Are you planning to buy a home and pay for it in cash? If so, it’s important to understand the concept of a proof of funds letter. This document serves as evidence that you have the financial means to complete the purchase.

Obtaining a proof of funds letter from your bank is one way to show that you have the necessary funds. In this article, we will explore what a proof of funds letter is, why it’s important, and how to obtain one. Whether you’re a first-time home buyer or a seasoned investor, understanding the process of obtaining a proof of funds letter is essential for making a cash purchase.

Table of Contents

What is a mortgage proof of funds letter?

A mortgage proof of funds letter is a document provided by a financial institution, such as a bank, that verifies that an individual has a certain amount of funds available for a mortgage down payment and closing costs. This letter is typically required by lenders as part of the mortgage application process to ensure that the borrower has the financial means to purchase the property.

The letter will typically include information such as the account holder’s name, the account balance, and the date the funds were verified. It is important to note that a mortgage proof of funds letter is different from a pre-approval letter which is an assessment by the lender of the borrower’s creditworthiness and ability to repay the loan.

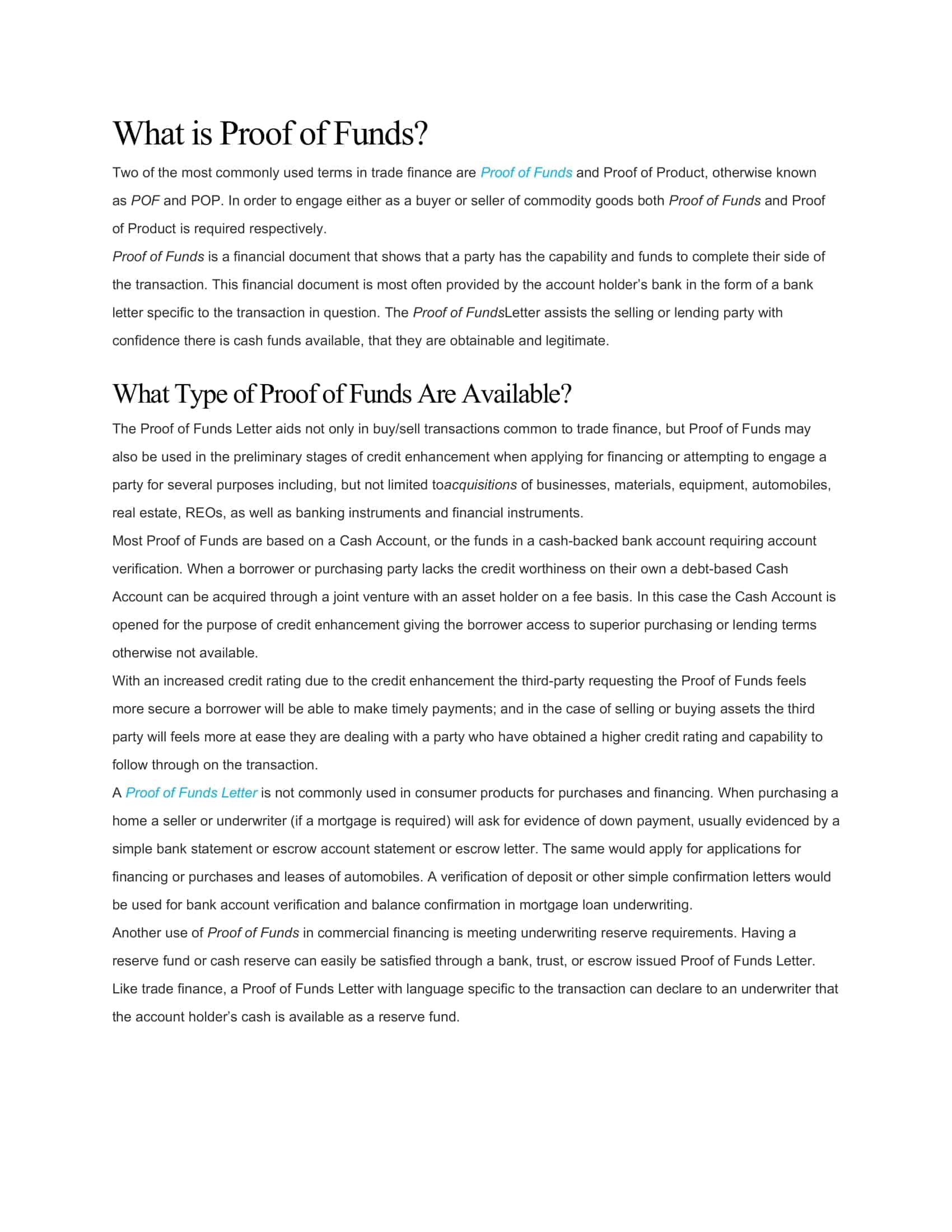

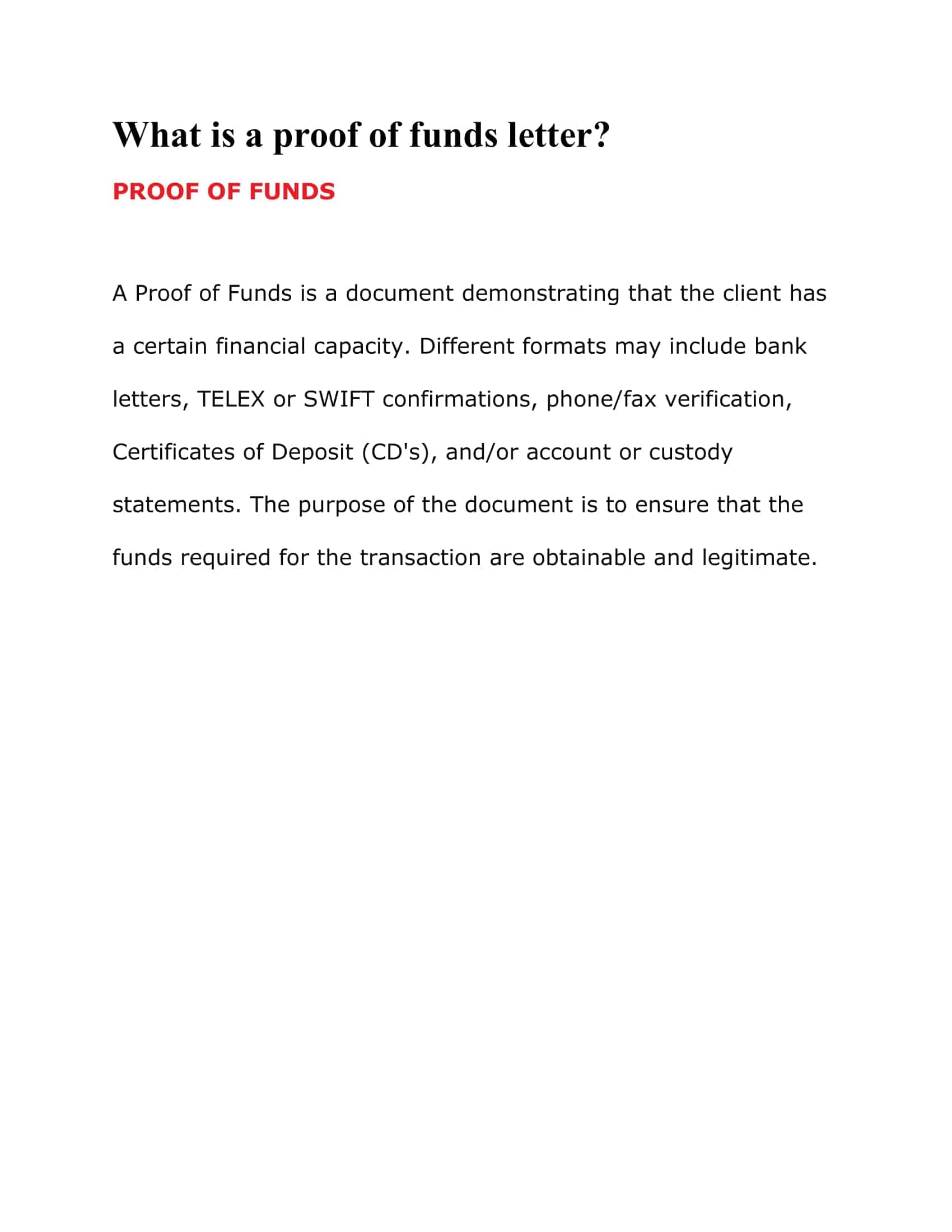

