When forming a business partnership, it is essential to have a well-drafted partnership agreement in place. A partnership agreement is a legal document that outlines the terms and conditions of the partnership, including the responsibilities and rights of each partner, the management and ownership of the business, and the process for resolving disputes. However, drafting a partnership agreement can be a daunting task, especially if you are not familiar with the legal language and requirements.

One common mistake is to rely solely on generic business partnership agreement template examples, without considering the specific needs of your partnership. In this article, we will explore the importance of a tailored partnership agreement and provide tips and guidance on how to draft one that is tailored to your unique situation. Whether you are just starting a business or are looking to update your existing partnership agreement, understanding the key components of a partnership agreement will help to ensure that your partnership is protected and successful.

Table of Contents

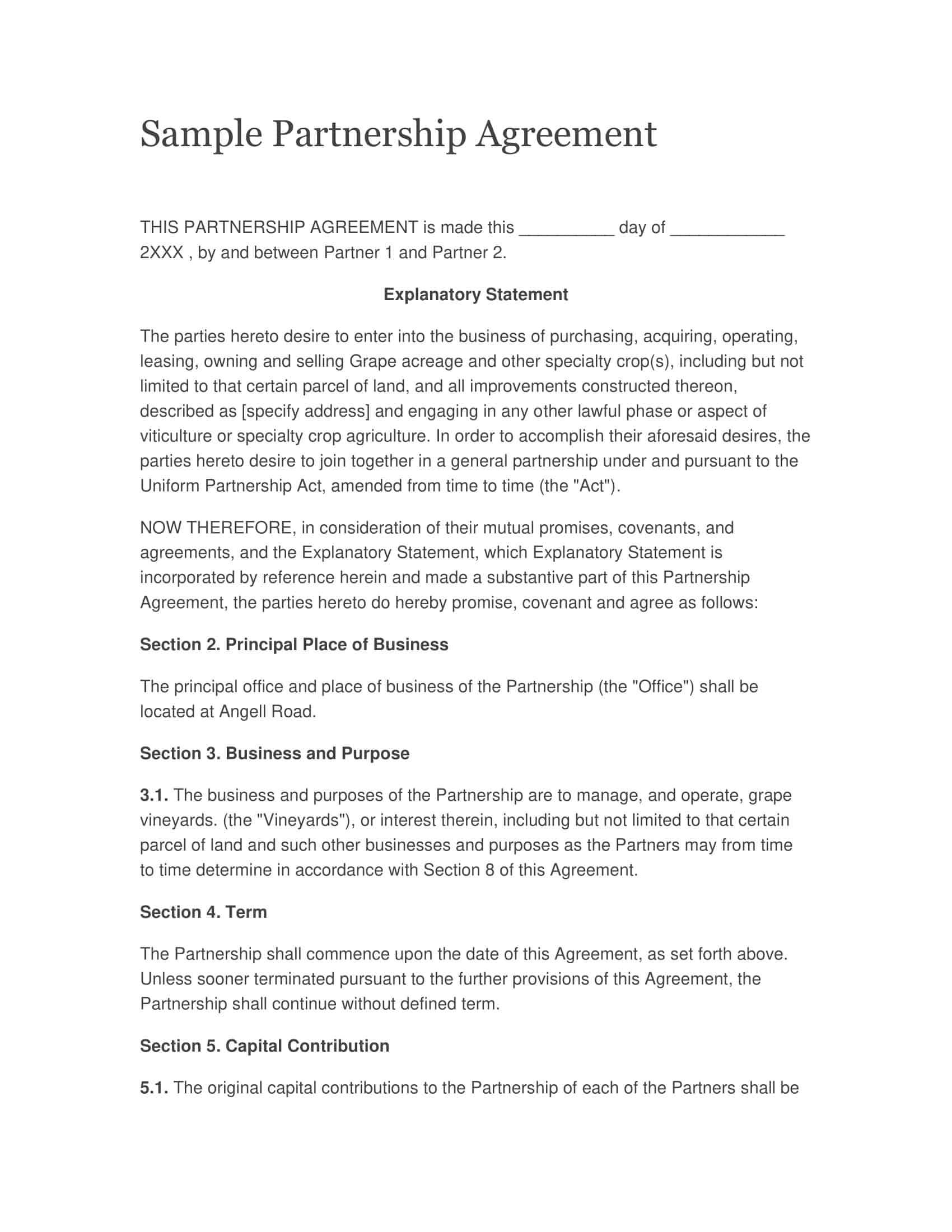

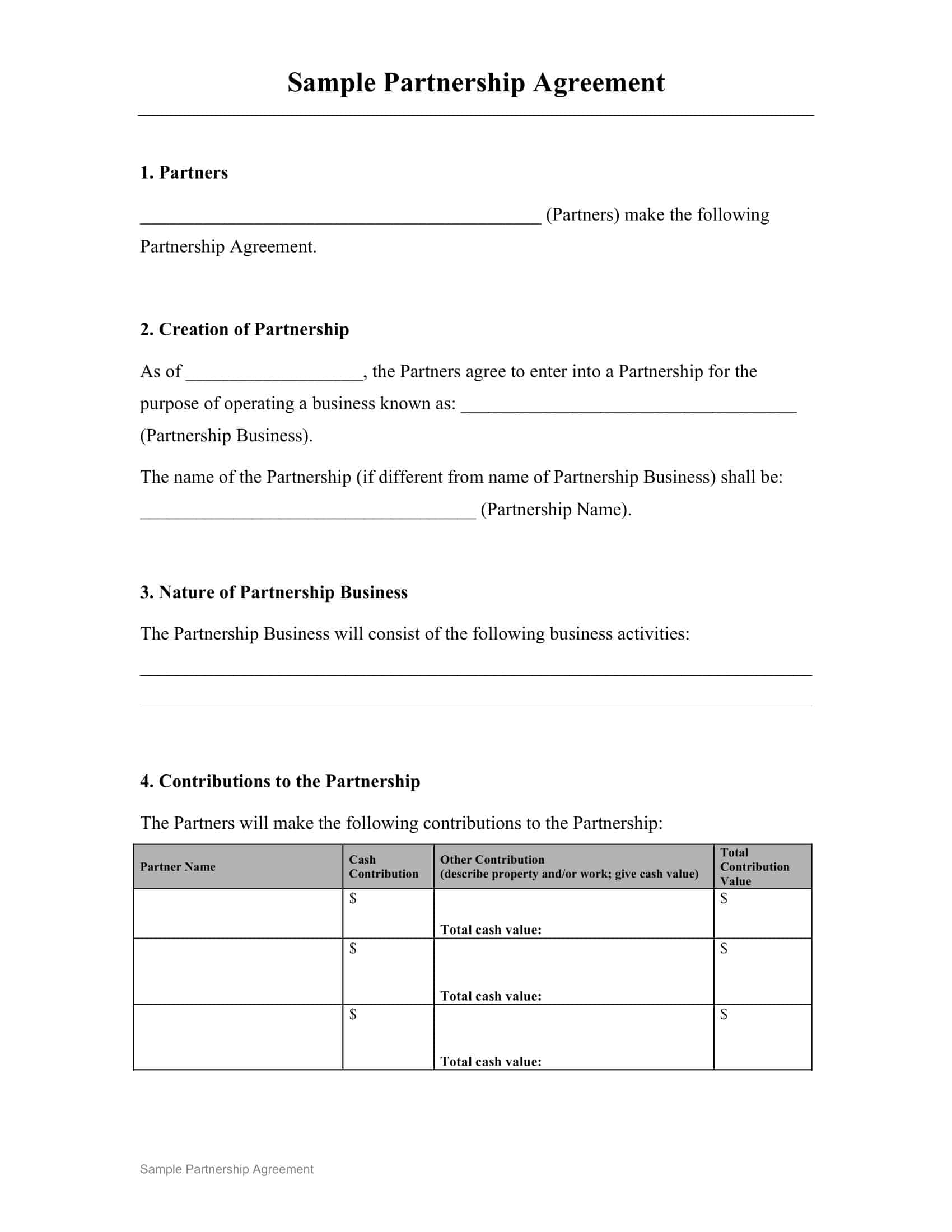

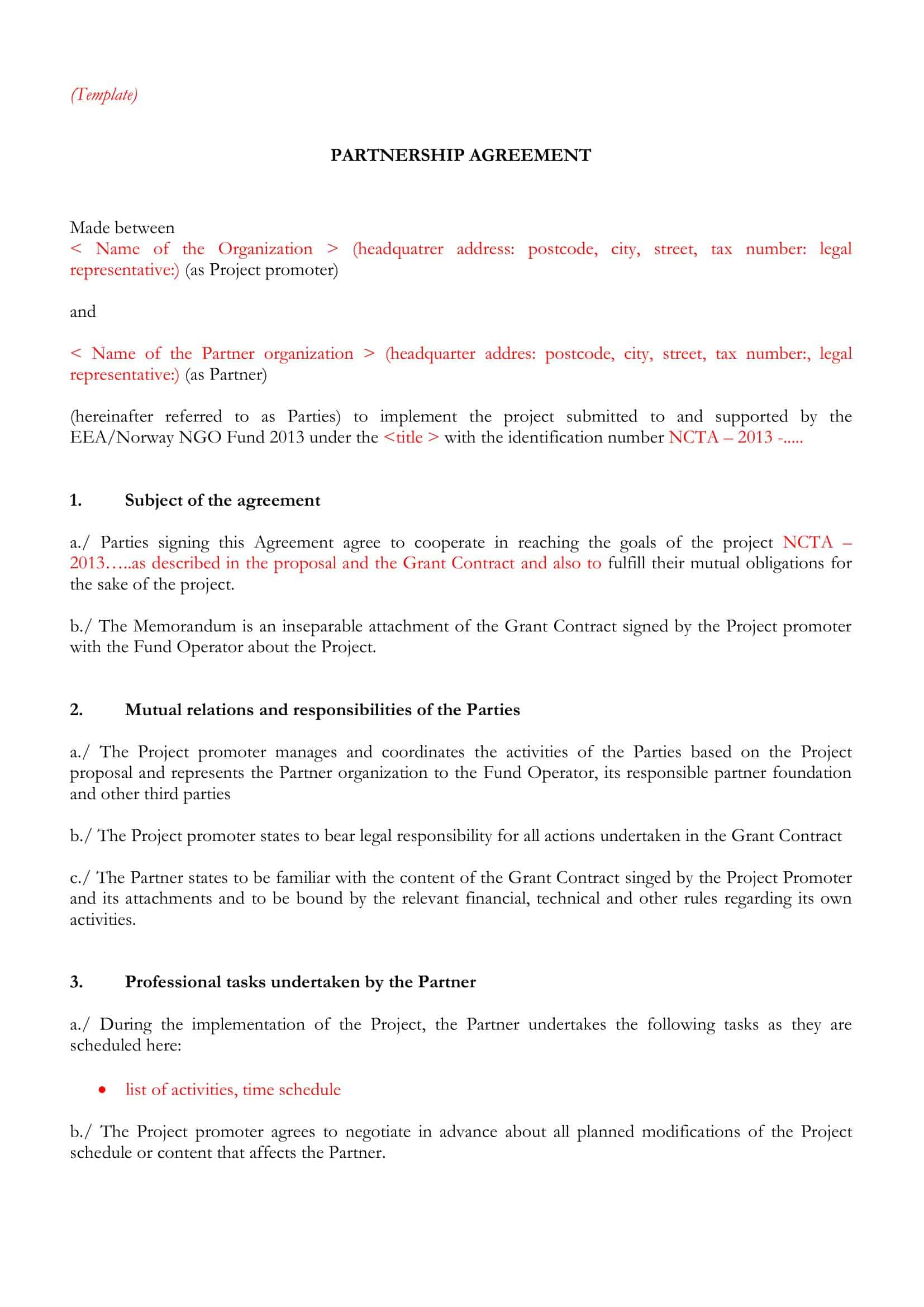

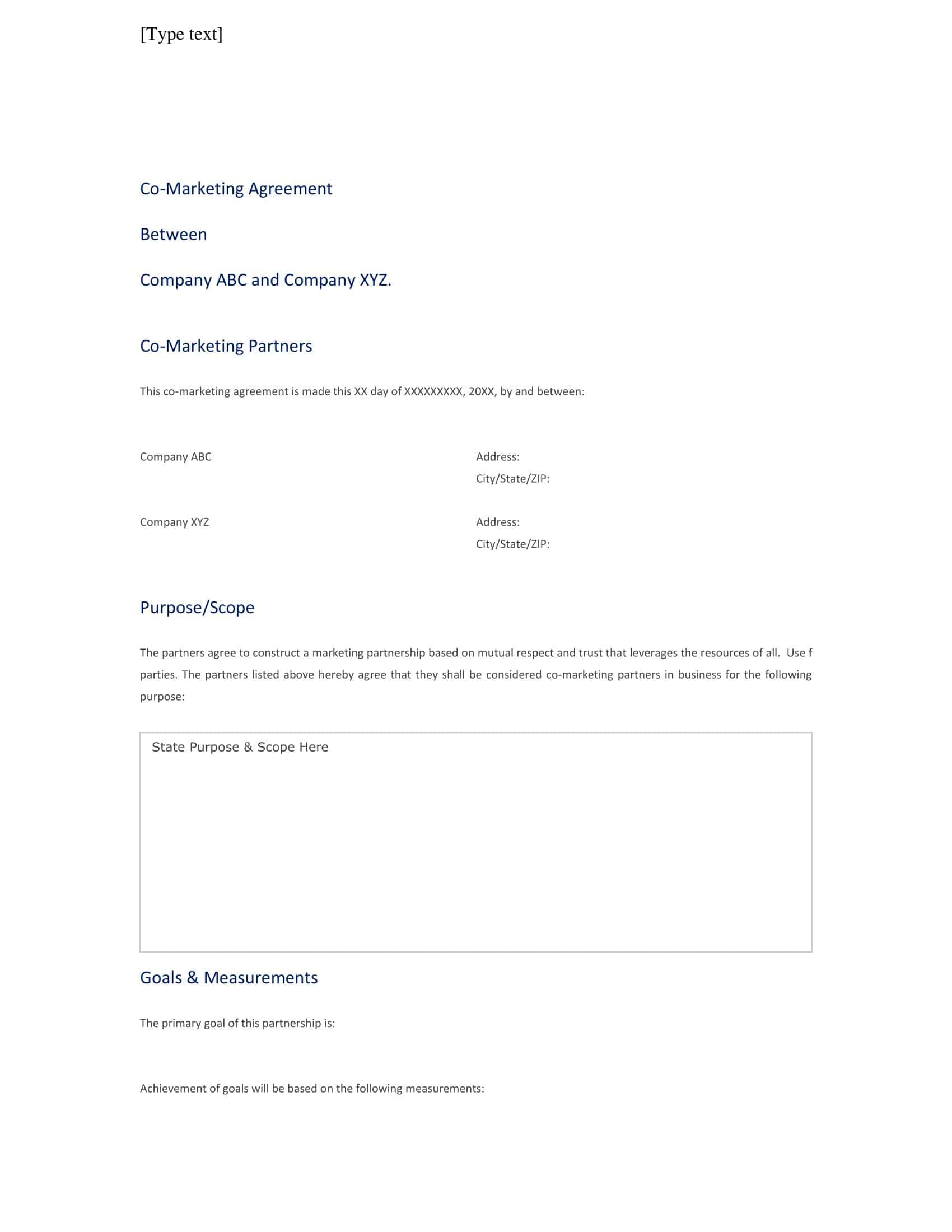

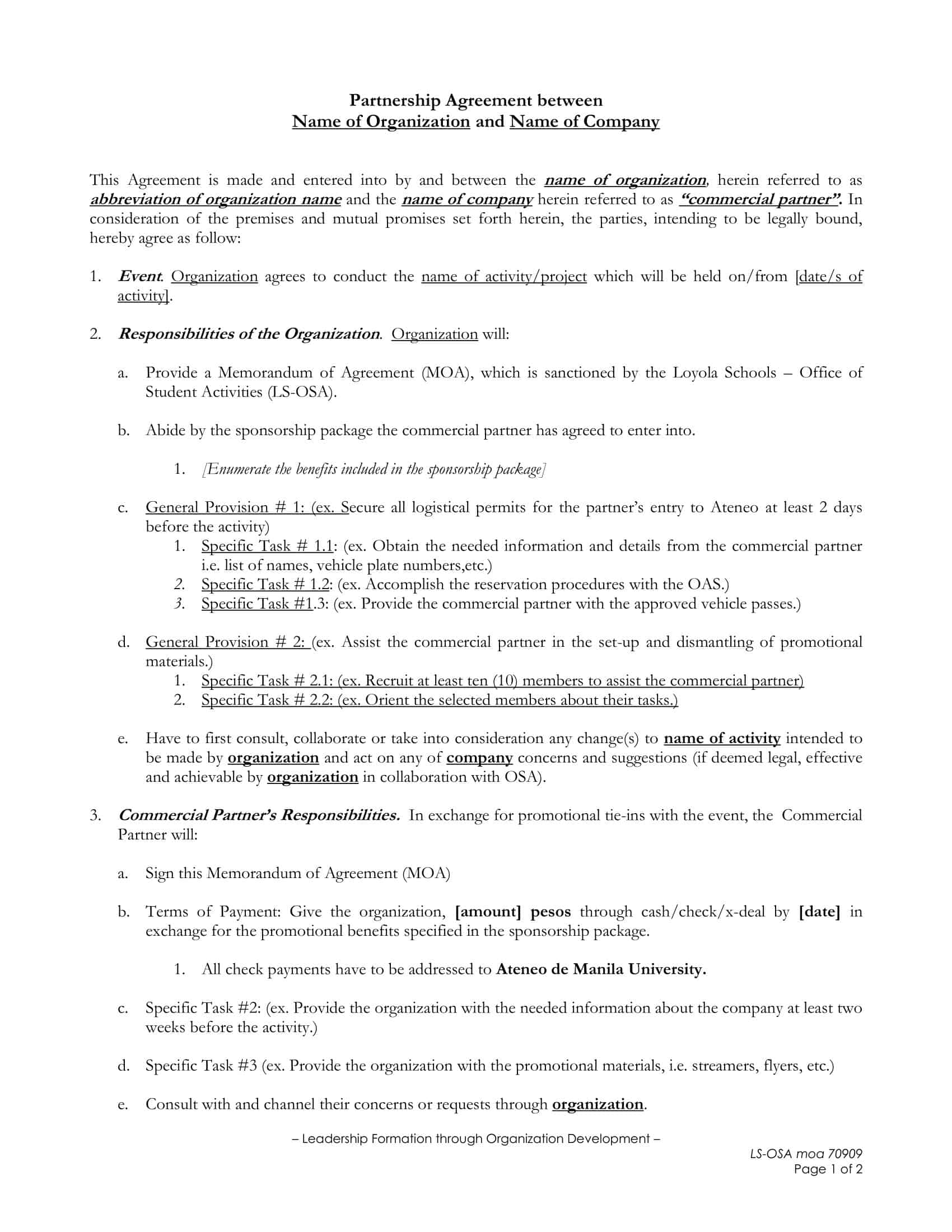

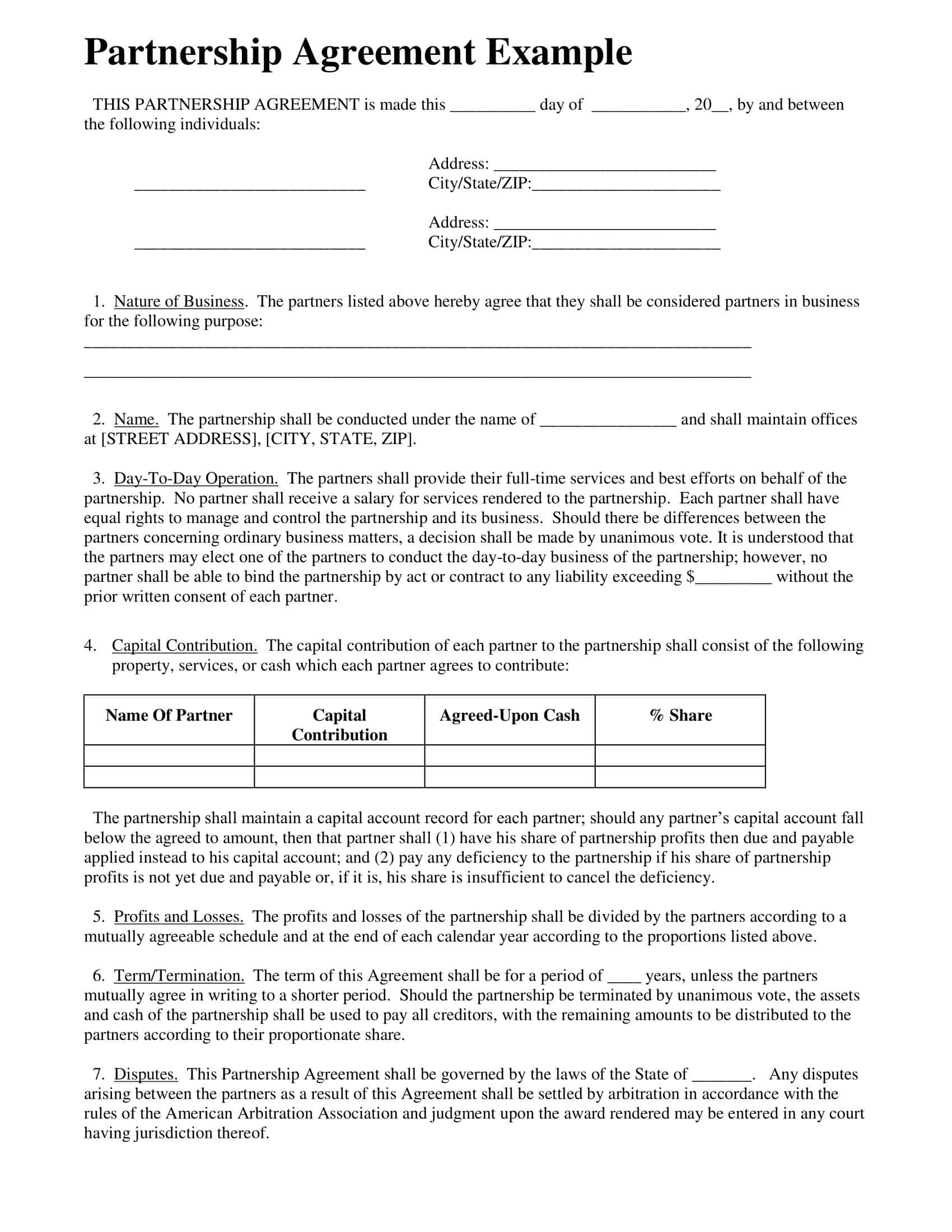

Partnership Agreement Templates

Partnerships are a popular business structure that allows two or more individuals or entities to join forces and work towards a common goal. One crucial aspect of establishing a successful partnership is drafting a well-defined partnership agreement. A partnership agreement serves as a legal document that outlines the rights, responsibilities, and obligations of each partner, as well as the overall framework for the partnership’s operations. To simplify the process, many individuals and businesses turn to partnership agreement templates. In this comprehensive guide, we will delve into the details of partnership agreement templates, exploring their significance, key components, customization options, and benefits.

Partnership agreement templates serve as invaluable tools for individuals and businesses embarking on a partnership venture. By providing a comprehensive framework that covers essential elements and allowing for customization, these templates streamline the process of creating a legally binding partnership agreement. By leveraging the benefits of partnership agreement templates, partners can establish a solid foundation for their collaboration, ensuring a harmonious and mutually beneficial partnership journey.

