Invoice creation doesn’t have to be a tedious, time-consuming task – especially when billing hourly. Whether you’re an independent contractor who gets paid by the hour or a service-based company charging hourly rates, having an efficient invoicing process is essential. In this article, we’ll explore the fundamentals of making professional hourly invoices that clearly communicate performed work and billable hours to clients.

An easy-to-use hourly invoice template is included as both a Word document and Excel file, providing a customizable framework to quickly generate polished invoices. With this template, you can avoid invoicing hassles and focus on providing excellent service to your clients. The template allows you to neatly organize project details, billable hours, and payment terms while maintaining a polished, consistent look. Read on to learn how easy hourly invoicing can be with the right template.

Table of Contents

What is an Hourly Invoice ?

An hourly invoice is a billing document that itemizes services provided on an hourly basis, specifying the dates and hours worked, hourly rates charged, and the total amount owed by the client. Unlike fixed-price invoices, hourly invoices detail all billable time spent on tasks and projects based on contractual hourly billing rates, providing transparency into delivered services and costs for both provider and client.

Hourly Invoice Templates

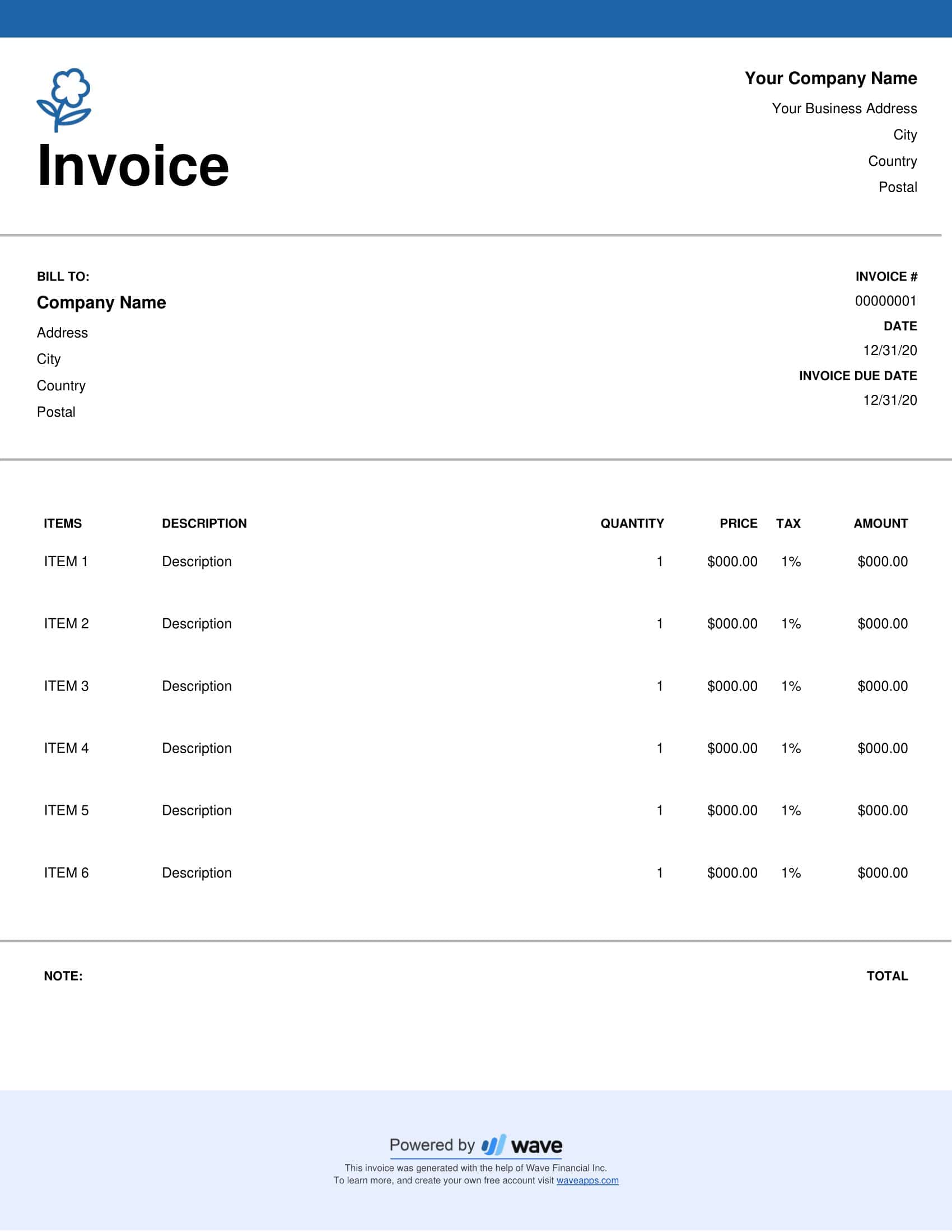

The hourly invoice template is a document used by freelancers and consultants to bill clients for work performed at an hourly rate. The template provides a standardized format to clearly present critical billing information to clients.

The template includes fields to enter the invoicing company name and address, client name and address, invoice number, date, payment terms, and a table to list the itemized services performed. Each line item includes columns for the date, a description of the work, the hourly rate, hours worked, and total amount due for that item. The template calculates the subtotal, taxes, discounts, and total amount due at the bottom.

Overall, the hourly invoice template streamlines the invoicing process for independent contractors paid by the hour. The organized layout and preformatted fields allow for quickly generating professional invoices. Having an hourly invoice template makes it simple to regularly bill clients for incremental work completed. It provides a clear and consistent way to communicate charges to clients for hourly services rendered. The template can be customized with company branding and saved for repeated use.

Benefits of Using an Hourly Rate Invoice

Using an hourly rate invoice comes with several advantages, especially for businesses and professionals who offer services that don’t have a fixed scope or can vary in duration. Here are the benefits of using an hourly rate invoice:

- Transparency for Clients: Hourly invoices provide a clear breakdown of how much time was spent on a particular task or project. This transparency can help build trust, as clients can see exactly what they’re paying for.

