Gift letters can be challenging to navigate. But, in the case of a mortgage, they can often give someone a welcome boost toward the goal of home ownership. This information will help you know more about gift letter templates and their role in mortgages. If a mortgage is what you’re looking for, why not start shopping around? With a little research on the internet, it should be quick work to find a right lender for your needs.

Table of Contents

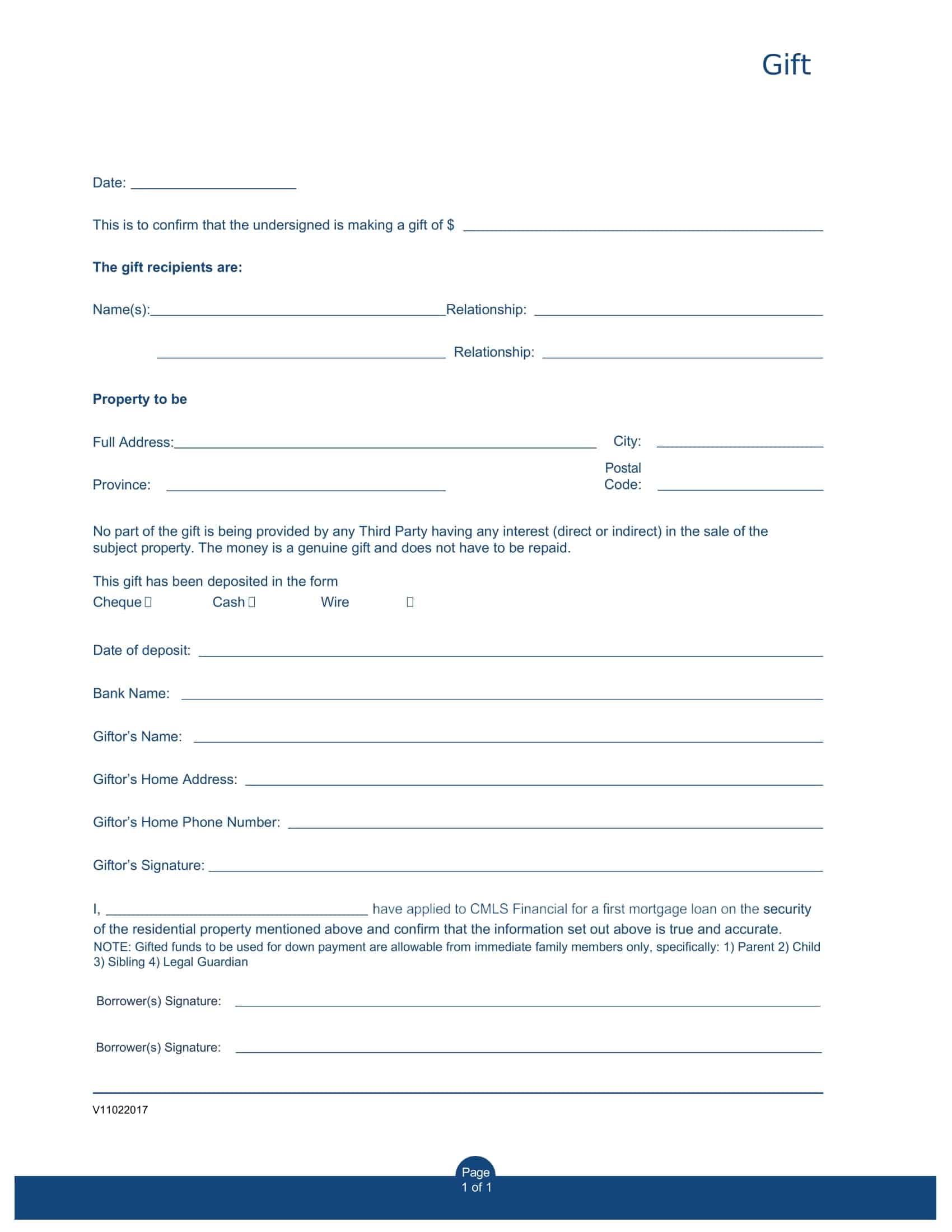

