Buy-sell agreements represent a crucial component in the organization and management of a business. These legal documents delineate the process by which a partner or co-owner’s shares are allocated in the event of their departure or death, significantly affecting the company’s future functionality and performance.

It is essential that buy-sell agreements are meticulously crafted to ensure the proper distribution or acquisition of shares when an owner either passes away or exits the company. Failure to precisely construct this vital document may result in the business’s operations being stalled until legal intervention resolves the share ownership issue.

As such, business owners should prioritize the creation of a comprehensive and accurate buy-sell agreement, giving due consideration to the intricacies involved in share transactions to prevent unfavorable outcomes.

Table of Contents

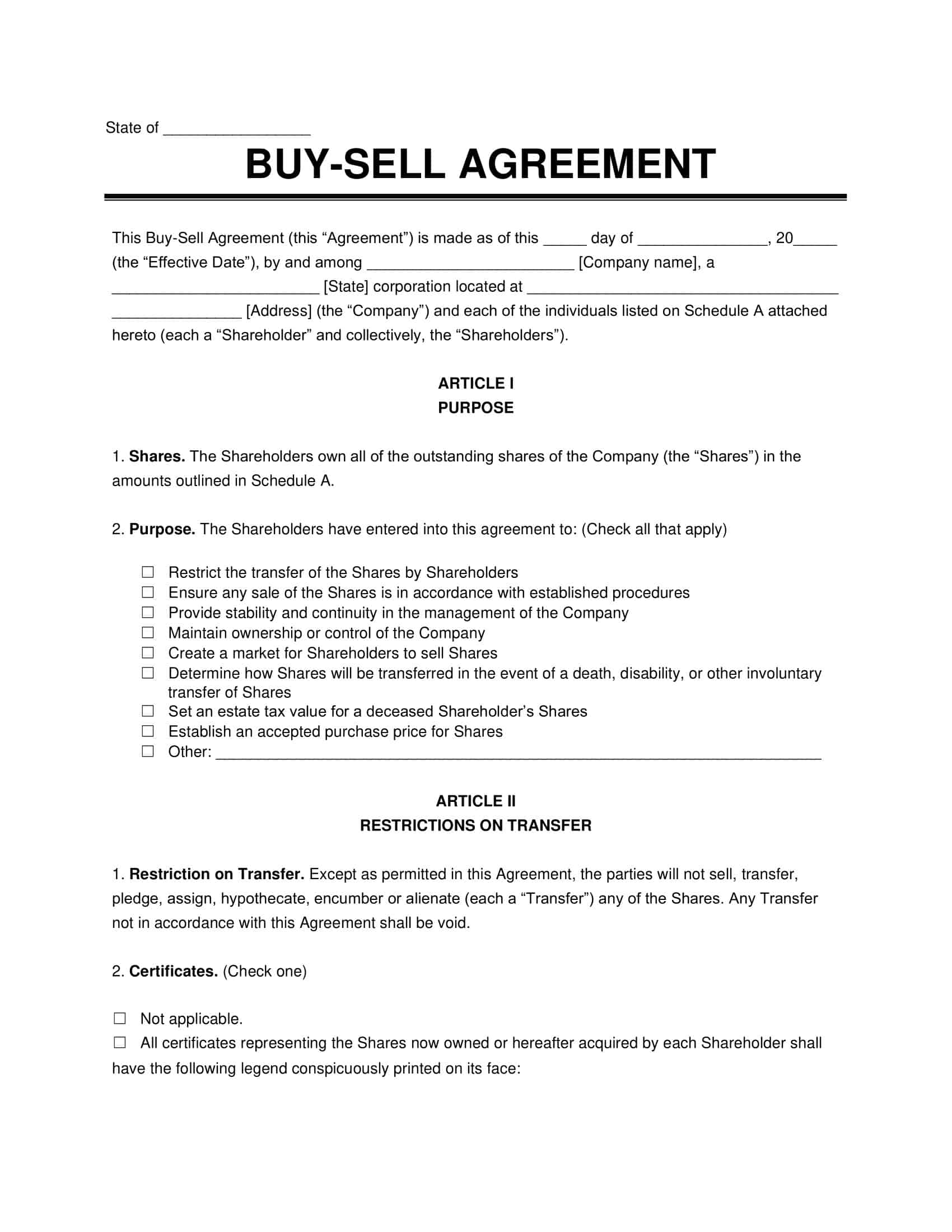

