Crafting the ideal freelancer agreement template is crucial for all the business transactions you’ll have with clients. When working with independent contractor agreements, it’s essential to carefully outline the terms and conditions of your collaboration. The more comprehensive your agreement, the better. This vital document helps manage your professional relationship with your client from both a legal and personal standpoint.

Being proficient in drafting the appropriate contract tailored to your field can significantly impact the progress of your work throughout the contract’s life. This document not only provides legal safeguards but also serves as a roadmap for how the work will be executed. It’s imperative to include all the relevant information in the document from the beginning of each professional relationship with your clients.

Table of Contents

Independent Contractor Agreement Templates

Independent contractor agreement templates are essential tools for establishing clear and legally binding agreements between businesses or individuals and independent contractors. These templates provide a structured framework that outlines the terms and conditions of the working relationship, ensuring both parties understand their rights and responsibilities.

An independent contractor agreement serves as a written contract between the hiring party, often referred to as the client or company, and the independent contractor, who is self-employed and provides services on a project basis. The agreement outlines the scope of work, payment terms, project timelines, and other crucial details necessary for a successful engagement.

The independent contractor agreement templates are designed to offer consistency and professionalism, making it easier for parties to create legally sound contracts without the need for extensive legal expertise. These templates are typically created by legal professionals and follow relevant laws and regulations in the jurisdiction in which they are intended to be used.

What is an independent contractor agreement?

Independent contractors, often referred to as freelancers, collaborate with clients on a temporary basis to complete specific tasks. Once the work is finished, the professional relationship concludes. Several industries frequently employ independent contractors, including:

- Technology

- Healthcare

- Travel

- Writing

- Staffing

- Legal services

This list represents just a handful of sectors that regularly engage with contractors for their expertise. Although not universally applicable, many industries rely on contractors to fulfill various roles.

The IRS typically mandates the existence of a contract between hiring parties and contract workers. Without such an agreement, both contractors and clients might face tax liabilities they don’t genuinely owe. One of the most significant advantages of having a basic contractor agreement in place is the legal protection it offers for all parties involved.

An independent contractor agreement provides essential legal protection at tax time and during disputes between a contractor and a client. Most contractors keep a blank agreement readily available to ensure their work isn’t hindered by the absence of a contract.

Contract work often falls under contractor documents provided by the client. However, this isn’t always the case. As a contractor, it’s crucial to carefully review any provided documents to ensure they fairly represent your interests in the professional relationship.

What are some other names for contract agreements?

Contract agreements can be known by several different names, depending on the context, industry, or the nature of the relationship between the involved parties. Here is a comprehensive list of some alternative names for contract agreements:

