In life, unexpected circumstances can arise, leaving us or our loved ones unable to advocate for ourselves. During such challenging times, having a durable power of attorney becomes paramount. This vital document empowers you to make decisions on behalf of another individual, ensuring their interests are protected. Additionally, a durable power of attorney form serves as a safeguard in case an unforeseen event renders you incapable of speaking for yourself. Its significance extends beyond individual needs, playing a crucial role in estate planning.

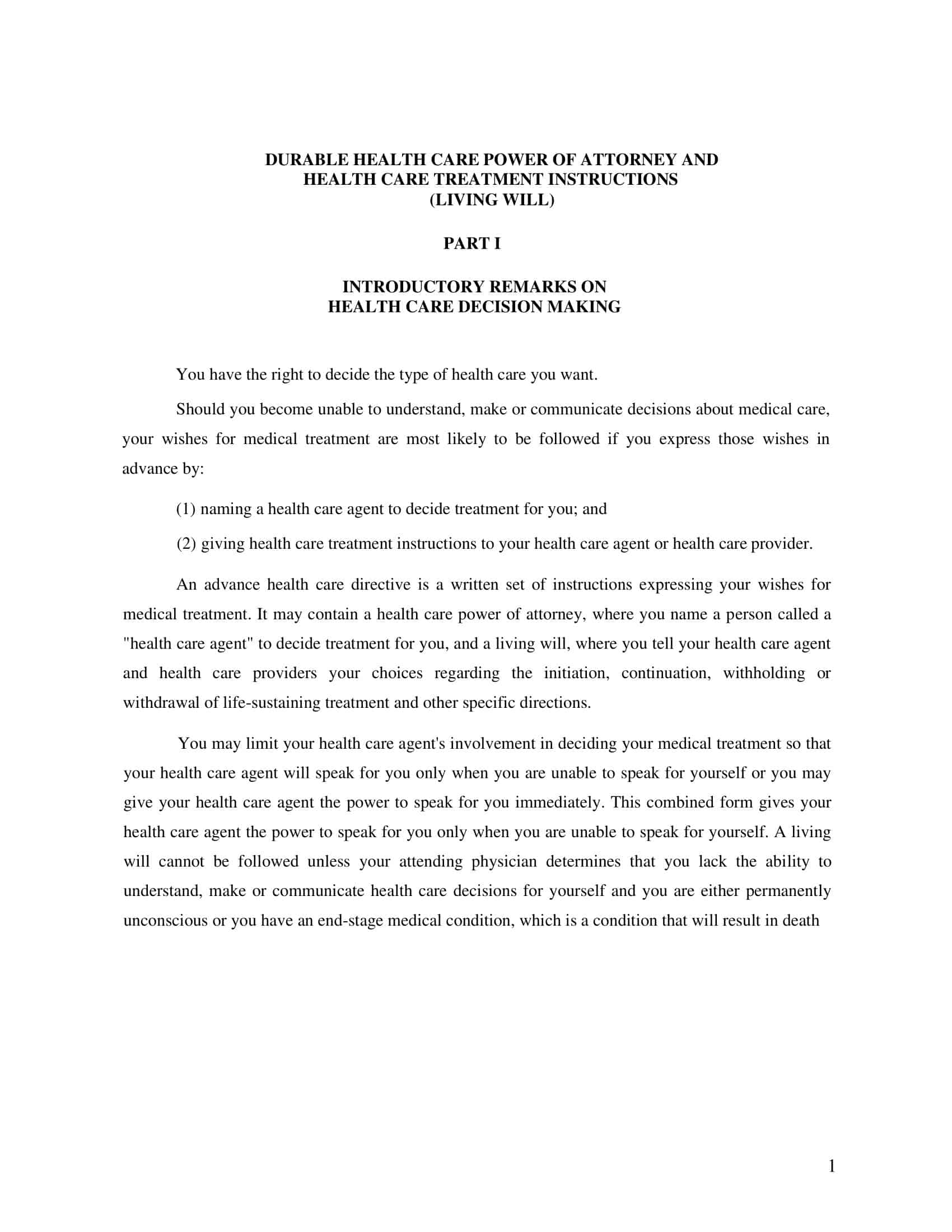

Many individuals wisely include this form as a fundamental part of their estate, recognizing the importance of proactive decision-making and preparedness. Particularly in healthcare situations, where the ability to communicate may be compromised, providing the right person with this form becomes essential. By acknowledging the potential changes life may bring, we embrace the responsibility of securing our well-being and the well-being of those we care about.

