Requesting an upfront deposit is a common and recommended practice for service providers booking new client work. However, simply stating a deposit is required without providing clear documentation can lead to confusion and payment delays. Sending a professional deposit invoice is crucial for formally requesting and collecting deposit payments from clients.

A deposit invoice specifies the deposit amount due, timeline for sending the deposit, terms for refunds or forfeits, and other key details. Having a system for creating and organizing detailed deposit invoices makes it easy to request deposits smoothly and consistently across your client projects. In this article, we will look at best practices for creating deposit invoices along with tips for streamlining the process using customizable deposit invoice templates. We will also provide downloadable templates in Word, PDF, and Excel formats that make generating deposit invoices simple and efficient.

Table of Contents

What is a Deposit Invoice?

A deposit invoice is a bill sent by a service provider to formally request a portion of the total payment upfront from a client before work begins. It outlines key details including the client name, project description, total project cost, deposit amount due, due date for sending the deposit, and terms for refunding or forfeiting the deposit.

Sending professional deposit invoices allows service providers like contractors, consultants, or event planners to secure a commitment from clients, cover initial expenses, and align on project expectations. For clients, the deposit invoice serves as documentation of funds paid and a reference for project scope and timelines. Having a system for creating clear, comprehensive deposit invoices is essential for securing deposits and avoiding misunderstandings.

