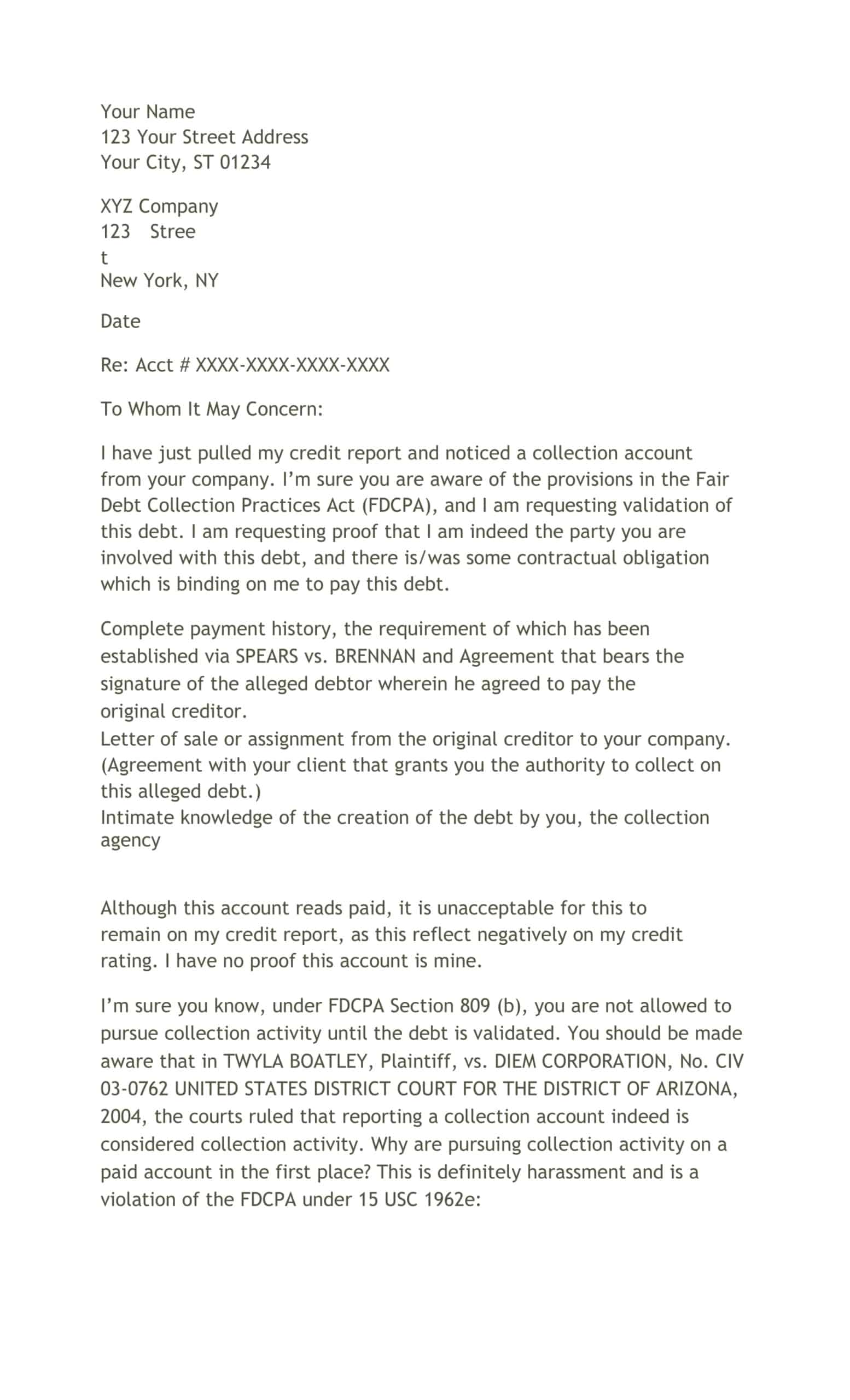

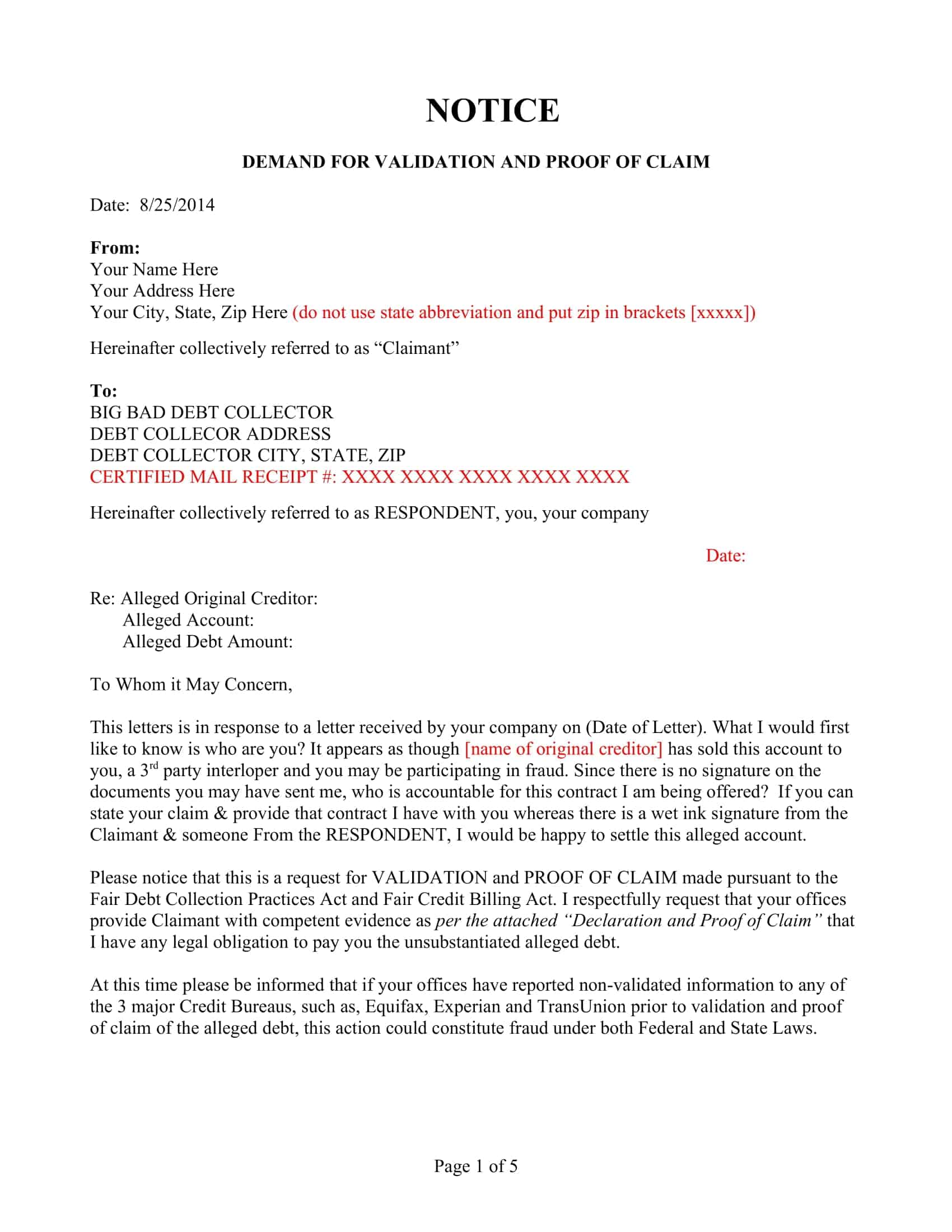

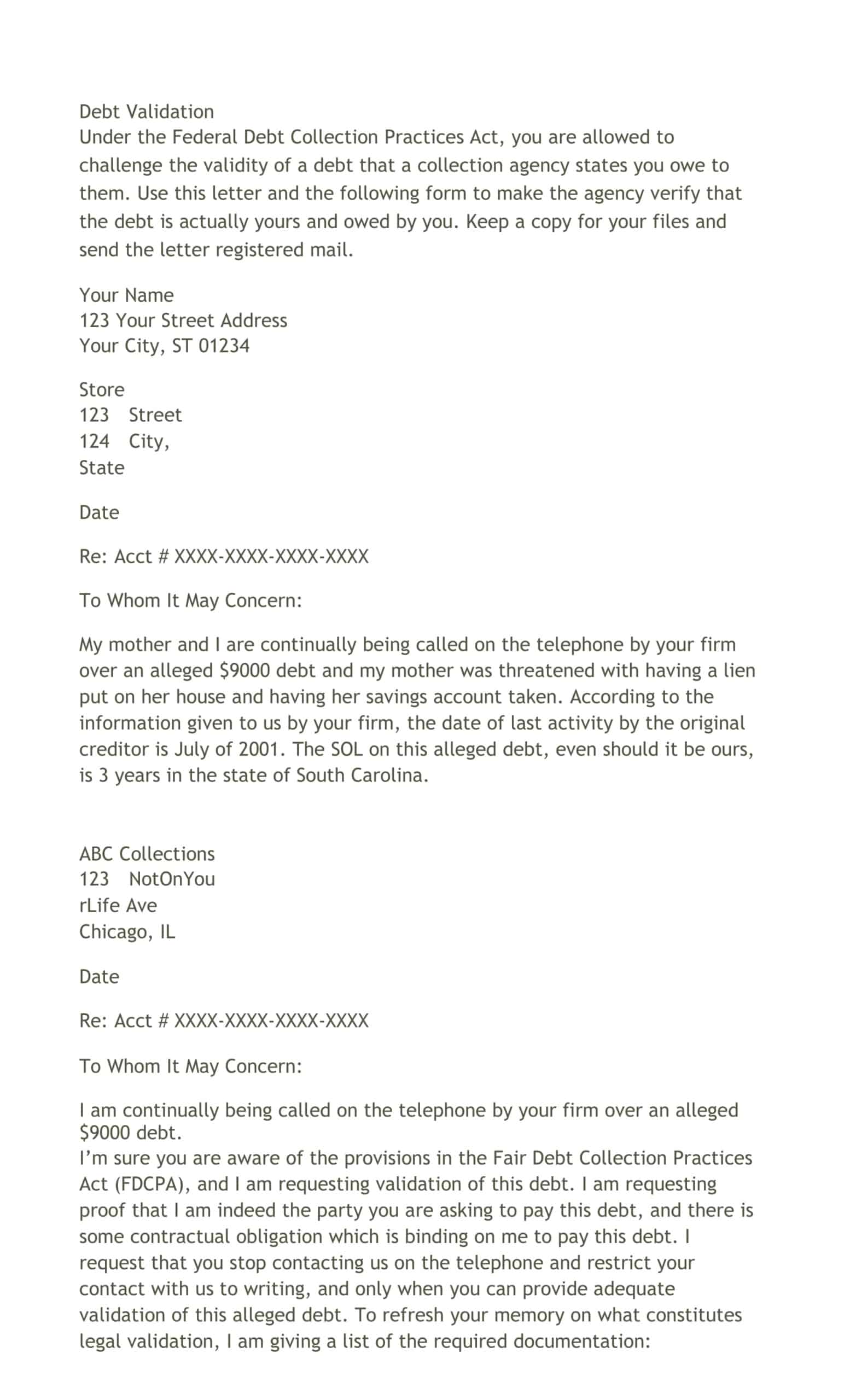

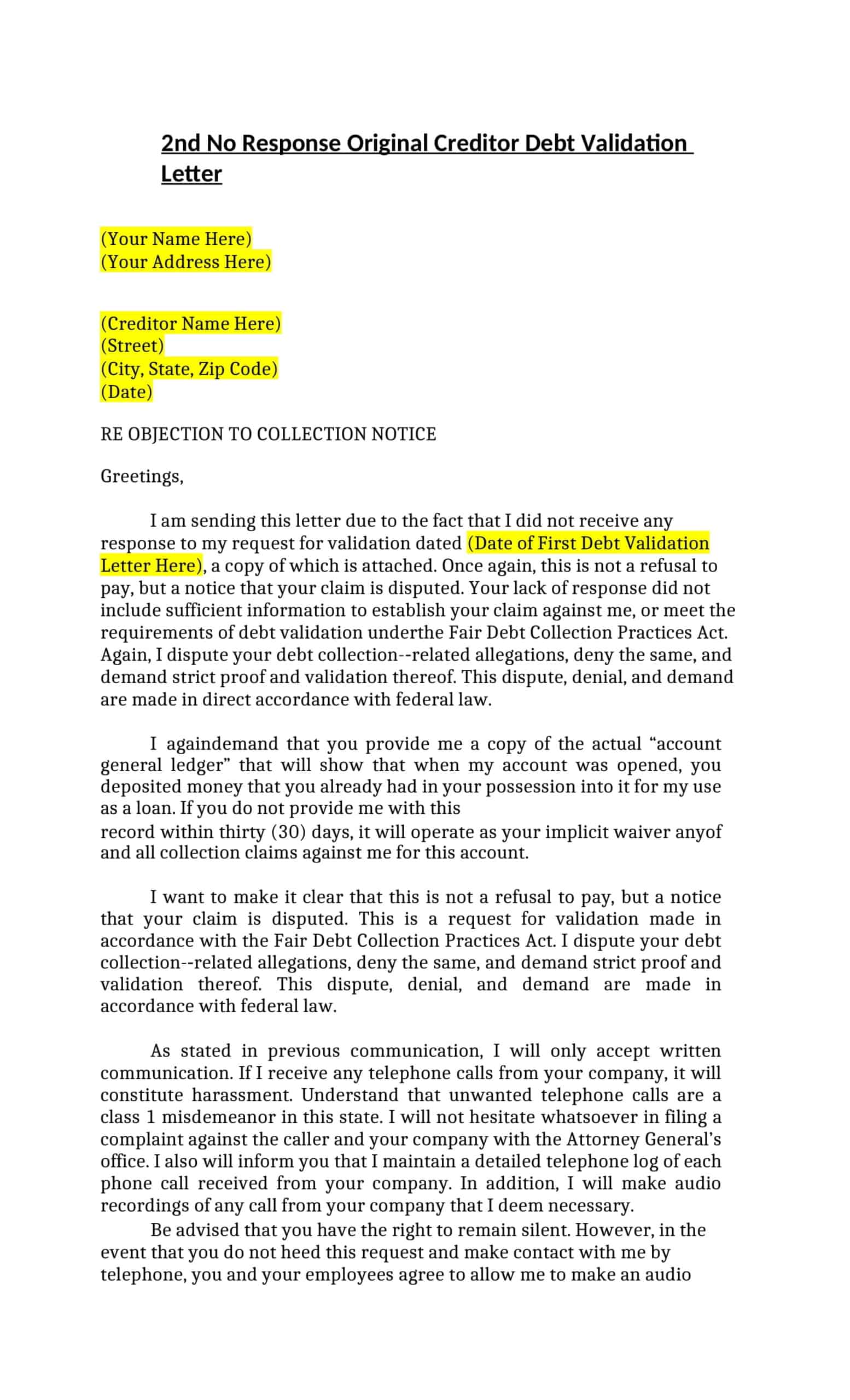

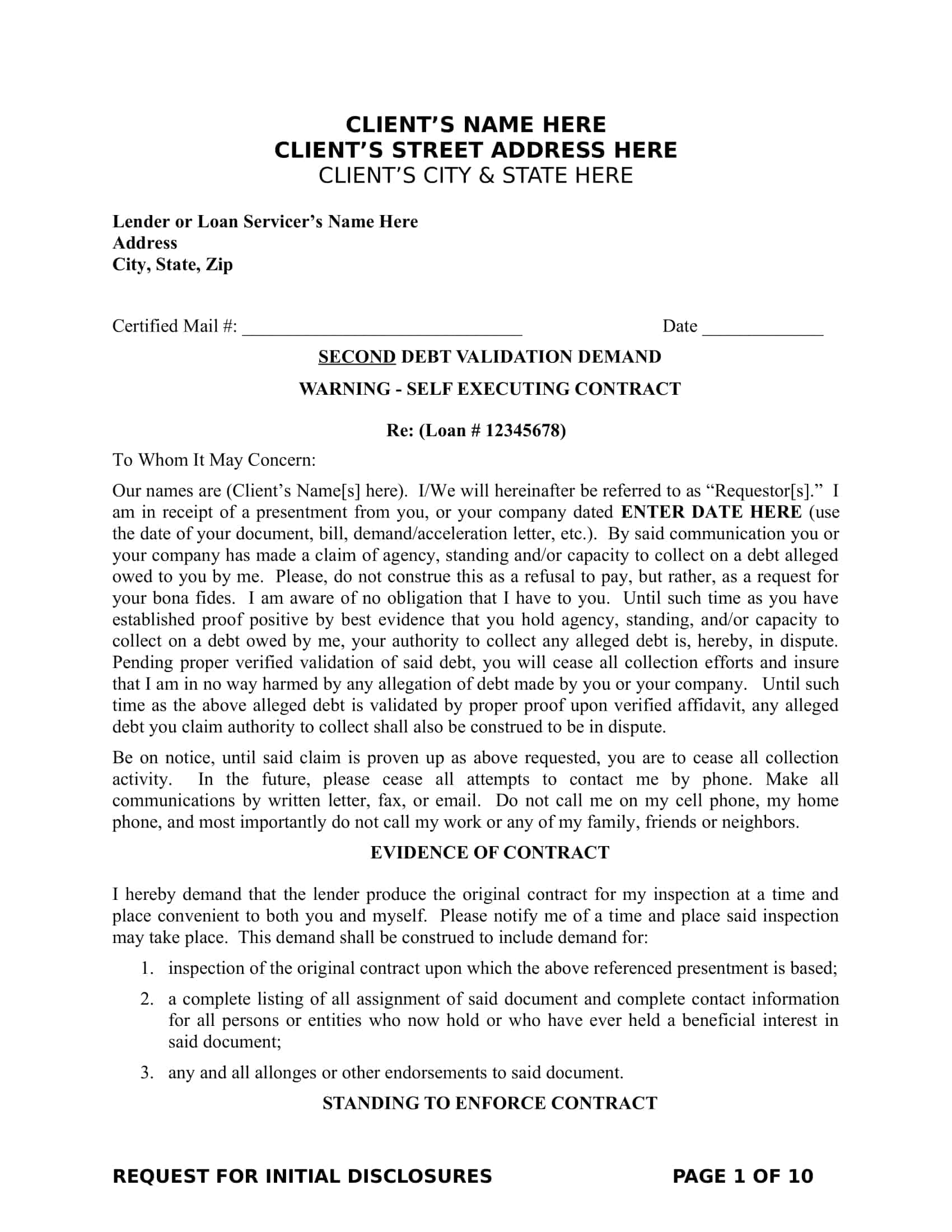