Table of Contents

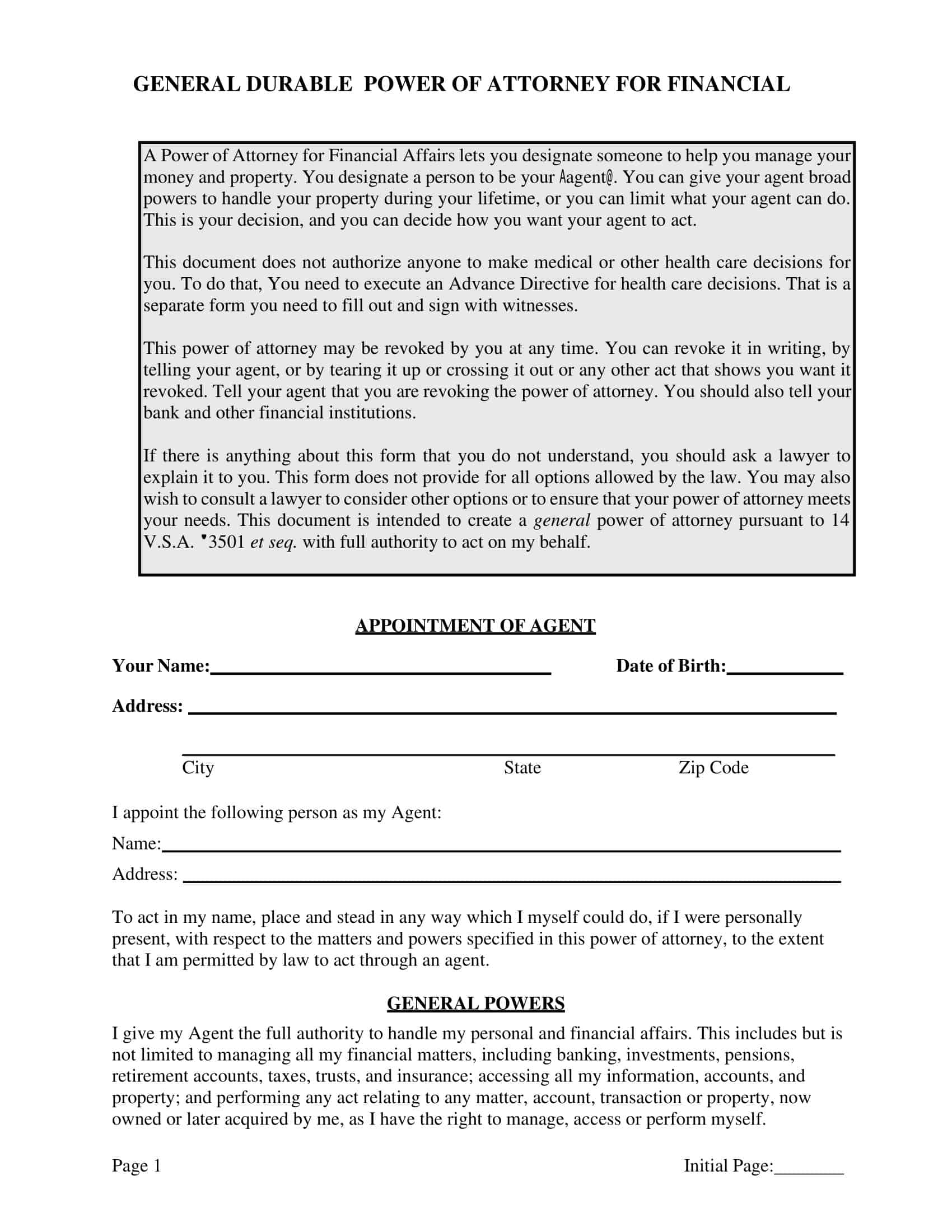

Durable Power of Attorney Templates

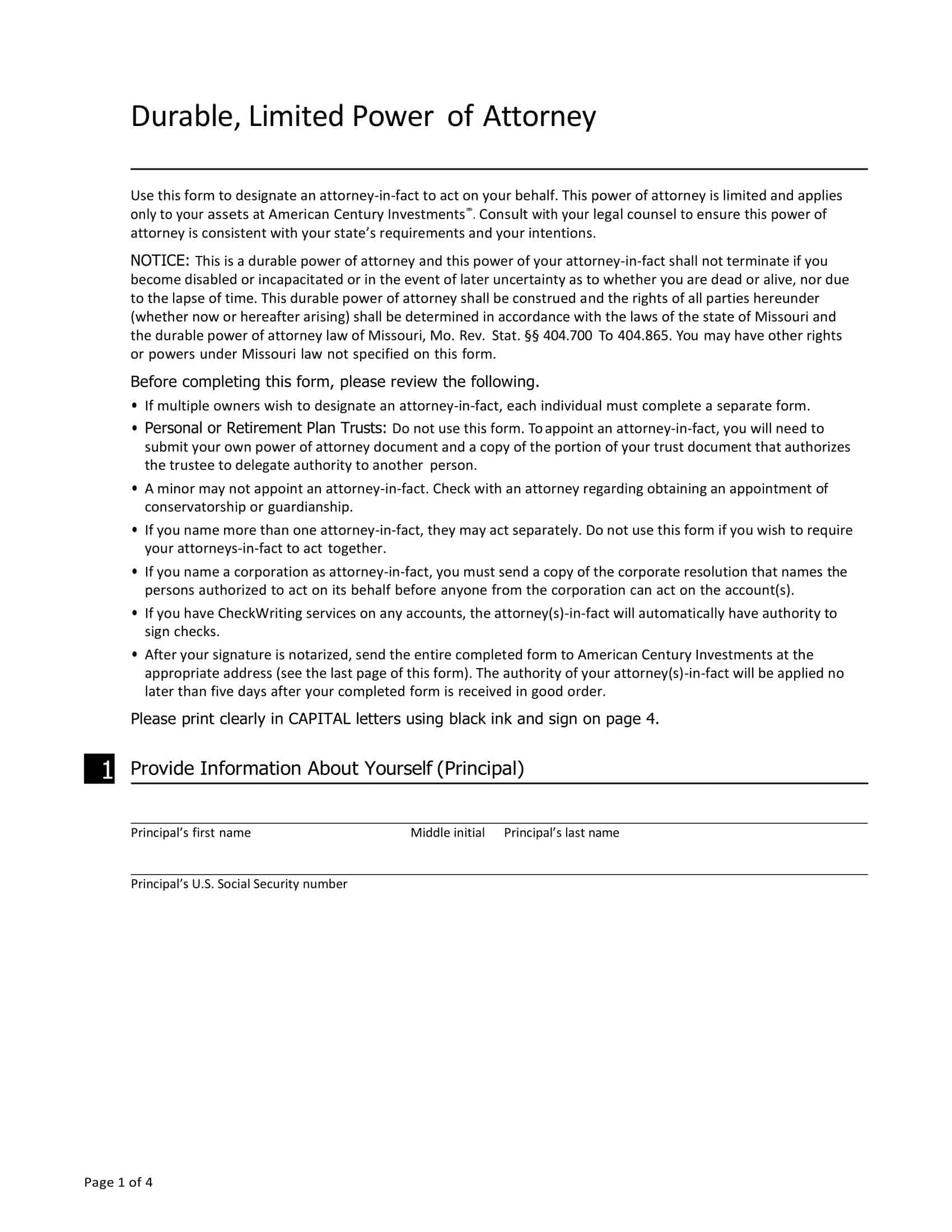

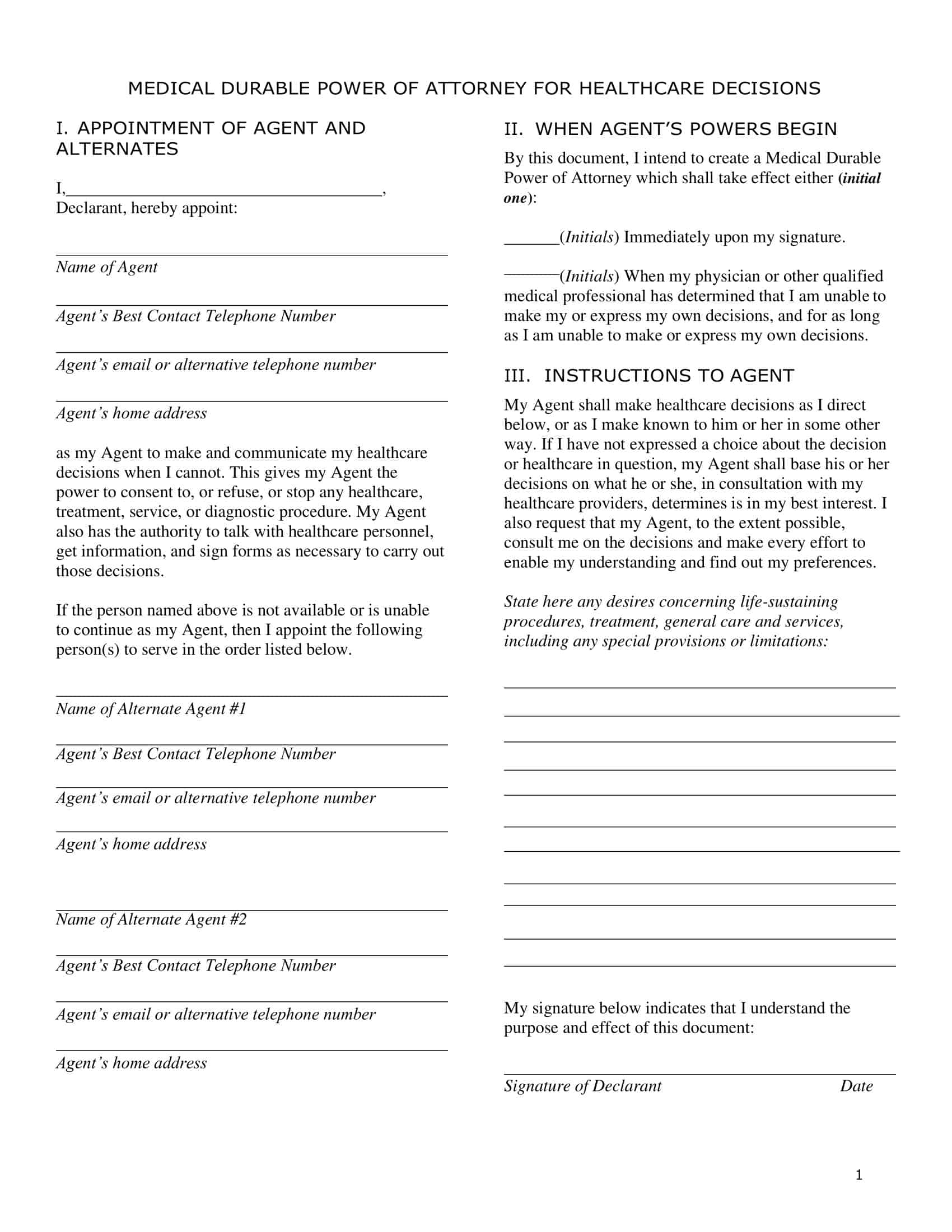

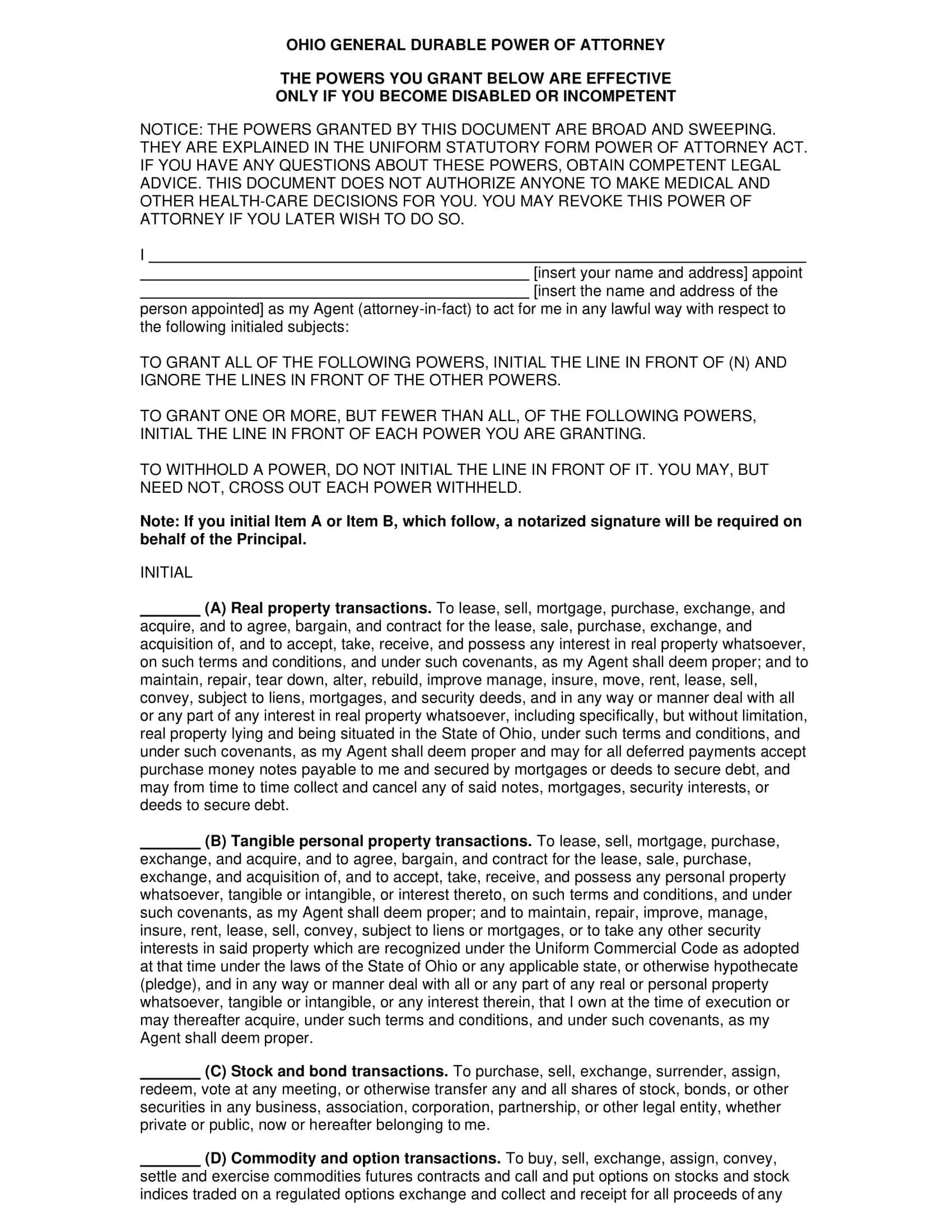

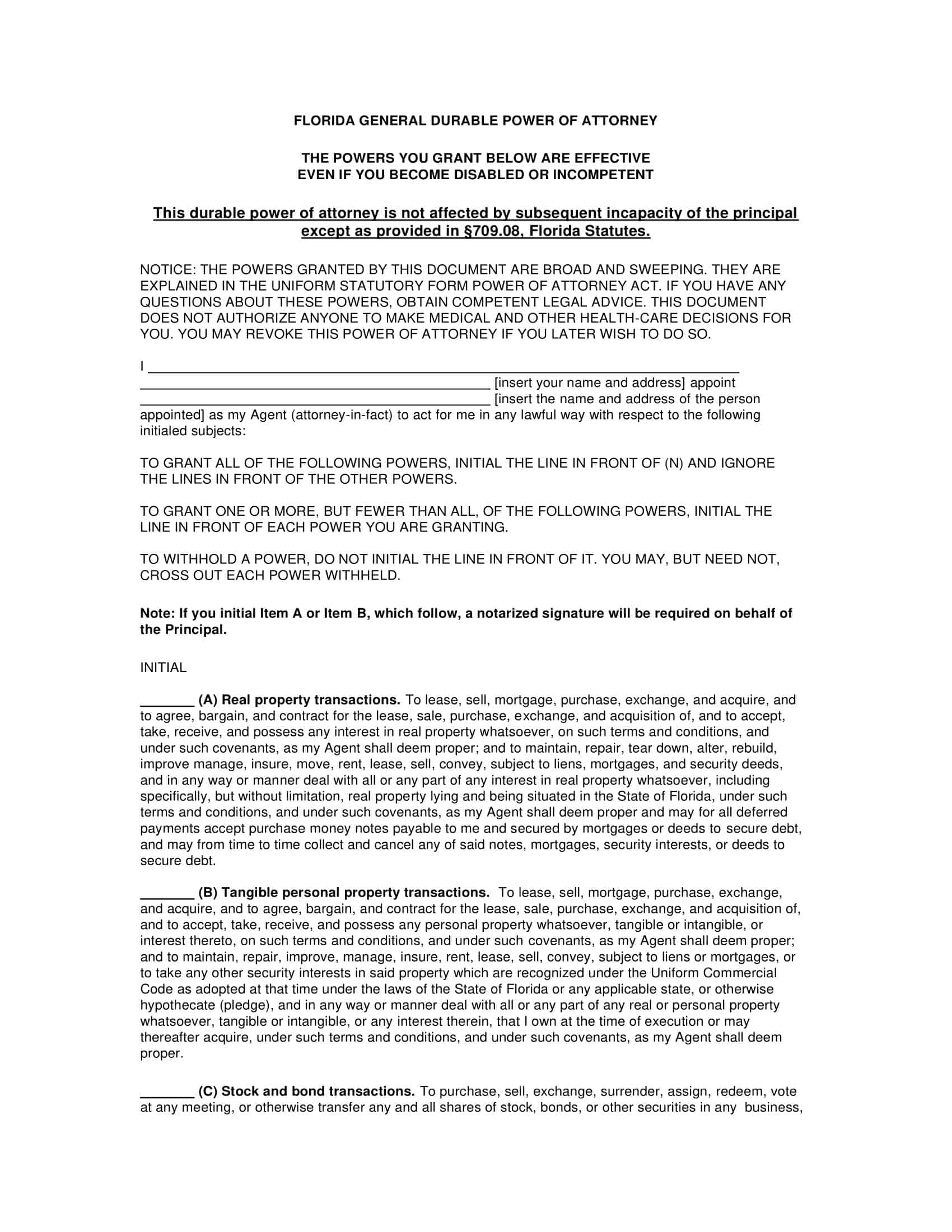

A durable power of attorney template is a legal document that allows individuals to designate someone, known as the “agent” or “attorney-in-fact,” to make important decisions and handle various financial and legal matters on their behalf. The term “durable” refers to the fact that the authority granted to the agent remains in effect even if the person creating the document, referred to as the “principal,” becomes incapacitated or mentally unable to make decisions.

A durable power of attorney template serves as a practical tool for individuals who wish to establish a plan for the management of their affairs in the event of incapacity. It provides a clear framework and legally binding instructions for the agent to act in the best interests of the principal. This legal document can offer peace of mind, ensuring that trusted individuals are empowered to handle important matters when the principal is unable to do so themselves.

