A stock certificate is a physical document that serves as proof of ownership of a specific number of shares in a company. These certificates, which can be handwritten or printed, typically include the name of the company, the stockholder’s name, the number of shares owned, and the date of issue.

Stock certificates are important because they provide evidence of ownership and can be used to transfer ownership of shares from one person to another. They also serve as a record of the company’s financial performance, including any dividends that have been paid out to shareholders.

Table of Contents

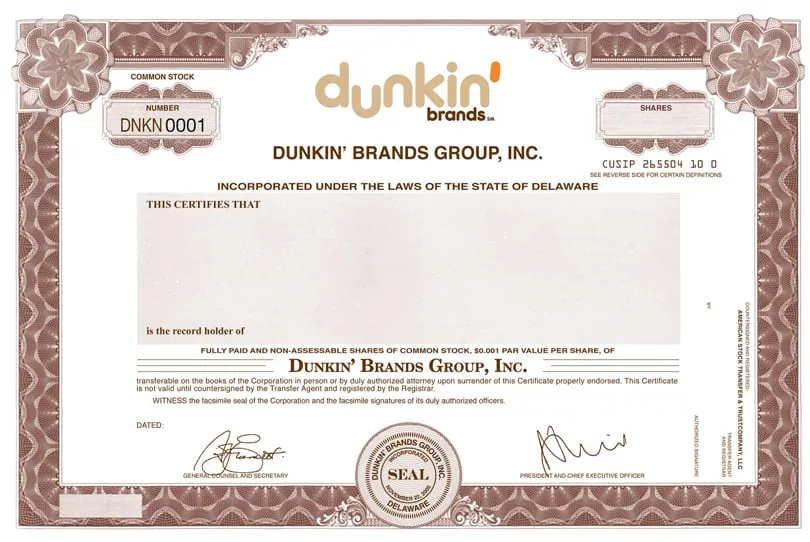