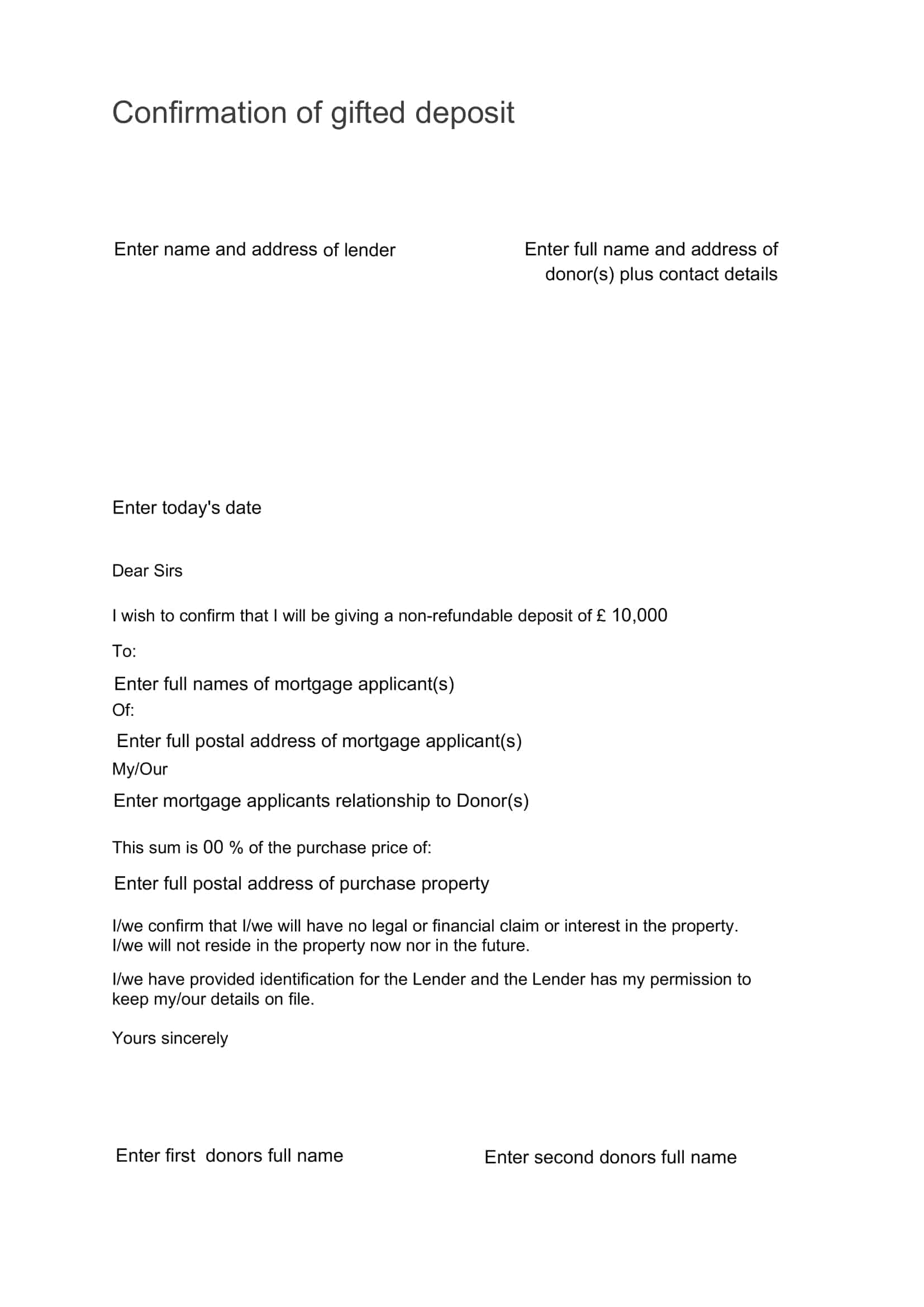

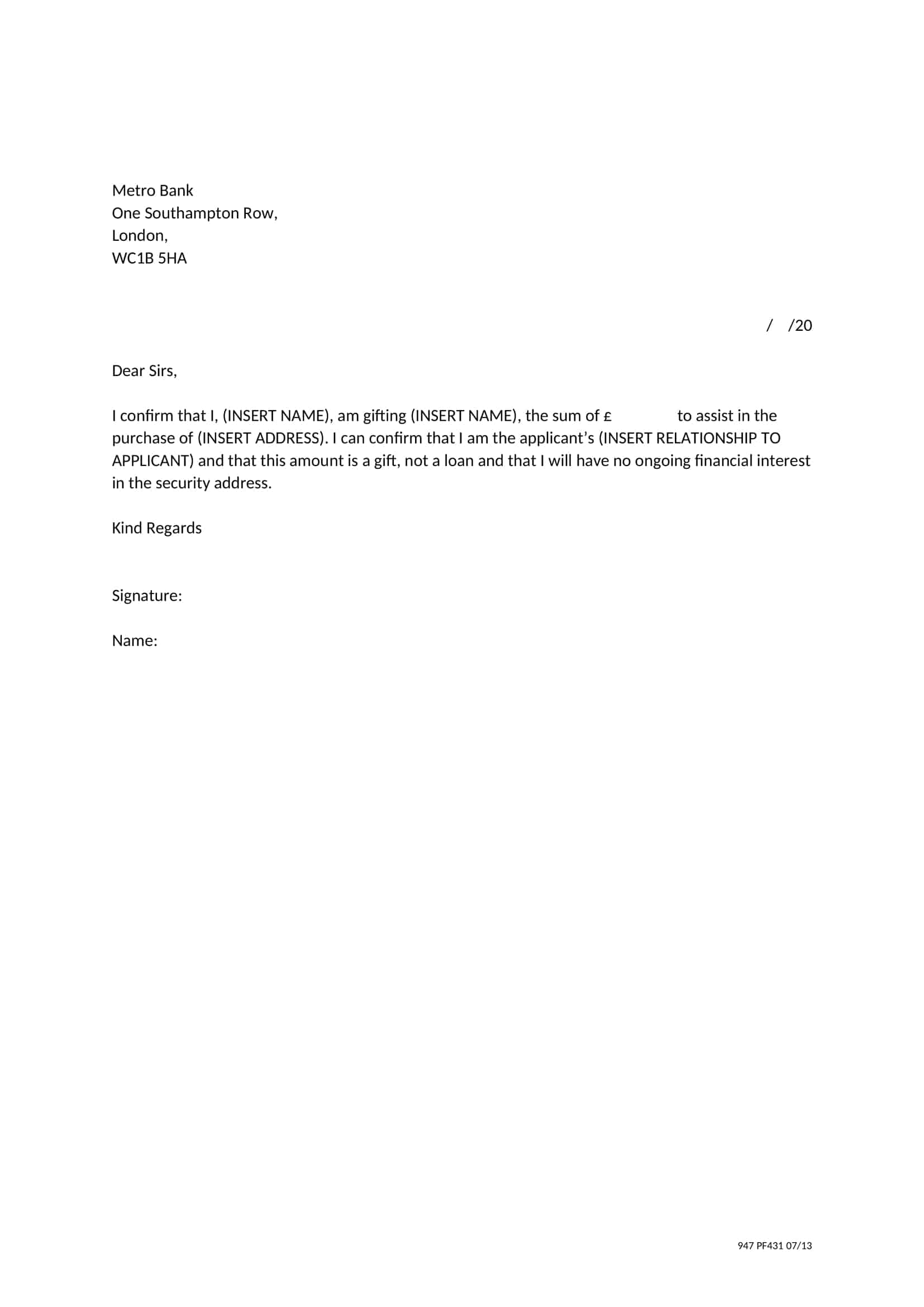

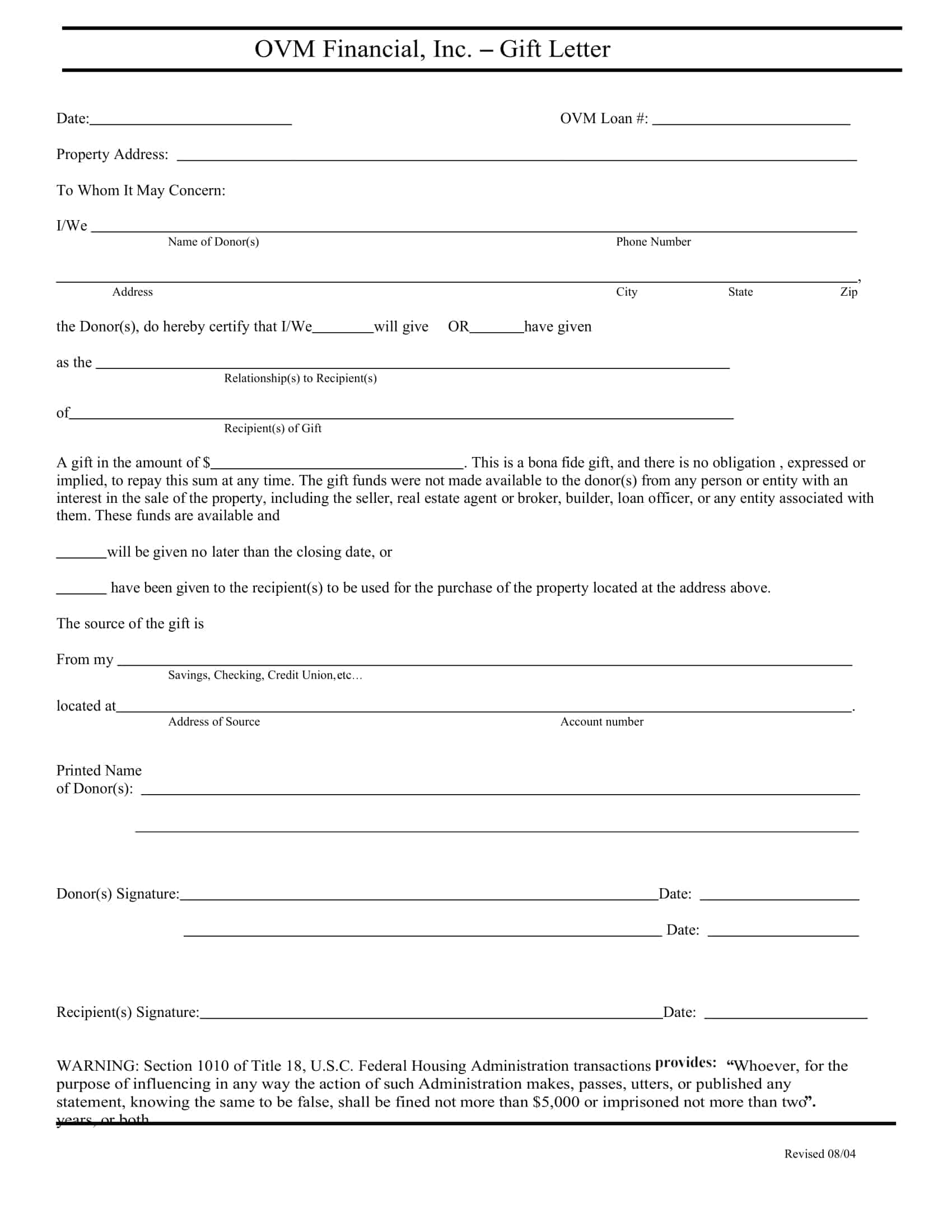

Gift Letter Templates

Gift Letter Templates: Express gratitude and streamline your gift-giving process with our versatile collection of free printable Gift Letter templates. Whether you’re giving or receiving a gift, these templates provide a formal and heartfelt way to document the details of the gift, including the sender, recipient, occasion, and any special instructions or sentiments.

