For independent contractors and self-employed professionals, getting paid for your services requires clear communication with clients about billing policies and payment expectations. Simply providing a price quote and waiting for the client to pay after completing work often leads to delays, confusion, and added effort chasing down invoices.

A better solution is to send clients a professional self-employed invoice upfront that outlines your billing processes and payment terms. A well-designed self-employed invoice displays important information like work description, rates, taxes, payment methods, and due date in an organized, easy-to-understand format. In this article, we’ll look at best practices for creating effective self-employed invoices as well as provide downloadable self-employed invoice templates to simplify and standardize your billing.

Table of Contents

What Is a Self-Employed Invoice?

![Free Printable Self-Employed Invoice Templates [Word, PDF] Hours Worked 1 Self Employed Invoice](https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice-640x360.jpg 640w, https://www.typecalendar.com/wp-content/uploads/2023/09/Self-Employed-Invoice-1200x675.jpg 1200w)

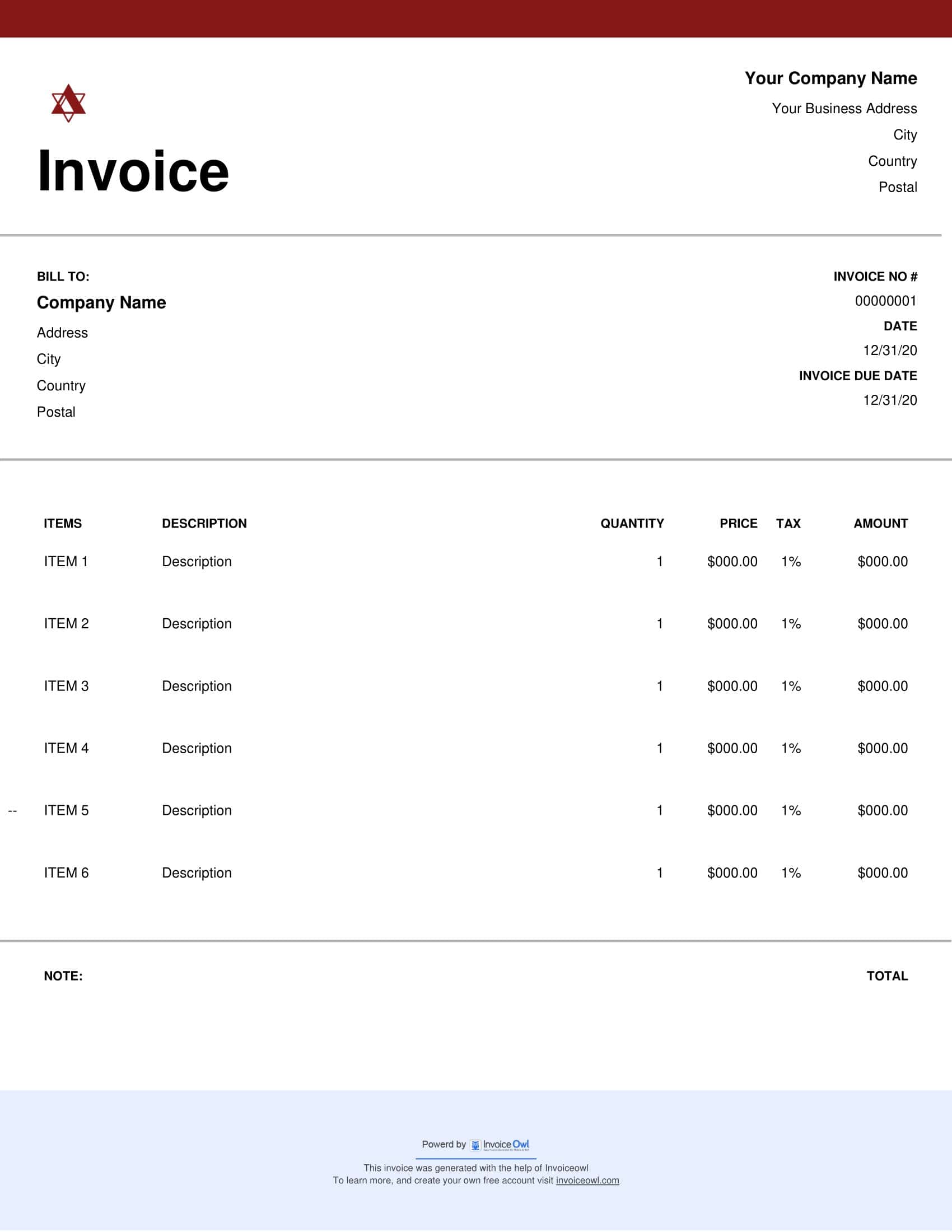

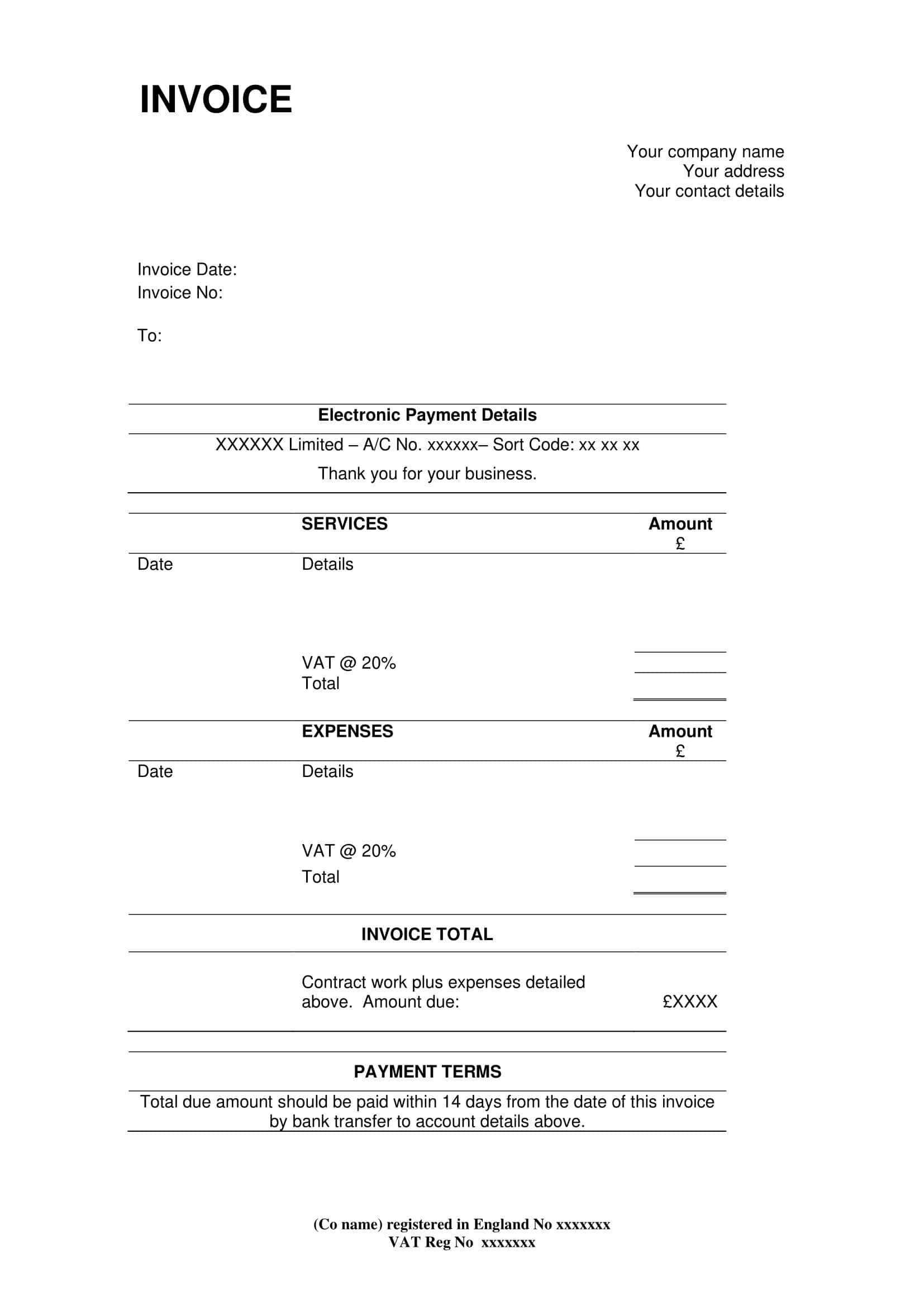

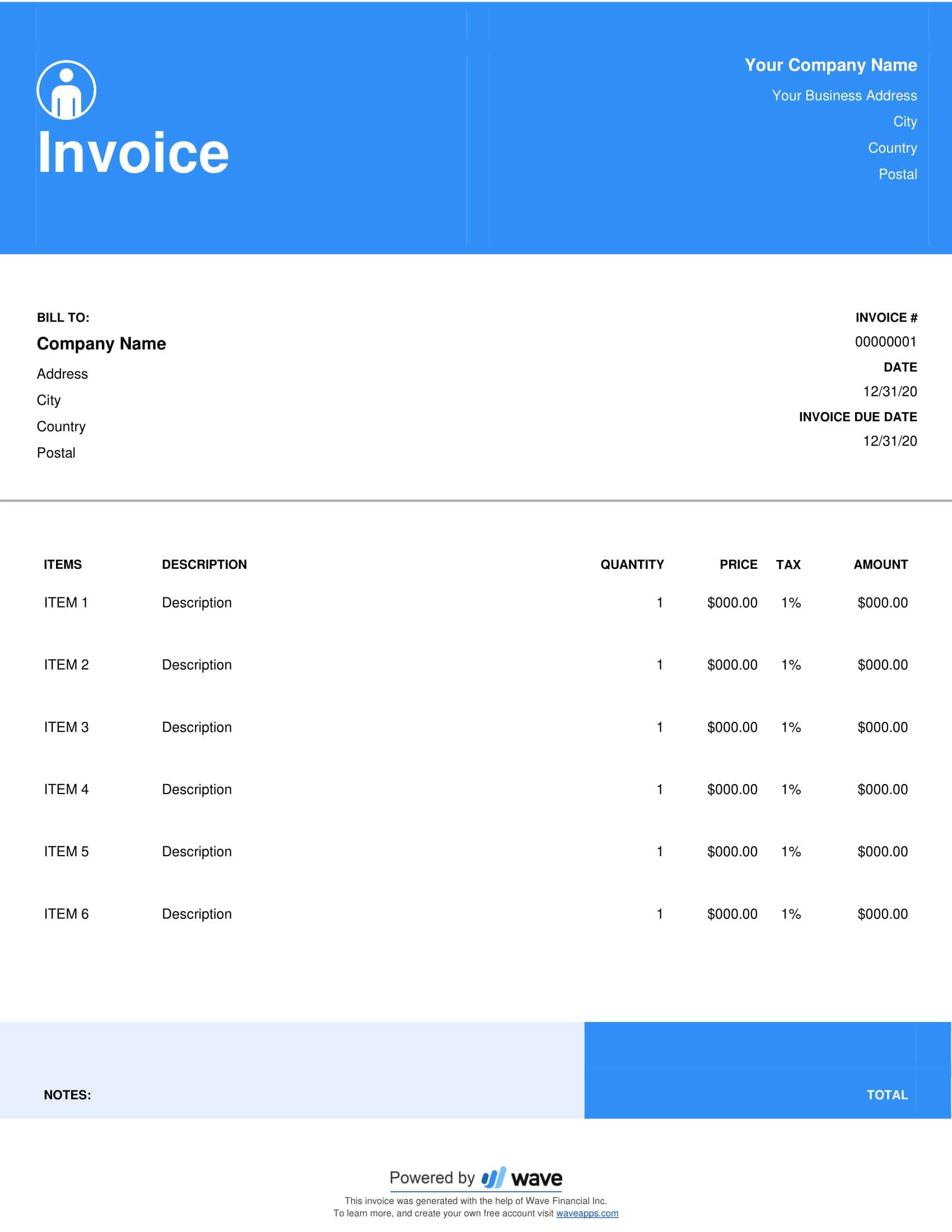

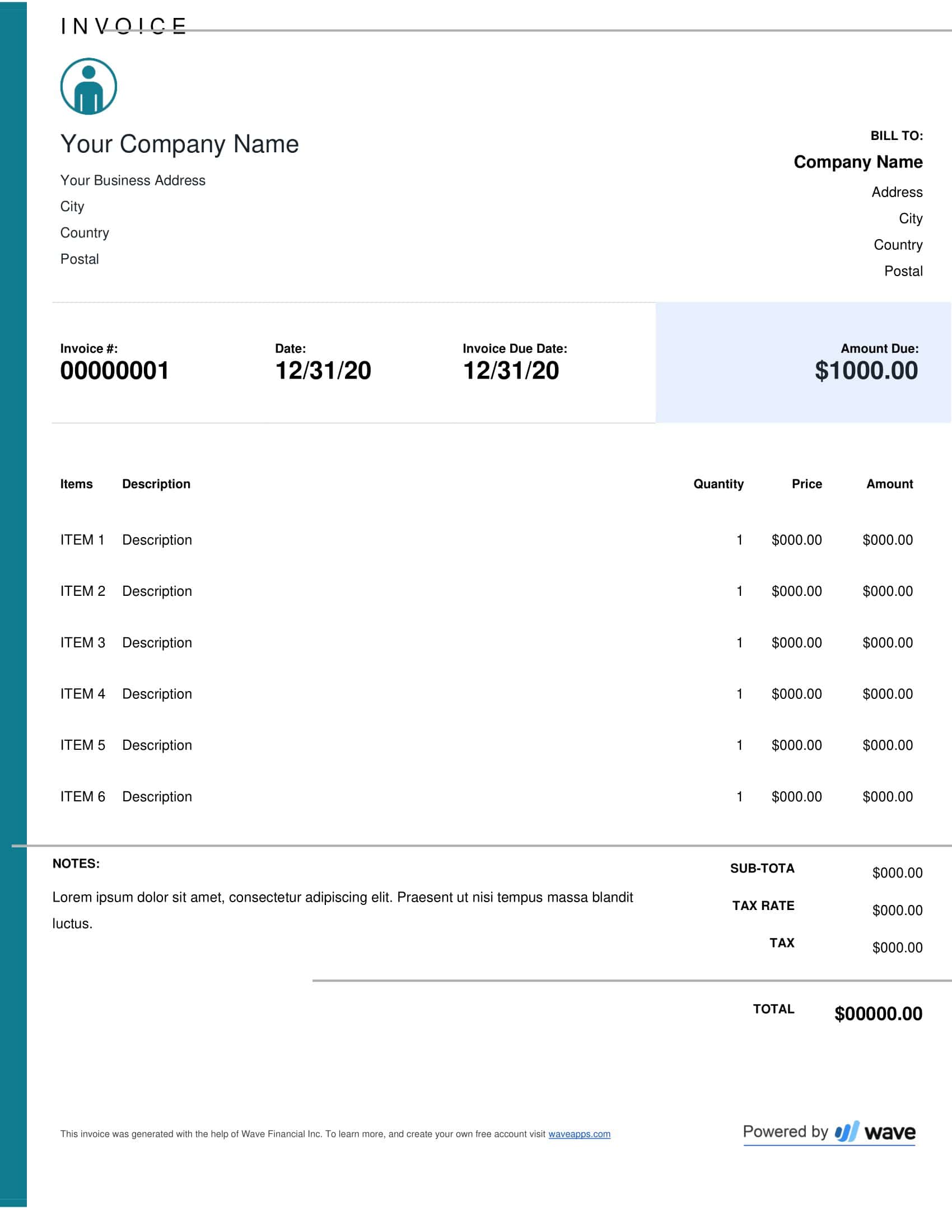

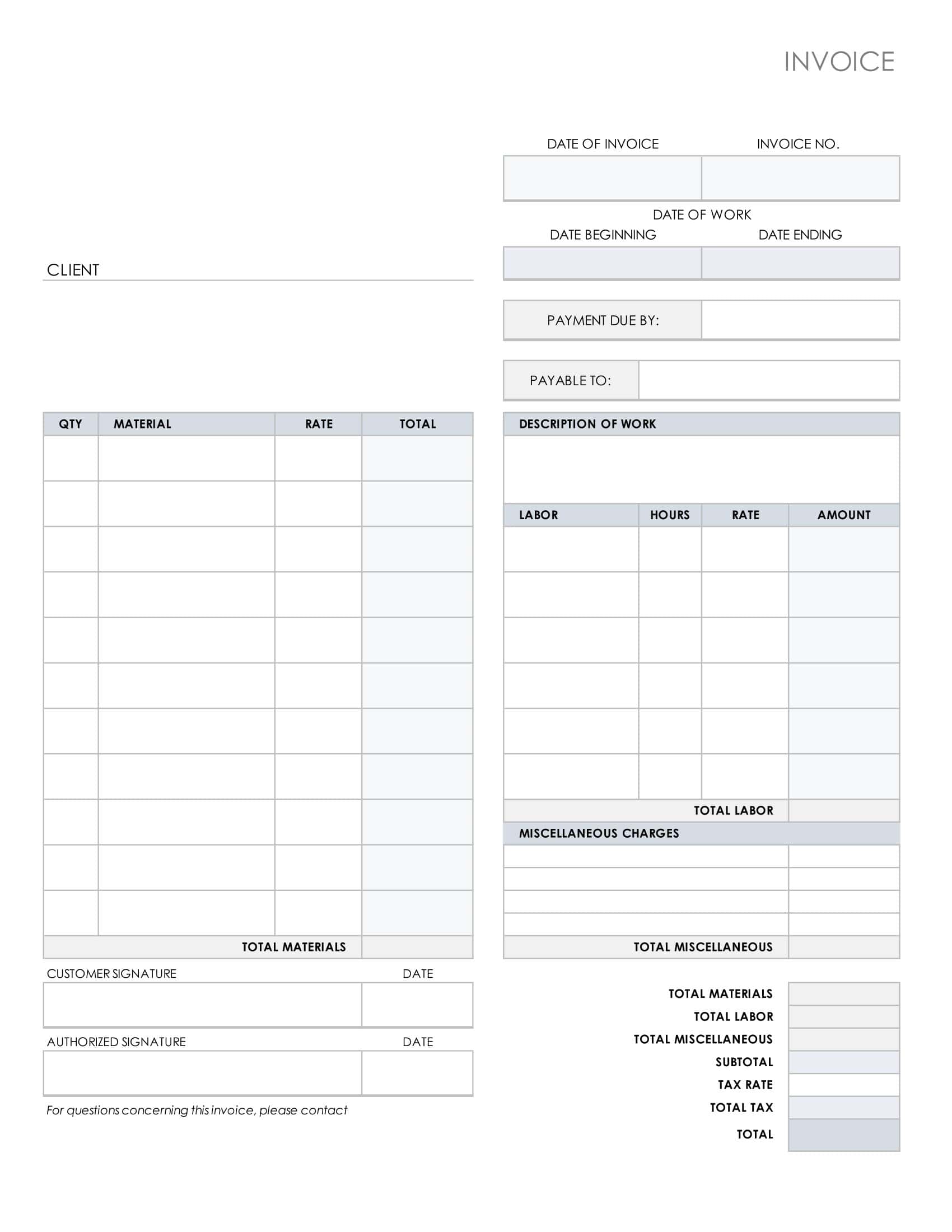

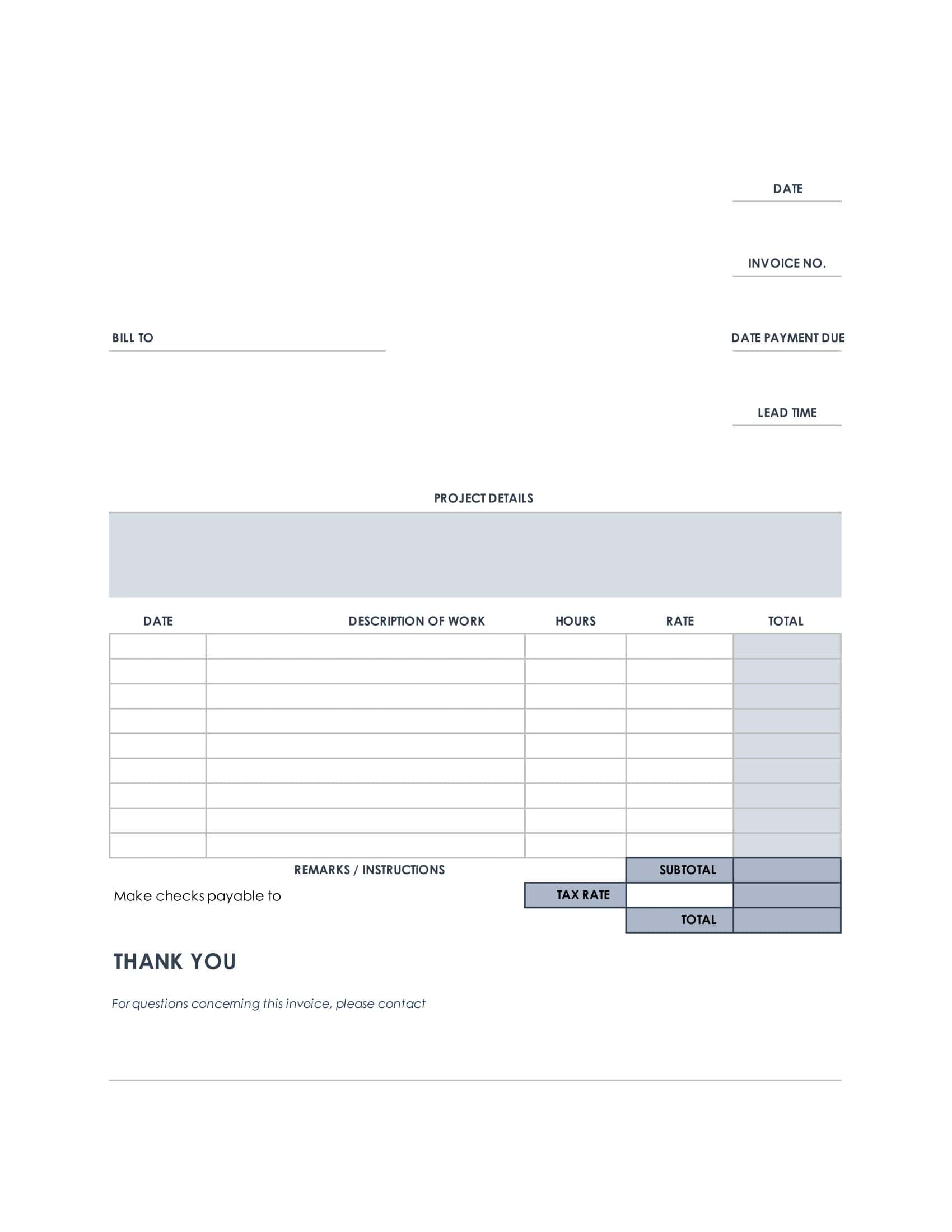

A self-employed invoice is a bill that independent contractors and freelance professionals send to clients to request payment for services provided. It documents important details like the service, hourly rate or project fee, taxes, expenses, payment terms, due date, and contractor’s information. Sending professional invoices allows self-employed individuals to clearly communicate their billing processes, get paid promptly, and create documentation for their records. For clients, receiving an invoice clarifies the expected payment amount and timeline. Well-designed self-employed invoice templates allow contractors to quickly generate polished, customized invoices that present all the pertinent details to clients in an organized format.