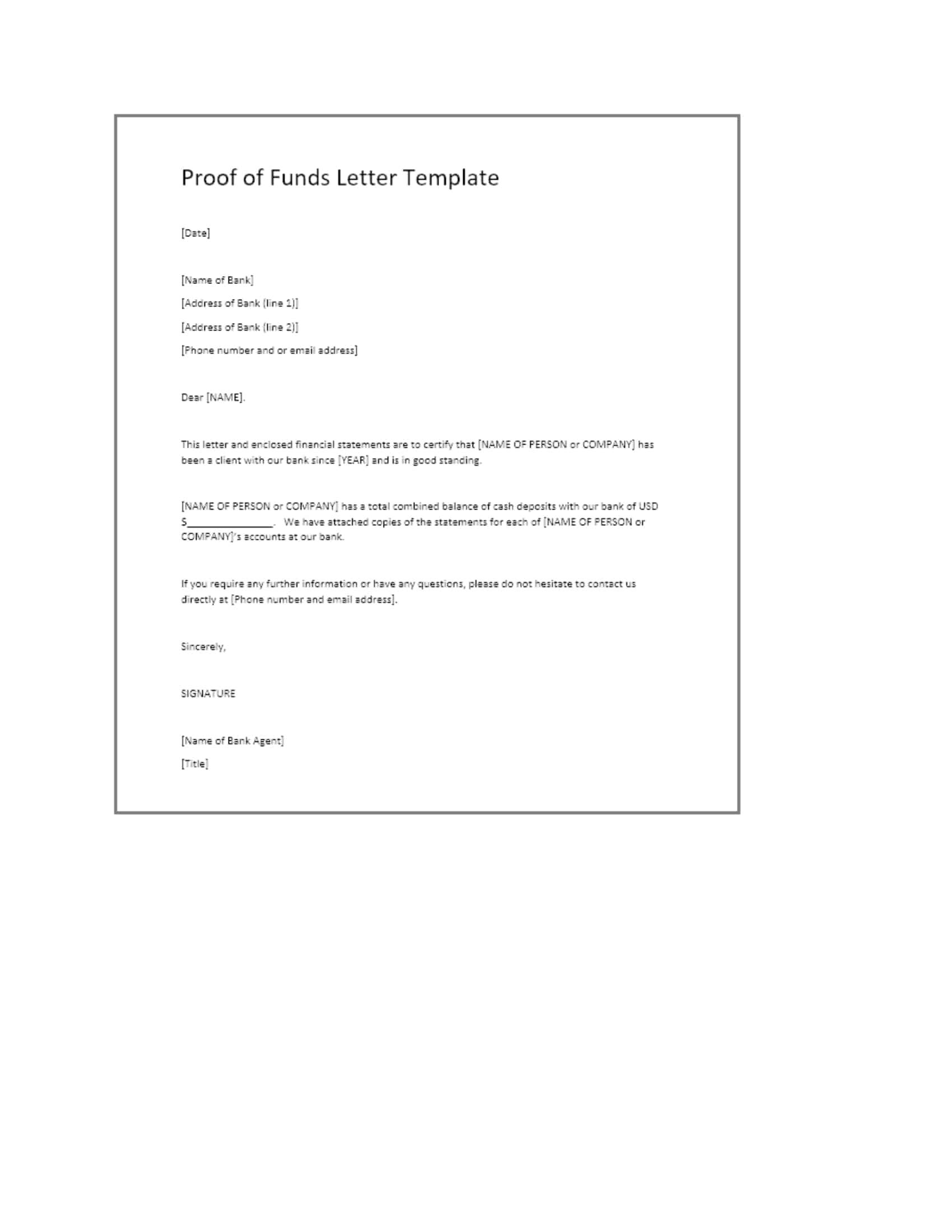

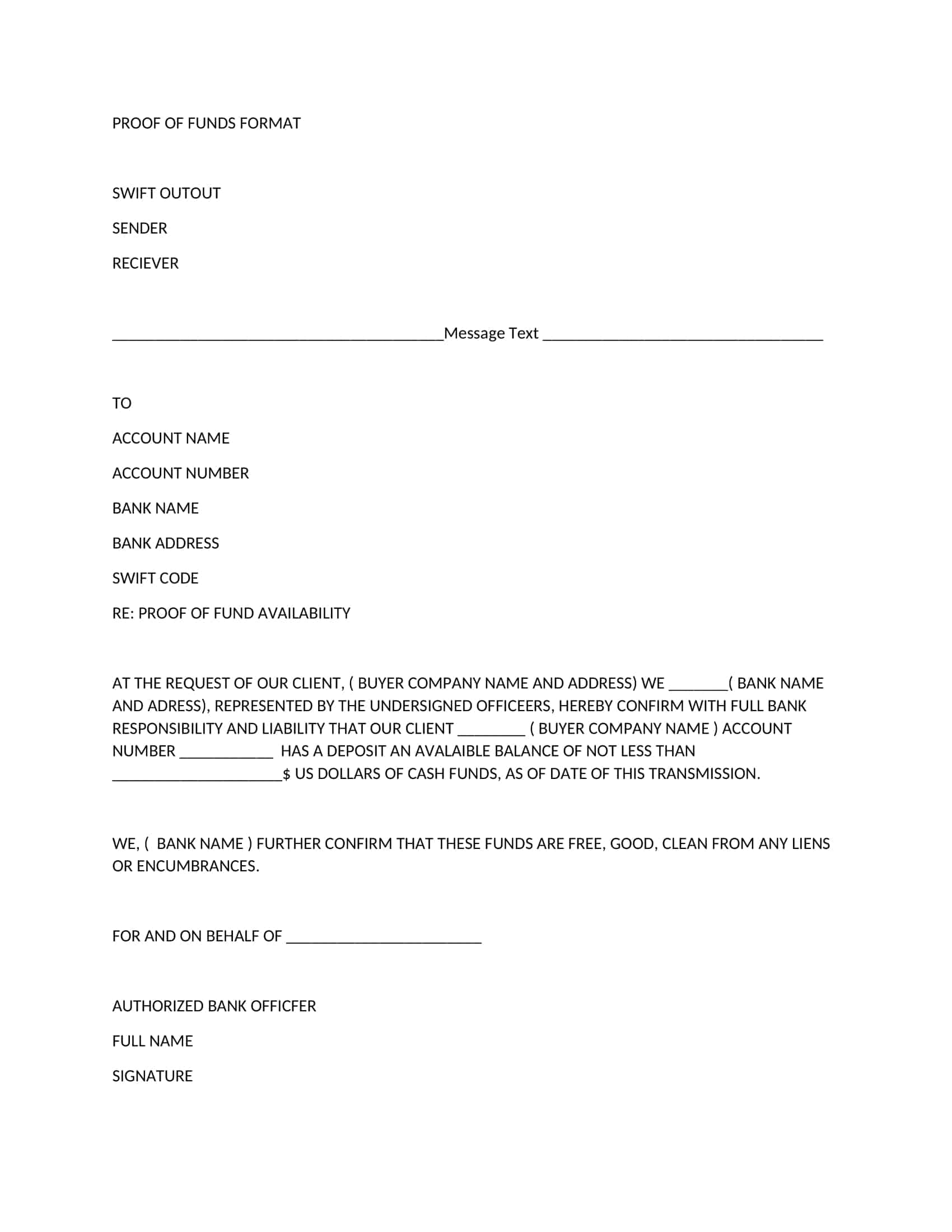

Proof of Funds Letter Templates

When it comes to financial transactions, having proof of funds is crucial. Our extensive collection of Proof of Funds Letter Templates offers you a convenient and professional way to verify your financial standing. Whether you’re a buyer, seller, or investor, these free, printable templates allow you to demonstrate your financial capability and provide assurance to the other party involved.