Use our templates to create personalized gift letters for birthdays, weddings, holidays, and more. Easily customize the templates to match your style and preferences, and create a lasting impression with your thoughtful gift. Download now and elevate your gift-giving experience.

Where can a gift letter template come from?

Gift letters for real estate transactions are common in the real estate industry. However, some people need help figuring out who to get it from. With so many options to choose from and after considering the different situations, you should be able to figure out who would best fit your gift letter template needs.

If you’re buying a home with a Federal Housing Authority loan, it may be necessary to get a letter of pre-approval stating that the buyer qualifies for a mortgage and the amount. There are two different types of gift letters you could use:

Fannie Mae

Fannie Mae is the largest source of home financing in the United States, guaranteeing mortgages for more than 10 million homebuyers. Its financing has helped more than 17 million individuals and families purchase a home since 1938.

Fannie Mae’s letters are important documents that are used to notify lenders about changes to mortgage policies and regulations. These letters will outline any changes made to the company’s guidelines, including interest rates and amortization schedules.

Fannie Mae uses these letters to announce any new products or services it offers to lenders. They also provide information about changes in their guidelines, such as how much down payment is required for a loan or how much money can be borrowed based on income level.

Lenders often use these letters when they have questions about how certain procedures should be followed when working with Fannie Mae clients.

FHA Gift Letter

FHA Gift Letter is a letter from the buyer to the home seller, which states the buyer does not have the funds to pay for the down payment and closing costs for a mortgage. It is an alternative to private mortgage insurance (PMI) and can be used when the borrower needs more liquid assets to make up for the difference between what they can afford and what they need for a down payment. The FHA gift letter must be submitted as part of your loan file after closing.

Who needs an FHA gift letter?

Borrowers who want to use this type of financing need an FHA-approved lender who will process the loan with no PMI. An FHA gift letter is required if any of the following applies:

You are buying with someone else’s money, such as an inheritance or proceeds from selling another property;

The borrower has little or no savings;

The borrower wants to buy a more expensive home than he or she could otherwise afford; or

The borrower plans on paying cash for some of their closing costs instead of using money from their own pocket.

What to include in your mortgage gift letter template?

A mortgage gift letter is a document that is used to explain how you paid for the down payment on your home. It’s important to note that this letter can’t be used as proof of funds but rather as proof of origin.

A mortgage gift letter is not required when applying for a mortgage loan, but it can help avoid delays and complications with the application process.

The mortgage gift letter template includes the following:

- The borrower’s name and the person who is gifting the mortgage loan to him/her.

- The address of both parties.

- The date on which this document has been signed by both parties (borrower and giver).

- An acknowledgment that the property gifted by the giver will be registered in the name of the borrower after completion of necessary formalities at the registrar office/registry office concerning the transfer of title deeds etc., as per law governing such matters in force at present or as may be amended from time to time.

- A statement that no encumbrance exists over any part of this property except where it is mentioned explicitly in this deed, if any encumbrance existed, but has been discharged or extinguished by way of release deed duly executed by all parties concerned before signing this mortgage gift deed, etc., as per law governing such matters in force at present or as may be.

Requirements for using a mortgage gift letter

The requirements for using a mortgage gift letter vary depending on the lender. Some lenders will require you to have an account with them, while others may not.

It’s important to know that some lenders will only accept the use of a gift letter if the borrower has been an established customer for at least 12 months.

The mortgage gift letter is a document that allows you to get a mortgage loan without having to include the funds from your parents or other family members as part of your income. The requirements for using this type of letter are straightforward and easy to meet.

You must be under the age of 35, have an annual income of at least $36,000, and be able to make monthly payments on your loan. You also need to have at least 10% of the purchase price saved in cash or a co-signer with enough money to cover at least 10% of the purchase price. If you don’t meet these criteria, you can still apply for a mortgage loan but will need to include your parent’s income as part of yours. This means that if you make $36,000 per year but want to buy a house for $200,000, you’ll need $20,000 in cash or savings before applying for your loan.

