An invoice is a crucial document in any business transaction as it serves as a formal record of the goods or services sold to a customer, along with the pricing details and payment terms.

The invoice is often referred to as a sales invoice by the vendor, while the buyer views it as a purchase invoice. It is a fundamental tool for businesses, as it helps to ensure smooth and efficient payment processes and to avoid disputes. For businesses of all sizes, having a clear and comprehensive invoice is vital to ensuring that financial transactions run smoothly and efficiently.

Whether you are a sole proprietor, part of a small business, or working for a larger company, understanding how to create a professional and effective invoice is a critical aspect of success.

The contents of an invoice should accurately reflect the goods or services provided, the prices, the total charges, and any applicable terms. By taking the time to craft an invoice that is detailed, clear, and concise, you can provide evidence of your transactions and establish a reliable system for invoicing and payment.

Table of Contents

Invoice Templates

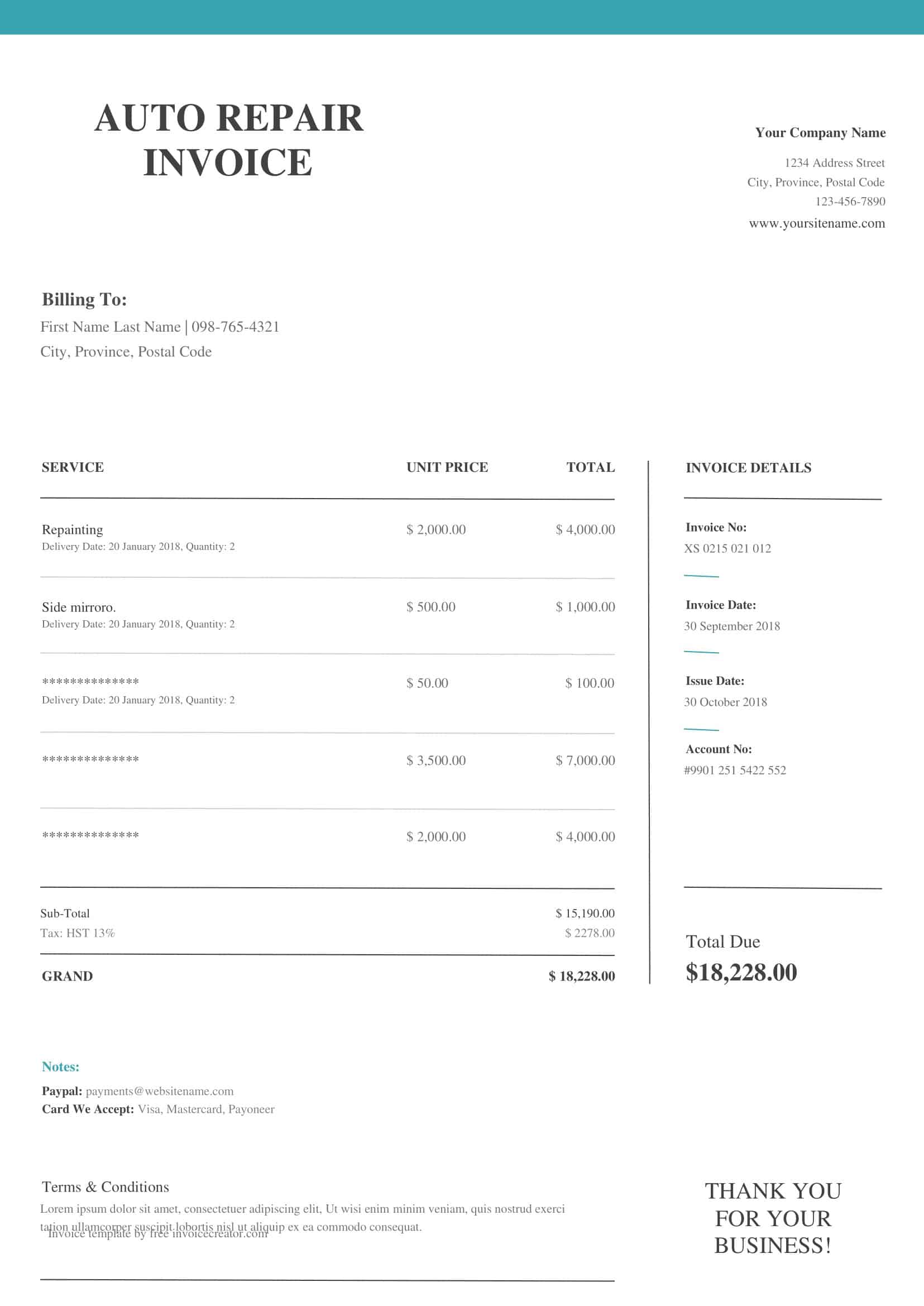

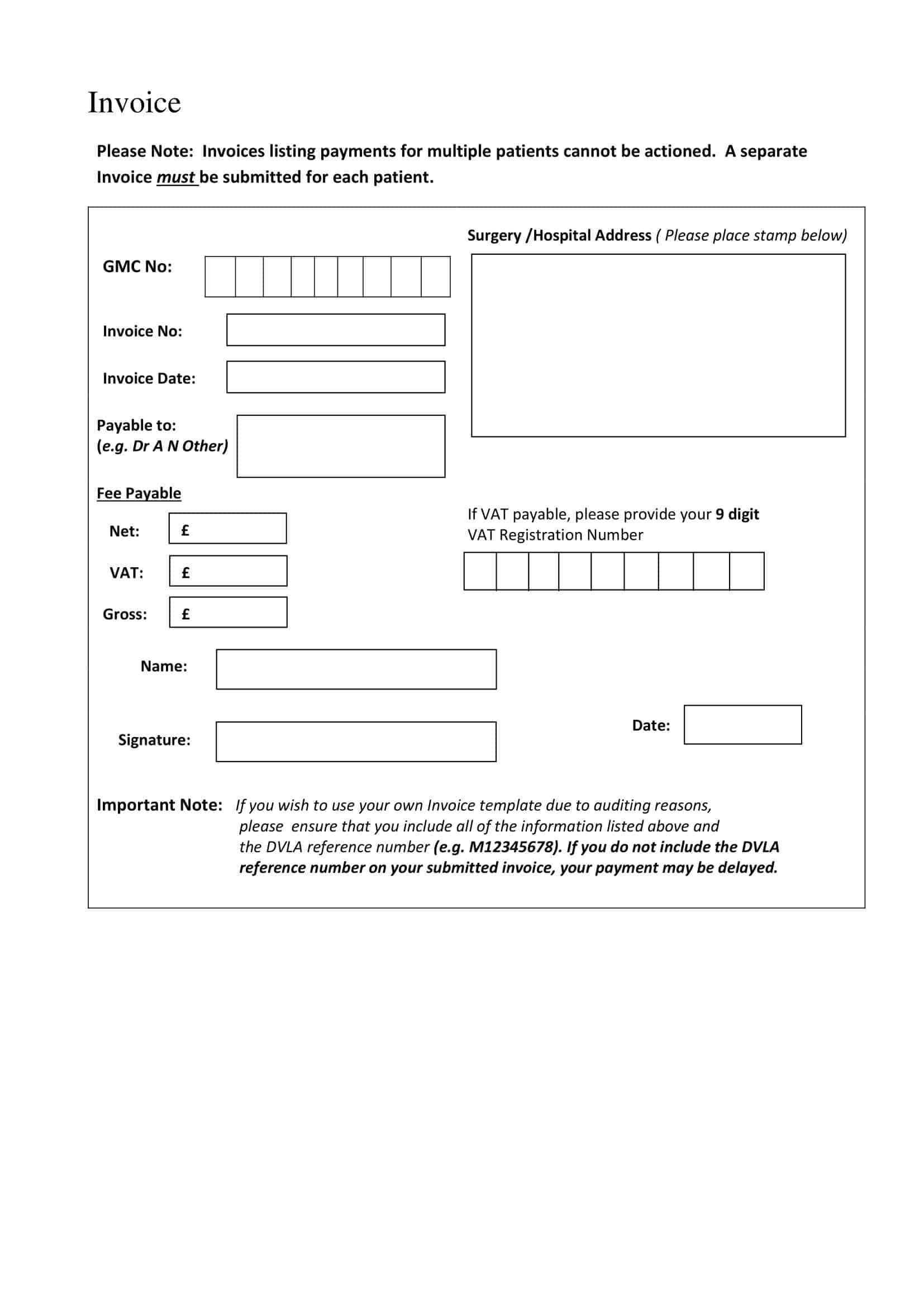

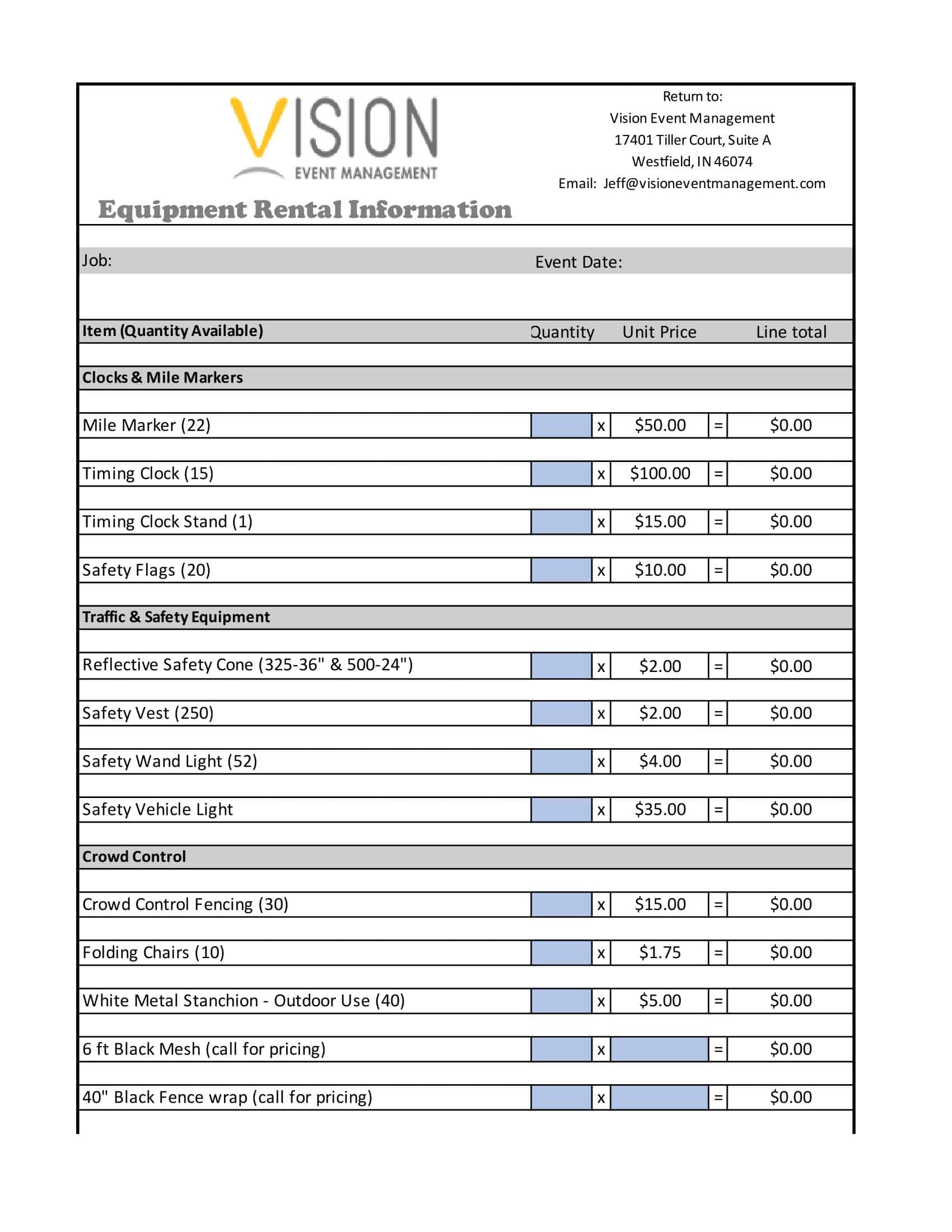

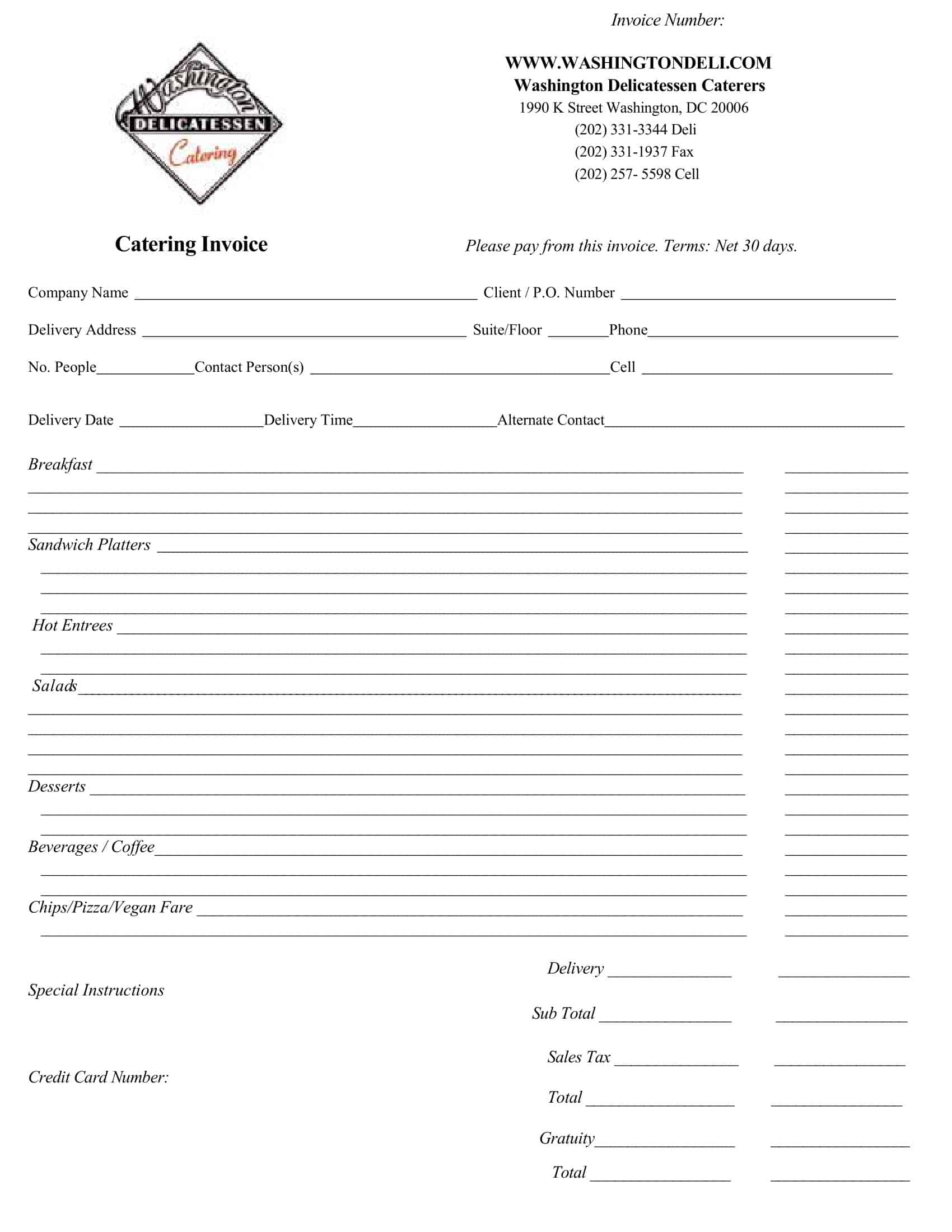

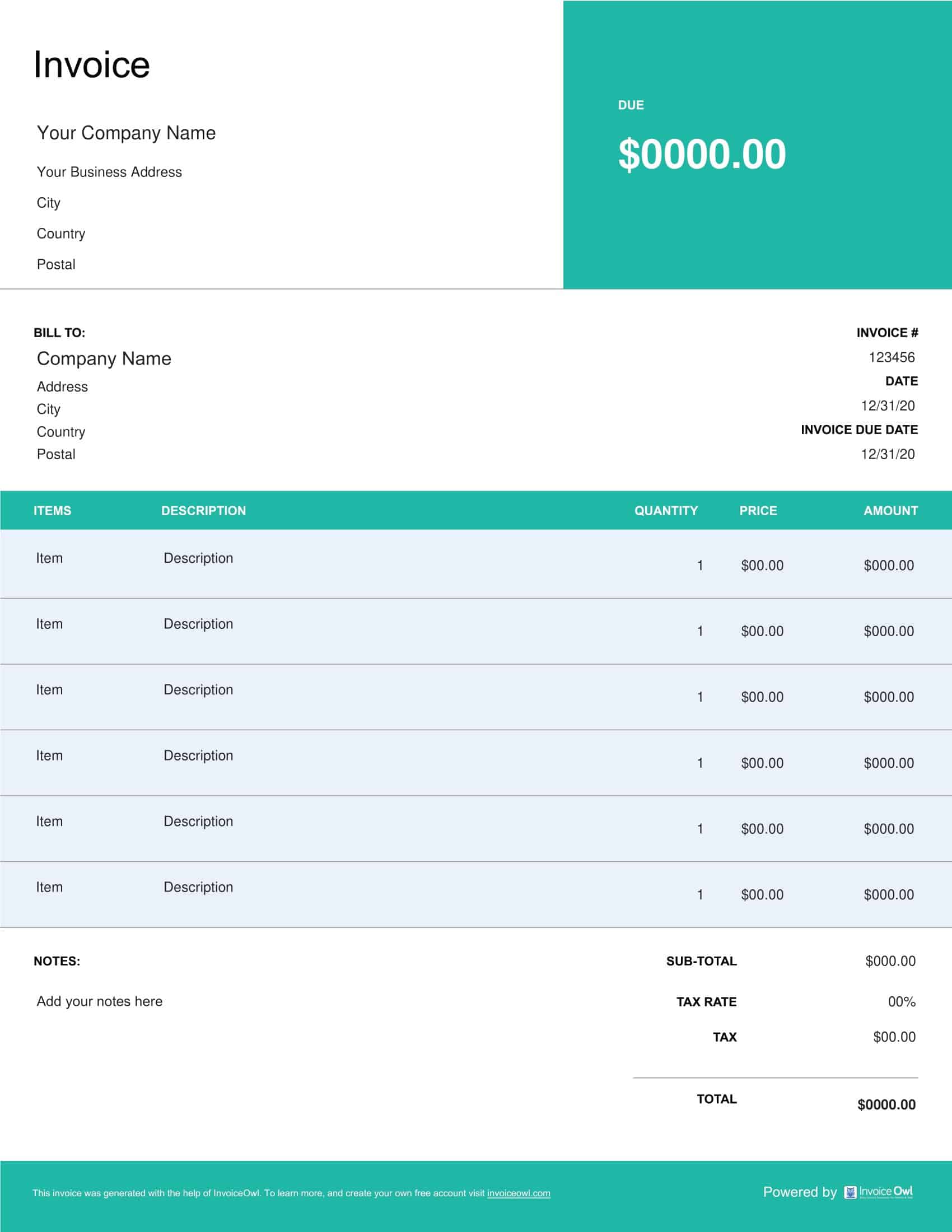

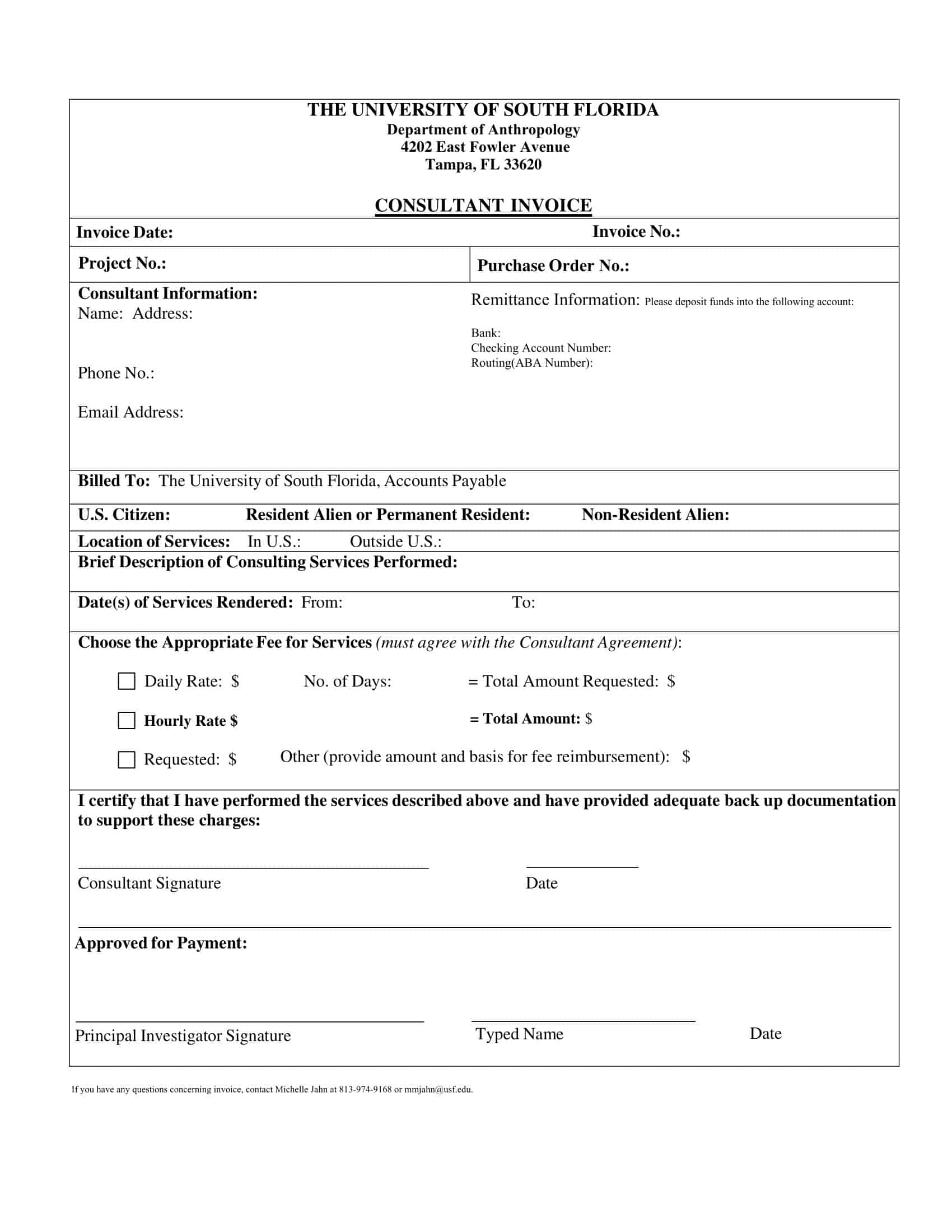

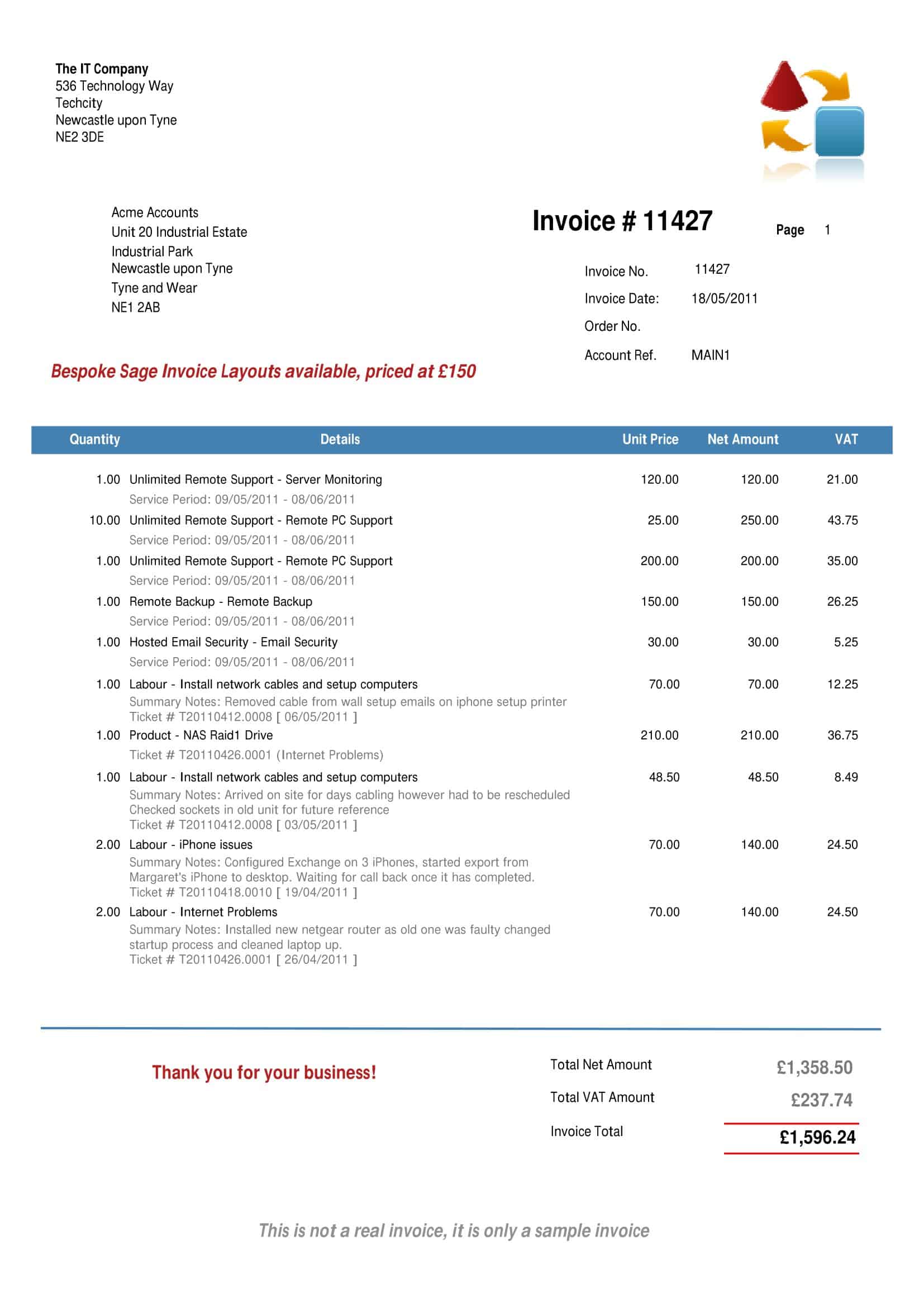

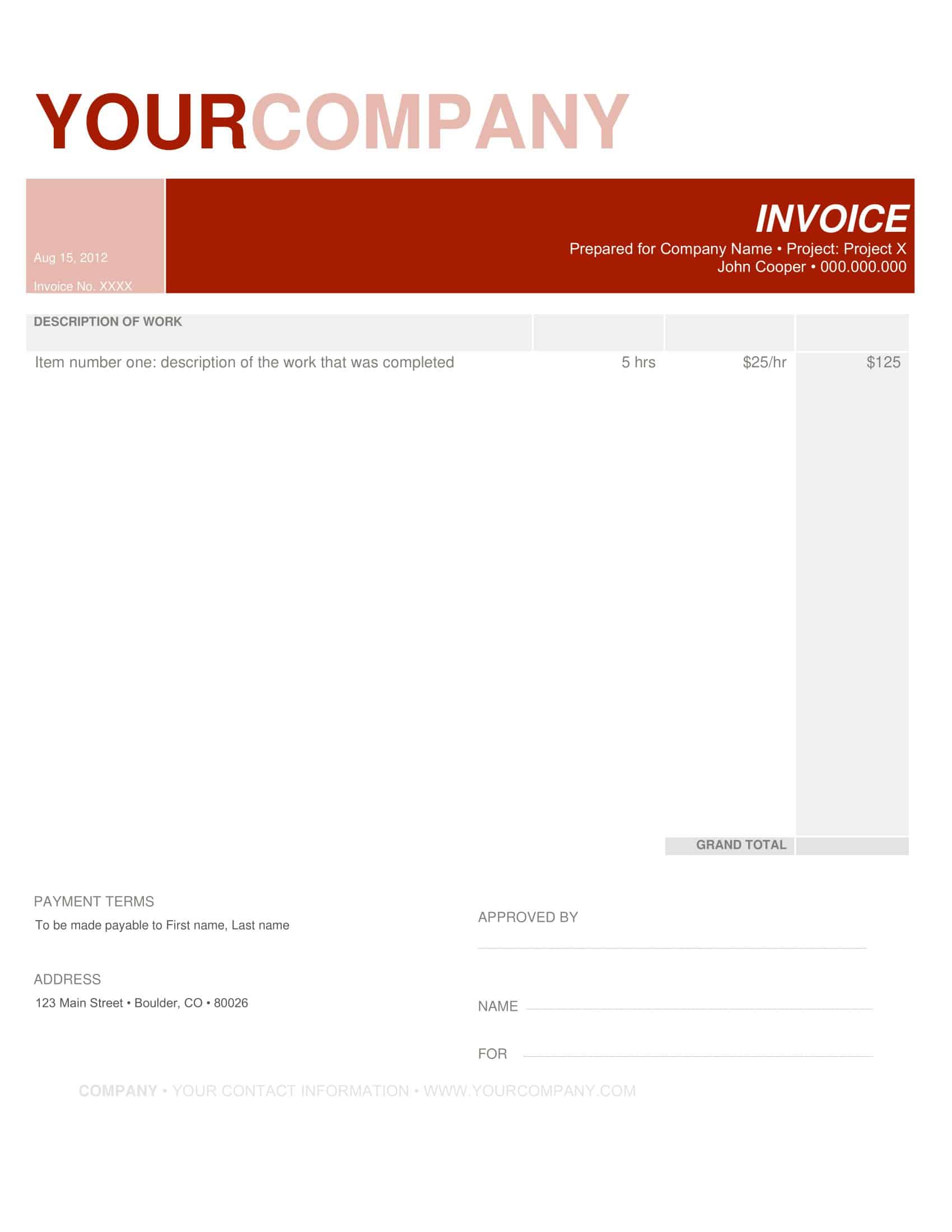

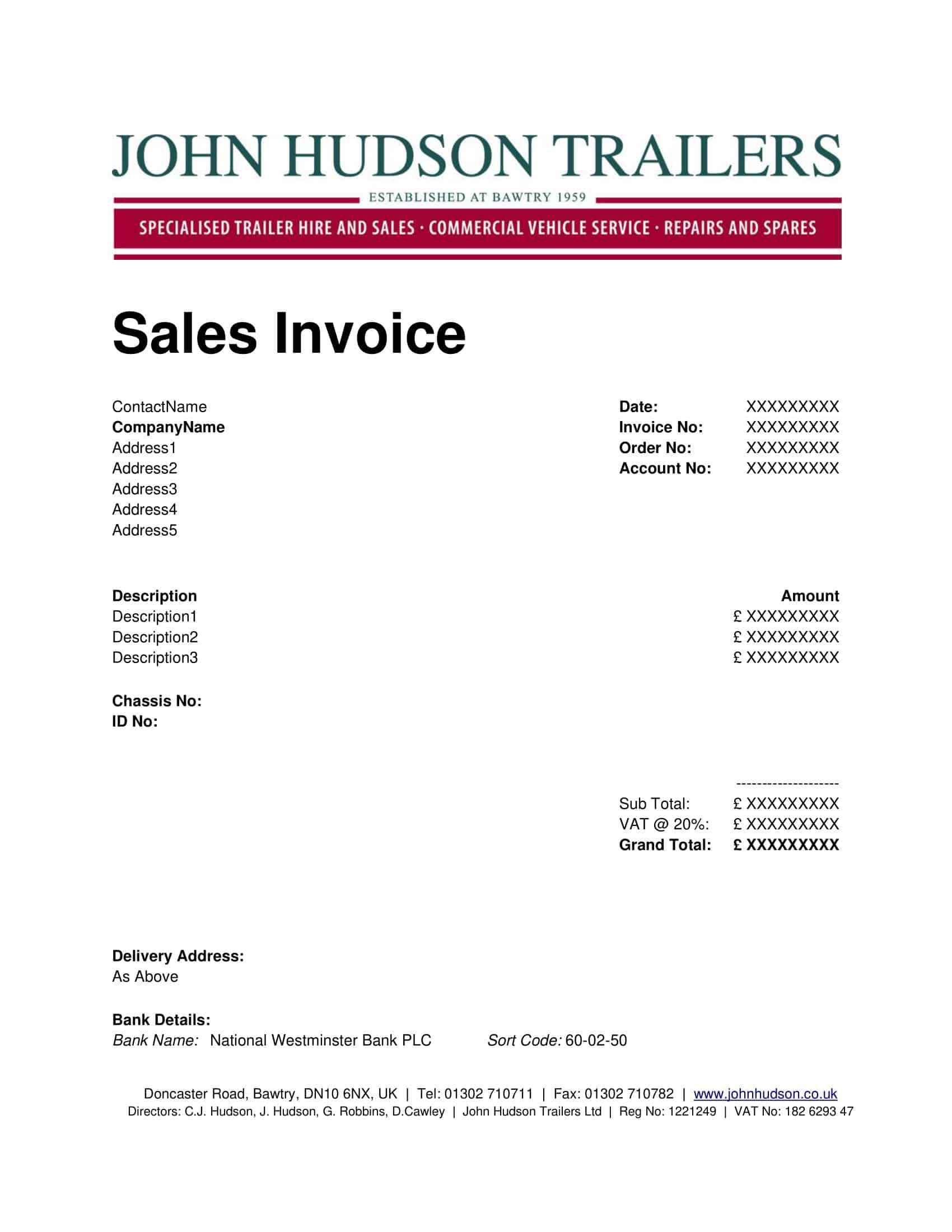

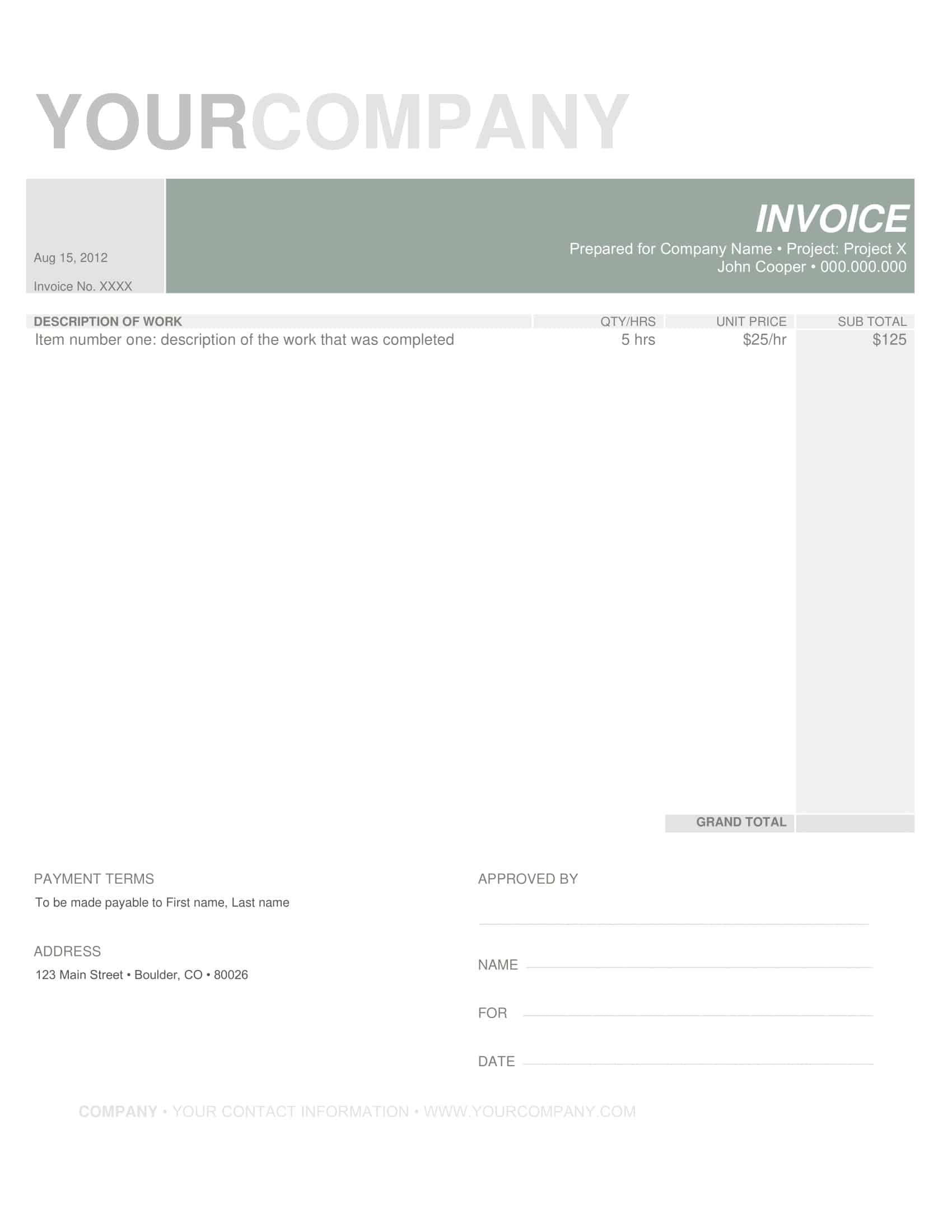

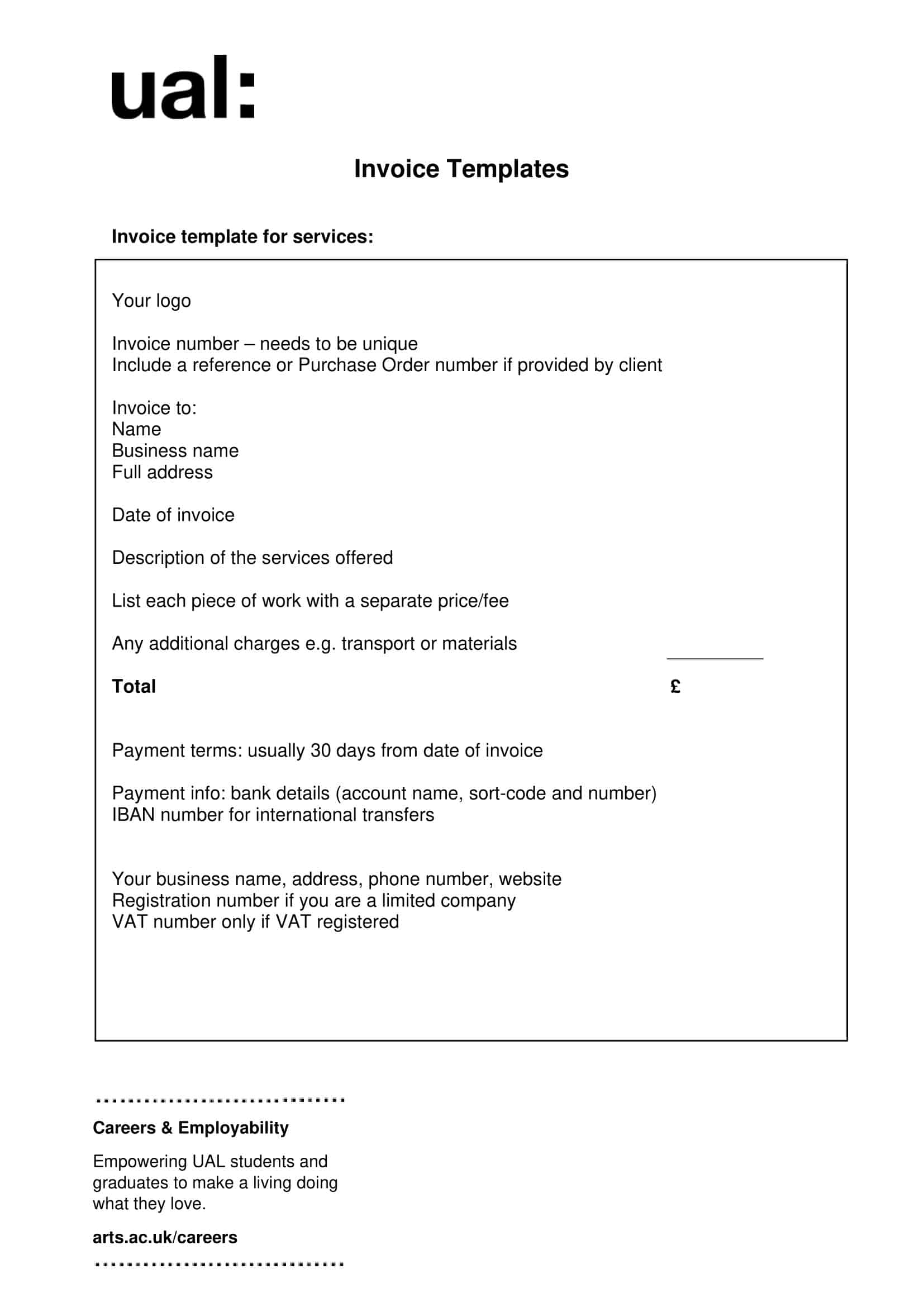

