Bank reconciliation is a crucial process for any business or individual that manages finances. It involves comparing the balance in a company’s accounting records with the corresponding balance in the bank statement, in order to identify and correct any discrepancies. This process can be complex and time-consuming, but by using a bank reconciliation template and forms, it can be made more efficient and effective.

In this article, we will delve deeper into the concept of bank reconciliation, and explore the various aspects of this process, including how to handle discrepancies and make adjustments to accounting records. Furthermore, we will explain how the bank reconciliation template can be used to make the process more streamlined and manageable. Ultimately, by understanding the ins and outs of bank reconciliation, businesses and individuals can ensure that their financial records are accurate and up-to-date.

Table of Contents

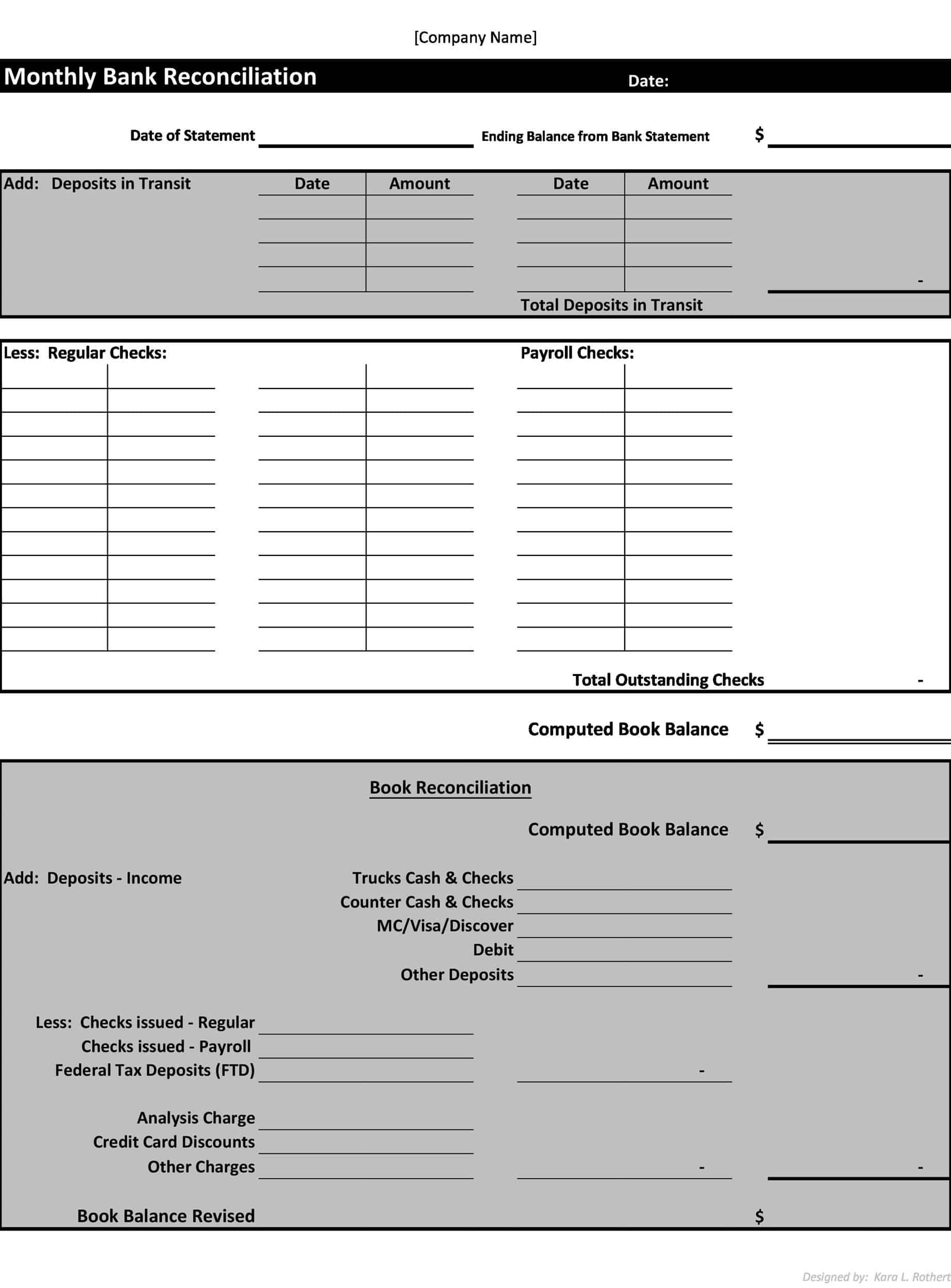

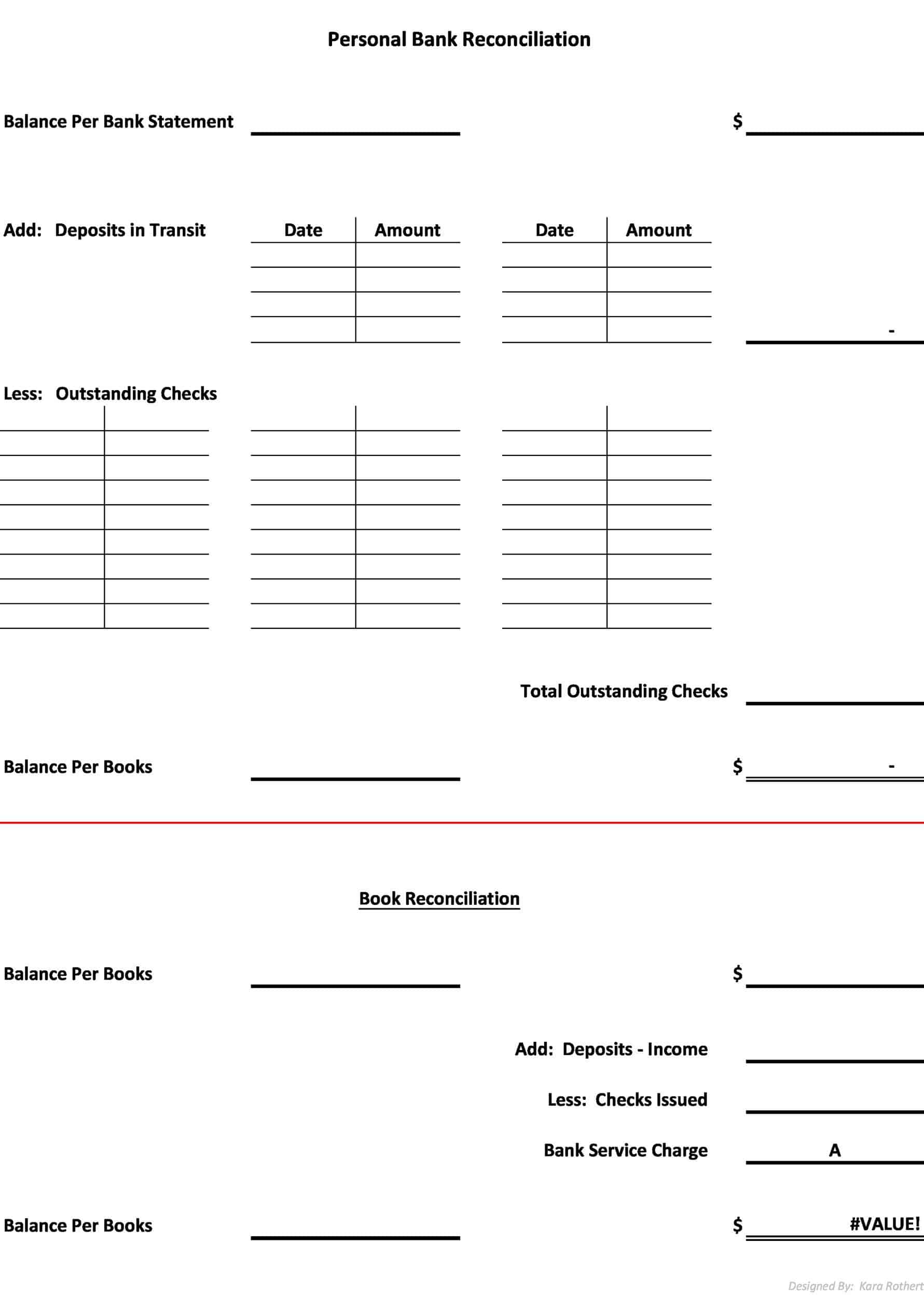

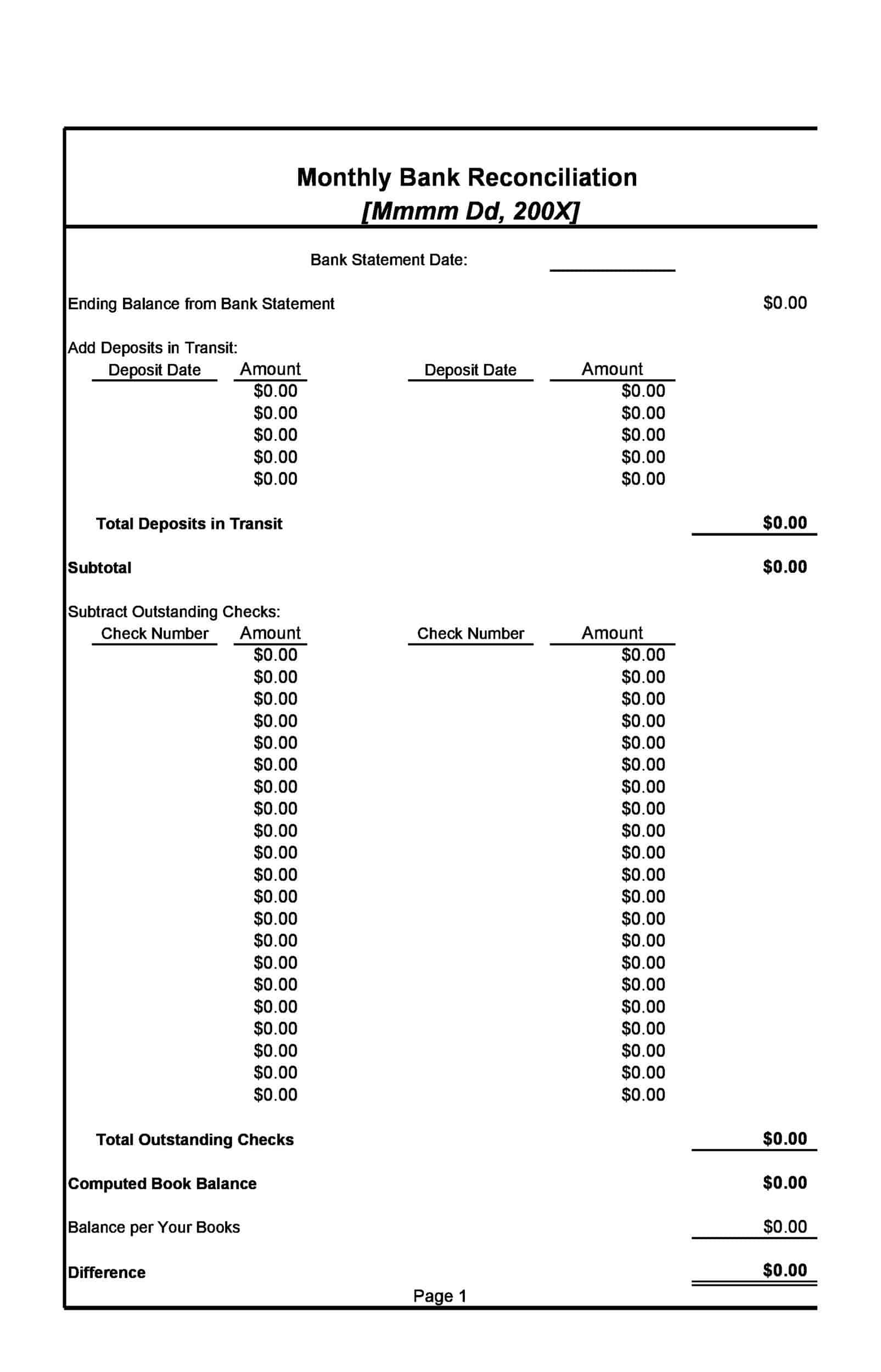

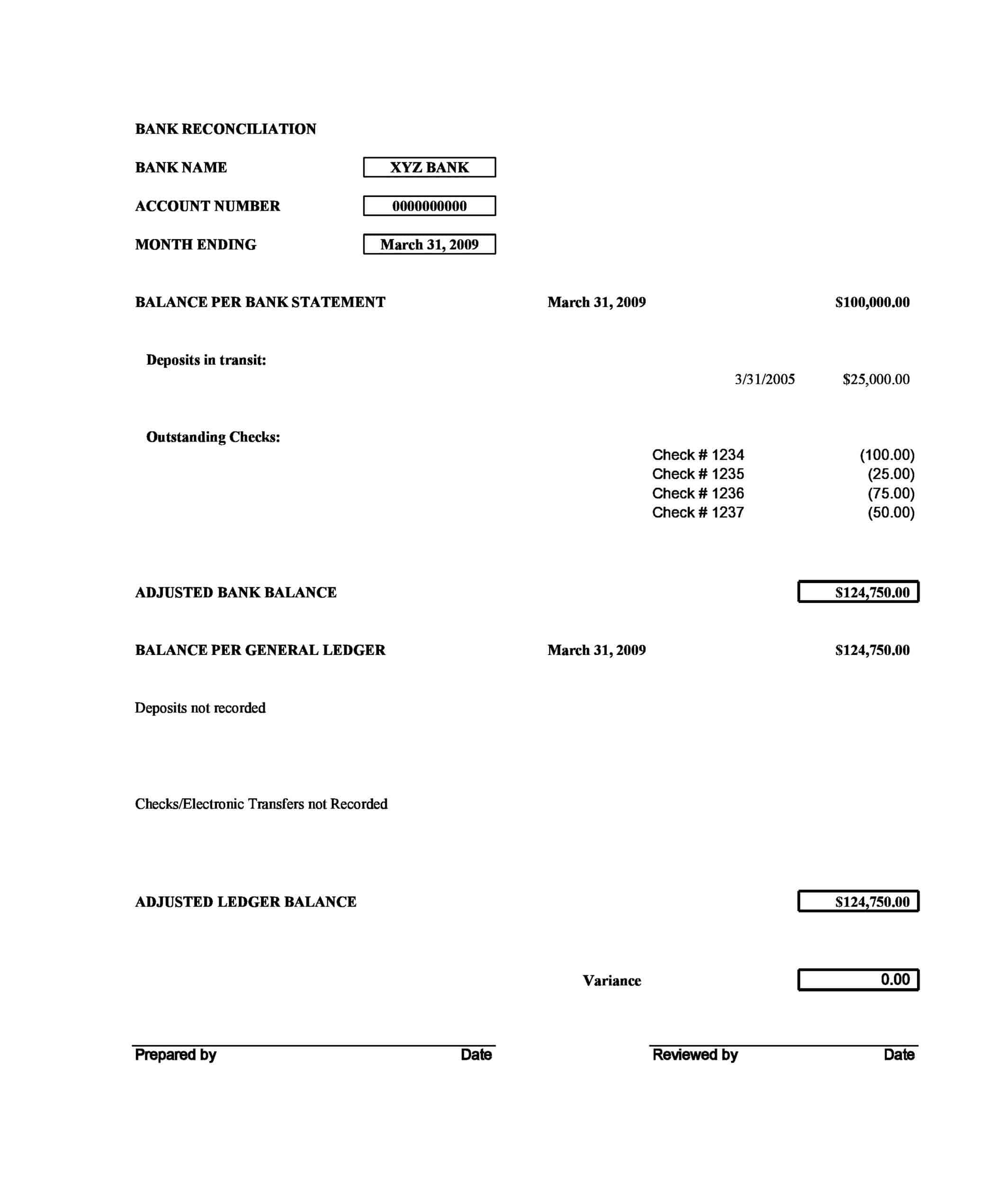

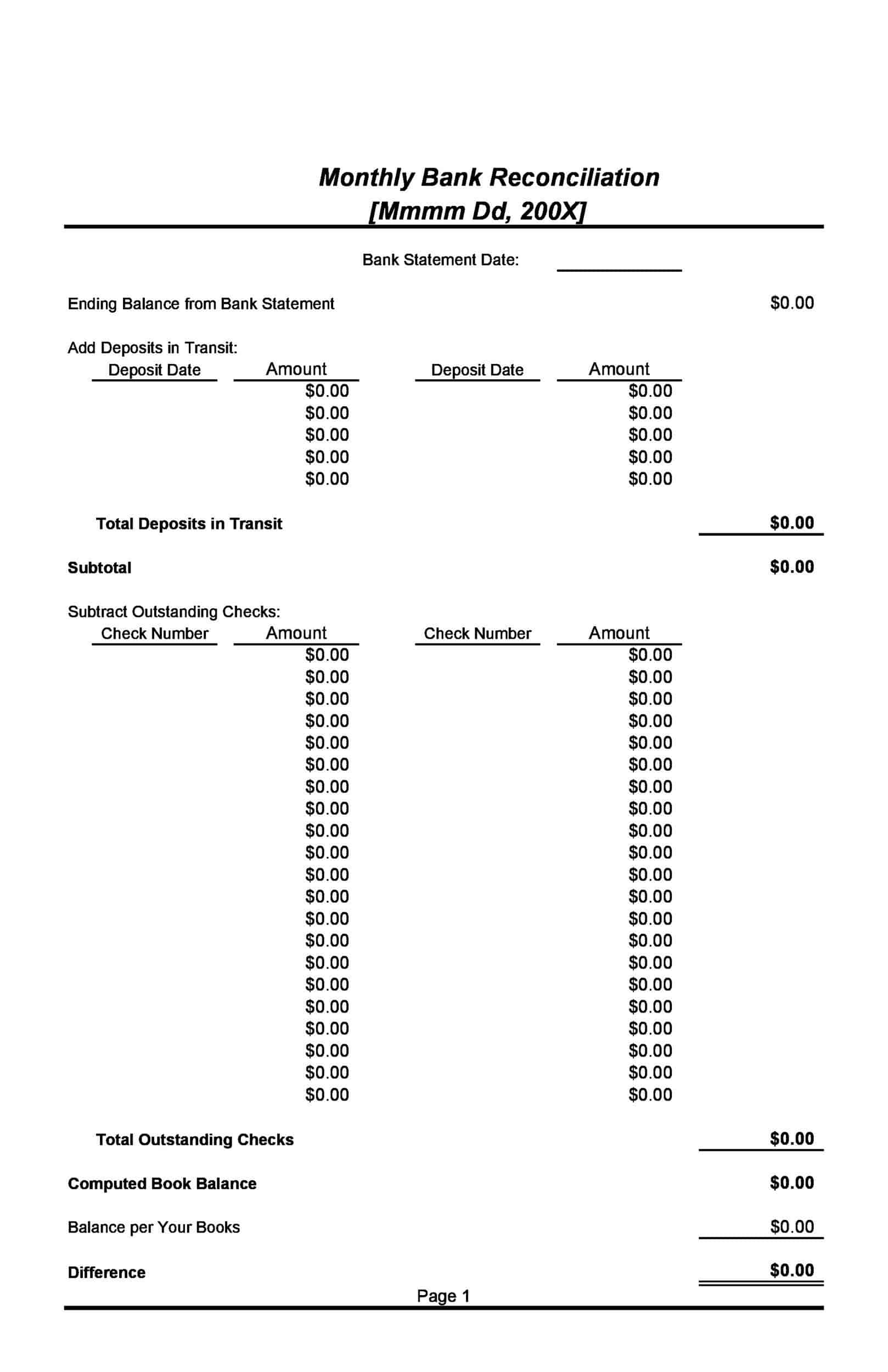

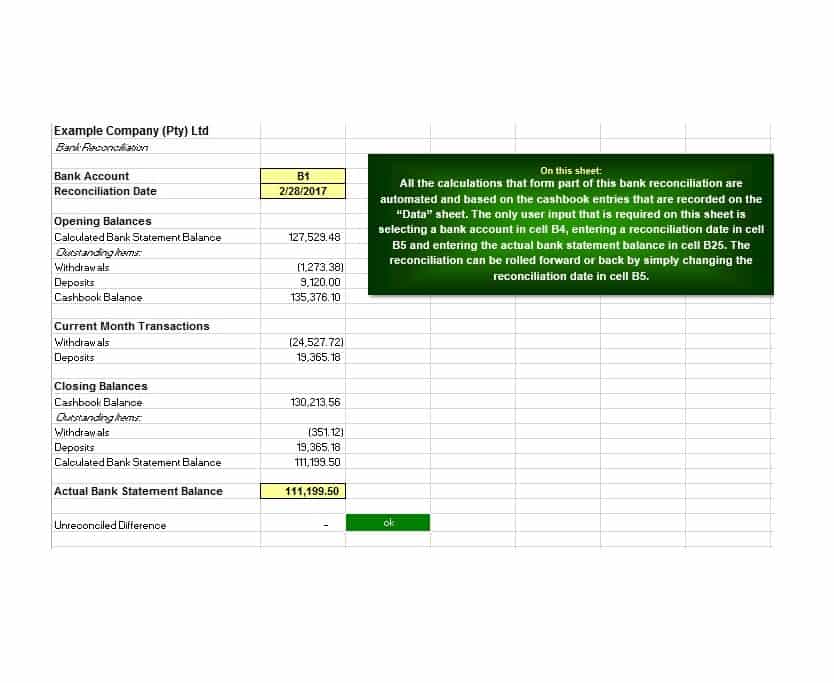

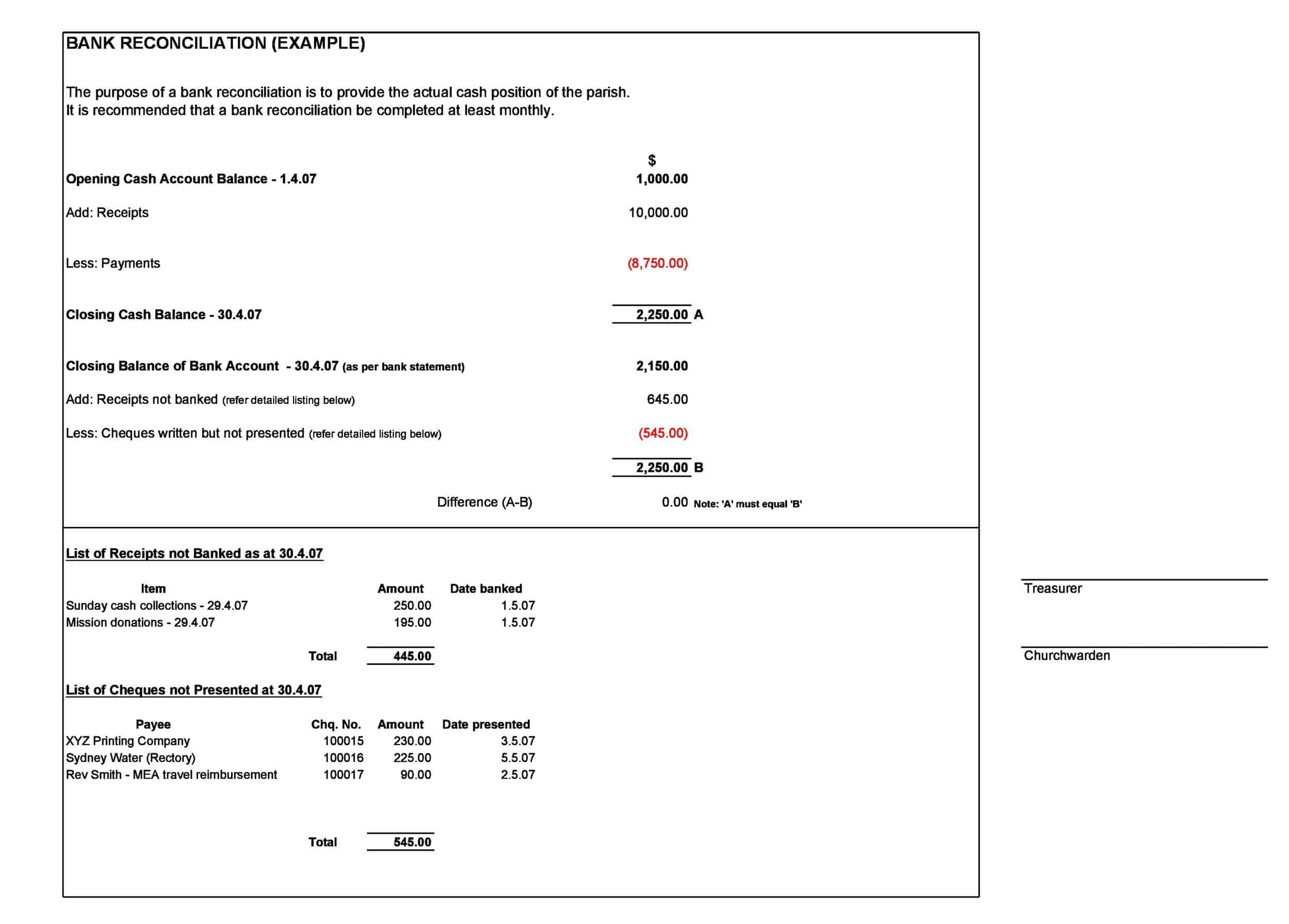

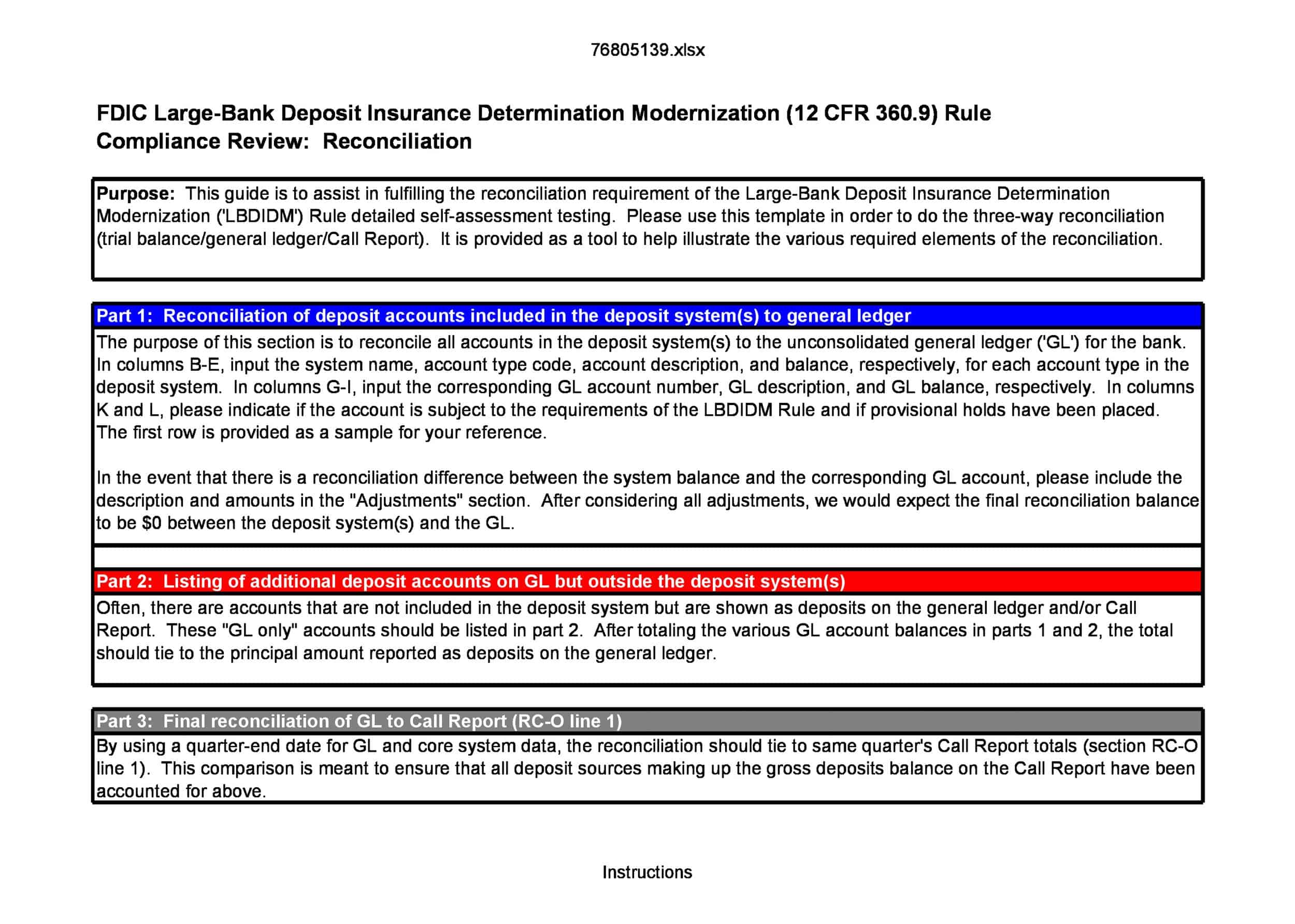

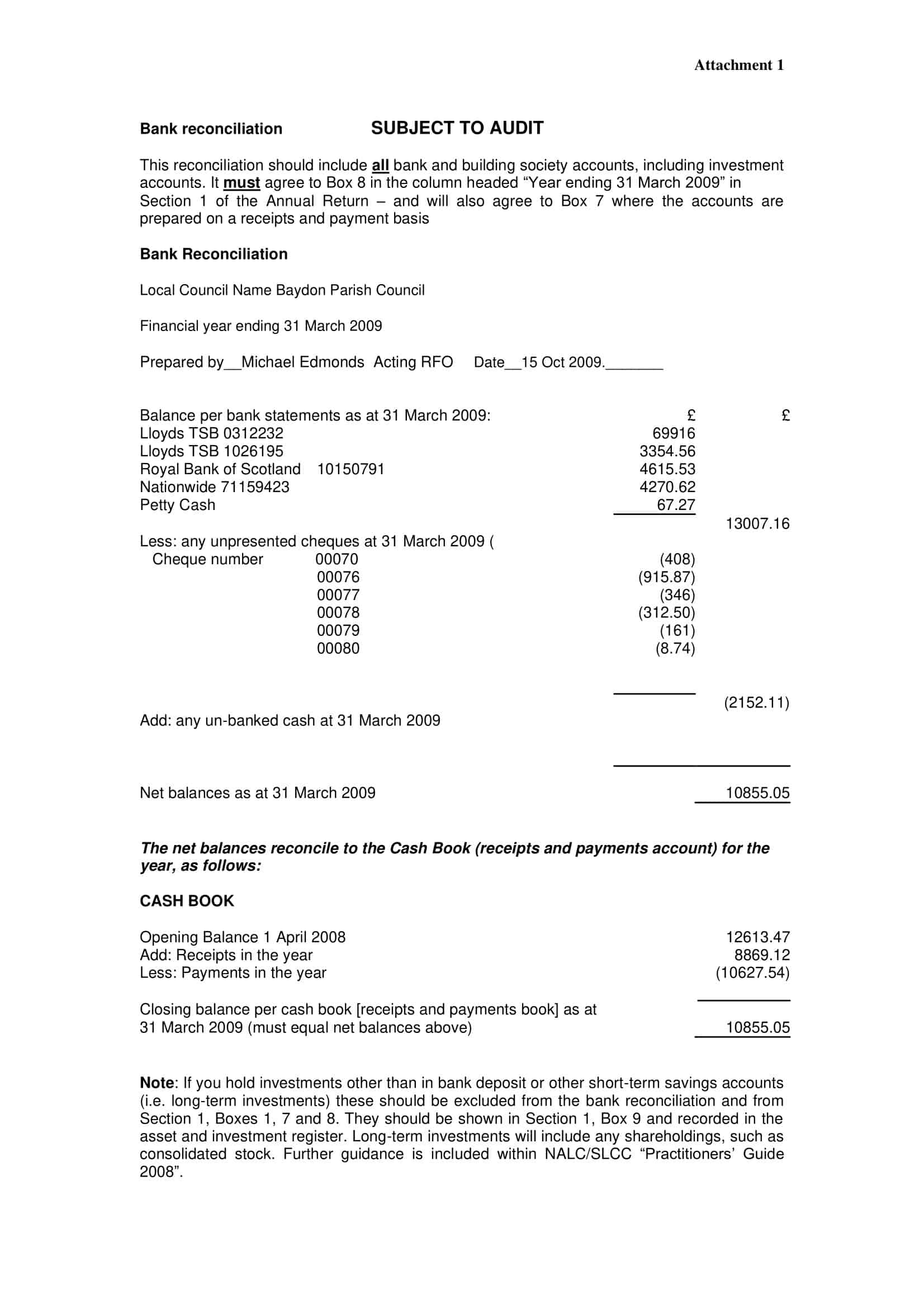