The template typically includes various sections that outline the powers and limitations of the agent. It allows the principal to specify the specific areas in which the agent can act, such as managing finances, handling real estate transactions, making healthcare decisions, or conducting business on the principal’s behalf. The level of authority granted to the agent can be tailored to the principal’s specific needs and preferences.

What is a durable power of attorney (POA)?

A durable power of attorney (POA) is a legal document that grants someone else, known as the agent or attorney-in-fact, the authority to act on your behalf and make important decisions when you are unable to do so yourself. The term “durable” in this context means that the power of attorney remains in effect even if you become mentally or physically incapacitated. This distinguishes it from a regular power of attorney, which typically becomes invalid in such circumstances.

A durable power of attorney can cover a wide range of decisions and responsibilities, including financial matters, property management, healthcare decisions, and legal affairs. The scope and limitations of the agent’s authority are defined in the power of attorney document, allowing you to customize it based on your specific needs and preferences.

Creating a durable power of attorney is a proactive measure that helps protect your interests and ensures that someone you trust can step in and make important decisions on your behalf in case of illness, disability, or any situation where you are unable to make decisions for yourself. It provides peace of mind and safeguards your wishes, allowing for a smooth continuation of your affairs even during challenging times.

Exploring Durable Power of Attorney: Understanding its Forms and Considerations

When seeking a durable power of attorney form, it is crucial to ensure that you find the right document that aligns with your specific needs. There are two primary types of power of attorney forms that you should be aware of:

Durable Power of Attorney Form:

The durable power of attorney form is designed to authorize someone, known as your agent, to make decisions on your behalf in the event that you become incapacitated. This form grants your agent the authority to act and make decisions for your care, even if you are in a coma or unable to make decisions on your own.

Non-Durable Power of Attorney:

On the other hand, the non-durable power of attorney is not intended for use in situations involving mental incapacity. This type of power of attorney may be suitable if you occasionally require assistance with decision-making but are still capable of making clear-headed choices. However, it may not be effective if you experience mental conditions such as dementia, where the assigned agent’s authority may become irrelevant.

