For freelancers offering specialized services across industries, sending professional invoices is a key practice for getting paid and building client relationships. However, independent contractors may not have experience creating formal invoices, relying instead on ad hoc payment requests. Learning proper invoicing can eliminate payment confusion and present a polished, credible image that retains clients. This article will explore best practices for freelance invoicing, from clearly detailing work completed to integrating your brand aesthetic.

We provide sample freelance invoice templates for a range of services to simplify and standardize your billing process. With clear instructions tailored to independents, you can quickly create invoices as professional as your services. Consistent invoicing demonstrates your expertise, justifies your rates, and keeps your freelance finances tidy. Use these templates and tips to level up your business operations.

Table of Contents

What Is A Freelance Invoice ?

A freelance invoice is a bill sent by a self-employed contractor or independent worker to a client after completing a project or providing services as outlined in their agreement. It itemizes the services provided, details the project timeline, shows any agreed expenses, applies taxes if relevant, and states payment terms and amount due.

A freelance invoice serves as a request for payment while also documenting what services were rendered and providing a record for both parties. It is a standard business practice that demonstrates the freelancer’s professionalism and enables them to receive compensation for their expertise and work product. Having clear, accurate freelance invoices are essential for independents to track revenue, manage client relationships, and sustain their livelihood.

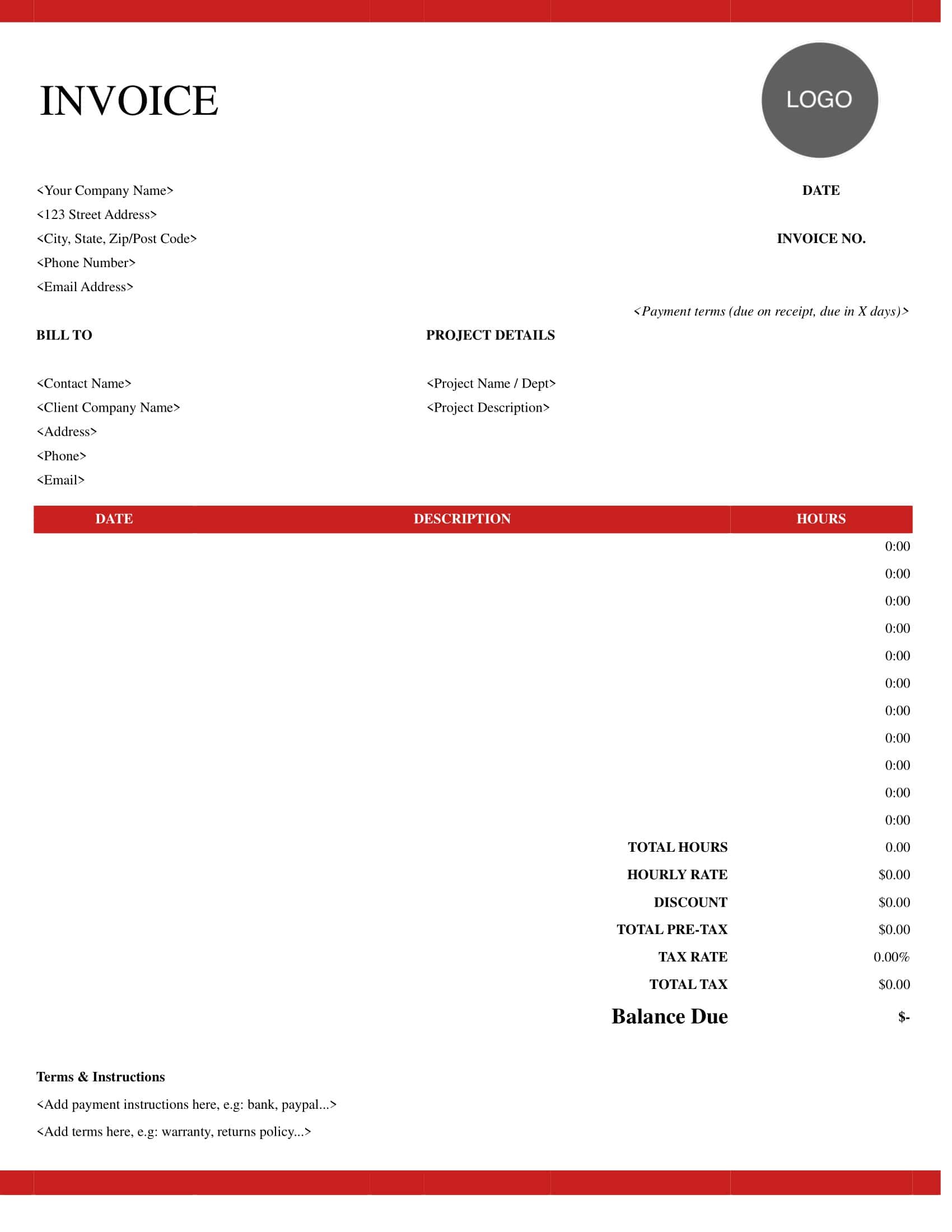

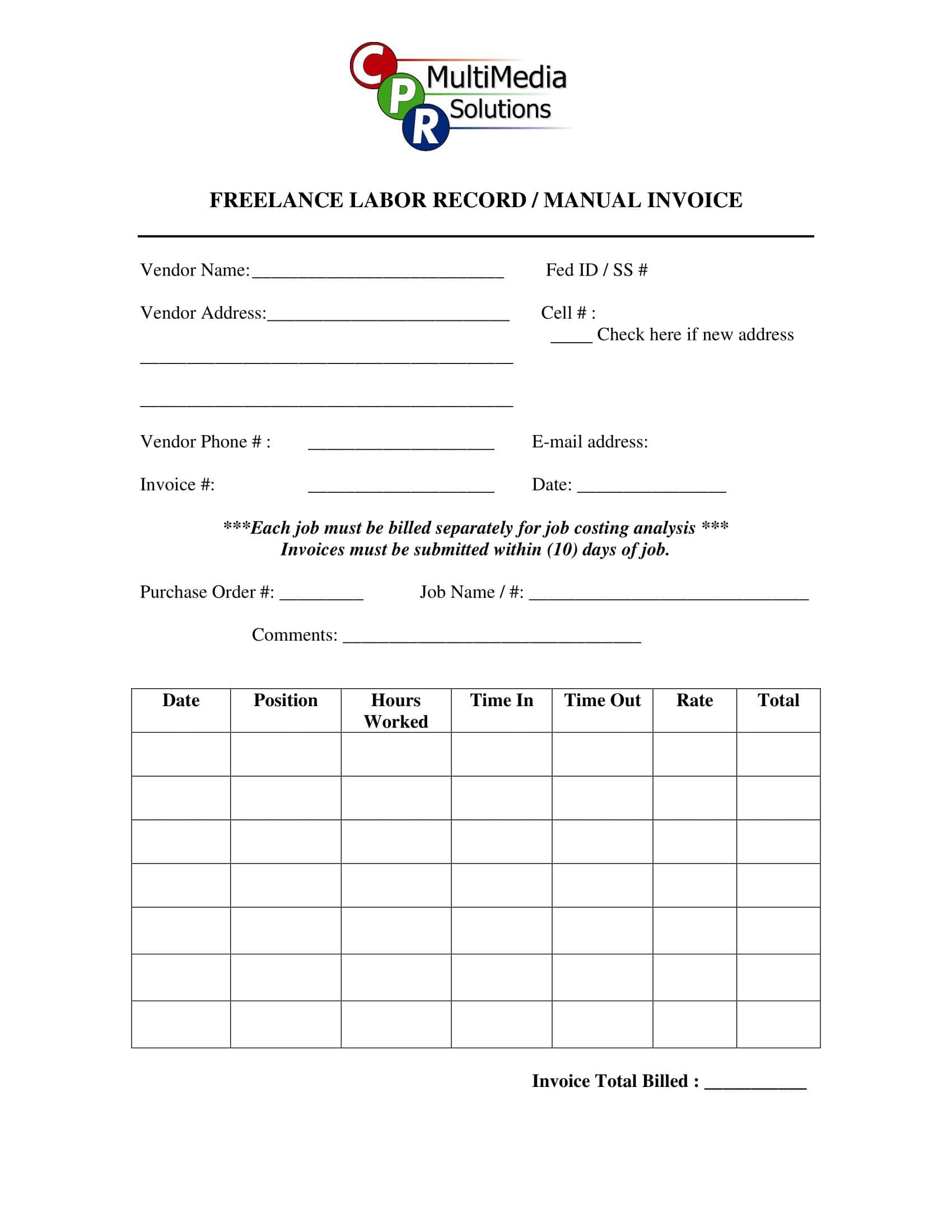

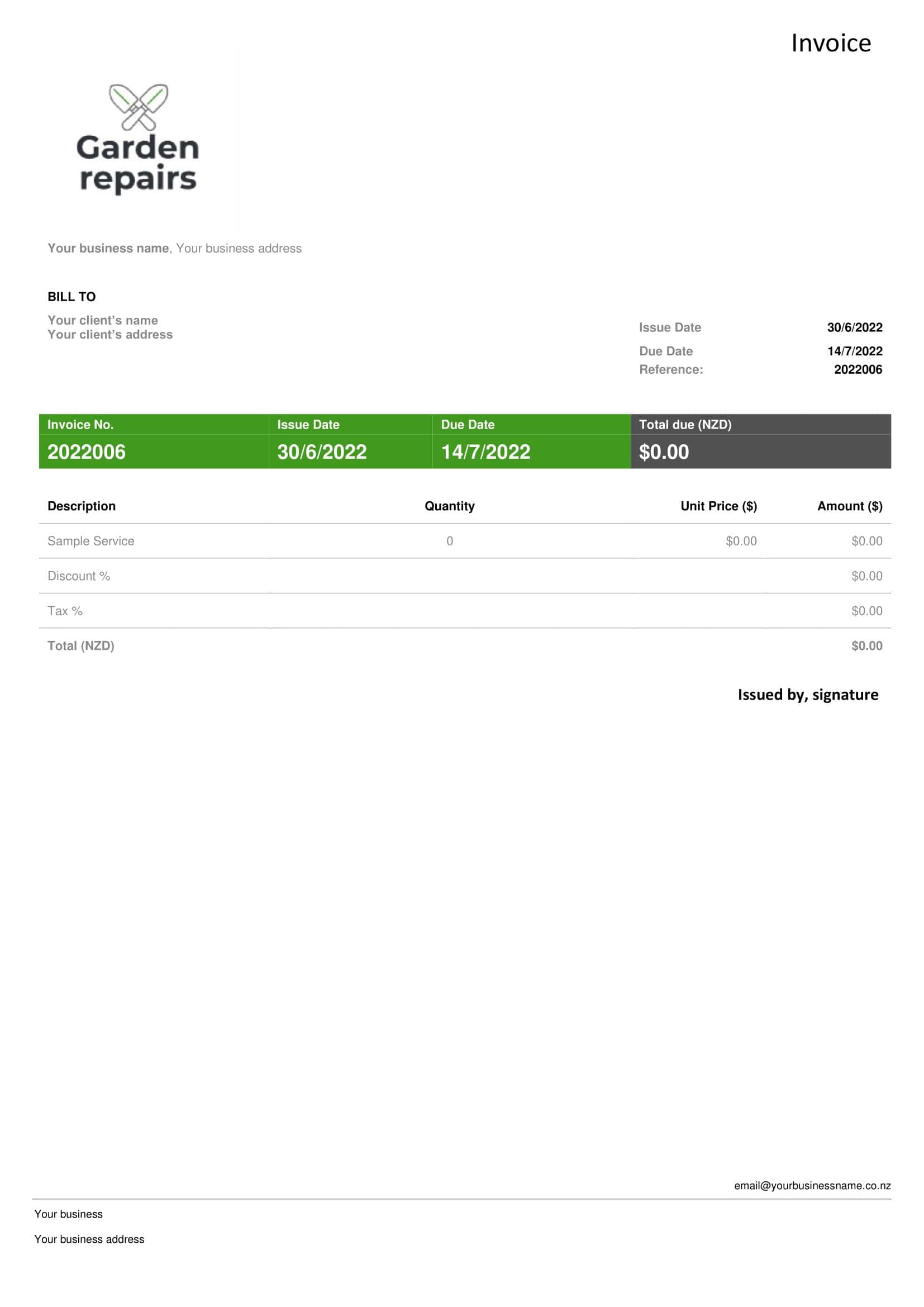

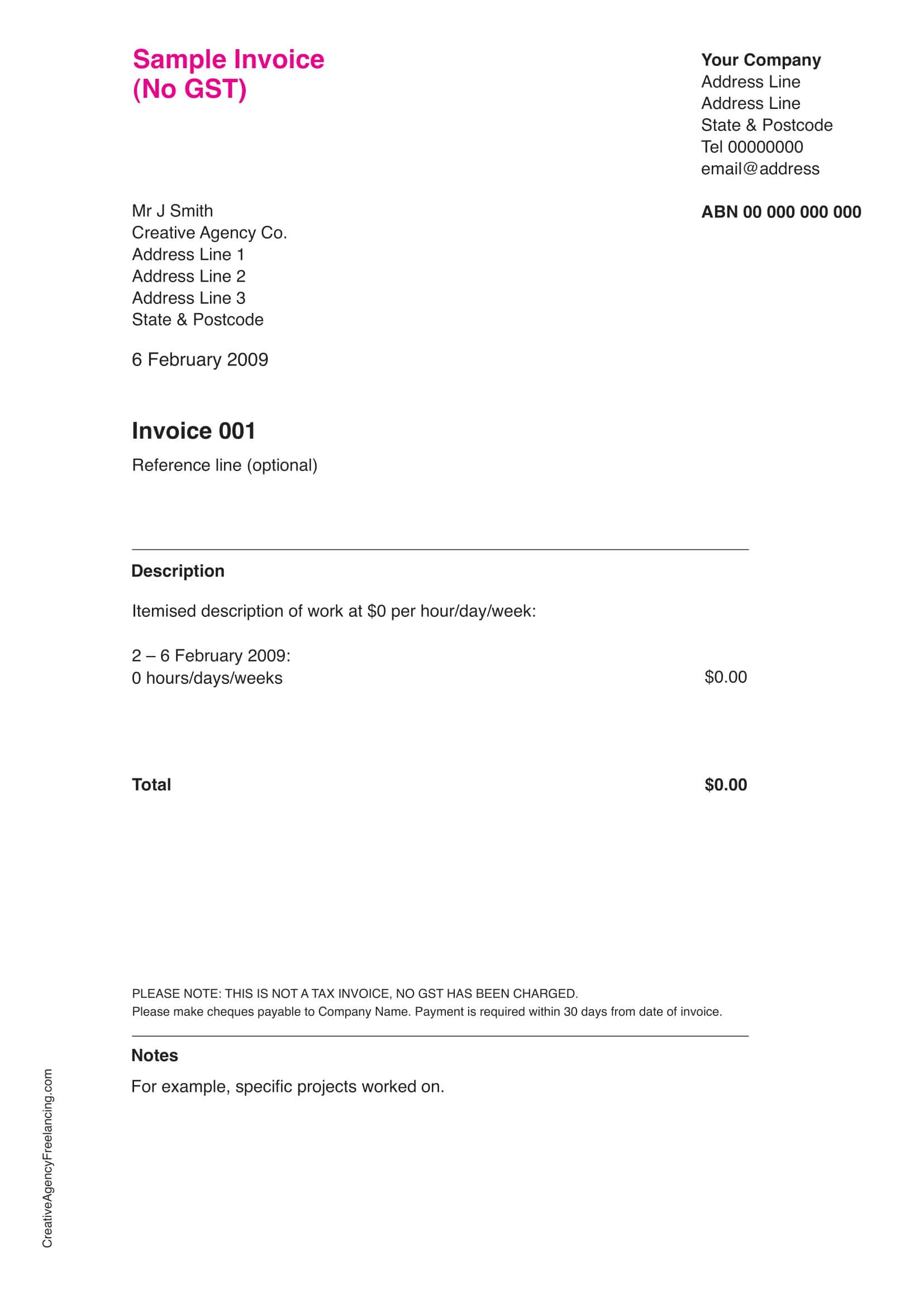

