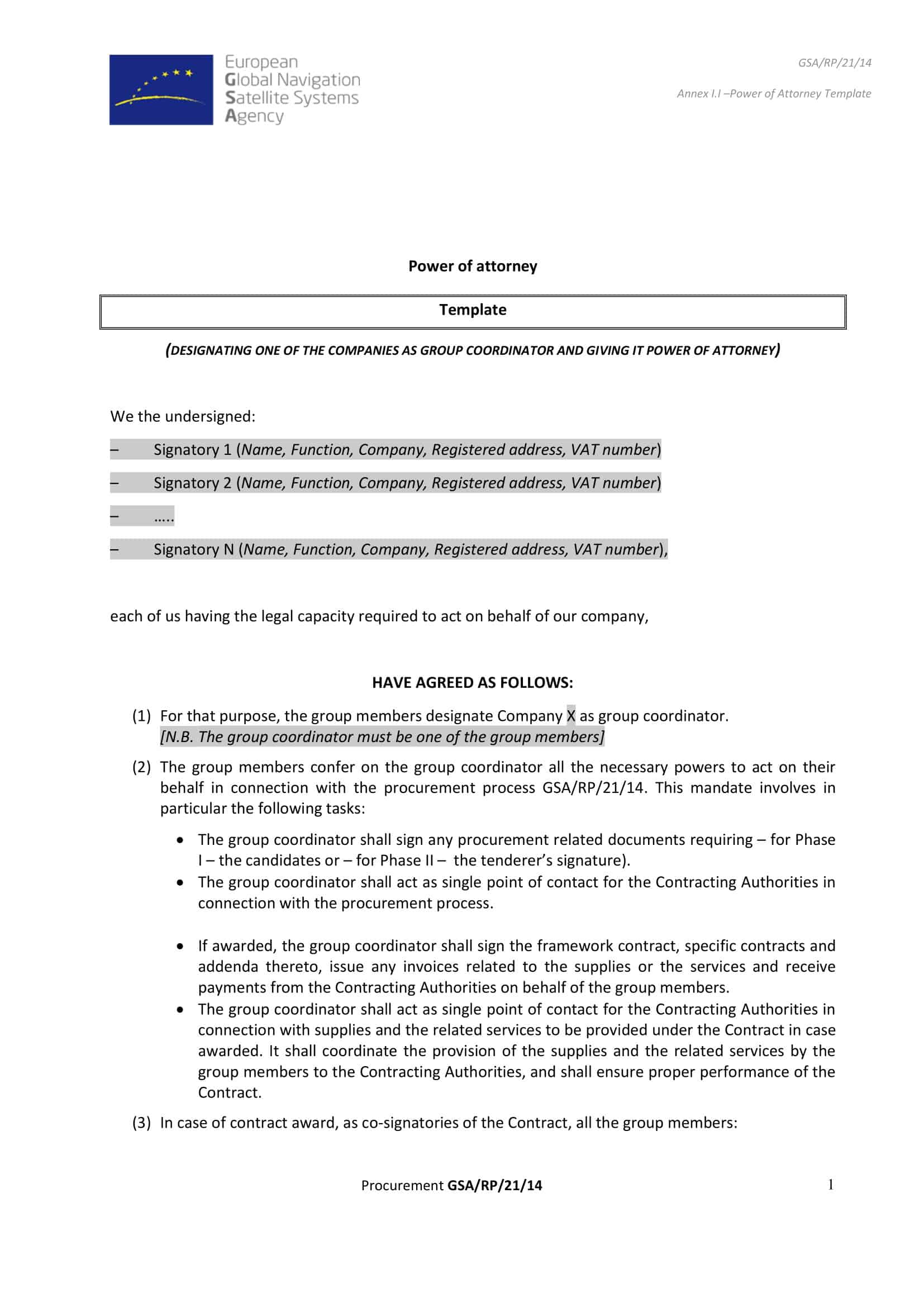

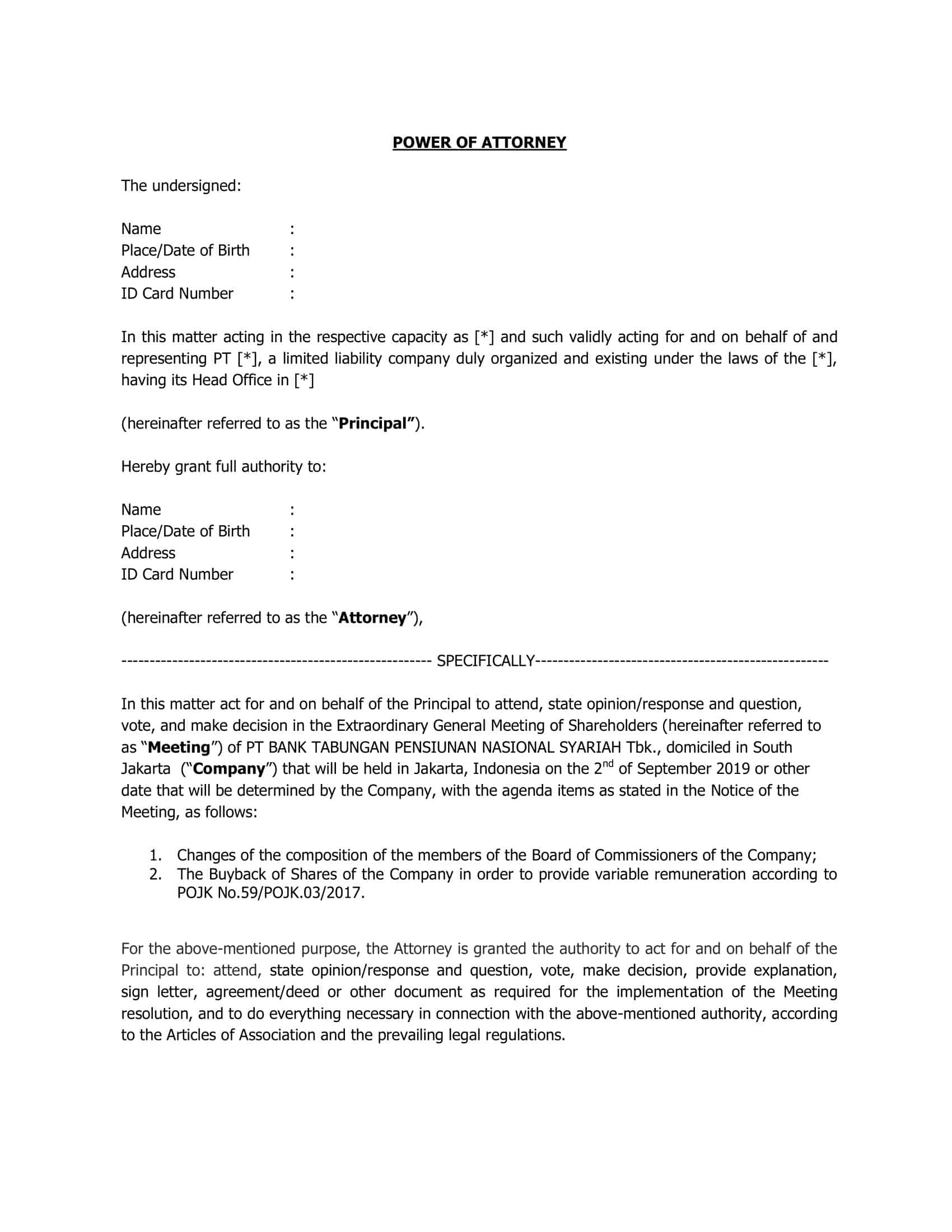

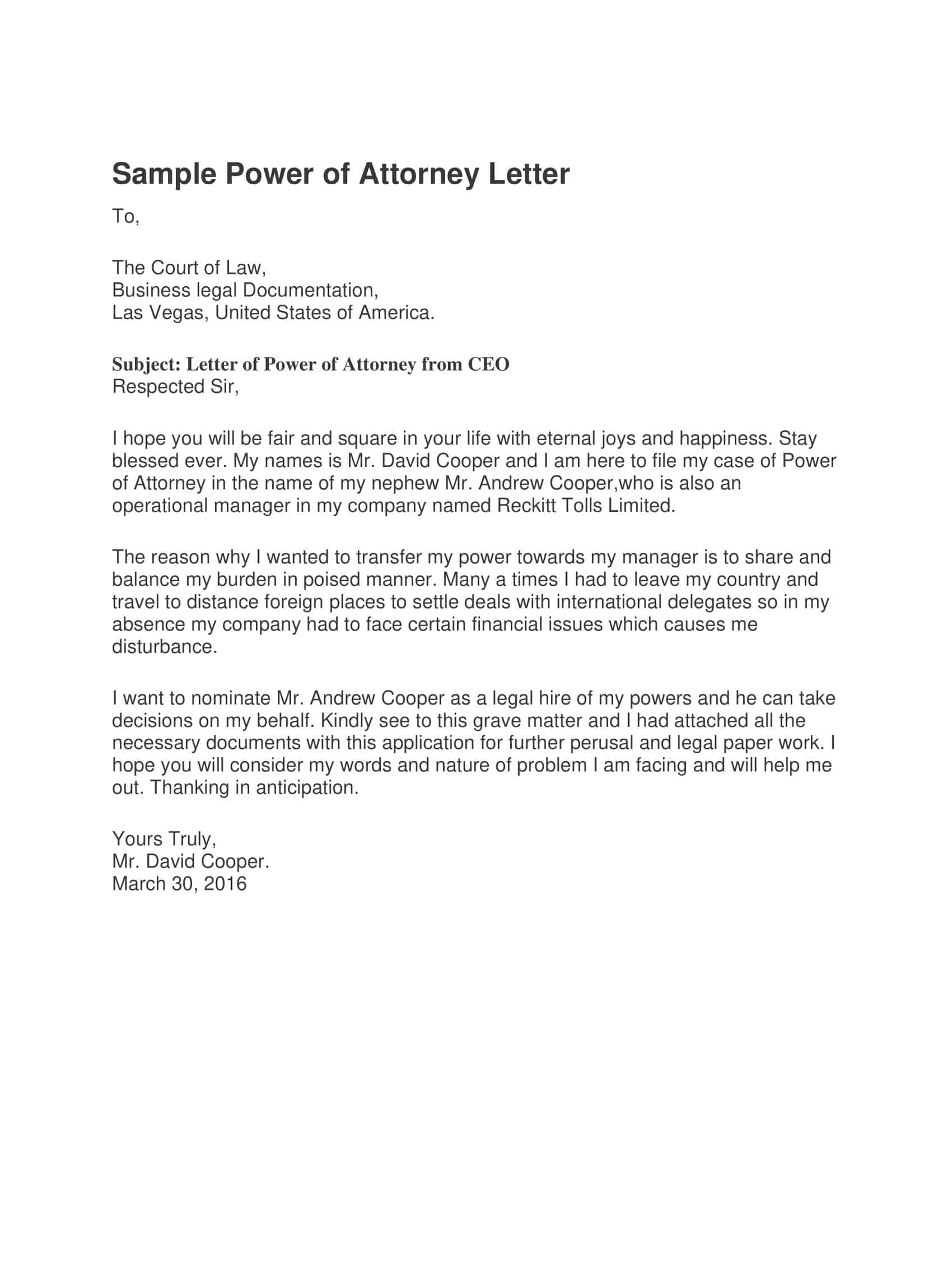

A Power of Attorney Letter is a document in which you authorize a person in writing to carry out certain transactions on your behalf. The scope of authority (which matters and which institutions), the duration (start and end dates or one-time), the geographic scope, the revocation terms, and the parties’ identity and contact information should be stated clearly in the document.In practice, two types are common: a general power of attorney (covering multiple matters and institutions) and a limited/special power of attorney (narrow authority for a single matter or institution). TypeCalendar’s Power of Attorney Letter template files separate these two approaches into clear blocks that you can understand at a glance, allowing you to easily remove unnecessary fields and simplify the text.

Table of Contents

When do you need a power of attorney?

