A bank deposit slip is a document that is used to record deposits made to a bank account. It is typically used when depositing cash or checks into a checking or savings account, and includes important information such as the account number, deposit amount, and the name of the account holder.

It is a crucial tool for keeping track of financial transactions and ensuring that deposits are credited to the correct account. In this article, we will discuss the various types of deposit slips, how to properly fill one out, and the benefits of using them for your banking needs.

Table of Contents

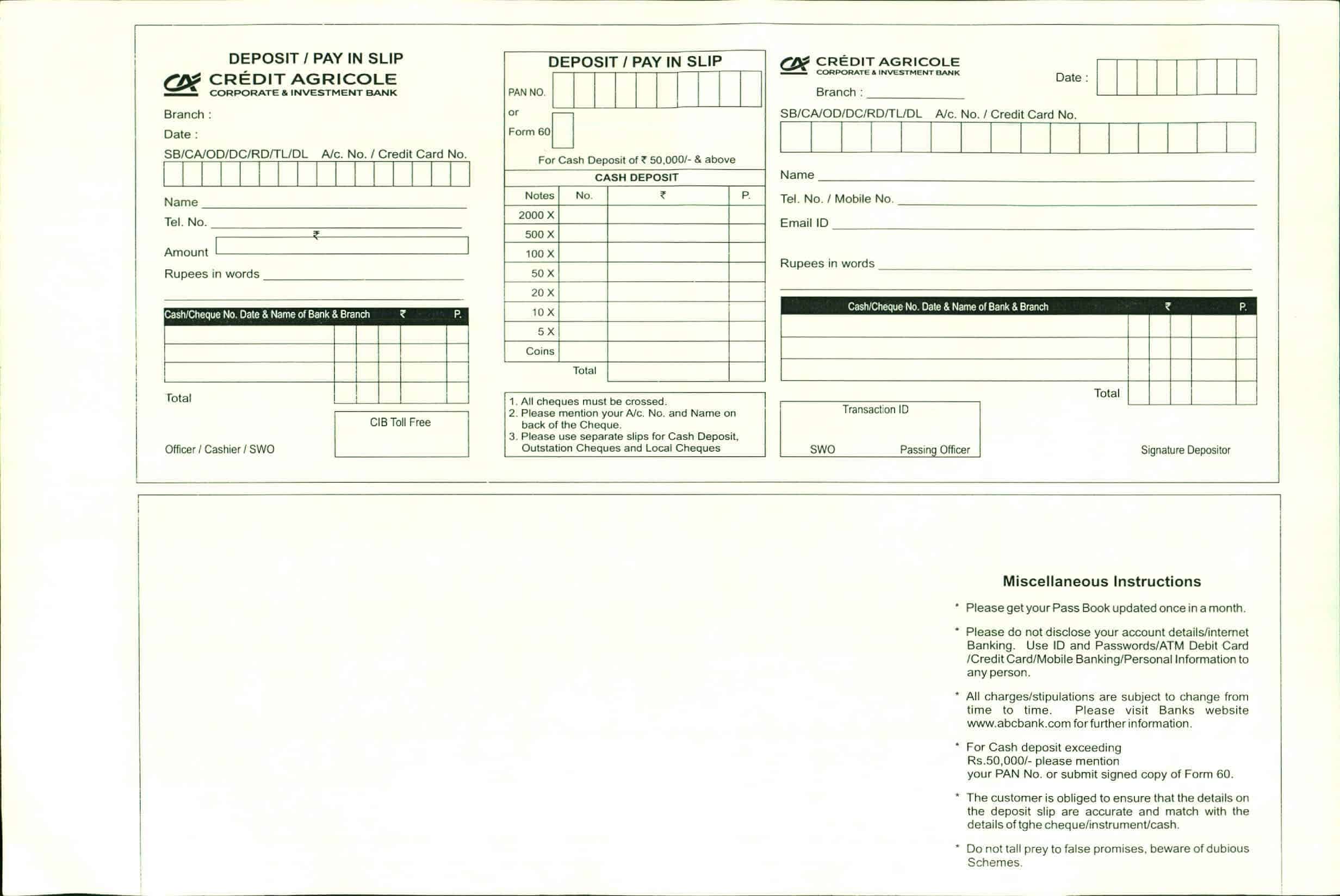

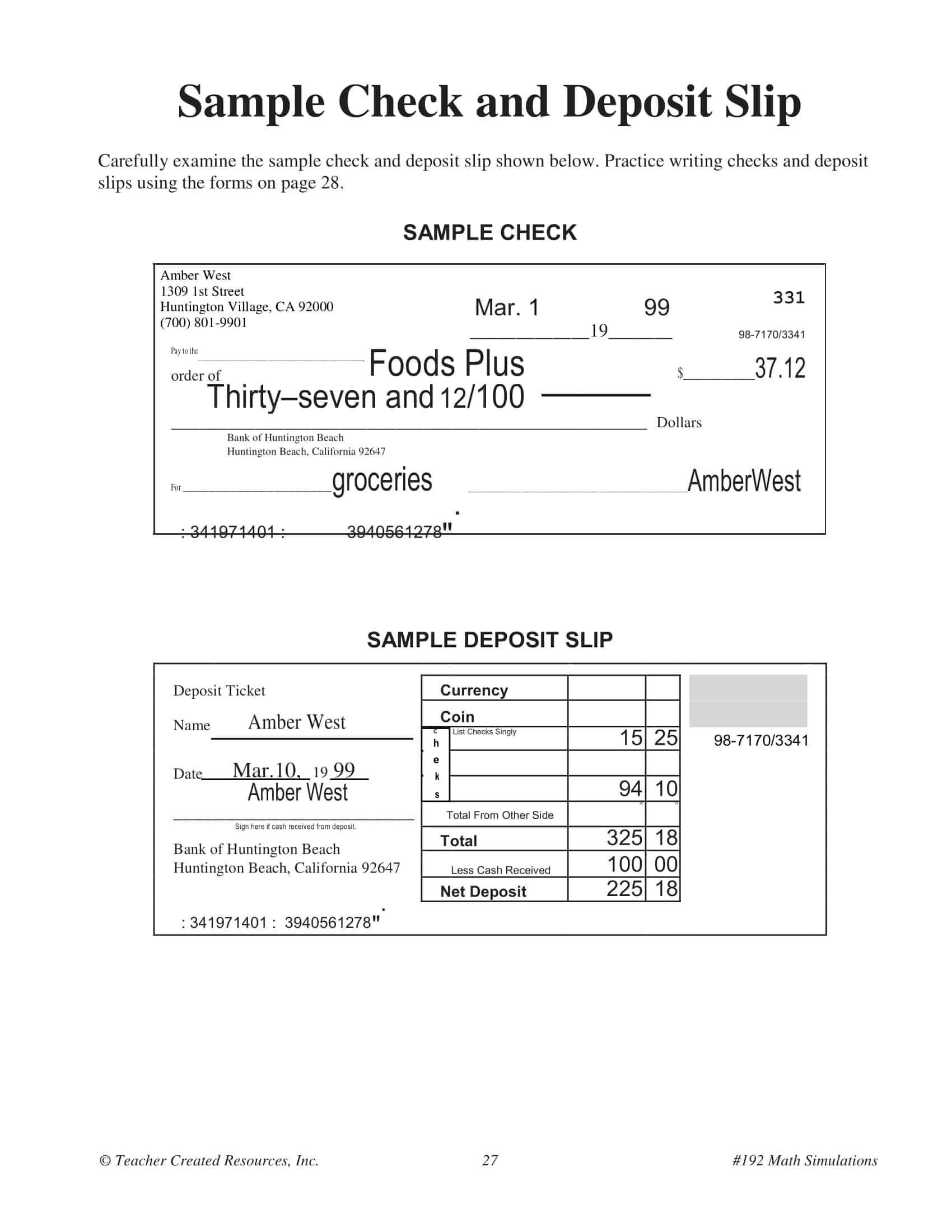

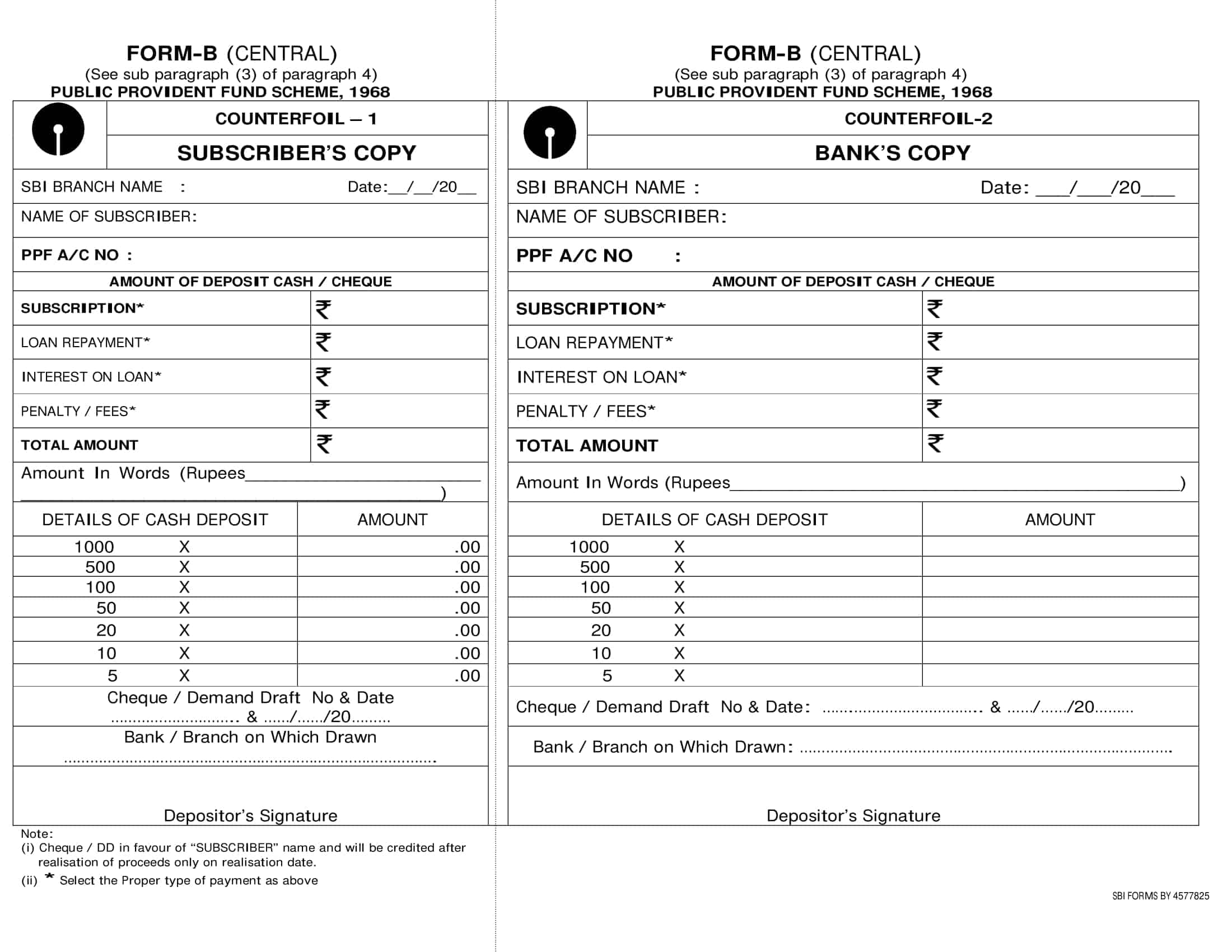

Bank Deposit Slip Templates

Deposit Slip Templates are pre-designed forms used by banks and other financial institutions for depositing money into a bank account. These templates include fields for the account holder’s name and account number, the date of the deposit, the amount of the deposit, and any other relevant information required by the bank. With these templates, individuals can easily create deposit slips for their transactions, making the deposit process more efficient and organized. They are available in various formats and are free and printable.

Key Elements of a deposit slip:

A bank deposit slip is a document that is used to record deposits made to a bank account. It is typically used when depositing cash or checks into a checking or savings account, and includes important information such as the account number, deposit amount, and the name of the account holder. In this article, we will discuss the various elements of a deposit slip and how to properly fill one out.

Account Number

The account number is a unique identifier that is assigned to each bank account. It is typically located at the top of the deposit slip and is used to ensure that the deposit is credited to the correct account.

Account Holder’s Name

The account holder’s name is the name of the person who owns the account. This is important as it helps to ensure that the deposit is credited to the correct account. The name of the account holder is typically located next to the account number.

Deposit Amount

The deposit amount is the total amount of cash or checks that is being deposited into the account. It should be written in numerical form in the appropriate space on the deposit slip.

Check Numbers

If depositing checks, the check numbers should be written on the deposit slip. This is important for keeping track of the checks and ensuring that they are credited to the correct account.

Date

The date of the deposit should be written on the deposit slip. This is important for keeping track of when the deposit was made and for reconciling the account.

Signature

A signature is required on the deposit slip as a way of verifying that the person making the deposit is authorized to do so. This signature should match the signature on file with the bank.

Deposit Slip Number

Each deposit slip has a unique number that is used to track the deposit and ensure that it is credited to the correct account. This number is typically located at the bottom of the deposit slip.

Memo

The memo section of the deposit slip is optional but it can be used to provide additional information about the deposit. This can include the purpose of the deposit or any special instructions.

When filling out a deposit slip, it is important to make sure that all of the information is accurate and legible. Any mistakes or errors can cause delays in processing the deposit and crediting it to the correct account. Additionally, it is important to keep a copy of the deposit slip for your records.

It is also important to note that some banks may have different format for their deposit slips. Banks may also have different requirements for certain information, so it is a good idea to check with your bank to see if there are any specific instructions or requirements that need to be followed when filling out a deposit slip.

How do you get a copy of deposit slip?

There are a few ways to obtain a copy of a deposit slip, depending on the bank or financial institution where the deposit was made:

Contact the bank or credit union

You can contact the bank or credit union where the deposit was made and request a copy of the deposit slip. They may ask you to provide some identifying information, such as your account number, in order to verify your identity. They may also charge a fee for providing a copy of the deposit slip.

Online banking

Many banks and credit unions offer online banking services, which allow you to view and print copies of deposit slips. You will need to log in to your account and navigate to the appropriate section of the site.

Visit a bank branch

You can also visit a bank branch and request a copy of the deposit slip in person. You may need to provide some identifying information, such as your account number, in order to verify your identity.

Check your records

If you kept a copy of the deposit slip for your own records, you can refer to that copy.

The Advantages of using Deposit Slip

There are several advantages to using deposit slips when making deposits to a bank account, including:

Accurate record keeping: Deposit slips provide a clear and accurate record of financial transactions, which can be helpful for reconciling accounts, budgeting, and tracking spending.

Reduced risk of errors: By filling out a deposit slip correctly, you can reduce the risk of errors and mistakes that could result in delays or inaccuracies in processing the deposit.

Faster processing: Because deposit slips provide all of the necessary information in one place, they can make the deposit process faster and more efficient.

