The Statement of Shareholder Equity is one of the key financial statements that provides valuable insights into a company’s financial health. This financial document summarizes changes in shareholders’ equity over an accounting period and helps investors understand how profitable a company has been and how much capital has been invested into the business.

In this article, we will explore what the Statement of Shareholder Equity is, the key components it outlines, and provide an example statement with a template for reference. Understanding this important financial document is key for any investor looking to analyze the performance and growth of a business.

Table of Contents

What Is Stockholders’ Equity?

Stockholders’ equity represents the assets that belong to a company’s shareholders. It is calculated by subtracting total liabilities from total assets and represents the residual interest or claim of shareholders to the assets of the company after deducting all liabilities. The key components of stockholders’ equity include paid-in capital (the amount shareholders paid for stock), retained earnings (net income that is retained and reinvested into the company rather than paid out as dividends), and accumulated other comprehensive income which includes items like foreign currency translations and unrealized gains/losses on certain investments.

Together these components represent the net worth of the company attributable to shareholders at a specific point in time. Stockholders’ equity is reported on a company’s balance sheet and statements of changes in equity, and reflects the investment shareholders have made in the company as well as the profits reinvested in the business over time.

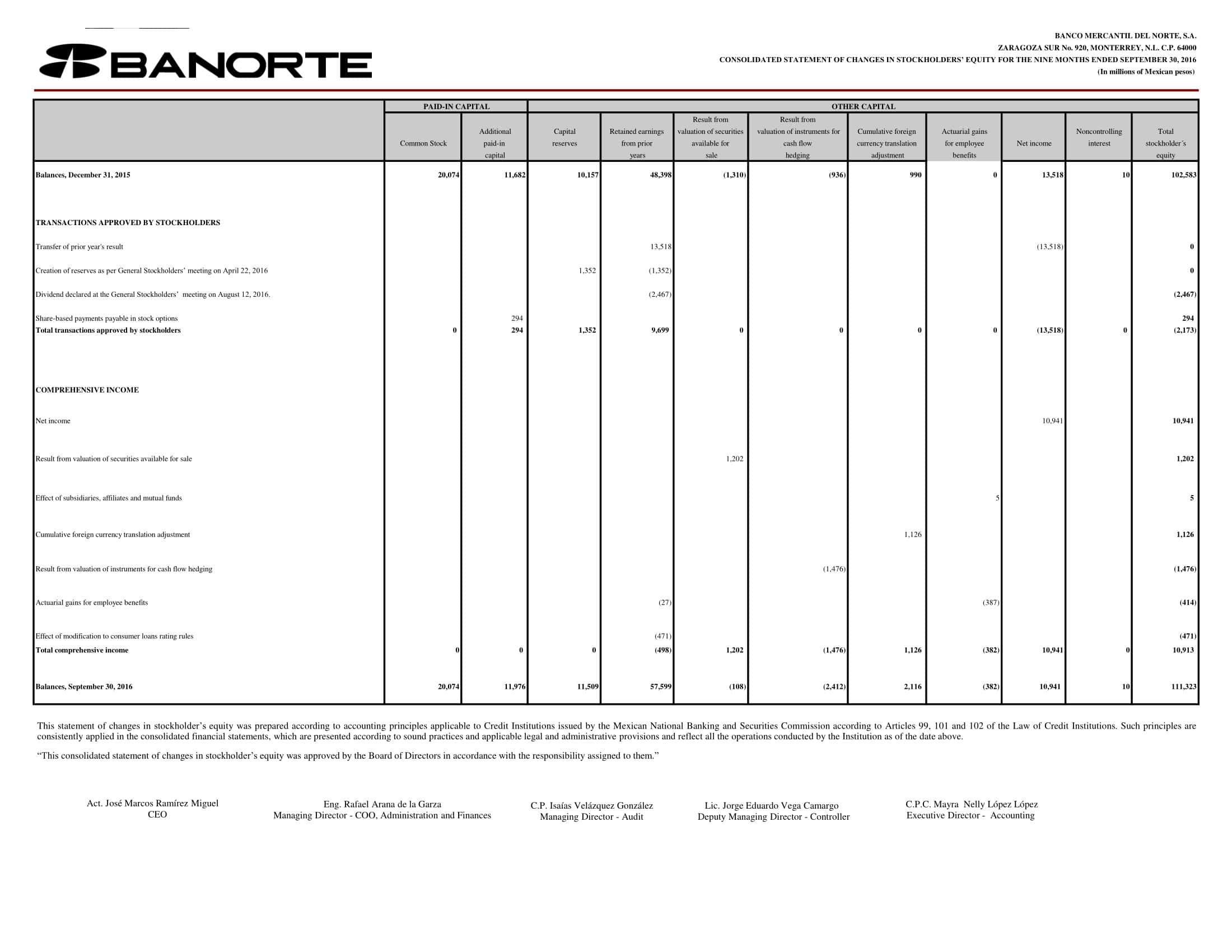

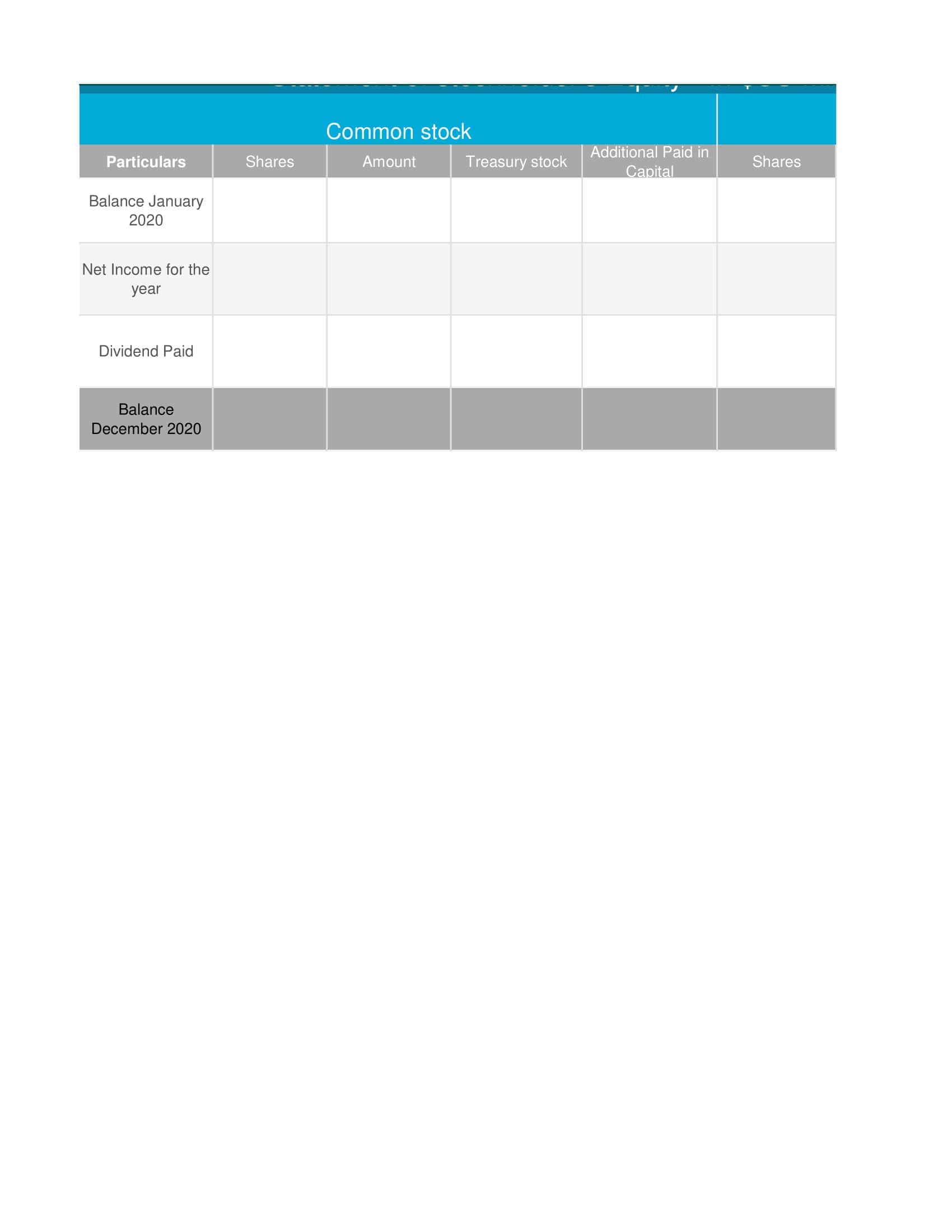

Statement of Stockholders’ Equity Templates

The statement of stockholders’ equity summarizes changes in equity over an accounting period. Our statement of stockholders’ equity template clearly presents this important information. This statement is a must for accounting students, financial analysts, and investors.

