Shifting through the dense fog of numbers and financial transactions, there exists an essential pillar of the business world: bookkeeping. A behind-the-scenes maestro, it orchestrates a harmonious symphony of economic activity, unassuming yet indispensable in its influence.

This invisible conductor guides the fiscal pulse of organizations, resonating throughout every venture’s journey. With its inextricable ties to the business heartbeat, bookkeeping’s allure lies in its capacity to illuminate financial paths and inspire strategic decision-making.

Table of Contents

What is Bookkeeping?

Bookkeeping is a systematic process of recording and organizing a company’s financial transactions. It serves as a fundamental aspect of financial management, ensuring accurate and up-to-date tracking of income, expenses, debts, and more.

Through this meticulous documentation of every monetary interaction, businesses gain a clear and comprehensive view of their financial health. These records, maintained according to accepted accounting principles, provide essential data that informs financial reporting, analysis, and decision-making, playing a crucial role in operational success and strategic planning.

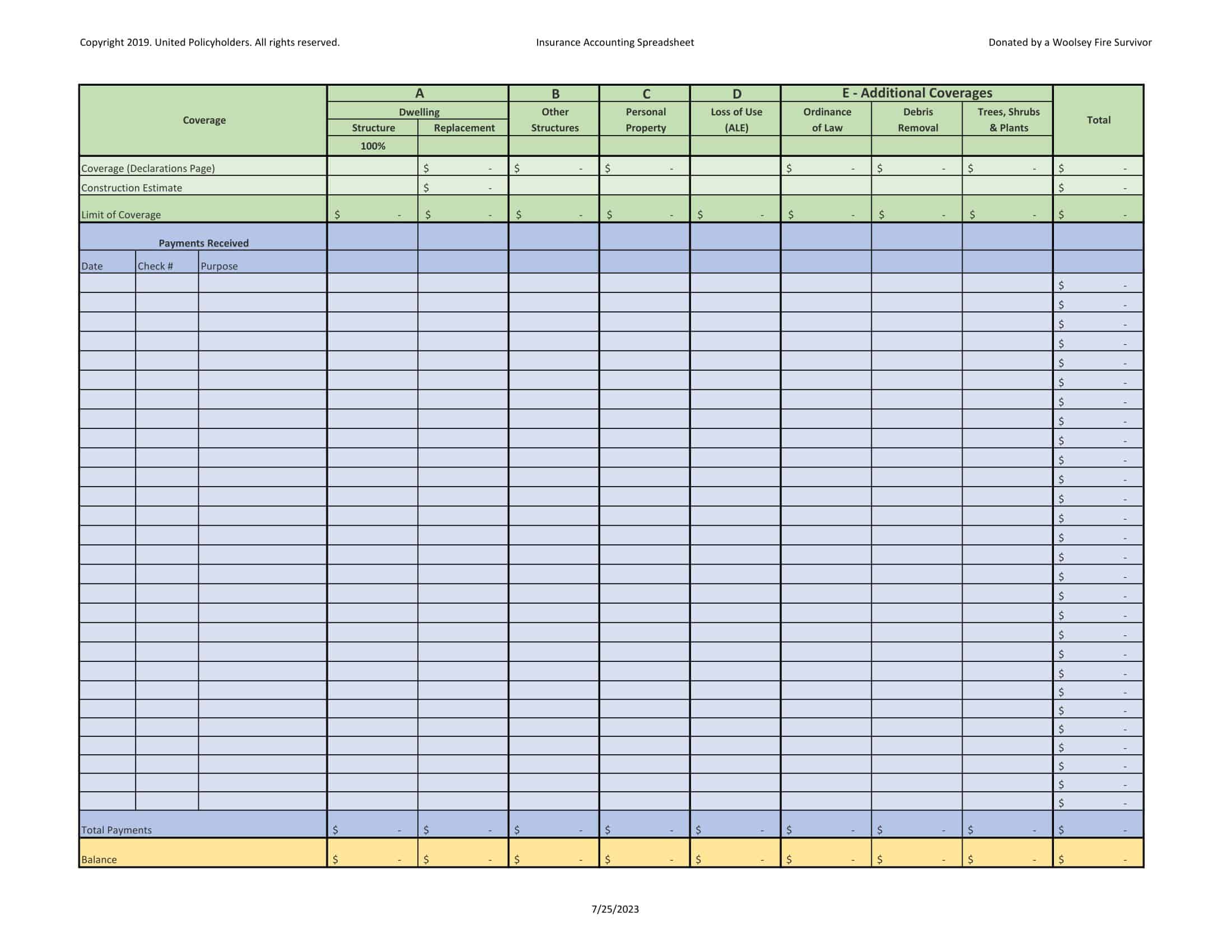

Bookkeeping Templates

Bookkeeping templates are valuable tools designed to aid the process of recording, organizing, and managing financial transactions. They offer a systematic way for businesses and individuals to keep track of income, expenses, and overall financial performance.

Often designed as Excel spreadsheets or Google Sheets, bookkeeping templates can range from basic to complex. Some include simple income and expense logs, while others might have multiple sections for categorizing transactions, managing invoices, tracking inventory, or preparing financial statements.

The usage of bookkeeping templates is widespread across various business types and sizes. For small businesses or startups, these templates can simplify financial management, reducing the need for comprehensive accounting software. Larger corporations might use more complex templates to supplement their primary accounting systems or for specific tasks.

Why is it important?

Bookkeeping holds a position of paramount importance in the landscape of business operations due to several reasons, all centered around maintaining accuracy, ensuring legal compliance, facilitating decision-making, and securing financial stability.

- Accuracy and Transparency: Bookkeeping ensures the accurate recording of all financial transactions. These transactions, when tracked with precision, provide a transparent picture of a business’s economic activity. It keeps the organization updated on expenses, income, and investments, making sure that there’s a clear, reliable, and real-time record of every dollar that goes in and out.

