Getting your bills organized can be a huge relief. It helps you avoid late fees, missed payments, and other issues that come from not paying bills on time. You can use this monthly bill template to help you stay organized. A monthly bill calendar list is essential when you are using a check register to keep track of your bills.

Table of Contents

What is a Bill Pay Checklist?

A bill pay checklist lists all the bills you need to pay each month. It’s a great way to stay organized and ensure that you don’t miss any payments.

A bill pay checklist can be used by anyone who pays bills online, whether it’s for personal or business purposes. This includes things like credit cards, student loans, and mortgages.

The best part about having an easy-to-use checklist is that it helps you keep track of everything. Instead of trying to remember when each bill is due and what the amount is, you can just check off each item on your list as it’s paid off.

Bill Pay Checklist Templates

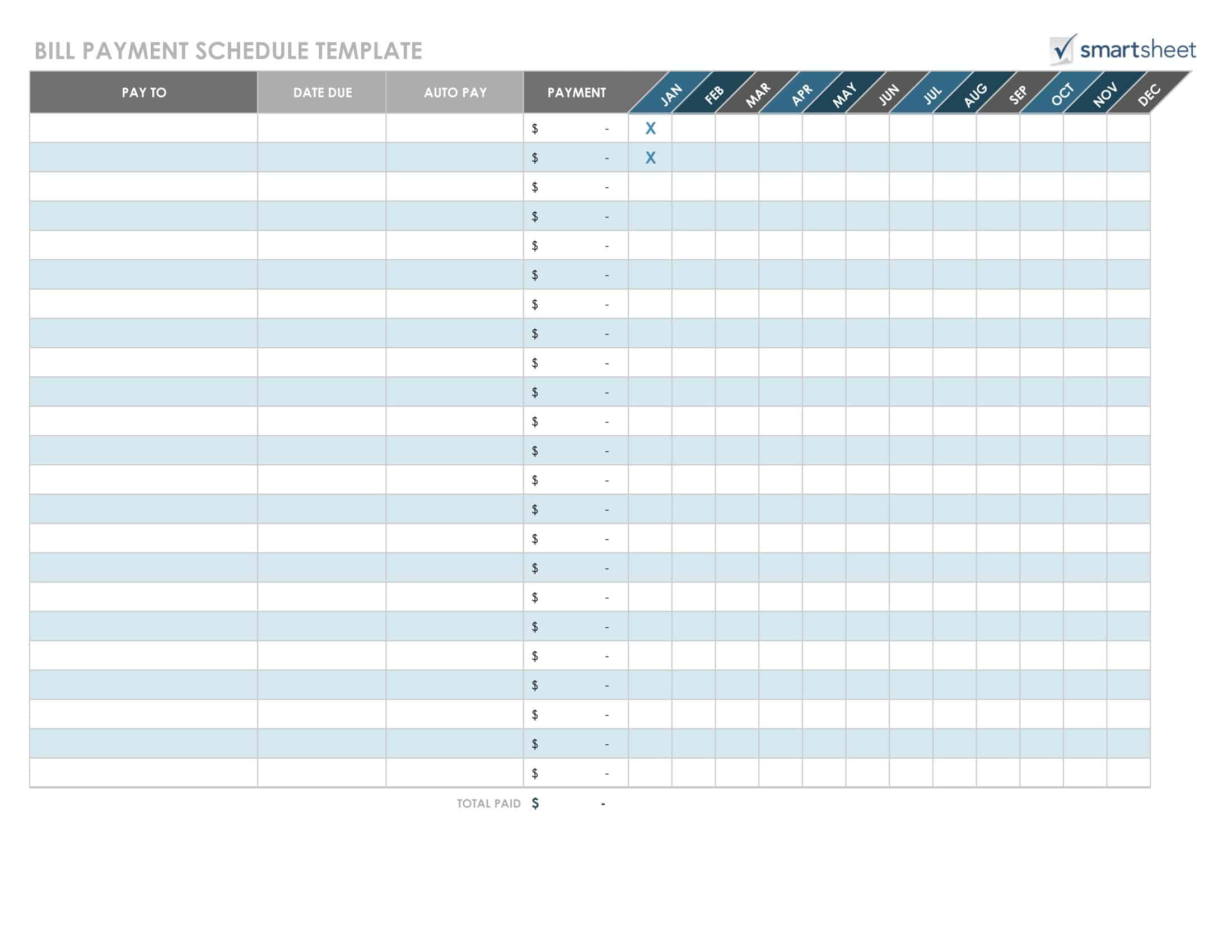

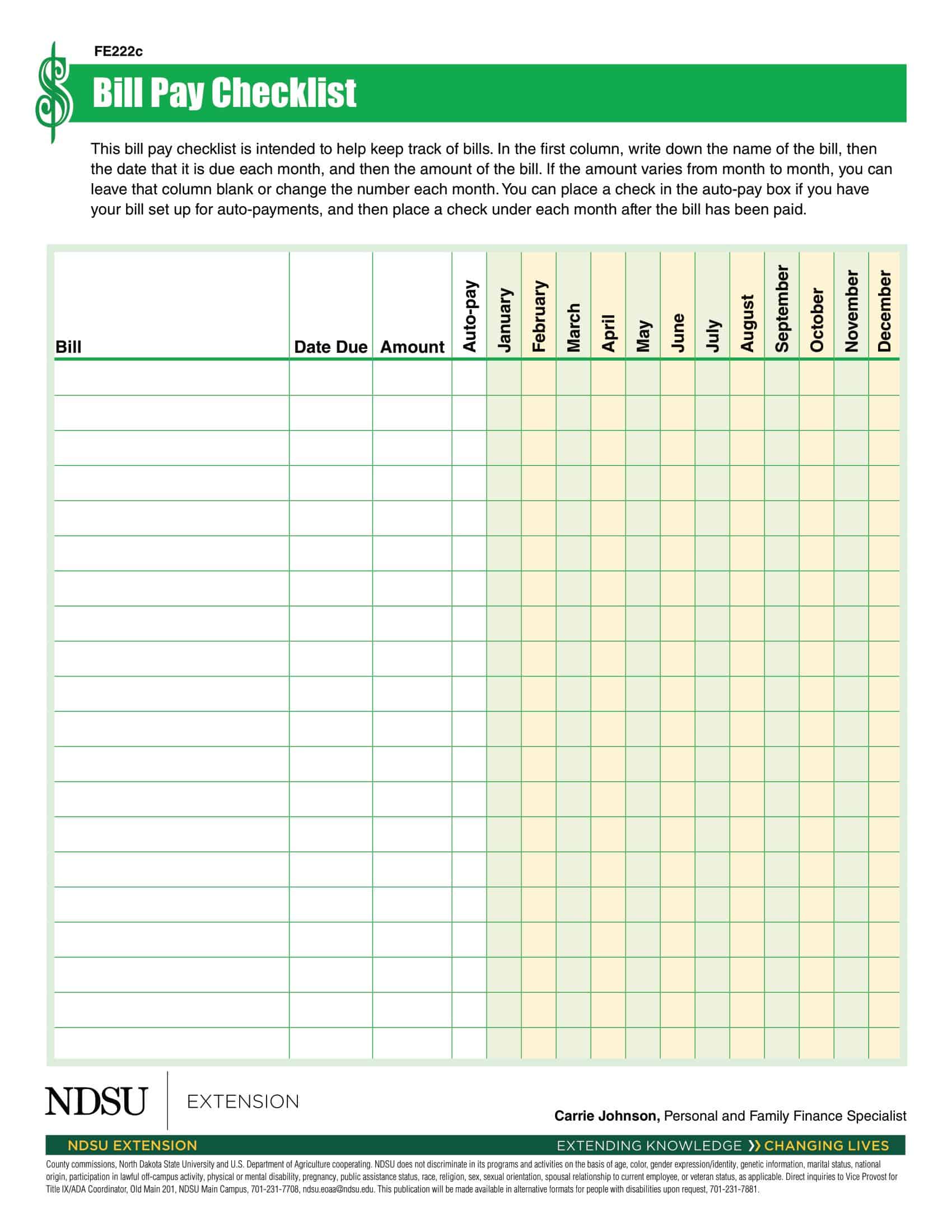

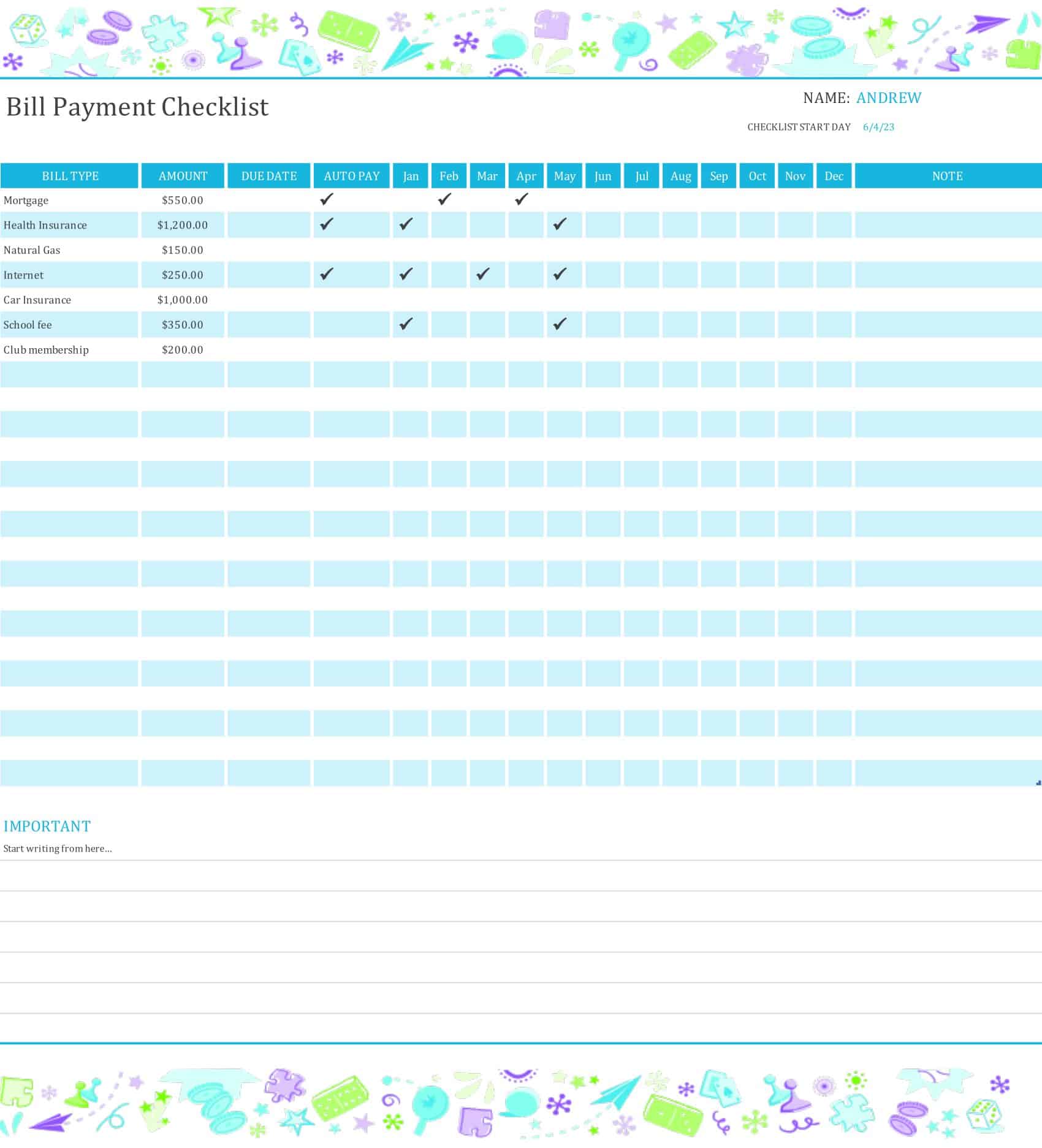

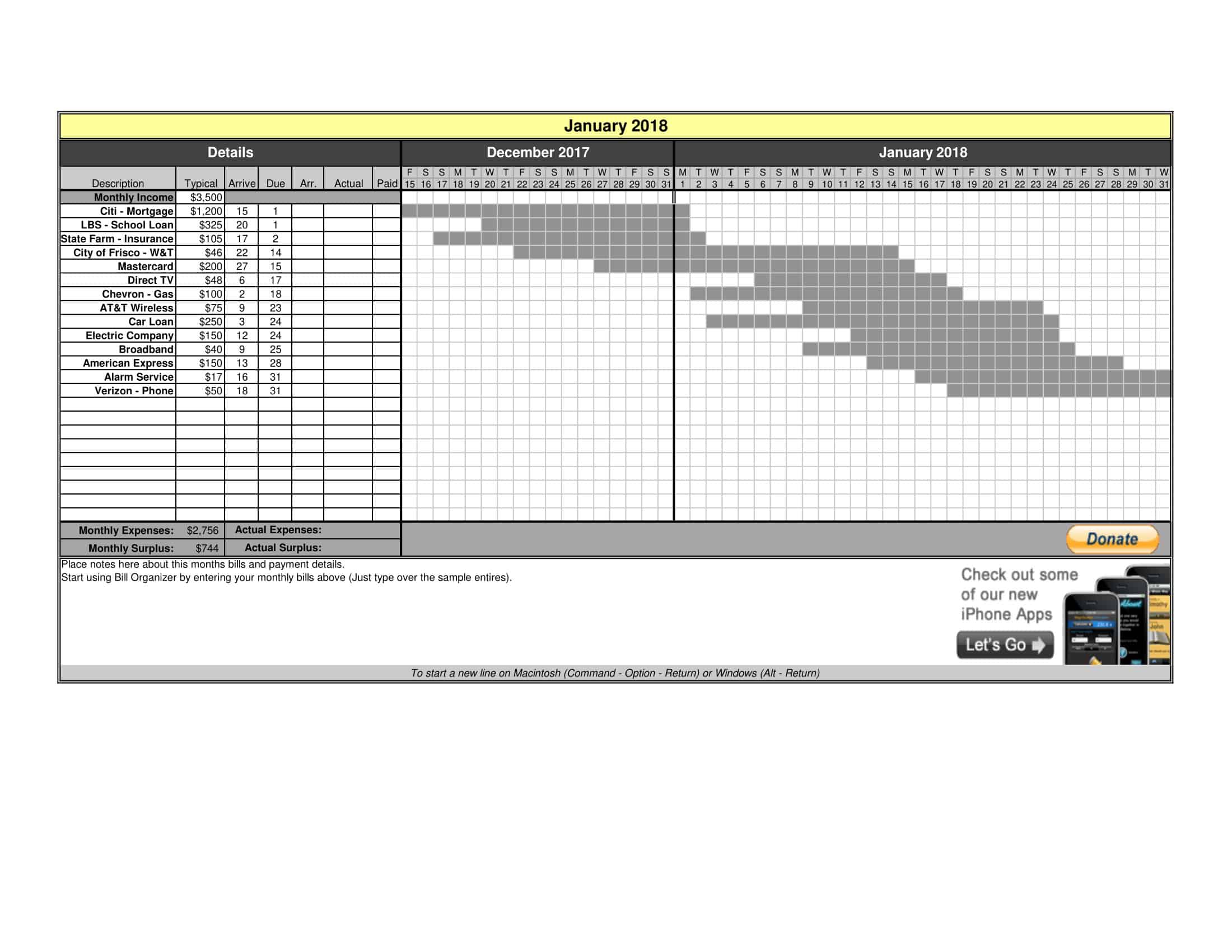

Bill Pay Checklist Templates are practical tools used to help individuals or households organize and manage their monthly bill payments effectively. These templates provide a structured format for tracking and ensuring timely payment of various bills, such as utilities, rent/mortgage, credit cards, insurance, subscriptions, and other recurring expenses.

Bill Pay Checklist Templates can be customized based on individual preferences, specific bill payment requirements, or budgeting needs. They can be designed as printable checklists, digital spreadsheets, or integrated into personal finance management apps or software. By utilizing Bill Pay Checklist Templates, individuals can stay organized, avoid missed payments, and maintain better control over their financial obligations. These templates serve as a helpful tool for managing bill payments, ensuring timely payments, and maintaining a healthy financial routine.

Types of bill pay checklists

If you’re looking for a way to stay organized with your bills, a bill pay checklist can help.

A bill pay checklist lists the bills you need to pay and when they are due. It helps you stay on top of your finances and avoid late fees or missed payments.

There are many types of bill pay checklists available online and in stores. Here are some examples:

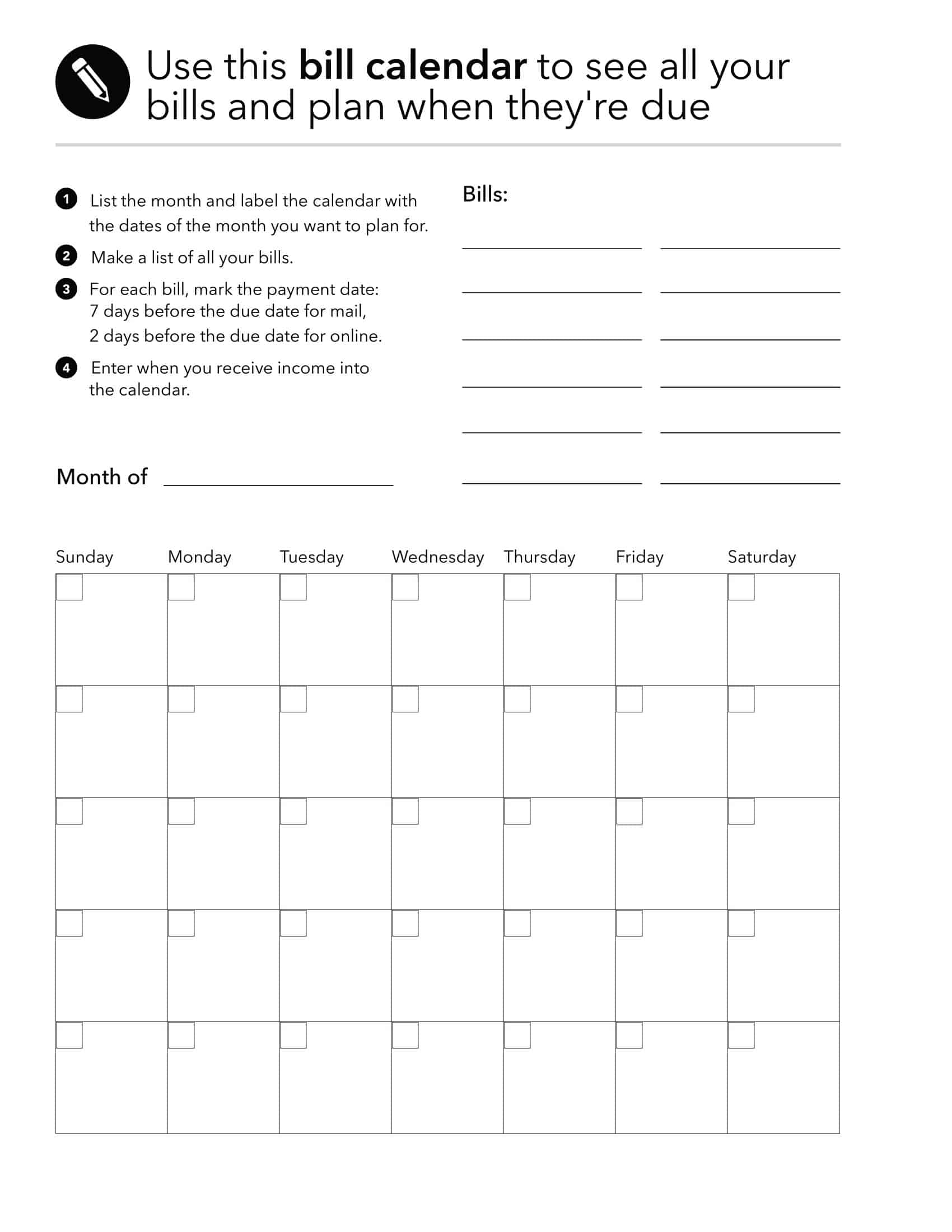

A monthly bill payment log

A monthly bill payment log is helpful because it allows you to keep track of all your due dates without having to go through every single one of them every month. You just check off each one as it comes along and then moves on to the next one. This makes it easy for you when it comes time to pay your bills because all you need to do is look at the calendar and see which ones are coming up next!

Yearly Bill Payment Logs

If you have a lot of regular monthly expenses that come out every year (such as rent or mortgage payments), then an annual bill payment log might be better suited for your needs. This type of checklist allows you to write down all these expenses and their due dates so that they’re not forgotten about until it’s too late!

We recommend using an annual budget checklist if you have multiple regular expenses that come out once every 12 months, such as rent or mortgage payments, property taxes, insurance premiums, and more!

Home Budget Checklist

This bill tracker is for those who have a home budget in place. This is a very important document for people trying to control their finances and want to know exactly where their money is going each month. The home budget checklist can help you keep track of all your expenses, including those that come up during the month, like gas, groceries, and entertainment.

Home maintenance checklist

This type of bill tracker is mainly used by homeowners who want to keep track of the regular maintenance of their homes. You can include many items in this list, such as checking the roof and gutters, changing light bulbs, cleaning the furnace filter, etc. You can also include a section where you can note down any other reminders that you have for yourself.

The important elements of a bill pay checklist

The nature of the bills

Make sure this section includes information about due dates and how many times the year bills are due. That way, when it comes time to pay them, you’ll know exactly when to expect them in the mail (or email).

The payment service for each bill

This section should list the name of each service that sends out your billing statement each month — whether it’s U.S. Postal Service or E-billing — as well as its website address so you can log into your account online and see upcoming payments’ due dates. Your checking account status

In this section, list any accounts that have been linked together for automatic payment processing and your current balance at each one (or at least those accounts with enough money in them).

Checking account status

This section should show whether your checking account is currently in good standing or if there are any issues with it (such as overdrafts). Suppose there are any issues with your checking account status. In that case, they should be addressed immediately so that they don’t affect any future payments made by you or your spouse/partner who uses their own checking account for their expenses.

Frequency of bill payment

Check with each company to find out how often they expect their bills to be paid and whether they charge late fees if payments are late. Some utility companies, for example, will cut off service if you don’t pay within a certain time period after their bill arrives. Others may not add late fees until the next billing cycle starts (for example, if your payment is due on the first day of the month but isn’t made until the fifth day).