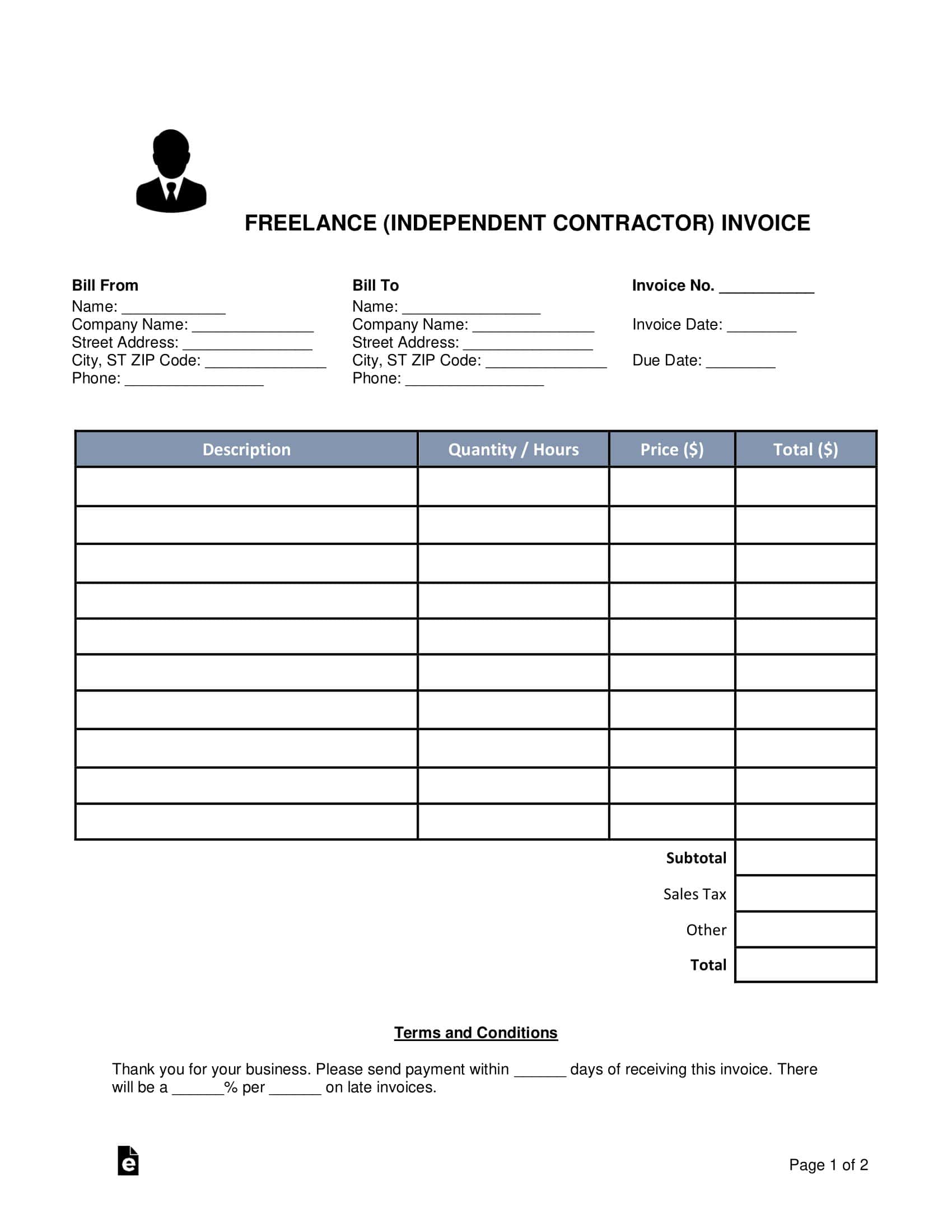

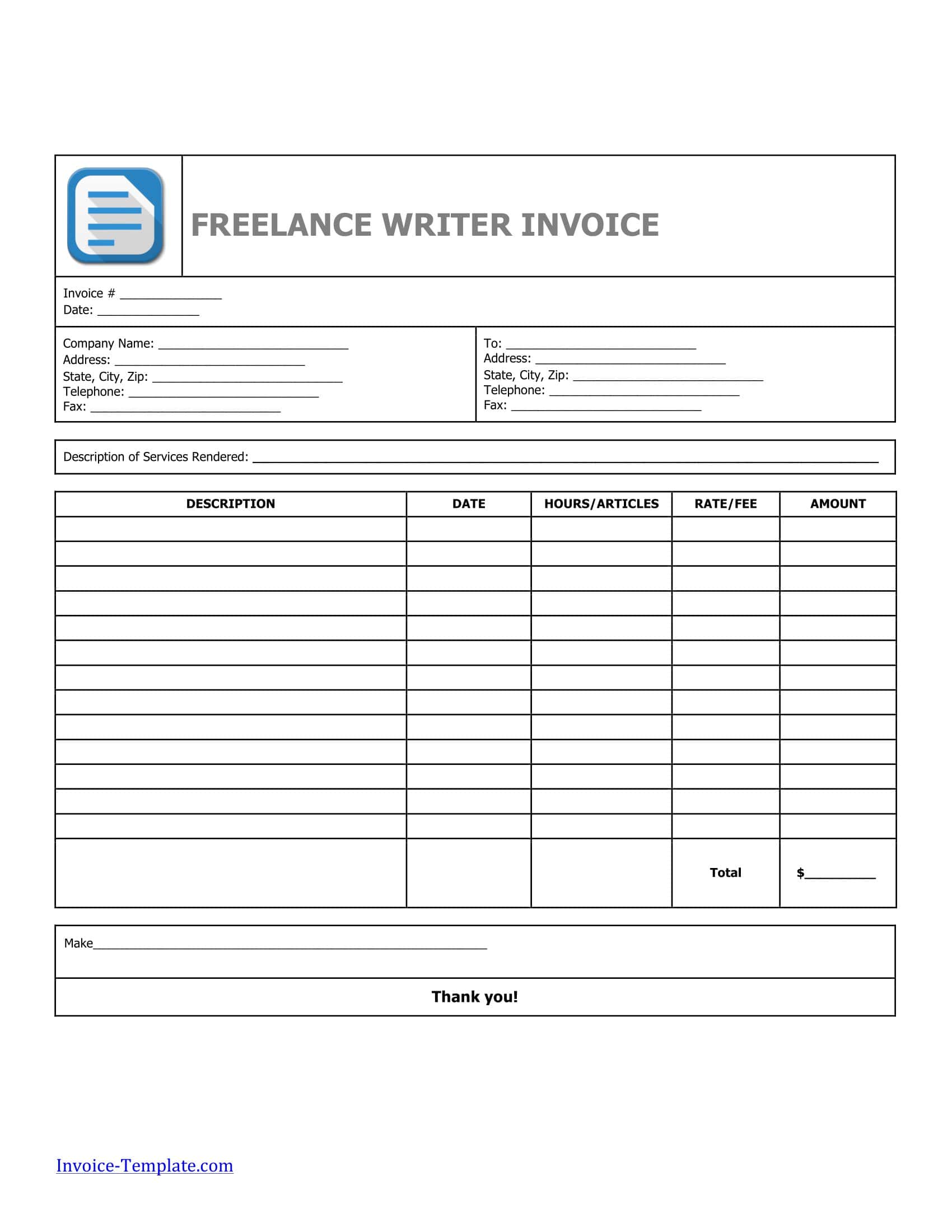

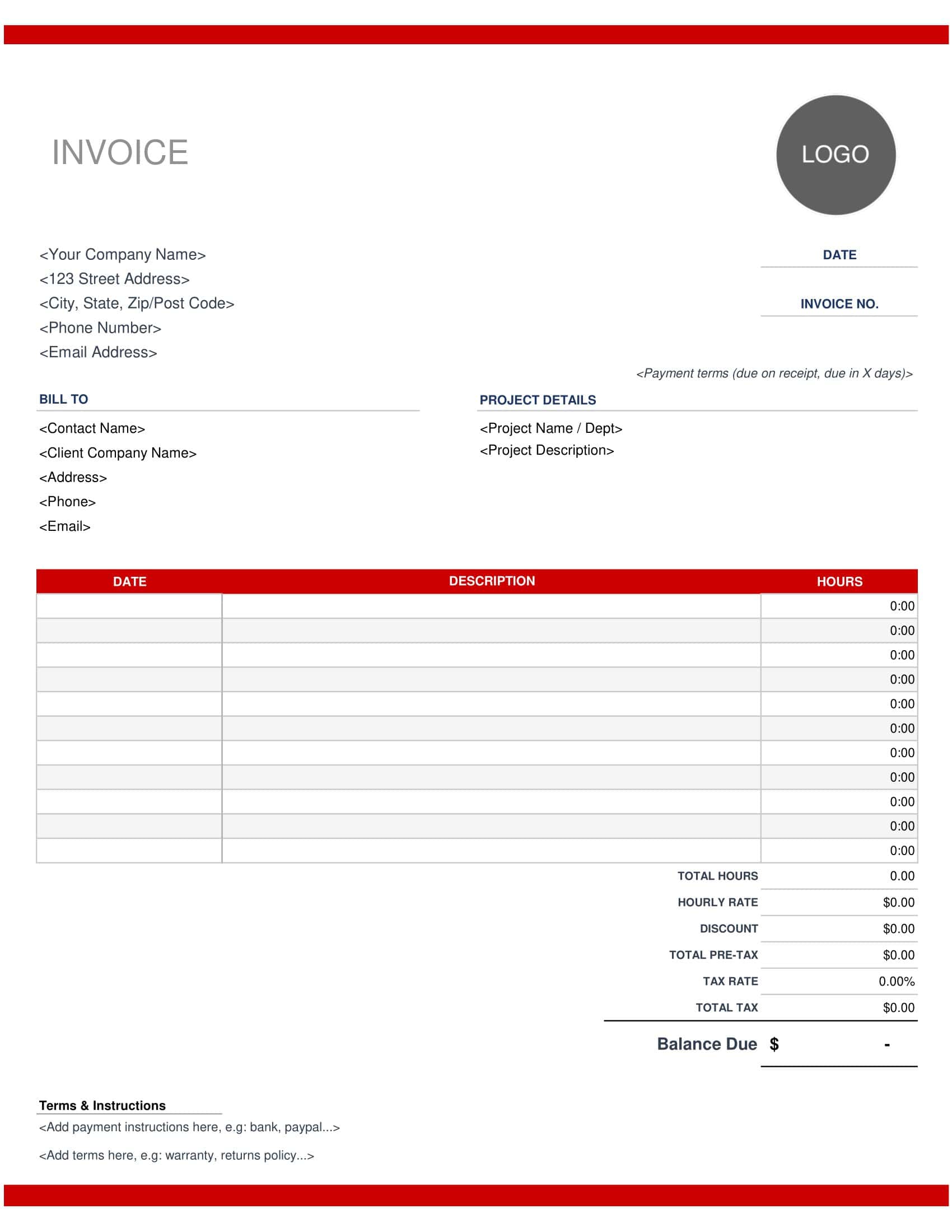

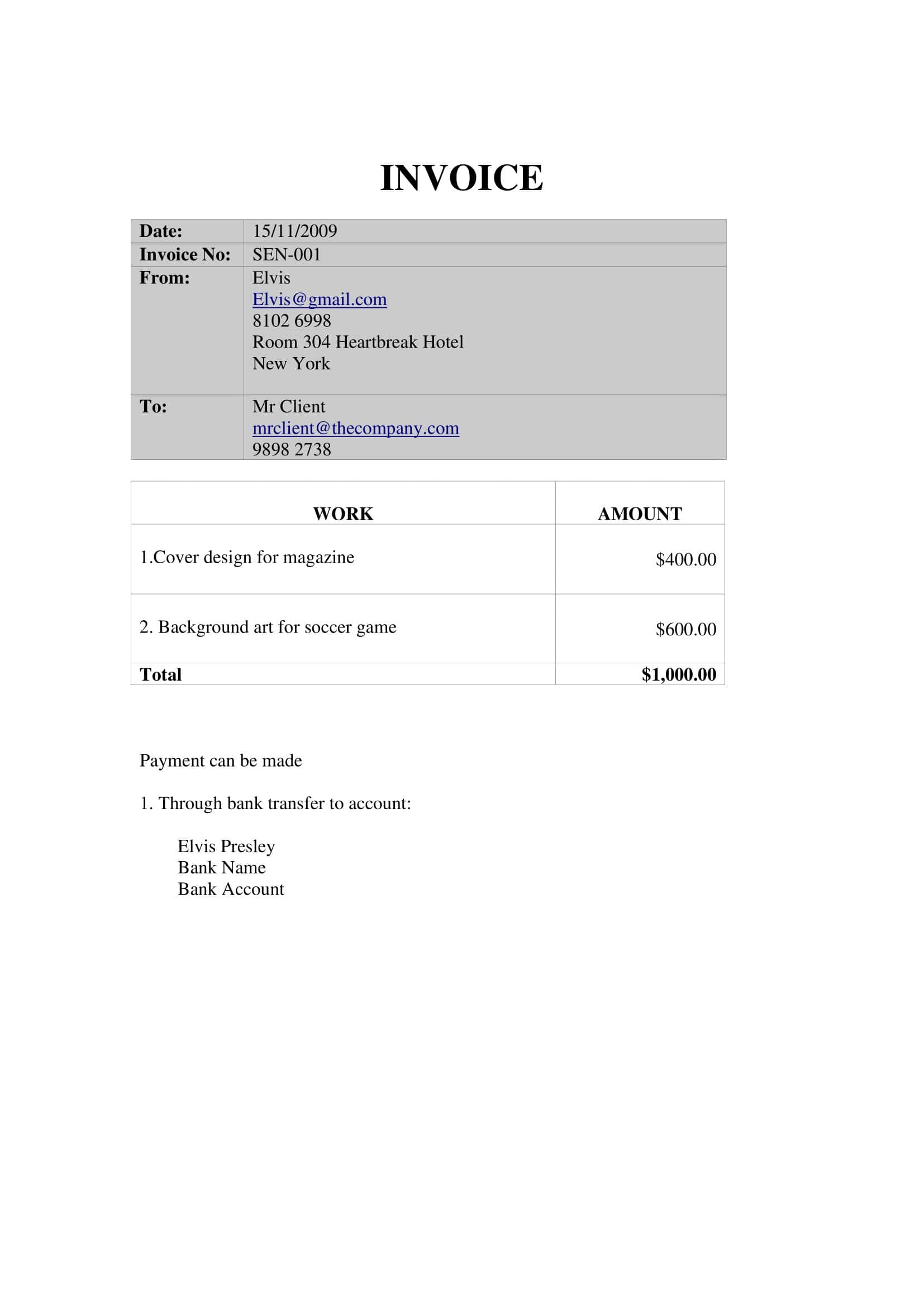

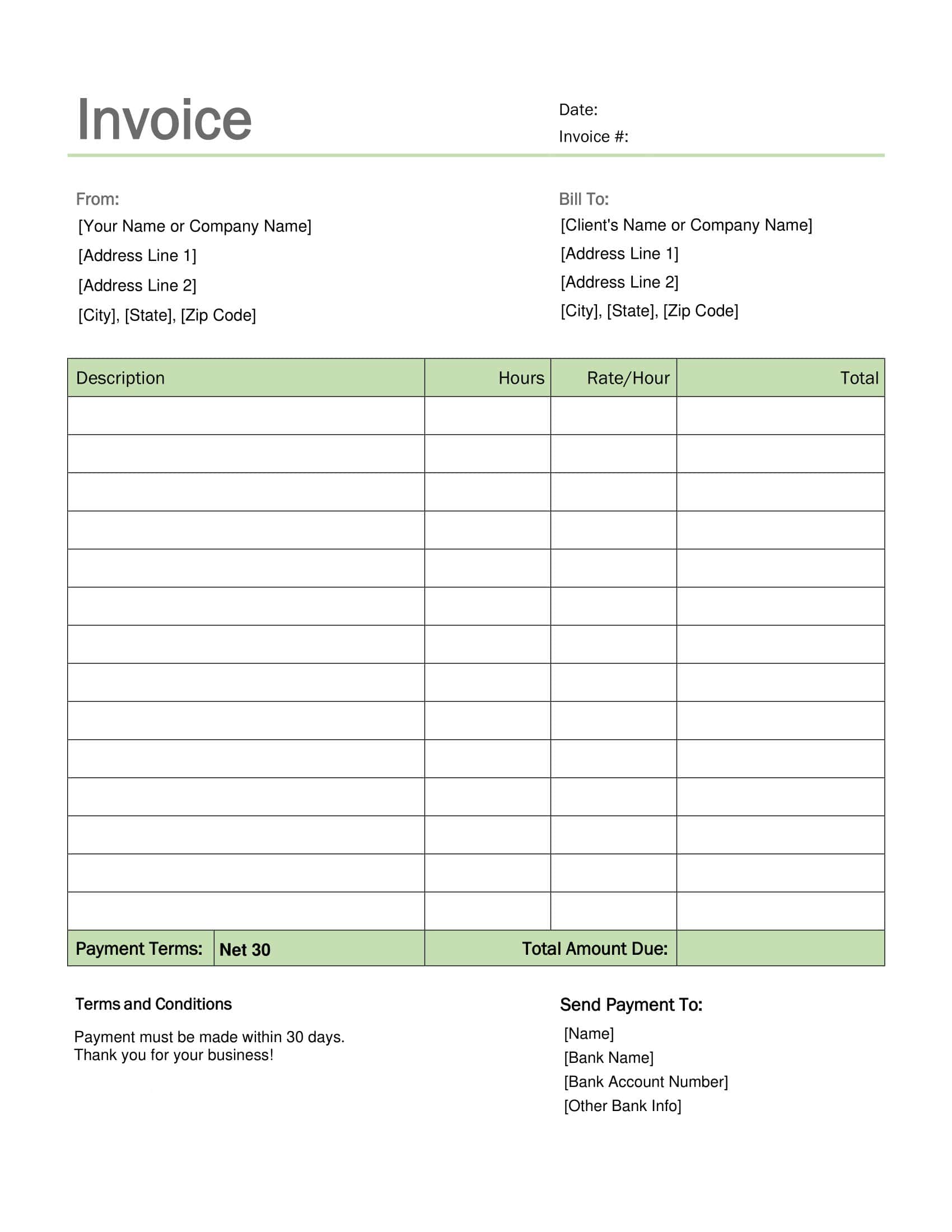

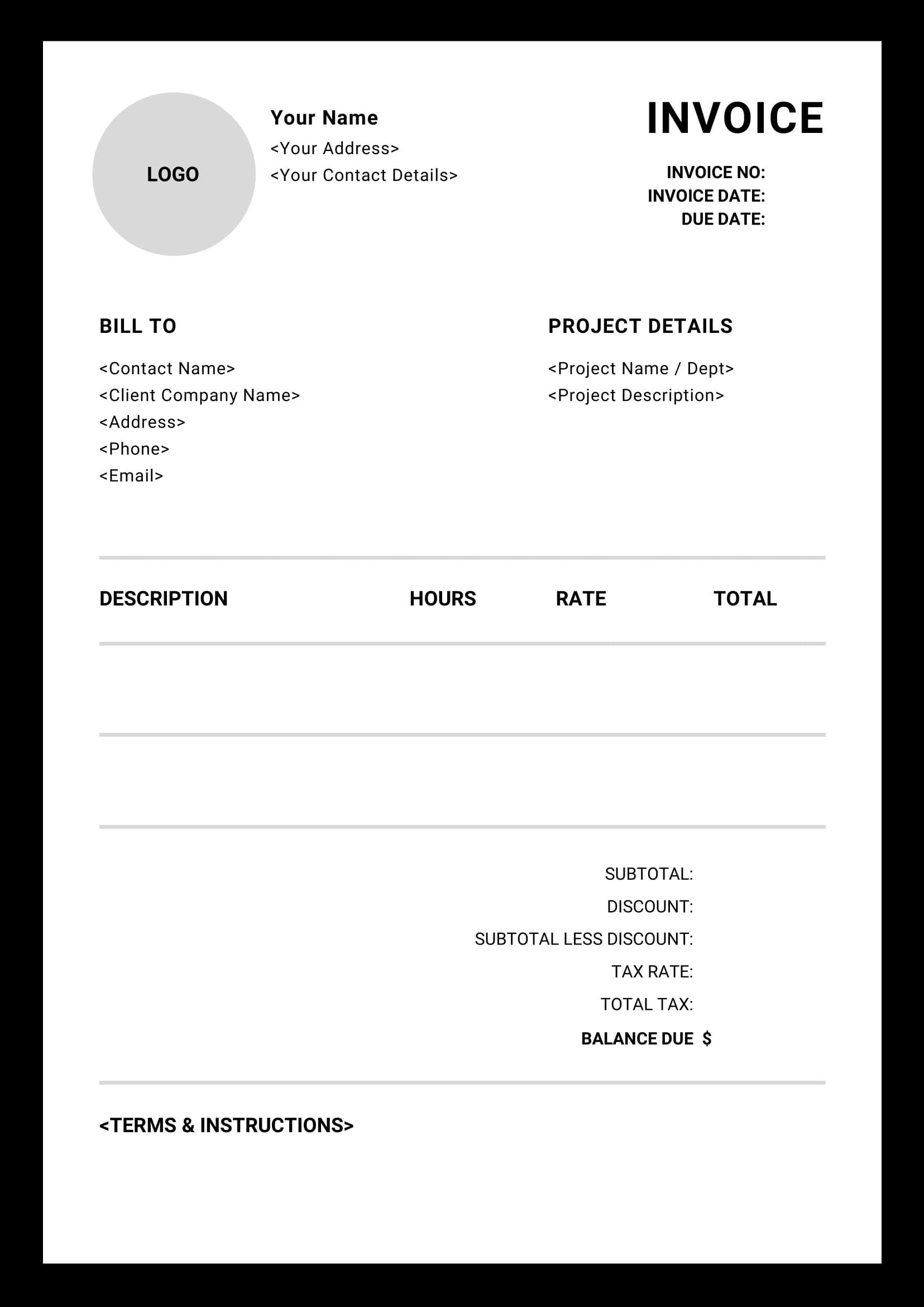

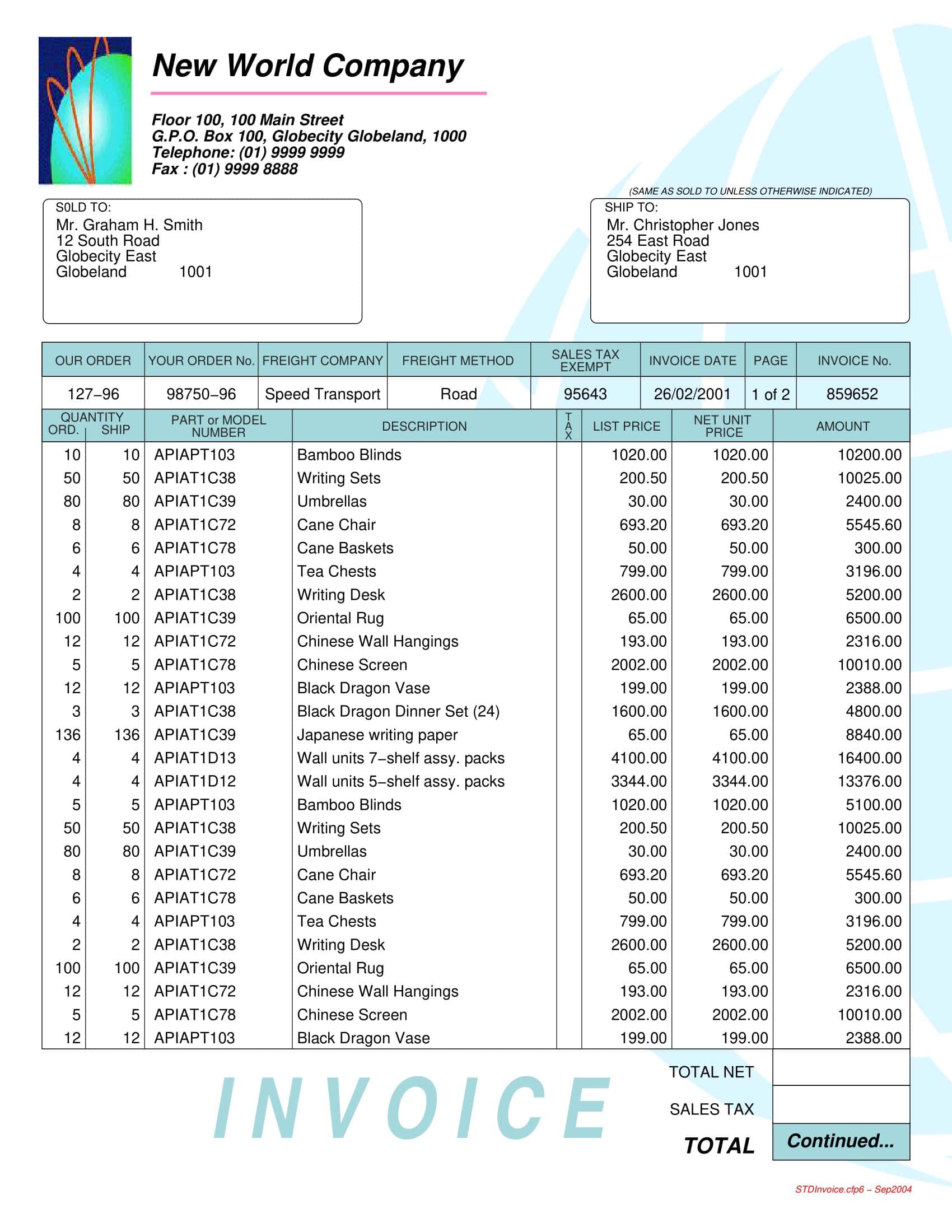

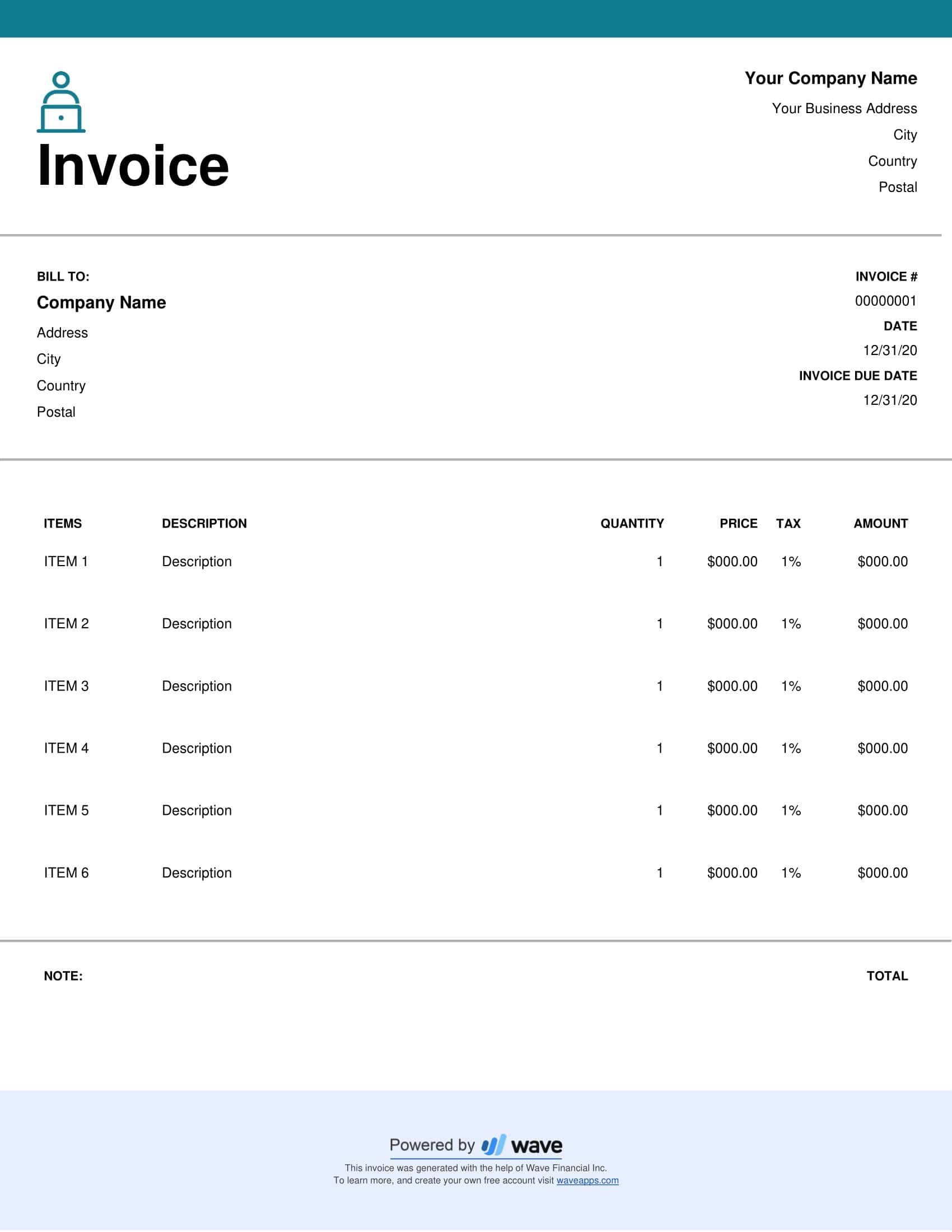

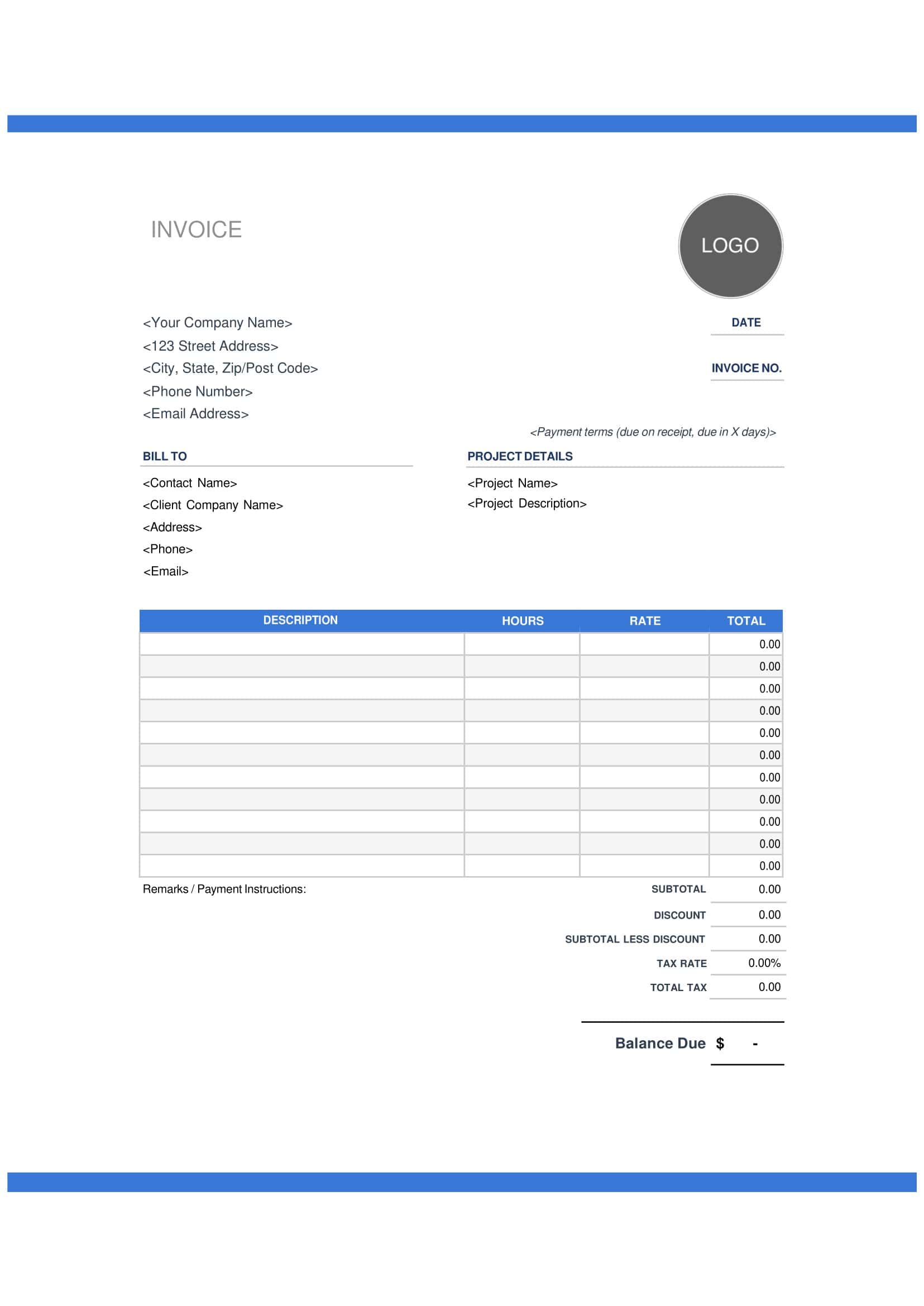

Freelance Invoice Templates

A freelance invoice is a bill sent by a freelancer to a client detailing the work completed and amount owed. It itemizes the services provided, fees charged, expenses incurred, taxes, and payment terms. Freelancers use invoices to formally request payment from clients after delivering work. They should include a unique invoice number, date, client and freelancer details, a description of services, and total amount due.

Invoice templates allow freelancers to easily generate standardized, professional-looking invoices to send clients. Ready-made templates within billing apps and software allow users to add invoice details specific to each project. This saves significant time over creating invoices from scratch. Useful template features include invoice autofilling, automatic calculations, payment tracking, and receipt generation. Templates make the process seamless.

The best templates clearly organize and display all necessary billing information in an easy-to-understand format for clients. Freelancers should look for templates that are customizable to their business’s needs. Checking that calculations are accurate and include relevant charges and taxes is essential. The template should look polished and make a good impression. With a solid freelance invoice template, freelancers can look professional and get paid quickly.

Benefits Of Using Freelance Invoice Template

Using a freelance invoice template offers several advantages for freelancers, especially those who are just starting out or those looking to streamline their invoicing process. A well-structured invoice not only helps freelancers maintain professionalism but also ensures timely payments and better financial management.