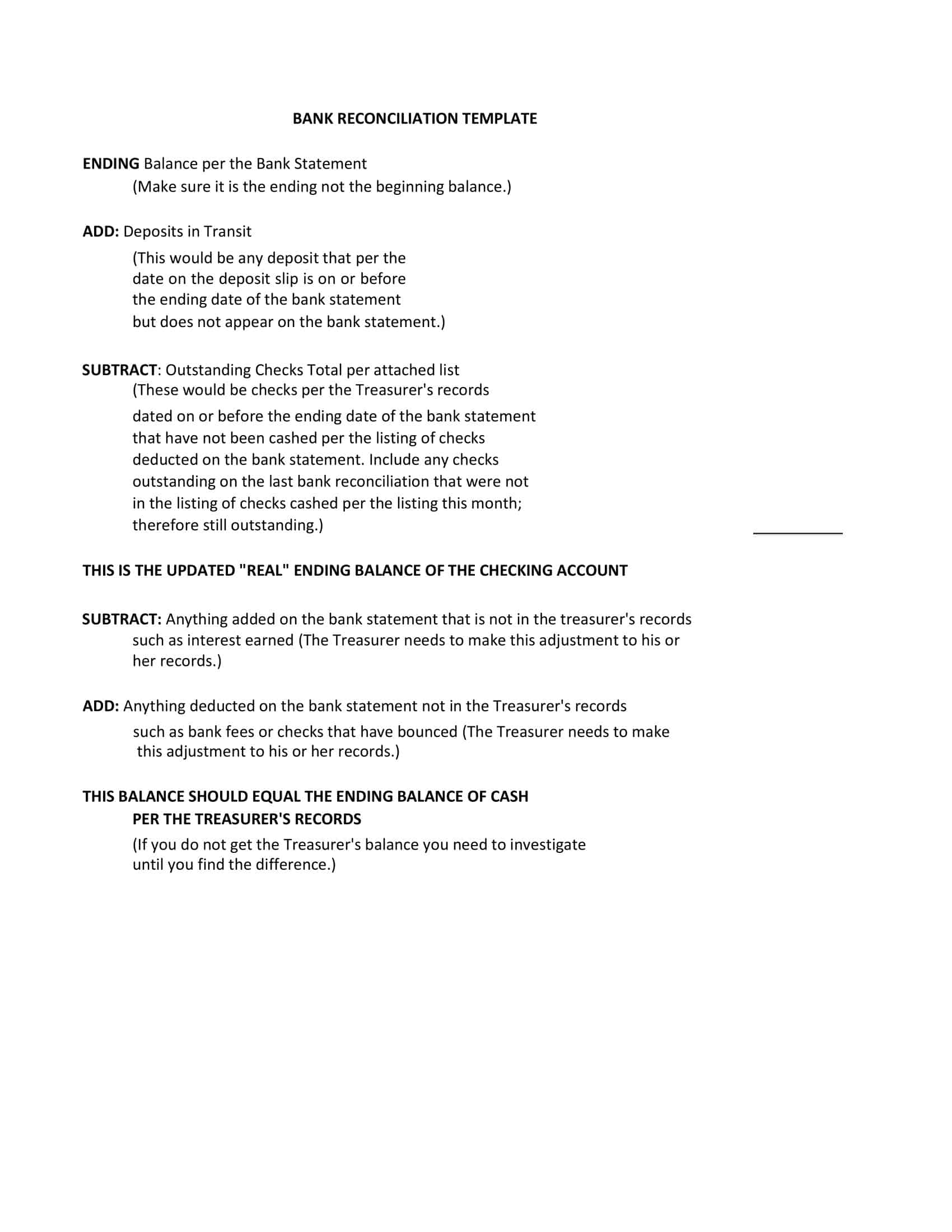

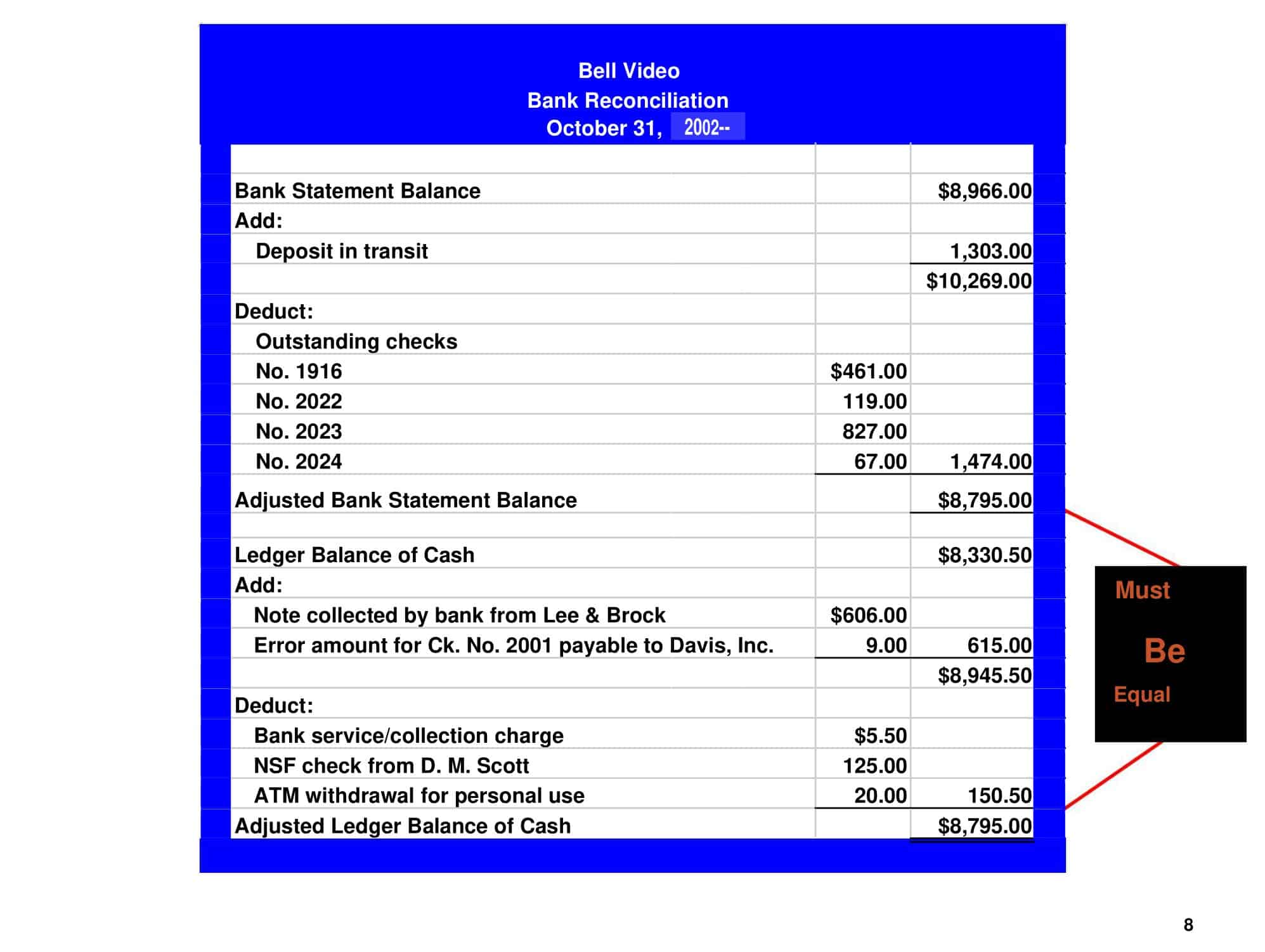

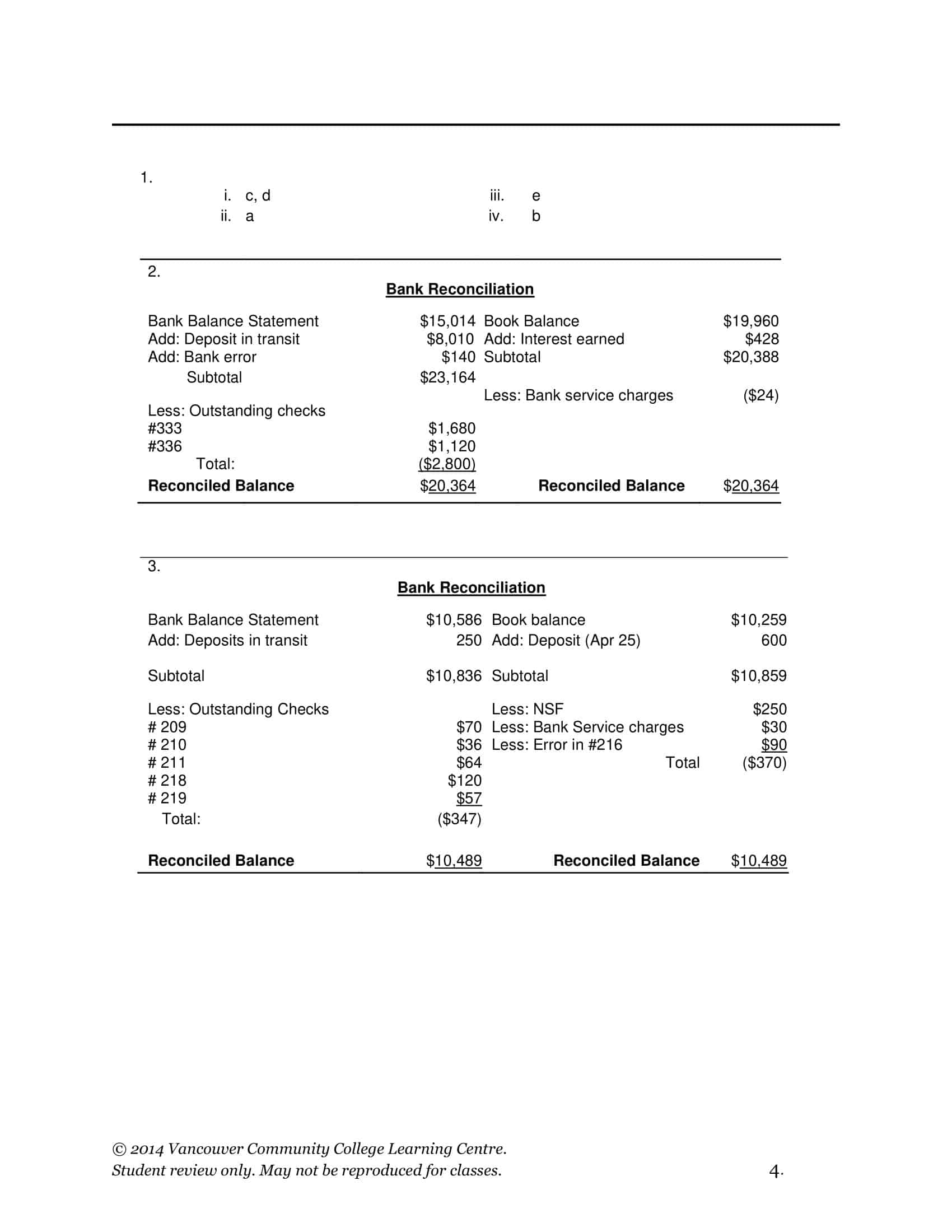

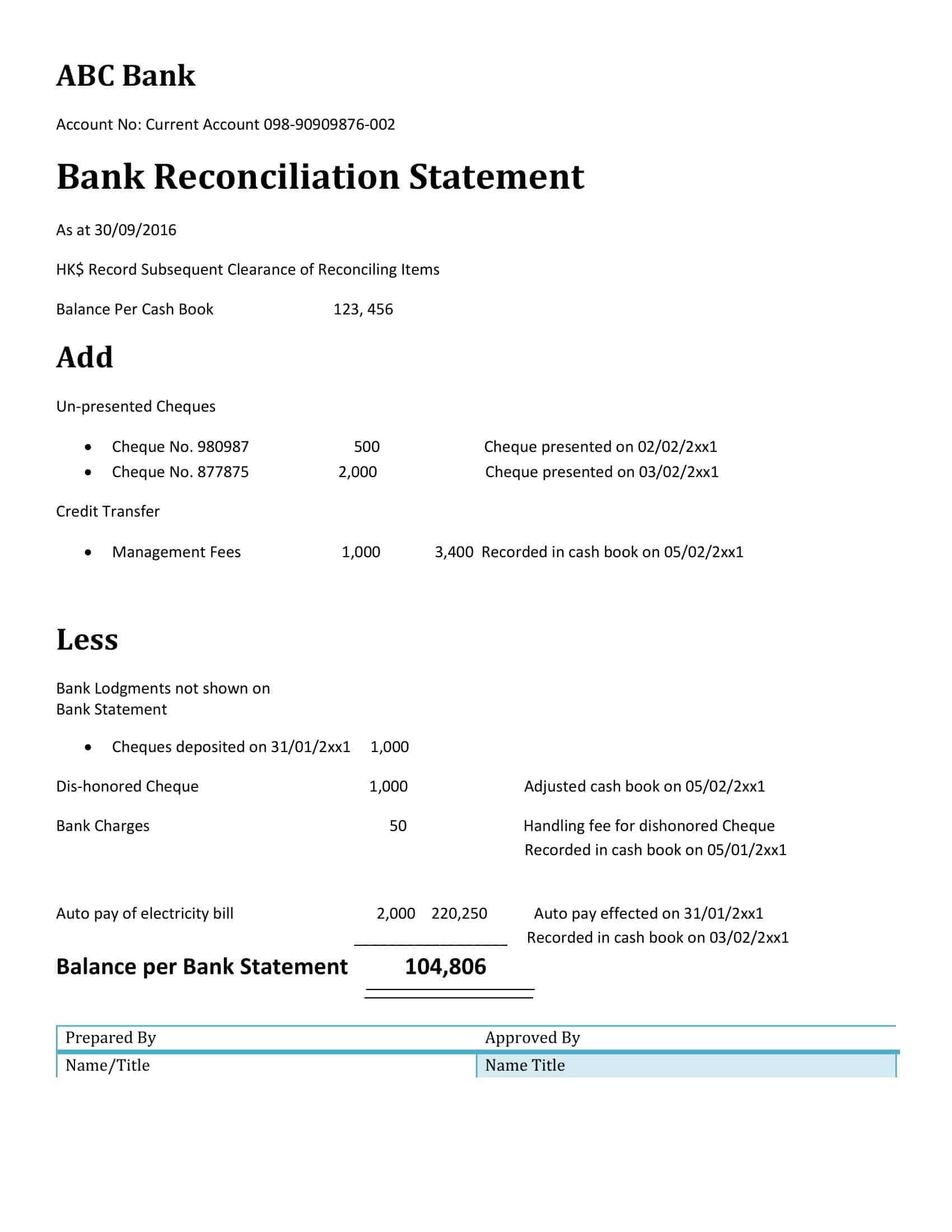

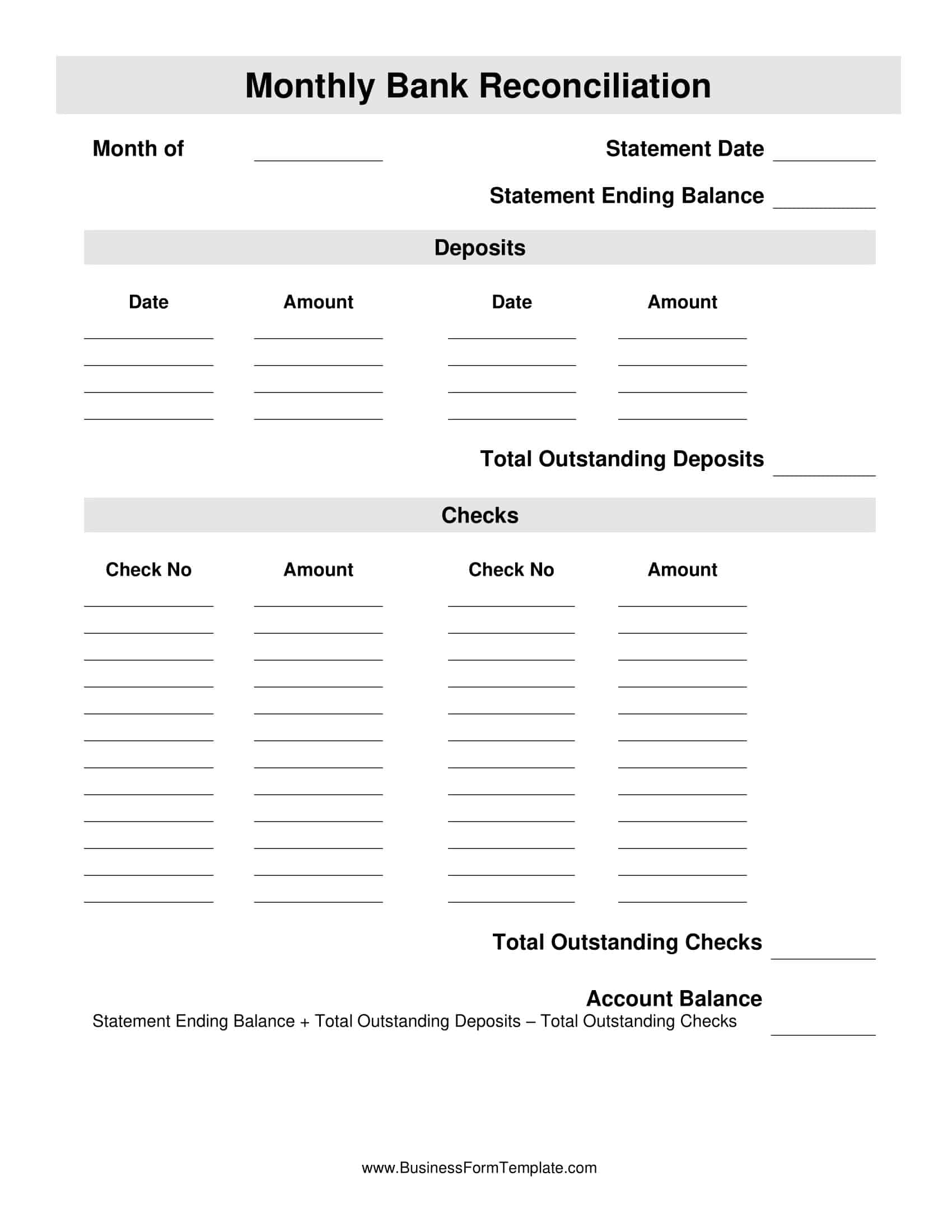

Bank Reconciliation Templates

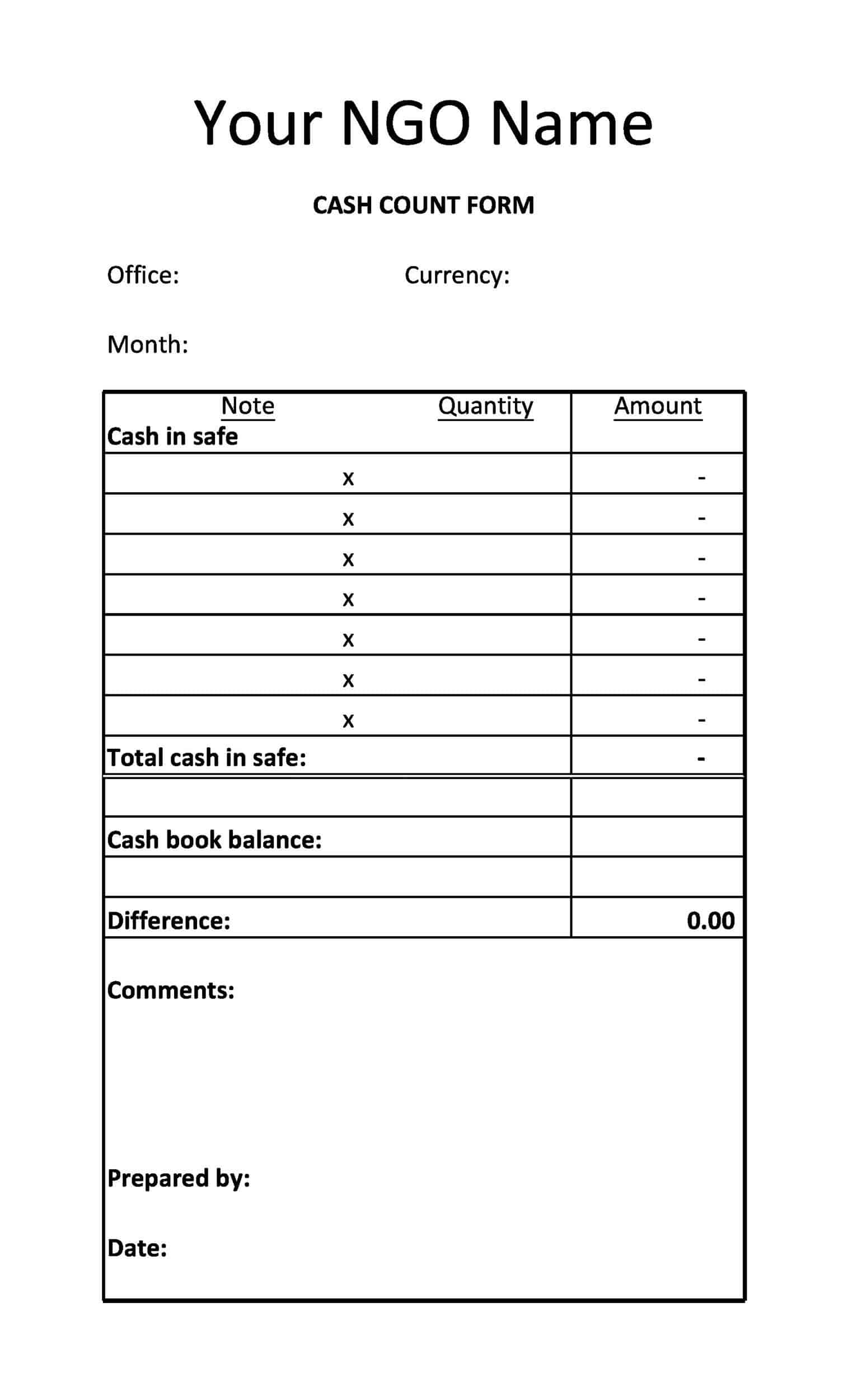

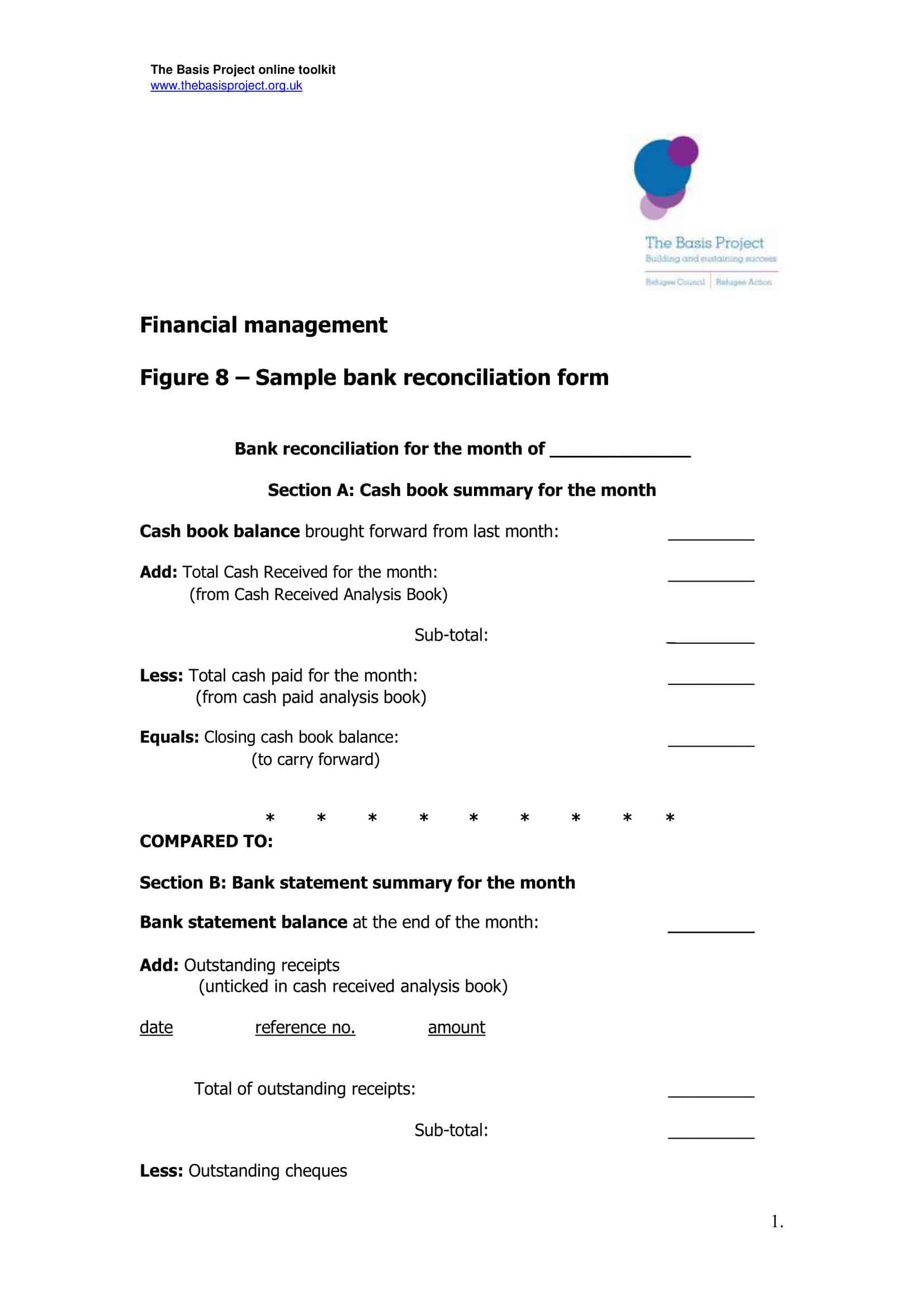

Bank Reconciliation Templates are pre-designed formats used by businesses and individuals to compare and reconcile their financial records with the corresponding bank statements. These templates provide a structured framework for systematically identifying and resolving discrepancies between the company’s or individual’s