Components of a partnership agreement

A partnership agreement should include the following key components:

Business Purpose: The agreement should clearly define the purpose of the partnership, including the specific business activities that the partners will be engaged in.

Partner Contributions: The agreement should specify the contributions that each partner will make to the partnership, including any financial investments, assets, or expertise that will be brought to the business.

Profit and Loss Distribution: The agreement should specify how profits and losses will be divided among the partners. This could be based on a percentage of each partner’s investment, or on a predetermined formula.

Management and Decision Making: The agreement should outline the roles and responsibilities of each partner in the management of the business, and how major decisions will be made.

Duration of the Partnership: The agreement should specify the duration of the partnership, whether it is a fixed term or an ongoing partnership.

Dissolution of the Partnership: The agreement should specify the conditions under which the partnership can be dissolved, such as if a partner wants to leave, if the business is not profitable or if there is a disagreement among partners.

Dispute Resolution: The agreement should include a process for resolving disputes that may arise among the partners. This can include mediation, arbitration, or legal action.

Governing Law: The agreement should specify the governing law that will be used to interpret and enforce the agreement.

Signature: The agreement should be signed by all partners to indicate their acceptance of the terms and conditions.

What Are The Types of Partnership?

There are several types of partnership, including:

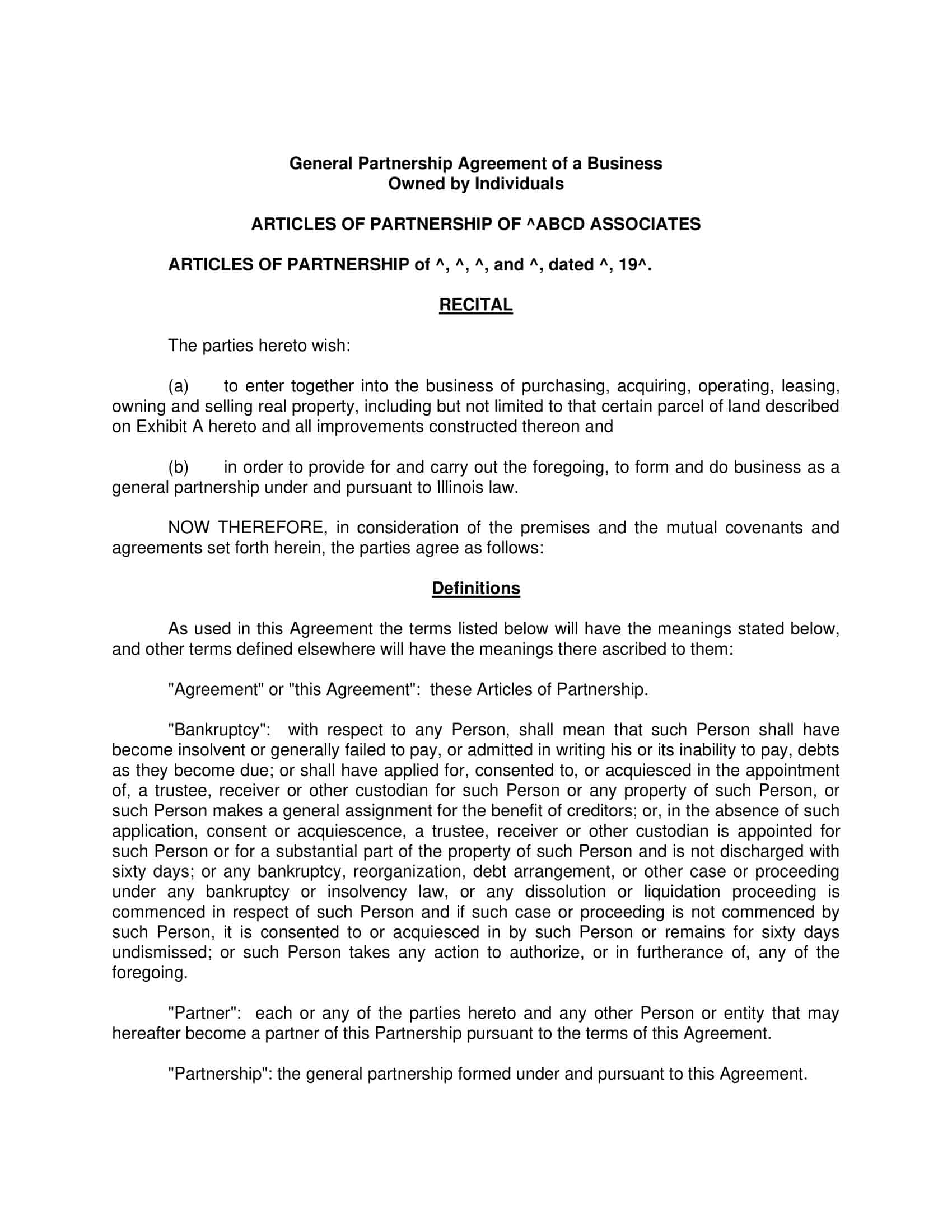

General partnership

A general partnership is a type of partnership where all partners share in the management and profits of the business. All partners are personally liable for the debts and obligations of the partnership.