With customizable sections for account details, balances, and verification statements, our templates make it easy to create a comprehensive Proof of Funds Letter tailored to your specific needs. Don’t miss out on opportunities due to lack of documentation—download our Proof of Funds Letter Templates now and confidently move forward in your financial endeavors.

Types of Proof of Funds Letters

There are several types of proof of funds letters that can be used to demonstrate financial capability to make a purchase, such as a home or property. Some of the most common types include:

Bank statement: This type of proof of funds letter is issued by a financial institution, such as a bank, and shows the current balance of an account, as well as the account holder’s name and the account number.

Asset statement: This type of proof of funds letter is also issued by a financial institution and shows a detailed list of assets, such as stocks, bonds, and real estate, that can be used to make the purchase.

Letter of credit: This type of proof of funds letter is issued by a bank and guarantees that the funds are available for the purchase.

Wire transfer: This type of proof of funds letter confirms that a wire transfer of funds has been made and is usually accompanied by a receipt from the bank.

Cashier’s check: This type of proof of funds letter is issued by a bank and is a check that is guaranteed to be honored by the bank.

Gift letter: This type of proof of funds letter is used when the funds for the purchase are being given as a gift from a family member or friend. It typically includes the name and contact information of the donor, the amount of the gift, and a statement that the funds are not being borrowed and do not need to be repaid.

Verification of deposit (VOD): This type of proof of funds letter is issued by a financial institution and verifies the account balance and account holder information. It is often used as part of the mortgage application process.

Self-declaration letter: This type of proof of funds letter is a statement made by the buyer in which they declare the amount of funds they have available for the purchase. It is often used in situations where the funds are not in a traditional bank account or are difficult to verify.

Retirement account statement: This type of proof of funds letter is a statement from a retirement account, such as a 401k or IRA, that shows the current balance and account holder information. It can be used as proof of funds for a down payment or closing costs.

Mistakes for Proof of Funds Letters

Not having an up-to-date letter

Lenders typically require a proof of funds letter that is less than 30 days old, so it’s important to make sure that the letter is current.

Not having enough funds

The proof of funds letter should demonstrate that you have enough funds to make the purchase, including the down payment and closing costs. Not having enough funds could delay or even cancel the loan application process.

Not providing all required information

The proof of funds letter should include all the required information such as account holder name, account number and balance. Omitting any of these details could lead to delays in processing the loan application.

Not providing the correct type of letter

Different types of purchases may require different types of proof of funds letters. Make sure that you are providing the correct letter for the purchase you’re making.

Not obtaining the letter from a reputable source

Lenders may not accept proof of funds letters from certain sources, such as offshore accounts. Be sure to obtain the letter from a reputable institution to avoid any issues with the loan application.

Not being truthful

Providing false information in a proof of funds letter is considered fraud and could lead to criminal charges. It is important to be truthful and accurate in providing the information.

Not providing a clear and legible copy

Lenders need to be able to read and verify the information on the proof of funds letter, so it’s important to provide a clear and legible copy of the letter.

Not understanding the purpose of the letter and what’s expected

It’s important to understand the purpose of the proof of funds letter and to know what information is required by the lender. Not understanding what’s expected could lead to delays in the loan application process.

Tips in Building Your Funds for Your Proof of Funds Letter

Start saving early: The earlier you start saving, the more time you have to build up your funds. Set a savings goal and make a plan to reach it.

