Are you planning on protecting your company or business against any loss? Say hello to indemnification agreements. No doubt you might have thought of the term liability, which can connect with indemnification and incentives.

An indemnity agreement is acquired by a third party that covers a party from future losses they might happen to experience. The document has provisions stating that the party applying for indemnification holds another party harmless in every direction, including expenses incurred and interest on said liabilities.

Table of Contents

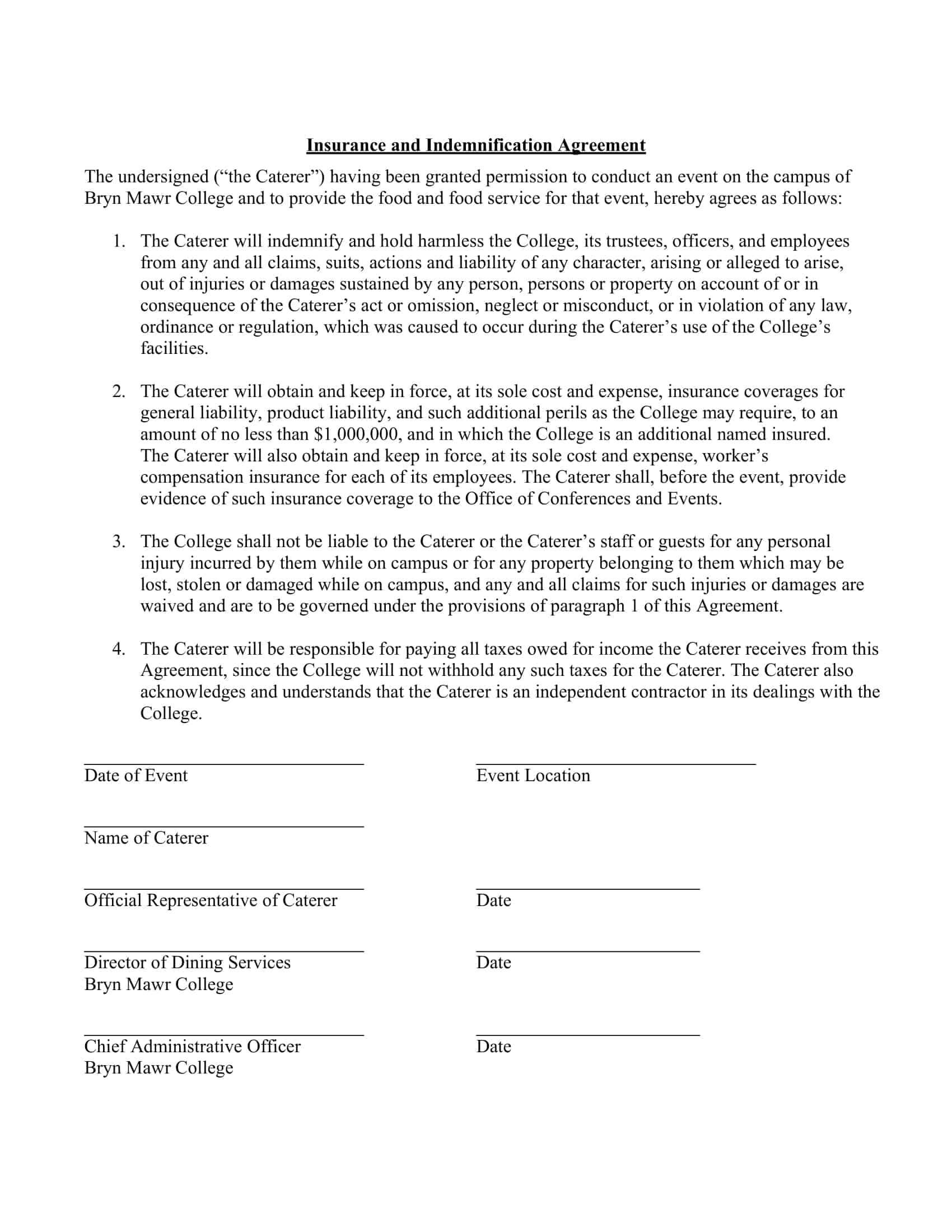

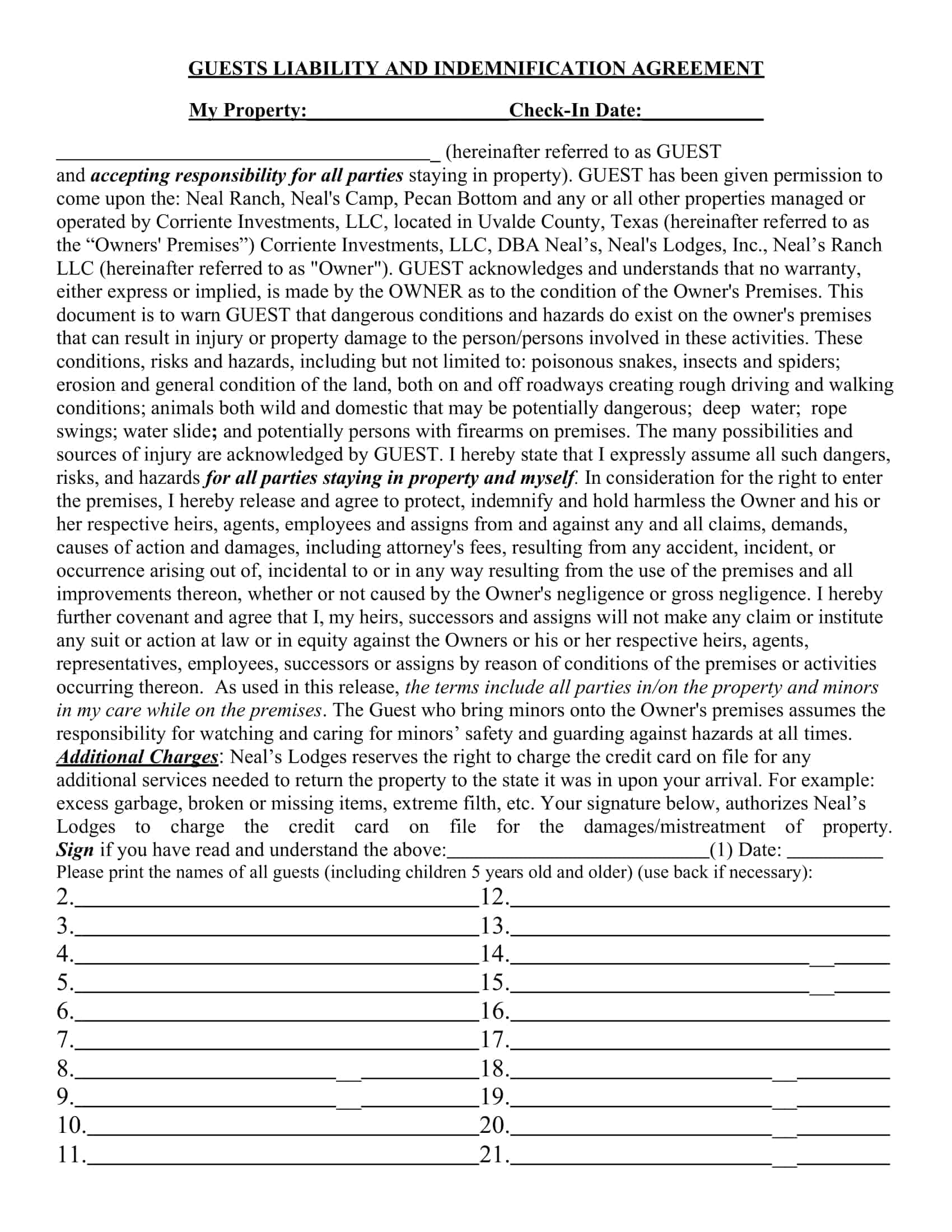

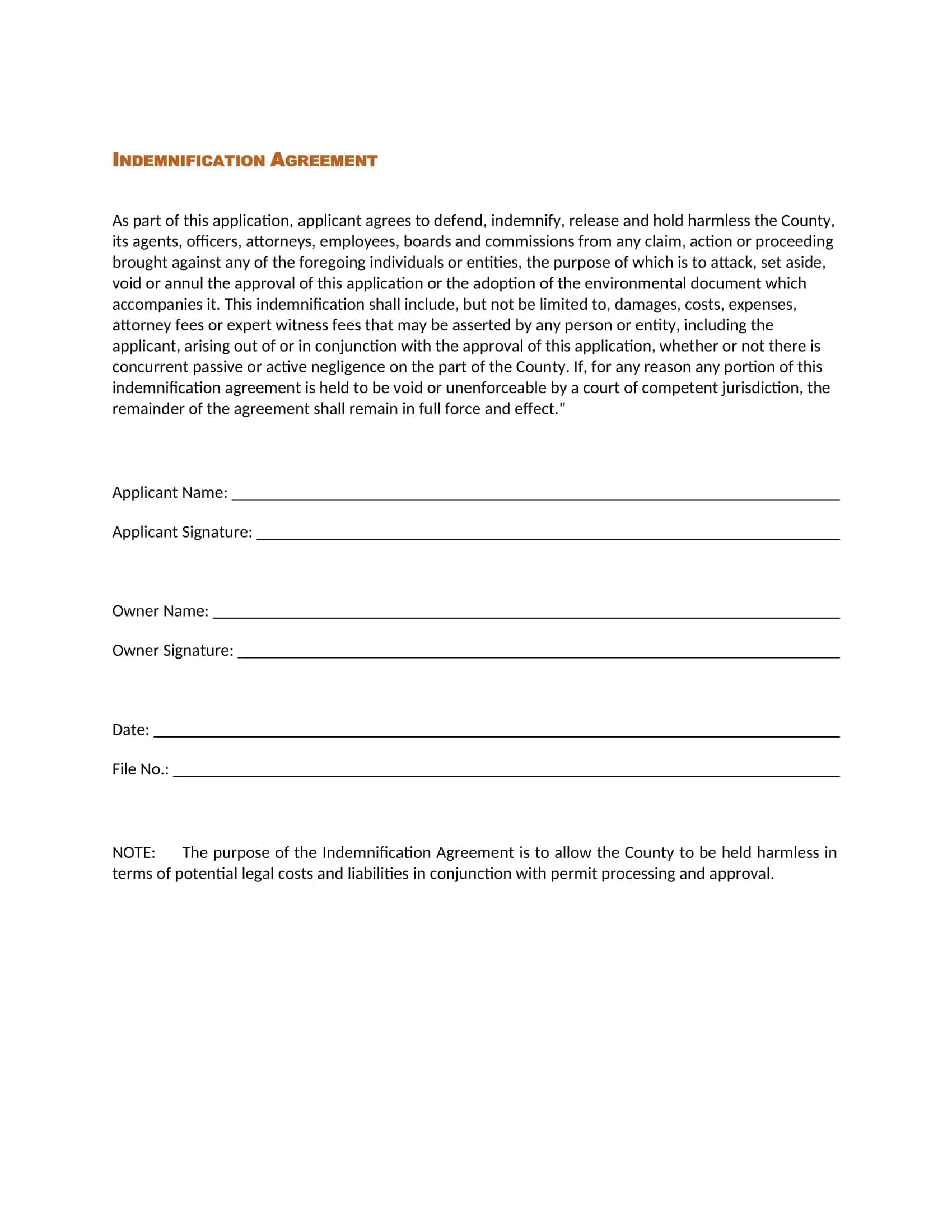

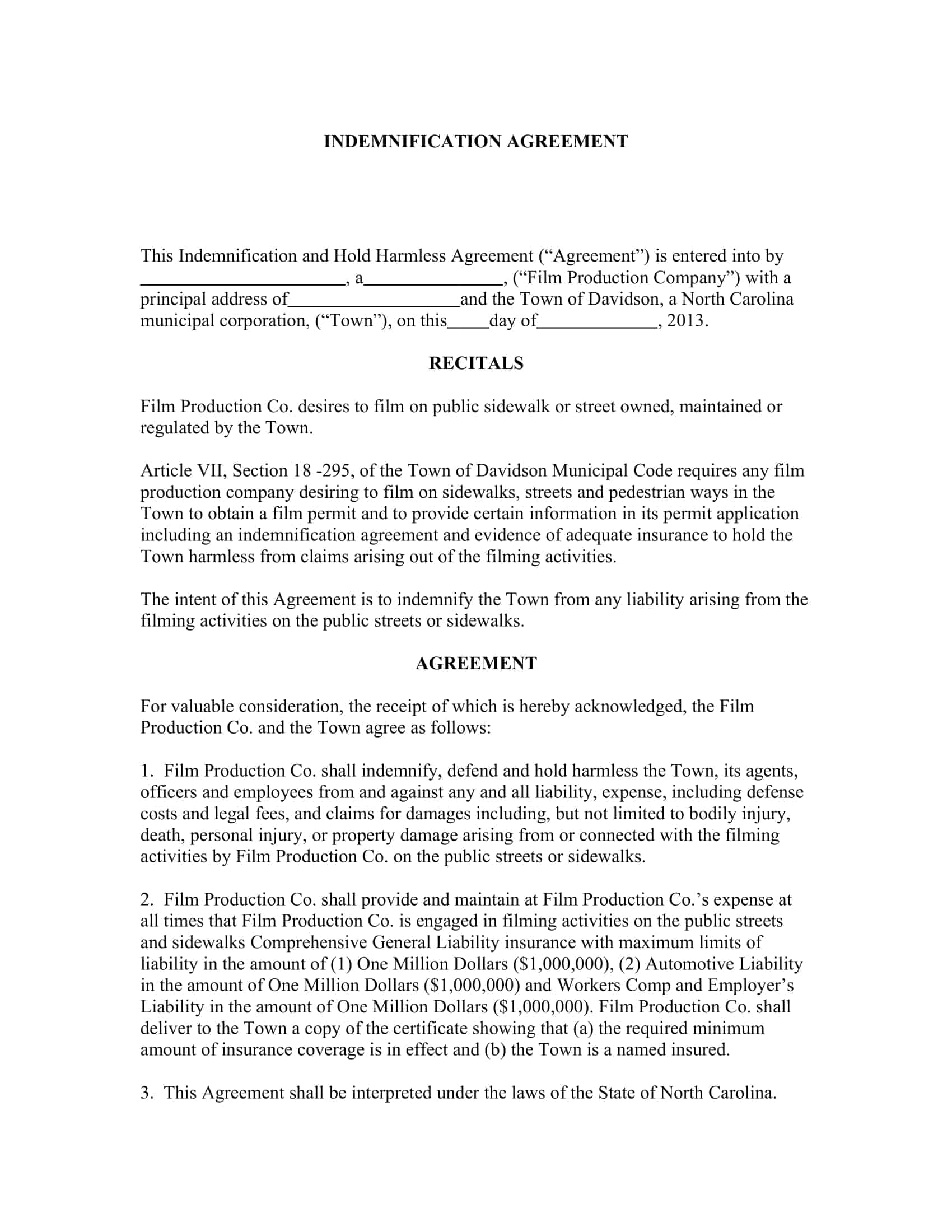

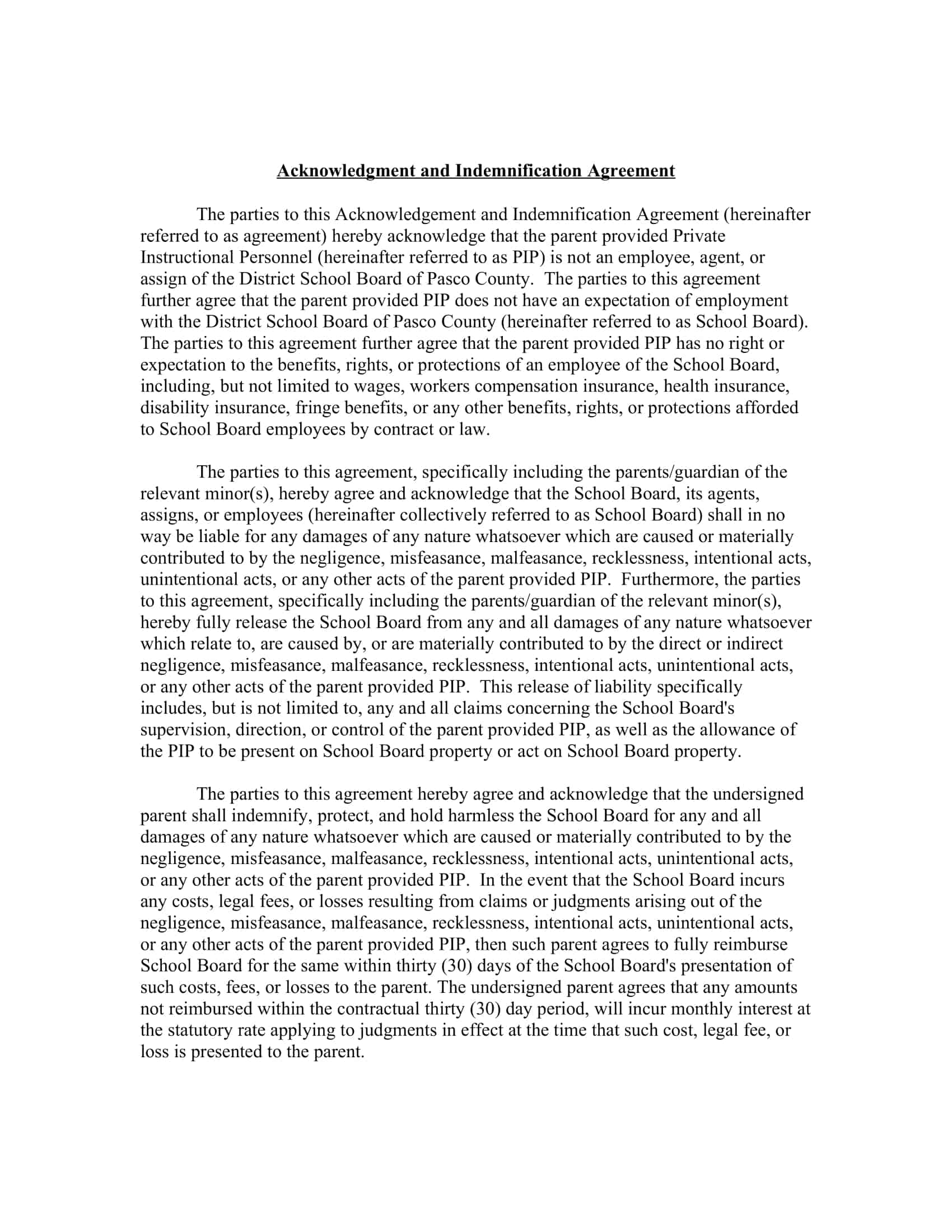

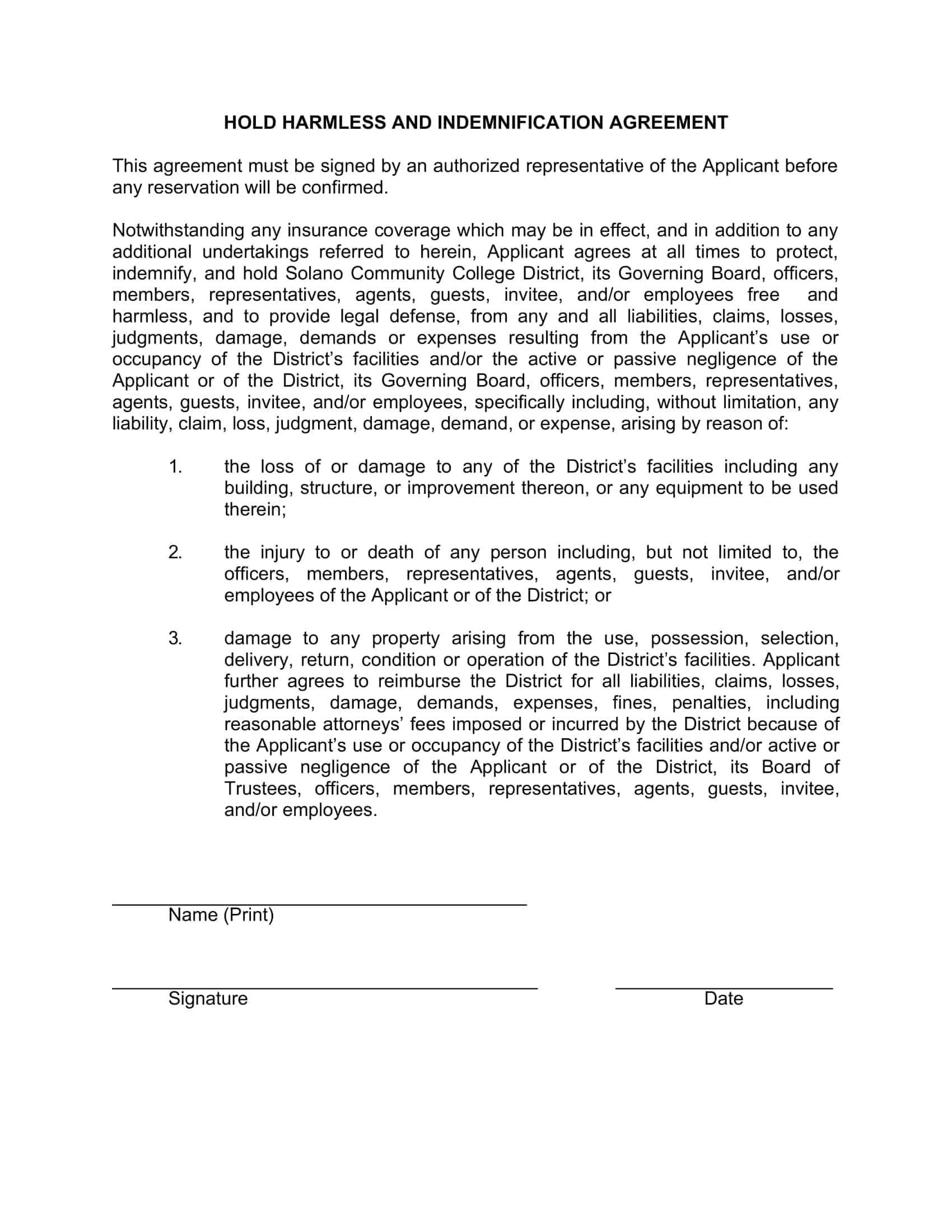

