Hey again! More thoughts on pay stubs for you…

Payday is always a lovely day when that hard-earned money hits your bank account. Whether it’s monthly or bi-weekly, nothing beats getting paid!

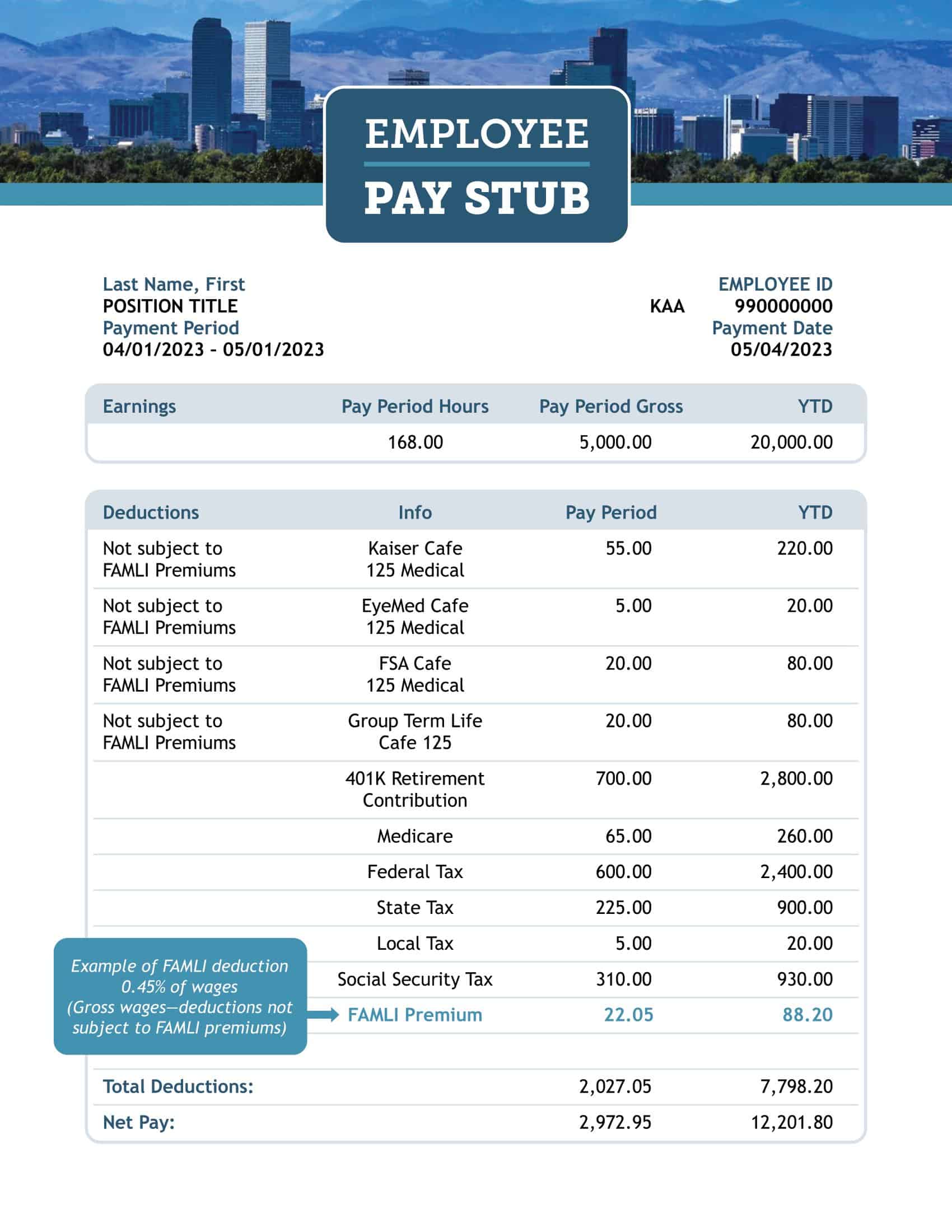

Of course, you want to be sure your employer is paying up accurately. That’s where your trusty pay stub comes in – your little summary of earnings, taxes, deductions, etc. for the period.

It’s reassuring to see everything laid out clearly, verifying you received what you’re owed. No mystery numbers or sketchy math from the payroll department.

Pay stubs also play an important role when an employee leaves a company. HR uses them to calculate final payments like severance and any leftover PTO.

One last pay stub outlines the details so both sides are on the same page for the final balance. Clean and simple.

So while pay stubs may seem boring on the surface, they provide critical clarity and assurance around pay. Employees and employers alike can breathe easy knowing the numbers add up.

Table of Contents

What Is a Pay Stub?