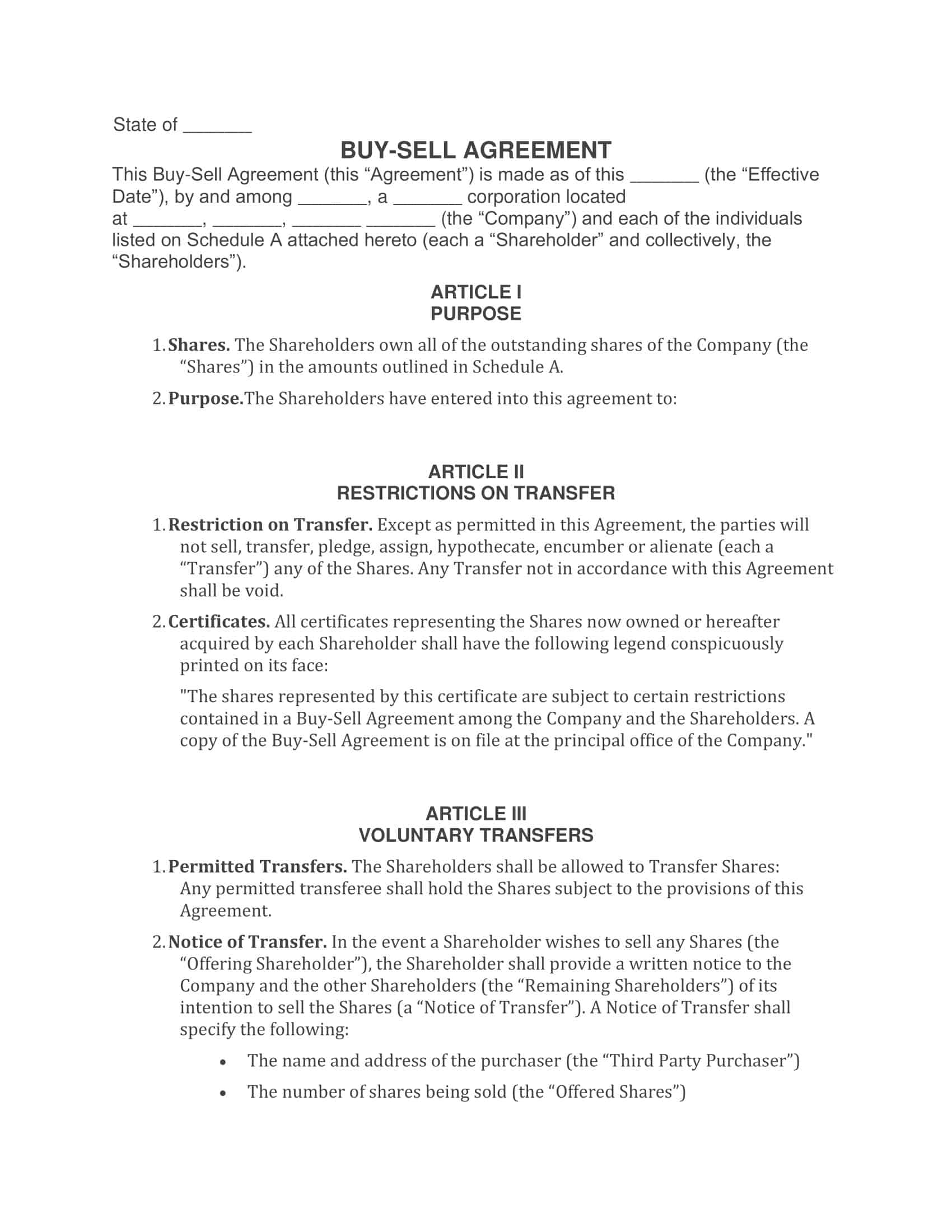

Buy-Sell Agreement Templates

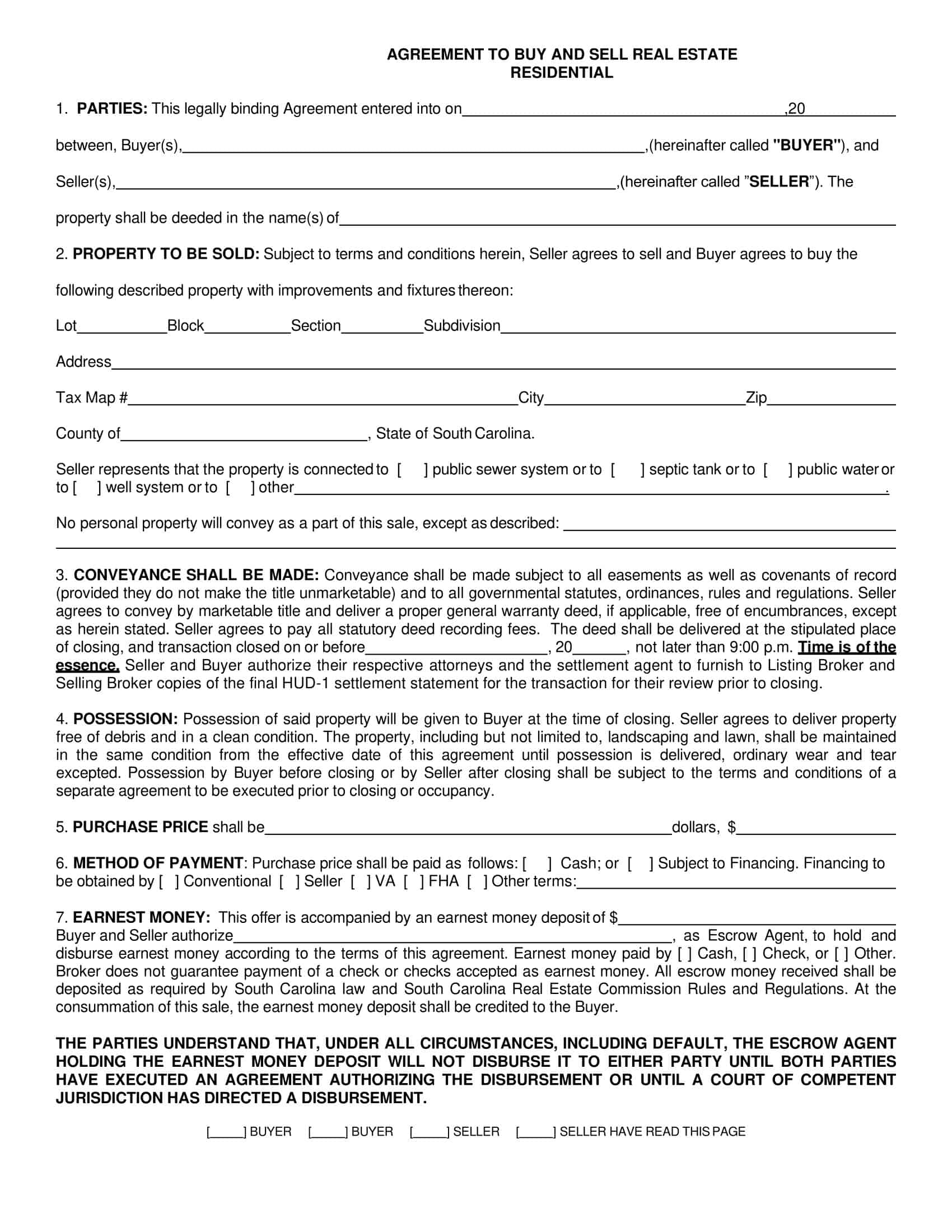

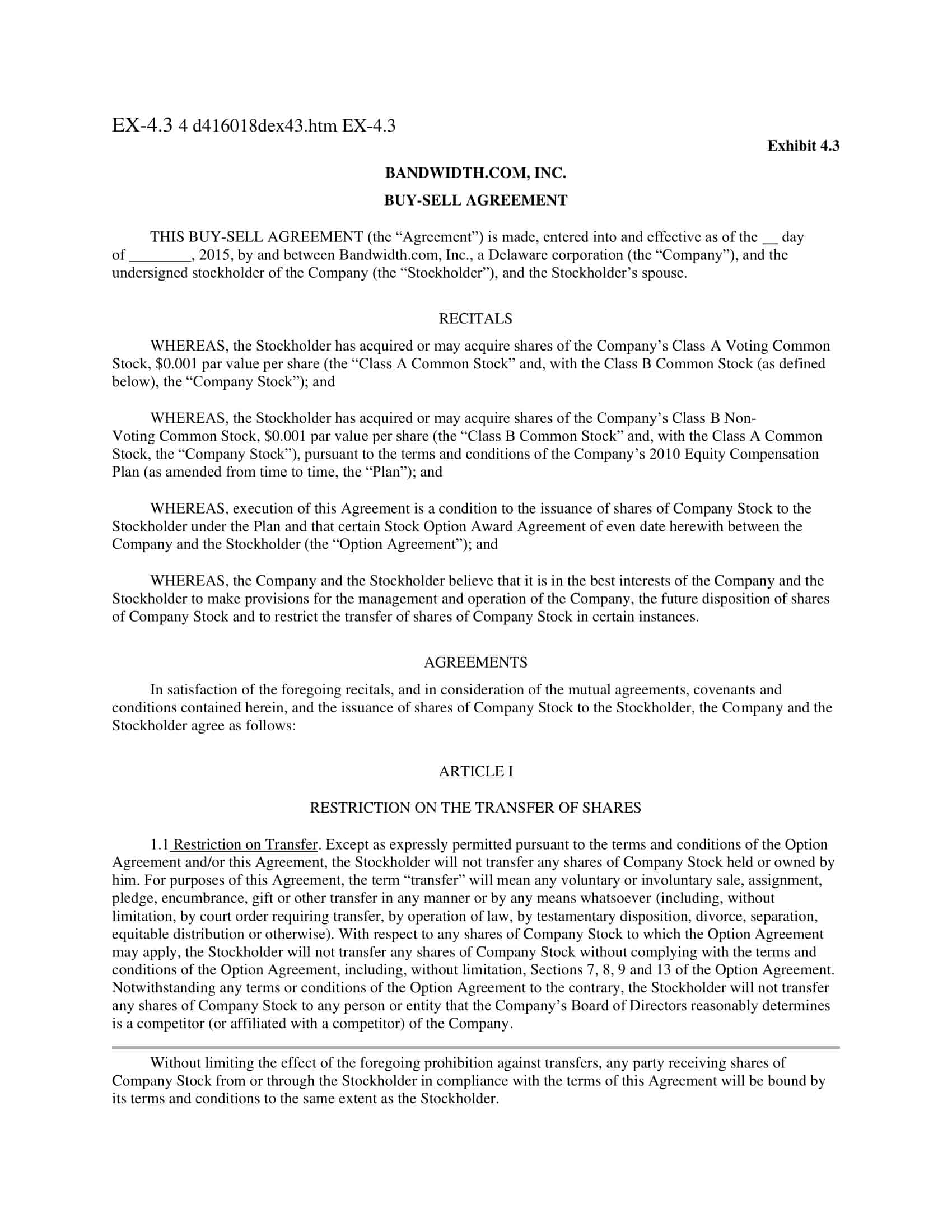

A buy-sell agreement template is a legally binding document that outlines the terms and conditions for buying or selling a business interest or ownership stake. It serves as a comprehensive agreement between the parties involved, typically business partners or shareholders, and provides a framework for the smooth transfer of ownership in various scenarios, such as retirement, disability, death, or voluntary exit.

This agreement is crucial for businesses of all sizes and types, including partnerships, limited liability companies (LLCs), and corporations. It helps establish a clear plan and procedure for the sale or transfer of shares, ensuring that the business can continue to operate seamlessly in the event of an unexpected change in ownership.