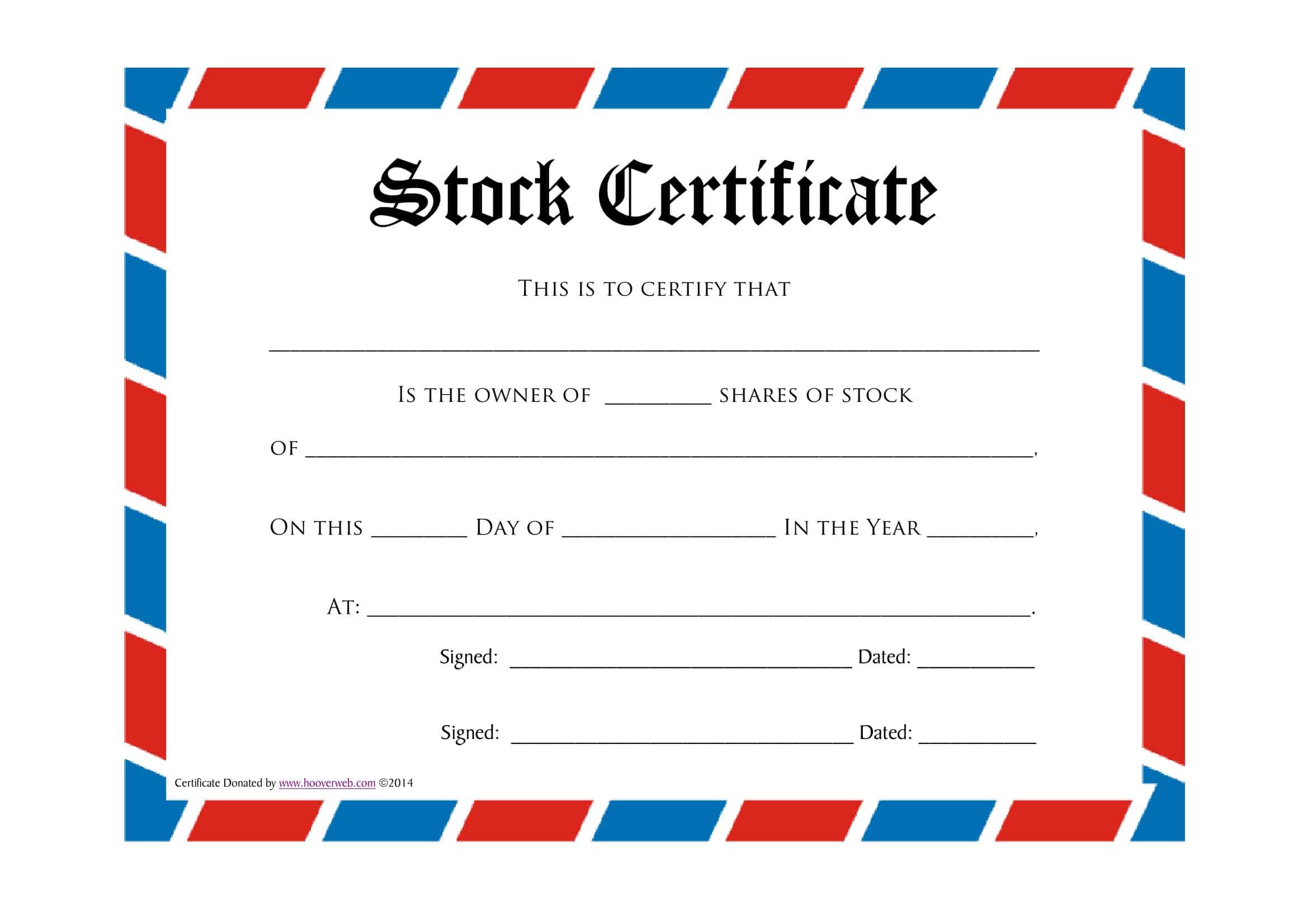

Stock Certificate Templates

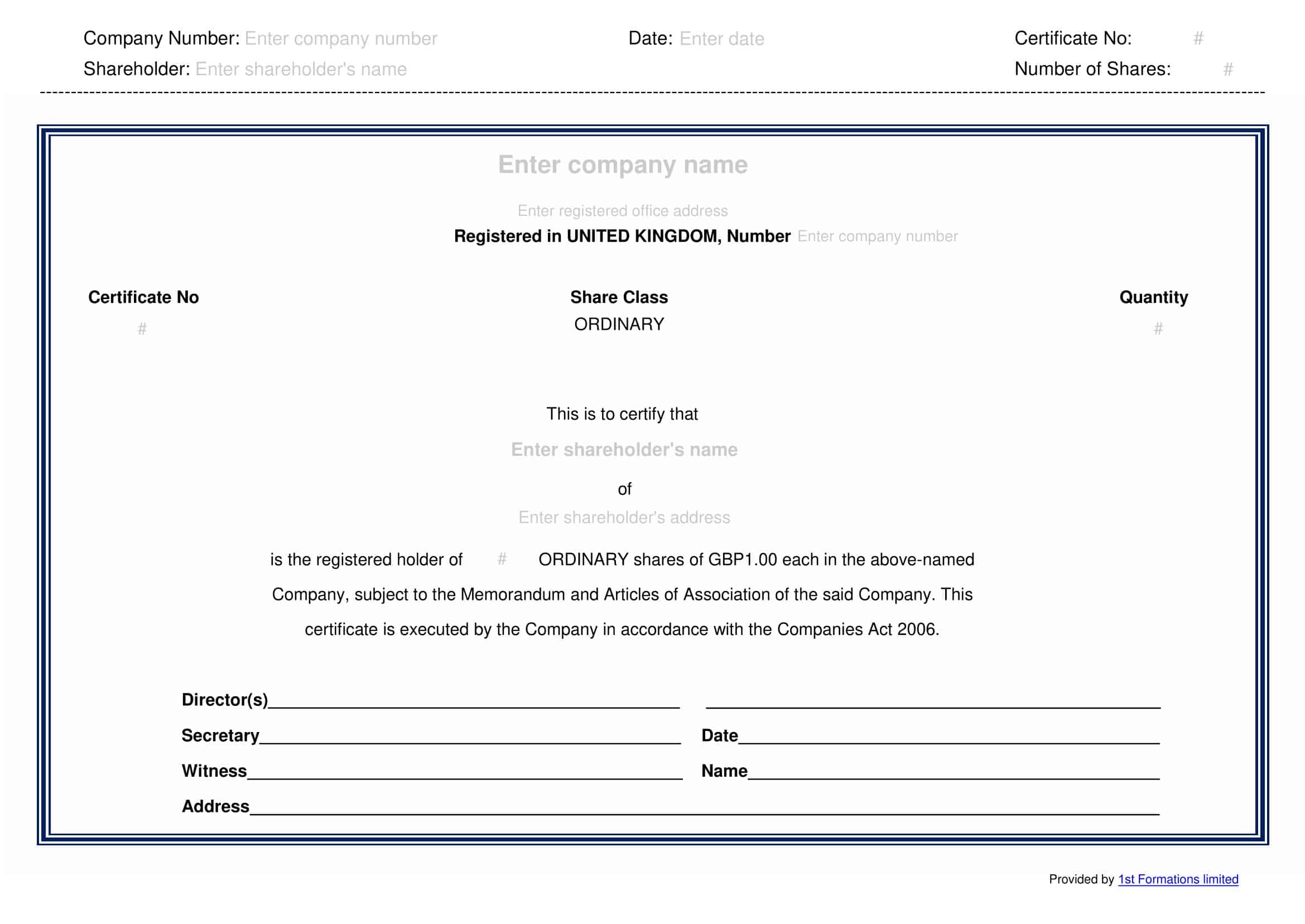

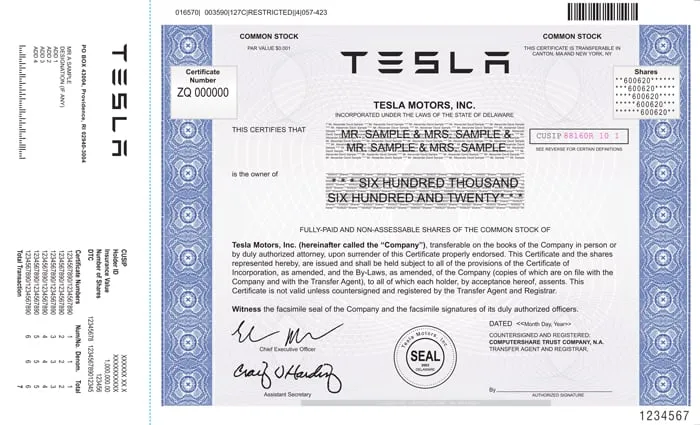

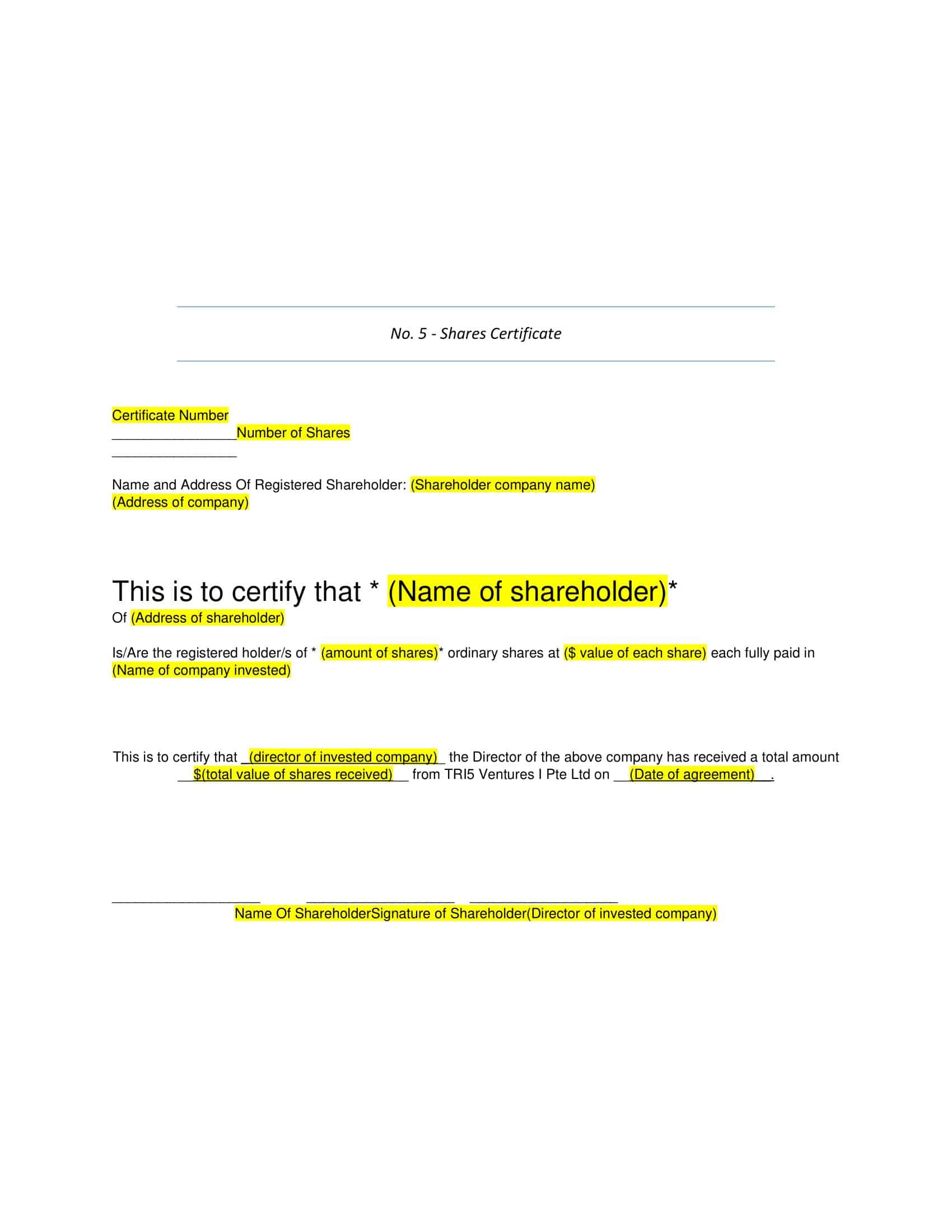

Stock certificate templates are professionally designed documents that serve as a tangible representation of ownership in a company or organization. These templates provide a consistent and structured format for creating stock certificates, ensuring accuracy and authenticity in recording ownership details.

A stock certificate is a legal document that confirms an individual or entity’s ownership of shares in a company. It serves as proof of investment and entitles the shareholder to various rights, such as voting privileges, dividends, and a share of the company’s assets. Stock certificate templates provide a standardized framework for issuing these certificates, making the process efficient and straightforward.

Stock certificate templates offer a consistent and professional approach to issuing ownership certificates, ensuring accuracy, security, and compliance with legal requirements. By utilizing these templates, companies can streamline their stock issuance process, reduce administrative errors, and provide shareholders with well-designed, official documents that reflect their ownership rights.

What Is a Stock Certificate Template?

