A startup budget template is a document that helps you establish your financial plans. Every startup has its own startup costs that are different from others. If you want to avoid any delays or obstacles, don’t use an existing sample of startup cost for your business. Instead, make one yourself in a format that everyone can understand.

Table of Contents

Startup Budget Templates

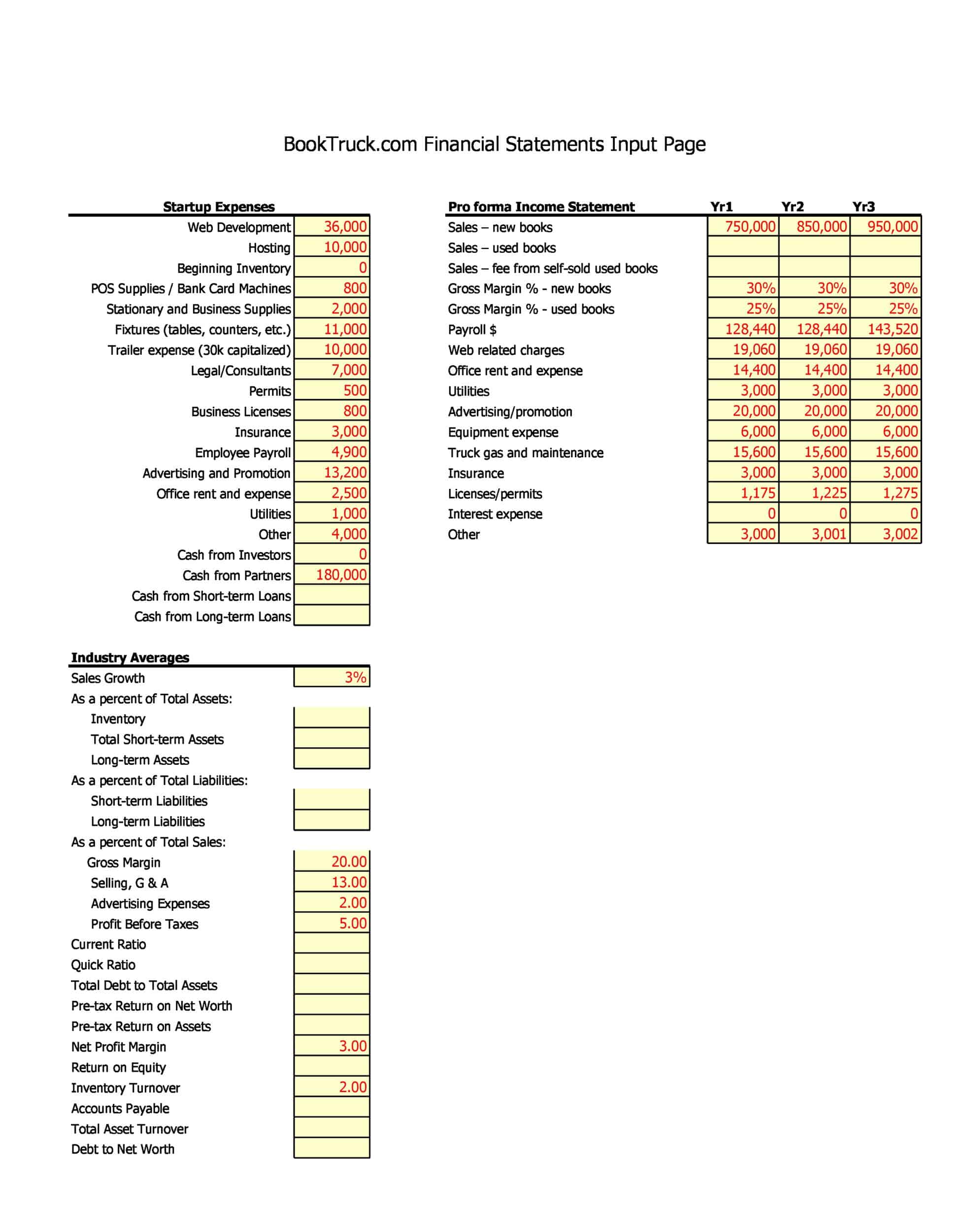

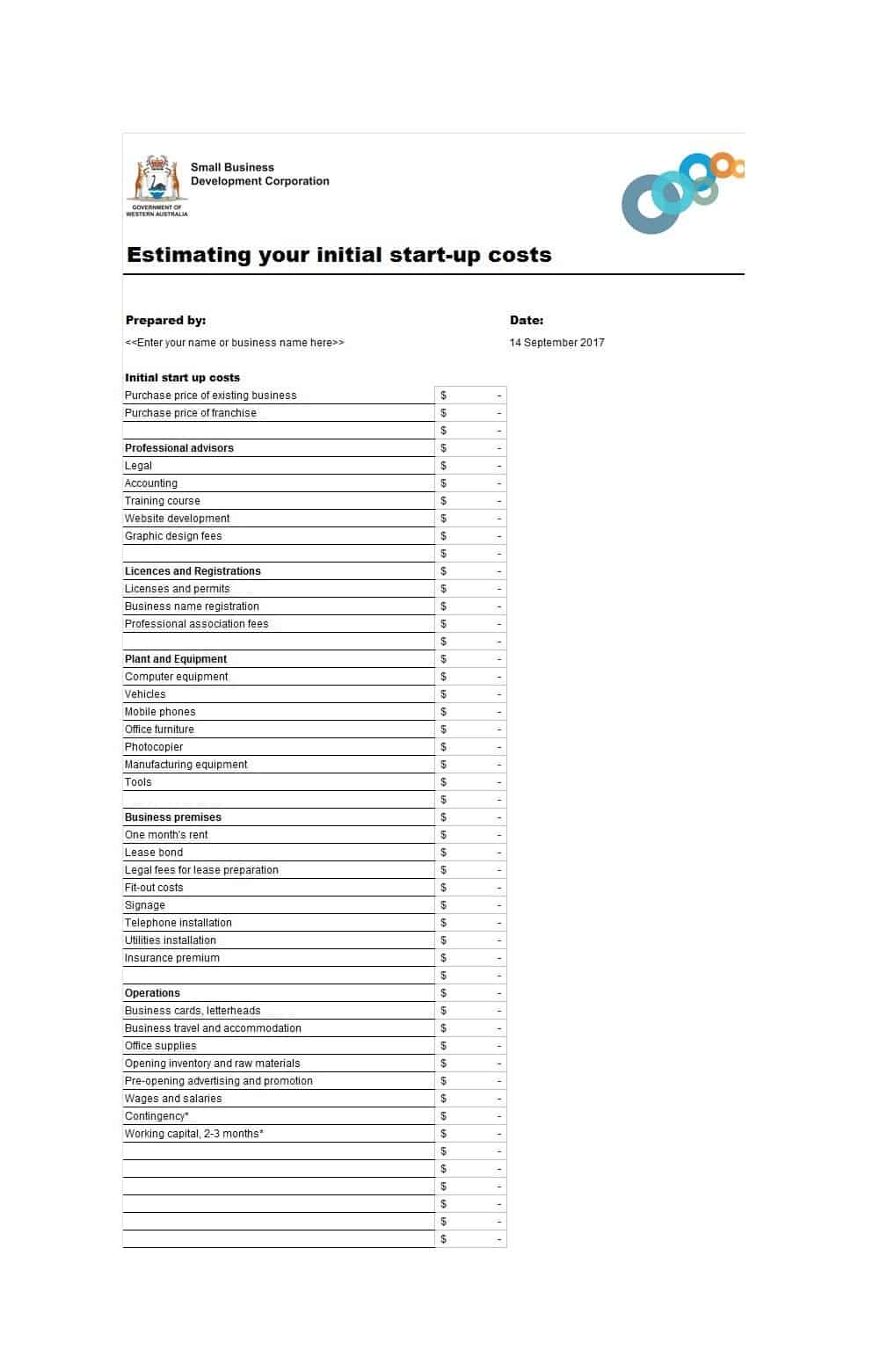

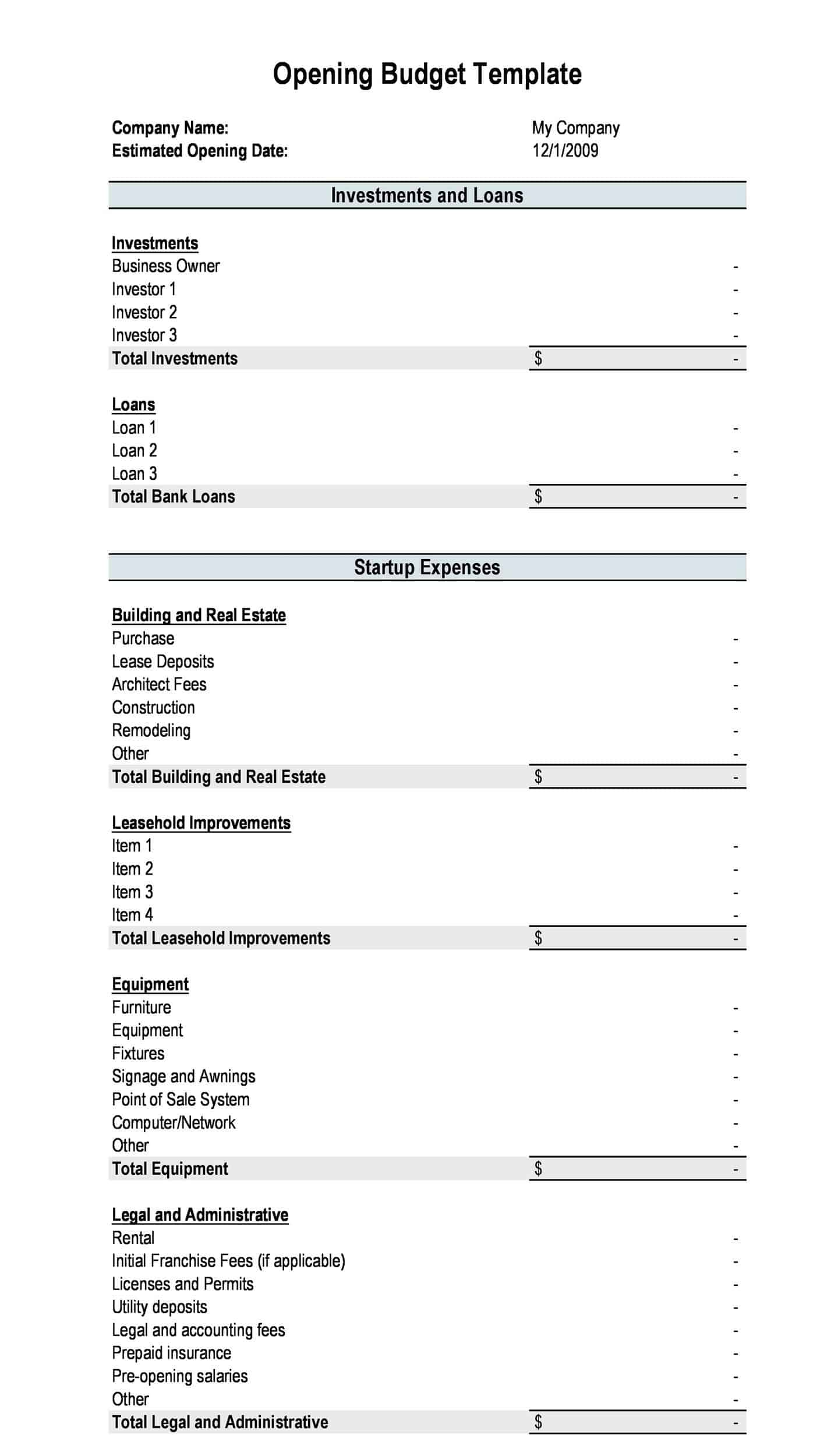

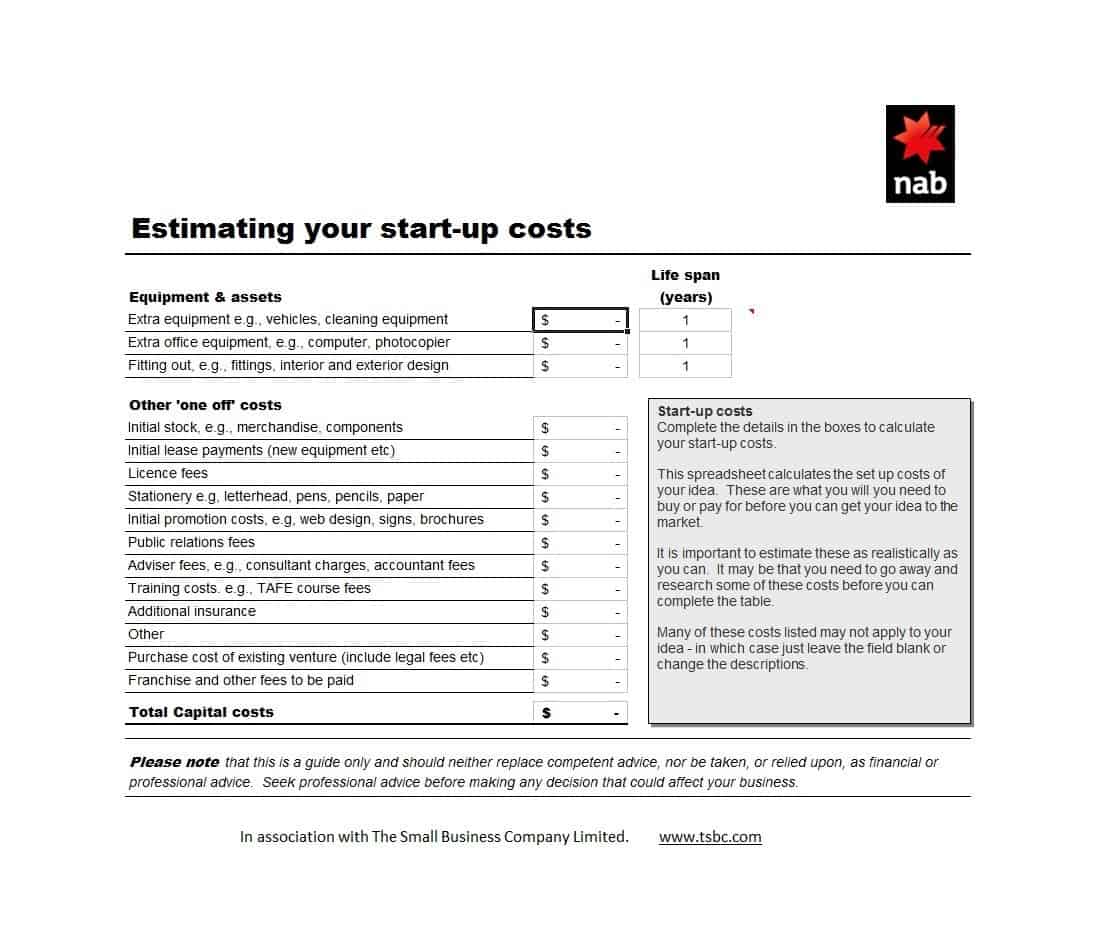

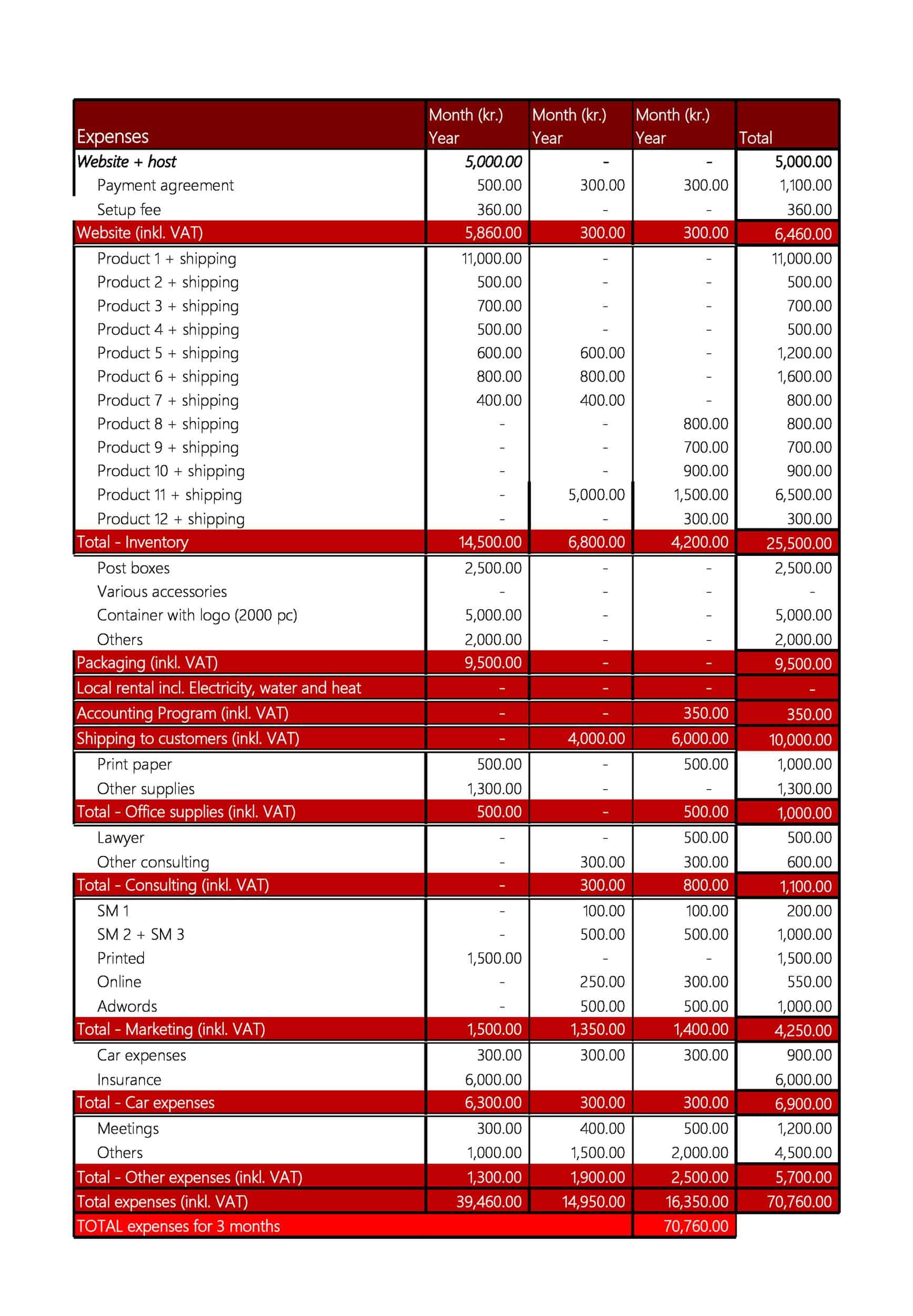

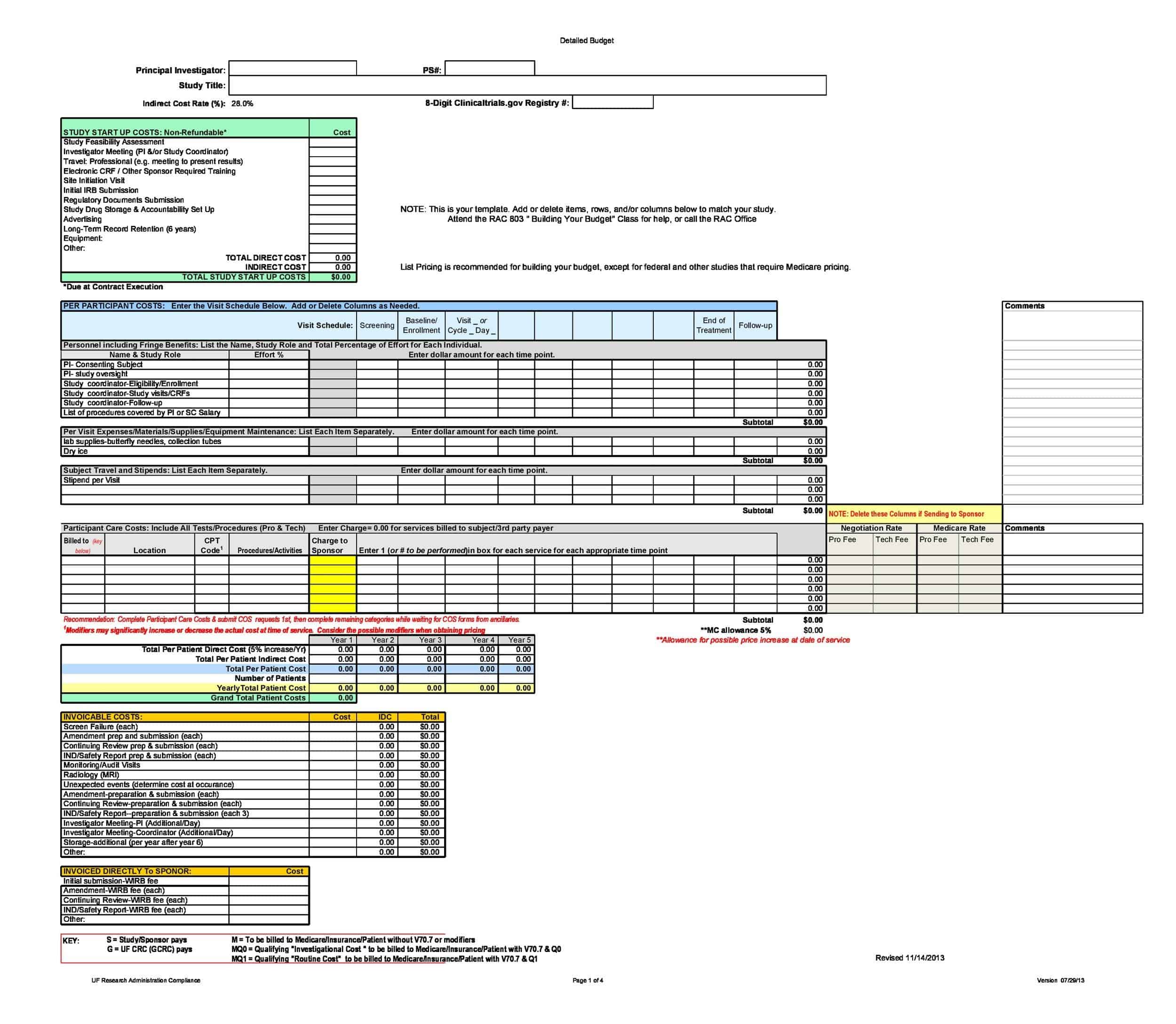

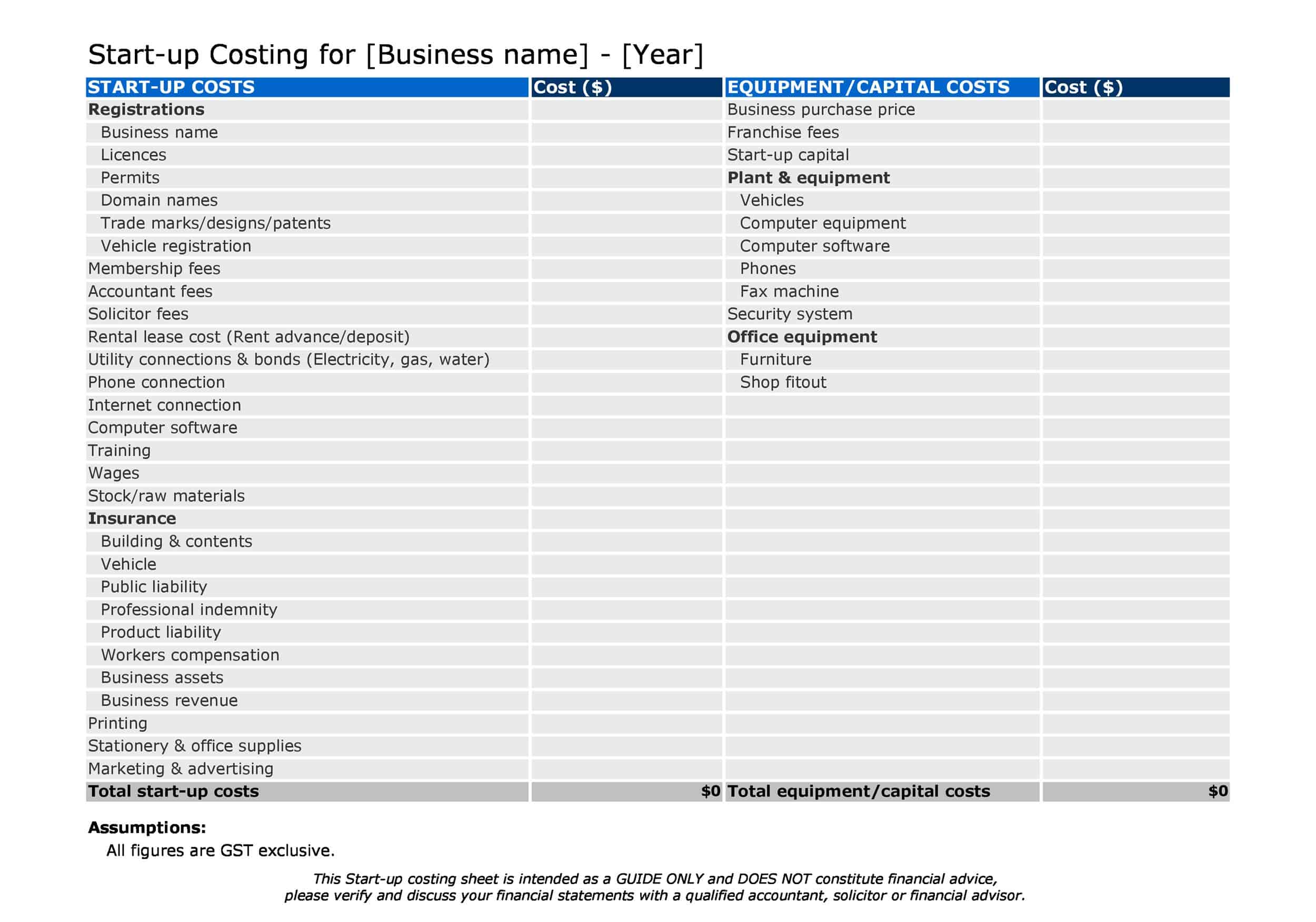