- Service Agreement

- Consulting Agreement

- Freelance Agreement

- Independent Contractor Agreement

- Business Contract

- Sales Agreement

- Purchase Agreement

- Employment Agreement

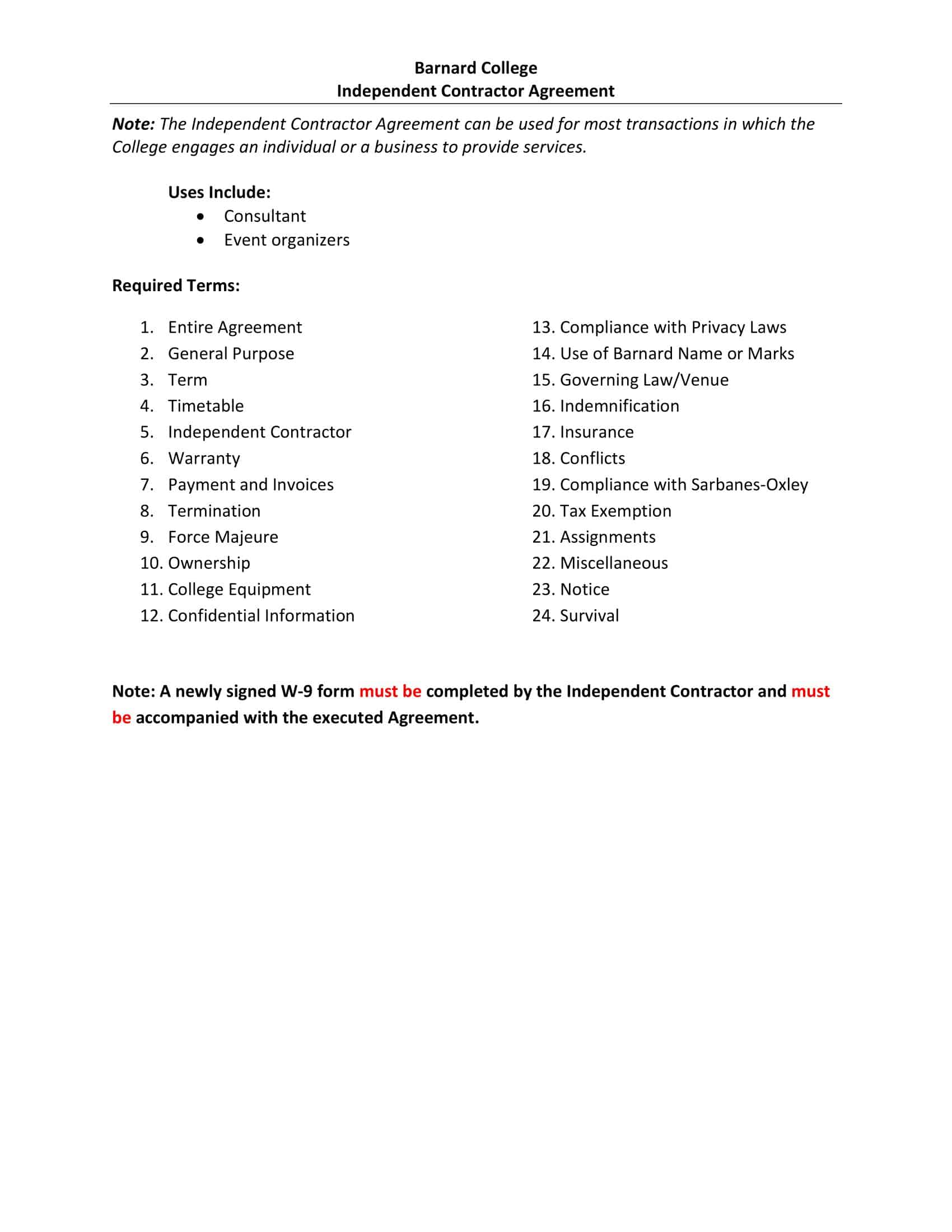

What should be included in an independent contractor agreement?

If you’re diving into the world of independent contracting, it’s essential to have a solid independent contractor agreement in place. This not only protects your interests but also helps establish clear expectations with your clients. So, what should you include in this all-important agreement? Let’s break it down.

Parties involved: Clearly identify yourself and your client, along with respective contact information, to establish who’s entering into this agreement.

Scope of work: Outline the nitty-gritty of the services you’re providing. Be as specific as possible, including deliverables, deadlines, and performance expectations. A well-defined scope of work helps avoid misunderstandings and keeps everyone on the same page.

Payment terms: Nobody likes chasing after payments, so it’s crucial to be upfront about payment details. Include the payment amount, schedule, and acceptable methods. You might also want to mention invoicing procedures and any late fees or penalties for non-payment.

Duration: Define the start and end dates of the contract, or specify the conditions under which the project is considered complete. This helps both parties understand the timeline of the work.

Independent contractor status: Emphasize that you’re not an employee, but rather a self-employed individual responsible for your own taxes, insurance, and benefits. This distinction is important for legal and tax purposes.

Confidentiality: You might be privy to sensitive information during your work, so it’s essential to address how you’ll handle your client’s intellectual property or proprietary information.

Termination: Life can be unpredictable, and sometimes things don’t work out as planned. Include a termination clause that outlines the conditions under which either party can end the contract and any required notice periods.

Ownership of work: Clarify who owns the work you produce and whether you can use it in your portfolio or for other purposes.

Liability and indemnification: Protect yourself by addressing liability for any damages, losses, or injuries that may occur during the project, and include indemnification clauses for both parties.

Dispute resolution: Lastly, outline how any disagreements between you and your client will be resolved, such as through mediation, arbitration, or litigation.

By including these essential elements in your independent contractor agreement, you’ll be well on your way to a successful and worry-free collaboration with your clients. Remember, a solid contract is the foundation for a great working relationship. So take the time to get it right, and happy freelancing!

What’s the Difference Between an Independent Contractor and an Employee?

Understanding the difference between an independent contractor and an employee is essential for both businesses and workers. These distinctions impact how tasks are carried out, taxes, benefits, and legal rights. Let’s dive into the key differences between the two:

1. Control over work:

Independent Contractors: They have more control over their work, including how, when, and where they complete tasks. They often have multiple clients and can set their schedules.

Employees: Employers have more control over employees’ work, including their schedules, work methods, and tools. Employees typically work for one company and follow the employer’s guidelines.

2. Taxes:

Independent Contractors: As self-employed individuals, they’re responsible for their tax liabilities, including income tax and self-employment tax. They receive a Form 1099-NEC from their clients and file their taxes accordingly.

Employees: Employers withhold income tax, Social Security, and Medicare taxes from employees’ paychecks. Employers also contribute to unemployment taxes and workers’ compensation. Employees receive a Form W-2 at the end of the year for tax filing purposes.

3. Benefits:

Independent Contractors: They generally don’t receive benefits such as health insurance, paid time off, or retirement plans from their clients. Contractors need to arrange and cover these benefits themselves.

Employees: Employees often receive benefits from their employers, including health insurance, paid time off, retirement plans, and other perks.

4. Job Security:

Independent Contractors: Their work relationship with clients is typically project-based or for a specific duration, meaning job security can be more uncertain.

Employees: They usually have more job security, and termination often requires adherence to specific procedures, such as providing notice or cause.

5. Legal protections:

Independent Contractors: They don’t have the same legal protections as employees, such as minimum wage, overtime pay, or protection under anti-discrimination laws.