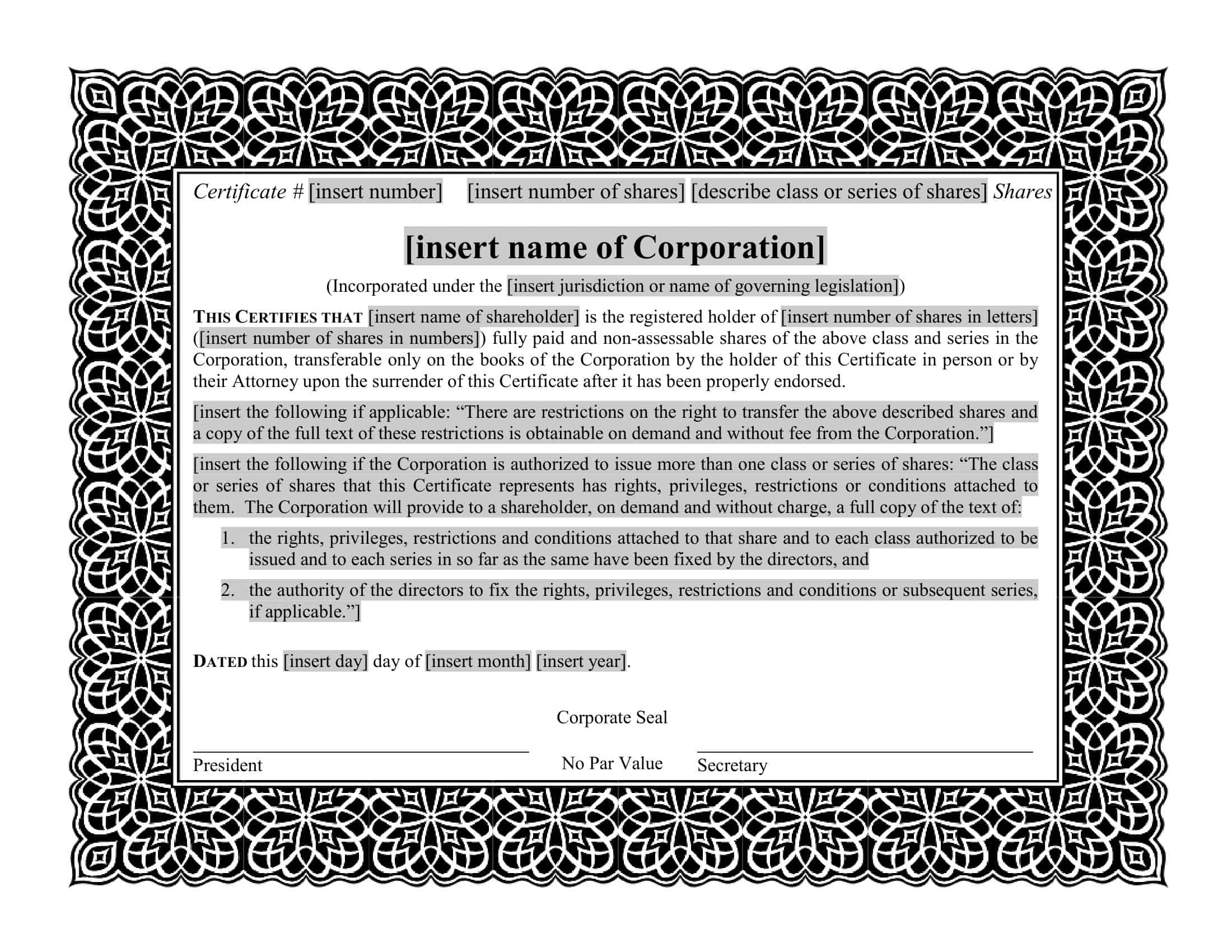

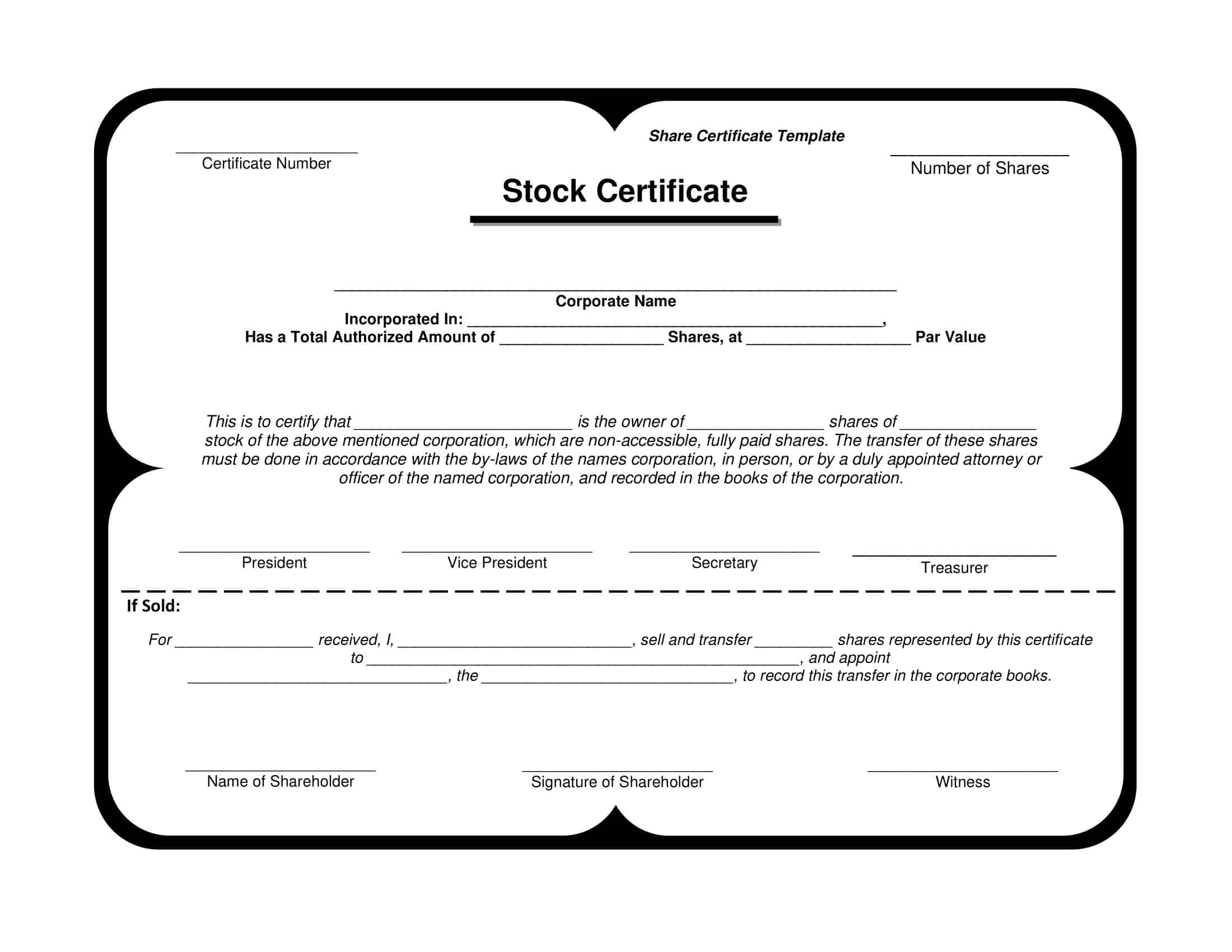

A stock certificate template is a pre-designed document that can be used as a starting point to create a customized stock certificate. It typically includes the layout and formatting of the certificate, as well as placeholders for the company’s name, the stockholder’s name, the number of shares owned, and the date of issue. Some stock certificate templates may also include additional information, such as the company’s logo, the signature of the company’s president or CEO, and the company’s mailing address.

Stock certificate templates can be created using a word processing or desktop publishing program, and can be customized to meet the specific needs and branding of the company issuing the certificate. They are often used by small businesses or startups that do not have the resources to create a customized stock certificate from scratch.

Essential informations in a stock certificate

A stock certificate typically includes the following essential information:

The name of the company: This is the legal name of the corporation that has issued the stock.

The stockholder’s name: This is the name of the person or entity that owns the shares represented by the certificate.

The number of shares owned: This is the number of shares that the stockholder is entitled to as the owner of the certificate.

The date of issue: This is the date on which the certificate was issued to the stockholder.

The par value of the shares: This is the face value of each share, which is typically a small nominal amount.

The class of stock: This refers to the type of stock that is represented by the certificate, such as common stock or preferred stock.