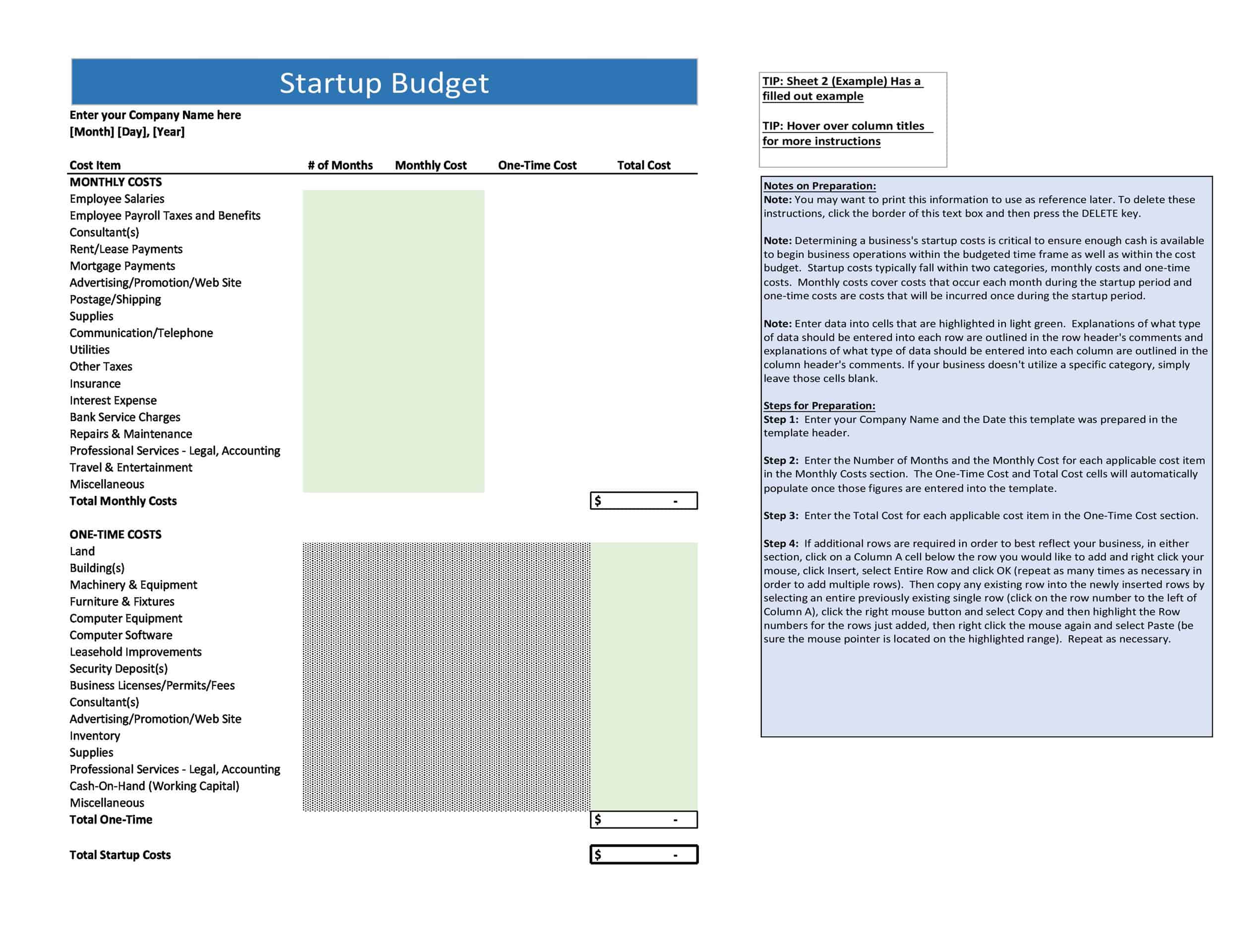

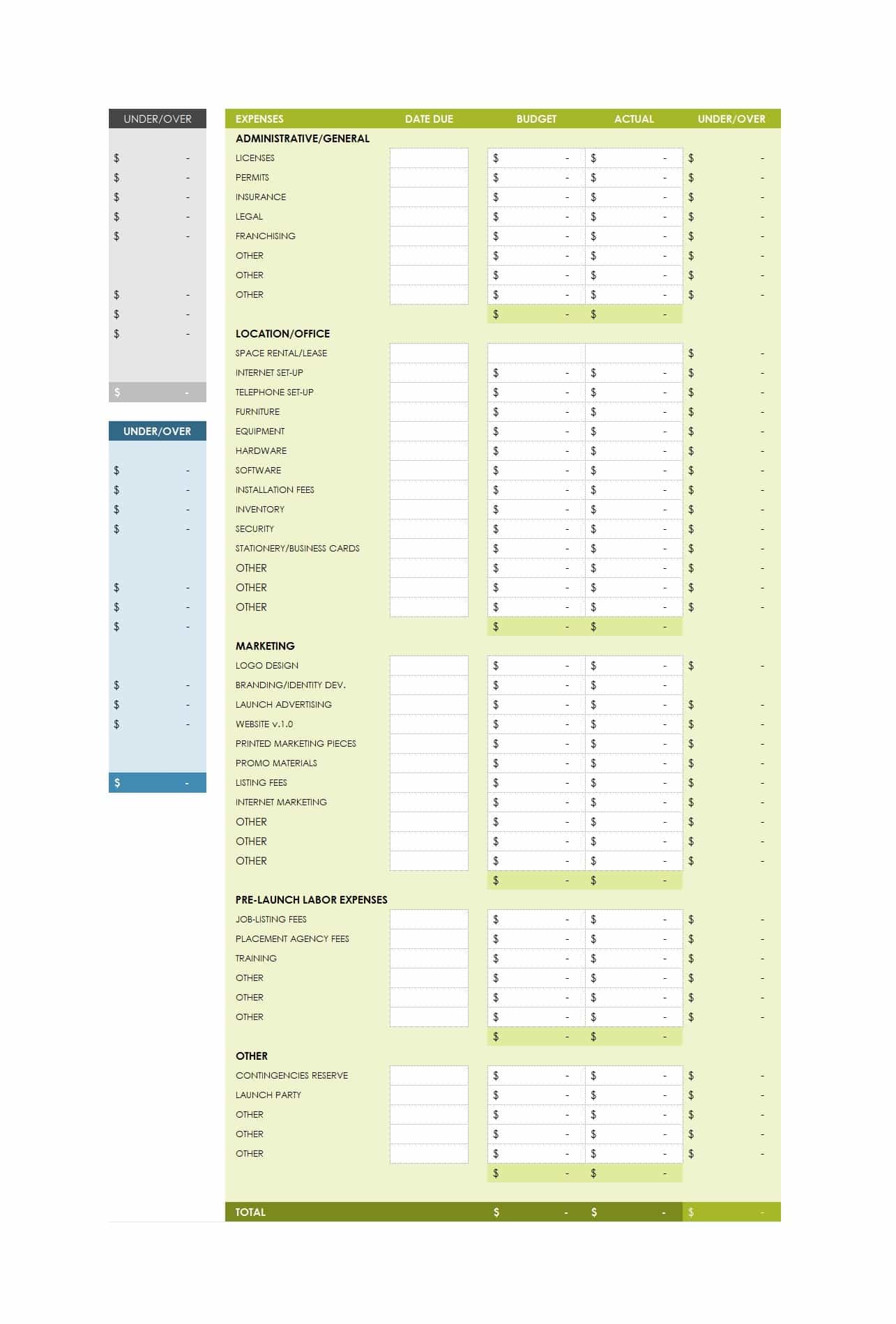

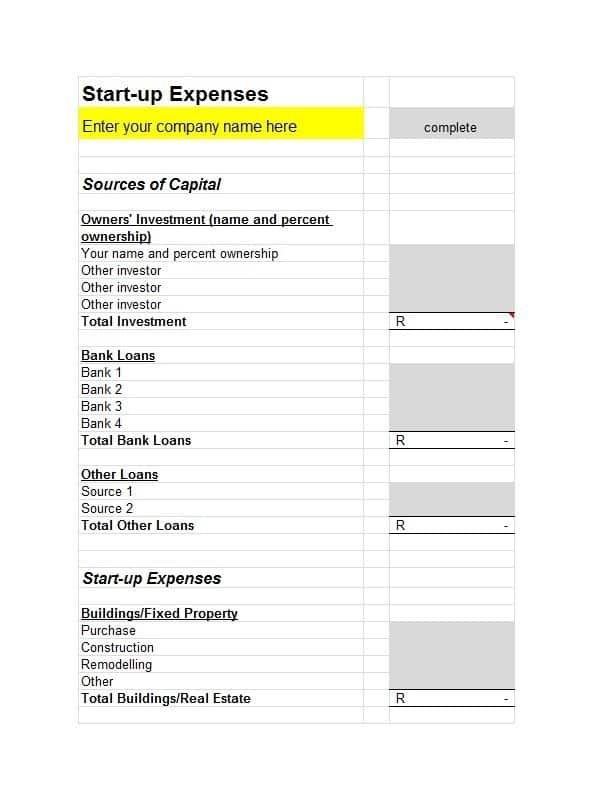

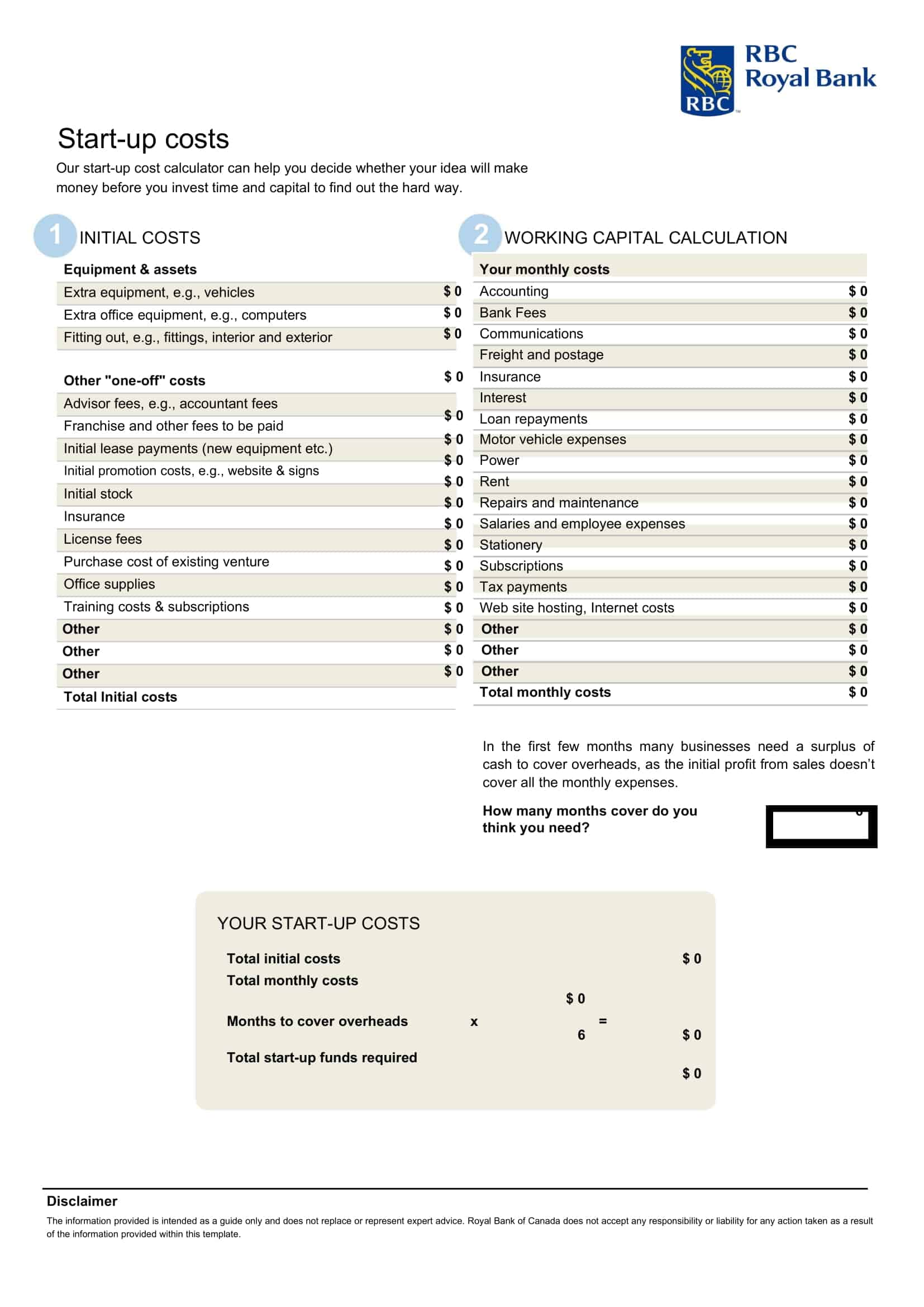

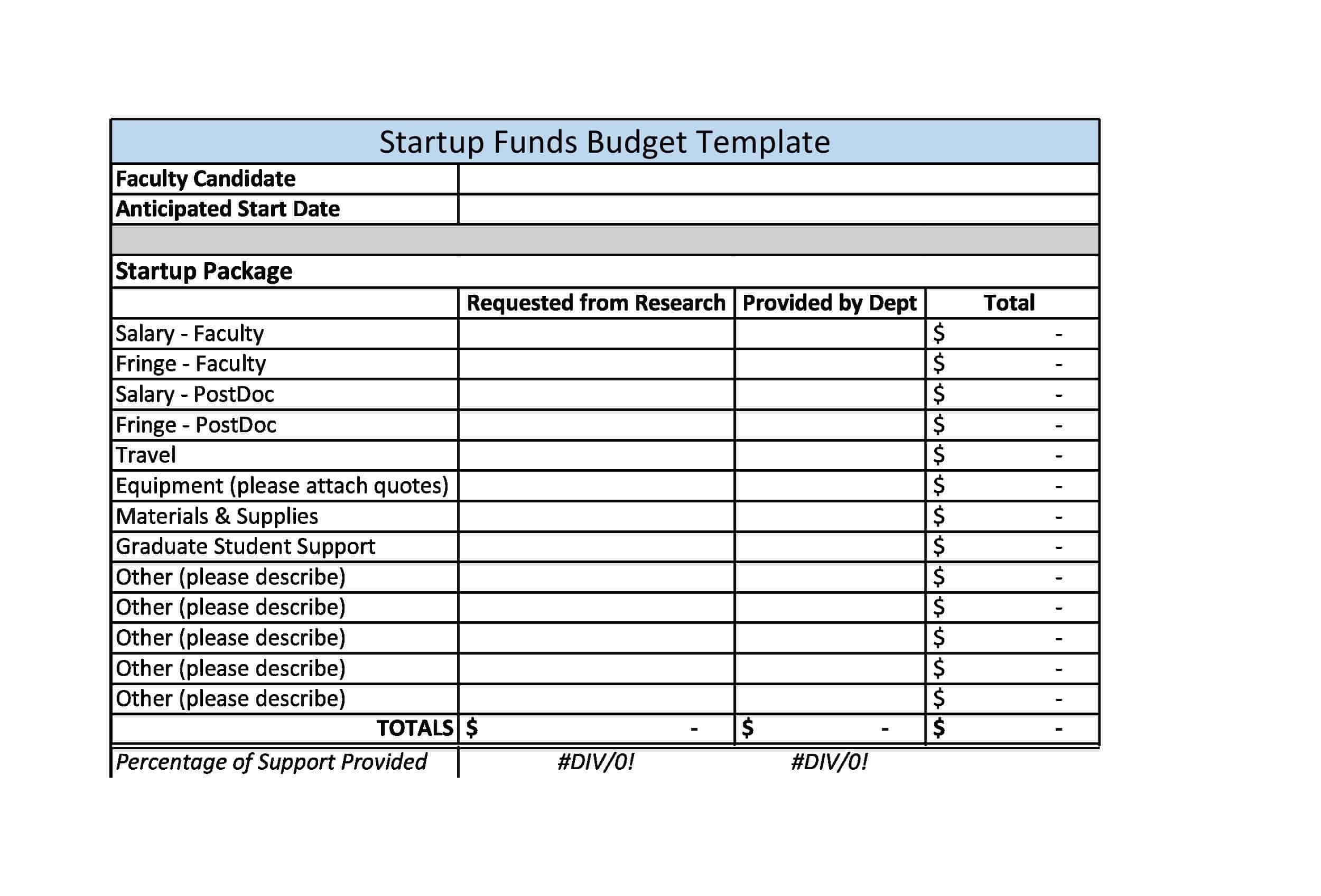

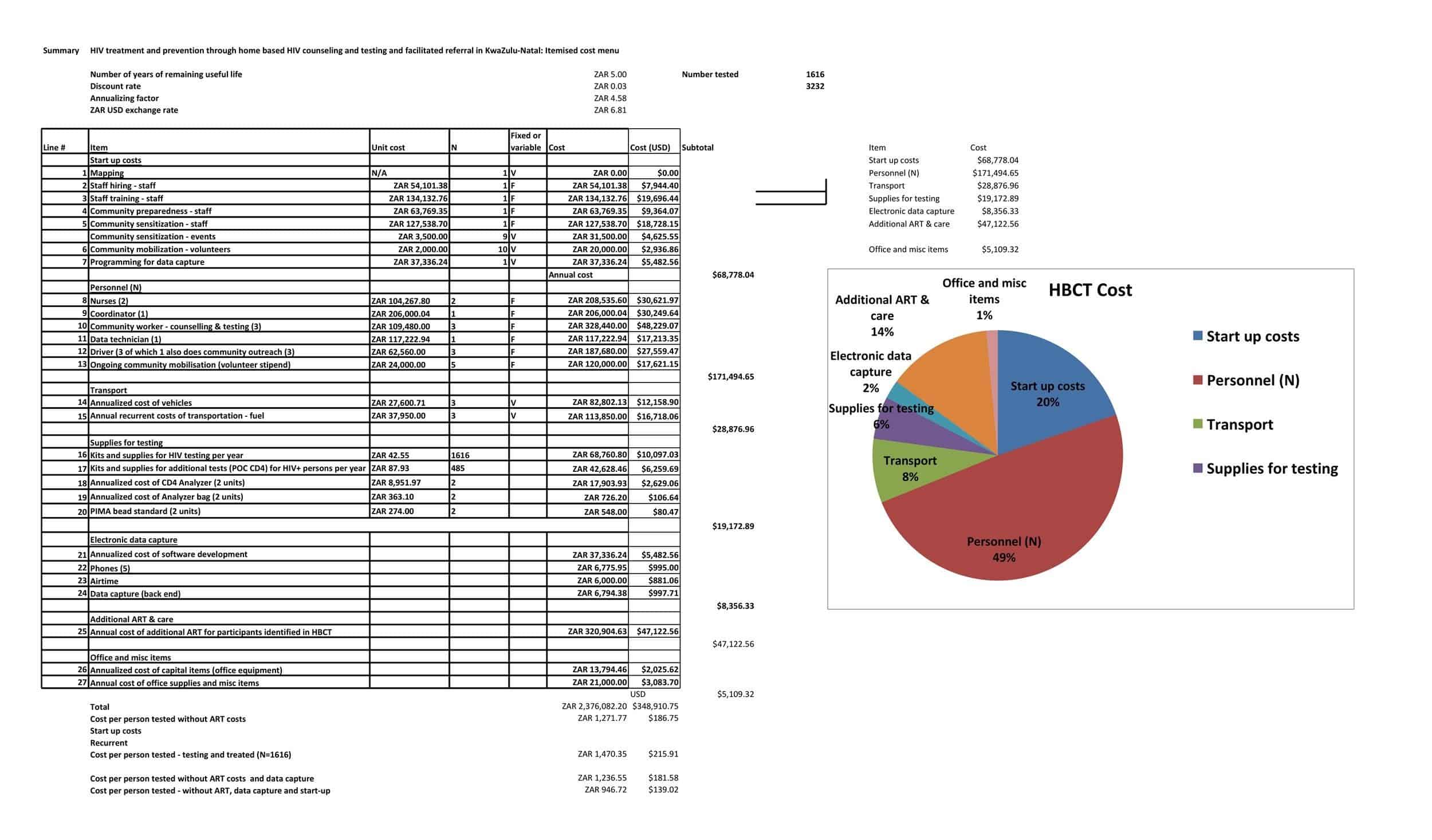

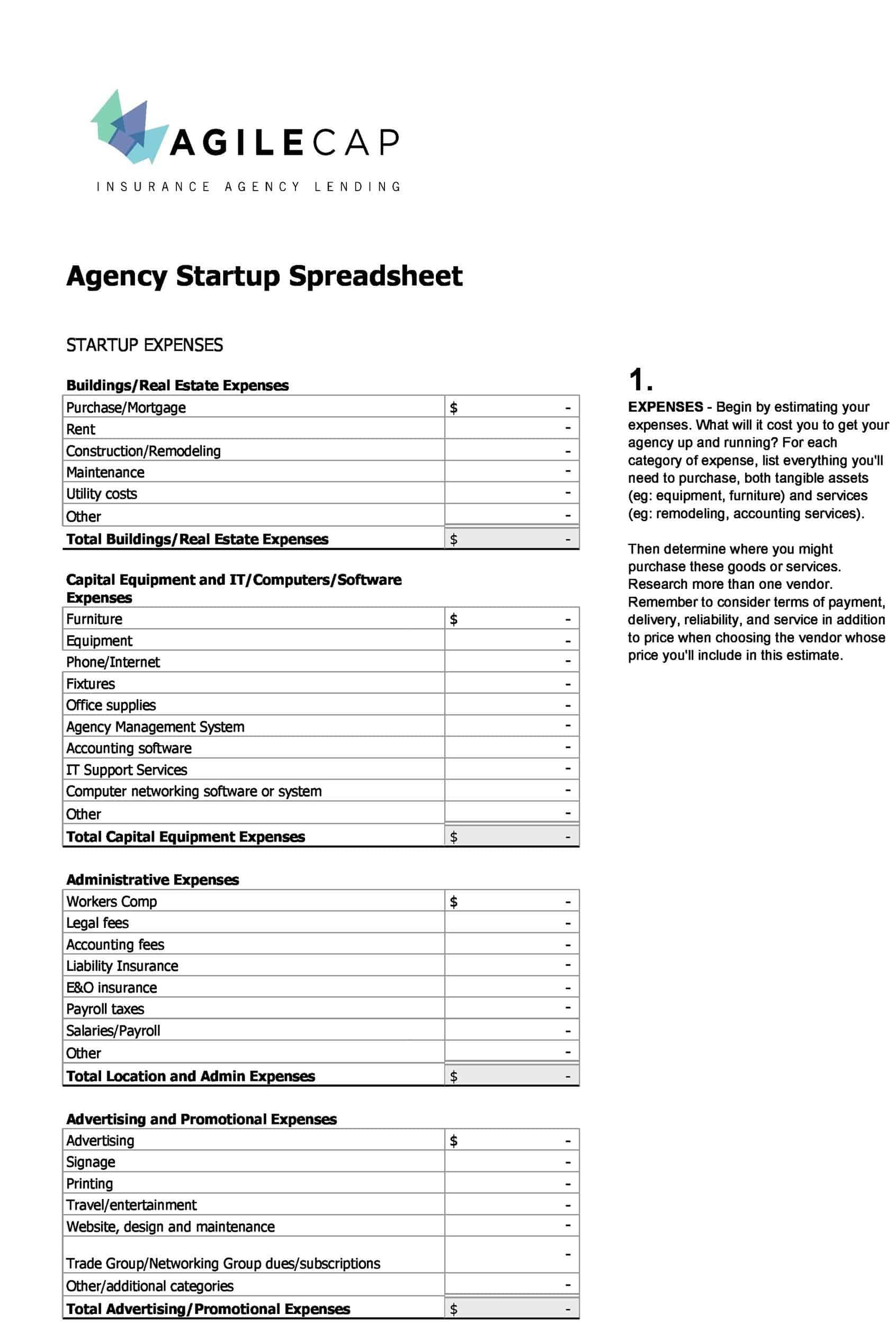

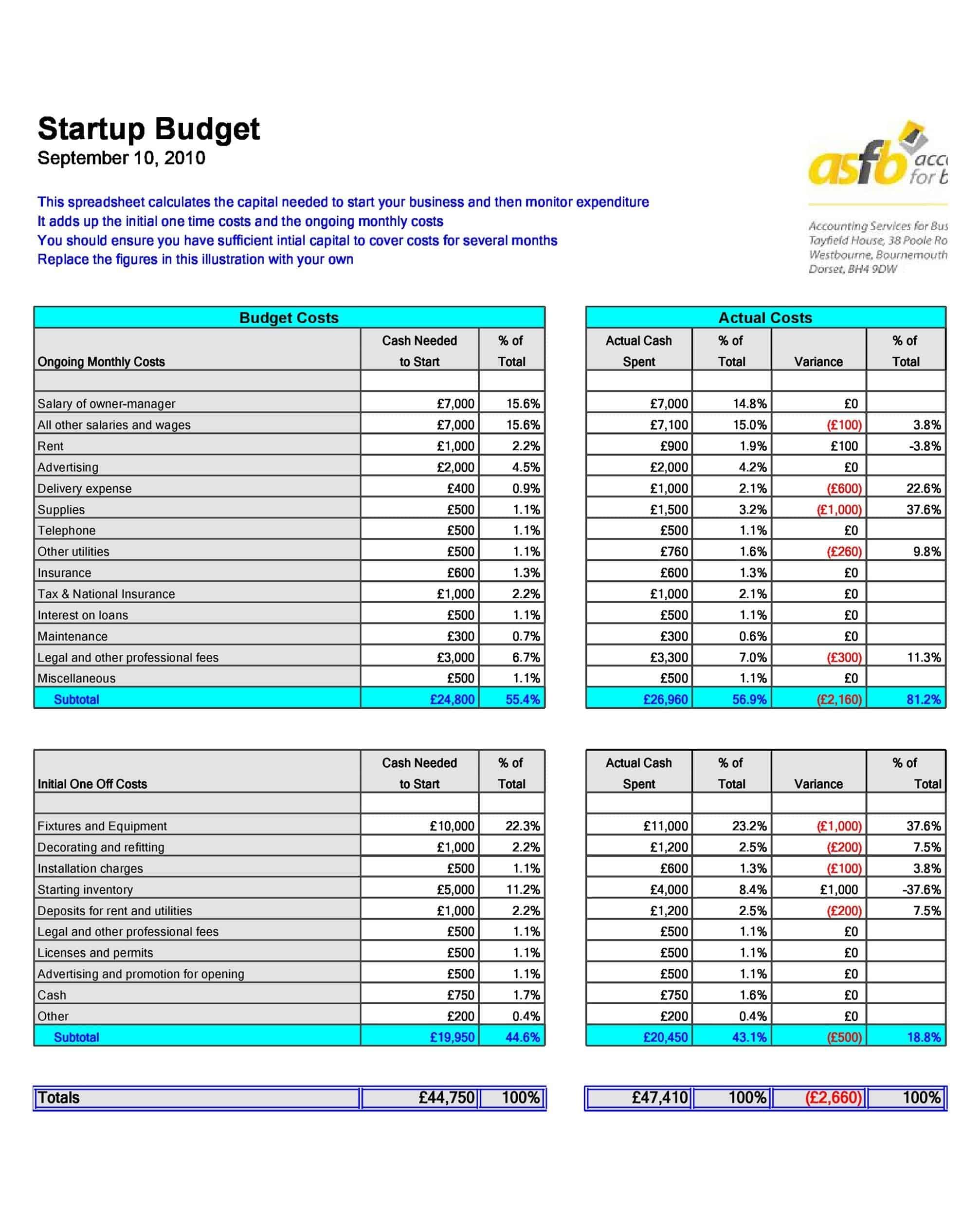