Employees: Employees are covered by various labor laws, including minimum wage requirements, overtime pay, family and medical leave, and anti-discrimination laws.

Understanding these differences is crucial for both businesses and workers. It helps ensure compliance with labor laws, tax regulations, and other legal requirements. Misclassifying workers can lead to fines, penalties, and back payments for employers, so it’s essential to classify workers accurately and understand the associated responsibilities.

How do I create an Independent Contractor Agreement?

Step 1: Gather information

Before you start drafting the agreement, collect all the necessary details, including the names and contact information of both parties (you and your client), the project’s scope, deadlines, payment terms, and other relevant information.

Step 2: Begin with the basics

Start your agreement by identifying the parties involved, the effective date, and a brief statement about the purpose of the contract. This sets the foundation for the rest of the document.

Step 3: Define the scope of work

Describe the specific services you’ll be providing, including project deliverables and deadlines. Be as detailed as possible to avoid misunderstandings and ensure everyone is on the same page.

Step 4: Establish payment terms

Clearly outline the payment amount, schedule, and methods. Include invoicing procedures and any late fees or penalties for non-payment.

Step 5: Set the duration

Specify the start and end dates of the contract or the conditions under which the project is considered complete.

Step 6: Clarify independent contractor status

Emphasize that you are not an employee but a self-employed individual responsible for your taxes, insurance, and benefits. This distinction is crucial for legal and tax purposes.

Step 7: Address confidentiality

Include a section on how you will handle sensitive information or intellectual property during the project to protect your client’s proprietary information and trade secrets.

Step 8: Include a termination clause

Outline the conditions under which either party can terminate the contract and any required notice periods.

Step 9: Define ownership of work

Clarify who owns the work you produce and whether you can use it in your portfolio or for other purposes.

Step 10: Discuss liability and indemnification

Address liability for damages, losses, or injuries that may occur during the project and include indemnification clauses for both parties.

Step 11: Detail dispute resolution

Specify how any disagreements between you and your client will be resolved, such as through mediation, arbitration, or litigation.

Step 12: Include any additional clauses

Depending on your specific situation, you may need to include additional clauses, such as non-compete, non-solicitation, or insurance requirements.

Step 13: Review and finalize

Carefully review the entire agreement to ensure it accurately reflects your understanding and intentions. Make any necessary revisions.

Step 14: Sign and date the agreement

Both parties should sign and date the agreement to make it legally binding. Each party should keep a copy for their records.

FAQs

Can an Independent Contractor Agreement be modified?

Yes, an Independent Contractor Agreement can be modified, but any changes should be agreed upon by both parties and documented in writing, either by amending the original agreement or creating a new one.

How can I determine if someone should be classified as an independent contractor or an employee?

The classification depends on the level of control the client has over the individual’s work, as well as other factors such as the worker’s economic dependence on the client. The IRS provides guidelines to help determine the proper classification, but it is always a good idea to consult with an attorney or tax professional to ensure compliance with applicable laws.

Do independent contractors need to provide their own insurance?

Independent contractors are typically responsible for providing their own insurance coverage, including general liability, professional liability, and workers’ compensation. This should be specified in the Independent Contractor Agreement.

Are there any tax implications for hiring an independent contractor?

Yes, there are tax implications for both the client and the contractor. Clients are not responsible for withholding taxes from the contractor’s payments, and they should provide a Form 1099-NEC to the contractor for income reporting purposes. Contractors are responsible for their own income and self-employment taxes.

What happens if an independent contractor fails to deliver the agreed-upon work?

If an independent contractor fails to deliver the work as outlined in the agreement, the client may have several options, such as seeking a refund, terminating the contract, or pursuing legal action for breach of contract. The specific remedies available will depend on the terms of the agreement.

Can an Independent Contractor Agreement have a non-compete clause?

Yes, an Independent Contractor Agreement can include a non-compete clause, which restricts the contractor from working with competitors or engaging in activities that directly compete with the client for a specified period. However, the enforceability of non-compete clauses varies by jurisdiction, and they must be reasonable in scope and duration to be considered valid.

Is a written Independent Contractor Agreement always necessary?

While a verbal agreement might be legally binding in some cases, it is always recommended to have a written Independent Contractor Agreement. This provides a clear record of the terms and conditions and serves as evidence in case of disputes or misunderstandings.

How should the Independent Contractor Agreement be terminated?

Termination of the agreement should follow the terms and conditions outlined in the contract. This may include providing notice within a specified timeframe, completing the agreed-upon work, or in cases of breach, following any remedies specified in the contract.

Can an independent contractor hire subcontractors?

An independent contractor may hire subcontractors to assist with the work, but this should be specified in the Independent Contractor Agreement. The contractor is usually responsible for the subcontractor’s performance and ensuring that they meet the terms of the agreement.

What is the difference between an independent contractor and a freelancer?

The terms “independent contractor” and “freelancer” are often used interchangeably, but they essentially refer to the same type of worker. Both are self-employed individuals who provide services to clients on a project basis and are not considered employees. However, the term “freelancer” is more commonly used in creative industries such as writing, design, or programming.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 3 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)