Once you have presented an impressive pitch and investors present you with a term sheet, the potential to agree on serving terms becomes almost immediate. Your previous days of anxiety leading up to this moment fades away as you decide to go along with the terms of a capital investment agreement.

Table of Contents

What Is a Term Sheet?

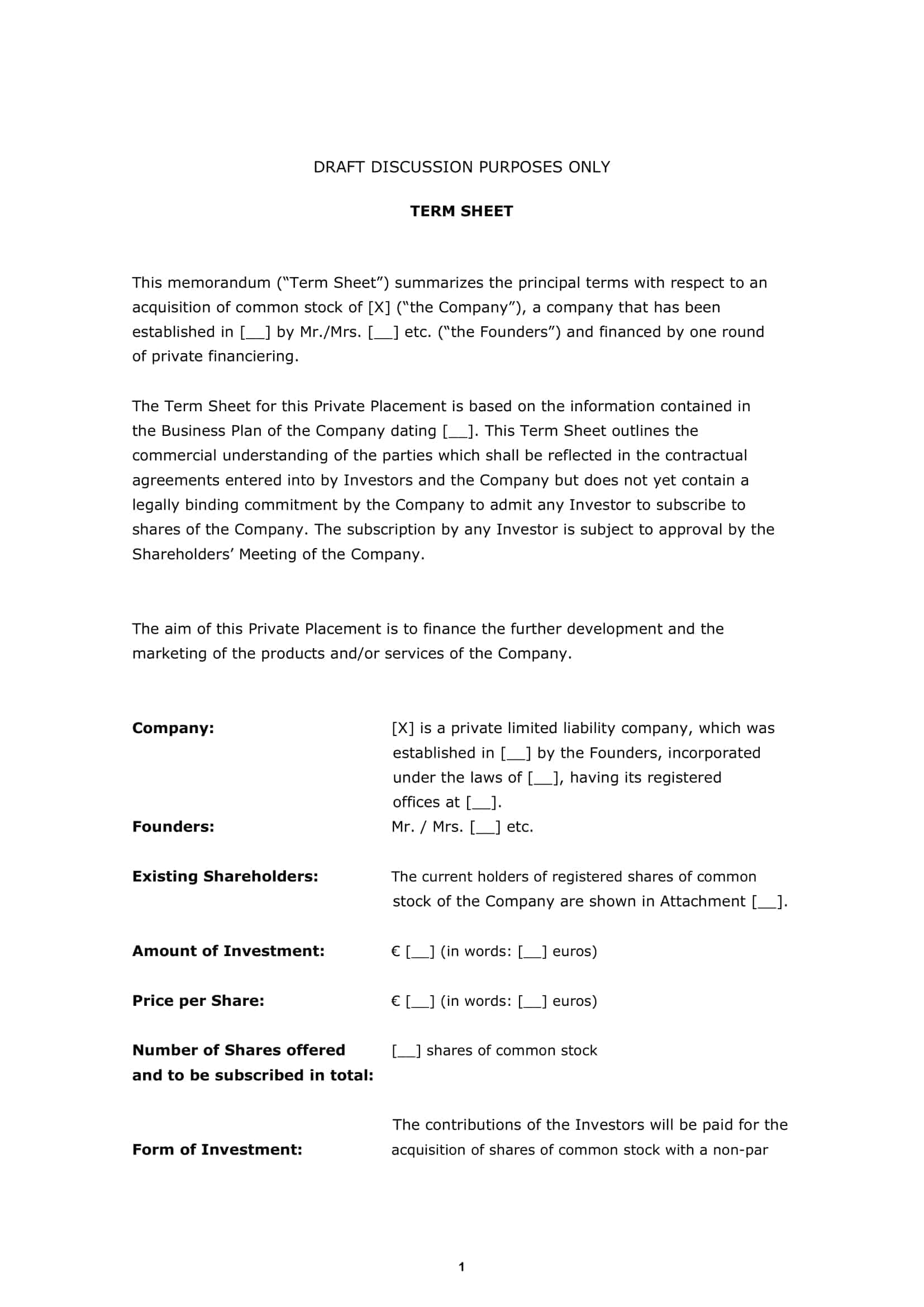

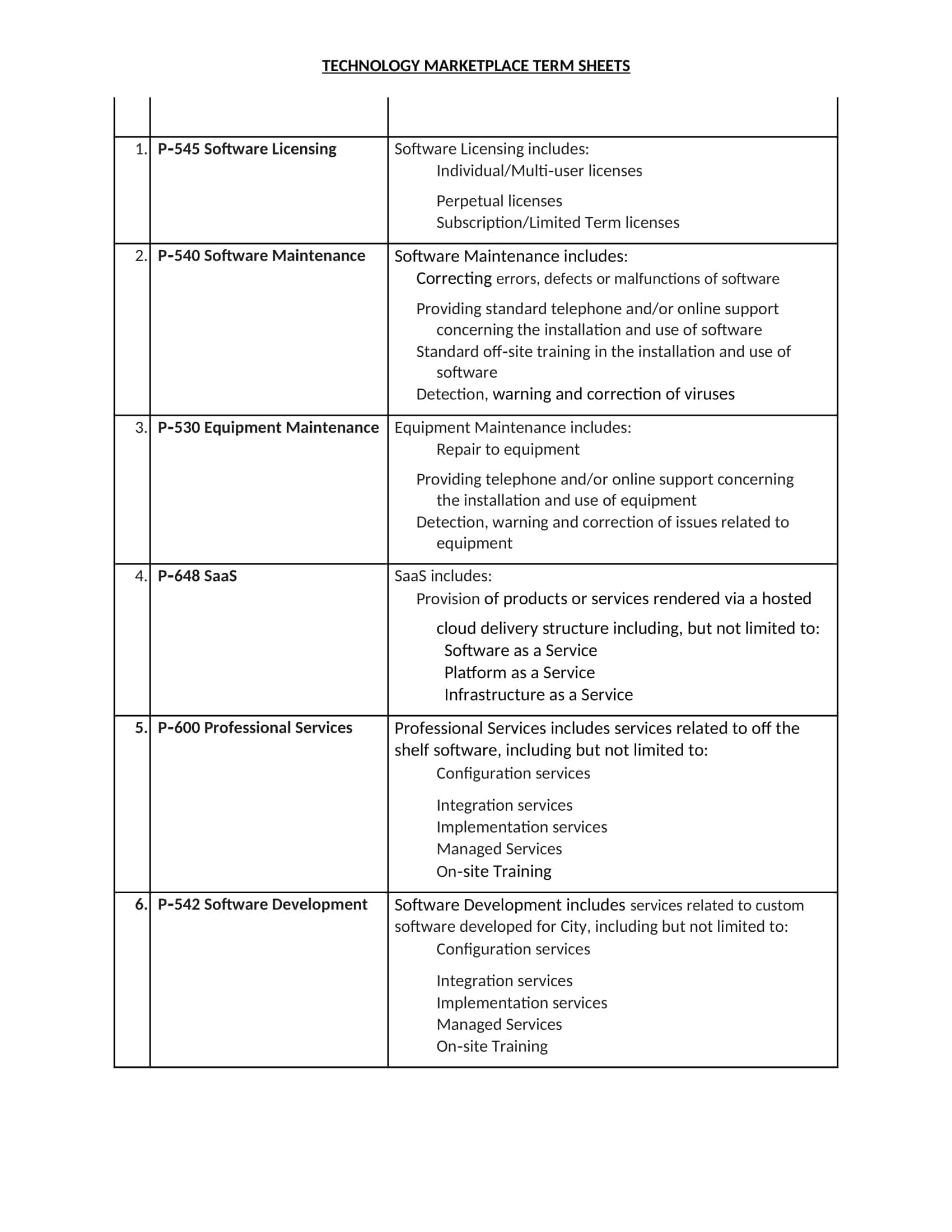

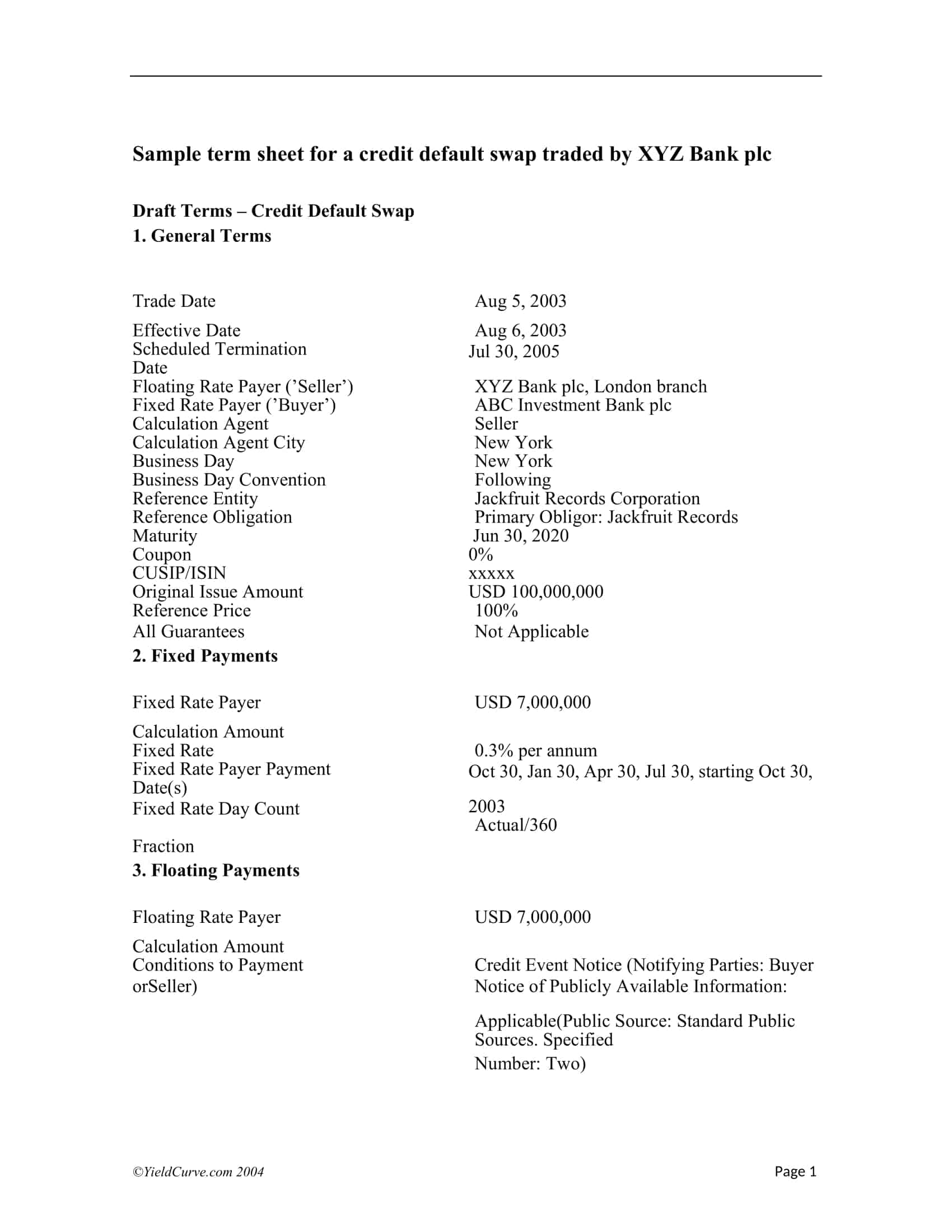

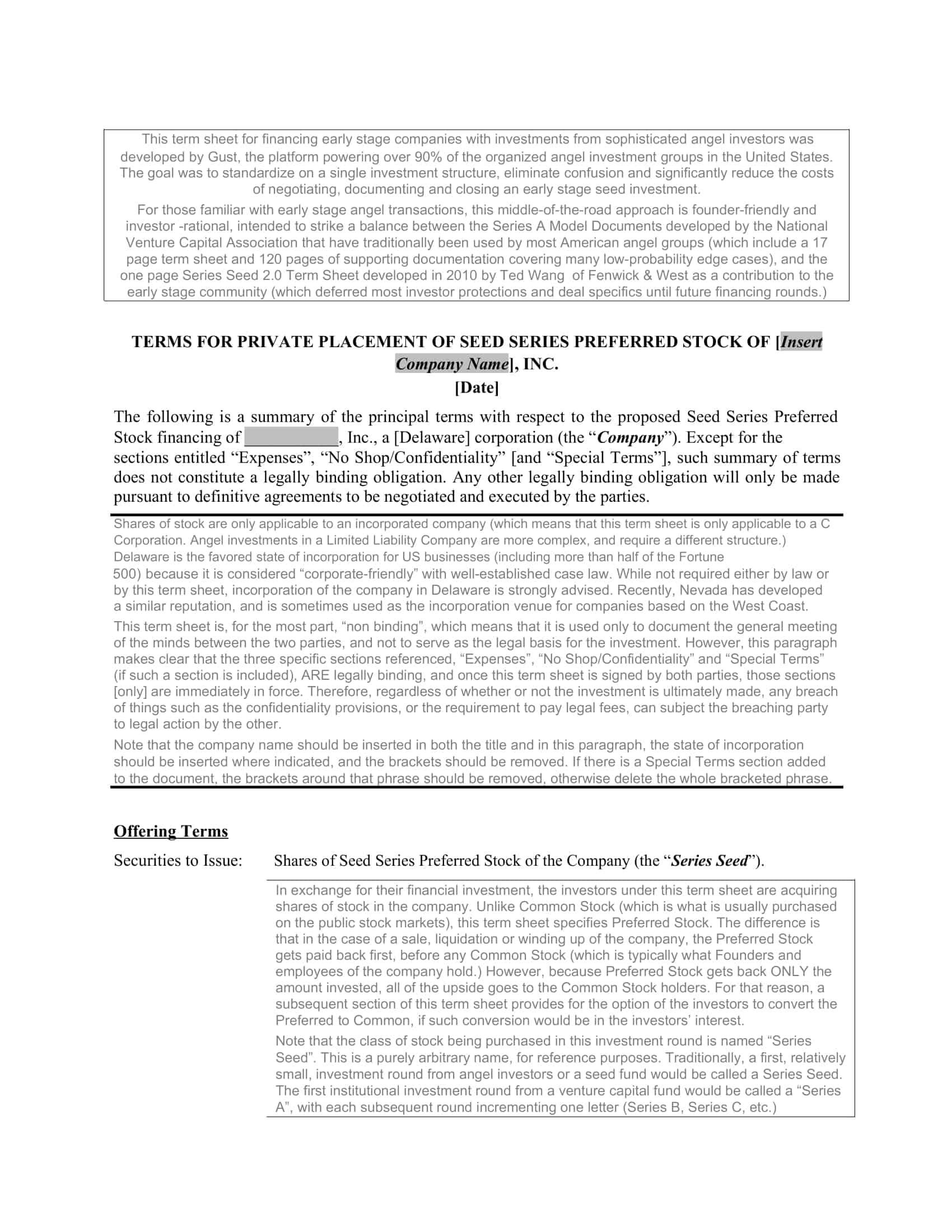

A term sheet template is a financial document that can serve as the foundation of any business deal. In finance, it’s usually used by private equity firms and venture capital firms that offer to invest in other businesses.

Entrepreneurs and their lawyers also use it to draft a term sheet when they need to create an initial agreement on specific terms and conditions before creating the final contract. A term sheet details the most important contract provisions, including valuation, management team composition, investment amount, etc.

