Amid the suite of financial documents that businesses generate, the Multi-Step Income Statement shines a spotlight on a company’s complex financial narrative. This comprehensive document dissects income and expenses into multifaceted categories, revealing a detailed panorama of a firm’s operational and non-operational performance.

Beyond just numbers, it tells a tale of how a business earns its revenues and incurs its costs, thereby offering stakeholders a comprehensive understanding of profit generation. Throughout this article, readers will encounter not only a thorough examination of each segment but will also be guided through illustrative examples that bring the Multi-Step Income Statement to life. This robust exploration will elucidate how this pivotal financial statement acts as a beacon for informed decision-making in the dynamic world of business finance.

Table of Contents

What Is a Multi-Step Income Statement?

A Multi-Step Income Statement is a detailed financial document that segregates a company’s revenues and expenses into multiple categories, providing a more intricate view of its financial performance. Unlike a simple income statement, it differentiates between core operating revenues and expenses and those from non-operating activities, allowing stakeholders to discern between regular business operations and incidental or one-time events. This delineation offers a clearer picture of a company’s primary profit-generating activities, helping investors, analysts, and management to make more informed decisions.

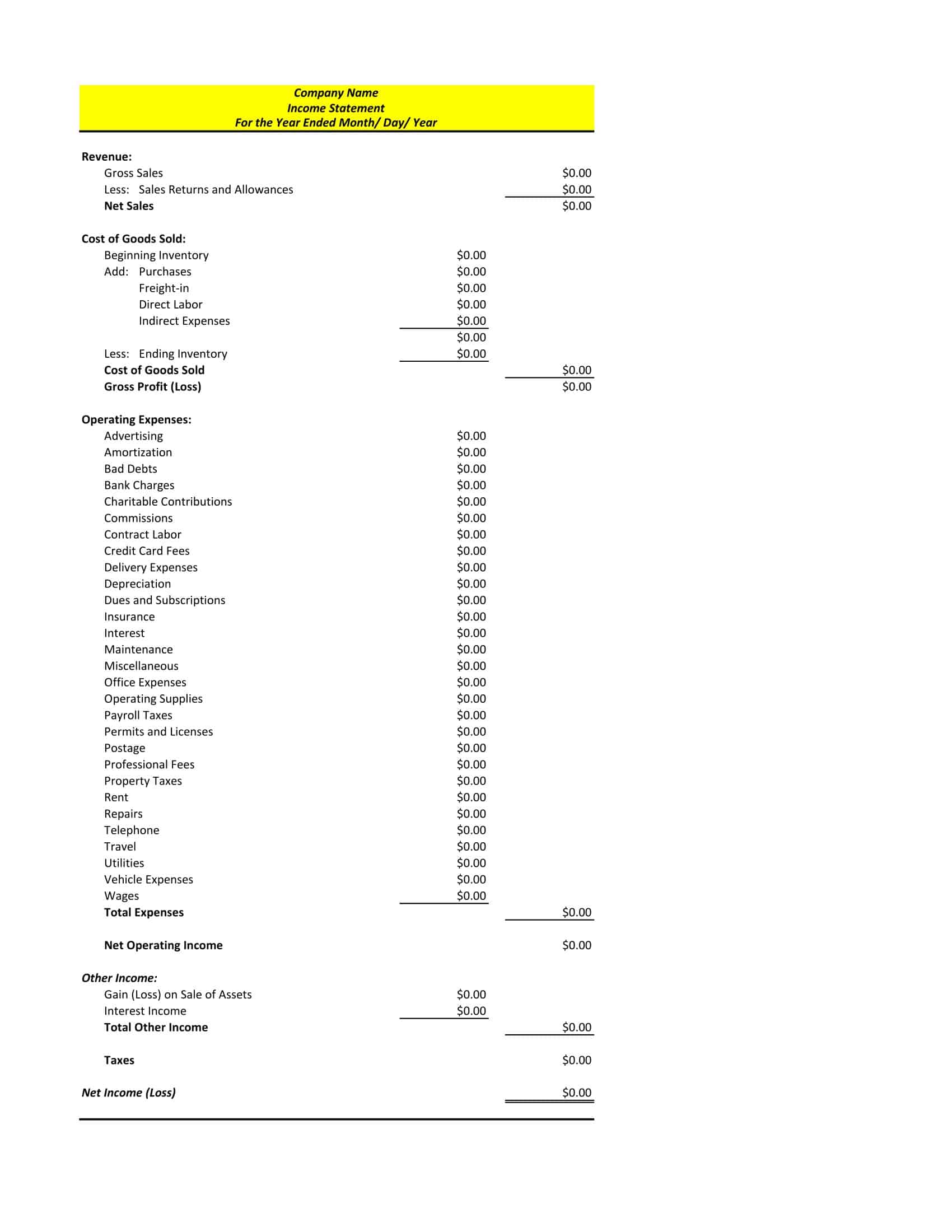

Multi-Step Income Statement Templates

A multi-step income statement is a more detailed profit and loss report separating operating and non-operating income and expenses. It provides a more comprehensive view of a company’s financial performance than a single-step income statement. The multi-step format lists components like revenue, cost of goods sold, operating expenses, interest, and taxes in distinct sections.

Multi-step income statement templates structure these financial data points for easy analysis. For example, template sections may include gross profit, operating income, income from continuing operations, and net income. These formatted templates calculate margins and subtotals not shown on single-step statements. The detailed breakdown better highlights relationships between accounts to assess operational efficiency.

When reviewing multi-step income statement templates, financial analysts should verify the accuracy of categories and accounting. The segmented format illustrates important ratios like gross margin and tax burden that drive strategic decisions. Templates automate calculations, ensuring correct net profit/loss. With clear organization and detailed business insights, multi-step templates improve financial transparency for management and investors.

Benefits of a Multi-Step Income Statement

The Multi-Step Income Statement, as the name suggests, breaks down a company’s financial activities into multiple steps, offering a more detailed snapshot than the traditional, single-step format. While it might initially seem cumbersome, the benefits it offers can significantly enhance the depth and clarity of financial analysis. Let’s delve into these advantages in detail:

- Enhanced Clarity in Operating Performance:

By separating operating revenues and expenses from non-operating ones, stakeholders get a clearer picture of the company’s core business activities. This delineation enables them to assess the strength and sustainability of primary revenue sources without the distortion from one-time or peripheral activities. - Identification of Non-Operating Activities:

Non-operating revenues and expenses—like gains or losses from asset sales, interest income, or expense—are clearly outlined. This distinction helps in identifying sporadic, non-recurring, or external factors that may not be indicative of the company’s regular business performance. - Gross Profit Analysis:

By stating the cost of goods sold separately from operating expenses, the multi-step format shows the gross profit. This is invaluable for businesses to gauge the profitability of their core product or service offerings before other operational expenses are considered. - Operational Expense Breakdown:

Operating expenses are further segmented into selling and administrative expenses, giving stakeholders a better understanding of where the company’s operational money goes. It aids in analyzing the efficiency of sales efforts and the overhead of running the business. - Better Comparative Analysis:

Because of its structured approach, year-over-year or between-company comparisons become more insightful. Analysts can easily discern patterns or anomalies in specific revenue or expense categories, facilitating more precise benchmarking and forecasting. - Improved Decision Making for Management:

The granular detail provided by a multi-step income statement aids management in making informed strategic decisions. For instance, if a company’s core operating profits are strong but overshadowed by high interest expenses, management might consider strategies for debt reduction. - Easier Financial Ratio Computations:

Ratios like the gross profit margin, which compares gross profit to net sales, can be easily derived from a multi-step income statement. Such ratios are pivotal for stakeholders aiming to gauge the company’s financial health and profitability. - Enhanced Stakeholder Confidence:

A transparent and detailed presentation of financial information can boost the confidence of investors, creditors, and other stakeholders. It showcases a company’s commitment to clarity and due diligence, potentially fostering trust and long-term relationships.

Which Types of Companies Employ Multi-Step Income Statements?

The Multi-Step Income Statement offers a granular look at an organization’s revenues and expenses, distinguishing between core operations and other financial activities. Due to its detailed nature, certain businesses tend to benefit from it more than others. Here’s an overview of which businesses typically use multi-step income statements:

Retailers and Wholesalers

These businesses often deal with a vast array of products, each with its own cost structure. The multi-step statement allows them to closely track the gross profit by subtracting the cost of goods sold from sales, revealing the profit margin from primary operations before other expenses are considered.