The statement outlines equity activity, including common stock issued, dividends paid, and changes in retained earnings. The beginning and ending balance in each equity account is shown along with activity during the period. Any treasury stock repurchased is deducted.

With this free printable statement of stockholders’ equity template, preparing an equity statement is fast and easy. The pdf format allows you to save and print the template as needed. Learn how to summarize equity changes while practicing with real-world examples. A statement of stockholders’ equity is essential for understanding a company’s finances. Download this template today!

What Is A Statement Of Stockholders’ Equity?

A statement of stockholders‘ equity is a financial statement that provides a summary of the changes in a company’s equity accounts over an accounting period. It shows the beginning and ending balances in the accounts that make up stockholders’ equity – common stock, additional paid-in capital, retained earnings, and accumulated other comprehensive income.

The statement reconciles the beginning and ending balances by showing increases and decreases in each account from transactions and events such as the issuance of stock, stock repurchases, dividends declared, net income or loss, and gains or losses recorded in other comprehensive income.

Who uses a statement of stockholder equity?

A statement of stockholders‘ equity is used by various parties, including:

- Company management – To analyze changes in equity accounts over an accounting period. The statement helps management see where equity capital is being generated from (such as new stock issuances) and how it is being affected by company performance and dividend policies. This assists in capital planning and decision making.

- Investors and shareholders – To see a summary of changes in stockholders’ equity accounts like retained earnings and additional paid-in capital. This helps them determine if shareholder value is being maintained and built over time through the company’s operations and financing activities. It also allows assessment of dividend payment capacity.

- Lenders and creditors – To help assess the company’s capital structure, financial risk, and ability to pay obligations. The statement provides insight into the balance sheet strength and shareholder investment. Creditors are interested in equity cushions and want to see retained earnings growth over time.

- Financial analysts – To conduct ratio analysis and assess company performance metrics related to equity, such as return on equity. The statement of equity aids with modeling and financial statement analysis to determine historical trends and make forecasts.

- Regulators – Government agencies may analyze the statement to ensure proper reporting of equity account changes and balances as required by accounting standards and regulations. The statement helps assess compliance.

Purpose Of Statement Of Stockholders’ Equity

The Statement of Stockholders’ Equity, also known as the Statement of Shareholders‘ Equity or the Equity Statement, serves several vital purposes in financial reporting and analysis:

- Equity Changes Overview: It provides a comprehensive overview of the changes in a company’s equity over a specific accounting period.

- Source of Changes: The statement details the sources of changes in stockholders’ equity, which might include net income, dividends, issuance or repurchase of shares, and other comprehensive income.

- Capital Management Insight: By showcasing stock issuance, repurchases, and dividend payouts, it offers insights into a company’s capital management strategies.

- Retained Earnings: It helps users track changes in retained earnings, which is the accumulated portion of net income that has not been distributed as dividends. This can be pivotal for assessing a company’s ability to reinvest in its operations or its propensity to return profits to shareholders.

- Ownership Changes: The statement reflects any changes in ownership interest, such as stock issuance or buybacks, which can impact control dynamics or earnings per share.

- Total Comprehensive Income: Beyond just net income, the statement sometimes includes total comprehensive income, capturing all changes in equity from non-owner sources, like unrealized gains or losses from available-for-sale securities or foreign currency translation adjustments.

- Stakeholder Transparency: It provides shareholders and potential investors with a clear picture of how their ownership value has changed over time and the reasons for those changes.

- Comparative Analysis: The statement often presents multiple periods side-by-side, allowing for a comparative analysis of equity changes over time.

Key Components of Stockholder’s Equity Statement

Delving into the intricate fabric of a company’s financial position requires an exploration of its Equity Statement. While the nuances and specifics can differ based on the company and its operational jurisdiction, a thorough breakdown of its customary elements offers invaluable insights:

- Common Stock:

- Represents the total value of shares that a company has issued.

- Often listed at par value, with the amount above par recorded in an additional paid-in capital account.

- Preferred Stock:

- Some companies issue preferred shares, which come with a set of rights different from common stock, such as priority in dividend distributions or asset liquidation.

