For nonprofit organizations, having clear, accurate financial statements is crucial for maintaining accountability and compliance. Financial statements not only communicate how funds are spent and managed, but also are necessary for seeking funding opportunities and donor support. Crafting comprehensive, professional financial statements tailored to meet nonprofit standards requires an understanding of required elements like the statement of financial position, activities, cash flows and more.

Having templates and guides can make the process smoother for organizations focused on missions over money. This article will delve into the key components of nonprofit financial statements, provide guidance on best practices, and include downloadable templates to support transparent nonprofit finance reporting. With these tips, nonprofits can approach financial statements strategically and present their activities in an accessible manner for boards and the public.

Table of Contents

What is a nonprofit financial statement?

A nonprofit financial statement is a formal report that outlines the financial activities and position of a nonprofit organization. Nonprofit financial statements typically include a statement of financial position showing assets, liabilities, and net assets; a statement of activities detailing revenues and expenses; and a statement of cash flows.

These documents provide an overview of the nonprofit’s sources of income, how funds are spent, the programs and services offered, and the organization’s overall financial health. Nonprofit financial statements demonstrate transparency and accountability to the board, donors, regulatory agencies, and the general public.

Nonprofit Financial Statement Templates

Nonprofit Financial Statement Templates provide a standardized structure for reporting key financial metrics that nonprofit organizations require for oversight, planning, and grant applications. Maintaining well-organized Nonprofit Financial Statement Templates ensures consistent bookkeeping and simplified reporting.

Nonprofit Financial Statement Templates include formatted documents for tracking revenues, expenditures, assets, liabilities, and net assets by program and funding source. Standard statements like the Statement of Financial Position, Activities, Cash Flows, and Functional Expenses simplify annual reporting consistency. Built-in calculations and analysis tools provide insights.

For nonprofits, having Nonprofit Financial Statement Templates instituted organization-wide promotes uniformity and efficiencies in fiscal management. Templates allow customization to capture metrics most relevant to the organization’s mission and operations. The clarity of routine reporting using Nonprofit Financial Statement Templates assists board governance and aids in securing donor funding through transparency.

Why do nonprofits need financial statements?

Nonprofit organizations, like their for-profit counterparts, require financial statements to provide an accurate representation of their financial position and operations. These statements are not only essential for internal management but are also crucial for various stakeholders associated with the organization. Here are detailed reasons why nonprofits need financial statements:

- Transparency and Accountability:

- Given that nonprofits usually rely on donations, grants, and public funding, there’s a moral and sometimes legal obligation to show how these funds are being utilized. Financial statements ensure that there’s transparency in how the funds are spent.

- They provide a clear picture of where the money comes from and where it goes, fostering trust with donors, volunteers, and the community at large.

- Internal Decision Making:

- Management and the board can use financial statements to make informed decisions about budgeting, programming, and strategy.

- They offer insights into the organization’s health, revealing trends in revenue and expenses, which can be used to anticipate future financial needs or challenges.

- Regulatory Compliance:

- Many jurisdictions require nonprofits to submit financial statements to regulatory bodies annually. This ensures that the organization is adhering to financial management standards and is not engaged in fraudulent activities.

- In some areas, if the nonprofit exceeds a certain size or funding threshold, it might also be required to undergo an external audit. The audit process will review these financial statements.

- Funding and Grant Applications:

- Grant-making bodies often ask for financial statements as part of the application process. They use this information to determine the financial health of an applicant and to ensure that funds will be used appropriately.

- Financial statements provide evidence that the nonprofit is a good steward of its resources, increasing the chances of securing funding.

- Donor Confidence:

- Prospective donors often review financial statements to determine whether a nonprofit is a worthy recipient of their funds.

- An organization with healthy financial statements and clear, transparent reporting is likely to attract more donors, as they can be assured that their contributions will be used effectively.

- Financial Planning:

- Financial statements can help organizations identify areas of financial strength and weakness. This assists in strategic planning, helping ensure long-term sustainability.

- They also provide historical data, which can be useful when forecasting future financial scenarios or setting future budgets.

- Stakeholder Communication:

- Various stakeholders, including employees, beneficiaries, and partners, may have an interest in the organization’s financial health. Financial statements are a standardized way of communicating this information.

- They provide a consistent benchmark over time, helping stakeholders understand how the organization is evolving financially.

- Risk Management:

- Regularly produced financial statements can help identify unusual trends or inconsistencies, which might indicate errors, fraud, or other financial risks.

- Early detection can prevent small issues from becoming significant crises.