Deposit Invoice Templates

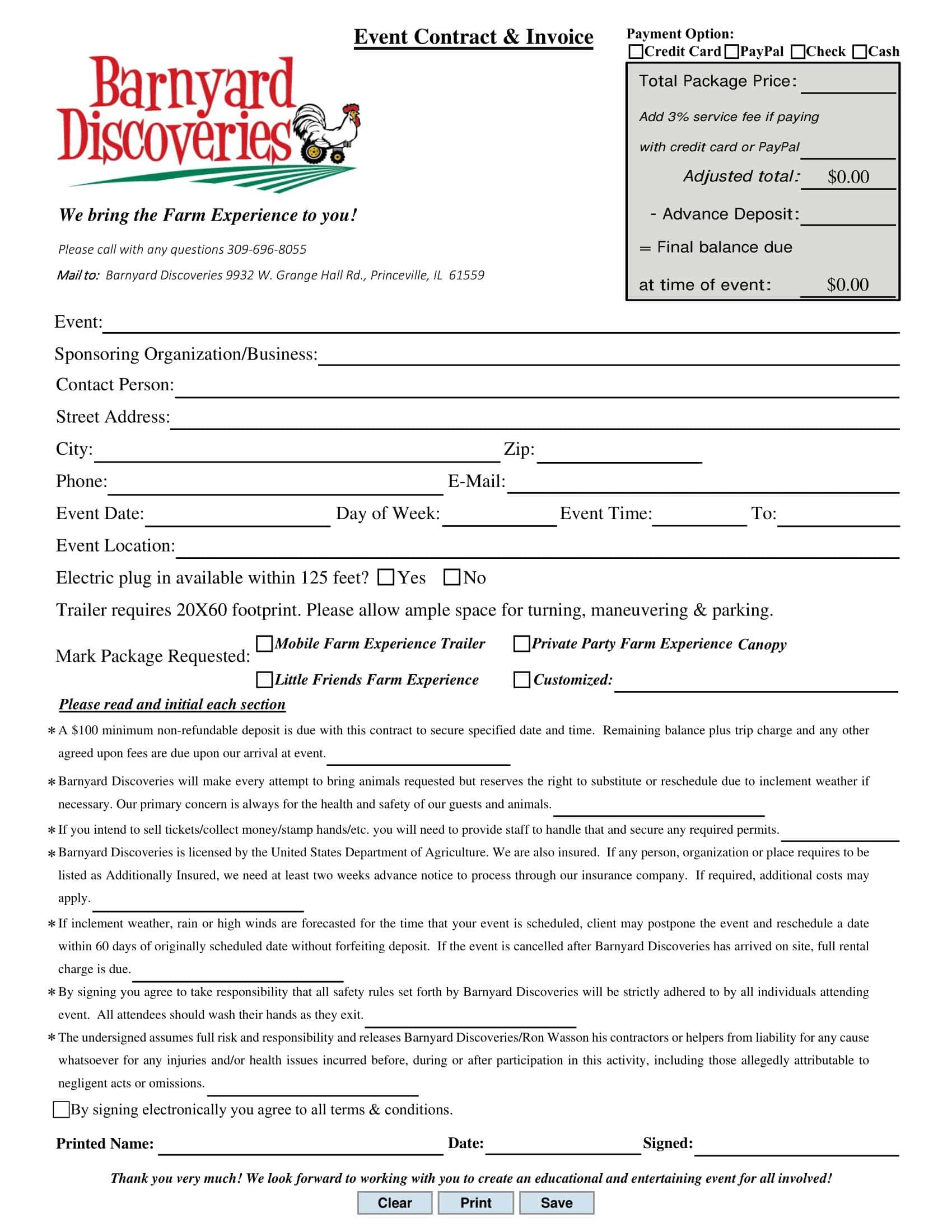

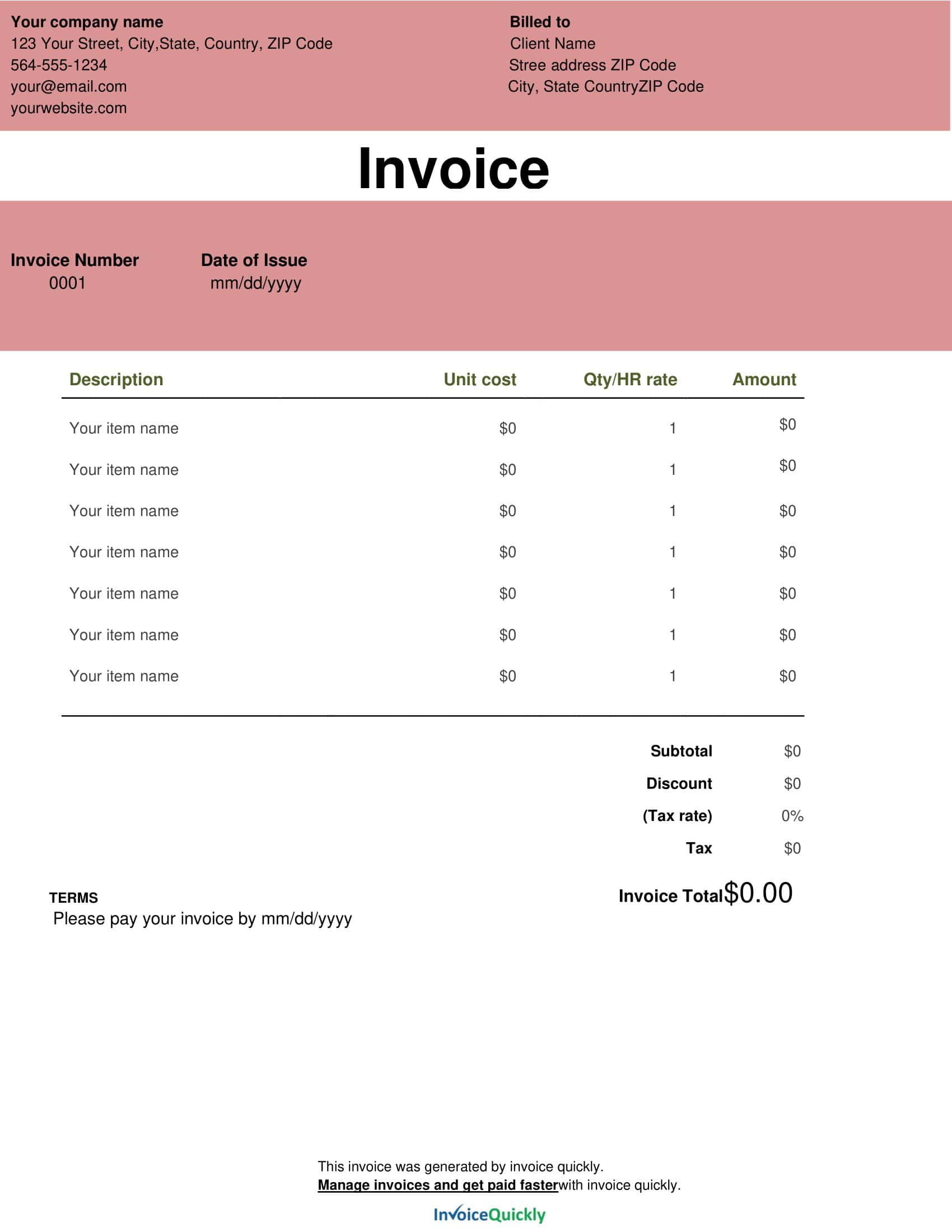

The deposit invoice template is a document used to formally request and record payment of a deposit for products or services. The template provides a standardized format to communicate deposit requirements to customers.

The template contains fields to capture key details including company information, customer details, invoice number, date, and a description of the deposit payment due. It highlights the amount required as a deposit and includes sections for taxes, discounts, and total amount payable. Billing terms, payment methods and due date can also be specified.

Overall, the deposit invoice template enables businesses to easily create professional invoices when collecting deposit payments from customers. The organized layout clearly communicates the required deposit and prompts payment. Having an on-hand template ensures a consistent process for requesting deposits across all customers. The deposit invoice template can be customized with company branding and information. It serves as a simple tool for formally requesting and tracking deposit payments required to secure products or services.

Benefits Of Using The Deposit Invoice

- Cash Flow Improvement:

- Deposit invoices can provide businesses with an immediate influx of cash. This is beneficial for managing expenses, especially if there are initial costs associated with starting a project.

- Risk Mitigation:

- By receiving a deposit, businesses reduce the risk of non-payment. If a customer decides not to proceed or doesn’t fulfill their payment obligations, the deposit can cover some of the expenses or time that have been invested.

- It also acts as a safeguard against clients who might be unsure about committing to the purchase or project.

- Client Commitment:

- A deposit invoice requires clients to make a financial commitment upfront. This usually ensures that they are serious about the project or purchase.

- It reduces instances of last-minute cancellations or changes, ensuring better planning and allocation of resources.

