Business expense management isn’t merely a task; it’s an essential cog in the wheel of successful financial planning. Our article focuses on the ever-relevant tool – a Business Expense Spreadsheet – your best ally in the battle against disarray and inefficiency.

From day-to-day operational costs to unpredictable expenditures, we’ll guide you on how to effectively record, track, and manage them all. Prepare to turn your financial chaos into streamlined coherence with the power of a well-structured spreadsheet.

Table of Contents

What is a business expense spreadsheet?

A business expense spreadsheet is a digital or paper document used by businesses to systematically record, track, and manage their financial expenditures. This could range from recurring operational costs like salaries, rent, and utilities, to variable expenses such as marketing costs, travel expenses, and professional fees.

The spreadsheet typically includes columns for the date, vendor, purpose of the expense, category, and the amount spent. By meticulously maintaining such a spreadsheet, businesses can not only keep their finances organized, but also analyze their spending patterns, make informed budgeting decisions, and simplify their tax preparation process.

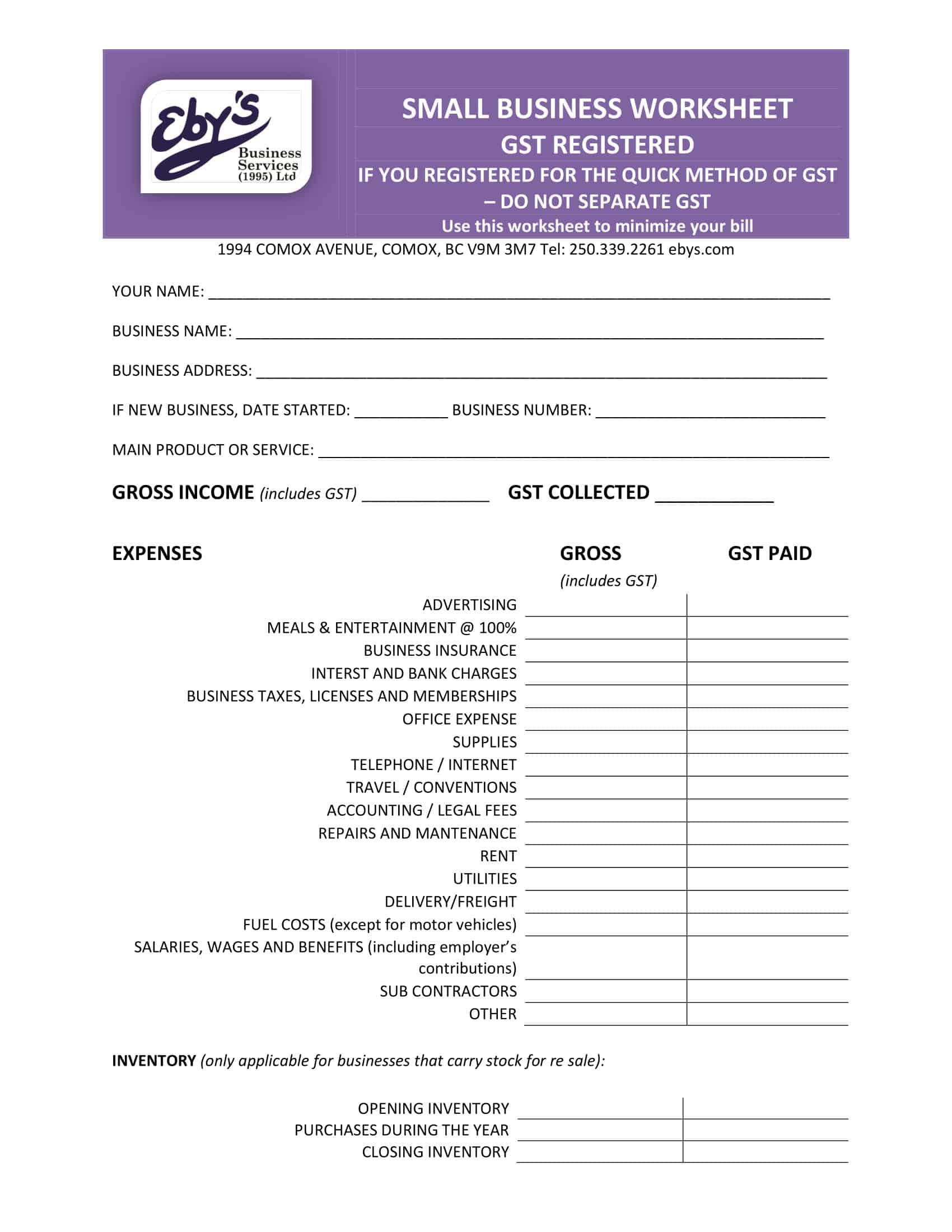

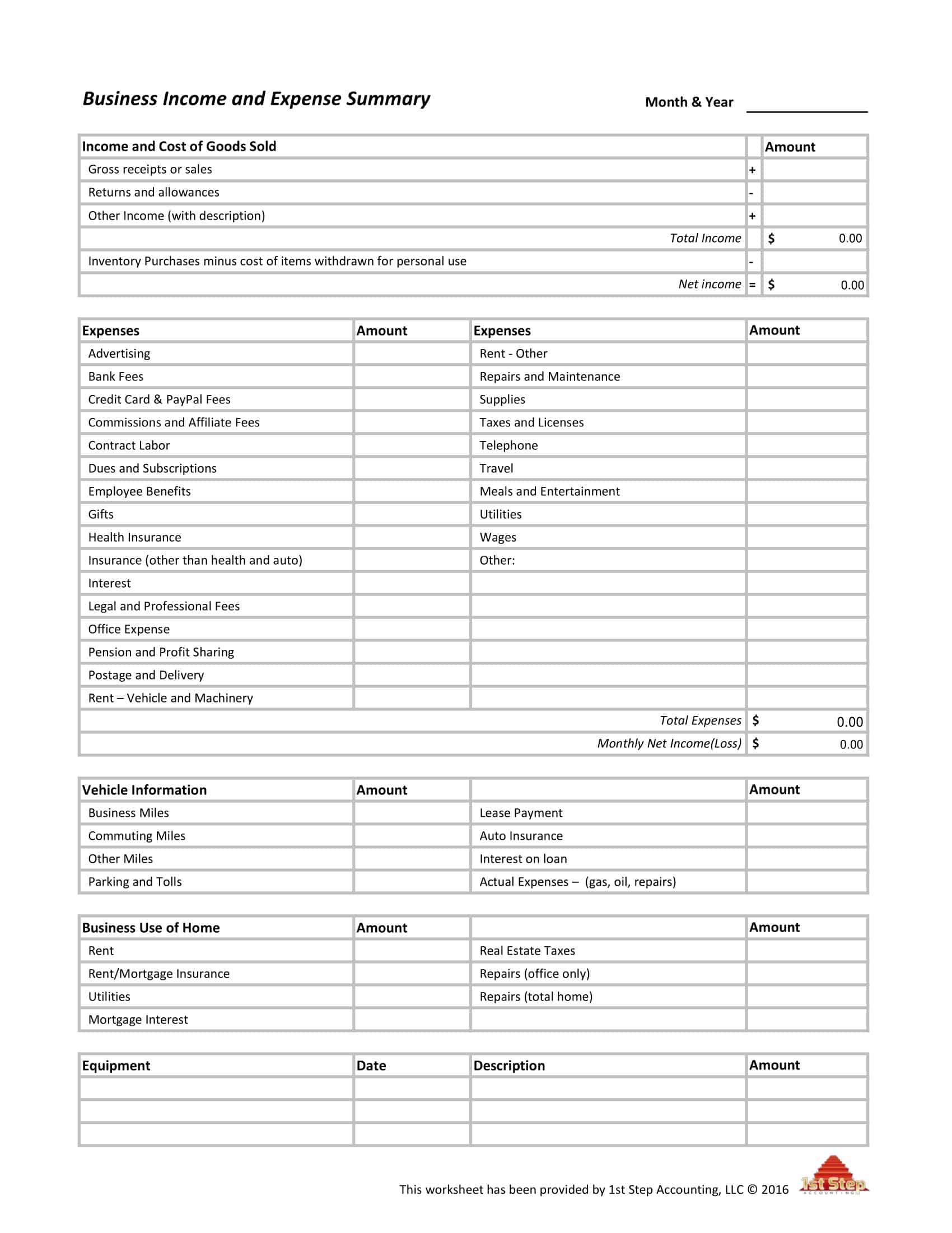

Business Expense Spreadsheet Templates

Business expense spreadsheet templates are preformatted tools designed for businesses to effectively track and manage their expenses. They provide a structured format to record various types of expenditures, making it easier to monitor costs, control spending, and plan budgets.

These templates are commonly designed as Excel spreadsheets or Google Sheets. They contain specific columns to record details such as the date, expense category, vendor, payment method, and the amount spent. Some templates may have additional sections for notes or invoice numbers.

Business expense spreadsheet templates cater to the needs of different types and sizes of businesses. They are suitable for both small businesses that need a simple and efficient tool to track everyday expenses, and larger companies that require a more detailed record of their spending.

Many templates offer customization features, allowing users to add or modify categories to align with their specific business needs. They may also include built-in formulas for automatic calculations of total expenses in a given period, or for each expense category.

Why is important to prepare a spreadsheet for tracking business expenses?

Understanding the importance of preparing a spreadsheet for tracking business expenses lies at the heart of effective financial management. Here are some key reasons why it’s essential:

- Financial Control: First and foremost, a business expense spreadsheet offers you a detailed overview of your company’s financial outflows. By listing all expenses, you can identify where your money is going, and that’s the first step towards controlling and optimizing your expenses.

- Budgeting: An expense tracking spreadsheet helps you create a more accurate budget. By categorizing and quantifying past expenses, you can forecast future spending with greater precision. It allows for smarter budget allocation and aids in resource optimization, keeping your business financially healthy.

- Identifying Trends: Over time, the data collected in the spreadsheet will reveal trends in your spending. You might find that certain expenditures peak during specific times of the year, or that some costs are increasing at a concerning rate. Identifying these trends allows you to take corrective measures proactively.