Key components of nonprofit financial statements

Nonprofit financial statements, while bearing similarities to those of for-profit entities, have unique components that reflect the organization’s specific focus on mission rather than profit. Here are the key components of nonprofit financial statements, detailed for better understanding:

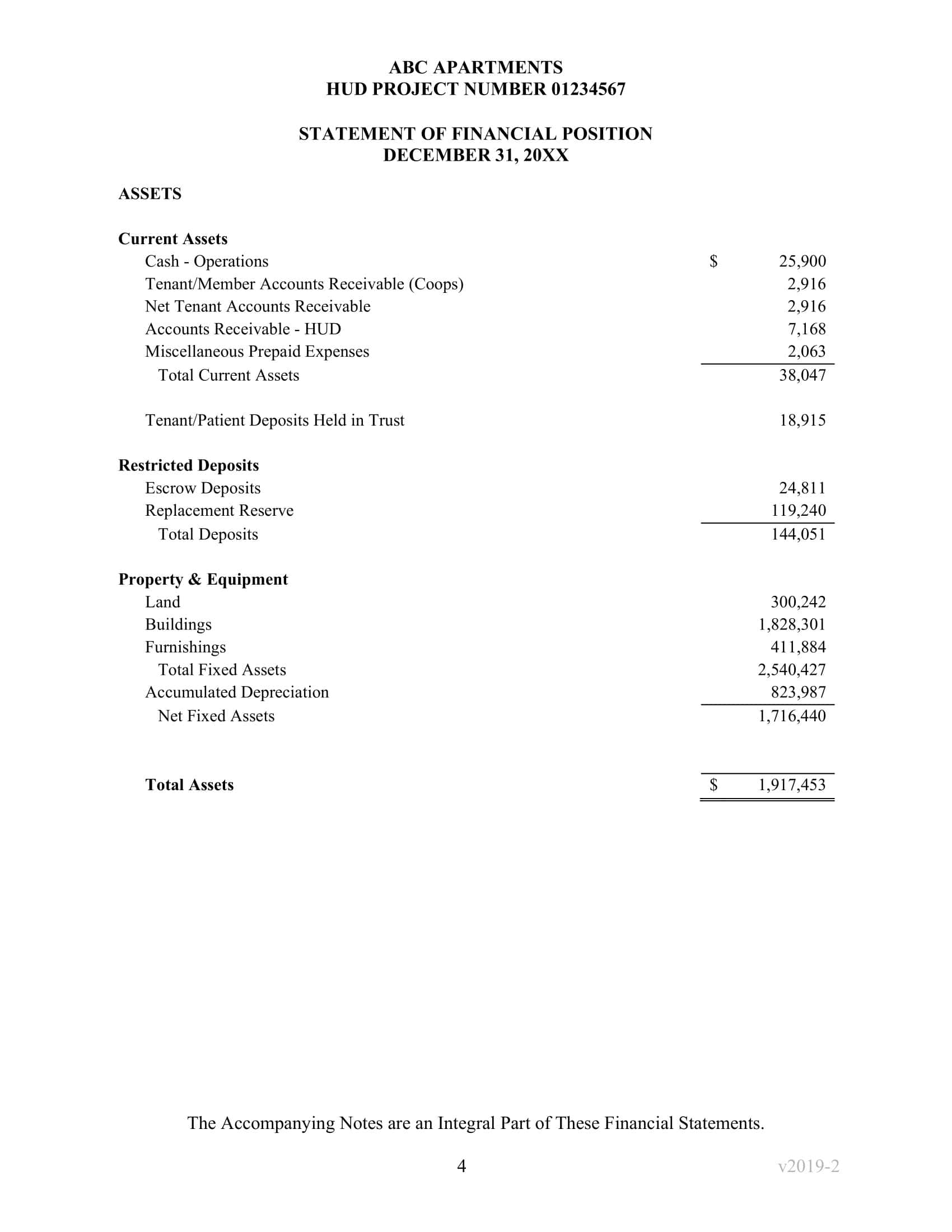

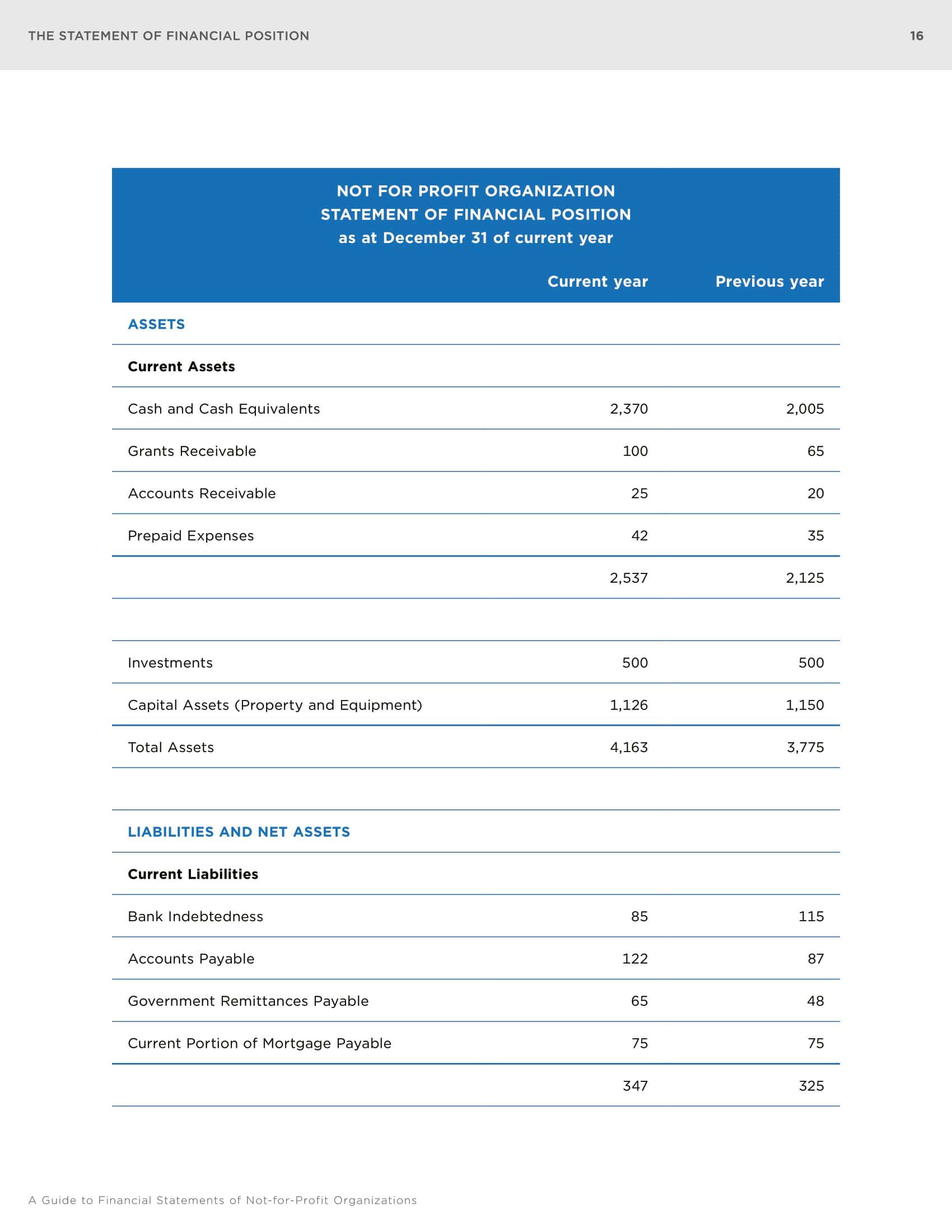

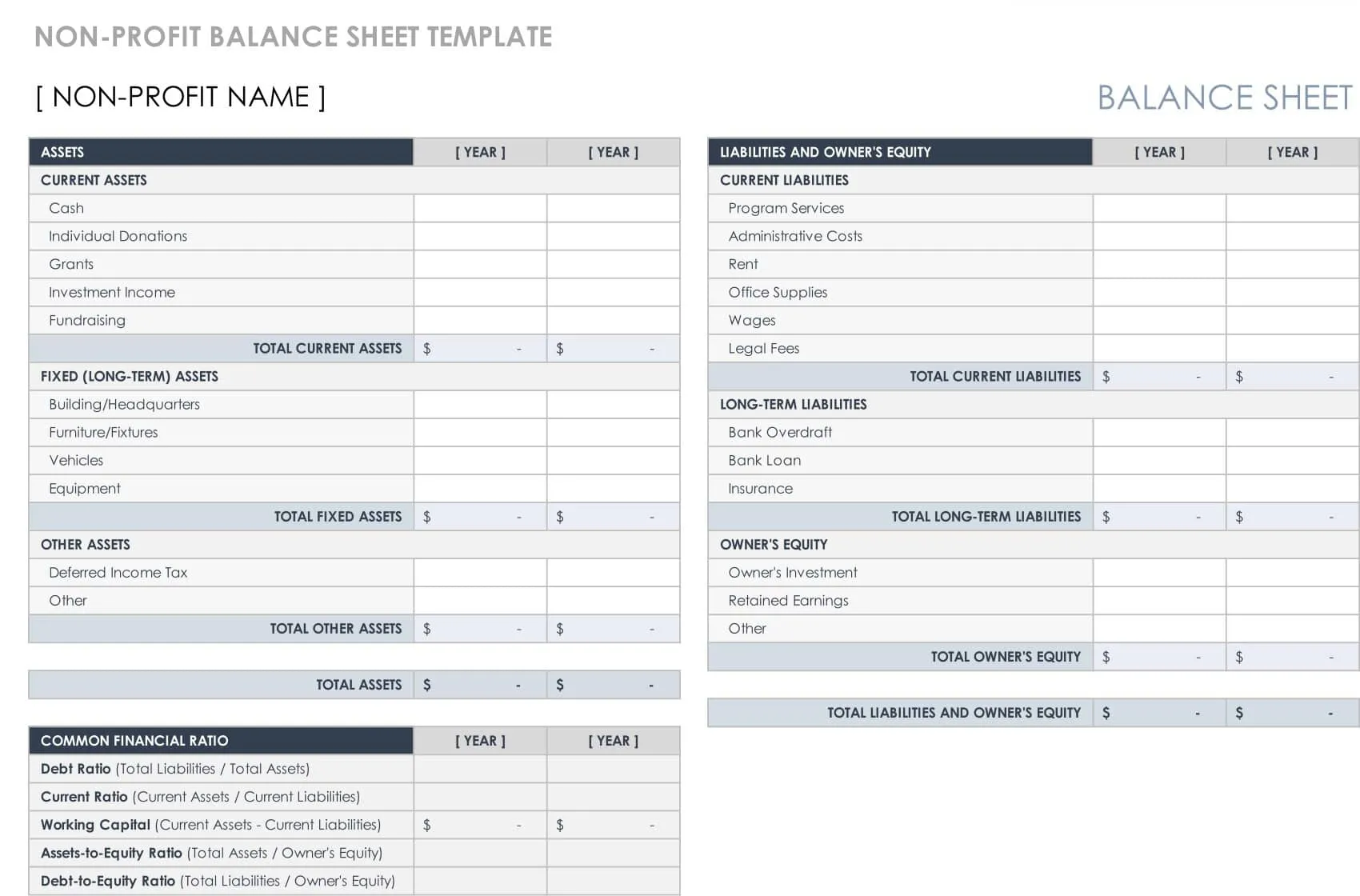

- Statement of Financial Position (Balance Sheet):

- Assets: These are resources owned or controlled by the nonprofit. They can be:

- Current Assets: Expected to be converted to cash or used up within a year, e.g., cash, accounts receivable, and inventory.

- Non-Current Assets: Long-term assets, e.g., property, plant, equipment, and long-term investments.

- Liabilities: These are the organization’s debts and obligations. Like assets, they can be:

- Current Liabilities: Due within a year, e.g., accounts payable and short-term loans.

- Non-Current Liabilities: Due in more than a year, e.g., long-term loans and mortgage payables.

- Net Assets: This represents the residual interest in the organization’s assets after deducting liabilities. It’s categorized into:

- Without Donor Restrictions: Funds that can be used at the organization’s discretion.

- With Donor Restrictions: Funds restricted for a specific purpose or time by the donor.

- Assets: These are resources owned or controlled by the nonprofit. They can be:

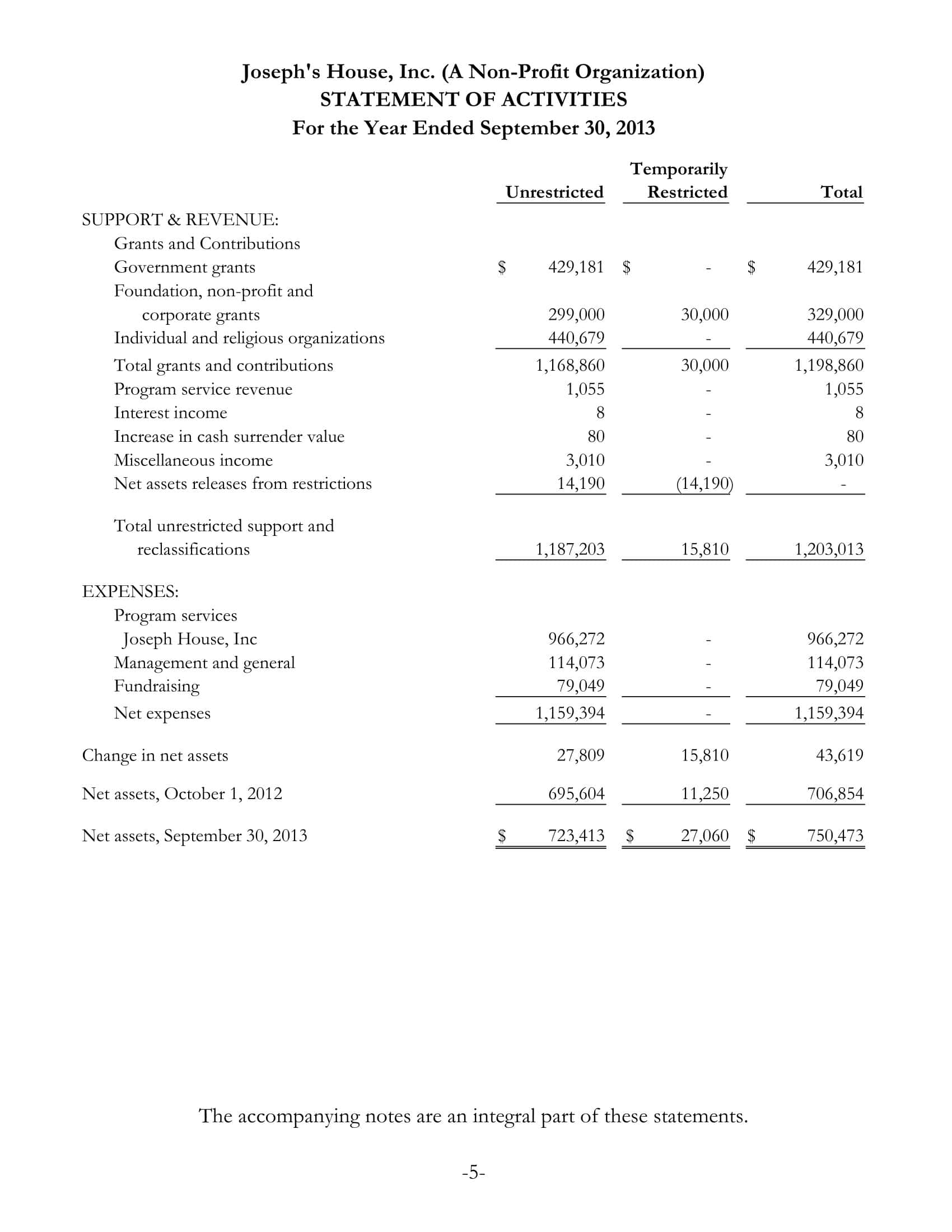

- Statement of Activities (Income Statement):

- Revenues and Support: These represent inflows of resources. They include:

- Contributions: Donations received from individuals, corporations, foundations, etc.

- Grants: Funds received from governmental or other organizations for specific purposes.

- Membership Dues: Fees received from members.

- Program Service Revenue: Income from the main activities of the nonprofit, e.g., ticket sales by a theater group.

- Investment Income: Income from investments, e.g., dividends and interest.

- Expenses: Outflows or usage of resources. These are typically categorized by function:

- Program Services: Costs directly related to the nonprofit’s main activities.

- Supporting Services: These are divided into:

- Management and General: Overhead and administrative costs.

- Fundraising: Costs related to raising contributions and grants.

- Change in Net Assets: This is the difference between revenues and expenses, reflecting the increase or decrease in net assets for the period.

- Revenues and Support: These represent inflows of resources. They include:

- Statement of Cash Flows:

- Details the sources and uses of cash and is categorized into:

- Operating Activities: Core revenue-producing activities of the organization.

- Investing Activities: Buying and selling assets like property and equipment or investments.

- Financing Activities: Cash transactions with the organization’s donors or creditors.

- This statement provides insights into the nonprofit’s ability to generate positive cash flow and meet its obligations.

- Details the sources and uses of cash and is categorized into:

- Statement of Functional Expenses:

- This is unique to nonprofits and offers a detailed breakdown of expenses by both function (program services, management & general, fundraising) and nature (salaries, rent, utilities).

- It provides transparency into how resources are allocated and spent.

- Notes to Financial Statements:

- These offer additional information to clarify and support the figures presented in the financial statements. They can include:

- Accounting policies adopted by the organization.

- Details on specific line items, e.g., property, investments.

- Information on commitments, contingencies, and subsequent events.

- Breakdown of expenses with and without donor restrictions.

- These offer additional information to clarify and support the figures presented in the financial statements. They can include:

Understanding Revenue in Nonprofits

A nonprofit’s revenue sources are the lifeblood that sustains its ability to fulfill its mission. But nonprofit revenue can have unique complexities and restrictions compared to for-profit businesses. Beyond just earned income, charitable nonprofits rely on diverse sources like donations, grants, government contracts, investments, and fundraising/events, among others. Each revenue stream has its own accounting treatments, trailing requirements, and financial impacts.

