When you are facing financial challenges, it can be difficult to keep up with your bills and other financial obligations. If you are experiencing hardship due to unexpected circumstances, such as a job loss or medical emergency, you may need to request special consideration or assistance from your creditors or lenders.

One way to do this is by writing a hardship letter, which is a formal request for help in managing your financial struggles. A hardship letter is a way to communicate your financial situation and explain why you need special consideration. By clearly outlining your financial hardship and your plans for overcoming it, you can help your creditors understand your situation and find ways to support you during this challenging time.

Table of Contents

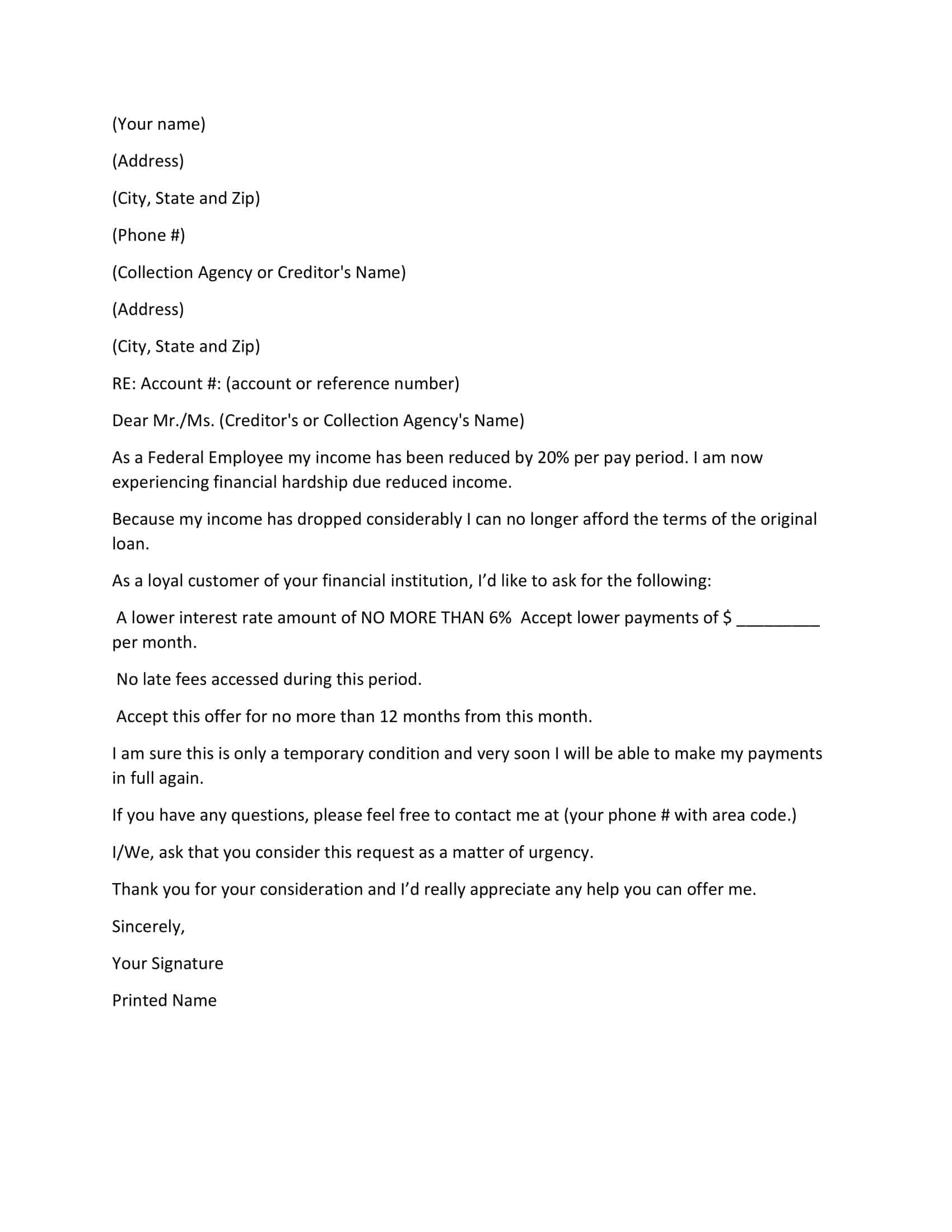

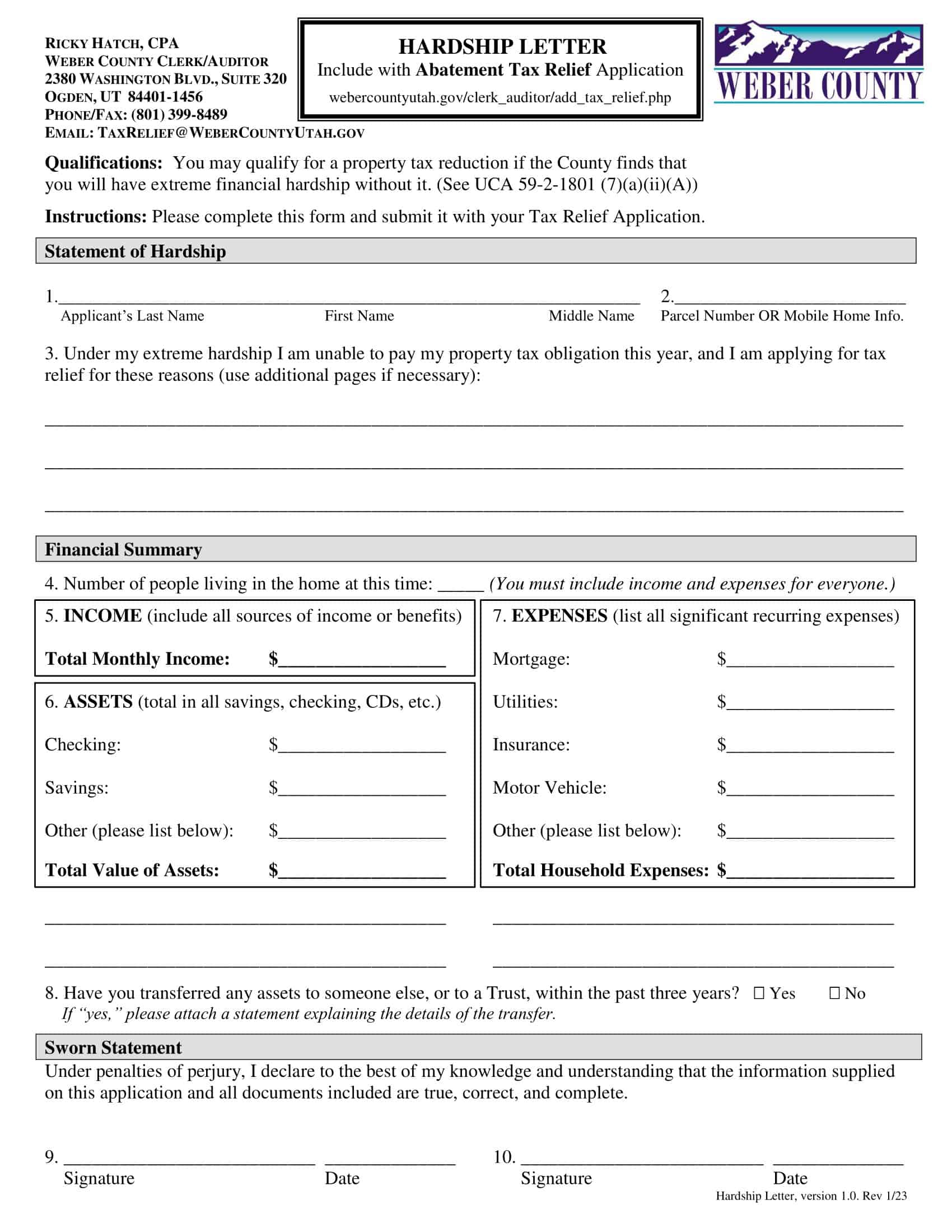

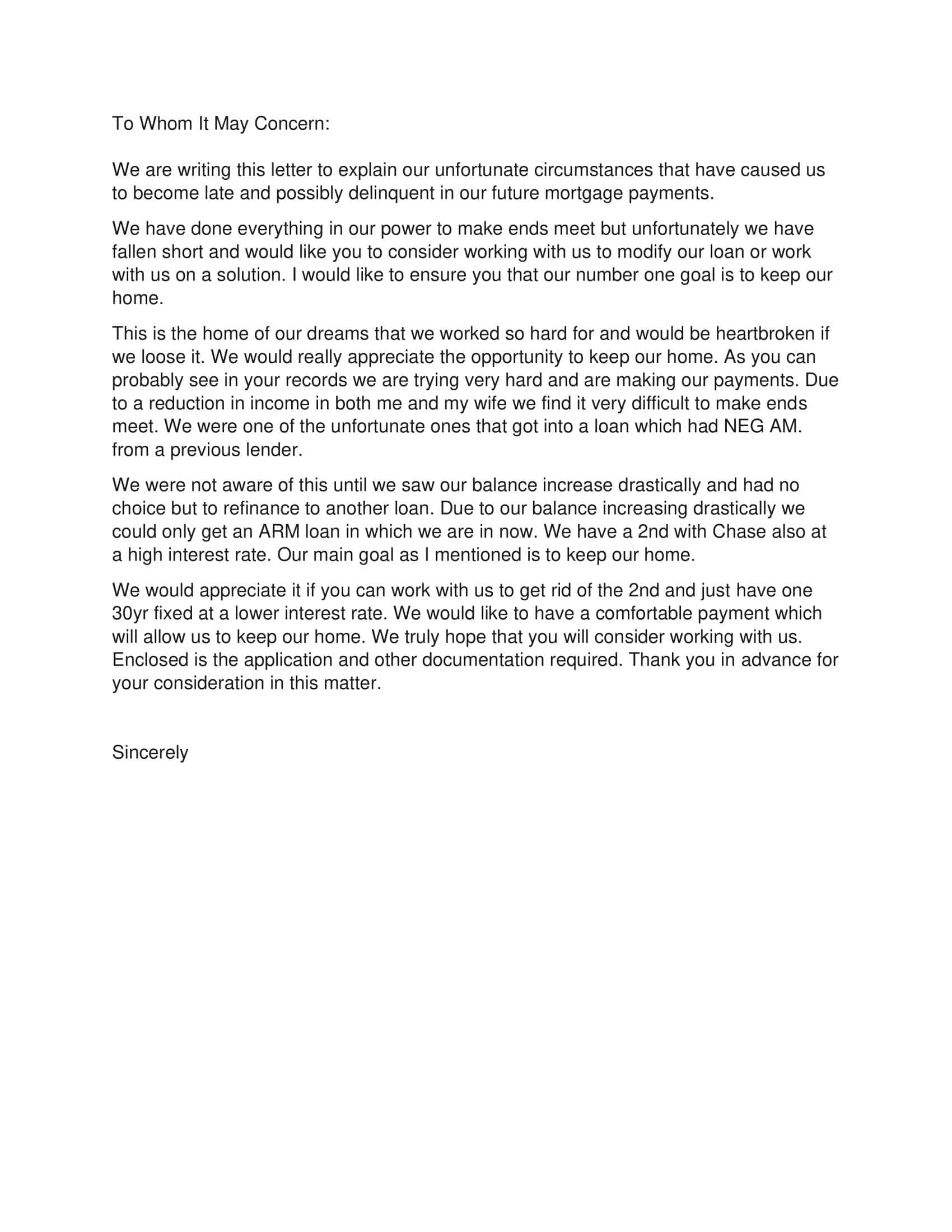

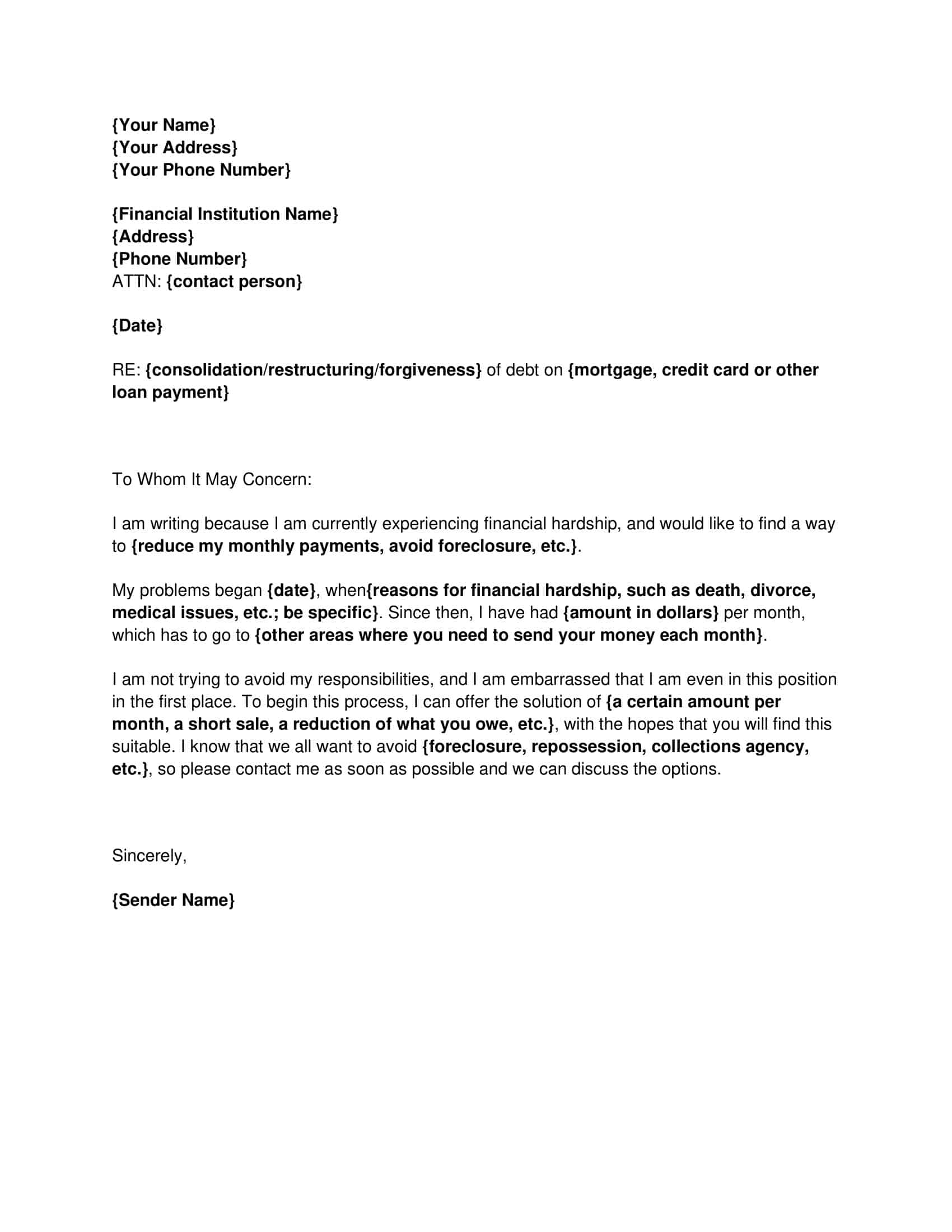

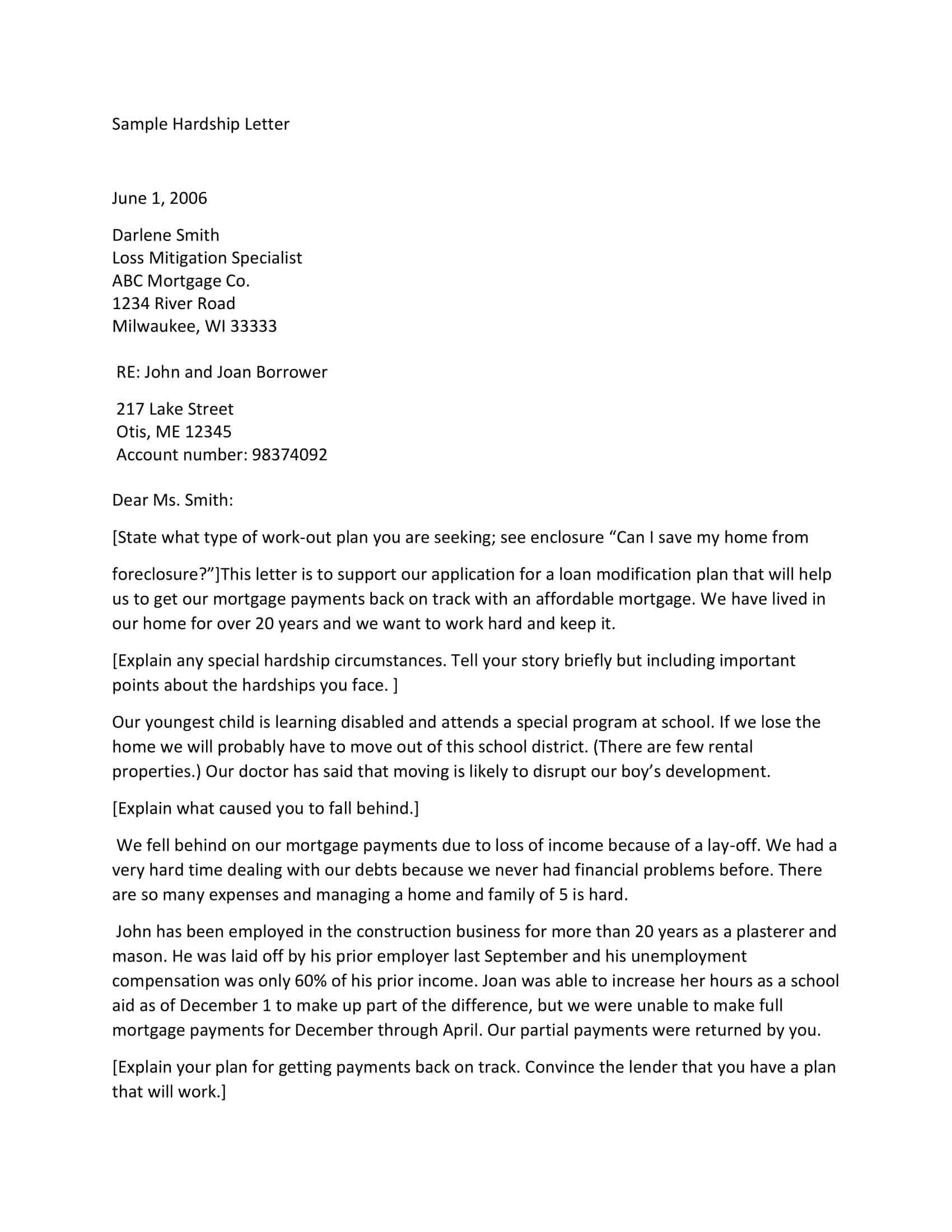

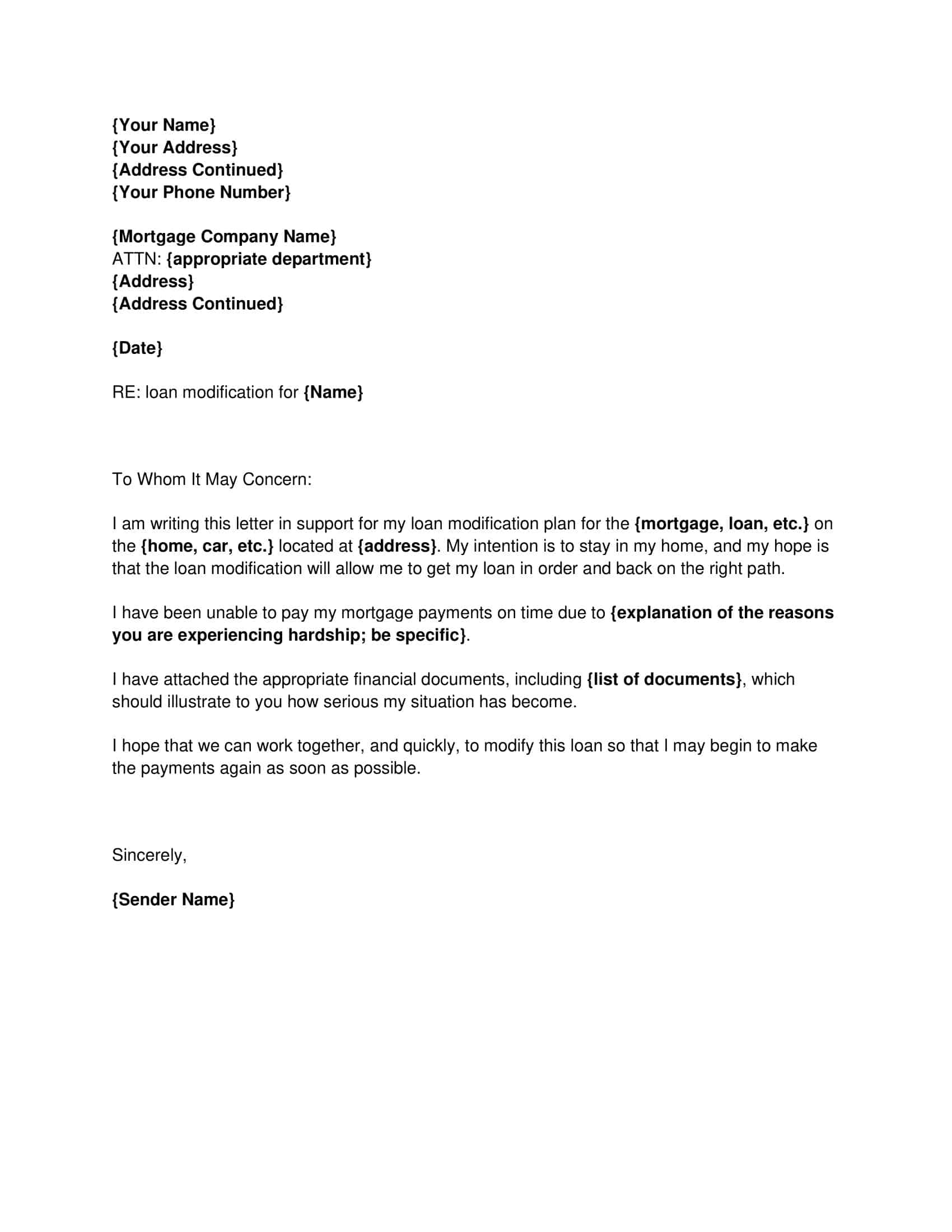

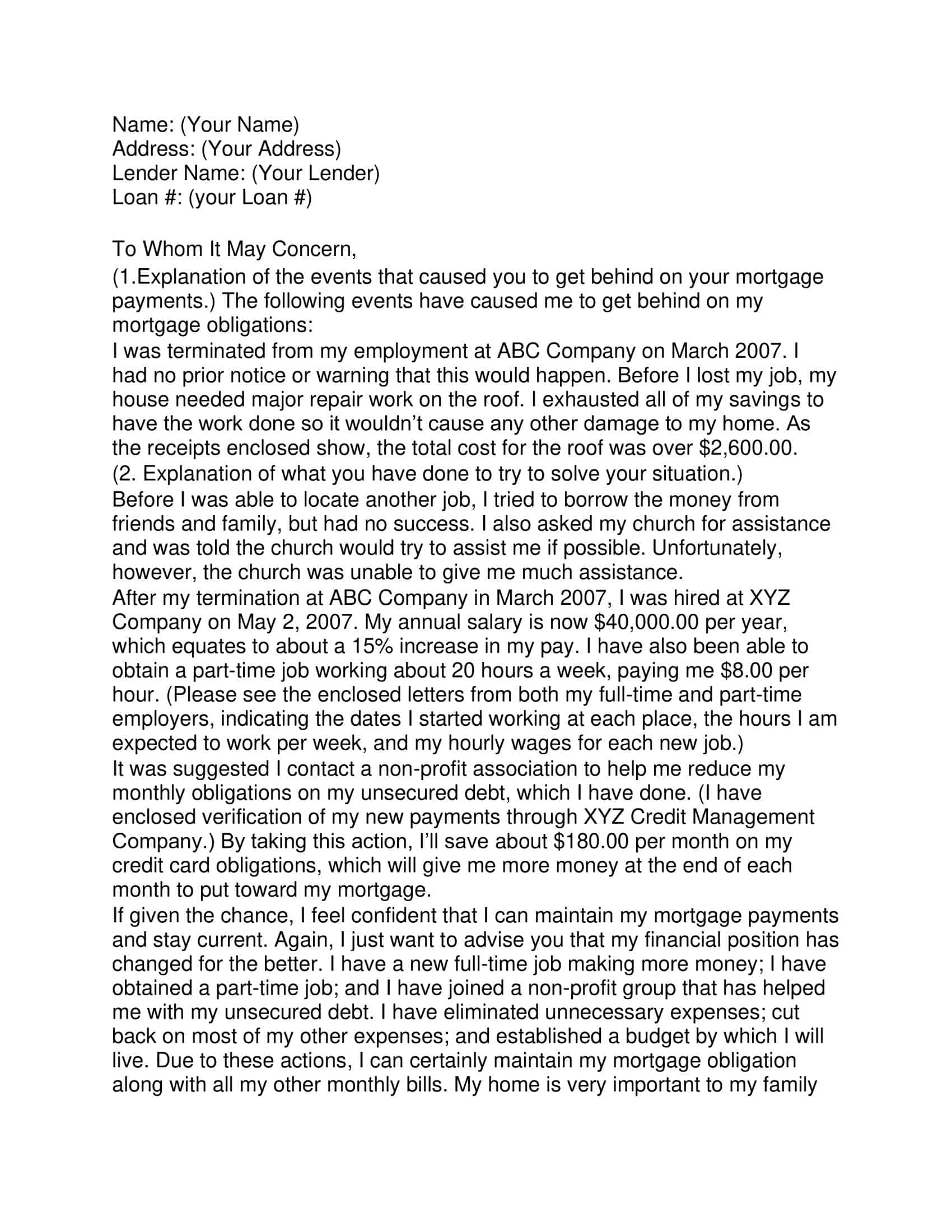

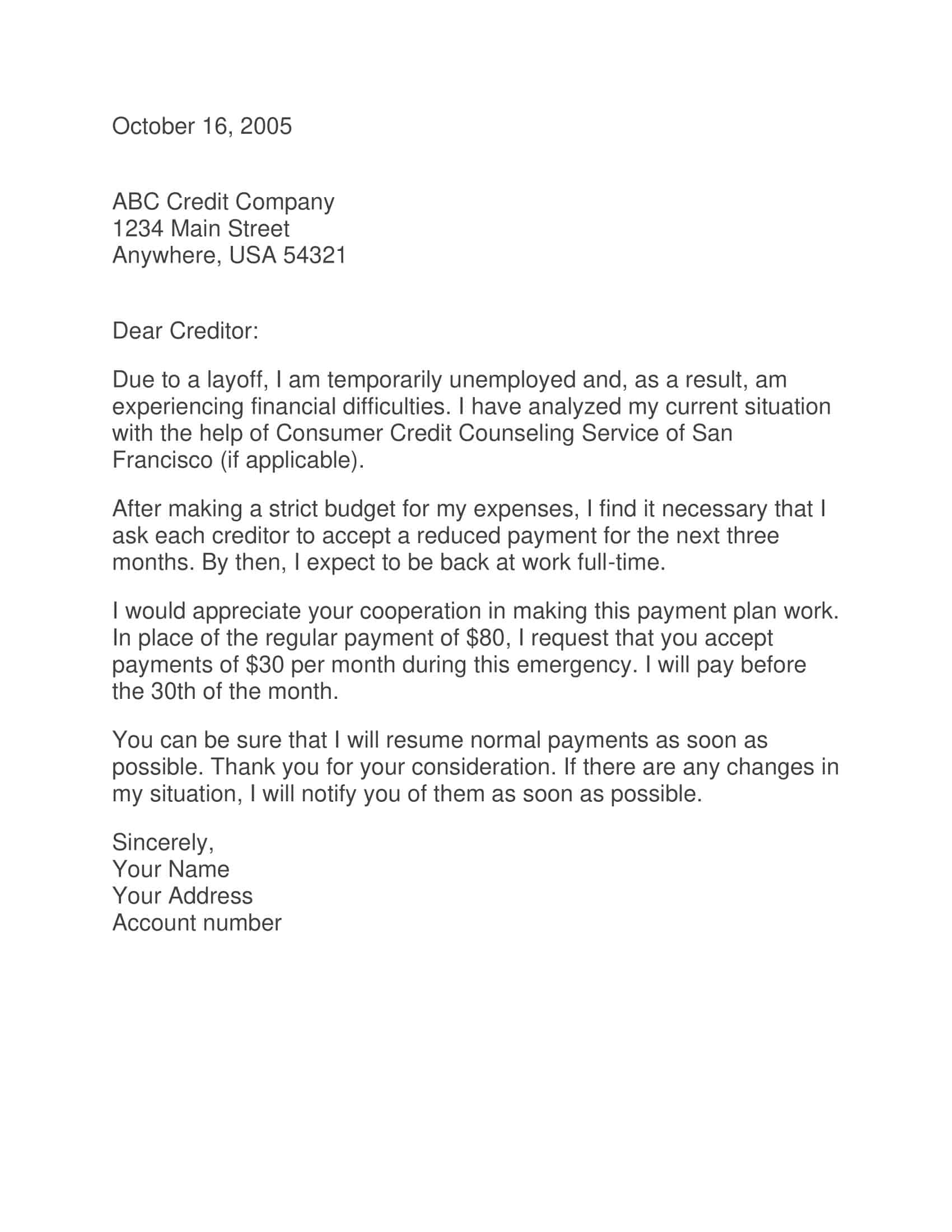

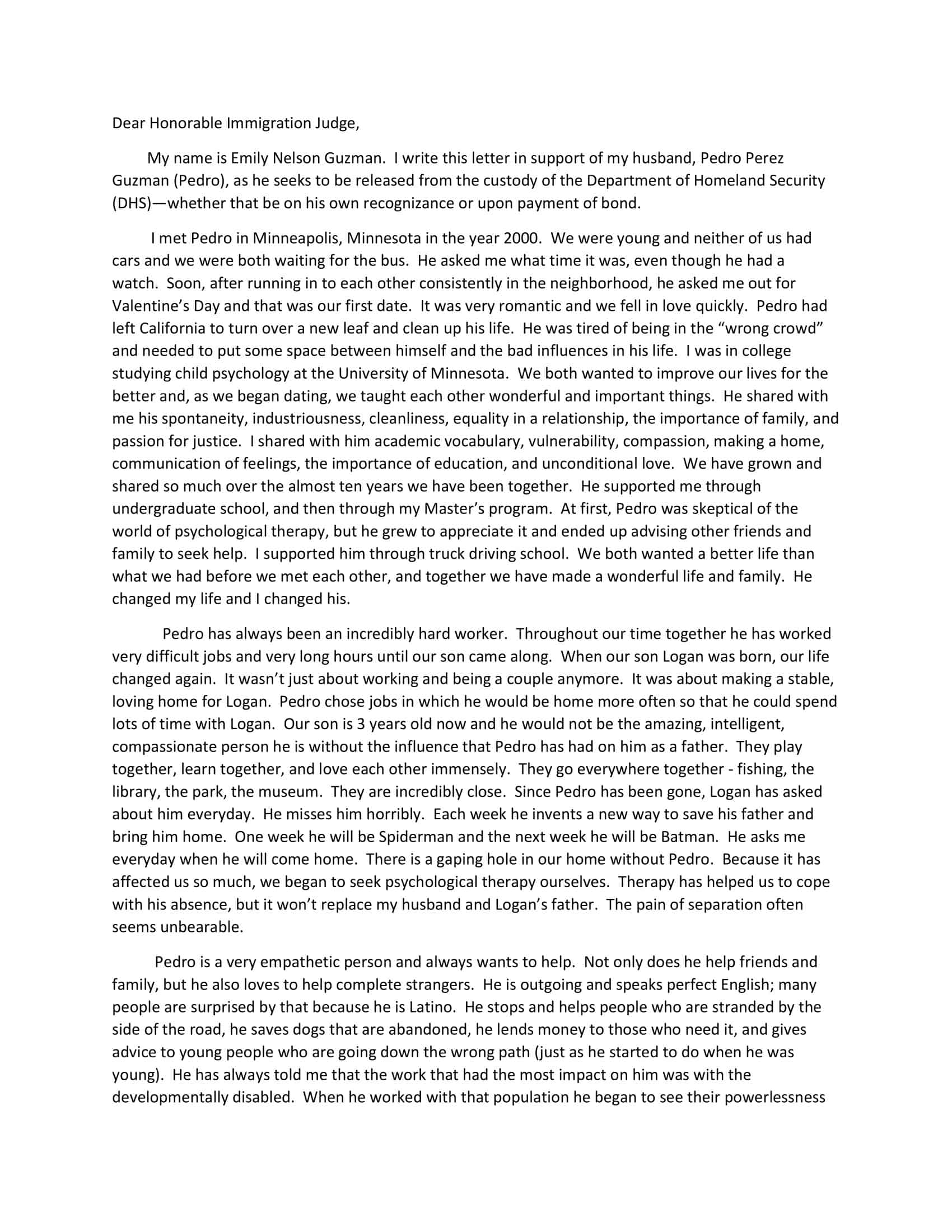

Hardship Letter Templates

