Credit reports play a pivotal role in shaping an individual’s financial reputation, serving as a critical reference for lenders when assessing one’s creditworthiness. Maintaining a favorable credit standing is essential, as any blemishes on your report can have a lasting impact on your ability to secure loans or favorable interest rates.

In the event of negative remarks on your credit report, a goodwill letter can be a valuable tool in requesting their removal. Although creditors are not legally obligated to eliminate accurate negative entries due to their internal policies with credit bureaus, composing a heartfelt and persuasive goodwill letter can significantly enhance your chances of rectifying your credit report and restoring your financial standing.

Table of Contents

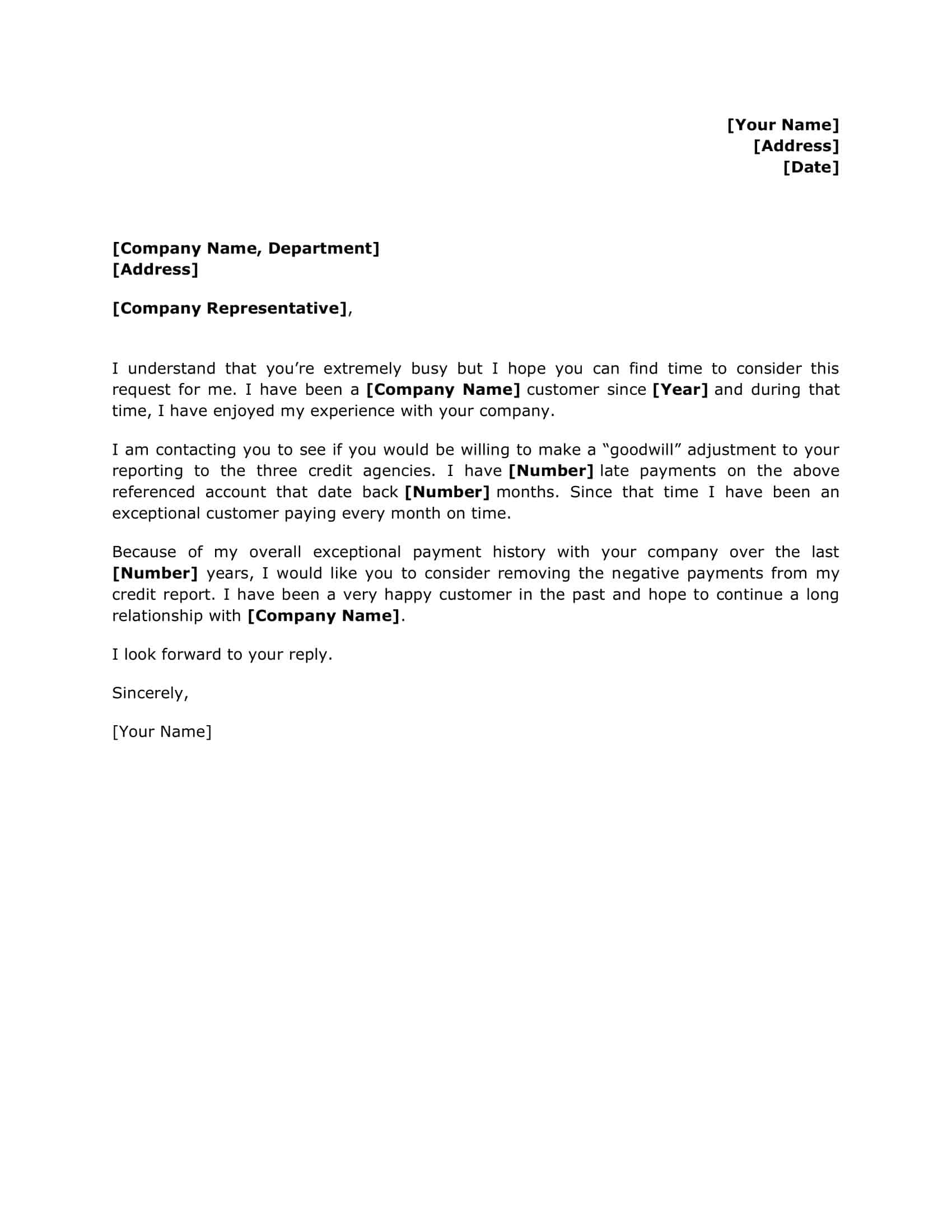

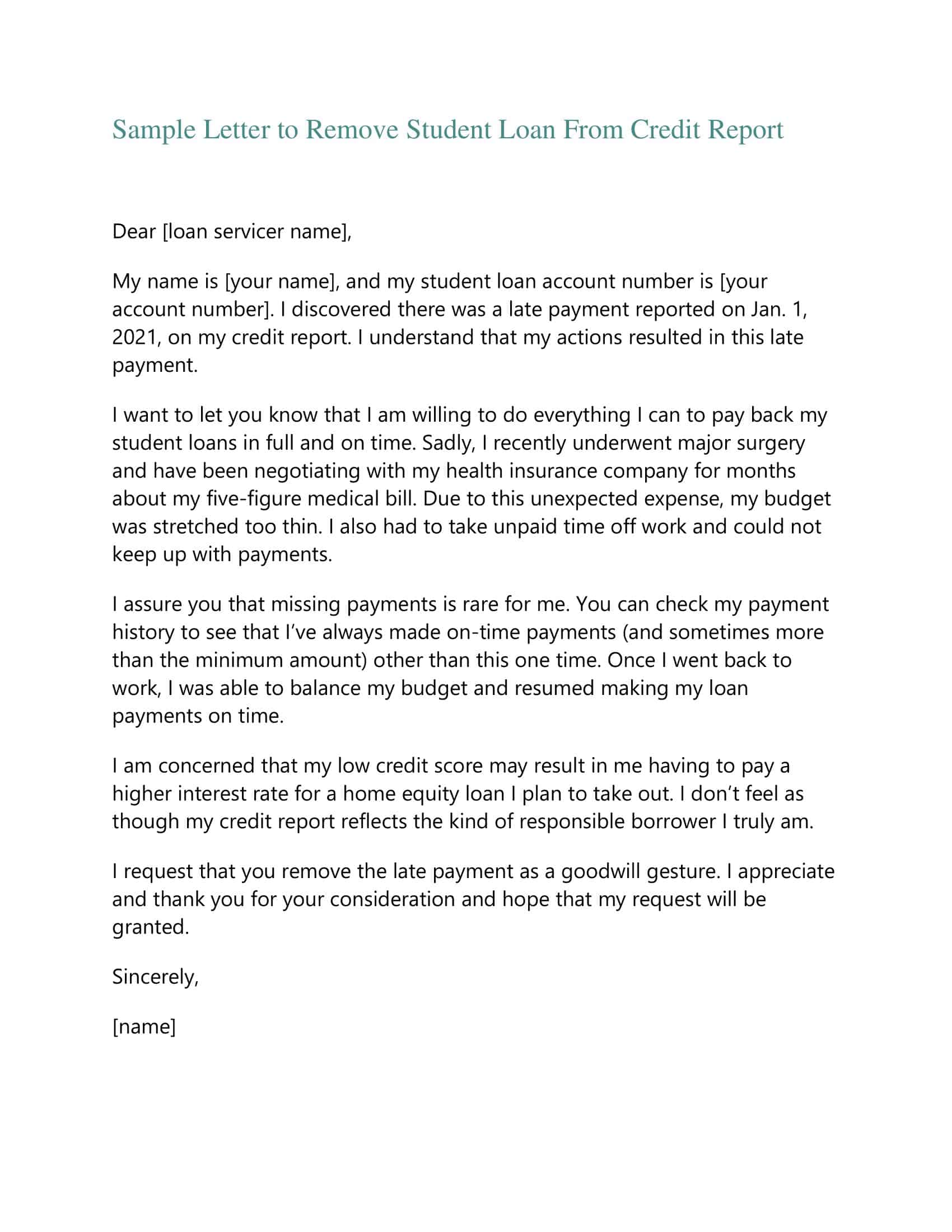

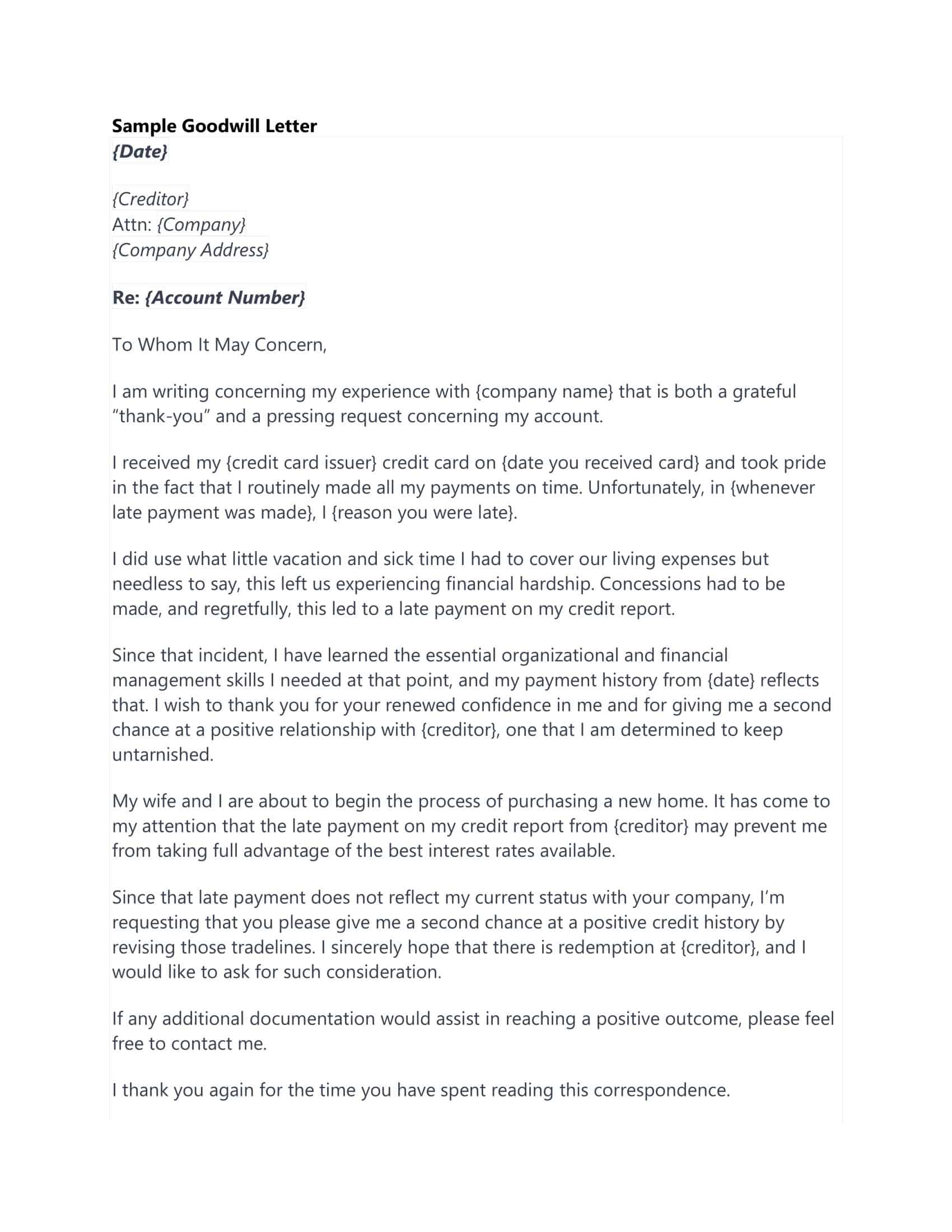

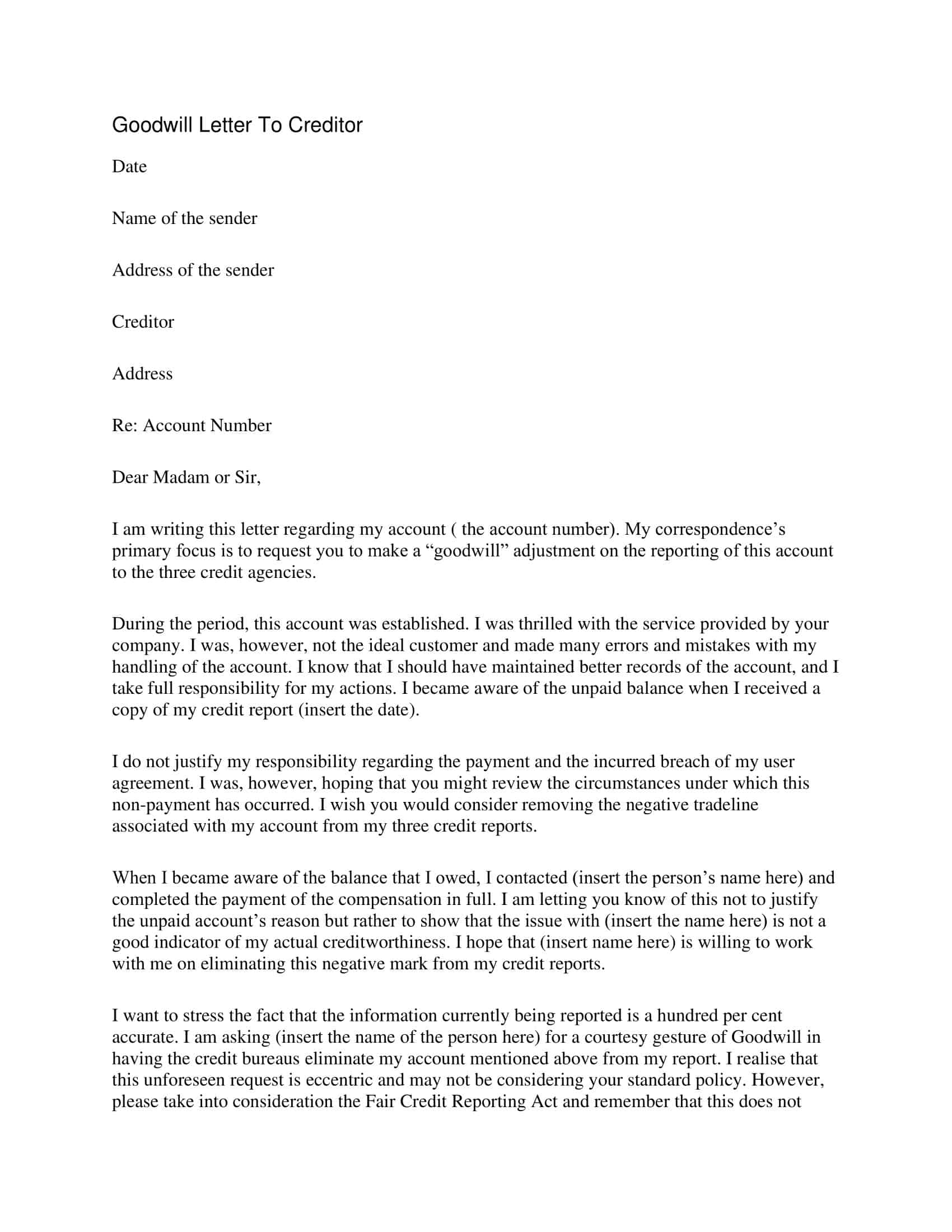

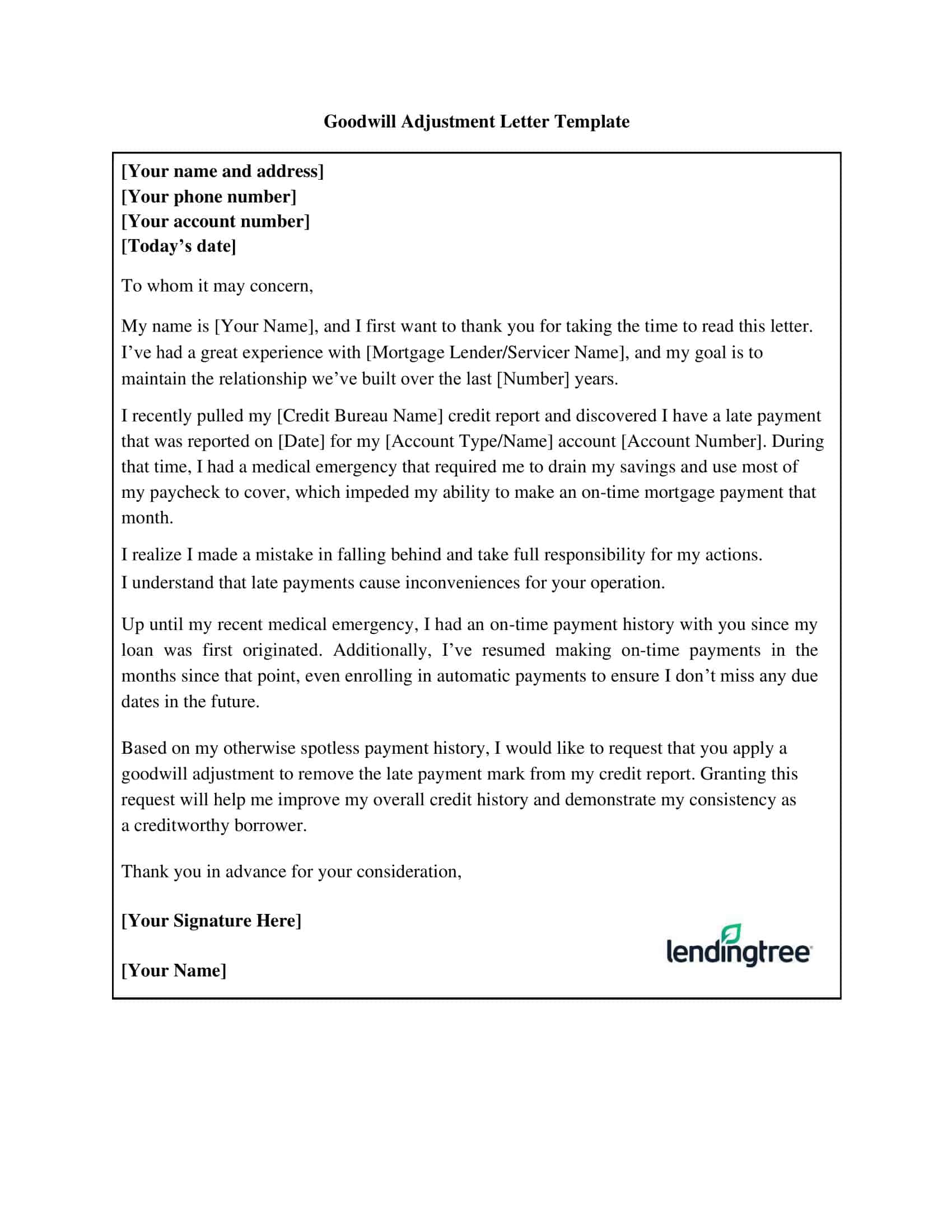

Goodwill Letter Templates

Goodwill Letter Templates are powerful tools that facilitate the process of expressing sincere apologies, gratitude, or request for forgiveness in a professional manner. These templates provide a consistent and structured format for individuals or businesses seeking to mend relationships, rectify misunderstandings, or address concerns with empathy and respect. By utilizing these templates, individuals can effectively communicate their intentions, demonstrate accountability, and foster positive connections while rebuilding trust.

