For visual artists, musicians, writers, and other creatives, getting paid for their work is an important part of sustaining a career in the arts. While informal agreements may suffice when selling or licensing art to friends, exhibiting at small venues, or taking on minor projects, most professional transactions require formal invoicing. An artist invoice not only ensures prompt payment, but also creates a paper trail for tax purposes and provides helpful documentation should disputes arise.

Creating a polished, comprehensive invoice need not be a chore, however. In this article, we will explore the key information that should be included on an artist invoice, provide tips for structuring your invoice in a clear and compelling way, and share customizable artist invoice templates for services ranging from fine art sales to creative commissions.

Table of Contents

What Is An Artist Invoice?

An artist invoice is a bill sent by a visual or performing artist to request payment for creative work or services rendered. It documents important details like the name of the artist and client, a description of the art or services provided, the agreed upon price or commission rate, invoice date, payment terms, and remittance information.

A clear, professional invoice allows artists to clearly communicate their billing policies, ensure prompt payment for their work, and create a record of transactions made. For many artists, issuing invoices is an essential business practice needed to earn income, track expenses for tax purposes, and formalize relationships with art buyers or clients. Well-designed artist invoice templates make it simple to quickly generate polished, customized invoices to suit each project.

Artist Invoice Templates

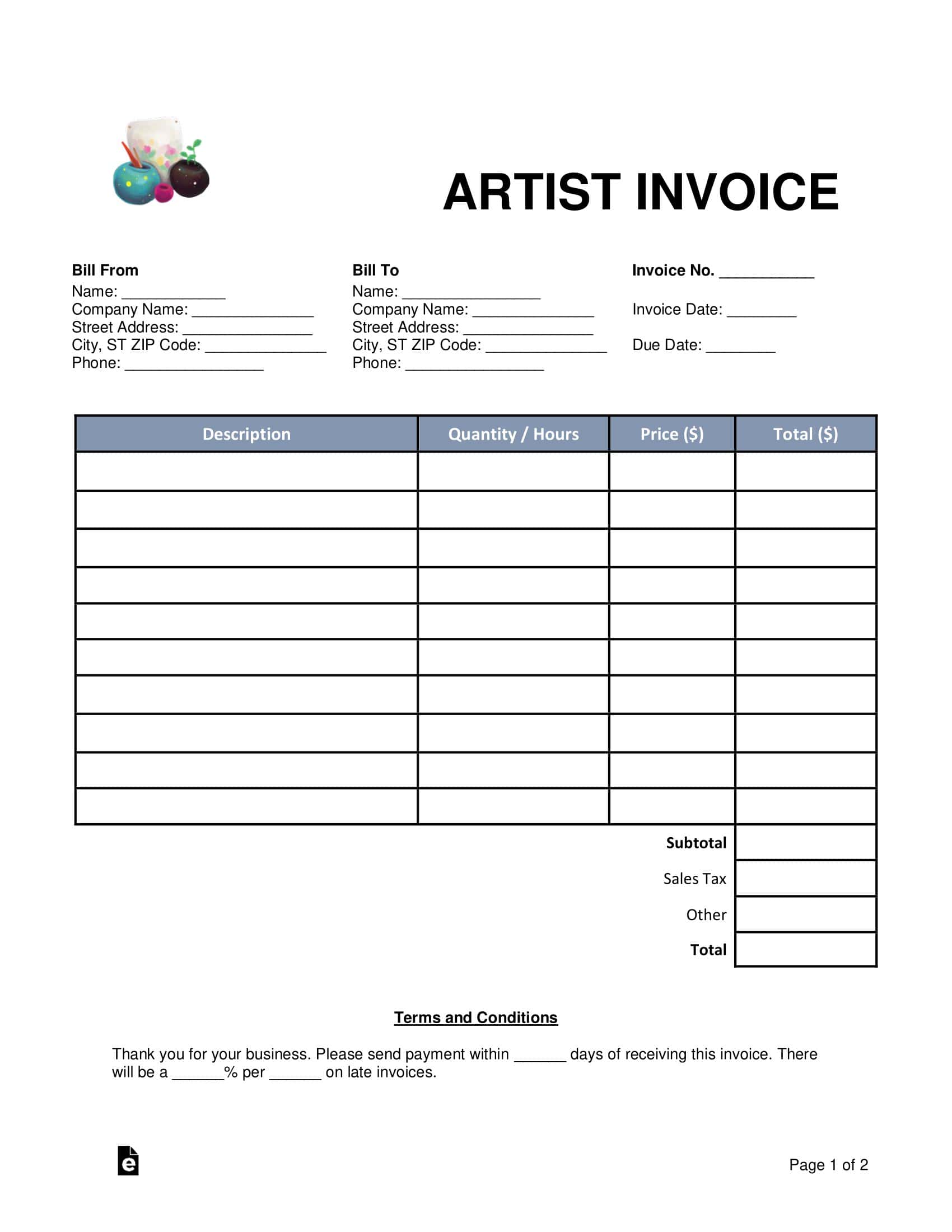

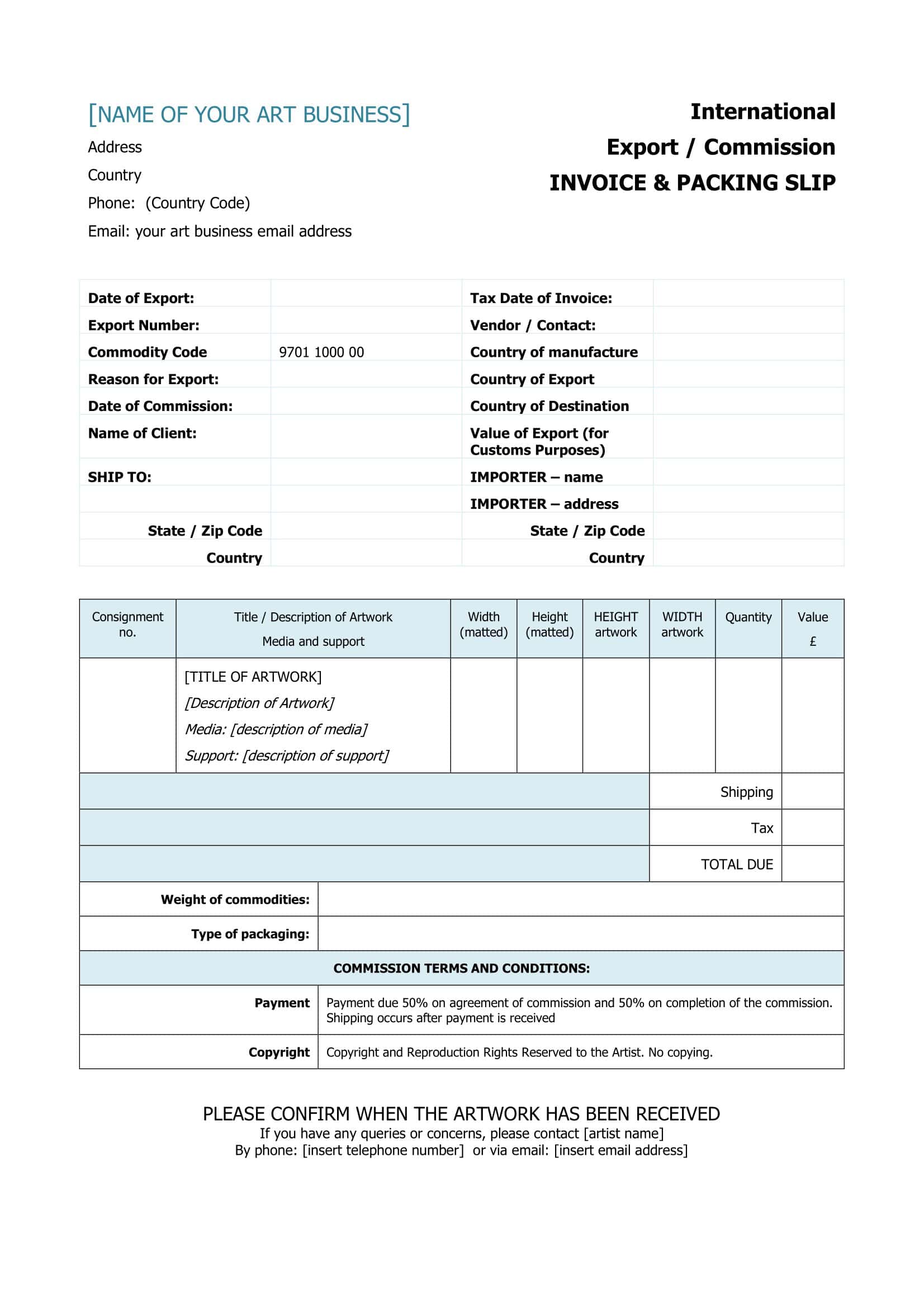