Manufacturing Companies

Manufacturers incur a variety of production costs, from raw materials to labor. By differentiating between the cost of goods manufactured and other operational expenses, these firms can better assess their production efficiency.

Large Corporations

Big enterprises with diverse departments or divisions use the multi-step approach to segregate various revenue streams and expense categories. This helps in a more detailed internal analysis and facilitates clear communication to external stakeholders about different segments of their operations.

Businesses with Significant Non-Operating Activities

Companies that frequently engage in activities outside their primary operations, such as selling assets, investing, or incurring non-operational debts, benefit from the distinction provided by the multi-step format. This helps to identify and evaluate the impact of these non-core activities on the overall financial performance.

Companies Seeking External Financing

External stakeholders, such as investors or creditors, appreciate a detailed breakdown of a company’s financial activities. A multi-step income statement can demonstrate a company’s operational strength independently of other financial factors, assisting in decision-making for potential lenders or investors.

Service Providers with Varied Revenue Streams

Service businesses that have multiple offerings or diverse revenue streams can use the multi-step format to break down their earnings from core services versus secondary or ancillary services.

Businesses in Rapid Growth or Transition Phases

Organizations undergoing significant changes—whether expanding, diversifying, or restructuring—might opt for a multi-step statement to track the impacts of such transitions on different areas of their financial performance.

Key Components of the Multi-Step Income Statement

A Multi-Step Income Statement offers an in-depth portrayal of a company’s financial activities by segregating various revenue streams and expense categories. This structure facilitates a clearer understanding of how a firm generates its profit. Let’s delve into the primary components that define this comprehensive document:

- Sales or Revenues:

This is the starting point of the statement, capturing the total revenue generated from the company’s main business activities, whether it’s selling goods, rendering services, or a combination of both. - Cost of Goods Sold (COGS):

For businesses that sell products, the COGS represents the direct costs associated with producing or purchasing those products. This includes raw materials, direct labor, and other direct manufacturing expenses. Subtracting COGS from sales yields the gross profit. - Gross Profit:

This is a critical metric indicating the profitability of the core business activities. It’s calculated by subtracting the COGS from total sales or revenues. It provides insights into how efficiently a company is producing or sourcing its goods. - Operating Expenses:

These are costs incurred in the normal course of business but are not directly tied to the production of goods or services. Operating expenses are typically segmented into:- Selling Expenses: These are costs associated with selling the product or service and might include advertising, sales commissions, shipping, and sales staff salaries.

- General and Administrative (G&A) Expenses: These are the broader operational expenses not directly tied to sales. Examples include office rent, salaries of administrative staff, utilities, and office supplies.

- Operating Income:

This metric offers a snapshot of a company’s profit from its core business activities, excluding any non-operating items. It’s derived by subtracting total operating expenses (both selling and G&A) from the gross profit. - Other Revenues and Expenses:

This section encompasses financial activities not tied to the primary business operations. Common items here include:- Interest Income: Earnings from investments or bank accounts.

- Interest Expense: Cost incurred on borrowed funds.

- Gains or Losses from Asset Sales: Profits or losses resulting from selling assets outside the regular course of business.

- Income Before Taxes:

By summing operating income and other revenues/expenses, you get the income before any tax considerations. This provides an overview of the company’s performance before the influence of taxation. - Income Tax Expense:

This represents the amount set aside for taxes based on the company’s taxable profit. - Net Income:

This is the bottom line—literally and figuratively. It’s the amount remaining after all expenses, including taxes, have been deducted from revenues. It’s the profit that belongs to the shareholders and can be reinvested in the business or distributed as dividends.

Advantages and Disadvantages of the Multi-Step Income Statement

The Multi-Step Income Statement offers a nuanced view of a company’s financial performance by breaking down revenues and expenses into multiple categories. As with any financial tool, it comes with its own set of pros and cons. Here’s a detailed guide to understanding both sides of the coin.

