Diving into the complex world of real estate investment can often feel like unraveling a multilayered enigma. With a panoply of terms, tactics, and tools, the domain may initially seem intimidating to the uninitiated.

Among these tools, the ‘rent roll‘ stands out as an indispensable asset, quietly yet profoundly influencing the assessment and success of investment properties. This article will unwrap the intricacies of the rent roll, providing you with a comprehensive understanding of its significance in the broader landscape of real estate investment.

Table of Contents

What is a Rent Roll ?

A rent roll is a crucial document in real estate management and investment, which provides a snapshot of the income potential and current financial status of a rental property. It includes essential details such as the number of units, lease terms, tenant names, rent amounts, and the dates when the rent is due, among other particulars.

Investors and property managers use the rent roll to analyze the profitability of a property, validate the income stated by the seller or landlord, and assess the financial risk associated with potential vacancies or defaulting tenants. Hence, a rent roll acts as a key barometer for the financial health and viability of an investment property.

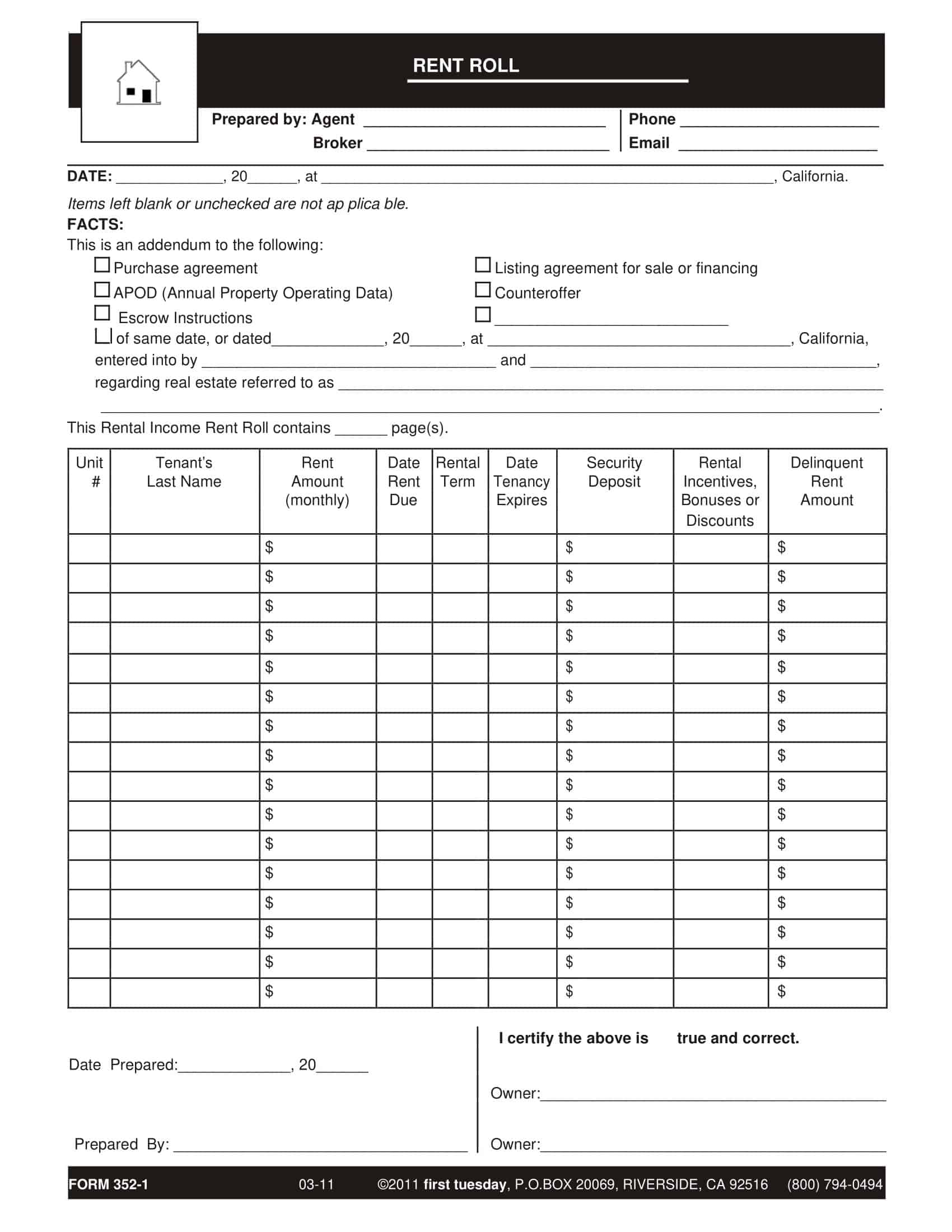

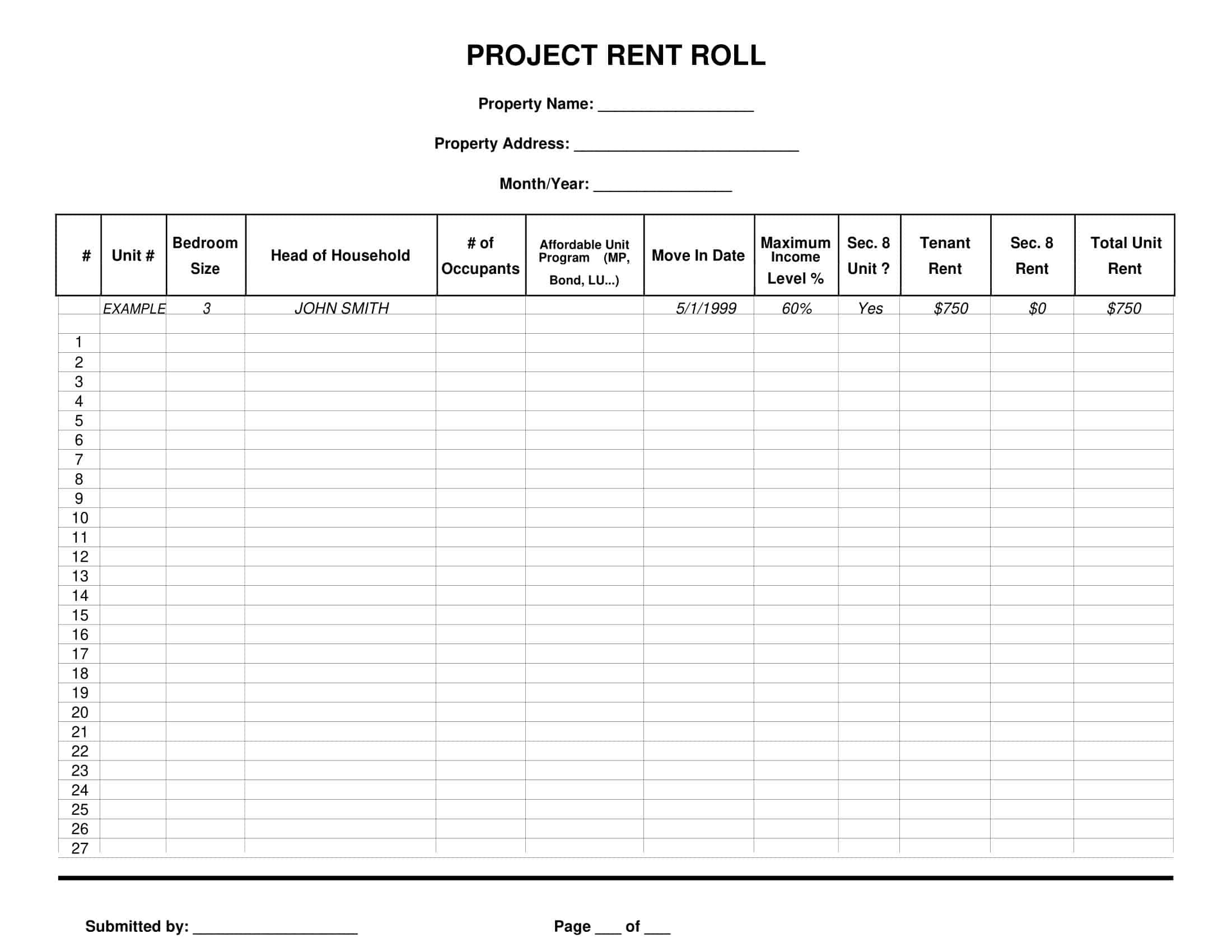

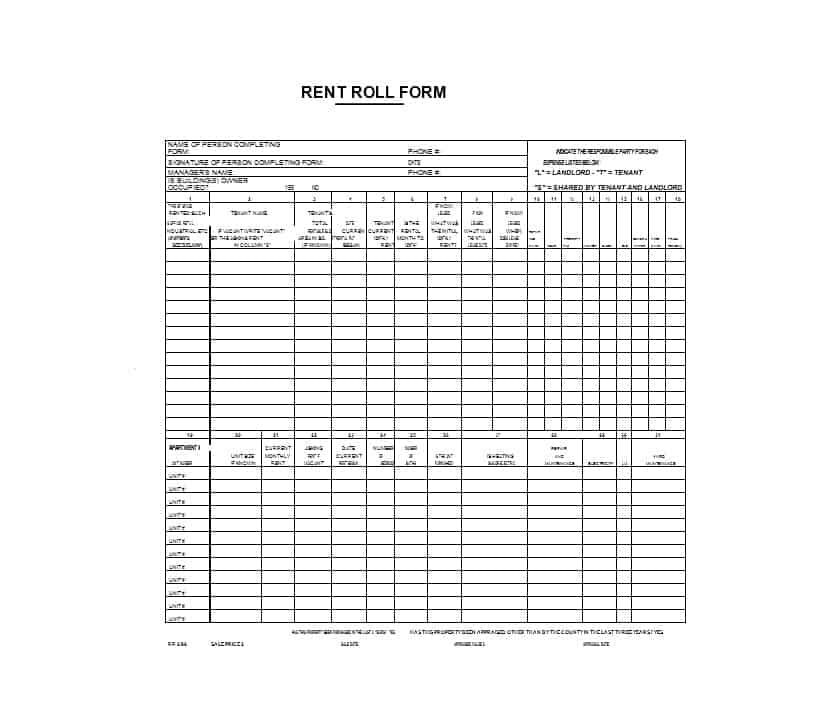

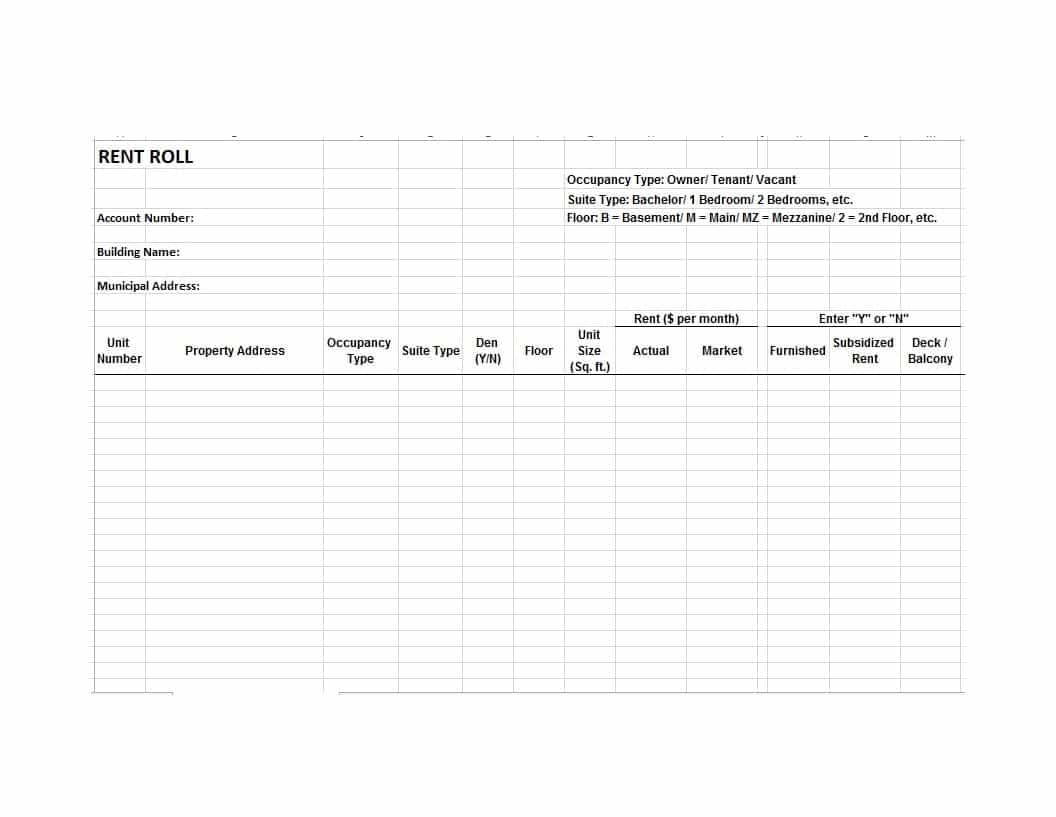

Rent Roll Templates

Rent Roll templates offer a comprehensive approach to property management. These free, printable templates serve as a streamlined tool for landlords and property managers to track rental income, tenant details, and lease dates efficiently.

Each template is structured to provide a clear view of the financial status of rental properties, contributing to effective property management. Tailored to the need for simplicity and efficiency, these Rent Roll templates pave the way for seamless tracking and recording of rental data. With user-friendly design and layout, they stand as an essential element in successful property management.

Purpose of a Rent Roll

