Managing payroll can be a complex endeavor, especially for larger companies with many employees. Tracking hourly wages, salaries, taxes, deductions, and net pay requires meticulous records and calculations. This is where a payroll ledger comes in handy. A payroll ledger is a document that outlines the earnings, deductions, and net payments for all employees on the company’s payroll.

Maintaining an accurate ledger provides a centralized overview of payroll distributions, supports financial reporting, and creates transparency for staff compensation. In this article, we’ll look at how payroll ledgers work, typical ledger components, and easy tips for creating your own ledger. We’ve also included downloadable payroll ledger templates to simplify the process of constructing a payroll tracking workbook tailored to your business needs. With a streamlined payroll ledger system, you can simplify payroll management and have clear visibility into your company’s compensation expenses.

Table of Contents

What Is A Payroll Ledger?

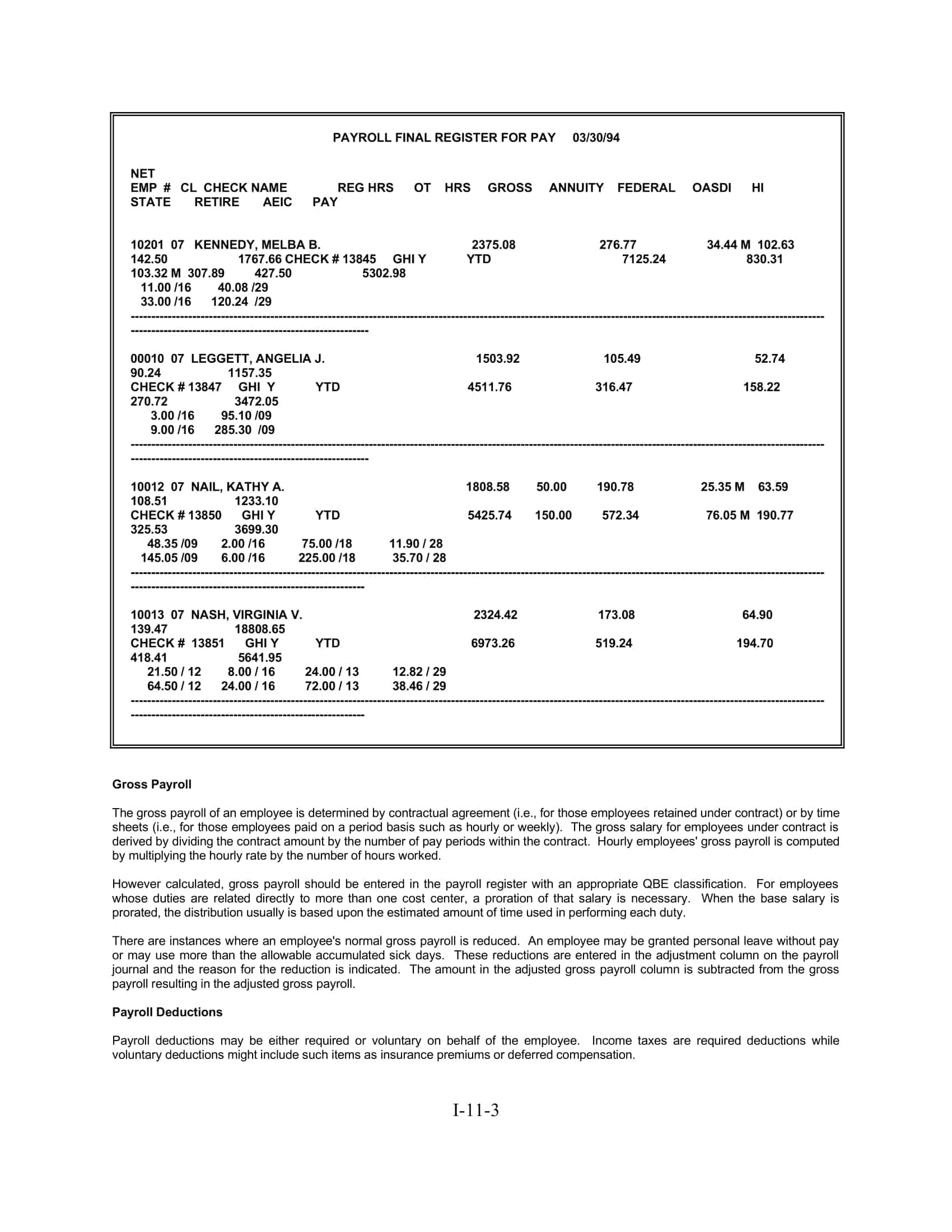

A payroll ledger is a detailed record used by businesses to track all employee compensation transactions. This ledger provides a comprehensive view of wages paid, tax withholdings, deductions, bonuses, and other compensation-related amounts for each employee over a specific period. It serves as a financial tool for accounting and HR departments to ensure accurate and timely payments while also fulfilling tax and regulatory reporting requirements.