Goodwill Letter Templates offer a structured and empathetic approach to repairing relationships, expressing gratitude, and seeking forgiveness. By utilizing these templates, individuals can effectively communicate their intentions, demonstrate accountability, and foster positive connections. With their ability to provide a consistent and professional framework, these templates are essential tools for individuals seeking to mend relationships, rectify misunderstandings, and rebuild trust with empathy and respect.

What is a goodwill letter?

![Free Goodwill Letter Printable Templates for Effective Apologies [PDF] 1 Goodwill Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Goodwill-Letter.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/05/Goodwill-Letter-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/05/Goodwill-Letter-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/05/Goodwill-Letter-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/05/Goodwill-Letter-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/05/Goodwill-Letter-1200x675.jpg 1200w)

A goodwill letter, also known as a goodwill adjustment letter or courtesy letter, is a written request sent to a creditor or lender asking them to remove a negative remark or late payment from your credit report. This letter typically explains the circumstances surrounding the negative entry and demonstrates your commitment to responsible financial management going forward.

Goodwill letters are not a guaranteed solution, as creditors are not obligated to remove accurate negative items from your credit report. However, if you can provide a genuine and persuasive explanation for the late payment or negative remark, the creditor may consider removing it as a gesture of goodwill, recognizing your previous positive payment history or your intention to make amends. This can help improve your credit score and strengthen your overall financial reputation.

Why do I need a goodwill letter?

A goodwill letter can be beneficial in the following situations:

Improve your credit score: Negative remarks on your credit report, such as late payments or delinquencies, can significantly impact your credit score. By successfully requesting the removal of these items through a goodwill letter, you may see an improvement in your credit score, which can enhance your financial reputation.

Access better loan terms: A higher credit score often leads to better loan terms, including lower interest rates and more favorable repayment options. Successfully removing negative items from your credit report can increase your chances of securing more favorable loan terms in the future.