The serial number of the certificate: This is a unique number that is assigned to each certificate to identify it.

The signature of the company’s president or CEO: This serves as a form of authentication and indicates that the certificate is official.

The corporate seal: This is a stamp or embossed symbol that represents the company and serves as an additional form of authentication.

Types of Stock Certificates

There are two main types of stock certificates: registered stock certificates and bearer stock certificates.

Registered stock certificates: These certificates are issued in the name of the stockholder and are registered with the company or its transfer agent. This means that the company maintains a record of the stockholder’s name and the number of shares owned. Registered stock certificates can be transferred to another person only by going through the proper legal channels and updating the company’s records.

Bearer stock certificates: These certificates are not registered in the stockholder’s name and do not have the stockholder’s name printed on the certificate. Instead, they are issued to “the bearer,” which means that whoever holds the certificate is considered the owner. Bearer stock certificates can be transferred simply by physically transferring the certificate to another person. Because of their ease of transfer, bearer stock certificates are less common than registered stock certificates and are often used in more risky or speculative investments.

When Is a Stock Certificate Used?

A stock certificate is typically used when a person or entity buys or sells physical stock in a company. In modern finance, it is more common for stock to be bought and sold electronically, without the need for a physical certificate. However, some investors or collectors may prefer to own a physical stock certificate as a tangible record of their ownership.

Stock certificates are also sometimes used in the following situations:

As collateral for a loan

A stock certificate can be used as collateral for a loan, in which case the lender holds onto the certificate until the loan is paid back.

As a gift

A stock certificate can be given as a gift, in which case the recipient becomes the owner of the shares represented by the certificate.

As part of a will or estate

A stock certificate can be included in a will or estate plan as a way to transfer ownership of the shares to another person after the owner’s death.

As a collectible

Some people collect stock certificates as a hobby, particularly those from historical or significant companies.

Overall, stock certificates are less commonly used today than they were in the past, due to the widespread adoption of electronic stock trading and the increased use of dematerialized (paperless) ownership records.

Rights and Privileges of Shareholders

Shareholders, also known as stockholders, are the owners of a company and have certain privileges as a result of their ownership. These privileges can vary depending on the type of stock that they own and the specific provisions of the company’s articles of incorporation and bylaws. Some of the general privileges of shareholders may include:

The right to vote

Shareholders have the right to vote on matters related to the company’s governance, such as the election of directors and the approval of major business decisions.

