A receipt is a written or printed document that serves as proof of a transaction between a buyer and a seller. It typically lists the date, items purchased, their cost, and any applicable taxes. Receipts play an important role in personal and business finance as they provide a record of expenses for budgeting and tax purposes.

With the rise of electronic payments and online shopping, digital receipts have become increasingly common, offering increased convenience and reduced paper waste. In this article, we will explore the various types of receipts and their uses.

Table of Contents

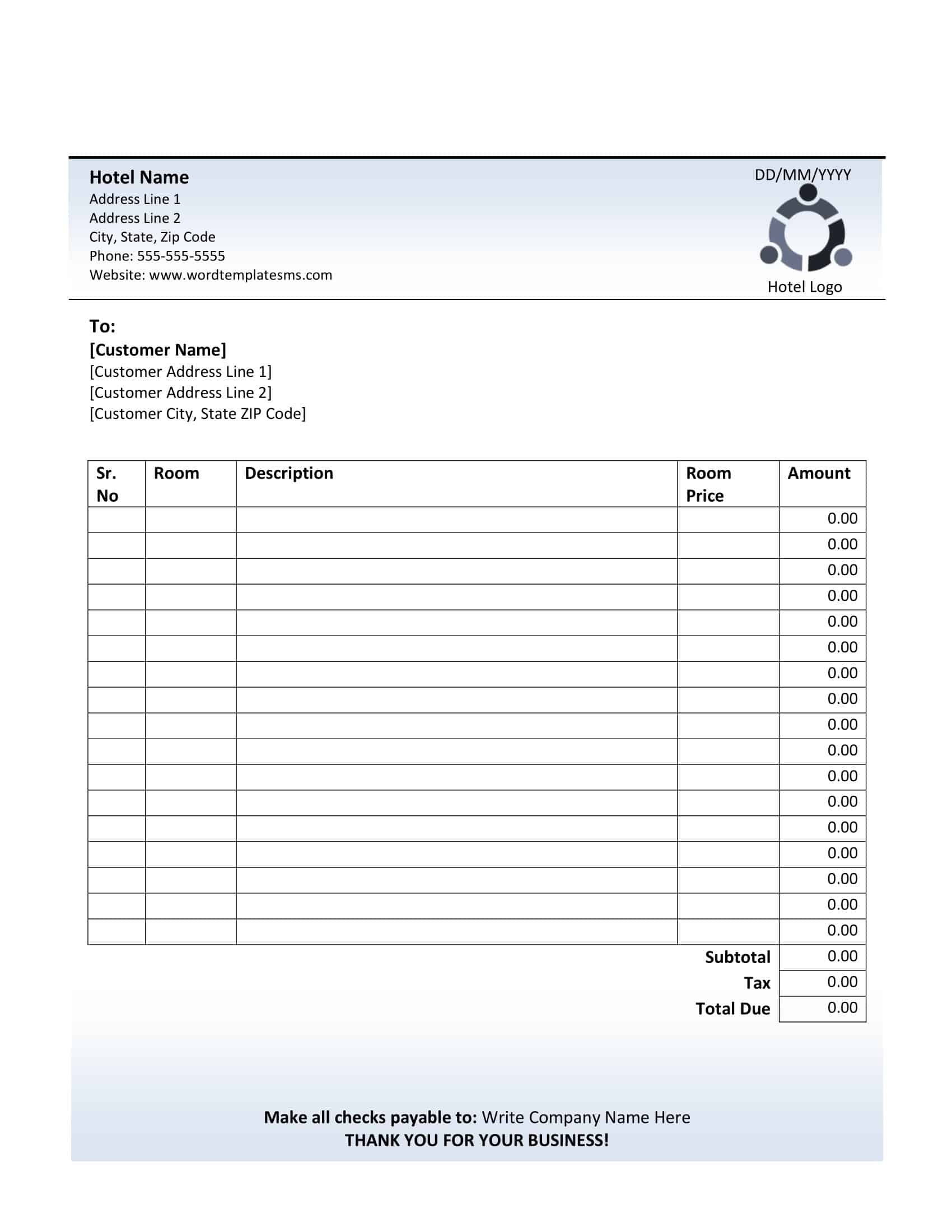

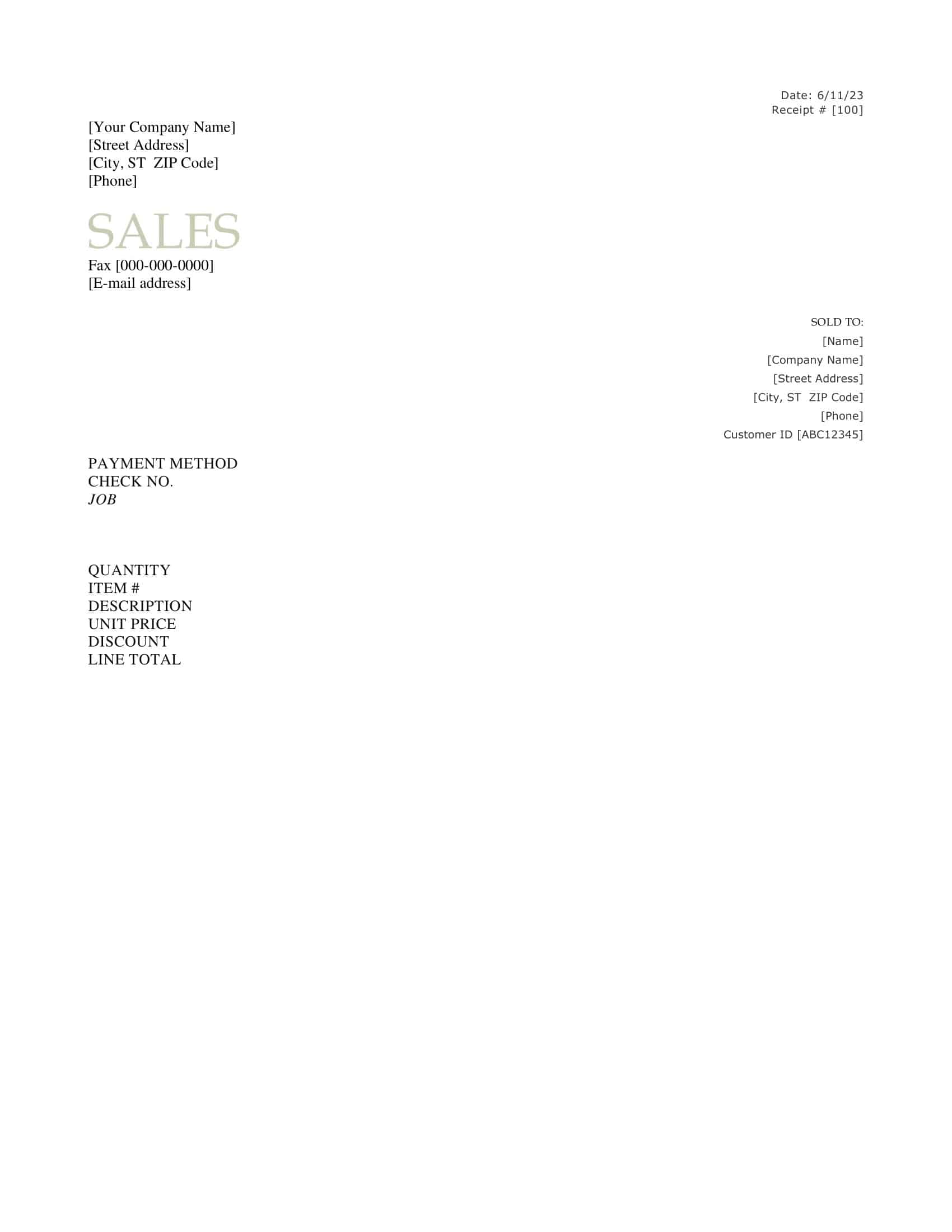

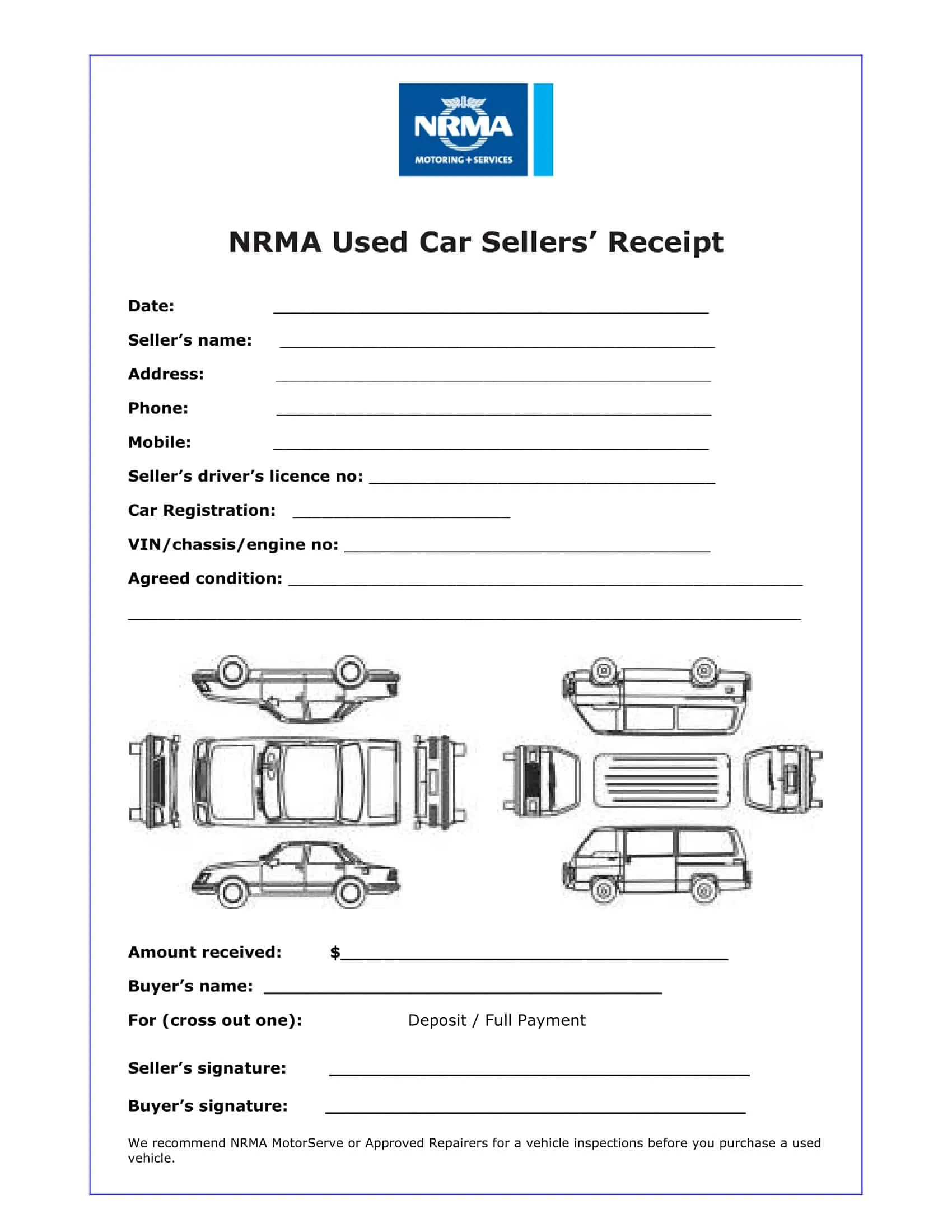

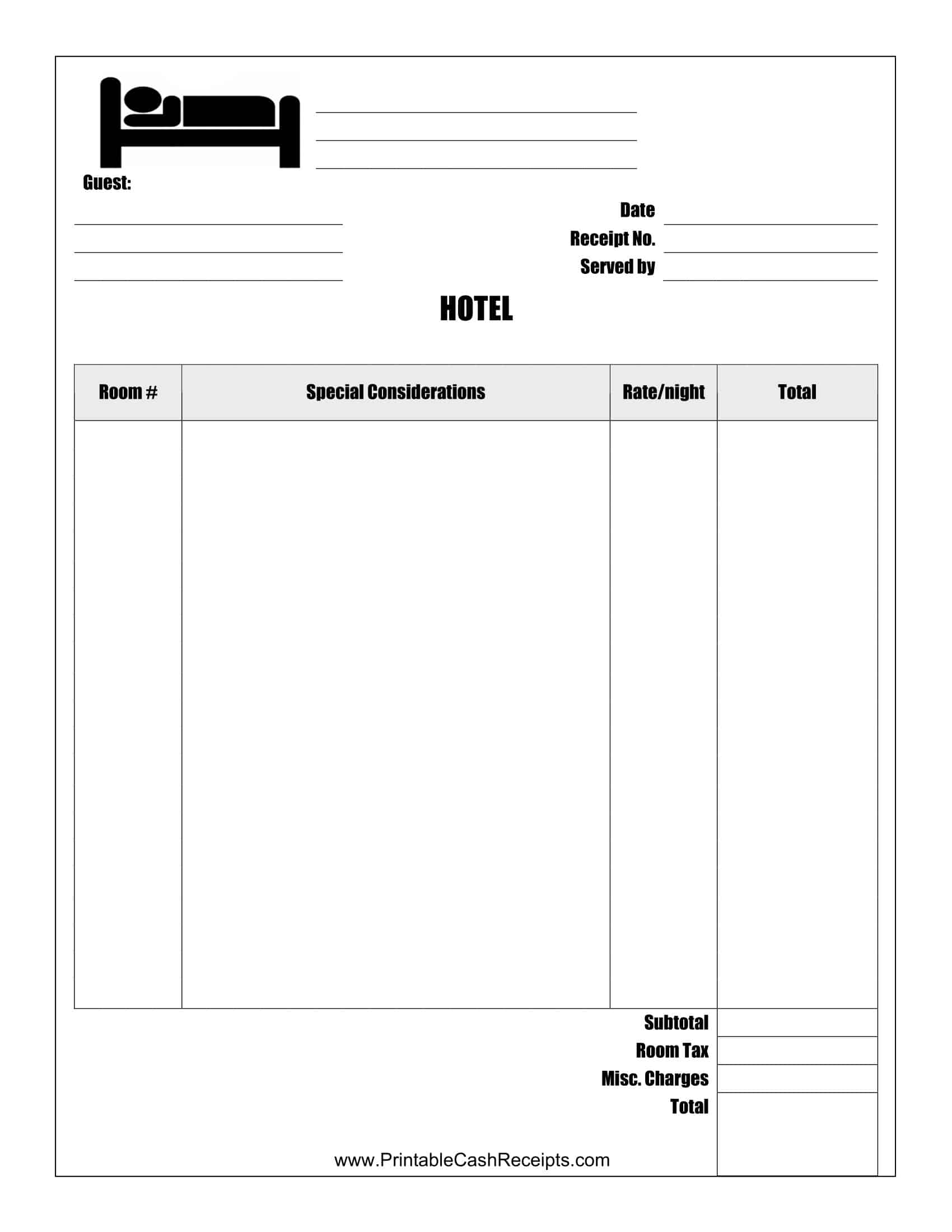

Receipt Templates

Receipt templates are pre-designed documents that serve as a standardized format for creating receipts for various transactions. They are commonly used by businesses and individuals to provide a clear record of the exchange of goods, services, or money. These templates offer a convenient and efficient way to generate professional-looking receipts without the need for extensive manual formatting.

A receipt template typically includes essential information such as the name and contact details of the seller or business, the name and contact details of the buyer or customer, a unique receipt number or reference, the date and time of the transaction, a description of the goods or services purchased, the quantity or duration of the transaction, the unit price or rate, any applicable taxes or fees, and the total amount paid.