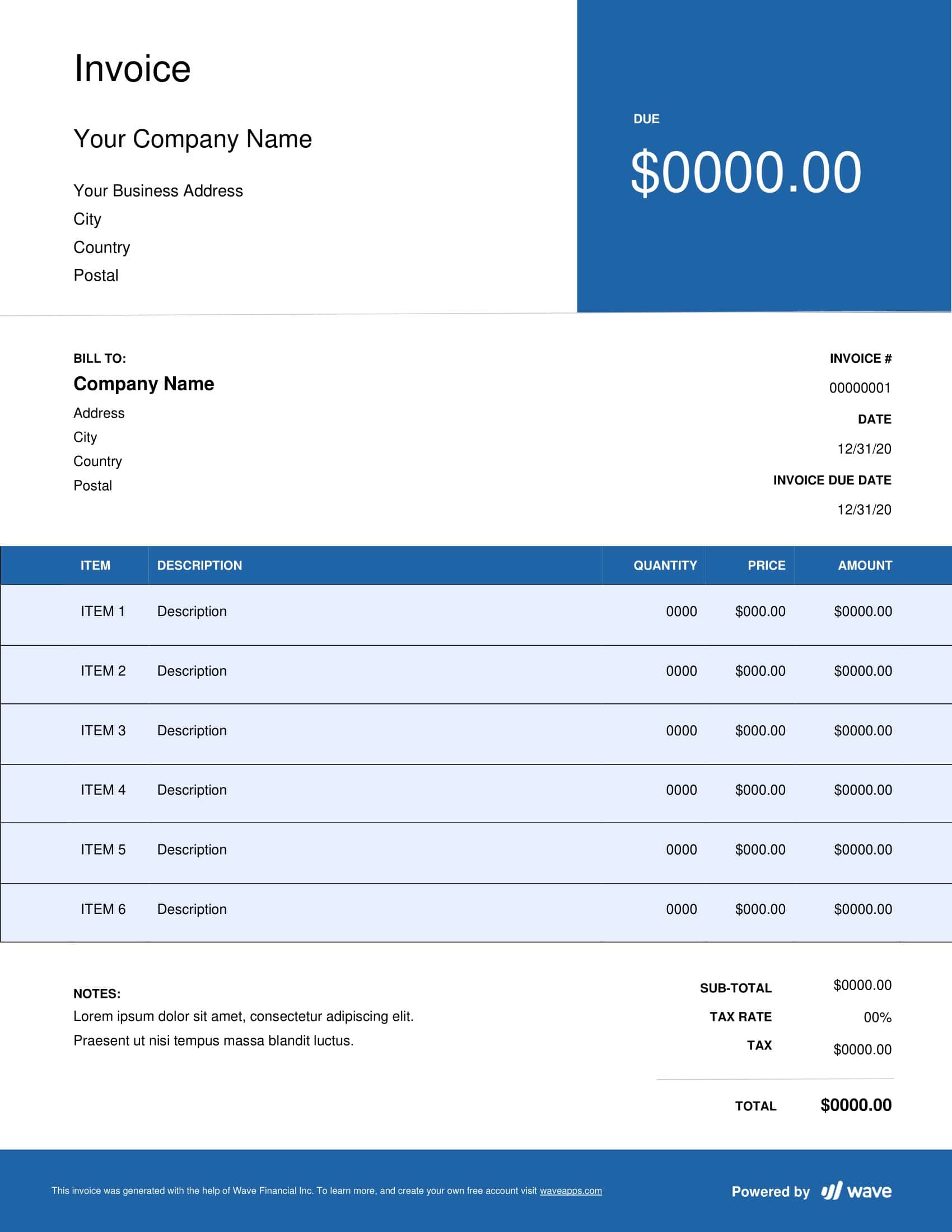

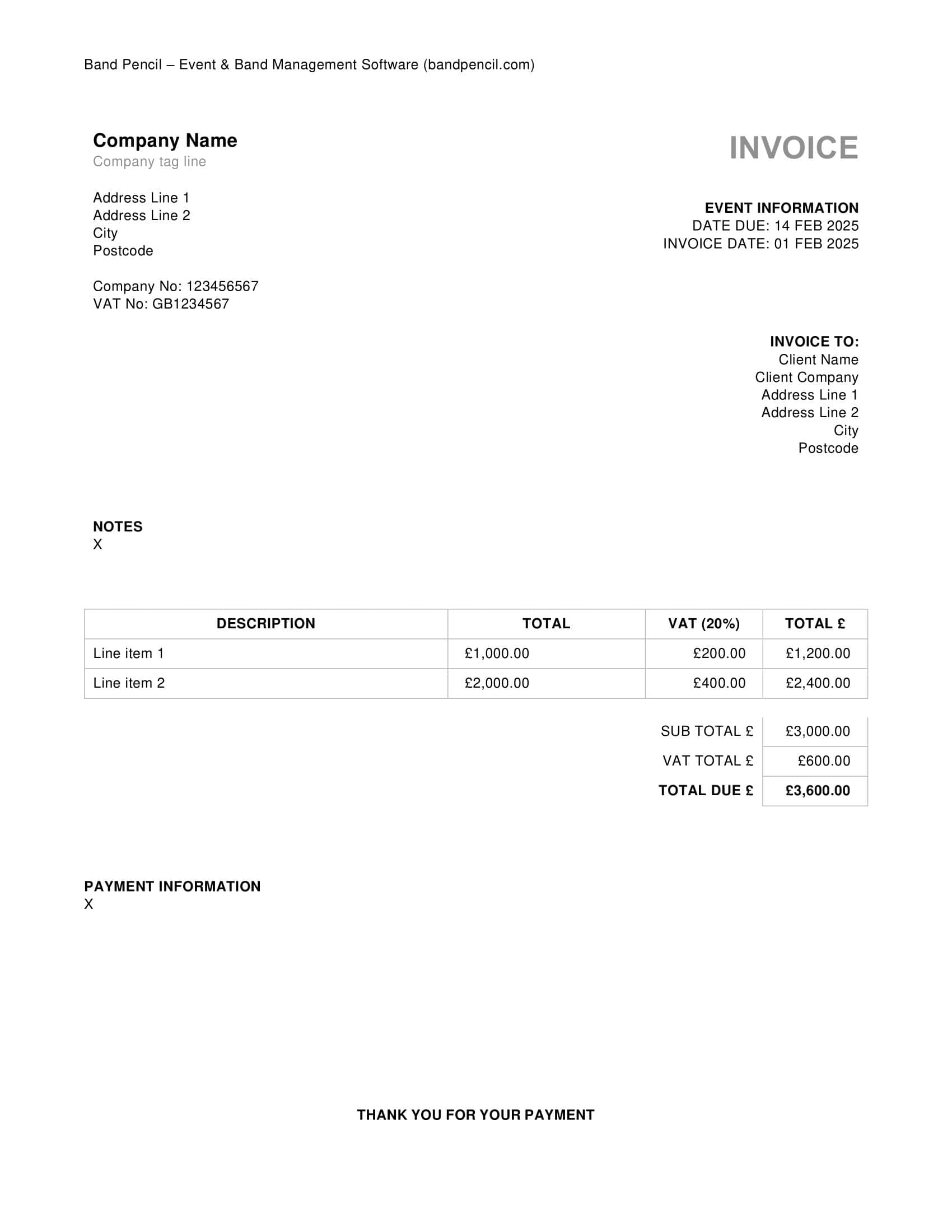

The artist invoice template is a document used by freelance artists and creators to bill clients for creative work. The template provides a clear format to outline services provided and associated charges.

The invoice template contains sections to list the artist’s information, client details, invoice number, date, payment terms, and a table to itemize services rendered. Line items include dates,descriptions, quantities, rates, and amount due for each. Subtotal, taxes, discounts, and balance due are calculated automatically.