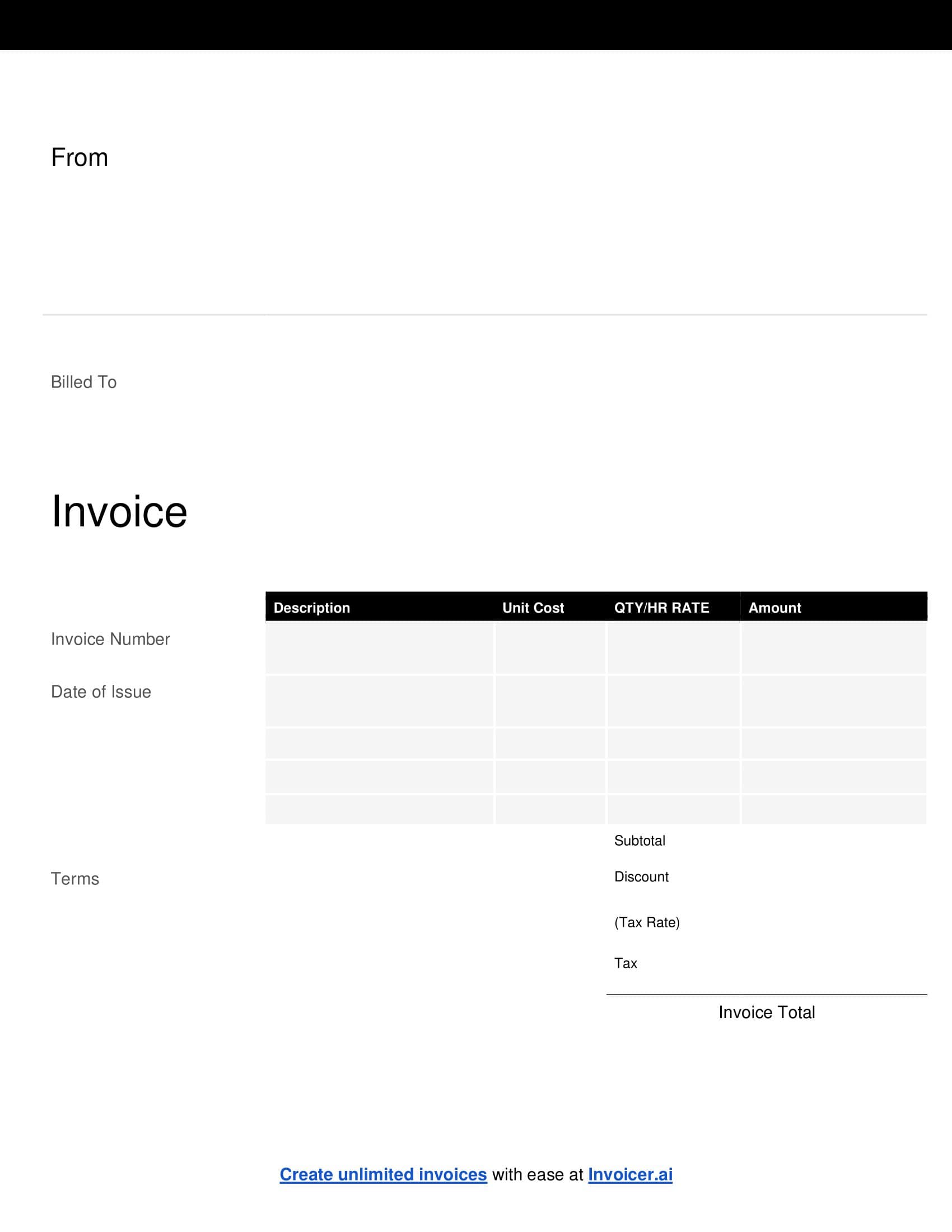

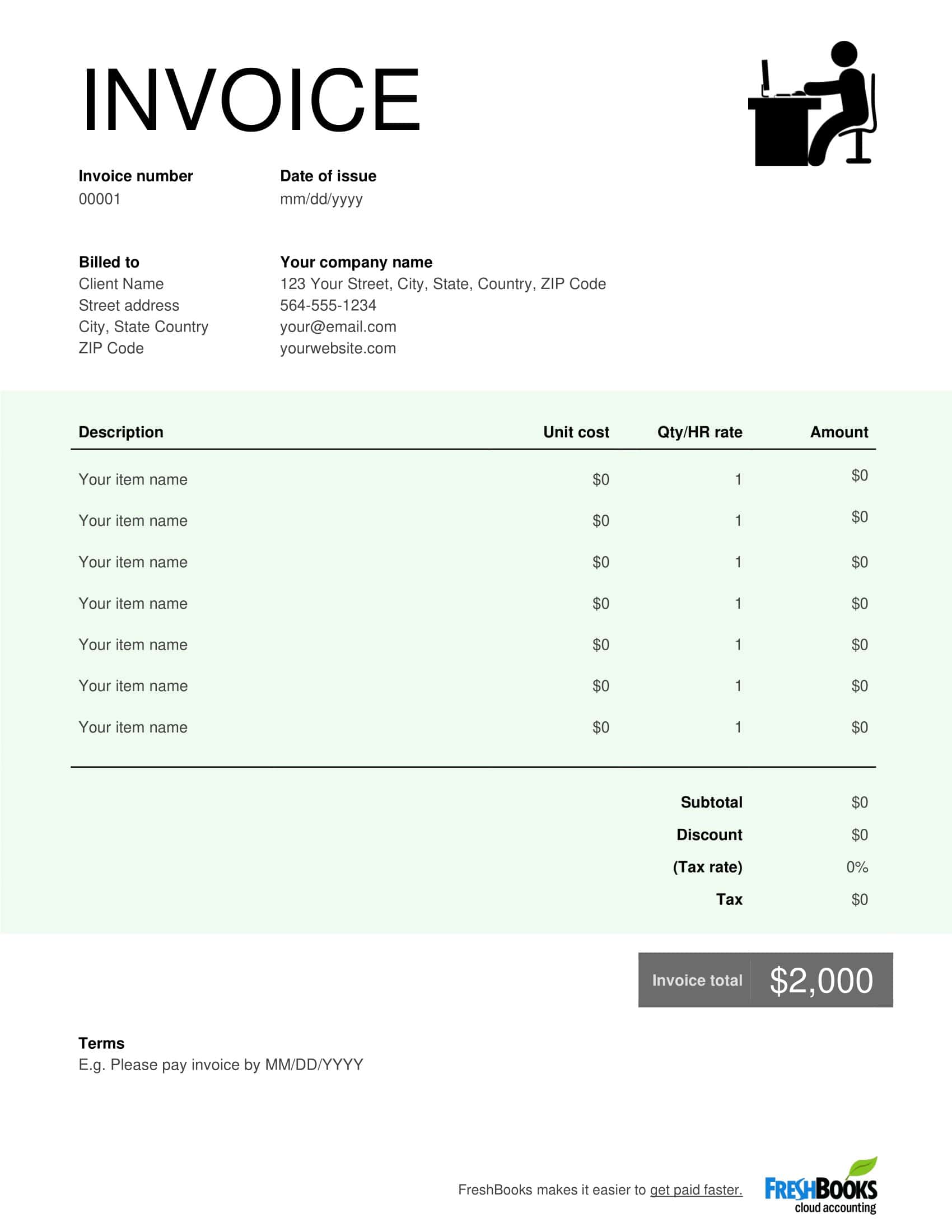

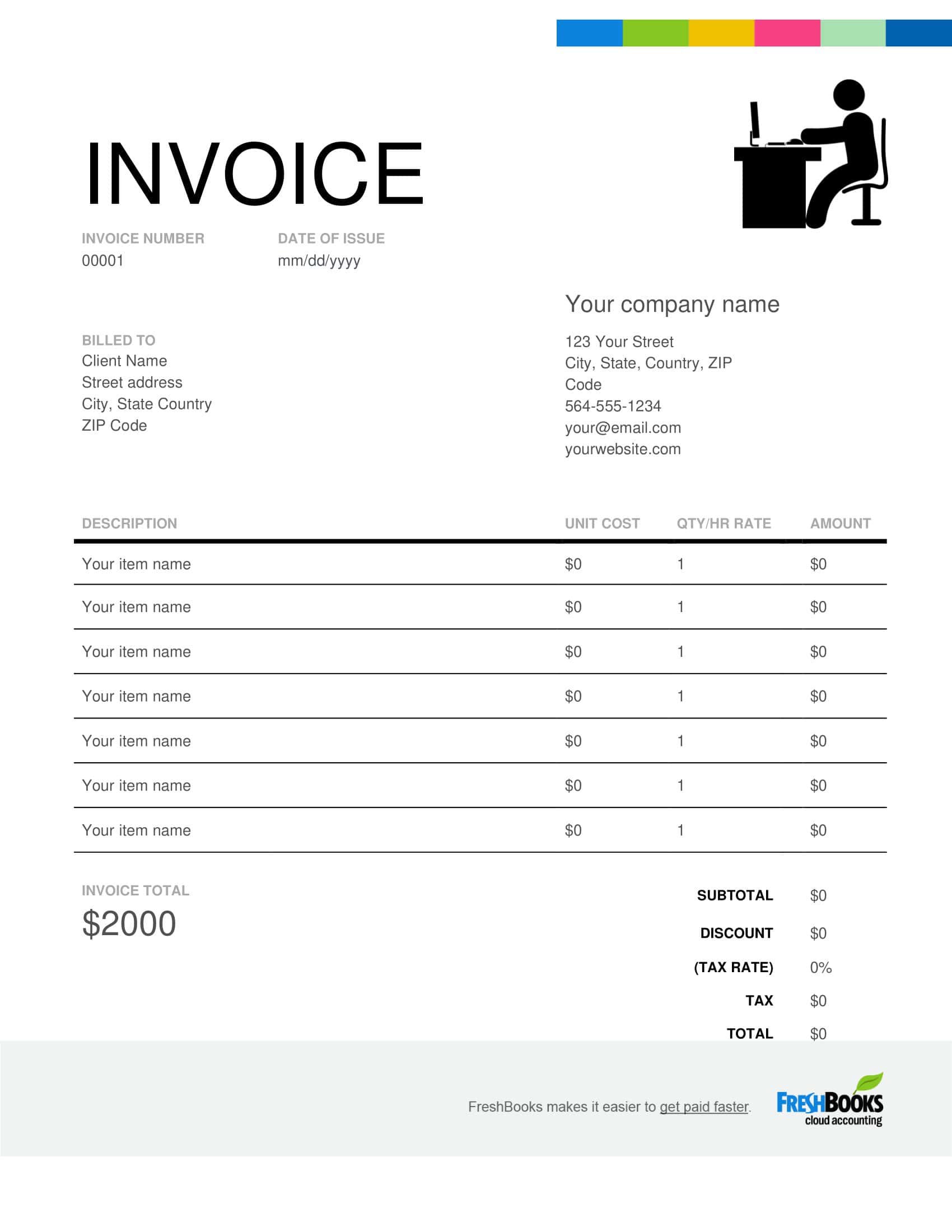

Self-Employed Invoice Templates