- Legal Compliance: Accurate bookkeeping ensures that businesses comply with legal obligations. For instance, tax calculations are based on financial data that stems from effective bookkeeping. If bookkeeping is inaccurate or missing, companies can face penalties or legal action from regulatory bodies. Properly kept books also make it easier to audit, as all necessary financial information is organized and easily accessible.

- Informed Decision-making: The records maintained through bookkeeping act as a source of critical information for strategic business decisions. These financial insights can drive budgeting, planning, and forecasting processes, helping businesses identify growth opportunities, trim unnecessary costs, and manage cash flows effectively.

- Financial Health Assessment: Bookkeeping provides a real-time evaluation of a company’s financial health. It helps in tracking financial performance over time, highlighting trends in revenue and expense. This analysis can uncover potential financial issues, allowing businesses to address them proactively and ensure financial sustainability.

- Investor and Lender Relations: For businesses seeking external funding, accurate and up-to-date books are vital. Investors and lenders need to review a company’s financial data to assess its performance, profitability, and overall financial stability before making a commitment. Bookkeeping provides this essential information, promoting trust and credibility.

- Efficiency: A well-structured bookkeeping system improves operational efficiency by simplifying the tracking of receivables and payables, managing inventory, and keeping a close eye on debts and credits. It reduces the time and effort spent on financial management, freeing resources for other vital business operations.

Types of bookkeeping

Navigating the intricate world of business finance, one encounters two primary systems of bookkeeping: single-entry and double-entry. These distinct approaches, each with its own merits and complexities, stand as the lifeblood of financial record keeping. Serving as the gateway to understanding a company’s fiscal health, the chosen method can dramatically shape the company’s financial management and decision-making processes. Here, we delve into the subtleties of both systems, aiming to elucidate their nuances, operational mechanisms, and suitable applications, providing a comprehensive understanding of these two key pillars of financial record keeping.