Overall, the artist invoice template allows creatives to quickly generate professional invoices to get paid for completed client work. The organized structure clearly communicates charges for creative services, licensing, or copyrights. An on-hand template promotes consistency from one project to the next. It can be customized with the artist’s branding and saved for repeat use when billing regular clients. The artist invoice template simplifies invoicing so freelance artists can focus on creating.

When to use an Artist Invoice

Here are some situations when you might need to use an Artist Invoice:

- Commissioned Work: If someone has commissioned a piece from you, whether it’s a painting, sculpture, illustration, or any other form of artwork, you’ll need an invoice to detail the work done and the agreed-upon price.

- Freelance Projects: Many artists work on a freelance basis for various clients, such as creating designs, illustrations, or graphics. Once the project is complete or at specific milestones (if it’s a longer-term project), an invoice should be sent.

- Artwork Sales: If you sell a piece of artwork, either directly to a buyer or through a gallery, an invoice will serve as a record of the transaction. It’s especially important if you’re shipping the art, as it can also act as a proof of purchase.

- Teaching or Workshops: If you’re an artist who also teaches art classes, workshops, or tutorials, you can use an invoice to bill students or institutions for your teaching services.

- Licensing Art: If someone wants to use your artwork for commercial purposes, like in advertisements, merchandise, or publications, they’ll typically need to license it from you. An invoice can detail the licensing terms and the associated fees.

- Exhibition Fees: If you’re participating in an exhibition and there’s a fee associated with showcasing your work or if someone rents your artwork for display, an invoice is necessary to detail the costs involved.

- Art-Related Services: Beyond creating artwork, many artists offer related services like framing, restoration, or consultation. Any time you provide these services, an invoice should be issued.

Key Components of an Artist Invoice

Creating a clear and detailed artist invoice is crucial for both professionalism and ensuring prompt payment. Here are the key components of an artist invoice, along with a brief description of each:

Header:

- Invoice Title: Clearly label the document as an “Invoice” so there’s no ambiguity about its purpose.

- Artist’s Logo or Name: If you have a professional logo, include it. If not, your full name or business name should be prominently displayed.

Artist’s Contact Information:

- Name: Your full name or the name of your art business.

- Address: Your mailing address.

- Phone Number: A contact number where you can be reached.

- Email Address: A professional email address.

- Website or Portfolio: If you have an online portfolio or website, include the URL.

Client’s Contact Information:

- Client’s Name or Business: The individual or company commissioning or purchasing the work.

- Client’s Address: The mailing address of the client.

- Client’s Phone Number and Email: Useful for any follow-up or communication about the invoice.

Invoice Details:

- Invoice Number: A unique identifier for each invoice. This helps with record-keeping and referencing.

- Invoice Date: The date when the invoice is issued.

- Due Date: The date by which payment should be received. It’s essential to clearly define this to set payment expectations.

Artwork or Service Details:

- Description: Detailed information about the artwork or service provided, such as the title of the work, dimensions, medium, or specifics about the project.

- Quantity: If multiple pieces or items are being sold or multiple sessions of a service were provided.

- Unit Price: The price for a single unit or item.

- Total Price: The total cost, which is the unit price multiplied by the quantity (if applicable).

Additional Costs:

This can include costs associated with:

- Materials: If they are billed separately.

- Shipping: If the artwork needs to be delivered.

- Taxes: If applicable in your region or for the nature of the transaction.

- Additional Fees: Any other fees or charges related to the work or transaction.

Total Amount Due:

This is the combined total of the artwork or service provided plus any additional costs, clearly indicating the amount the client owes.

Payment Terms and Instructions:

- Payment Methods: Specify acceptable payment methods, e.g., bank transfer, check, credit card, or platforms like PayPal.

- Payment Instructions: Detailed instructions on how to pay, including bank account details (if applicable) or online payment links.

- Late Payment Policy: If you have any penalties or interest charges for late payments, outline them here.

Notes or Additional Information:

Any additional details or specifics related to the artwork, the transaction, or any special agreements between you and the client.

Thank You Note:

A brief thank you message for their business. This adds a personal touch and emphasizes good customer relations.

How to Create an Artist Invoice?