Limited partnership

A limited partnership is a type of partnership where there are one or more general partners who manage the business and are personally liable for the debts and obligations of the partnership, and one or more limited partners who do not participate in the management of the business but provide capital and are only liable for the debts and obligations of the partnership to the extent of their capital contributions.

Limited liability partnership (LLP)

A limited liability partnership is a type of partnership where partners have limited personal liability for the debts and obligations of the partnership. This means that partners are not personally liable for the actions of other partners.

Joint venture

A joint venture is a type of partnership where two or more parties come together to undertake a specific project or business activity. The partners share in the profits and losses of the venture and have a specific time frame in which the venture will be in effect.

Mutual agreement partnership

A mutual agreement partnership is a type of partnership where two or more parties come together to undertake a specific project or business activity, but without the formal registration or setting up of a legal entity.

Each type of partnership has its own advantages and disadvantages and it is important to understand the difference before making the decision of which one to choose. It is advisable to consult with a lawyer or a financial advisor to help you choose the right partnership structure that best fits your needs and goals.

Who Writes Partnership Agreements?

Partnership agreements are typically written by one or more of the partners, or by an attorney or legal professional who specializes in business law. It’s important that the agreement is thorough and comprehensive to ensure that it covers all aspects of the partnership and addresses any potential issues that may arise.

When writing a partnership agreement, it is best to consult with an attorney who has experience in drafting partnership agreements. An attorney can help you to ensure that the agreement is legally binding and compliant with state and federal laws, and that it includes all the necessary provisions and clauses. They will also be able to review the agreement and make recommendations for any changes or additions that should be made to ensure that it meets the needs of all parties involved.

It is also possible for the partners to create the agreement themselves and have it reviewed by a legal professional to ensure that it is legally binding and compliant with state and federal laws. In this case, it is important to be familiar with the key components of a partnership agreement and understand the legal requirements of your state.

In any case, all partners should have the opportunity to review the agreement, ask questions and make suggestions before it is signed. The final agreement should be clear and easy to understand, and should be agreed upon by all partners before it is signed.