If your lender does not require an account with them but does require a credit check, it’s best to wait until you’ve been approved for your loan before asking family members or friends for their help. This way, they’ll know that you’re in good standing with them, and sending money to your bank account is safe.

If you haven’t been approved yet and are just starting out on your home-buying journey, consider using another type of financing instead — such as getting pre-approved by a lender first — so that you can start building up your credit history before applying for a mortgage loan.

Minimum contribution requirements of borrowers for a letter of request

If you are planning to request an investment, you will have to follow specific rules and regulations. These regulations are very important because they ensure that your request is genuine and not taken lightly. One such regulation is the minimum contribution requirement. It is a sum of money that the borrower must contribute for the loan amount requested by him.

The minimum contribution requirement varies from lender to lender and from country to country. If you wish to know about the minimum contribution requirement of your home country or any other country, then you can easily get it from websites like www.lendingtree.com or www.moneytree.com by entering the name of your country and searching thereon.

The minimum contribution requirement is also known as collateral requirement, down payment amount, equity contribution amount, or equity percentage, etc., depending on the type of loan you take.

The minimum amount required depends on several factors, such as the purpose of taking a loan, the type of property being owned by the borrower, etc.. Still, generally speaking, it is between 10% and 20% of the total loan amount.

The minimum contribution requirement for gift letters is $1,000 or 25% of the home’s total purchase price, whichever is greater. For example, if you plan on buying a home for $300,000, your minimum contribution requirement would be $7500 (25% of $300,000) or $12,500 (50% of $150,000).

If you’re planning on buying a home with someone else, you’ll need to ensure that each party contributes at least 25% of the total purchase price.

In some cases, lenders may require more than these minimums. If they do and you need to meet those requirements, they may ask you to put down more money towards your down payment or to buy less expensive homes.

Is there a limit for a mortgage gift letter?

There are no limits to how much money you can gift a borrower for their mortgage. This is a gift, not a loan, so no repayment terms or interest rates are associated with it.

However, if you want to keep your relationship on the up-and-up with the IRS, then you need to ensure that you and the borrower have no financial interest in any aspect of the home purchase. You should also ensure that you have no say over where the money is spent and that it’s not mixed in with any other funds.

FAQs

What is a gift letter template?

A gift letter template is a pre-written document that contains boilerplate language commonly used in a gift letter. It will have blank fields and sample text of sections like the introduction, body, and signature that the donor completes with specifics about their monetary gift to the recipient. Gift letter templates allow donors to easily create a properly formatted letter without writing from scratch.

How do you write a gift letter?

To write a gift letter:

- State the date the gift letter is written and who it is addressed to.

- Identify the donor, recipient, and amount of gift given.

- Explain relationship between donor and recipient.

- Specify reason for the monetary gift with details.

- Confirm gift does not need to be repaid or expect services.

- State the gift funds are from donor’s own accounts.

- Include any supporting documents that verify source of funds.

- Have letter signed by donor stating all information is truthful.

What is an example of a financial gift letter?

Here is an example financial gift letter:

To Whom It May Concern:

I, John Smith, gifted my daughter Jane Doe $30,000 on January 1, 2022 to help purchase her first home at 123 Main St, Anytown, USA 12345. Jane is my only daughter, and I wanted to help her with a down payment for her first home as a gift. This money is from my personal savings account at ABC Bank, account #1234. I do not expect Jane to repay this gift or provide any services in exchange for it. Please contact me if you require any additional information to document this financial gift.

Sincerely,

John Smith 123 Park Ave, Anytown, USA 12345

555-123-4567

How do I write a gift letter for a mortgage template?

Use a gift letter template and fill in key details like:

- Donor and recipient names, relation, and contact info

- Date and amount of gift

- Purpose is to assist with home purchase at [address]

- Confirm gift does not need to be repaid

- State source of gift funds and no services expected

- Include documents verifying donor’s accounts/funds

- Donor’s signature and date on completed letter

Customize the template language as needed, but ensure it establishes the gift nature of the funds per lender requirements. Attach verification docs.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)