Here’s a detailed guide on the benefits of using a freelance invoice template:

Professional Appearance:

- Creates a Brand Identity: A consistent invoice template allows you to incorporate your logo, color scheme, and branding. This reinforces your brand every time a client receives an invoice.

- Establishes Credibility: A well-structured and detailed invoice communicates professionalism, which can make you seem more credible in your clients’ eyes.

Time-saving:

- Pre-filled Information: Basic information such as your business name, address, contact details, and bank/payment information can be pre-filled, saving time with every invoice.

- Easy Duplication: For repeat clients or similar services, you can simply duplicate a previous invoice and make necessary adjustments, speeding up the invoicing process.

Consistency:

- Standard Format: Using a template ensures that you always follow the same format, making it easier for clients to understand and process your invoices.

- Avoids Omissions: A template ensures that essential details, like payment terms and due dates, are not inadvertently left out.

Easy Tracking & Organization:

- Sequential Numbering: Most invoice templates come with a system for sequential numbering, allowing you to keep track of invoices and ensuring none are missed.

- Clear Overview: By having a consistent layout, you can quickly scan past invoices for important details or comparisons.

Customization:

- Tailored to Your Needs: Templates are usually customizable, allowing you to add or remove fields based on your specific requirements.

- Flexible Design Options: Whether you want to modify the color scheme, add a personal touch, or incorporate specific payment instructions, a template provides that flexibility.

Clarity for Clients:

- Detailed Breakdown: A template can ensure that you always provide a clear breakdown of services rendered, making it easier for clients to understand charges.

- Promotes Transparency: Detailed invoices reduce the chances of misunderstandings or disputes, as clients can clearly see what they’re being charged for.

Enhanced Cash Flow Management:

- Timely Payments: With reminders for due dates and clear payment instructions, clients are more likely to pay on time.

- Easier Bookkeeping: Using consistent templates makes it easier to track income, pending payments, and financial patterns.

Integration with Other Tools:

- Software Compatibility: Many freelance invoice templates are designed to be compatible with popular accounting and financial software, allowing for seamless integration.

- Digital Features: Some templates come with features like the ability to add clickable links, making it easier for clients to view details or even make online payments.

Legal Protection:

- Clear Terms: Invoice templates typically come with fields for payment terms, late payment penalties, and other terms of service, providing a clear legal understanding between you and the client.

- Evidence of Work: A detailed invoice serves as a record of the work done, which can be valuable in case of disputes.

What Should A Freelance Invoice Template Include?

Creating a professional invoice is crucial for freelancers as it not only ensures you get paid correctly and on time, but it also represents your professionalism to your clients. Below is a detailed guide on what to include in a freelance invoice template:

Header:

- Your Business Name & Logo: If you have a personal brand or company name, include it at the top along with a logo if you have one.

- Your Contact Details: This includes your address, phone number, email, and any other relevant contact information.

Client’s Information:

- Client’s Name/Company: Clearly state the name of the person or company you provided services for.