By utilizing a buy-sell agreement template, business owners can proactively plan for potential ownership changes and avoid uncertainties and conflicts. It provides a clear roadmap for the future of the business, protecting the interests of all parties involved and promoting a smooth transition of ownership. However, it’s important to customize the template to suit the specific needs and circumstances of the business, seeking legal advice to ensure compliance with applicable laws and regulations.

What Is a Buy and Sell Agreement?

A buy-sell agreement, also known as a buyout agreement, is a legally binding contract between co-owners of a business that outlines the terms and conditions under which an owner’s shares can be bought or sold in the event of specific triggering situations, such as the owner’s death, disability, retirement, or departure from the company.

The primary purpose of a buy-sell agreement is to establish a fair market value for the shares and to provide a predefined plan for the smooth transfer of ownership, ensuring business continuity and minimizing disputes among remaining owners or between the remaining owners and the departing owner or their estate.

Buy-sell agreements can take various forms, including cross-purchase agreements, where the remaining owners buy the shares directly, or redemption agreements, where the company itself buys back the shares. These agreements can also include a combination of both. Funding for buy-sell agreements is often facilitated through life insurance policies or other financial arrangements to provide the necessary liquidity for the transaction.

How Buy-Sell Agreements Work

A buy-sell agreement is a comprehensive legal contract that outlines the terms, conditions, and procedures for the transfer of ownership of a business in the event of specific triggering situations. These situations may include the death, disability, retirement, or departure of an owner, among other circumstances. The agreement ensures business continuity, minimizes disputes, and maintains the stability of the company during the transition. Here’s how a buy-sell agreement generally works:

Triggering events: The agreement defines a set of situations that activate the buy-sell provisions. Common triggering events include the death or disability of an owner, voluntary or involuntary departure, bankruptcy, divorce, or reaching a certain age or length of service.

Valuation of the business: The agreement establishes a method to determine the fair market value of the business, which is critical for setting the price at which shares will be bought or sold. This can be done through an appraisal by an independent third party, a formula-based valuation, or a mutually agreed-upon value that is periodically updated.

Types of buy-sell agreements: The contract may take various forms, such as a cross-purchase agreement, where the remaining owners buy the departing owner’s shares directly, or a redemption agreement, where the company itself buys back the shares. Some agreements may combine elements of both types.

Funding mechanism: The buy-sell agreement specifies how the transaction will be funded. Common funding methods include life insurance policies, sinking funds, loans, or installment payments. Life insurance is particularly popular in cases of death, as it provides immediate liquidity to facilitate the share purchase.

Transfer restrictions: The agreement may place certain restrictions on the transfer of shares to maintain control among the existing owners, such as a right of first refusal, which gives the remaining owners the option to purchase the shares before they can be offered to external parties.

Buyout terms and payment: The buy-sell agreement outlines the terms of the buyout, including the timeline for the transaction, the payment structure, and any contingencies or conditions that must be met.

Tax considerations: The agreement should address any tax implications associated with the buy-sell transaction, such as the tax treatment of the payment to the departing owner or their estate, and the tax basis of the acquired shares for the remaining owners.

Legal and binding: The buy-sell agreement should be drafted by an experienced attorney to ensure its legal validity and enforceability. All parties should review and sign the document, acknowledging their understanding and consent to the terms and conditions.

A comprehensive buy-sell agreement is a critical component of business succession planning, providing a clear roadmap for the smooth transfer of ownership and minimizing the potential for disputes or disruptions in the company’s operations.

What Is the Benefit of a Buy and Sell Agreement?

A buy-sell agreement offers several benefits to business owners, providing a framework for the smooth transition of ownership and safeguarding the continuity and stability of the business. Key benefits of a buy-sell agreement include:

Business continuity: The agreement ensures that the business continues to operate smoothly during the transfer of ownership, providing a predefined plan for the management and remaining owners to follow.

Fair valuation: The agreement establishes a method for determining the fair market value of the business, ensuring that both the departing owner or their estate and the remaining owners are treated equitably during the transaction.

Minimizing disputes: By clearly outlining the terms and conditions for transferring ownership, a buy-sell agreement minimizes the potential for disputes among owners or between the owners and the departing owner’s estate.

