A balance sheet provides a snapshot of a company’s financial position at a given point in time. Organizing this statement into clear sections makes the data even more insightful. A classified balance sheet separates assets, liabilities, and equity accounts into current and long-term categories. This format divides short-term, liquid accounts from those providing longer-term value.

Classifying balance sheet accounts clarifies the timing of account flows and allows deeper analysis. In this article, we will explore the structure of a classified balance sheet and how it enhances financial reporting. We will also provide classified balance sheet templates and examples to use as guides for your own financial statements. Let’s examine how segregating account types into current and non-current classifications improves financial communication and analysis.

Table of Contents

What is a Classified Balance Sheet?

![Free Printable Classified Balance Sheet Templates [Excel, PDF] Example 1 Classified Balance Sheet](https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-640x360.jpg 640w, https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet-1200x675.jpg 1200w, https://www.typecalendar.com/wp-content/uploads/2023/08/Classified-Balance-Sheet.jpg 1920w)

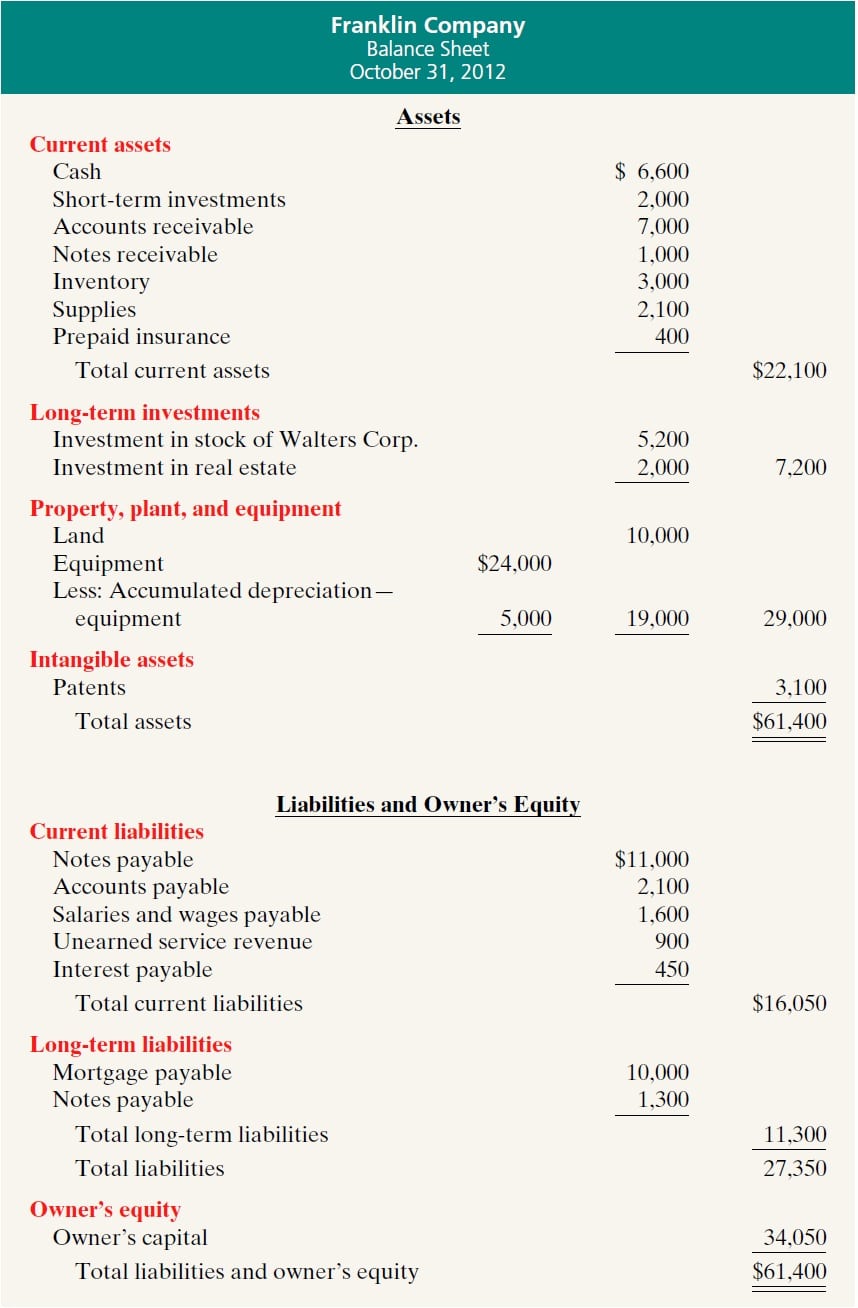

A classified balance sheet is a financial statement that organizes assets, liabilities, and equity accounts into current and long-term categories. Current accounts consist of short-term, liquid assets that can quickly become cash, such as inventory or accounts receivable, along with short-term debts due within a year. Long-term accounts are assets providing value beyond a year, like fixed assets, and long-term liabilities such as bonds payable.

The equity section remains unclassified. Sorting accounts in this way provides more clarity around the timing of account flows and the firm’s financial flexibility compared to an unclassified presentation. Classified balance sheets are preferred because they facilitate more detailed financial analysis and communication of corporate financial health.

Classified Balance Sheet Templates

Preparing a classified balance sheet correctly categorizes assets and liabilities. Our classified balance sheet pdf makes this process easy for students or bookkeepers. This template divides accounts into current, long-term, and equity sections.

The current assets section covers accounts converted into cash within 12 months. This includes cash, accounts receivable, inventory, and short-term investments. Long-term assets are resources held for over a year like buildings, equipment, and long-term investments.

Current liabilities are obligations paid within 12 months, including accounts payable and short-term debt. Long-term liabilities come due after a year such as bonds payable. The equity section outlines capital contributed by shareholders and retained earnings. Download our classified balance sheet pdf to learn proper balance sheet organization while practicing account classification.