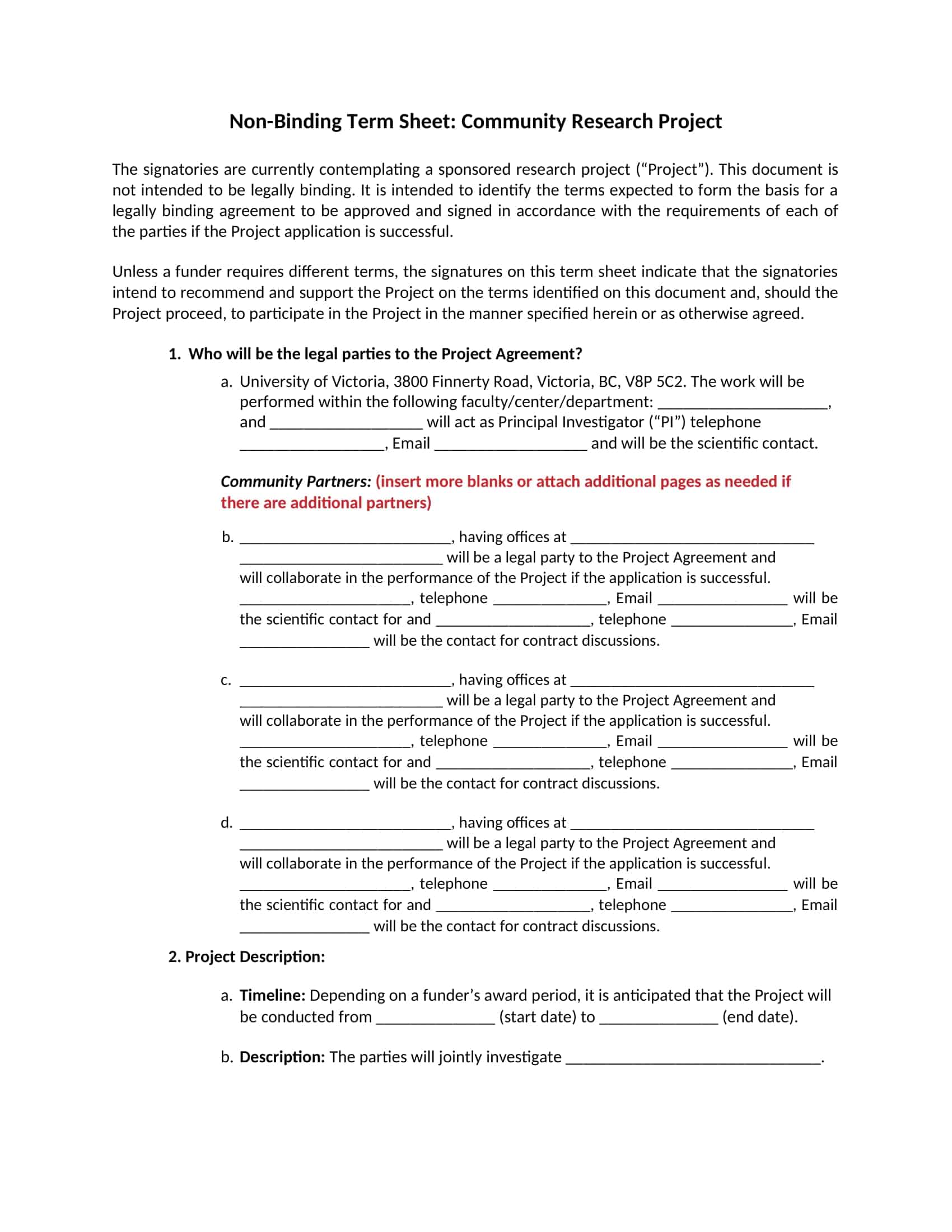

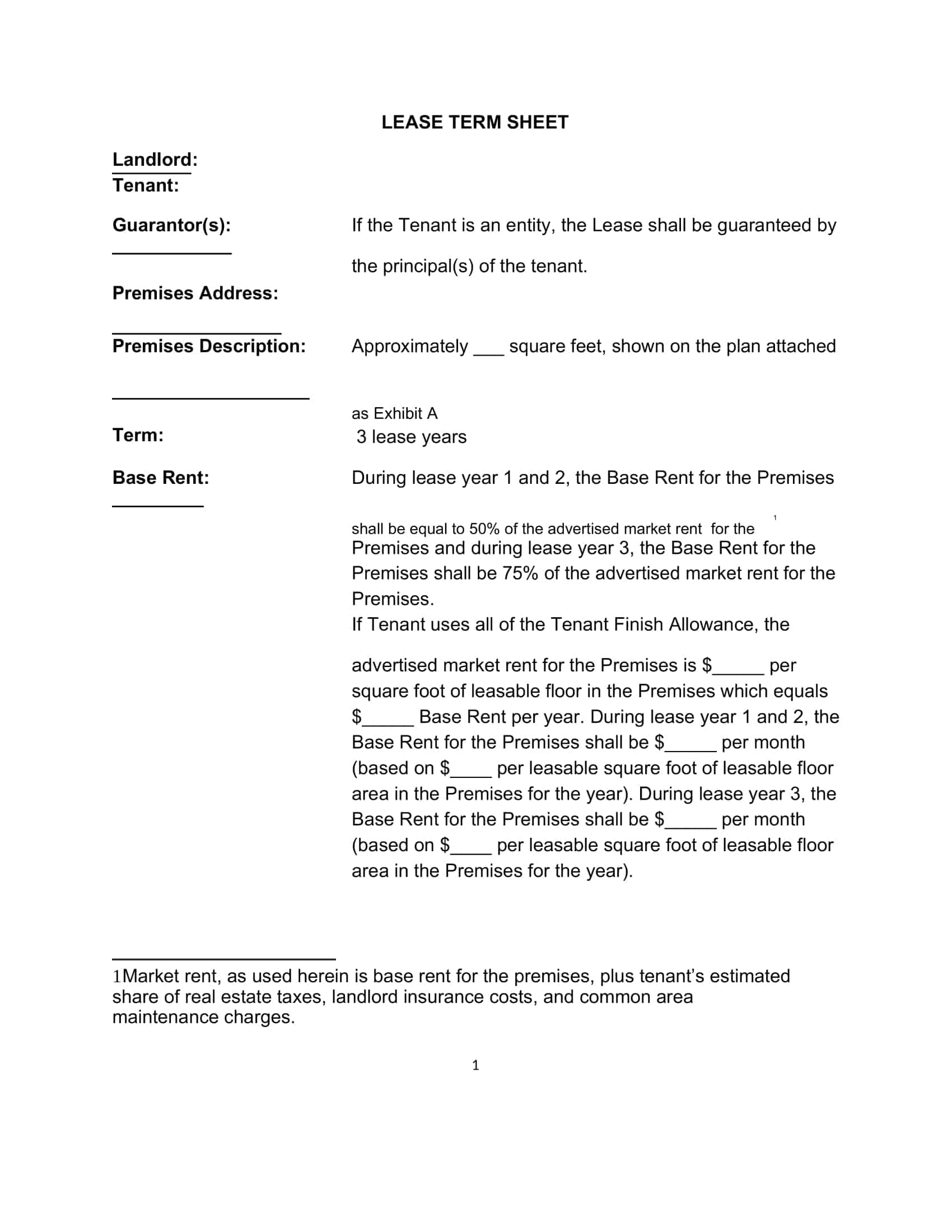

Term Sheet Templates

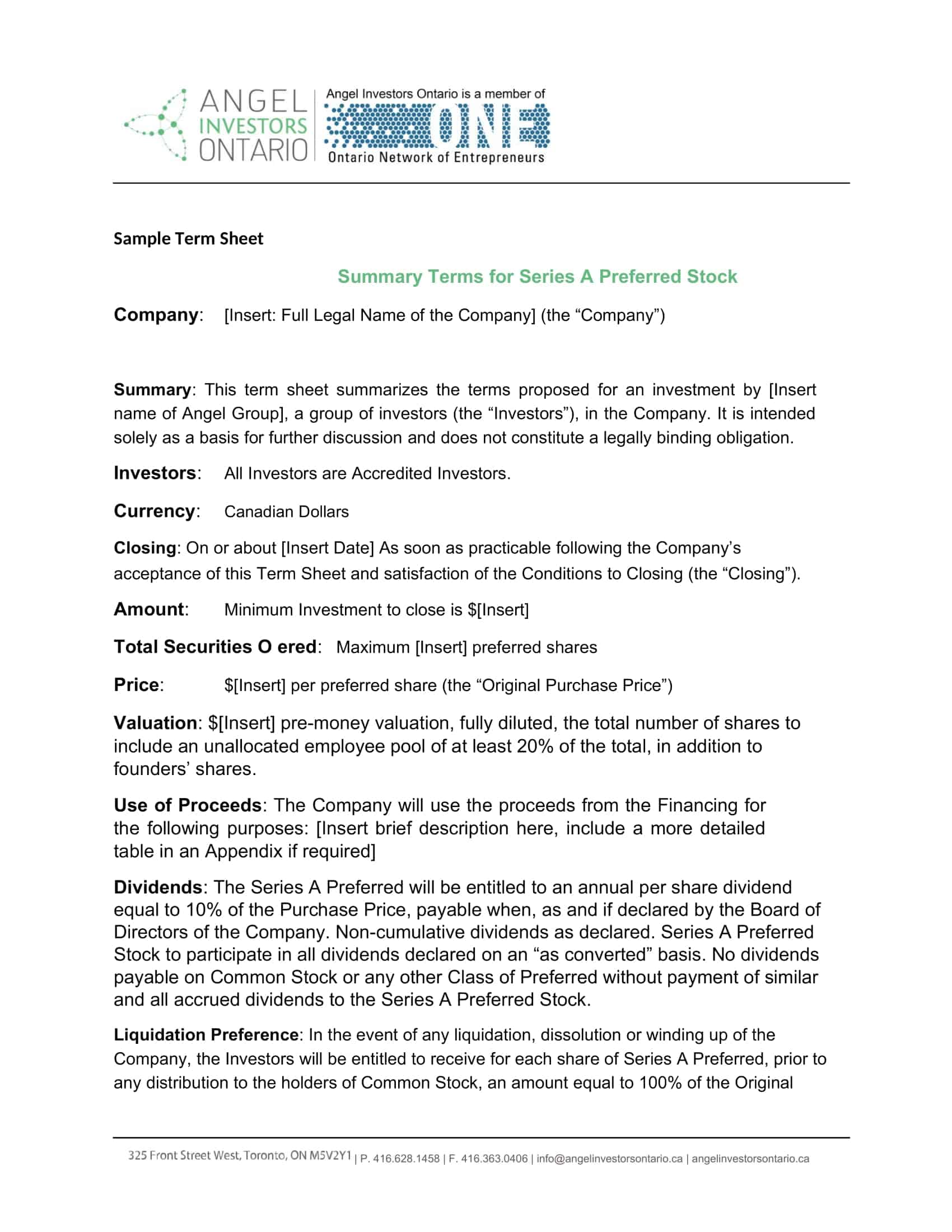

Facilitate negotiations and outline key terms with our comprehensive collection of Term Sheet Templates. A term sheet is a preliminary agreement that outlines the terms and conditions of a proposed business transaction, such as an investment or partnership. Our customizable and printable templates provide a structured framework for capturing the essential elements of the deal, including valuation, equity distribution, financing terms, governance, and exit strategies.