- Like common stock, preferred stock may also be listed at its par value.

- Additional Paid-In Capital (APIC):

- This account captures the excess amount received from shareholders over the par value when the stock is issued.

- Represents capital from shareholders that is not due to retained earnings or capital stock.

- Retained Earnings:

- Accumulated net income that hasn’t been distributed as dividends.

- It will increase with net income and decrease with net losses and dividends.

- Treasury Stock:

- Represents shares that the company has repurchased but not retired.

- Typically, it’s presented as a negative figure because it reduces total stockholders’ equity.

- Accumulated Other Comprehensive Income (AOCI):

- Represents unrealized gains and losses that haven’t flowed through the income statement.

- Examples include unrealized gains/losses from available-for-sale securities, foreign currency translation adjustments, and certain pension adjustments.

- Stock Dividends and Stock Splits:

- These affect the number of shares outstanding and may require adjustments in the equity statement. For instance, a stock split may double the number of shares while halving the par value per share.

- Contributions and Withdrawals:

- For certain types of companies, especially partnerships, contributions from and withdrawals by owners are reported.

- Non-controlling Interest:

- In consolidated financial statements, if a company owns more than 50% but less than 100% of another company, the portion not owned is reflected as a non-controlling interest in equity.

- Represents the portion of equity in a subsidiary not owned by the parent company.

For each of these components, the Statement of Stockholders’ Equity will typically show:

- The beginning balance at the start of the period.

- Additions or reductions during the period.

- The ending balance at the end of the period.

Difference Between Cash Flow Statement and Statement of Shareholders’ Equity

The Statement of Owner’s Equity and the Cash Flow Statement are two important financial statements that provide valuable, yet distinct, information to users about different aspects of a company’s financial position and performance. While the two statements are interconnected, there are several key differences between the focus, objectives, and utility of each statement.

- Purpose:

- Statement of Owner’s Equity: This report details the changes in the equity section of the balance sheet during a specific period. It reveals how capital, retained earnings, drawings, and other equity items have changed over time.

- Cash Flow Statement: This statement tracks the flow of cash and cash equivalents coming into and going out of the business during a specific period, segmented into operating, investing, and financing activities.

- Components:

- Statement of Owner’s Equity: Generally contains beginning equity, net income (or loss) from the income statement, any owner’s additional contributions or withdrawals, and any other gains or losses that might not appear on the income statement.

- Cash Flow Statement: Consists of three major sections – Operating Activities (related to the primary business operations like receiving from customers or paying suppliers), Investing Activities (related to assets such as purchasing or selling property or equipment), and Financing Activities (related to obtaining or repaying capital, like issuing stock or paying dividends).

- Timeline Perspective:

- Statement of Owner’s Equity: Provides a bridge between two balance sheet dates to illustrate how equity has evolved over that period.

- Cash Flow Statement: Demonstrates how cash has moved within the organization over a specific period, helping to explain the changes between two consecutive balance sheet’s cash and cash equivalents.

- Nature of Information:

- Statement of Owner’s Equity: Focuses solely on equity components.

- Cash Flow Statement: Provides a comprehensive look at cash activities, irrespective of whether they impact equity, liabilities, or assets.

- Utility for Stakeholders:

- Statement of Owner’s Equity: Useful for owners, shareholders, and potential investors to understand how their equity or ownership value in the company has changed.

- Cash Flow Statement: Vital for all stakeholders, including creditors, investors, and management, to assess liquidity, solvency, and the overall ability of the business to generate and use cash.

- Indication of Financial Health:

- Statement of Owner’s Equity: Reflects changes in the net assets owned by shareholders. A continually increasing owner’s equity might suggest good profitability and financial health.

- Cash Flow Statement: A business can be profitable yet still have cash flow problems. A positive operating cash flow is generally a good indicator of a company’s short-term health, as it means the primary business activities are generating cash.

- Interdependence with Other Statements:

- Statement of Owner’s Equity: Usually relies on figures from both the balance sheet (beginning equity) and the income statement (net income/loss).

- Cash Flow Statement: Derived from changes between two balance sheet periods and incorporates information from the income statement to detail the cash inflows and outflows.

How To Create A Statement Of Shareholder Equity?

