Understanding the intricacies of a catering invoice can be the difference between a smooth event execution and a logistical nightmare. This article will explore the essential elements that form the backbone of these specialized invoices, illuminating how they are constructed, what they should include, and their pivotal role in the catering industry.

We will provide insights and useful tips for both catering professionals and clients to facilitate clear communication, accurate billing, and ultimately, successful events. Whether you’re a seasoned caterer or someone planning a special occasion, this comprehensive guide to catering invoices is sure to enhance your knowledge and readiness.

Table of Contents

What is a catering invoice?

A catering invoice is a detailed document issued by a caterer to a client, outlining the services rendered for an event. It typically includes a breakdown of the costs associated with different elements such as food, beverages, staff, equipment rentals, and other event-specific services.

This invoice not only serves as a billing tool, ensuring the caterer gets paid accurately and on time, but it also acts as a written agreement between the two parties, clarifying the terms and conditions of the service. It’s an essential piece of documentation in the catering business that promotes transparency, accountability, and clear financial tracking.

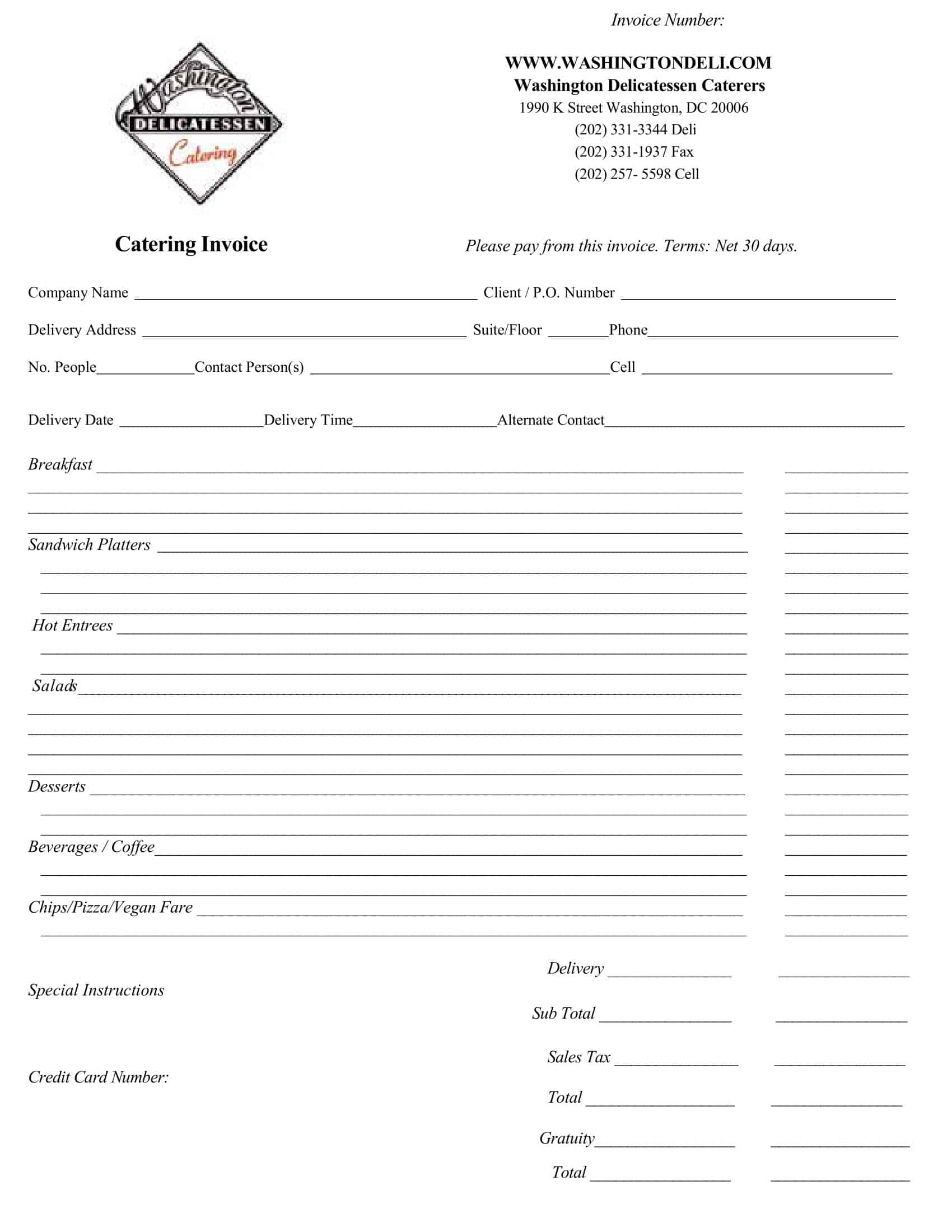

Catering Invoice Templates

Catering Invoice Templates are standardized documents used in the catering business to bill clients for services rendered. They outline the services provided, the costs associated, and the total amount due, providing clear and transparent financial communication with clients.