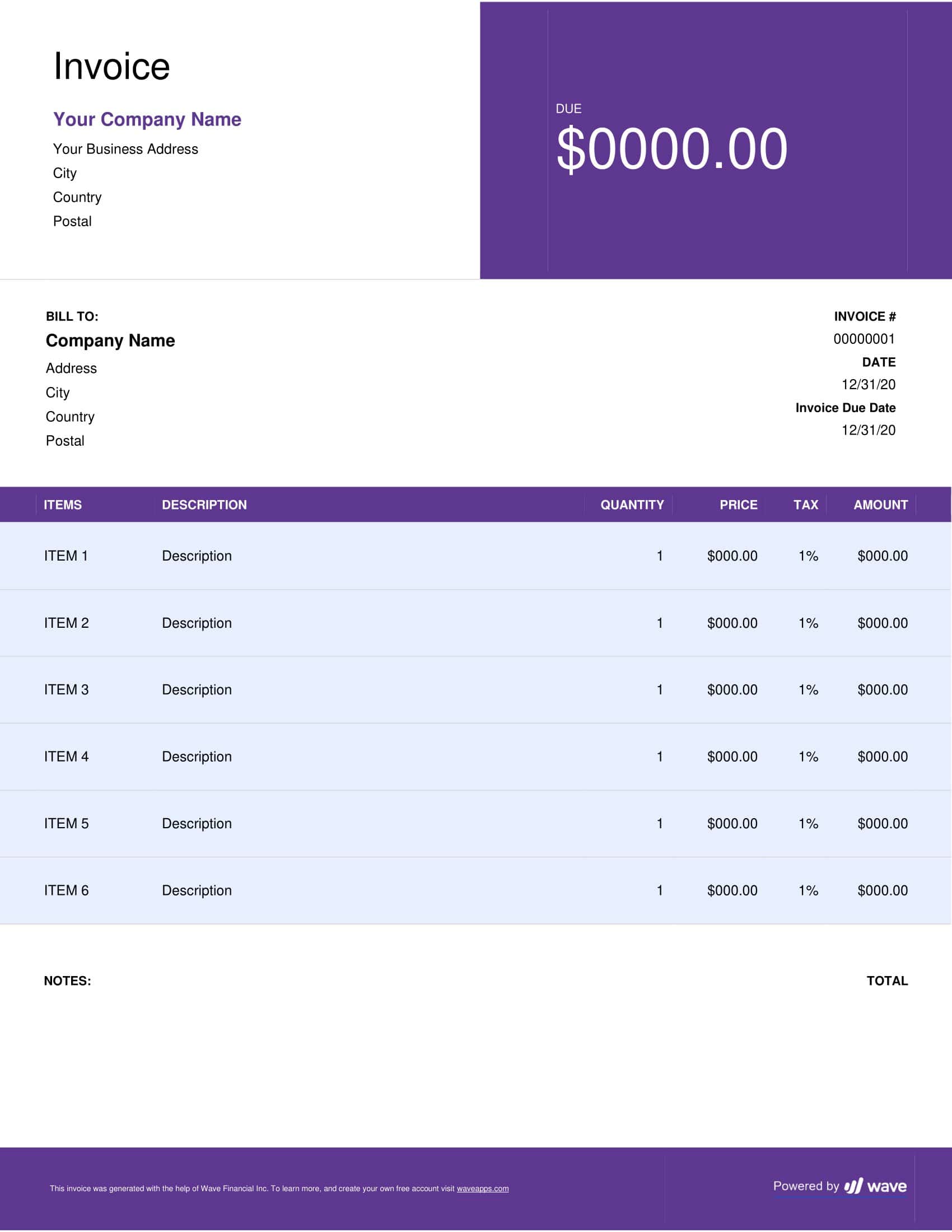

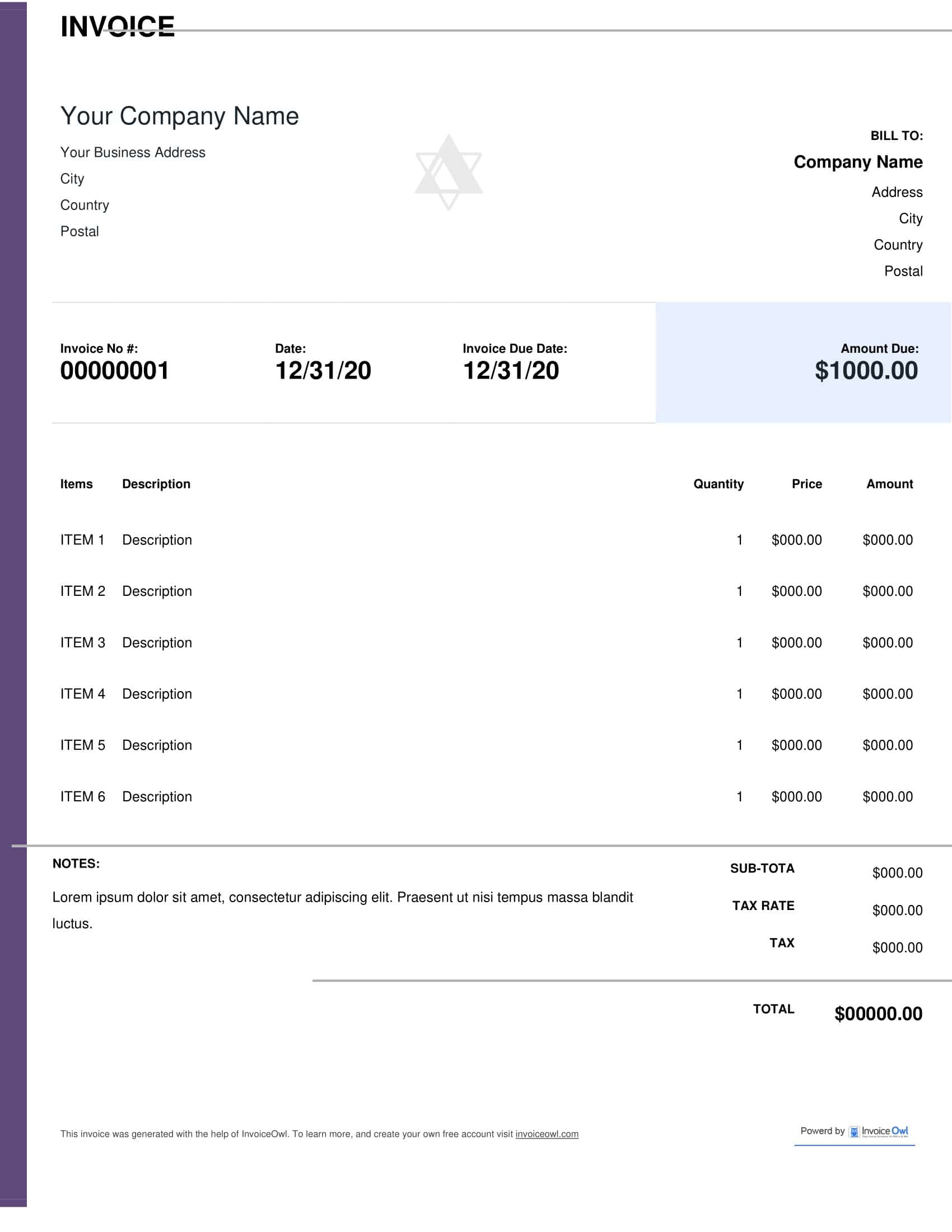

The self-employed invoice template is a document for freelancers and independent contractors to bill clients for services provided. The template streamlines creating professional invoices to clearly communicate charges.