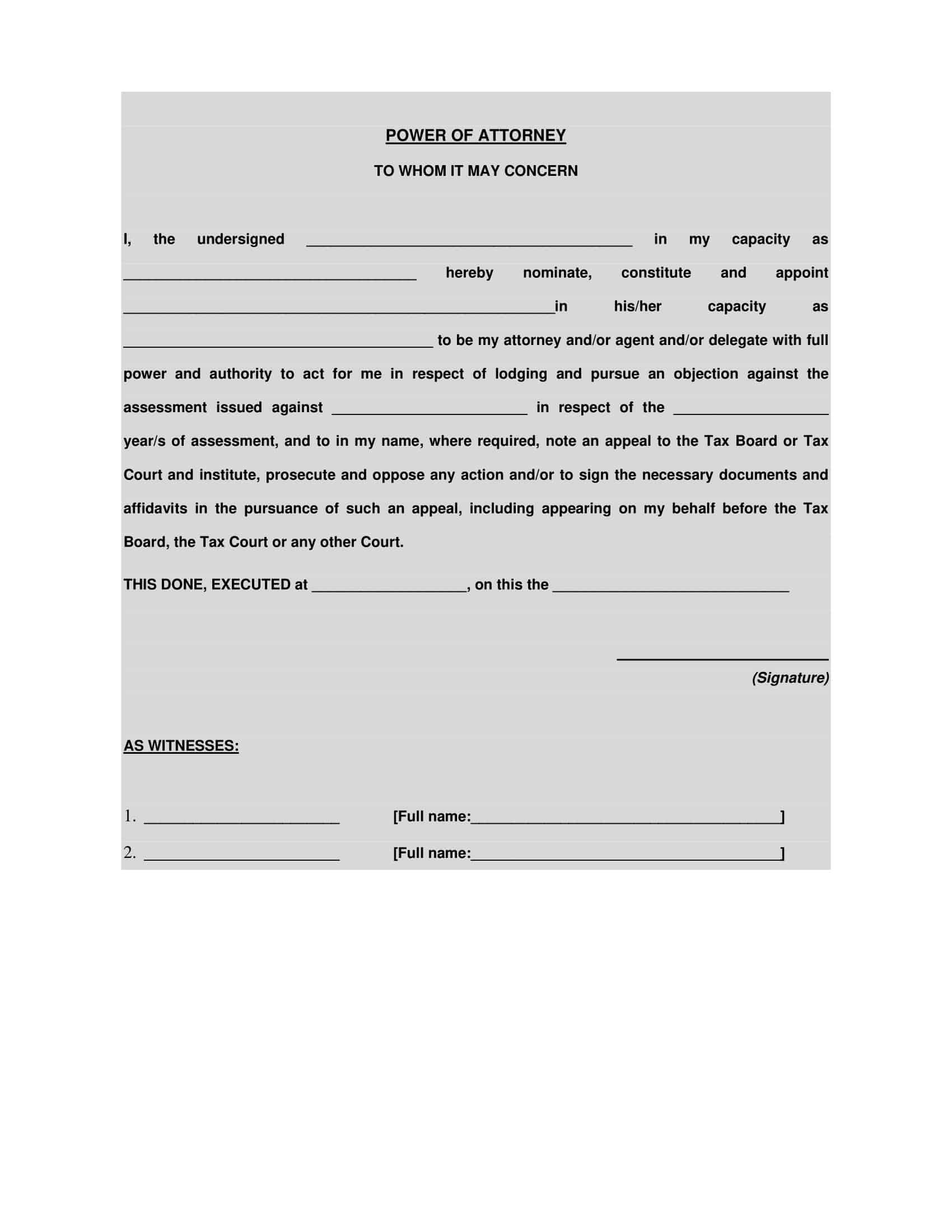

Power of attorney letters are used to progress the process without stopping when you are not present. The most common examples include signing documents at bank branches and obtaining information, package delivery/receiving, obtaining and applying for documents at public institutions, vehicle delivery and service acceptance, appointments and document tracking in title deed and real estate transactions, parent/guardian permissions for school and health records, and one-time, short-term authorizations.

A correctly designed Power of Attorney Letter template reduces the risk of misunderstanding by keeping the scope in moderation; if necessary, it speeds up the process with ready-made fields reserved for witness signature or notary approval. TypeCalendar uses modular paragraphs you can narrow to your needs, such as “document delivery only,” “application and signature only,” or “time-limited special authority.”

Power of Attorney Letter Templates

What’s included in the TypeCalendar package?