Purpose of a Classified Balance Sheet

The classified balance sheet, a cornerstone in financial reporting, serves several critical purposes in the realm of accounting and business management. These purposes ensure that stakeholders, from investors to management, can make informed decisions based on a company’s financial standing. Let’s delve deeper into the salient purposes of this invaluable tool:

- Categorization for Clarity: One of the primary purposes of a classified balance sheet is to categorize assets and liabilities into current and non-current (or long-term) sections. This division aids in swiftly discerning the liquidity position of a company.

- Current Assets: Typically convertible into cash or used up within a year, this category includes items like cash, accounts receivable, and inventory.

- Non-Current Assets: These are expected to bring value over a longer period, often beyond one year. Examples include property, plant, equipment, and intangible assets like patents.

- Current Liabilities: Obligations due within the forthcoming year, such as accounts payable or short-term loans.

- Non-Current Liabilities: Debts and other obligations that are due beyond a year, like long-term loans or deferred tax liabilities.

- Liquidity Assessment: By distinguishing between current and non-current assets and liabilities, stakeholders can quickly assess a company’s ability to meet its short-term financial obligations. A higher proportion of current assets relative to current liabilities generally indicates a comfortable liquidity position.

- Financial Ratio Derivation: Classified balance sheets facilitate the calculation of various financial ratios. For instance, the current ratio (current assets divided by current liabilities) and the quick ratio (quick assets divided by current liabilities) are essential liquidity metrics derived directly from the classified data.

- Future Planning & Strategy Formulation: The detailed breakdown aids management in strategy formulation. By understanding what resources are available in the short term versus the long term, companies can make plans for capital expenditures, manage working capital, or decide on financing strategies.

- Investor & Creditor Analysis: Potential investors and creditors rely heavily on the classified balance sheet. It provides them with insights into the company’s operational efficiency, how it finances its operations, and its overall solvency. For instance, a company with a significant portion of its assets tied up in inventory might be of concern to investors who fear slow-moving stock.

- Comparative Analysis: Classified balance sheets enable comparative analysis, either with a company’s past performance or with other businesses in the same sector. This comparison can unearth trends, strengths, weaknesses, opportunities, and threats.