1. Single-Entry Bookkeeping:

Single-entry bookkeeping, akin to maintaining a check register, is a simple, straightforward method of bookkeeping that suits smaller businesses with limited transactions. This system records only one entry for each transaction and typically includes a daily summary of cash inflows and outflows, alongside periodic summaries of cash receipts and expenditures.

In the single-entry method, each transaction affects only one account—either an income or expense account. For example, if a company receives cash from a customer, it would record one single entry showing an increase in its cash account. Similarly, if a business incurs an expense, it records a decrease in its cash account.

While the single-entry system is easier to understand and implement, it lacks the robustness and detail of other methods. It doesn’t provide a comprehensive view of the company’s financial situation, failing to record assets, liabilities, or equity accounts. It also makes it more challenging to detect errors or fraud due to the absence of a self-balancing structure.

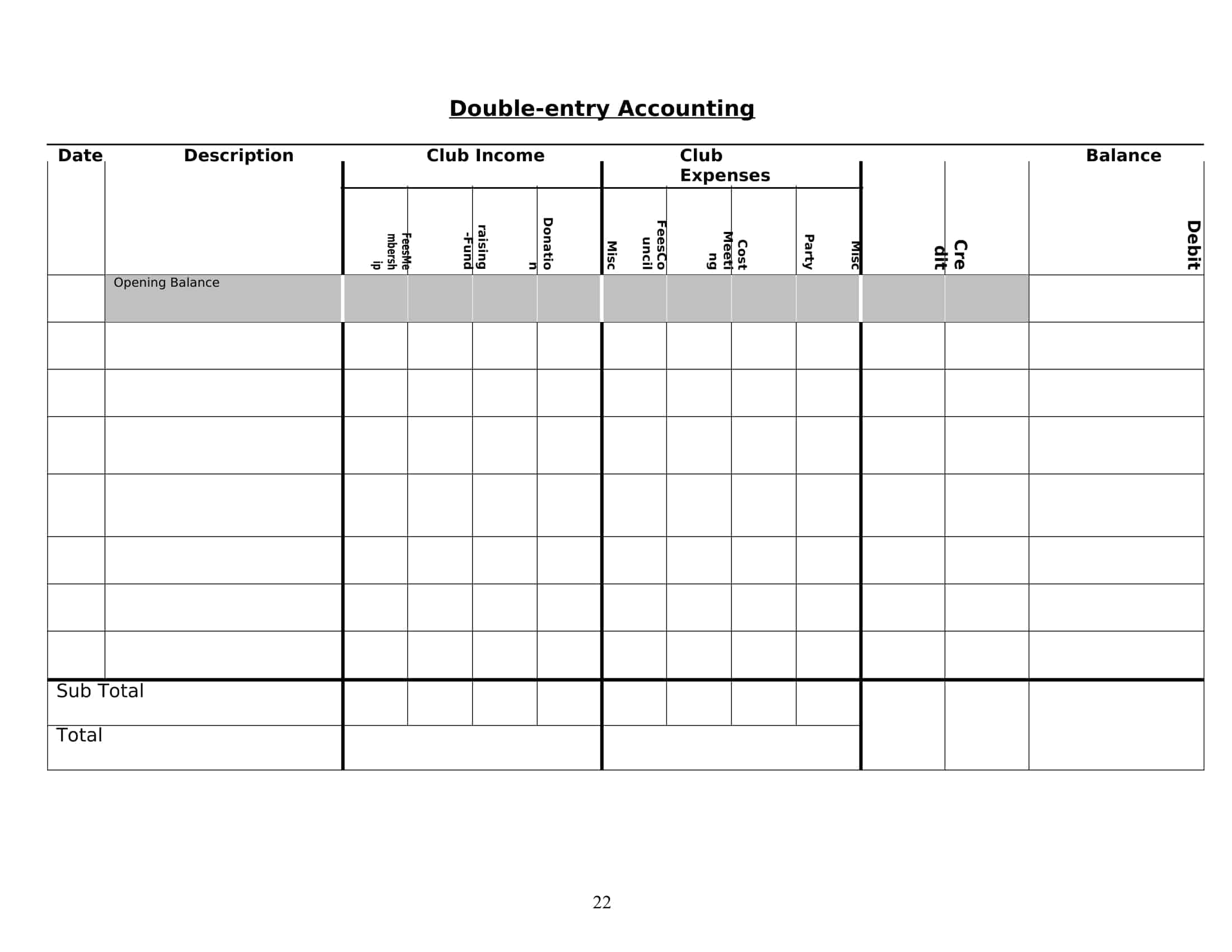

2. Double-Entry Bookkeeping:

Contrasting with the simplicity of single-entry, double-entry bookkeeping is a more comprehensive, detailed, and widely used system. It demands recording two entries for every transaction—a debit in one account and a corresponding credit in another.

This approach ensures the accounting equation (Assets = Liabilities + Equity) always remains balanced, making it easier to detect errors. Each transaction affects two accounts; for instance, if a company purchases inventory on credit, it would debit (increase) its Inventory account and credit (increase) its Accounts Payable account.

The double-entry system offers a more complete picture of a company’s financial health. By recording assets, liabilities, income, expenses, and equity, it allows for detailed financial statements like the balance sheet, income statement, and cash flow statement. This method supports efficient financial analysis, internal audits, and decision-making processes.

However, the double-entry method is more complex and requires a higher level of understanding of accounting concepts. It also demands more time and resources, making it more suitable for medium to large businesses with a higher volume of transactions.