In summary, receipt templates are pre-designed documents that offer a consistent format for creating receipts. They streamline the process of generating receipts, ensure essential information is included, and provide a professional and organized appearance. By using receipt templates, businesses and individuals can save time, enhance professionalism, and maintain accurate records of their transactions.

The importance of receipts

Receipts are an essential part of personal and business finance, as they serve as a record of transactions and expenses. They help individuals and businesses keep track of their spending, make budgeting easier, and provide proof of purchase for tax purposes or reimbursement claims. Receipts are also used as a means of ensuring accountability and transparency in business transactions.

By providing a detailed record of the items purchased, their cost, and the date of the transaction, receipts help to prevent disputes and fraudulent activities. In short, receipts play a vital role in helping individuals and businesses manage their finances effectively and maintain a clear record of their expenses.

Why Should You Issue Receipts?

There are several reasons why it is important to issue receipts:

Legal requirement: In many countries, issuing receipts is a legal requirement for businesses, and failure to do so can result in penalties and fines.

Record-keeping: Receipts serve as an important record-keeping tool, providing a record of transactions that can be used for budgeting and tax purposes.

Transparency and accountability: Receipts provide transparency in business transactions and promote accountability by providing a detailed record of the items purchased, their cost, and the date of the transaction.

Customer satisfaction: Providing a receipt to a customer after a transaction helps to build trust and customer satisfaction, as it serves as proof of purchase and gives the customer a clear record of the transaction.

Dispute resolution: In case of a dispute, receipts can be used as evidence to help resolve the issue.

Tax compliance: Receipts can help businesses comply with tax laws and regulations by providing a clear record of expenses for tax purposes.

Reimbursement claims: Receipts can be used to support reimbursement claims for expenses incurred on behalf of an employer or a client.

Inventory management: Receipts can be used to keep track of inventory and ensure that businesses have the necessary supplies to meet customer demand.

Improving cash flow: Receipts can help improve cash flow by providing a clear record of payments received, enabling businesses to reconcile their accounts more easily.

Auditing: Receipts can be used as evidence during an audit, helping businesses to demonstrate compliance with financial reporting standards and tax laws.

Marketing: Receipts can be used as a marketing tool by including advertising or promotions on them.

In summary, issuing receipts is an important practice for businesses, as it helps to meet legal requirements, maintain accurate records, promote transparency and accountability, increase customer satisfaction, and resolve disputes.

Contents of a Receipt

A receipt typically includes the following information:

Date of transaction: The date of the transaction is an important piece of information included on the receipt.

Company name and information: The company name, address, phone number, and logo are typically included on the receipt.

Itemized list of products or services: The receipt should include a detailed list of the products or services purchased, along with their cost and any applicable taxes.