- Regulatory Compliance: In many jurisdictions, providing a classified balance sheet is a regulatory requirement, ensuring standardization in financial reporting and promoting transparency in the business ecosystem.

The Main Components Of A Classified Balance Sheet

A classified balance sheet provides a detailed view of a company’s financial position at a particular point in time by categorizing assets and liabilities into distinct sections. This structured approach allows for a clearer understanding of the company’s short-term and long-term financial standing. Let’s explore in detail the primary components found on a classified balance sheet:

- Assets: These are resources owned by the company that have future economic value. Assets are categorized as follows:

- Current Assets: These are assets expected to be converted to cash or used up within a year.

- Cash and Cash Equivalents: Includes currency, bank deposits, and short-term investments readily convertible to cash.

- Accounts Receivable: Amounts owed to the company by customers for sales made on credit.

- Inventory: Goods available for sale or raw materials waiting to be used in production.

- Prepaid Expenses: Payments made in advance for services or benefits the company will receive in the future, like insurance or rent.

- Marketable Securities: Short-term investments that can be easily sold.

- Non-Current Assets: These have a long-term use or value to the company.

- Property, Plant, and Equipment (PP&E): Tangible assets used in business operations, like machinery, buildings, and land.

- Intangible Assets: Non-physical assets like patents, copyrights, trademarks, and goodwill.

- Long-term Investments: Investments that the company intends to hold for more than a year.

- Other Non-current Assets: Items like deferred tax assets or long-term notes receivable.

- Current Assets: These are assets expected to be converted to cash or used up within a year.

- Liabilities: These represent the company’s obligations or debts. Liabilities are categorized as:

- Current Liabilities: Obligations expected to be settled within a year.

- Accounts Payable: Amounts the company owes to suppliers or other creditors for goods and services.

- Short-term Loans or Notes Payable: Debt obligations due within one year.

- Accrued Liabilities: Expenses that have been incurred but not yet paid, such as wages payable.

- Current Portion of Long-term Debt: The portion of a long-term debt that is due within the coming year.

- Unearned Revenue or Deferred Revenue: Payments received in advance for services or goods to be delivered in the future.

- Non-Current Liabilities: Obligations not due within one year.

- Long-term Debt: Debts that are due in more than one year.

- Deferred Tax Liabilities: Taxes that are due in future periods.

- Other Long-term Liabilities: Items such as pension obligations or capital lease obligations.

- Current Liabilities: Obligations expected to be settled within a year.

- Equity: This represents the owners’ claim on the company’s assets after deducting liabilities. The components vary based on the business structure:

- Owner’s Equity (for sole proprietorships) or Partners’ Equity (for partnerships): Includes the initial investment and subsequent additional contributions, minus withdrawals, plus net income or minus net losses over time.

- Shareholders’ Equity (for corporations):

- Common Stock: Represents equity ownership in a corporation.

- Retained Earnings: Cumulative earnings of the company that have not been distributed to shareholders.

- Additional Paid-In Capital: Amounts received from shareholders in excess of the par or stated value of the shares.

- Treasury Stock: Shares bought back by the company.

- Other Comprehensive Income: Cumulative gains and losses that bypass the income statement but affect shareholders’ equity.

Classified Balance Sheet Vs. Standard Balance Sheet

A balance sheet, in its essence, provides a snapshot of a company’s financial position at a particular point in time, detailing its assets, liabilities, and equity. The manner in which this information is presented can differ, leading to variations such as the classified and standard (or unclassified) balance sheets. Here’s a detailed comparison between the two:

1. Structure and Organization:

- Classified Balance Sheet:

- Assets and liabilities are separated into current and non-current (or long-term) categories.

- This offers a more detailed view, especially in terms of liquidity and solvency.

- Standard (Unclassified) Balance Sheet:

- Assets, liabilities, and equity are listed, but they’re not categorized into current and non-current sections.

- This results in a simpler presentation, but potentially less analytical utility.

2. Intended Audience:

- Classified Balance Sheet:

- Particularly useful for external stakeholders like investors, creditors, and analysts who are keen on assessing the company’s short-term liquidity and long-term financial stability.