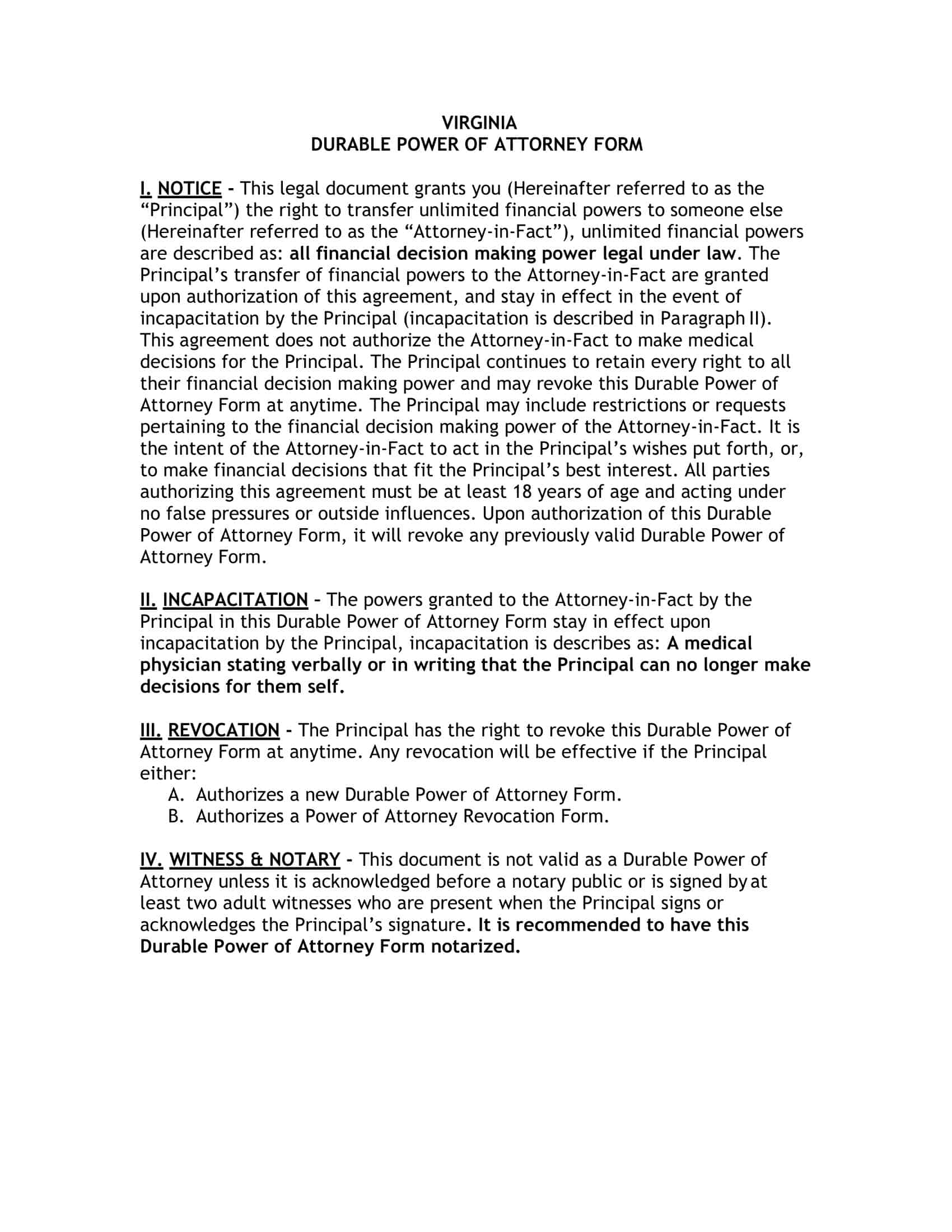

For a durable power of attorney to take effect, two conditions must be met:

- Properly signing the document according to the regulations of the state in which you reside.

- The occurrence of your incapacitation.

- It is important to note that a durable power of attorney ends under the following circumstances:

- You create a new power of attorney, superseding the previous one.

- Your demise.

- If there is an expiration date specified in the form.

- The named agent is unable to fulfill their duties, and there is no alternate person designated.

- You become incapacitated, preventing any modifications to the document.

To address this, it is advisable to designate a second person to take over the responsibilities outlined in the power of attorney in case the initial agent is unable to fulfill their role. By including a backup agent, you ensure that your interests are protected and decisions can continue to be made in your best interest, even in unforeseen circumstances.

What Powers Does Your Named Agent Possess with the Durable Power of Attorney?

The power granted through this document enables your named agent to handle a wide range of crucial responsibilities on your behalf. They can effectively manage your investments, handle your banking transactions, take care of bill payments, and execute various types of contracts. Particularly in matters of health, your agent becomes empowered to make critical decisions when you are unable to do so due to declining health or other circumstances.

Additionally, your agent can assist with tax-related matters, handle insurance claims and legal disputes, and even oversee your investment and retirement accounts. However, it’s important to note that the specific actions your named person can undertake may be subject to limitations. For instance, certain accounts or assets held solely in your name may have restricted access.

The extent and limitations of your Durable Power of Attorney (DPOA) can be tailored to your preferences, allowing you to include specific provisions that cater to your unique situation. By adding detailed instructions to the document, you can ensure that the major aspects relevant to your DPOA’s usage are covered comprehensively. It is essential to fill out all the necessary sections of the provided form or include them as specific additions, as any omissions may lead to complications concerning your financial support, healthcare decisions, and overall well-being.

When to use a durable power of attorney

A durable power of attorney (DPOA) serves as a valuable legal tool in specific situations when you may require assistance or representation for decision-making. Here are some common scenarios where utilizing a durable power of attorney is highly recommended:

Incapacity Due to Illness or Injury:

If you experience a sudden illness, sustain an injury, or face a medical condition that renders you unable to make decisions, a DPOA ensures that a trusted individual can step in as your agent. They can act on your behalf, managing your affairs and making important choices regarding healthcare, finances, and personal matters.

Planning for Future Incapacity:

A proactive approach involves establishing a DPOA in advance, anticipating the possibility of future incapacity. By selecting a trusted agent and granting them authority in the document, you secure a smooth transition in case you become mentally or physically incapacitated. This preemptive measure provides peace of mind and safeguards your interests.

Managing Financial Matters:

A DPOA is invaluable for managing financial affairs when you are unable to do so yourself. Whether you are temporarily unavailable due to travel, have limited mobility, or are facing health challenges, your appointed agent can handle tasks such as bill payments, managing bank accounts, dealing with investments, and filing taxes on your behalf.

Business or Legal Affairs:

In situations where you are unable to personally attend to important business or legal matters, a DPOA grants your agent the authority to represent you. This can include signing contracts, negotiating agreements, handling litigation, or managing real estate transactions. By having a designated agent with the necessary powers, you can ensure continuity in your professional and legal obligations.

Specific Time Periods or Events:

You may choose to activate a DPOA for specific time frames or events, such as during an extended overseas trip, military deployment, or any other circumstances where you anticipate being unavailable or unable to handle responsibilities on your own.

Understanding when to use a durable power of attorney empowers you to proactively plan for potential incapacity, maintain control over decision-making, and secure trusted representation during critical periods. It is advisable to consult with a qualified attorney to draft a DPOA that aligns with your specific needs and local legal requirements.