Creating an artist invoice is an essential process for professionals in the creative industry. It ensures that you get compensated accurately and on time for the services or products you provide. Here’s a step-by-step guide to help you craft an artist invoice:

Step 1: Choose a Medium

Before you start, decide whether you want to create your invoice manually, use a pre-made template, or utilize invoicing software.There are various ways to make an invoice: handwritten on paper, on a computer using software like Word or Excel, or through specialized invoicing platforms. The best method will depend on the frequency of your invoicing and your personal preferences. Invoicing platforms are especially beneficial for those regularly sending invoices, as they often come with features like automated reminders and online payment processing.

Step 2: Start with Your Details

Your invoice should begin with your name or business name, address, phone number, email, and any other relevant contact information.It’s essential to have your information clearly stated at the top. This not only makes you look professional but ensures that your client knows exactly who the invoice is from. If you have a logo or branding, consider incorporating that as well to make your invoice stand out and look professional.

Step 3: Include Client’s Details

Just below your details, list your client’s name or business name, address, and other contact details.By listing your client’s details, you make sure the invoice goes to the right recipient. This is particularly crucial if you’re sending your invoice to a large company where it might get lost among many other documents.

Step 4: Date and Invoice Number

Every invoice should have a date and a unique invoice number. This helps both you and your client track payments and due dates.The invoice number is crucial for your records and for any potential future disputes. If you’re creating invoices manually, ensure each number is unique. If you’re using software, it will typically auto-generate this number for you.

Step 5: List Your Services or Products

Clearly describe the services or products you provided. List each item on a new line and include quantity, rate, and total cost.The clarity is paramount. Whether you’re an illustrator who has provided several pieces of artwork or a musician hired for multiple gigs, itemizing each service/product ensures there’s no ambiguity about what’s being charged.

Step 6: Include the Total Amount

At the bottom of your invoice, provide a clear and bold total amount due. If applicable, also list taxes or any other additional charges.Your client should be able to quickly identify the total amount they owe. Make this number easy to find. If there are any discounts or additional fees, ensure these are also clearly itemized before you present the final total.

Step 7: State Payment Terms

Clearly mention your payment terms. This includes the due date, accepted payment methods, and any late fees if the payment isn’t received on time.Setting clear payment terms upfront helps avoid any misunderstandings later on. For instance, if you expect payment within 30 days of the invoice date, specify this. If you accept specific payment methods like bank transfers or online payments, provide the necessary details.

Step 8: Add a Thank You Note

A brief thank-you note at the end of the invoice fosters positive client relationships. Express gratitude for their business.It’s a small gesture, but a thank-you note can go a long way in building and maintaining positive client relationships. It’s an affirmation of your professional rapport and a gentle reminder of the person behind the work.

Step 9: Review and Send

Before sending, thoroughly review your invoice for accuracy. Once sure, send it via your chosen method, be it email, post, or through an invoicing platform.Mistakes can happen, so always double-check your invoices. Ensure that there are no typos, miscalculations, or omitted details. Once you’ve reviewed and are confident everything is accurate, send it promptly to ensure timely payment.

Invoicing Tips and Best Practices for Artists

Invoicing is a crucial part of the business side of being an artist. Proper invoicing helps ensure timely payments, fosters trust with clients, and maintains a professional appearance. Here are some invoicing tips and best practices tailored for artists:

Stay Organized:

- Tip: Maintain a systematic filing system, either digitally or physically, to keep track of all your invoices.

- Why: This ensures that you can quickly reference any past transactions, which can be helpful during tax time or if there’s a payment dispute.

Use Clear Descriptions:

- Tip: Avoid vague descriptions. Instead of writing “Artwork,” be specific: “18×24 oil painting of a seascape.”

- Why: Detailed descriptions prevent any ambiguity and make sure the client understands what they are being billed for.

Set Clear Payment Terms:

- Tip: Clearly define your payment terms, whether it’s 15, 30, or 60 days. Consider adding late payment fees to encourage timely payment.

- Why: Setting boundaries and expectations upfront can prevent potential misunderstandings and delays in payment.

Offer Multiple Payment Options:

- Tip: Allow clients to pay via bank transfer, credit card, online platforms like PayPal, or even newer methods like cryptocurrency if you’re comfortable.