Increase borrowing opportunities: Lenders and creditors are more likely to approve loan applications from individuals with a good credit history. By addressing negative items on your credit report, you may increase your borrowing opportunities and access to credit.

Strengthen your relationship with creditors: A goodwill letter can demonstrate your commitment to addressing past financial mistakes and maintaining a responsible financial management approach. This can help strengthen your relationship with creditors and improve their confidence in your ability to manage your finances responsibly.

Address extenuating circumstances: A goodwill letter provides an opportunity to explain any extenuating circumstances or hardships that contributed to the negative item on your credit report, such as job loss, medical emergencies, or other unforeseen events. By explaining the context surrounding the negative entry, you may encourage the creditor to be more understanding and consider removing it from your credit report.

Keep in mind that creditors are not obligated to remove accurate negative items from your credit report, and a goodwill letter does not guarantee success. However, if you can present a compelling case and demonstrate your commitment to responsible financial management, a goodwill letter can be an effective tool for improving your credit report and overall financial standing.

When do you need Goodwill Letter ?

You might need a goodwill letter in the following situations:

Late payments: If you have a history of on-time payments but accidentally missed one or more payments due to unforeseen circumstances, you can request the creditor to remove the late payment record as a gesture of goodwill.

Delinquencies: If you have a delinquency on your credit report due to an oversight or temporary financial hardship, you can use a goodwill letter to explain the situation and request the removal of the delinquency.

Account charge-offs: If your account was charged off due to non-payment or default, you can request the creditor to remove the charge-off entry by explaining the circumstances that led to the default and providing evidence of your improved financial management.

Collection accounts: If you have a collection account on your credit report, you can write a goodwill letter to the collection agency to request the removal of the negative entry after you have paid off the debt or settled the account.

Loan modifications or forbearance: If you had a loan modification or forbearance due to financial hardship, and it resulted in negative reporting, you can use a goodwill letter to request the removal of the negative remarks from your credit report.

