Handling finances can be a complex task, and when it comes to the transfer of funds, efficiency, and security are paramount. Direct deposit is a modern solution that simplifies this process, allowing employers to send payments directly to an employee’s bank account, thus saving time, minimizing errors, and reducing paper waste.

In this article, we will discuss the Direct Deposit Authorization Form, an integral part of this process. This form authorizes the transfer of funds into a specific account, serving as a legal consent document. We’ll delve into its importance, how it works, and the key elements that should be included in it.

Table of Contents

What is a Direct Deposit Authorization Form?

A Direct Deposit Authorization Form is a document that a recipient, often an employee, uses to grant a payor, typically an employer, permission to electronically transfer funds into a bank account. This form, usually provided by the organization making the deposit, contains pertinent details such as the recipient’s bank name, account type (checking or savings), account number, and bank’s routing number.

It also includes information about the payor and the type and frequency of the payments to be deposited. This document ensures the funds are correctly deposited into the right account, and serves as a written record of the recipient’s consent to the direct deposit arrangement. In most cases, the form needs to be signed and dated by the account holder, further reinforcing its legal standing. Direct deposit eliminates the need for paper checks and manual deposits, thereby offering an efficient and secure mode of transaction for both parties involved.

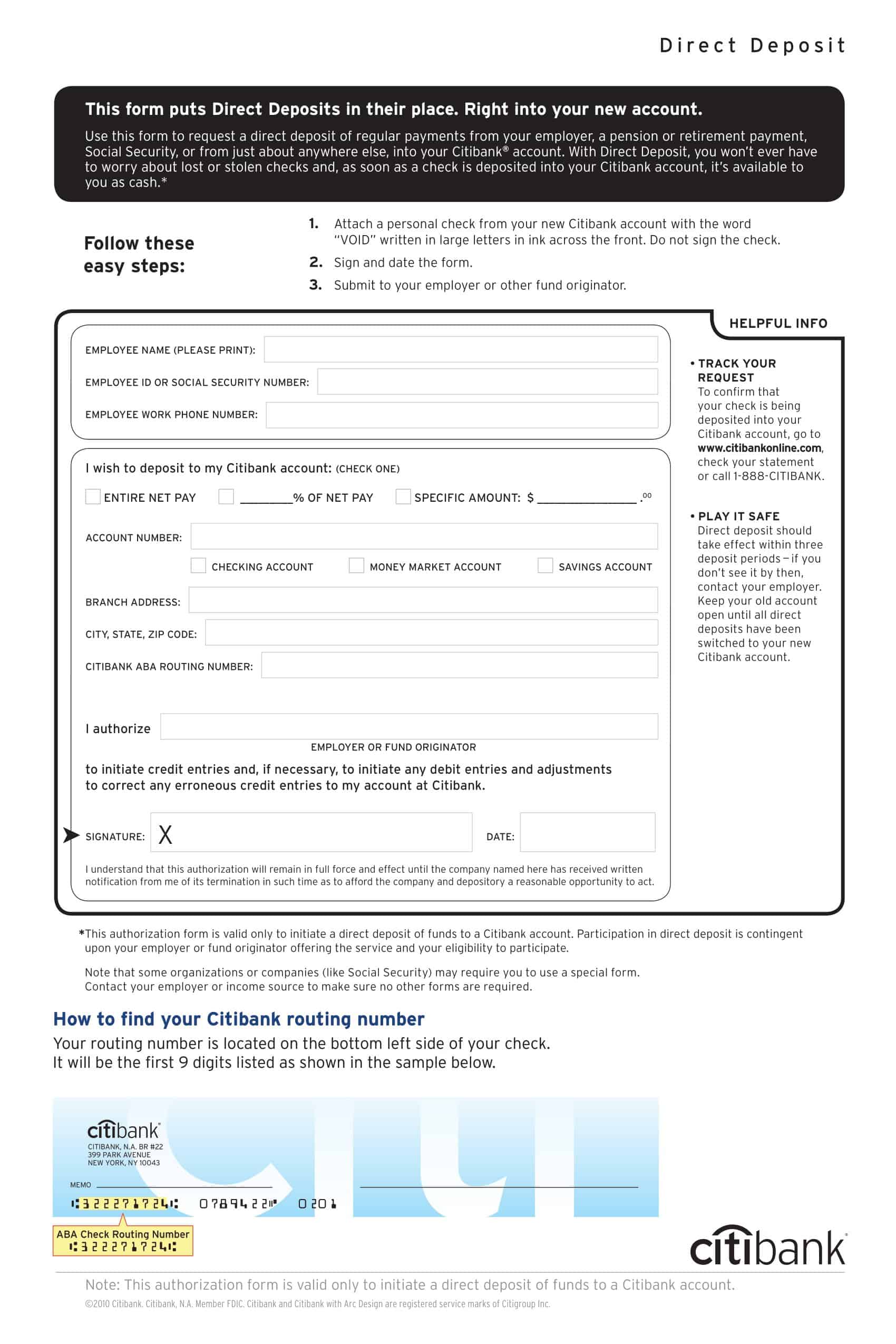

