Understanding the relevance and necessity of donation receipts is a crucial aspect for both donors and recipients, often linked to fiscal responsibility, transparency, and tax regulations. This article delves into the intricacies of donation receipts — essential documents that validate the act of giving, whether monetary or in kind.

As a testimony to the donor’s generosity and a legal requirement for non-profit organizations, these receipts are not just slips of paper but carry profound implications for charitable operations, financial reporting, and the donor’s tax deductions. Our exploration will guide you through their importance, the necessary components of a comprehensive donation receipt, and the legal requirements associated with them.

Table of Contents

What is a Donation Receipt?

A donation receipt is a formal document that serves as proof that a donor made a charitable contribution to a nonprofit organization. The donation can be either cash, such as money, checks, electronic funds transfers, and credit card donations, or non-cash, which includes physical goods like clothing, equipment, food, or other tangible assets.

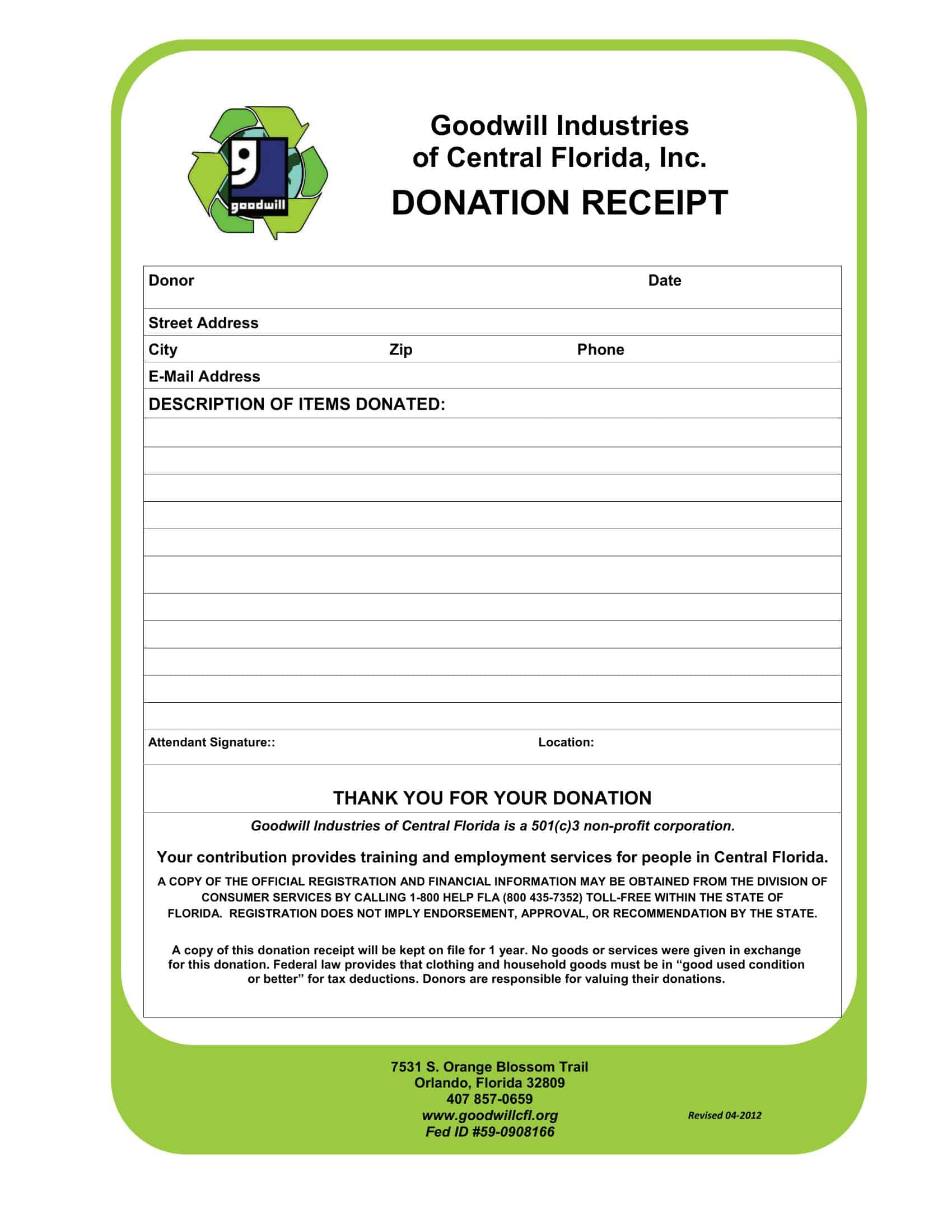

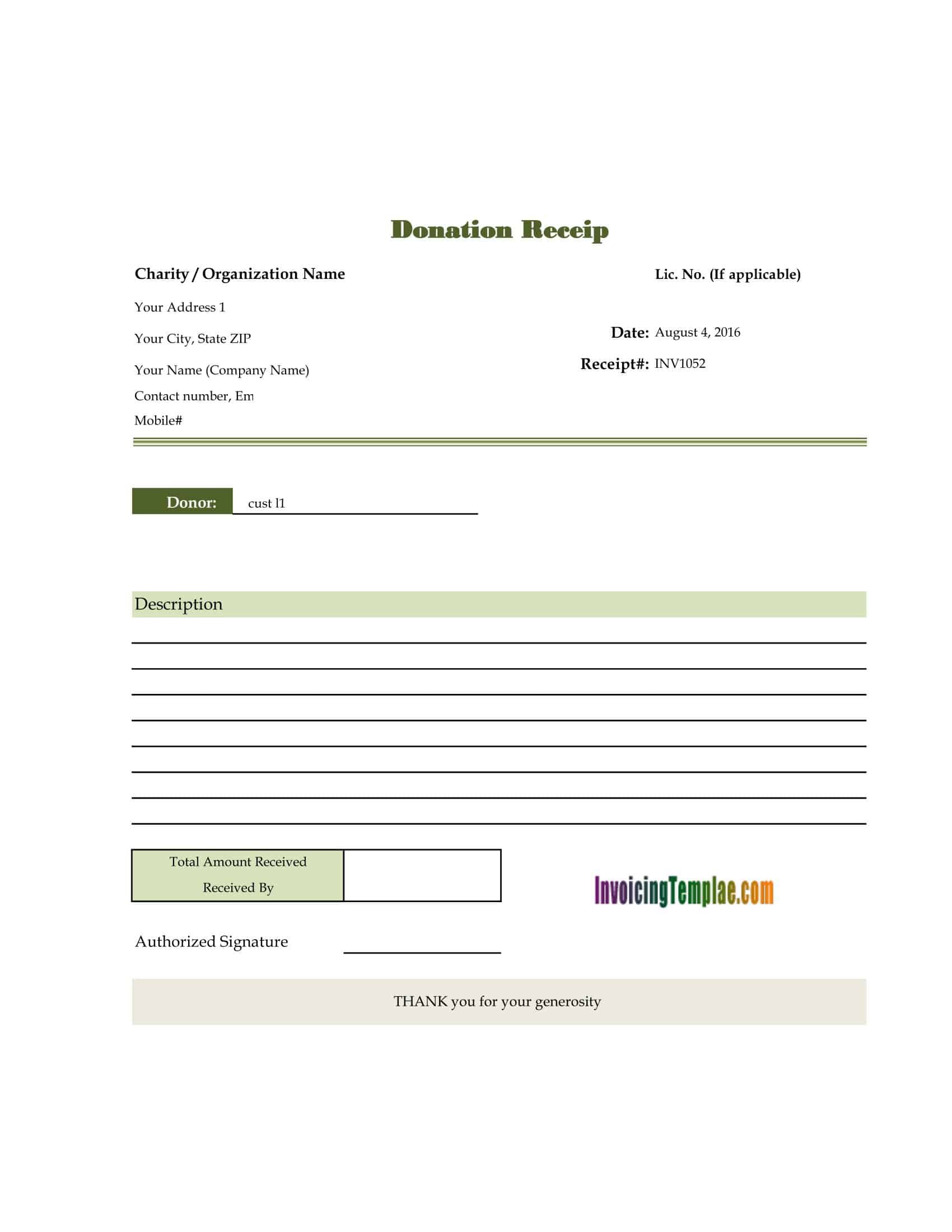

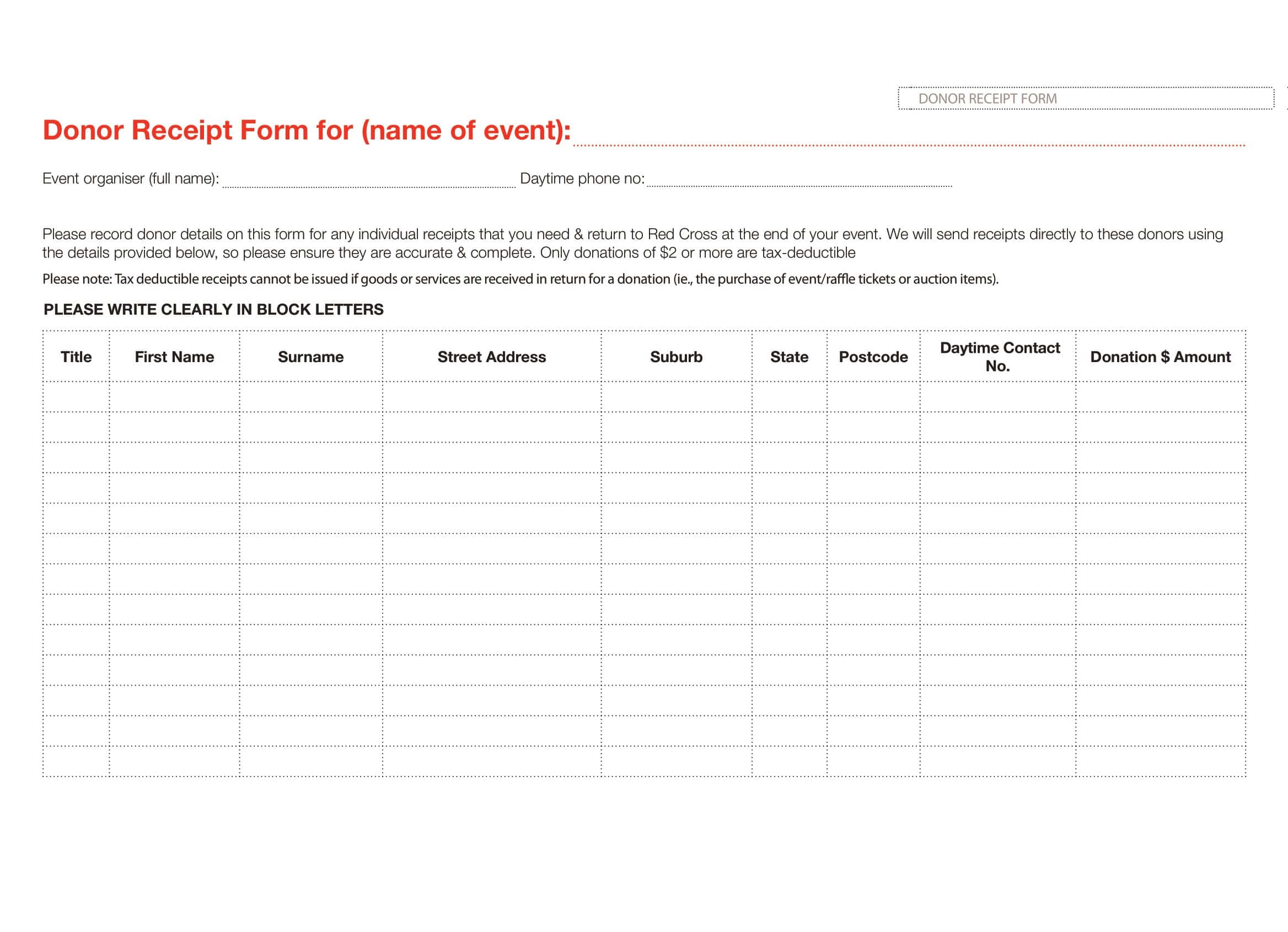

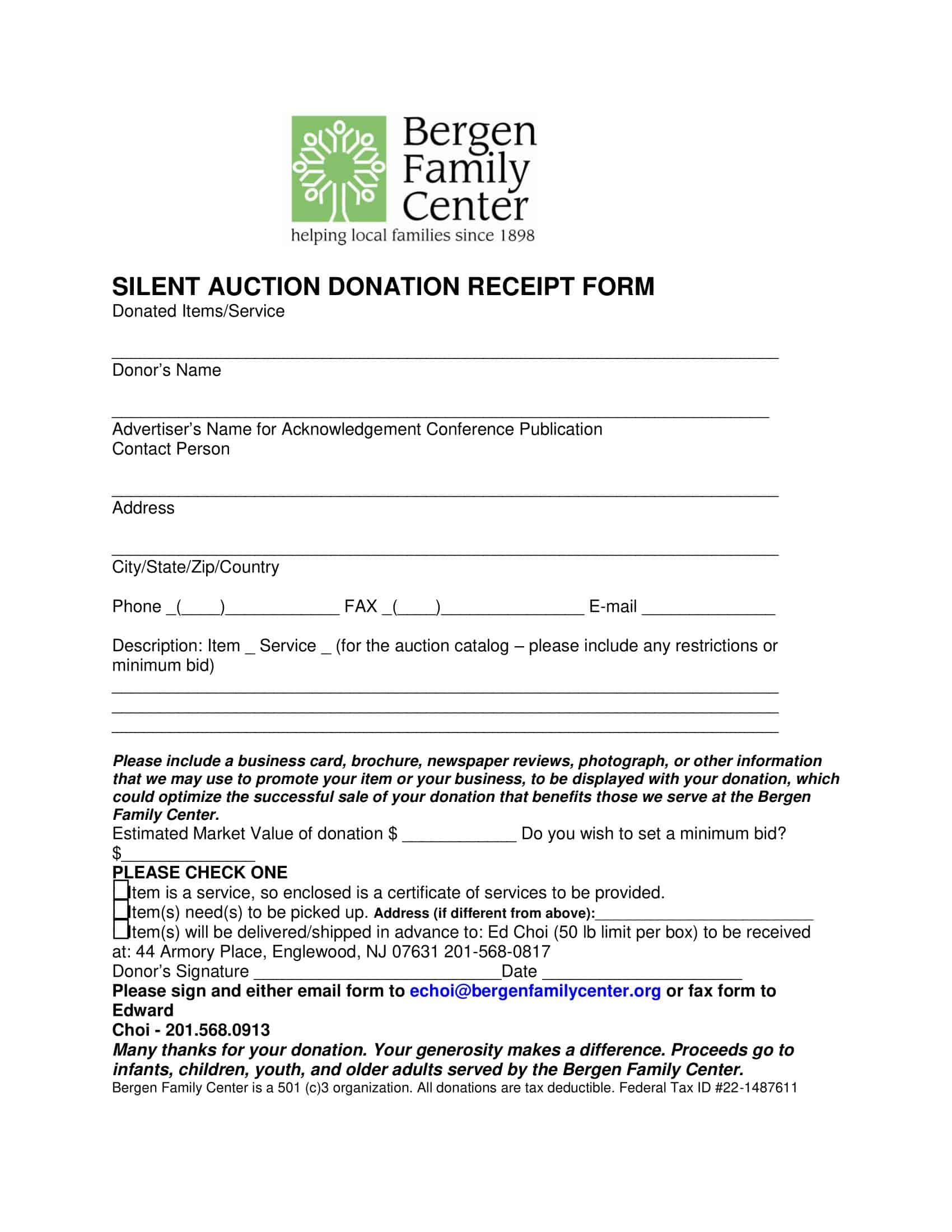

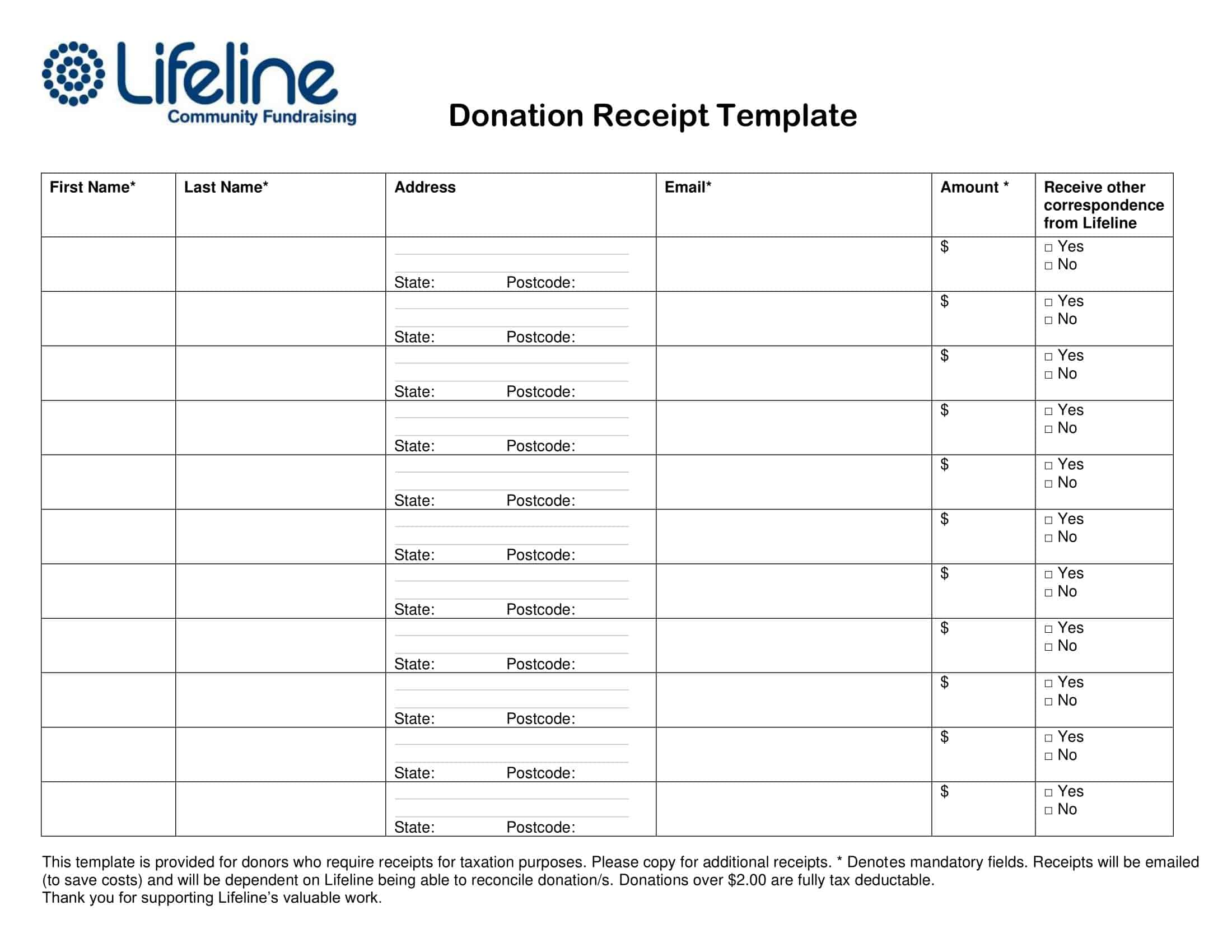

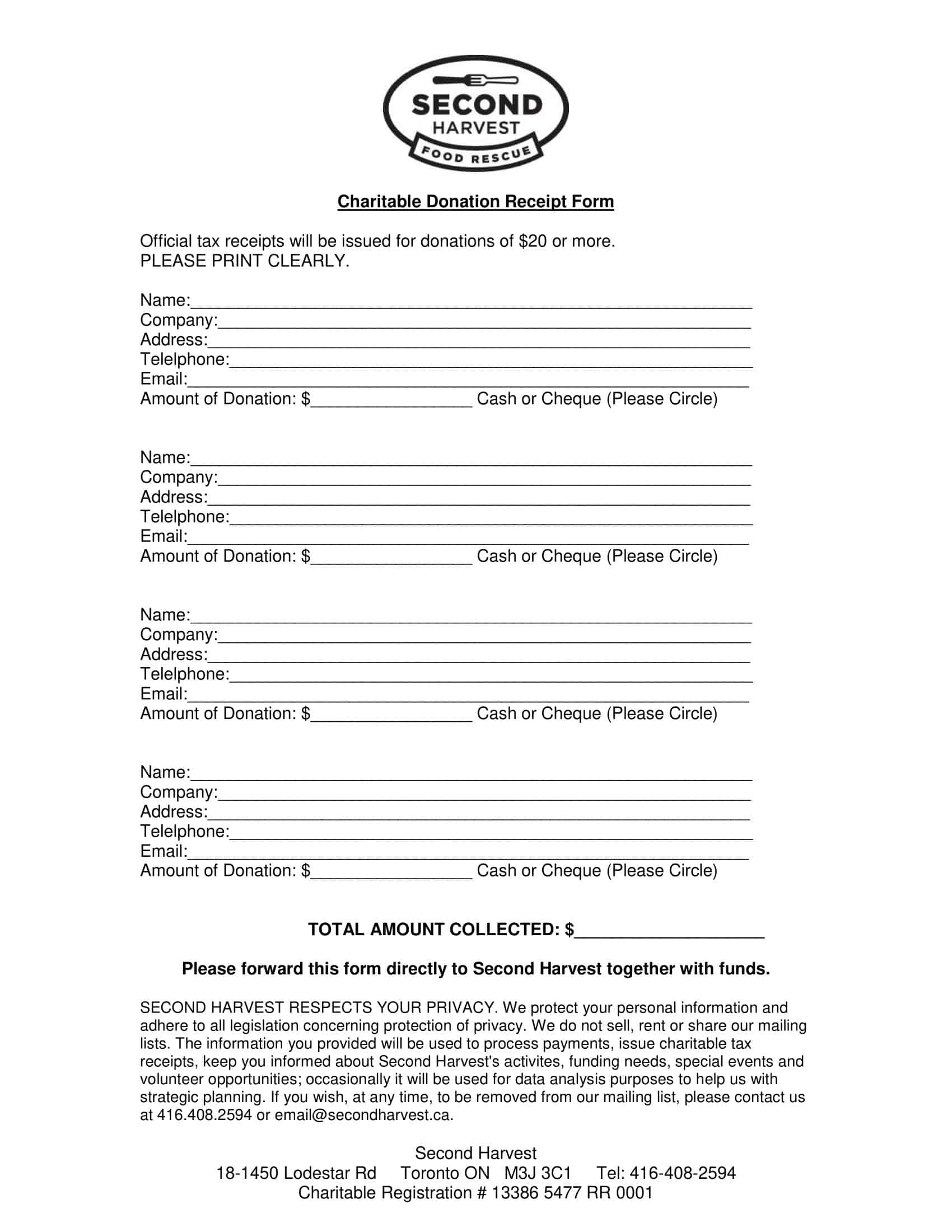

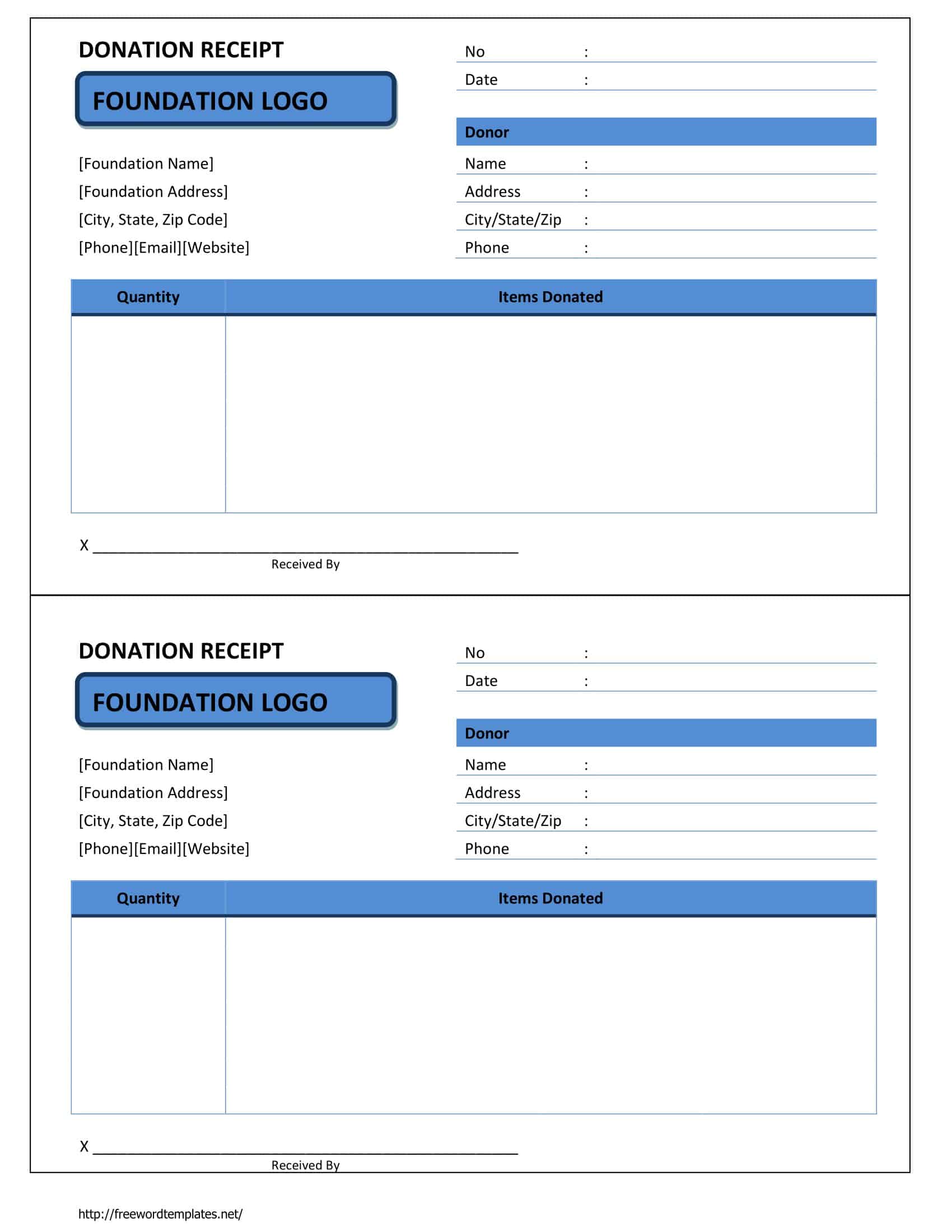

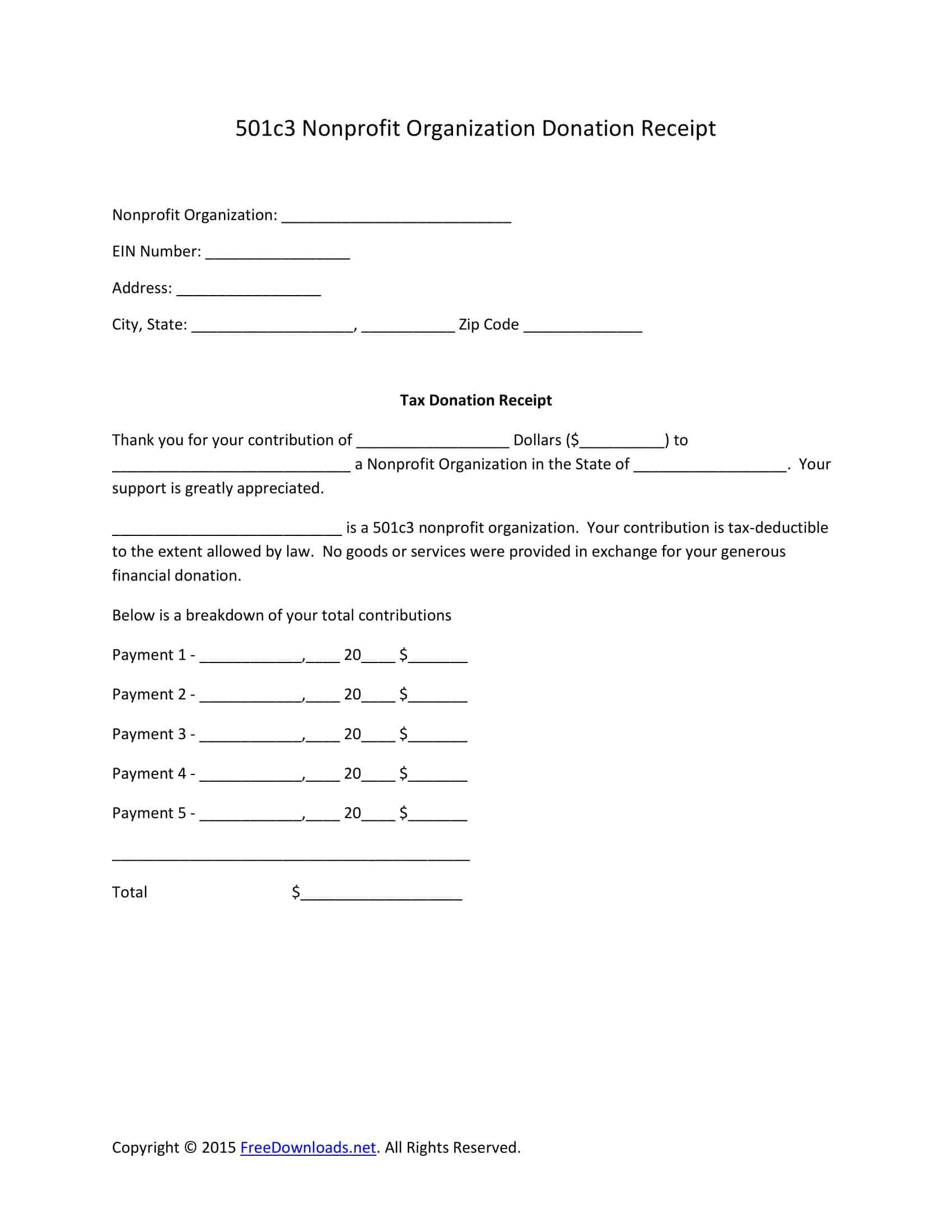

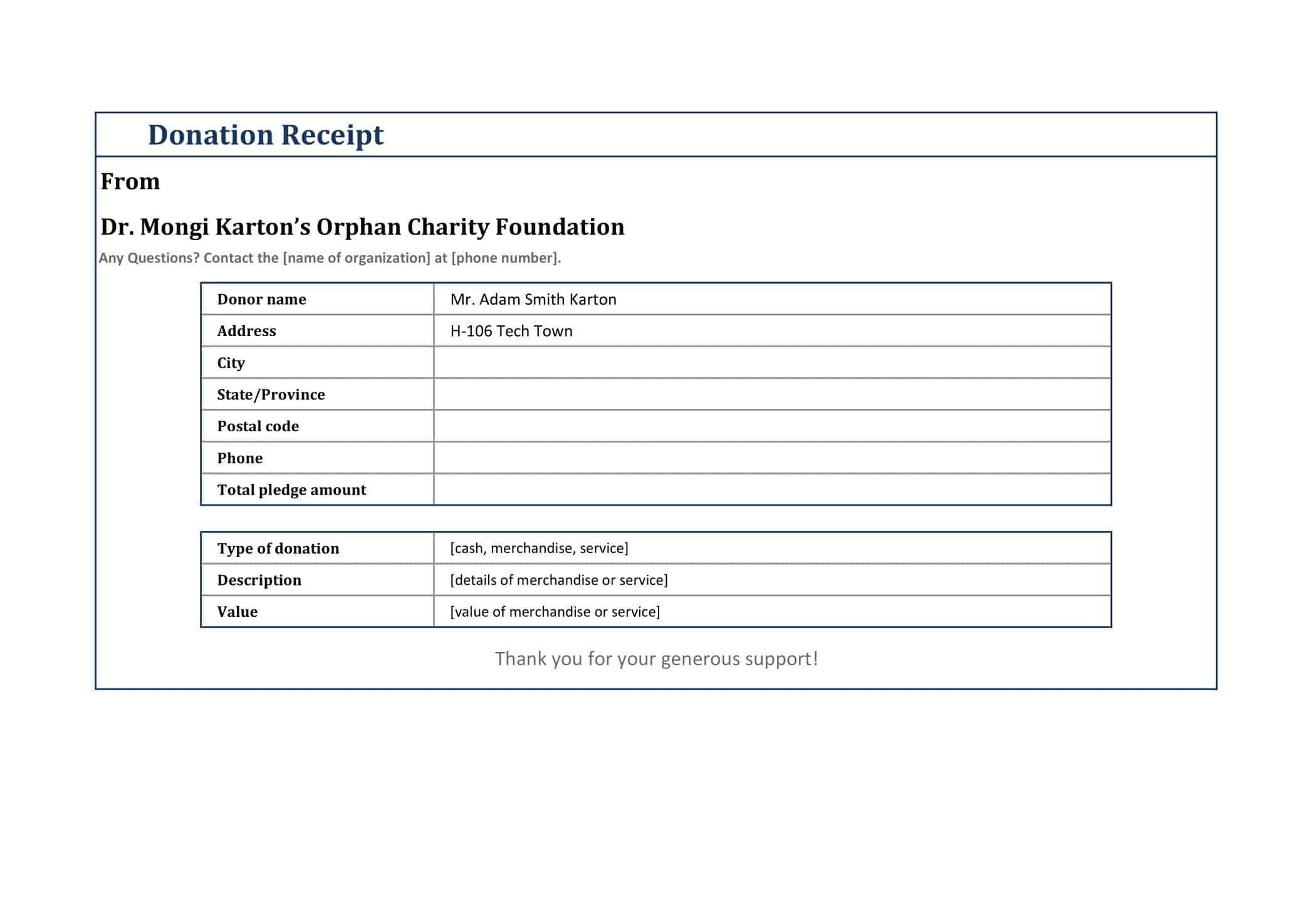

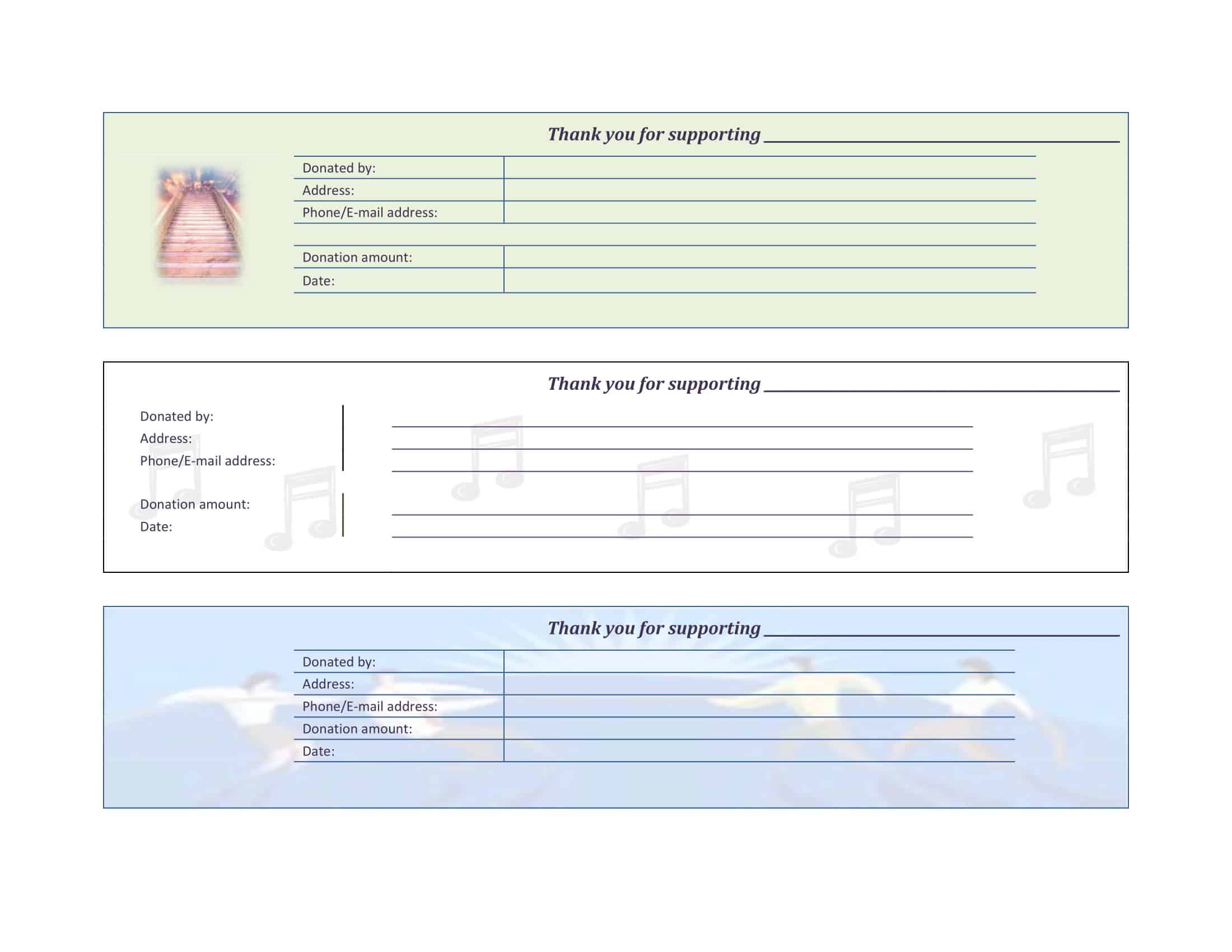

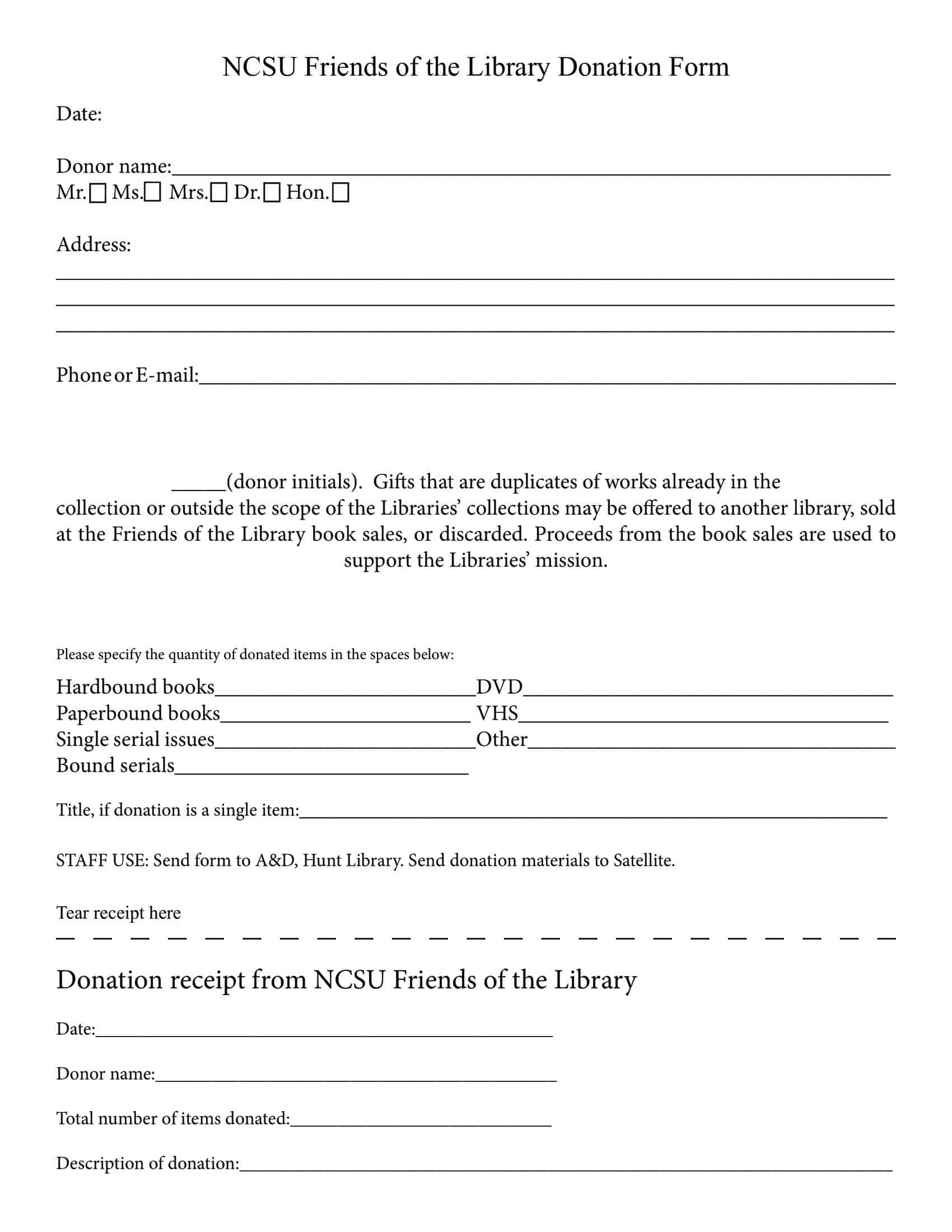

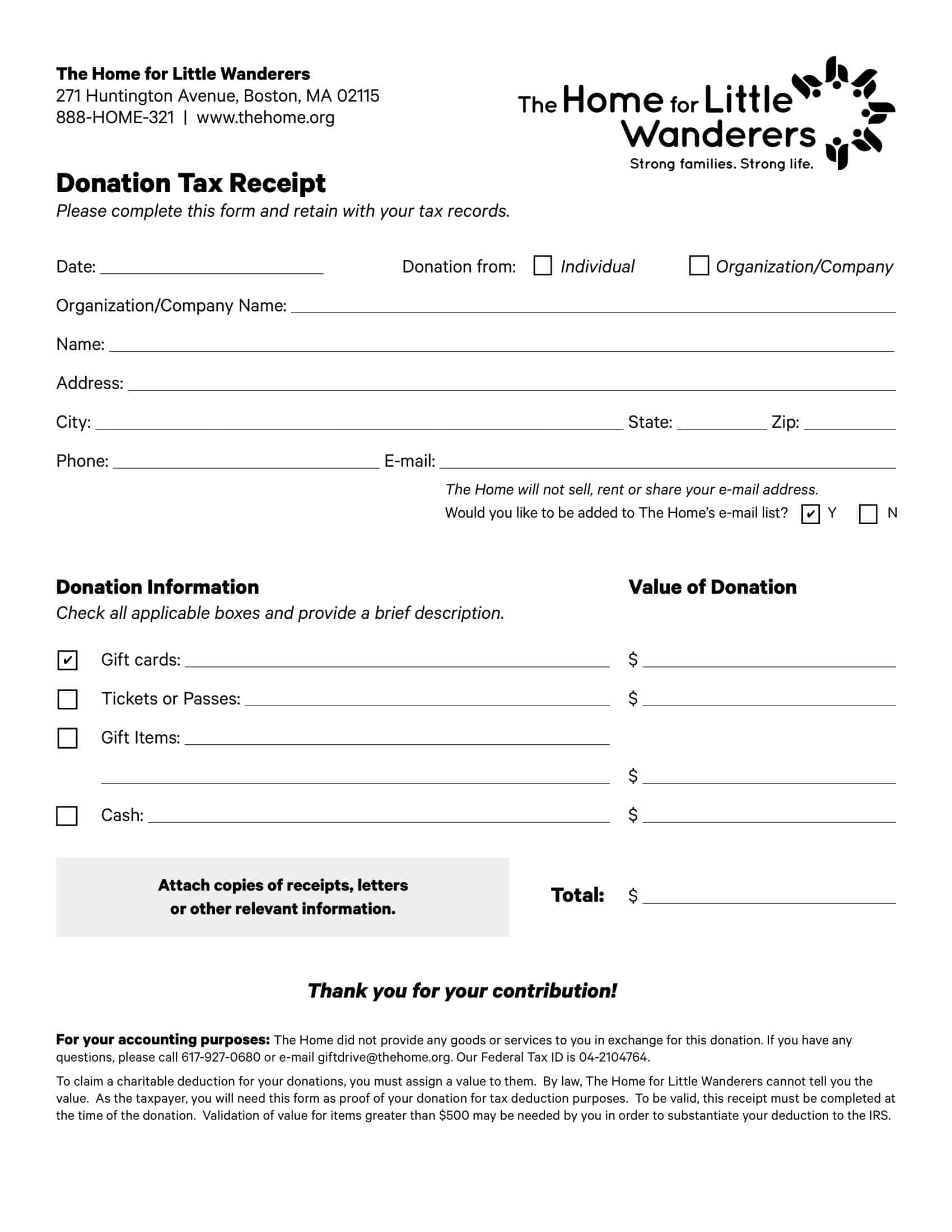

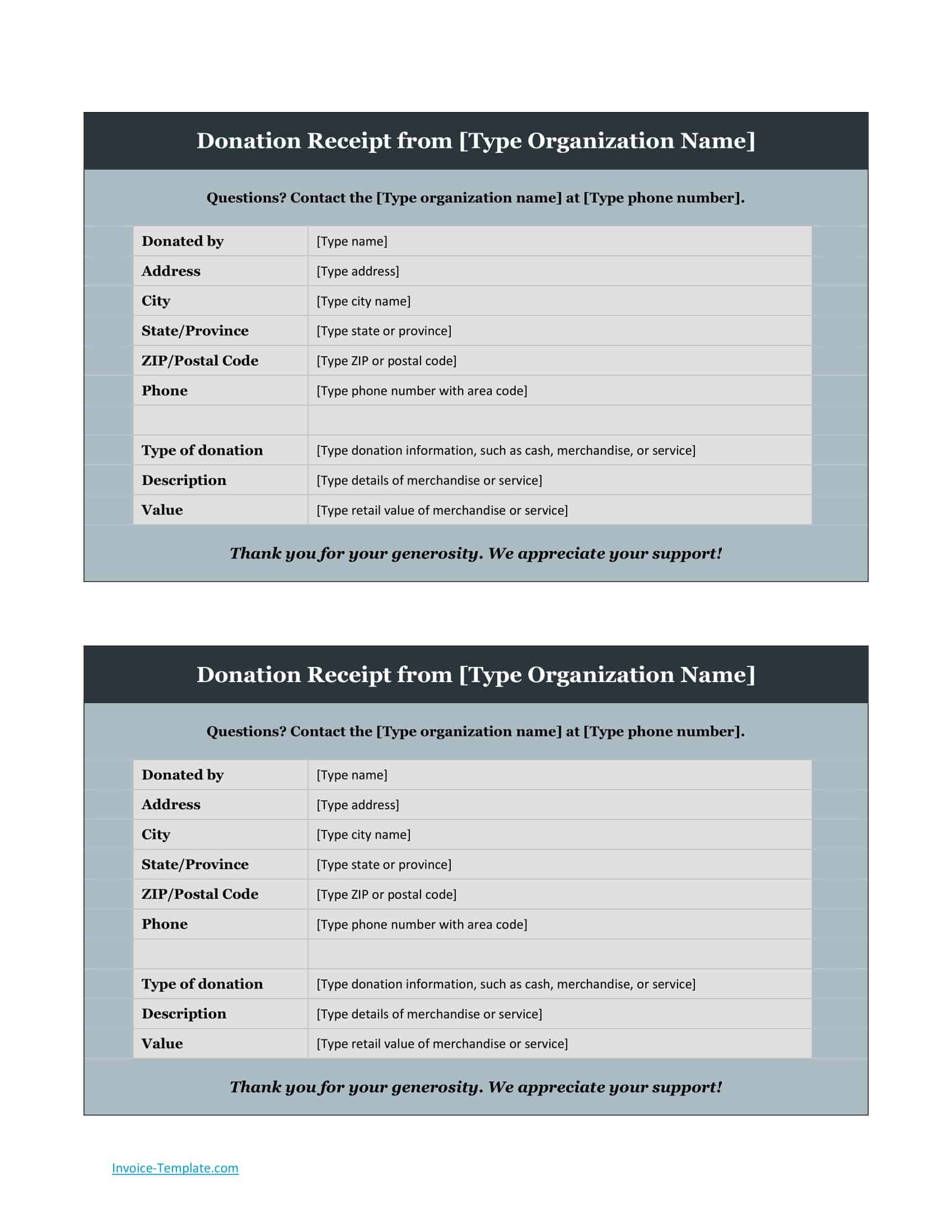

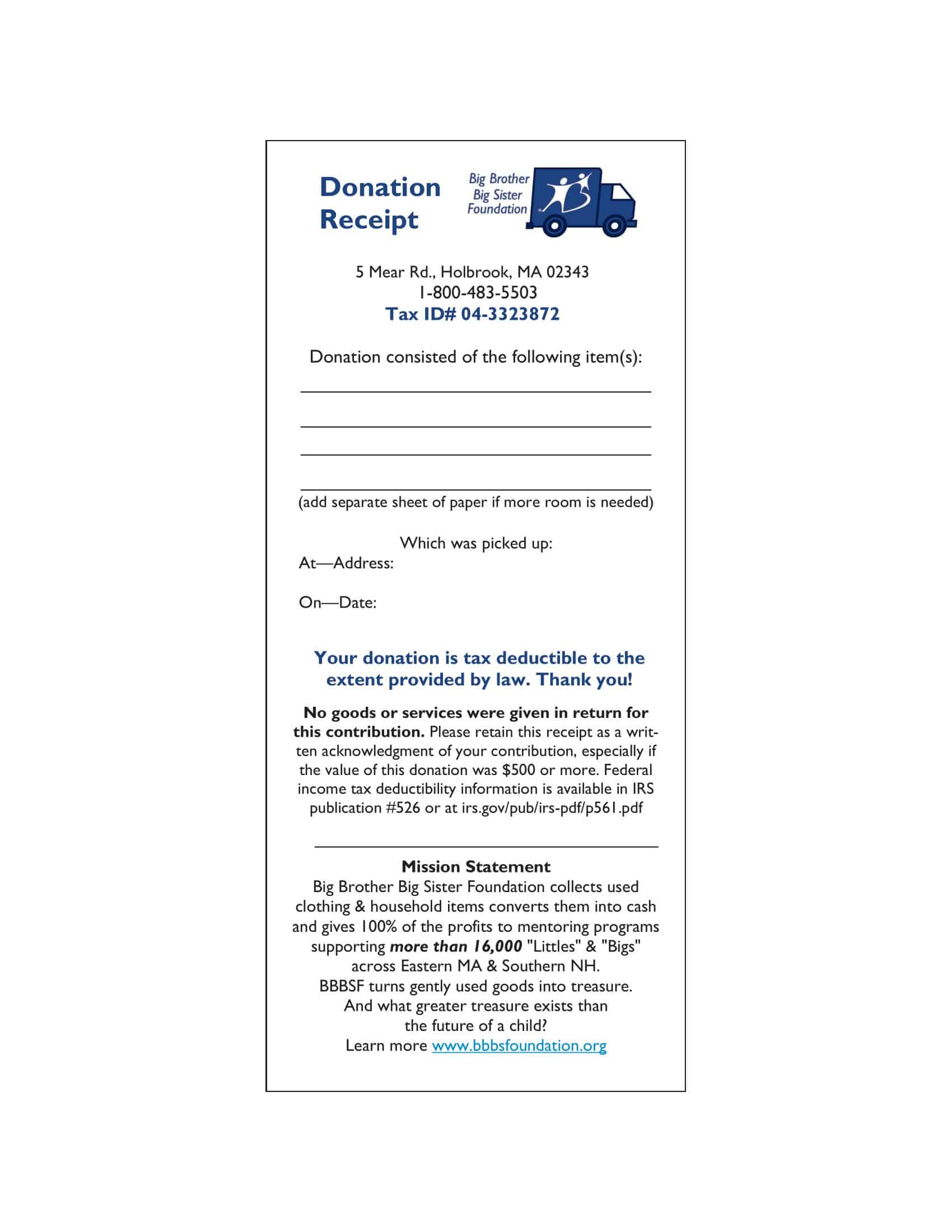

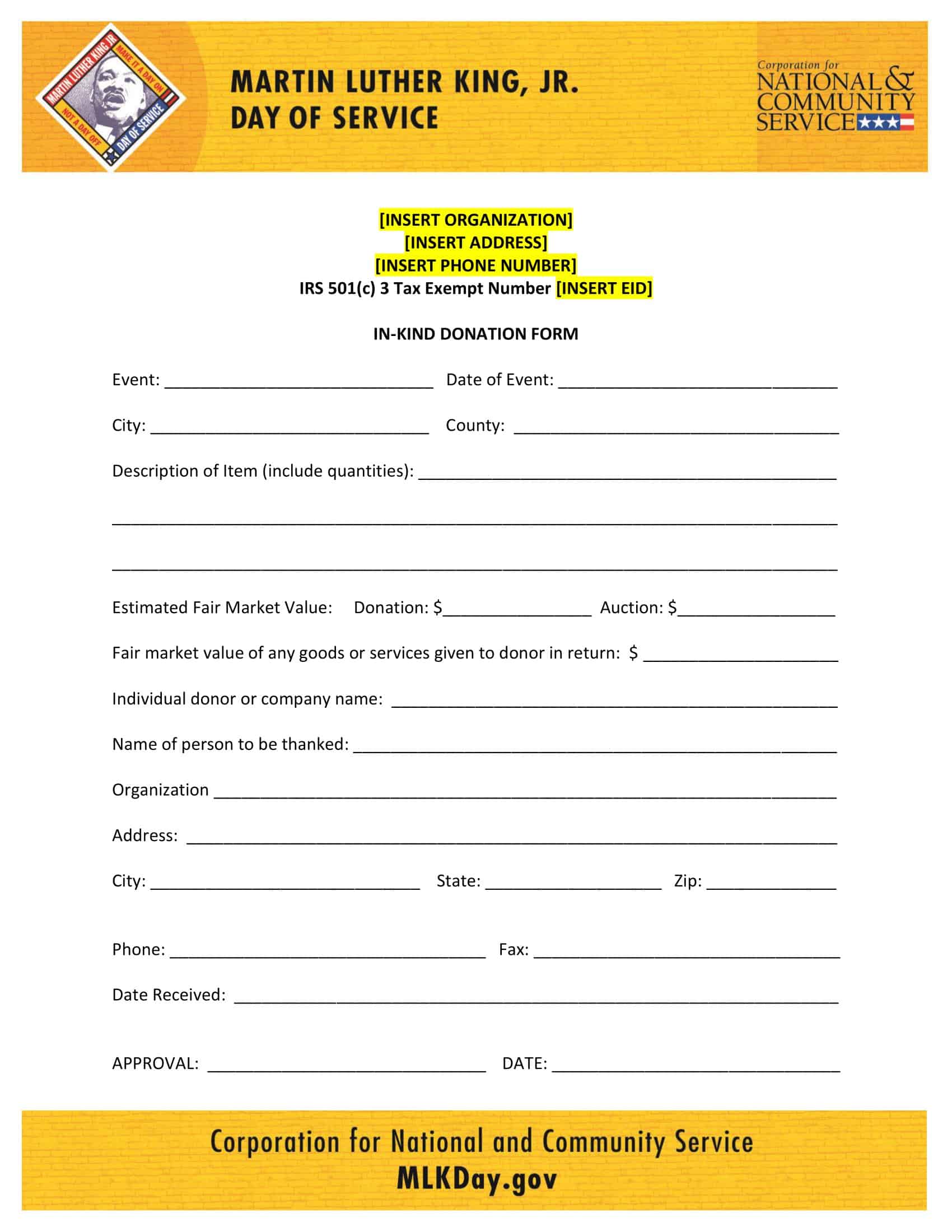

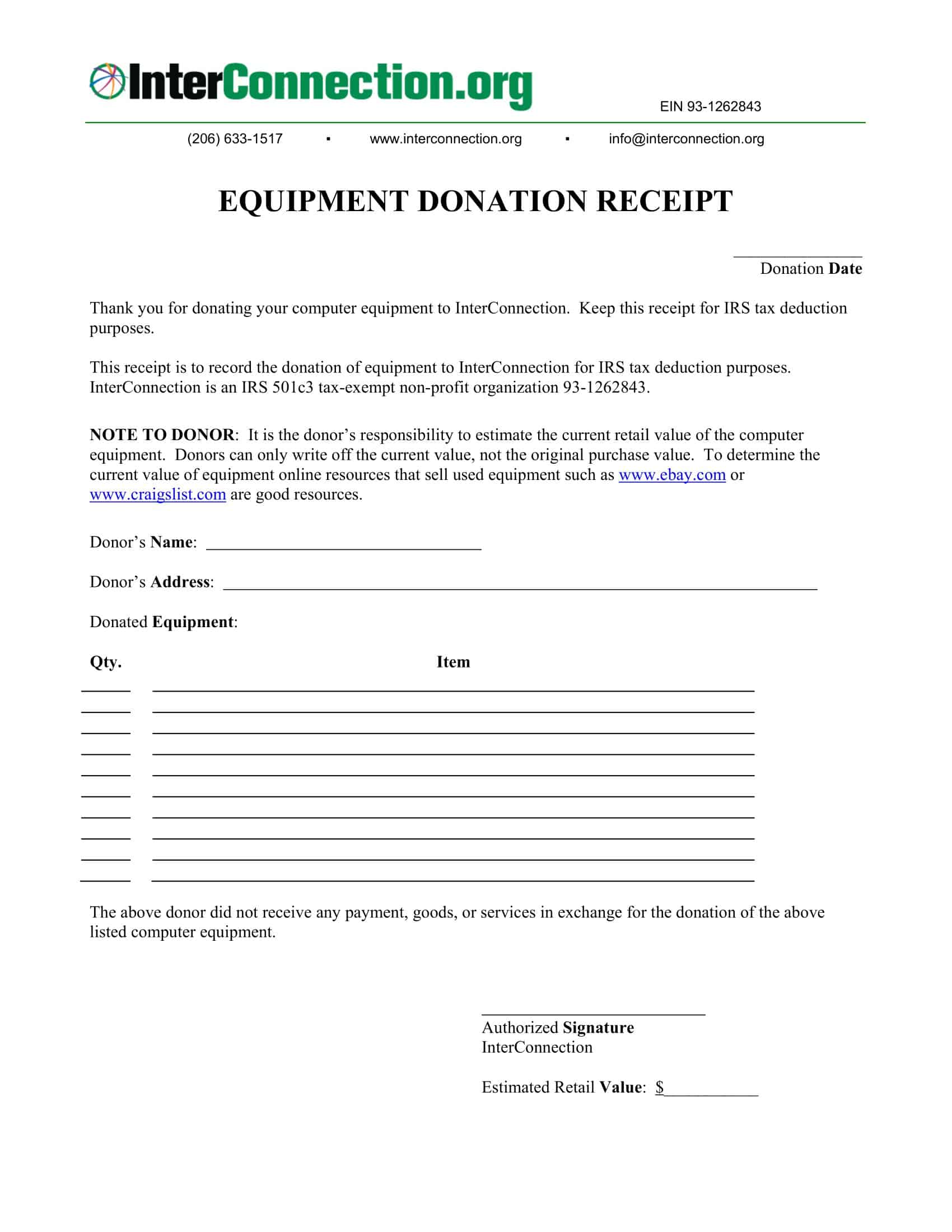

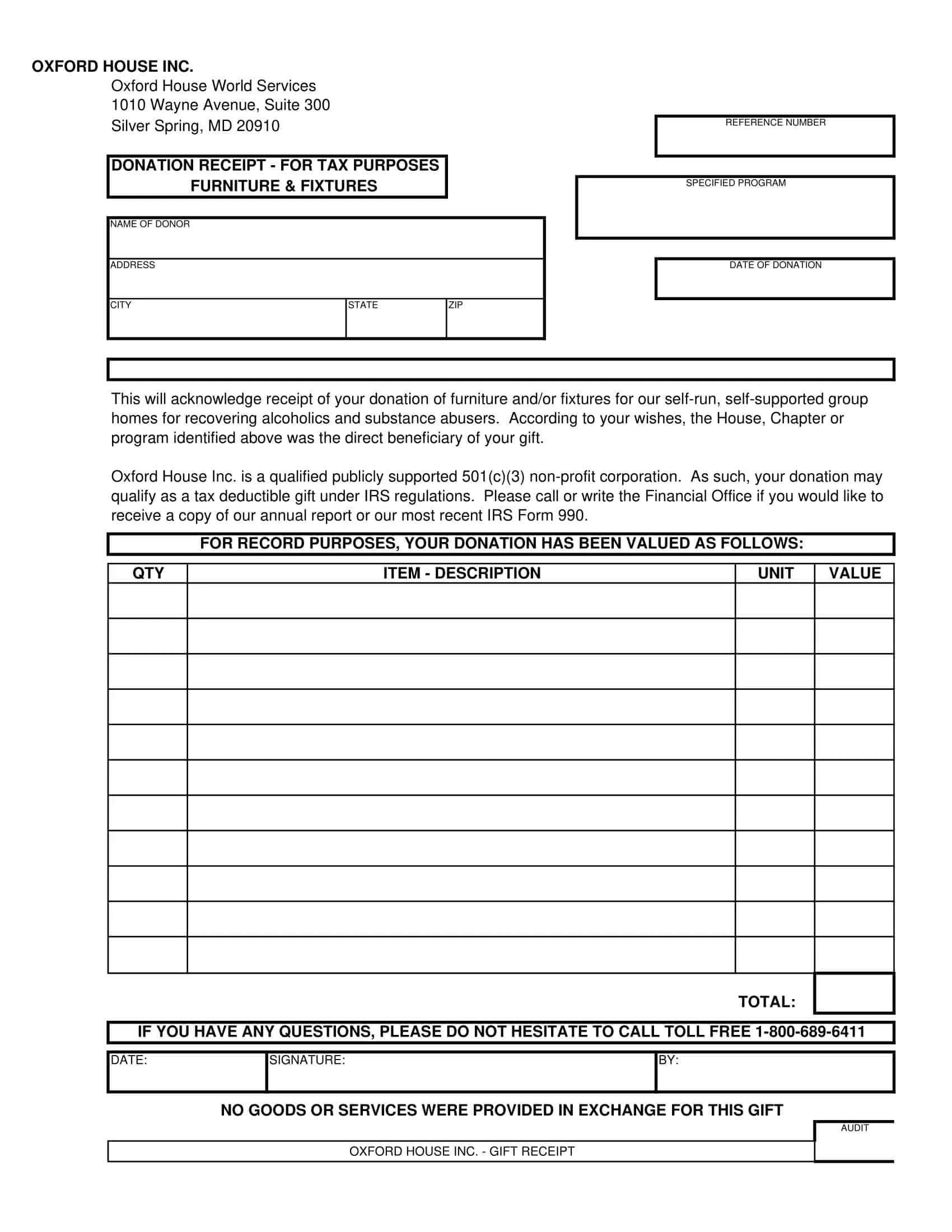