Payment method: The receipt should indicate the payment method used, such as cash, credit card, or check.

Total amount: The receipt should include the total amount of the transaction, including any applicable taxes and discounts.

Receipt number: A unique receipt number is typically included on the receipt to help identify the transaction and facilitate record-keeping.

Sales tax information: If applicable, the receipt should indicate the amount of sales tax paid and the sales tax rate.

Thank you or appreciation message: Many receipts include a thank you or appreciation message to the customer.

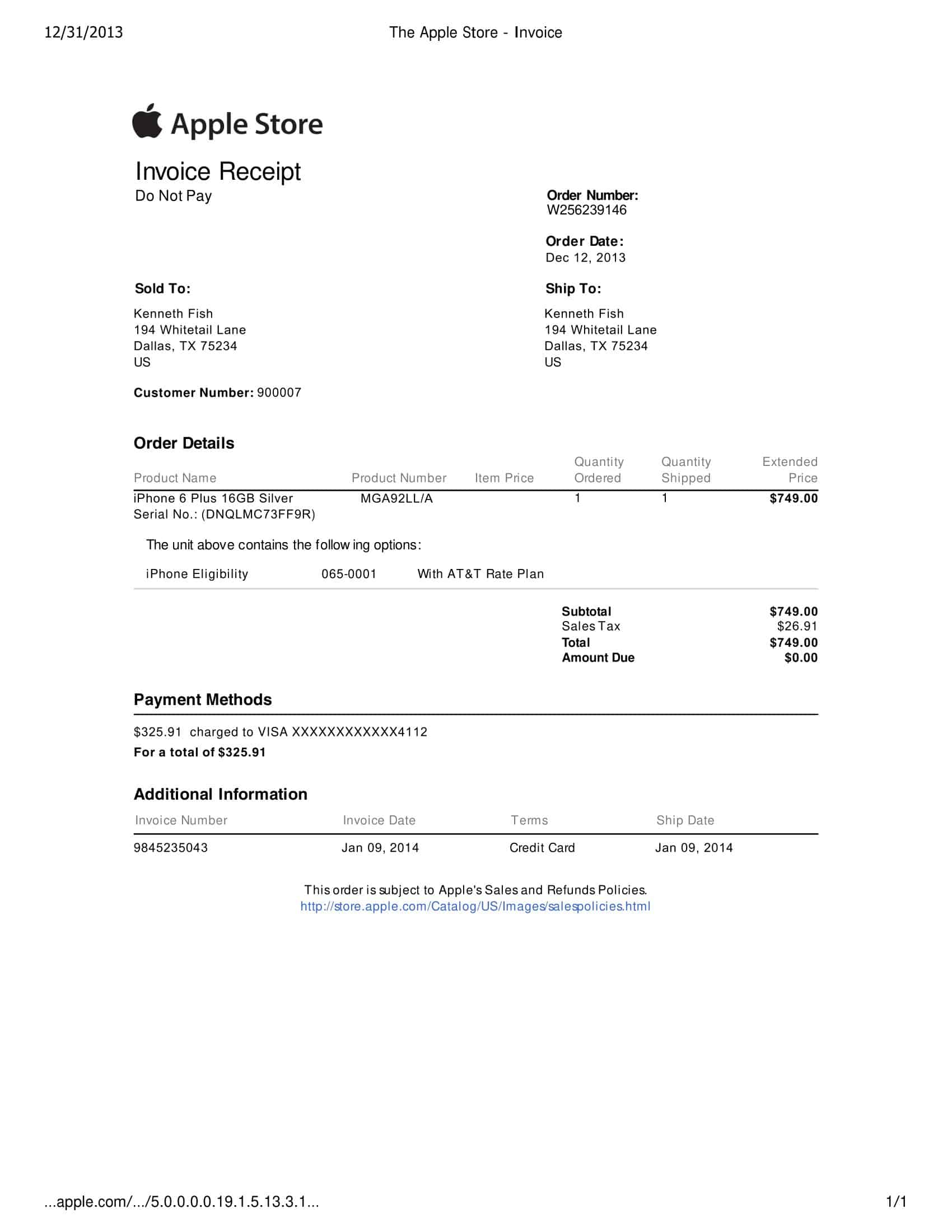

Receipt vs. invoice

Receipt and invoice are two commonly used financial terms, but they refer to different things.

A receipt is a document that serves as proof of a transaction between a buyer and a seller. It typically includes the date, items purchased, their cost, and any applicable taxes. A receipt is usually given to the customer immediately after the transaction is complete.

An invoice, on the other hand, is a bill sent by a seller to a buyer, indicating the products or services provided and the amount due for payment. An invoice is typically sent after the products or services have been provided, and it serves as a request for payment. Invoices typically include more detailed information about the products or services provided, such as quantities, unit prices, and the payment terms.

In summary, a receipt serves as proof of a transaction and is usually given immediately after the transaction is complete, while an invoice is a bill sent by a seller to a buyer indicating the products or services provided and the amount due for payment.

Types of Receipts

There are several types of receipts, including:

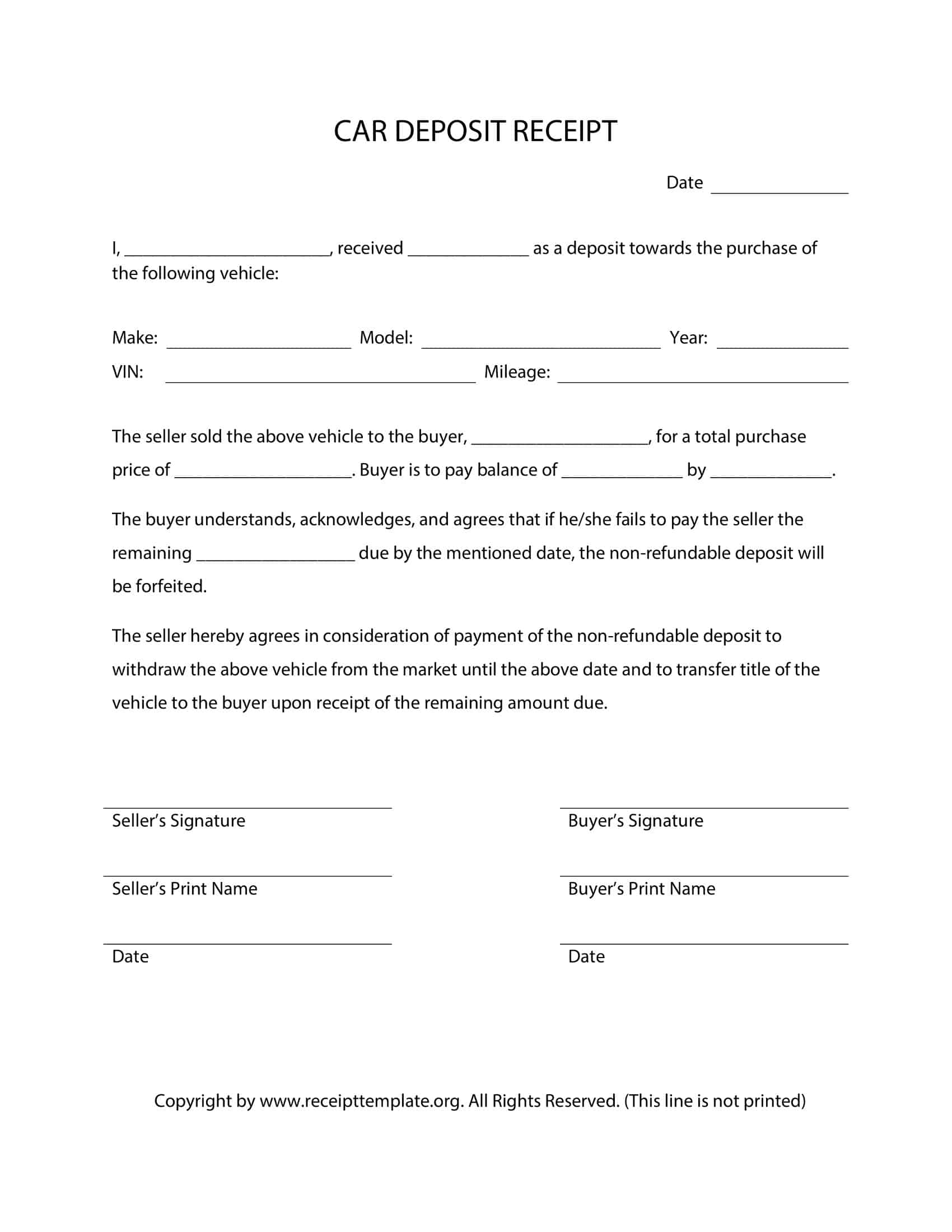

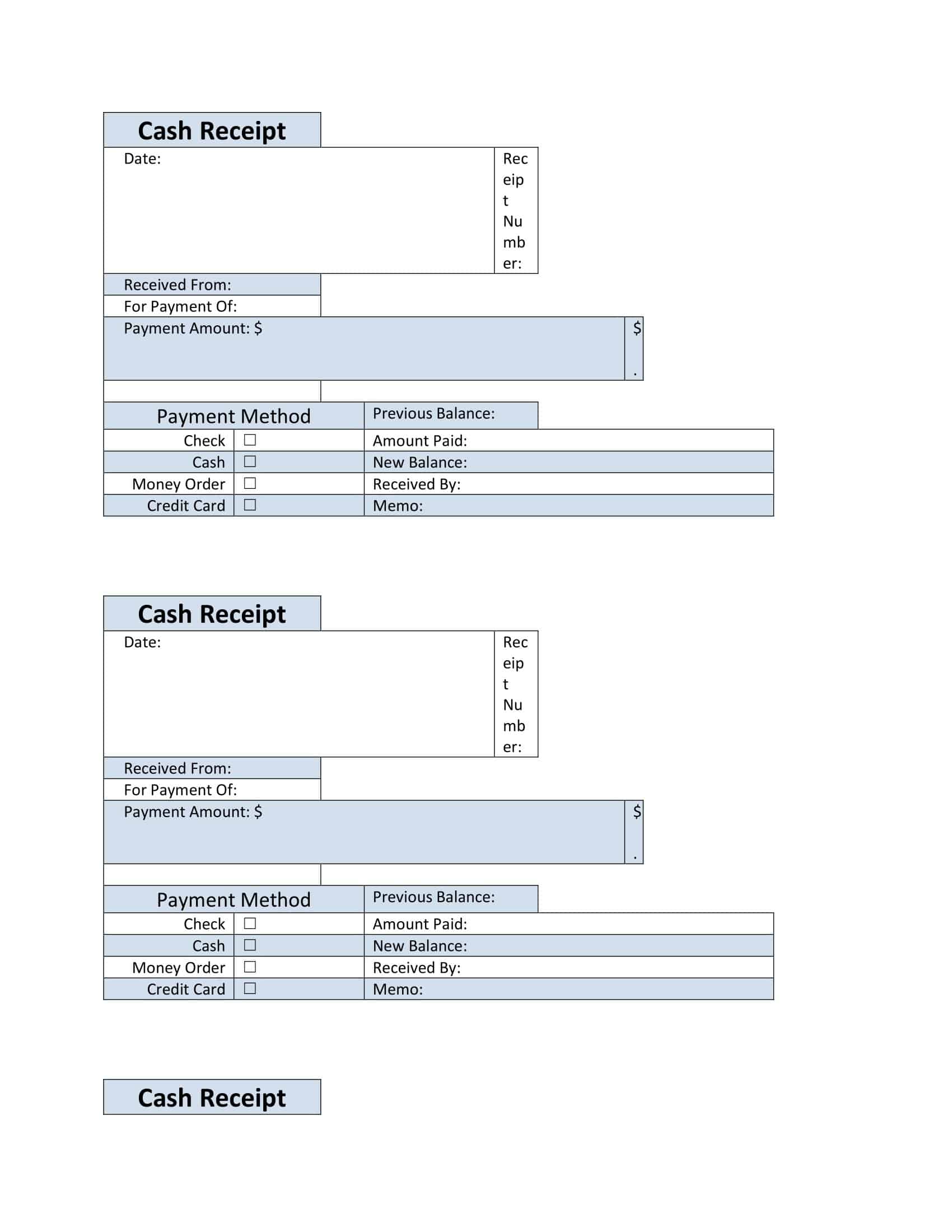

Cash receipt

A cash receipt is issued when payment is made in cash, and it serves as proof of the transaction.

