Running a business often requires bringing on specialized independent contractors to complete projects or provide services. To ensure these contractors are properly compensated for their work, a clear invoicing process is needed. An independent contractor invoice allows these contractors to outline the services provided, costs agreed upon, and payment terms all in one document.

For independent contractors, a professional invoice template is an important tool for tracking payments and ensuring they receive the compensation owed to them in a timely manner. In this article, we will provide key information about independent contractor invoices as well as include downloadable and customizable independent contractor invoice templates. Having an effective invoicing process benefits both businesses and the contractors they bring on board for outsourced work.

Table of Contents

What is an Independent Contractor?

An independent contractor is a self-employed individual who provides goods or services to a company or entity as specified in a contract agreement. Unlike an employee, an independent contractor operates their own business and is not under the direct control or supervision of the hiring organization. They set their own hours, provide their own equipment and materials, and determine how the work gets done according to their expertise.

Independent contractors are responsible for their own taxes, do not receive employment benefits, and are not considered agents of the hiring company. They can work for multiple clients at one time and are typically paid per project, deliverable, or hourly rate for the services they provide under a business-to-business relationship, submitting invoices to each client independently. Independent contractors allow organizations to outsource specialized services on an as-needed basis as spelled out in a contract.

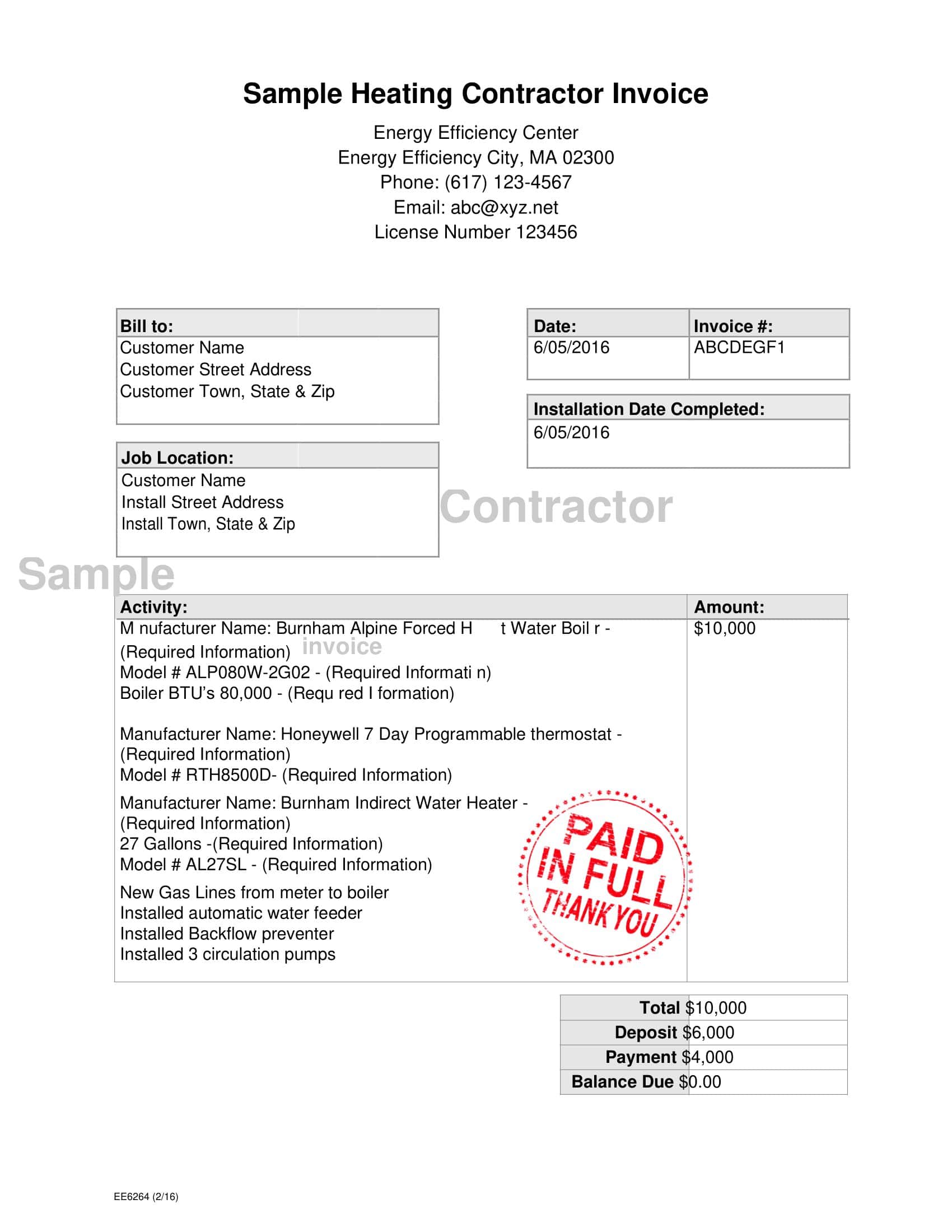

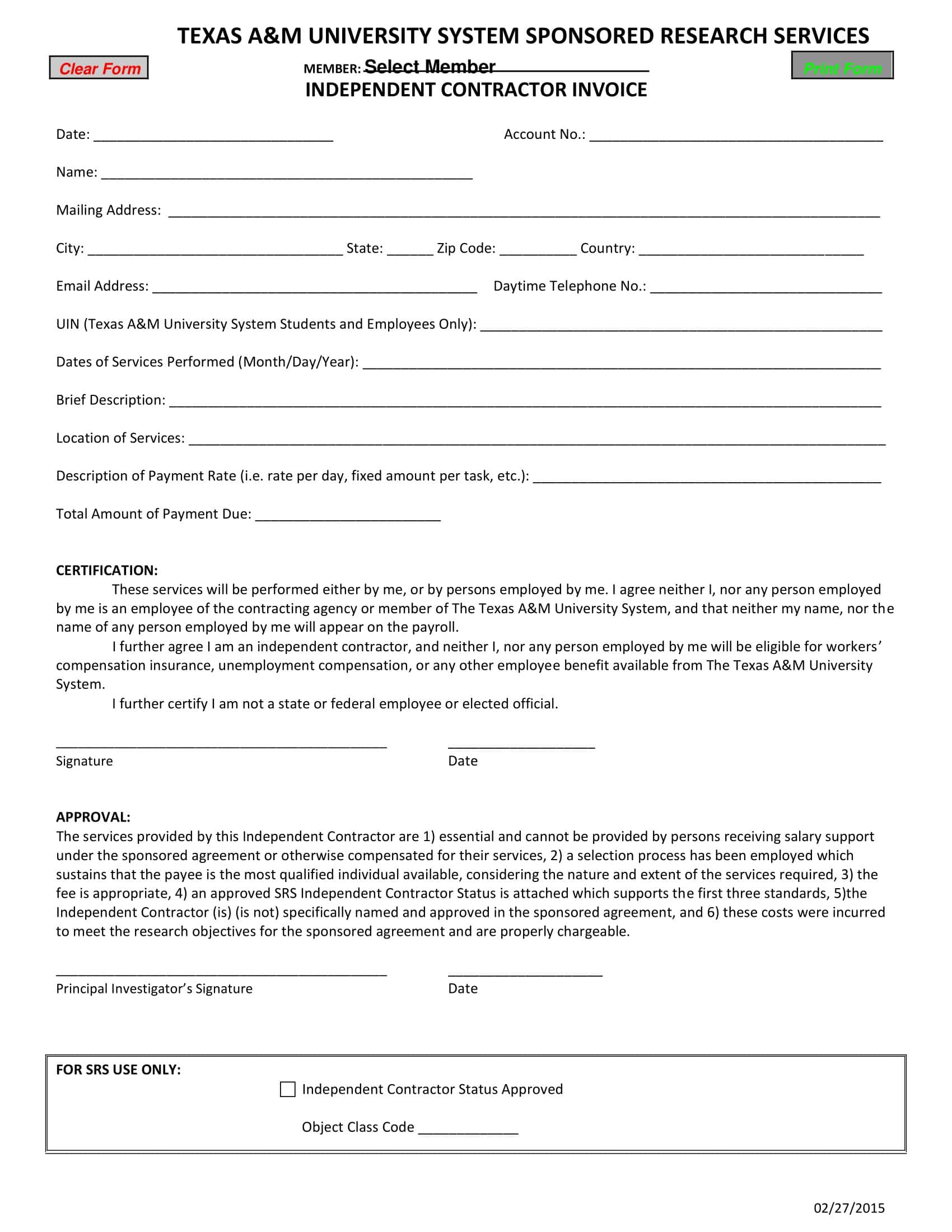

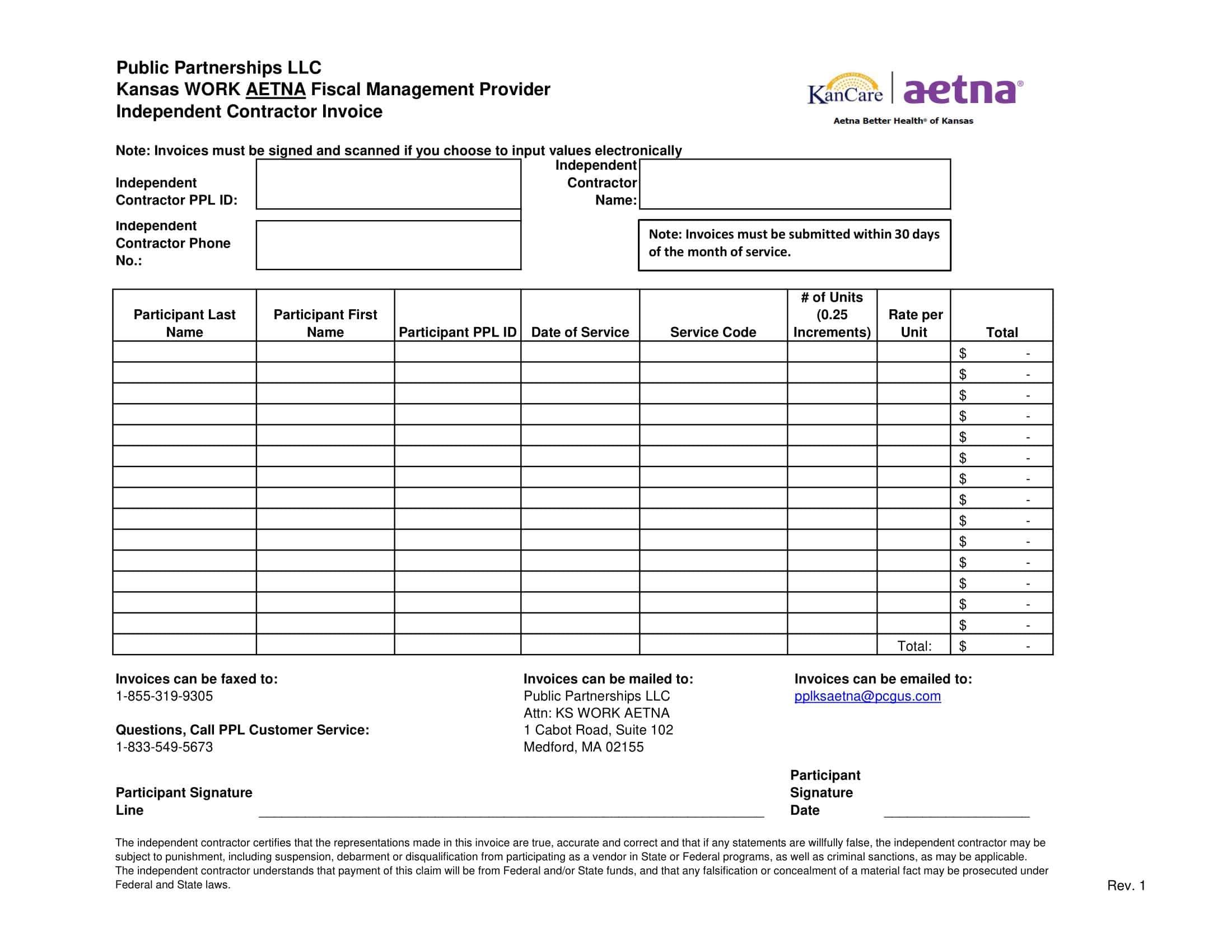

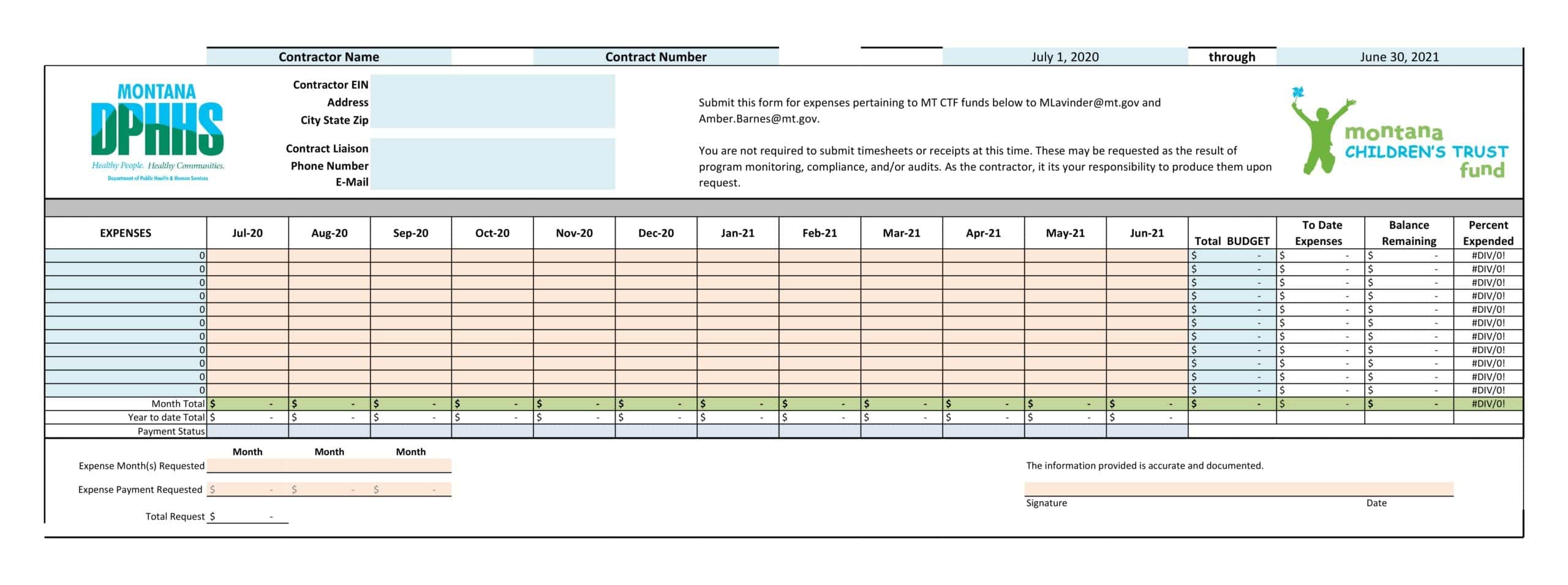

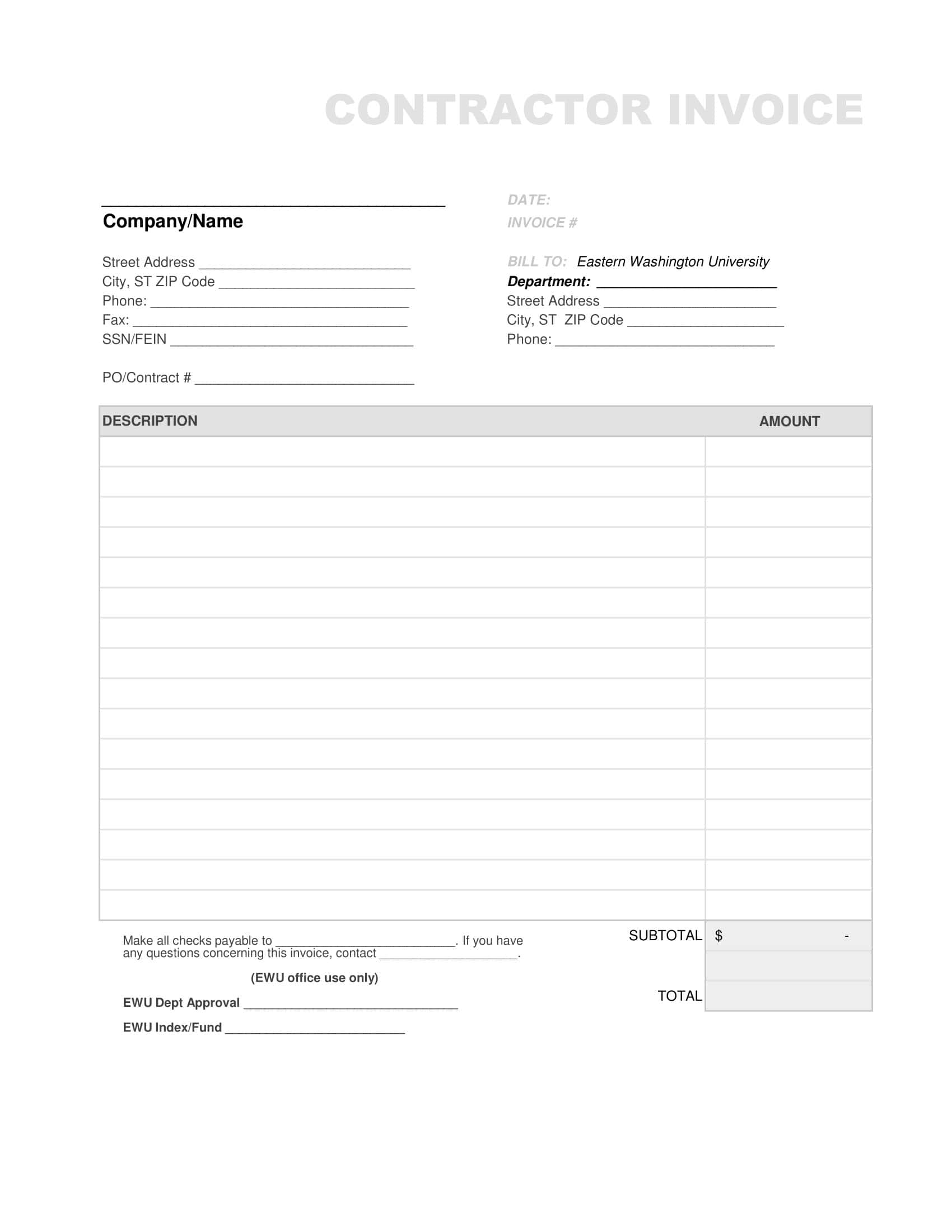

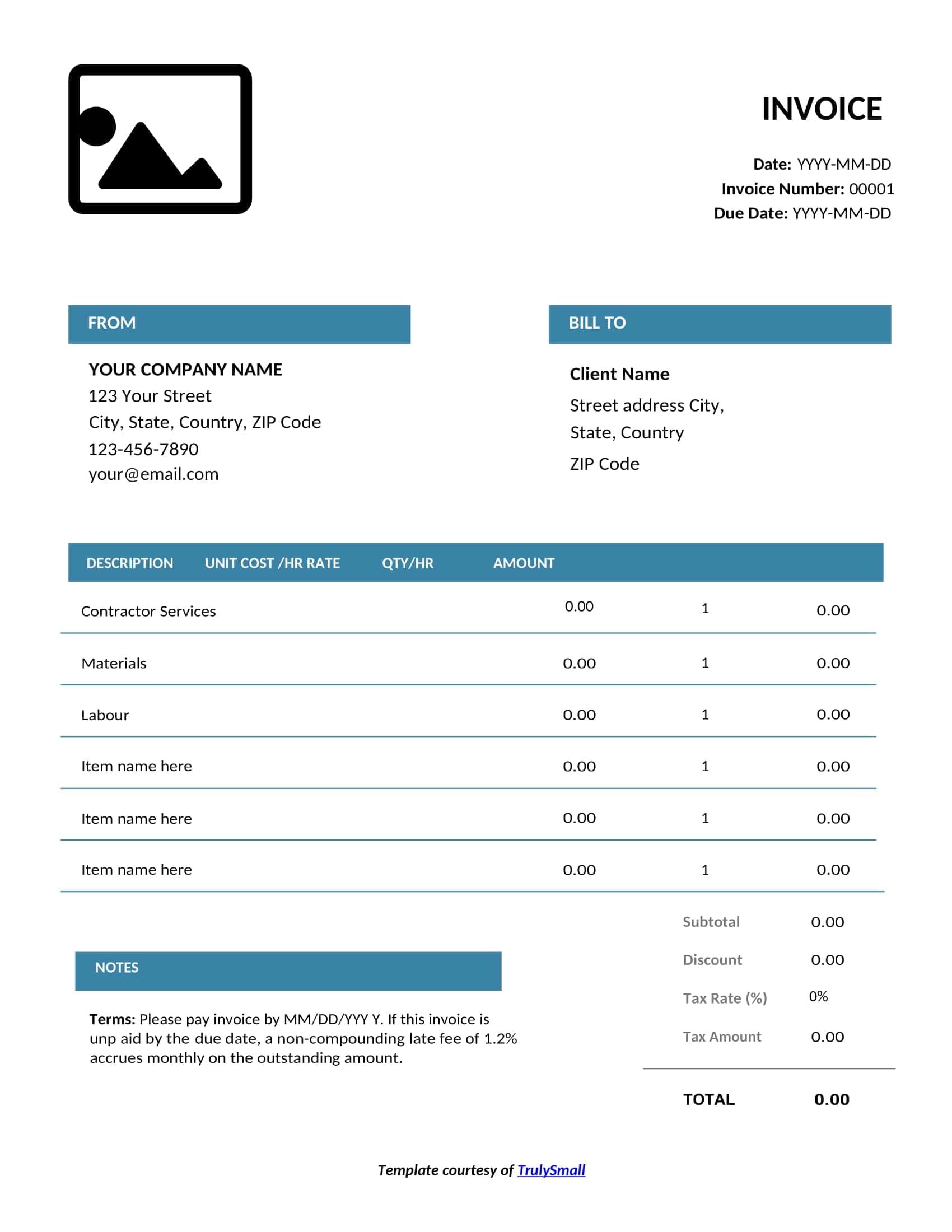

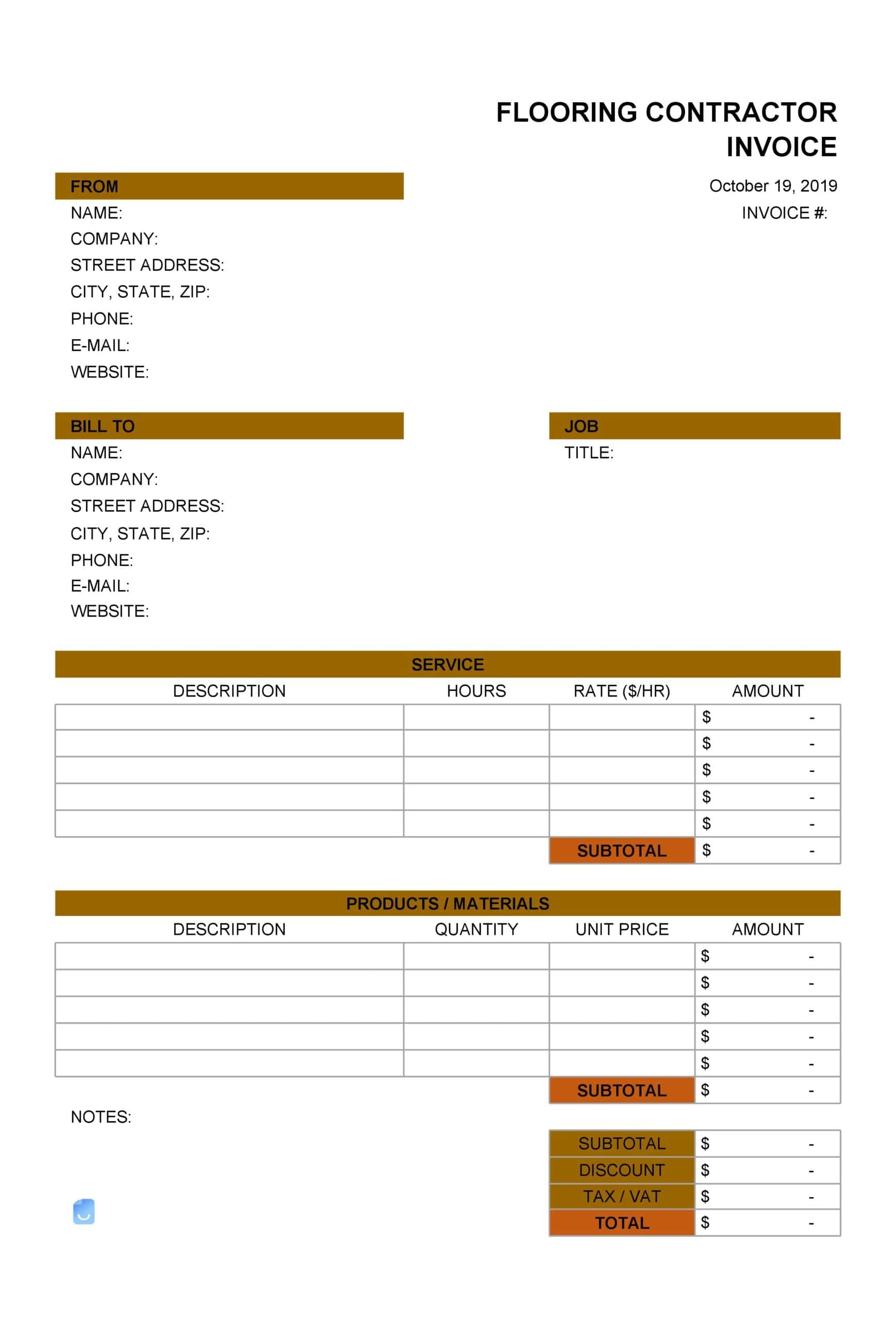

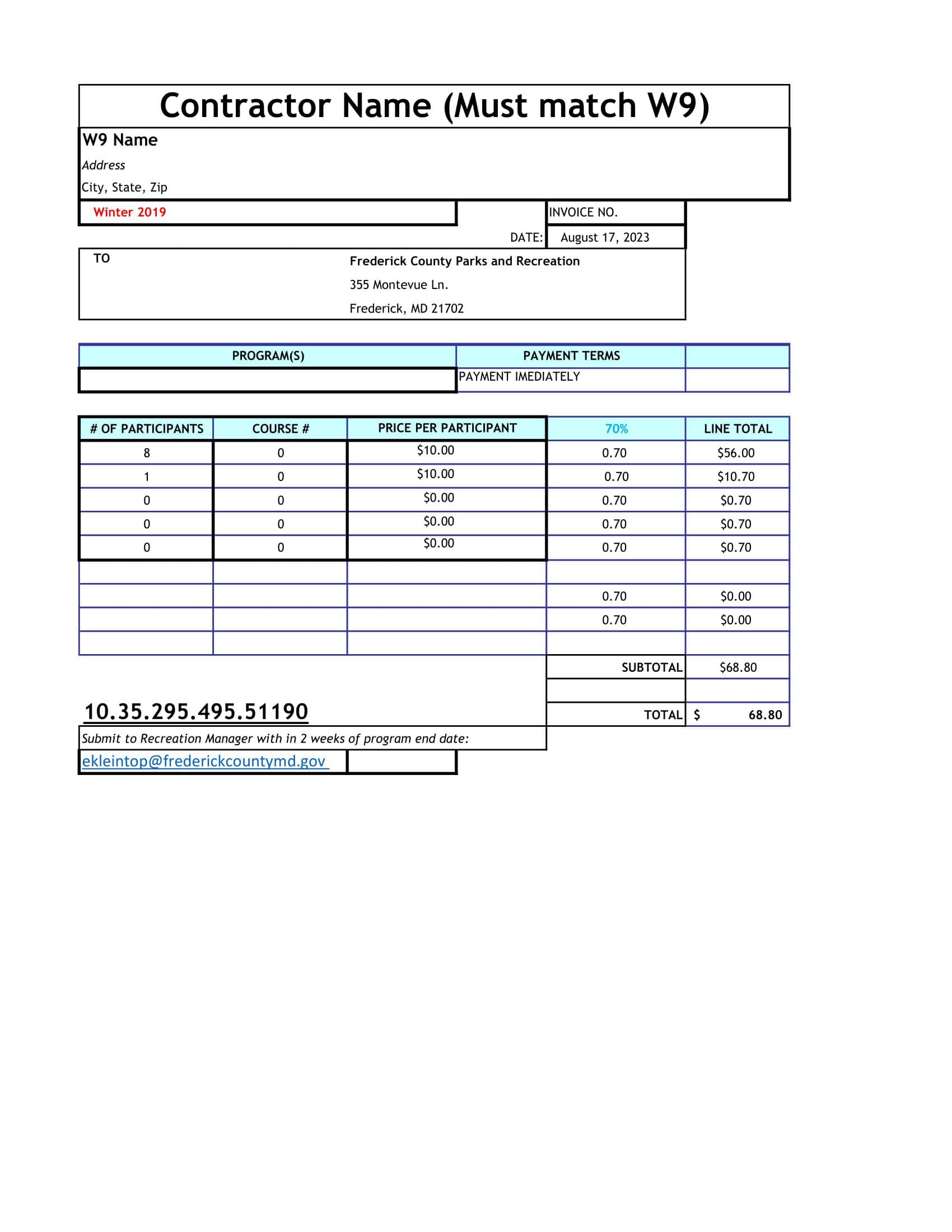

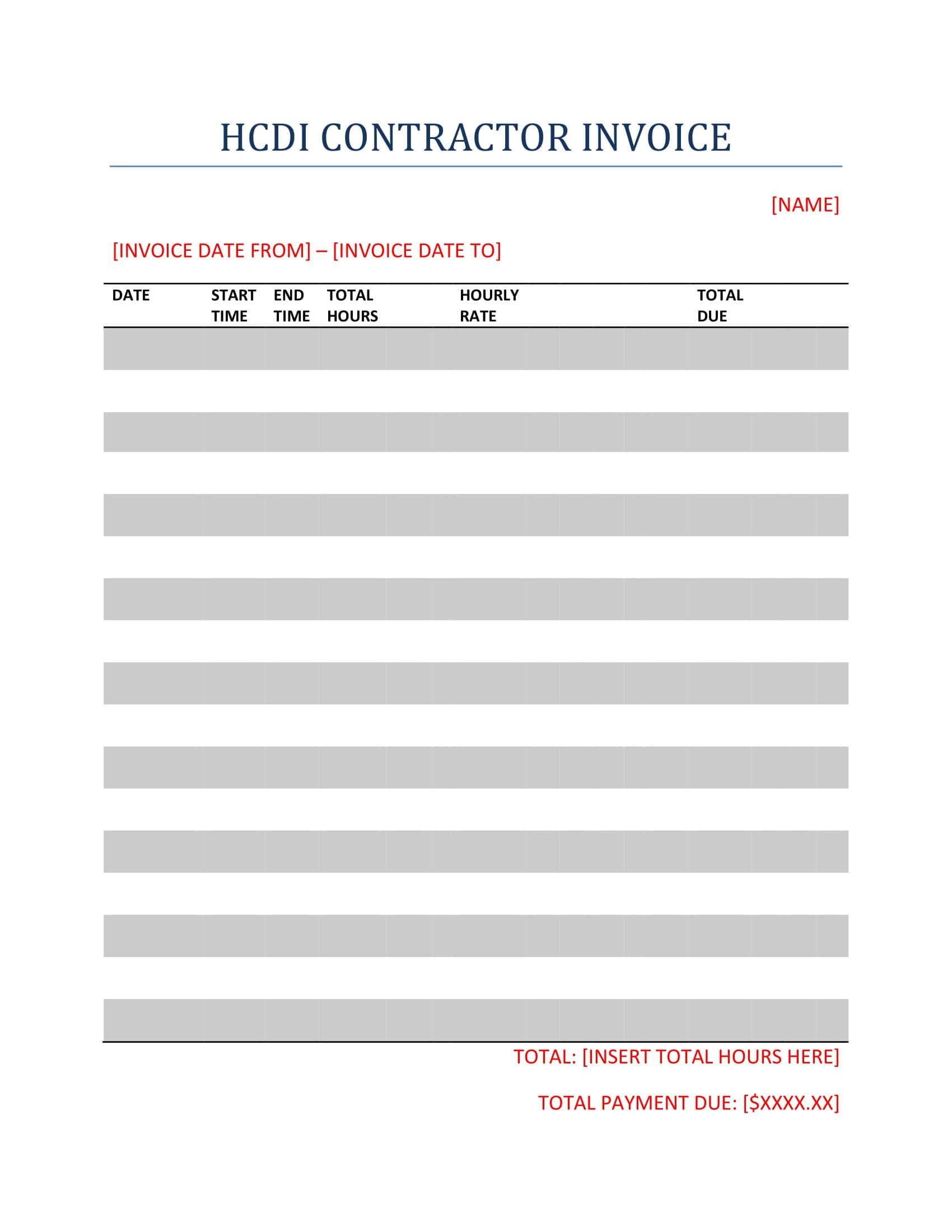

Independent Contractor Invoice Templates