By utilizing our Term Sheet Templates, you can streamline the negotiation process, align expectations, and create a foundation for further due diligence and final agreement. Whether you’re a startup founder, investor, or business professional, our templates offer a valuable tool to communicate and document the core terms of a potential deal. Streamline your deal-making efforts, protect your interests, and lay the groundwork for successful business transactions with our user-friendly templates. Download now and create term sheets that pave the way for mutually beneficial agreements.

What Is a Term Sheet Template?

A term sheet template is a non-binding legal document that outlines the terms of an agreement. It contains certain details, including the parties involved, consideration, conditions and period to which the contract applies, and other stipulations.

What is included in a term sheet?

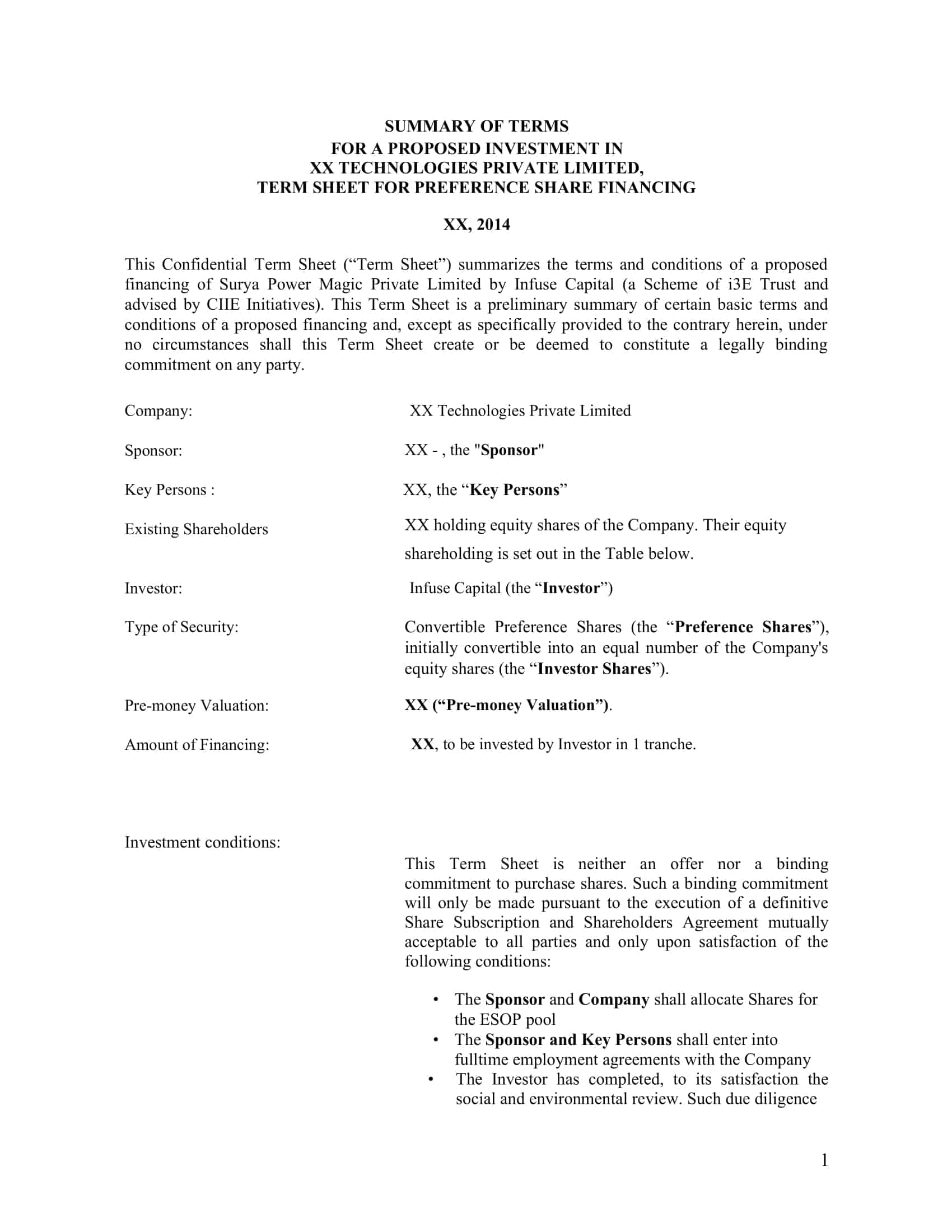

1. Details about the parties involved and the agreement

The first part of a term sheet should include the names of all parties involved, including founders, investors, and any other relevant individuals. The next section should include information about what the parties agree to do and how long they will be doing it.

2. Option Pools

Option pools ensure that early employees get some equity in your company and create incentives for them to stay with your company after vesting periods are over. It’s also a way for angel investors to ensure that they have a say in key hires at their portfolio companies without having to worry about dilution or conflicts of interest with other investors who might have an interest in that employee’s stock options.

3. Liquidation and Participation

Liquidation preferences determine who gets paid first if you sell your company or get acquired by another company for cash or stock. Typically this is set up so that founders get paid first; then angel investors get paid second before everyone else gets paid out according to how much of their stake has vested at that point in time (typically after three years).