The payroll ledger can be maintained manually or with the assistance of payroll software. When reconciled regularly, it helps in preventing discrepancies and errors in the payroll process, ensuring that employees receive the correct pay and that the business remains compliant with financial regulations.

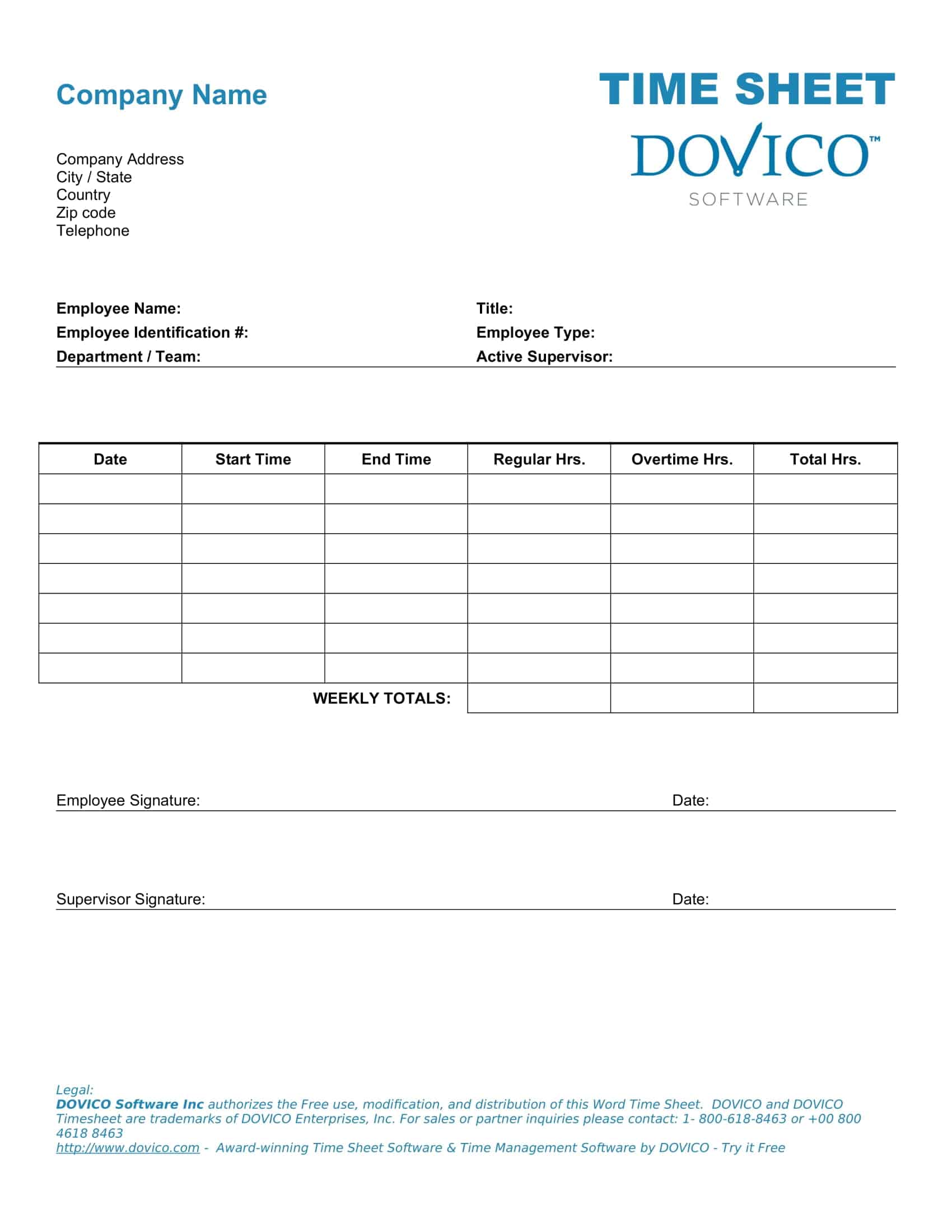

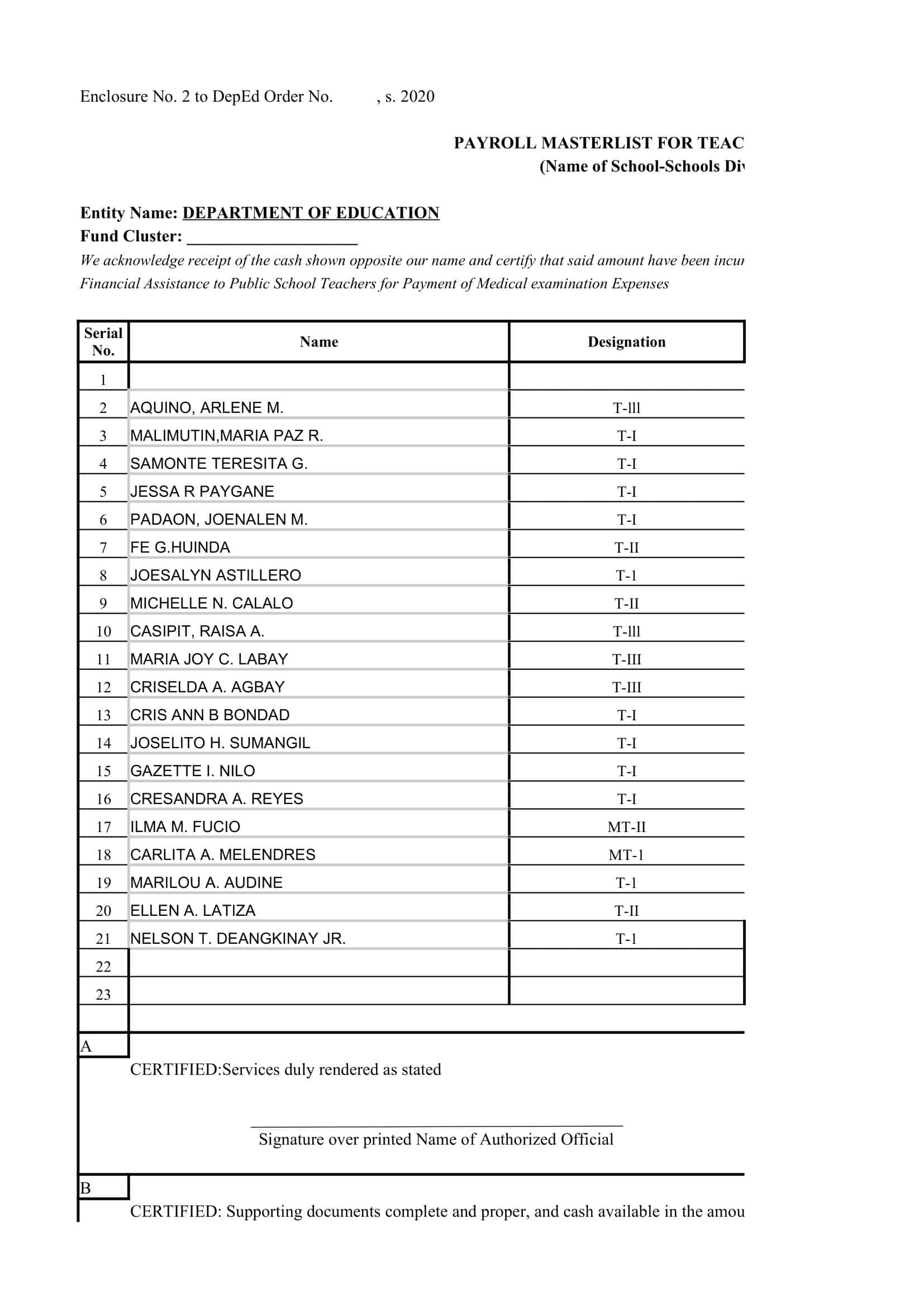

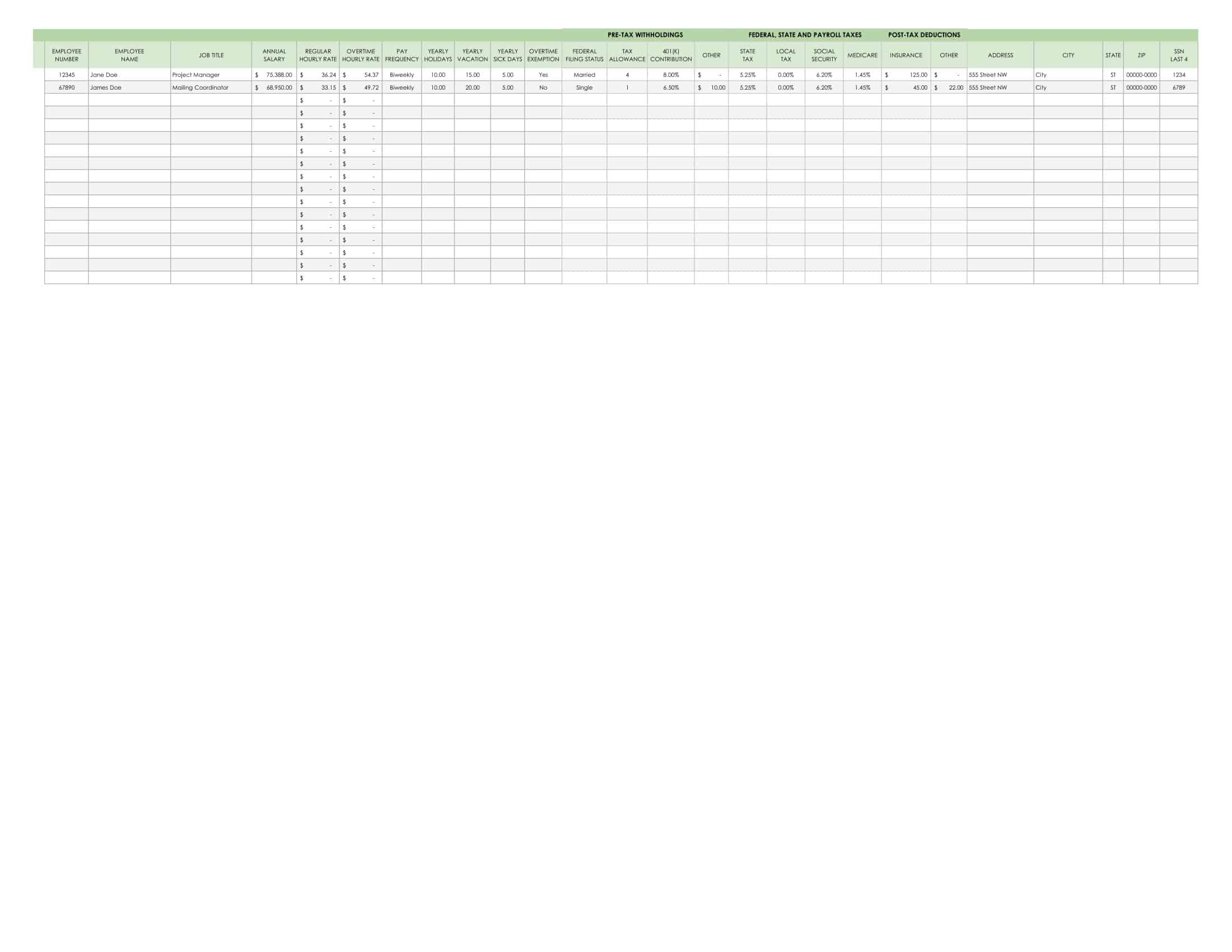

Payroll Ledger Templates

Payroll Ledger Templates provide an important accounting tool to help businesses efficiently track and manage detailed wage expenses. Maintaining well-organized Payroll Ledger Templates allows companies to closely monitor cumulative payroll costs, employee compensation histories, and labor budget vs. actuals. The templates make it easy to sort and analyze payroll data.