- Cost Reduction: With all expense data visible and sortable, you can easily identify areas of excess spending. Perhaps office supplies are costing more than they should, or maybe your utility bills are higher than industry averages. The spreadsheet becomes a tool for identifying such opportunities for cost reduction.

- Tax Preparation: Come tax season, having all your expense data in one place simplifies the process of calculating deductible expenses. This can make the difference between a chaotic, last-minute rush and a smooth, stress-free process. It also helps in avoiding any penalties associated with incorrect tax filing.

- Auditing and Compliance: The spreadsheet acts as an easily accessible log for auditing purposes. It ensures transparency and helps meet any financial compliance regulations that your business needs to adhere to.

- Cash Flow Management: Regularly updated expense spreadsheets provide real-time insights into your company’s cash flow, enabling timely interventions whenever necessary.

- Decision Making: When deciding on business strategies or plans, the spreadsheet offers valuable data to guide those decisions. It provides financial evidence that can support or deter potential strategies.

What to Include in a Business Expenses Spreadsheet ?

Designing an effective business expense spreadsheet requires a clear understanding of the key elements that should be included. Here’s a detailed guide:

- Expense Category: The first thing to include in your spreadsheet is the category of the expense. This could be utilities, rent, salaries, marketing costs, travel expenses, professional fees, office supplies, etc. Categorizing your expenses allows for easier analysis and budgeting.

- Vendor/Service Provider: Record the name of the vendor or service provider associated with each expense. This helps you keep track of where your money is going, and may be useful for auditing purposes or when reviewing contracts and agreements.

- Date: Include the date of each expense. This allows you to monitor your spending over time, identify trends or seasonal patterns, and makes it easier to locate specific transactions when needed.

- Description: Add a brief description for each expense. This could include the purpose of the expense, or any other details that would help you understand the nature of the cost. This is especially important for miscellaneous or one-off expenses.

- Amount: Perhaps the most critical item on the list is the amount of each expense. This should be recorded accurately to ensure correct totals and averages.

- Payment Method: Indicate the method of payment used for each expense. This could be cash, credit card, direct debit, etc. This helps with reconciling bank statements and tracking credit card expenditures.

- Receipts/Invoice Reference: If you keep digital copies of receipts or invoices, you can include a reference to the relevant document in your spreadsheet. This could be a link to where the document is stored, or the filename if you save them on your computer.

- Tax Deductible Status: Note whether each expense is tax-deductible. This is crucial for tax time and can save you money if managed correctly.

- Reimbursement Status: If any expenses are due to be reimbursed, either by clients or employees, it’s important to note these and their status (pending, paid, etc).

- Notes: Finally, have a column for any additional notes or comments. You can use this to note any unusual circumstances, reminders, or follow-ups related to the expense.

Different types of spreadsheets for business expenses

There are various types of spreadsheets that businesses can use to manage and track their expenses. Each one serves a specific purpose and can be used in different scenarios depending on the nature of your business. Here are some examples:

Operating Expenses Spreadsheet

This type of spreadsheet tracks all the expenses related to the day-to-day operations of the business. It typically includes items such as salaries, rent, utilities, office supplies, and other costs that recur regularly.

Capital Expenditure Spreadsheet

Used to track and manage capital expenditures, which are large and usually one-time investments in long-term assets like property, plant, or equipment. These spreadsheets help in budgeting for significant expenses and calculating depreciation for tax purposes.