- Flexibility: With hourly billing, you can adjust the scope of work without needing to renegotiate the entire contract. If a client requests additional tasks or services, you can simply add the extra hours to the invoice.

- Fair Compensation: You get paid for every hour worked. This is especially beneficial when a project turns out to be more complex or time-consuming than initially expected.

- Simplicity: For many freelancers and businesses, it’s easier to track hours than to estimate the total cost of a project upfront. Hourly rate invoicing eliminates the need to predict unforeseen challenges or complications that might arise.

- Encourages Efficiency: When clients know they’re being billed by the hour, they are often more motivated to work efficiently, provide timely feedback, and avoid unnecessary revisions.

- Protection Against Scope Creep: Hourly invoicing can act as a deterrent against “scope creep” (when a project expands beyond its original objectives). Since clients are aware they will be billed for additional hours, they are more likely to stick to the original scope or understand the need for additional payment if the scope changes.

- Detailed Record-Keeping: Maintaining a record of hours worked not only benefits invoicing but can also help in analyzing productivity, estimating future projects, or justifying costs.

- Easier Adjustments: If there are disputes about particular tasks or elements of a project, it’s straightforward to identify and adjust specific hours or rates without having to recalculate the entire invoice.

- Cash Flow Management: For long-term projects, hourly rate invoices can be sent periodically (e.g., weekly or monthly), allowing for consistent cash flow rather than waiting for project completion.

- Alignment with Certain Industries: Some industries or professions, like legal services or consulting, traditionally bill by the hour. Using hourly rate invoicing in such cases aligns with industry norms and client expectations.

What Should be Included in an Hourly Invoice Template

An hourly invoice is primarily used when services are billed on an hourly basis. To create a clear, comprehensive, and professional hourly invoice, consider including the following elements:

Header:

- Company Name/Logo: Your business’s name and logo for branding.

- Address: Your business’s physical or mailing address.

- Phone Number: Your contact number.

- Email Address: Business email where clients can send inquiries.

- Website: If applicable.

Client Information:

- Client’s Name/Company: The person or entity being billed.

- Client’s Address: Physical or mailing address of the client.

- Client’s Phone Number: Optional, but helpful.

- Client’s Email Address: Client’s contact email.

Invoice Information:

- Invoice Number: A unique identifier for tracking purposes. It’s essential for record-keeping.

- Date of Issue: When the invoice was created.