- Standard Balance Sheet:

- Often used for internal reporting purposes, where detailed categorization isn’t deemed necessary. It gives a quick snapshot to the management.

3. Analytical Utility:

- Classified Balance Sheet:

- Allows for the computation of important financial ratios like the current ratio and the quick ratio, which gauge a company’s ability to meet short-term obligations.

- Standard Balance Sheet:

- While still useful, the lack of segregation into current and non-current categories means users have to dig deeper to extract the data needed for similar liquidity analyses.

4. Clarity on Short-Term Obligations:

- Classified Balance Sheet:

- Clearly highlights the company’s short-term obligations (current liabilities) and its immediate resources (current assets) to meet those obligations.

- Standard Balance Sheet:

- All liabilities are lumped together, making it harder to distinguish between obligations due within a year and those due in the longer term.

5. Length & Detail:

- Classified Balance Sheet:

- Generally longer and more detailed due to the categorical breakdown.

- Standard Balance Sheet:

- Tends to be shorter and more concise given its lack of categorization.

6. Predominant Use:

- Classified Balance Sheet:

- Common in external financial reporting, especially for larger corporations that need to provide detailed information to stakeholders.

- Standard Balance Sheet:

- Often found in internal reports or for smaller businesses where the distinction between current and non-current items might not be as critical.

7. Adaptability:

- Classified Balance Sheet:

- Requires regular updating and reclassification, especially when certain assets near the end of their “current” lifespan or when long-term liabilities become due within a year.

- Standard Balance Sheet:

- Does not require such frequent reclassification because of its non-segmented nature.

Summary:

While both the classified and standard balance sheets serve the primary purpose of reflecting a company’s financial position, the depth of detail and manner of presentation differ significantly. The choice between them hinges on the intended audience, the nature of the business, and the specific financial insights sought.

What is the Accounting Equation?

The accounting equation is a fundamental principle that ensures a company’s financial statements are always balanced. It reflects the relationship between a company’s assets, liabilities, and equity. The accounting equation is expressed as:

- Assets=Liabilities+EquityAssets=Liabilities+Equity

How To Use The Accounting Equation With A Classified Balance Sheet

Utilizing the accounting equation with a classified balance sheet involves understanding the segmented categories of assets, liabilities, and equity. A classified balance sheet further organizes these elements into current and long-term (or non-current) categories. Here’s a step-by-step guide on how to apply the accounting equation to a classified balance sheet:

Step 1: Understand the Equation

The fundamental accounting equation is: Assets=Liabilities+EquityAssets=Liabilities+Equity

Step 2: Segregate Current and Non-Current Items

On a classified balance sheet:

- Assets are divided into Current Assets and Non-Current Assets.

- Liabilities are divided into Current Liabilities and Non-Current Liabilities.

Step 3: Identify & List Current Assets

Current assets are assets that will be used up or converted into cash within one year. They include:

- Cash and Cash Equivalents

- Accounts Receivable

- Inventory

- Prepaid Expenses

- Short-term Marketable Securities

Sum up the total of all current assets.

Step 4: Identify & List Non-Current Assets

These are long-term assets that provide value beyond one year. They include:

- Property, Plant, and Equipment (PP&E)

- Intangible Assets (like patents and copyrights)

- Long-term Investments

- Other long-term assets like deferred tax assets

Sum up the total of all non-current assets.

Step 5: Identify & List Current Liabilities

Current liabilities are obligations that will be settled within one year. They include:

- Accounts Payable

- Short-term Loans or Notes Payable

- Accrued Liabilities

- Unearned or Deferred Revenue

- Current Portion of Long-term Debt

Sum up the total of all current liabilities.

Step 6: Identify & List Non-Current Liabilities

Long-term liabilities that won’t be settled in the next year. Examples are:

- Long-term Debt (like bonds or mortgages payable)

- Deferred Tax Liabilities

- Pension Liabilities

Sum up the total of all non-current liabilities.