- Client’s Address: Include their business address.

- Client’s Contact Information: Their phone number and email address.

Invoice Details:

- Invoice Number: Each invoice should have a unique number for tracking purposes.

- Date of Issue: The date you sent out the invoice.

- Due Date: The date by which you expect to be paid. This can be upon receipt, net 30 days (meaning they have 30 days to pay), or any other terms you’ve agreed upon.

Breakdown of Services:

- Description: Describe the service you provided. Be as detailed as necessary. For instance: “Web design services: homepage design.”

- Quantity/Hours: State the number of hours you’ve worked or the quantity of items/services you’ve delivered.

- Rate: Your hourly rate or price per item/service.

- Total: For each service, multiply the quantity/hours by the rate.

Expenses:

If you’ve incurred any costs while delivering your service and have agreed to bill these to your client, list them here.

- Description: What the expense was for. E.g., “Stock image purchase.”

- Amount: How much the expense cost.

Total Amount:

- Subtotal: The sum of all services provided before any discounts, taxes, or added expenses.

- Discount: If you’ve offered a discount, mention it here either as a percentage or a flat amount.

- Taxes: If you’re required to charge taxes, calculate the amount here based on the applicable rate.

- Grand Total: The final amount your client owes after adding taxes and subtracting discounts.

Payment Details:

- Accepted Payment Methods: Clearly state if you accept bank transfers, checks, credit cards, or digital wallets like PayPal.

- Payment Instructions: If there are specific details they need to know or follow, include them. For bank transfers, provide your bank account details.

Additional Notes or Terms:

- Late Payment Terms: If there’s a penalty or interest on late payments, mention it here.

- Thank You Note: A short thank you message for their business.