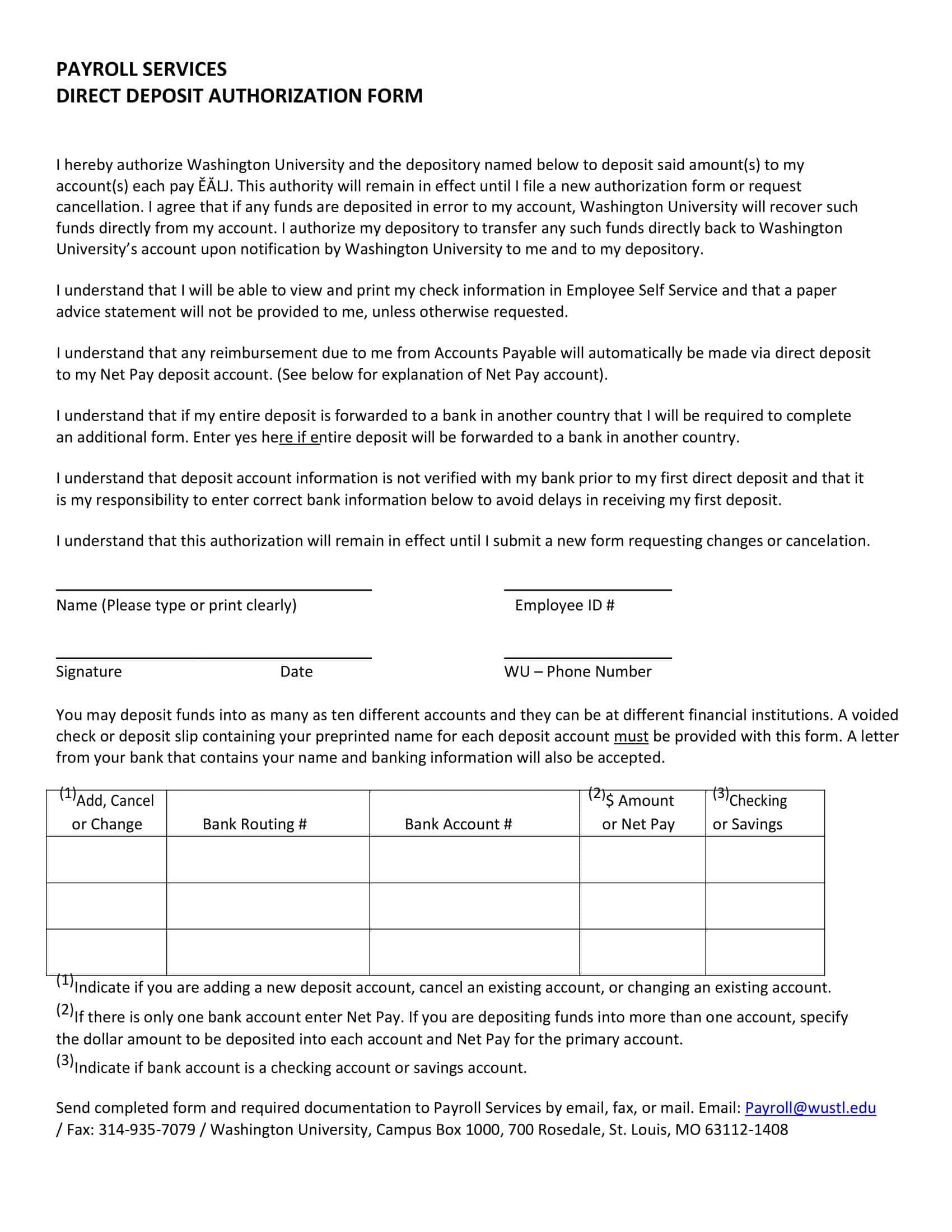

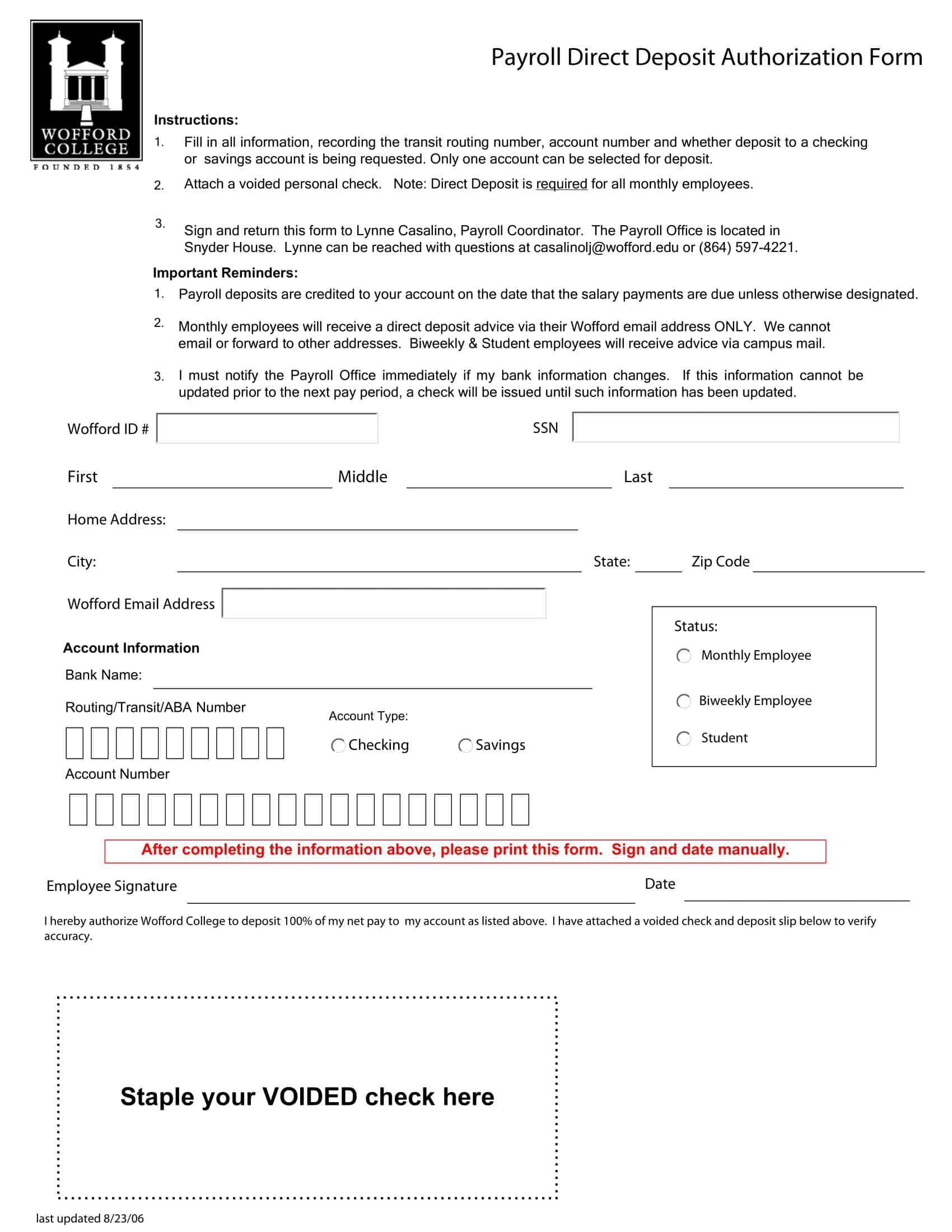

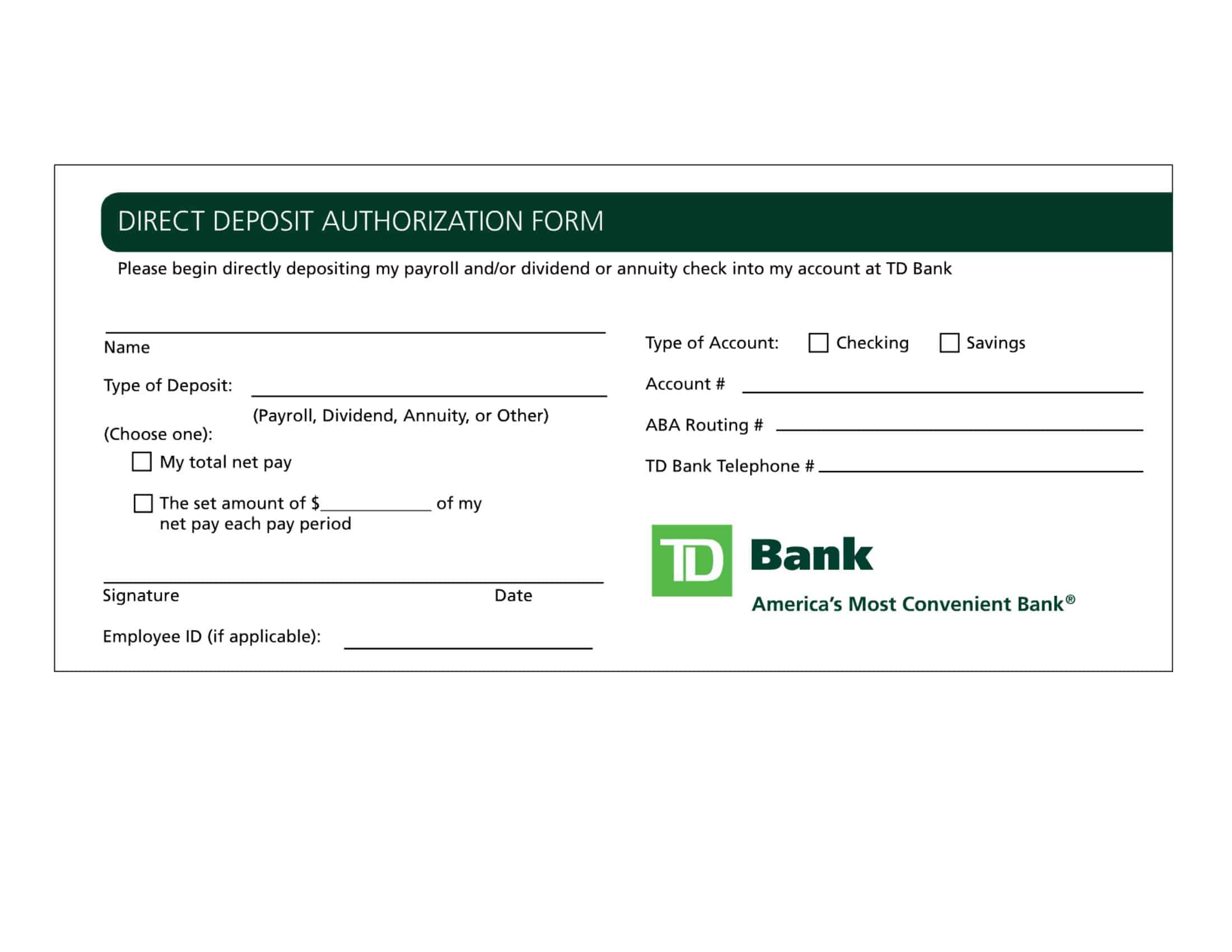

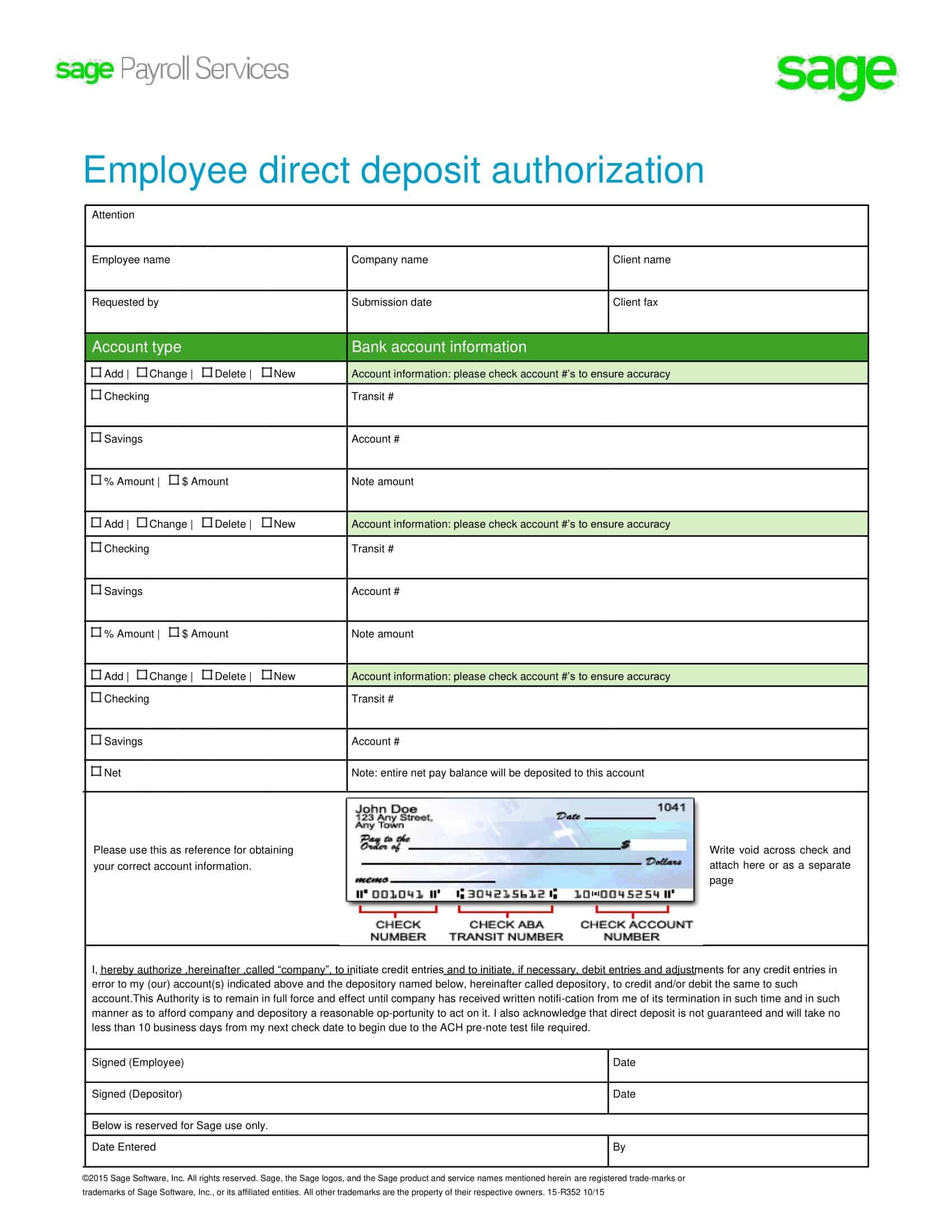

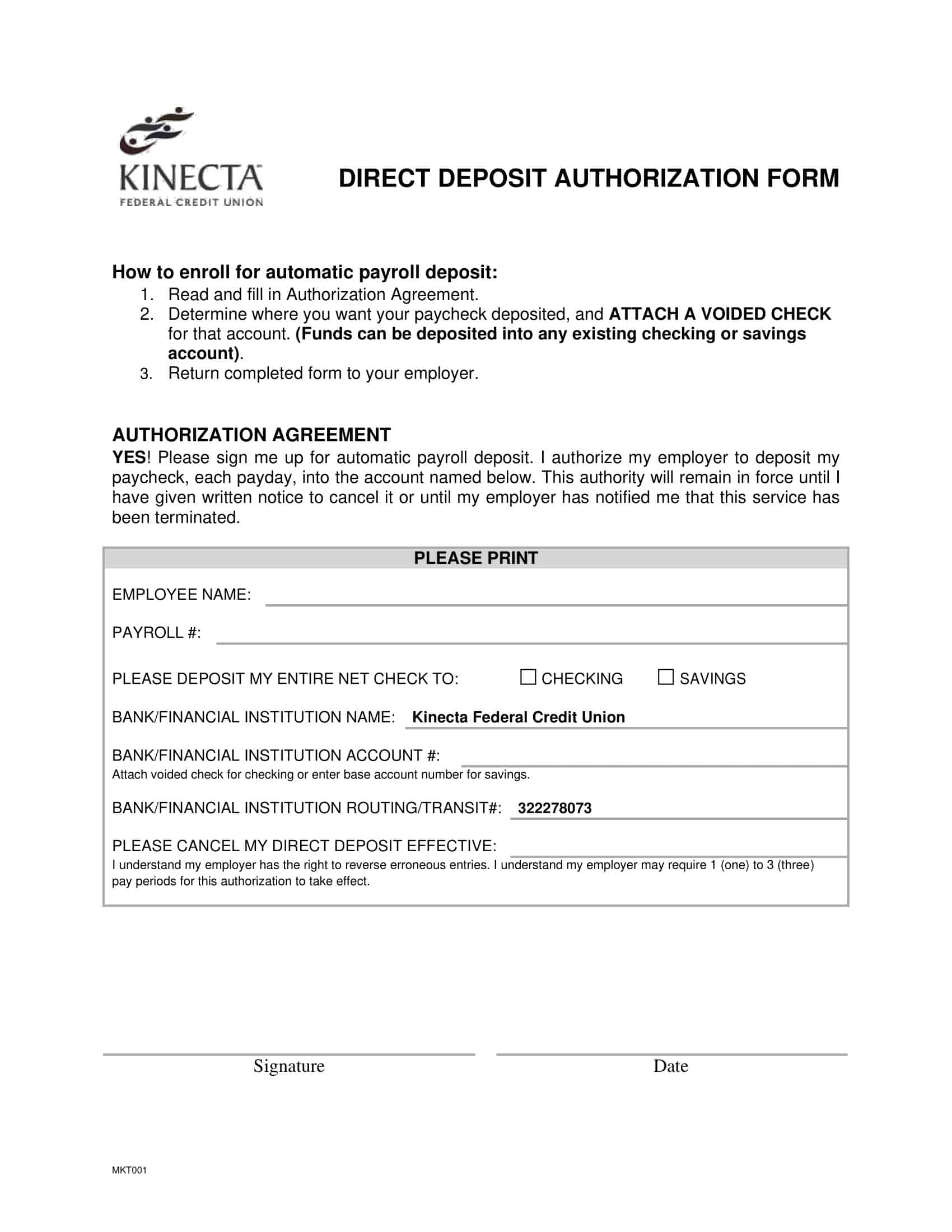

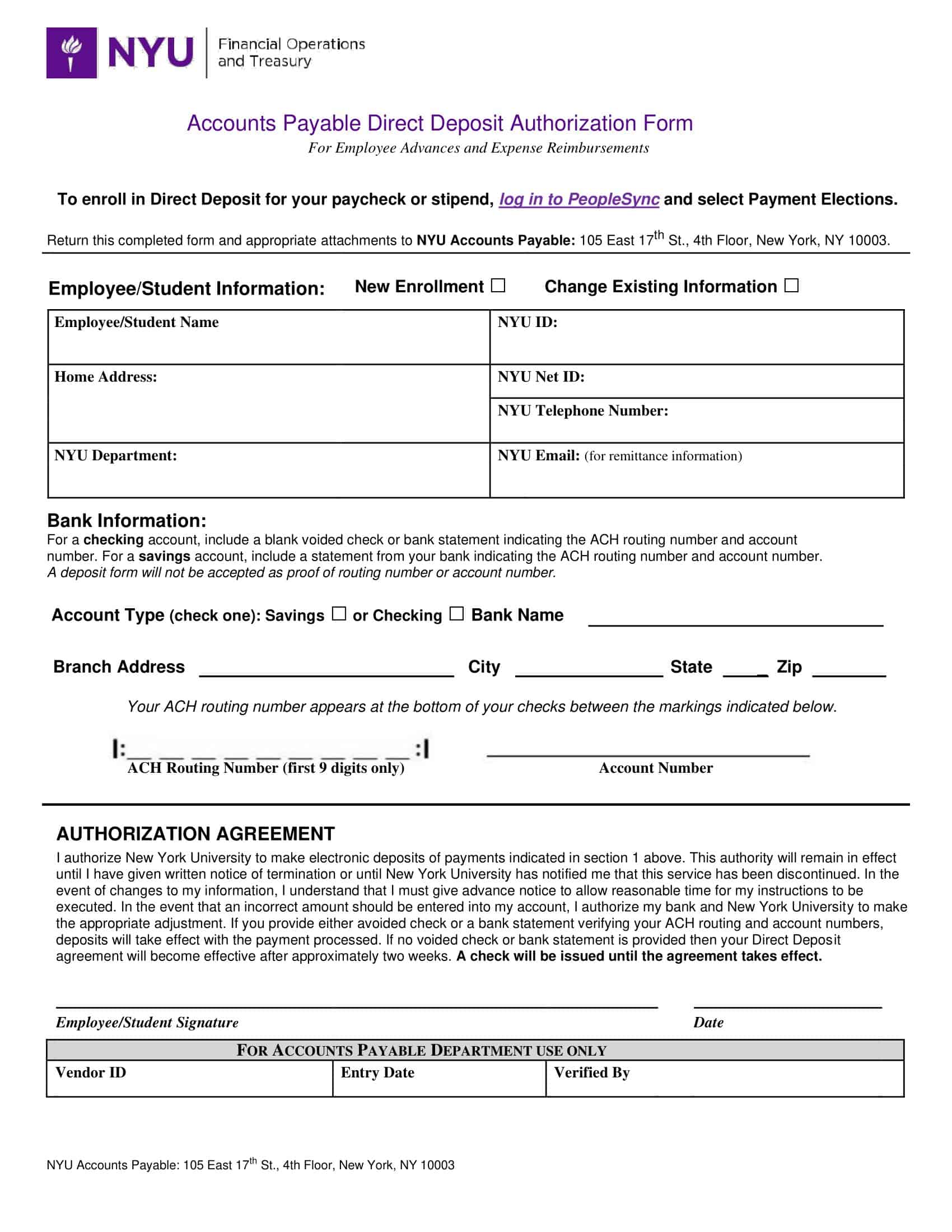

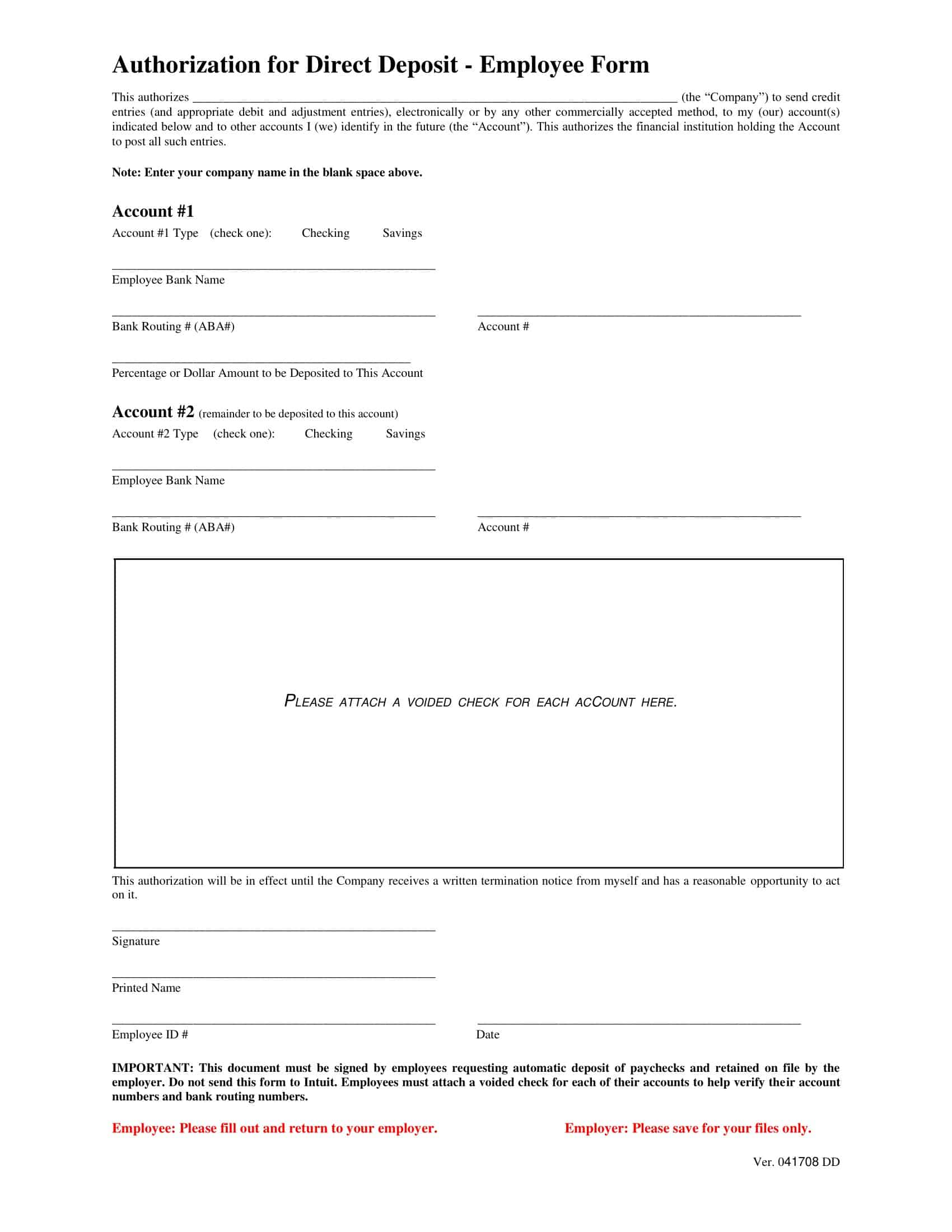

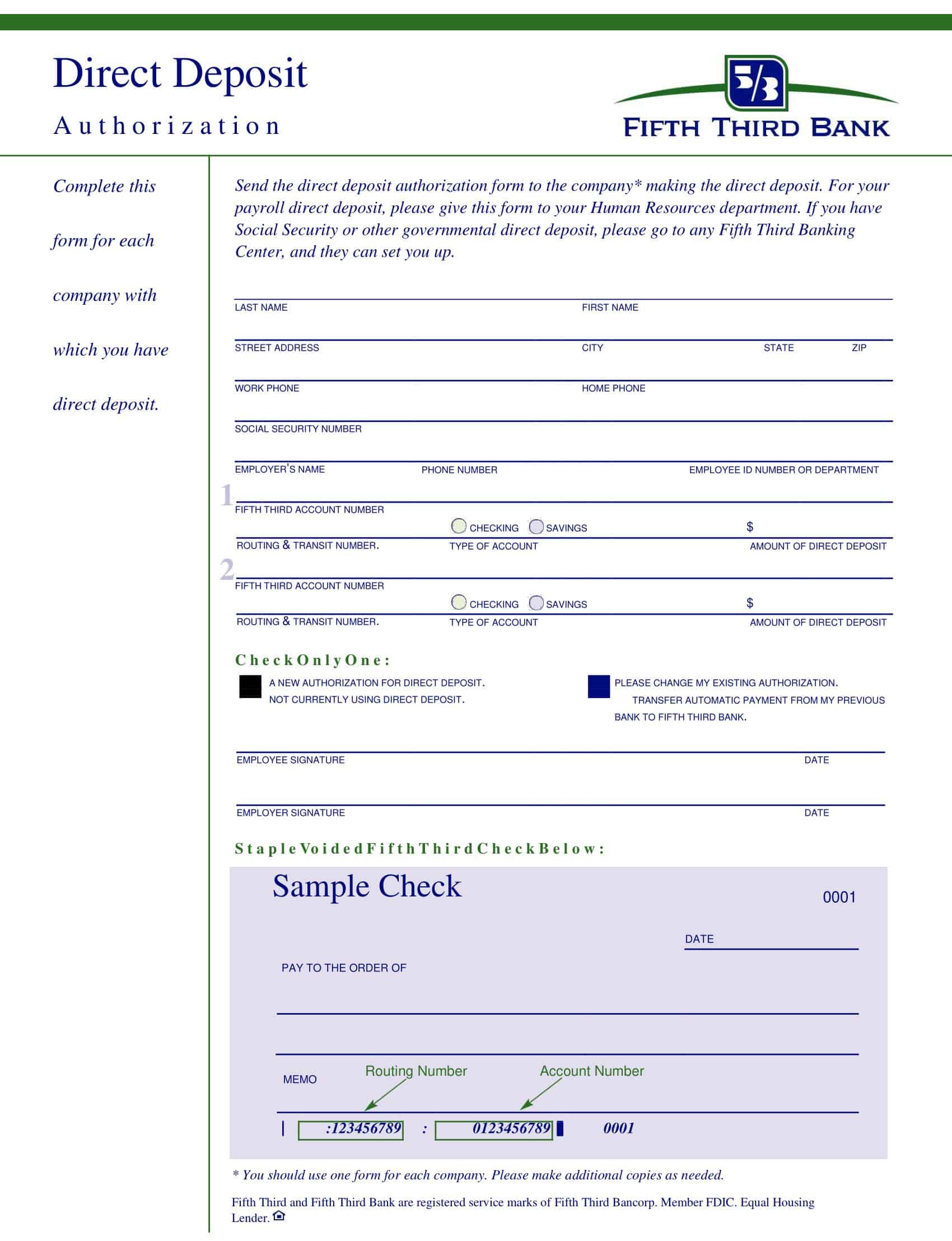

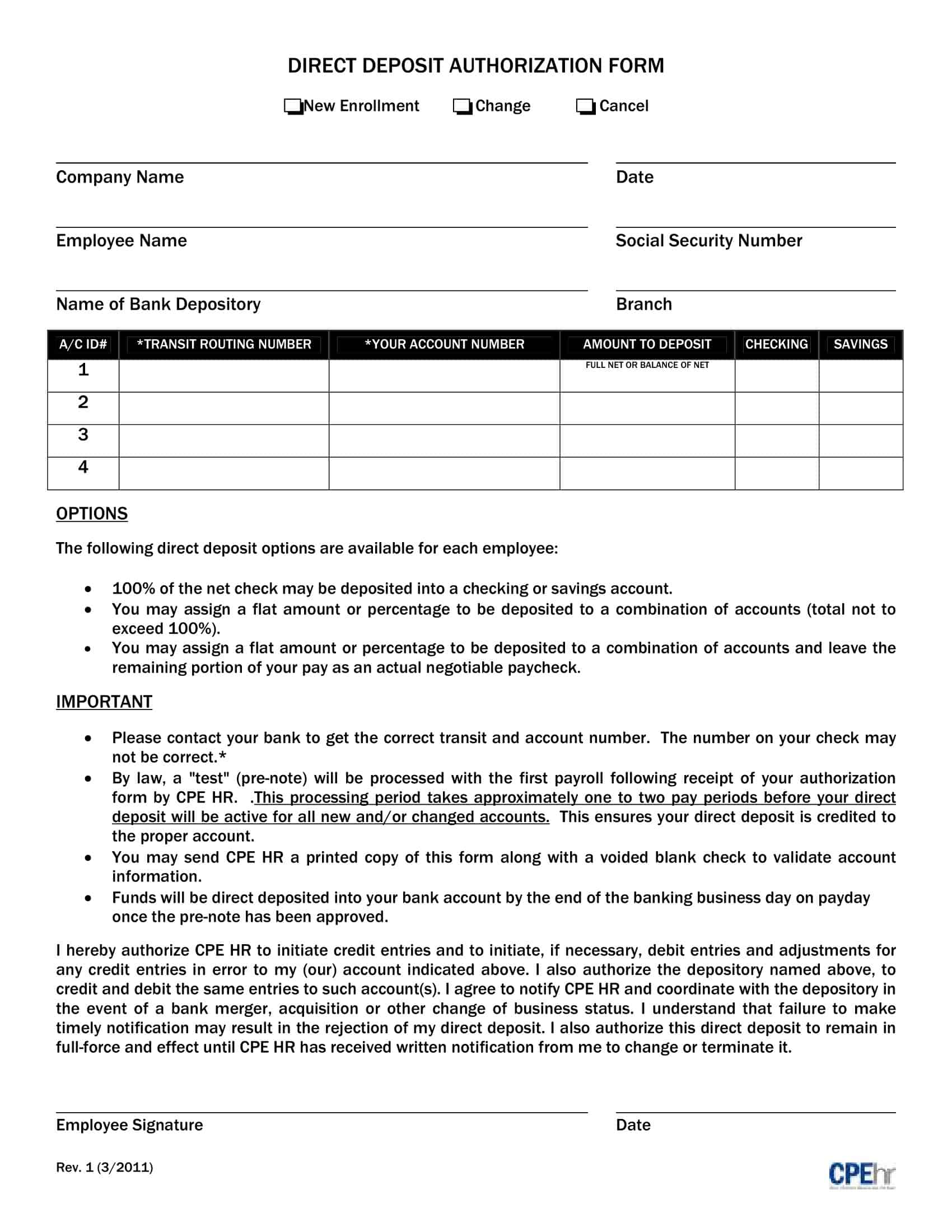

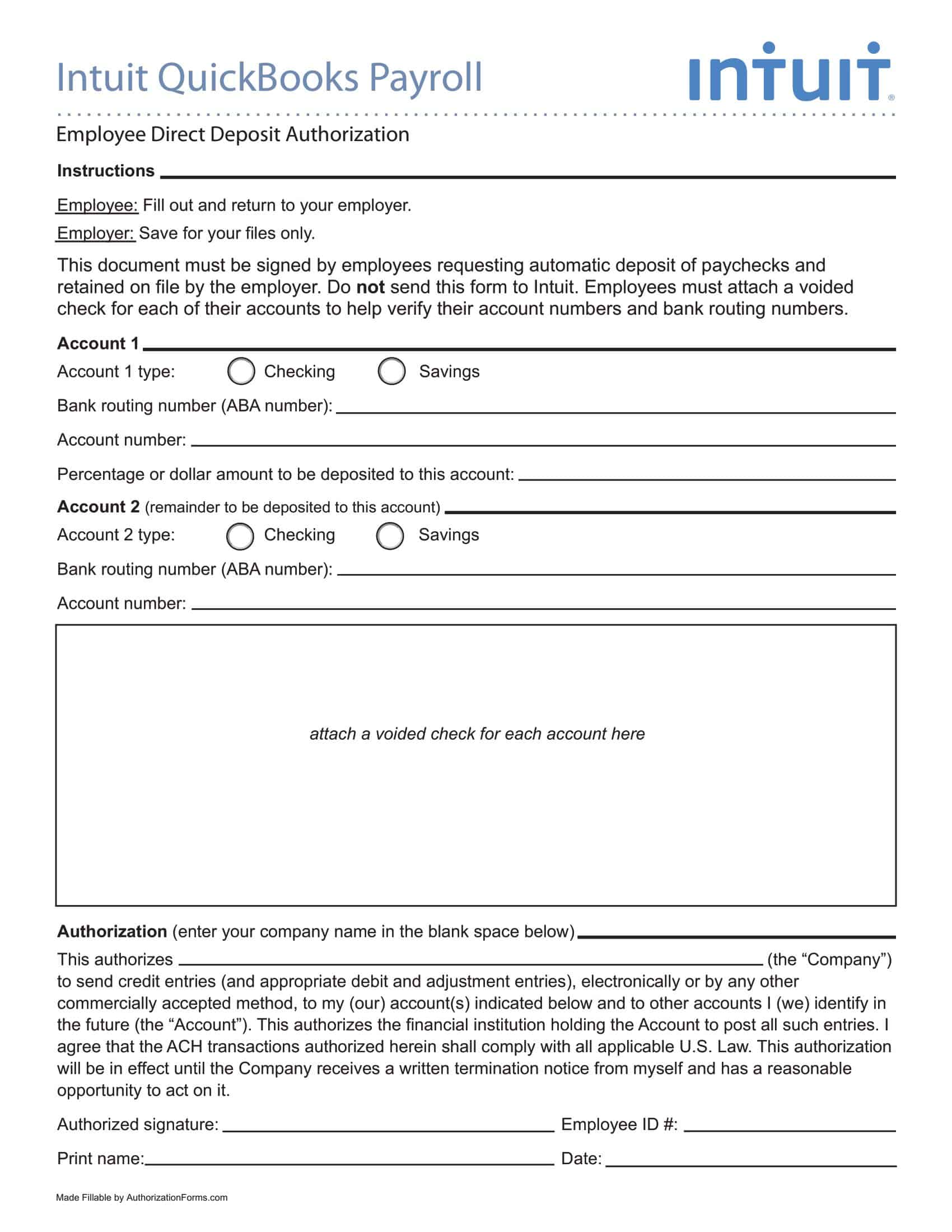

