A temporary power of attorney is an invaluable legal instrument that empowers someone to act on your behalf when you are unable to do so. Whether it’s handling legal matters, addressing personal concerns, or managing financial affairs, this document serves as a crucial tool to ensure that important tasks are taken care of during your absence or when you need to step away from your responsibilities, be it for personal or business reasons. While it may be known by different names, its purpose remains consistent—to provide a trusted individual with the authority to make decisions on your behalf, granting you peace of mind.

It’s important to note that a temporary power of attorney differs from a durable power of attorney, as it is not designed to be effective in situations where you become incapacitated and unable to make decisions independently. Instead, it is specifically tailored for unique circumstances that may arise in the future, which could still warrant the need for someone to act on your behalf temporarily. Understanding the process of drafting or writing this document is crucial, as it equips you with the knowledge to address common situations where a temporary power of attorney can serve as a valuable asset. By familiarizing yourself with its intricacies, you can ensure that your interests are safeguarded and that your affairs are well-managed, even in your absence.

Table of Contents

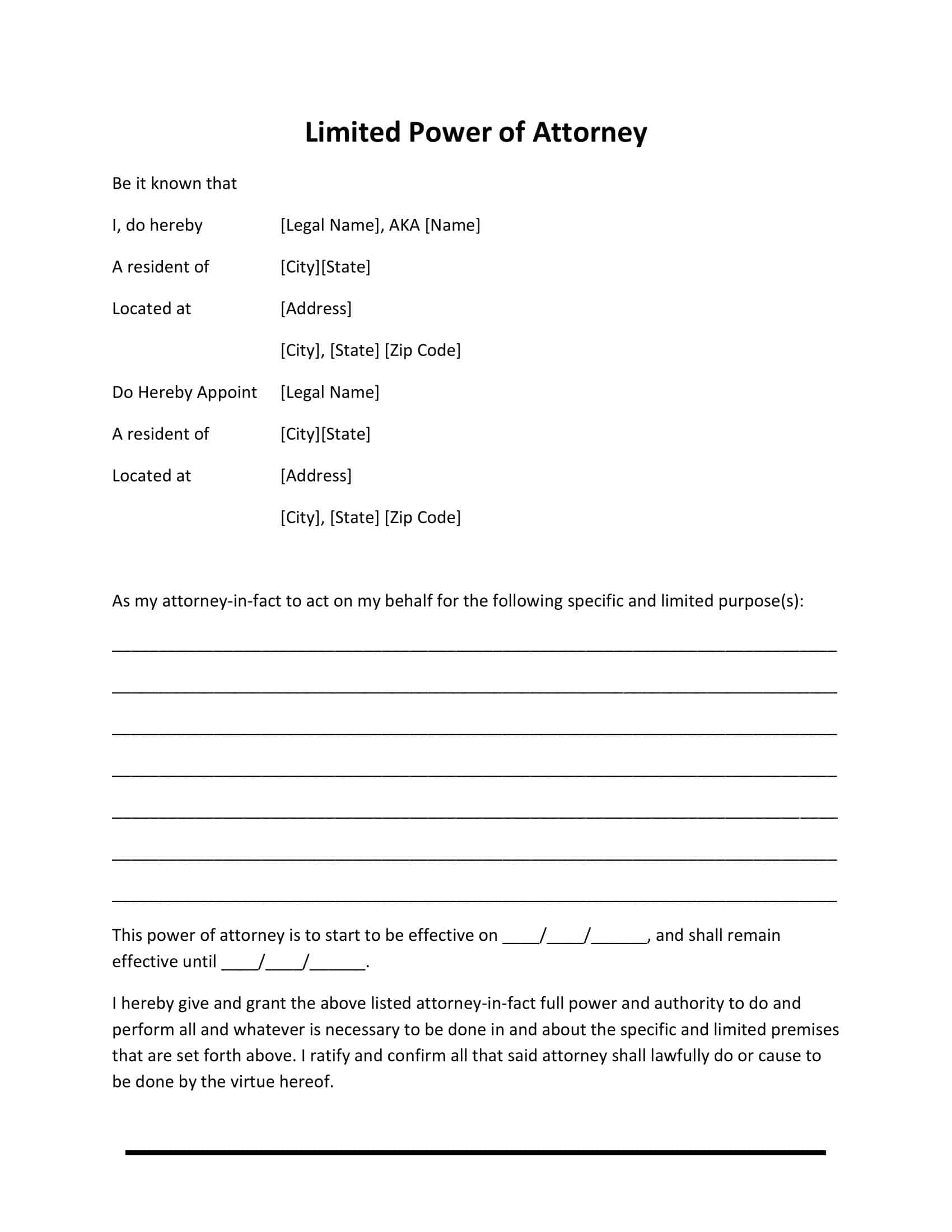

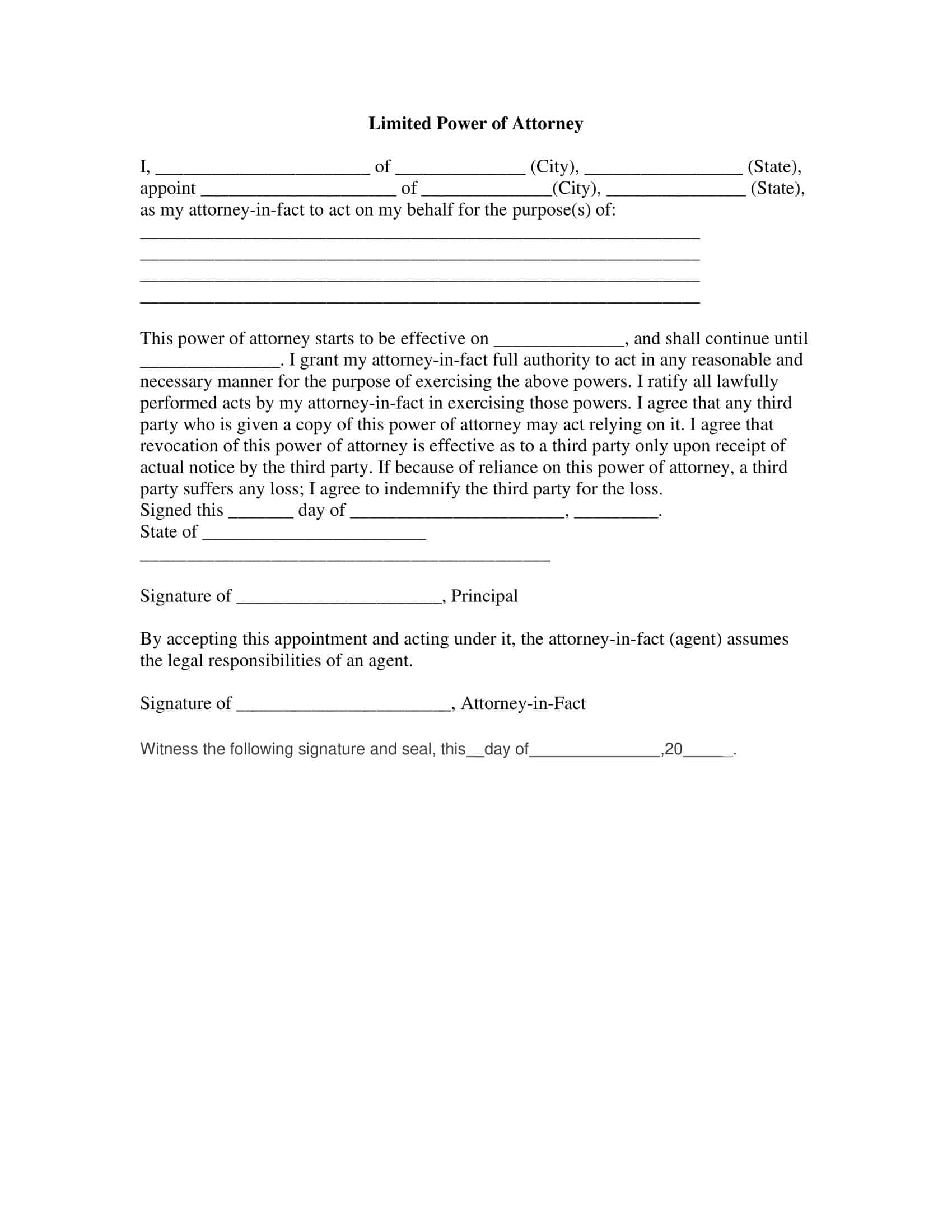

Limited Power Of Attorney Templates

A limited power of attorney is a legal document that grants specific powers to an individual, known as the attorney-in-fact or agent, to act on behalf of another person, referred to as the principal. This type of power of attorney is designed to provide a clear and concise framework for authorizing someone to handle specific tasks or make decisions on behalf of the principal, while still maintaining control and oversight.

Limited power of attorney templates serve as standardized and structured documents that can be customized to suit the unique needs and circumstances of the principal. These templates ensure that all essential elements and legal requirements are properly addressed, providing a comprehensive framework for the delegation of authority.

Limited power of attorney templates provide a convenient and reliable framework for individuals to delegate authority while maintaining control over specific matters. They offer a flexible and customizable solution, allowing individuals to tailor the powers granted to suit their unique needs and circumstances. By using these templates, individuals can ensure that their intentions are clearly articulated and legally binding, providing peace of mind and a streamlined process for the execution of important tasks or decisions. It is important, however, to consult with a legal professional when using any legal document template to ensure it aligns with the specific laws and regulations of the relevant jurisdiction.