In summary, both systems have their pros and cons, and the selection between single-entry and double-entry bookkeeping depends largely on the complexity and scale of the business operations.

Tasks and examples of the Bookkeeping system

Bookkeeping is a multifaceted process involving a series of tasks crucial for maintaining accurate financial records. These tasks may vary slightly based on the size and type of business, but most bookkeeping systems encompass the following core responsibilities:

Recording Transactions

At the heart of bookkeeping lies the task of recording all business transactions. This includes every financial interaction such as sales, purchases, payments, receipts, and other revenue or expense-related transactions. For example, every time a product is sold, a bookkeeper would record this transaction, indicating the amount received and the account affected, in the company’s ledger.

Posting Debits and Credits

In a double-entry bookkeeping system, bookkeepers post transactions as debits and credits across two separate accounts. For instance, if a business purchases office supplies for $200 on credit, the bookkeeper would debit the Office Supplies account and credit the Accounts Payable account, indicating that the company now owes $200.

Producing Invoices

Bookkeepers generate invoices for sales or services provided. This might involve creating an invoice for a completed project detailing the work done and the amount owed. These invoices are then sent to customers or clients, and their payment status is tracked.

Managing Payroll

Ensuring employees are paid accurately and on time is another essential function of bookkeeping. This includes calculating hourly wages or salaries, withholding taxes, and processing payments. For example, if a company employs ten workers, the bookkeeper would track their hours, compute their wages, and manage their payroll distribution.

Reconciling Bank Statements

Reconciliation is the process of matching the company’s financial records with bank statements to ensure accuracy. This can include verifying that all checks have cleared, all deposits have been recorded, and no fraudulent transactions have occurred.