Having clarity on the various nonprofit revenue categories, terminology, and how these incomes affect statements is key for strategic planning and accurate finance management. This overview will delve into the main nonprofit revenue types, revenue recognition policies, conditional vs. unconditional revenues, and what revenues signify for organizations. Understanding the core principles around nonprofit revenues empowers leadership to make smart funding decisions and set their nonprofits up for sustainable success.

Donations and Grants

For many nonprofits, donations and grants constitute a significant portion of their revenue. Donations can come from individuals, corporations, or other entities, often driven by the desire to support the organization’s mission. These donations may be one-time gifts or recurring contributions, and they can vary in amount from a few dollars to significant sums. Grants, on the other hand, are typically funds provided by foundations, government agencies, or other institutions for specific purposes or projects. While grants can bring in considerable amounts, they often come with strings attached, requiring the nonprofit to meet certain criteria or report on how the funds are used.

Fundraising Events

Fundraising events are public or private activities organized to generate revenue for nonprofit organizations. These events can range from galas, auctions, and dinners to walkathons, concerts, or bake sales. While they serve as a mechanism to raise funds, they also play a crucial role in raising awareness, building community, and fostering a sense of camaraderie among supporters. It’s important to note that while such events can be lucrative, they also involve costs and extensive planning, and their net revenue should be carefully assessed against the effort and resources expended.

Membership Dues

For nonprofits that operate membership models, such as clubs, associations, or societies, membership dues are a primary revenue stream. These dues are fees that members pay, either annually or on another regular basis, in exchange for benefits, services, or simply to support the organization’s work. The structure and amount of these dues can vary widely depending on the organization’s objectives, the value proposition for members, and the targeted demographic. In some cases, these dues might also grant members voting rights or other forms of participation in the organization’s governance.

Program Service Fees

Many nonprofits offer services or programs that come with associated fees. For instance, a nonprofit educational institution might charge tuition, or a health-focused nonprofit might charge patients for medical services. These program service fees serve a dual purpose. Firstly, they help the organization cover the costs of delivering the particular service. Secondly, they ensure that the service reaches those who truly value it. However, it’s essential for nonprofits to strike a balance, ensuring that fees don’t become a barrier to access for those they aim to serve.

More on Nonprofit Revenue

Beyond the mentioned avenues, nonprofits can explore other revenue streams. For example, some nonprofits generate income through sales of products, whether these are merchandise, publications, or other goods related to their mission. Others might leverage their assets by renting out space or equipment. Sponsorships, partnerships with for-profit entities, and endowment income can also play roles in diversifying revenue. It’s crucial for nonprofits to have multiple revenue streams to ensure financial stability and resilience, especially in changing economic climates.

Expenses in Nonprofit Financial Statements

For any nonprofit, effectively and ethically managing expenses is crucial to both executing the mission and upholding public trust. The expenses detailed in a nonprofit’s financial statements provide critical insights into how judiciously the entity utilizes its financial resources. Statements should strike a balance between spending necessary amounts to drive impact while maintaining reasonable overhead costs and minimizing waste.

Distinguishing between program, administrative, and fundraising expenses paints a full picture of where donated funds are applied. Evaluating year-over-year spending also informs strategic planning to keep expenses aligned with revenues. With tight margins, nonprofits must be able to justify that every dollar spent, whether on salaries, supplies, travel, or other costs, serves the organizational purpose. This overview will explore best practices in nonprofit expense reporting to support informed analysis and decision making.

Program Expenses: Program expenses, also known as program services expenses, are costs directly tied to a nonprofit’s primary mission. These are the funds spent on actual charitable, educational, service, or other activities that fulfill the organization’s purpose. For example, an animal rescue nonprofit would allocate funds to rescue operations, medical care, and rehoming initiatives as part of its program expenses. Evaluating these expenses can offer insights into how efficiently a nonprofit is channeling its resources towards its central mission. A high percentage of total expenses directed at program services is often seen positively, indicating that most of the organization’s funds are directly serving its cause.

Administrative Expenses: Administrative expenses, sometimes referred to as general or management expenses, are the costs associated with the overall function and governance of the nonprofit. These costs aren’t directly linked to program services but are essential for the organization to run smoothly. Administrative expenses include salaries of executive staff, office rent, utilities, and supplies not used in direct service delivery, and other overhead costs. While necessary, it’s vital for nonprofits to manage these expenses, ensuring they don’t consume a disproportionate share of the budget. Donors often scrutinize the ratio of administrative to program expenses to assess the efficiency of a nonprofit’s operations.