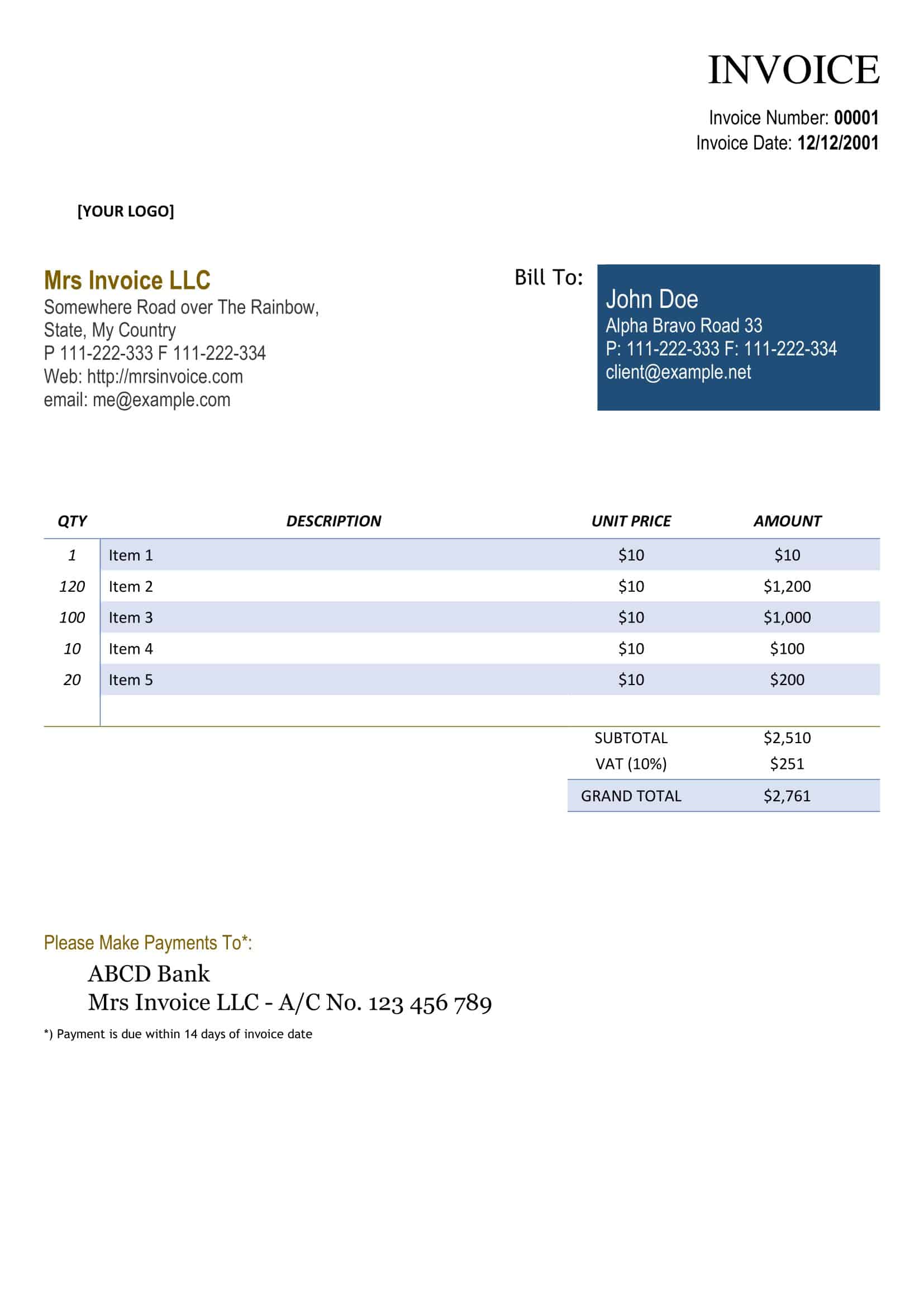

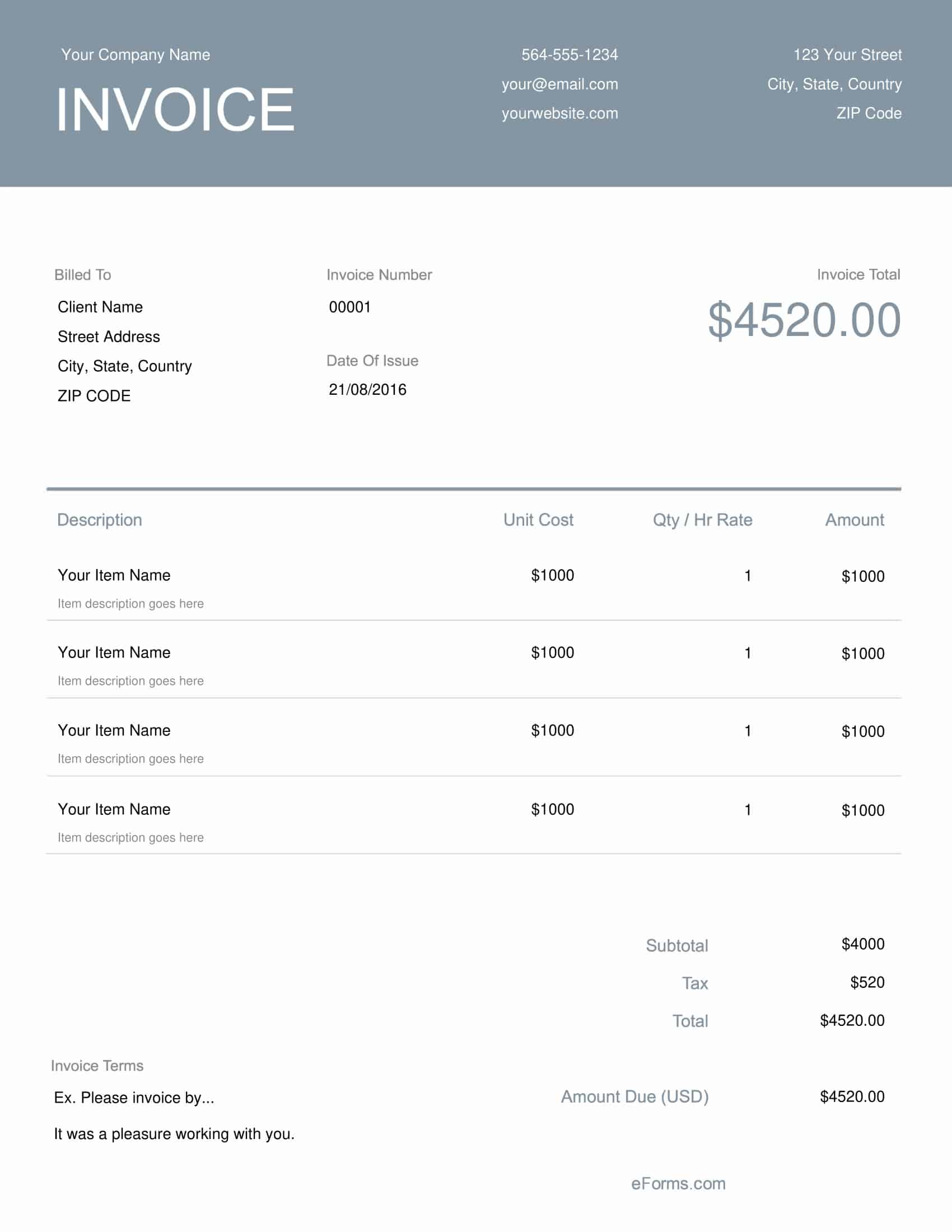

Invoice templates are pre-designed documents that provide a structured format for creating professional and consistent invoices. They are widely used by businesses of all sizes and industries to streamline the invoicing process and ensure accuracy and professionalism in their financial transactions. These templates serve as a framework for creating invoices, making it easier to include essential details such as the seller’s and buyer’s information, itemized lists of products or services provided, quantities, prices, taxes, and payment terms.

The primary purpose of invoice templates is to provide a standardized layout and structure that simplifies the invoicing process. By using a template, businesses can save time and effort in creating invoices from scratch while maintaining a cohesive and professional appearance across all their financial documents. This consistency not only enhances the brand image but also helps build trust and credibility with clients and customers.

Invoice templates are typically created using popular software applications such as Microsoft Word, Excel, or specialized accounting software. These templates may come in various formats, including Word documents, Excel spreadsheets, PDF files, or even online forms. They can be customized according to the specific needs and branding requirements of a business, allowing for the inclusion of logos, color schemes, and personalized contact information.

What is the purpose of an invoice?