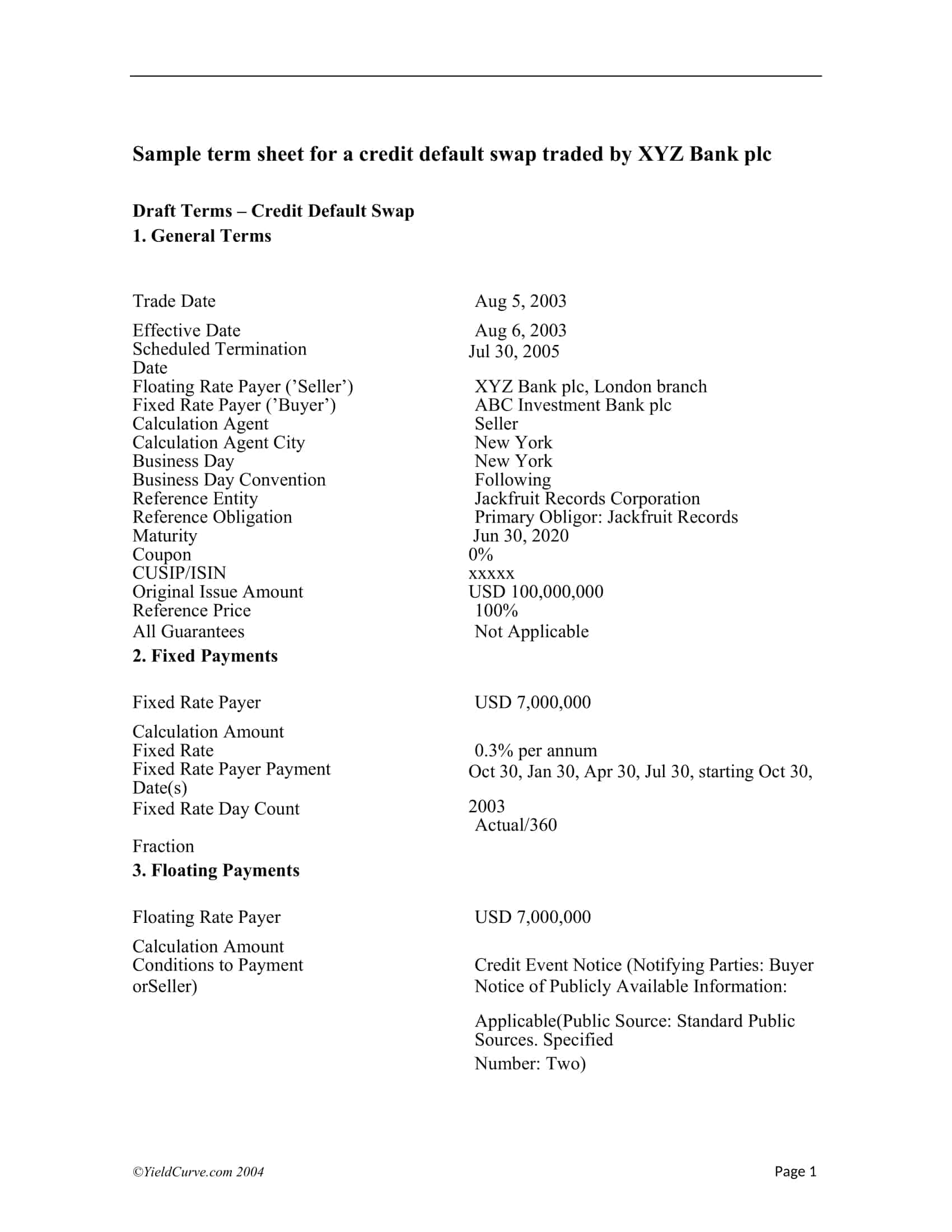

4. Dividends – Dividends are a portion of the earnings that are paid to stockholders. Dividends can be paid in cash or in kind, such as shares of stock. A term sheet should specify how much dividends are paid and when they are paid.

Dividend policy: The company will pay out dividends at least once per year, subject to approval by the board of directors at an annual meeting or special meeting called for that purpose.

If you want your company to issue dividends often, you can add more detail about how many times per year it will pay them out. If you prefer that they not pay out more than once per year, it’s best to specify this as well. For example:

Dividend policy: The company will pay out dividends at least once per year, subject to approval by the board of directors at an annual meeting or special meeting called for that purpose. In addition, if we have excess cash on hand after paying off all outstanding debts and expenses related to our business, we may choose to use those funds for other purposes (such as buying back shares from investors).

5. Protective Provisions – Protective provisions are clauses that protect investors from different types of losses. These clauses can include buyback provisions, drag-along rights, drag-down rights, negative covenants, and more.

6. Controlling Rights – Controlling rights refer to the ability of one party to control another party’s actions or decisions. For example, if one party controls another party’s actions or decisions through voting rights or other rights granted by law, then that party has controlling rights over the other party.