Reduce expenses: Look for ways to reduce your expenses, such as cutting back on dining out, shopping for sales, or finding a less expensive place to live.

Increase income: Look for ways to increase your income, such as getting a part-time job or starting a side business.

Invest: Consider investing in stocks, bonds, or real estate to help grow your funds.

Open a high-yield savings account: Some banks offer high-yield savings accounts that offer higher interest rates, helping your savings grow faster.

Use tax refunds or bonuses: If you receive a tax refund or bonus, consider using it to build your funds for the purchase.

Seek financial advice: Consult a financial advisor to develop a personalized plan to help you achieve your savings goals.

Be mindful of the fees and charges: Some financial institutions may charge fees for account maintenance or transactions, which could eat into your savings. Be sure to understand the fees associated with your account and choose the one that best suits your needs.

Keep track of your finances: Keep track of your income and expenses to help you stay on track with your savings goals.

Be Patient: Building funds for a purchase like a house may take time, it’s important to be patient and consistent with your savings plan, and to stay motivated.

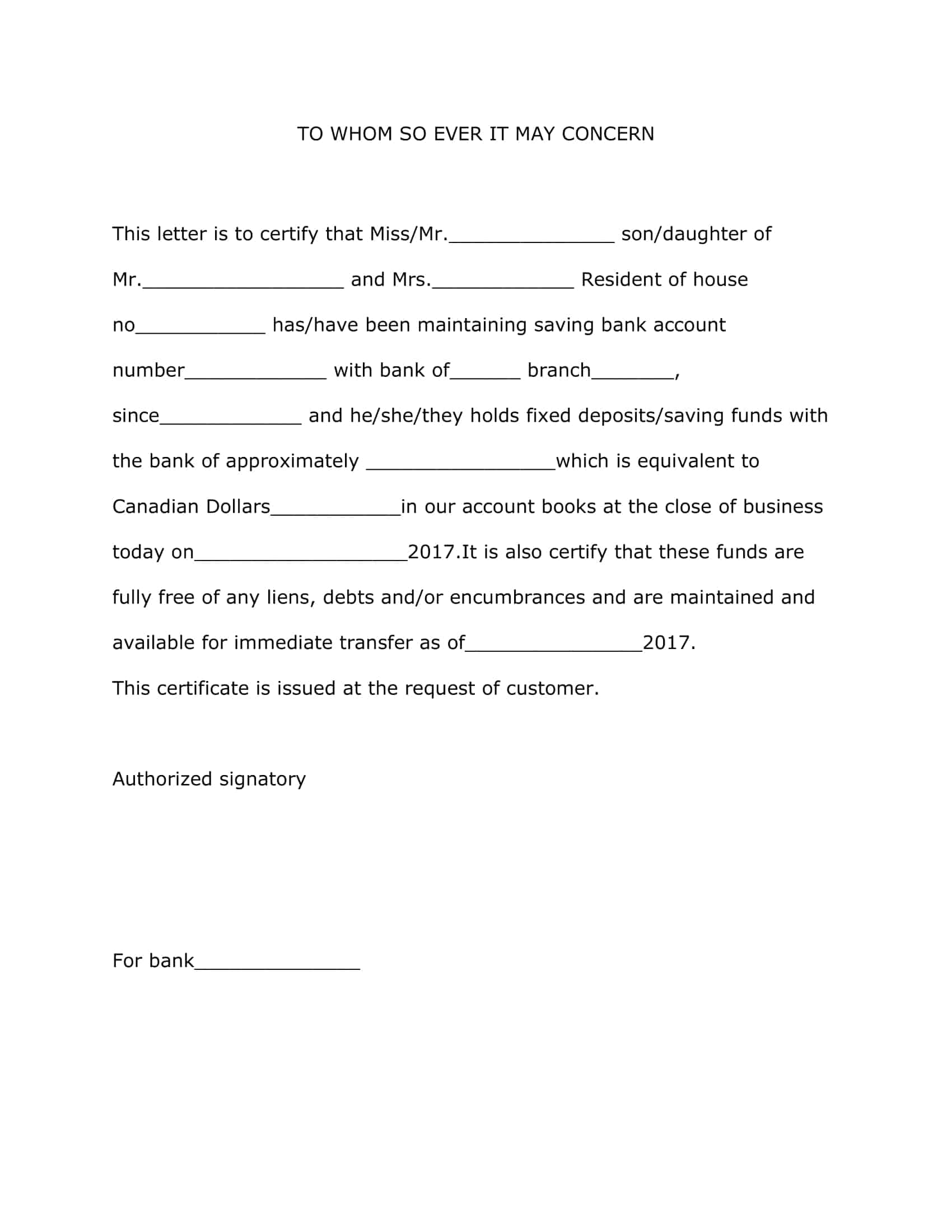

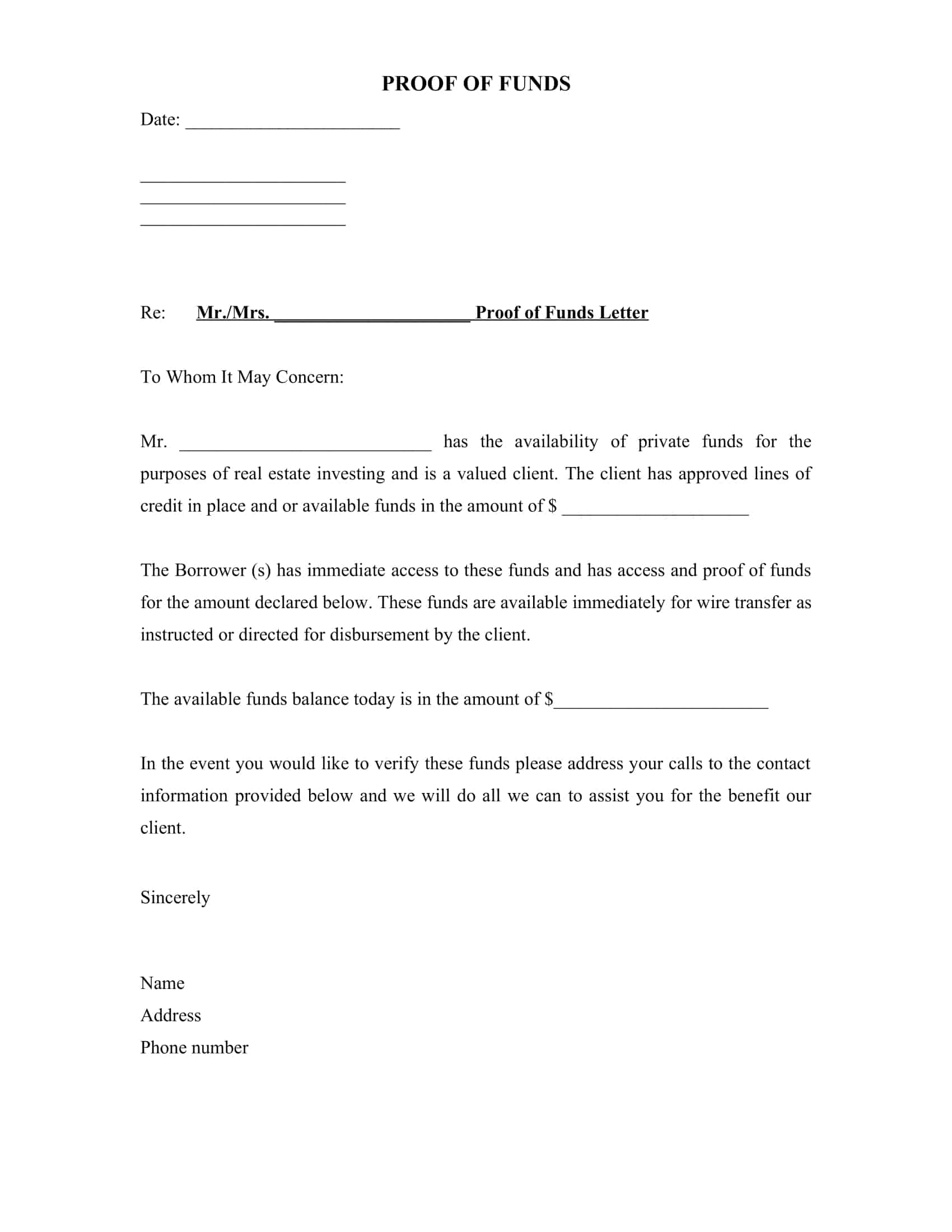

How to Write a Proof of Funds Letter

A proof of funds letter is a document that verifies the availability of sufficient funds for a specific purpose, such as a real estate purchase or business investment. Writing a proof of funds letter can be a straightforward process, but it is important to include all of the necessary information and present it in a clear and professional manner. Here is a step-by-step guide for writing a proof of funds letter:

Step 1: Gather all of the necessary information.

In order to write a proof of funds letter, you will need to have the following information on hand:

- The amount of funds available for the specific purpose