![Free Printable Invoice Templates [Excel, Word, PDF] & Blank Download 1 Invoice](https://www.typecalendar.com/wp-content/uploads/2023/06/Invoice.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/06/Invoice-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/06/Invoice-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/06/Invoice-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/06/Invoice-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/06/Invoice-1200x675.jpg 1200w)

Invoices are essential documents in business. They list products or services provided, quantities, pricing, payment terms, and other relevant details. Well-designed invoice templates make creating and tracking invoices much easier. Templates allow you to reuse the same format repeatedly, ensuring consistency. Many contain basic fields like date, invoice number, customer name and address, etc. Templates can also calculate totals, taxes, etc. automatically. More advanced templates may connect to accounting software or customer databases. Overall, invoice templates improve workflow efficiency.

In addition to templates, most invoicing software provides other tools. These allow customizing invoice appearance, generating invoices from order forms, sending invoices electronically, accepting online payments, etc. Features like recurring invoices for regular services and automated reminders for overdue invoices are extremely helpful. Some systems offer collaboration features so multiple team members can access and manage invoices. Mobile apps allow generating and sending invoices on-the-go.

Choosing the right invoicing templates and software can optimize and automate the invoicing process. This saves time, minimizes errors, provides professional looking invoices, and improves get paid faster. Evaluating options based on business needs and workflow is advised. Sufficient flexibility and integration capabilities are also important. With quality templates and tools, invoicing becomes simple and fast.

What should an invoice include?

An invoice should include the following key elements:

Business Name and Information: The business name, address, phone number, and any other relevant contact information should be included on the invoice.

Customer Information: The name and address of the customer receiving the invoice should be clearly indicated.

Invoice Number: A unique invoice number should be assigned to each invoice to ensure easy tracking and identification.

Date of Issue: The date the invoice was issued should be clearly indicated.

Description of Goods or Services: A detailed description of the goods or services provided should be included, along with any relevant specifications or details.

Prices: The prices of the goods or services should be clearly indicated, including any taxes or additional charges.

Total Amount Due: The total amount due, including any taxes or additional charges, should be calculated and indicated on the invoice.

Payment Terms: The payment terms, including the payment due date, the method of payment, and any late payment fees, should be indicated.

Signature: A signature or electronic equivalent may be required to provide evidence of the invoice’s authenticity and acceptance by both parties.

