The Debt Snowball method is a popular strategy for paying off debt that involves focusing on paying off smaller debts first, while still making minimum payments on larger debts. The idea behind this method is that by quickly paying off small debts, individuals will experience a sense of accomplishment and momentum that will help them stay motivated to continue paying off their debt.

This can be a powerful tool for those who are struggling to get a handle on their finances and are looking for a way to start chipping away at their debt. Whether you have a few small credit card balances or a larger student loan, the Debt Snowball method can help you create a plan for paying off your debt and achieving financial freedom.

Table of Contents

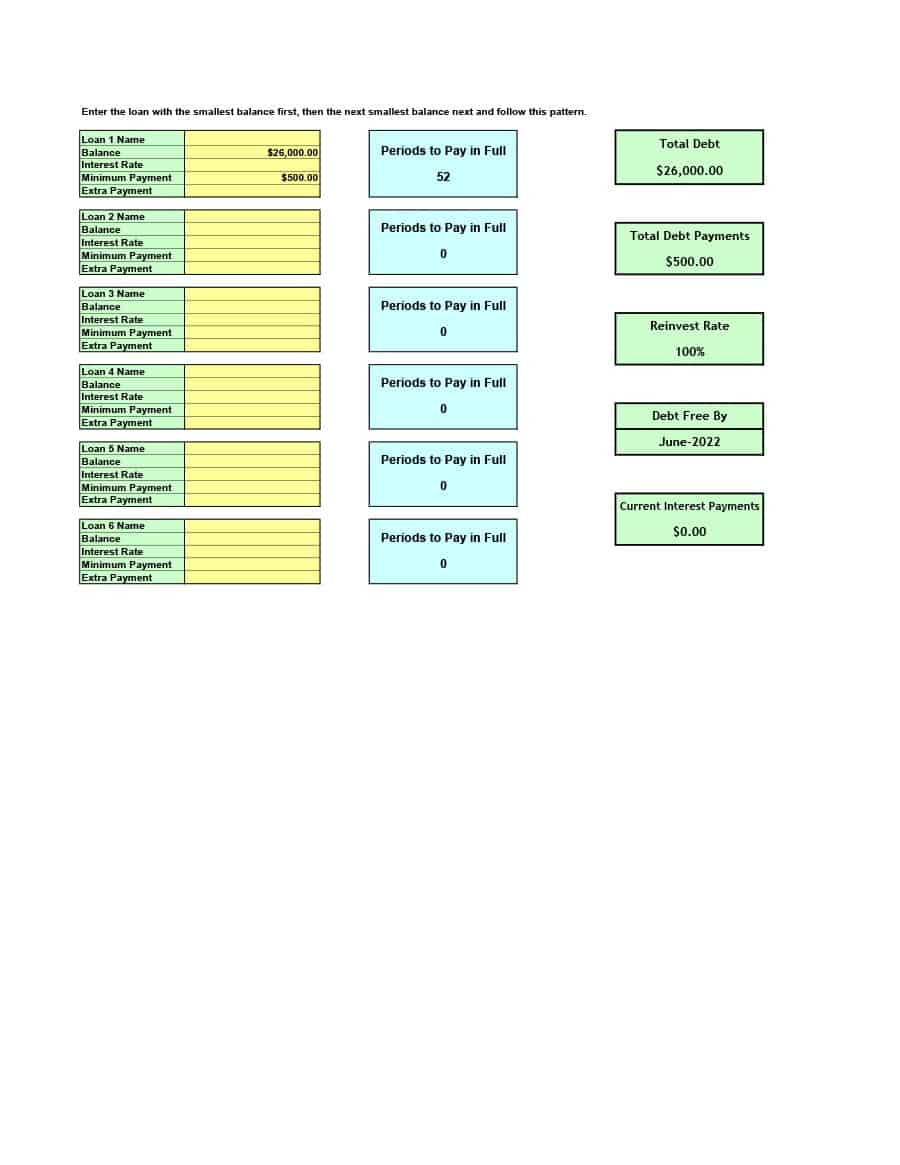

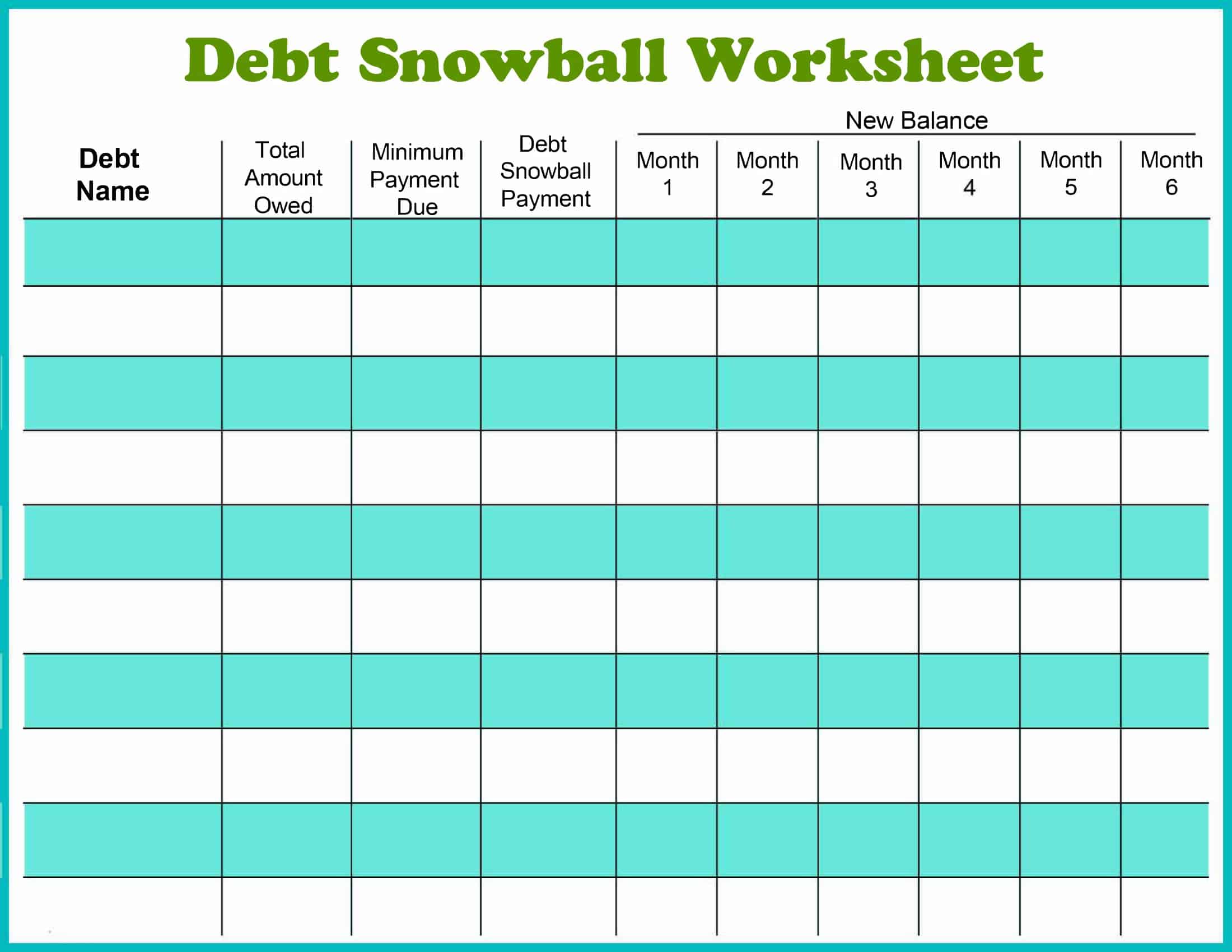

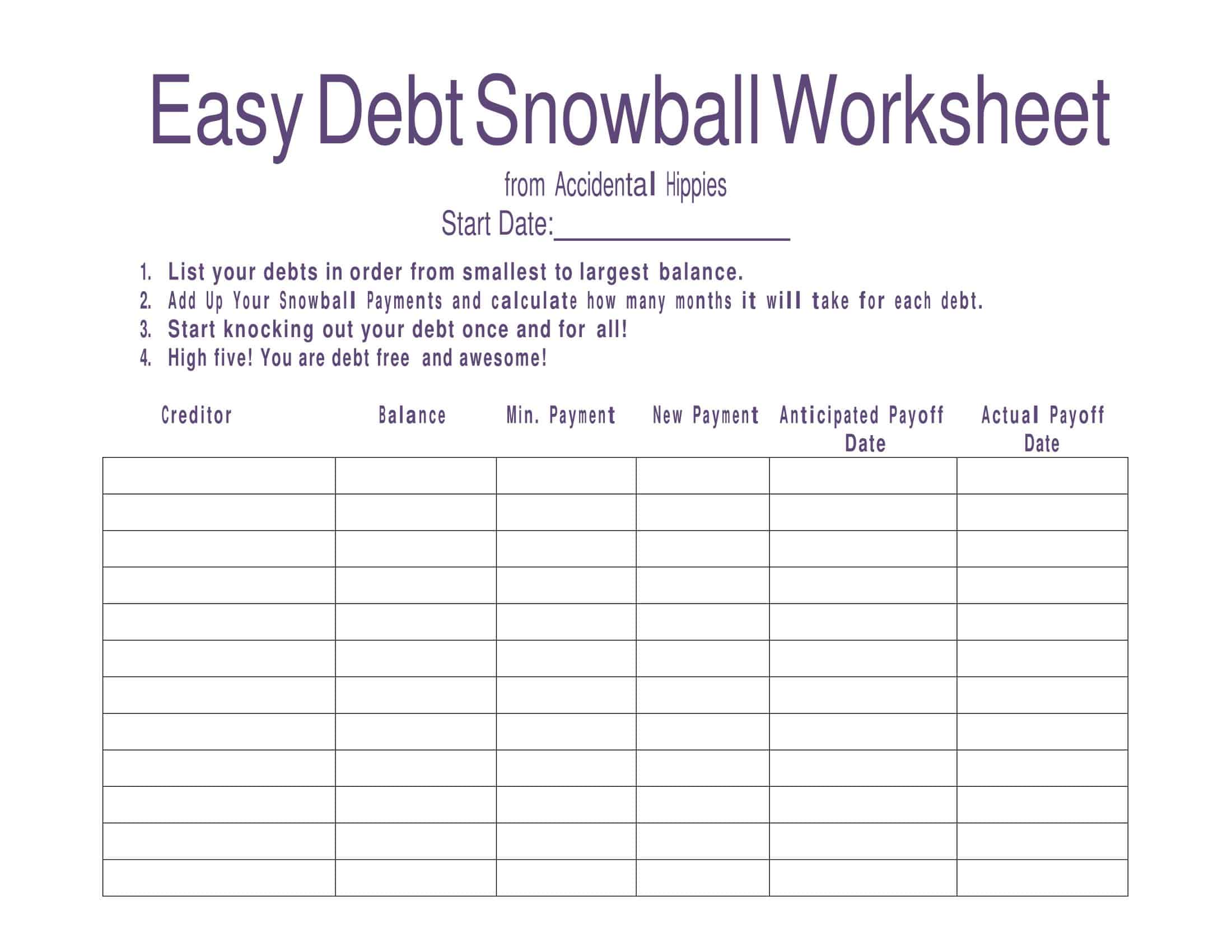

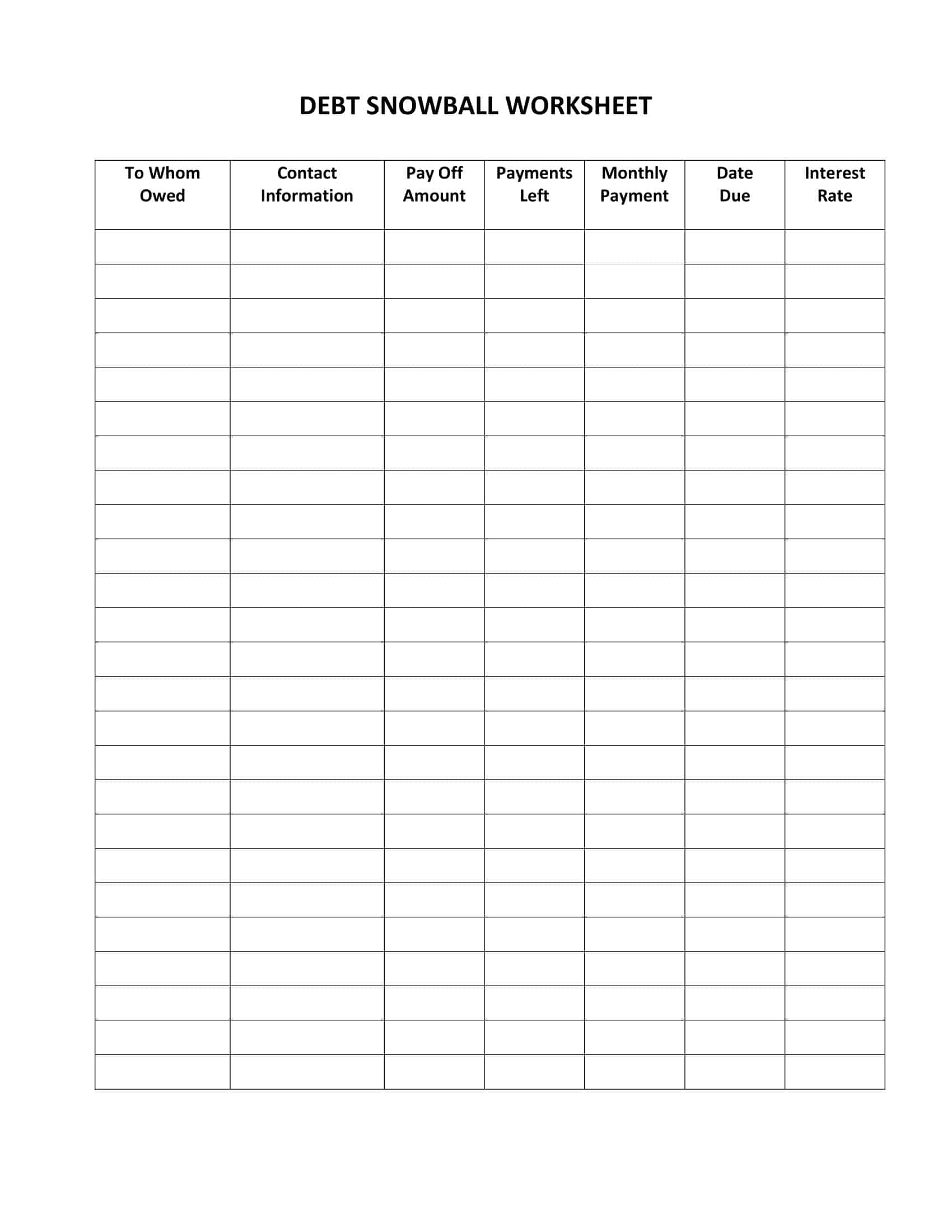

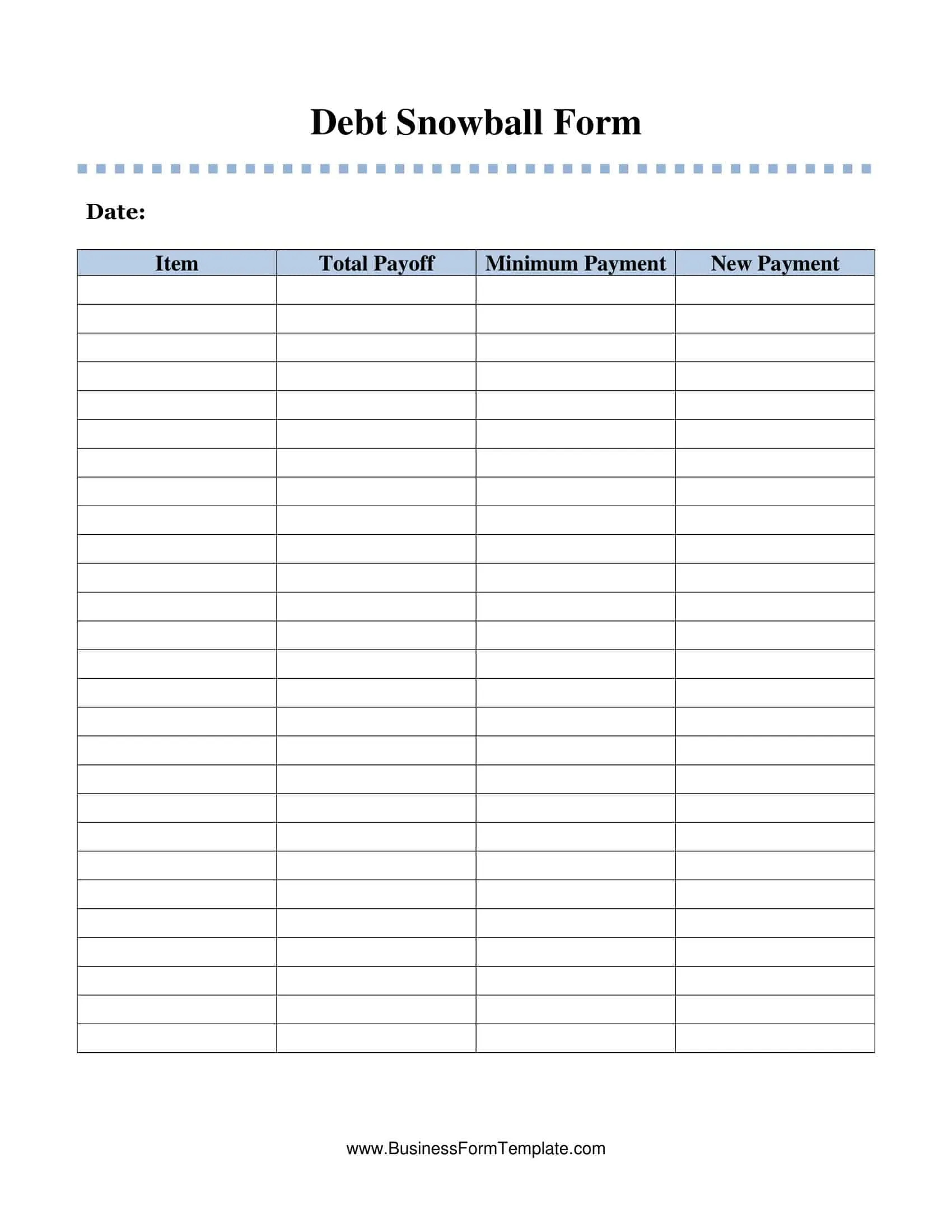

Debt Snowball Templates

Debt Snowball Templates are pre-designed formats used to assist individuals or households in managing and paying off their debts in an organized and efficient manner. These templates provide a structured framework for creating a debt repayment plan based on the debt snowball method. The debt snowball method focuses on paying off debts in a strategic order, starting with the smallest balances first, and gradually progressing to larger debts. Debt Snowball Templates ensure consistency, clarity, and motivation in the debt repayment process, helping individuals achieve their financial goals and become debt-free.

Debt Snowball Templates provide a structured and organized approach to debt repayment. By utilizing these templates, individuals can prioritize and tackle their debts effectively, gaining momentum and motivation as they see progress in paying off smaller debts. These templates promote financial discipline, goal-setting, and a systematic approach to debt reduction. Debt Snowball Templates are valuable tools for individuals or households seeking to regain control of their finances, eliminate debt, and achieve long-term financial freedom.

The advantages of using the debt snowball method

The Debt Snowball method offers several advantages for individuals looking to pay off their debt:

Provides motivation

By focusing on paying off small debts first, individuals can experience a sense of accomplishment and motivation that can help them stay committed to their debt repayment plan.