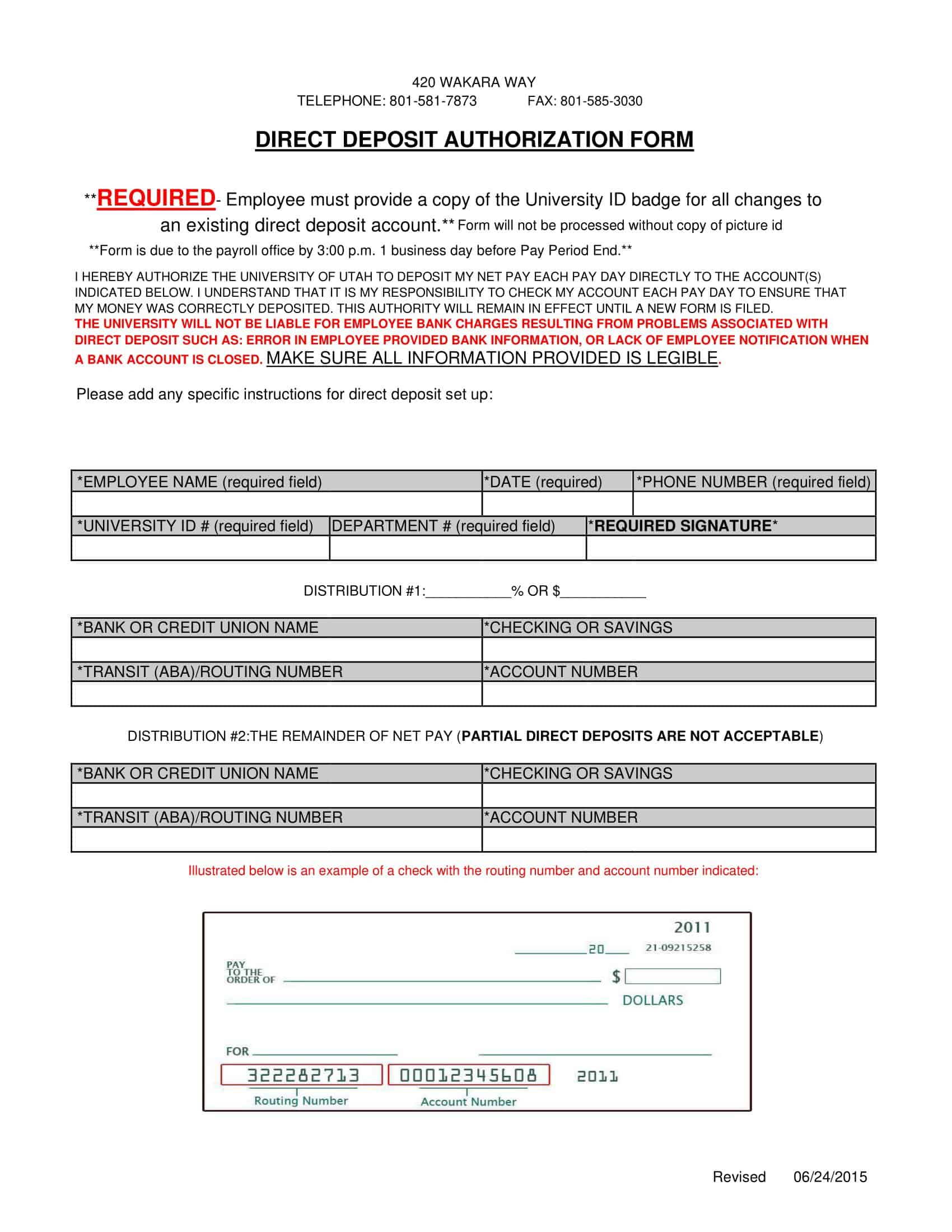

Direct Deposit Authorization Form Templates

Direct Deposit Authorization Form Templates are valuable resources for organizations and individuals facilitating automatic transfer of payments directly into the bank accounts of employees, vendors, or clients. These templates present a standard format for collecting and recording all necessary details required to execute direct deposits.