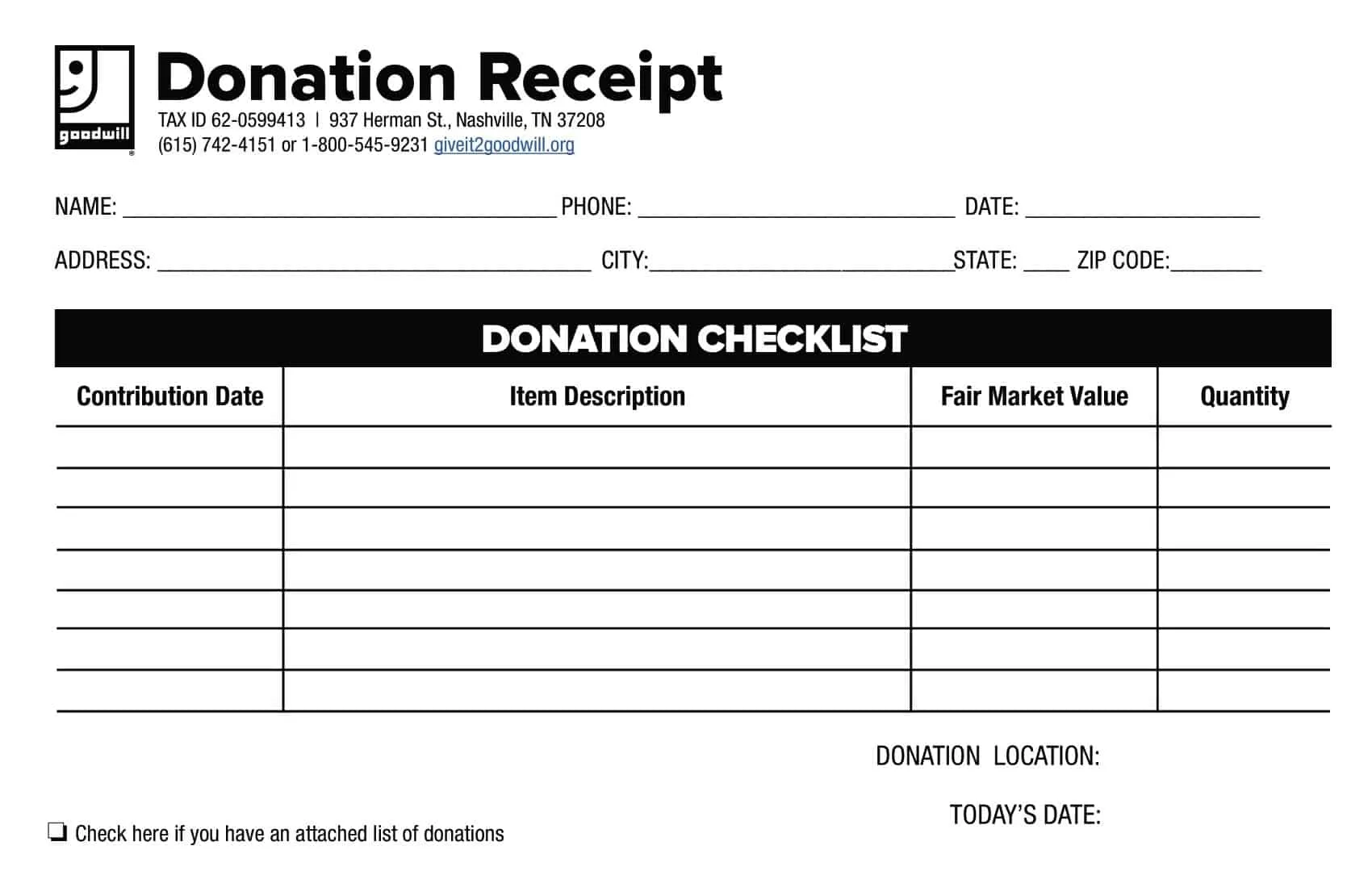

Donation Receipt Templates

Donation Receipt Templates are essential tools for any organization involved in charitable activities. They are pre-formatted documents which can help streamline the process of providing evidence of donations to the donors, crucial for tax deduction purposes.

At the core of these templates are the mandatory fields that capture key information. The details include donor’s name, amount donated, the date of donation, and description of items donated in cases of non-cash donations. They also have sections for the organization’s details such as name, address, and Tax Identification Number, which are vital for tax documentation.

These templates are typically designed to be easily customizable to align with the organization’s branding. Various formats such as Word, PDF, and Excel are available to cater to different needs. An efficient donation