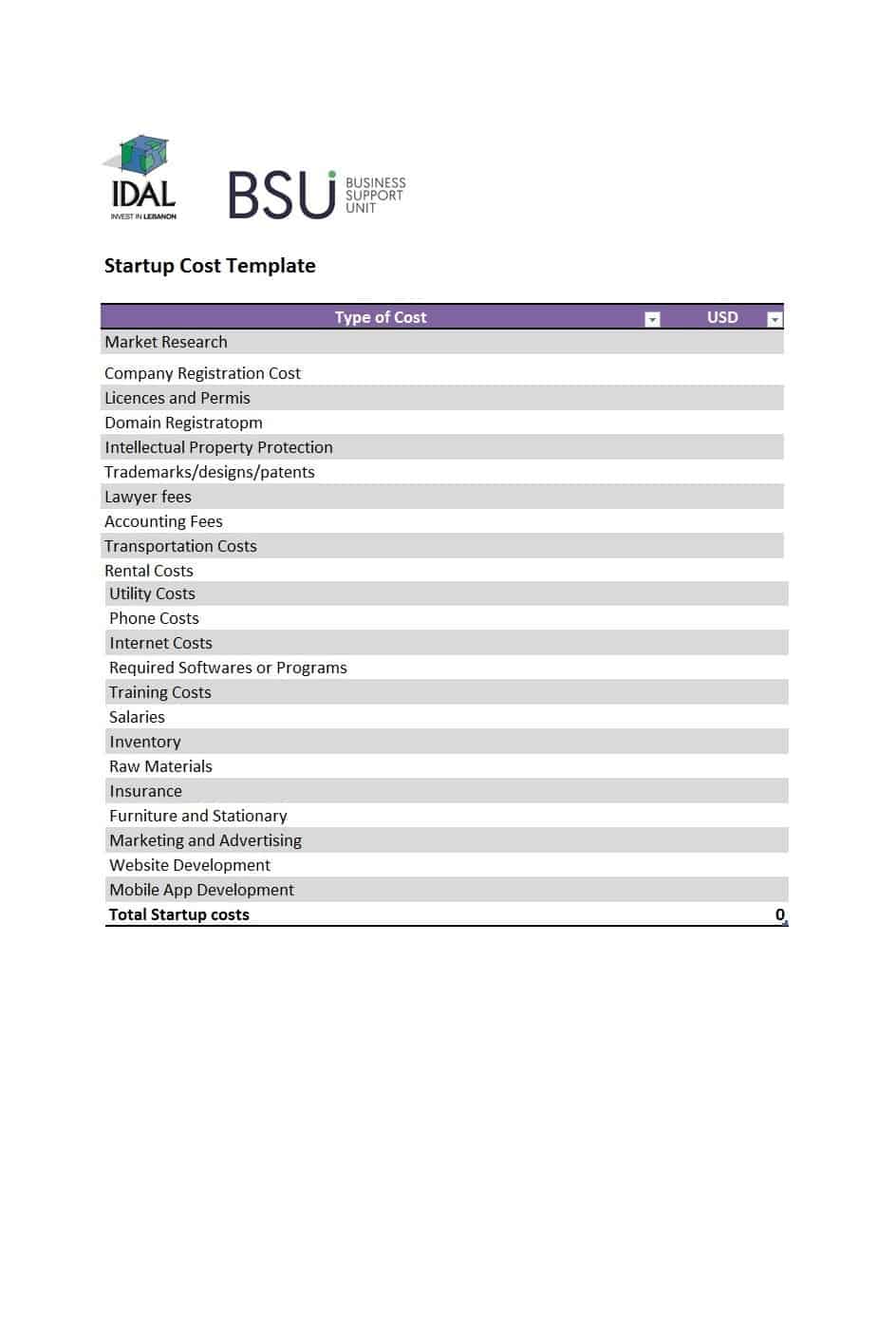

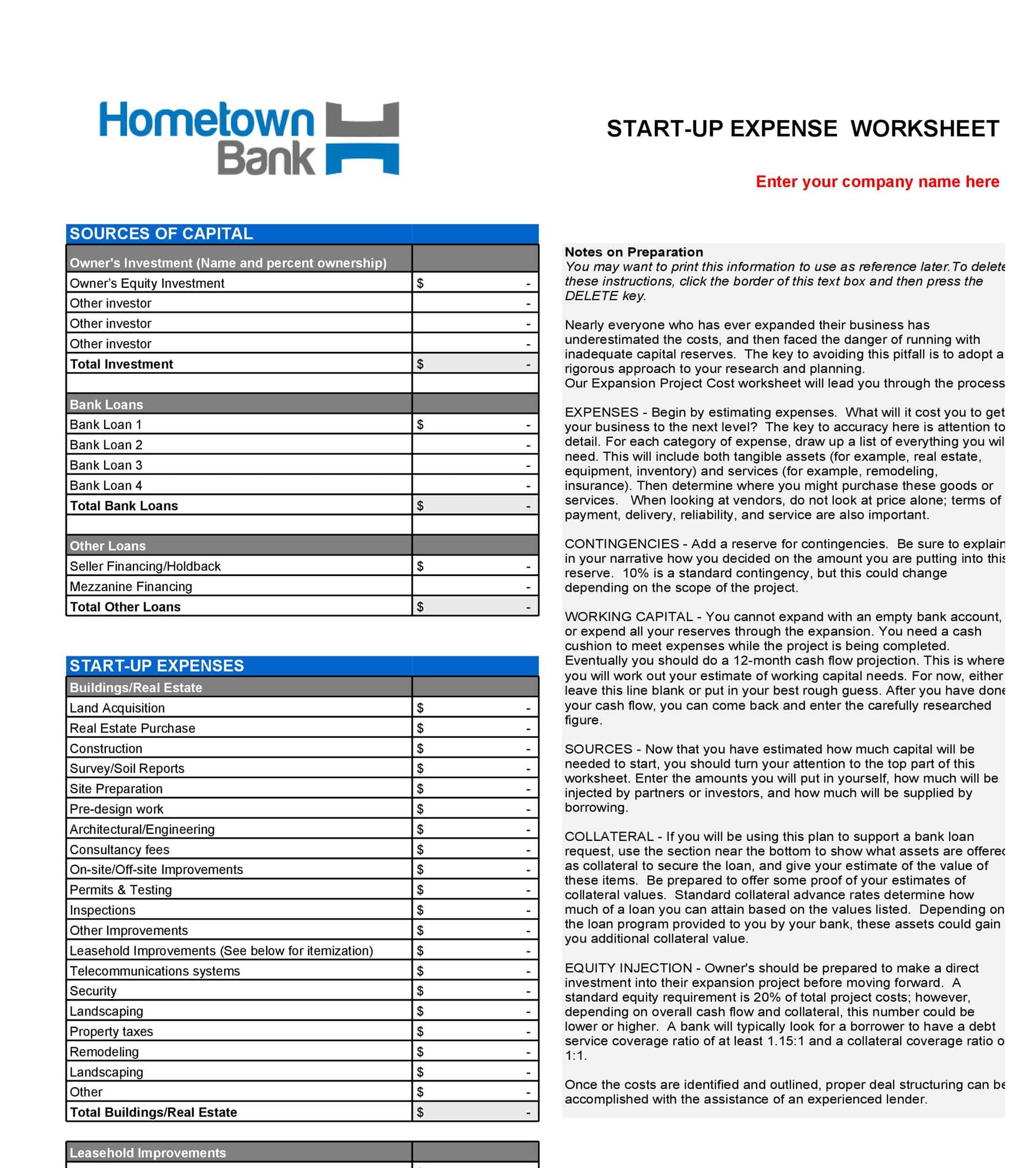

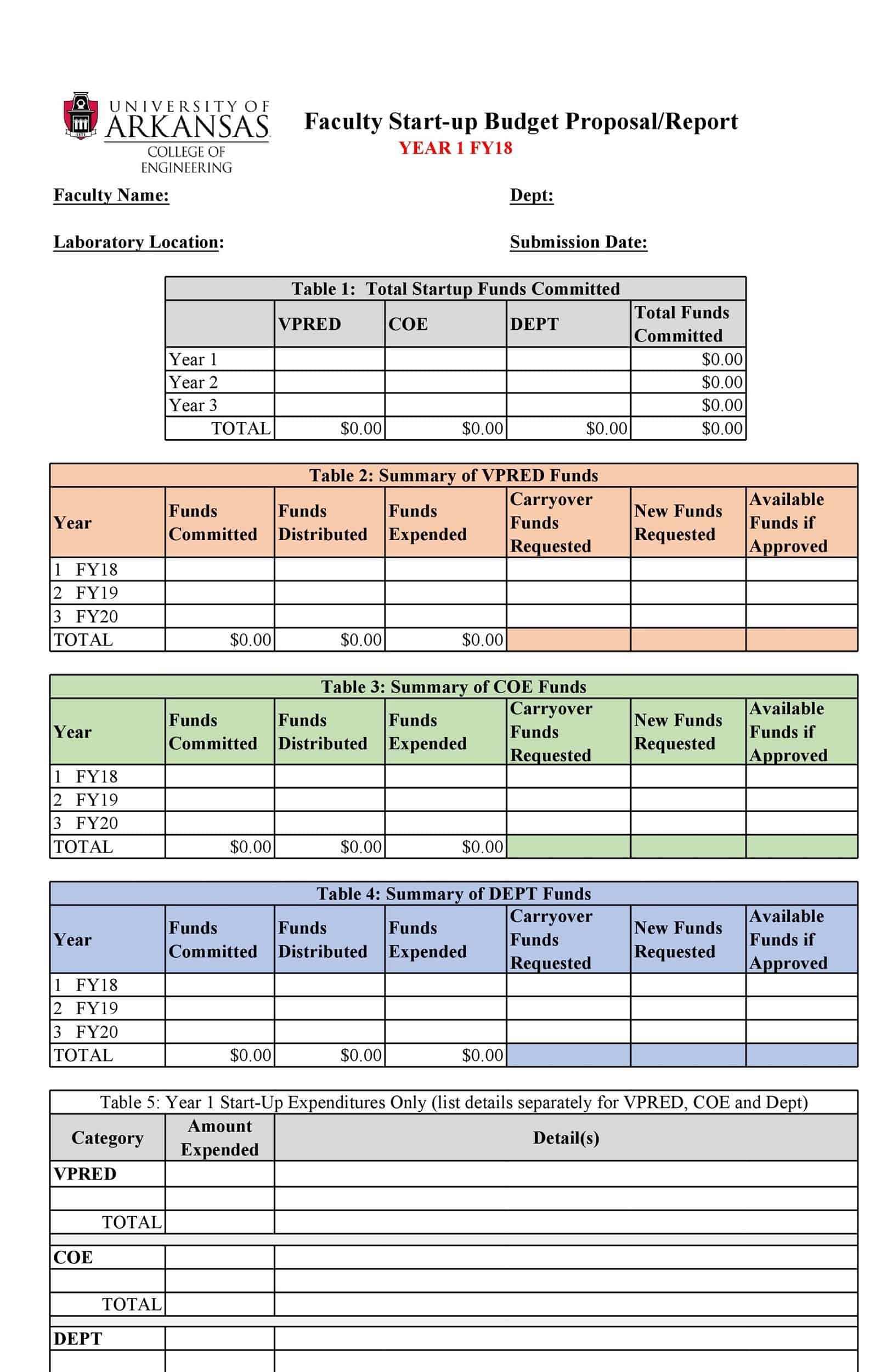

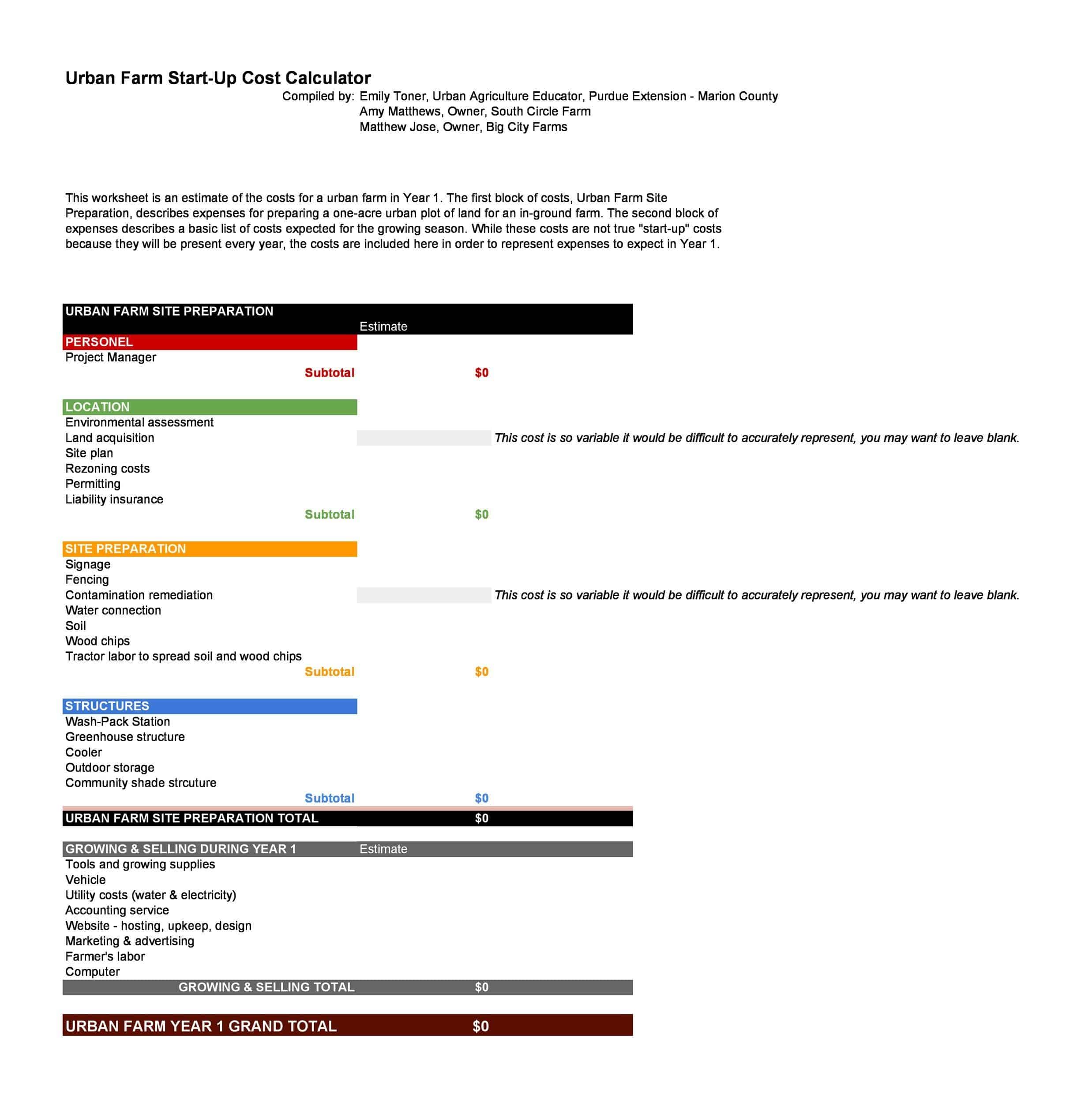

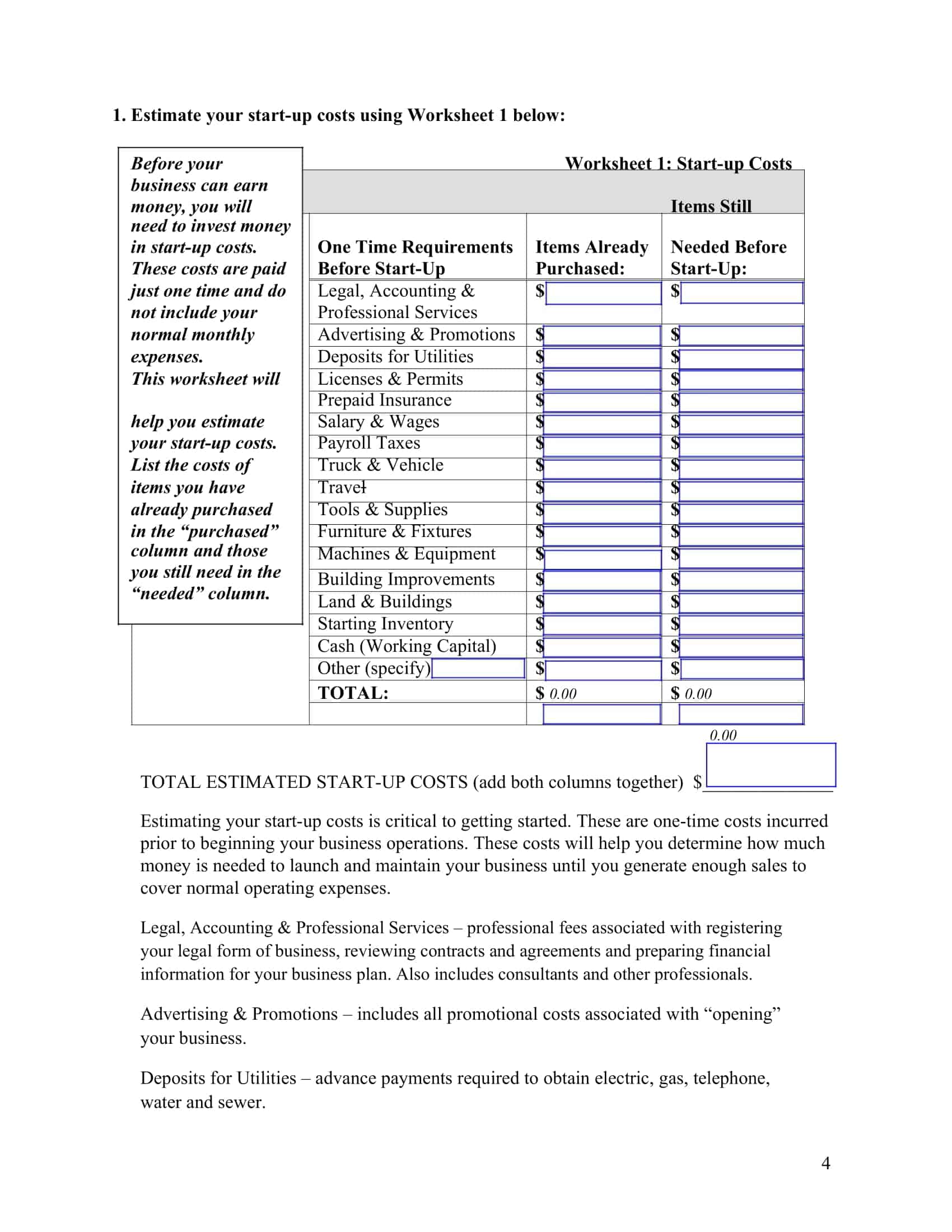

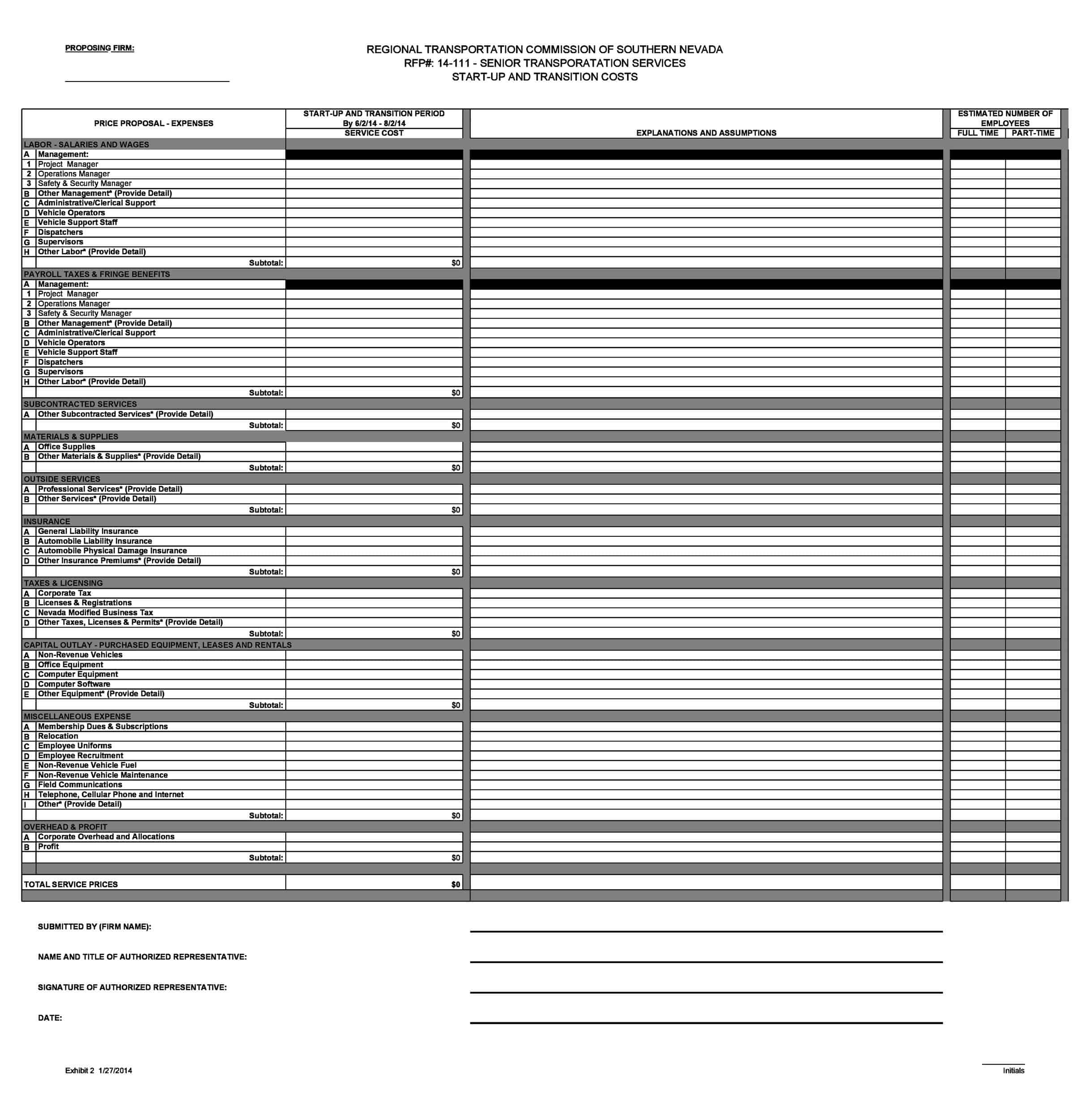

Startup Budget Templates are essential tools used by entrepreneurs and business owners to plan, organize, and track the financial aspects of starting a new business venture. These templates provide a structured format for estimating and managing the costs associated with launching a startup, helping entrepreneurs make informed decisions, allocate resources effectively, and ensure financial stability during the early stages of business development.