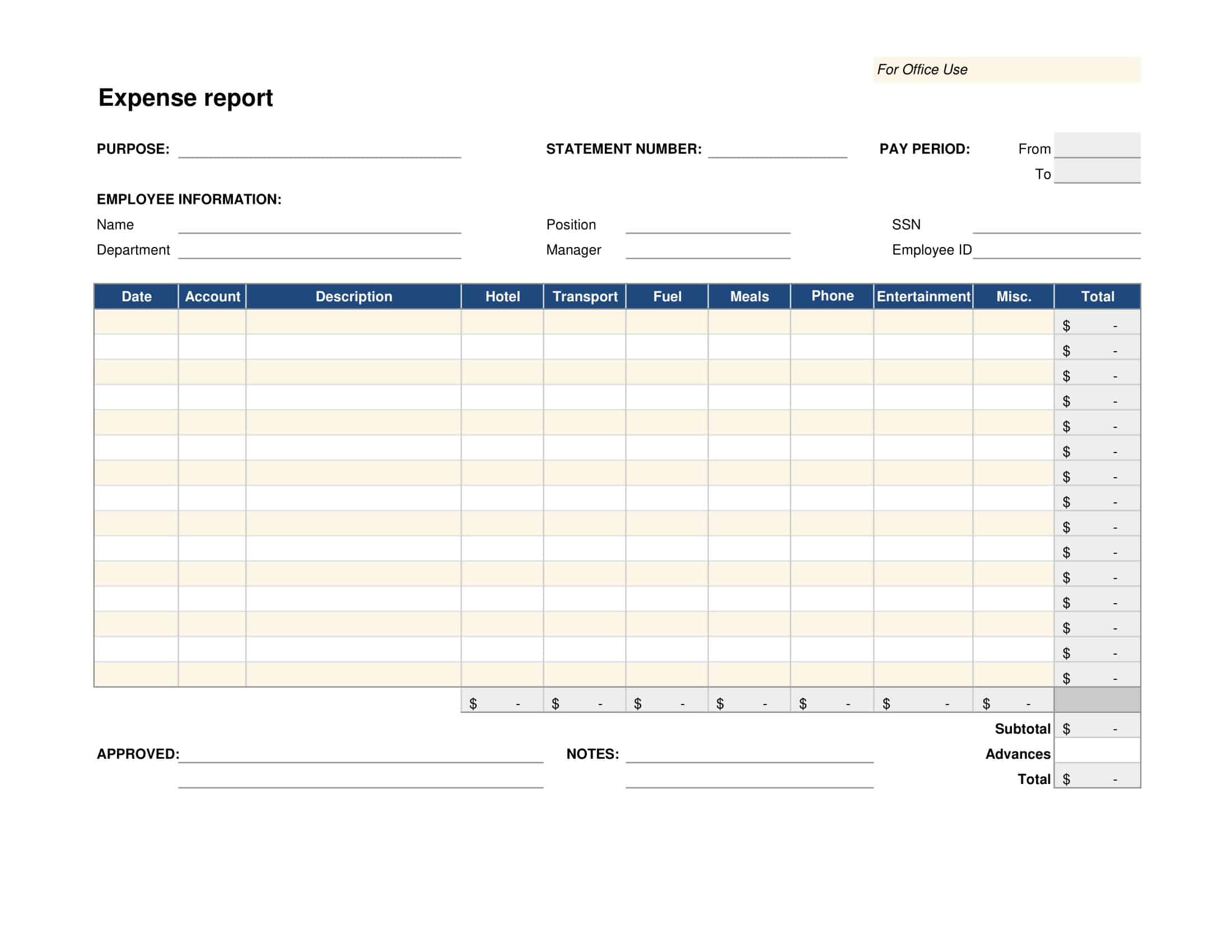

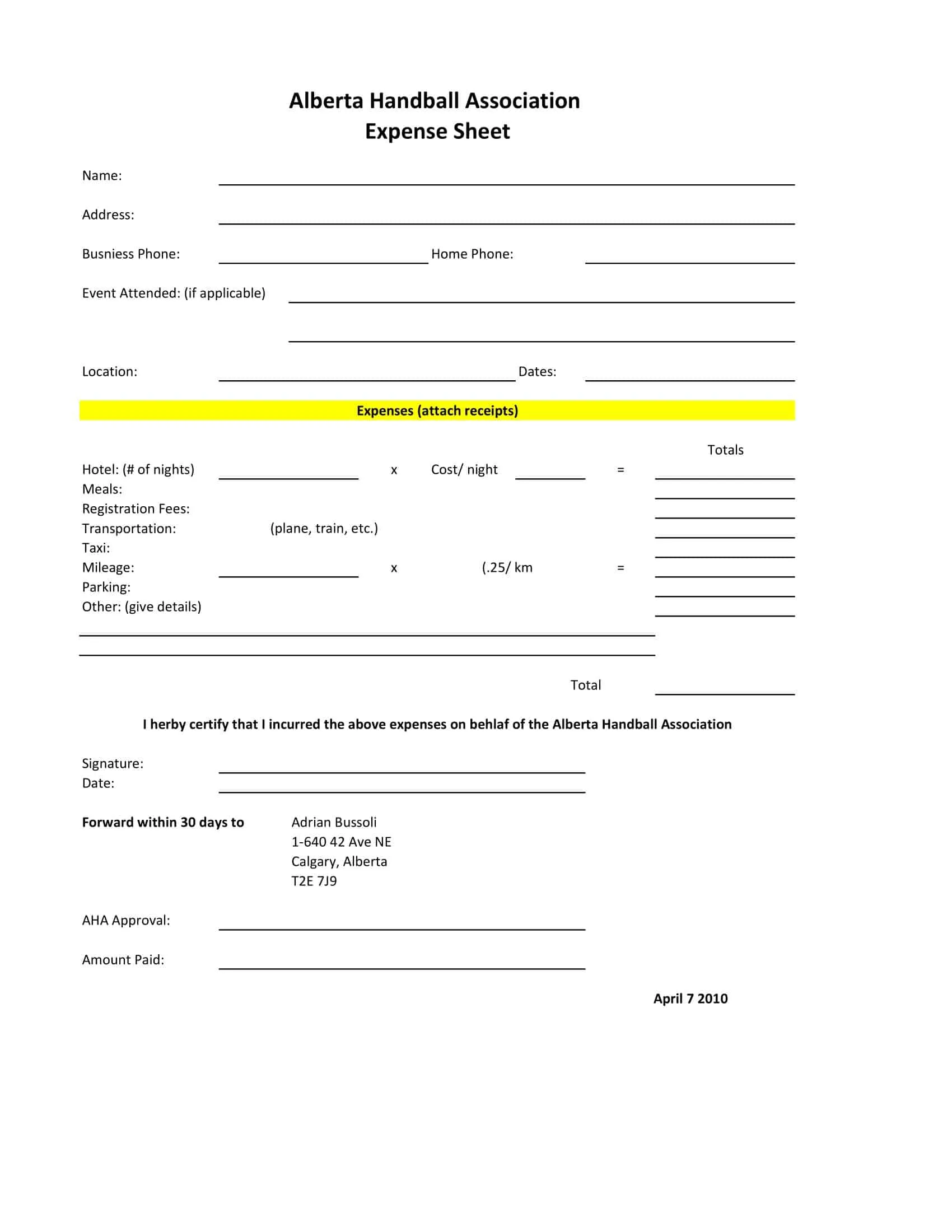

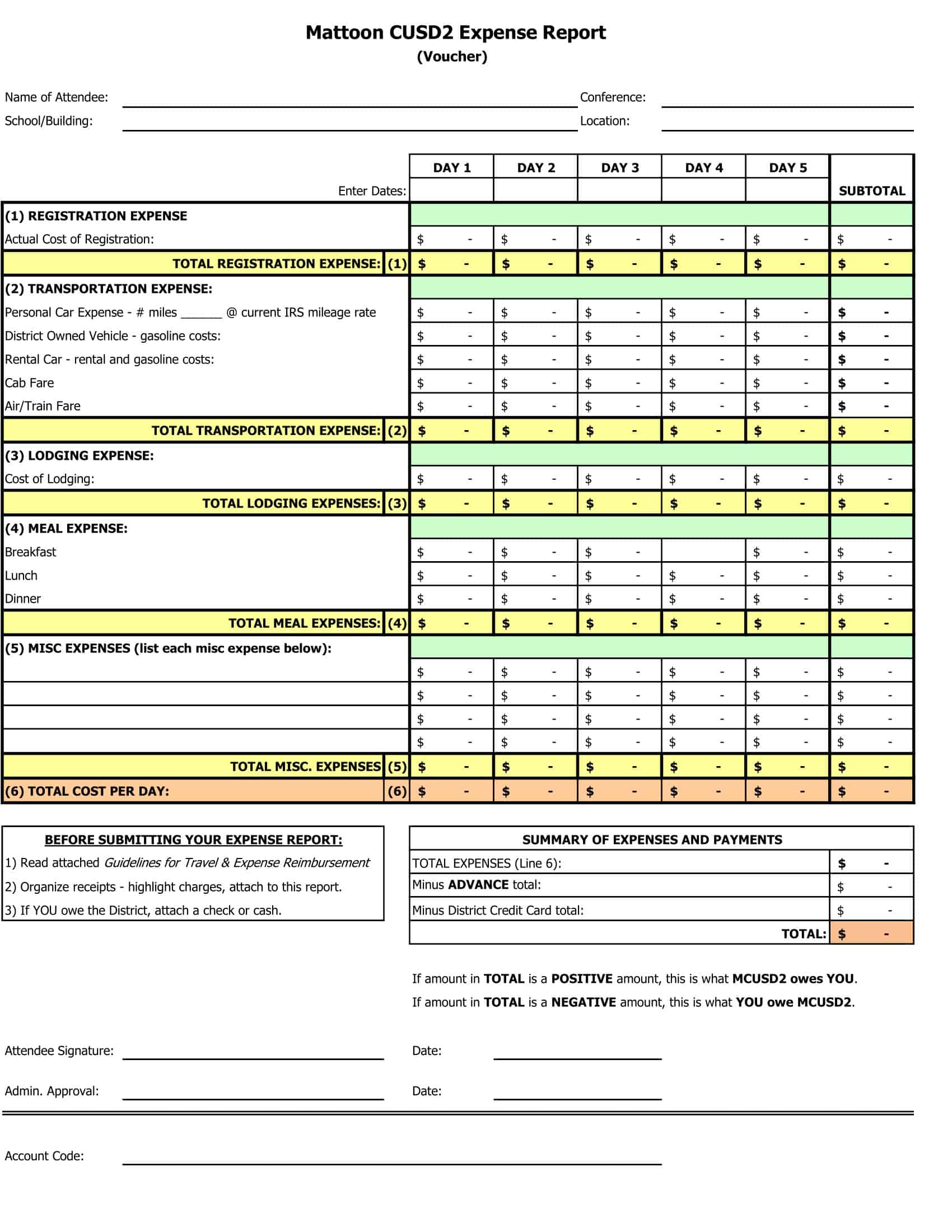

Travel Expenses Spreadsheet

This type of spreadsheet is particularly useful for businesses with employees who travel frequently for work. It includes items like transportation, lodging, meals, and other travel-related expenses, and can be used to track spending, apply for reimbursements, and manage budgets.

Project-Based Expenses Spreadsheet

For businesses that operate on a project basis, this type of spreadsheet helps in tracking costs associated with individual projects. It can be used to allocate resources, monitor project budgets, and calculate profitability.