Discounts and coupons on utility bills

Find out whether there are any discounts available from your utility provider — especially if you’re paying online — and what they are. You might also want to take advantage of any coupons that can help reduce your costs further.

Family bills records

Keep track of who pays what at what time, so everyone knows how much money is coming in and going out of the household account each month. This will help prevent overspending.

Setting up your bill pay checklist.

To ensure you get started right, we’ve created a checklist covering the basics of setting up online bill payments with us.

- Select the type of bill payment account you want to create: Personal Account or Business Account. You can also choose the type of account you want by clicking on the drop-down menu in the upper right-hand corner of our website and selecting “Create a New Account.” Read more about our different types of accounts here.

- Choose whether or not you are eligible for paperless statements. If you’re unsure, go ahead and select “Yes” so you don’t miss any important information from your credit card company or other companies that send you paper statements by mail each month!

- Enter all required personal details (email address, phone number, etc.), so we can contact you if there is ever a problem with your bill payments (or anything else).

- Create an easy-to-remember password and security question (for example: What was your first pet’s name?). Then click “Next” at the bottom of this page and follow the instructions.

How to Use A Bill Pay Checklist

You have a lot on your plate. Bills, bills, and more bills. You can’t afford to miss a payment, or it could cost you money in late fees and other penalties.

To help you remember all the little details involved with bill paying, create a checklist for yourself. It will help you ensure you’re getting paid what’s due to you and staying on top of your payments.

Here are some tips for using a checklist to manage your bills:

- Set up reminders for yourself. Use an online calendar or planner to set up reminders, so you don’t forget when payments are due each month. This way, you’ll never miss a payment again!

- Make sure to check your bank statement every month for any charges that weren’t authorized by you or weren’t expected. This can help prevent unauthorized charges from appearing on your account later on down the road, which can result in overdraft fees or worse!

- Create a separate list or folder in your email inbox specifically for all of your bills, so they’re easy to find when it’s time to pay them off each month; don’t put them in with other emails or documents because they may get lost!

- If you have any accounts that automatically renew or charge a fee, check their settings so that they do not occur during the next payment cycle. For example, if you have a credit card that charges an annual fee on January 1st, check its settings so that no payments are scheduled on January 1st or 2nd. Paying these bills manually will prevent them from being charged an additional fee or renewed automatically when they should not be because you have already paid them through this bill-pay transaction!

- Select any payees who you want to pay early or late by checking the appropriate box on each payee’s information screen (for example, if you want to pay your rent early).

FAQs

How do I make a bill checklist?

Make a table or spreadsheet with columns for the bill name, due date, amount owed, date paid, and notes. List out all your regular bills like rent, utilities, loans, subscriptions, etc. Update it as new bills come in. Check off each one when you pay it for an easy way to track bill payments.

How do I keep track of my bill payments?

Mark all due dates on your calendar as soon as bills arrive. Set up automatic payments or reminders on your phone when possible. Request email notices for bills to help remember. Use a bill organizer or spreadsheet to record payments. Check it weekly and check off items when paid. Save receipts or confirmation numbers. Note any autopay dates.

How do I set up a bill paying system?

First, catalogue all your recurring bills with due dates and amounts in a checklist format. Choose a consistent bill pay schedule, like weekly or bi-monthly. Decide on payment methods – automatic bank drafts, mailed checks, online payments. Use calendar alerts and notebook logging to stay organized. Automate as much as possible. Pay the highest priority bills first.

Is there an app that puts all your bills in one place?

Yes, apps like Mint, Tiller, and Prism compile all your bills in one dashboard. They track due dates, scan your email for bill notices, record payment history, and can send alerts. Some will create charts of your spending or allow you to sync transactions with your bank. These apps aim to simplify bill organization.

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 1 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Goal Chart Templates [PDF, Word, Excel] 3 Goal Chart](https://www.typecalendar.com/wp-content/uploads/2023/06/Goal-Chart-150x150.jpg)