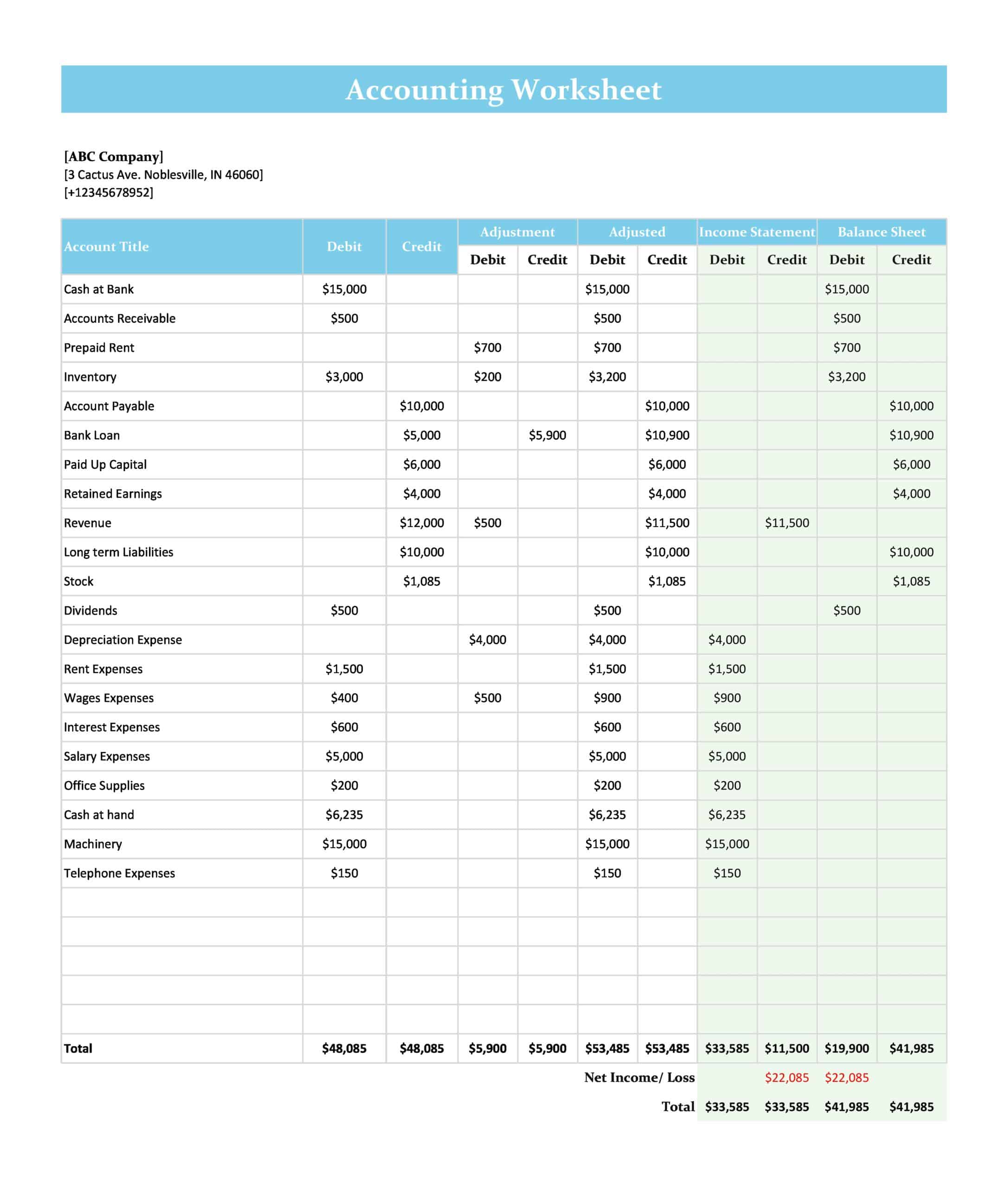

Preparing Financial Statements

Bookkeepers often prepare basic financial statements, such as profit and loss statements, balance sheets, and cash flow statements. These documents provide valuable snapshots of a business’s financial health and are instrumental in making informed decisions.

Maintaining and Balancing Subsidiary Accounts

Bookkeepers often handle various subsidiary accounts like Accounts Payable, Accounts Receivable, or Inventory accounts. They ensure these accounts are balanced and accurately reflect the company’s financial activities. For instance, the bookkeeper would monitor the Accounts Receivable account to track all outstanding invoices and ensure that all payments are received and recorded.