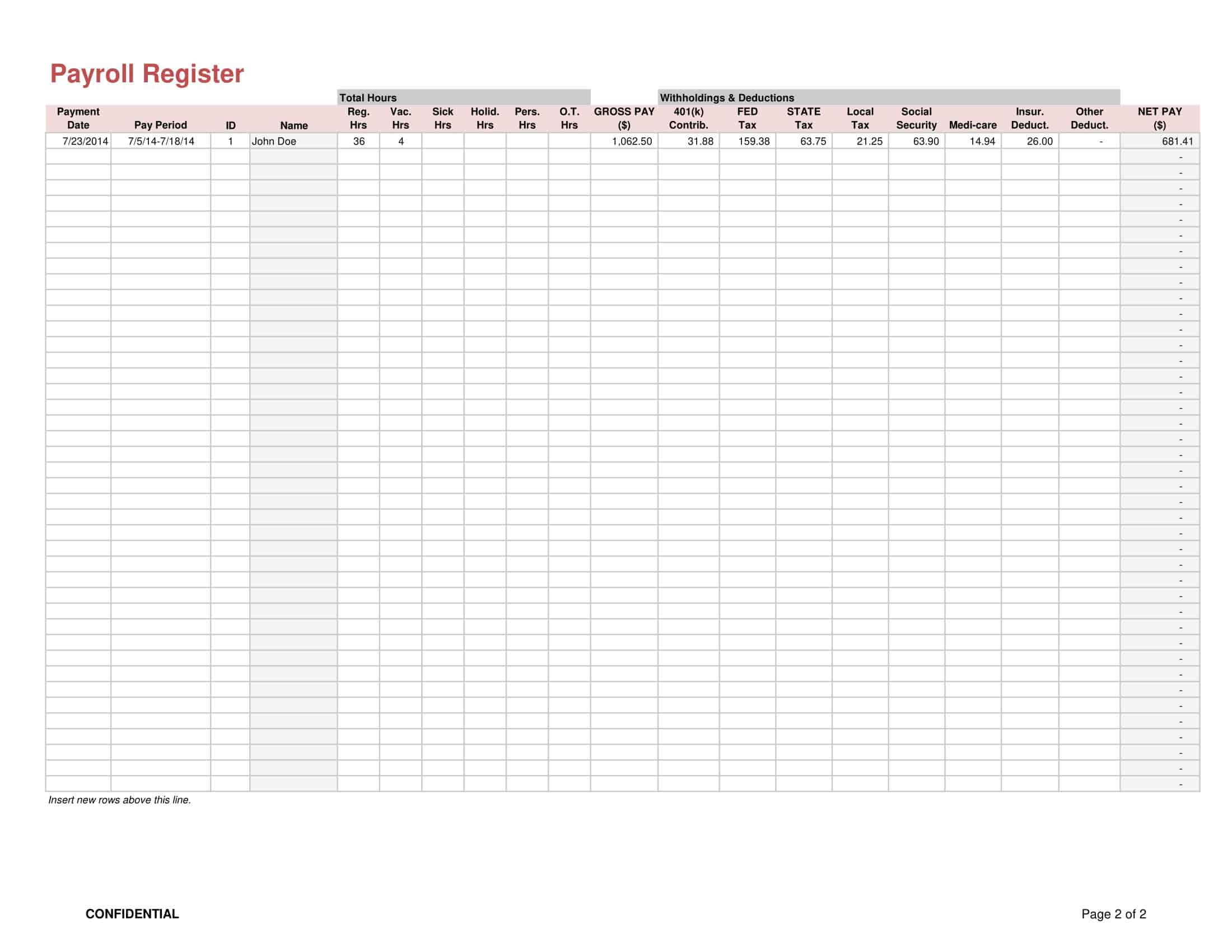

The Payroll Ledger Templates have a tabular format listing each employee’s name, pay rate, withholding amounts, and net wage paid per pay period. Additional customizable columns can log information like hours worked, overtime pay, bonuses, or special deductions. Built-in formulas automatically calculate subtotals per employee and companywide totals for convenient summarization. Using standardized Payroll Ledger Templates simplifies auditing payroll data for accuracy.

For any business, Payroll Ledger Templates give critical oversight into one of their largest expenses. The optimized templates allow customized organization of payroll information to best inform compensation analysis and cost control initiatives. With all the details seamlessly compiled in one place, the Payroll Ledger Templates save time and provide companies with an efficient tool to track obligations, monitor budgets, and ensure accurate employee payment.

Purpose Of A Payroll Ledger

The payroll ledger plays a pivotal role in the smooth functioning of a business’s financial and human resource operations. Understanding its comprehensive purpose is vital for accurate and efficient payroll management. Here’s a detailed look into the primary purposes of a payroll ledger:

Financial Documentation and Record Keeping: At its core, a payroll ledger serves as a detailed record of all payroll transactions. It helps businesses maintain an organized history of wages, bonuses, deductions, and more. This historical data is critical for referencing past payroll periods or supporting decisions about compensation adjustments.

Accuracy and Verification: By regularly updating and reconciling the payroll ledger, businesses can spot discrepancies or errors, ensuring that employees are compensated correctly. Discrepancies might arise due to miscalculations, system glitches, or even fraud. A well-maintained ledger helps in identifying these promptly.

Tax Reporting and Compliance: A payroll ledger consolidates data required for various tax forms and reports. It tracks tax withholdings for federal, state, and local taxes, making it easier to ensure compliance and file required tax documents. Without a precise ledger, businesses risk incurring penalties for misreporting or underpayment.

Budgeting and Financial Planning: The ledger provides a clear picture of the company’s labor costs. By analyzing these costs, businesses can develop budgets, make forecasts, and strategize on hiring or compensation adjustments.

Audit and Review Preparedness: In the event of an internal review or external audit, a payroll ledger serves as a primary document. It provides auditors with a clear trail of all compensation-related transactions, enabling them to verify the authenticity and correctness of reported figures.

