A General Ledger is a critical component of any accounting system, serving as the primary record of a company’s financial transactions. It is used to track and record financial information for all accounts, including assets, liabilities, and equity.

This article will explore the importance of a General Ledger, its key components, and how it is used to create financial statements and reports. Whether you are a business owner, accountant, or financial professional, understanding the General Ledger is essential for making informed financial decisions.

Table of Contents

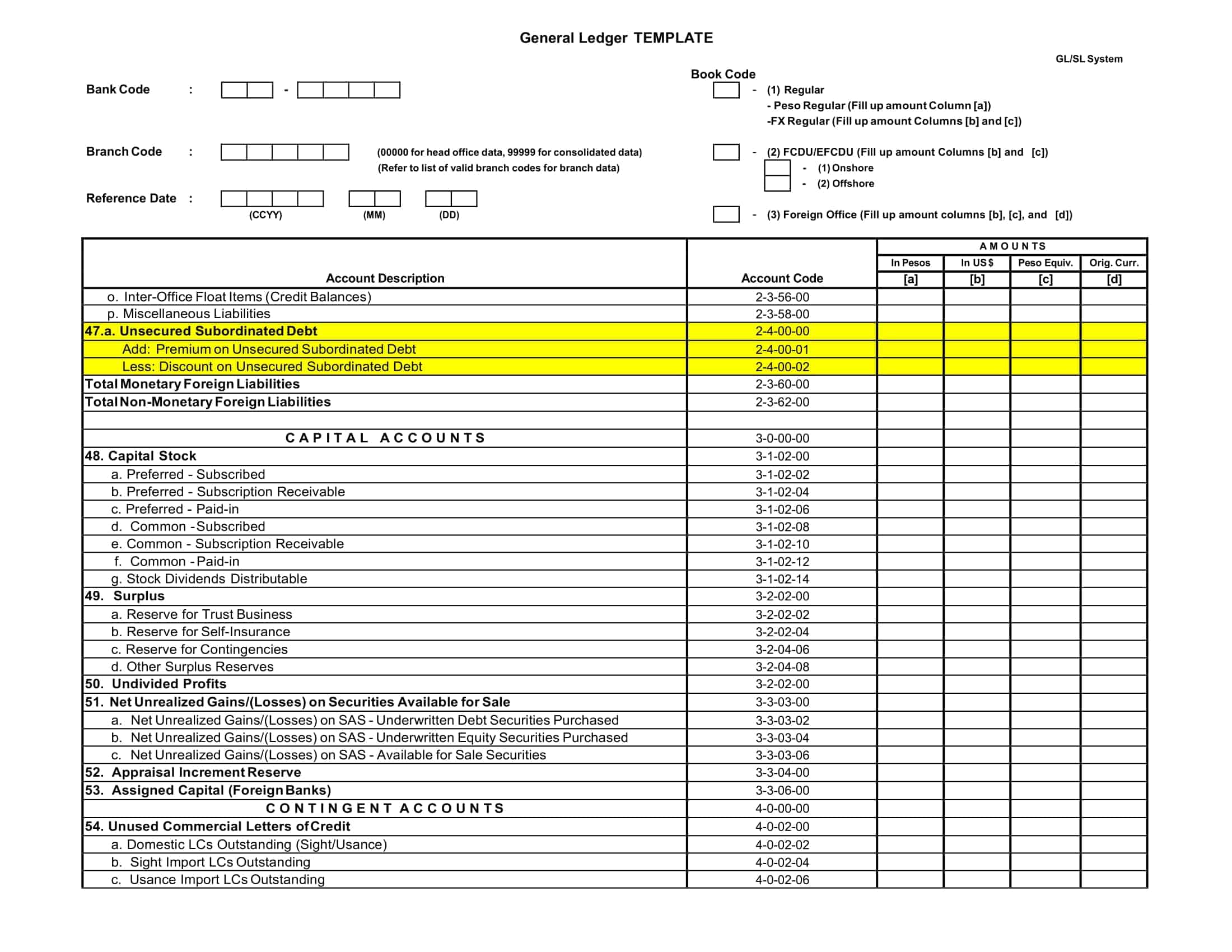

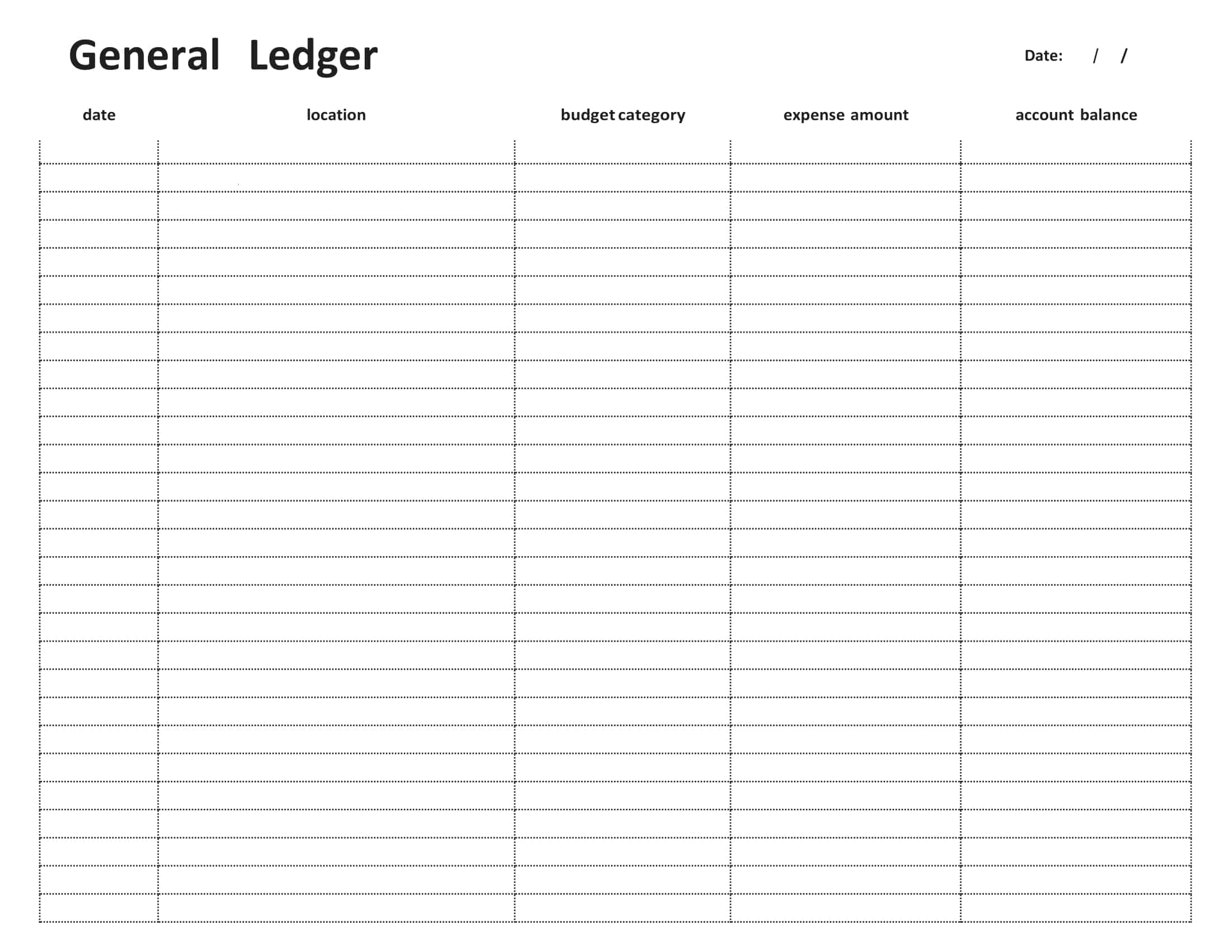

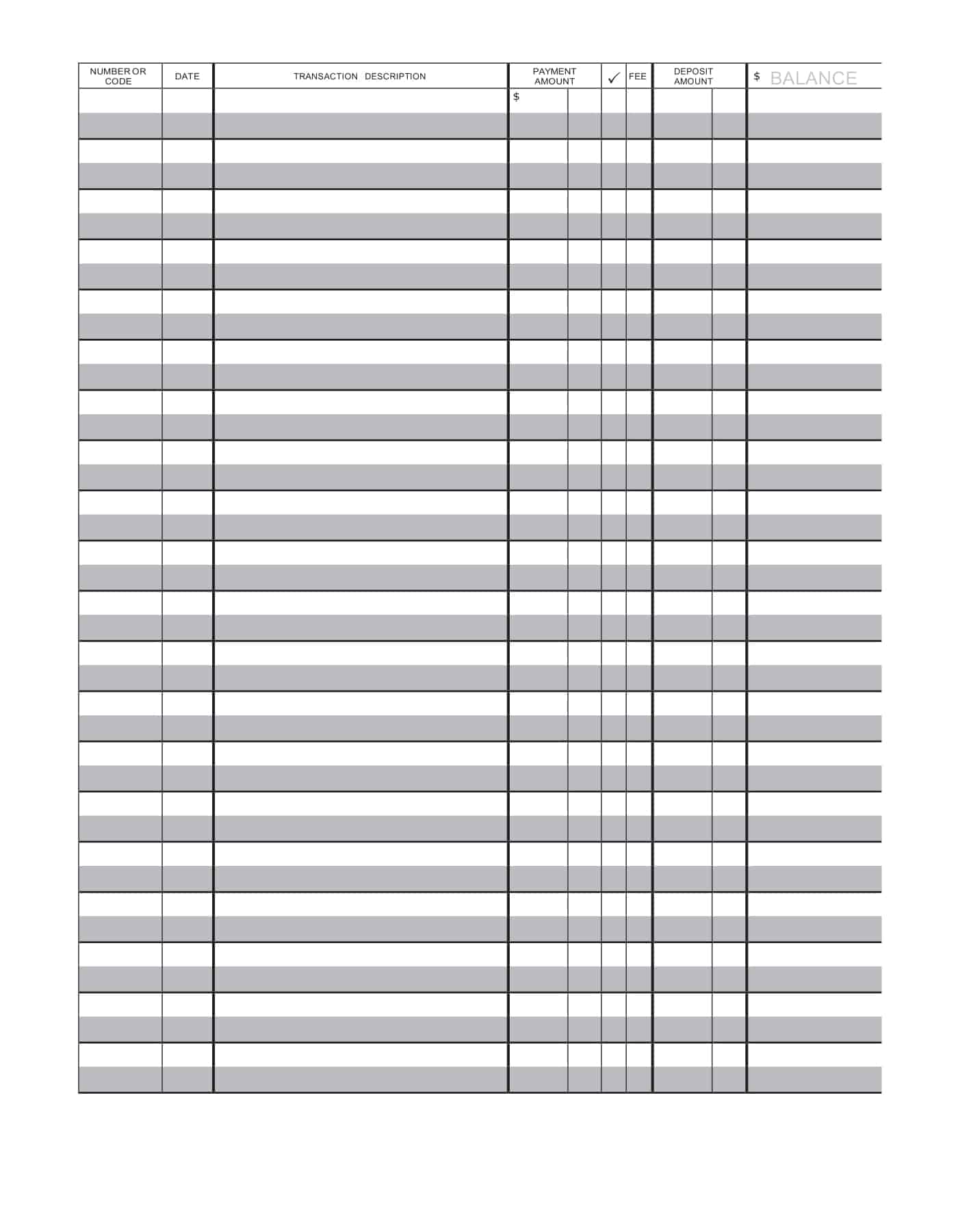

General Ledger Templates

General Ledger Templates: Simplify your financial record-keeping and maintain accurate accounts with our comprehensive collection of free printable General Ledger templates. Designed for businesses of all sizes, these templates provide a structured framework to track and summarize financial transactions, including income, expenses, assets, and liabilities.

Easily record journal entries, track balances, and generate financial statements with ease. Whether you’re a small business owner or a seasoned accountant, our templates offer customizable formats and user-friendly interfaces to streamline your bookkeeping process. Download now and take control of your financial management with confidence.