Including these key elements in an invoice helps to ensure that it is complete, accurate, and easy to understand, thereby improving the efficiency of payment processes and avoiding disputes.

When should you send an invoice?

An invoice should be sent when the goods or services have been provided, or when the customer has received the goods, whichever occurs first. It is generally best to send the invoice as soon as possible after the transaction has taken place, as this helps to avoid delays in payment and ensures that the customer has a clear understanding of the payment terms.

For businesses that provide services, it is common to send invoices at regular intervals, such as at the end of the week or month, or after completion of a project. In this case, it is important to clearly communicate the invoicing schedule to the customer in advance, and to send the invoice promptly when the services have been rendered.

Regardless of the timing, it is important to make sure that the invoice is accurate and complete, including all relevant information and the correct amount due. By sending invoices promptly and accurately, businesses can help to ensure that payment is received in a timely manner and avoid any potential disputes.

Different types of invoice

There are several different types of invoices, including:

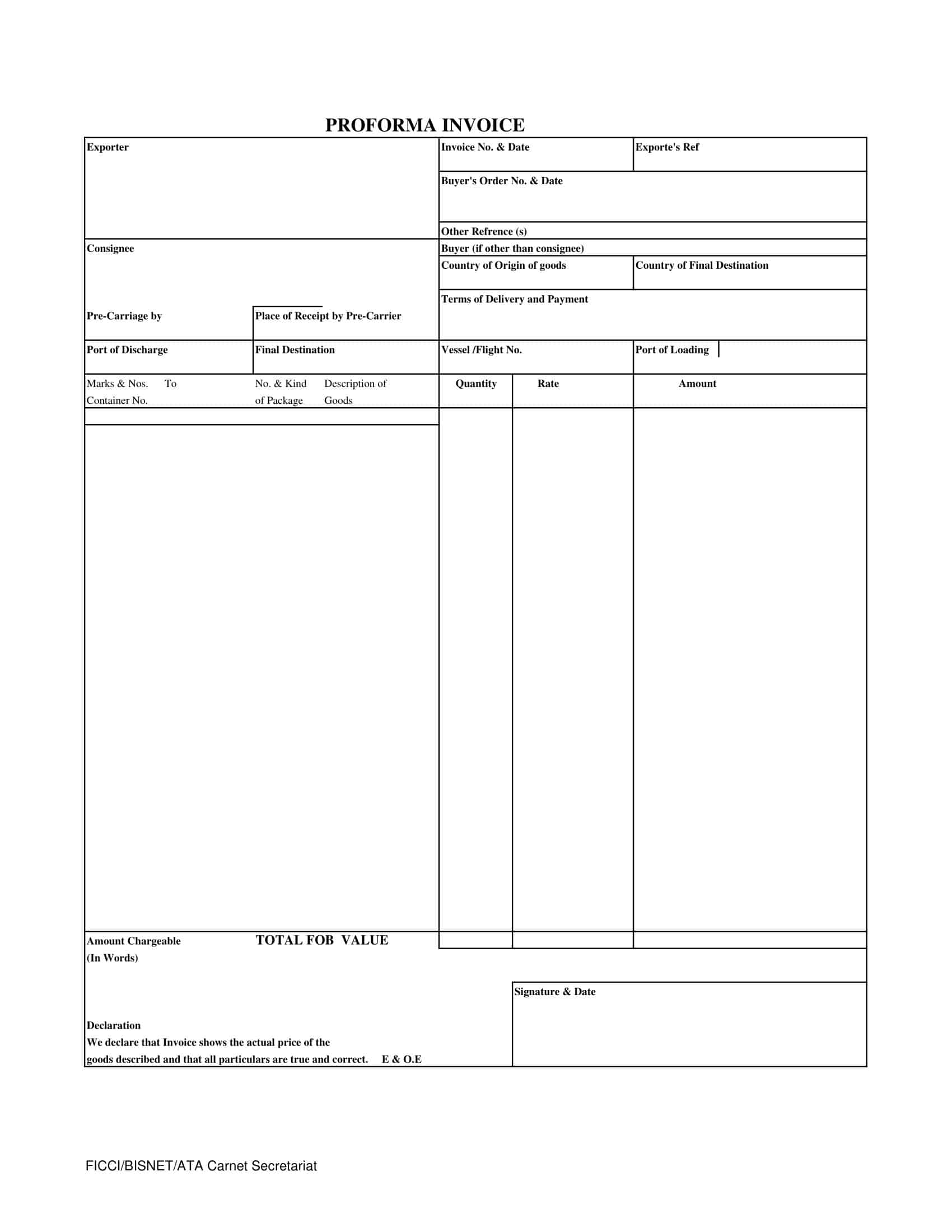

Proforma Invoice: A proforma invoice is a preliminary invoice that is issued before the goods or services have been provided. It is used to confirm the details of a sale, including the prices and payment terms, and is often used as a placeholder until the final invoice can be issued.