How to Write a Business Partnership Agreement

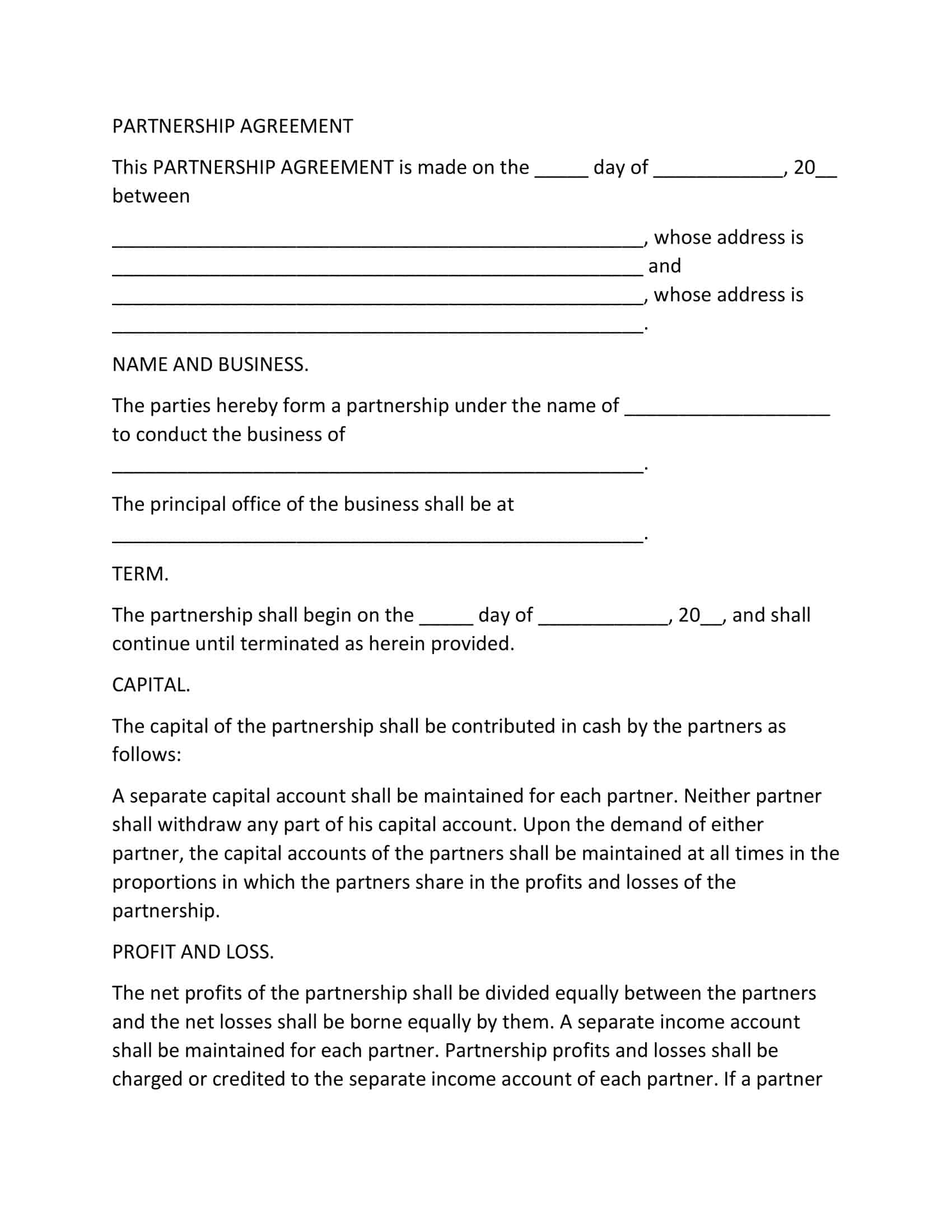

Preparing a partnership agreement involves several steps:

Define the business purpose: Clearly define the purpose of the partnership, including the specific business activities that the partners will be engaged in.

Determine the partner contributions: Identify the contributions that each partner will make to the partnership, including any financial investments, assets, or expertise that will be brought to the business.

Decide on profit and loss distribution: Determine how profits and losses will be divided among the partners. This could be based on a percentage of each partner’s investment, or on a predetermined formula.

Establish management and decision-making roles: Outline the roles and responsibilities of each partner in the management of the business, and how major decisions will be made.

Determine the duration of the partnership: Specify the duration of the partnership, whether it is a fixed term or an ongoing partnership.

Establish dissolution procedures: Specify the conditions under which the partnership can be dissolved, such as if a partner wants to leave, if the business is not profitable, or if there is a disagreement among partners.

Create a dispute resolution process: Include a process for resolving disputes that may arise among the partners. This can include mediation, arbitration, or legal action.

Choose a governing law: Specify the governing law that will be used to interpret and enforce the agreement.

Have the agreement reviewed by a lawyer: Have the agreement reviewed by a lawyer to ensure that it is legally binding and compliant with state and federal laws.

Sign the agreement: Once all parties have agreed to the terms and conditions of the partnership agreement, have it signed by all partners to indicate their acceptance of the terms and conditions.

By following these steps, you can ensure that your partnership agreement is comprehensive and tailored to your unique situation, and that it addresses any potential issues that may arise in the partnership. It is advisable to review the agreement periodically to ensure that it still serves the needs of the partnership and make any necessary updates.

FAQs

How often should a partnership agreement be reviewed?

It is advisable to review the partnership agreement periodically to ensure that it still serves the needs of the partnership and make any necessary updates. It is also important to review the agreement when there is a change in the partnership, such as the addition or removal of a partner or a significant change in the business operations.

Why is a partnership agreement important?

A partnership agreement is important because it establishes the legal framework for the partnership and helps to protect the interests of all partners. It ensures that all partners understand their roles and responsibilities and how the partnership will be managed, and it provides a clear process for resolving disputes and dissolving the partnership.

Can a partnership agreement be changed?

Yes, a partnership agreement can be amended or modified at any time, as long as all partners agree to the changes. It is important to have any changes reviewed by a lawyer to ensure that they are legally binding and compliant with state and federal laws.

What happens if a partner violates the partnership agreement?

If a partner violates the partnership agreement, the other partners have the right to take legal action. The partnership agreement should have a dispute resolution process outlined, which can include mediation, arbitration, or court action. The violation may also be grounds for termination of the partnership.

Can a partnership agreement be terminated?

Yes, a partnership agreement can be terminated by mutual agreement of the partners, by the expiration of the agreed-upon term, or by the occurrence of an event specified in the agreement such as the death, disability, or bankruptcy of a partner.

Is a written partnership agreement legally required?

While a written partnership agreement is not legally required, it is highly recommended as it provides a clear understanding of the rights and responsibilities of all partners and protects the interests of all parties involved. Without a written agreement, the partnership will be governed by the state’s default partnership laws, which may not be suitable for the specific circumstances of the partnership.

How do you dissolve a partnership?

The dissolution of a partnership can occur in a number of ways, including mutual agreement of the partners, the expiration of the agreed-upon term, the occurrence of an event specified in the partnership agreement, or by court order. The partnership agreement should have a dissolution process outlined, which should be followed. It is important to notify any creditors and to settle any outstanding debts before dissolving the partnership.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Limited Partnership Agreement Templates [PDF, Word] LPA 2 Limited Partnership Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Limited-Partnership-Agreement-2-150x150.jpg)

![%100 Free Hoodie Templates [Printable] +PDF 3 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)