- Better Financial Planning:

- Knowing that a certain portion of the funds is coming in allows businesses to plan their finances more efficiently.

- It aids in budgeting, especially when there are foreseeable expenses related to the project or goods.

- Flexibility in Payment Structures:

- Deposit invoices can be structured to suit the needs of both businesses and clients. For instance, businesses can decide to charge 50% upfront and the rest upon completion or opt for a milestone-based payment structure.

- Protects Against Unforeseen Circumstances:

- If, for some reason, a project is delayed or cannot be completed, having received a deposit ensures that the business isn’t operating at a total loss.

- Builds Trust:

- In some cases, especially for new businesses or freelancers, showing a willingness to work with a deposit can build trust. It demonstrates to the client that the business is committed to delivering the agreed-upon product or service.

- Reduces Administrative Burden:

- Chasing payments can be time-consuming. By securing a deposit, businesses can reduce the number of times they need to follow up with clients for payments.

- Can Aid in Scaling Operations:

- For businesses that are growing or looking to take on larger projects, deposit invoices can provide the necessary funds to scale operations, hire additional help, or purchase necessary equipment.

- Enhanced Client Relationships:

- A clear deposit invoice system sets clear expectations for both parties. When clients are aware of the payment structure from the outset, it can prevent disputes and misunderstandings later on, leading to better business-client relationships.

What To Include On A Deposit Invoice Template?

A deposit invoice template serves to request an upfront payment from a client before services are fully delivered or before a product is shipped. Ensuring that the invoice is clear, detailed, and professional is crucial. Here’s a detailed breakdown of what to include on a deposit invoice template:

1. Header:

- Business Information: Your company’s name, address, phone number, email address, and any other relevant contact information.