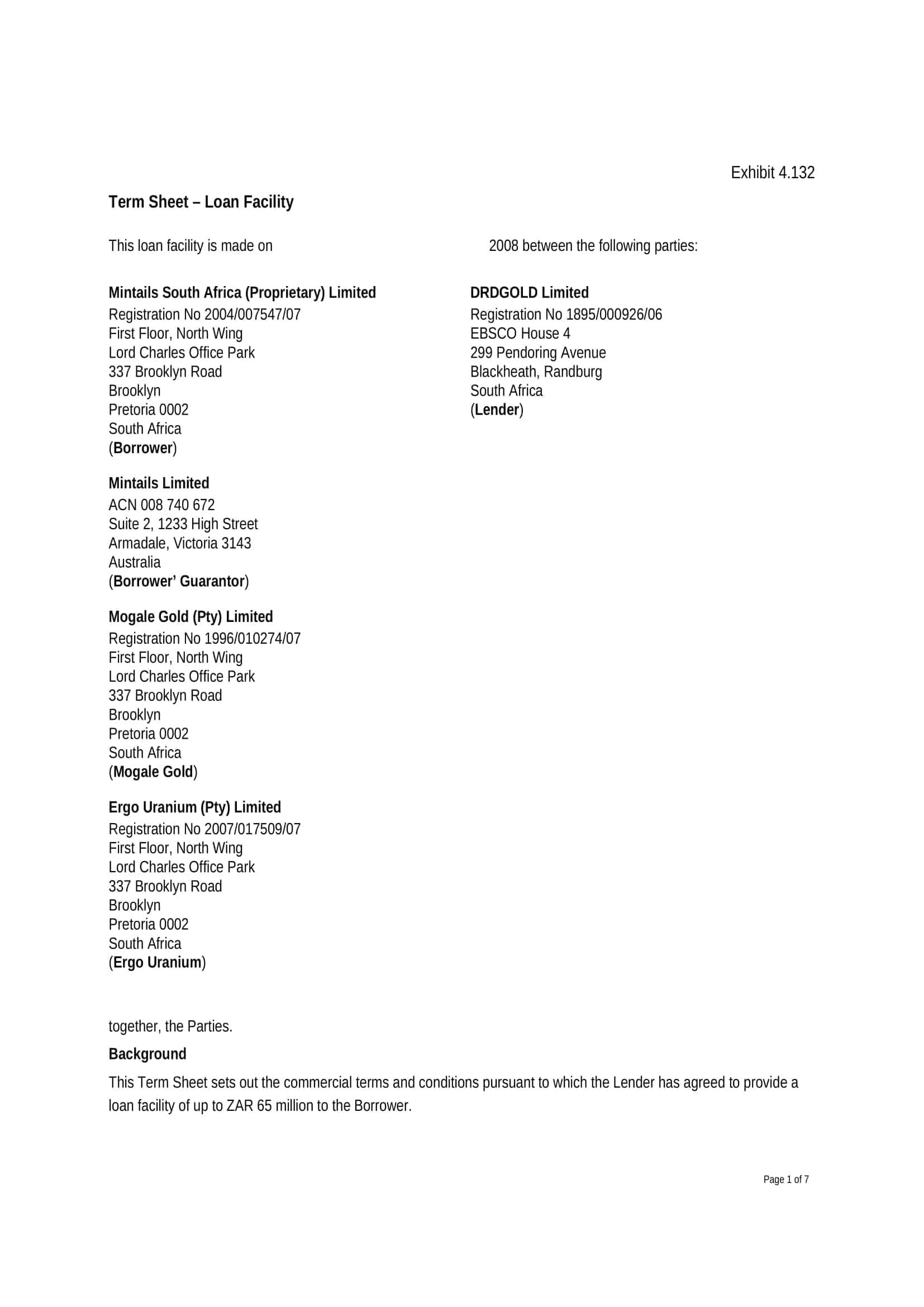

The Terms Sheet in M&A

Whether you’re a startup looking to close a seed round, or an established company looking to expand through an acquisition, you will likely be faced with trying to understand the term sheet of your agreement. Terms sheets are used in mergers and acquisitions (M&A) for many reasons.

They allow both parties in a deal to agree on the key points of their partnership without the risk of having to be committed should final negotiations fail. It is because of this that both parties can discuss details related to valuation over competitive terms.

Difference between an LOI and a Term sheet

An LOI is a document that outlines the terms of an agreement between two parties. It’s typically used in mergers and acquisitions but can be used in any situation where two parties must agree on how they will deal with certain issues.

For example, let’s say you want to buy a house from someone for $300,000. You agree on the price and other important details like the closing date and inspection period. That’s all included in your letter of intent. Now both parties have something to refer back to if there are any questions about what was agreed upon or if any changes need to be made.

The term sheet serves as a starting point for negotiations between an entrepreneur and venture capitalist or angel investor who might fund his/her venture. Sample term sheets are typically needed for negotiations between an entrepreneur and venture capitalist or angel investor who might fund his/her venture. They primarily serve as the basis for negotiations. Once you close the deal, the terms of the deal reached will be very similar to the ones on your.

Conclusion

The term sheet, a preliminary non-binding agreement, is the first step toward setting up an investment round. Ask your lawyer to draft your own terms, as it also helps you save on legal fees. If a startup gets a term sheet from investors, it allows entrepreneurs to prepare for raising money.

After discussing the investment with investors and if they are willing to invest, the founder and the investor will go ahead with drafting the term sheet. The general purpose of a term sheet is to obtain a preliminary description of the basic terms of interest to a potential business and its principals. One main objective of having a term sheet is to communicate that there is a high level of interest from potential investors in regard to financial backing.

FAQs

What is included on a term sheet?

A term sheet typically includes the investment amount, valuation, share structure, investor rights, voting rights, liquidation preference, dividends, redemption rights, and other key terms of the deal. It summarizes the main agreed terms.

What is a term sheet template?

A term sheet template is a pre-formatted document containing standard headings and fields for a term sheet that can be customized for specific deals. It serves as a starting structure to streamline term sheet creation.

What is the most important thing on the term sheet?

The most important items on a term sheet are typically the economic terms like the amount invested, valuation, liquidation preference, dividend rights, voting rights, and key shareholder controls. These heavily impact the financial outcome for investors.

How do you create a term sheet?

To create a term sheet:

- List basic deal points like amount invested, valuation, stock details

- Define shareholder rights for voting, board seats, etc.

- Outline liquidation preference and distribution of proceeds

- Include provisions for dividends, redemptions, transfers

- Add other relevant terms like drag-along rights

- Use clear language and define unfamiliar terms

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)