Builds momentum

As individuals pay off small debts, they can use the money they were previously using to make payments on those debts to begin paying off larger debts. This can help them to quickly build momentum in their debt repayment efforts.

Simplifies the process

The Debt Snowball method simplifies the debt repayment process by providing a clear and easy-to-follow plan. By focusing on one debt at a time, individuals can avoid feeling overwhelmed by their debt.

Helps to avoid interest charge

By focusing on paying off high-interest debts first, individuals can save money on interest charges in the long run.

Helps to improve credit score

Paying off debt can help to improve credit score, and the Debt Snowball method can help individuals to make steady progress in reducing their debt, which can lead to an improved credit score over time.

Focuses on the big picture

By paying off small debts first, individuals can start to see the progress they are making and feel more in control of their finances, which can help them to focus on the big picture and stay committed to their debt repayment plan.

Increases self-discipline

The Debt Snowball method requires individuals to prioritize and manage their finances, which can help them develop better self-discipline and money management skills.

Helps to create a budget

The Debt Snowball method can help individuals to create a budget, as they need to allocate money to pay off their debts while still covering their living expenses.

Increases savings

By paying off debt, individuals can free up more money in their budget, which can be used to save for future goals such as retirement or buying a house.

Helps to reduce stress

Carrying large amounts of debt can be stressful, and the Debt Snowball method can help individuals to reduce their stress by providing a clear plan for paying off their debt and achieving financial freedom.

Helps to improve financial literacy

By using the Debt Snowball method, individuals can learn about personal finance, budgeting, and money management, which can help them make better financial decisions in the future.

Helps to prioritize spending

By allocating money to pay off debts, individuals can learn to prioritize their spending and make more informed decisions about where they spend their money.