- Due Date: When the payment is expected.

- Payment Terms: E.g., “Net 30 days” means the invoice is due within 30 days of the invoice date.

Service Details:

- Description: Brief description of the services provided.

- Date: When the service was performed.

- Hours Worked: Number of hours worked on that date or task.

- Hourly Rate: The rate at which you’re charging for your services.

- Total for Each Service: Multiply the hourly rate by the number of hours worked.

Expenses: (if applicable)

- If you have incurred any additional costs on behalf of the client, list them out.

- Description: Briefly describe the expense.

- Date of Expense: When you paid or incurred the expense.

- Amount: The cost of the expense.

Subtotals and Totals:

- Subtotal: Sum of all services before taxes or discounts.

- Discount: If offering a discount, specify the amount or percentage.

- Taxes: Calculate any applicable taxes. Mention the tax rate if relevant.

- Total Amount Due: Final amount the client owes after considering the discounts, taxes, and expenses.

Payment Information:

- Accepted Payment Methods: E.g., bank transfer, credit card, check, etc.

- Payment Instructions: Detailed information on how to make a payment. For instance, if you accept bank transfers, provide your bank account details.

Notes/Comments:

- This section is for any additional information or special instructions that the client might need to be aware of. You might mention late payment penalties or express gratitude for their business.

Footer:

- Confidentiality Note: A brief note mentioning that the invoice contains confidential information.

- Tax ID or Business Registration Number: Especially important for businesses, as clients might need it for their records.

Attachments (if necessary):

- Attach any relevant documents, receipts, or detailed breakdowns supporting the invoice.

How to Invoice for Hourly Work

Invoicing for hourly work is essential for many professionals and businesses. Here’s a detailed step-by-step guide to help you invoice for hourly work:

Step 1: Choose the Right Tool

- Manual Methods: Use word processing or spreadsheet software (like Microsoft Word or Excel, Google Docs or Sheets). Templates are often available.

- Invoice Software: Invest in invoicing software or apps designed specifically for billing. These often come with features like time tracking, automatic calculations, and online payment integrations.

Step 2: Gather Necessary Information

- Collect your business details: logo, name, address, contact number, email, and possibly tax ID or business registration number.

- Obtain client details: name, company, address, and contact information.

- Prepare details about the work: description of tasks, dates of work, total hours worked, hourly rate, and any additional expenses incurred.

Step 3: Create a Header

- Insert your business logo (if available) for a professional touch.

- List your business name, address, phone number, email, and website.

Step 4: Input Client Information

- Label this section “Bill To” or “Client Information.”

- Include the client’s name or company name, address, and other contact details.

Step 5: Fill Out Invoice Details

- Invoice Number: Assign a unique invoice number. This helps in tracking payments and organizing records.

- Invoice Date: The date when the invoice is created.

- Due Date: Specify when the payment is due (e.g., “Due on receipt” or “Net 30 days”).

Step 6: List Services Provided

- Create a table with columns for “Date,” “Description,” “Hours Worked,” “Hourly Rate,” and “Total.”

- Fill out the table for each task or work session.

- Under “Description,” be as specific as possible about the services rendered.

- Clearly indicate the number of hours worked and the rate per hour. Multiply these for each row to get the “Total” for each task.

Step 7: Calculate and Input Subtotals, Taxes, and Total Amount

- Subtotal: Sum of all the totals from the services provided.

- Expenses: List any reimbursable expenses, if applicable.

- Discount: Deduct any discounts offered to the client.

- Taxes: Calculate and add any taxes applicable. Indicate the rate if needed.

- Total Amount Due: Sum up everything to get the final amount the client owes.

Step 8: Add Payment Instructions

- Clearly state accepted payment methods (e.g., bank transfer, check, credit card).

- For methods like bank transfer, provide necessary details (account number, bank name, routing number, IBAN, BIC/SWIFT for international transfers, etc.).

- Specify any late payment policies or penalties if applicable.

Step 9: Include a Note or Comment Section

- Use this space to clarify any specifics, offer gratitude for the client’s business, or give additional instructions or information.

Step 10: Review the Invoice

- Double-check all details for accuracy: client information, hourly rates, hours worked, calculations, and payment instructions.