These templates generally consist of sections to capture vital information including the name of the account holder, bank name, account type, account number, and bank routing number. Some templates might also include space for additional details such as the purpose of the payment or specific instructions for the banking institution.

The utility of these templates extends across various scenarios where direct deposit is the preferred payment method. For example, businesses can use these templates for payroll processing to ensure employees receive their salaries promptly. Individuals might use them to authorize automatic transfers for recurring payments such as rent or utility bills.

The Advantages of a Direct Deposit

Direct Deposit is a fast, convenient, and secure method of transferring funds that offers a multitude of benefits. Here are some of the main advantages of using this service:

1. Convenience: Direct deposit saves you a trip to the bank. The funds are automatically deposited into your account on the payment date, and you can access them immediately. This is particularly beneficial if you’re unable to visit the bank during working hours, or if you’re out of town.

2. Speed: Direct deposit is often faster than receiving a physical check. Since there’s no need to wait for the check to arrive in the mail, or for the check to clear once it has been deposited, you can access your funds more quickly.

3. Safety: It eliminates the risk of checks being lost in the mail, stolen, or misplaced. Since the payment is transferred electronically, the chance of fraud or theft is significantly reduced.

4. Efficiency: For businesses, direct deposit reduces the time and cost of writing, mailing, and processing checks. It also enables them to maintain a more organized and efficient payroll system.

5. Environmentally friendly: By eliminating the need for paper checks, direct deposit is a more environmentally friendly payment option.

6. Consistency: With direct deposit, you receive your payment at the same time every pay period. This can help with budgeting and financial planning.

7. Flexibility: Some direct deposit programs allow you to split your paycheck between multiple accounts. This can be a convenient way to automatically save money or share income between different household accounts.

8. Record Keeping: Direct deposits create a better paper trail. The deposits show up on your bank statement, making it easy to track income for tax purposes or budget planning.

Types of Direct Deposit Authorization Forms

Direct Deposit Authorization Forms can vary in their specifics based on the entity initiating the deposit and the purpose of the deposit. However, they all share the common purpose of authorizing the electronic transfer of funds into a specific bank account. Here are some common types of Direct Deposit Authorization Forms:

1. Employment Direct Deposit Authorization Form: This is the most common type of direct deposit form, used by employers to deposit wages, salaries, and other forms of compensation directly into their employees’ bank accounts. This form typically requires the employee’s name, employee identification number, bank name, bank routing number, account number, and account type (checking or savings).

2. Government Benefits Direct Deposit Authorization Form: This form is used to authorize the deposit of government benefits like Social Security, Veterans Affairs benefits, tax refunds, or unemployment benefits. Recipients of these benefits must provide similar banking information to the appropriate government agency.

3. Retirement/Pension Direct Deposit Authorization Form: Those who receive retirement or pension benefits can have these funds directly deposited into their bank accounts. To set this up, they need to provide their account information to their pension fund or other retirement benefit provider.

4. Student Loan/Financial Aid Direct Deposit Authorization Form: Educational institutions or loan providers use this form to deposit funds such as student loans, grants, or scholarships directly into students’ bank accounts.

5. Child Support/Alimony Direct Deposit Authorization Form: Some states allow the direct deposit of child support or alimony payments. The recipient provides their banking information to the state’s disbursement unit to set up direct deposits.

6. Investment Dividends Direct Deposit Authorization Form: Investors can have dividends or distributions from their investments directly deposited into their bank accounts by filling out an authorization form provided by their brokerage or investment firm.

7. Vendor Direct Deposit Authorization Form: Used by businesses to authorize direct deposits of payments to their vendors, this form expedites payments, ensuring vendors receive their funds in a timely manner.

What Information Should You Include on a Direct Deposit Authorization Form

A Direct Deposit Authorization Form is a crucial document that initiates the process of electronic fund transfer. To ensure accuracy and security, the form should contain specific pieces of information. Here are the key elements that should be included:

1. Employee or Payer Information: This includes full name, address, and other identification details such as an employee ID or Social Security number. This identifies who the money is being transferred to in the case of a payroll direct deposit, or from in the case of other direct deposits.

2. Employer or Payee Information: This includes the company name, address, and possibly a company identification number. This identifies who is initiating the direct deposit.

3. Financial Institution Information: The name of the bank or credit union where the funds will be deposited should be included.

4. Account Information: This includes the type of account (checking or savings), the account number, and the bank’s routing number. This is critical as it specifies where the funds should be deposited.

5. Type and Frequency of Deposit: This information describes the type of payments to be deposited (such as payroll, government benefits, or investment dividends) and how often they will be made (like weekly, bi-weekly, monthly).

6. Amount to be Deposited: For some types of direct deposits, you might need to specify the amount to be deposited. This is especially relevant if only a portion of a payment (like a paycheck) is being directly deposited or if the deposits are being split among multiple accounts.

7. Multiple Deposit Information: If the funds are being split among multiple accounts, information for each account should be included. You should also specify how much should go to each account either as a percentage of the total or as a specific amount.

8. Authorization and Signature: This is a statement that the account holder authorizes the direct deposit. The account holder should sign and date the form.

9. Attachments: Sometimes a voided check or deposit slip is required along with the form to verify the account information.

How to Set Up Direct Deposit

Setting up direct deposit can greatly streamline the process of receiving payments, whether it’s your paycheck, government benefits, or other forms of income. Here’s a detailed guide to help you through the process:

Obtain the Direct Deposit Authorization Form

The first step is to acquire the necessary authorization form. If you’re setting up direct deposit for your wages, ask your employer’s human resources or payroll department. For government benefits or other payments, the form can usually be found on the relevant organization’s website.

Fill Out the Form

Complete the form with all the required information. This typically includes your name, your bank’s name, the type of account (checking or savings), and your account number and bank routing number. These can usually be found on your personal checks or your online banking portal. If you’re unsure, contact your bank to confirm this information.

Choose the Deposit Amount

If you’re allowed to specify how much of your paycheck or other payment you want to be deposited, determine the amount or percentage and enter it on the form. You can often split your direct deposit among multiple accounts.

Attach a Voided Check or Deposit Slip (if required)

Some organizations may require you to attach a voided check or deposit slip with your form. This is used to verify the bank information you provided. To create a voided check, simply write “VOID” across the front of a blank check.

Sign and Date the Form

This signifies your agreement with the direct deposit. Make sure to review all the details before signing.

Submit the Form

Return the completed form (and voided check or deposit slip, if required) to your employer, government agency, or whoever requested it. This can often be done electronically, but in some cases, you might need to mail it or drop it off in person.

Confirm the Setup

It may take a few weeks for the direct deposit to be set up. You may receive a notification once it’s active, or you may be asked to confirm that the setup was successful by checking your bank account for the deposit.

Monitor Your Bank Statements

Regularly review your bank statements to ensure the direct deposits are being made correctly. If you notice any discrepancies, contact the depositing organization and your bank immediately.

Setting up direct deposit might seem complicated, but with these steps, you can easily navigate the process. The convenience and security of direct deposit make it a worthwhile option for managing your payments.

Filling Out a Direct Deposit Authorization Form

Filling out a Direct Deposit Authorization Form is an important step in setting up electronic funds transfers. It’s a straightforward process, but accuracy is essential. Follow this step-by-step guide to ensure you complete the form correctly:

1. Obtain the Form: The form can usually be obtained from your employer’s payroll or human resources department. For other types of direct deposit, like government benefits, you can often find the form on the relevant organization’s website.