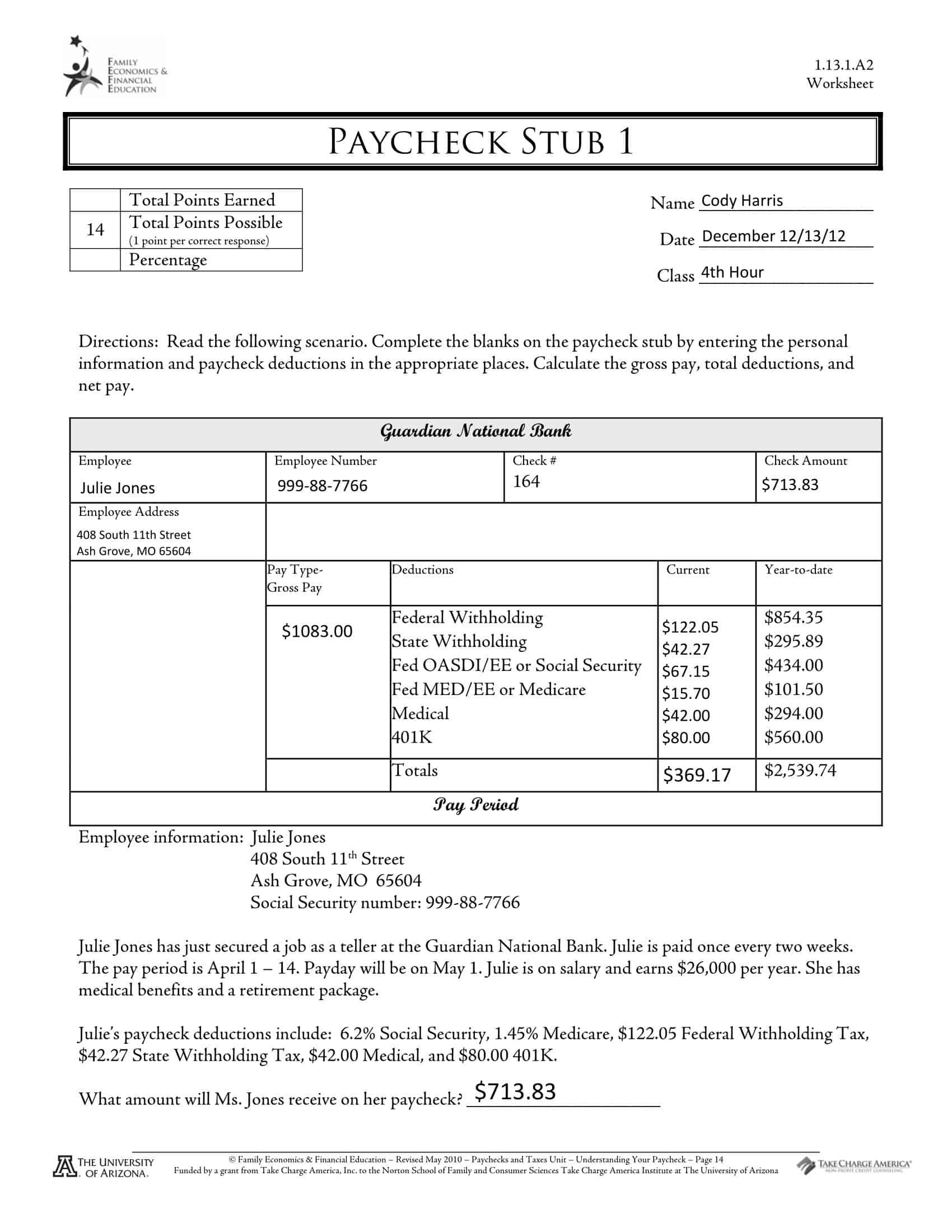

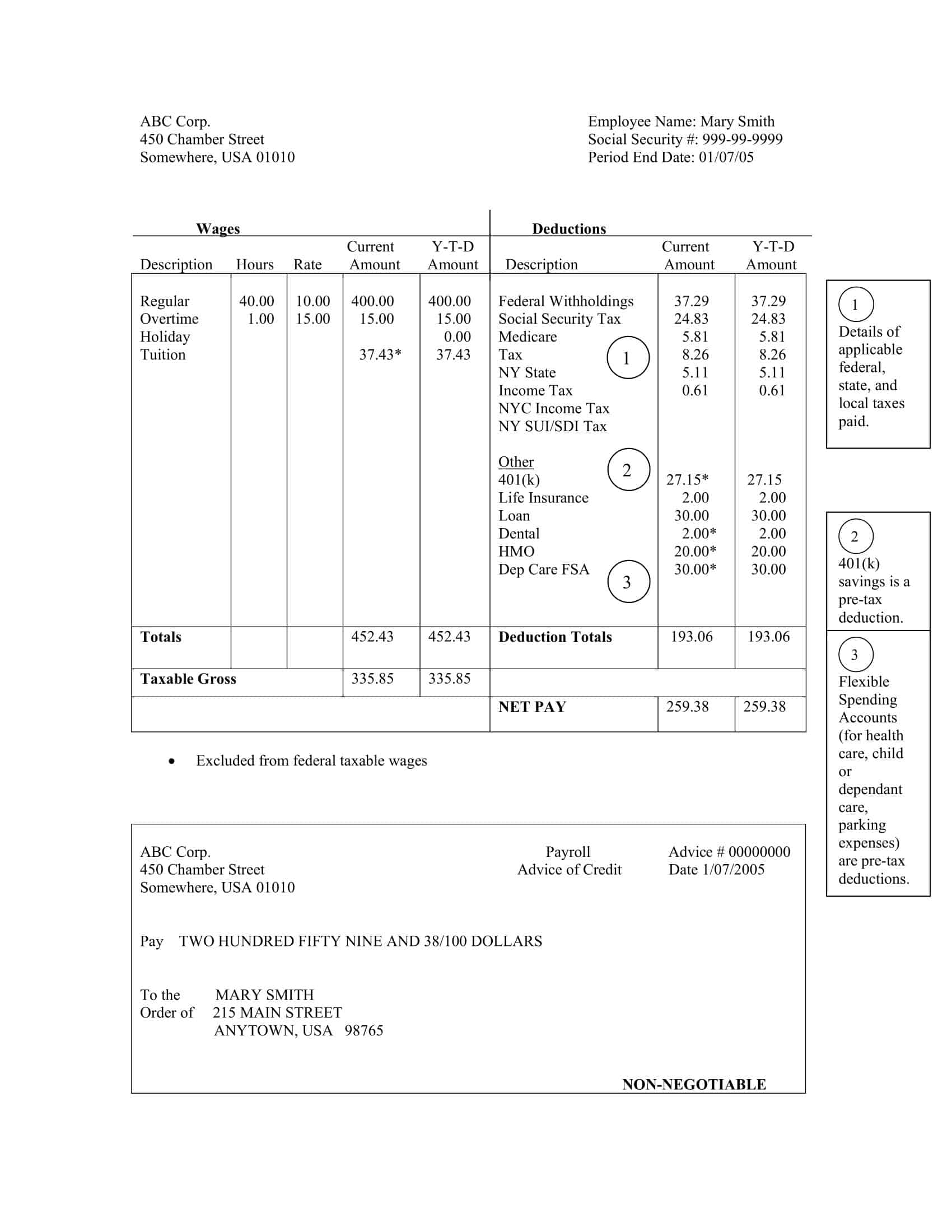

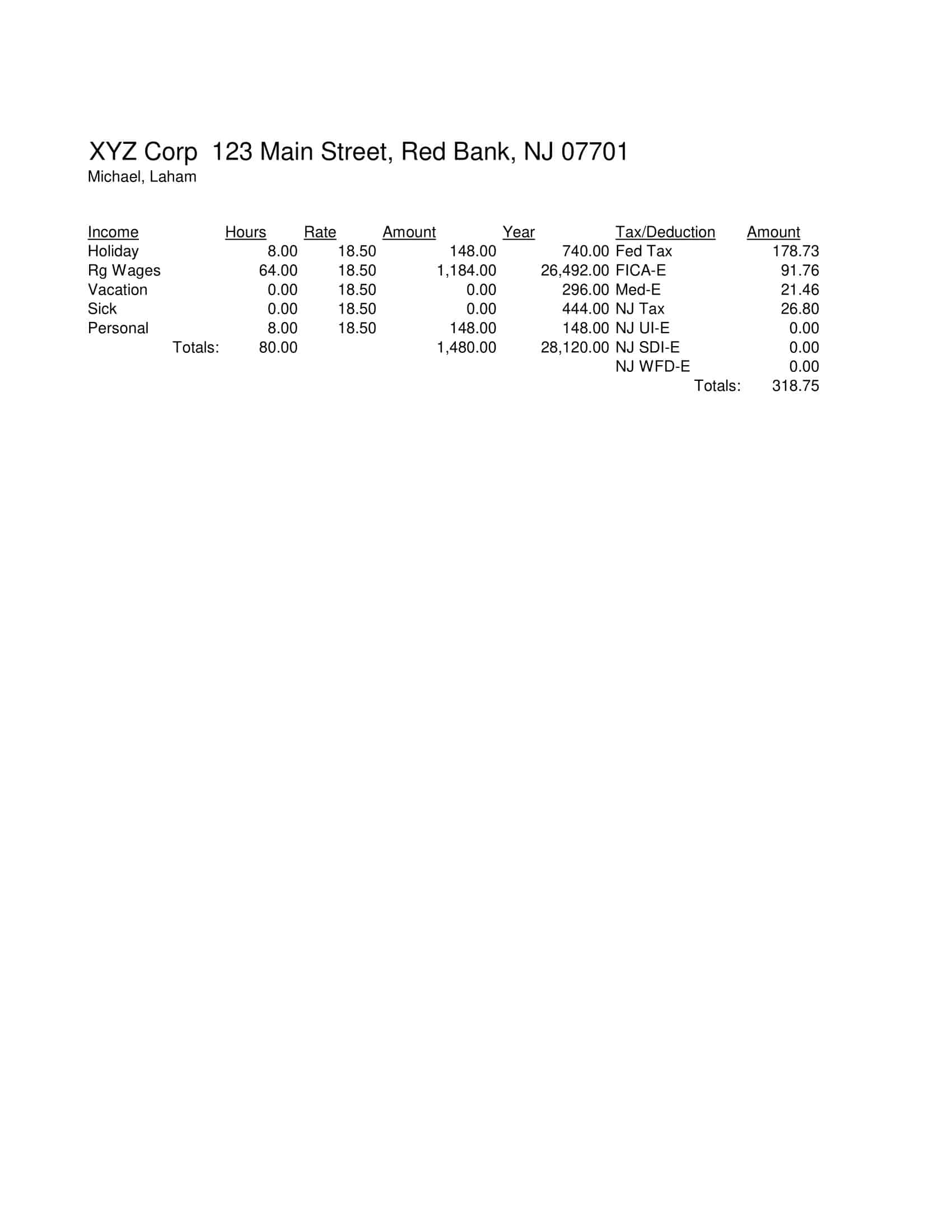