Running your own business? Be sure to use an independent contractor invoice to bill clients for your services. An independent contractor invoice is a document that lists the services provided, hours worked, and total amount due. Unlike an employment timesheet, it specifically bills the client rather than collecting internal time tracking. The independent contractor invoice templates make it easy to customize and send professional-looking invoices to clients.

The key parts of an independent contractor invoice include the invoice number, client name and address, description of services, number of hours worked, hourly rate, total amount owed, and payment terms. Additional fields can be added such as project name, purchase order number, or mileage and expenses. The independent contractor invoice templates allow customization of logo, colors, and fonts to match your business branding. They do the math calculations automatically to prevent errors.

Sending an independent contractor invoice promptly and consistently is a best practice for getting paid on time. The independent contractor invoice templates take the hassle out of billing so you can focus on the work. Be sure to use one that allows tracking of payments and automates reminders for overdue invoices. Maintain clear communication and set expectations with clients about when invoices will be sent. With a professional invoice template, independent contractors look organized and clients can quickly pay for services provided.

What is a Contractor Invoice?

A contractor invoice is a bill sent by an independent contractor or freelancer to a client as a request for payment for services rendered. It outlines the work completed by the contractor over a period of time, breaks down associated costs, specifies any retainer or deposits made, and states the total amount still owed by the client. A contractor invoice serves as formal documentation requesting the client pay for the contractor’s services, detailing the specific project or tasks completed and the agreed-upon compensation.

It is typically more detailed than a standard receipt, itemizing expenses, labor hours, hourly rates, and taxes. The contractor invoice should be submitted on a regular schedule, such as weekly or monthly, based on the terms in the contractor services agreement. This billing document states what the client owes so they can submit payment and the contractor can have a record of the services provided.

Essential Elements of an Independent Contractor Invoice Template