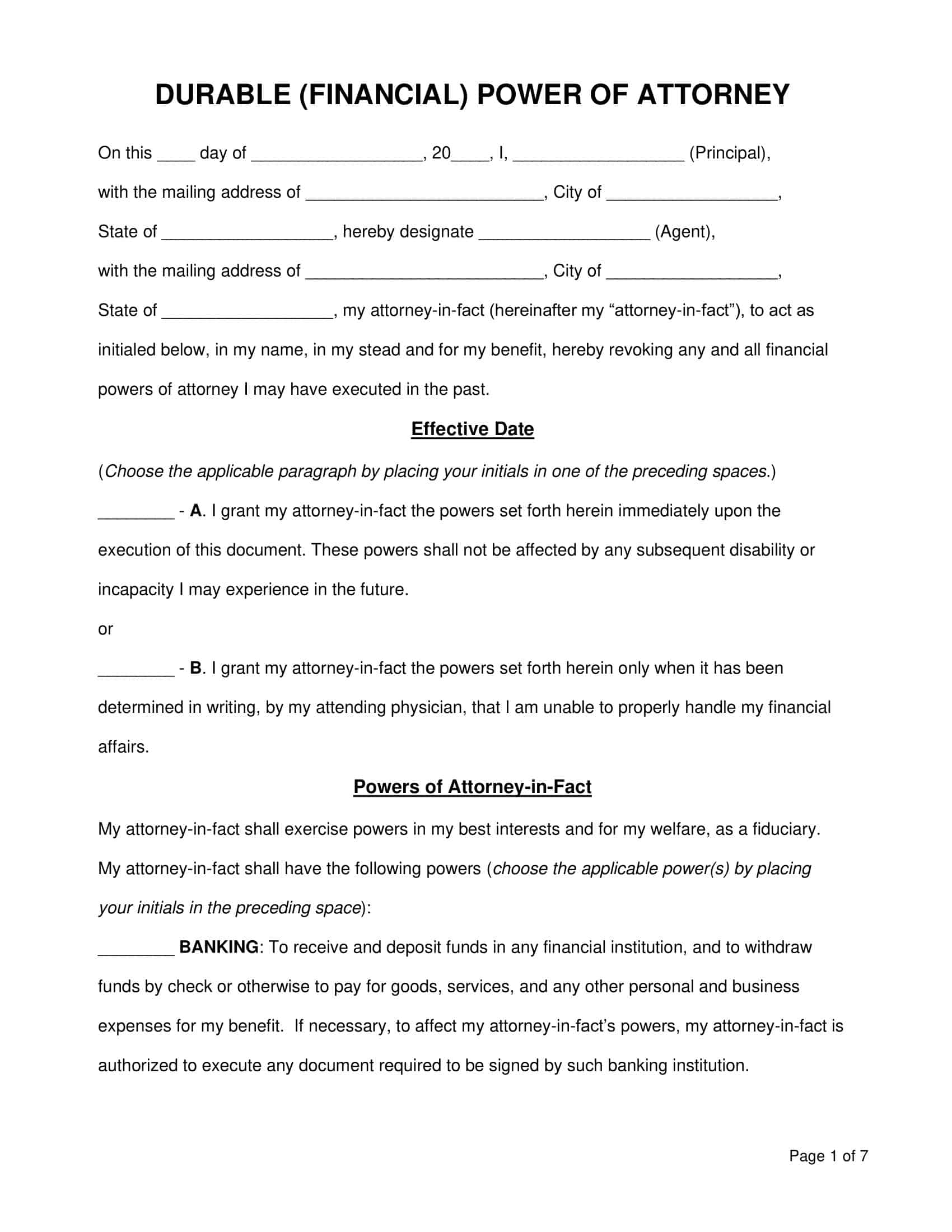

Filling Out a Durable Power of Attorney Form: A Comprehensive Step-by-Step Guide

Step 1: Understand the Purpose and Scope

Before beginning to fill out a durable power of attorney (DPOA) form, ensure you understand its purpose, scope, and the powers you intend to grant to your chosen agent. Familiarize yourself with the specific requirements and regulations of your jurisdiction, as they may vary.

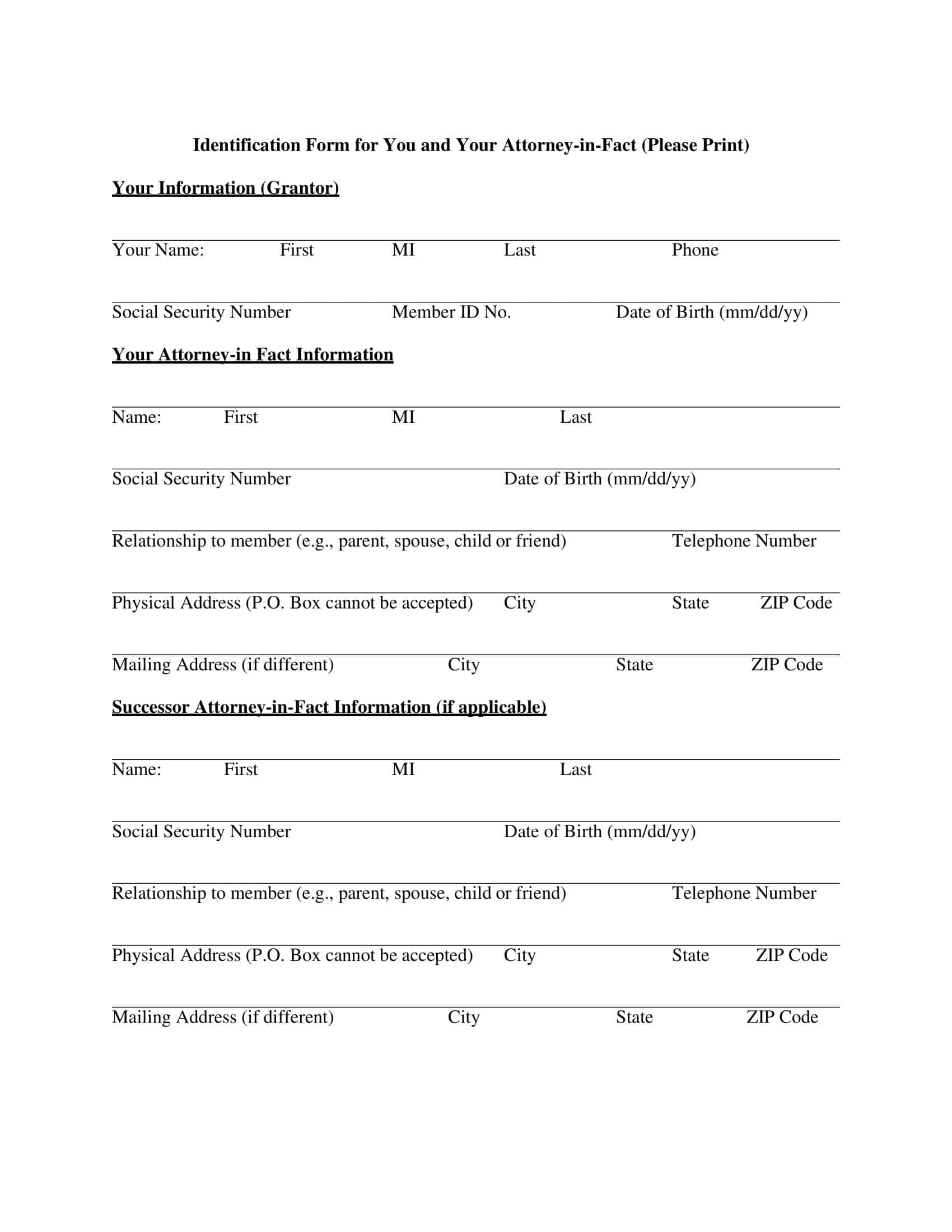

Step 2: Gather the Required Information

Collect all the necessary information and documentation before starting the form-filling process. This may include personal details, identification documents, and any specific instructions or preferences you wish to include.