2. Identify Yourself: Fill in your personal information, including your full legal name and your employee ID or Social Security Number, if applicable. Some forms may also require your address and contact details.

3. Specify Your Bank’s Details: You’ll need to provide the name of your bank or credit union. You might also need the bank’s address and the bank’s routing number, a nine-digit number that identifies your bank in a transaction.

4. Provide Account Information: Indicate whether you’re using a checking or savings account for the deposit. Enter your account number, which is usually up to 17 characters long. Both the routing number and account number can typically be found on your personal checks or via your online banking account.

5. Determine Deposit Amount: If you’re setting up direct deposit with your employer, you may have the option to deposit a certain amount or percentage of your paycheck into different accounts. Determine how much you want to go to this account and fill this in. If you’re depositing the entire amount into one account, you can often skip this step.

6. Attach a Voided Check or Deposit Slip (If Required): Some forms may require you to attach a voided check or deposit slip for the account where the funds will be deposited. To void a check, write “VOID” across the front of a blank check from your checkbook.

7. Sign and Date the Form: Review all the information to ensure it’s correct, then sign and date the form. This verifies that you authorize the direct deposit transactions.

8. Submit the Form: Return the completed form to the appropriate party — your employer, the government agency, or other payer. Keep a copy of the completed form for your records.

9. Confirmation: It might take a couple of deposit cycles for the direct deposit to be set up. During this period, you may continue to receive checks or payments as you did before. Once the direct deposit is active, confirm the deposits are being made correctly by checking your bank account.

Alternative Ways to Pay Employees Without Direct Deposit

While direct deposit is a popular and efficient method of paying employees, it’s not the only option available. Some employees might prefer different methods, or some businesses might find other methods more suitable for their circumstances. Here are a few alternative ways to pay employees without direct deposit:

1. Paper Checks: This is the traditional method of paying employees. The employer writes a check to the employee who then deposits or cashes the check at their bank. While this method does have some additional costs (like check paper, ink, and sometimes mailing costs), it can be beneficial for employees without bank accounts.

2. Payroll Cards: A payroll card, or pay card, works like a debit card. Each pay period, the employer loads the employee’s wages onto the card, and the employee can then use the card to make purchases, withdraw cash at an ATM, or transfer funds to a bank account. This method can be a good option for employees without bank accounts, but be aware of potential fees associated with these cards.

3. Cash: Paying employees in cash is another option, though it’s less common due to the lack of paper trail and potential security issues. If you choose this method, you should provide a detailed pay stub and make sure you have a record of the payment for tax purposes.

4. Mobile Payment Apps: Some employers might consider using mobile payment apps like Venmo, PayPal, or Zelle. These services allow you to transfer money directly to your employees. Be sure to check the terms of service for these apps, as some might not allow business transactions, and there could be fees associated.

5. Cryptocurrency: While still quite new and not widely adopted, some companies are beginning to offer cryptocurrency, like Bitcoin, as a form of payment. Be aware that this option comes with a high degree of volatility and potential regulatory issues, so it’s important to understand the implications before choosing this method.

6. Third-party Check Cashing Services: In some cases, employers might pay through third-party check cashing services. This can be helpful for employees without bank accounts, but these services often charge fees.

FAQs

Why would I need to fill out a Direct Deposit Authorization Form?

You would need to fill out a Direct Deposit Authorization Form if you want your income, such as your salary or government benefits, to be deposited directly into your bank account. It offers convenience, security, and faster access to your funds compared to traditional methods.

How do I obtain a Direct Deposit Authorization Form?

You can usually obtain a Direct Deposit Authorization Form from your employer, government agency, or financial institution. Many organizations provide the form as part of their onboarding or payroll process. Alternatively, you may find printable versions of the form on official websites or by contacting the relevant institution directly.

Is it safe to provide my bank account information on a Direct Deposit Authorization Form?

Direct Deposit Authorization Forms are designed to facilitate secure electronic transactions. However, it is important to ensure that you are providing your information to a trusted and legitimate source. Make sure the form is from a reputable organization or employer to protect your personal and financial information.

Can I cancel or change my direct deposit arrangement?

Yes, you can usually cancel or change your direct deposit arrangement by contacting your employer or the organization that manages your income. They will provide you with the necessary procedures and forms to make any modifications to your direct deposit setup.

How long does it take for direct deposit to take effect?

The time it takes for direct deposit to take effect can vary. Some employers or organizations may require a processing period before initiating the direct deposit, which could be a few days to a few weeks. It’s best to check with your employer or the relevant organization for specific timelines.

What happens if I close the bank account listed on my Direct Deposit Authorization Form?

If you close the bank account listed on your Direct Deposit Authorization Form, you should promptly notify your employer or the organization responsible for the direct deposit. They will provide you with instructions on updating your bank account information to ensure uninterrupted direct deposit services.

Are there any fees associated with direct deposit?

In most cases, direct deposit is a free service provided by employers or organizations. However, it’s advisable to check with your bank or financial institution to confirm if there are any associated fees, as some banks may have specific account types or conditions that could incur charges for direct deposit services.

Can I split my direct deposit between multiple bank accounts?

It depends on the policies of your employer or the organization handling the direct deposit. Some systems allow you to split your direct deposit into multiple accounts, such as allocating a percentage or fixed amount to different accounts. Check with your employer or the relevant organization to see if this option is available.

How long does it take for funds to appear in my account through direct deposit?

The timing of funds appearing in your account can vary depending on the policies of your employer or the organization initiating the direct deposit. Generally, funds are deposited into your account on the same day the payment is issued or within one to two business days.

Can I use direct deposit for receiving government benefits?

Yes, direct deposit is commonly used for receiving government benefits such as Social Security, Medicare, unemployment benefits, and tax refunds. Government agencies often encourage individuals to sign up for direct deposit to ensure timely and secure delivery of funds.

Can I use direct deposit if I don’t have a traditional bank account?

In some cases, yes. While direct deposit is typically associated with traditional bank accounts, alternative financial services such as prepaid debit cards or online payment platforms may offer direct deposit options. These services allow you to receive funds electronically without a traditional bank account. Check with the specific service provider for more information.

What if there is an error in my direct deposit, such as an incorrect amount or missing payment?

If you notice an error in your direct deposit, you should contact your employer or the organization responsible for the payment immediately. They will investigate the issue and work towards resolving it. It’s important to act promptly to rectify any errors and ensure the correct payment is processed.

Can I use direct deposit for international transactions?

Direct deposit is primarily used for domestic transactions within the same country. If you need to receive funds from abroad, other options such as wire transfers or international payment services may be more suitable. These methods typically involve additional fees and require specific banking information, such as SWIFT or IBAN numbers.

Is direct deposit available for self-employed individuals or freelancers?

Yes, self-employed individuals or freelancers can often set up direct deposit for receiving payments from clients or customers. This can streamline payment processes and provide a convenient way to receive income. You may need to provide your clients or customers with your bank account details to facilitate direct deposit.

Can I use direct deposit for non-payroll payments, such as pensions or annuities?

Yes, direct deposit is commonly used for non-payroll payments, including pensions, annuities, and other recurring payments. These types of payments can be set up for direct deposit to ensure a reliable and efficient transfer of funds into your designated bank account.

Do I need to notify my bank if I set up direct deposit?

In most cases, you don’t need to specifically notify your bank when setting up direct deposit. However, it’s always a good idea to ensure that your bank account information is up to date and accurate. If you have any concerns or questions, you can contact your bank to confirm their policies regarding direct deposit.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)