Advantages:

Detailed Insight into Core Operations

By distinguishing between operating and non-operating activities, stakeholders gain a clear picture of a company’s primary revenue-generating activities, allowing them to assess the firm’s inherent profitability.

Clear Gross Profit Analysis

Revealing gross profit separately offers valuable insight into how profitable a company’s primary offerings are before accounting for other operational costs. This can help in identifying potential inefficiencies in production or procurement.

Segmented Operating Expenses

With operating expenses broken down into selling and administrative categories, businesses can pinpoint where their operational funds are primarily directed. This aids in evaluating sales strategies and understanding overhead costs better.

Better Benchmarking and Forecasting

The structured approach facilitates year-on-year and peer-to-peer comparisons. Analyzing specific revenue or expense categories helps in spotting trends, anomalies, or opportunities.

Enhanced Stakeholder Communication

The detailed format of the statement allows businesses to communicate their financial health and operations transparently, fostering trust among investors, creditors, and other stakeholders.

Facilitates Strategic Decision Making

The clear segmentation of revenue streams and expense categories assists management in spotting areas for potential growth or improvement and making informed strategic choices.

Disadvantages:

Complexity for Smaller Businesses

For small businesses with simple operations, the multi-step format might introduce unnecessary complexity, consuming more time and resources than it offers in value.

Potential for Overanalysis

While detail can be beneficial, there’s a risk of getting bogged down in the minutiae. Too much focus on the many categories might lead to overlooking broader trends or overarching business strategies.

Standardization Challenges

Different companies might categorize certain revenues or expenses slightly differently, potentially complicating comparative analyses across firms.

Learning Curve for Novices

Stakeholders unfamiliar with the intricacies of a multi-step income statement might find it daunting initially. It could be challenging for those without a financial background to discern the most crucial takeaways.

Risk of Misinterpretation

With so many categories and segments, there’s a risk of drawing conclusions based on isolated data points without considering the statement as a whole. For instance, robust gross profits might be overshadowed if one doesn’t account for high selling expenses.