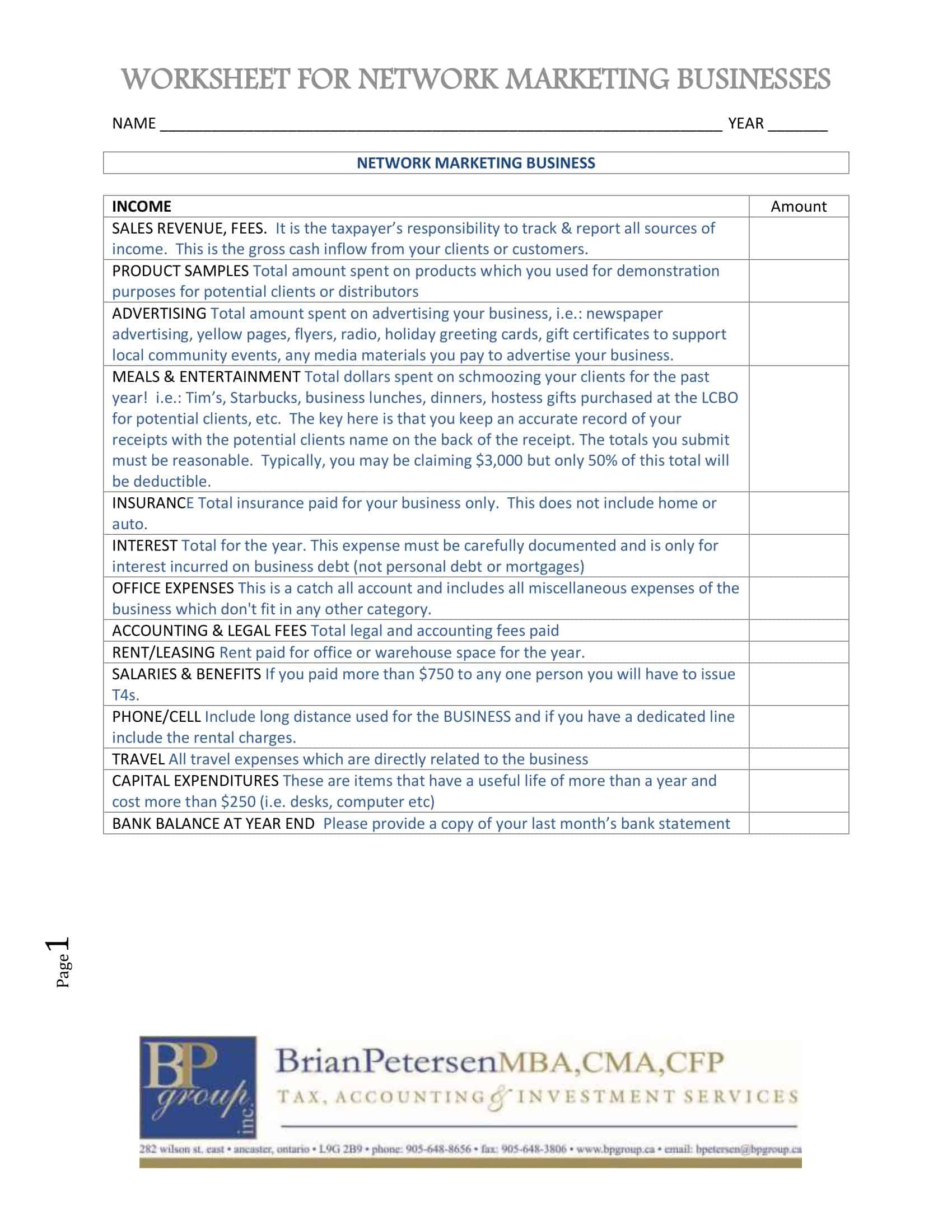

Sales and Revenue Spreadsheet

Although it’s not strictly an expense spreadsheet, this type tracks revenue and related expenses, such as cost of goods sold or sales commissions. This can be useful for assessing the profitability of different products or services.

Tax Expenses Spreadsheet

This spreadsheet keeps track of expenses that are tax-deductible. It’s a valuable tool during tax season, making it easier to claim deductions and ensuring compliance with tax laws.