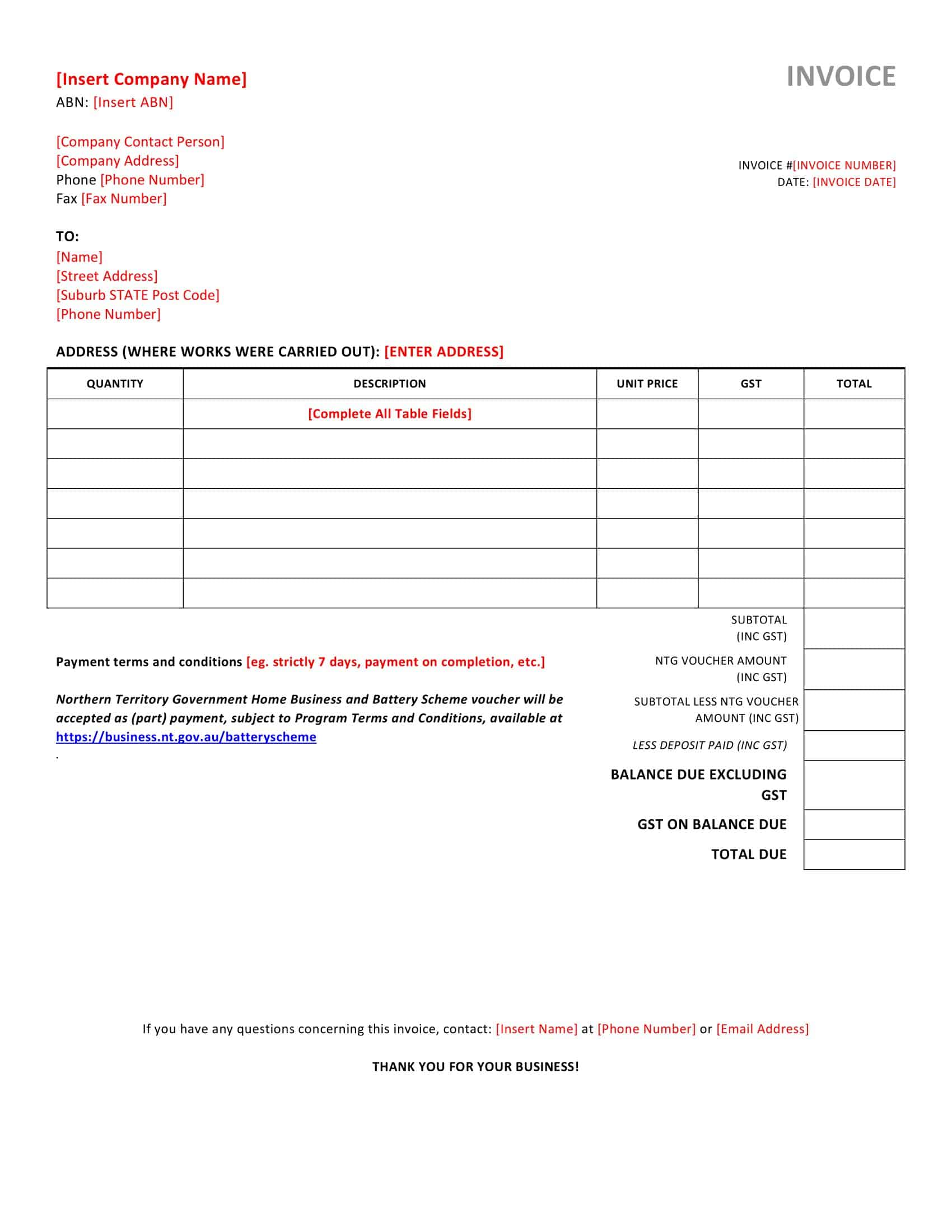

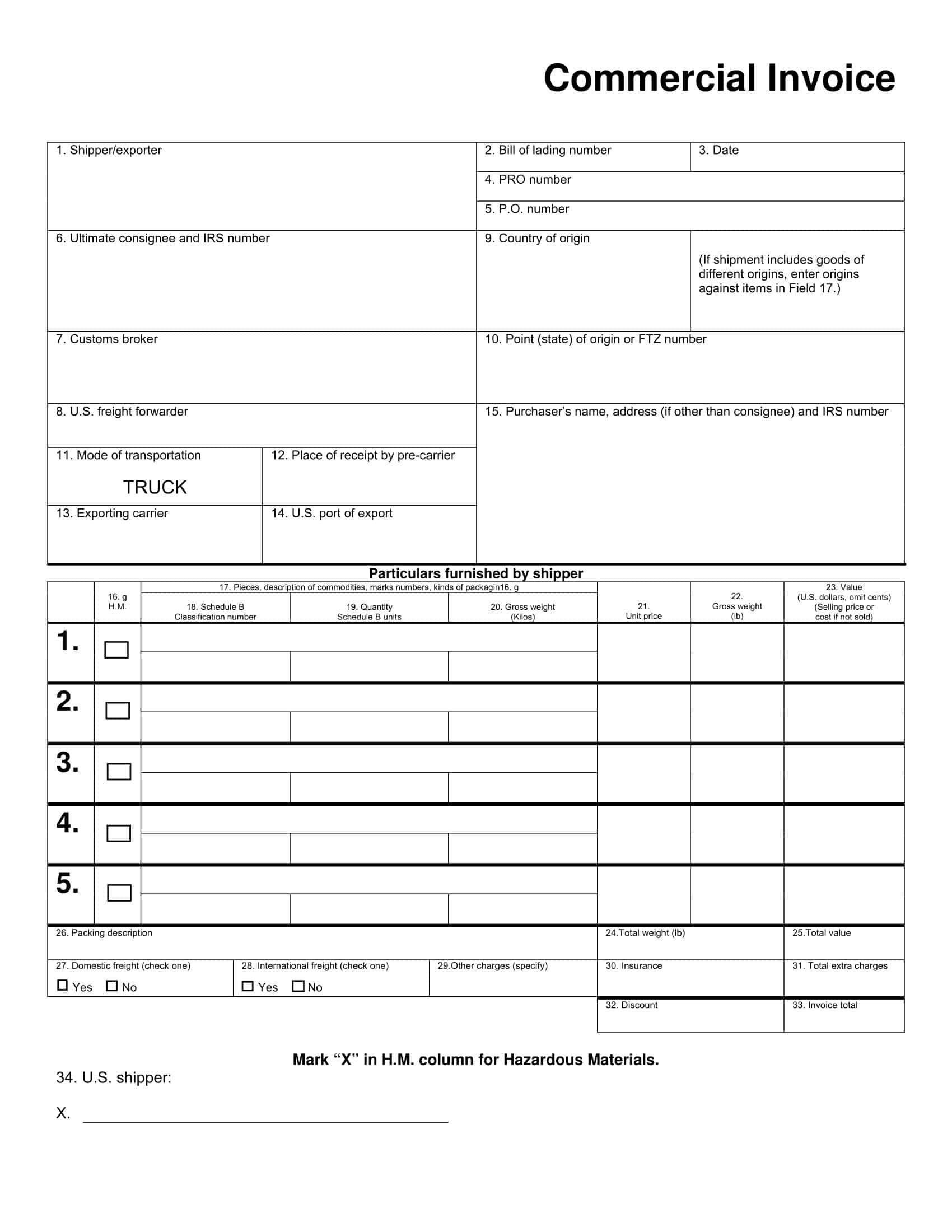

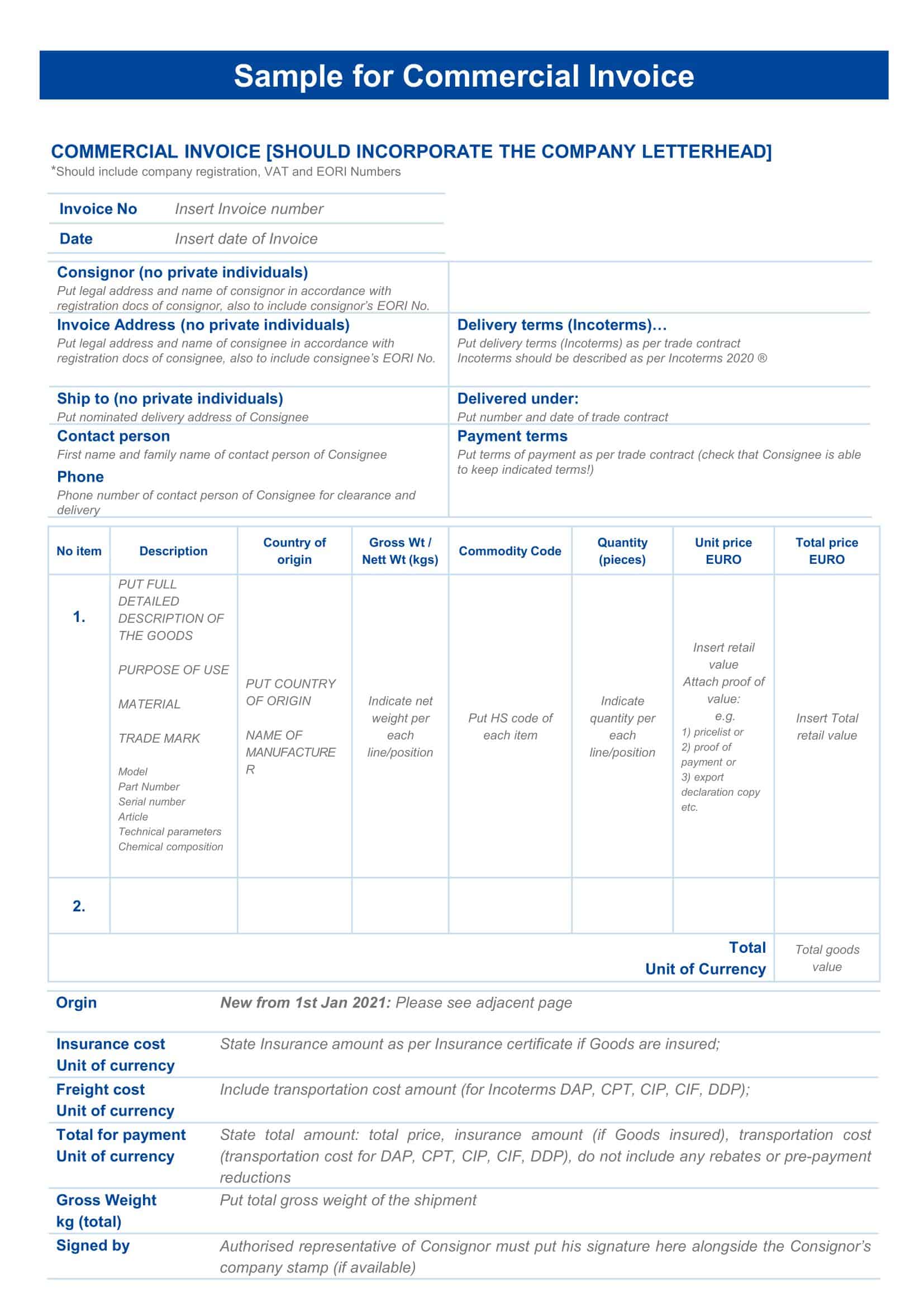

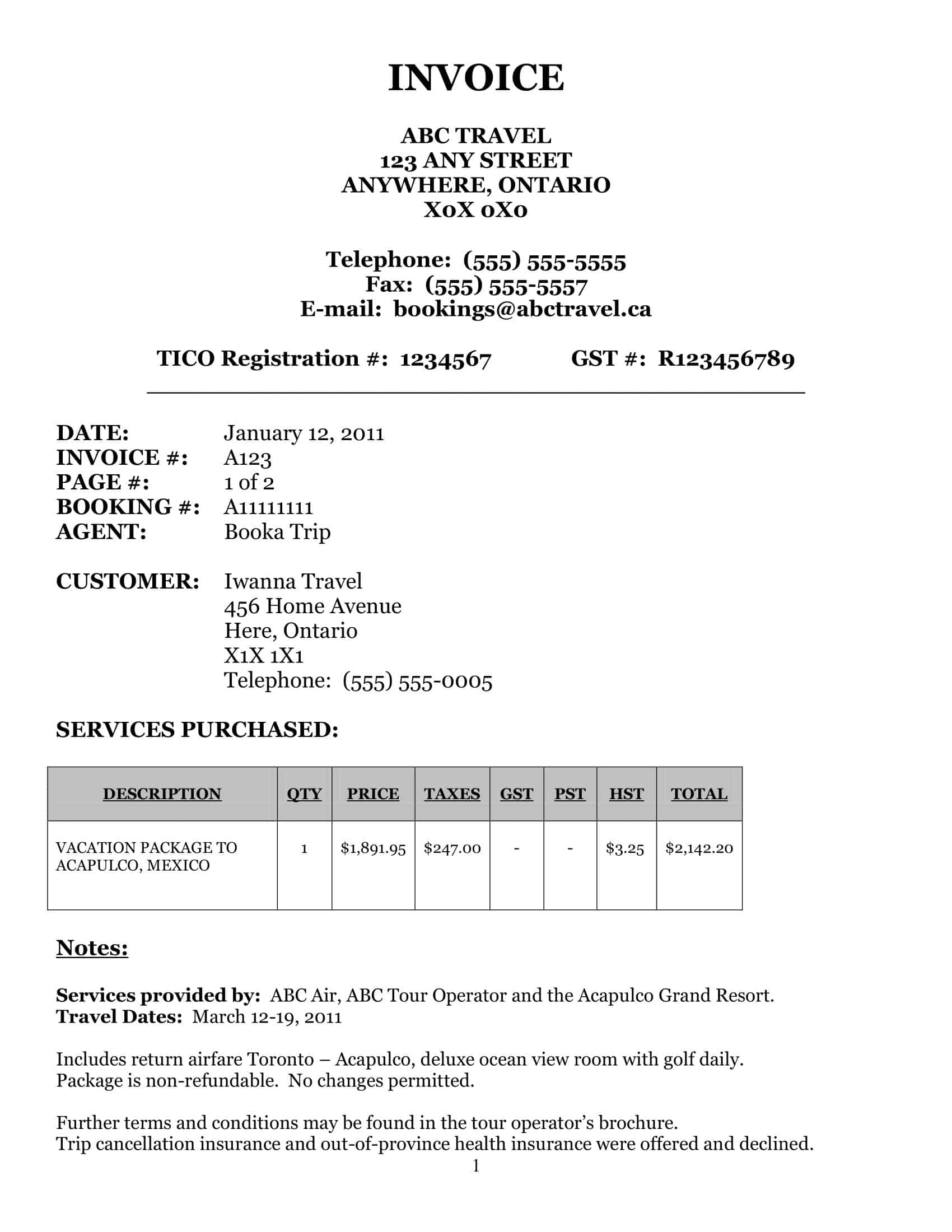

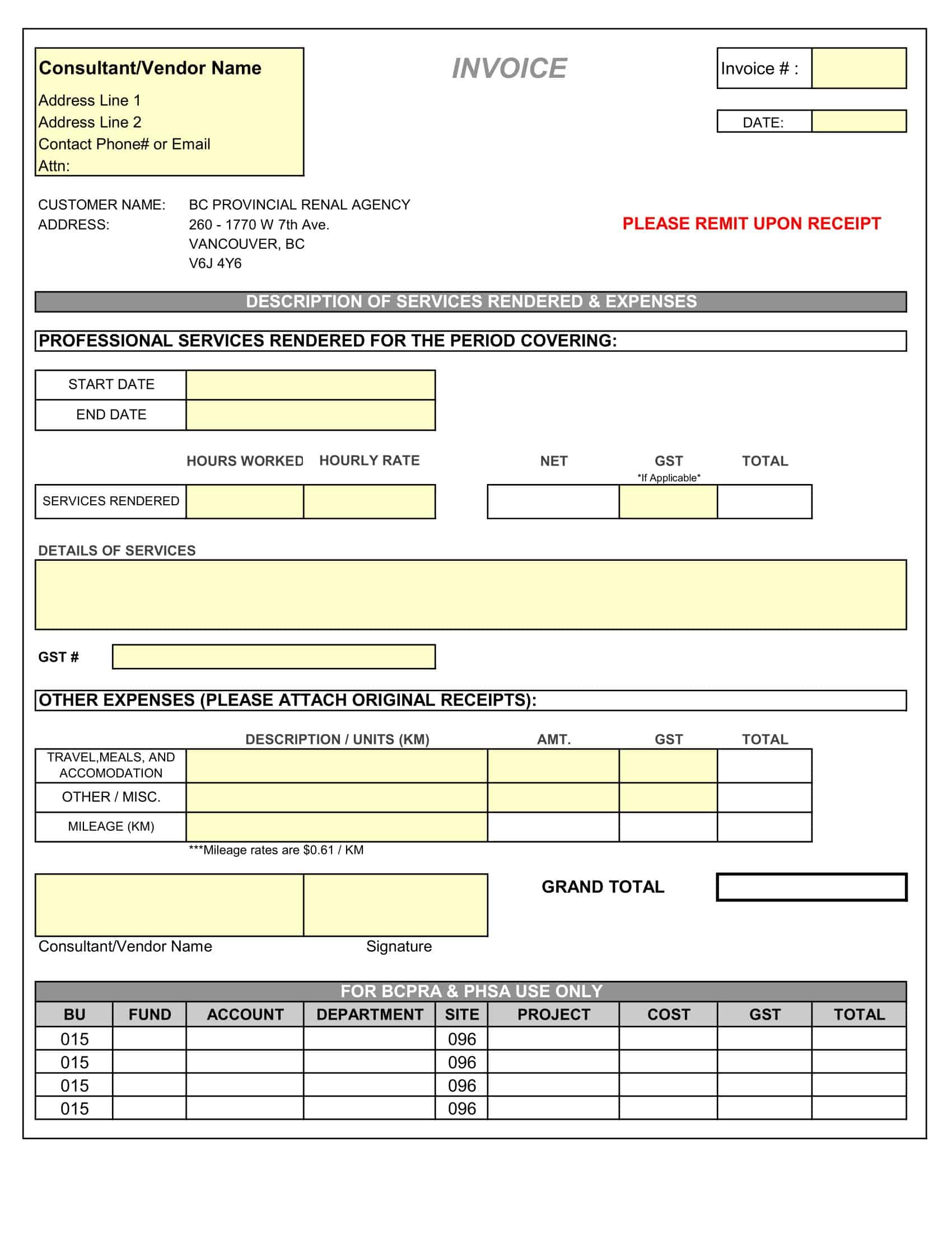

Commercial Invoice: A commercial invoice is a formal invoice that is used in international trade transactions. It provides detailed information about