Startup Budget Templates play a vital role in the planning and management of financial resources during the critical early stages of a business. By utilizing these templates, entrepreneurs can develop realistic financial projections, identify potential financial risks, and make informed decisions to ensure the financial stability and success of their startup. Regularly reviewing and updating the Startup Budget enables entrepreneurs to adapt to changing circumstances, optimize resource allocation, and maintain financial control. It is important to note that Startup Budget Templates serve as a guide, and actual financial outcomes may vary based on market conditions, industry dynamics, and individual business factors.

What types of businesses need a startup budget?

Have you ever considered the type of expenses that are required to start a business from scratch? Many new business owners don’t. This can become an issue when they face unforeseen expenses or cash crunches during their startup.

It doesn’t matter how small your business is, if it is a startup, you need to create a budget estimate from the get-go. Otherwise, you’ll leave yourself vulnerable to the risk of underfunding.

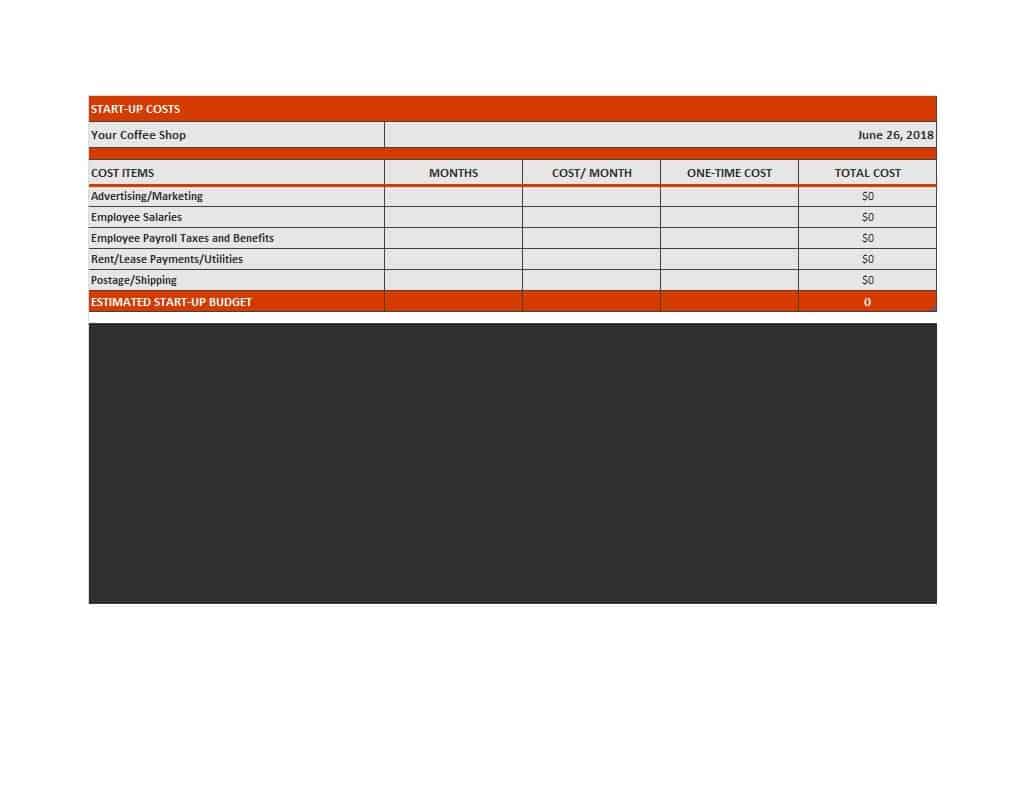

Restaurants

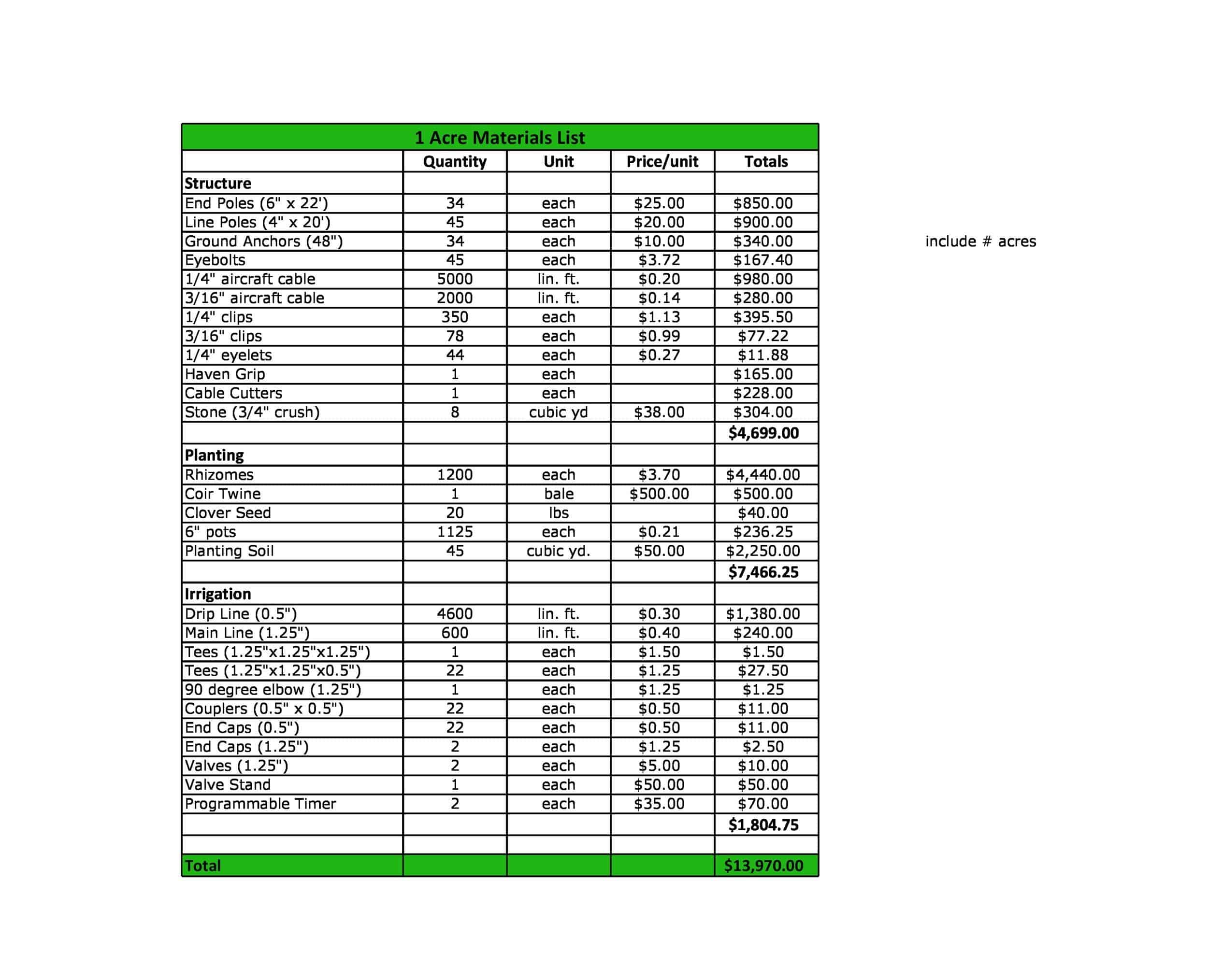

The cost of opening a restaurant depends on many factors, such as the look you want to give your restaurant, your location, labor costs, and all other foreseeable expenses. By investing in a startup cost template, you can simplify your business plan.

A good way to figure out the finances you need in opening a restaurant is by creating a business plan. To create one, you need to know how much of your finances will be spent on equipment and facilities, then add other costs such as menu development, supplier sourcing, staff sourcing, cleaning costs, and more.

Online businesses

You probably know that there are different types of businesses and all of them have different features. One frequent type is, for example, an online business. As opposed to other businesses, such as restaurants or shops, software companies can afford more advanced IT infrastructure like advanced hosting services. Due to this, software services usually tend to be rather expensive and time-consuming in comparison to other solutions like online businesses’ cost templates.

Franchise businesses

A franchise business cost template helps you get organized and see the total sum of all expenses related to your new franchise. It gives you a realistic picture of what it actually costs to start a franchised business. You can use it as a checklist so that you don’t miss anything when you sit down with your financial advisor to discuss your business start-up budget. It’s usually around the time you actually sit down with an advisor that you have all the necessary details about your expenses and learn more about each item.

Home-based businesses

A home-based business is just what it sounds like—a business that is operated from your home or apartment. While it is true that you will save on overhead costs, such as rent and utilities, you need to establish a startup cost budget so you are prepared for the unexpected in the form of expenses like shipping supplies or acquiring additional retail inventory.

Tips for creating your startup budget

You can create your budget using Excel. This way, you can quickly see the results when you make changes to your budget. If you don’t want to use Excel, remember that you can always use corporate budget planning software.

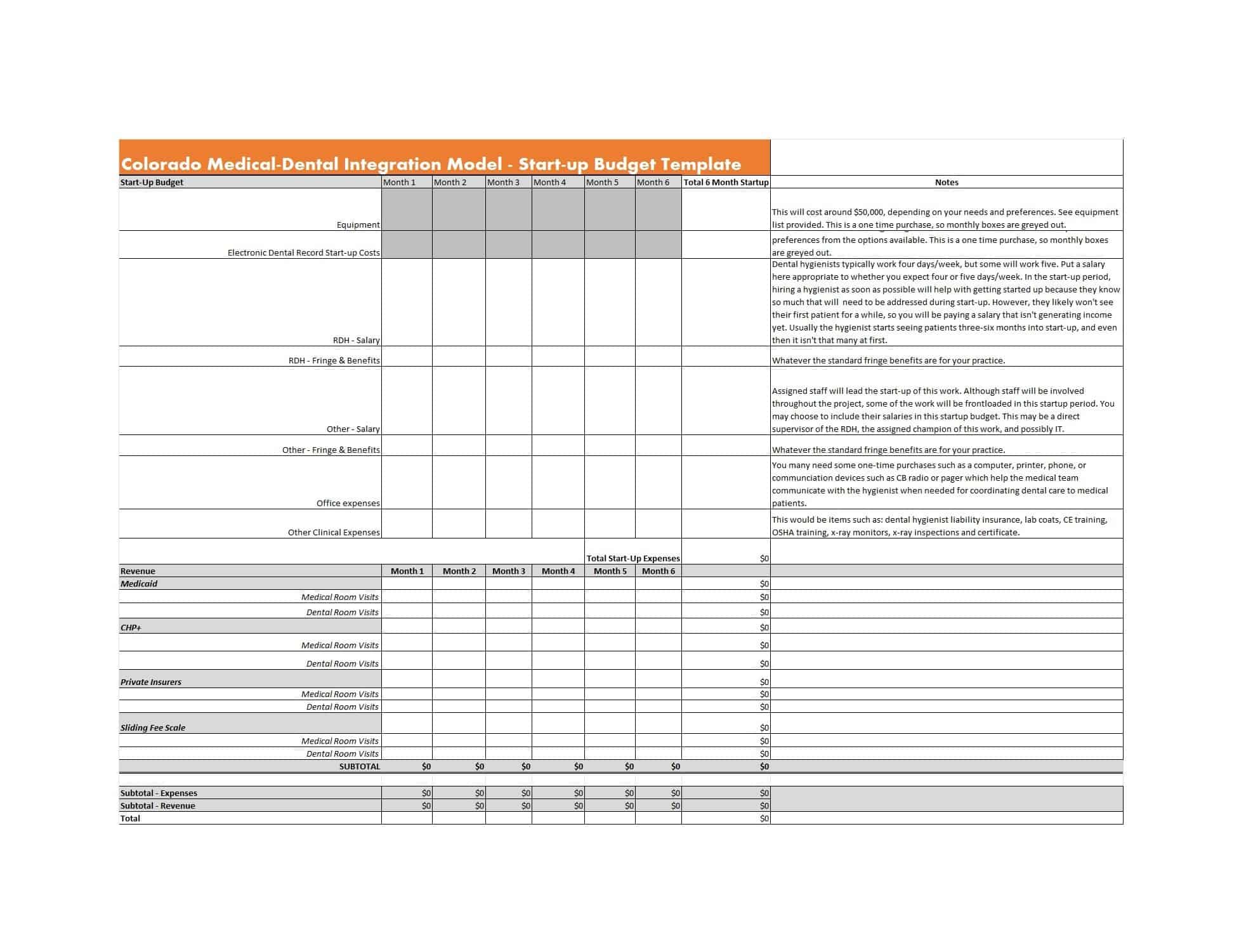

Most investors will ask us to prepare a monthly and three-year cash flow statement and a three-year income statement.

Income taxes are a variable expense, and you may not know what taxes you will have to pay until you calculate your net income.

Do not include taxes in fixed expenses or variable expenses, but I recommend tracking them in a separate category.

The most important thing to know before preparing a startup budget: underestimate sales and forecast expenses HIGH. Because it always costs more and it takes longer than you think to bear the costs. Getting to the point where you expect sales may take longer than you think.

How do you manage a startup budget?