Creating a statement of stockholders’ equity involves several steps to accurately present the activity affecting equity accounts between two balance sheet dates. The information provided in this statement is useful for assessing the sources of equity capital as well as any dividends paid or losses incurred that reduce equity.Here are the steps:

Step 1: Understand the Components of the Statement

The Statement of Shareholder Equity generally includes the following components:

- Opening equity balance

- Additions to equity (like net income from the income statement)

- Subtractions from equity (like dividends)

- Other changes (like issuance or buyback of shares)

For instance, let’s assume ABC Corporation began the year with an opening equity balance of $100,000.

Step 2: Calculate Net Income or Loss

Before you can detail the changes in equity, you must determine your company’s net income or net loss for the period. This is derived from the income statement. Add this amount to the opening balance of shareholder equity.

Example: If ABC Corporation earned a net income of $50,000, you’d add this to the opening equity balance, resulting in $150,000.

Step 3: Account for Dividends or Withdrawals

Subtract any dividends (for corporations) or owner withdrawals (for smaller businesses or sole proprietorships) from the total. This reflects the return of profits to shareholders or owners and decreases total equity.

Example: If ABC Corporation paid out $10,000 in dividends during the year, you’d subtract this from the $150,000, resulting in a balance of $140,000.

Step 4: Factor in New Stock Issues or Buybacks

If the company issued new shares during the period, the proceeds from the issuance would increase equity. Conversely, if the company bought back shares (treasury stock), it would decrease equity. Adjust the equity amount accordingly.

Example: If ABC Corporation issued new shares and raised $20,000 but also bought back shares worth $5,000, you’d add the net of these two figures ($15,000) to the equity balance, resulting in $155,000.

Step 5: Make Adjustments for Other Comprehensive Income

Other Comprehensive Income (OCI) encompasses revenue, expenses, gains, and losses that haven’t been realized and thus aren’t included in the net income figure. This might involve unrealized gains or losses from investments, pensions, or foreign currency translations. Add or subtract these amounts as required.

Example: If ABC Corporation had an unrealized gain from investments worth $5,000, you’d add this to the equity balance, resulting in a final equity balance of $160,000.

Step 6: Present the Closing Equity Balance

After all adjustments are made, the resulting figure represents the closing equity balance for the period. This figure provides stakeholders with a clear picture of how equity has changed over the period.

In our example, ABC Corporation’s Statement of Shareholder Equity would show an opening balance of $100,000, net additions of $60,000 (combining net income, stock transactions, and OCI), and subtractions of $10,000 (from dividends), leading to a closing balance of $160,000.

This Statement of Shareholder Equity, when provided alongside other financial statements, gives shareholders a comprehensive view of how their stake in the company has evolved over the period.

Statement of Stockholders’ Equity Example

XYZ Company

Statement of Stockholders’ Equity

For the Year Ended December 31, 20XX

| Component | Beginning Balance | New Stock Issued | Stock Repurchased | Stock-based Compensation | Net Income | Dividends Declared | Other Adjustments | Ending Balance |

| Common Stock – Class A | $xx,xxx | $xx,xxx | ($xx,xxx) | – | – | – | $xx,xxx | $xx,xxx |

| Common Stock – Class B | $xx,xxx | $xx,xxx | ($xx,xxx) | – | – | – | $xx,xxx | $xx,xxx |

| Additional Paid-In Capital | $xx,xxx | $xx,xxx | – | $xx,xxx | – | – | $xx,xxx | $xx,xxx |

| Retained Earnings | $xx,xxx | – | – | – | $xx,xxx | ($xx,xxx) | – | $xx,xxx |

| Accumulated Other Comprehensive Income | $xx,xxx | – | – | – | – | – | $xx,xxx | $xx,xxx |

| Total Equity | $xx,xxx | $xx,xxx | ($xx,xxx) | $xx,xxx | $xx,xxx | ($xx,xxx) | $xx,xxx | $xx,xxx |

How to Calculate Stockholders’ Equity

The basic equation for Stockholders’ Equity is:

Stockholders’ Equity=Total Assets−Total LiabilitiesStockholders’ Equity=Total Assets−Total Liabilities

List out all components of Equity

Before starting the calculation, gather data on common stock, retained earnings, APIC, treasury stock, and AOCI from the company’s balance sheet.