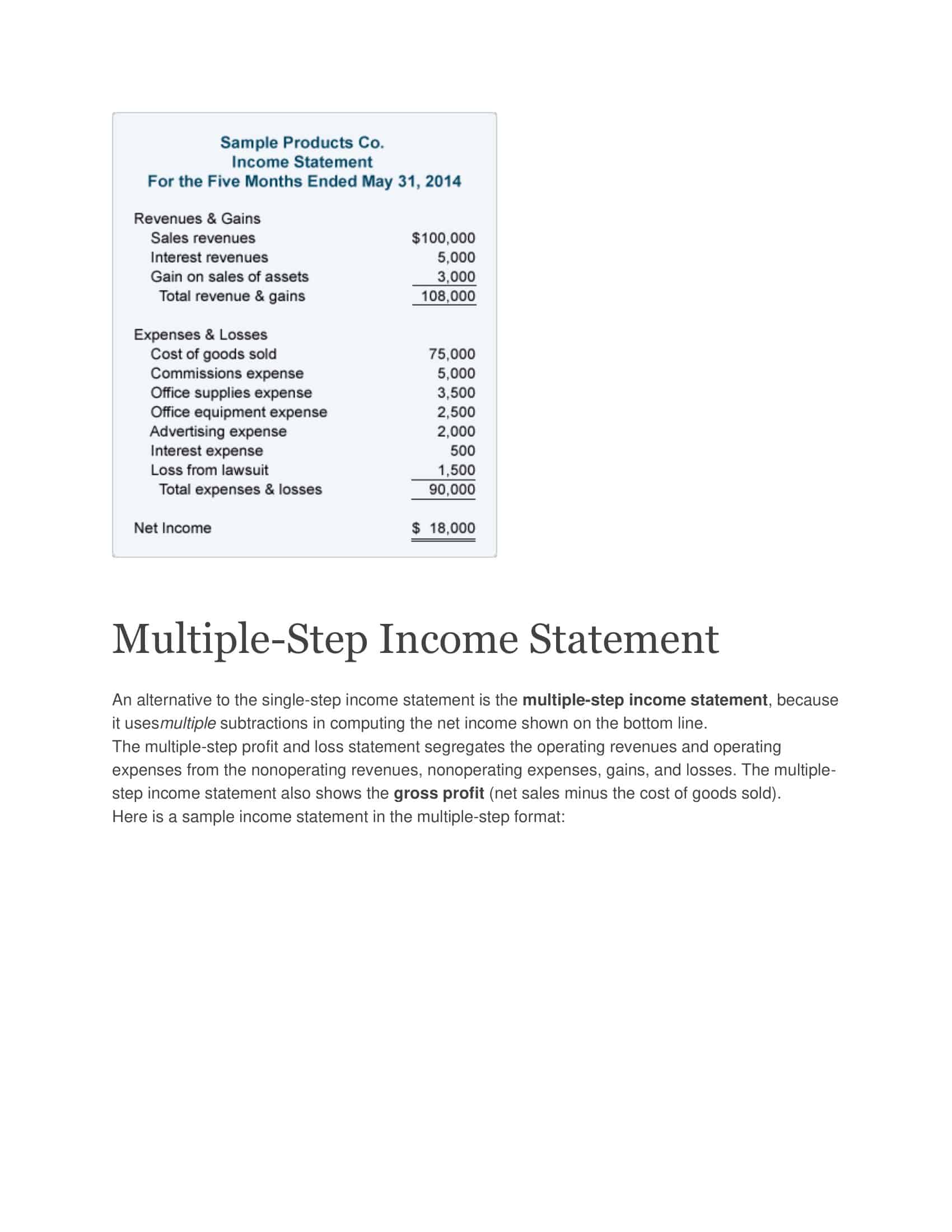

Single-step income statement vs. Multi-step income statement

The income statement, also known as the profit and loss statement, is a crucial financial document that showcases a company’s profitability over a specific period. While both the Single-Step and Multi-Step Income Statements serve this primary purpose, they differ in format, depth, and detail. Let’s compare these two formats across various parameters to understand their distinctive features.

1. Format & Presentation:

- Single-Step Income Statement: This format is straightforward, consolidating all revenue items under one category and all expenses under another. The net income is calculated by subtracting total expenses from total revenues, using a single step.

- Multi-Step Income Statement: As the name suggests, this format involves multiple stages or steps in calculating net income. It provides a detailed breakdown, distinguishing between operating and non-operating revenues and expenses, as well as showcasing gross profit and operating income separately.

2. Depth of Analysis:

- Single-Step Income Statement: While simpler to prepare and read, this format doesn’t provide a deep dive into the different components of revenue and expenses, making it harder to analyze the nuances of a company’s financial performance.

- Multi-Step Income Statement: The multi-step format allows for a more comprehensive analysis, revealing insights about gross margins, operational efficiency, and the impact of non-operational activities on the bottom line.

3. Components & Categories:

- Single-Step Income Statement: All revenues (from sales, interest income, rental income, etc.) are combined into a single category. Similarly, all expenses (whether operational, financial, or otherwise) are grouped together.

- Multi-Step Income Statement: This format presents:

- Sales or Revenues

- Cost of Goods Sold (COGS)

- Gross Profit (Sales minus COGS)

- Operating Expenses (divided into Selling and General & Administrative Expenses)

- Operating Income

- Other Revenues and Expenses (like interest or gains/losses from asset sales)

- Income Before Taxes

- Tax Expenses

- Net Income

4. Utility & Application:

- Single-Step Income Statement: Ideal for smaller businesses with simpler financial structures. Due to its straightforward nature, it’s also easier for non-financial stakeholders to grasp.

- Multi-Step Income Statement: Preferred by larger corporations, manufacturing entities, and businesses with diverse revenue streams. This format provides detailed insights, making it useful for in-depth financial analysis, strategic planning, and communication to external stakeholders.

5. Comparative & Trend Analysis:

- Single-Step Income Statement: While it’s easy to compare net incomes year-over-year, the lack of detail can mask underlying issues or trends in specific revenue or expense categories.

- Multi-Step Income Statement: Facilitates a detailed comparative analysis. Stakeholders can discern patterns in gross profit margins, operational costs, or non-operating activities, making it easier to spot anomalies, efficiencies, or areas of concern.

6. Potential for Misinterpretation:

- Single-Step Income Statement: The risk here lies in its simplicity. A single lump sum of revenues and expenses might overlook significant financial insights.