Hardship Letter Templates are pre-designed formats used by individuals or families to communicate their financial or personal difficulties to creditors, lenders, or relevant institutions. These templates provide a structured framework for expressing hardships, explaining the circumstances, and requesting assistance or accommodation. Hardship Letter Templates ensure consistency, clarity, and professionalism in conveying one’s challenges, seeking understanding, and exploring potential solutions.

Hardship Letter Templates provide a structured and empathetic approach to communicating personal or financial difficulties. By utilizing these templates, individuals can ensure that their hardships are conveyed clearly, professionally, and consistently. These templates facilitate understanding, empathy, and potential solutions from creditors or relevant institutions. Hardship Letter Templates serve as valuable tools for individuals or families seeking assistance or accommodations during challenging times, fostering effective communication and potential resolutions.

What Is a Hardship Letter?

A hardship letter is a written explanation of your financial struggles that you submit to your creditors or lenders as a request for special consideration or assistance. This letter is an opportunity to communicate your financial situation and explain why you need help in managing your debts or other financial obligations.

Hardship letters are often used when you are experiencing financial hardship due to unexpected circumstances, such as a job loss, medical emergency, or natural disaster. By clearly outlining your financial hardship and your plans for overcoming it, you can help your creditors understand your situation and find ways to support you during this challenging time.

What Is a Hardship Letter Template?

