Your bank may demand “official EIN verification,” your payment processor might insist on an IRS document before opening an account, and if you misplace your CP-575 and can’t provide it to a vendor, everything grinds to a halt. The document that solves this problem is the EIN Verification Letter (IRS 147C). Issued by the IRS, this letter officially confirms your company’s Employer Identification Number (EIN). However, it takes time in practice to call the IRS to get the document, to authenticate by fax, or to properly format the file that you will submit to the bank. The EIN Verification Letter Templates (147C) package we created at TypeCalendar is designed to speed up this exact process.

Table of Contents

What Is an EIN Verification Letter (IRS 147C)?

The CP-575 is the initial setup letter. Many people lose it over the years. In this case, the IRS will send a new letter confirming your EIN, called the “147C Letter”. Banks, lenders, government contractors, and major suppliers accept this document as “official evidence.” So having a properly formatted request letter, an ID and fax cover sheet, and a standard “EIN Confirmation Packet” to share afterward will speed things up.

EIN Verification Letter Templates (147c)

Why Ready‑Made EIN 147C Templates Save You Time

Rather than scrambling at the last minute—what to say when you call the IRS, what goes on the fax cover sheet, how to word the email to your bank you’ll have ready made text for every step. Questions like “Is our company name written exactly like this?” and “What format should I use on the address line?” are handled by pre-filled fields. That eliminates needless back-and-forth and approval delays caused by typos.

What’s Included in TypeCalendar’s Free EIN 147C Template Pack

We provide 20+ EIN Verification Letter templates and related documents. They’re all free, watermark‑free, and downloadable with a single click:

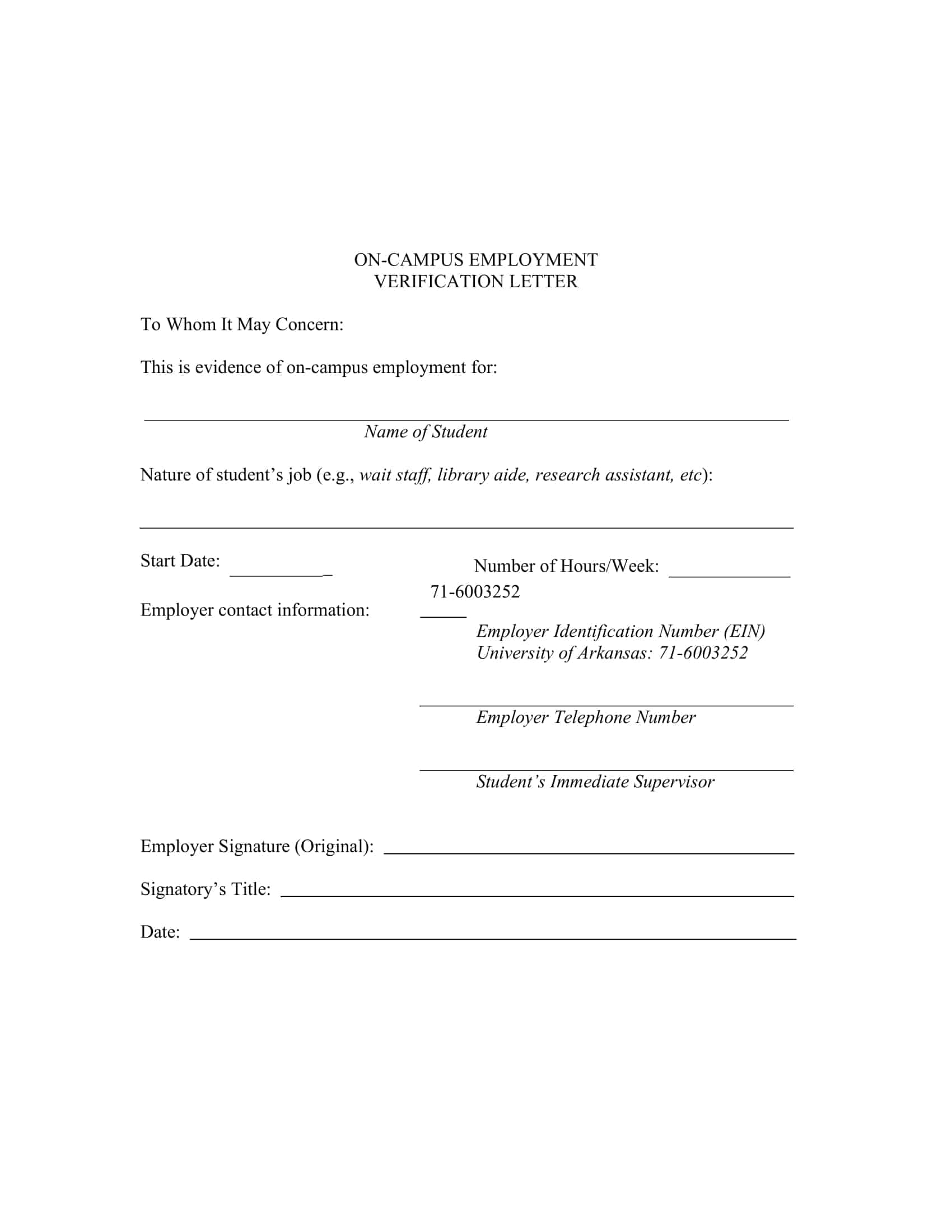

IRS 147C Request Cover Letter (Word / PDF / Google Docs)

It is the official request letter you will use when making a request to the IRS by fax or mail. There are blank fields for company name, EIN, registered address, and authorized person information.