Typically at the top of these templates, there’s an area for business information. This includes the name, address, and contact details of the catering company. It also includes client information such as the name, address, and contact details.

Following this in many templates, there’s a section for the invoice number and date. These elements are vital for record keeping, tracking services, and managing payments.

Directly after this, most templates feature a description of services section. Here, every service rendered, item of food or drink provided, or equipment rented is listed. Each item typically has an associated unit price and quantity, and a line total.

What It is Used for ?

A catering invoice serves several crucial purposes. Primarily, it is used as a billing tool to request payment from the client for the services rendered during a specific event. It outlines in detail the various charges including the costs of food, beverages, labor, equipment, and sometimes transportation or other expenses.

This aids in ensuring that the caterer is paid accurately and on time. Additionally, the invoice serves as a formal record of the transaction, which is important for accounting and tax purposes for both the caterer and the client. Finally, it provides a means of communication and clarification between the caterer and the client, helping to avoid misunderstandings by clearly specifying the services provided and their associated costs.

Why Are Catering Invoices Important?

Catering invoices play a crucial role in the efficient operation and financial health of any catering business, as well as offering several benefits to the client. Let’s delve deeper into why they’re so important.

- Financial Accuracy: Invoices ensure financial accuracy by providing a detailed breakdown of the costs associated with a catering event. This includes the cost of food and beverages, staff wages, equipment rental, and other expenses. This transparency helps the client understand where their money is going and ensures the caterer is paid correctly.

- Record Keeping: Catering invoices serve as an essential record of transactions. For the caterer, this helps with bookkeeping and tracking revenue and expenses, which is crucial for tax filing and financial planning. For clients, it provides a record of expenses, which may be needed for their own accounting, tax purposes, or reimbursement in the case of corporate events.

- Legal Protection: A detailed invoice can also serve as a form of legal protection. In the event of a dispute over payment or services provided, an invoice can provide a written account of what was agreed upon, including detailed services and prices.

- Professionalism: Using detailed invoices reflects a high level of professionalism. It shows clients that the caterer operates a serious and organized business. This can increase client confidence and potentially lead to more business through word-of-mouth and repeat customers.

- Communication: An invoice acts as a communication tool between the caterer and the client. It outlines exactly what services are to be provided, helping to avoid misunderstandings. It also provides an opportunity for the caterer to communicate policies regarding payment terms, such as due date, late fees, or deposit requirements.

- Cash Flow Management: Regular invoicing helps with cash flow management. By promptly issuing invoices and clearly stating payment due dates, a caterer can better predict their income stream, which is essential for managing expenses and planning for growth.

What should a catering invoice include?

A well-structured and comprehensive catering invoice should include a number of essential elements that provide clarity and detail about the services provided and their costs. Here are the key components:

- Header: This should include the word “Invoice” to clearly identify the document. You may also want to include your logo for branding purposes.

- Caterer’s Information: This includes the caterer’s name, address, contact information, and tax identification number. If the caterer is a registered company, the company name should be included.

- Client’s Information: Similarly, you should include the client’s name, address, and contact details. If the client is a company, include the company’s name and address.

- Invoice Number: Every invoice should have a unique number for tracking and reference purposes.

- Date: This includes the date the invoice is issued and the date the payment is due.

- Event Details: Important details about the event should be listed, such as the event date, location, duration, and type of event (e.g., wedding, corporate function, birthday party, etc.).

- Detailed Breakdown of Services and Costs: This is where you list the services you provided and their respective costs. This could include the cost per plate or per person for food, staff costs (like chefs, waitstaff), rental costs (for equipment or venue), transportation costs, and any other services provided. The description should be clear and detailed.

- Subtotal: The total cost before any taxes, discounts, or additional fees.

- Taxes and Additional Fees: If applicable, include sales tax, service charges, or other fees.

- Total Cost: The final amount the client owes, including all taxes and fees.

- Payment Terms: Specify when the payment is due and the accepted methods of payment (e.g., cash, check, credit card, bank transfer, etc.). You might also mention any late payment fees or penalties.

- Thank You Note: Although not mandatory, a brief note thanking the client for their business can add a nice touch and help to maintain a positive relationship.

How to Create a Catering Invoice

Creating a catering invoice involves several steps that can be easily followed. Here’s a step-by-step guide to creating an effective and professional catering invoice:

Step 1: Choose an Invoice Template or Software Depending on the size of your catering business, you might opt for an invoice template available in Word, Excel, or similar software. Alternatively, you might use a dedicated invoice software or a comprehensive accounting solution which includes an invoicing feature.

Step 2: Incorporate Branding Elements Add your logo and business name at the top of the invoice. Use your brand’s colors and fonts to keep it consistent and professional.

Step 3: Include Your Contact Information Write down your business’s full name, address, email, phone number, and if applicable, your tax identification number.

Step 4: Add Client Information Include your client’s full name, address, and contact details. If the client is a company, include the company name.