The right to receive dividends

Shareholders may be entitled to receive a portion of the company’s profits in the form of dividends. The amount and frequency of dividends are typically determined by the company’s board of directors.

The right to sell their shares

Shareholders have the right to sell their shares to other investors, either through a broker or directly to the buyer.

The right to inspect the company’s financial records

Shareholders have the right to review the company’s financial records and ask questions about the company’s financial performance.

The right to sue the company or its directors

In certain situations, shareholders may have the right to bring legal action against the company or its directors for breach of fiduciary duty or other wrongdoing.

It’s important to note that the privileges of shareholders are subject to the provisions of state and federal law, as well as the company’s articles of incorporation and bylaws. Shareholders should carefully review these documents to understand their rights and obligations as owners of the company.

How to cash in your paper stock certificates

There are several steps involved in cashing in stock certificates:

Find a buyer

You can sell your stock to another investor through a brokerage firm or directly to the buyer. If you are selling through a brokerage firm, you will need to open an account and place an order to sell your stock. If you are selling directly to a buyer, you will need to find a willing buyer and agree on a price.

Transfer ownership

In order to transfer ownership of the stock to the buyer, you will need to sign the back of the stock certificate and fill out a stock power form. The stock power form is a legal document that transfers ownership of the stock from you to the buyer. You will need to provide the buyer with the original stock certificate and the completed stock power form.

Send the documents to the transfer agent

The transfer agent is a company that is responsible for maintaining the company’s records of stock ownership. You will need to send the original stock certificate and the completed stock power form to the transfer agent, along with any fees that may be required. The transfer agent will then update the company’s records to reflect the transfer of ownership and issue a new stock certificate to the buyer.

Wait for the stock to be transferred

The transfer process can take several weeks to complete. During this time, you will not be able to sell or transfer the stock again.

Collect your proceeds

Once the transfer is complete, the buyer will pay you the agreed-upon price for the stock. If you are selling through a brokerage firm, the proceeds will be deposited into your brokerage account. If you are selling directly to a buyer, you will receive payment by check or bank transfer.

FAQs

Is a stock certificate necessary to own stock?

Not necessarily. In the past, stock certificates were the only way to prove ownership of stocks. However, today, most stocks are held electronically in a brokerage account, and a stock certificate is not required to prove ownership.

Can a stock certificate be replaced if it is lost or destroyed?

Yes, it is possible to replace a lost or destroyed stock certificate. The process for doing so varies depending on the company and the brokerage firm holding the stock. In general, the shareholder will need to provide proof of ownership and complete a request for a replacement certificate.

Can a stock certificate be transferred to another person?

Yes, a stock certificate can be transferred to another person by completing a transfer form and submitting it to the company or brokerage firm holding the stock. The new owner will then be issued a new stock certificate in their name.

Are there different types of stock certificates?

There are several types of stock certificates, including common stock, preferred stock, and restricted stock. Common stock represents ownership in a company and entitles the shareholder to vote at shareholder meetings and receive dividends. Preferred stock generally has a higher claim on a company’s assets and earnings than common stock, and may also have a fixed dividend. Restricted stock is stock that is subject to certain restrictions, such as a vesting period, and may not be sold or transferred until the restrictions are lifted.

What is a digital or electronic stock certificate?

A digital or electronic stock certificate is an electronic record of ownership of a specific number of shares in a company, rather than a physical certificate. Some companies offer electronic stock certificates as an alternative to traditional paper certificates.

Can a stock certificate be sold or traded?

Yes, a stock certificate can be sold or traded through a brokerage account or on a stock exchange. The process for doing so is similar to selling or trading any other security.

Is it possible to own a stock certificate directly from a company?

It is possible to own a stock certificate directly from a company, but this is less common than owning stock through a brokerage account. In order to own a stock certificate directly from a company, the shareholder will need to complete a request for the certificate and purchase the stock directly from the company.

Do all companies issue stock certificates?

Not all companies issue stock certificates. Some companies have transitioned to electronic record keeping and no longer issue physical stock certificates.

Are stock certificates valuable?

The value of a stock certificate is determined by the value of the underlying stock. If the stock is worth a lot, the certificate may have value as a collectible. However, the primary value of a stock certificate is as proof of ownership of the underlying stock.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)