The template contains standard fields including client/company name and address, invoice number, date, itemized services with rates and amounts due. It calculates totals for subtotal, taxes, discounts and overall balance owed. The structured format allows quickly generating invoices for ongoing client work.

Overall, the self-employed invoice template helps solopreneurs simplify invoicing and get paid efficiently. The organized sections ensure important billing information is captured. Details like payment terms and bank account details for direct deposit can be included. The template promotes consistency from one invoice to the next. It can be customized with individual business branding elements. Having an on-hand invoice template removes the hassle for self-employed professionals invoicing clients for regular services.

Why are Invoices Necessary for Self-Employed People?

Invoices are a fundamental tool for self-employed individuals, playing a critical role in both financial and operational aspects of their businesses. Here’s a detailed guide on why invoices are essential for self-employed people:

1. Proof of Transactions:

- Legitimacy: Invoices provide a formal record of the goods or services you’ve provided to a client. This not only legitimizes the transaction but also demonstrates professionalism.

- Details: They detail the exact nature, quantity, and cost of work or products provided, offering clarity to both parties involved.

2. Financial Management:

- Cash Flow Monitoring: Regular invoicing helps self-employed individuals monitor their income, which is essential for maintaining healthy cash flow.

- Budgeting: Having a clear record of incoming funds assists in budgeting and financial planning for future business activities.

3. Taxation:

- Income Reporting: For tax purposes, self-employed people need to report their income accurately. Invoices act as a record of earned income throughout the fiscal year.

- Expense Deductions: If you’re invoicing for expenses (e.g., materials, outsourced services), these invoices can support your claims for business expense deductions.

4. Legal Protection:

- Contractual Evidence: In the event of disagreements or disputes, invoices can serve as evidence of the terms and agreement between you and your client.

- Debt Recovery: Should a client fail to pay, having a detailed invoice is essential if you decide to pursue legal avenues or hire a collection agency.

5. Tracking and Organization:

- Client Records: Invoices can help keep track of which clients have been billed, the amount charged, and any outstanding balances.

- Payment Terms: They specify payment terms (e.g., net 30 days), ensuring clients are aware of when payments are due.

- Service/Product History: Over time, invoices help you track the history of services rendered or products sold, aiding in inventory management and service refinement.

6. Professionalism and Branding:

- Reputation: Issuing well-structured, clear invoices promotes a professional image, potentially leading to more business or referrals.

- Branding: Customized invoices can carry your brand’s logo, color scheme, and other branding elements, reinforcing brand identity with clients.

7. Client Relationships:

- Transparency: By clearly outlining costs, terms, and descriptions of services/products, you ensure transparency, leading to trust and better business relationships.

- Communication: Regular invoicing is an opportunity to communicate with clients, ensuring both parties are aligned in terms of expectations and deliverables.

8. Punctual Payments:

- Reminders: An invoice acts as a formal reminder for clients about payments due.

- Payment Options: Modern invoices can include various payment options, making it easier for clients to settle their bills, which in turn ensures you get paid faster.

9. Setting Terms and Conditions:

- Late Fees: Invoices can detail consequences for late payments, such as interest or late fees, setting clear boundaries from the outset.

- Refund/Return Policies: If applicable, your invoice can also detail any policies related to refunds or returns.

For self-employed individuals, invoicing is more than just a means to get paid; it’s an integral part of business management. Regular and professional invoicing practices can significantly impact the success and smooth operation of a self-employed venture.

What To Include On A Self Employed Invoice Template?

Creating an invoice as a self-employed individual requires thoroughness to ensure you get paid promptly and maintain clear records. Here’s a detailed list of elements to include on a self-employed invoice template:

1. Header:

- Your Business Information: Even if you’re self-employed, you might operate under a business name. Include your name (or business name), address, phone number, email address, and any other relevant contact details.

- Logo: If you have a personal or business logo, place it prominently at the top.

2. Title:

- Label the document clearly as an “Invoice” to avoid any ambiguity.

3. Unique Invoice Number:

- Each invoice should have a unique number for tracking and record-keeping. It can be sequential or based on a specific system you devise.

4. Date Information:

- Invoice Date: The day you issue the invoice.

- Due Date: The day by which the payment should be made. This can be based on agreed terms, e.g., “Net 30” means 30 days from the invoice date.

5. Client Information:

- Client Name/Company Name: The individual or company you’re invoicing.

- Client Address: Their physical or mailing address.

- Contact Details: Include phone number, email, or other pertinent data.

6. Description of Services or Products:

- Clearly list the services you’ve provided or products you’re charging for. This can be itemized or summarized, depending on the nature of the work.

- Include quantities, hours, rates, and dates of work where relevant.

7. Pricing and Costs:

- Item/Subtotal: The cost associated with each product or service.

- Taxes: Any applicable taxes based on your region or the nature of the service.

- Discounts: Any agreed-upon discounts.

- Total Amount: The sum owed after considering all the above factors.

8. Payment Information:

- Preferred Payment Method(s): Such as bank transfer, PayPal, check, or credit card.

- Payment Details: Account numbers, routing numbers, or any other relevant information.

- Payment Terms: Clarify any terms related to late payments, potential penalties, or early payment discounts.

9. Notes or Additional Information:

- Use this space to add extra details, personalized messages, or to clarify any special terms. This is also where you can thank your client for their business.

10. Tax Information (if applicable):

- Depending on where you’re located, you might need to include your tax identification number, VAT number, or other tax-related details.

11. Footer or Disclaimers:

- Any legal disclaimers, refund policies, or other standard terms and conditions pertinent to your industry or service.

12. Signatures (if required):

- Some self-employed individuals prefer to have a space for their own signature and the client’s, especially if the invoice is closely tied to a contractual agreement.

Creating a standard invoice template can save time in the future. Various tools and software, such as QuickBooks, FreshBooks, or Microsoft Office, offer customizable invoice templates that can be tailored to fit the needs of self-employed professionals.

When to Send A Self-Employed Invoice?

The ideal time for independent contractors and freelancers to send invoices is immediately after completing the work or reaching an agreed upon milestone in an ongoing project. Sending the invoice promptly eliminates any lag time between service delivery and payment collection. Many self-employed professionals send the invoice on the last day of work or submit it weekly or monthly for recurring services.

Setting a consistent invoicing schedule (such as the 1st and 15th of every month) helps train clients when payment will be expected. Some contractors require partial payment upfront and send the remainder of the invoice upon project completion. But in general, invoicing as soon as possible after providing services allows self-employed individuals to get paid faster.

Different Invoice Types for the Self-Employed

Depending on the nature of their work and the terms of their business relationships, self-employed professionals may encounter a variety of invoice types. Here’s a detailed description of different invoice types tailored for the self-employed:

Standard Invoice

A standard invoice is the most common form of invoicing and is used across a multitude of industries and professions. This type of invoice clearly outlines the specific services or products provided, the respective prices or rates, and the total amount due. It typically begins with basic details like the business and client information, followed by an itemized list of all the services/products with their costs.