the goods being sold and the terms of the transaction, and is often required for customs purposes.

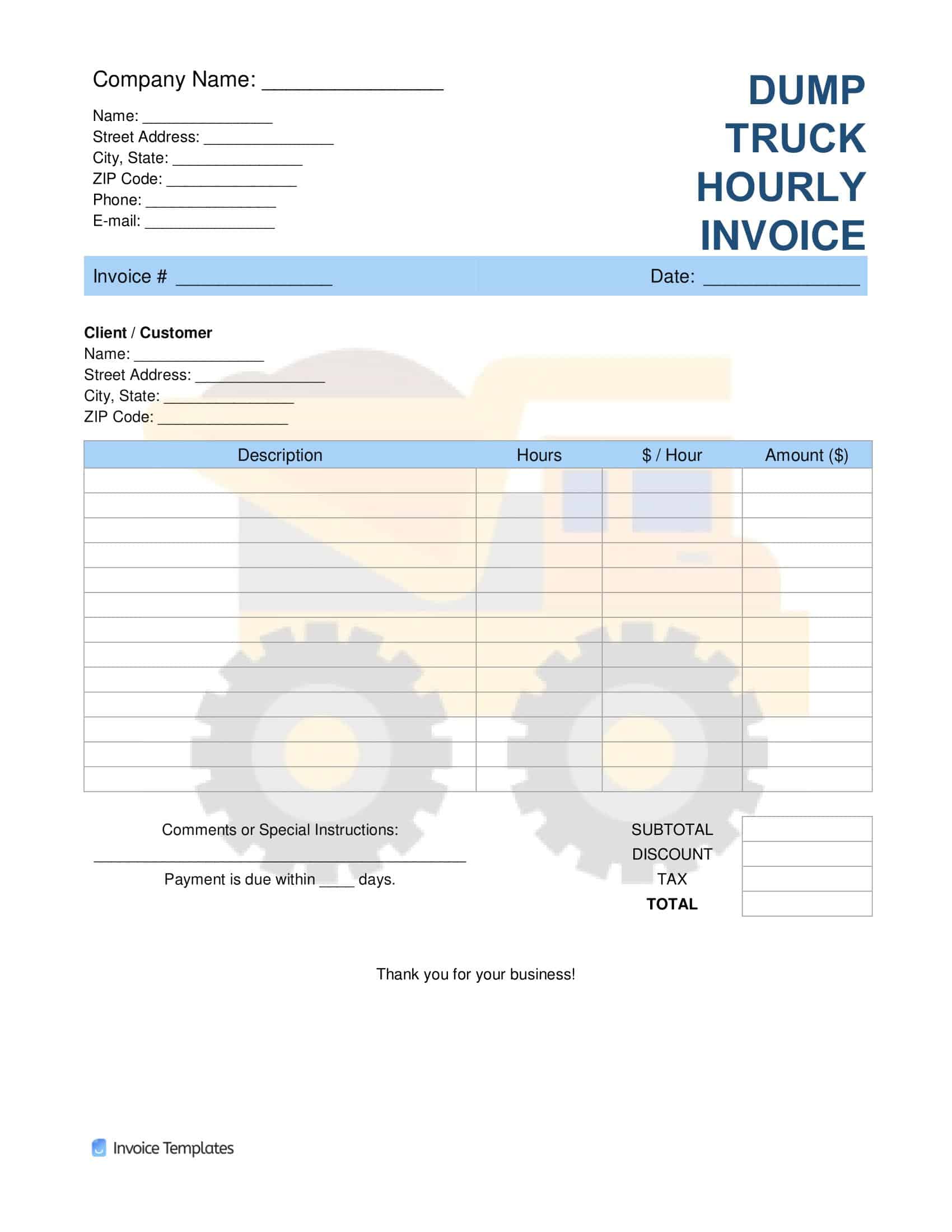

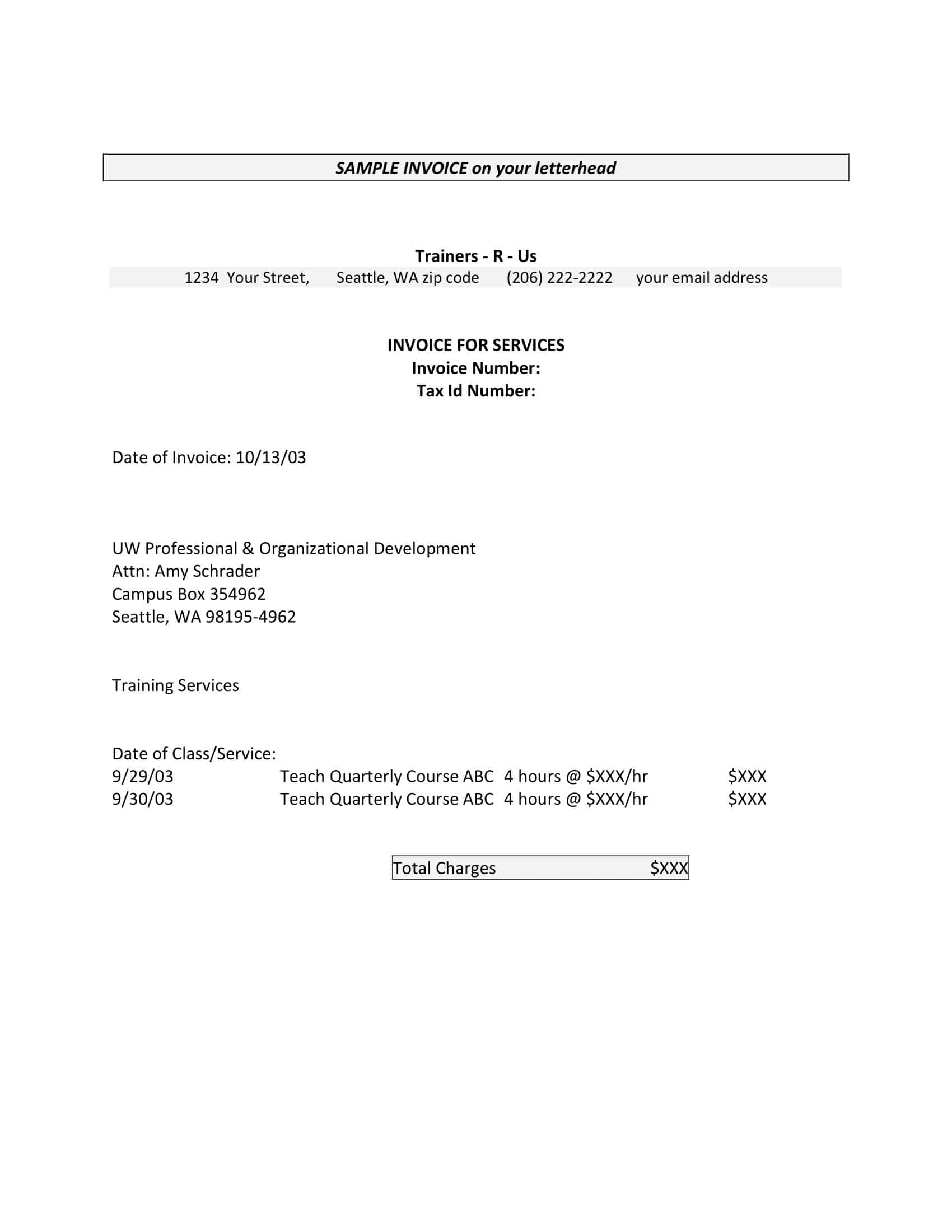

Service Invoice: A service invoice is used to bill for services rendered. It includes a detailed description of the services provided, the prices, and the payment terms.