Maintaining control: The agreement often includes transfer restrictions, such as the right of first refusal, which allows the remaining owners to maintain control of the business by purchasing the departing owner’s shares before they can be offered to external parties.

Funding mechanism: The agreement specifies a funding mechanism, such as life insurance policies or sinking funds, ensuring that the necessary funds are available to complete the buyout transaction.

Tax planning: A buy-sell agreement can help owners plan for the tax implications associated with the transfer of ownership, providing guidance on tax-efficient strategies and minimizing potential tax liabilities.

Family and estate planning: For family-owned businesses, a buy-sell agreement can be an essential part of estate planning, ensuring that the owner’s heirs are fairly compensated for their inherited business interests while also protecting the business’s ongoing viability.

Attracting investors and lenders: A well-drafted buy-sell agreement can provide reassurance to investors and lenders, as it demonstrates that the business has a plan in place to address changes in ownership and maintain operational stability.

Facilitating retirement and succession planning: A buy-sell agreement can serve as a valuable tool for business owners who are approaching retirement, providing a clear exit strategy and facilitating the transfer of ownership to the next generation or other successors.

Legal clarity and enforceability: A buy-sell agreement creates a legally binding contract among the owners, ensuring that the terms and conditions for the transfer of ownership are clear, enforceable, and agreed upon by all parties.

Types of Buy-Sell Agreements

There are several types of buy-sell agreements, each with its own structure and mechanism for transferring ownership of a business. The most common types include:

Cross-Purchase Agreement

In a cross-purchase agreement, the remaining co-owners agree to buy the shares of the departing owner directly. When a triggering event occurs, the remaining owners use their personal funds or a pre-arranged funding source, such as life insurance policies on the lives of the other owners, to purchase the shares. This type of agreement is particularly popular among smaller businesses with few owners, as it allows the remaining owners to increase their ownership stake and receive a step-up in tax basis for the acquired shares.

Redemption Agreement (Entity-Purchase Agreement)

In a redemption agreement, the business itself agrees to buy back the shares of the departing owner. The company usually establishes a funding mechanism, such as corporate-owned life insurance policies or sinking funds, to ensure the availability of funds when needed. This type of agreement is more suitable for larger businesses with multiple owners, as it simplifies the buyout process by involving the company as the sole buyer. However, the remaining owners do not receive a step-up in tax basis for the acquired shares in a redemption agreement.

Hybrid Agreement (Combination of Cross-Purchase and Redemption)

A hybrid agreement combines elements of both cross-purchase and redemption agreements. In this arrangement, the company has the option to buy back the shares, and if it chooses not to, the remaining owners have the option to purchase the shares individually. This provides flexibility in structuring the buyout and allows the parties to adapt to changing circumstances or tax laws.

Wait-and-See Buy-Sell Agreement

This is a variation of the hybrid agreement, where the parties initially defer the decision on whether the company or the remaining owners will purchase the shares. Once a triggering event occurs, the parties reassess the situation and make a decision based on their current financial positions, tax considerations, and other factors.

One-Way Buy-Sell Agreement

This type of agreement is typically used when there is a single owner or a significant majority owner. In this case, the owner enters into an agreement with a third party, such as a key employee or an outside investor, who agrees to purchase the owner’s shares in the event of a triggering event. The funding mechanism for the buyout can be pre-arranged through life insurance policies or other financial arrangements.

Who Needs a Buy-Sell Agreement?

A buy-sell agreement is particularly beneficial for the following types of business entities and situations:

Closely-held businesses: These include small and medium-sized businesses with a limited number of owners or shareholders, where the departure or death of an owner can significantly impact the business operations and ownership structure.

Partnerships: A buy-sell agreement is essential for businesses operating as partnerships, as it provides a clear roadmap for handling the departure, retirement, or death of a partner and prevents potential disputes among the remaining partners.

Family-owned businesses: In family-owned businesses, a buy-sell agreement can help ensure a smooth transition of ownership among family members and protect the business’s ongoing viability. It can also address potential family conflicts and clarify the rights and responsibilities of each family member involved in the business.

Businesses with key employees: A buy-sell agreement can be crucial for businesses with key employees who hold ownership interests. The agreement can outline the process for transferring ownership interests if a key employee leaves the company or becomes disabled, ensuring business continuity.