What is a limited power of attorney?

A Limited Power of Attorney (POA) is a legal document that gives someone, known as an agent or attorney-in-fact, the authority to act on behalf of another person, known as the principal, in specific situations or for a limited time period.

The “limited” aspect means that the agent’s power is not broad or general; rather, it’s confined to particular situations or tasks as defined by the principal in the document. This can be anything from selling a specific piece of property, to managing certain financial transactions, or making health decisions under certain conditions.

It’s important to note that a limited power of attorney is automatically revoked when the principal dies,becomes incapacitated, or at a predetermined date or after a specific event, as specified in the document.

For example, if a principal creates a Limited Power of Attorney allowing their agent to handle property transactions while the principal is out of the country for six months, the POA would typically be designed to expire at the end of that six month period.

In the event of the principal’s incapacity, a Durable Power of Attorney is needed instead. Unlike a general or limited power of attorney, a Durable Power of Attorney remains in effect even if the principal becomes incapacitated.

It’s crucial to understand that drafting a power of attorney involves significant legal considerations, so it’s recommended to consult with a legal professional to ensure all the implications and conditions are understood by both the principal and the agent.

Limited Power of Attorney Types

There are several types of Limited Power of Attorney (POA) that can be used depending on the specific needs and circumstances of the principal. Here are a few examples:

Real Estate POA

This type of limited power of attorney allows an agent to handle property transactions on behalf of the principal. This can include buying or selling property, managing property, or dealing with real estate disputes.

Financial POA

This kind of limited POA gives the agent the authority to handle specific financial matters for the principal. This could involve managing bank accounts, paying bills, handling investments, or dealing with tax matters.

Healthcare POA

While often a more comprehensive document, a limited healthcare POA could authorize the agent to make specific medical decisions on the principal’s behalf. This might be used for a particular procedure or treatment course.

Child Care POA

This limited POA allows an agent to make decisions regarding a principal’s child for a specified period. This is often used when a parent is out of town or otherwise temporarily unable to care for their child.

Vehicle POA

This type of limited POA permits an agent to buy, sell, or handle other transactions involving the principal’s vehicle.

Military POA

Used by military personnel, this type of limited POA can cover a variety of situations, including financial or domestic matters, while the service member is deployed.

Business POA

This type of limited POA allows an agent to make decisions related to a business owned by the principal. This could include signing contracts or dealing with other business matters.

How to get a limited power of attorney

Obtaining a limited power of attorney (POA) involves several steps. Here is a simplified guide, but please consult with a legal professional to ensure all requirements are met and your interests are properly protected:

Decide on the Powers: The first step is to determine what specific powers you wish to grant to the agent. This could be related to healthcare decisions, financial transactions, or any other specific task that you wish the agent to carry out on your behalf.

Choose an Agent: Choose a trusted individual who will act as your agent, also known as the “attorney-in-fact”. This person will have the power to act on your behalf within the constraints defined by the POA.

Draft the Document: Write the limited power of attorney document. This document should clearly identify the principal (you), the agent, and the specific powers granted to the agent. It should also specify the duration of the POA, if it’s not meant to last indefinitely.

Consult with a Legal Professional: To ensure that the document is legally sound and meets your specific needs, it is highly recommended to consult with a lawyer. They can help you ensure the document is correctly written and all necessary elements are included.

Sign the Document: Once the document is drafted, both you and the agent should sign it. The document might also require notarization and/or witnesses depending on the laws in your jurisdiction.

Notify Relevant Parties: After the document is signed and notarized, notify any relevant parties of the POA. For example, if the agent is granted power to handle your banking transactions, you should notify your bank about the POA.

Common reasons for using an LPOA

A Limited Power of Attorney (LPOA) is a legal document that gives someone else the power to act in your place under specific, clearly defined circumstances. There are several reasons why one might consider using an LPOA. Here are a few common ones:

Specific Financial Transactions: An LPOA can grant someone the authority to handle specific financial transactions on your behalf. For example, if you’re unable to be present for the closing of a real estate transaction, you could use an LPOA to allow someone else to sign the documents on your behalf.

Business Operations: If you own a business and need to be away for a period of time, an LPOA could be used to allow a trusted individual to make certain decisions or handle certain aspects of the business in your absence.

Healthcare Decisions: While typically a separate document known as a Healthcare Power of Attorney is used for this purpose, an LPOA could be used to allow someone to make specific healthcare decisions for you under certain conditions.

Elder Care: An elder who might not be able to manage certain aspects of their finances or personal care may use an LPOA to allow a family member or other trusted individual to help manage those specific areas.

Travel or Absence: If you’re going to be out of the country or otherwise unavailable, you can use an LPOA to let someone handle certain matters for you while you’re away.