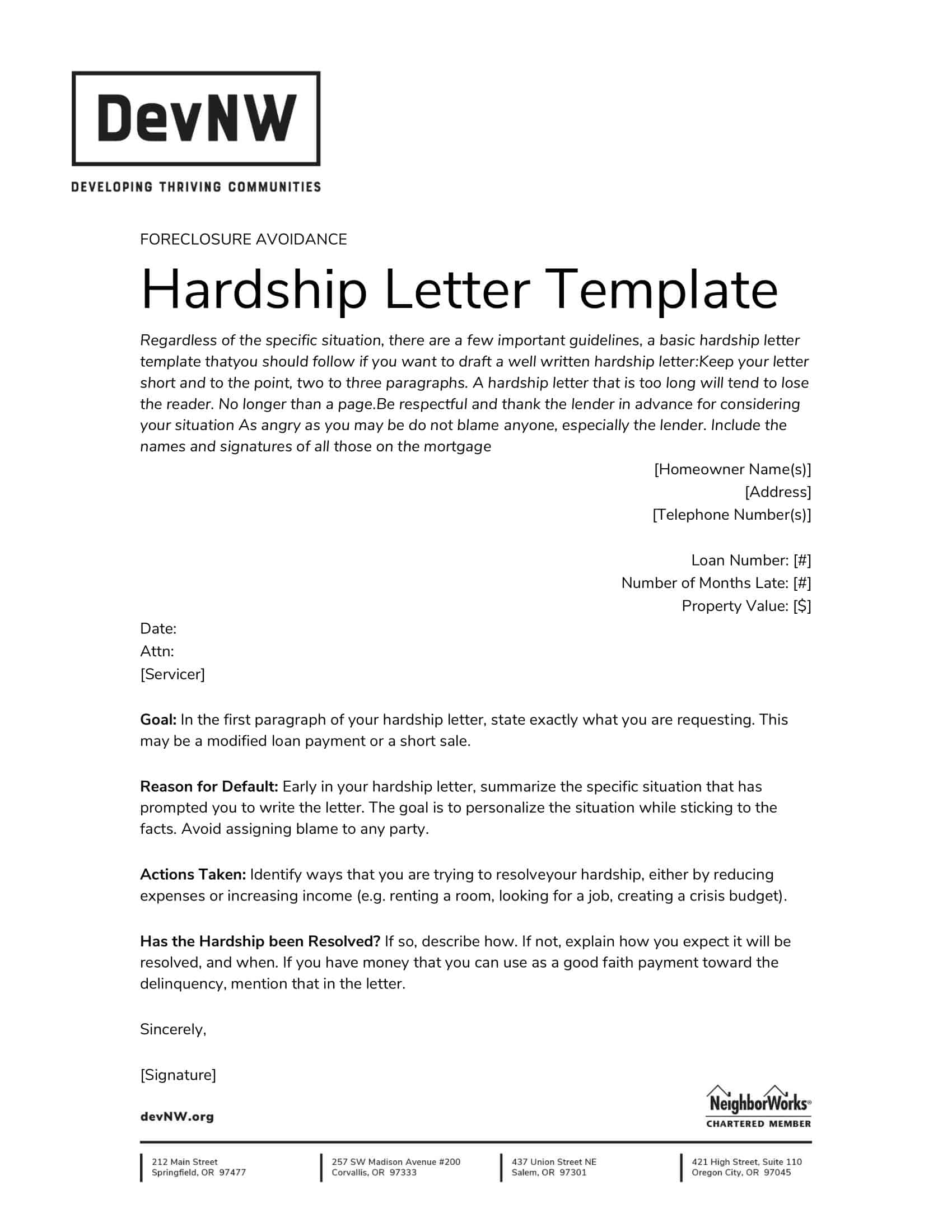

A hardship letter template is a pre-formatted document that provides a structure for you to write a hardship letter. This template typically includes prompts and guidelines for the information you should include in your letter, such as your current financial situation, the circumstances that led to your hardship, and your plans for overcoming it. Using a hardship letter template can help you organize your thoughts and ensure that you include all the relevant information in your letter. It can also help you create a professional-looking document that is clear and easy to read.