receipt template will also have a place to describe the organization’s mission, providing a subtle reminder of the impact the donor’s contribution is making.

When Is a Donation Receipt Required?

The requirement for a donation receipt often depends on the jurisdiction and the amount of the donation. In the United States, as of my knowledge cutoff in September 2021, here are the general rules:

- Donations of less than $250: The IRS does not require a receipt for cash donations under $250. However, the donor might still want to request one for personal record-keeping.

- Donations of at least $250 but not more than $500: The IRS requires a receipt for each individual donation of $250 or more. The receipt must include the name of the organization, the amount of cash that was donated (or a description of the property), and whether the donor received any goods or services in exchange for the donation.

- Donations over $500 but less than $5,000: Donors must have a receipt and fill out IRS Form 8283, Section A.

- Donations of $5,000 or more: In addition to the receipt, donors must fill out IRS Form 8283, Section B, and might also require an appraisal of the donated property.

Non-cash donations have their own set of rules, and the value of the donated goods often determines whether a receipt is necessary and what documentation is required.

Why Do You Need a Donation Receipt?

Donation receipts serve several key purposes for both the donor and the recipient non-profit organization:

Tax Deductions

In many jurisdictions, including the United States, donations made to registered non-profit organizations can qualify for tax deductions. A donation receipt serves as proof of the donation and is required by the tax authority (like the IRS in the United States) to claim these deductions.

Record Keeping