How to Use the Debt Snowball Method to Pay Off Debt

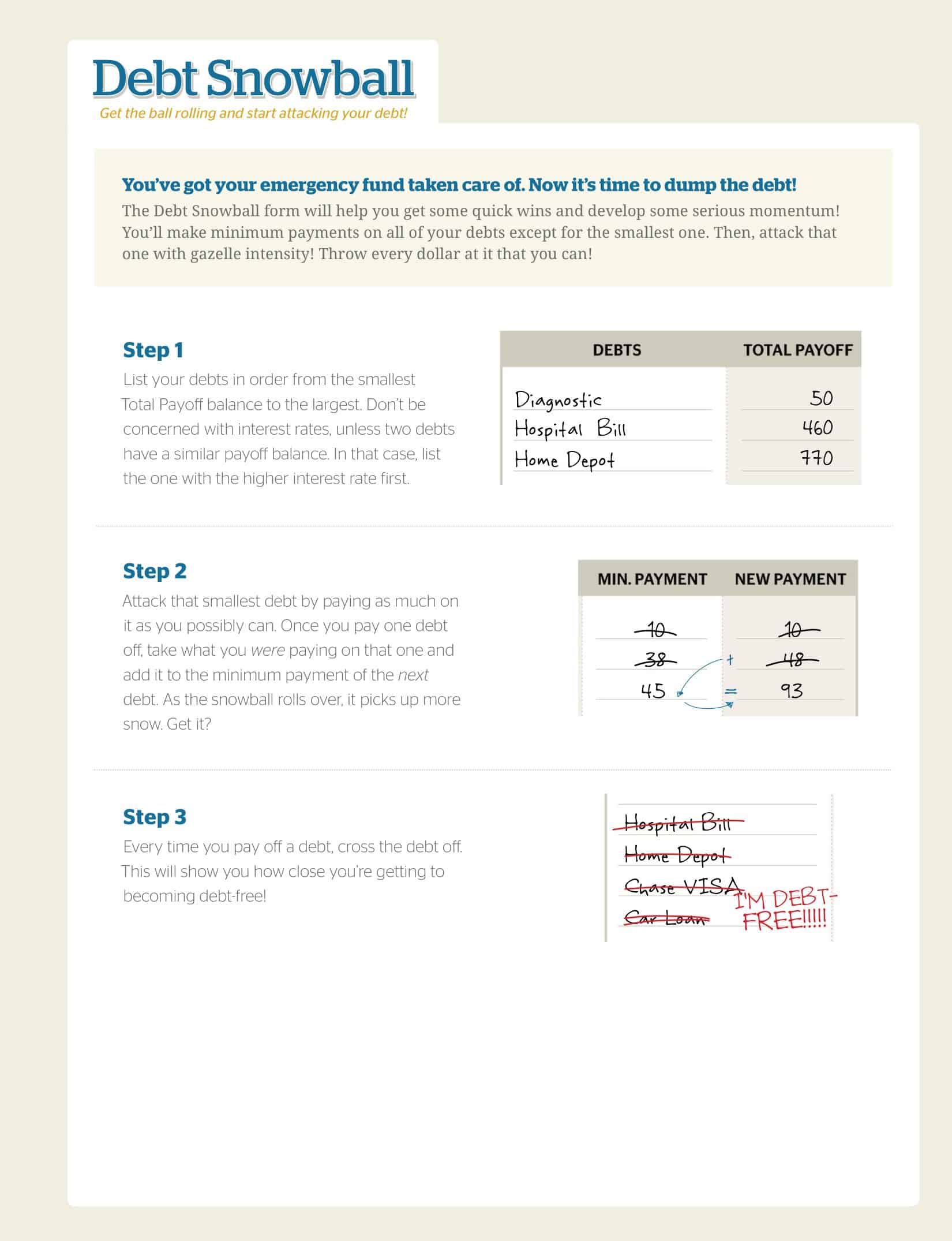

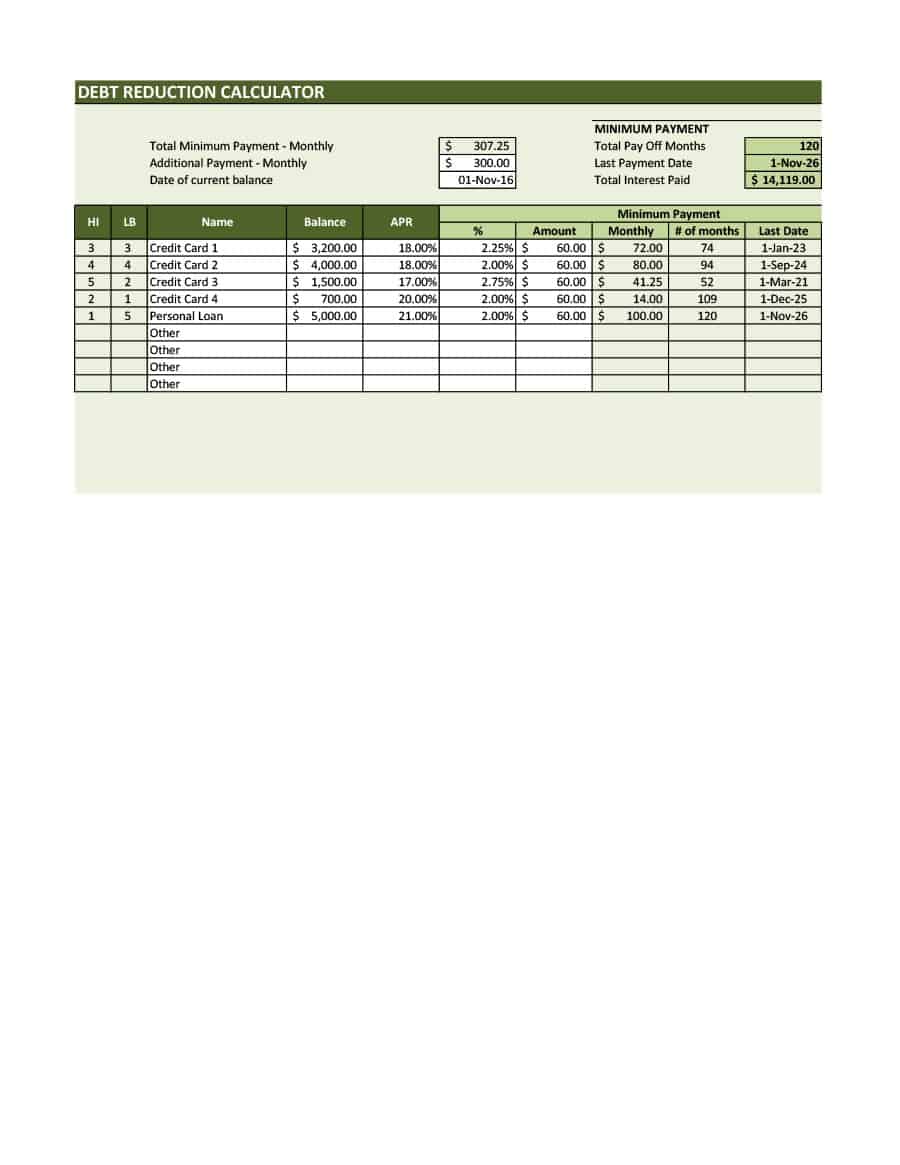

The Debt Snowball method is a debt repayment strategy that involves focusing on paying off smaller debts first, while still making minimum payments on larger debts. Here’s how the method works:

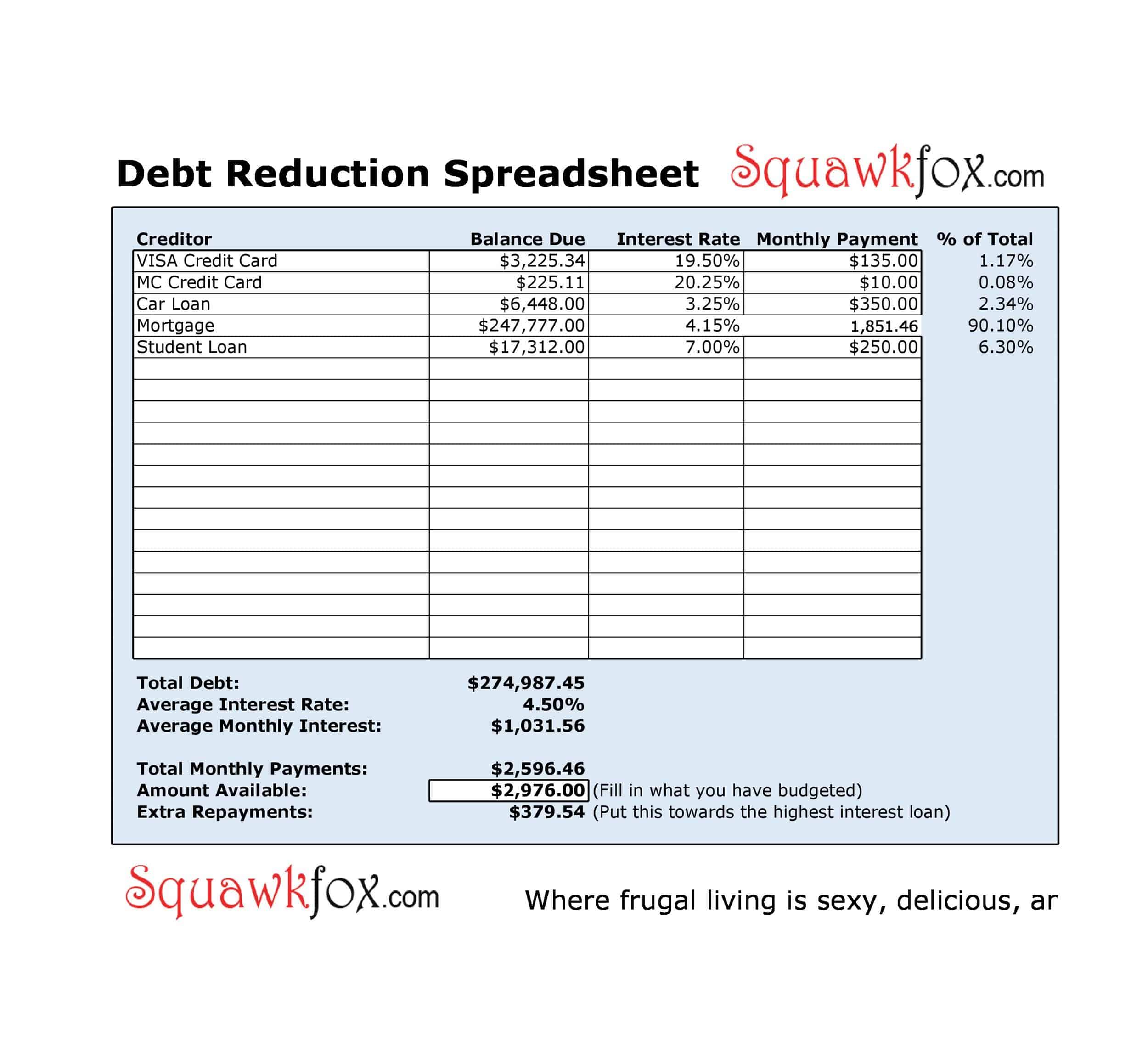

Make a list of all your debts: Write down all of your debts, including the creditor, the balance, and the minimum monthly payment.

Prioritize your debts: Arrange your debts in order of smallest to largest balance, regardless of the interest rate.

Make minimum payments on all debts except the smallest: For all your debts except the smallest one, make the minimum payments required.

Pay extra on the smallest debt: Use any extra money you have available to pay extra on the smallest debt. For example, if the minimum payment is $50, you could pay $75 or $100.

Repeat the process: Once the smallest debt is paid off, repeat the process by moving on to the next smallest debt and applying the same method.

Keep repeating: Keep working your way down the list of debts, paying off the smallest ones first, and making minimum payments on the larger debts.

Keep track of your progress: Keep track of your progress and celebrate each time you pay off a debt.

This method is called a “snowball” because as you pay off each debt, the money you were using to pay it off gets added to the payments of the next debt, creating a snowball effect that can help to quickly pay off all of your debts. It’s important to keep in mind that while the Debt Snowball method can be an effective way to pay off debt, it may not be the best approach for everyone. It’s important to evaluate one’s own financial situation and determine if the Debt Snowball method is the best approach for them.

Debt Avalanche vs. Debt Snowball: What’s the Difference?

Debt Avalanche and Debt Snowball are two popular debt repayment strategies that are used to help individuals pay off their debt. While both methods involve making minimum payments on all debts and paying extra on one debt at a time, the main difference between the two is the order in which the debts are paid off.

Debt Avalanche: The Debt Avalanche method involves focusing on paying off the debt with the highest interest rate first, while still making minimum payments on all other debts. The idea behind this method is that by paying off the highest interest rate debt first, individuals will save the most money on interest charges in the long run.

Debt Snowball: The Debt Snowball method, on the other hand, involves focusing on paying off the smallest debt first, while still making minimum payments on all other debts. The idea behind this method is that by quickly paying off small debts, individuals will experience a sense of accomplishment and momentum that will help them stay motivated to continue paying off their debt.