Employee Benefit Management: Modern payroll ledgers often encompass more than just wages. They also detail benefits like health insurance, retirement contributions, vacation accruals, and more. This holistic view helps in managing and allocating these benefits accurately.

Supporting Financial Statements: For accounting purposes, the payroll ledger feeds into other financial statements like the income statement and balance sheet. Accurate payroll figures are crucial for a true representation of a company’s financial health.

Legal and Regulatory Compliance: Beyond taxes, there are several employment and labor regulations that businesses must adhere to. These might relate to minimum wage, overtime, equal pay, and more. A payroll ledger helps in demonstrating compliance with these laws, acting as evidence if ever required.

Employee Queries and Grievances: Employees might occasionally have questions or concerns regarding their pay. A well-detailed payroll ledger provides HR with the information needed to address these queries efficiently, ensuring clarity and transparency.

Performance Evaluations and Adjustments: Payroll data, especially when seen over time, can be an essential input into performance evaluations. It provides a clear record of bonuses, raises, and other compensation adjustments tied to performance metrics.

Benefits Of Using A Payroll Ledger Template

Using a payroll ledger template offers a plethora of benefits, streamlining the intricate process of payroll management and ensuring that it functions seamlessly. At the heart of these advantages is the template’s structured framework, which standardizes and organizes the vast amount of information involved in payroll operations.

First and foremost, a payroll ledger template simplifies data entry. Rather than starting from scratch each time, businesses have a consistent format to follow. This not only saves considerable time but also reduces the likelihood of errors. Templates often come with built-in formulas or automation features, which can automatically calculate totals, deductions, or other relevant figures, further ensuring accuracy in the process. This consistent structure fosters familiarity, meaning that anyone tasked with managing or reviewing the payroll can quickly understand and navigate the ledger.

Moreover, a template enhances efficiency in record-keeping. With categories and sections clearly defined, inputting data becomes more systematic. As months and years pass, this consistent format facilitates easy comparisons across different time periods, making trends in wages, overtime, or other payroll components discernible at a glance. This streamlined approach not only aids in-house operations but also simplifies tasks like external reporting or audits. When external parties, such as auditors or regulatory agencies, need to review payroll data, the standardized format of a template ensures that they can access and interpret the information swiftly.