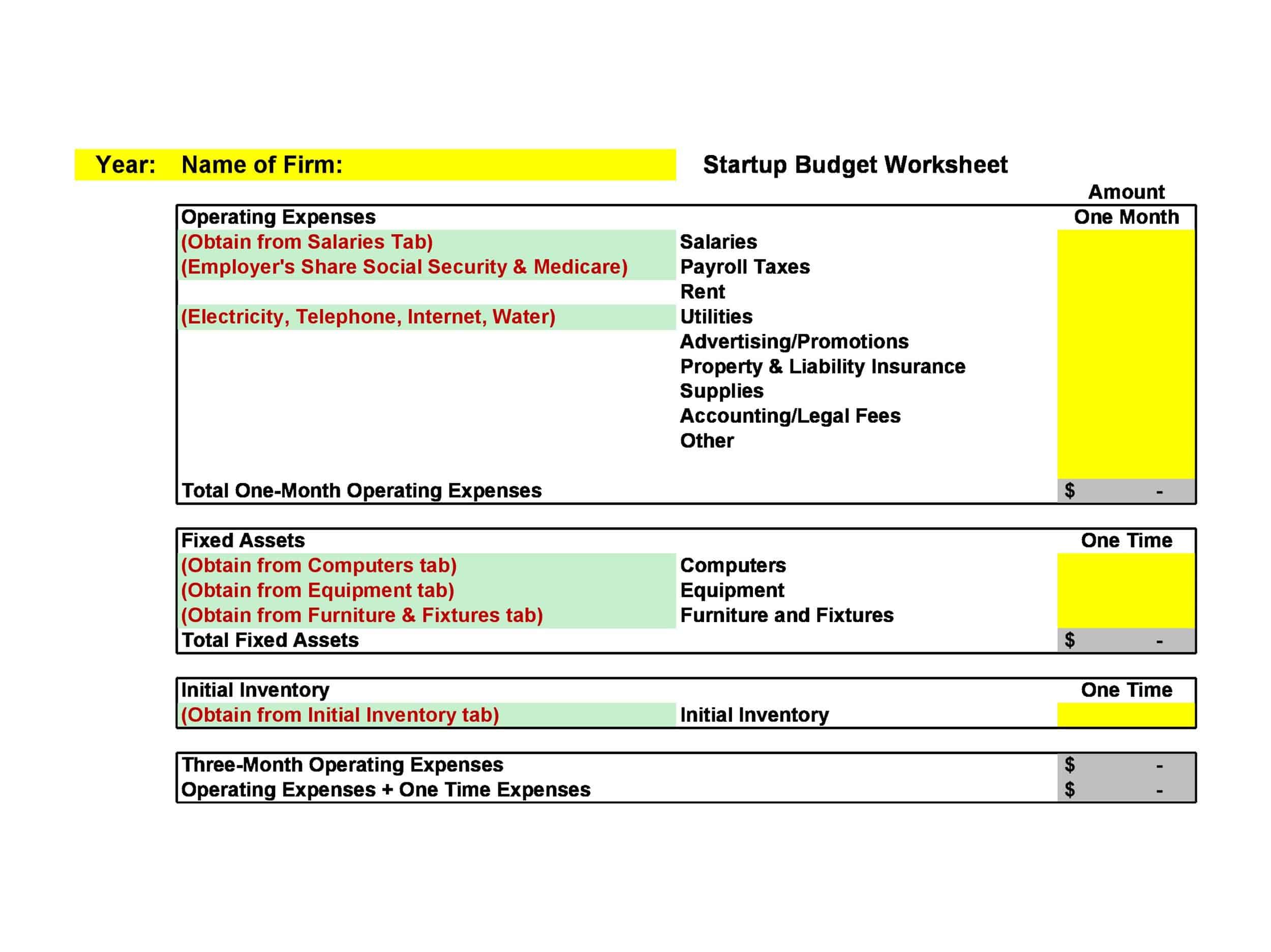

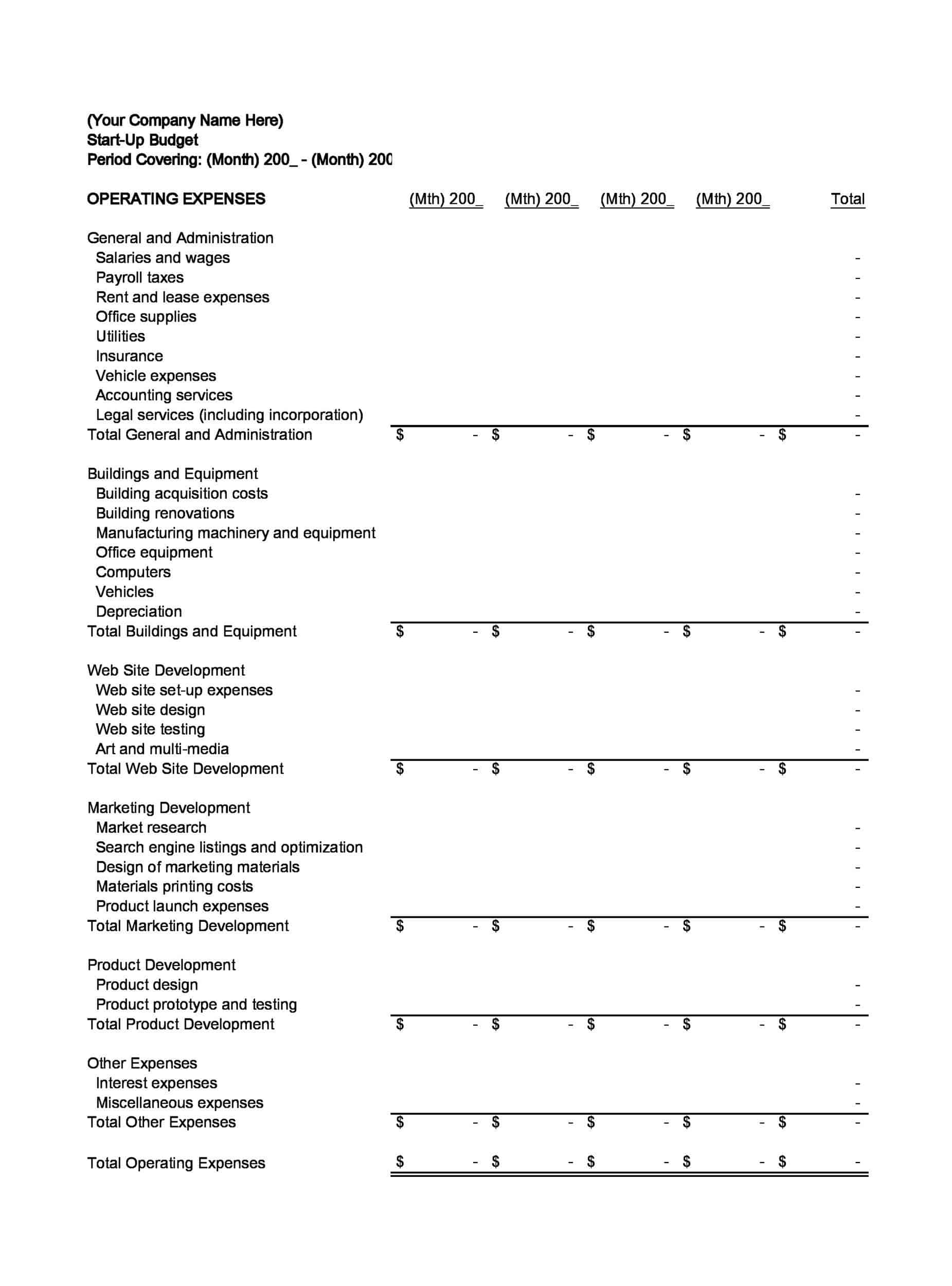

Estimating Monthly Fixed and Variable Expenditures

Fixed costs are costs that do not change, that is, do not depend on the number of customers you have. My advice to you is to collect as much information as possible about your possible fixed expenses every month. Where do I start, you might ask. Below is a list of the most common monthly fixed expenses incurred:

- Rent

- Electricity/Water/Natural Gas

- Phone bills

- Debit card commissions

- Fixed monthly expenses for the website

- Monthly rentals of rented equipment

- Office materials

- Subscriptions to broadcasters

- Advertising expenses you will make online

- Insurance

- Accounting and consultancy service

- Miscellaneous expenses

- Loan interest

Then you can start estimating variable expenses. These are expenses that will vary depending on the number of clients you work with each month. Here are some examples of these expenses:

- Mail, Shipping, Cargo

- Sales commissions

- Production costs, general production expenses

- Raw materials and auxiliary materials,

- Cost of Goods Sold

- Packaging, Freight charges

If you have started a service business, you will not have many variable costs.

Forecasting Monthly Sales

We can say that this step is the hardest part of the budget. Because we’re starting a new business and it’s really hard to predict what the sales will be. However, we can prepare the sales projection in 3 different ways:

We can say that the most optimistic scenario is the most optimistic forecast for the sales to be realized in the first year.

The worst case scenario is the worst case scenario where sales are underestimated in the first six months.

The possible scenario, the average of the first two scenarios, is the best budget that can be shown to the investor if you are trying to find financing.

Creating a Cash Budget

Cash flow is literally the amount of money entering and leaving the business each month. Cash flow is vital to the sustainability of the business.

Managing cash flow is a crucial tool for keeping your new business afloat. For a startup, cash flow is more important than profit. You can make a profit on paper, but you can’t pay your business’s bills if you don’t have money in the bank.

To create the cash budget, you will need to combine how much you will collect against the sales you make each month and your monthly fixed expenses. Here’s a reminder: keep in mind that sales and collections may differ unless you have a cash or credit card business. That’s why you should use the sales that you foresee to collect in the cash flow.

FAQs

What is the average budget for a startup?

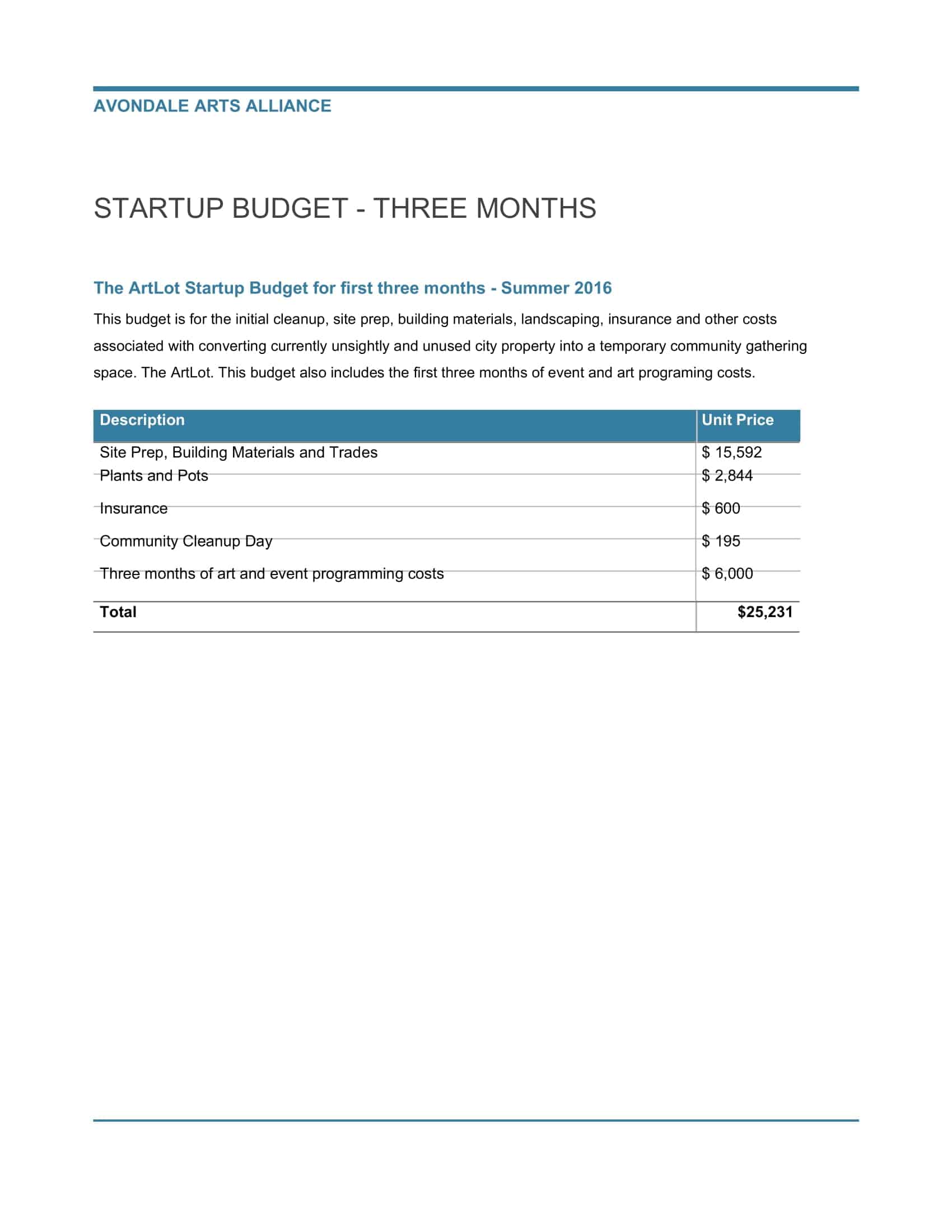

The average startup budget ranges from $10,000 to $150,000 depending on the type of business. Most experts recommend having a minimum of $15,000 to $25,000 in initial capital to cover incorporation, licenses, workspace, basic equipment, marketing, and operating costs for the first 6-12 months.

How do I create a startup budget?