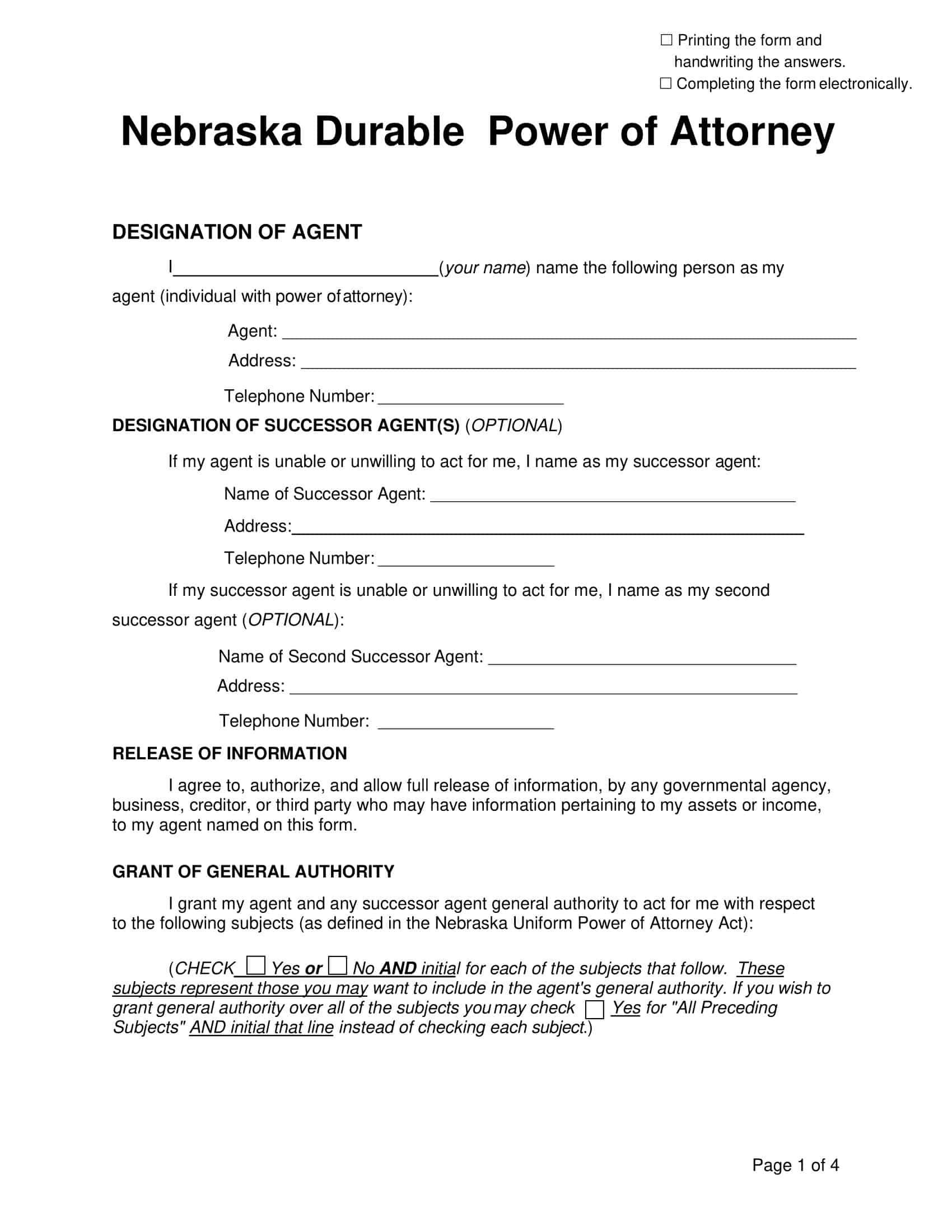

Step 3: Choose Your Agent(s)

Select the individual(s) you trust to act as your agent(s) in the DPOA. Consider their reliability, competence, and willingness to fulfill the responsibilities outlined in the document. It is wise to choose alternate agents in case the primary agent is unable or unwilling to act on your behalf.

Step 4: Determine Powers and Limitations

Decide on the powers and limitations you want to grant to your agent. Think about financial matters, healthcare decisions, legal affairs, and other specific areas where you require representation. Ensure the powers you grant align with your intentions and preferences.

Step 5: Obtain the Appropriate Durable Power of Attorney Form

Obtain the correct DPOA form that complies with the legal requirements of your jurisdiction. You can consult with an attorney, download a template from reputable legal websites, or obtain a form from a government office or legal stationery store.

Step 6: Review the Form

Carefully read through the entire DPOA form, including any accompanying instructions or guidelines. Understand the sections, provisions, and language used in the document. Pay attention to any mandatory fields, formatting requirements, and signatures.

Step 7: Personalize the Form

Begin filling out the form by entering your personal information, such as your full legal name, address, and contact details. Include the same details for your appointed agent(s).

Step 8: Specify Powers and Limitations

Clearly state the powers you are granting to your agent(s) and any specific limitations or conditions associated with those powers. Be thorough and specific, addressing financial matters, healthcare decisions, property management, and any other areas of concern.

Step 9: Witnesses and Notary

Check whether the DPOA form requires witnesses or notary acknowledgment. Follow the instructions provided to ensure the document is properly witnessed and/or notarized, as required by law.

Step 10: Seek Legal Advice (Optional)

Consider consulting with an attorney specializing in estate planning or elder law. They can review your completed DPOA form to ensure it aligns with your intentions, conforms to local regulations, and adequately protects your interests.

Step 11: Sign and Date

Sign the DPOA form in the designated spaces and include the date of execution. If witnesses are required, ensure they also sign the document. If notary acknowledgment is necessary, have the form notarized accordingly.

Step 12: Distribute Copies

Make multiple copies of the signed and completed DPOA form. Distribute them to relevant parties, including your appointed agent(s), alternate agents (if any), your attorney (if applicable), healthcare providers, financial institutions, and any other individuals or entities involved in decision-making processes outlined in the DPOA.

Step 13: Review and Update Periodically

Regularly review your DPOA to ensure it reflects your current wishes and circumstances. Update the document as necessary, especially in the event of changes in personal relationships, agents’ availability, or changes in applicable laws.

FAQs

When does a durable power of attorney take effect?

A durable power of attorney can take effect immediately upon signing or can be triggered by a specific event, such as your incapacitation. This is usually specified in the document itself.

How do I choose an agent for my DPOA?

When selecting an agent, choose someone you trust implicitly and who is capable of acting in your best interests. Consider their reliability, ability to make sound decisions, and willingness to take on the responsibilities outlined in the DPOA. It is wise to choose alternate agents in case the primary agent is unable or unwilling to act.