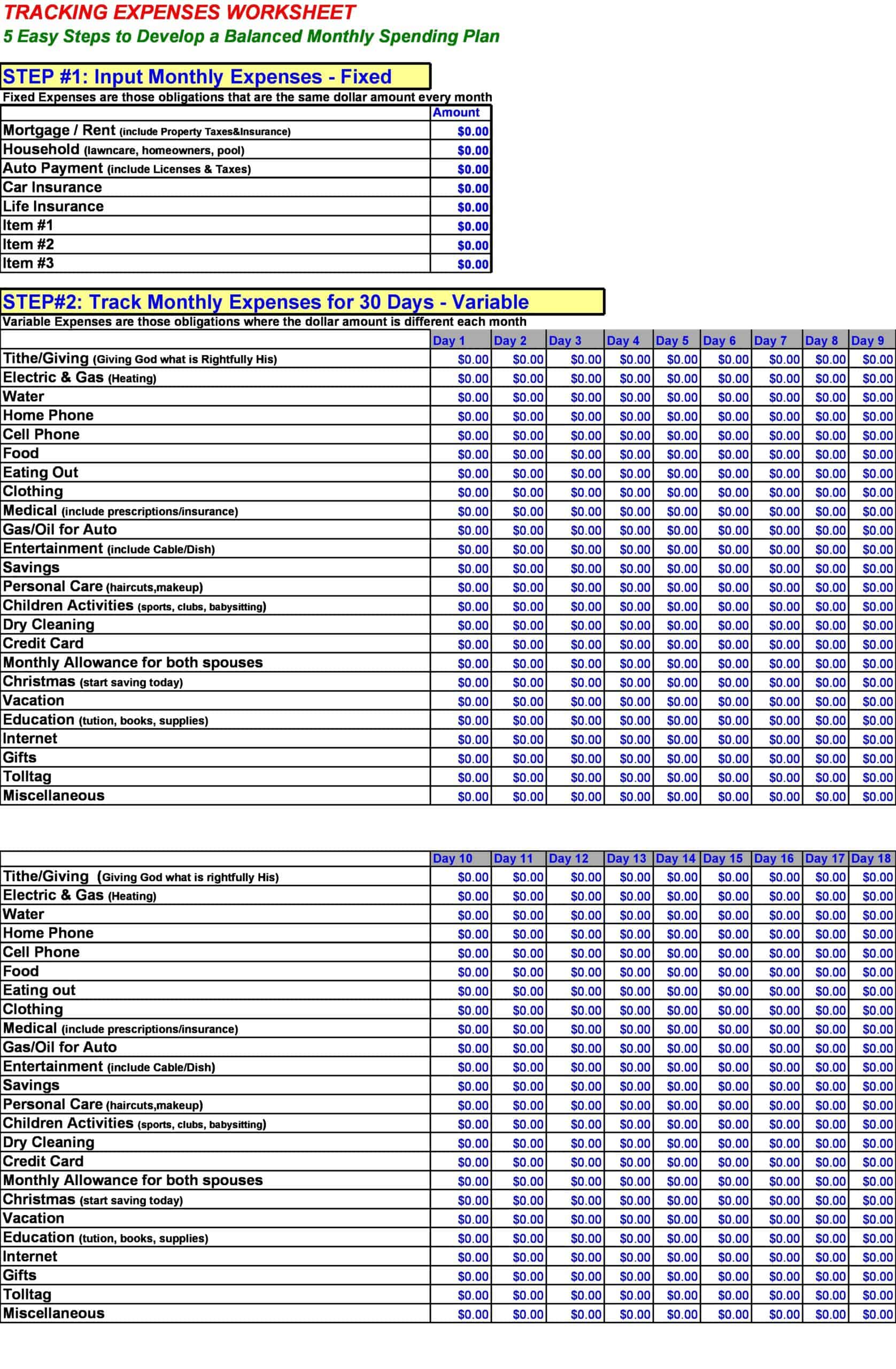

Monthly Business Expenses Spreadsheet

This type of spreadsheet is used to record and track all business expenses on a monthly basis. It helps in understanding spending patterns, managing monthly budgets, and forecasting future expenses.

Annual Business Expenses Spreadsheet

This is a comprehensive spreadsheet that gives you a year-at-a-glance view of all your expenses. It’s ideal for annual budgeting and strategic planning.

Start-Up Costs Spreadsheet

This spreadsheet is designed for new businesses to estimate and track their initial start-up costs. It includes expenses like legal fees, licensing, initial inventory, marketing, and more.

Tips for Efficient Expense Tracking With Spreadsheet

Efficient expense tracking with spreadsheets doesn’t just happen. It’s a process that requires consistency, organization, and a few strategic practices. Here are some tips to make your expense tracking more effective:

- Stay Consistent: Consistency is key when tracking expenses. Establish a routine for entering data into your spreadsheet, whether it’s daily, weekly, or monthly. This reduces the chances of forgetting or overlooking expenses.

- Use Categories: Categorizing your expenses makes your spreadsheet easier to navigate and analyze. Common categories might include salaries, utilities, marketing, travel, and supplies. Adjust these to match the needs of your business.

- Keep it Simple: While it’s important to be thorough, try to keep your spreadsheet as simple as possible. Too many categories or details can make the spreadsheet overwhelming and less likely to be used effectively.

- Automate Where Possible: Look for ways to automate your expense tracking. This could be through linking your spreadsheet to your bank account or using software that can export data directly into your spreadsheet.

- Regularly Review and Update: Periodically review and update your spreadsheet. This not only helps in catching any errors but also in spotting trends, understanding your spending habits, and making necessary adjustments.

- Attach Receipts: If possible, attach digital copies of receipts or invoices to your spreadsheet entries. This makes it easier to recall specific expenses and provides a backup in case of auditing.

- Utilize Spreadsheet Features: Modern spreadsheet software like Excel or Google Sheets offer powerful features for sorting, filtering, and visualizing data. Learning to use these tools can make your expense tracking more efficient and insightful.

- Train Your Team: If multiple people are responsible for entering data into the spreadsheet, make sure they’re all trained on how to do it correctly and consistently. This reduces the risk of errors and ensures everyone is on the same page.