There are many different hardship letter templates available online, and you can also create your own by using a word processing program or a blank document. It is important to customize the template to fit your specific situation and needs, and to make sure that your letter is clear, concise, and well-written.

Overcoming Obstacles: When to Use a Financial Hardship Letter to Request Help

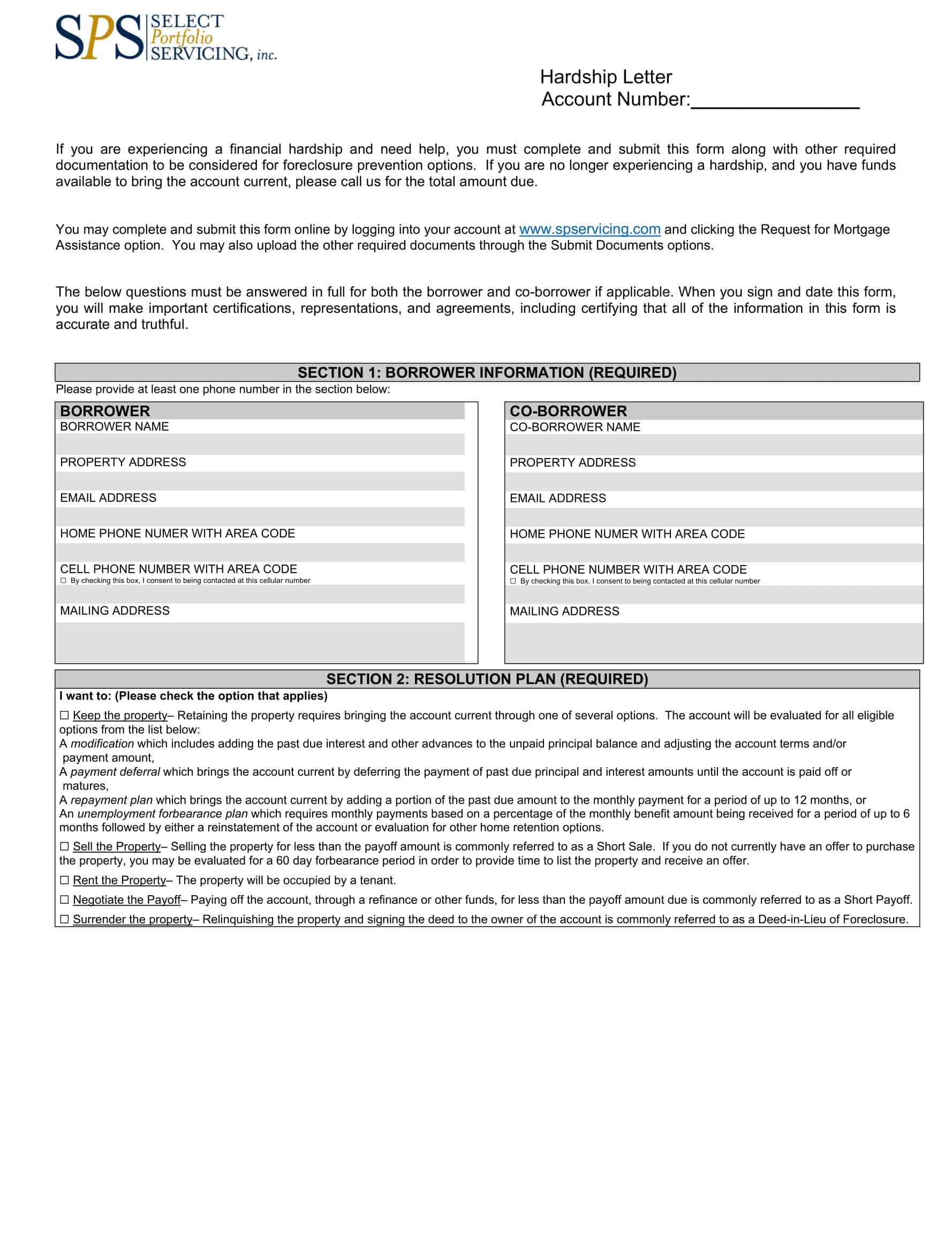

A financial hardship letter is a written explanation of a person’s financial difficulties and request for assistance. It is often used to request consideration for a loan modification, mortgage modification, or other form of financial relief. A financial hardship letter is typically required when a person is struggling to make ends meet and needs to request assistance in order to avoid defaulting on a loan or missing other financial obligations. In some cases, a financial hardship letter may also be used to request assistance with other financial matters, such as medical bills or credit card debts.

How to Write a Hardship Letter

Writing a hardship letter can be a difficult and emotional task, but it is an important step in requesting financial assistance. Here are some tips to help you write an effective hardship letter:

Step 1

Keep it concise: A hardship letter should be brief and to the point. It is important to clearly and concisely explain your situation and request for assistance.

Step 2

Be honest: It is important to be truthful in your hardship letter. Lenders and other financial institutions will be able to verify the information you provide, so it is important to be honest about your financial situation.