- The source of the funds (e.g. savings account, investment account, etc.)

- The name and contact information of the person or institution that will be providing the funds

- The name and contact information of the person or institution that will be receiving the letter

Step 2: Write the letter.

Once you have all of the necessary information, you can begin writing the letter. The letter should be written in a professional and formal tone, and should include the following elements:

- A heading with the date and the name and contact information of the person or institution that will be receiving the letter

- A salutation, addressing the recipient by name

- A statement of the purpose of the letter, including the amount of funds available and the source of the funds

- A statement confirming that the funds are available and can be used for the specific purpose

- A statement giving permission for the recipient to verify the availability of the funds, if necessary

- A closing, such as “Sincerely,” followed by your name and contact information

Step 3: Review and edit the letter.

Once you have written the letter, it is important to review it for accuracy and clarity. Check for any typos or grammatical errors, and make sure that all of the information is correct and presented in a clear and professional manner.

Step 4: Sign and submit the letter.

Once you are satisfied with the letter, sign it and submit it to the person or institution that will be receiving it. It’s important to keep in mind that this letter should only be used as a proof of funds, and should not be used for any other purpose.

In summary, a proof of funds letter is a document that verifies the availability of sufficient funds for a specific purpose. The process of writing a proof of funds letter involves gathering all of the necessary information, writing the letter in a professional and formal tone, reviewing and editing the letter, and submitting it to the appropriate person or institution. Make sure that the letter is accurate and clear and that the funds are available and can be used for the specific purpose, and the letter is signed by the person who’s the funds belongs to.