Closed accounts with negative remarks: If you have closed accounts with negative remarks on your credit report, you can request the creditor to remove those remarks, especially if you had a positive payment history with them before the negative event occurred.

What to include in a goodwill letter?

When writing a goodwill letter, it’s essential to include the following elements to increase your chances of success:

Contact information: Begin the letter with your name, address, phone number, and email address, as well as the date. Include the creditor’s name and address, and the account number associated with the negative entry.

Polite and respectful tone: Approach the creditor with a respectful and humble tone, acknowledging their authority in the matter and expressing gratitude for their consideration.

Explanation of the negative entry: Clearly explain the negative item on your credit report, specifying the date it occurred and any relevant details. Be concise and factual, avoiding overly emotional language.

Reason for the negative entry: Provide a genuine and reasonable explanation for the negative entry, such as a job loss, medical emergency, or other extenuating circumstances. Be honest and avoid making excuses or blaming others.

Demonstration of your commitment to financial responsibility: Emphasize your history of timely payments and responsible credit use, if applicable. Explain the steps you’ve taken to prevent similar issues in the future, such as creating a budget, setting up automatic payments, or improving your financial management skills.

Request for removal or adjustment: Clearly state your request for the removal or adjustment of the negative item on your credit report. Be specific about what you are asking for, whether it’s the removal of a late payment, deletion of a collection account, or updating the status of a charged-off account.

Express gratitude: Thank the creditor for their time and consideration of your request. Acknowledge their discretion in the matter and express your appreciation for any assistance they can provide.

Provide supporting documentation (optional): If you have any relevant documentation that supports your explanation, such as medical bills, proof of unemployment, or correspondence about a billing error, consider attaching copies to your letter as evidence.

Closing and signature: End the letter with a polite closing, such as “Sincerely” or “Best regards,” followed by your full name and signature.

Advantages and Disadvantages of a Goodwill Letter

In today’s financial landscape, maintaining a healthy credit score is crucial for accessing loans, credit cards, and other financial products. One tool that can help in repairing credit is the goodwill letter, which can be sent to creditors requesting the removal of negative items from your credit report. While goodwill letters offer a number of advantages, such as potentially improving your credit score and increasing borrowing opportunities, they also come with some disadvantages, such as the uncertainty of a successful outcome. In this blog post, we will explore the advantages and disadvantages of using a goodwill letter to improve your credit standing, helping you make a more informed decision about whether this approach is right for your unique financial situation.

Advantages of a goodwill letter:

- Potential improvement in credit score: If a creditor agrees to remove a negative entry from your credit report, it can lead to an improvement in your credit score, enhancing your overall financial reputation.

- Increased borrowing opportunities: Successfully removing negative items from your credit report can make it easier for you to obtain loans, credit cards, or other lines of credit in the future.

- Better loan terms: With a higher credit score, you may be eligible for more favorable loan terms, such as lower interest rates or more flexible repayment options.

- Opportunity to explain circumstances: A goodwill letter allows you to provide context for the negative entry on your credit report, explaining any extenuating circumstances or hardships that contributed to the issue.

- Strengthened relationship with creditors: Demonstrating your commitment to addressing past financial mistakes and maintaining responsible financial management can help strengthen your relationship with creditors and improve their confidence in your ability to manage your finances responsibly.

Disadvantages of a goodwill letter:

- No guarantee of success: Creditors are not obligated to remove accurate negative items from your credit report, and there is no guarantee that they will agree to your request. The outcome depends on the creditor’s goodwill and their internal policies.

- Time-consuming process: Writing a well-crafted goodwill letter can be time-consuming, as it requires careful consideration of your circumstances and the ability to articulate your request effectively. Additionally, waiting for a response from the creditor can take time, and there is no guarantee of a positive outcome.

- Limited effectiveness for multiple negative items: Goodwill letters are most effective when addressing isolated incidents on your credit report. If you have multiple negative entries or a history of poor financial management, a goodwill letter may not be as effective in improving your credit situation.

- Risk of drawing attention to negative entries: In some cases, sending a goodwill letter could draw attention to the negative entries on your credit report, potentially leading to further scrutiny by the creditor. This could be counterproductive if the creditor decides not to grant your request.

- Emotional stress: Writing a goodwill letter can be emotionally challenging, as it requires you to acknowledge and confront past financial mistakes. This process can be stressful, particularly if you are unsure about the outcome of your request.

Goodwill Letter Vs. Pay For Delete Letter

Goodwill Letter and Pay for Delete Letter are two different approaches to addressing negative items on your credit report. Here’s a comparison between the two:

Goodwill Letter:

- Purpose: A goodwill letter is a written request to a creditor asking them to remove a negative remark or late payment from your credit report as a gesture of goodwill. This letter usually explains the circumstances surrounding the negative entry and demonstrates your commitment to responsible financial management going forward.