Additionally, customization is a valuable benefit. While templates provide a foundational structure, they are often flexible enough to be tailored to a company’s specific needs. Whether it’s adding unique categories, adjusting columns for different tax rates, or incorporating specific company policies, a template can be modified to fit the precise requirements of a business. This adaptability ensures that the ledger remains relevant and useful, irrespective of changes in payroll processes or regulations.

In conclusion, using a payroll ledger template is akin to having a reliable blueprint for one of the most crucial financial functions of a business. It not only simplifies the immediate task of documenting payroll details but also offers long-term benefits in analysis, compliance, and operational efficiency. Investing in a well-designed template is a proactive step toward proficient payroll management.

How To Use A Payroll Ledger?

Using a payroll ledger efficiently requires a methodical approach. Whether you’re a small business owner handling payroll yourself or an HR professional in a larger organization, the steps remain largely consistent. Here’s a detailed guide on how to use a payroll ledger:

1. Selecting or Designing the Ledger:

- Choose a Format: Depending on your preference, choose between a manual ledger book, spreadsheet software like Microsoft Excel or Google Sheets, or specialized payroll software.

- Template Selection: If you’re using spreadsheet software, consider starting with a payroll ledger template. Many are available online. Ensure the template you choose encompasses all the fields you require.

2. Setup & Customization:

- Tailor to Needs: Modify your chosen template to fit your company’s specific needs. Add or remove columns as necessary.

- Standard Information: Begin by entering standard employee information such as name, employee ID, position, and department.

- Categories: Set up columns for gross pay, deductions (taxes, insurance, retirement contributions, etc.), net pay, overtime, bonuses, and any other relevant payroll components.

3. Data Entry:

- Regular Pay: Input the regular hours worked for each employee and multiply by their hourly wage or input their monthly/weekly salary.

- Overtime: If applicable, enter the overtime hours worked and calculate the extra payment due.

- Bonuses & Commissions: Add any additional compensations that need to be accounted for.

- Deductions: Calculate and input various deductions, such as tax withholdings, social security contributions, healthcare premiums, and any other applicable deductions.

- Net Pay: Compute the net pay for each employee by subtracting total deductions from the gross pay.

4. Verification & Reconciliation:

- Check for Accuracy: Review the data to ensure there are no discrepancies or omissions. This might involve cross-referencing with timecards, invoices, or other relevant documents.

- Reconciliation: Regularly reconcile the payroll ledger with bank statements or accounting software to ensure payments are accurately reflected and any discrepancies are quickly addressed.

5. Periodic Updates:

- Payroll Cycle: Update the ledger in sync with your payroll cycle, be it weekly, bi-weekly, monthly, etc.

- Changes & Adjustments: Account for raises, new hires, terminations, tax rate changes, or any other payroll-related modifications.

6. Reporting & Analysis:

- Generate Reports: Use the data in the ledger to generate periodic reports for management. This might include labor costs, departmental wage breakdowns, or overtime trends.

- Year-End Procedures: At the end of the fiscal year, ensure that all data is accurate for year-end reporting and tax filings.

7. Backup & Security:

- Save and Backup: Regularly save and backup your payroll ledger, especially if using digital formats. Consider cloud storage for additional security.

- Confidentiality: Ensure that the ledger is stored securely, given the sensitive nature of the data. If using software, use strong passwords and consider encryption for added security.

8. Audit Trails:

- Document Changes: Keep track of any edits or adjustments to the ledger. An audit trail helps in understanding any modifications and ensures transparency and accountability.

- External Reviews: In case of external audits, having a well-maintained payroll ledger will simplify the review process.

9. Continuous Review & Improvement:

- Feedback Loop: Regularly consult with the payroll team and other stakeholders to understand any challenges or suggestions for improvement.

- Training: If multiple individuals handle the ledger, ensure they are adequately trained and familiar with the procedures.

What To Include In A Payroll Ledger Template

A payroll ledger template should encapsulate all necessary details to ensure that an organization’s payroll process is both accurate and transparent. Here’s a list of essential elements to include in a payroll ledger template:

- Employee Information:

- Employee ID: A unique identifier for each employee.

- Full Name: The complete name of the employee.

- Position/Title: The role or job title of the employee.

- Department/Division: The department or team the employee belongs to.

- Earnings:

- Hourly Rate/Salary: The basic hourly rate for hourly employees or the salary for salaried employees.

- Regular Hours: Number of hours worked during the standard working period.

- Overtime Hours: Number of hours worked beyond the regular hours.

- Gross Pay: Total earnings before deductions, calculated as (hourly rate x regular hours) + (overtime rate x overtime hours) for hourly employees or the monthly/weekly salary for salaried employees.

- Bonuses/Commissions: Any additional earnings the employee received.

- Total Earnings: The sum of gross pay and any bonuses or commissions.

- Deductions:

- Federal Tax Withholding: Amount deducted for federal taxes.

- State/Local Tax Withholding: Amount deducted for state and/or local taxes.

- Social Security: Deduction for social security.

- Medicare: Deduction for Medicare.