Both methods have their pros and cons. The Debt Avalanche method can help individuals save money on interest charges in the long run, but it may take longer to see progress and may not be as motivating for some people. The Debt Snowball method can provide a quick sense of accomplishment, but it may not save as much money on interest charges in the long run. It’s important for individuals to evaluate their own financial situation and determine which method is the best approach for them.

Debt Consolidation vs. Debt Snowball

Debt Consolidation and the Debt Snowball method are two different ways of addressing debt, and each has its own advantages and disadvantages.

Debt Consolidation: Debt consolidation is the process of combining multiple debts into a single loan with a lower interest rate and a fixed monthly payment. This can make it easier to manage debt by reducing the number of bills to keep track of and lowering the overall interest rate. It can also help to lower the monthly payments and make it more affordable to pay off the debt. However, it doesn’t address the underlying problem that led to the accumulation of the debt and it may not be suitable for everyone, especially if they have poor credit score.

Debt Snowball: The Debt Snowball method, on the other hand, is a debt repayment strategy that involves focusing on paying off smaller debts first, while still making minimum payments on larger debts. The idea behind this method is that by quickly paying off small debts, individuals will experience a sense of accomplishment and momentum that will help them stay motivated to continue paying off their debt. This method addresses the problem of multiple debts by providing a clear and simple plan for paying them off. It may not save as much money on interest charges in the long run, but it helps to create a sense of accomplishment and may be more motivating for some individuals.

In summary, debt consolidation can help to make it more affordable to pay off debt and easier to manage multiple bills, but it doesn’t address the underlying problem that led to the accumulation of debt. On the other hand, the Debt Snowball method addresses the problem of multiple debts by providing a clear and simple plan for paying them off and it may be more motivating for some individuals. Ultimately, the choice between these two methods will depend on the individual’s financial situation and priorities.

An Example of the Debt Snowball

Here is an example of how the Debt Snowball method could work:

Let’s say an individual has the following debts:

Credit Card 1: $1,500 balance, $25 minimum payment, 15% interest rate

Credit Card 2: $2,000 balance, $35 minimum payment, 18% interest rate

Personal Loan: $10,000 balance, $150 minimum payment, 7% interest rate

Car Loan: $15,000 balance, $300 minimum payment, 5% interest rate

The individual prioritizes their debts and arranges them in order of smallest to largest balance, regardless of interest rate:

Credit Card 1: $1,500 balance, $25 minimum payment, 15% interest rate

Credit Card 2: $2,000 balance, $35 minimum payment, 18% interest rate

Personal Loan: $10,000 balance, $150 minimum payment, 7% interest rate

Car Loan: $15,000 balance, $300 minimum payment, 5% interest rate

The individual makes the minimum payments on all debts except the smallest debt (Credit Card 1). They decide to pay an extra $50 on this debt each month.

Credit Card 1: $1,500 balance – $75/month

Credit Card 2: $2,000 balance – $35/month

Personal Loan: $10,000 balance – $150/month

Car Loan: $15,000 balance – $300/month

After 6 months, the individual is able to pay off Credit Card 1 in full. They then move on to the next smallest debt, Credit Card 2, and apply the same method.

Credit Card 2: $2,000 balance – $85/month

Personal Loan: $10,000 balance – $150/month

Car Loan: $15,000 balance – $300/month

The individual continues to make minimum payments on their other debts and pay extra on the next smallest debt until all debts are paid off.

FAQs

How long does it take to pay off debt using the Debt Snowball method?

The length of time it takes to pay off debt using the Debt Snowball method will vary depending on the amount of debt and the individual’s budget. However, by focusing on paying off the smallest debt first, individuals can quickly see progress and stay motivated to continue with the plan.

Is the Debt Snowball method suitable for everyone?

The Debt Snowball method may not be suitable for everyone. It’s important for individuals to evaluate their own financial situation and determine if the Debt Snowball method is the best approach for them.

Can I use Debt Consolidation and the Debt Snowball method together?

Yes, it’s possible to use both Debt Consolidation and the Debt Snowball method together. Debt Consolidation can help to lower the interest rate and make it more affordable to pay off the debt, while the Debt Snowball method can provide a clear and simple plan for paying off the debts. However, it’s important to keep in mind that debt consolidation may not be suitable for everyone, especially if they have poor credit score.

Can I change my debt repayment plan after starting the Debt Snowball method?

Yes, you can change your debt repayment plan at any time. If you find that the Debt Snowball method is not working for you or you come across unforeseen expenses, you can adjust your plan to fit your needs. It’s important to remember that the most important thing is to make a plan and stick to it.

Can I make extra payments on other debts while using the Debt Snowball method?

Yes, you can make extra payments on other debts while using the Debt Snowball method. However, it’s important to prioritize paying off the smallest debt first in order to see progress and stay motivated. Any extra payments should be applied to the smallest debt first before applying to other debts.

What should I do if I have trouble sticking to the Debt Snowball method?

If you are having trouble sticking to the Debt Snowball method, it’s important to reevaluate your budget and make sure that you are allocating enough money to debt repayment. You can also consider seeking professional help from a financial advisor, credit counselor, or accountant. It’s also important to stay motivated and remind yourself of the end goal, which is to become debt-free.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)