When creating an invoice as a contractor, you’ll want to ensure it is both professional and detailed, allowing for clear communication between you and your client. An effective contractor invoice typically includes the following elements:

- Header:

- Your Business Name: If you’re an independent contractor, this might just be your own name.

- Your Business Logo: If applicable.

- Contact Information: This includes your address, phone number, email, and possibly your website.

- Client’s Contact Information:

- Client’s name or company name.

- Client’s address.

- Phone number and/or email address.

- Invoice Details:

- Invoice Number: Unique for record-keeping and referencing.

- Invoice Date: The date you issued the invoice.

- Due Date: The date by which the payment should be made.

- Description of Services/Goods Provided:

- Detailed descriptions of the work completed or goods provided.

- The date the service was provided (especially if over multiple days).

- The quantity (for instance, hours of work if billing hourly).

- Pricing and Payment Details:

- Unit Price: If you’re charging by the hour, this would be your hourly rate. Otherwise, it could be the price for each item or service.

- Total Amount: The total amount for each line item (e.g., hours x rate).

- Subtotal: The sum of all line items before taxes and additional charges.

- Taxes: If applicable, any sales tax or VAT should be added.

- Other Fees: Such as late fees, equipment rental, or any other additional charges.

- Total Amount Due: This is the grand total after all additions and subtractions.

- Payment Terms and Methods:

- Payment Terms: Specify any terms like “Net 30” (meaning the payment is due within 30 days of the invoice date).

- Accepted Payment Methods: E.g., bank transfer, check, credit card, online payment platforms like PayPal.

- Bank Details: If you prefer a bank transfer, provide the necessary details.

- Notes or Additional Information:

- Any relevant information not covered elsewhere. This could include details about the project, clarification on charges, or a thank-you note to the client.

- Terms and Conditions:

- This section may cover any legal stipulations, late payment penalties, or other contractual details.

- Footer:

- Any additional contact or business details not included in the header.

- Business registration or licensing numbers, if applicable.

How To Write A Independent Contractor Invoice?

Creating an invoice as an independent contractor is crucial for maintaining a professional appearance and ensuring you receive payment in a timely manner. Here’s a step-by-step guide to help you write one:

Step 1: Choose an Invoice Template or Software

- Use Pre-made Templates: Many word processing and spreadsheet software (like Microsoft Word or Excel) offer invoice templates.

- Use Specialized Software: Accounting or invoicing software like QuickBooks, FreshBooks, or Zoho Invoice often have built-in invoicing features.

Step 2: Add Your Personal or Business Information

- Header: Clearly write “Invoice” at the top.

- Your Name/Business Name: Include your full name or your business name if you have one.

- Your Address: This should include your street address, city, state, postal code, and country.

- Contact Information: This can include your phone number, email address, and any other relevant contact methods.

Step 3: Include Client’s Information

- Client’s Name or Business Name: Write down the name of the person or company you provided services for.

- Client’s Address: This should be their billing address.

- Client’s Contact Information: This can be an email or phone number.

Step 4: Add Invoice Details

- Invoice Number: Every invoice should have a unique number for tracking purposes.

- Date: This is the date you’re issuing the invoice.