- Logo: If your company has a logo, place it prominently at the top. This adds a professional touch and reinforces brand identity.

2. Title:

- Clearly label the document as “Deposit Invoice” or “Down Payment Invoice” so there’s no ambiguity about its purpose.

3. Unique Invoice Number:

- Every invoice should have a unique invoice number for tracking and reference purposes. This aids in record-keeping and is essential for any potential follow-ups or disputes.

4. Date Information:

- Invoice Date: The date when the invoice is generated.

- Due Date: The date by which the deposit should be paid.

5. Client Information:

- Client Name/Company Name: The individual or company you’re billing.

- Client Address: Their physical or mailing address.

- Contact Details: Phone number, email address, or any other relevant contact data.

6. Description of Goods/Services:

- Provide a clear description of the product or service for which the deposit is being requested. Even if the deposit is for a part of the service, it’s beneficial to list the full scope to set expectations.

7. Pricing Information:

- Total Cost: The full cost of the service or product.

- Deposit Amount: The upfront amount you’re requesting. This can be a flat amount or a percentage of the total cost.

- Balance Due: Remaining amount that will be due after the deposit is paid.

8. Payment Terms and Conditions:

- Specify preferred payment methods (e.g., bank transfer, check, credit card).

- Outline any penalties for late payments or potential discounts for early payments.

- Clearly state the conditions under which the deposit is refundable or non-refundable.

9. Banking Details (if relevant):

- If you’re accepting bank transfers, include your bank account details. Ensure you only provide the necessary details and always prioritize security.

10. Notes or Special Instructions:

- Use this section to add any additional information, like specific instructions on how to pay, or to reiterate terms of service, or any other clarifications.

11. Footer:

- Thank You Note: A short appreciation note for the client’s business can make your invoice feel more personalized.

- Tax Information: If applicable, include your business’s tax identification number or VAT number.

12. Legal Disclaimers (if any):

- Depending on the nature of your business or the terms of the service, you might need to include legal disclaimers or information regarding warranties.

13. Signatures:

- While not always necessary, especially for digital invoices, having a space for signatures might be useful, especially if the deposit invoice doubles as a contract or agreement.

When should you issue a Deposit Invoice?

A deposit invoice should be issued when a vendor, service provider, or business wishes to secure a portion of the payment upfront before they deliver the full scope of goods or services. Issuing such an invoice is especially common in scenarios where significant resources, time, or custom work is required, or when the total amount due is substantial.

There are several situations when a deposit invoice becomes particularly pertinent:

- Beginning of a Project or Service: For many professionals, especially freelancers and contractors, it’s standard practice to request a deposit at the outset of a project. This initial payment not only establishes a formal commitment from the client but also provides the professional with funds to cover preliminary expenses or supplies.

- Custom Orders: For businesses dealing in customized goods, such as bespoke furniture, tailored outfits, or personalized jewelry, a deposit invoice can be issued to cover the initial costs of materials and labor. Since these items are tailored to individual customer preferences, a deposit protects the business from potential losses should the customer back out.

- Bookings and Reservations: In industries like event planning, hospitality, or rentals, a deposit invoice might be sent when a customer wants to reserve a date, venue, or item. This ensures that the business compensates for potential opportunity costs if the customer cancels or doesn’t show up.

- High Demand or Limited Availability: In cases where a product or service is in high demand or has limited slots, businesses might opt for deposit invoices to prioritize serious customers and eliminate non-committal inquiries.

- Long-Term Projects: For projects spanning over a long duration, a deposit invoice might be part of a milestone-based payment structure. It can be used to initiate the project, with subsequent invoices issued at different project stages.

How to Create a Deposit Invoice?

Creating a deposit invoice is essential for businesses that require a partial payment upfront for services or products. This upfront payment is typically called a deposit or down payment. Here’s a step-by-step guide to help you create a deposit invoice:

Step 1: Understand the Purpose of the Deposit Invoice

Before creating the invoice, ensure you understand the reason for collecting a deposit. A deposit can act as a security for both parties, securing the business’s time/resources and the client’s commitment.