For the donor, a donation receipt can help keep track of their charitable giving over the course of a year. This can be helpful for personal budgeting and financial planning. For non-profit organizations, these receipts help maintain accurate records of donations received.

Transparency and Accountability

From the non-profit’s perspective, issuing donation receipts is a part of maintaining transparency and accountability. It ensures that they have a record of all donations received, which can be important for financial reporting, audits, and building trust with donors and the community.

Legal Compliance

In some instances, providing a donation receipt is a legal requirement. For example, in the U.S., non-profit organizations are required to provide a receipt for any individual donation over $250.

What to Include in a Donation Receipt

Creating a detailed, compliant donation receipt requires including certain key elements. Here’s a comprehensive guide to what should be included in a donation receipt:

Organization’s Information: The full legal name of the nonprofit organization, its address, and possibly its tax ID number should be included. This information validates the receipt and verifies that the donation was made to a registered nonprofit.

Donor’s Information: The donor’s full name and contact information (address, phone number, email) should be included. This confirms the donation was made by the named individual or organization.

Date of the Donation: The exact date when the donation was made needs to be recorded on the receipt. This is especially important for tax purposes, as it determines the tax year in which the donation can be claimed.

Amount of the Donation: For monetary donations, the exact amount donated should be included. If the donation was made in a currency other than the local currency, that should be specified as well.