- Tone: A goodwill letter typically adopts a polite, respectful, and humble tone. You acknowledge the creditor’s authority and express gratitude for their consideration.

- When to use: Goodwill letters are most effective when you have an otherwise strong payment history and the negative entries on your credit report are isolated incidents. They work best when you have a reasonable explanation for the late payment or negative remark, such as job loss, medical emergencies, or other unforeseen events.

- Success rate: The success of a goodwill letter depends on the creditor’s goodwill and their internal policies. There’s no guarantee that they will remove the negative item, but a persuasive and genuine letter can increase your chances of success.

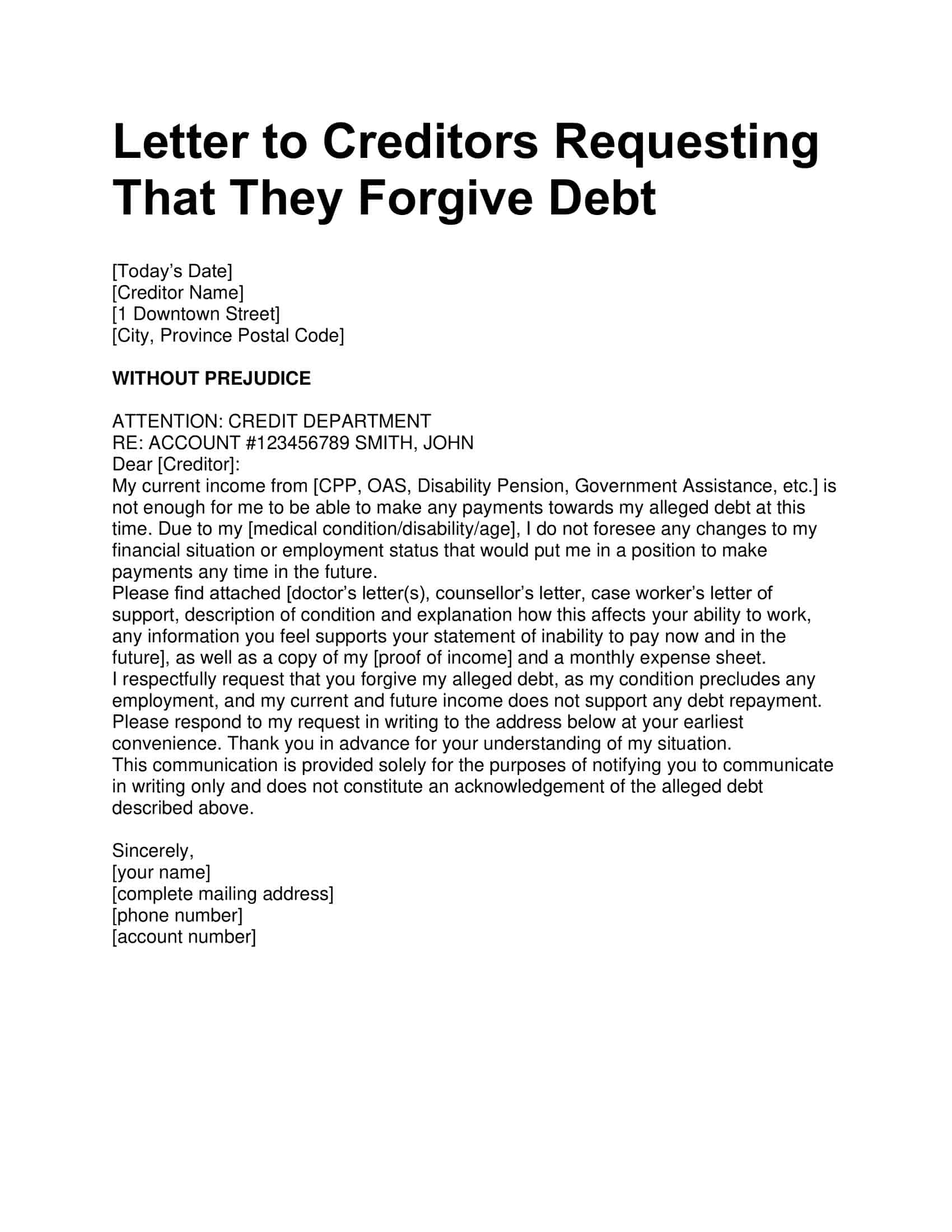

Pay for Delete Letter:

- Purpose: A pay for delete letter is a written agreement between you and a collection agency or creditor where you offer to pay the outstanding debt in full or negotiate a settlement amount in exchange for the removal of the negative item from your credit report.