Complying with Legal Requirements

Compliance with legal and tax requirements is an essential aspect of bookkeeping. This can involve preparing accurate tax returns based on the company’s financial records and making sure payments are made on time. For instance, bookkeepers need to calculate and pay various taxes such as sales tax, income tax, and payroll taxes, helping the company avoid any penalties for late or incorrect payments.

Bookkeeping vs. Accounting

Bookkeeping and accounting are two critical functions in managing a company’s financials. While they are interrelated and often assumed to be synonymous, they are distinct in their roles, objectives, and the degree of expertise required. Below are some detailed comparisons to illustrate their differences.

1. Objectives:

- Bookkeeping: The main objective of bookkeeping is to accurately record all financial transactions in a systematic, timely, and consistent manner. It ensures that all sales, purchases, payments, and receipts are tracked and documented.

- Accounting: Accounting goes beyond merely recording transactions. It involves interpreting, classifying, analyzing, reporting, and summarizing financial data. Accounting aims to present a clear financial image of the company to aid stakeholders in making informed decisions.

2. Role and Tasks:

- Bookkeeping: Key tasks of bookkeeping include recording financial transactions, maintaining and balancing ledgers, managing accounts payable and receivable, and reconciling bank statements. It essentially deals with the day-to-day financial tasks and maintains the groundwork for the accountants.

- Accounting: Accounting encompasses a broader range of responsibilities. It involves preparing adjusting entries (records of expenses that have occurred but aren’t yet recorded in the bookkeeping process), preparing financial statements, performing audits, completing income tax returns, and setting up financial management procedures.

3. Skills and Expertise:

- Bookkeeping: Bookkeeping requires basic knowledge of financial tasks, with an emphasis on detail-oriented work and good organizational skills. A bookkeeper may not necessarily need a degree but should possess a clear understanding of the transaction process and basic financial tasks.

- Accounting: Accounting requires a higher level of expertise and education. Accountants need to have a comprehensive understanding of the accounting principles and practices. Many accountants hold a bachelor’s degree in accounting or finance and may also have advanced designations such as Certified Public Accountant (CPA).

4. Decision Making:

- Bookkeeping: Bookkeeping does not generally involve decision-making. It’s a transactional and administrative role that deals with the process of logging the company’s financial information.

- Accounting: Accounting plays a significant role in strategic decision-making. Accountants analyze and interpret financial data to provide strategic advice. They can provide insights on cost efficiency, budget management, and investment strategies.

5. Financial Statements:

- Bookkeeping: While bookkeepers maintain the records necessary for producing financial statements, they usually do not create these statements themselves.

- Accounting: Accountants use the data provided by bookkeepers to prepare financial statements, including the income statement, balance sheet, and cash flow statement.

Components of Bookkeeping

Bookkeeping, a vital aspect of every business’s financial management, consists of several key components, each critical to maintaining accurate, up-to-date, and comprehensive financial records:

1. Transaction Recording: This involves documenting every financial transaction made by the business, such as sales, purchases, revenue, expenses, etc. All transactions should be recorded promptly to maintain the accuracy of financial records.

2. Ledger Maintenance: The general ledger is a cornerstone of the bookkeeping system. It’s a complete record of all financial transactions over the life of the company. It includes assets, liabilities, equity, revenue, and expenses. Maintaining this ledger involves recording every financial transaction in the appropriate account and ensuring the accuracy of these records.

3. Accounts Payable and Receivable: Managing accounts payable (the money a business owes to suppliers) and accounts receivable (the money a business is owed by customers) is an important component. Timely payment to suppliers, chasing up outstanding customer payments, and reconciling discrepancies are all part of this process.

4. Payroll Management: Bookkeeping also involves managing payroll, ensuring that employees are paid accurately and on time. It includes tracking employee hours, calculating wages, withholding taxes, and processing payments.