Fundraising Expenses: Fundraising expenses encompass the costs incurred while mobilizing financial resources for the organization. These can include the production and postage of fundraising materials, costs of organizing fundraising events, salaries of fundraising staff, and any other expenses directly related to donor outreach and engagement efforts. While investing in fundraising is crucial to ensure a steady inflow of revenue, it’s also essential for nonprofits to monitor the return on investment. A high fundraising expense without a corresponding increase in donations might signal inefficiencies. Donors and financial analysts often evaluate the fundraising efficiency ratio, which divides fundraising expenses by total contributions, to gauge how effectively a nonprofit is converting fundraising efforts into actual donations.

How to Create Financial Statements for a Non Profit Organization

Creating accurate financial statements for a nonprofit is essential for transparency, trustworthiness, and financial management. Here’s a step-by-step guide to help you through the process:

Step 1: Gather Relevant Financial Data

Start by collecting all relevant financial data for the period you’re reporting on. This includes bank statements, invoices, receipts, payroll data, donation records, and any other financial transactions.

Example: If you’re preparing an annual statement for 2023, you’d gather all transaction records from January 1, 2023, to December 31, 2023.

Step 2: Segregate Data into Relevant Categories

Sort the data into categories like revenue (donations, grants, service fees, etc.) and expenses (program-related, administrative, fundraising, etc.).

Example: All monies received from fundraising events would be categorized under “Fundraising Revenue.”

Step 3: Prepare the Statement of Financial Position (Balance Sheet)

This statement provides a snapshot of the organization’s assets, liabilities, and net assets at a specific point in time.

Example: List out current assets like cash ($20,000), accounts receivable ($5,000), and property ($50,000). Similarly, note down liabilities like accounts payable ($3,000). The net assets would be the difference between total assets and total liabilities.

Step 4: Create the Statement of Activities (Income Statement)

Detail your revenues and expenses over a period (e.g., a fiscal year), showing the change in net assets.

Example: If you started the year with net assets of $50,000, earned revenue of $30,000, and incurred expenses of $20,000, your ending net assets would be $60,000.

Step 5: Draft the Statement of Cash Flows

This statement shows how changes in the balance sheet and income statement affect cash and cash equivalents. It breaks down operations, investing, and financing activities.

Example: If your nonprofit sold an asset, the proceeds would appear under “cash flows from investing activities.”

Step 6: Include Notes to the Financial Statements

These provide additional details and context for the data in the financial statements. Notes can clarify accounting methods, commitments, contingent liabilities, or any significant events that might impact financials.

Example: If you adopted a new accounting method that fiscal year, you’d detail this in the notes.

Step 7: Review and Ensure Compliance

Ensure that your financial statements adhere to the Generally Accepted Accounting Principles (GAAP) and any other relevant regulations or standards.

Example: If a new accounting standard was released that year regarding how grants should be recorded, make sure your statement complies.

Step 8: Get an External Audit (If Applicable)

While not all nonprofits require an external audit, larger ones or those receiving certain types of government funding might. An audit provides an added layer of assurance on the accuracy of financial statements.

Example: Hire a CPA firm to review your financial statements and provide an auditor’s opinion on their accuracy and compliance.

Step 9: Present to Stakeholders

Once finalized, share your financial statements with key stakeholders, like your board of directors, donors, grant-making entities, and the general public, as needed.

Example: During your annual board meeting, provide each member with a copy of the financial statements, offering them a chance to review, ask questions, and provide feedback.

Step 10: File with Relevant Authorities

Depending on your jurisdiction, you may need to file your financial statements with regulatory bodies, especially if you’re a registered charity.

Example: In the U.S., many nonprofits have to file a Form 990 with the IRS, detailing their financials.

Challenges and Common Issues in Nonprofit Financial Statements

Complex Revenue Recognition: In the nonprofit sector, revenue recognition can be more intricate than in the for-profit realm due to the diversity of funding sources and conditions attached to them. Organizations often receive grants, donations, and pledges with stipulations on when and how the funds should be used. This creates a challenge in determining when to recognize these funds as revenue. For example, a grant awarded to a nonprofit may stipulate that funds can only be used in the following fiscal year. Even though the organization receives the money this year, it cannot recognize it as revenue until the next year when it’s used as stipulated.

In-kind Donations: In-kind donations refer to contributions of goods or services rather than cash. These can range from physical items like equipment and supplies to services like pro bono consulting or advertising. The challenge here lies in accurately valuing these donations. Nonprofits need to assign a fair market value to in-kind contributions, which can be subjective, especially for specialized services or unique items. For instance, if an artist donates a piece of artwork for an auction, the nonprofit must determine its market value for both recognition in financial statements and for the donor’s potential tax deduction.