Sales receipt

A sales receipt is issued when products or services are sold, and it includes details such as the date of the transaction, items purchased, and the total cost.

Payment receipt

A payment receipt is issued when payment is made, and it serves as proof that the payment has been received.

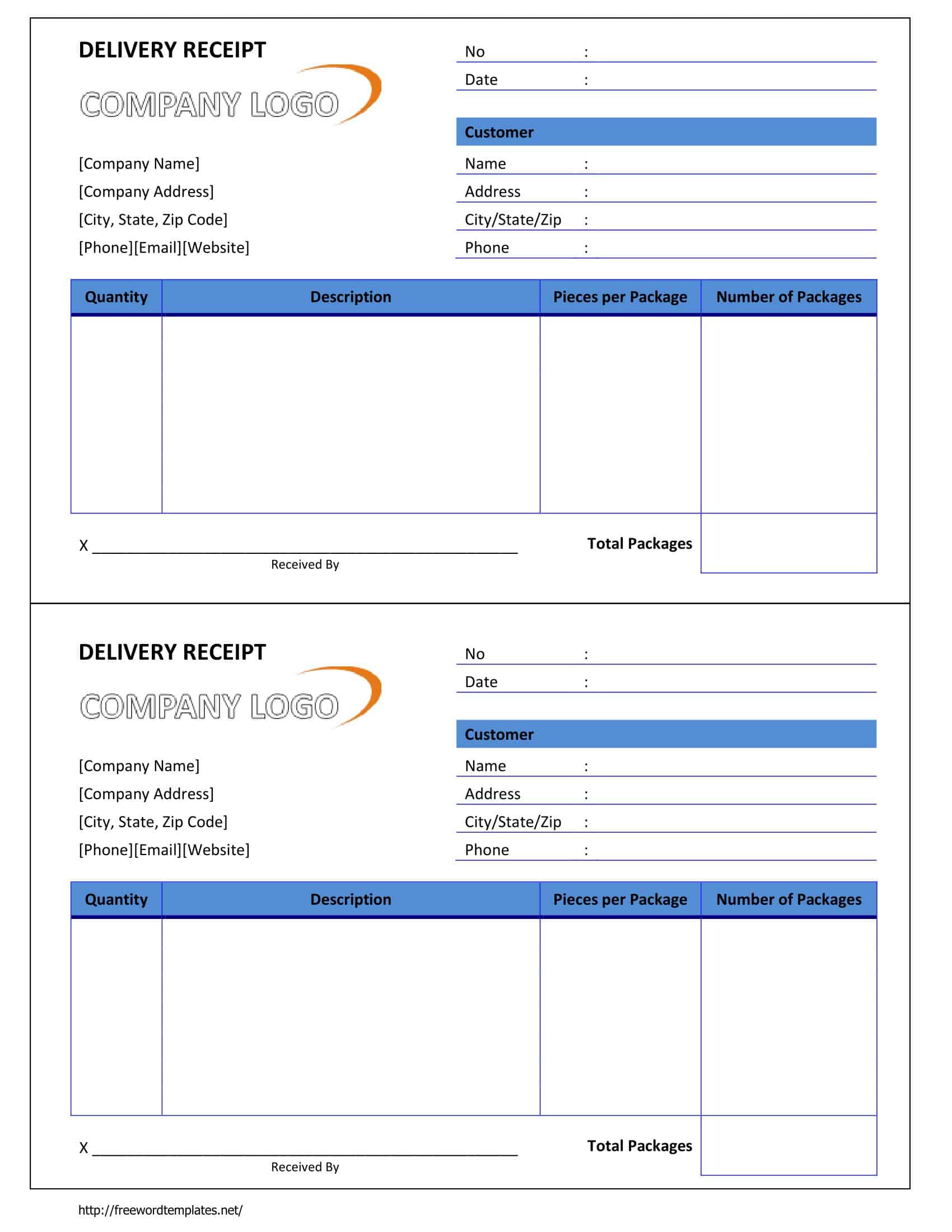

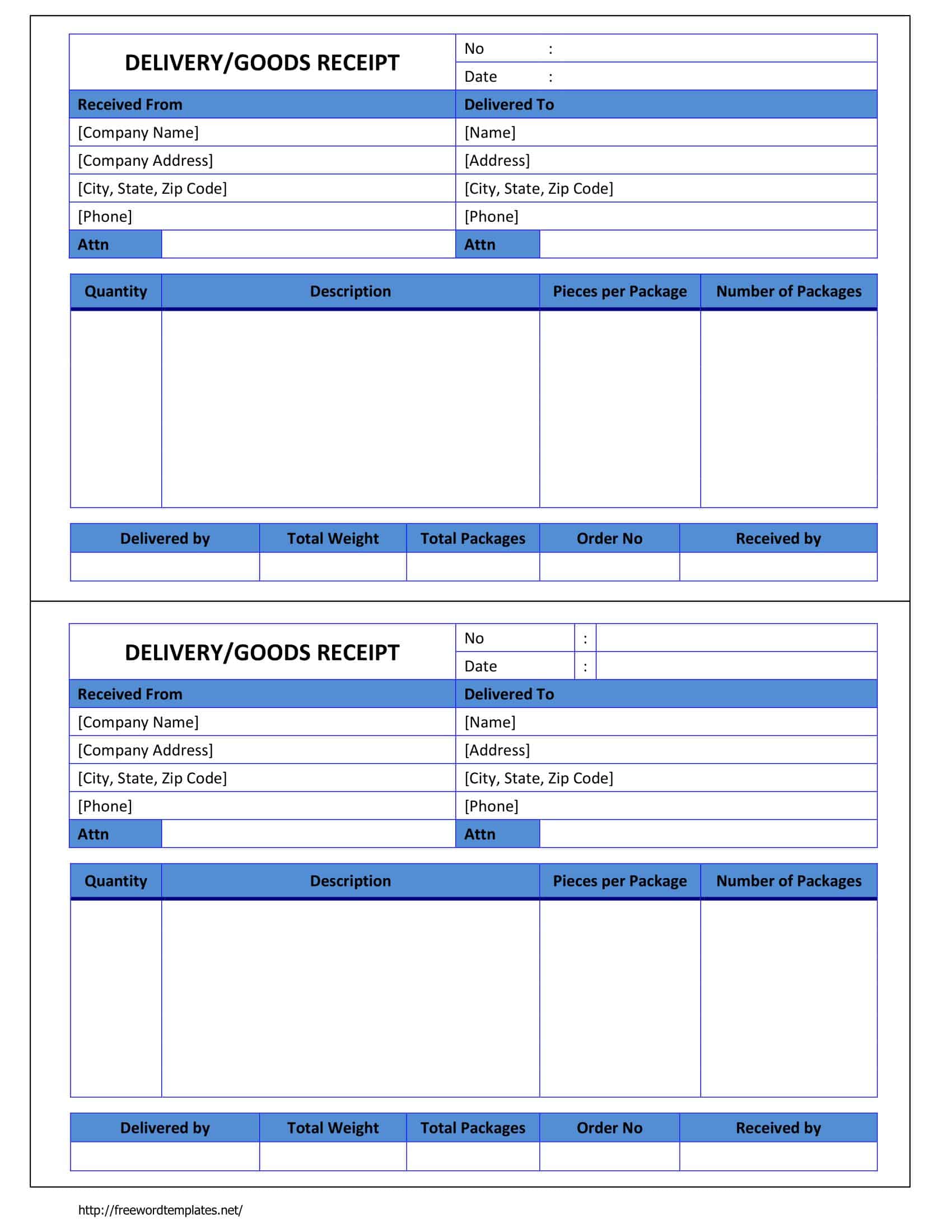

Delivery receipt

A delivery receipt is issued when products or services are delivered, and it serves as proof that the delivery has been made.