Calculate Total Contributed Capital

This is the sum of common stock and APIC. Total Contributed Capital=Common Stock+APICTotal Contributed Capital=Common Stock+APIC

For example, if a company has $100,000 in common stock and $20,000 in APIC, the Total Contributed Capital would be $120,000.

Calculate Total Retained Earnings:

This is usually provided directly in the balance sheet. If the company has been operating for several years, it would have accumulated a significant amount in retained earnings.

For instance, if the company has retained earnings of $50,000, this is the figure you’d use.

Factor in Accumulated Other Comprehensive Income (AOCI)

This amount can be taken directly from the balance sheet. Let’s say AOCI is -$5,000 (a negative figure represents a loss).

5. Subtract Treasury Stock

Treasury stock reduces shareholders’ equity. If the company has repurchased $10,000 worth of its own stock, this amount will be subtracted.

6. Calculate Total Stockholders’ Equity

Sum up the components:

Stockholders’ Equity=Total Contributed Capital+Retained Earnings+AOCI−Treasury StockStockholders’ Equity=Total Contributed Capital+Retained Earnings+AOCI−Treasury Stock

Using the figures from the above examples: \text{Stockholders’ Equity} = $120,000 + $50,000 – $5,000 – $10,000 = $155,000

The resulting figure ($155,000) represents the shareholders’ equity or the ownership interest of stockholders in the corporation.

Conclusion

In conclusion, the statement of stockholders‘ equity is a crucial financial statement that summarizes changes in equity accounts over a period. As we have illustrated through several examples, creating this statement involves gathering ending account balances, listing opening balances, adding activity like new stock issuances and dividend declarations, and validating ending account amounts match the balance sheet.

Analyzing the statement provides insight into the sources of equity capital and impacts on shareholder value. For additional guidance, there are many free, editable templates available online to download and customize when constructing your company’s statement of stockholders’ equity. Careful preparation of this statement and review of equity changes will help assess financial strength and shareholder returns over time.

FAQs

Why is the statement of stockholders’ equity important?

The statement provides insight into what’s affecting the company’s net worth or shareholder value over a period. It helps investors and stakeholders understand how management is funding its operations—whether through issuing new shares, retaining profits, or buying back shares. Additionally, it sheds light on how much profit is reinvested in the business versus distributed as dividends.

What is accumulated other comprehensive income (AOCI)?

AOCI is a component of stockholders’ equity that captures unrealized gains and losses from certain items, such as foreign currency translation adjustments, pension plan adjustments, or unrealized gains and losses on available-for-sale securities. These items impact equity but are not included in net income until they’re realized.

Can stockholders’ equity be negative?

Yes, it’s possible for stockholders’ equity to be negative. This situation, known as a deficit, might occur if a company has accumulated more losses over time than profits or if it has paid out more in dividends than its cumulative earnings. A consistent negative equity can be a red flag for investors and creditors as it indicates potential insolvency or financial distress.

How does a stock split impact the statement of stockholders’ equity?

A stock split increases the number of shares outstanding without changing the overall value of equity. For instance, in a 2-for-1 split, each existing share would be divided into two. While the number of shares doubles, the total equity value remains the same. This action would be reflected in the common stock and possibly the APIC components of the equity statement, depending on the structure of the split.

How often is the statement of stockholders’ equity prepared and reported?

Typically, companies prepare the statement of stockholders’ equity quarterly and annually, in line with other financial statements. However, the frequency can vary based on regulatory requirements and the company’s internal policies.

What causes changes in stockholders’ equity?

Changes in stockholders’ equity can be due to a variety of factors, including:

- Net income or loss from the income statement

- Issuance or repurchase of shares

- Payment of dividends

- Adjustments due to other comprehensive income (like unrealized gains/losses from investments)

- Stock splits or stock dividends

- Other adjustments like corrections of errors from prior periods

What’s the difference between “authorized,” “issued,” and “outstanding” shares in the context of stockholders’ equity?

- Authorized shares refer to the maximum number of shares that a company is allowed to issue as per its charter.

- Issued shares are the actual number of shares a company has given out to shareholders, which may include shares that are later bought back.

- Outstanding shares are the shares currently held by shareholders, including both institutional investors and individual shareholders. It’s derived by subtracting treasury stock from issued shares.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Problem Statement Templates [PPT, Excel] Project, Business 2 Problem Statement](https://www.typecalendar.com/wp-content/uploads/2022/12/Problem-Statement-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2022/12/Problem-Statement-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)