Endowment Funds and Restrictions: Endowment funds are donations made to nonprofits with the stipulation that the principal amount is preserved and only the income generated from investing the principal can be used. This presents multiple challenges. First, there’s the task of ensuring and tracking that the principal remains untouched. Then, nonprofits must distinguish between temporarily restricted net assets (funds to be used in a specific time frame or for a particular purpose) and permanently restricted net assets (the principal of endowments). Moreover, fluctuations in the value of the invested endowment due to market dynamics can complicate the financial reporting process. For instance, if an endowment’s investments lose value, it could dip below the original principal, raising questions about how to report and manage the deficit.

In essence, the unique nature of nonprofit operations and funding mechanisms introduces complexities not typically seen in standard for-profit financial statements. These challenges necessitate specialized knowledge and careful attention to ensure that financial statements are accurate, compliant, and reflective of the organization’s true financial position.

Conclusion

A nonprofit’s financial statements tell the story of how successfully it is advancing its mission and sustaining operations. More than just documents for compliance, thoughtfully crafted financial statements are essential for transparency, strategic planning, and funding efforts. By understanding the key components like position statements, activities statements, cash flow, and expenses/revenues, nonprofit leaders can accurately showcase their organization’s financial health.

Utilizing the reporting best practices and template guidance provided empowers nonprofits to produce financial statements tailored to their programs and needs. Though finance management may not be a nonprofit’s main focus, dedicating time to polish these critical documents pays dividends when it comes to oversight, public assurance, and funding opportunities. Financial statements prepared with care and accuracy help nonprofits continue changing lives and making a difference.

Nonprofit Financial Statement Examples

Nonprofit Organization Name

Statement of Financial Position

| Assets | Current Year | Previous Year |

| Current Assets: | ||

| – Cash and Cash Equivalents | $XXXXX | $XXXXX |

| – Accounts Receivable | $XXXXX | $XXXXX |

| Non-Current Assets: | ||

| – Property, Plant, and Equipment | $XXXXX | $XXXXX |

| Total Assets | $XXXXX | $XXXXX |

| Liabilities and Net Assets | Current Year | Previous Year |

| Current Liabilities: | ||

| – Accounts Payable | $XXXXX | $XXXXX |

| Non-Current Liabilities: | ||

| – Long-Term Debt | $XXXXX | $XXXXX |

| Total Liabilities | $XXXXX | $XXXXX |

| Net Assets: | ||

| – Unrestricted | $XXXXX | $XXXXX |

| – Temporarily Restricted | $XXXXX | $XXXXX |

| – Permanently Restricted | $XXXXX | $XXXXX |

| Total Net Assets | $XXXXX | $XXXXX |

| Total Liabilities and Net Assets | $XXXXX | $XXXXX |

Statement of Activities

| Activities | Current Year | Previous Year |

| Revenues: | ||

| – Donations and Grants | $XXXXX | $XXXXX |

| – Fundraising Events | $XXXXX | $XXXXX |

| Expenses: | ||

| – Program Expenses | $XXXXX | $XXXXX |

| – Administrative Expenses | $XXXXX | $XXXXX |

| – Fundraising Expenses | $XXXXX | $XXXXX |

| Net Income (Revenue – Expenses) | $XXXXX | $XXXXX |

Statement of Cash Flows

Notes to Financial Statements

1. Note on Accounting Policies

Description about the nonprofit’s accounting policies.

2. Note on Donations

Description about donation types and amounts.

Nonprofit Organization Address | Phone | Email

FAQs

How is a nonprofit financial statement different from a for-profit’s financial statement?

While there are similarities in the basic principles of accounting, nonprofit financial statements focus on accountability to stakeholders rather than profitability. For instance, nonprofits report net assets rather than equity and classify these assets based on restrictions (unrestricted, temporarily restricted, and permanently restricted).

How often should a nonprofit prepare financial statements?

Ideally, nonprofits should prepare internal financial statements monthly or quarterly for management purposes. However, externally, annual financial statements are standard, often accompanying required annual filings.

Are all nonprofits required to get an audit?

No, not all nonprofits need an audit. The requirements vary based on the size of the organization, the amount of funding they receive, and specific state or grant-imposed criteria. However, larger nonprofits or those with significant public funding typically undergo external audits.

What role does the board play in a nonprofit’s financial statements?

The board of directors of a nonprofit has a fiduciary duty to ensure the organization is financially sound and that its resources are used appropriately. They review, approve, and provide oversight on financial statements and budgets.

Why is revenue recognition complex in nonprofit financial statements?

Revenue recognition in nonprofits is intricate due to the varied sources of funding and the conditions donors often attach. Grants, pledges, and donations may come with stipulations on usage or timeframes, making it challenging to determine when to recognize these as revenue.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)