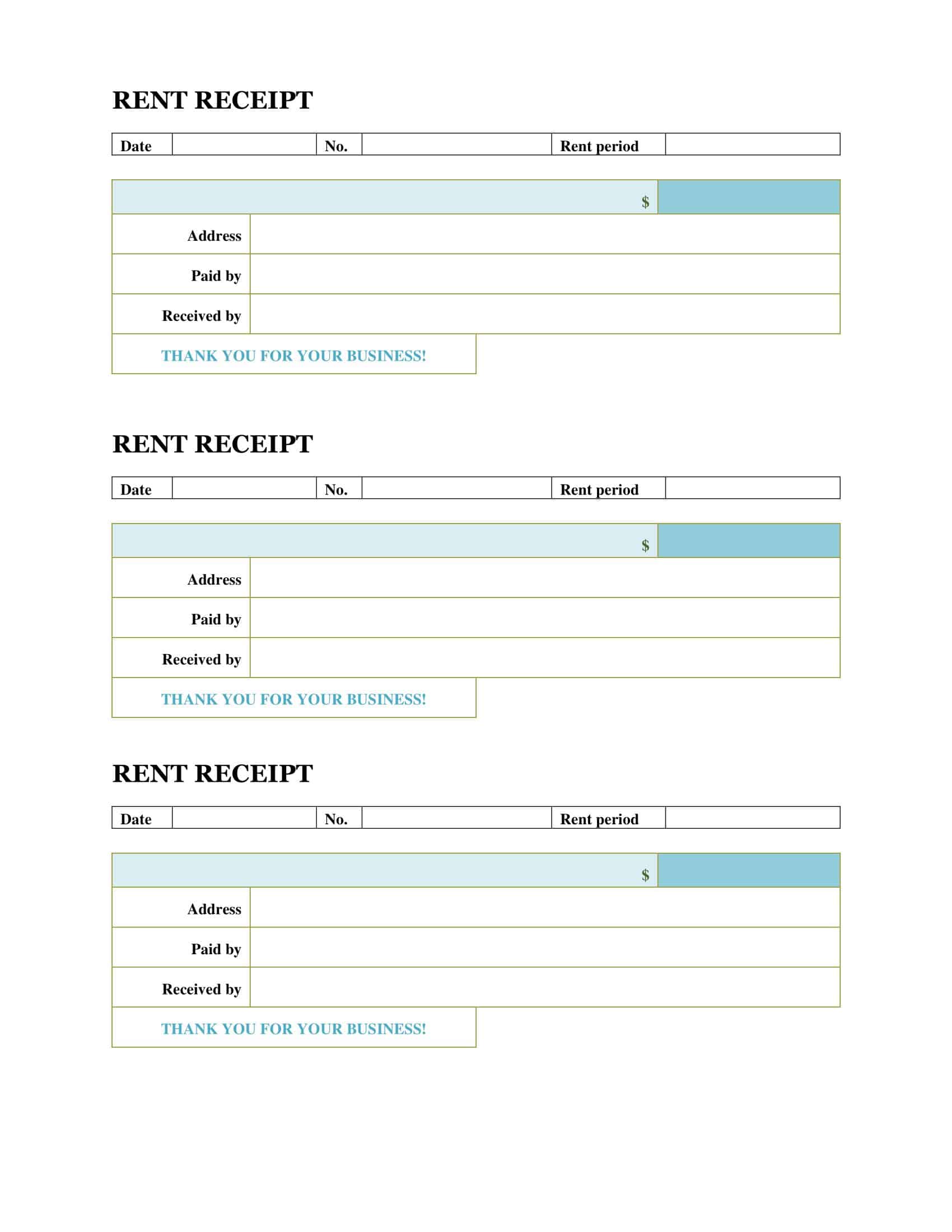

Rent receipt

A rent receipt is issued when rent is paid, and it serves as proof of payment for the tenant.

Donation receipt

A donation receipt is issued when a donation is made, and it serves as proof of the donation for tax purposes.

Refund receipt

A refund receipt is issued when a refund is given, and it serves as proof of the refund for both the customer and the business.