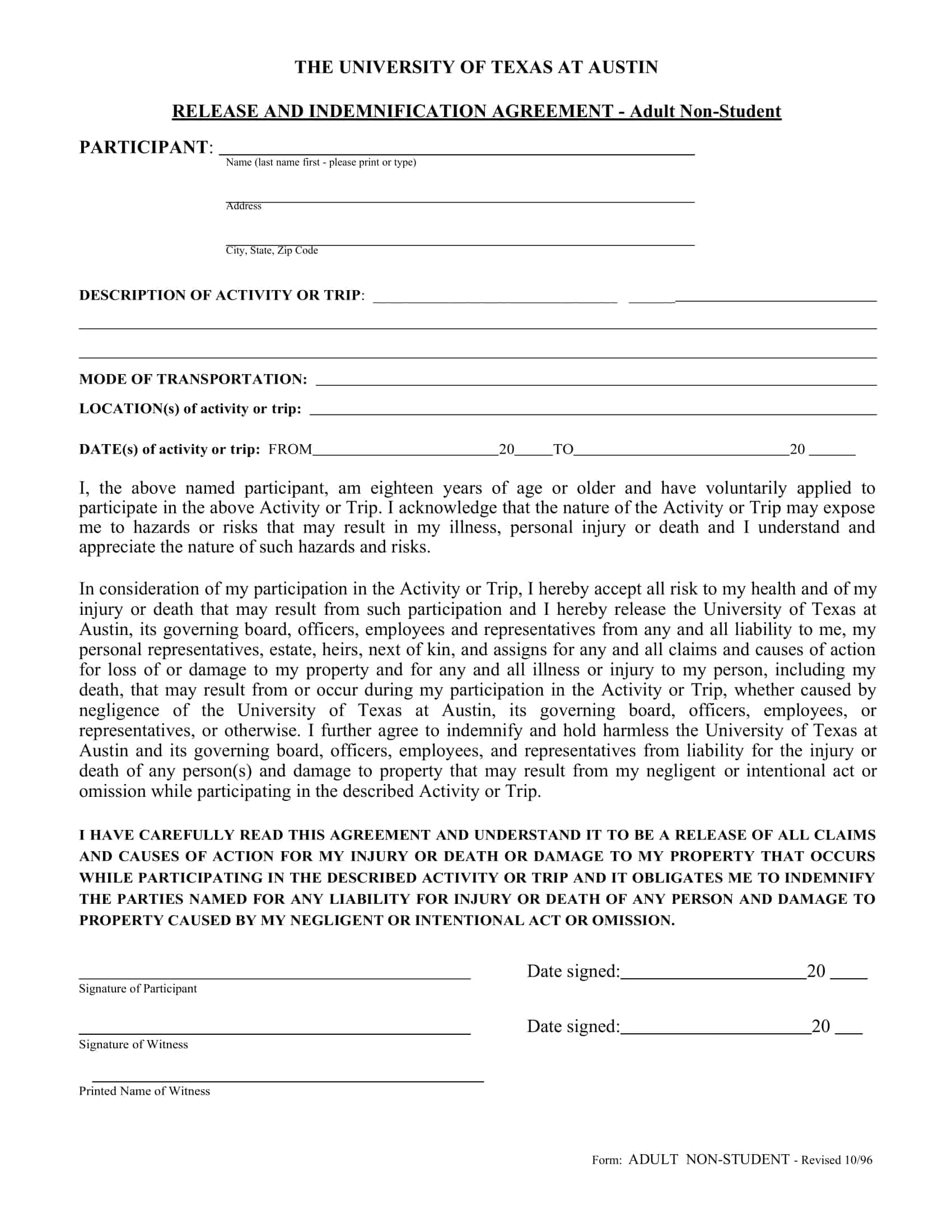

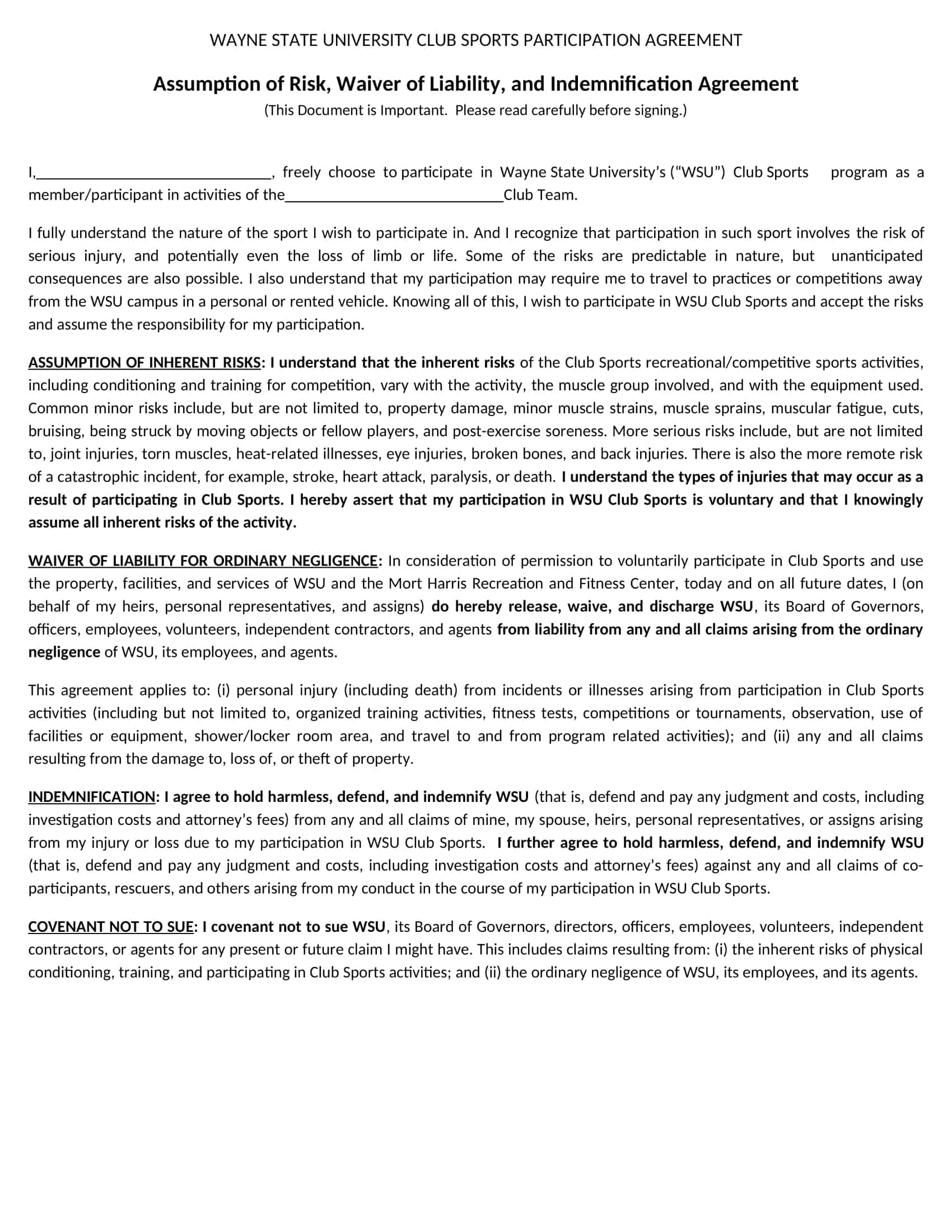

Indemnification Agreement Templates

Protect your interests and establish clear contractual obligations with our collection of free printable Indemnity Agreement templates. These templates provide a legally binding agreement between two parties, outlining the terms and conditions of indemnification in various scenarios. Whether you’re entering into a business partnership, engaging in a high-risk activity, or conducting a transaction with potential liabilities, our templates offer a robust framework to allocate risks and responsibilities.

Customize the templates to reflect the specific indemnity provisions, insurance requirements, and dispute resolution mechanisms relevant to your agreement. By clearly defining the scope of indemnification, our templates help mitigate financial and legal risks, ensuring a solid foundation for your business or personal endeavors. Download now and safeguard your interests with our comprehensive and customizable Indemnity Agreement templates.