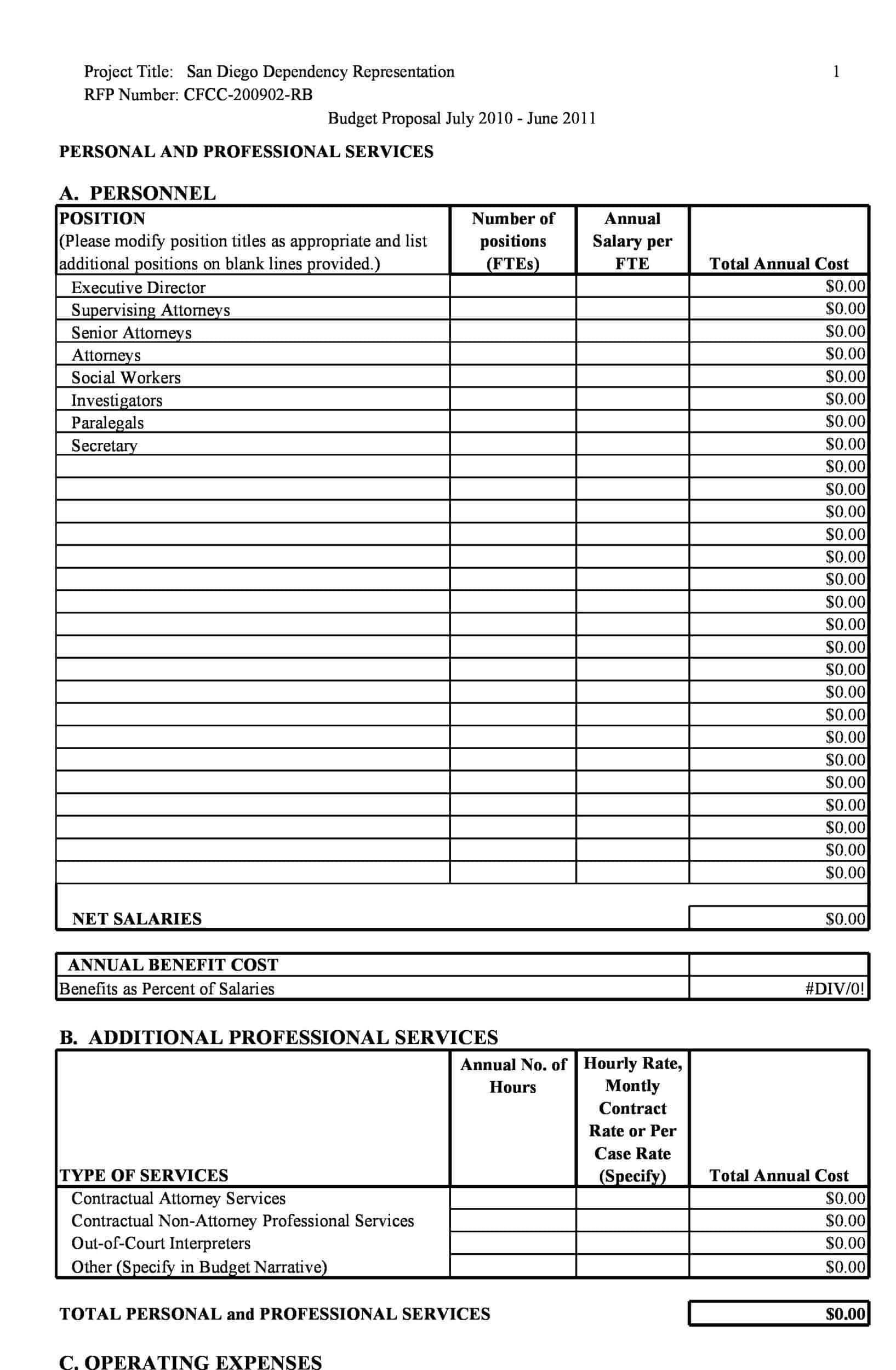

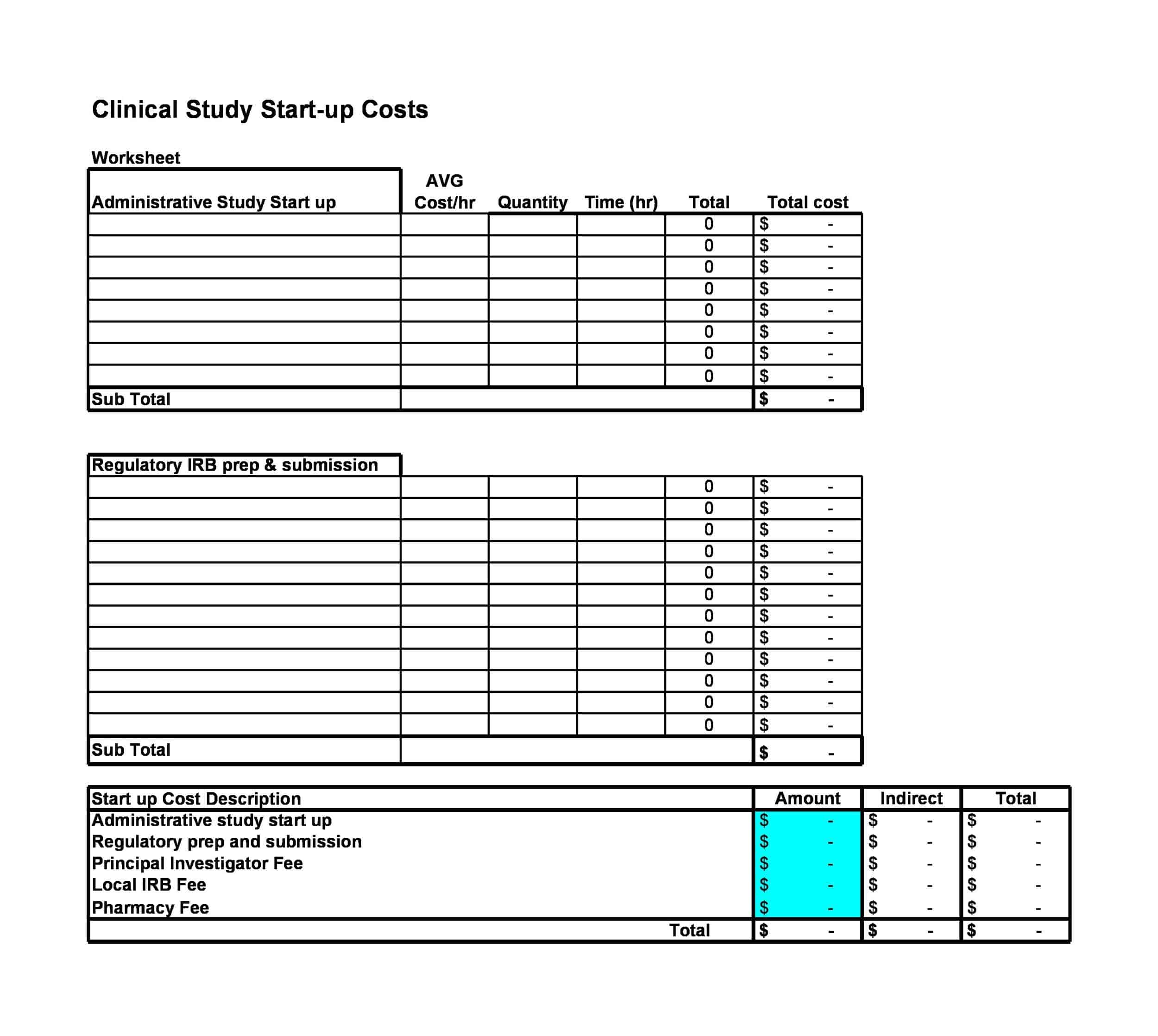

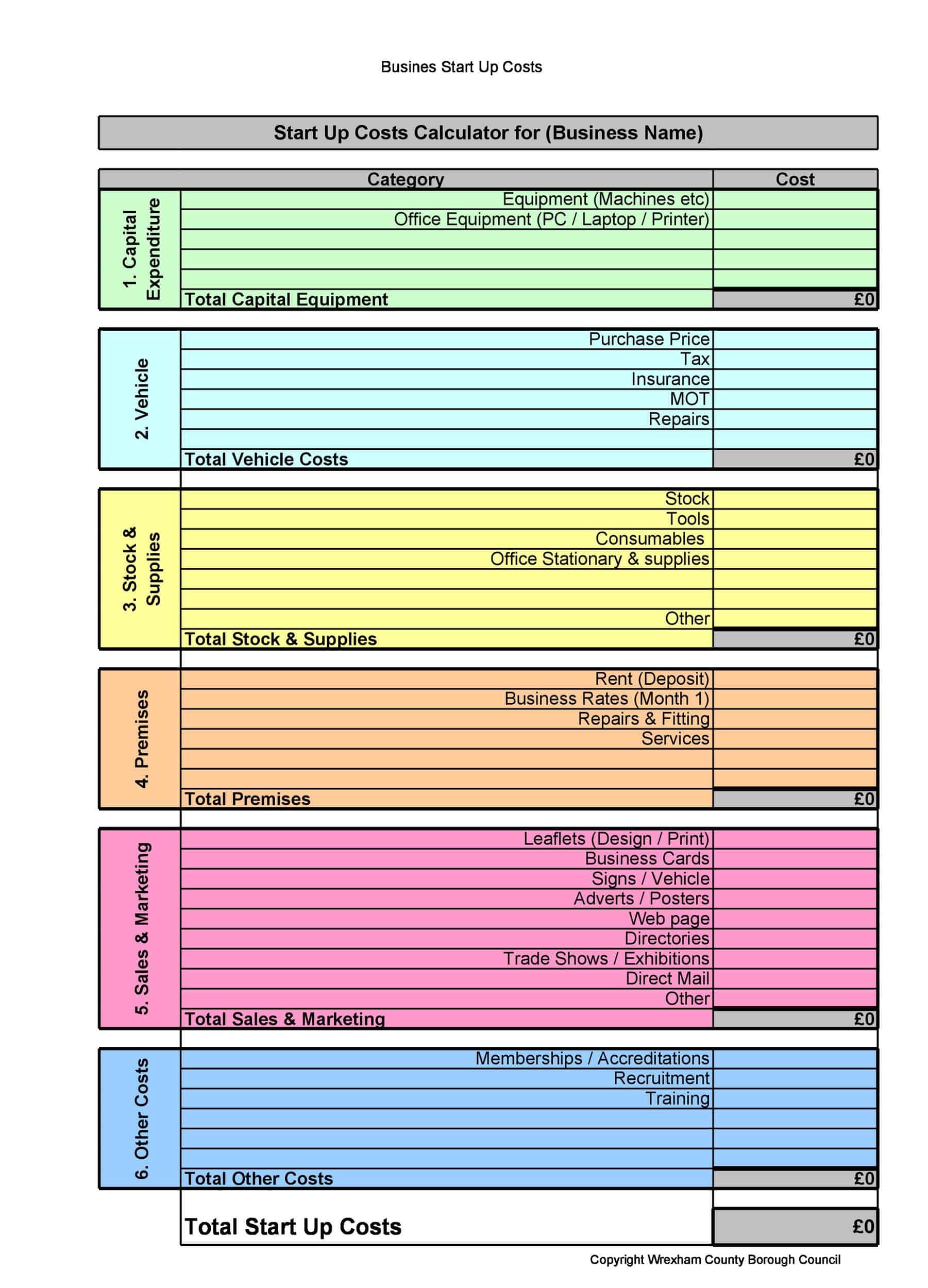

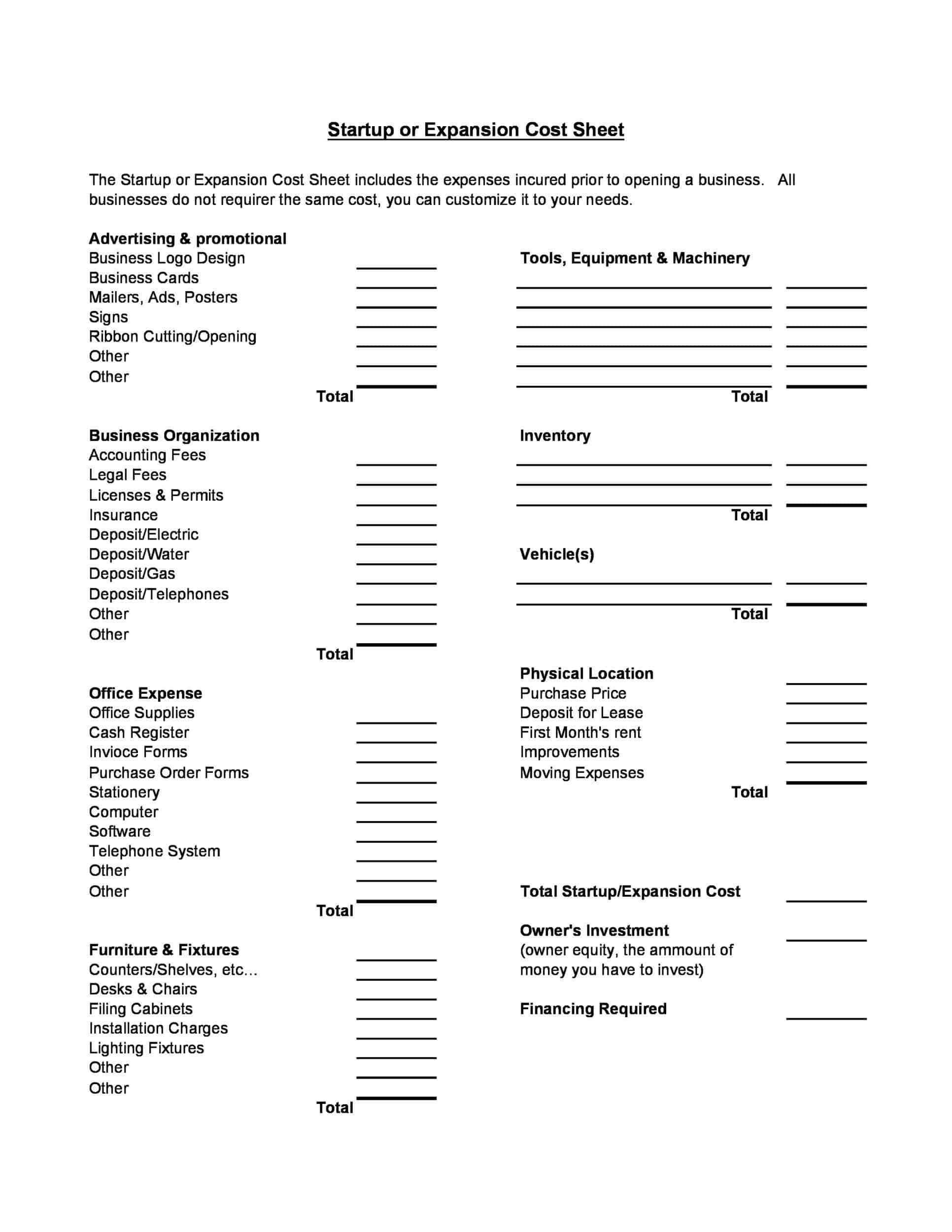

To create a startup budget: estimate costs of business registration, licenses, real estate, remodeling, equipment, inventory, insurance, payroll, marketing, contractors, professional services, and pre-revenue living costs based on benchmarks. Factor contingencies on these line items. Maintain with actuals.

What are the components of a startup budget?

Typical startup budget components are: startup legal/administration fees, R&D work-phase funding, market compensation research, prototyping/tooling, workspace costs, production equipment, starting inventory orders, branding, advertising, personnel, insurance, and working capital reserves.

What is a start budget?

A start budget outlines the initial spending plan detailing one-time startup costs like entity formation, plus early periodic operating expenses estimated for the first 6-12 months of launching a new business before it can reliably self-fund through ongoing revenues.

What does a zero budget look like?

A zero budget, created when no working capital or little cash is available upfront for the venture, maximizes bootstrapping efforts with little to no upfront spends. It involves minimizing costs in the ideation phase then incrementally building income through production, founders’ own sweat equity, and very lean scaling.

What is a zero budget called?

A zero budget for a startup goes by common names like no-budget startup, bootstrapping, sweat equity model, or ground-up budgeting – indicating the process of incrementally building business income streams first before any expenses need paid out when no initial funding capital exists.

How do I start a budget with no money?

Ways to start a business without excess cash are: Leverage skills/experience for services you can provide right away, utilize existing personal resources and tools on hand, barter offerings, use profits from first sales to slowly purchase absolutely necessary capabilities/capacity, operate very lean until sustained.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)