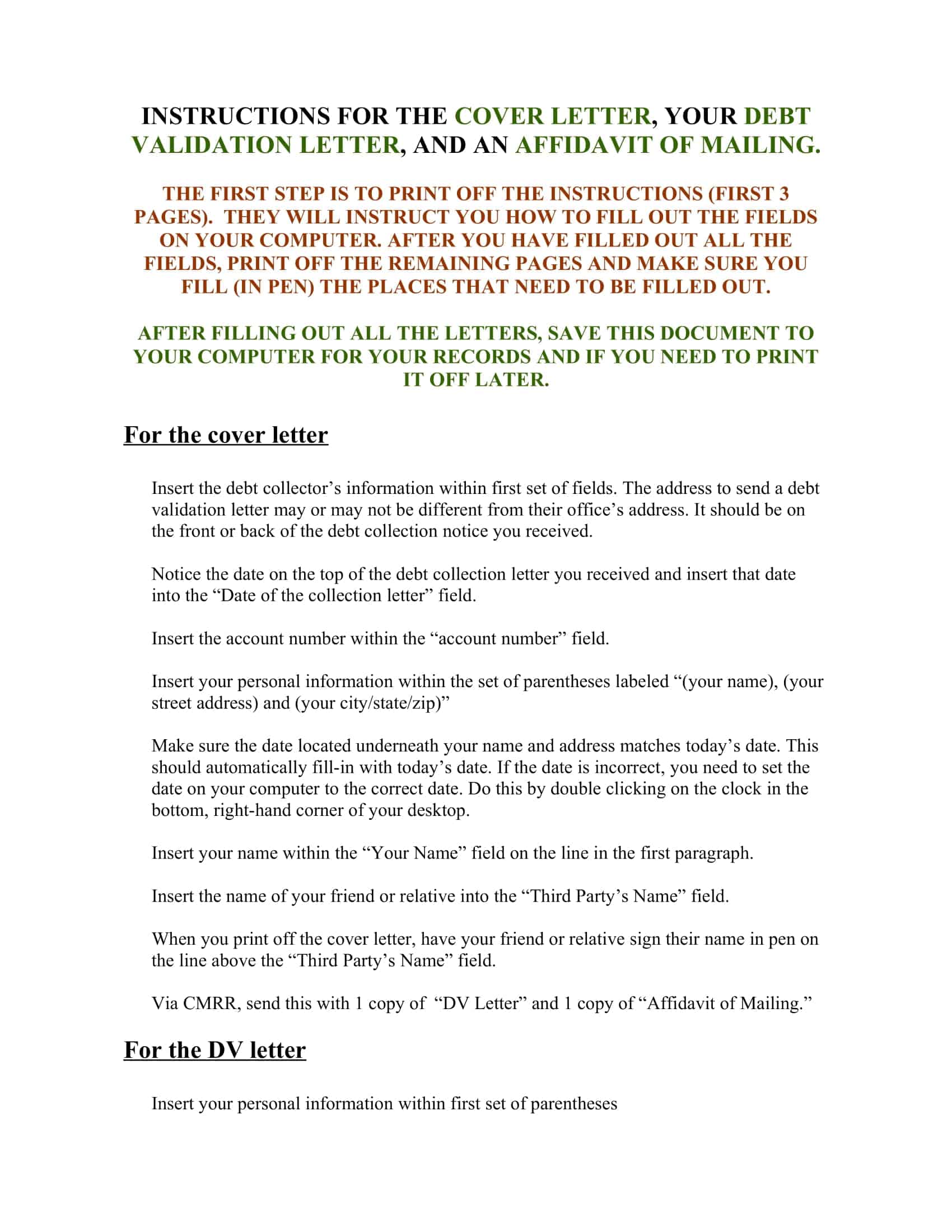

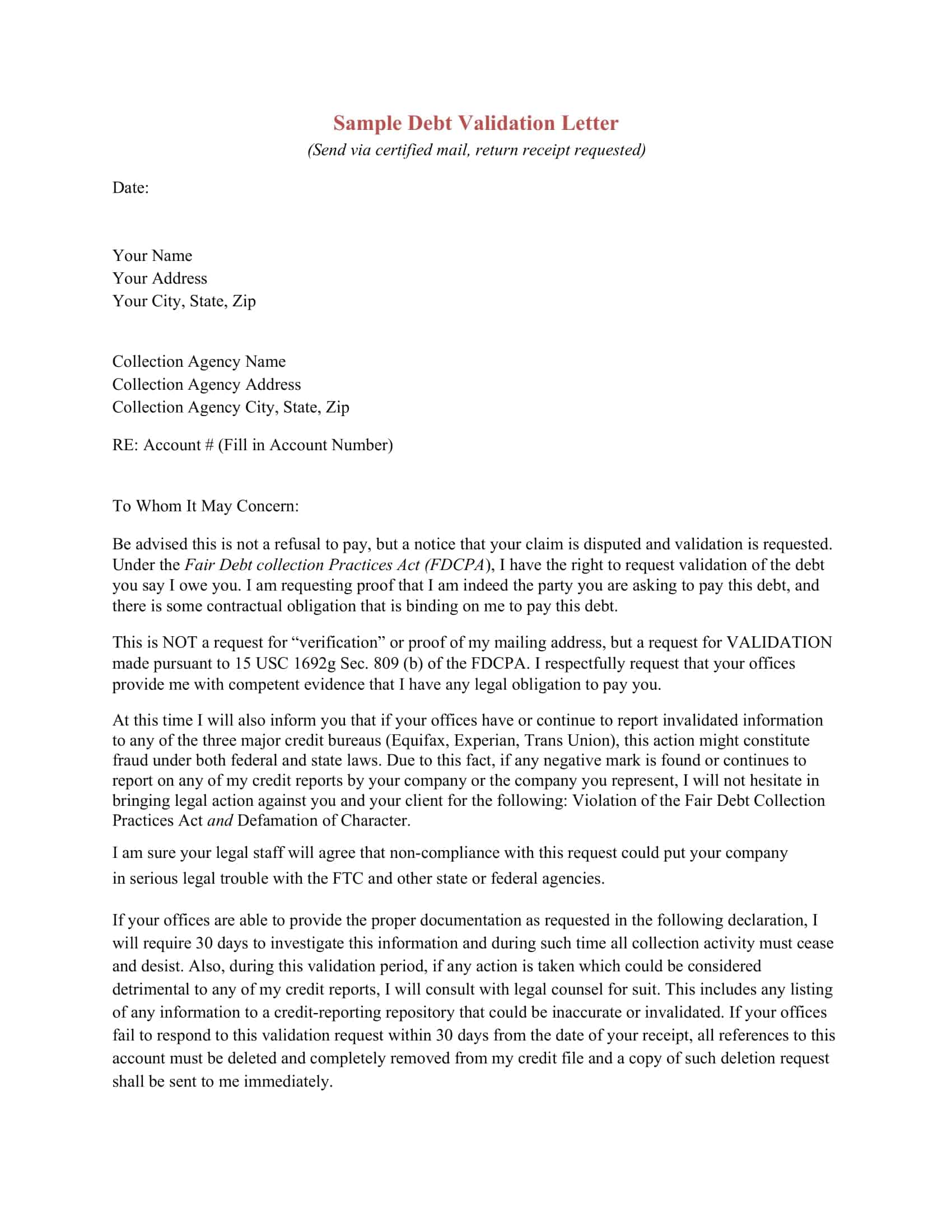

Debt Validation Letter Templates

Debt validation letter templates are designed to help individuals who are trying to dispute or validate a debt that a creditor is attempting to collect. These templates can provide a clear and concise way to communicate with creditors, outlining the debt in question and requesting proof of its validity. With a debt validation letter, you can protect your rights as a consumer and ensure that any debt you owe is accurate and verifiable. These templates are free, printable, and easy to use, making them a valuable tool for anyone dealing with debt collectors.

How Can I Use a Debt Validation Letter?

If you receive a collection notice or call from a company claiming that you owe money, use these tips to help you decide whether to send a debt validation letter:

- Make sure the debt is yours!

- If it’s not yours, don’t pay for it!

- If it’s yours, try to negotiate with the collector for lower interest rates or fees before sending them a dispute letter or payment offer; if they accept your offer, then send them one immediately before they change their minds!

What Is A Collection Agency Demand Letter?