Step 3

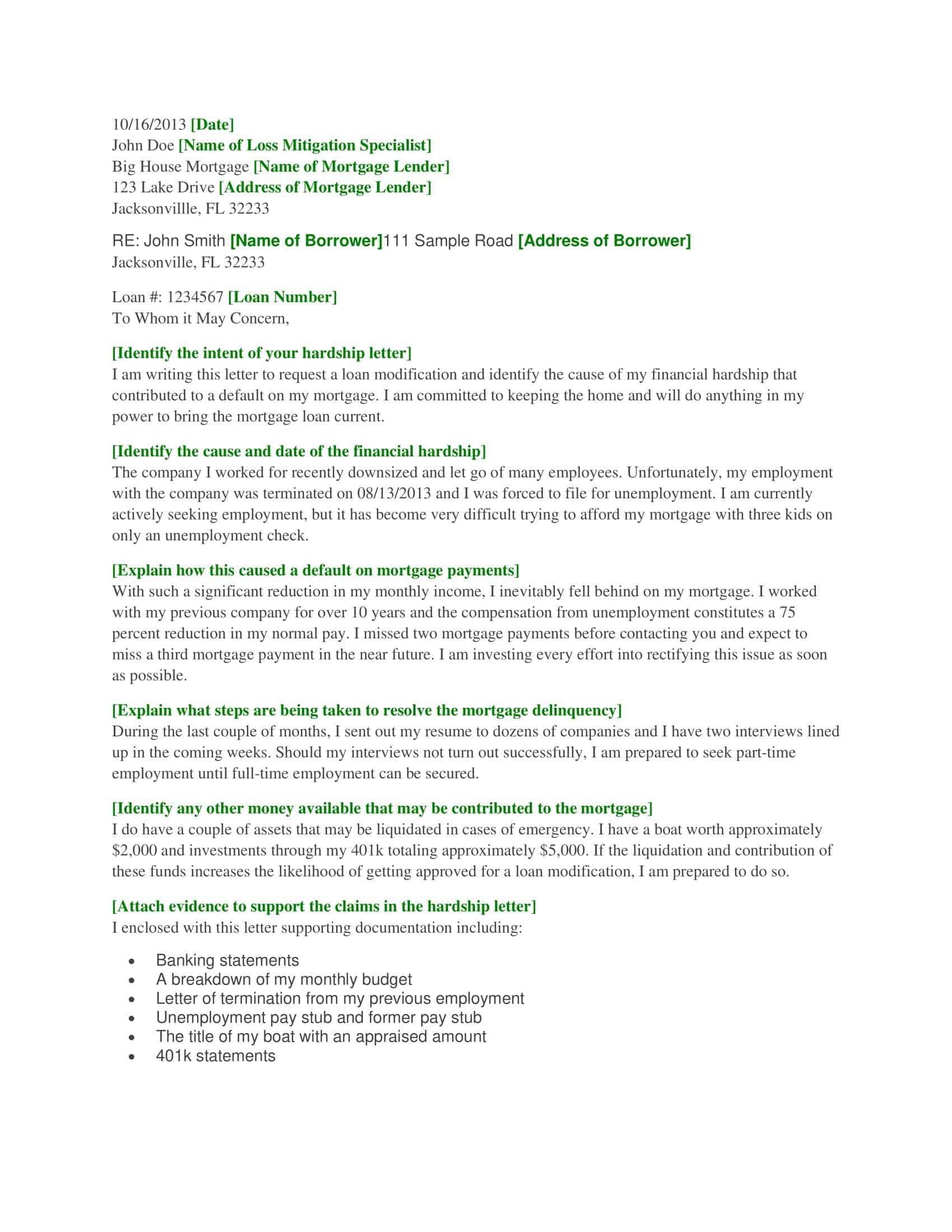

Explain the circumstances: Your hardship letter should explain the circumstances that have led to your financial difficulties. This may include a job loss, medical expenses, or other unexpected expenses.

Step 4

Provide evidence: In order to support your request for assistance, it is helpful to provide evidence of your financial difficulties. This may include pay stubs, bills, and other financial documents.

Step 5

Request specific assistance: In your hardship letter, it is important to request specific assistance, such as a loan modification or mortgage modification. Clearly outline what you are requesting and how it will help you overcome your financial difficulties.

Step 6

Show your willingness to work with the lender: Lenders want to see that you are willing to work with them to find a solution to your financial difficulties. In your hardship letter, explain any steps you have already taken to address your financial situation and any plans you have for improving your financial situation in the future.

Step 7

Keep a copy: It is important to keep a copy of your hardship letter for your own records. You may need to refer back to it in the future or provide it to other financial institutions.

Sample Hardship Letter

[Your Name]

[Your Address]

[City, State ZIP]

[Date]

[Lender’s Name]

[Lender’s Address]

[City, State ZIP]

Re: [Loan or Account Number]

Dear [Lender],

I am writing to request consideration for a [loan modification/mortgage modification/other form of financial assistance] due to financial hardship.

[Briefly describe your financial situation and the circumstances that have led to your hardship. Be specific and provide details, such as job loss, medical expenses, or other unexpected expenses.]

As a result of these circumstances, I am unable to make my regular payments on my [loan/mortgage/other financial obligation]. I am committed to finding a solution that will allow me to meet my financial obligations and get back on track.

I am enclosing [list any supporting documents, such as pay stubs or bills] for your review. These documents demonstrate my current financial situation and the challenges I am facing.

I am requesting a [loan modification/mortgage modification/other form of financial assistance] that will allow me to make more affordable payments on my [loan/mortgage/other financial obligation]. I believe that this will provide me with the opportunity to get back on track and meet my financial obligations in the future.

I understand that I have a responsibility to repay my [loan/mortgage/other financial obligation] and I am willing to work with you to find a solution that is mutually beneficial. I appreciate your consideration and look forward to your response.

Sincerely,

[Your Name]

FAQs

Here are some FAQs and answers about hardship letters:

Who should write a hardship letter?

If you are experiencing financial difficulties and are unable to meet your financial obligations, you may want to consider writing a hardship letter. A hardship letter can be a useful tool in negotiating a temporary reduction or modification of your financial obligations.

What should be included in a hardship letter?

A hardship letter should include a detailed explanation of your financial situation and how it is causing difficulties. It should also include any steps you have taken to try to address the situation, such as seeking additional income or cutting expenses. Additionally, the letter should explain what you are requesting and why it is necessary, as well as provide any documentation to support your claims.

How should a hardship letter be formatted?

A hardship letter should be formatted like a business letter, with your contact information at the top, followed by the date, the recipient’s contact information, and a salutation. The body of the letter should be clearly organized and easy to read, with paragraphs separated by blank lines. The letter should conclude with a polite closing and your signature.

Who should the hardship letter be addressed to?

The hardship letter should be addressed to the person or organization that holds the financial obligation that you are seeking to modify or reduce. For example, if you are seeking a temporary modification of your mortgage payments, the letter should be addressed to your mortgage lender.

Can a hardship letter be used to request a reduction in credit card payments?

Yes, a hardship letter can be used to request a reduction in credit card payments. In this case, you would address the letter to your credit card issuer and explain how your financial circumstances are making it difficult for you to make the full payment each month. You could also ask for a temporary reduction in the interest rate on your credit card to make the payments more manageable.

Can a hardship letter be used to request a reduction in student loan payments?

Yes, a hardship letter can be used to request a reduction in student loan payments. In this case, you would address the letter to your student loan servicer and explain how your financial circumstances are making it difficult for you to make the full payment each month. You could also ask for a temporary reduction in the interest rate on your student loans to make the payments more manageable.

Can a hardship letter be used to request a reduction in car payments?

Yes, a hardship letter can be used to request a reduction in car payments. In this case, you would address the letter to the lender who holds your car loan and explain how your financial circumstances are making it difficult for you to make the full payment each month. You could also ask for a temporary reduction in the interest rate on your car loan to make the payments more manageable.

Can a hardship letter be used to request a reduction in rent or mortgage payments?

Yes, a hardship letter can be used to request a reduction in rent or mortgage payments. In this case, you would address the letter to your landlord or mortgage lender and explain how your financial circumstances are making it difficult for you to make the full payment each month. You could also ask for a temporary reduction in the amount of the payment or a temporary deferral of payments until your financial situation improves.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)