Recurring Invoice: A recurring invoice is used for repeating services, such as a monthly subscription or retainer. It includes the same information as a standard invoice, but is issued on a recurring basis.

Credit Invoice: A credit invoice is used to indicate a credit or refund for goods or services. It is used to offset the original invoice and can be issued as a result of overpayment, returns, or other circumstances.

Self-Billing Invoice: A self-billing invoice is issued by a customer, rather than the vendor. It is often used by larger companies to streamline their invoicing processes.

Purchase Order Invoice: A purchase order invoice is used to match the goods received to the purchase order issued by the customer. It is used to confirm that the customer received the correct goods and quantities, and to facilitate payment.

Debit Note: A debit note is used to request a debit from a customer’s account in response to an incorrect invoice. It is used to correct errors in invoices, such as incorrect quantities or prices.

Vat Invoice: A VAT (Value Added Tax) invoice is used to bill for goods and services that are subject to VAT. It includes the VAT amount and the total amount due, including the VAT.

Consolidated Invoice: A consolidated invoice is used to combine multiple invoices into a single invoice. This can be useful for customers who receive regular invoices from the same vendor, as it reduces the number of invoices they need to track and pay.

Advance Invoice: An advance invoice is used to request payment before the goods or services have been provided. It is used as a way of securing payment, especially for large or complex projects.

Partial Invoice: A partial invoice is used to bill for only a portion of the goods or services provided. It is used when the full transaction cannot be completed or invoiced at once.

Each type of invoice serves a specific purpose and is used in different circumstances. By understanding the different types of invoices, businesses can choose the best option for their needs and ensure that they are accurately recording their transactions.

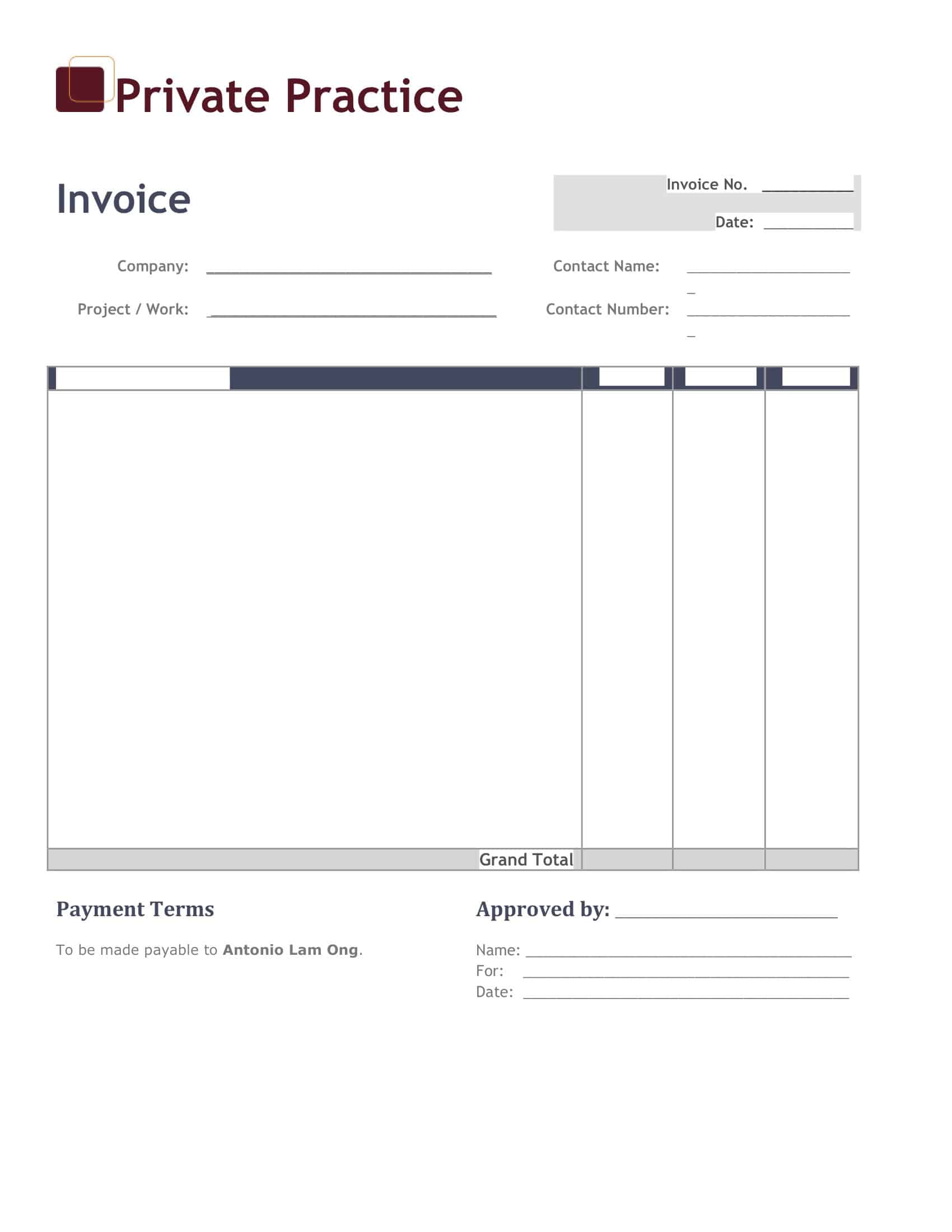

Blank Invoice Template

A blank invoice is a template that can be used to create an invoice for a customer. It typically includes all of the standard information that is required on an invoice, such as the company’s contact information, the customer’s information, the date, and a description of the goods or services being provided.

Blank invoices can be created in various formats, such as Microsoft Word, Microsoft Excel, or a specialized invoicing software. The advantage of using a blank invoice is that it provides a starting point for creating an invoice, making it easier and quicker to complete. The information can be customized for each customer or transaction, making it a flexible and versatile tool for businesses of all sizes.

In addition to being useful for creating invoices, blank invoices can also be used as a way to track payments, as they provide a clear record of the amounts due and when they were paid. This can be especially useful for businesses that work with multiple customers or provide a large volume of goods or services.

By using blank invoices, businesses can simplify their invoicing process, ensure accuracy and completeness, and help to streamline their accounts payable and receivable processes. It is a simple, yet effective tool for managing the financial aspects of a business.

How to create an invoice: A step-by-step guide

Creating an invoice is an essential step in the billing process for businesses of all sizes. It is a document that provides an itemized list of goods or services that were sold to a customer, along with the total amount due for payment. Having a clear and accurate invoice helps to ensure that the customer is aware of what they owe and when it is due, and also helps to keep track of payments and transactions for the business.

Here is a step-by-step guide on how to create an invoice:

Step 1: Gather the necessary information

Before you can create an invoice, you will need to gather the following information:

- Your business name, address, and contact information

- The customer’s name and address

- The date of the transaction

- A description of the goods or services provided

- The price of each item or service

- The total amount due

- Payment terms, such as the due date and method of payment

Step 2: Choose a format

There are several different formats that can be used to create an invoice, including Microsoft Word, Microsoft Excel, or invoicing software. Choose the format that works best for your business and the transaction, and open a new document or file.

Step 3: Add your business information

Include your business name, address, and contact information at the top of the invoice. This can include your company name, street address, city, state, zip code, phone number, and email address.

Step 4: Add the customer’s information

Include the customer’s name and address in the appropriate fields. This information can be entered manually or pulled from a database if using invoicing software.

Step 5: Add the date

Include the date of the transaction. This can be the date that the goods were sold or the date that the services were provided.

Step 6: Add a description of the goods or services provided

Include a clear and detailed description of each item or service that was provided to the customer. This should include the quantity of each item and the unit price.

Step 7: Calculate the total amount due

Calculate the total amount due by multiplying the quantity of each item by the unit price, and then adding up all of the totals. Enter this amount in the appropriate field.

Step 8: Add payment terms

Include any relevant payment terms, such as the due date and method of payment. This could include a statement that payment is due within 30 days, or that payment can be made by check or credit card.

Step 9: Review and print

Carefully review the invoice to make sure that all of the information is accurate and complete. If using invoicing software, you can typically preview the invoice before printing. If using a manual format, such as Microsoft Word or Excel, you may need to print a copy for your records and for the customer.

Step 10: Send the invoice to the customer

Send the invoice to the customer by email, regular mail, or another method that is convenient and appropriate.

By following these steps, you can create a clear and accurate invoice that will help to ensure that the customer is aware of what they owe and when it is due, and also help to keep track of payments and transactions for the business. This will help to improve the overall efficiency and effectiveness of your billing process.

FAQs

How is an invoice different from a receipt?

An invoice is a document that is sent before payment is made, while a receipt is a document that is provided after payment has been received. An invoice serves as a bill for the goods or services that were sold, while a receipt serves as proof of payment.

How often should invoices be sent?

The frequency of invoicing depends on the terms of the agreement between the seller and the customer. Some businesses may invoice monthly, while others may invoice after each transaction or project. The important thing is to ensure that invoices are sent in a timely manner and that payment terms are clearly defined.

How long does a customer have to pay an invoice?

The length of time that a customer has to pay an invoice is typically specified in the payment terms. This can range from a few days to several months, depending on the agreement between the seller and the customer.

What is the difference between an invoice and a quote?

An invoice is a bill for goods or services that have already been provided or sold. A quote is a preliminary estimate of the cost of goods or services that a customer may receive in the future. A quote is not a bill and is not binding on either the customer or the seller.

Can I make an invoice without a business name or registration?

Yes, you can make an invoice without a business name or registration, but it is generally recommended that you include a business name and registration information on your invoices. This information helps to identify your business and provides a level of legitimacy to your invoices.

What should I do if a customer disputes an invoice?

If a customer disputes an invoice, it’s important to address the issue promptly and professionally. Start by reviewing the invoice and the customer’s concerns to determine the cause of the dispute. If necessary, consider reaching out to the customer for additional information or clarification. If the dispute cannot be resolved, you may need to seek the assistance of a mediator or legal professional.

Is it necessary to have a physical invoice or can it be digital?

It is not necessary to have a physical invoice. Many businesses now use digital invoicing, which allows for faster and more efficient processing and tracking of payments. There are many invoicing software programs available that can be used to create and send digital invoices.

Can I charge additional fees or interest on overdue invoices?

This depends on the laws in your jurisdiction and the payment terms agreed upon with the customer. In some cases, late fees or interest may be allowed, but it is important to be aware of the legal restrictions and to clearly communicate any additional fees or interest to the customer before they incur any charges.

How can I ensure that invoices are paid on time?

To ensure that invoices are paid on time, it’s important to have clear payment terms and due dates, to follow up with customers who have overdue invoices, and to be prepared to take action if necessary, such as withholding delivery of goods or services or taking legal action. You can also consider offering incentives for early payment or using invoicing software that provides automatic reminders and payment tracking.

![Free Printable Roommate Agreement Templates [Word, PDF] 2 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 4 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)