The main objective of a standard invoice is straightforward: to request payment for services rendered or products sold. For a self-employed individual, using a standard invoice can be highly effective as it lays out all essential information in a concise manner, ensuring that the client knows exactly what they’re being billed for.

Proforma Invoice

A proforma invoice is more of a preliminary document than an actual demand for payment. Essentially, it gives the client an idea of what costs to expect, but it doesn’t serve as an official request for payment. This type of invoice is particularly useful in scenarios where the exact amount might not be known in advance, such as in international trade where shipping costs, taxes, or customs duties may vary.

For self-employed professionals, issuing a proforma invoice can be a proactive way to set clear expectations with clients, especially when dealing with large projects or complex orders. By offering a preliminary breakdown of costs, both parties can have a mutual understanding of the anticipated financial obligations.

Recurring Invoice

Recurring invoices are used for ongoing services where the client is billed the same amount periodically—be it monthly, quarterly, or annually. This type of invoice is common among self-employed professionals offering subscription-based services, like software solutions, consultancy retainers, or maintenance contracts.

The benefit of using recurring invoices is that they streamline the billing process, especially when the amount remains consistent over time. Instead of creating a new invoice each period, the self-employed individual can set a schedule, thereby automating the billing process to a degree. This not only saves time but also ensures consistency in payment cycles, which can be pivotal for cash flow.

Deposit Invoice (or Upfront/Advance Invoice)

As the name suggests, a deposit invoice is used to request an upfront payment before the full service is rendered or the entire product is delivered. This type of invoice is particularly beneficial for self-employed professionals who might need funds to kick-start a project, purchase necessary materials, or simply secure a commitment from the client.

It’s not uncommon in fields like custom crafts, consultancy, or event planning to ask for a deposit to safeguard against potential losses. By issuing a deposit invoice, the self-employed individual can gain a measure of financial security, ensuring they aren’t left uncompensated for initial efforts or investments.

How to Create a Self-Employed Invoice

Creating an invoice as a self-employed individual is crucial for ensuring you’re compensated for your work. Here’s a detailed step-by-step guide:

Step 1: Choose an Invoicing Platform

In today’s digital age, there are numerous invoicing tools available that can simplify the process for self-employed professionals. Platforms such as FreshBooks, QuickBooks, and Wave offer customizable invoice templates that cater to various industries. When choosing a platform, consider factors like its usability, features, pricing, and integration with other tools you might be using. While many opt for digital tools due to their convenience and features like automatic reminders, traditionalists might still prefer manual invoices created using software like Microsoft Word or Excel. Your choice should align with your comfort level and the preferences of your clients.

Step 2: Incorporate Branding Elements

To present yourself professionally, incorporate personal or business branding elements into your invoice. This includes your business name (or your name if you don’t use a separate business name), a logo (if you have one), and possibly a brand color scheme. Consistent branding not only makes your invoices look more professional but also ensures easy recognition by clients. Your branding reflects your business identity, and maintaining consistency helps instill trust and confidence in your clients, especially when dealing with financial transactions.

Step 3: Input Essential Details

Start with your business information, including your name (or business name), address, phone number, email, and any other relevant contact details. Follow this with client details such as their name, company (if applicable), address, and contact information. Next, ensure each invoice has a unique invoice number—this is crucial for tracking and future references. Also, specify the invoice date and the due date, which informs the client when payment is expected.

Step 4: Itemize Services and Costs

Clearly list the services you’ve provided or the products sold. For each item or service, mention the quantity, rate, and the total cost. If you worked hourly, specify the number of hours and your hourly rate. If you offered a discount or if there are taxes applicable, ensure these are itemized as well. The bottom of this section should provide a clear total amount due. This itemization serves two primary purposes: clarity and transparency. It helps the client understand the breakdown of costs and ensures that you’re compensated fairly for each aspect of your work.

Step 5: Specify Payment Information

Detail how you’d like to be paid. Whether you prefer bank transfers, credit card payments, checks, or platforms like PayPal, make sure to provide all necessary details. This might include bank account numbers, routing numbers, or PayPal email addresses. Alongside this, clearly state your payment terms. If payment is due within 30 days, label it as “Net 30.” If there are penalties for late payments or discounts for early ones, ensure these are mentioned. This step eliminates payment ambiguities and sets clear expectations with the client.

Step 6: Add Additional Information or Notes

This section can be used to provide any extra details or clarifications. For example, you can elaborate on specific terms of service, delivery details, or offer gratitude for the client’s business. Personalizing your invoice with a thank-you note can build rapport and foster positive client relationships.

Step 7: Review and Send

Before sending, thoroughly review the invoice for accuracy. Ensure all details, from client names to payment amounts, are correct. Mistakes can cause delays in payment or lead to disputes. Once satisfied, send the invoice via your chosen method, whether that’s email, post, or through an invoicing platform.

Conclusion

Sending clear, professional invoices is crucial for self-employed individuals to get paid for their services. However, creating tailored invoices for each client manually is incredibly time consuming. That’s why leveraging customizable self-employed invoice templates can be so valuable. They provide a polished, consistent invoice format that can be adapted for your specific clients and billing needs. In this article, we’ve covered best practices and tips for self-employed invoicing success.

To help you streamline generating invoices, we offer a selection of downloadable self-employed invoice templates in Word, Excel, and PDF formats. Our templates allow you to quickly produce invoices that present your services, rates, and payment terms in an organized, client-friendly format. Be sure to download one of our templates today to simplify your self-employed invoicing!

FAQs

What’s the difference between a self-employed invoice and a regular business invoice?

Essentially, the content and purpose of both are the same: to request and record payment for services or goods. However, a self-employed invoice might be more personalized, reflecting an individual’s name and details rather than a company’s. In some cases, a self-employed person might not have a business name or logo, so the invoice would be under their personal name. Additionally, the scale and nature of services or products might differ based on individual freelancers or contractors versus larger businesses.

How often should I issue an invoice as a self-employed individual?

The frequency of invoicing depends on the terms agreed upon with the client. If it’s a one-off job, you’ll send an invoice once the work is completed. For ongoing projects, you might invoice monthly, bi-weekly, or based on project milestones. Always clarify invoicing frequency in your initial agreement or contract with the client.

Is it mandatory to include tax information on a self-employed invoice?

This largely depends on your jurisdiction and the nature of your work. In many countries, if you’re registered for tax purposes (like VAT in the UK or GST in Australia), you need to include relevant tax information on your invoice. If you’re unsure, it’s best to consult with a local accountant or financial advisor to ensure compliance.

Can I use digital tools for invoicing or should I stick to traditional paper invoices?

Digital invoicing tools are widely accepted and often preferred due to their convenience, efficiency, and eco-friendliness. They often come with additional features like payment reminders, automatic calculations, and digital record-keeping. However, the choice between digital and paper invoicing should be based on both your comfort level and the preferences or requirements of your clients.

As a self-employed person, should I keep copies of all the invoices I send out?

Absolutely. Maintaining records of all sent invoices is crucial for various reasons, including financial management, tax purposes, and potential disputes. Whether you keep digital copies or physical ones, ensure they are organized and stored securely.

![Free Printable Roommate Agreement Templates [Word, PDF] 2 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 4 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)