Fax Cover Sheet for IRS 147C

The header and contact lines are arranged on a single page, in accordance with the identity verification steps determined by the IRS.

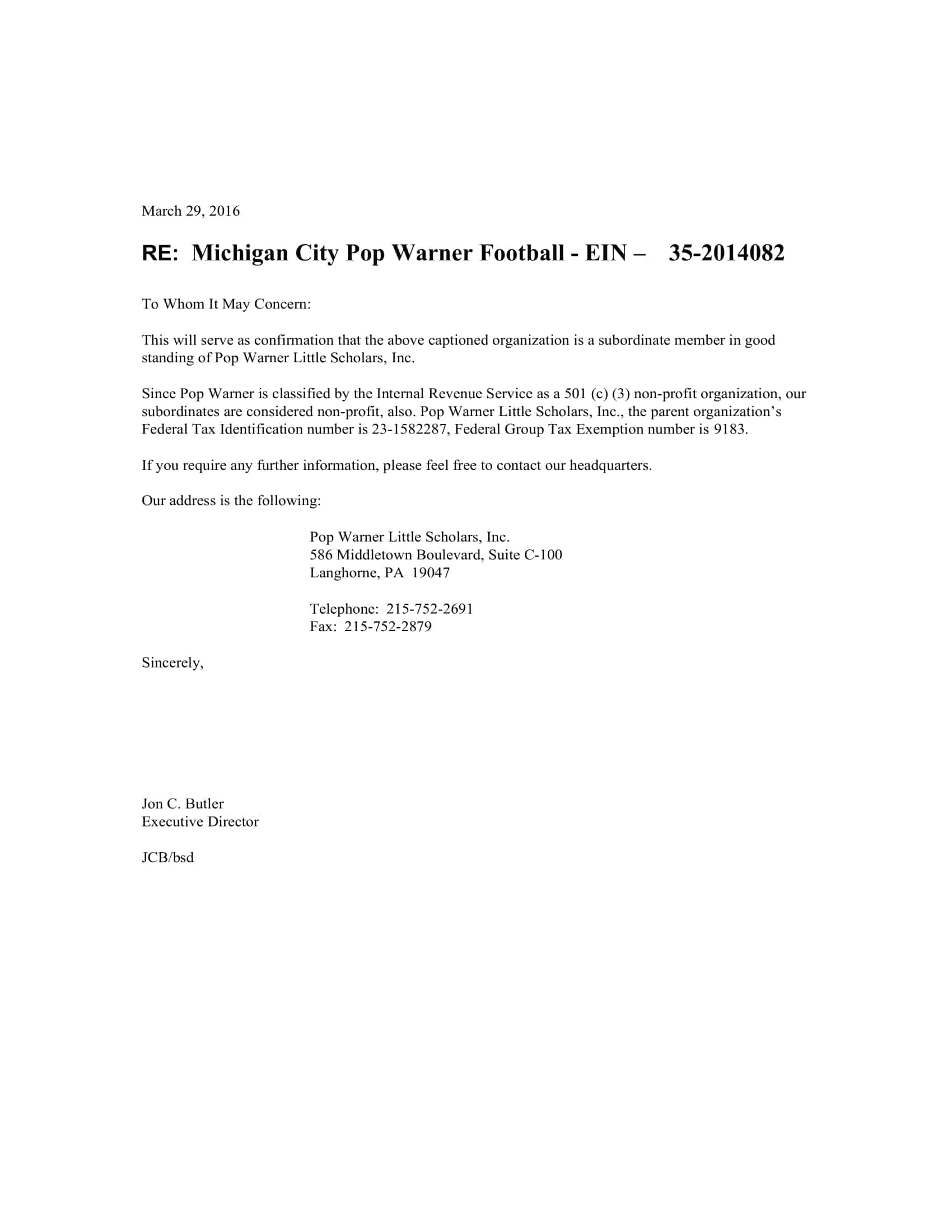

Bank / Vendor Submission Letter

A letter of accompaniment that you will send to the bank, payment provider or your supplier stating “EIN Verification Letter attached”.

Internal Record Template (147C Log Sheet)

On what date did you call, who did you contact, what number did you fax to, when did the confirmation arrive; a small tracking page for you to keep it all in one table.

Email/Text Snippet Set

Short, ready-made message phrases that you can send to your staff or business partners saying, “The EIN verification letter is attached.”

File Formats & Easy Editing (Word, PDF, Google Docs)

All templates are available in Word (.docx), PDF (printable and fillable), and Google Docs formats. You can easily add signature blocks, company logos, or note fields. PDF versions are ideal for quick printing or attaching to an email; Word and Google Docs versions let you update fields like name, address, and date whenever they change.

Download Free EIN 147C Templates and Get Back on Track Download the EIN Verification Letter Templates (147C) collection from TypeCalendar now. Don’t waste time hunting for documents reply to your bank, vendor, or the IRS in one shot with a complete, correctly formatted request and delivery packet. Streamline your workflow and turn EIN verification into a routine, not a roadblock.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 2 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 3 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)