Step 5: Generate Unique Invoice Number and Dates Every invoice should have a unique invoice number for easy tracking and reference. Also, include the date the invoice is issued and the payment due date.

Step 6: Include Event Details Add relevant details about the event such as the date, time, location, and type of event.

Step 7: Itemize Services Provided and Costs In a table or list, itemize each service provided with its associated cost. This can include food and beverage charges, staff costs, equipment rental fees, and other relevant expenses.

Step 8: Calculate and Present the Subtotal Tally up all the costs to present a subtotal, which is the total cost before taxes, discounts, or other fees.

Step 9: List Taxes and Additional Fees List any taxes, service fees, or other charges that need to be added to the subtotal.

Step 10: Present the Total Amount Due Add up the subtotal and any extra charges to get the final total, which is the amount due by the client.

Step 11: Specify Payment Terms and Conditions Clearly state when the payment is due and what payment methods are accepted. Include any late fees or penalties for overdue payment.

Step 12: Add a Thank You Note Finish off the invoice with a courteous thank-you note to the client for their business.

Step 13: Review and Send Make sure to review your invoice for any errors or omissions before you send it to the client.

FAQs

Can a catering invoice be customized?

Yes, a catering invoice can be customized to fit the specific needs of the catering company and the client. You can add your company’s logo, adjust the formatting, include specific terms and conditions, or even use a pre-designed catering invoice template to streamline the process.

Are there any taxes applicable to catering services?

The applicability of taxes on catering services varies depending on the jurisdiction. In some regions, catering services may be subject to sales tax, value-added tax (VAT), or other local taxes. It’s important to research and understand the tax regulations in your area and consult with a tax professional to ensure compliance.

Can I include gratuity or service charges on the catering invoice?

Including gratuity or service charges on the catering invoice is common practice in the industry. If you charge an automatic gratuity or service charge, clearly state it on the invoice. However, it’s important to check the local regulations and inform the client about any additional charges beforehand to avoid misunderstandings or disputes.

How should I calculate the prices for catering services on the invoice?

The pricing for catering services can be calculated in different ways, depending on your business model. Some common methods include:

- Per-person pricing: Determine a fixed price per person based on the menu items and services provided.

- Menu item pricing: Assign individual prices to each menu item and calculate the total based on the quantities ordered.

- Package pricing: Offer pre-set packages with a fixed price that includes a specific combination of menu items and services.

- Custom pricing: Provide customized quotes based on the client’s unique requirements, such as special dietary needs or specific event details.

Q: How should I handle a deposit or advance payment on the catering invoice?

A: If you require a deposit or advance payment from clients, you can mention it on the invoice. Specify the amount of the deposit, the due date, and any applicable refund policies or conditions. Clearly communicate the payment terms to the client to ensure a smooth transaction process.

Q: What payment methods should I accept for catering services?

A: The payment methods you accept can vary based on your preferences and the convenience for your clients. Common payment methods for catering services include:

- Cash: Accepting cash payments is straightforward, but it’s essential to provide receipts and maintain proper records.

- Checks: Clients can pay by personal or business checks. Ensure that the checks are valid and properly endorsed.

- Credit/debit cards: Setting up a card payment system allows clients to make payments using their credit or debit cards.

- Bank transfers: Provide your bank account details for clients to transfer funds directly to your business account.

- Online payment platforms: Utilize online payment platforms like PayPal, Stripe, or Square for secure and convenient transactions.

- Payment apps: Accept payments through popular mobile payment apps such as Venmo, Apple Pay, or Google Pay.

Q: Is it necessary to keep records of the catering invoices?

A: Yes, it is essential to maintain proper records of your catering invoices for accounting, tax purposes, and business management. Keep copies of the issued invoices, payment receipts, and any related correspondence with clients. These records help with financial reporting, reconciliation, and potential audits.

Q: Can I use invoice templates for catering invoices?

A: Yes, using invoice templates can save time and ensure consistency in your invoicing process. You can find pre-designed catering invoice templates online or use invoicing software that offers customizable templates. Customize the template to include your company information, logo, and specific details related to your catering services.

Q: How long should I keep catering invoice records?

A: The duration for which you should keep catering invoice records may vary depending on your jurisdiction’s tax and legal regulations. In general, it is recommended to keep records for a minimum of three to seven years. However, consult with a tax professional or accountant to determine the specific record retention requirements in your area.

Q: Can I issue a revised invoice if there are changes or corrections needed?

A: Yes, if there are changes or corrections needed after an invoice has been issued, you can provide a revised invoice to the client. Clearly indicate that it is a revised invoice and include an explanation of the changes made. It helps maintain accurate financial records and ensures transparency with the client.

Q: What is the recommended timeline for sending a catering invoice to the client?

A: It is generally recommended to send the catering invoice to the client as soon as possible after the services have been rendered. Promptly sending the invoice improves cash flow and reduces the chances of payment delays. Consider sending the invoice within 24 to 48 hours of completing the catering event or as agreed upon in your contract or agreement with the client.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)