- Other Specific Notes: Any other terms or notes relevant to the project or your business terms.

Footer:

- Website & Social Links: If relevant, it can be a good idea to promote your website or professional social media profiles.

- Professional Affiliations: If you’re a member of any professional bodies, you might mention this in the footer.

How To Create An Invoice For Freelance Work: A Detailed Guide

In the world of freelancing, clear and professional communication is paramount, especially when it comes to financial matters. One integral aspect of this communication is invoicing. An invoice not only ensures that you get compensated for your hard work but also helps establish trust with your clients.

Whether you’re new to freelancing or just looking to refine your invoicing process, having a systematic approach can make a significant difference. Here’s a comprehensive, step-by-step guide on how to create an invoice for freelance work to ensure you get paid promptly and maintain a positive rapport with your clients:

Step 1: Gather Client and Project Information

Begin by collating all necessary client details including the client’s name, address, phone number, and email address. The same goes for your own information. It’s also useful to keep a record of the specific work you’ve completed, as this will make the invoicing process smoother. For longer-term projects, consider keeping a log or spreadsheet detailing work hours, tasks completed, and dates.

Step 2: Choose an Invoicing Platform or Software

In today’s digital age, there are myriad invoicing platforms and software designed for freelancers. They offer templates, automated features, and more. Tools like FreshBooks, QuickBooks, or Wave can simplify the process. However, if you prefer a more hands-on approach, you can design your invoice using Microsoft Word, Excel, or Google Docs. Regardless of the method, ensure that the platform or software meets your needs and looks professional.