General ledger examples

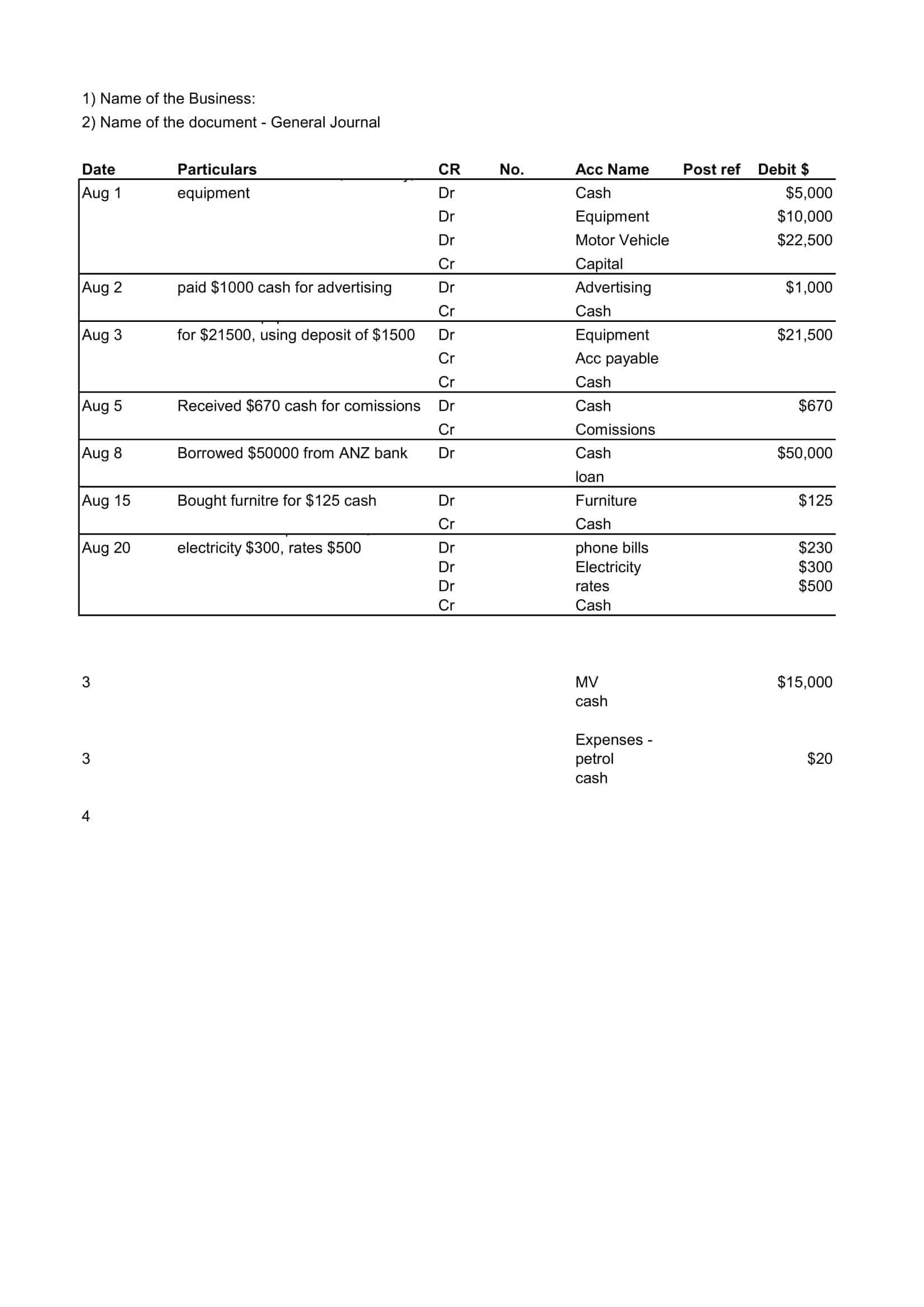

Here are a few examples of how a General Ledger can be used to record different types of financial transactions:

Purchasing inventory

When a company purchases inventory, the cost of the inventory will be recorded as a debit in the inventory account in the General Ledger. The payment for the inventory will be recorded as a credit in the accounts payable account.

Selling goods

When a company sells goods, the revenue from the sale will be recorded as a credit in the sales account in the General Ledger. The cost of the goods sold will be recorded as a debit in the cost of goods sold account.

Paying bills

When a company pays bills, the payment will be recorded as a debit in the accounts payable account in the General Ledger. The payment will be recorded as a credit in the cash account.

Paying employee salaries

When a company pays employee salaries, the cost will be recorded as a debit in the salaries expense account in the General Ledger. The payment will be recorded as a credit in the cash account.

Recording a loan

When a company takes out a loan, the loan amount will be recorded as a debit in the loans payable account in the General Ledger. The payment will be recorded as a credit in the cash account.

Depreciation of assets

When a company depreciates an asset, the depreciation expense will be recorded as a debit in the depreciation expense account and the corresponding credit will be recorded in the accumulated depreciation account.

Benefits of General Ledger

The benefits of a general ledger include:

Accurate and timely financial reporting

A general ledger provides a comprehensive record of all financial transactions, allowing for the generation of accurate and up-to-date financial statements.