- Multi-Step Income Statement: With its detailed structure, there’s a chance of getting bogged down in specifics, potentially leading to overanalysis or misinterpretation if not viewed holistically.

How to Prepare a Multi-Step Income Statement: A Step-by-Step Guide

Preparing a multi-step income statement requires a structured approach. This guide will lead you through each step, providing clarity and illustrative examples for a comprehensive understanding.

Step 1: Gather Necessary Financial Data

Before you begin, ensure you have all the relevant financial data from the period in question. This includes sales figures, expense receipts, records of any asset sales, and so on.

Example:

For ABC Company, gather records showing:

- Total sales: $500,000

- Cost of goods sold: $250,000

- Operating expenses (broken down further into selling and administrative expenses)

- Other revenues or losses

- Tax records

Step 2: Calculate Gross Profit

Deduct the Cost of Goods Sold (COGS) from total sales.

Formula:

Gross Profit = Sales – COGS

Example:

Gross Profit = $500,000 (Sales) – $250,000 (COGS) = $250,000

Step 3: List & Deduct Operating Expenses

Categorize and list out all operating expenses. Then, subtract them from the gross profit.

Sub-Step 3.1: Identify Selling Expenses These are expenses associated directly with selling a product or service.

Example:

Sales commissions: $20,000

Shipping: $5,000

Sub-Step 3.2: Identify General & Administrative Expenses These are the broader operational costs.

Example:

Office rent: $50,000

Utilities: $10,000

Now, sum up the total operating expenses:

$20,000 + $5,000 + $50,000 + $10,000 = $85,000

Step 4: Calculate Operating Income

Subtract total operating expenses from the gross profit.

Formula:

Operating Income = Gross Profit – Total Operating Expenses

Example:

Operating Income = $250,000 (Gross Profit) – $85,000 (Operating Expenses) = $165,000

Step 5: Account for Other Revenues and Expenses

Include other non-operating income and expenses, such as interest earned or paid, and gains or losses from asset sales.

Example:

Interest Income: $5,000

Loss from asset sale: $10,000

Net non-operating activities = $5,000 (Interest) – $10,000 (Loss) = -$5,000

Step 6: Calculate Income Before Taxes

Combine your operating income with net non-operating activities.

Formula:

Income Before Taxes = Operating Income + Net Non-operating Activities

Example:

Income Before Taxes = $165,000 + (-$5,000) = $160,000

Step 7: Deduct Tax Expenses

Subtract the amount set aside for taxes from the income before taxes.

Example:

If the tax expense for ABC Company is $40,000: Net Income = $160,000 (Income Before Taxes) – $40,000 (Tax Expense) = $120,000

Step 8: Arrive at the Net Income

The result after deducting tax expenses from income before taxes will give you the net income, which is the bottom line figure indicating the company’s profitability for the period.

Example:

For ABC Company, the net income for the period would be $120,000.