Step 3: Assign a Unique Invoice Number

For organizational purposes, each invoice should have a unique number. This aids in tracking payments and referencing in future communication. The number can be sequential, like 001, 002, 003, or it can be a combination of letters and numbers related to the client or project, e.g., ABC-001.

Step 4: Clearly State Payment Terms

It’s vital to lay out payment terms unambiguously. Include details like due dates (e.g., “Due within 30 days of invoice date”), accepted payment methods (PayPal, bank transfer, etc.), and any potential late fees. Clearly outlining these terms helps in reducing late payments and avoids potential conflicts.

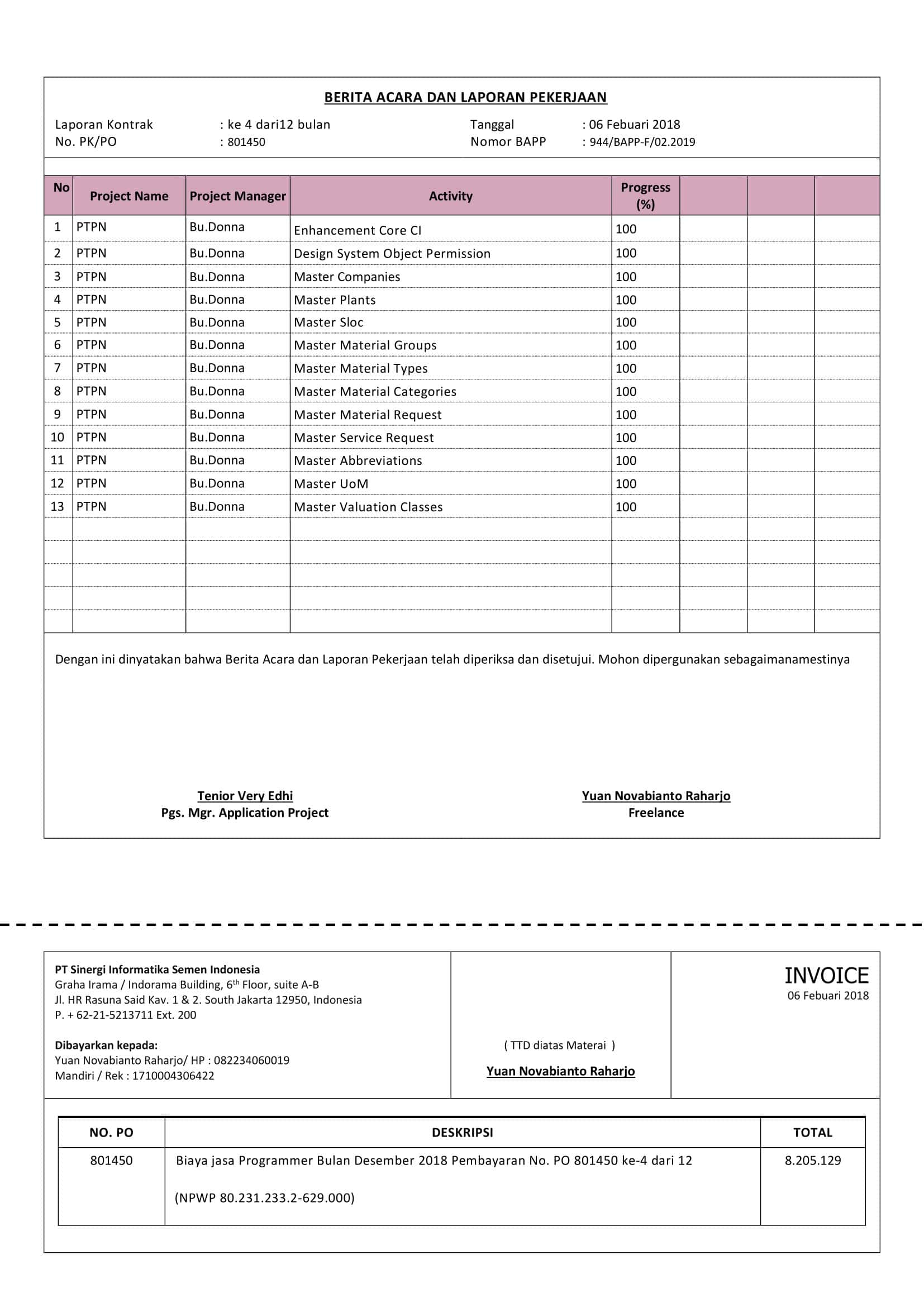

Step 5: Itemize Services Provided

Detail each service you provided. This could mean hourly breakdowns, milestones achieved, or specific tasks completed. For each item, provide a brief description, the rate (hourly or per item), the quantity, and the total cost. Ensure it’s easy to understand, so the client is fully aware of what they’re being charged for.

Step 6: Calculate and Include Tax, if Applicable

If you’re required to charge sales tax, value-added tax (VAT), or any other tax, ensure it’s correctly calculated and added to the invoice. This will largely depend on your region and the nature of your services. Some clients might also require tax identification numbers, so ensure you provide them if necessary.

Step 7: Highlight the Total Amount Due

After listing all your services and adding any applicable taxes, highlight the total amount that the client owes you. Make sure this is prominent and easy to spot. This will make it straightforward for clients when they process your payment.

Step 8: Add Personal Notes or Thank You

Though not mandatory, adding a personal touch, such as thanking the client for their business, can foster positive relations. This little gesture can make you stand out and encourage repeat business.

Step 9: Double-Check Everything

Review your invoice for accuracy. Ensure that all calculations are correct, client details are accurate, and there are no spelling errors. Professionalism is paramount, and errors can delay payments.

Step 10: Send the Invoice Promptly

Once your invoice is prepared, send it to your client promptly. Email is often the preferred method, but confirm with your client. Make sure to keep a copy (digital or printed) for your records. If using email, consider sending the invoice as a PDF to prevent any formatting issues.

How To Send Your Invoice To The Client

Sending your invoice to a client is a critical step in the payment process. Properly delivering an invoice not only ensures timely payment but also demonstrates your professionalism. Here’s a step-by-step guide on how to send your invoice to a client:

Step 1: Confirm the Correct Recipient

Before sending the invoice, confirm who the invoice should be addressed to and their contact details. Some clients may have a specific department or person that handles payments. Sending your invoice directly to them can speed up the payment process.

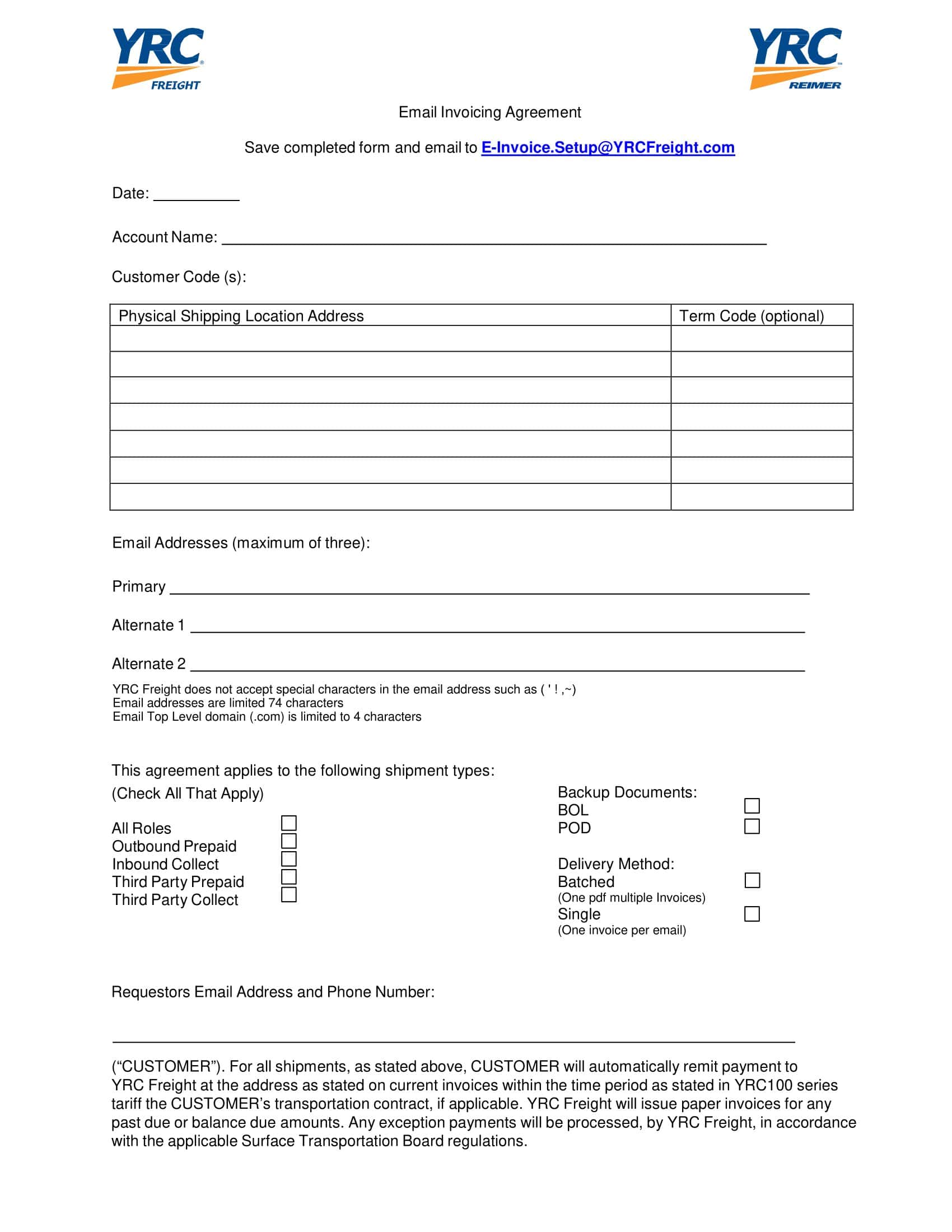

Step 2: Choose a Suitable Delivery Method

There are various methods to send invoices:

- Email: This is the most common method for freelancers. Convert your invoice to a PDF to preserve formatting, and then attach it to the email. The subject line should be clear, e.g., “Invoice #123 for [Your Name/Your Company’s Name].”