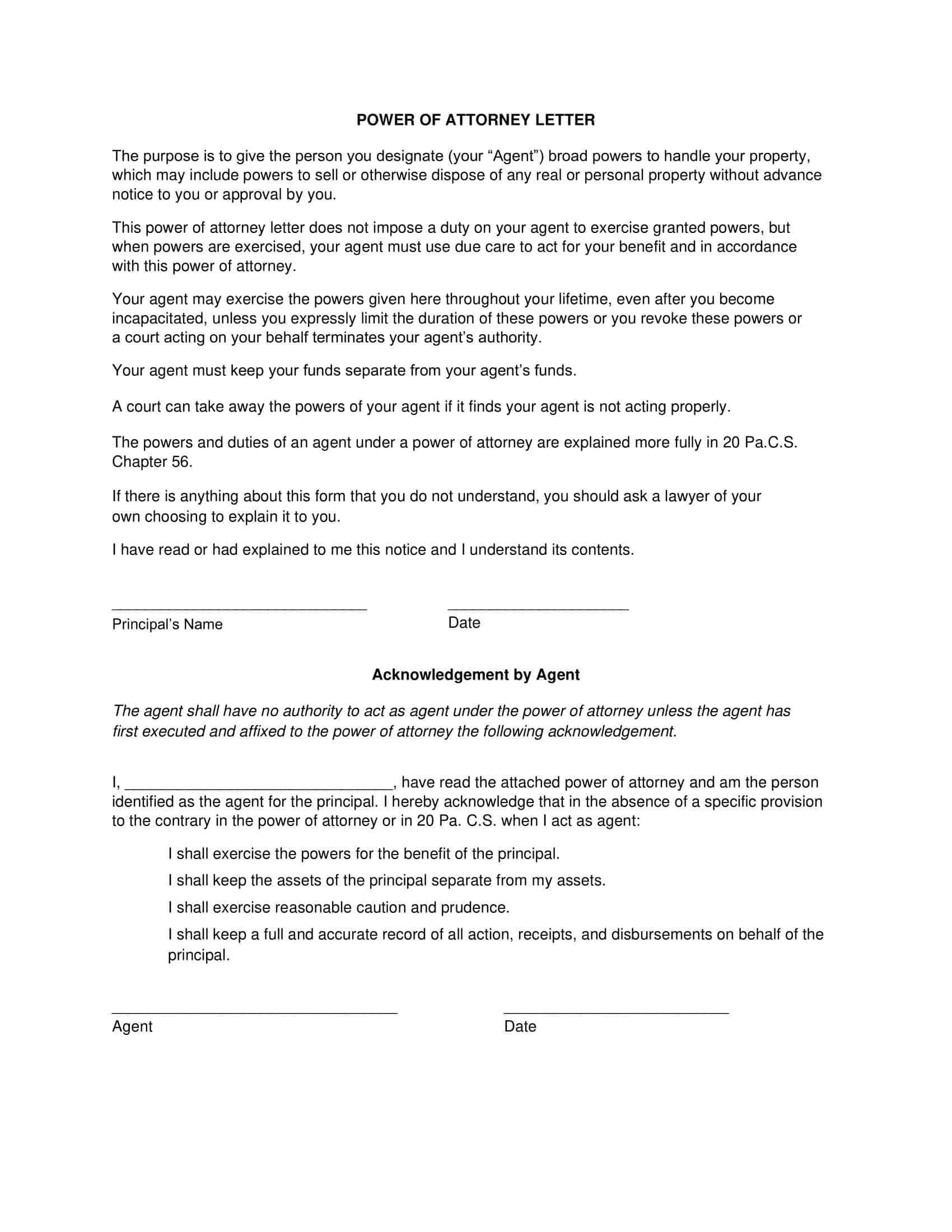

TypeCalendar offers 36 free Power of Attorney Letter templates, all in one folder. The package contains content divided into scenarios such as ”General Authorization“, ”Special Authorization – Banking“, ”Special Authorization – Vehicle / Real Estate“, ”Document Delivery–Receipt“, ”One-Time / Short-Term Authorization“ and ”Parent/Guardian Authorization”. Each template includes principal and agent (attorney-in-fact) identification fields, a scope of authority checklist, effective and end dates, a revocation clause, a communications/status note, witness and notary blocks, and a list of attachments (copy of ID, appointment or application number).

You can choose between formal–institutional tone, warmer–appreciation-oriented tone or short summary versions depending on the need; you can use email text, official letter and “acceptance slip” variants together for the same scenario.

Formats, editing, and output (ready to use)

All templates are available in DOCX, PDF, and Google Docs formats, with A4 and US Letter sizes available. Placeholders (full name, ID or passport number, address, scope of transaction, date) are fully editable. You can hide or remove fields you don’t need. PDF files are ready to be printed; when “Actual Size” is selected, signature–initials lines are aligned correctly. Signature blocks and acknowledgment/receipt forms are also provided as separate pages for e-signature workflows. High-contrast versions for black-and-white printers, 300 dpi resolution for long-lasting use, and spacing settings suitable for company letterhead are included in the package.

Download now: create a valid power of attorney letter in minutes

Download the free 36-template Power of Attorney collection from TypeCalendar. Choose the template that fits your situation, fill in the scope, duration, and ID fields, turn on witness/notary blocks if needed, then print or send for e-signature. Whether it is a one-time document submission or a comprehensive bank–real estate transaction, a properly structured template speeds up the process, reduces errors and facilitates archiving. Download and edit today; move the authorization step to a clear, organized and acceptable format.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![%100 Free Hoodie Templates [Printable] +PDF 2 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 3 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)