A collection agency demand letter is a legal document sent by a debt collector to someone who has failed to pay their bills on time. The letter informs the debtor that they owe money to a particular company and includes details about how much they owe and when they must pay it back to avoid further action being taken against them.

What to Include in a Letter Requesting Debt Validation?

A debt validation letter is a tool that you can use to dispute the validity of a debt.

The Fair Debt Collection Practices Act (FDCPA) requires that the debt collector must verify your debts before pursuing any legal action against you.

Here’s what to include in a letter requesting debt validation:

- Your name, address, and contact information

- The name and address of the original creditor or collection agency, if different from your own creditor.

- The account number associated with the debt, if known. If not, provide as much information as possible about the alleged debt, including the last payment date and the amount owed.

- The date on which you first contacted the debt collector or creditor about this matter (if applicable).

- A request for verification of the debt. This should include details such as when you paid off or settled an account or disputed it with someone other than the current collection agency in question.

- A statement that you request validation of all or part of the debt within 30 days of receiving this letter.

How to Write a Letter Requesting Debt Validation?

The Fair Debt Collection Practices Act (FDCPA) allows you to dispute the validity of a debt in writing. The debt collector must then cease collection efforts until it can verify the debt. Once this is done, the collection agency must send you a “validation notice” that includes how much money you owe and where to send payments.

You can write a letter requesting validation of your debt in several ways. Call the FTC’s Consumer Response Center at 877-FTC-HELP (1-877-382-4357) if you have any questions. Or read on for some tips.

Step 1: State that you are disputing the validity of the debt

Here’s a sample sentence: “I dispute the validity of this debt.” Be sure to include all relevant information about your account, including your name, address, and Social Security number. Include any information that might help validate your request — such as an original copy of your contract or proof of payment history.

Step 2: Explain why you’re disputing the account

Include any reasons why you think this particular account isn’t valid or shouldn’t be included on your credit report.

Step 3: Provide details about how much money is owed

This section provides details about how much money is owed to the creditor and when it should be paid back. It is also recommended that you provide a breakdown of how much was spent on each purchase so that it becomes easier for them to verify the debt.

Sample Debt Validation Letters

Dear Sir/Madam:

My name is ______________, and I am writing in response to a debt collection letter that I received from you dated ________________. Please provide the following information about this account:

The name of the original creditor.

The amount owed when the account was first charged off.

The date on which the account was charged off if different from the date above.

A description of all events that have occurred since the date of charge-off that may affect my ability to pay this debt (e.g., bankruptcy discharge, wage garnishment, or other legal judgment).

I have enclosed a copy of my credit report for your review, which shows no unpaid debts ever reported as delinquent or charged off by this creditor. I have also enclosed copies of documents showing that all payments have been made on time or within 30 days after their due date since January 1, _______. If there are any discrepancies with my credit report or documentation submitted herewith, please contact me immediately so we may resolve them before proceeding with further action on this matter.

FAQs

What is the purpose of a debt settlement letter?

The goal is to negotiate and reach a settlement for less than the full amount owed. This saves money and helps avoid further collection actions.

What is the proper tone?

The tone should be polite yet firm. Don’t make threats or insults. Demonstrate willingness to find a mutually acceptable resolution.

Should I request debt validation?

Yes, it’s recommended to formally request written proof and verification of the debt if it’s not a bill you recognize. This is called a debt validation letter.

What information can I request?

You have a right to request the original creditor name, purchase dates, account statements showing the debt, and validation it is collectible.

Does debt validation work?

If the collection agency cannot validate the debt, they must cease collection efforts. However, the process may delay reaching a settlement.

What should be included in the letter?

- Account details like the account number, amount owed, creditor name

- Statement that you want to resolve the debt

- Proposed settlement offer amount

- Reason and explanation why you cannot pay in full

- Request for deletion from your credit report upon payment

In summary, a firm yet polite settlement letter works best, alongside requesting verification of unfamiliar debts before negotiating a reduced payoff amount. Maintain copies of all correspondence.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)