- Why: Making it easier for your clients to pay increases the chances of receiving timely payments.

Be Prompt with Invoicing:

- Tip: Send your invoice as soon as the project is completed or delivered.

- Why: The quicker you send the invoice, the sooner you’re likely to be paid. Plus, the work is still fresh in the client’s mind.

Follow Up:

- Tip: If a payment deadline is approaching or has passed, don’t hesitate to send a polite reminder.

- Why: Clients can forget or overlook invoices. Regular follow-ups can remind them of their obligation without sounding confrontational.

Personalize Your Invoice:

- Tip: Add personal touches such as your logo or a unique design.

- Why: Not only does this look professional, but it also helps your invoice stand out and be remembered.

Keep Records:

- Tip: Save copies of all correspondence, including email exchanges and signed agreements.

- Why: This can be useful in the event of a disagreement or for referencing past projects.

Use Professional Tools:

- Tip: Consider using invoicing software or platforms tailored for freelancers and artists.

- Why: These tools often come with added features such as payment tracking, automatic reminders, and even tax calculations.

Build Relationships:

- Tip: Beyond just sending invoices, try to foster positive relationships with your clients.

- Why: A good rapport can lead to repeat business, referrals, and a smoother invoicing process overall.

Stay Updated on Tax Obligations:

- Tip: Understand any tax obligations in your country related to your earnings. Some countries require charging VAT or other taxes on your invoices.

- Why: Being aware of and adhering to tax regulations prevents potential legal issues and fines.

Be Open to Negotiation:

- Tip: While it’s important to value your work, be prepared for clients to negotiate rates or payment terms. Have a strategy for these discussions.

- Why: Flexibility can lead to better client relationships and long-term contracts.

Conclusion

Creating professional invoices is a cornerstone of running an successful art business. While generic invoice templates are readily available, they don’t address the unique needs of artists and creatives. Using an artist-specific invoice template saves time and ensures you communicate all the important details like materials, commission rates, and payment terms.

No need to start from scratch – we offer downloadable artist invoice templates in Word, PDF, and Excel formats that you can easily customize for your specific projects and clients. The templates make invoicing quick and painless so you can get back to doing what you love – creating art. Whether you’re an illustrator, performer, painter or photographer, you’ll find the right template here to bill clients and get paid efficiently. Be sure to download one today to level up your art business!

FAQs

Are electronic invoices acceptable for artists?

Absolutely. Electronic invoices are not only acceptable but are also becoming the norm in many industries, including the art world. They offer an efficient, eco-friendly, and instant way to send and receive invoices.

Do I need to charge tax on my artist invoice?

This depends on local regulations and the nature of your services. Some regions require artists to charge a sales tax on physical artwork but not on services. Others might have exemptions for certain types of art. It’s essential to be familiar with your local tax laws and consult with a tax professional if in doubt.

Should I ask for an advance payment or deposit?

Many artists ask for a deposit or advance payment, especially for larger projects or commissions. This ensures some level of commitment from the client and provides initial funds for materials or other expenses.

How long should I keep copies of my artist invoices?

It’s recommended to keep copies for a minimum of 3-7 years, depending on local tax laws and regulations. Some artists prefer to maintain records even longer for their reference.

When is the right time to send an artist invoice?

The timing for sending an artist invoice can vary based on the agreement between the artist and the client. However, common scenarios include:

- Upon Completion: This is the most common practice where artists send an invoice once the artwork or service is completed.

- In Stages: For larger projects or commissions, artists might bill in stages, such as 50% upfront and 50% upon completion.

- Upfront Deposit: For custom work or when materials are expensive, artists may request a percentage (e.g., 20-50%) of the total cost upfront, followed by the final invoice after completion.

- Monthly or Periodic: For ongoing services, like art lessons or long-term projects, artists might send invoices on a regular basis, such as monthly.

How should artists handle unpaid invoices?

If an invoice goes unpaid:

- First, send a polite reminder to the client before the due date.

- If the payment is overdue, send a more formal reminder or notice.

- Communicate with the client to understand any reasons for the delay.

- Consider offering a payment plan if the client faces financial difficulties.

- As a last resort, consider legal action or employing a collections agency.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)