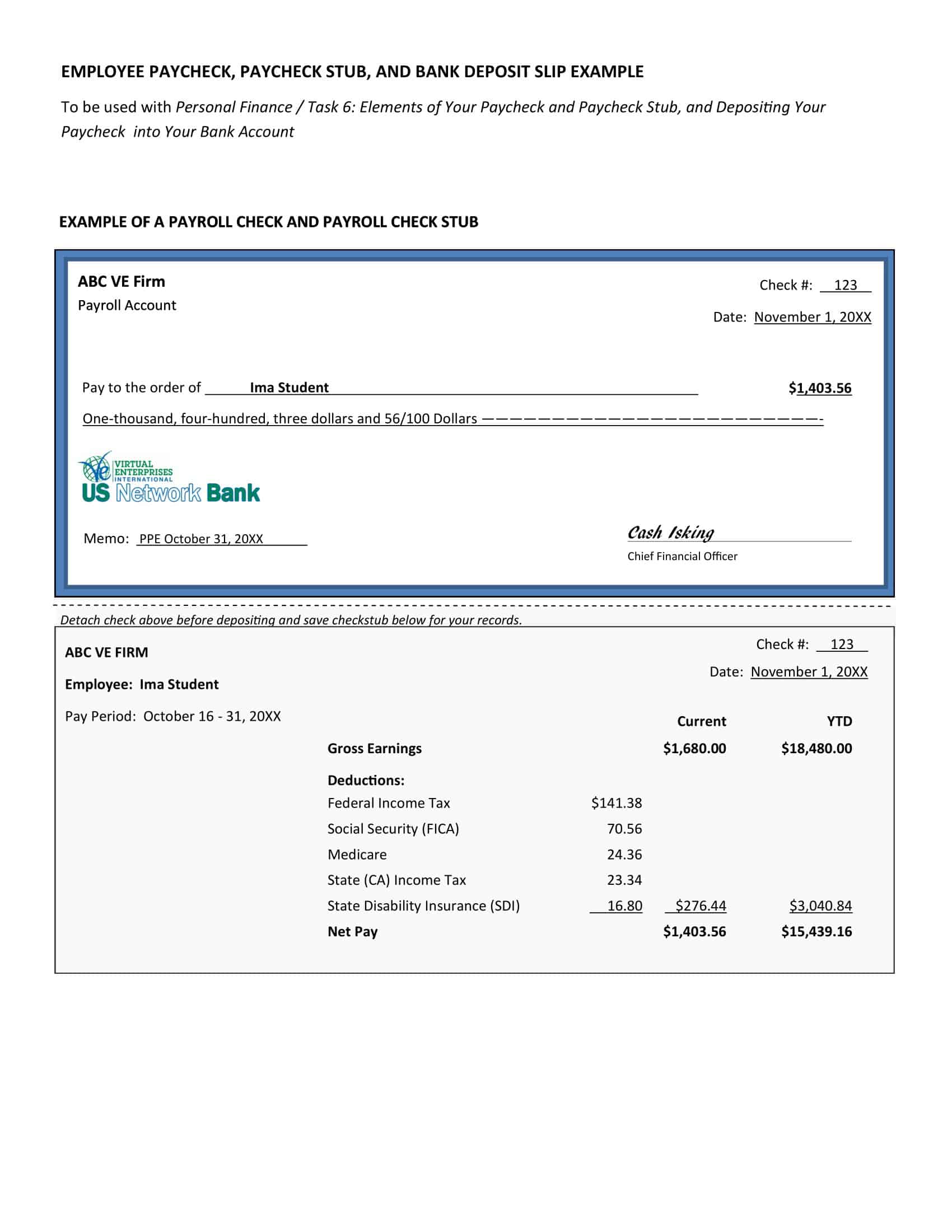

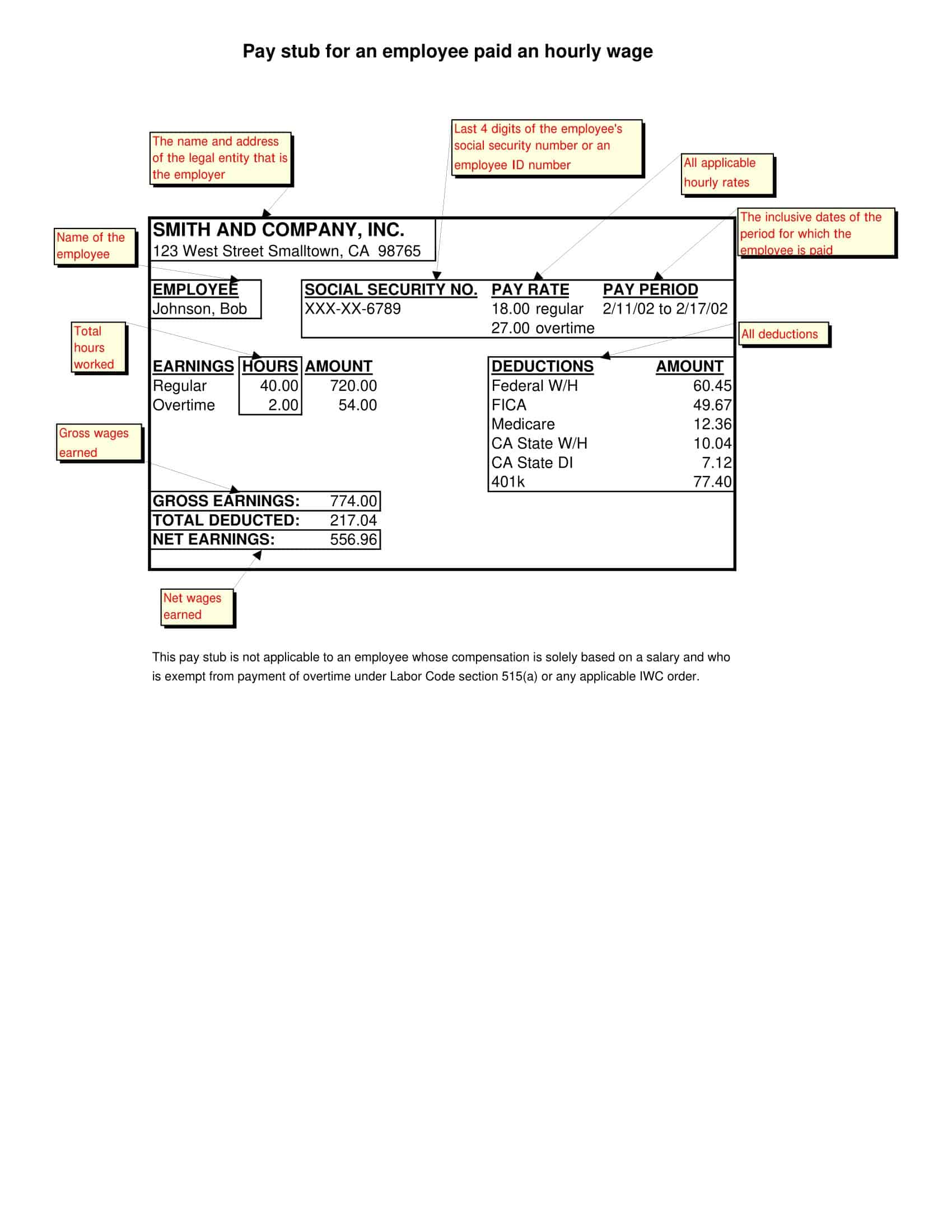

A pay stub (also called a payslip) is the little document you get with your paycheck that breaks down all the nerdy details. You know – the gross amount you earned, any taxes and insurance taken out, other random deductions, etc.