Step 7: Identify & List Equity Items

Depending on the business structure, equity components might vary. For corporations, this can include:

- Common Stock

- Retained Earnings

- Additional Paid-In Capital

- Other components like Treasury Stock or Other Comprehensive Income

For sole proprietorships or partnerships, equity might be represented as:

- Owner’s Capital

- Drawings or Withdrawals

Sum up the total equity.

Step 8: Apply the Accounting Equation

Now, combine the totals:

Total Assets (Current + Non-Current) should equal Total Liabilities (Current + Non-Current) plus Equity.

Step 9: Verify the Balance

Ensure that both sides of the equation are balanced: Total Assets=Total Liabilities+Total EquityTotal Assets=Total Liabilities+Total Equity

If they’re not equal, review the classifications and calculations to check for errors.

Step 10: Continuous Monitoring

As financial transactions occur, they will affect different parts of the balance sheet. Regularly update the classified balance sheet and ensure the accounting equation remains in balance.

How helpful is the Classified Balance Sheet format?

The classified balance sheet format provides several advantages over an unclassified presentation when communicating a company’s financial position:

Firstly, dividing assets and liabilities into current and long-term categories clarifies the timing of when accounts will become cash or require payment. Short-term liquidity and cash generation can be better evaluated knowing which assets may quickly convert to fund current liabilities. Segregating immediate and forthcoming cash commitments from longer-term debts also provides context on solvency.

Secondly, the classified format enables more specialized analysis of working capital, liquidity, and financial flexibility by isolating short-term operating accounts. Current ratios and metrics focus on components directly tied to funding operations and upcoming obligations. Trends in these accounts over time are more meaningful indicators than analyzing total assets and liabilities.

Finally, the classified layout improves benchmarking to industry norms, percentages, and historical trends. Comparing sub-categories like inventory turnover or current liabilities to revenues within the same business or across businesses is more insightful than broad comparisons. Classified financial reporting also aligns with how managers monitor business segments.

In summary, dividing balance sheet accounts into current and long-term classifications provides clarity that unclassified presentations lack. This improves decision-making, analysis, and communication of the operational health and financial stability of the business.

Classified Balance Sheet Template (with Example)

Company XYZ

Classified Balance Sheet

As of December 31, 2023

| ASSETS | |

| Current Assets: | |

| Cash and Cash Equivalents | $50,000 |

| Accounts Receivable | $20,000 |

| Inventory | $30,000 |

| Total Current Assets | $100,000 |

| Non-Current Assets: | |

| Property, Plant, and Equipment | $200,000 |

| Intangible Assets | $10,000 |

| Total Non-Current Assets | $210,000 |

| TOTAL ASSETS | $310,000 |

| LIABILITIES AND EQUITY | |

| Current Liabilities: | |

| Accounts Payable | $15,000 |

| Short-term Loans | $10,000 |

| Total Current Liabilities | $25,000 |

| Non-Current Liabilities: | |

| Long-term Debt | $100,000 |

| Total Non-Current Liabilities | $100,000 |

| Equity: | |

| Common Stock | $100,000 |

| Retained Earnings | $85,000 |

| Total Equity | $185,000 |

| TOTAL LIABILITIES AND EQUITY | $310,000 |

FAQs

Why is it called “classified”?

It’s termed “classified” because it organizes assets and liabilities into distinct categories or classifications, specifically based on their maturity dates.

What distinguishes current assets from non-current assets?

Current assets are resources expected to be converted to cash or used up within one year, such as cash, accounts receivable, and inventory. Non-current assets, on the other hand, are long-term assets expected to provide value to the company for more than one year, like buildings, land, and long-term investments.

How are liabilities categorized on a classified balance sheet?

Liabilities are divided into current liabilities and non-current liabilities. Current liabilities are obligations the company expects to settle within one year, while non-current liabilities are obligations due in more than one year.

Is a classified balance sheet required by law?

While the exact requirements can vary by jurisdiction, many countries’ accounting standards or regulatory bodies mandate or recommend the use of a classified balance sheet, especially for publicly traded companies. It’s essential to check local regulations and standards.

![%100 Free Hoodie Templates [Printable] +PDF 2 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 3 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 4 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)