- Payment Due Date: Clearly state when the payment is due (e.g., “Due upon receipt” or “Net 30 days”).

Step 5: List the Services Provided

- Description: Clearly describe each service you provided.

- Date of Service: Indicate when you performed each service.

- Rate: If you charge by the hour, list your hourly rate. If it’s a flat fee, indicate so.

- Hours/Quantity: Indicate how many hours you worked or how many items were provided.

- Total Cost: Multiply the rate by the hours or quantity for each service.

Step 6: Calculate the Total Amount

- Subtotal: This is the total before any taxes or discounts.

- Taxes: If you need to charge taxes, calculate and list them here.

- Discounts: If you’ve offered any discounts, indicate and deduct them.

- Total Amount Due: Sum up everything to provide a final total.

Step 7: Specify Payment Terms

- Payment Methods: Mention accepted methods like checks, bank transfers, credit cards, or platforms like PayPal.

- Late Payment Policy: If you charge late fees or have specific policies for overdue payments, include those details.

Step 8: Add Additional Notes or Comments

- This section can be used for any extra information you want to convey, like thanking the client, giving additional instructions, or providing details about future services.

Step 9: Proofread and Send

- Double-check: Ensure all details are accurate, from your client’s name to the total amounts.

- Send the Invoice: Depending on your agreement, you can send it via email, mail, or any other method. If using email, consider sending the invoice as a PDF to ensure formatting remains consistent.

Step 10: Keep a Record

- Physical Copies: If you prefer, print and store them in a file.

- Digital Backups: Save a digital copy on your computer or cloud storage for easy retrieval.

When Should You Send Contractor Invoices?

The ideal time for an independent contractor to send an invoice is specified in their contract agreement with the client. Typically, the contractor will send an invoice on a regular schedule, such as weekly, bi-weekly, or monthly as the work is completed. For long-term or ongoing projects, the independent contractor may invoice periodically over the course of the project based on milestones or percentage of work completed. Some contractors invoice at the end of the month for all services provided during that month.

The invoice should outline the specific details of the work performed during the billing period along with any expenses incurred. Whenever the contractor submits invoices, it is crucial they are sent in a very timely manner. This allows the client to process and pay the invoices as efficiently as possible, avoiding late payments and maintaining positive relations. Setting clear expectations for invoicing and payment terms in the contract prevents any confusion and ensures the independent contractor is paid promptly.

Tips To Avoid Contractor Invoicing Mistakes

Contractor invoicing mistakes can lead to disputes, payment delays, and damage to the professional relationship. To avoid these pitfalls, consider the following tips:

Clear Contracts: Before starting any project, have a clear and written agreement that outlines payment terms, work scope, deadlines, and other essential details.

Use Invoicing Software: There are many invoicing software options available that can help streamline the process, automatically calculate totals, and reduce human errors.

Detailed Descriptions: Always provide detailed descriptions of the work completed. Instead of just saying “services rendered,” itemize the tasks.

Correct Rates and Amounts: Double-check to ensure that you have billed at the agreed-upon rate and that you’ve factored in any discounts or additional charges that were agreed upon.

Include Important Details:

- Payment Due Date: Clearly indicate when the payment is due.

- Accepted Payment Methods: State whether you accept checks, credit cards, bank transfers, etc.

- Late Fee Policies: If you charge late fees, specify the amount or percentage.

- Verify Client Details: Ensure that you have the correct name, address, and other contact details of the client on the invoice.

Invoice Numbering: Use a consistent and sequential numbering system for your invoices to make tracking easier.

Regularly Review Your Accounts: Periodically review your accounts to ensure that all invoices have been sent, are accurate, and that you’ve received payments for them.

Maintain Clear Communication: If there are any changes or updates regarding the invoice or payment terms, communicate them to your client promptly. This avoids misunderstandings and helps maintain trust.

Keep Records: Always keep copies of all sent invoices, contracts, and any related email or written communication. This can be vital if any disputes arise.

Stay Organized: Organize your invoices in a way that’s easy to reference, whether it’s by date, client name, or project.

Clarify Taxes: Ensure you’re charging the right tax rate if applicable. Also, clarify who will bear the tax charges in your contract or agreement.

Set Reminders: Use software or calendar systems to remind you when to send out invoices, especially if they’re on a recurring basis.

Be Prompt: Send out invoices as soon as the work is completed or as agreed in the contract. This reduces the chances of forgetting details and helps with cash flow.

Consider Electronic Invoicing: E-invoices are efficient, reduce the chance of loss, and typically result in quicker payments.

Professional Appearance: Make sure your invoice looks professional, with a clear layout, your logo, and company details.

Feedback Loop: Encourage your clients to notify you immediately if there are any discrepancies or questions about the invoice. This proactive approach can nip potential problems in the bud.

FAQs

Do I need to keep a copy of my invoices?

Yes, it’s crucial to keep copies of all your invoices for accounting and tax purposes. Typically, it’s recommended to retain these records for at least 3-7 years, but the exact duration may vary based on local tax laws.

Do I need to send an invoice if the client has already paid in advance?

Yes, it’s still a good practice to send an invoice for record-keeping, even if payment has been received in advance. This provides clarity and a paper trail for both you and the client.

How can I protect myself from non-paying clients?

Always have a signed agreement or contract before beginning work. This agreement should outline payment terms, deliverables, and what happens if either party fails to uphold their end of the bargain. Also, consider asking for partial payment upfront, especially for larger projects or new clients.

How do I handle international clients and currency differences?

With international clients, ensure you specify the currency on your invoice. Consider using invoicing software that handles currency conversion or working with payment gateways that simplify international transactions. Also, be aware of any additional transaction fees.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)