It’s created by your employer to give you visibility into exactly where your hard-earned money is going each pay period. As an employee, it’s great to have that transparency so there’s no mystery.

Pay stubs are also handy for employers when they’re doing payroll and want to double check taxes are being withdrawn properly. Comparing stubs against tax returns can ensure everything lines up.

So while pay stubs may not be the most exciting read, they provide important clarity and insight into your compensation. You can verify you’re receiving what you’re owed and catch any errors.

Next time you get your stub, give it more than a quick glance! It contains valuable info to understand your earnings from every angle. Just don’t get too lost in the weeds!

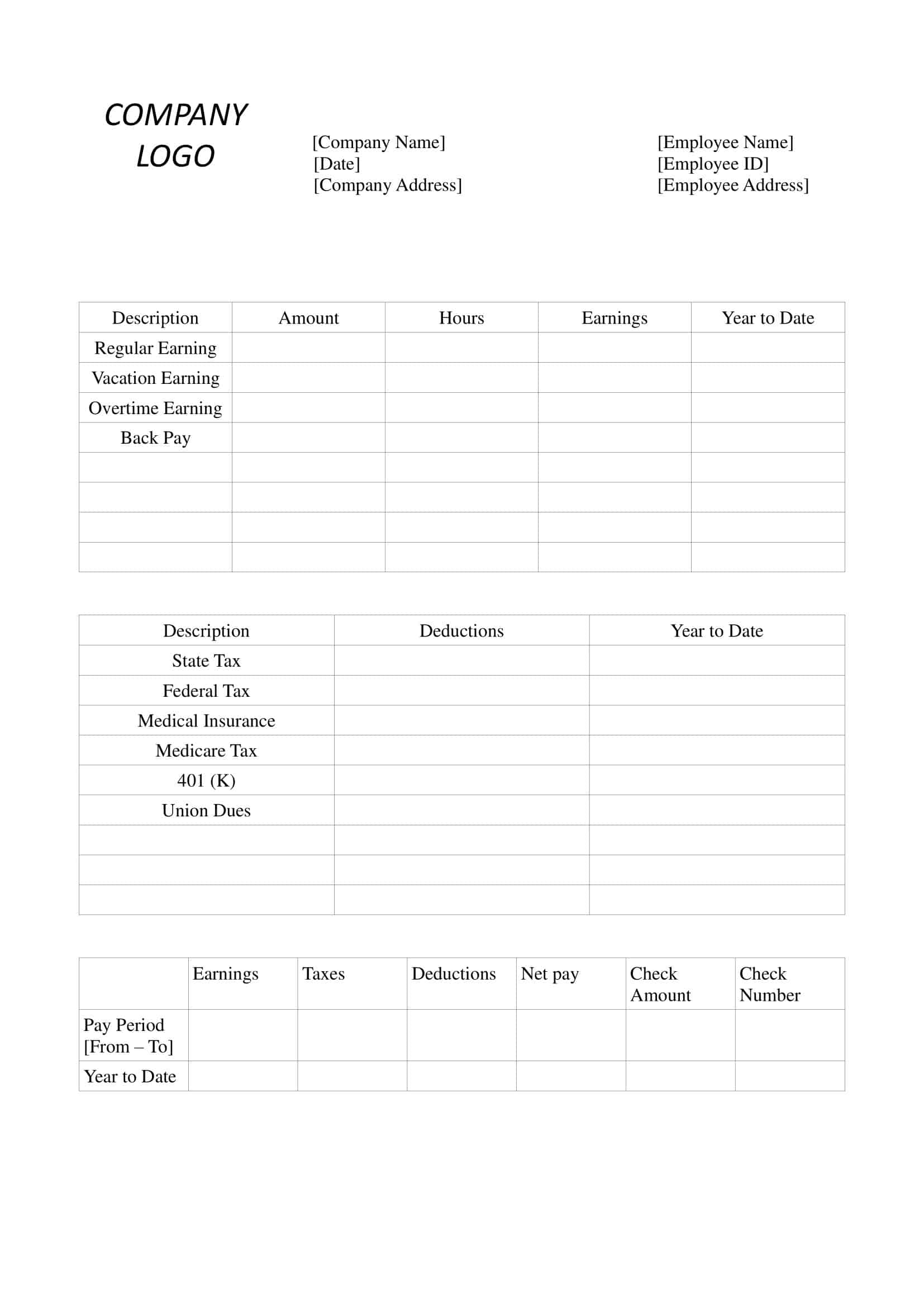

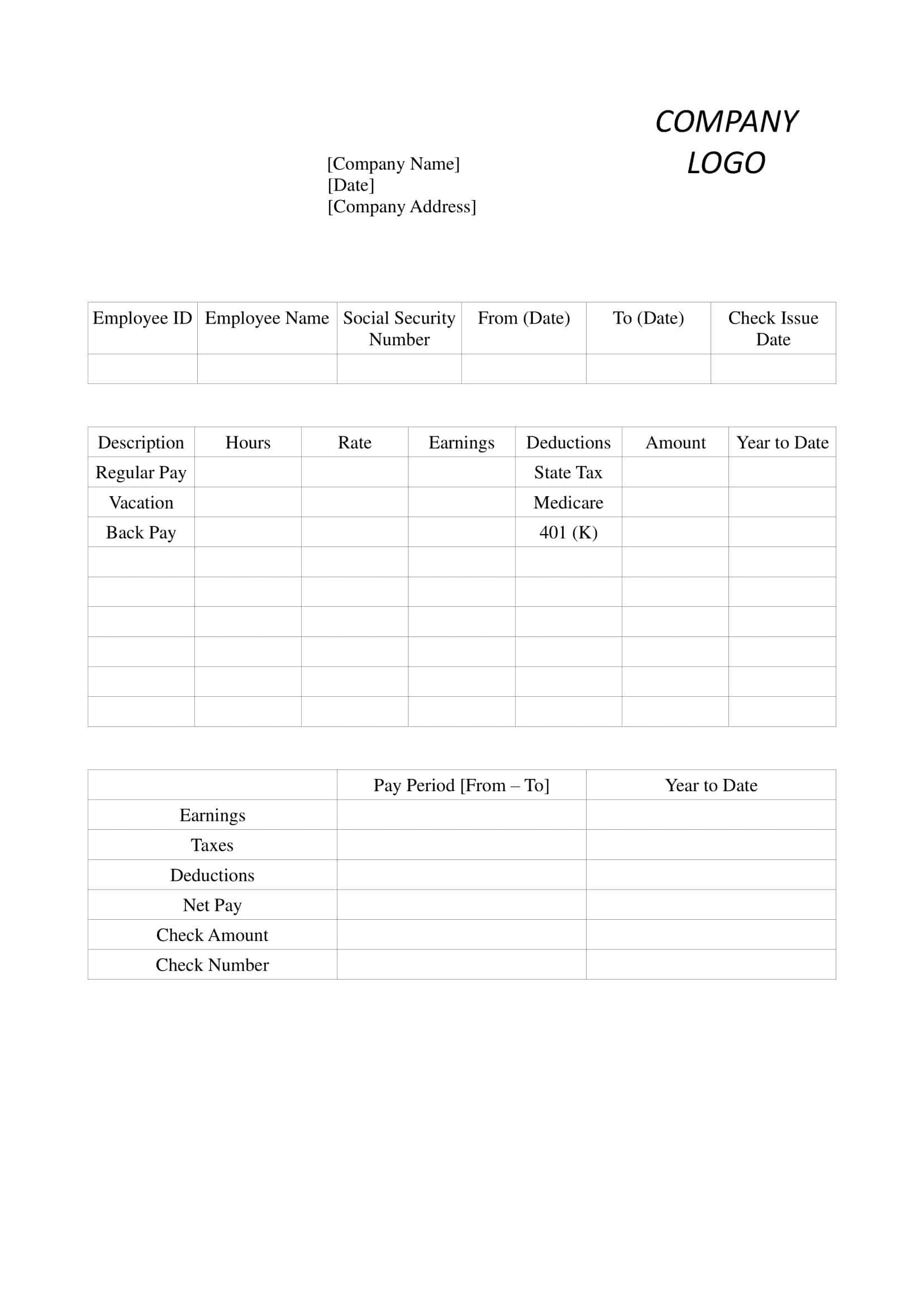

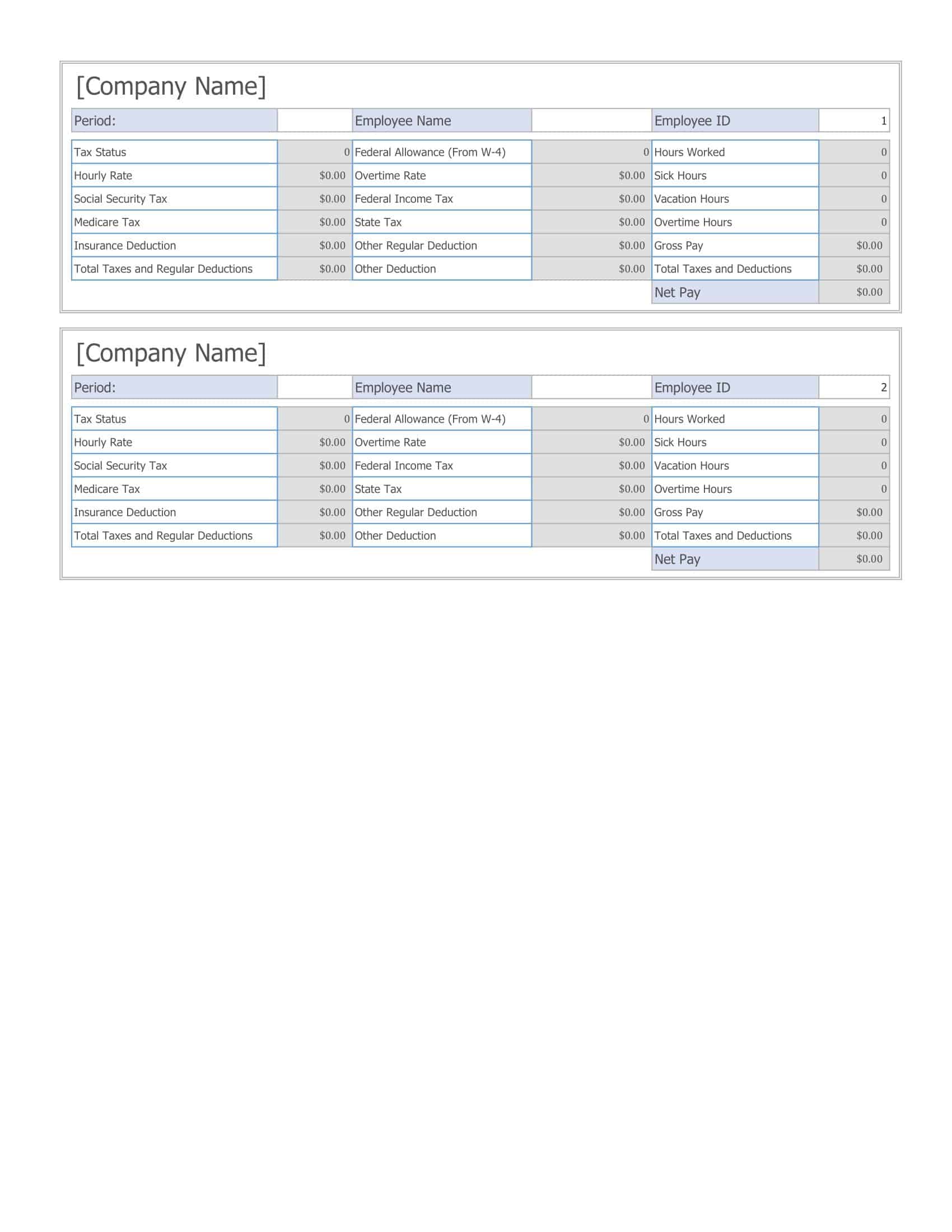

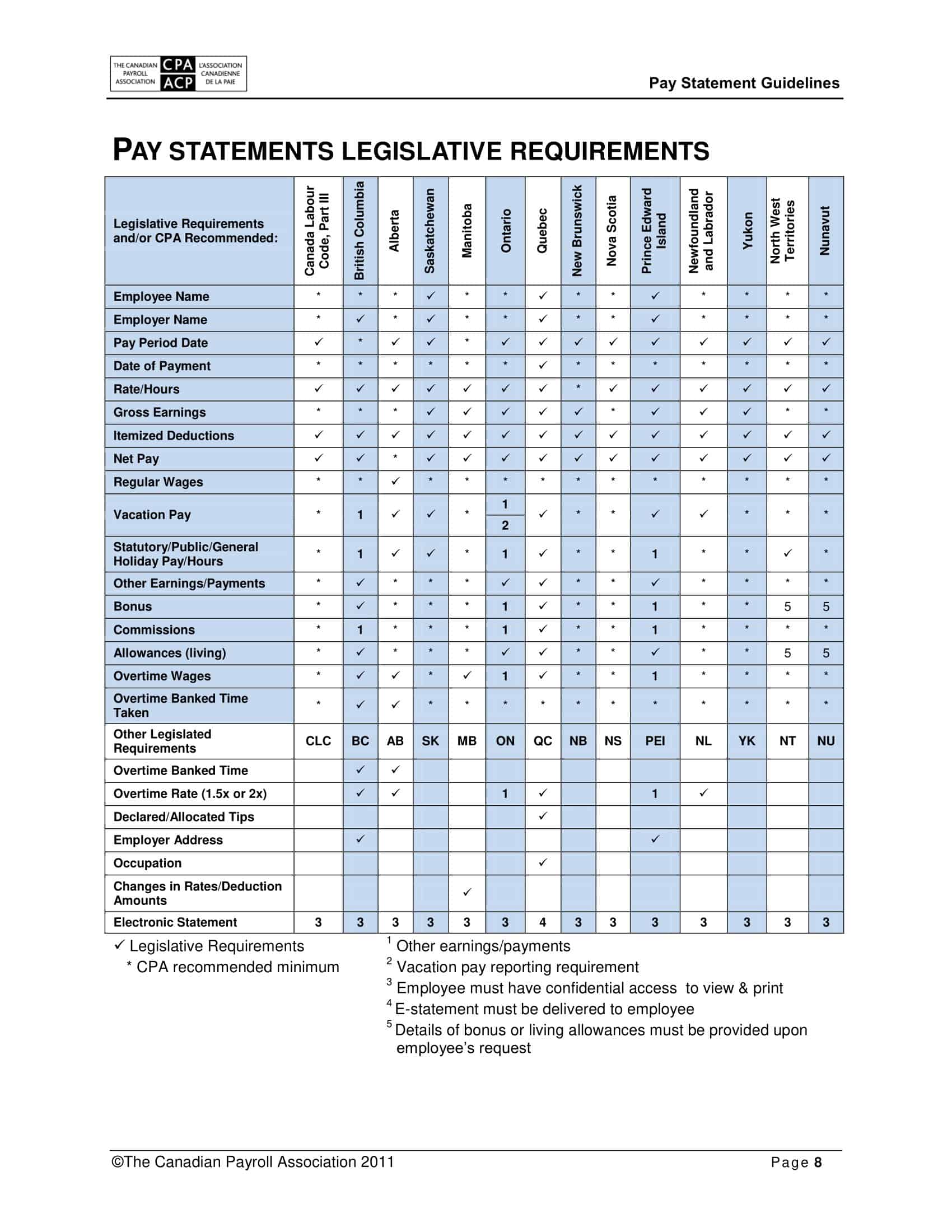

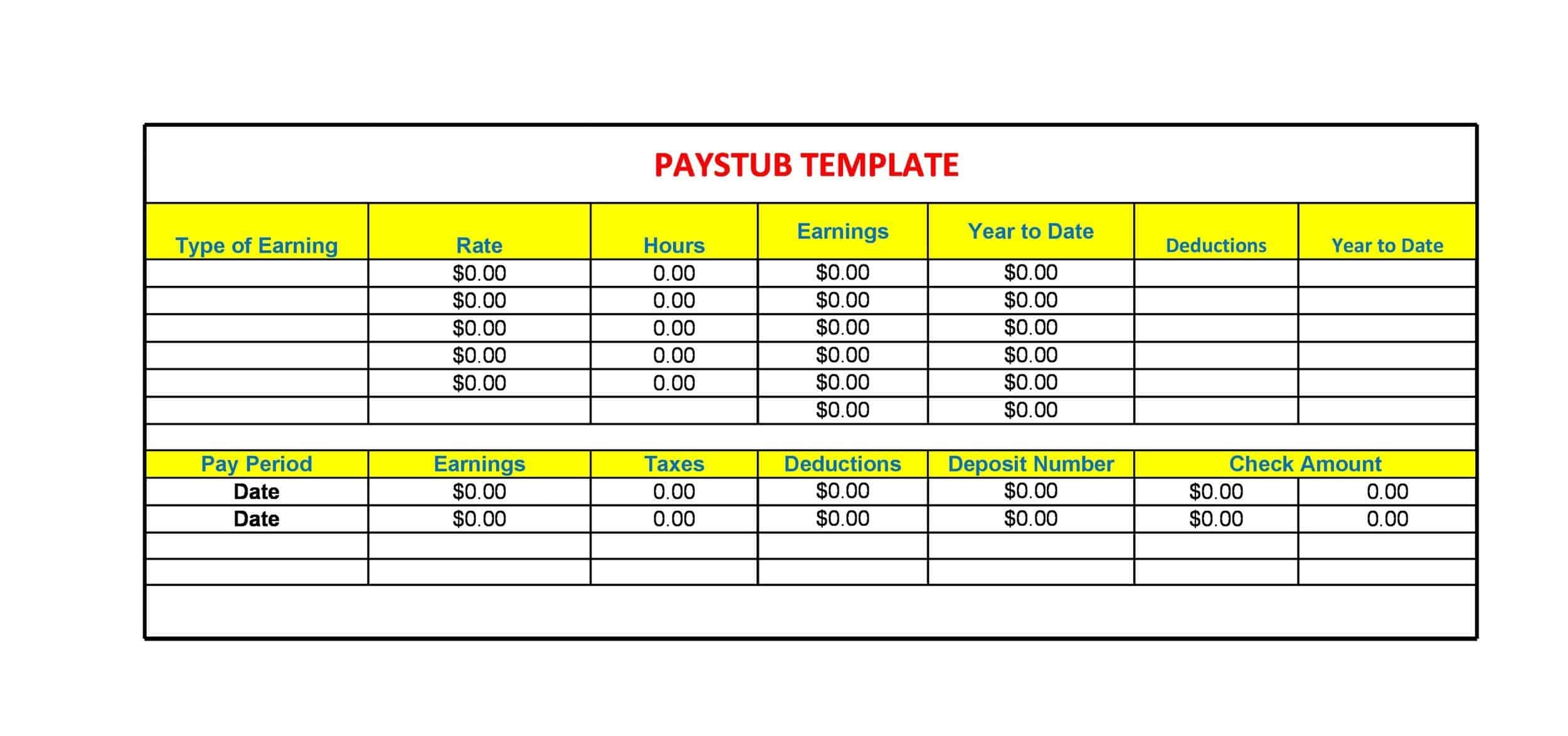