Better financial control and management

The general ledger allows for the tracking and analysis of financial data, which can be used to make informed business decisions and improve overall financial management.

Compliance with regulations

A general ledger is often a requirement for compliance with various accounting and tax regulations, such as the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS).

Auditing and fraud detection

A general ledger can be used for auditing purposes, allowing for the detection of any discrepancies or fraudulent activity.

Easier budgeting and forecasting

A general ledger provides a historical record of financial transactions, which can be used to create budgets and forecasts for future financial performance.

Essential elements of a General Ledger

The essential elements of a general ledger include:

Chart of accounts: A list of all the accounts used to record financial transactions, such as assets, liabilities, income, and expenses.

Journal entries: Detailed records of each financial transaction, including the date, account affected, and debits and credits.

Accounts: A record of all transactions for a specific account, including the beginning balance, debits, credits, and ending balance.

Trial balance: A report that shows the balances of all accounts in the general ledger and confirms that the total debits equal the total credits.

Financial statements: Reports generated from the general ledger, such as income statements, balance sheets, and cash flow statements.

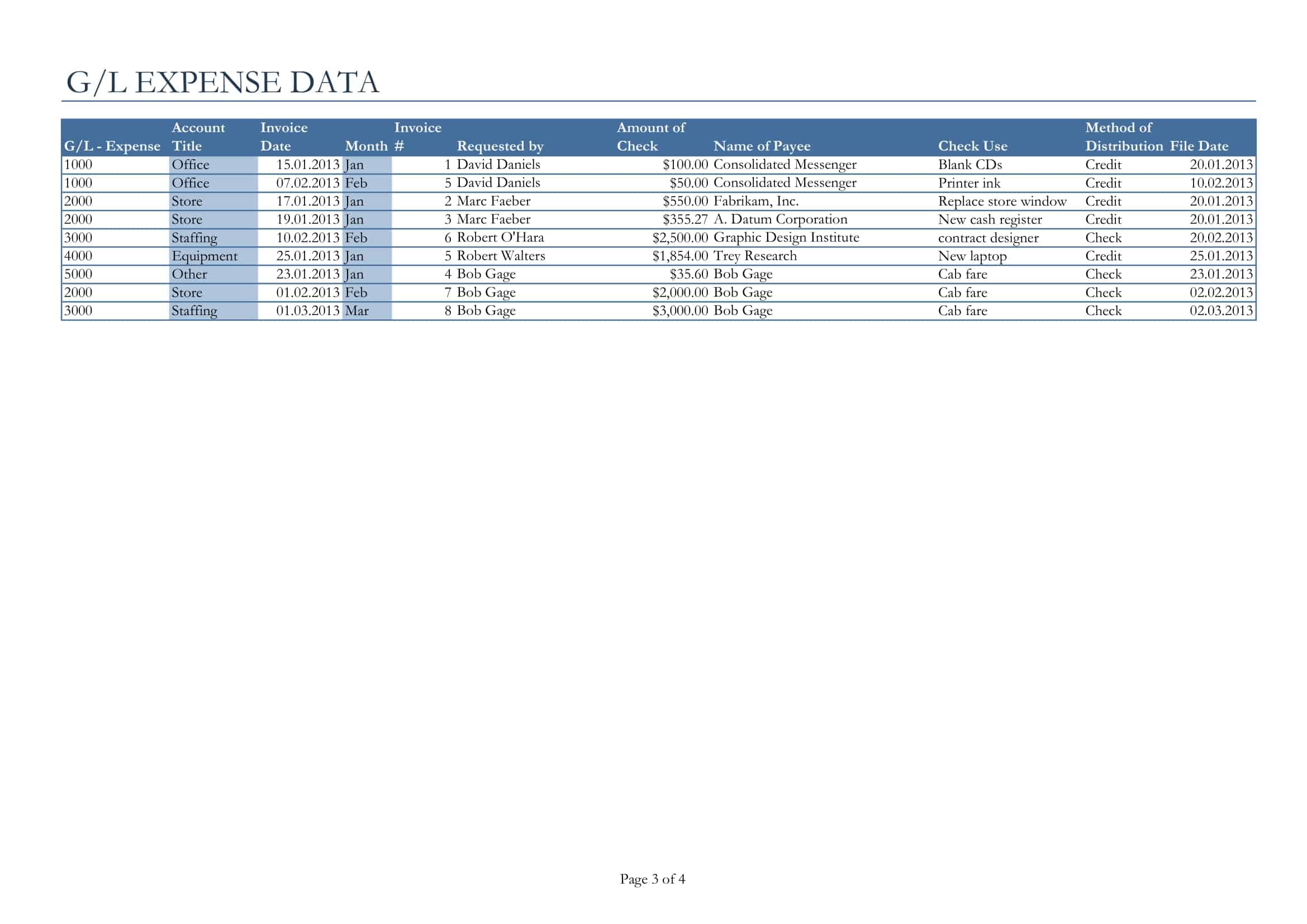

Subsidiary ledgers: Detailed records for specific accounts, such as accounts receivable or accounts payable, that are used to support the information in the general ledger.

Auditing and reconciliation: processes to ensure the accuracy and completeness of the general ledger and identify any discrepancies or errors.

How to make a General Ledger Template

Creating a general ledger involves several steps, including setting up the chart of accounts, recording journal entries, and generating financial statements. Here is a detailed step-by-step guide on how to create a general ledger:

Step 1: Set up the Chart of Accounts

The first step in creating a general ledger is to set up the chart of accounts. This is a list of all the accounts used to record financial transactions, such as assets, liabilities, income, and expenses. The chart of accounts should be designed to meet the specific needs of your business and should be organized in a logical and consistent manner.

Step 2: Record Journal Entries

Once the chart of accounts has been set up, the next step is to record journal entries for each financial transaction. Journal entries should include the date of the transaction, the account affected, and the debit and credit amounts. It’s important to ensure that the total debits equal the total credits for each journal entry.

Step 3: Create Accounts

With the journal entries recorded, the next step is to create accounts for each account listed in the chart of accounts. An account is a record of all transactions for a specific account, including the beginning balance, debits, credits, and ending balance. Each account should be updated with the appropriate journal entries.

Step 4: Generate a Trial Balance