Step 2: Choose an Appropriate Invoice Template or Software

If you’re using invoicing software, there may be a template specifically for deposits. If not, you can modify a standard invoice template. Some popular software options include QuickBooks, FreshBooks, and Zoho Invoice.

Step 3: Clearly Label the Document

At the top of the invoice, clearly label it as a “Deposit Invoice” or “Down Payment Invoice.” This distinguishes it from final or standard invoices and sets clear expectations for the client.

Step 4: Include Standard Invoice Information

List out essential details:

- Your business name, address, and contact information

- Client’s name and address

- Invoice date and unique invoice number

- Payment due date

Step 5: Detail the Services or Products

List the full scope of services or products that the client will receive. Even if the deposit only covers a portion of the total, showing the full scope sets clear expectations.

Step 6: State the Deposit Amount and Total Cost

Clearly mention the deposit amount required. It’s also a good idea to state the total cost of the service or product, so the client understands the deposit in context. For example:

- Total Cost of Service: $1000

- Deposit Required: $200

- Balance After Deposit: $800

Step 7: Mention Payment Terms

Clearly state the payment terms. Include preferred payment methods, any additional fees (like late fees), and mention when the balance will be due (either after a certain period or upon completion of the service or delivery of the product).

Step 8: Provide Additional Information

Include any other relevant details or terms related to the deposit. For instance, you might mention if the deposit is refundable, under what circumstances, and the timeline for refunds.

Step 9: Add a Personal Note or Thank You

Including a personal note can enhance your professional relationship. A simple acknowledgment or thank you for their business can go a long way in building goodwill.

Step 10: Review and Send

Before sending the invoice, double-check all the details to ensure accuracy. Once satisfied, send the deposit invoice to your client through their preferred method (email, mail, or other).

Conclusion

Collecting project deposits is an important business practice for service providers to secure client commitments. However, creating customized deposit invoices from scratch for each client engagement can be time-consuming and prone to errors. Using professional deposit invoice templates simplifies the process. In this article, we discussed best practices for deposits and determining optimal deposit invoice timing.

To help streamline deposit invoicing for your business, we provide downloadable deposit invoice templates in Word, PDF, and Excel formats. Our templates allow you to quickly generate customized invoices that formally communicate deposit details to clients. With just a few edits, you can add your company and client details and send polished deposit invoices instantly. Be sure to download one of our free templates today to level up your deposit invoicing and kickoff projects smoothly.

FAQs

Is a deposit invoice legally binding?

While an invoice itself is not a contract, it is a record of the agreement between the seller and the buyer. When combined with other communications and agreements, a deposit invoice can help establish terms and expectations. Always consult legal counsel to ensure your invoicing practices are legally sound.

How is the deposit amount determined?

The deposit amount can be a flat fee or a percentage of the total invoice amount. The specific amount or percentage is often based on industry norms, the nature of the work, or the risk involved.

What happens after I receive the deposit?

Once a deposit is received, work can commence based on the terms agreed upon. Upon completion, a final invoice is typically sent, which will account for the deposit and state the remaining balance.

Is the deposit refundable?

Deposit refund policies vary. Some deposits are non-refundable, while others may be refundable under specific conditions. It’s essential to specify the refund terms clearly on the deposit invoice or in the associated contract.

Do I need to include tax in the deposit invoice?

It depends on local tax regulations and the nature of the goods or services. If tax applies, it’s often prorated based on the deposit amount. It’s advisable to consult with a tax professional to ensure compliance.

What if a client doesn’t pay the deposit?

If a client doesn’t pay the deposit as agreed, you may decide to delay starting the work or providing the product. Communication is key: reach out to the client to understand any concerns and possibly negotiate terms if necessary.

Can I use a deposit invoice for international clients?

Yes, but ensure the invoice includes currency details, potential foreign transaction fees, and any other relevant information to avoid misunderstandings.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

I finally found a good description for a deposit invoice. However, how should your following invoice should look like? Once the deposit is paid and the 2nd, 3rd, 4th invoice seeds to be sent, and how should your final invoice look like?