Pay Stub Templates are essential tools used by employers to provide detailed and consistent documentation of employees’ earnings and deductions. These templates help generate accurate and professional pay stubs that outline the breakdown of an employee’s wages, taxes, deductions, and other financial information related to their compensation. Pay Stub Templates ensure transparency, facilitate compliance with legal requirements, and serve as a valuable resource for employees to understand their earnings.

Pay Stub Templates provide employers with a standardized and organized method of documenting employee earnings and deductions. By utilizing these templates, employers can generate professional pay stubs that accurately reflect the financial details of each employee’s compensation. Pay stubs offer transparency and clarity, allowing employees to understand how their wages are calculated and the breakdown of deductions.

They also serve as important records for both employers and employees, aiding in tax filing, budgeting, loan applications, and other financial purposes. Whether used by small businesses, large corporations, or payroll service providers, Pay Stub Templates ensure consistent and accurate documentation of employee earnings.

FAQs

Can you make your own pay stubs?

It is not recommended to make fake or false pay stubs. However, you can manually create a pay stub for your records using a template in a program like Excel. Ensure all information is accurate.

How do I manually create a pay stub?

You can create a pay stub in Excel using columns for details like pay period, company info, employee info, hours worked, pay rate, deductions, and net pay. Use formulas to calculate totals and balances. Print and format to look official.

What 3 items must appear on your pay stub?

At minimum, pay stubs must show the employee’s gross pay, total deductions, and net pay for the specific pay period. Other standard details include payroll date, pay period dates, and company information.

Do banks verify pay stubs?

Many banks will verify pay stub information submitted as income verification when you apply for a loan or mortgage. Fake pay stubs could be flagged as fraud.

Is faking paystubs easy?

No, accurately faking authentic-looking pay stubs is difficult. There are many details needed like proper calculations, employer addresses, and pay period dates. Use legitimate documentation.

How can I prove my income without pay stubs?

You can prove income without pay stubs using tax returns, W2s, letters from your employer, or bank statements showing direct deposit paychecks.

Does Excel have pay stub template?

Yes, you can find pre-made pay stub templates for Excel that calculate deductions and net pay. Search for “pay stub template” and customize with your own data.

What can I use as a substitute for a pay stub?

Income alternatives include tax returns, W2 form, employment verification letter, or bank statements. Submit multiple types of income proof if needed.

Can a pay stub be handwritten?

Handwritten pay stubs are not advisable since authentic pay stubs are computer-generated. A handwritten version is unlikely to be accepted as proof of income.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)