- Health Insurance: Amount deducted for health insurance premiums.

- Retirement Contributions: Amount deducted for retirement plans like 401(k) or pensions.

- Other Deductions: Any other miscellaneous deductions, such as union dues, garnishments, or charitable contributions.

- Total Deductions: The sum of all deductions.

- Net Pay:

- Net Pay: The amount an employee receives after all deductions, calculated as total earnings minus total deductions.

- Dates & Periods:

- Pay Period Start Date: The beginning date of the pay cycle.

- Pay Period End Date: The ending date of the pay cycle.

- Payment Date: The date on which the paycheck is issued.

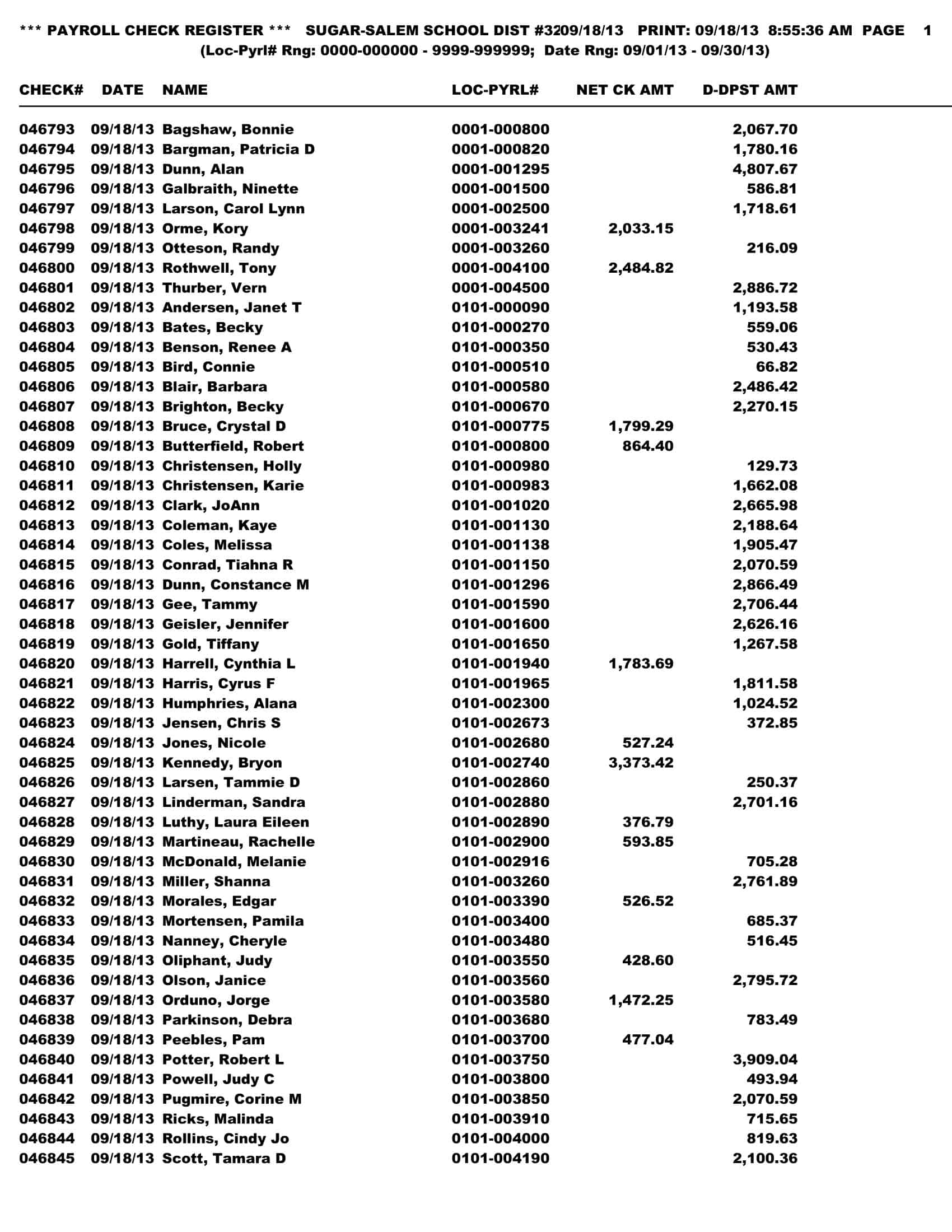

- Additional Details:

- Bank Details: Information about the bank where the payment is made (useful for electronic transfers).

- Check Number: If payment is made by check, include its number for reference.

- Accruals & Benefits (if applicable):

- Vacation Hours Earned: Number of vacation hours the employee has accrued.

- Sick Hours Earned: Number of sick hours accrued.

- Other Benefits: Details of other benefits like stock options, bonuses, etc.

- Notes/Comments:

- A section for any additional notes, observations, or comments about the payroll for that period.