- Ensure there are no typos or mistakes.

Step 11: Send the Invoice

- Determine the client’s preferred method: email, mail, through invoicing software, etc.

- If emailed, consider sending the invoice as a PDF to maintain formatting. Include a clear subject line (e.g., “Invoice #12345 from [Your Business Name]”).

Step 12: Track and Follow Up

- Record the invoice in your accounting or record-keeping system.

- Monitor for payment by the due date. If payment isn’t received, send a polite reminder to the client. Some invoicing software offers automatic reminders.

Step 13: Confirm Receipt and Thank the Client

- Once the payment is received, it’s good practice to send a “Thank You” note or payment confirmation to maintain a positive relationship with the client.

When Is The Right Time To Send An Hourly Invoice To Your Clients?

Determining when to send hourly invoices to clients requires striking a balance between keeping clients informed and minimizing administrative workload. Here are some tips on best practices for timing your hourly invoices:

Send invoices frequently enough for transparency. Sending an invoice only once a month or at project completion leaves clients in the dark. Consider sending invoices every 1-2 weeks. This keeps clients aware of accumulating costs, allows them to course correct if needed, and gives them smaller, more manageable bills rather than one large surprise invoice.

But not so frequently it’s burdensome. While transparency is important, invoicing daily or multiple times a week creates unnecessary administration. The goal is to find a frequency that keeps clients informed without overwhelming them (or you) with constant paperwork.

Invoice at logical billing milestones. The end of a week or project phase provides a neat cutoff for tallying billable hours. Invoicing at logical stopping points keeps costs organized by milestone while allowing you to invoice at regular intervals.

Avoid long delays between work and invoicing. Invoicing for services provided a month ago not only lacks transparency, but also risks forgetting key details. Try to invoice within 1-2 weeks of services to maintain accuracy.

Set expectations upfront. When establishing a contract, provide a clear timeframe for when invoices will be delivered so there are no surprises. This prevents payment delays or confusion down the road.

No perfect timing fits every situation. Heavily consider your clients’ expectations and preferences. Establish invoicing schedules that provide transparency and meet their needs, while factoring in your own workload constraints. With communication, you can strike mutually agreeable invoice timing.

Tips for Effective Invoicing:

- Clear Communication: Always communicate with the client about invoicing expectations at the start of a project. It reduces surprises and potential disputes.

- Prompt Invoicing: Send invoices promptly based on your agreed schedule. Delays in invoicing can lead to delays in payment.

- Detailed Records: Maintain detailed records of the hours worked, tasks completed, and expenses incurred. The more detailed and clear your invoice, the less room there is for confusion.

- Follow Up: If the due date for payment has passed and the client hasn’t settled the invoice, send a polite reminder.

- Thank Clients: When clients make a payment, it’s good practice to acknowledge receipt and thank them. It fosters a positive professional relationship.

Conclusion

Invoicing clients on an hourly basis provides flexibility, transparency, and ensures you receive payment for all your hard work. However, creating professional hourly invoices manually can be a headache. With the customizable hourly invoice templates provided here as Word, Excel, and PDF downloads, you can skip the busywork and quickly generate polished invoices to send clients. These templates allow you to neatly track dates, billable hours, and hourly rates while calculating totals automatically.

No more hunting for spreadsheet templates or trying to format complicated tables in Word – just plug in your details and the template does the work for you. With a few clicks, you can look organized and professional for clients. Spend your extra time growing your business, not building invoices. Just click to download the hourly invoice template file type that works for you. You’ll be ready to invoice clients easily so you can receive timely payments and grow your business.

FAQs

How do I calculate the total on an hourly invoice?

To calculate the total, multiply the number of hours worked by the hourly rate. If there are multiple tasks or services, calculate the total for each and then sum them up. Don’t forget to add any additional expenses or taxes if applicable.

Can I include expenses in my hourly invoice?

Yes, many professionals include additional expenses incurred while working on the client’s project. These expenses should be itemized separately, and it’s helpful to provide a brief description and the amount for each.

How can I ensure timely payment of my hourly invoices?

Clearly specify the due date on the invoice, maintain open communication with the client, and send polite reminders if the payment is overdue. Some professionals also offer early payment discounts or implement late payment fees as incentives.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)