- Protect Your Data: Keep your spreadsheet secure. This might include regular backups, using secure cloud storage, and restricting access to those who need it.

- Plan for Taxes: Keep track of which expenses are tax-deductible and ensure they’re clearly marked in your spreadsheet. This will save you a lot of time and potential confusion when it’s time to file your taxes.

How to prepare a business expense spreadsheet

Creating a business expense spreadsheet may seem daunting, but breaking it down into steps makes the process more manageable. Here is a step-by-step guide:

Step 1: Choose Your Platform

First, decide on the software you’ll use to create your spreadsheet. Excel and Google Sheets are both popular choices with extensive features. Google Sheets has the added advantage of cloud-based accessibility and collaboration.

Step 2: Define Your Columns

Your spreadsheet should have different columns for different types of information. Standard columns might include Date, Vendor, Description, Category, Amount, Payment Method, and Receipt/Invoice Reference. Make sure to leave room for any additional columns that might be specific to your business, like Project Name or Client.

Step 3: Categorize Expenses

Categorize your expenses in a way that makes sense for your business. Common categories include salaries, utilities, rent, marketing, travel, supplies, etc. Having distinct categories will allow you to analyze your expenses more efficiently.

Step 4: Input Data

Start inputting your expense data. Be sure to include as much detail as necessary in the description and to accurately record the amount spent. Consistency is key here, as this will be an ongoing task.

Step 5: Create a System for Receipts

Whether you’re keeping physical receipts or digital copies, it’s important to have a system in place. You could attach digital receipts directly to your spreadsheet or note the location of the physical receipt.

Step 6: Implement Regular Updates

Decide on a regular schedule for updating your spreadsheet. This could be daily, weekly, or even monthly, depending on your volume of expenses. Stick to this schedule to ensure your spreadsheet stays current.

Step 7: Utilize Spreadsheet Features

Take advantage of features offered by your spreadsheet software. This might include creating dropdown lists for categories, using formulas to automatically add up amounts, or using filters to sort and analyze your data.

Step 8: Secure and Back Up Your Data

Make sure your spreadsheet is stored securely and backed up regularly. If you’re using cloud-based software like Google Sheets, your data is automatically saved and backed up. However, it’s still good practice to export and save a copy of your spreadsheet in a separate, secure location periodically.

Step 9: Review and Analyze

Regularly review and analyze your expenses. Look for trends, areas of overspending, and opportunities for budget adjustments. Over time, this will provide valuable insights into your business’s financial health.

Step 10: Prepare for Taxes

Lastly, keep tax time in mind as you maintain your spreadsheet. Note which expenses are tax-deductible and ensure these are easy to identify. This will save you time and potential headaches when it’s time to file your taxes.

Conclusion

In conclusion, a well-structured business expense spreadsheet is more than just a ledger of financial transactions; it’s a powerful tool that can unlock insights into your business’s financial health. From enabling better budgeting and fostering smart decision-making to simplifying tax preparation, the benefits of a meticulous expense tracking system are far-reaching. While it requires consistency and a keen eye for detail, the rewards in terms of cost savings, efficiency, and transparency are immeasurable. So take the first step today towards streamlined financial management with a customized business expense spreadsheet, and watch as your business navigates its financial landscape with newfound clarity and control.

FAQs

Are there any templates available for business expense spreadsheets?

Yes, there are numerous templates available for business expense spreadsheets. Many spreadsheet software applications, such as Microsoft Excel and Google Sheets, offer pre-designed templates that you can customize to suit your specific needs. Additionally, you can find a variety of free and paid templates online from websites that specialize in providing business and finance resources.

How often should I update my business expense spreadsheet?

It is recommended to update your business expense spreadsheet regularly to maintain accurate and up-to-date records. The frequency of updates depends on the volume of transactions and your business needs. For some businesses, updating the spreadsheet on a daily or weekly basis may be necessary, while others may find that monthly updates are sufficient. It’s important to establish a routine that works best for you to ensure accurate tracking of expenses.

Can I import data into a business expense spreadsheet from other sources?

Yes, you can import data into a business expense spreadsheet from various sources, depending on the capabilities of your chosen spreadsheet software. For example, you can import data from bank statements, credit card statements, or accounting software exports. Some spreadsheet applications also offer integration with other business tools, allowing you to import expense data directly.

Is it possible to share a business expense spreadsheet with others?

Yes, it is possible to share a business expense spreadsheet with others. Most spreadsheet software provides collaboration features that allow you to share the document with colleagues or stakeholders. You can control the level of access each person has, such as view-only or editing permissions. Sharing the spreadsheet can help multiple individuals or teams collaborate on expense management, budgeting, or financial reporting tasks.

Are there any alternatives to using a spreadsheet for business expense tracking?

Yes, there are alternative methods for business expense tracking apart from spreadsheets. Some businesses may opt for dedicated expense tracking software or mobile applications that offer specialized features for expense management. These tools often provide automation, receipt scanning, integration with accounting systems, and other advanced functionalities. Additionally, some accounting software packages include expense tracking modules that can streamline the process. Consider exploring these alternatives to find the solution that best fits your business needs.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)