Sample Payroll Ledger Template

| Employee Name | Pay Period | Salary/Hourly Rate | Hours | Gross Pay | Deductions | Net Pay |

| John Doe | 1/1/2023 – 1/15/2023 | $25/hour | 80 | $2,000 | Taxes: $500 Benefits: $75 | $1,425 |

| Jane Smith | 1/1/2023 – 1/15/2023 | $60,000/year | N/A | $2,500 | Taxes: $600 401k: $100 Insurance: $50 | $1,750 |

How to Create a Payroll Ledger in Excel ?

Creating a payroll ledger in Excel can be achieved with relative ease, given Excel’s vast array of tools for data management and computation. Here’s a step-by-step guide to help you set up a comprehensive payroll ledger:

Step 1: Open Excel & Start with a Blank Workbook

Launch Excel and choose a blank workbook to start with a clean slate.

Step 2: Set Up Your Columns

Label your columns with the following headers (or any specific headers relevant to your business):

- Employee ID

- Employee Name

- Position/Title

- Department

- Pay Period Start Date

- Pay Period End Date

- Hourly Rate/Salary

- Regular Hours

- Overtime Hours

- Gross Pay

- Deductions (with sub-columns for specific types like Federal Tax, State Tax, Health Insurance, etc.)

- Net Pay

- Notes/Comments

Step 3: Format the Cells

- Click on the columns that will contain monetary values.

- Right-click and choose ‘Format Cells’.

- Under ‘Number’, select ‘Currency’ and adjust the format to your preference.

Step 4: Insert Formulas

For columns that require calculations, set up formulas:

- Gross Pay: If calculating hourly, = (Hourly Rate x Regular Hours) + (Overtime Rate x Overtime Hours).

- Total Deductions: Sum of all individual deductions.

- Net Pay: = Gross Pay – Total Deductions.

Step 5: Input Data

Enter the information for each employee in the rows under the appropriate columns. As you enter data, Excel will automatically calculate values based on the formulas you’ve inserted.

Step 6: Create Drop-Down Lists (Optional)

For columns like ‘Department’ or ‘Position/Title’, you can create drop-down lists for consistency:

- Select the cells where you want the drop-down lists.

- Click on the ‘Data’ tab and choose ‘Data Validation’.

- From the allow box, choose ‘List’.

- Enter the values you want in the list separated by commas or select a range in Excel where you’ve written them.

Step 7: Freeze Header Row

To make your header row visible while scrolling:

- Click on the row below your header.

- Go to the ‘View’ tab.

- Click on ‘Freeze Panes’ and select ‘Freeze Top Row’.

Step 8: Conditional Formatting (Optional)

You can highlight specific cells based on certain criteria, such as employees with overtime:

- Highlight the ‘Overtime Hours’ column.

- Go to the ‘Home’ tab and select ‘Conditional Formatting’.

- Choose a rule, for instance, ‘Cell Value > 0’.

- Set a format (like a specific background color) for cells meeting this criteria.

Step 9: Save Your Work

- Click on ‘File’ in the top left corner.

- Choose ‘Save As’ and select a location on your computer.

- Enter a name for your payroll ledger and click ‘Save’.

Step 10: Protect Your Sheet (Optional)

If you want to prevent unauthorized changes:

- Click on the ‘Review’ tab.

- Select ‘Protect Sheet’.

- Enter a password and confirm it.

FAQs

Can I use software other than Excel for my payroll ledger?

Yes, there are various payroll software and platforms available, both cloud-based and offline, that can serve as alternatives to Excel. Some popular ones include QuickBooks, ADP, and Paychex. These often come with added features like direct deposit, tax filing, and integrations with other HR tools.

How often should I update my payroll ledger?

Ideally, you should update your payroll ledger in sync with your payroll cycle, whether that’s weekly, bi-weekly, monthly, etc. It ensures that all transactions are recorded promptly and accurately.

What’s the difference between a payroll ledger and a general ledger?

A payroll ledger focuses exclusively on payroll transactions, detailing each employee’s earnings, deductions, and net pay. In contrast, a general ledger is a complete record of all financial transactions for a business, including assets, liabilities, equity, revenue, and expenses. The payroll ledger might be considered a subsidiary ledger that feeds into the broader general ledger.

Do I need to keep a hard copy of my payroll ledger?

While many businesses are moving towards digital solutions for environmental and efficiency reasons, you may want to check local regulations and company policies. Some jurisdictions or company guidelines may require hard copies for specific record-keeping purposes.

How long should I retain my payroll ledger records?

The duration for retaining payroll records varies by jurisdiction. However, a common recommendation is to keep them for at least three to seven years, as this timeframe covers most audit, tax, and claim periods. Always check local regulations for specific guidelines.

Are there legal considerations when managing a payroll ledger?

Yes, businesses must ensure that they’re compliant with wage laws, tax regulations, and record-keeping requirements. This includes timely payment of wages, accurate tax withholdings, and proper documentation for potential audits.

What should I do if I discover discrepancies in my payroll ledger?

If you find any discrepancies, it’s essential to investigate immediately. Cross-reference with other records, consult with your payroll department, and make necessary corrections. It’s also crucial to understand the root cause to prevent future errors.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)