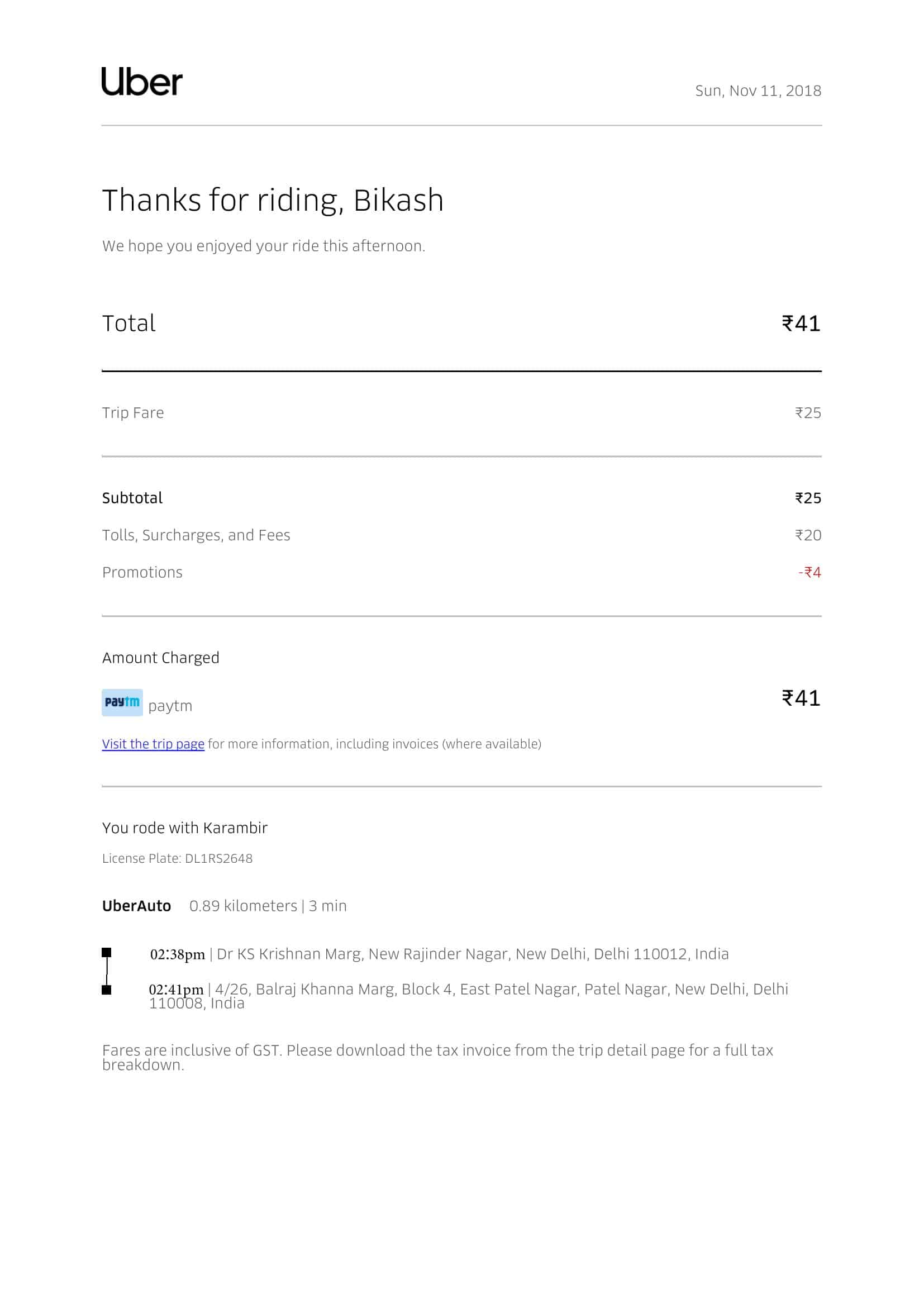

Electronic receipt

An electronic receipt is issued and stored in electronic format, and it serves as proof of the transaction.

Blank Receipt Template

A blank receipt template is a pre-designed document that can be filled in with the necessary information to create a receipt.

How to Create a Receipt in Microsoft Word

Creating a receipt in Microsoft Word is simple and can be done with the following steps:

- Open Microsoft Word: Open Microsoft Word on your computer.

- Create a new document: To create a new document, click on “File” and then “New.” Select a blank document or choose from a variety of templates.

- Add the necessary information: To add the necessary information, start by typing the company name and address in the header. Then, add the date of the transaction and a unique receipt number.

- Itemized list of products or services: In the main body of the receipt, create an itemized list of the products or services purchased, along with their cost.

- Payment method: Indicate the payment method used, such as cash, credit card, or check.

- Total amount: Calculate the total amount of the transaction, including any applicable taxes and discounts, and add it to the receipt.

- Add a thank you or appreciation message: Many receipts include a thank you or appreciation message to the customer.

- Format the receipt: To format the receipt, you can use Microsoft Word’s built-in formatting options, such as font type, size, and color, to make the receipt look professional.

- Save the receipt: Once you have finished creating the receipt, save it to your computer for future reference.

FAQs

Are receipts legally required?

In most countries, receipts are not legally required, but they are considered best practice for businesses. Some industries, such as retail and food service, may have specific regulations regarding the issuance of receipts.

Can I use a digital receipt instead of a paper receipt?

Yes, digital receipts, such as those sent via email or stored in a digital wallet, are becoming more common and are considered a valid form of receipt. However, some businesses may still prefer to provide paper receipts.

What should I do if I lose my receipt?

If you lose your receipt, contact the company and see if they can issue a duplicate copy. Some companies may keep digital records of receipts, while others may require a request in writing.

Can a receipt be handwritten?

Yes, a receipt can be handwritten, but it is important to make sure that the handwriting is legible and the information is clear. Some businesses may prefer to use a printed receipt to ensure that all information is clear and accurate.

What if the total amount on the receipt is incorrect?

If the total amount on the receipt is incorrect, it is important to bring this to the attention of the business as soon as possible. They should issue a corrected receipt with the correct total amount.

How long should a business keep receipts on file?

The length of time that a business should keep receipts on file can vary depending on the industry and regulations. It is typically recommended to keep receipts for at least three years in case of an audit or dispute.

What if a receipt is not issued for a transaction?

If a receipt is not issued for a transaction, it can be difficult to prove that the transaction took place. It is always best practice for businesses to issue receipts for all transactions.

Can a receipt be issued for a return or refund?

Yes, a receipt can be issued for a return or refund. This type of receipt is called a return receipt and should include details about the products or services being returned and the reason for the return.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)