A rent roll is an important document for anyone in the real estate industry, particularly for landlords and property managers, investors, and lenders. The purpose of a rent roll is multi-fold. It serves as an informative summary of the current lease status of rental properties and has practical and strategic uses.

Verification of Property Income: The primary purpose of a rent roll is to verify the income being generated by a property or portfolio of properties. The rent roll provides a breakdown of each unit’s rent, deposits, lease start and end dates, and other important financial information. It is often used by landlords and property managers to track rent payments and ensure they align with the expected income.

Investment Analysis: For investors considering purchasing rental properties, a rent roll can provide valuable insights into the financial performance of the asset. It can reveal trends, such as the frequency of tenant turnover, rent collection issues, or the presence of long-term tenants. By analyzing this data, investors can better assess the risks and potential returns associated with a property, helping them make informed investment decisions.

Loan Underwriting: Banks and other financial institutions use rent rolls during the underwriting process for real estate loans. They can assess the risk associated with the loan by examining the property’s income-generating capacity. If the property isn’t generating enough income to cover the loan payments, it’s likely the lender will deny the loan.

Property Management: Rent rolls are crucial for property management. They help keep track of key details such as lease expiration dates, security deposits, tenant names, and the rental rate. This information is useful for maintaining operational efficiency, planning lease renewals or increases, and managing tenant relationships.

Valuation of the Property: Rent rolls can also contribute to determining the value of a property. The capitalization rate, an important metric in real estate valuation, is calculated based on the net operating income of the property, which can be derived from the rent roll.

Legal and Dispute Resolution: In legal situations, a rent roll can serve as a formal record of rent payments, terms of leases, and other relevant details. This can be essential in resolving tenant disputes or in court cases related to the property.

Who Uses Rent Rolls?