- Physical Mail: If the client prefers a hard copy, or if it’s a requirement, mail the invoice. Use a tracked method to ensure delivery.

- Online Invoicing Platforms: Tools like FreshBooks, QuickBooks, or Wave allow you to send invoices directly through their platforms. These tools might also enable you to see when a client has viewed the invoice.

- Fax: Some businesses might still prefer this method, though it’s less common nowadays.

Step 3: Draft a Professional Message

If you’re sending your invoice via email, accompany it with a concise and professional message. Mention the attached invoice, the total due, the due date, and a thank you for the business. Ensure your tone is courteous and informative.

Step 4: Attach Any Supporting Documents

If the project required receipts, work logs, or any other supporting documents, ensure they’re attached along with your invoice. This provides transparency and justifies the figures on your invoice.

Step 5: Set a Reminder for Yourself

Schedule a reminder in your calendar to check on the status of the invoice. This will help you remember to follow up if the payment is nearing its due date and hasn’t been made yet.

Step 6: Keep Track of Sent Invoices

Maintain a record (digital or physical) of all the invoices you send. This helps you manage your finances, track pending payments, and provides a reference for any future disputes or queries.

Step 7: Follow Up

If the due date is approaching or has passed, and you haven’t received payment, don’t hesitate to send a polite follow-up. Sometimes, invoices can be overlooked or misplaced, and a gentle reminder can expedite your payment.

Step 8: Acknowledge Payment Receipt

Once you receive payment, it’s a good practice to send a short thank-you note acknowledging the receipt. This not only fosters good relations but also confirms that you’ve received the payment.

Special Considerations For Freelancers

Navigating the freelancing world can be intricate, particularly when it comes to finances and invoicing. Freelancers often face unique scenarios that require a specialized approach to ensure a smooth billing process. Here’s a deeper dive into some special considerations freelancers should be aware of:

Handling Deposits and Partial Payments

- Why It’s Important: Many freelancers require a deposit, especially for larger projects or with new clients. This ensures some financial security and can also be a measure of the client’s commitment.

- How to Approach It: Clearly state in your agreement or contract that a certain percentage (often 25%-50%) is required upfront as a deposit. Once the work commences, this amount is deducted from the final invoice. For longer projects, you might want to set milestones and invoice after each is achieved. Always maintain open communication with the client about your payment expectations.

Dealing with Expenses and Reimbursements

- Why It’s Important: During a project, you might incur expenses that should be reimbursed by the client. These can range from software licenses to travel expenses.

- How to Approach It: Always discuss potential expenses with the client at the project’s outset. Keep detailed records and original receipts. On your invoice, list these expenses separately, providing a clear description for each. Consider attaching copies of receipts or other evidence to eliminate any doubts.

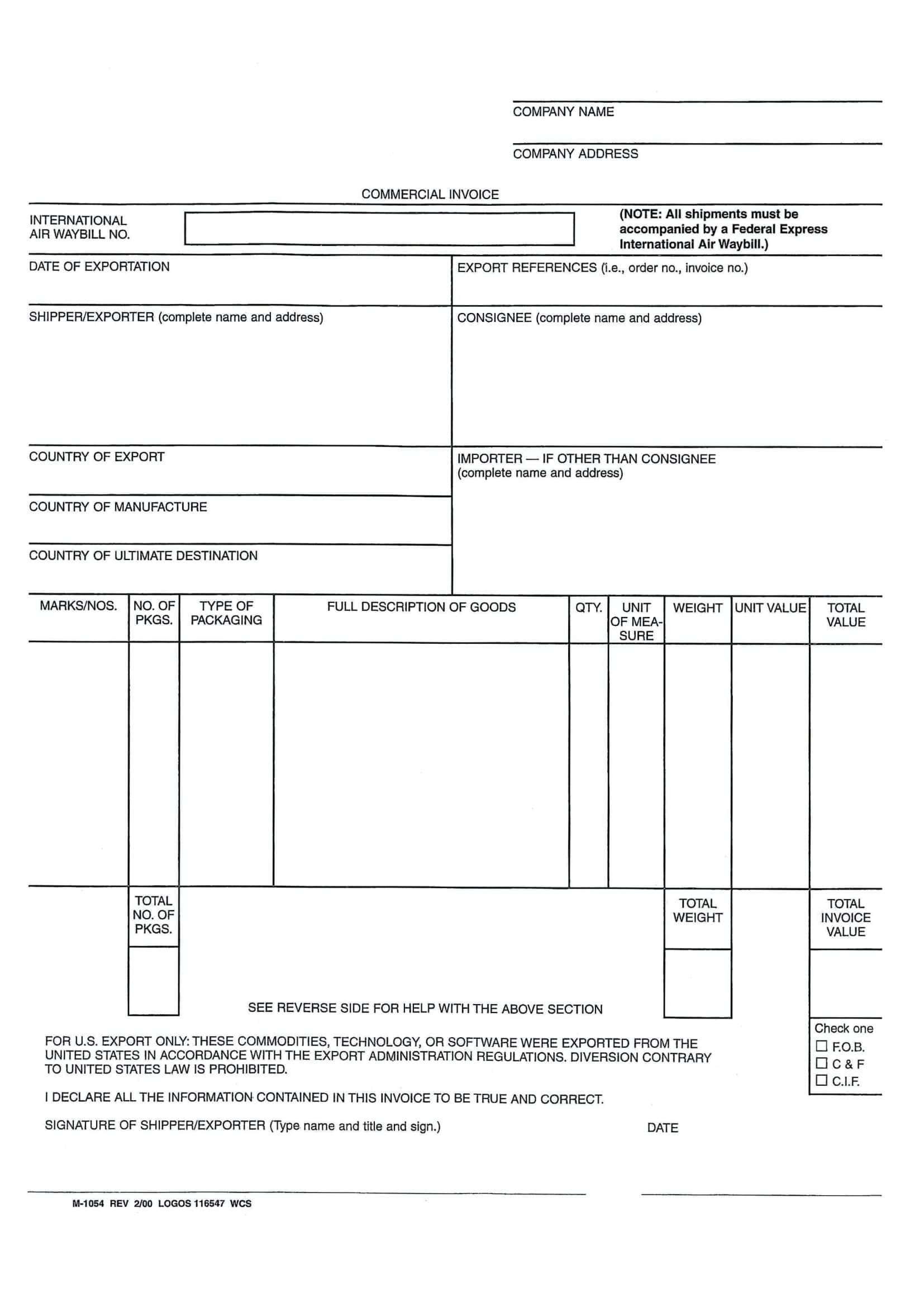

Multi-currency Invoicing for International Clients

- Why It’s Important: If you’re working with clients from different countries, dealing with multiple currencies can be a challenge. Exchange rates, transaction fees, and local taxes can complicate the invoicing process.

- How to Approach It: Use invoicing software that supports multi-currency invoicing. Discuss and agree upon the currency you’ll invoice in before starting the project. Some freelancers opt to invoice in their home currency, while others choose the client’s currency to simplify things for them. Also, be transparent about who will shoulder any currency conversion fees or bank charges.

Invoicing for Ongoing Retainers vs. One-time Projects

- Why It’s Important: Ongoing retainers and one-time projects have different scopes, durations, and expectations. The invoicing strategy should reflect these differences.

- How to Approach It:

- For Ongoing Retainers: If you’re on retainer, you’ll typically invoice at regular intervals, such as monthly. The invoice might reflect a flat fee agreed upon in the contract or be based on hours worked. Ensure that the client understands the services covered under the retainer and any services that might incur additional charges.

- For One-time Projects: For a standalone project, the invoice often comes upon project completion, unless there’s an agreed-upon deposit or milestone payments. Clearly outline the project’s scope in your contract to avoid “scope creep” and unexpected extra work without compensation.

FAQs

How do I number my invoices?

You can start with any number, like 001, and increment for each subsequent invoice. Some freelancers prefer using a combination of letters and numbers, like INV001, or including the date, like 20230812-001.

Can I include late fees in my invoice?

Yes, many freelancers specify a late fee for overdue payments. If you plan to charge a late fee, ensure it’s clearly mentioned in both your contract and the invoice, along with the grace period.

How do I accept payments through my invoice?

You can specify your accepted payment methods on the invoice. These might include bank transfers, checks, online payment platforms (like PayPal or Stripe), or others. Providing multiple options can make it more convenient for your clients.

What if a client doesn’t pay even after the due date?

First, send a gentle reminder. If there’s no response, follow up with more formal reminders. As a last resort, consider hiring a collection agency or pursuing legal action. Always aim for open communication and understanding with clients to avoid such situations.

Should I keep a copy of my invoices?

Yes, always keep a copy for your records. This is important for accounting, tax purposes, and potential disputes.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)