5. Bank Reconciliation: Regularly reconciling the company’s books with its bank statements is crucial to identify and rectify any discrepancies, helping to maintain accurate financial records.

6. Financial Reporting: Although usually more associated with accounting, basic financial reporting can also be a component of bookkeeping. This might involve preparing initial drafts of financial statements like income statements or balance sheets based on the financial data recorded.

7. Document Management: Maintaining and organizing financial documentation such as invoices, receipts, and tax forms is a vital part of the bookkeeping process. Proper document management supports audit trails and helps ensure compliance with legal and tax requirements.

8. Tax Preparation: Although detailed tax planning and filing are typically handled by an accountant, a bookkeeper often assists with preparing and organizing the necessary data. They ensure that all the relevant financial information is available and accurate for tax filing purposes.

How to become a bookkeeper

Becoming a bookkeeper involves a series of steps, from acquiring the right education to gaining experience and certification. Here is a step-by-step guide to help you navigate this career path:

Step 1: Obtain a High School Diploma

Your first step towards a career in bookkeeping is earning a high school diploma or equivalent. Courses like mathematics, economics, and business can give you a foundational understanding of the skills required for bookkeeping.

Step 2: Earn an Associate’s Degree or Related Certification

Although some bookkeepers are hired with just a high school diploma, many employers prefer bookkeepers with a postsecondary education. An associate’s degree in accounting or business can be beneficial. Alternatively, you can earn a bookkeeping certificate from a local community college. These programs typically cover subjects like accounting principles, spreadsheets, payroll, and tax preparation.

Step 3: Gain Practical Experience

Work experience is crucial in the bookkeeping field. You can start as an entry-level bookkeeping clerk or an accounting assistant and learn the practical aspects of the job. This experience can include managing accounts, entering financial data, and assisting with tax preparation. It can also expose you to different bookkeeping software, which is vital in modern bookkeeping roles.

Step 4: Learn Bookkeeping Software

Proficiency in bookkeeping software is a must in today’s digital world. Familiarize yourself with popular software like QuickBooks, Xero, or Sage. Many of these software providers offer their own certification programs, which can boost your credentials.

Step 5: Obtain Certification

While not mandatory, professional certification can enhance your credibility and job prospects. The American Institute of Professional Bookkeepers (AIPB) and the National Association of Certified Public Bookkeepers (NACPB) both offer certification exams to bookkeepers who can show proof of work experience and pass a comprehensive exam.

Step 6: Continue Professional Development

Bookkeeping, like any other profession, demands continuous learning. Stay updated with the latest industry trends, software updates, and regulatory changes. Regularly attending workshops, webinars, or courses can help you keep your skills sharp.

Step 7: Consider Specialization

Depending on your career goals, you may want to specialize in a certain area of bookkeeping, such as payroll services or tax preparation. Specialized knowledge can open up new opportunities and increase your earning potential.

Step 8: Gain Membership in Professional Organizations

Joining professional organizations like AIPB or NACPB can provide networking opportunities, access to continuing education programs, and other professional resources. These memberships can aid in your professional growth and expand your career prospects.

How to Create a Bookkeeping Spreadsheet in Excel

Creating a bookkeeping spreadsheet in Excel can help you manage your finances efficiently. Below is a step-by-step guide to creating a simple bookkeeping spreadsheet:

Step 1: Open a New Workbook

Open Excel and create a new workbook. You can either start with a blank workbook or use one of the built-in templates.

Step 2: Define Your Headers

At the top of your spreadsheet, define your headers. For a basic bookkeeping spreadsheet, you might use headers such as “Date”, “Description”, “Income”, “Expense”, and “Balance”. Enter each of these in a separate cell in the first row of your spreadsheet.

Step 3: Format Your Columns

Format your columns to accommodate the type of data you’ll be entering. For instance, you’ll want to format the “Date” column to display dates, the “Income” and “Expense” columns to display currency, and the “Description” column to display text.