A variety of professionals in the real estate industry use rent rolls, each for different purposes. Here’s a detailed look at who uses rent rolls and why:

Landlords and Property Managers

They use rent rolls as a tool for tracking the financial status of the properties they manage. This includes rent payments, lease durations, deposits, and more. It’s a quick and efficient way to monitor which units are occupied, which are vacant, who owes rent, and when leases are due to expire. This helps them maintain operational efficiency, plan for lease renewals or rent increases, and manage tenant relationships.

Real Estate Investors

Before purchasing a rental property, real estate investors will want to examine the rent roll. It helps them assess the financial performance of the property by revealing how much income it generates, the consistency of that income, and the frequency of tenant turnover. This information helps investors gauge the potential return on their investment and decide whether or not to proceed with the purchase.

Real Estate Brokers and Agents

Brokers and agents use rent rolls to gain insights into a property’s financial performance, which aids them in setting a fair market price. By understanding the property’s income, they can better serve their clients by either providing guidance to investors looking to buy or helping landlords determine an appropriate selling price.

Banks and Lenders

During the underwriting process for a loan, banks and lenders use rent rolls to evaluate the risk associated with lending money for the purchase of a property. They need to know that the property can generate enough income to cover loan payments. If the property isn’t generating sufficient revenue, or if there’s a high rate of tenant turnover, the lender might consider the loan too risky.

Appraisers and Property Valuers

Appraisers use rent rolls to determine the value of a property. By analyzing the income data from the rent roll, they can calculate the property’s net operating income, which is a key input when determining a property’s value using the income approach.

Accountants and Tax Professionals

Accountants use rent rolls to prepare financial reports and ensure accurate income tracking. It helps them in the process of reconciling accounts and preparing tax returns. Tax professionals, on the other hand, can use this document to calculate property taxes based on the income the property generates.

Real Estate Attorneys

In cases of legal disputes, a rent roll can serve as a formal record of lease terms, rent payments, and other tenant details. Attorneys may use this documentation in court or during dispute resolution procedures.

Insurance Companies

Insurance companies may refer to rent rolls to determine the adequate amount of coverage for a rental property. They can get information on the number of tenants, lease agreements, and income generation which can influence insurance premiums and the terms of the policy.

The benefits of Using a Rent roll

A rent roll is an invaluable tool in the real estate industry, offering numerous benefits that streamline operations, inform strategic decisions, and ensure financial accuracy. Here’s a deeper look at the unique advantages it provides:

Operational Efficiency and Tracking

A rent roll offers a comprehensive overview of all units in a rental property or portfolio of properties. This snapshot view allows landlords and property managers to monitor vacancies, upcoming lease expirations, or rent increases, enabling proactive management of the property. Additionally, by offering a centralized record of all tenant leases, it simplifies the process of tracking and recording rent payments, helping prevent missed payments or delays.

Performance Analysis

Rent rolls serve as a performance analysis tool, allowing owners, investors, and property managers to track income trends and tenant turnover rates. This analysis can identify potential issues before they become major problems, such as high turnover or frequent late payments, which could indicate dissatisfaction among tenants. It also allows property owners and managers to gauge the property’s financial health and its sustainability over the long term.

Investment Evaluation

A rent roll plays a crucial role in evaluating real estate investments. Potential investors can scrutinize a property’s rent roll to assess its income-generating capacity, which directly impacts the property’s value and the return on investment. It also provides insights into the property’s management efficiency, tenant stability, and the potential need for repairs or maintenance, all of which can influence an investment decision.

Risk Assessment for Lenders

For banks and other financial institutions, rent rolls provide a detailed view of a property’s financial status, enabling them to assess the risk associated with a loan. By evaluating the income stream from the property, lenders can determine whether the owner has the capacity to repay the loan, reducing the risk of default.

Legal Documentation

In the event of disputes or legal issues, a rent roll can serve as a vital piece of documentation. It can provide a record of rental payments, lease terms, and deposit details, supporting landlords and property managers in cases of disputes over unpaid rent, security deposit deductions, or lease violations.