Succession planning: Business owners who are planning for their retirement or succession should consider implementing a buy-sell agreement to facilitate the transfer of ownership to their successors, whether they are family members or other business partners.

Companies seeking external investment: A buy-sell agreement can provide reassurance to external investors or lenders by demonstrating that the business has a plan in place to address changes in ownership and maintain operational stability.

How to set up your buy-sell agreement

Setting up a buy-sell agreement involves careful planning, consultation with legal and financial advisors, and collaboration among business owners. Here is a step-by-step guide to help you establish a buy-sell agreement:

Identify the need

Assess your business structure and determine whether a buy-sell agreement is necessary for your situation, taking into account factors such as the number of owners, the nature of the business, and your succession planning goals.

Consult with professionals

Engage experienced legal and financial advisors to help you navigate the process of setting up a buy-sell agreement. Their expertise will ensure that the agreement is comprehensive, legally enforceable, and considers potential tax implications.

Discuss with co-owners

Communicate openly with your co-owners about the need for a buy-sell agreement and work together to establish common goals, expectations, and concerns regarding the transfer of ownership.

Choose the type of agreement

Determine the most suitable type of buy-sell agreement for your business, whether it be a cross-purchase agreement, redemption agreement, hybrid agreement, wait-and-see agreement, or one-way agreement.

Define triggering events

Clearly outline the situations that will activate the buy-sell provisions, such as death, disability, retirement, divorce, bankruptcy, or the voluntary departure of an owner.

Establish a valuation method

Agree on a method for determining the fair market value of the business at the time of a triggering event, which can involve an independent appraisal, a predetermined formula, or a mutually agreed-upon value that is updated periodically.

Determine the funding mechanism

Decide on how the buyout transaction will be funded. Common options include life insurance policies, sinking funds, loans, or installment payments.

Set transfer restrictions

Incorporate any limitations on the transfer of ownership interests, such as the right of first refusal or other mechanisms to maintain control among existing owners.

Address tax considerations

Work with your financial advisor to address the tax implications associated with the buy-sell transaction and plan for potential tax liabilities.

Draft the agreement

Have your legal advisor draft the buy-sell agreement, ensuring that it includes all necessary elements, is legally binding, and addresses the concerns of all parties involved.

Review and sign the agreement

Carefully review the drafted buy-sell agreement with your co-owners and professional advisors. Make any necessary revisions and ensure that all parties understand and agree to the terms and conditions. Once finalized, have all parties sign the agreement to make it legally enforceable.

Establish a review schedule

Set up a schedule for periodic review and updates of the buy-sell agreement to ensure it remains relevant and reflects any changes in the business, tax laws, or the owners’ personal circumstances.

FAQs

How is the value of the business determined in a buy-sell agreement?

The valuation method is agreed upon by the owners and can involve an independent appraisal, a predetermined formula, or a mutually agreed-upon value that is updated periodically.

How is a buy-sell agreement funded?

Funding mechanisms for buy-sell agreements can include life insurance policies, sinking funds, loans, or installment payments.

Can a buy-sell agreement be changed?

Yes, a buy-sell agreement can be amended with the consent of all parties involved. It’s essential to establish a review schedule to ensure the agreement remains relevant and reflects changes in the business or owners’ circumstances.

Are buy-sell agreements legally enforceable?

Yes, buy-sell agreements are legally enforceable contracts when properly drafted and signed by all parties involved.

What is the role of life insurance in a buy-sell agreement?

Life insurance policies can be used as a funding mechanism for buy-sell agreements. The policy proceeds can provide liquidity to the remaining owners or the business to facilitate the purchase of the deceased owner’s shares.

How do taxes affect buy-sell agreements?

Tax implications of a buy-sell agreement depend on the type of agreement, the structure of the transaction, and the specific tax laws in place. Consulting a financial advisor can help address potential tax liabilities and optimize tax strategies related to the buy-sell transaction.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 2 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)

![Free Printable Separation Agreement Templates [PDF, Word] 3 Separation Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Separation-Agreement-1-150x150.jpg)