Step 4: Input Your Data

Start entering your data under each column. For each transaction, input the date, a brief description, and the amount. If it’s income, enter it in the “Income” column. If it’s an expense, enter it in the “Expense” column.

Step 5: Calculate the Balance

In the “Balance” column, you’ll want to create a formula that calculates your running balance. Click on the first cell under the “Balance” column (it should be the second row, as the first row contains headers). Assuming your “Income” is in column C and “Expense” is in column D, enter the following formula:

- =SUM(C2)-SUM(D2)

Hit ‘Enter’ after you’ve typed the formula. This will calculate your balance for the first transaction.

Step 6: Drag the Formula

Click on the cell with the formula you just entered. Move your cursor to the bottom right corner of the cell until you see a small square (this is called the “fill handle”). Click and drag this square down the column to apply the formula to all cells. This will automatically calculate the balance after each transaction when you enter new data.

Step 7: Save Your Spreadsheet

Go to ‘File’ > ‘Save As’ and choose a location on your computer to save your spreadsheet. Enter a name for your file and click ‘Save’.

This spreadsheet is now ready for you to keep track of your income, expenses, and balance. As you continue to enter new transactions, the spreadsheet will automatically update your balance.

FAQs

How long should I retain my financial records?

The retention period for financial records depends on legal requirements and industry standards. As a general guideline, it is recommended to retain financial records for a minimum of 5 to 7 years. This includes invoices, receipts, bank statements, tax returns, contracts, and other supporting documents. However, specific regulations may vary by country and industry, so it’s important to consult with a legal or accounting professional to ensure compliance.

What is a chart of accounts?

A chart of accounts is a systematic listing of all the accounts used in a business’s accounting system. It provides a structured framework for organizing financial transactions and helps categorize and classify them appropriately. The chart of accounts typically includes various categories, such as assets, liabilities, equity, revenues, and expenses, with specific accounts under each category. It ensures consistency and uniformity in recording financial data and enables easy reference and analysis of financial information.

What are some common bookkeeping methods for tracking expenses?

Common bookkeeping methods for tracking expenses include:

- Receipts and Invoices: Keeping a record of all receipts and invoices related to business expenses, categorizing them by type (e.g., office supplies, utilities, rent).

- Expense Tracking Software: Utilizing specialized software or apps that allow you to enter and categorize expenses digitally, automatically calculating totals and generating reports.

- Bank and Credit Card Statements: Reviewing bank and credit card statements regularly to identify and categorize business-related expenses.

- Petty Cash System: If your business uses petty cash, maintaining a log of all cash transactions and keeping receipts for reimbursements.

- Online Payment Platforms: If you frequently make online payments, utilizing platforms that provide transaction history and categorization features for easier expense tracking.

Should I hire a professional bookkeeper?

Hiring a professional bookkeeper can be beneficial for many businesses, especially those with complex financial transactions or limited accounting knowledge. A professional bookkeeper can help ensure accurate and timely record-keeping, compliance with tax regulations, and provide valuable financial insights.

It allows business owners to focus on their core activities and reduces the risk of errors or omissions in the books. However, the decision to hire a bookkeeper depends on the size and needs of your business, as well as your budget. Small businesses or startups with straightforward financial transactions may be able to handle bookkeeping tasks internally or with the assistance of accounting software.

What is accrual basis and cash basis accounting?

Accrual basis and cash basis accounting are two methods used to recognize and record revenues and expenses:

- Accrual Basis Accounting: Under this method, revenues and expenses are recognized when they are earned or incurred, regardless of when the money is actually received or paid. It matches income and expenses to the accounting period in which they are associated, providing a more accurate picture of a business’s financial performance.

- Cash Basis Accounting: This method recognizes revenues and expenses only when cash is received or paid. It does not consider accounts receivable or accounts payable. Cash basis accounting is simpler and more straightforward but may not provide an accurate representation of a business’s financial position, especially for businesses with credit transactions or long-term contracts.\

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)