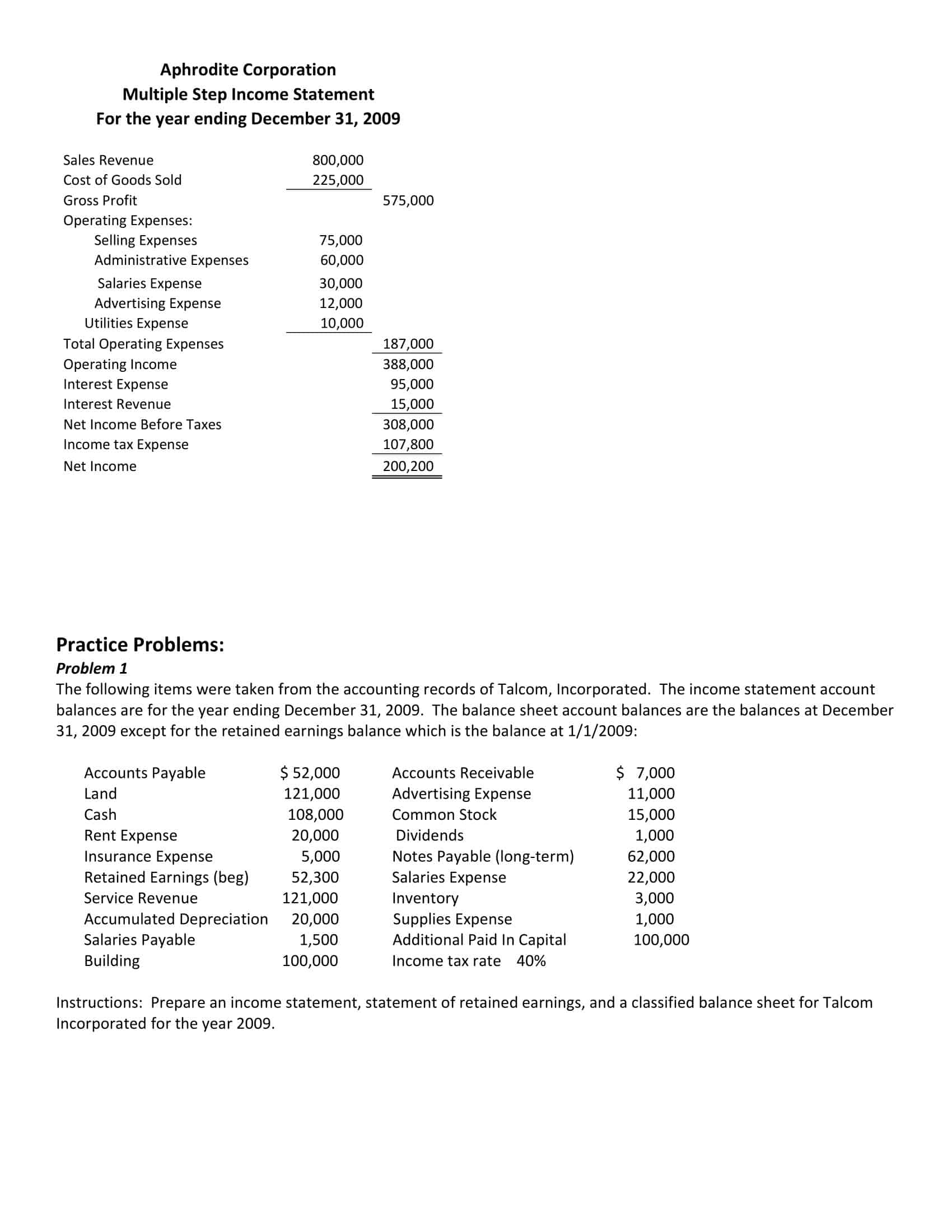

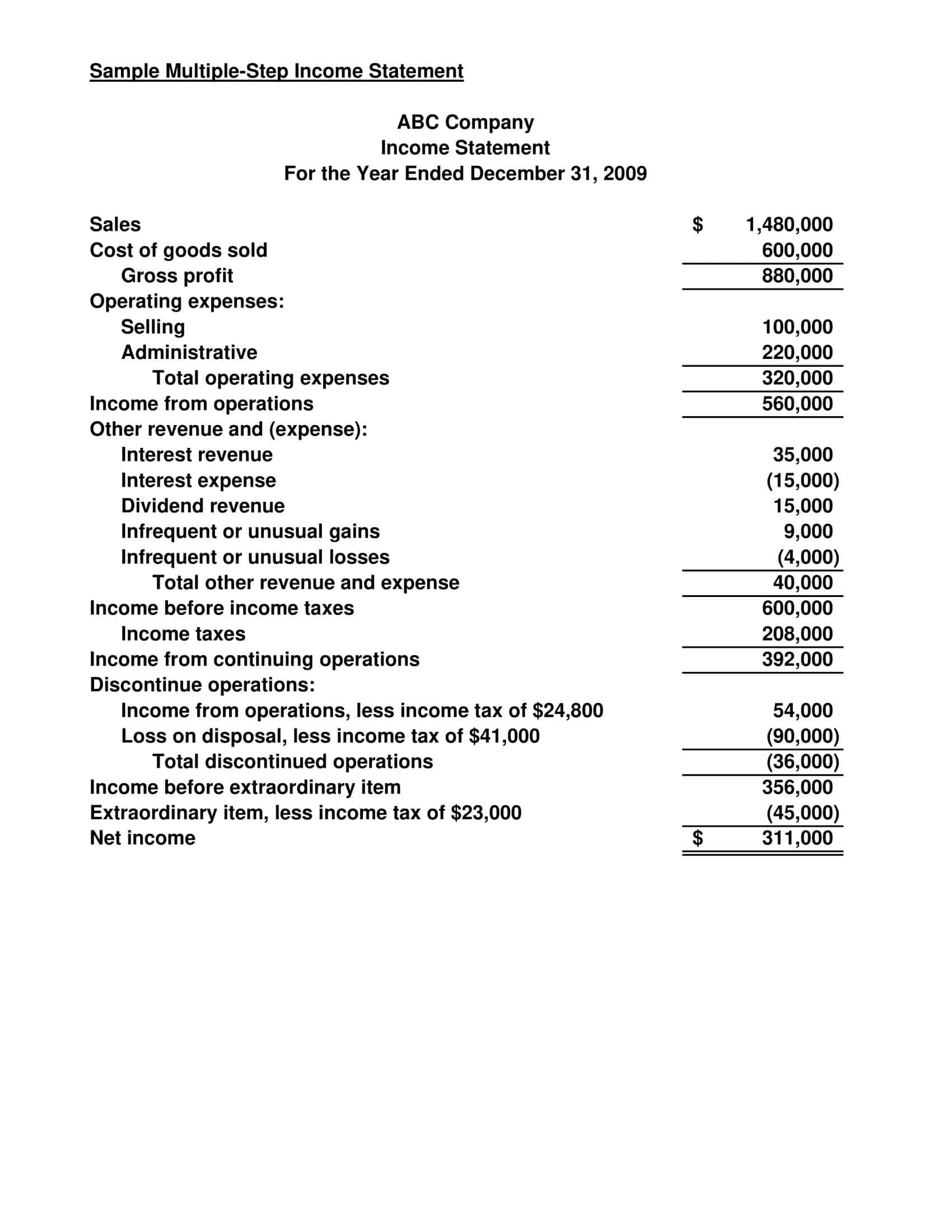

Multi-step Income Statement Example

| ABC Company | |

| Income Statement | |

| For the Year Ended December 31, 2023 | |

| Sales | $500,000 |

| Less: Cost of Goods Sold | $250,000 |

| Gross Profit | $250,000 |

| Selling Expenses: | |

| – Sales Commissions | $20,000 |

| – Shipping | $5,000 |

| General & Administrative Expenses: | |

| – Office Rent | $50,000 |

| – Utilities | $10,000 |

| Total Operating Expenses | $85,000 |

| Operating Income | $165,000 |

| Other Revenues and Expenses: | |

| – Interest Income | $5,000 |

| – Loss from Asset Sale | -$10,000 |

| Income Before Taxes | $160,000 |

| Tax Expense | $40,000 |

| Net Income | $120,000 |

FAQs

Are Multi-Step Income Statements mandatory for companies?

While the format can vary based on regulatory requirements, industry practices, or management’s preference, publicly traded companies in the U.S. often use the multi-step format to provide clearer information to investors and stakeholders.

What’s the significance of Gross Profit in a Multi-Step Income Statement?

Gross Profit represents the difference between sales and the cost of goods sold (COGS). It provides insights into a company’s core operations, excluding other operational expenses.

How is operating income calculated in a Multi-Step Income Statement?

Operating income is calculated by subtracting total operating expenses (both selling and administrative) from the gross profit. It represents the profit a company earns from its primary business operations.

Can a company have a positive operating income but a negative net income?

Yes, a company can have a positive operating income but end up with a negative net income due to substantial non-operating expenses, interest payments, or significant tax liabilities.

How do companies handle irregular items on a Multi-Step Income Statement?

Irregular items, such as discontinued operations, extraordinary items, or changes in accounting principles, are typically listed separately at the bottom of the income statement, before net income, ensuring they don’t skew the understanding of regular operations.

How often should a company prepare a Multi-Step Income Statement?

Typically, publicly-traded companies prepare and publish a Multi-Step Income Statement quarterly and annually. However, for internal purposes, companies might prepare them monthly or as required for better financial monitoring.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)