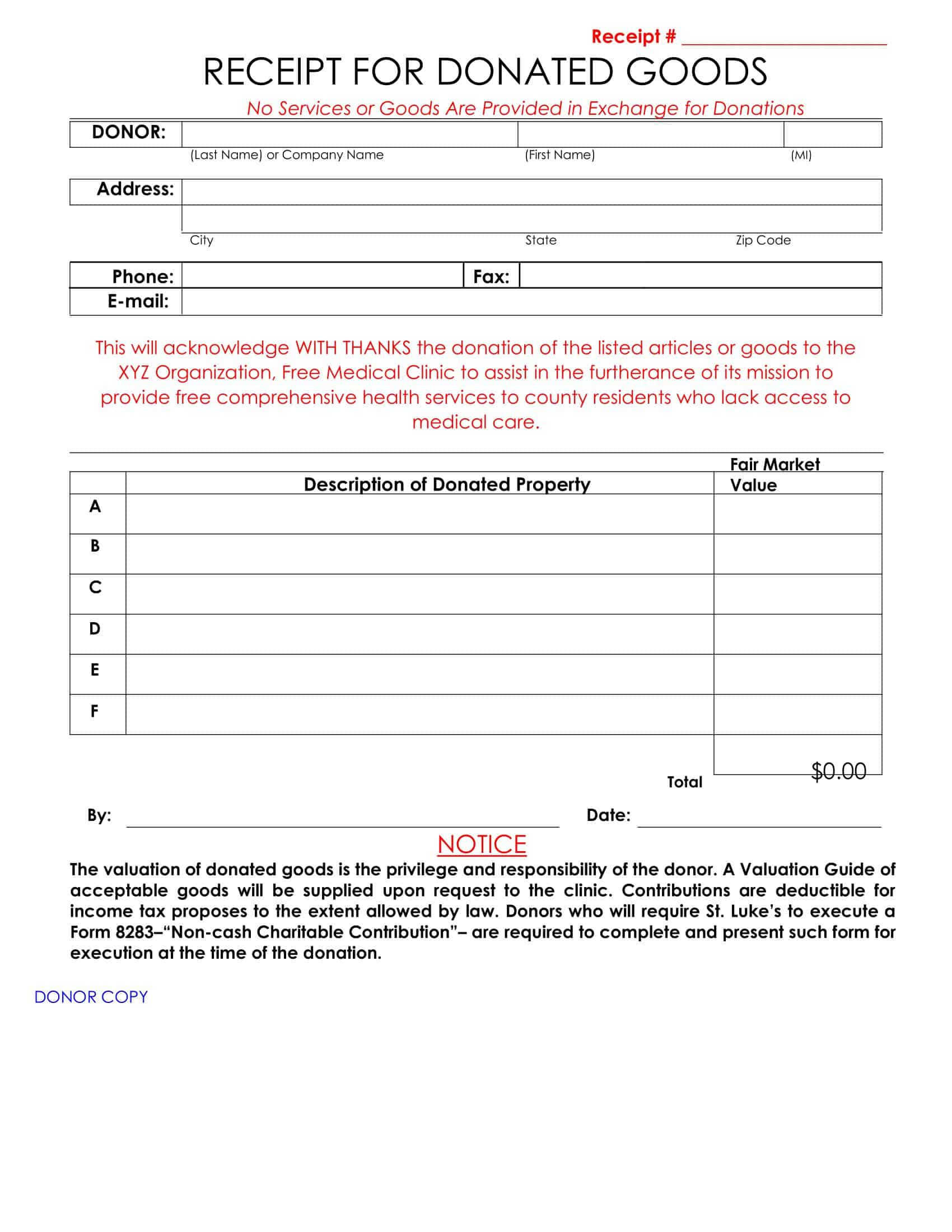

Description of the Donation: If the donation was made in-kind (non-monetary goods or services), a detailed description of the donation should be included, such as the condition and approximate value of the goods. However, the nonprofit generally does not assign a monetary value to in-kind donations; this is typically the responsibility of the donor.

Statement of Goods or Services: The receipt should include a statement that either 1) no goods or services were provided by the organization in return for the donation, 2) goods or services that consist entirely of intangible religious benefits were provided, or 3) a description and good faith estimate of the value of goods or services (if any) that an organization provided in return for the donation. This part is crucial for determining the tax-deductible amount of the donation.

Tax Exempt Status: A statement declaring the organization’s tax-exempt status, confirming that it is eligible to receive tax-deductible donations, is often included on donation receipts.

Donor Acknowledgment: A thank-you statement or acknowledgment for the donor’s generosity helps express appreciation and cultivate a relationship with the donor.

Signature: The receipt should be signed by an authorized representative of the nonprofit organization. This could be a digital or physical signature.

Types of donation receipts

Donation receipts can be categorized based on the type of donation received. Here’s a detailed guide to the main types of donation receipts:

Cash Donation Receipts

These are receipts given for donations made in the form of cash, check, or electronic funds transfer. They generally include the donor’s name, the donation amount, the date of the donation, a statement indicating whether any goods or services were provided in exchange for the donation, and the nonprofit organization’s details.

Non-Cash (In-Kind) Donation Receipts

These receipts are for donations of goods or services rather than cash. This might include items like clothing, furniture, food, or professional services. The receipt should include a detailed description of the donated items or services, the date of the donation, and similar details as in a cash donation receipt. Nonprofits usually do not assign a value to these goods or services; it’s generally the donor’s responsibility to determine their fair market value for tax purposes.

Vehicle Donation Receipts

Donating a car, boat, or other vehicles to a nonprofit can require special documentation. In the U.S., for example, the nonprofit should provide a Form 1098-C or a similar statement to acknowledge receipt of the vehicle. This should include details about the vehicle, such as the make, model, year, and identification number, along with a statement regarding whether the organization intends to sell the vehicle or use it in its operations.

Quid Pro Quo Donation Receipts

These are specific receipts for donations where the donor receives something in return for their contribution, like a meal at a fundraising dinner or merchandise. The receipt should specify the value of what was received by the donor and that this value must be subtracted from the donation amount to determine the tax-deductible portion of the contribution.

Annual or Consolidated Receipts

Some nonprofits provide annual summaries of a donor’s contributions over a tax year. These are particularly helpful for regular donors, as it consolidates all their donations into one document, making it easier for tax preparation.

Gift in Memory or in Honor Receipts

These receipts are provided when a donation is made in someone else’s name, usually in memory of a deceased person or in honor of a living one. They have the same information as a typical receipt, along with the name of the person in whose memory or honor the gift is made.

How to Create a Donation Receipt

Creating a donation receipt can be straightforward if you follow a step-by-step process. Here’s a detailed guide to help you:

Step 1: Gather Donor Information

You will need the donor’s full name, address, and, if possible, contact information such as a phone number or email address. This information is important for record-keeping and for sending the receipt to the donor.

Step 2: Document the Donation Details

If the donation is monetary, record the exact amount donated. If it’s an in-kind donation, note a detailed description of the donated item or service. For both, record the date the donation was received. In the case of a vehicle or property donation, additional details such as make, model, year, and identification number (for vehicles), or address and description (for properties), will be necessary.

Step 3: Determine and Describe any Goods or Services Offered in Return

If the donor received any goods or services in return for the donation, note this on the receipt. The fair market value of these goods or services should also be noted because the donor can only claim a deduction for the amount of the donation that exceeds this value.

Step 4: Add Your Organization’s Information

The donation receipt should clearly state the name, address, and contact information of your nonprofit organization. If applicable, you should also include your organization’s tax ID number and a statement confirming your organization’s tax-exempt status.

Step 5: Include a Statement of Receipt

Include a statement that acknowledges that your organization received a donation from the individual or entity named.

Step 6: Sign the Receipt

The receipt should be signed by an authorized representative of the nonprofit organization. This could be a physical signature, but a digital signature is also often acceptable.

Step 7: Send the Receipt to the Donor

You can mail a physical copy of the receipt to the donor, or you can send it electronically via email.

Step 8: Keep a Copy for Your Records

It’s important to keep a copy of all donation receipts for your organization’s financial records. This will be essential for accounting purposes, potential audits, and annual reporting.

What to Avoid When Creating and Sending Donation Receipts

Creating and sending donation receipts requires careful attention to certain legal and ethical guidelines. Here are several “don’ts” to consider during this process:

Don’t #1: Don’t Assign Value to Non-Cash Donations

Non-profit organizations should provide a description of the non-cash goods donated, but they should avoid assigning a monetary value to these items. It’s the donor’s responsibility to determine the fair market value for tax purposes.

Don’t #2: Don’t Forget to Specify Quid Pro Quo Contributions

If a donor receives anything of value in return for their donation (such as a meal at a fundraising event or merchandise), this is known as a quid pro quo contribution. The receipt should clearly indicate the fair market value of the goods or services provided and inform the donor that only the portion of the donation that exceeds this value is tax-deductible.

Don’t #3: Don’t Neglect the Timing

Send the donation receipts promptly. It’s best practice to issue the receipt as soon as possible after the donation is made. This is not only helpful for the donor but also a good practice to maintain for proper record keeping. In the United States, for tax purposes, donors must receive the receipt by the date they file their tax returns or the due date of the return (including any extensions), whichever comes first.

Don’t #4: Don’t Overlook Required Information

Be careful to include all the necessary information: donor’s name, organization’s details, date of the donation, amount or description of what was donated, and a statement whether any goods or services were provided in return for the donation. Missing any of this information can invalidate the receipt.

Don’t #5: Don’t Lose Track of Donations

Maintain organized records of all donations received and receipts issued. This is important for your organization’s financial management, for potential audits, and for annual reporting.

Don’t #6: Don’t Violate Donor Privacy

Respect the privacy of your donors. Personal information should be handled with care and used only for official purposes. Ensure your organization is in compliance with data privacy laws in your region.

Don’t #7: Don’t Skip Verifying Tax-Exempt Status

Ensure your organization is currently recognized as tax-exempt under the law. If your status changes or is revoked, be sure to inform your donors as it affects the deductibility of their donations.

Don’t #8: Don’t Forget to Express Gratitude

While not legally required, expressing gratitude to donors is an important part of maintaining good relationships and encouraging future donations. An impersonal or curt receipt can leave a negative impression. Thank your donors warmly for their generosity.

FAQs

How long should I keep my donation receipts?

In general, you should keep your donation receipts as long as they may be needed for tax purposes. In the U.S., this is typically seven years.

What if I didn’t receive a donation receipt?

If you didn’t receive a donation receipt but would like one, you should contact the nonprofit organization and request it. They’re generally required to provide one upon request.

Can I claim a tax deduction without a donation receipt?

That often depends on the amount you donated and the tax laws in your jurisdiction. In the U.S., for example, you can generally claim a tax deduction for donations under $250 without a receipt, but it’s advisable to have one for your records. For donations of $250 or more, a receipt is required.

How do I value non-cash donations for my tax return?

Non-cash donations are generally valued at their fair market value – the price they would sell for in their current condition at the current time. It’s typically the donor’s responsibility to determine this value.

Do all donations to non-profit organizations qualify for a tax deduction?

Not all donations qualify for a tax deduction. In general, the non-profit organization should have a tax-exempt status recognized by the tax authority (such as 501(c)(3) status in the United States). Certain types of donations (like services and time) also may not qualify. It’s advisable to check with a tax advisor or the organization itself if you’re unsure.

Can I get a donation receipt for volunteering my time?

Generally, you cannot deduct the value of your time or services that you give to a nonprofit. However, some out-of-pocket expenses directly related to volunteering services might be tax-deductible. You should ask the non-profit for a receipt for these expenses.

Can I create my own donation receipt if I lost the original one?

No, you should not create your own donation receipt. If you lost your original receipt, you should contact the non-profit organization and ask for a duplicate. They will usually be happy to help.

What if a non-profit organization refuses to give a receipt?

If a non-profit organization refuses to provide a receipt, you may not be able to claim the donation as a tax deduction. In such cases, you may want to consider reporting the incident to your local tax authority.

Can a non-profit retroactively provide a donation receipt for a past donation?

Generally, a non-profit can issue a receipt for a past donation, as long as they have accurate records of the donation, and the request is made within the same tax year of the donation. However, it’s always best to request the receipt at the time of the donation or as soon as possible afterward.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Receipt Templates [Word, Excel, PDF] 3 Receipt](https://www.typecalendar.com/wp-content/uploads/2023/06/Receipt-150x150.jpg)