Legal Representation: An LPOA can be used to grant someone the power to act on your behalf in specific legal matters, such as appearing in court for you, if you cannot or do not wish to do so yourself.

How to write an LPOA

Writing a Limited Power of Attorney (LPOA) requires careful planning and drafting. Here is a step-by-step guide to help you navigate this process:

Step 1: Determine the Scope of the Power

Decide on the specific powers you want to grant to the agent. This could be for a specific transaction, like selling a property, or it could be a specific set of tasks, like managing your finances while you’re abroad.

Step 2: Choose Your Agent

Select a trusted individual to act as your agent. This person should be reliable, trustworthy, and capable of carrying out the tasks you’re delegating.

Step 3: Find a Template or Lawyer

You can either use a legal document template, which can be found online or in software packages, or hire a lawyer to draft the LPOA for you. If your situation is complex, it’s advisable to consult with a lawyer.

Step 4: Draft the Document

Begin by identifying yourself (the “principal”) and the person you’re appointing (the “agent” or “attorney-in-fact”). Clearly define the specific powers you’re granting to the agent, and make sure to specify the duration of the LPOA if it’s not meant to last indefinitely.

Step 5: Review State Requirements

Each state has different requirements for making a POA valid, such as notarization or witnesses. Make sure your document complies with these requirements.

Step 6: Sign and Notarize

Once the document is drafted to your satisfaction, sign it. Your signature may need to be notarized, and witnesses might need to sign the document too, depending on state law.

Step 7: Distribute Copies

Provide a copy of the LPOA to your agent and any institutions (like banks or hospitals) that may need it. You should also keep a copy for your records.

Step 8: Revoke or Update as Needed

Remember, you can revoke or change your LPOA at any time, as long as you are mentally competent. If your circumstances change, make sure to update or revoke your LPOA as needed.

FAQs

How does an LPOA differ from a General Power of Attorney?

A General Power of Attorney grants the agent broad powers to act on behalf of the principal in many different matters, such as financial or healthcare decisions. An LPOA, on the other hand, only grants the agent authority to act in specific situations defined by the principal.

Can an LPOA be revoked?

Yes, an LPOA can be revoked at any time by the principal, provided they are mentally competent. This is typically done by sending a written notice of revocation to the agent and any institutions or parties that had a copy of the LPOA.

Does an LPOA need to be notarized?

The need for notarization varies by jurisdiction. Some states require a notary, while others require witnesses, and some require both. It’s important to check the laws in your state or consult with a legal professional to ensure your LPOA is valid.

What happens if the principal becomes mentally incapacitated?

Unless the LPOA is “durable,” it will typically become invalid if the principal becomes mentally incapacitated. A Durable Power of Attorney remains in effect even if the principal becomes unable to make decisions for themselves.

Can the agent do whatever they want with an LPOA?

No, the agent is legally required to act in the best interests of the principal. The agent’s powers are also limited to the specific tasks or situations outlined in the LPOA document.

Can an LPOA be used to handle all of the principal’s affairs?

No, an LPOA is designed to allow the agent to handle specific tasks or situations on behalf of the principal. If the principal wants to give the agent broad authority to handle all of their affairs, they would likely need a General Power of Attorney.

Can more than one agent be appointed in an LPOA?

Yes, a principal can appoint more than one agent. The principal can also specify if the agents are to act together (jointly) or can act separately (severally).

What should I do if I lose my LPOA document?

If the original document is lost, a certified copy can often be used in its place. If no copies are available, a new LPOA may need to be drafted and signed.

Does an LPOA expire?

An LPOA can expire if an expiration date is specifically mentioned in the document. If there is no such date, it generally remains valid until the principal revokes it or passes away.

What happens to the LPOA when the principal dies?

Upon the death of the principal, the LPOA immediately becomes void. The agent no longer has the authority to act on the principal’s behalf. The handling of the principal’s affairs would then typically fall to the executor of the will or, in the absence of a will, the state’s laws of intestacy.

Can the agent delegate their authority to someone else?

Typically, no. The agent cannot usually delegate their authority to another person unless the LPOA specifically allows for such delegation.

Can an agent be held liable for their actions under an LPOA?

Yes, an agent can be held liable if they act outside the authority granted by the LPOA, fail to act in the principal’s best interests, or misuse their authority in some other way.

Can I have an LPOA and a General Power of Attorney?

Yes, you can have both, but it’s important to ensure that they don’t contradict each other. If they do, the more recent document may take precedence.

Can I create an LPOA on my own, or do I need a lawyer?

You can create an LPOA on your own, especially if your needs are straightforward. However, it’s often a good idea to consult with a lawyer to ensure that the document accurately reflects your wishes and complies with all relevant laws.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)