Valuation Support

For appraisers, a rent roll is an essential document for property valuation. It provides verifiable data on the property’s income, which feeds into calculations of net operating income and the capitalization rate, key metrics used in the income approach to property valuation.

Financial Reporting and Tax Preparation

For accountants and tax professionals, a rent roll is vital for preparing financial reports and tax returns. It provides a record of income earned and deposits held, ensuring accurate reporting and helping to streamline the process of preparing and filing taxes.

Types of rent roll forms

Rent roll forms can come in various types, largely dependent on the type of rental property they are designed to track and manage. Despite the variance, they all share the common function of documenting important information about rental units and their tenants. Here is a more detailed guide about some different types of rent roll forms:

Residential Rent Roll Form: This type of rent roll form is used for residential properties like single-family homes, duplexes, apartments, and condominiums. Key information in a residential rent roll form typically includes the tenant’s name, lease start and end dates, monthly rent, security deposit, number of bedrooms/bathrooms in each unit, and any other specifics related to the unit such as parking spaces or storage. It may also include notes on the payment history of the tenant, and information about late fees if applicable.

Commercial Rent Roll Form: Used for commercial properties such as office buildings, shopping centers, or industrial properties, a commercial rent roll form usually contains more complex details than a residential rent roll. This is due to the different nature of commercial leases, which often include provisions for escalations, rent holidays, expense pass-throughs, and variable lease terms. Details typically include tenant names, business names, leased square footage, lease commencement and expiration dates, base rent, additional rent (like CAM charges, insurance, tax contributions), renewal options, and any special terms of the lease.

Multifamily Rent Roll Form: Multifamily rent roll forms are used for properties with multiple residential units like apartment complexes. The information tracked on these forms often includes the tenant’s name, unit number, lease start and end dates, monthly rent, security deposit, number of occupants, and pet details. This form might also include details about the property’s amenities that justify the rent amounts, such as in-unit laundry, fitness center access, or a swimming pool.

Mixed-Use Property Rent Roll Form: This type of rent roll is used for properties that combine residential, commercial, and/or industrial uses. These forms would track a mixture of information found in both residential and commercial rent roll forms, dependent on the specific tenant mix. They would include all pertinent details related to each lease, including the type of unit, size, lease terms, rent amount, and tenant information.

Mobile Home Park Rent Roll Form: This type of form is used for mobile home parks where the residents often own the mobile home but rent the land it sits on. Information on this form usually includes the tenant’s name, space or lot number, lease start and end dates, monthly rent, and any other fees charged such as utility or maintenance fees.

Storage Facility Rent Roll Form: For storage facilities, this form typically includes the renter’s name, storage unit number, size of the unit, lease start and end dates, monthly rent, and security deposit. It may also track additional details such as late fees, insurance fees, or any other income derived from the tenant.

How to Create a Rent Roll

Creating a rent roll involves gathering all the relevant information about your rental property or properties, your tenants, and their respective leases. Here’s a step-by-step guide:

Step 1: Choose the Right Format

Depending on your preference and the complexity of your rental situation, you can create a rent roll using a simple spreadsheet program like Microsoft Excel or Google Sheets. Alternatively, you can use more sophisticated property management software that may have built-in rent roll templates.

Step 2: List the Property or Properties

Start by listing your properties. If you have multiple properties, include the address of each one. If you have a multi-unit property, list each unit separately.

Step 3: Detail the Units

Next to each property or unit, provide relevant details such as the square footage, number of bedrooms and bathrooms (if it’s a residential unit), and any other key features.

Step 4: Include Tenant Information

For each rental unit, list the tenant’s name. If it’s a commercial property, include the name of the business.

Step 5: Outline the Lease Terms

Detail the terms of each lease. This should include the lease start date and end date. Also indicate whether the lease is month-to-month or fixed-term.

Step 6: Detail the Rent

List the monthly rent amount for each unit. Be sure to update this information whenever the rent changes due to lease renewals or rent increases.