- Tone: The tone of a pay for delete letter is more transactional and negotiative, as you are proposing a mutually beneficial arrangement between you and the creditor or collection agency.

- When to use: Pay for delete letters are typically used when dealing with collection agencies or charged-off accounts. They are most effective when you haven’t paid the outstanding debt yet and are willing to negotiate a settlement in exchange for the removal of the negative item from your credit report.

- Success rate: The success of a pay for delete letter depends on the willingness of the collection agency or creditor to accept your offer. Keep in mind that pay for delete agreements are not legally enforceable, and some creditors or collection agencies might refuse to enter into such arrangements due to their agreements with credit bureaus.

How to Write A Goodwill Letter

Step 1: Gather your contact information

Before writing your goodwill letter, gather your personal contact information, such as your name, address, phone number, and email address. Also, collect the creditor’s name, address, and the account number associated with the negative entry on your credit report.

Step 2: Use a professional format

Format your letter as a formal business letter, starting with the date and followed by your contact information, the creditor’s contact information, and a formal salutation, such as “Dear [Creditor’s Name].”

Step 3: Begin with a polite and respectful tone

Start your letter with a respectful and humble tone, acknowledging the creditor’s authority in the matter and expressing gratitude for their time and consideration.

Step 4: Explain the negative entry

Clearly describe the negative item on your credit report, specifying the date it occurred and any relevant details. Be concise and factual, avoiding overly emotional language.

Step 5: Provide a reason for the negative entry

Offer a genuine and reasonable explanation for the negative entry, such as a job loss, medical emergency, or other extenuating circumstances. Be honest and avoid making excuses or blaming others.

Step 6: Highlight your commitment to financial responsibility

Emphasize your history of timely payments and responsible credit use, if applicable. Explain the steps you’ve taken to prevent similar issues in the future, such as creating a budget, setting up automatic payments, or improving your financial management skills.

Step 7: Clearly state your request

State your request for the removal or adjustment of the negative item on your credit report. Be specific about what you are asking for, whether it’s the removal of a late payment, deletion of a collection account, or updating the status of a charged-off account.

Step 8: Express gratitude

Thank the creditor for their time and consideration of your request. Acknowledge their discretion in the matter and express your appreciation for any assistance they can provide.

Step 9: Attach supporting documentation (optional)

If you have any relevant documentation that supports your explanation, such as medical bills, proof of unemployment, or correspondence about a billing error, consider attaching copies to your letter as evidence.

Step 10: Close and sign the letter

End the letter with a polite closing, such as “Sincerely” or “Best regards,” followed by your full name and signature.

Step 11: Proofread and edit

Carefully proofread your letter for grammatical errors and typos, ensuring it is well-written and professional.

Step 12: Send the letter

Mail your letter to the creditor using a trackable mailing service, such as certified mail with return receipt requested, to ensure it reaches the intended recipient and to have proof of delivery.

Step 13: Follow up

If you don’t hear back from the creditor within 30 days, consider following up with a phone call or email to inquire about the status of your request. Be patient and respectful, as the creditor may be processing your request or have a backlog of similar requests.

FAQs

How long does it take to get a response to a goodwill letter?

The time it takes to receive a response to your goodwill letter can vary depending on the creditor’s internal processes and workload. Generally, you can expect to hear back within 30 days. If you don’t receive a response within that time frame, consider following up with a phone call or email.

Is there a guarantee that my goodwill letter will be successful?

There is no guarantee that a creditor will agree to remove a negative item from your credit report upon receiving a goodwill letter. The outcome depends on the creditor’s goodwill and their internal policies. However, a well-crafted, genuine, and persuasive letter can increase your chances of success.

Can a goodwill letter be used for multiple negative items on my credit report?

While it’s possible to address multiple negative items in a single goodwill letter, the effectiveness of the letter may decrease if you have a pattern of late payments or other negative remarks. Goodwill letters are most effective when addressing isolated incidents and demonstrating a strong history of responsible credit management.

Can I send a goodwill letter to a collection agency?

Yes, you can send a goodwill letter to a collection agency, especially if you have already paid the debt or settled the account. In your letter, you can request the removal of the collection account from your credit report as a gesture of goodwill. However, success is not guaranteed, as the outcome depends on the collection agency’s policies and willingness to comply with your request.

What if my goodwill letter is rejected?

If your goodwill letter is rejected, you can consider other options to improve your credit, such as disputing inaccurate information on your credit report, paying down outstanding debts, and maintaining a consistent payment history. You may also consider reaching out to a credit counselor or financial advisor for guidance on improving your credit situation.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 2 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![%100 Free Hoodie Templates [Printable] +PDF 3 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 4 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)