records and the bank’s records. Bank Reconciliation Templates ensure accuracy, transparency, and consistency in financial reporting, helping to identify errors, fraudulent activities, or missing transactions.

Bank Reconciliation Templates assist in comparing and reconciling the financial records with the bank statement, ensuring accuracy and integrity in financial reporting. By using these templates, businesses and individuals can identify any discrepancies, errors, or fraudulent activities, enabling prompt resolution and maintaining the financial health of the organization. Bank Reconciliation Templates facilitate transparency, accountability, and compliance with financial regulations, providing an essential tool for accurate financial management and decision-making.

What is Bank Reconciliation?

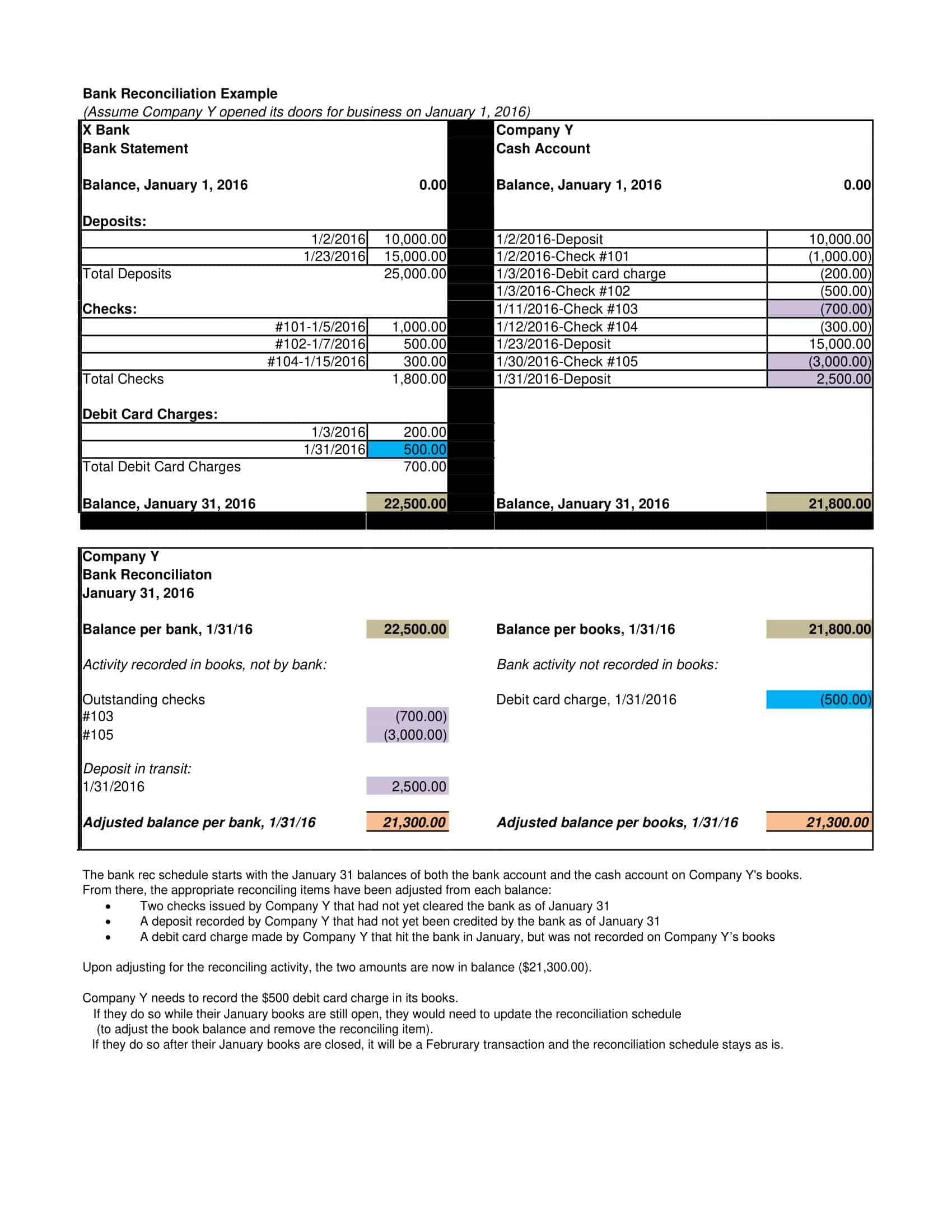

Bank reconciliation is the process of comparing the balance in a company’s accounting records with the corresponding balance in the bank statement, in order to identify and correct any discrepancies. This process helps ensure that the company’s financial records are accurate and up-to-date.

During bank reconciliation, transactions from the bank statement are matched against the corresponding entries in the company’s accounting records. Any discrepancies are then investigated and explained, and the necessary adjustments are made to the accounting records. Bank reconciliation is typically performed on a regular basis, such as monthly or quarterly, to ensure that any discrepancies are identified and corrected in a timely manner.

Why Is Reconciliation Important ?

Bank reconciliation is an important process for businesses and individuals for several reasons. One of the main reasons is that it helps ensure the accuracy of the company’s financial records. By comparing the balance in the company’s accounting records with the corresponding balance in the bank statement, discrepancies can be identified and corrected, which can prevent errors and misstatements in the financial records.

Another important aspect of bank reconciliation is that it can help detect and prevent fraud. By regularly reviewing and reconciling bank transactions, businesses and individuals can identify any suspicious or unauthorized transactions and take the necessary steps to prevent further fraud.

Additionally, bank reconciliation is essential for tax compliance. Businesses and individuals must report accurate financial information to tax authorities, and bank reconciliation can help ensure that the financial records are accurate and up-to-date for tax reporting purposes.