A trial balance is a report that shows the balances of all accounts in the general ledger and confirms that the total debits equal the total credits. This step is important to ensure that the general ledger is in balance and that there are no errors or discrepancies in the journal entries.

Step 5: Generate Financial Statements

With the trial balance completed, the next step is to generate financial statements from the general ledger. Financial statements such as income statement, balance sheet, and cash flow statement, provide a snapshot of a company’s financial performance and can be used to make informed business decisions.

Step 6: Set up Subsidiary Ledgers

Subsidiary ledgers are detailed records for specific accounts, such as accounts receivable or accounts payable, that are used to support the information in the general ledger. These ledgers provide more detailed information than the general ledger, and can be used to track transactions related to specific customers or vendors.

Step 7: Auditing and Reconciliation

The last step in creating a general ledger is to perform auditing and reconciliation. Auditing is the process of reviewing and verifying the accuracy and completeness of the general ledger. Reconciliation is the process of comparing the general ledger to other records, such as bank statements, to ensure that the information is accurate.

It’s important to regularly update and maintain the general ledger to ensure that it remains accurate and up-to-date. This may involve making journal entries for new transactions, updating accounts, and generating new financial statements.

It’s also important to note that many businesses use accounting software to automate the process of creating and maintaining a general ledger. This software can streamline many of the steps outlined above, such as recording journal entries and generating financial statements, making it easier to create and maintain a general ledger.

FAQs

What types of transactions are recorded in a general ledger?

A general ledger records all financial transactions, including income, expenses, assets, liabilities, and equity.

How is a general ledger different from a journal?

A journal is used to record specific types of transactions, such as sales or purchases, while a general ledger is a record of all financial transactions. Transactions are first recorded in a journal and then transferred to the general ledger.

How is a general ledger organized?

A general ledger is typically organized into account categories, such as assets, liabilities, income, and expenses. Each account has a unique account number and is used to record specific types of transactions.

How is the general ledger used in financial reporting?

The general ledger is used to create financial statements, such as the balance sheet and income statement. These statements provide a snapshot of a company’s financial position and performance at a specific point in time.

Can you give an example of how general ledger is used in accounting?

Sure, Let’s say a company sells a product for $100. The sales transaction would first be recorded in the sales journal and then transferred to the general ledger. The $100 would be credited to the company’s income account and debited to the customer’s account in the general ledger. This transaction would then be used to update the company’s financial statements.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)