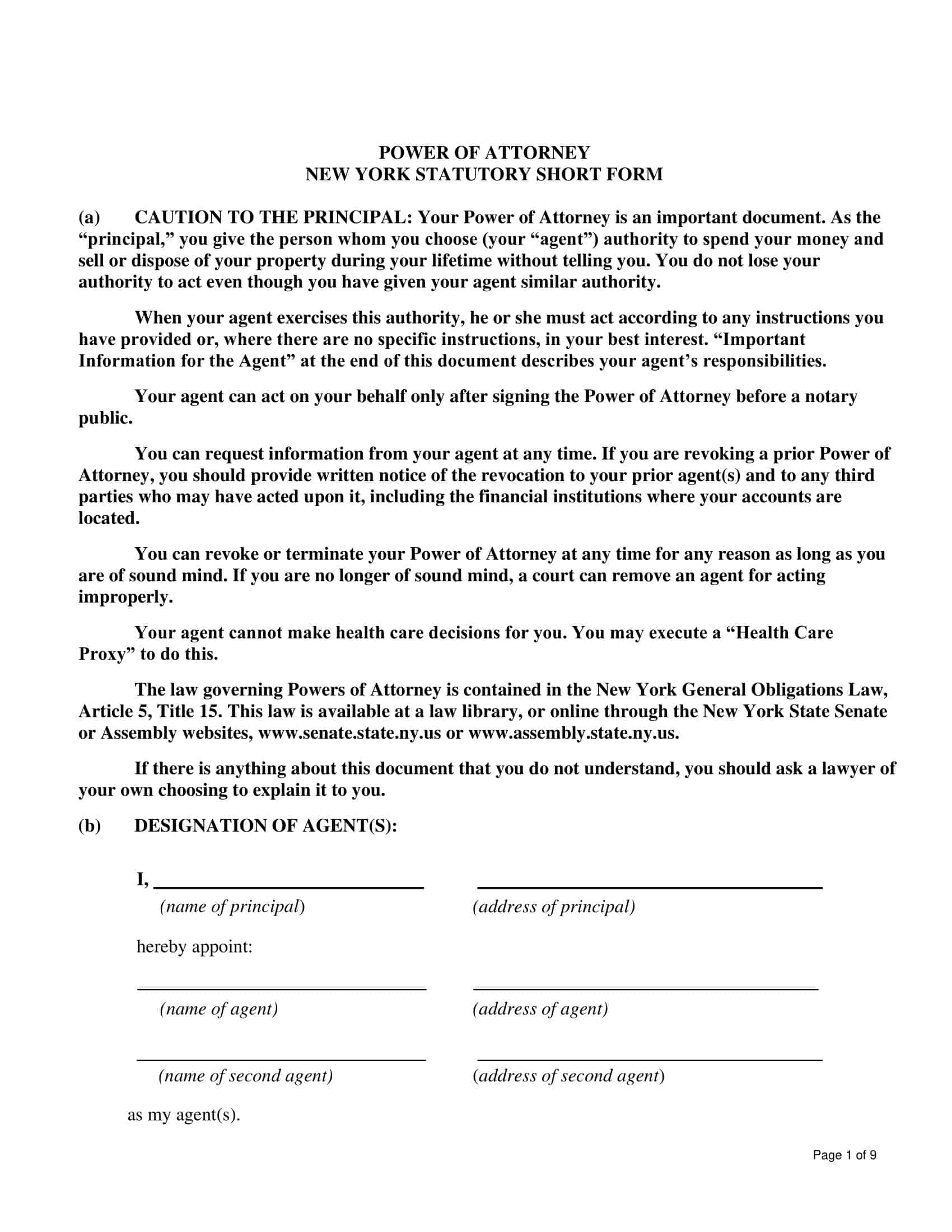

Can I have multiple agents?

Yes, you can appoint multiple agents, either to act jointly or in succession. If appointing multiple agents, specify whether they must act together (jointly) or can act independently (severally). You can also designate a specific order in which alternate agents will assume responsibilities.

How long does a durable power of attorney remain valid?

A durable power of attorney remains valid until you revoke it, pass away, or a termination event occurs as specified in the document, such as a specific date or the fulfillment of a certain condition.

Can a durable power of attorney be revoked or changed?

Yes, as long as you have the legal capacity to do so, you can revoke or change your durable power of attorney at any time. This can be done by creating and signing a new DPOA document or through a written revocation notice.

Can a durable power of attorney be used without my incapacitation?

Generally, a durable power of attorney becomes effective only when you are incapacitated. However, some DPOAs may include provisions for immediate use even when you have the capacity to make decisions.

Is a durable power of attorney valid across state lines?

While durable power of attorney laws can vary between states, most states recognize validly executed DPOAs from other states. However, it’s essential to consult with an attorney to ensure compliance with the laws of the specific jurisdiction.

Can a durable power of attorney be used for elder care and long-term care decisions?

Yes, a durable power of attorney is commonly used for elder care and long-term care decisions. It allows your agent to make healthcare decisions and manage your financial affairs, ensuring your needs are met as you age or face health challenges.

What is the difference between a durable power of attorney and a general power of attorney?

The main difference is that a durable power of attorney remains effective even if you become incapacitated, while a general power of attorney typically becomes invalid in such circumstances. A durable power of attorney provides a continuity of decision-making authority during incapacity, whereas a general power of attorney is suitable for situations when you are fully capable of making decisions on your own behalf.

Can I have different agents for financial and healthcare decisions?

Yes, you can appoint different agents for financial and healthcare matters. In fact, it is common to choose separate individuals with the appropriate expertise and understanding of each respective area. This allows you to ensure that decisions in each domain are made by individuals best suited to handle them.

Can a durable power of attorney be used to make end-of-life decisions?

Depending on the jurisdiction and the specific powers granted in the DPOA, it may be possible to include provisions for end-of-life decision-making. However, it is essential to consult with an attorney to understand the laws and requirements regarding end-of-life decisions in your jurisdiction.

Can I create a durable power of attorney if I already have a living will or healthcare proxy?

Yes, a durable power of attorney can complement a living will or healthcare proxy. While a living will or healthcare proxy focuses specifically on healthcare decisions, a durable power of attorney can encompass broader decision-making authority, including financial matters and legal affairs.

Can I use a durable power of attorney to transfer property or assets to my agent?

It depends on the specific language and powers granted in the DPOA. In some cases, a durable power of attorney may include provisions that allow the agent to manage or transfer property or assets on your behalf. However, it is crucial to carefully consider and discuss such powers with an attorney to ensure they align with your intentions and legal requirements.

Can I create a durable power of attorney for someone who already has a legal guardian?

The ability to create a durable power of attorney for someone under a legal guardianship may vary based on local laws and the specific circumstances of the individual. In some cases, it may be possible to create a limited durable power of attorney that grants certain powers not covered by the guardianship. Consulting with an attorney is recommended to navigate such situations.

Can a durable power of attorney be challenged or revoked by family members?

It is possible for family members or interested parties to challenge a durable power of attorney if they believe it was created under undue influence, fraud, or if the agent is not acting in the best interests of the principal. The process and grounds for revoking or challenging a DPOA can vary based on jurisdiction. Consulting with an attorney experienced in estate planning and elder law can provide guidance on this matter.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)