What is indemnity?

Indemnity is a monetary or value or deed paid by the responsible person to the injured party that is used to compensate for material or moral damages caused as a result of an unlawful act. The court may decide to pay moral indemnity to compensate for the injuries suffered by personal rights, material indemnity to compensate for the loss of property due to the unlawful act, or to pay punitive damages in order to pay for all the damage thought to have been caused because of an illegal act. Indemnity can also be defined as the price paid by one party in order to protect themselves from losing their possessions if they are sued by another party.

What Is an Indemnity Agreement?

An indemnity agreement is a contract between two parties that states that one of the parties will be held harmless, with no liability for damages or losses due to activities as a party to the agreement. The indemnity agreement is intended to protect the party that might be held liable by holding the person harmless from that liability. The language contained in an indemnity agreement may have some limitations.

What is the purpose of the contract of indemnity? (Indemnification Agreement)

An indemnity is a contract where the indemnifier steps up to take responsibility for the losses and injuries listed in the agreement. Indemnity agreements define the scope of liability, but the terms of an indemnification agreement can be reasonably complicated.

Multiple parties will be involved in some scenarios, so you may need counsel from a business attorney to help create an effective indemnity agreement. The language used in this document clearly defines the extent of a party’s liability, as well as the ways in which they can reduce their monetary responsibility.

What is included in an indemnity agreement?

An indemnity agreement is an general form of agreement in which one party is obligated to protect or save another from financial hardship due to a loss.

The “indemnified” party is the party protected; the “indemnifier” is the party that must save the other from financial hardship when a disaster strikes.

An indemnity agreement can be used to protect the interests of both parties. Although it is not legally required for a party to sign an indemnification agreement, it may explain the consideration (usually a sum of money) that will be used to secure the agreement.

A complete indemnity agreement should state the specific terms under which the indemnitee will be held harmless. The indemnitee must approve any settlement deal before they enter into the contract with the other party.

A standard indemnification agreement exists in many business transactions, although it may not always be clearly defined. Like all other contracts and legal documents, Indemnification agreements are generally comprised of several elements.

The person seeking indemnification should review and understand what is included in this agreement.

What is the difference between a hold harmless agreement and an indemnity agreement?

It is important to note that this legal document is often confused with a similar one – a Hold Harmless Agreement. Though these two documents have a lot in common in terms of purpose and meaning, they are different in a few ways.

While both forms protect the parties from certain liabilities, only indemnification provides broader coverage. This form also covers losses that are not connected to a breach of an agreement or duties. A Hold Harmless Agreement does not provide such comprehensive coverage.

Conclusion

Indemnity agreements can be found in many forms, from a few lines in small business contracts to long paragraphs of detailed legalese that parties agree upon during big deals or before big projects. An indemnity agreement is a common legal practice that is highly used at the time of purchase of insurance policies which provides that if any kind of loss comes out of any accident and it is not directly insured by the policyholder, then the company will accept liability for the same and pay accordingly.

The insurance company, too, has an indemnity agreement with its directors and shareholders so that they agree to take full responsibility after conducting due diligence on their statements.

FAQs

How do I write an indemnity agreement?

Start an indemnity agreement by identifying the parties involved. Specify the circumstances under which indemnification will be triggered. Define the types of damages covered – losses, claims, liabilities, costs. Clarify that the indemnifying party is solely responsible and will defend, reimburse and hold harmless the indemnified party. State the duration and any limits on liability. Include governing jurisdiction.

What is an example of an indemnification agreement?

A common example is a landlord requiring a tenant to sign an agreement indemnifying the landlord from any injuries or property damage that occur within the rental unit. The tenant agrees to pay for all losses the landlord suffers as a result. The tenant is the indemnifying party.

What is the reasonable indemnification clause?

A reasonable indemnity clause limits the liabilities covered to those directly caused by the indemnifying party and caps the amount to a reasonable approximation of foreseeable damages. Overly broad clauses can be deemed unenforceable.

What are the three types of indemnification?

The three main types are:

- Limited indemnity – caps liability up to a fixed amount.

- Unlimited or full indemnity – covers all costs regardless of amount.

- Comparative indemnity – allocates liability based on proportional responsibility.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 2 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)

![Free Printable Separation Agreement Templates [PDF, Word] 3 Separation Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Separation-Agreement-1-150x150.jpg)