Better control over your finances: Using deposit slips can help you to stay organized and keep track of your finances, giving you a better understanding of your income and expenses.

Compliance with bank regulations: Many banks require customers to use deposit slips as a way of complying with regulations, such as the Bank Secrecy Act (BSA) which is an anti-money laundering (AML) law.

Proof of deposit: Deposit slips serve as proof of deposit for you and for the bank. In case of any disputes or errors, you can refer to the deposit slip as evidence of the deposit.

Simplify the deposit process: Deposit slips simplify the deposit process as you don’t need to fill out multiple forms or provide multiple pieces of information. All the relevant information is provided on the deposit slip and you just need to fill it out correctly.

Easy to track: Deposit slips make it easy to track your deposits. You can simply refer to the deposit slip to see the amount you deposited and the date of deposit.

How to fill-up your deposit slip ?

Filling out a deposit slip correctly is important to ensure that the deposit is credited to the correct account and processed efficiently. The process may vary slightly depending on the bank or financial institution, but generally, the steps to fill out a deposit slip are as follows:

Write your account number: Look for the section labeled “Account Number” on the deposit slip and write your account number in the space provided. Make sure to double check that the account number is correct.

Write your name: Write your name in the space provided on the deposit slip. This will help to ensure that the deposit is credited to the correct account.

Write the deposit amount: Look for the section labeled “Deposit Amount” and write the total amount of cash or checks being deposited in the space provided. Be sure to write the amount in numerical form and double check that the amount is correct.

Write check numbers: If depositing checks, look for the section labeled “Check Numbers” and write the check numbers in the space provided. This is important for keeping track of the checks and ensuring that they are credited to the correct account.

Write the date: Look for the section labeled “Date” and write the date of the deposit in the space provided. This is important for keeping track of when the deposit was made and for reconciling the account.

Sign the deposit slip: Look for the section labeled “Signature” and sign the deposit slip in the space provided. This is a way of verifying that the person making the deposit is authorized to do so.

Fill the memo section: The memo section of the deposit slip is optional but it can be used to provide additional information about the deposit. This can include the purpose of the deposit or any special instructions.

Review the deposit slip: Before submitting the deposit slip, double check all the information for any errors or mistakes. Make sure that all of the information is accurate and legible.

FAQs

Are there any fees associated with using a deposit slip?

Some banks may charge a fee for providing a copy of the deposit slip or for certain types of deposits. It’s a good idea to check with the bank or credit union to see if there are any fees associated with using deposit slips.

Can I use a deposit slip for electronic transfer?

No, deposit slips are typically used for depositing cash or checks into a bank account. For electronic transfers, you would typically use online banking or mobile banking services.

Do I need to use a deposit slip for every deposit I make?

Some banks may require the use of deposit slips for every deposit, while others may only require them for larger deposits or for certain types of transactions. It’s a good idea to check with your bank or credit union to see if they have any specific policies or guidelines regarding the use of deposit slips.

Can I make a deposit at an ATM using a deposit slip?

Some ATMs may allow you to make a deposit using a deposit slip, but it is more common to make deposits at ATMs using an envelope with cash or checks. It’s a good idea to check with your bank or credit union to see if they have any specific policies or guidelines regarding making deposits at ATMs.

Can I deposit cash and checks together on the same deposit slip?

Yes, you can deposit cash and checks together on the same deposit slip. You should write the deposit amount in numerical form and list the check numbers separately on the deposit slip.

Can I deposit foreign currency on a deposit slip?

It depends on the bank or credit union. Some banks may accept foreign currency deposits, while others may not. It’s a good idea to check with your bank or credit union to see if they accept foreign currency deposits and if there are any specific guidelines or requirements that need to be followed.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Morse Code Charts [Numbers, Alphabet] 2 Morse Code Chart](https://www.typecalendar.com/wp-content/uploads/2023/09/Morse-Code-Chart-150x150.jpg)