The Main Purposes of Bank Reconciliation

Bank reconciliation is a process that serves several key purposes. The main purposes of bank reconciliation are as follows:

Ensuring the accuracy of financial records

The primary purpose of bank reconciliation is to ensure that the balance in a company’s accounting records is accurate and matches the corresponding balance in the bank statement. By comparing these two balances, discrepancies can be identified and corrected, which helps ensure that the company’s financial records are accurate and up-to-date.

Detecting and preventing fraud

By regularly reviewing and reconciling bank transactions, businesses and individuals can identify any suspicious or unauthorized transactions and take the necessary steps to prevent further fraud.

Maintaining tax compliance

Bank reconciliation is essential for tax compliance. Businesses and individuals must report accurate financial information to tax authorities, and bank reconciliation can help ensure that the financial records are accurate and up-to-date for tax reporting purposes.

Monitoring the financial performance of a business

Bank reconciliation provides an overview of cash-flow and enables to track the money coming in and going out, which can help businesses to understand their financial performance and make informed decisions.

Identifying errors and mistakes

Bank reconciliation helps to identify errors and mistakes that occur in the daily transactions, such as incorrect amounts entered or double entries, it allows to rectify these errors before they cause more significant issues.

Compliance with regulations

Banks and financial institutions are highly regulated and require regular reporting and record keeping. Reconciling your bank accounts regularly helps to ensure that all transactions are compliant with regulations and laws.

Some Tips for Preparing the Bank Reconciliation Form

Preparing a bank reconciliation can be a complex and time-consuming task, but by following a few key tips, it can be made more manageable and efficient. Here are some tips for preparing a bank reconciliation:

Gather all necessary information: Before you begin the reconciliation process, make sure you have all the necessary information, including the bank statement, a copy of the company’s accounting records, and any other relevant documents. This will help ensure that you have all the information you need to complete the reconciliation.

Organize your information: Once you have all the necessary information, organize it in a way that makes it easy to review. For example, you can create a spreadsheet or use a bank reconciliation template to organize the transactions from the bank statement and the accounting records.

Start with the most recent transactions: As you begin to match transactions from the bank statement with those in the accounting records, start with the most recent transactions and work your way backwards. This will help you identify and correct any discrepancies more quickly.

Compare the balances: Once you have matched all the transactions, compare the ending balance from the bank statement with the corresponding balance in the company’s accounting records. If there is a difference, investigate the cause and make the necessary adjustments to the accounting records.

Check for unrecorded transactions: As you review the transactions, be on the lookout for any unrecorded transactions that may have occurred. These are transactions that have not yet been recorded in the accounting records, but are reflected on the bank statement.

Look for unusual transactions: As you review the transactions, also look for any unusual transactions. For example, if there is a large deposit or withdrawal that you don’t recognize, you’ll need to investigate further to determine the cause.

Keep detailed records: As you perform the reconciliation, keep detailed records of any discrepancies and the steps you take to correct them. This will help you track any issues that arise and will be useful for future reference.

Follow up on outstanding items: Some items on the bank statement may still be outstanding at the time of reconciliation, they might be checks that haven’t cleared yet or outstanding deposit slips. Follow-up on these items and make sure that they are recorded in the next reconciliation.

Use bank reconciliation software: to automate the process and make it more efficient, many businesses and individuals use bank reconciliation software that automatically imports transactions from the bank statement, matches them with the transactions in the accounting records, and identifies any discrepancies.

Conduct the reconciliation frequently: The more frequently the bank reconciliation is done, the easier it will be to spot any discrepancies, and the less time it will take to correct them. It is recommended to do the bank reconciliation at least once a month.

FAQs

How often should bank reconciliation be done?

It is recommended that bank reconciliation be done on a regular basis, such as monthly or quarterly. This helps to catch errors or discrepancies early on and prevent them from becoming larger issues.

What is the difference between a “cleared” and “uncleared” check?

A cleared check is one that has been processed by the bank and the funds have been transferred from the payer’s account to the payee’s account. An uncleared check is one that has not yet been processed by the bank and the funds have not yet been transferred.

Can bank reconciliation be done electronically?

Yes, many banks offer online banking services that allow companies to view their bank statements and reconcile their records electronically. This can be more efficient and reduce the risk of errors.

Can bank reconciliation be automated?

Yes, many accounting software programs have built-in bank reconciliation features that can automate the process. These software programs can automatically match and reconcile transactions, making the process faster and more accurate.

Who is responsible for bank reconciliation?

The responsibility for bank reconciliation typically falls on the company’s finance or accounting department. The person responsible for bank reconciliation should be a reliable and accurate individual with a good understanding of accounting principles and the company’s financial records.

What are some common errors that can be caught during bank reconciliation?

Some common errors that can be caught during bank reconciliation include:

- Deposits in transit: Deposits made by the company that have not yet been reflected on the bank statement

- Outstanding checks: Checks written by the company that have not yet been processed by the bank

- Bank service charges: Fees or charges that were not recorded in the company’s records

- Duplicate payments: Payments made twice by mistake.

- Errors made by the bank.

What are the steps involved in bank reconciliation?

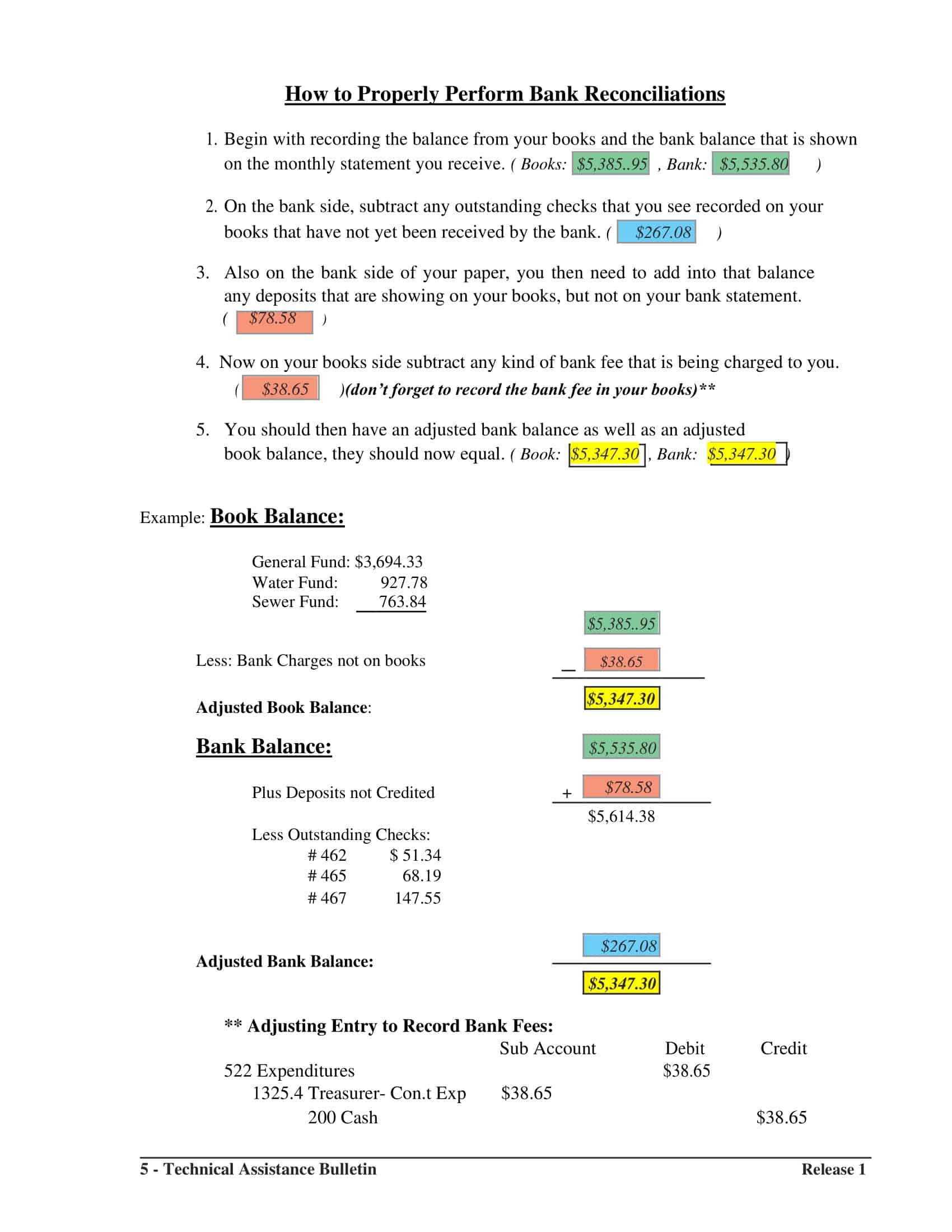

The steps involved in bank reconciliation typically include:

- Obtaining the bank statement from the bank

- Comparing the bank statement with the company’s records

- Identifying and resolving any discrepancies

- Recording any transactions that were not reflected on the bank statement

- Updating the company’s records to reflect the reconciled balance.

What are some best practices for bank reconciliation?

Some best practices for bank reconciliation include:

- Reconciling on a regular basis

- Maintaining accurate and up-to-date records

- Using an accounting software program to automate the process

- Reviewing bank statements and reconciling them as soon as they are received

- Reconciling cash transactions first, followed by non-cash transactions.

- Cross-checking the transactions with the financial statements.

- Performing bank reconciliation by an independent person.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)