Step 7: Include Security Deposit Information

Document the amount of the security deposit held for each unit. This can help manage refunds when tenants move out.

Step 8: Note Any Additional Fees

Include any additional fees such as parking fees, pet fees, or service fees, that may be relevant to each unit. These should be added to the rental income.

Step 9: Document Payment History

Maintain a record of each unit’s payment history. This can help you quickly spot any late or missing payments.

Step 10: Keep It Updated

A rent roll is a living document that should be updated regularly. This includes updating lease terms upon renewal, updating rent amounts when they change, and noting when tenants move in or out. Regular updates ensure the document remains an accurate reflection of the property’s current income status.

Important tips for growing your rent roll

Here are some additional strategies to grow your rent roll and maximize the return on your property investment:

- Invest in Property Upgrades: By improving the quality and appeal of your properties, you can justify higher rental prices and attract more desirable tenants. This might include modernizing units, adding amenities, or improving the property’s exterior.

- Ensure Excellent Tenant Service: Keeping your existing tenants happy reduces turnover, saving you the time and money associated with finding new tenants. This includes responding promptly to maintenance requests, respecting tenant privacy, and communicating effectively.

- Adopt Technology: Use modern property management software to streamline operations, improve tenant communication, and make payments easier. This can also reduce errors in your rent roll and save time in managing the properties.

- Implement a Robust Tenant Screening Process: By attracting and selecting high-quality tenants, you’re more likely to maintain consistent occupancy rates and reduce the risk of unpaid rent or property damage.

- Stay Competitive with Market Rates: Regularly assess the rental market to ensure your prices are competitive. This can help attract new tenants and retain current ones.

- Hire a Qualified Property Manager: If your portfolio is growing large or you don’t have the time to manage it effectively, hiring a property manager can be a worthwhile investment. They can help you maximize your rent roll and ensure your properties are managed professionally.

- Offer Long-Term Leases: By encouraging tenants to commit to longer leases, you can reduce the turnover rate and ensure a consistent income stream for a longer period.

- Provide Incentives for Lease Renewals: Offering incentives such as minor rent discounts or improvements to the property can encourage tenants to renew their leases, maintaining your rental income.

- Market Your Properties Effectively: Use high-quality photos and detailed descriptions when advertising your properties. List them on popular rental sites to reach a larger audience and fill vacancies more quickly.

- Maintain Your Properties: Regular maintenance and prompt repairs can make tenants more likely to stay and less likely to request rent reductions or break their leases.

- Offer Extra Services or Amenities: Additional offerings such as cleaning services, included utilities, or pet-friendliness can make your properties more attractive to potential tenants and allow you to charge higher rent.

FAQs

How can I analyze a Rent Roll?

Rent Rolls can be analyzed to determine the financial performance of a rental property. Key factors to consider include total rental income, occupancy rates, lease expiration dates, rental arrears, and any outstanding fees or charges. This analysis helps in assessing the property’s profitability and identifying areas for improvement.

Are Rent Rolls confidential?

Rent Rolls generally contain sensitive and confidential information about tenants and their rental agreements. Property owners and managers should handle Rent Rolls with care and ensure compliance with applicable data privacy laws and regulations.

Can Rent Rolls be used for loan applications?

Yes, Rent Rolls are commonly used when applying for loans or financing for real estate investments. Lenders often review Rent Rolls to assess the rental income potential of a property, which helps them determine the loan amount and terms.

How often should a Rent Roll be updated?

Rent Rolls should be updated regularly to reflect any changes in tenant occupancy, rental amounts, lease terms, or other relevant information. It is recommended to update the Rent Roll whenever there are new lease agreements, lease renewals, or changes in tenant status.

Are there any legal requirements for maintaining Rent Rolls?

The legal requirements for maintaining Rent Rolls may vary depending on the jurisdiction. It is advisable to consult local regulations and laws pertaining to property management and data privacy to ensure compliance.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)