FAQs

Who needs to write a proof of funds letter?

A proof of funds letter is typically written by an individual or institution that has the funds available for a specific purpose. For example, if someone is trying to buy a house, they would need to provide a proof of funds letter to the seller or lender to confirm that they have the necessary funds for the purchase.

What information should be included in a proof of funds letter?

A proof of funds letter should include the amount of funds available for the specific purpose, the source of the funds, the name and contact information of the person or institution providing the funds, and the name and contact information of the person or institution receiving the letter.

How can I verify the authenticity of a proof of funds letter?

To verify the authenticity of a proof of funds letter, you can contact the institution or person that provided the letter to confirm that the funds are available and can be used for the stated purpose. Additionally, you can also contact the financial institution where the funds are held to confirm that the letter is accurate.

Can a proof of funds letter be used for multiple purposes?

No, a proof of funds letter is specific to a particular purpose, such as a real estate purchase or business investment. It should only be used for the purpose for which it was written and should not be used for any other purpose.

Are there any legal requirements for a proof of funds letter?

While there may be no specific legal requirements for a proof of funds letter, it is important that the letter is accurate and truthful, and that the funds are truly available for the stated purpose. Misrepresenting the availability of funds in a proof of funds letter can have legal consequences.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![%100 Free Hoodie Templates [Printable] +PDF 3 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)